- ALKS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Alkermes (ALKS) 8-KResults of Operations and Financial Condition

Filed: 12 Feb 25, 7:05am

Fourth Quarter and Year-End 2024 Financial Results & Business Update February 12, 2025 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Information Certain statements set forth in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: Alkermes plc’s (the “Company”) expectations with respect to its current and future financial, commercial and operating performance, business plans or prospects, including its expected revenue and profitability. The Company cautions that forward-looking statements are inherently uncertain. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to various risks, assumptions and uncertainties. These risks, assumptions and uncertainties include, among others: whether the Company is able to sustain profitability; the Company’s commercial activities may not result in the benefits that the Company anticipates; clinical development activities may not be completed on time or at all and the results of such activities may not be positive, or predictive of final results from such activities, results of future development activities or real-world results; potential changes in the cost, scope, design or duration of the Company’s development activities; the unfavorable outcome of arbitration, litigation, including so-called “Paragraph IV” litigation, or other proceedings or other disputes related to the Company’s products or products using the Company’s proprietary technologies; the U.S. Food and Drug Administration or other regulatory authorities may make adverse decisions regarding the Company’s products; the Company and its licensees may not be able to continue to successfully commercialize their products or support growth of such products; there may be a reduction in payment rate or reimbursement for the Company’s products or an increase in the Company’s financial obligations to government payers; the Company’s products may prove difficult to manufacture, be precluded from commercialization by the proprietary rights of third parties, or have unintended side effects, adverse reactions or incidents of misuse; and those risks, assumptions and uncertainties described under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and in subsequent filings made by the Company with the U.S. Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov, and on the Company’s website at www.alkermes.com in the ‘Investors – SEC Filings’ section. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, the Company disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this presentation. Non-GAAP Financial Measures: This presentation includes information about certain financial measures that are not prepared in accordance with generally accepted accounting principles in the U.S. (“GAAP”), including non-GAAP net income, EBITDA (earnings before interest, taxes, depreciation and amortization) and Adjusted EBITDA, which excludes from earnings share-based compensation expense in addition to the components of EBITDA. The Company provides these non-GAAP financial measures of the Company’s performance to investors because management believes that these non-GAAP financial measures, when viewed with the Company’s results under GAAP and the accompanying reconciliations, are useful in identifying underlying trends in ongoing operations. These non-GAAP measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similar measures presented by other companies. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, to the extent reasonably determinable, can be found in the Appendix of this presentation. Note Regarding Trademarks: The Company and its affiliates are the owners of various U.S. federal trademark registrations (®) and other trademarks (TM), including ARISTADA®, ARISTADA INITIO® , LYBALVI® and VIVITROL®. INVEGA SUSTENNA® is a registered trademark of Johnson & Johnson or its affiliated companies. VUMERITY® is a registered trademark of Biogen MA Inc., used by Alkermes under license. Any other trademarks referred to in this presentation are the property of their respective owners. Appearances of such other trademarks herein should not be construed as any indicator that their respective owners will not assert their rights thereto.

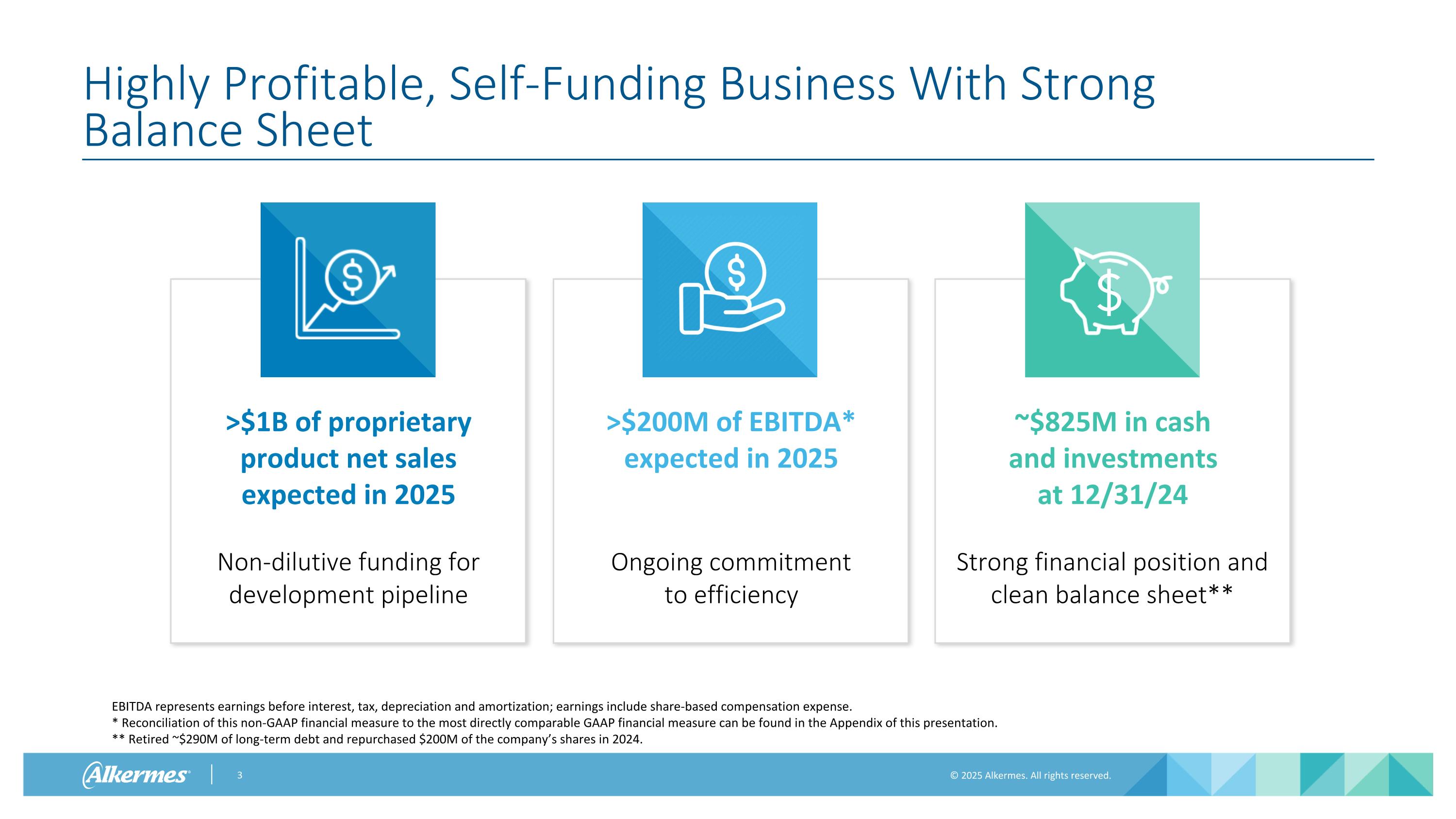

Highly Profitable, Self-Funding Business With Strong Balance Sheet EBITDA represents earnings before interest, tax, depreciation and amortization; earnings include share-based compensation expense. * Reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure can be found in the Appendix of this presentation. ** Retired ~$290M of long-term debt and repurchased $200M of the company’s shares in 2024. >$1B of proprietary product net sales expected in 2025 Non-dilutive funding for development pipeline >$200M of EBITDA* expected in 2025 Ongoing commitment to efficiency ~$825M in cash and investments at 12/31/24 Strong financial position and clean balance sheet**

Q4 & FY 2024 Financial and Operational Performance

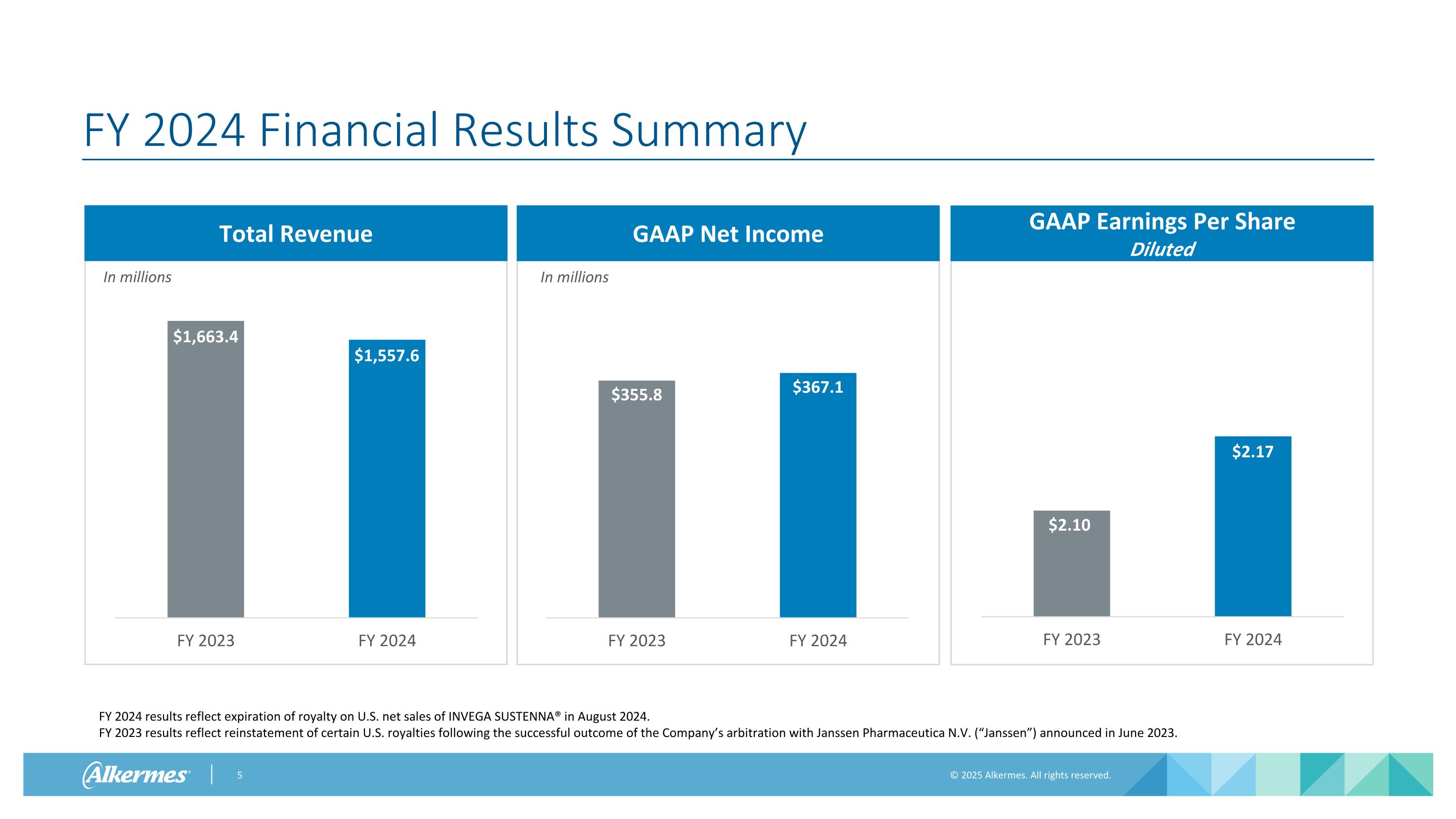

In millions FY 2024 Financial Results Summary Total Revenue In millions GAAP Net Income GAAP Earnings Per Share Diluted FY 2024 results reflect expiration of royalty on U.S. net sales of INVEGA SUSTENNA® in August 2024. FY 2023 results reflect reinstatement of certain U.S. royalties following the successful outcome of the Company’s arbitration with Janssen Pharmaceutica N.V. (“Janssen”) announced in June 2023.

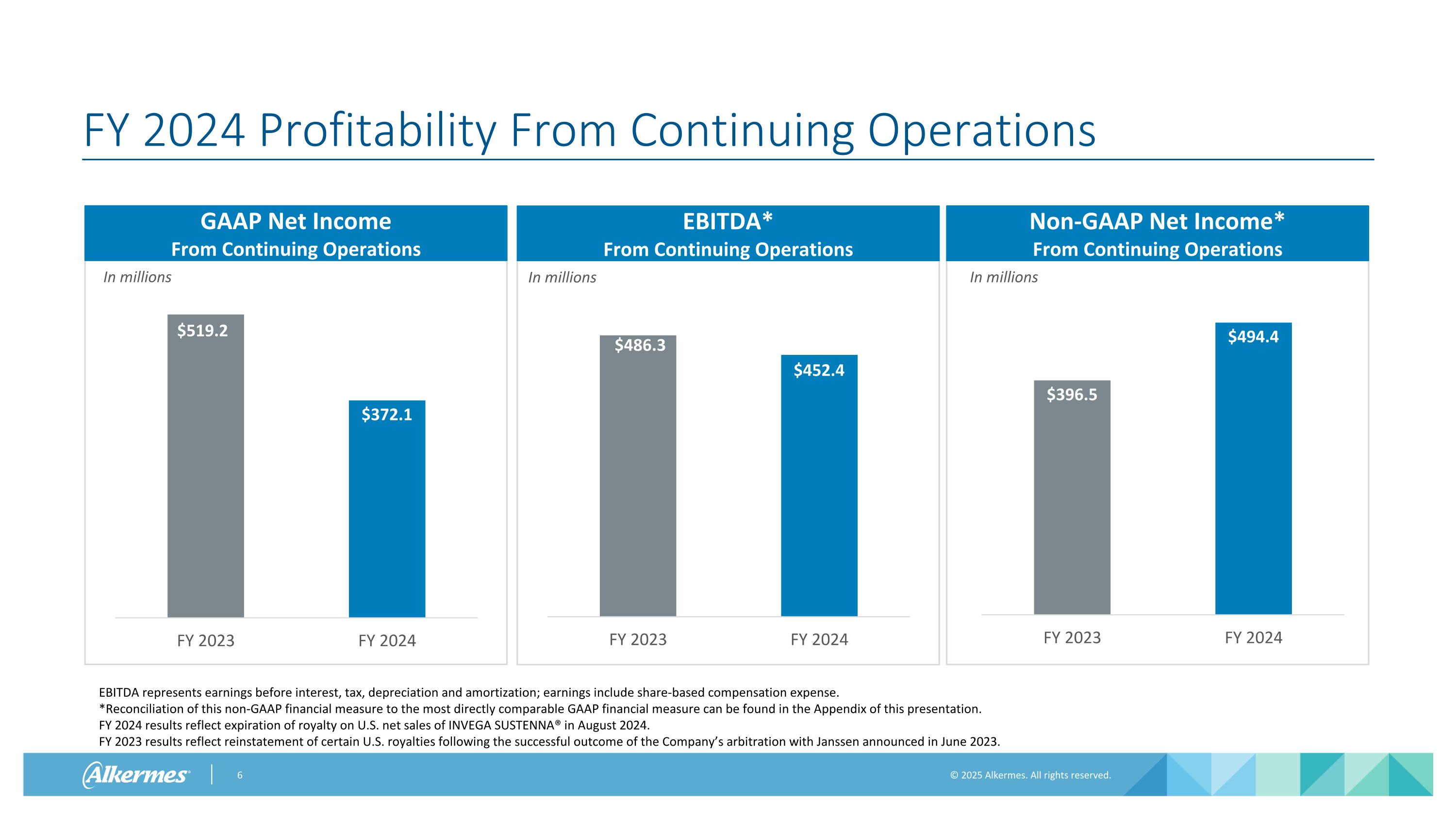

In millions FY 2024 Profitability From Continuing Operations GAAP Net Income From Continuing Operations In millions Non-GAAP Net Income* From Continuing Operations EBITDA* From Continuing Operations In millions EBITDA represents earnings before interest, tax, depreciation and amortization; earnings include share-based compensation expense. *Reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure can be found in the Appendix of this presentation. FY 2024 results reflect expiration of royalty on U.S. net sales of INVEGA SUSTENNA® in August 2024. FY 2023 results reflect reinstatement of certain U.S. royalties following the successful outcome of the Company’s arbitration with Janssen announced in June 2023.

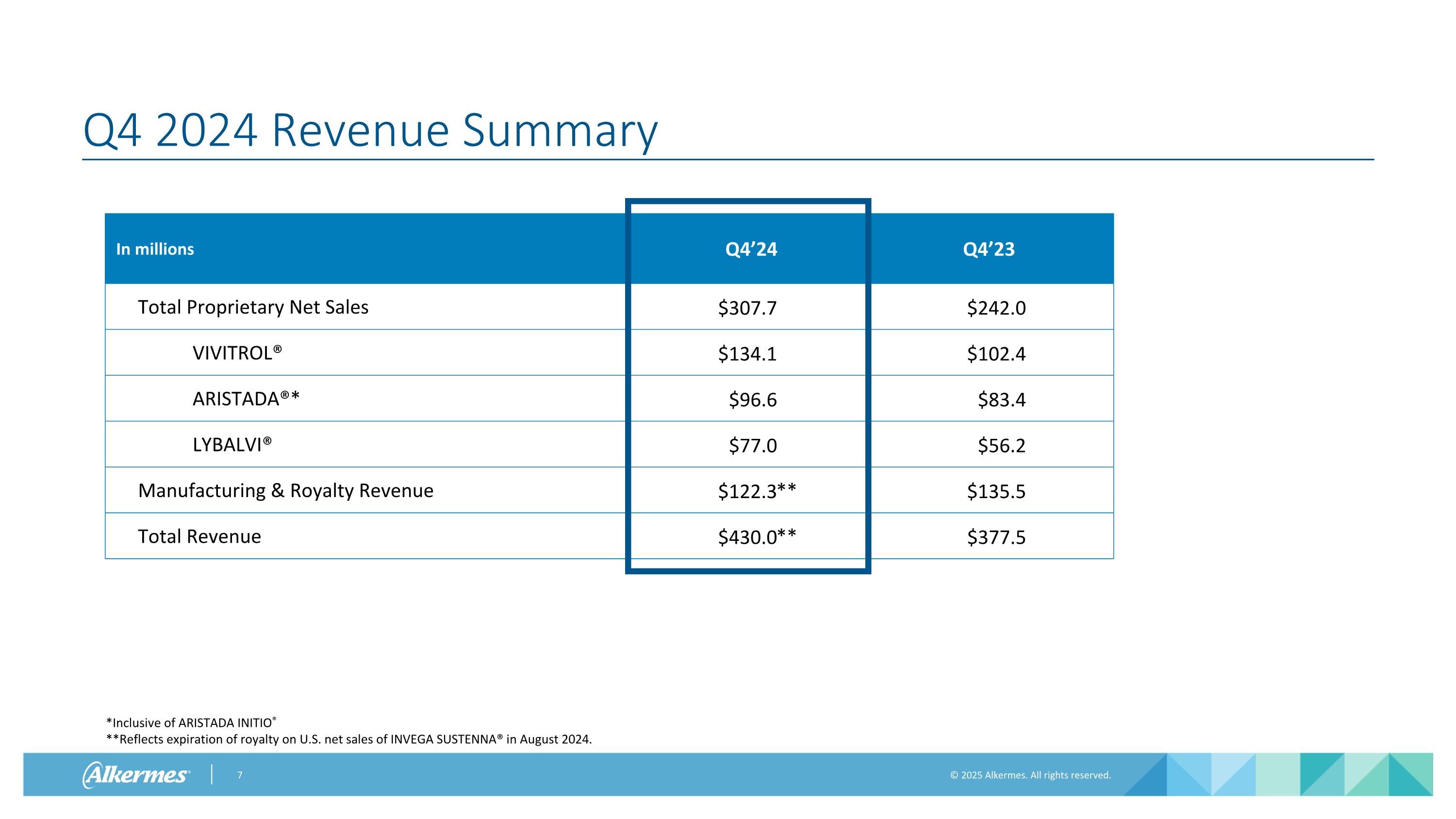

Q4 2024 Revenue Summary In millions Q4’24 Q4’23 Total Proprietary Net Sales $307.7 $242.0 VIVITROL® $134.1 $102.4 ARISTADA®* $96.6 $83.4 LYBALVI® $77.0 $56.2 Manufacturing & Royalty Revenue $122.3 $135.5 Total Revenue $430.0 $377.5 *Inclusive of ARISTADA INITIO® **Reflects expiration of royalty on U.S. net sales of INVEGA SUSTENNA® in August 2024. ** **

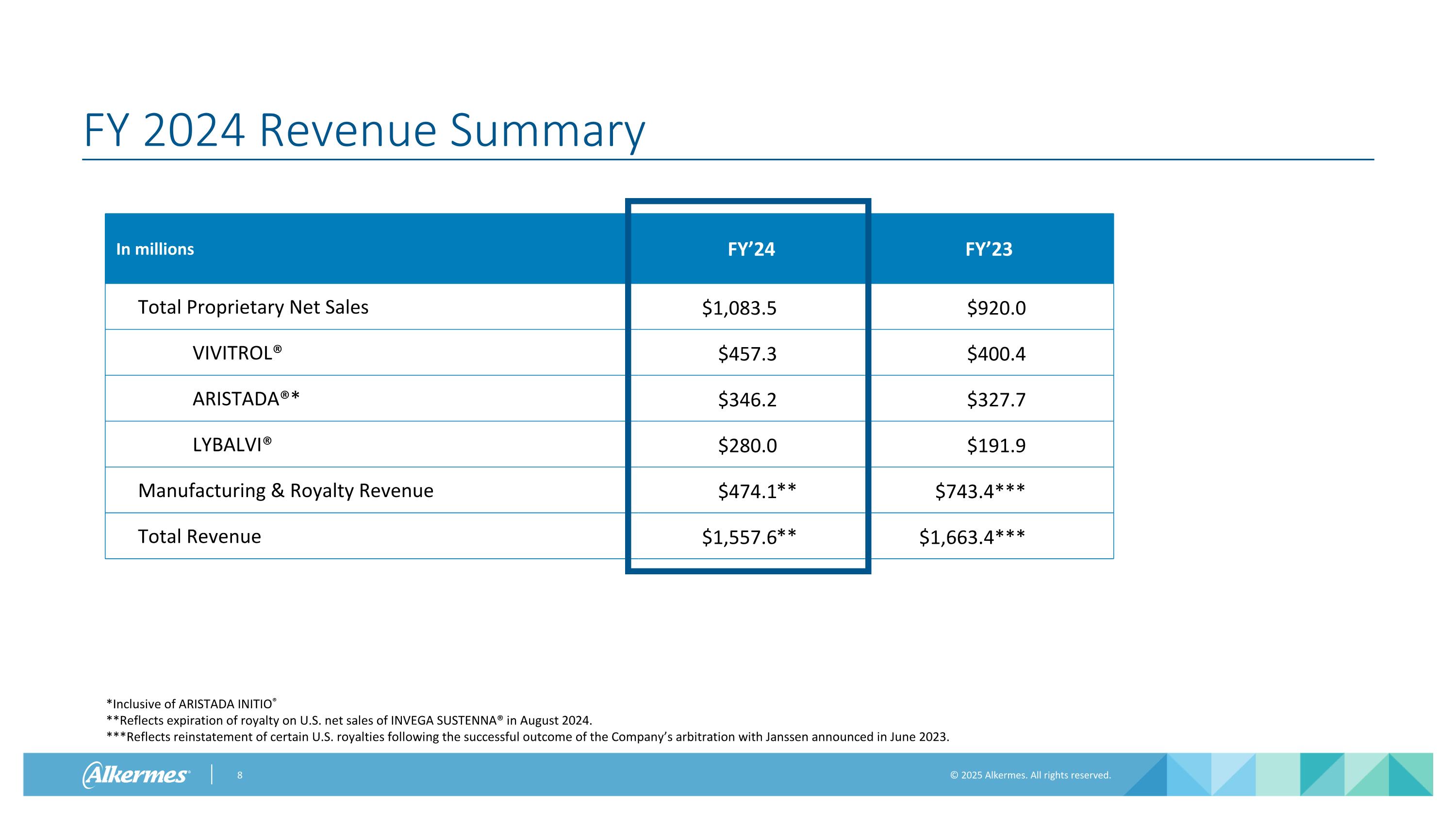

FY 2024 Revenue Summary In millions FY’24 FY’23 Total Proprietary Net Sales $1,083.5 $920.0 VIVITROL® $457.3 $400.4 ARISTADA®* $346.2 $327.7 LYBALVI® $280.0 $191.9 Manufacturing & Royalty Revenue $474.1 $743.4*** Total Revenue $1,557.6 $1,663.4*** *Inclusive of ARISTADA INITIO® **Reflects expiration of royalty on U.S. net sales of INVEGA SUSTENNA® in August 2024. ***Reflects reinstatement of certain U.S. royalties following the successful outcome of the Company’s arbitration with Janssen announced in June 2023. ** **

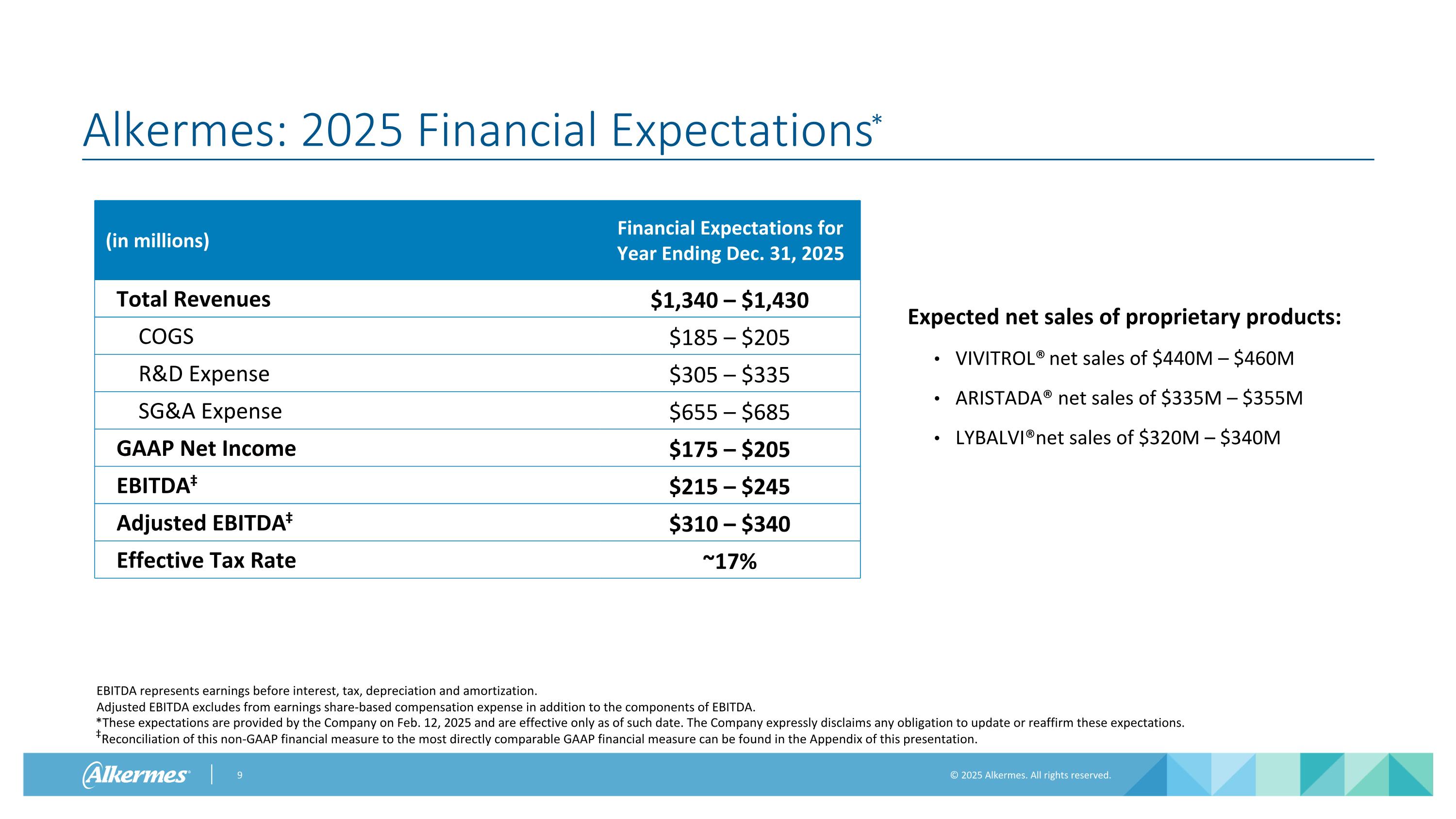

Alkermes: 2025 Financial Expectations* *These expectations are provided by the Company on Feb. 12, 2025 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations. ‡Reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure can be found in the Appendix of this presentation. (in millions) Financial Expectations for Year Ending Dec. 31, 2025 Total Revenues $1,340 – $1,430 COGS $185 – $205 R&D Expense $305 – $335 SG&A Expense $655 – $685 GAAP Net Income $175 – $205 EBITDA‡ $215 – $245 Adjusted EBITDA‡ $310 – $340 Effective Tax Rate ~17% Expected net sales of proprietary products: VIVITROL® net sales of $440M – $460M ARISTADA® net sales of $335M – $355M LYBALVI® net sales of $320M – $340M EBITDA represents earnings before interest, tax, depreciation and amortization. Adjusted EBITDA excludes from earnings share-based compensation expense in addition to the components of EBITDA.

2024 Commercial Review

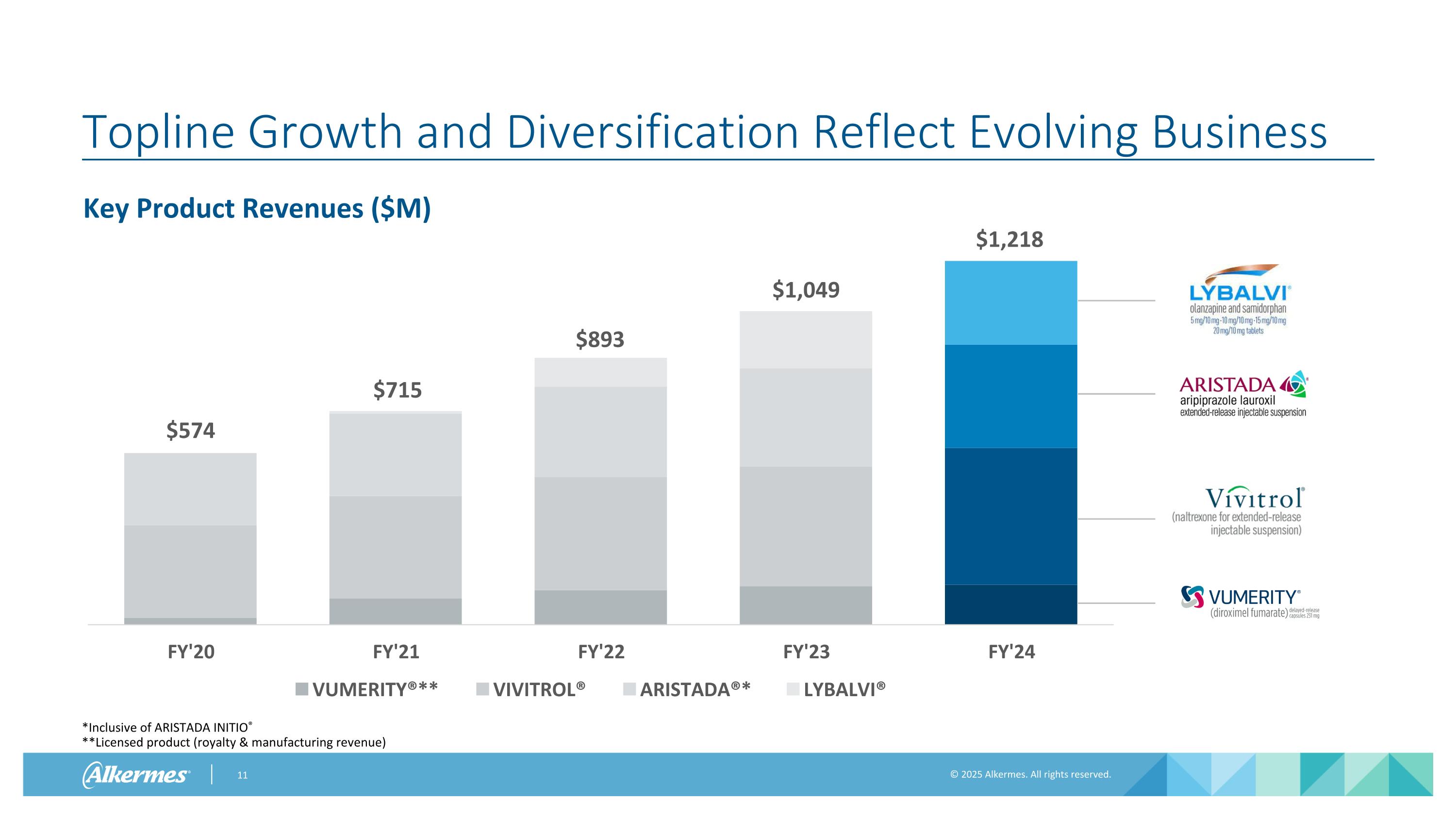

Topline Growth and Diversification Reflect Evolving Business *Inclusive of ARISTADA INITIO® **Licensed product (royalty & manufacturing revenue) Key Product Revenues ($M) $574 $715 $893 $1,049 $1,218

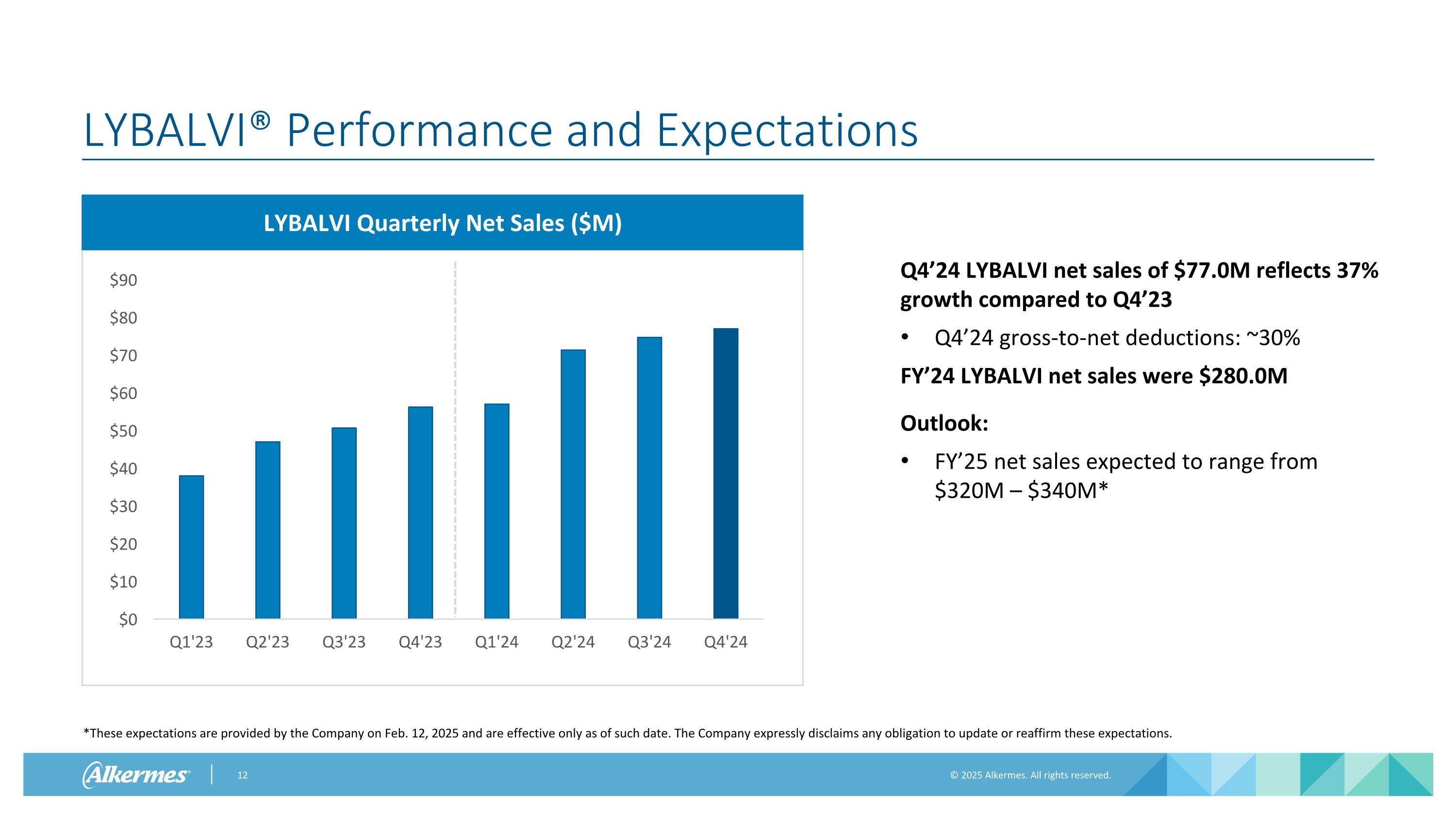

LYBALVI® Performance and Expectations *These expectations are provided by the Company on Feb. 12, 2025 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations. LYBALVI Quarterly Net Sales ($M) Q4’24 LYBALVI net sales of $77.0M reflects 37% growth compared to Q4’23 Q4’24 gross-to-net deductions: ~30% FY’24 LYBALVI net sales were $280.0M Outlook: FY’25 net sales expected to range from $320M – $340M*

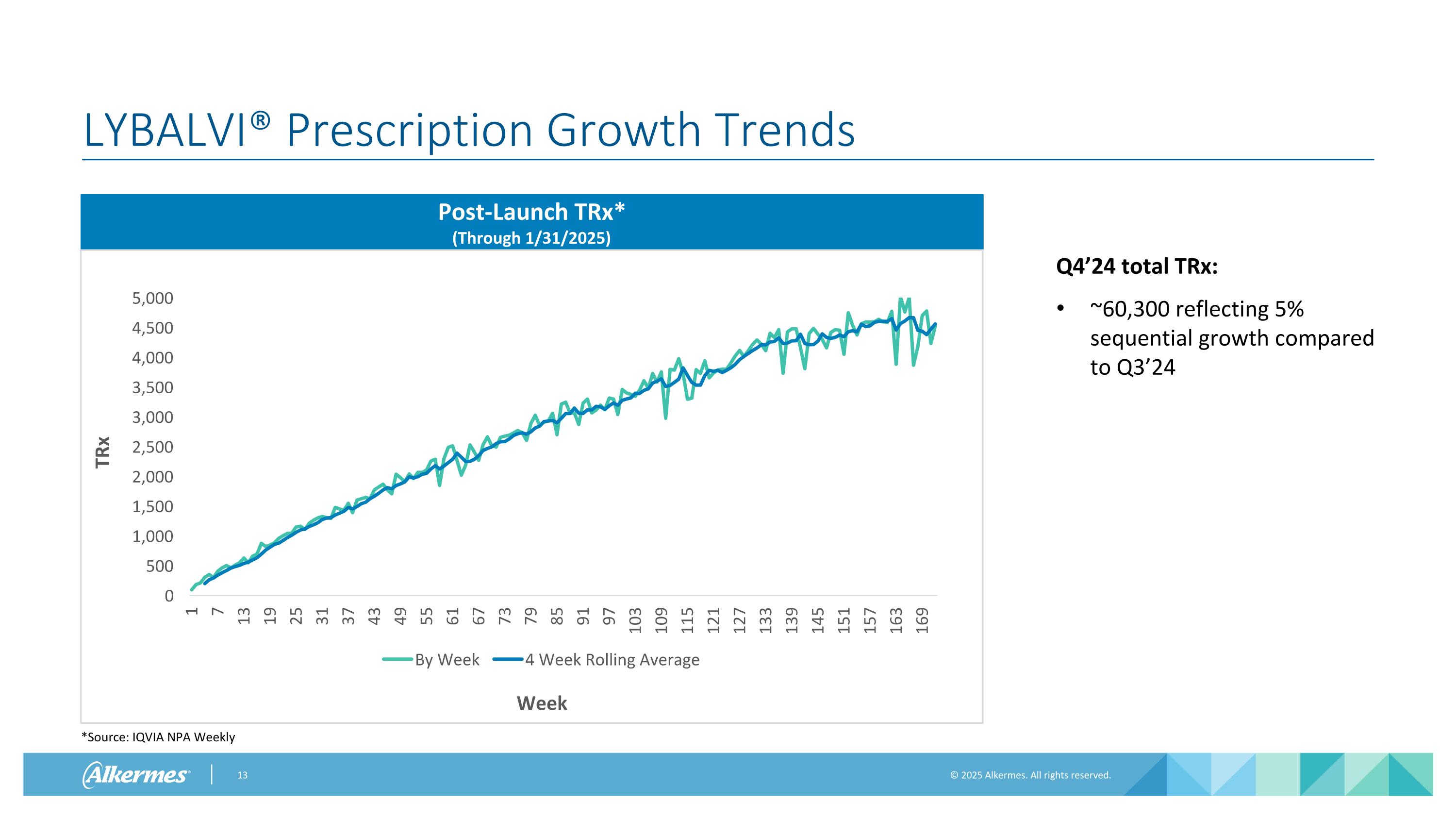

LYBALVI® Prescription Growth Trends Q4’24 total TRx: ~60,300 reflecting 5% sequential growth compared to Q3’24 *Source: IQVIA NPA Weekly Post-Launch TRx* (Through 1/31/2025) TRx Week

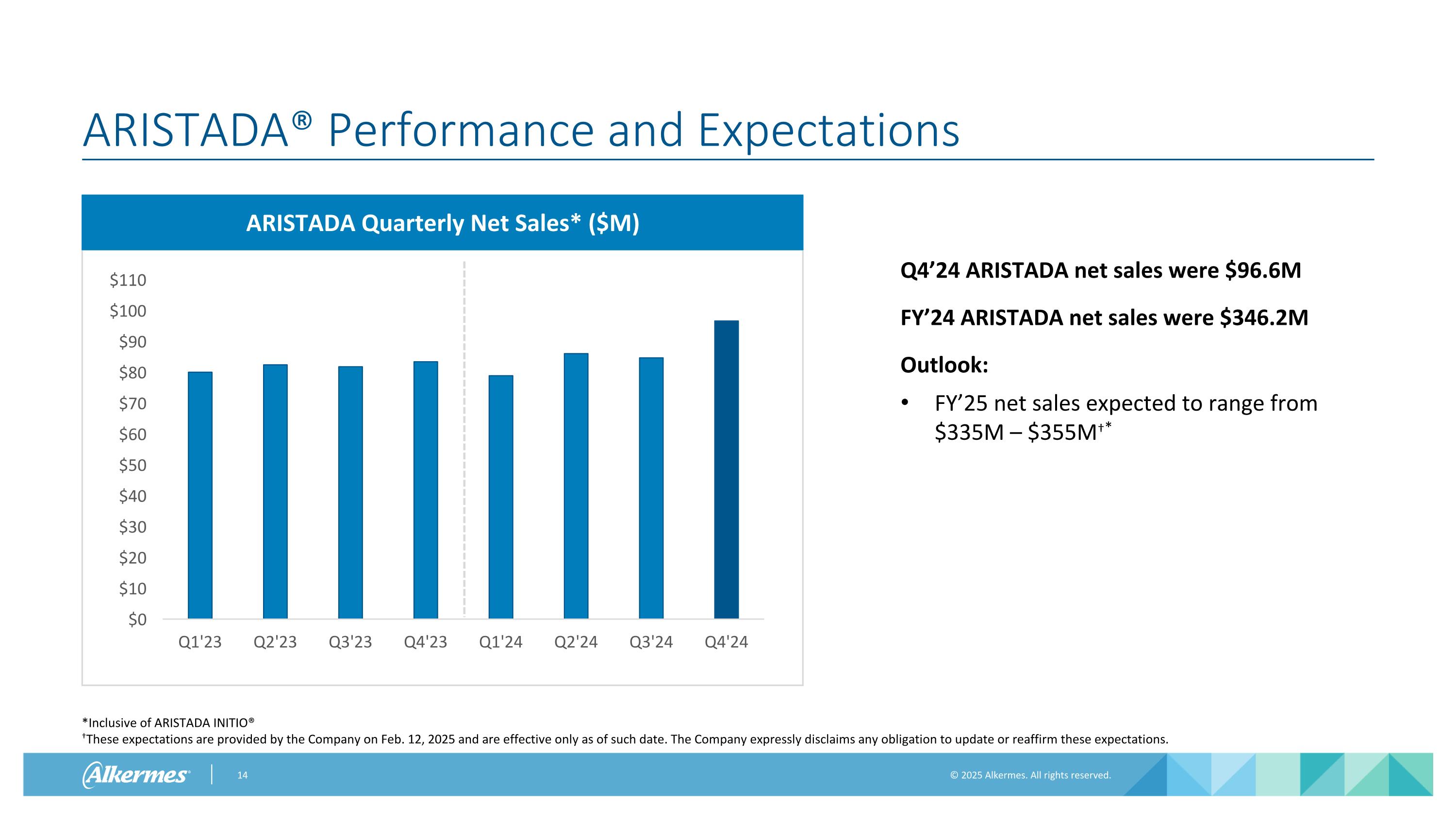

ARISTADA® Performance and Expectations ARISTADA Quarterly Net Sales* ($M) Q4’24 ARISTADA net sales were $96.6M FY’24 ARISTADA net sales were $346.2M Outlook: FY’25 net sales expected to range from $335M – $355M†* *Inclusive of ARISTADA INITIO® †These expectations are provided by the Company on Feb. 12, 2025 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations.

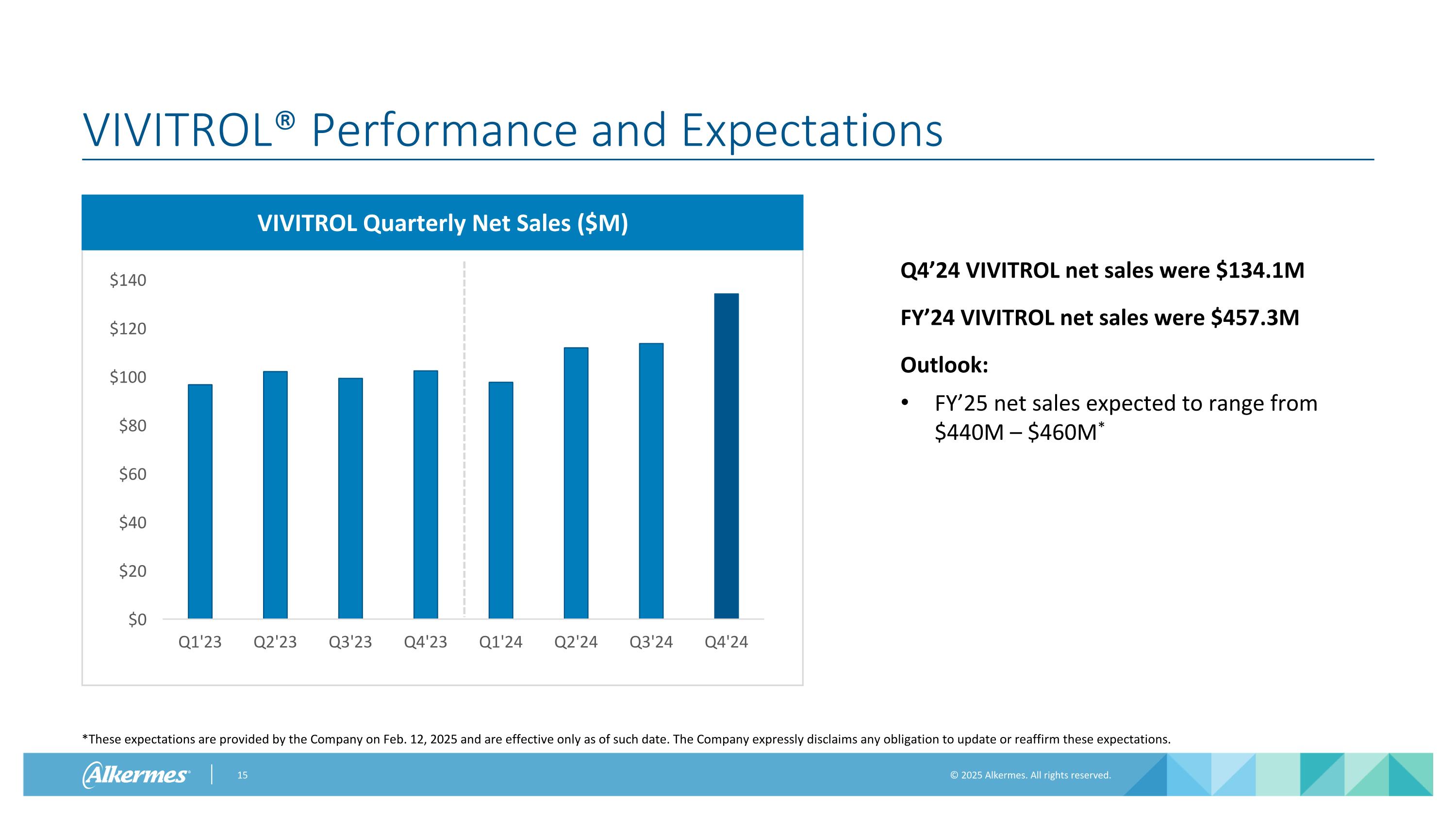

VIVITROL® Performance and Expectations VIVITROL Quarterly Net Sales ($M) *These expectations are provided by the Company on Feb. 12, 2025 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations. Q4’24 VIVITROL net sales were $134.1M FY’24 VIVITROL net sales were $457.3M Outlook: FY’25 net sales expected to range from $440M – $460M*

Appendix

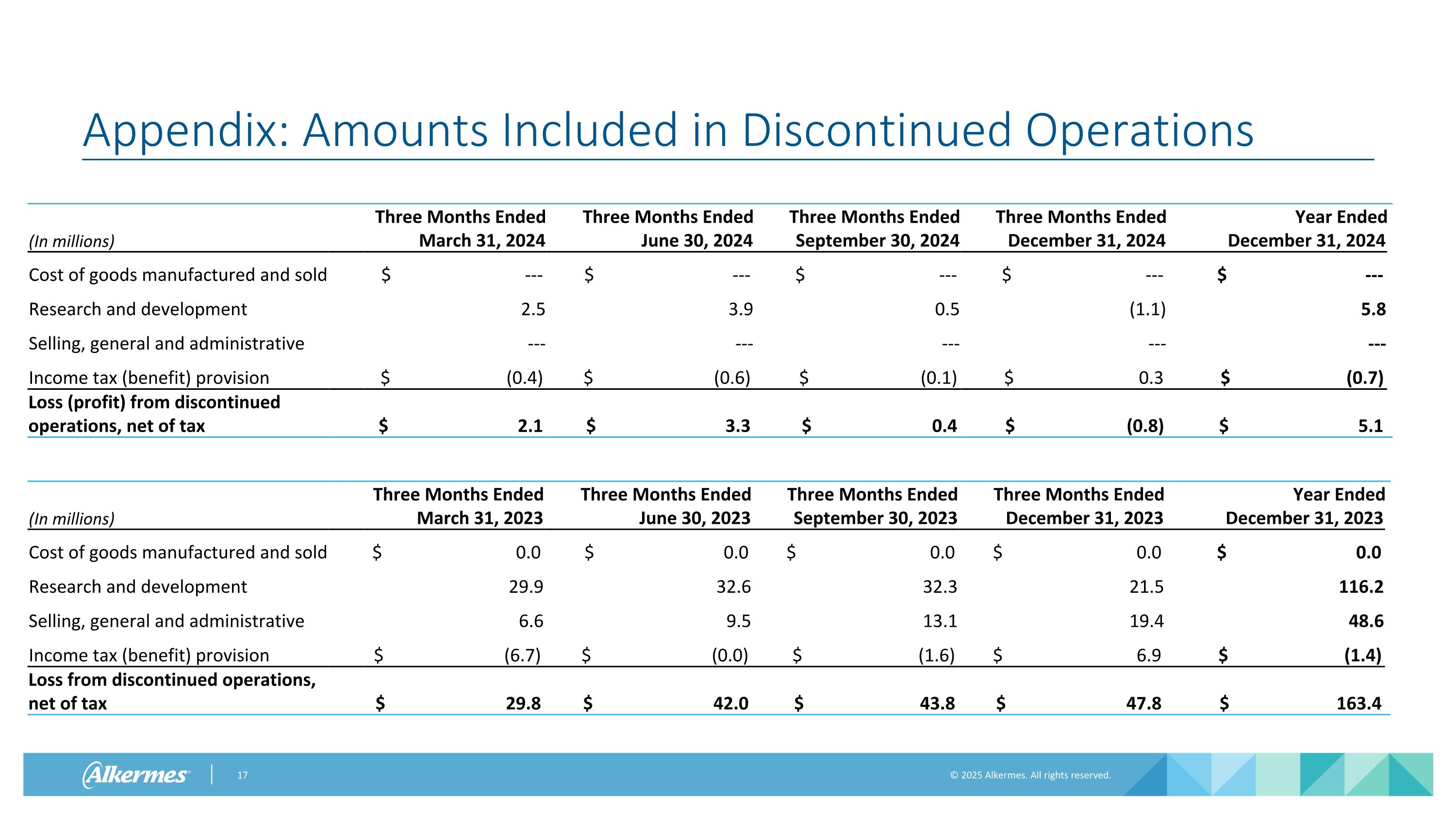

Appendix: Amounts Included in Discontinued Operations (In millions) Year Ended December 31, 2023 Three Months Ended March 31, 2024 Three Months Ended June 30, 2024 Three Months Ended September 30, 2024 Three Months Ended December 31, 2024 Year Ended December 31, 2024 Cost of goods manufactured and sold $ --- $ --- $ --- $ --- $ --- Research and development 2.5 3.9 0.5 (1.1) 5.8 Selling, general and administrative --- --- --- --- --- Income tax (benefit) provision $ (0.4) $ (0.6) $ (0.1) $ 0.3 $ (0.7) Loss (profit) from discontinued operations, net of tax $ 2.1 $ 3.3 $ 0.4 $ (0.8) $ 5.1 (In millions) Year Ended December 31, 2023 Three Months Ended March 31, 2023 Three Months Ended June 30, 2023 Three Months Ended September 30, 2023 Three Months Ended December 31, 2023 Year Ended December 31, 2023 Cost of goods manufactured and sold $ 0.0 $ 0.0 $ 0.0 $ 0.0 $ 0.0 Research and development 29.9 32.6 32.3 21.5 116.2 Selling, general and administrative 6.6 9.5 13.1 19.4 48.6 Income tax (benefit) provision $ (6.7) $ (0.0) $ (1.6) $ 6.9 $ (1.4) Loss from discontinued operations, net of tax $ 29.8 $ 42.0 $ 43.8 $ 47.8 $ 163.4

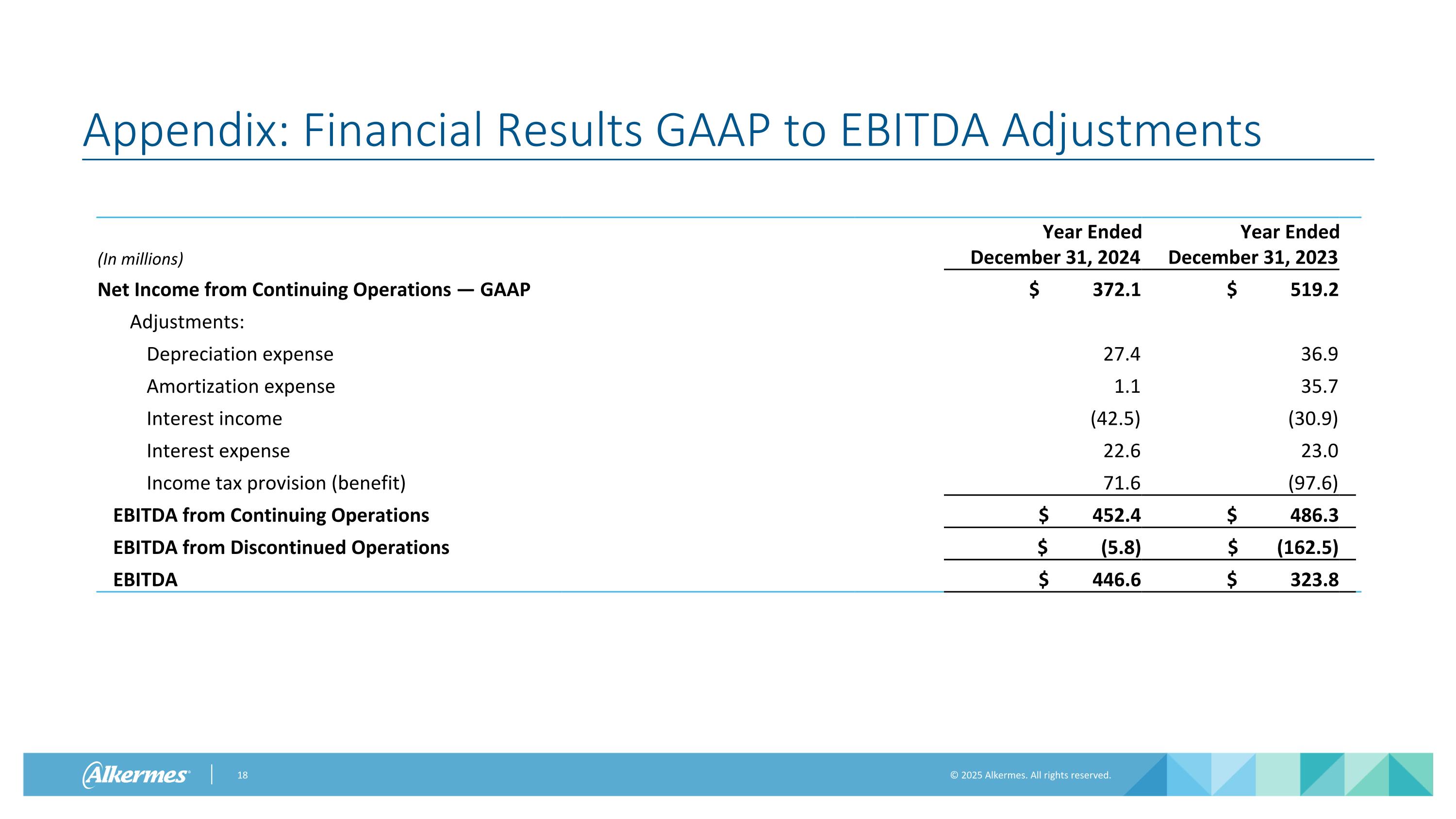

Appendix: Financial Results GAAP to EBITDA Adjustments (In millions) Year Ended December 31, 2024 Year Ended December 31, 2023 Net Income from Continuing Operations — GAAP $ 372.1 $ 519.2 Adjustments: Depreciation expense 27.4 36.9 Amortization expense 1.1 35.7 Interest income (42.5) (30.9) Interest expense 22.6 23.0 Income tax provision (benefit) 71.6 (97.6) EBITDA from Continuing Operations $ 452.4 $ 486.3 EBITDA from Discontinued Operations $ (5.8) $ (162.5) EBITDA $ 446.6 $ 323.8

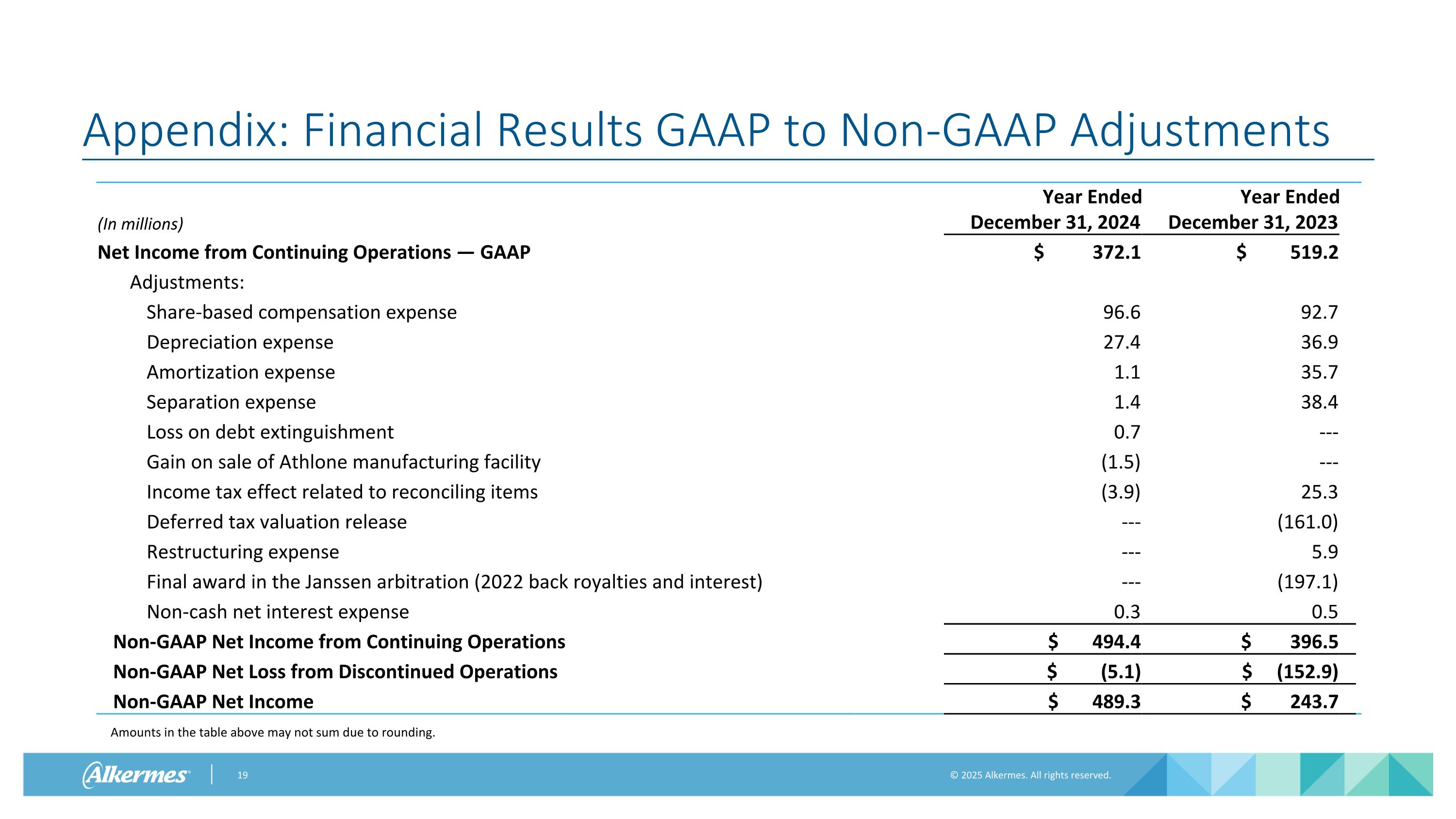

Appendix: Financial Results GAAP to Non-GAAP Adjustments (In millions) Year Ended December 31, 2024 Year Ended December 31, 2023 Net Income from Continuing Operations — GAAP $ 372.1 $ 519.2 Adjustments: Share-based compensation expense 96.6 92.7 Depreciation expense 27.4 36.9 Amortization expense 1.1 35.7 Separation expense 1.4 38.4 Loss on debt extinguishment 0.7 --- Gain on sale of Athlone manufacturing facility (1.5) --- Income tax effect related to reconciling items (3.9) 25.3 Deferred tax valuation release --- (161.0) Restructuring expense --- 5.9 Final award in the Janssen arbitration (2022 back royalties and interest) --- (197.1) Non-cash net interest expense 0.3 0.5 Non-GAAP Net Income from Continuing Operations $ 494.4 $ 396.5 Non-GAAP Net Loss from Discontinued Operations $ (5.1) $ (152.9) Non-GAAP Net Income $ 489.3 $ 243.7 Amounts in the table above may not sum due to rounding.

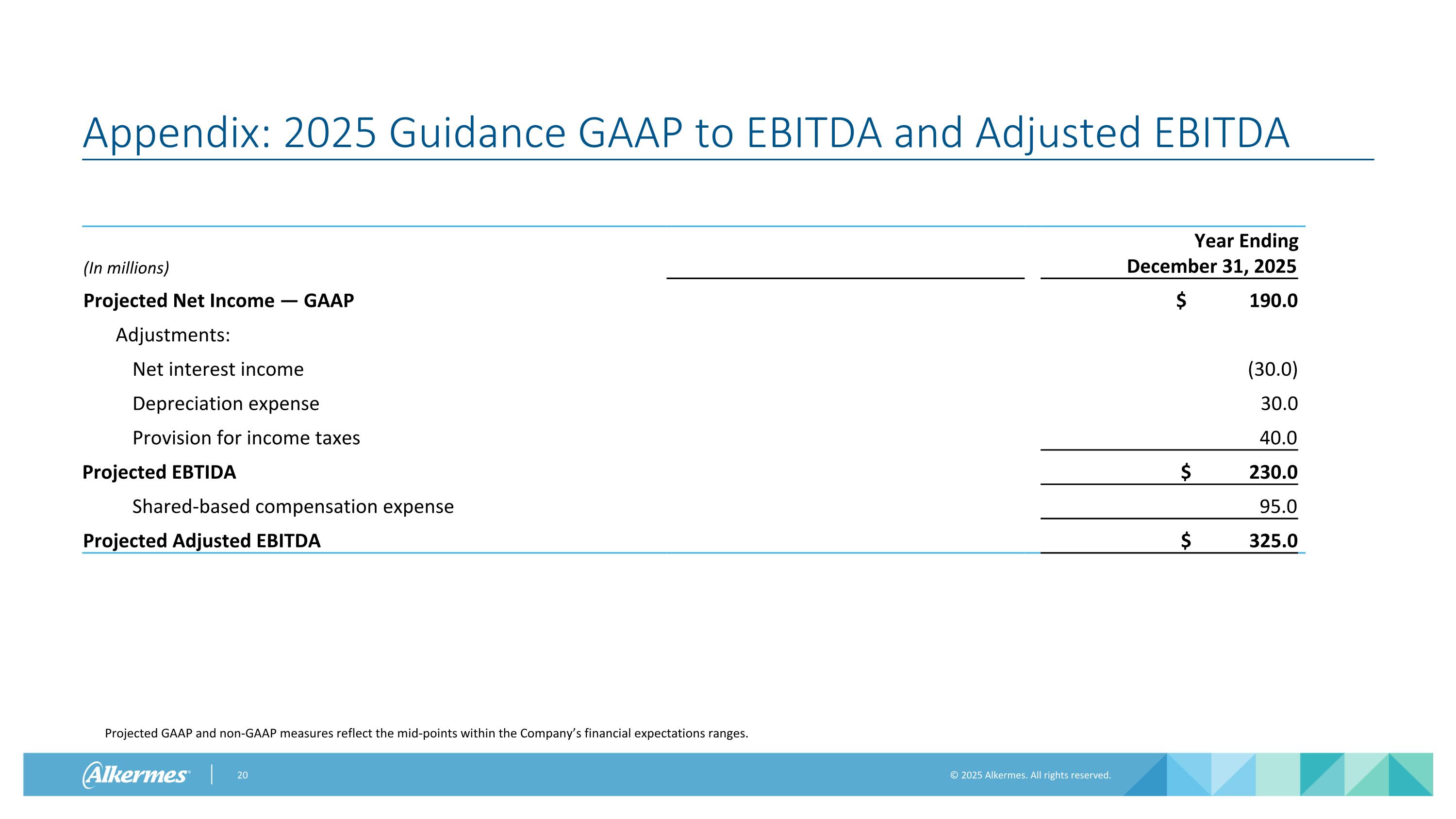

Appendix: 2025 Guidance GAAP to EBITDA and Adjusted EBITDA Projected GAAP and non-GAAP measures reflect the mid-points within the Company’s financial expectations ranges. (In millions) Year Ended December 31, 2023 Year Ending December 31, 2025 Projected Net Income — GAAP $ 190.0 Adjustments: Net interest income (30.0) Depreciation expense 30.0 Provision for income taxes 40.0 Projected EBTIDA $ 230.0 Shared-based compensation expense 95.0 Projected Adjusted EBITDA $ 325.0

www.alkermes.com