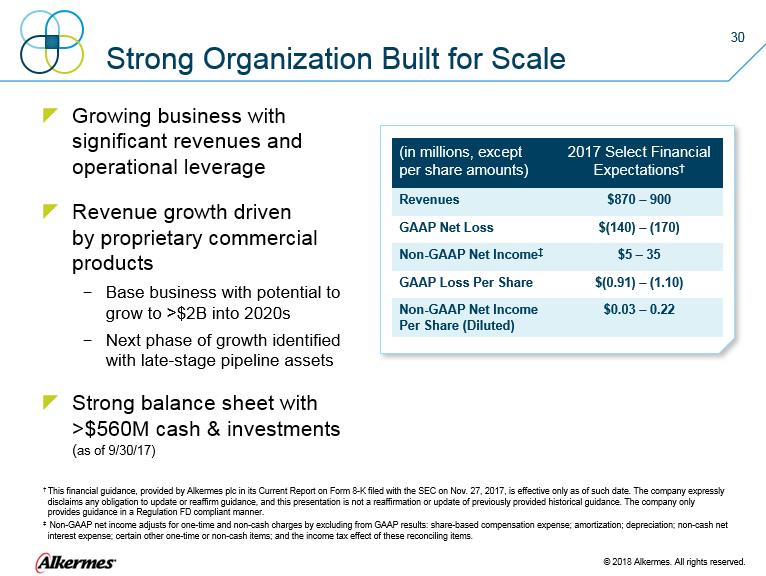

| 2 Forward-Looking Statements and Non-GAAP Financial Information Certain statements in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning future financial and operating performance, business plans or prospects of the company; the continued growth of the long-acting injectable antipsychotic market and the company’s commercial products; improvements to and modernization of the treatment ecosystem for opioid dependence; the timing, funding, results and feasibility of product development activities; whether the studies conducted for ALKS 5461, ALKS 3831 and ALKS 8700 will meet FDA’s requirements for approval and the company’s expectations and timelines for regulatory action by the FDA relating to the NDA submissions for ALNCD and ALKS 5461; the potential financial benefits that may be achieved under the license and collaboration agreement between the company and Biogen; and the therapeutic value and commercial potential, including blockbuster status, of the company’s products. Although the company believes that such forward-looking statements are based on reasonable assumptions within the bounds of its knowledge of its business and operations, the forward-looking statements are neither promises nor guarantees and they are necessarily subject to a high degree of uncertainty and risk. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to risks, assumptions and uncertainties. You are cautioned not to place undue reliance on the forward-looking statements contained herein. The factors that could cause actual results to differ are discussed in the Alkermes plc Annual Report on Form 10-K for the year ended Dec. 31, 2016 and Quarterly Reports on Form 10-Q for the quarters ended Mar. 31, 2017 and Sept. 30, 2017, under the heading “Item 1A. Risk Factors”, and in other subsequent filings made by the company with the U.S. Securities and Exchange Commission (SEC), which are available on the SEC's website at www.sec.gov and on the company’s website at www.alkermes.com in the “Investors—SEC filings” section. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, the company disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this presentation. Non-GAAP Financial Measures This presentation includes information about certain financial measures that are not prepared in accordance with generally accepted accounting principles in the U.S. (GAAP), including non-GAAP net income and non-GAAP net income per share. These non-GAAP measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similar measures presented by other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found in the Alkermes plc Current Reports on Form 8-K filed with the SEC on Oct. 26, 2017 and Nov. 27, 2017. Note Regarding Trademarks The company is the owner of various U.S. federal trademark registrations (®) and other trademarks (TM), including ARISTADA® and VIVITROL®. Any other trademarks referred to in this presentation are the property of their respective owners. Appearances of such other trademarks herein should not be construed as any indicator that their respective owners will not assert their rights thereto. © 2018 Alkermes. All rights reserved. Alkermes* |