First Quarter 2022 Financial Results & Business Update April 27, 2022 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Information Certain statements set forth in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: Alkermes plc’s (the “Company”) expectations with respect to its future financial, commercial and operating performance, business plans or prospects, including the Company’s expectations of improvement in COVID-19 pandemic-related disruptions beginning in the second quarter of 2022; the potential therapeutic and commercial value of the Company’s marketed and development products; and the Company’s plans to execute on its 2022 strategic priorities, including with regard to its commercial portfolio, its development pipeline, and its financial expectations and long-term profitability targets. The Company cautions that forward-looking statements are inherently uncertain. The forward-looking statements contained in this presentation are neither promises nor guarantees and they are necessarily subject to a high degree of uncertainty and risk. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to various risks, assumptions and uncertainties. These risks, assumptions and uncertainties include, among others: the Company may not be able to achieve its targeted financial and profitability metrics in a timely manner or at all; the impacts of the ongoing COVID-19 pandemic and continued efforts to mitigate its spread on the Company’s business, results of operations or financial condition; the unfavorable outcome of arbitration or litigation, including the arbitration proceedings with Janssen Pharmaceutica N.V. (“Janssen”) and so-called “Paragraph IV” litigation or other patent litigation which may lead to competition from generic drug manufacturers, or other disputes related to the Company’s products or products using the Company’s proprietary technologies; clinical development activities may not be completed on time or at all; the results of the Company’s development activities may not be positive, or predictive of final results from such activities, results of future development activities or real-world results; the U.S. Food and Drug Administration (“FDA”) or other regulatory authorities may not agree with the Company’s regulatory approval strategies or components of the Company’s marketing applications and may make adverse decisions regarding the Company’s products; the Company and its licensees may not be able to continue to successfully commercialize their products; there may be a reduction in payment rate or reimbursement for the Company’s products or an increase in the Company’s financial obligations to government payers; the Company’s products may prove difficult to manufacture, be precluded from commercialization by the proprietary rights of third parties, or have unintended side effects, adverse reactions or incidents of misuse; and those risks, assumptions and uncertainties described under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended Dec. 31, 2021 and in subsequent filings made by the Company with the U.S. Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov, and on the Company’s website at www.alkermes.com in the ‘Investors – SEC filings’ section. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, the Company disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this presentation. Non-GAAP Financial Measures: This presentation includes information about certain financial measures that are not prepared in accordance with generally accepted accounting principles in the U.S. (GAAP), including non-GAAP net income (loss) and non-GAAP loss per share. The Company provides these non-GAAP financial measures of the Company’s performance to investors because management believes that these non-GAAP financial measures, when viewed with the Company’s results under GAAP and the accompanying reconciliations, are useful in identifying underlying trends in ongoing operations. These non-GAAP measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similar measures presented by other companies. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, to the extent reasonably determinable, can be found in the Appendix of this presentation. Note Regarding Trademarks: The Company and its affiliates are the owners of various U.S. federal trademark registrations (®) and other trademarks (TM), including ARISTADA®, ARISTADA INITIO® , LYBALVI® and VIVITROL®. Any other trademarks referred to in this presentation are the property of their respective owners. Appearances of such other trademarks herein should not be construed as any indicator that their respective owners will not assert their rights thereto.

Agenda Introduction Sandy Coombs, SVP, Investor Relations & Corporate Affairs Q1 2022 Financial Results Iain Brown, Chief Financial Officer Q1 2022 Commercial Review Todd Nichols, Chief Commercial Officer Business and R&D Pipeline Update Richard Pops, Chief Executive Officer

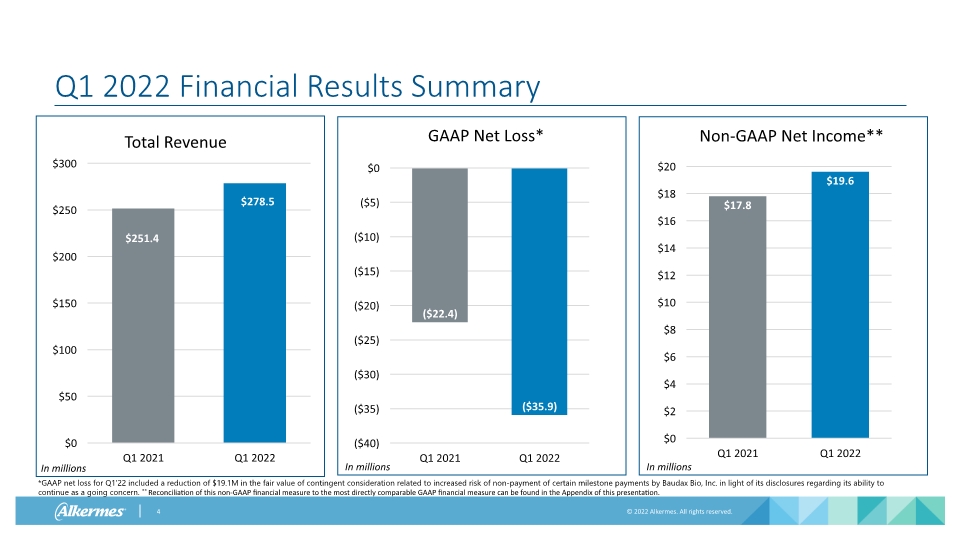

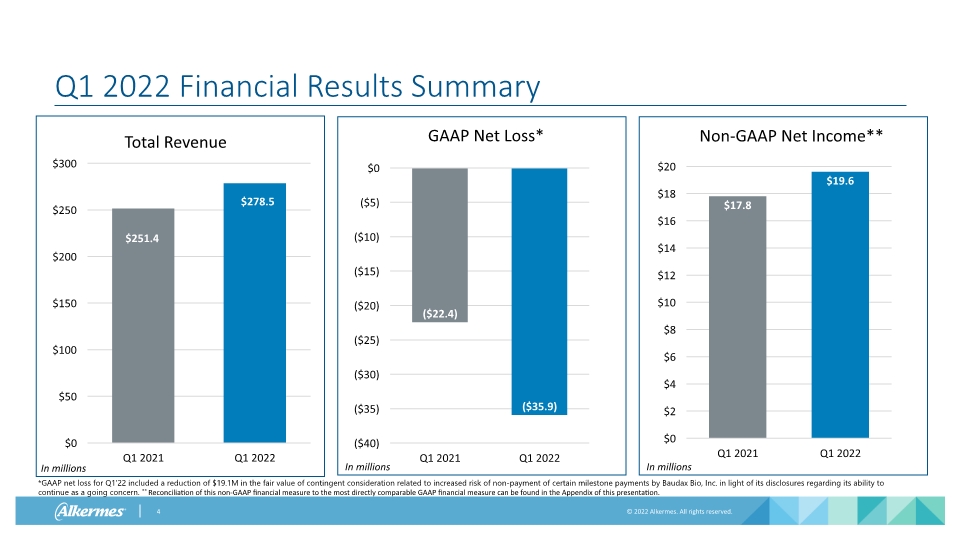

In millions In millions In millions Q1 2022 Financial Results Summary *GAAP net loss for Q1’22 included a reduction of $19.1M in the fair value of contingent consideration related to increased risk of non-payment of certain milestone payments by Baudax Bio, Inc. in light of its disclosures regarding its ability to continue as a going concern. ** Reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure can be found in the Appendix of this presentation.

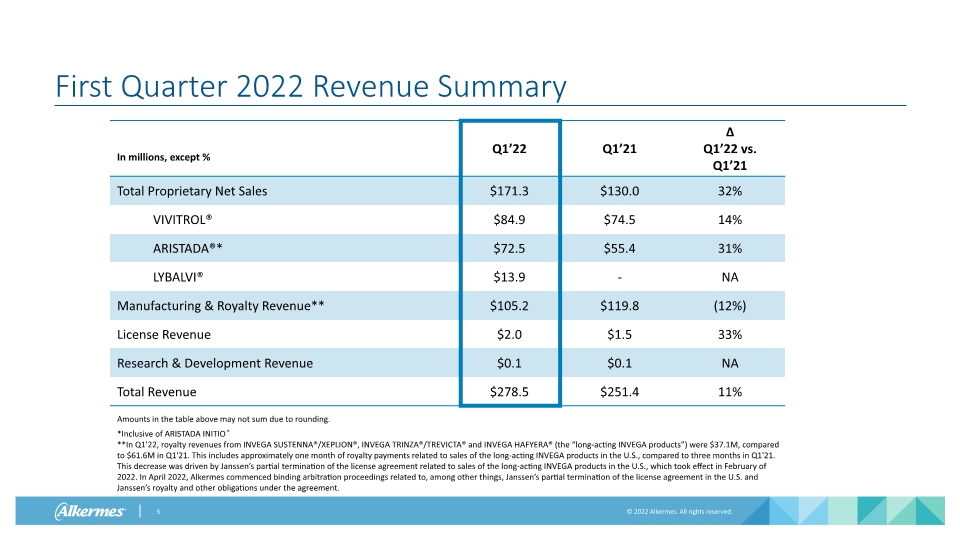

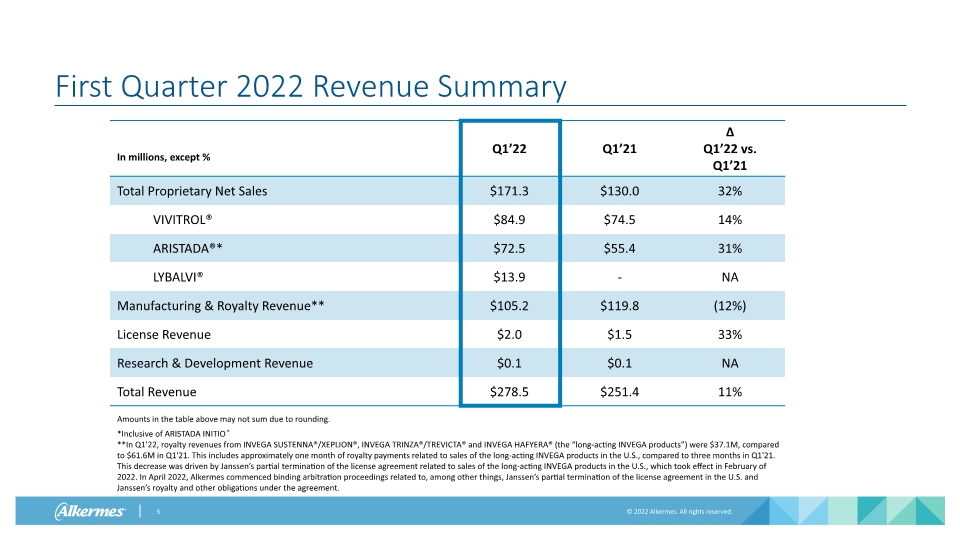

First Quarter 2022 Revenue Summary Amounts in the table above may not sum due to rounding. *Inclusive of ARISTADA INITIO® **In Q1'22, royalty revenues from INVEGA SUSTENNA®/XEPLION®, INVEGA TRINZA®/TREVICTA® and INVEGA HAFYERA® (the “long-acting INVEGA products”) were $37.1M, compared to $61.6M in Q1'21. This includes approximately one month of royalty payments related to sales of the long-acting INVEGA products in the U.S., compared to three months in Q1'21. This decrease was driven by Janssen’s partial termination of the license agreement related to sales of the long-acting INVEGA products in the U.S., which took effect in February of 2022. In April 2022, Alkermes commenced binding arbitration proceedings related to, among other things, Janssen’s partial termination of the license agreement in the U.S. and Janssen’s royalty and other obligations under the agreement.

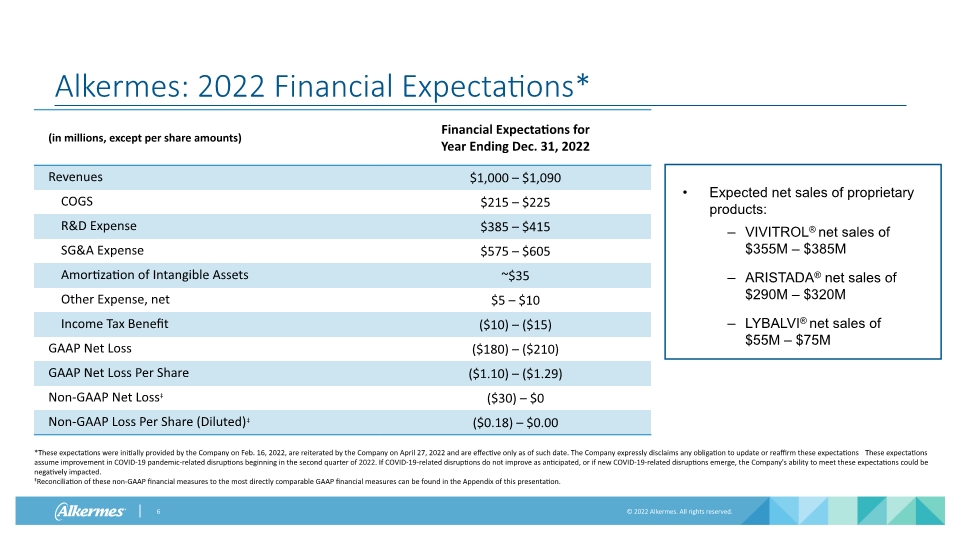

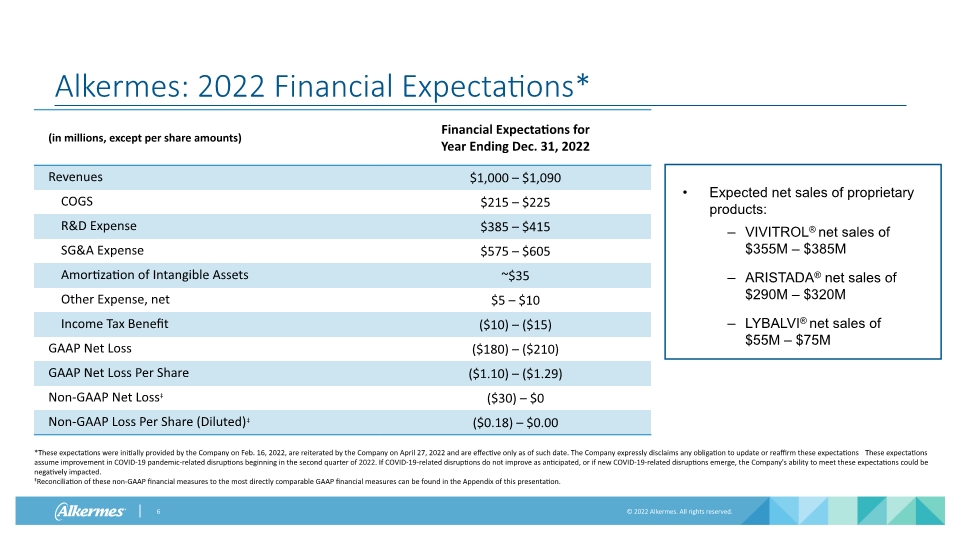

Alkermes: 2022 Financial Expectations* *These expectations were initially provided by the Company on Feb. 16, 2022, are reiterated by the Company on April 27, 2022 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations These expectations assume improvement in COVID-19 pandemic-related disruptions beginning in the second quarter of 2022. If COVID-19-related disruptions do not improve as anticipated, or if new COVID-19-related disruptions emerge, the Company's ability to meet these expectations could be negatively impacted. ‡Reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found in the Appendix of this presentation. Expected net sales of proprietary products: VIVITROL® net sales of $355M – $385M ARISTADA® net sales of $290M – $320M LYBALVI® net sales of $55M – $75M

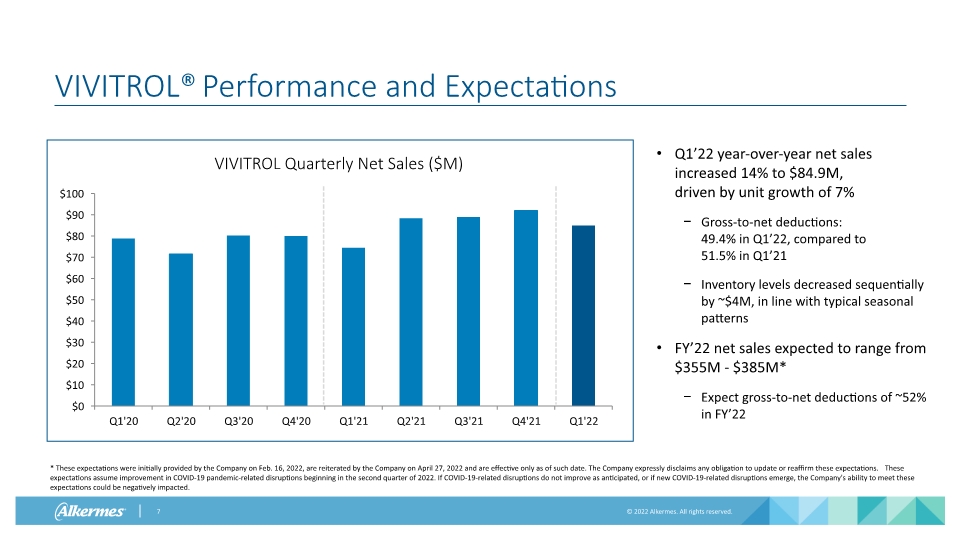

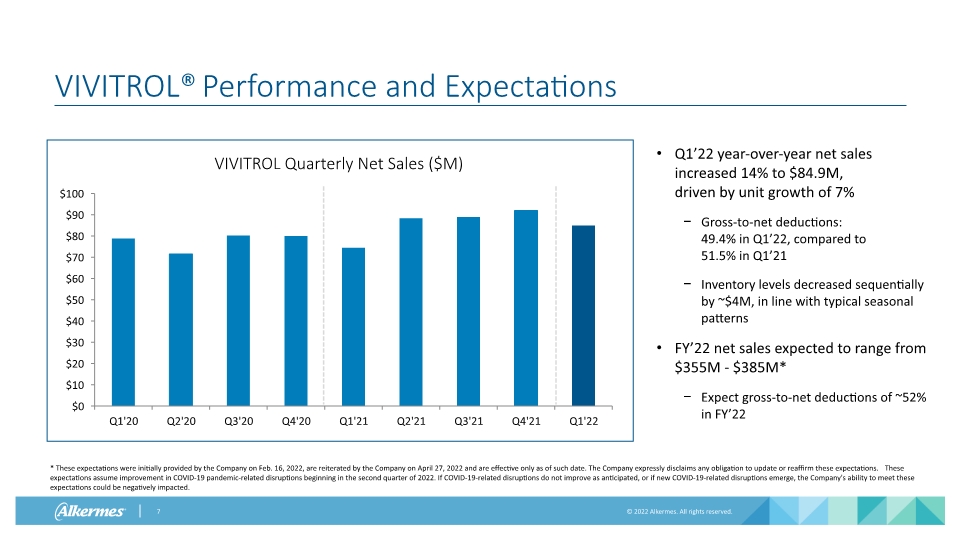

VIVITROL® Performance and Expectations Q1’22 year-over-year net sales increased 14% to $84.9M, driven by unit growth of 7% Gross-to-net deductions: 49.4% in Q1’22, compared to 51.5% in Q1’21 Inventory levels decreased sequentially by ~$4M, in line with typical seasonal patterns FY’22 net sales expected to range from $355M - $385M* Expect gross-to-net deductions of ~52% in FY’22 VIVITROL Quarterly Net Sales ($M) * These expectations were initially provided by the Company on Feb. 16, 2022, are reiterated by the Company on April 27, 2022 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations. These expectations assume improvement in COVID-19 pandemic-related disruptions beginning in the second quarter of 2022. If COVID-19-related disruptions do not improve as anticipated, or if new COVID-19-related disruptions emerge, the Company's ability to meet these expectations could be negatively impacted.

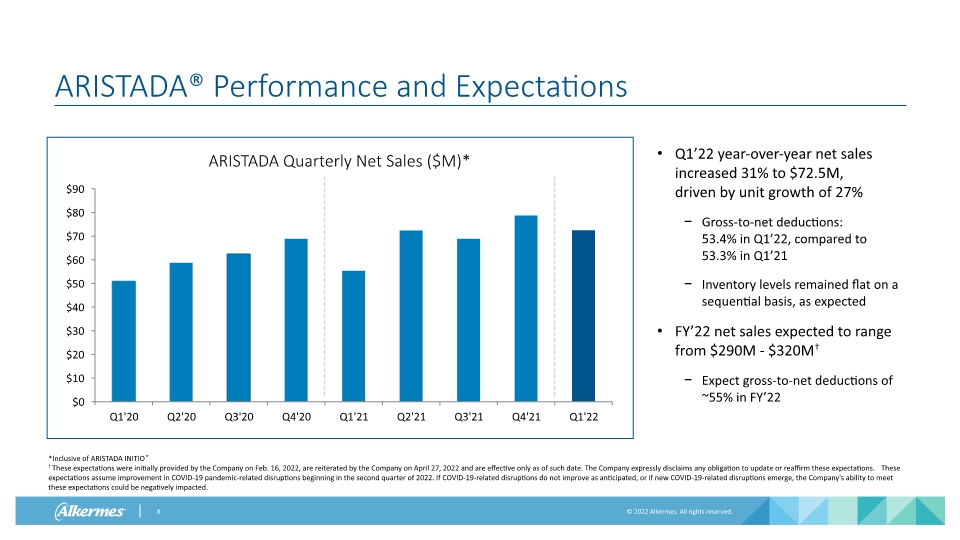

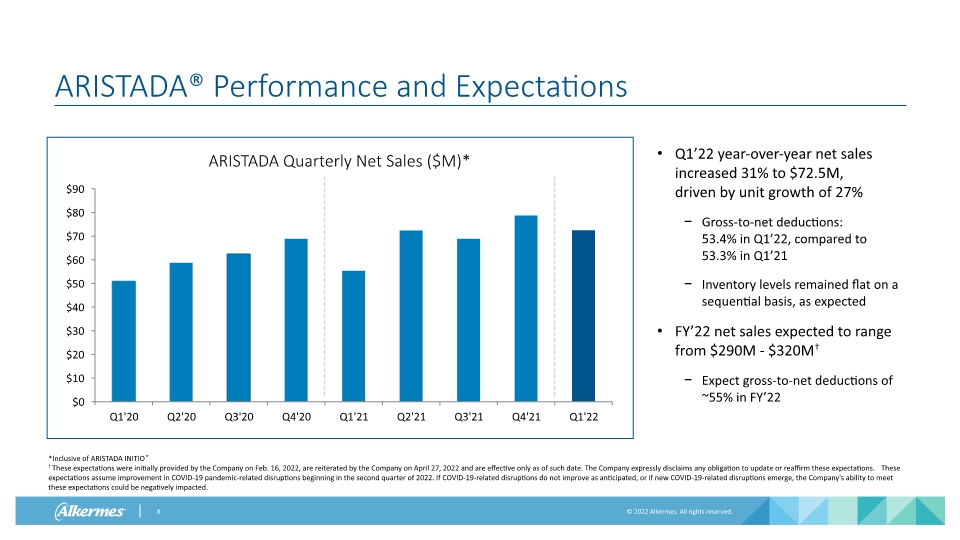

ARISTADA® Performance and Expectations Q1’22 year-over-year net sales increased 31% to $72.5M, driven by unit growth of 27% Gross-to-net deductions: 53.4% in Q1’22, compared to 53.3% in Q1’21 Inventory levels remained flat on a sequential basis, as expected FY’22 net sales expected to range from $290M - $320M† Expect gross-to-net deductions of ~55% in FY’22 ARISTADA Quarterly Net Sales ($M)* *Inclusive of ARISTADA INITIO® † These expectations were initially provided by the Company on Feb. 16, 2022, are reiterated by the Company on April 27, 2022 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations. These expectations assume improvement in COVID-19 pandemic-related disruptions beginning in the second quarter of 2022. If COVID-19-related disruptions do not improve as anticipated, or if new COVID-19-related disruptions emerge, the Company's ability to meet these expectations could be negatively impacted.

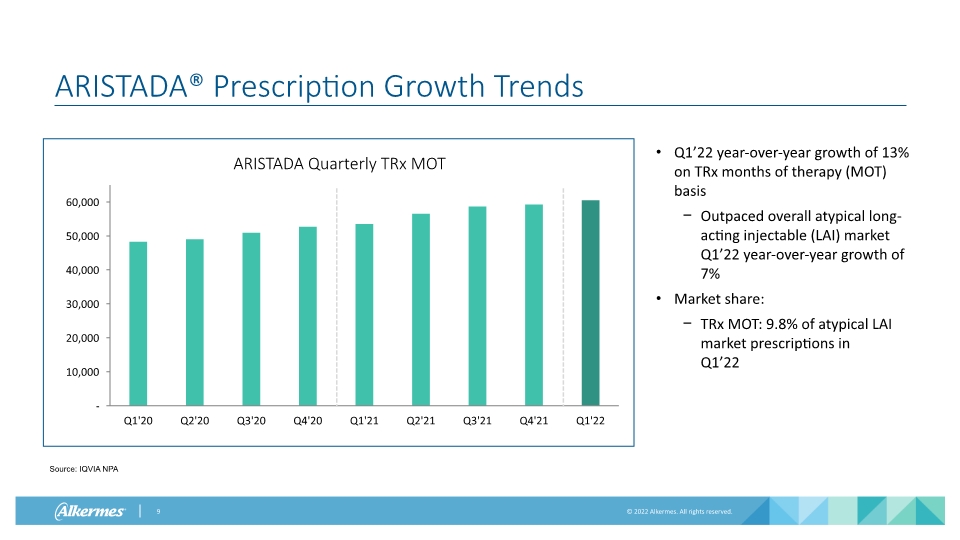

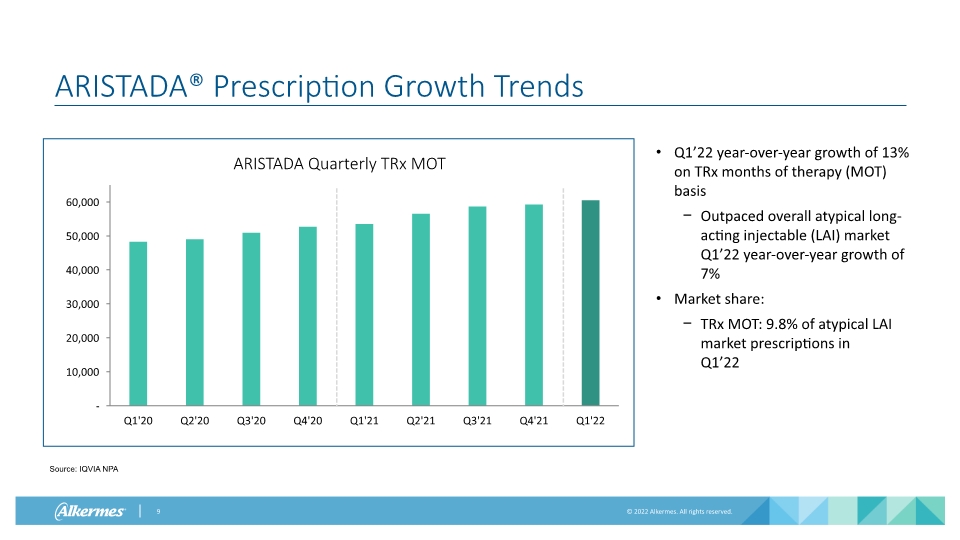

ARISTADA® Prescription Growth Trends Q1’22 year-over-year growth of 13% on TRx months of therapy (MOT) basis Outpaced overall atypical long-acting injectable (LAI) market Q1’22 year-over-year growth of 7% Market share: TRx MOT: 9.8% of atypical LAI market prescriptions in Q1’22 ARISTADA Quarterly TRx MOT Source: IQVIA NPA

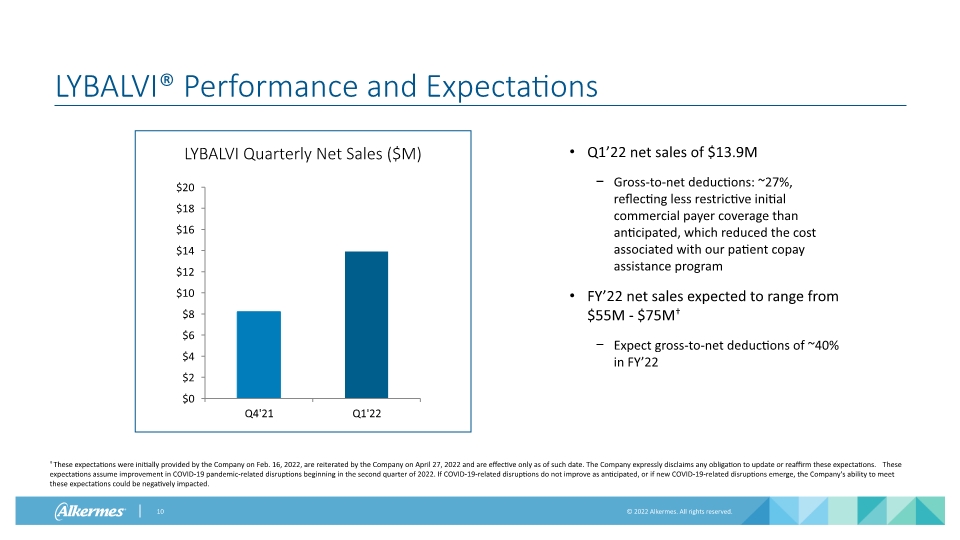

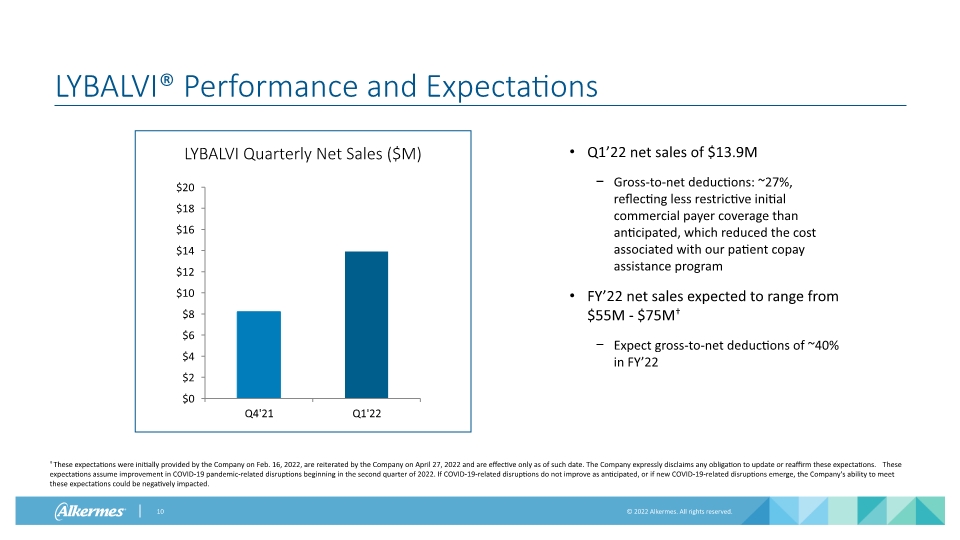

LYBALVI® Performance and Expectations LYBALVI Quarterly Net Sales ($M) † These expectations were initially provided by the Company on Feb. 16, 2022, are reiterated by the Company on April 27, 2022 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations. These expectations assume improvement in COVID-19 pandemic-related disruptions beginning in the second quarter of 2022. If COVID-19-related disruptions do not improve as anticipated, or if new COVID-19-related disruptions emerge, the Company's ability to meet these expectations could be negatively impacted. Q1’22 net sales of $13.9M Gross-to-net deductions: ~27%, reflecting less restrictive initial commercial payer coverage than anticipated, which reduced the cost associated with our patient copay assistance program FY’22 net sales expected to range from $55M - $75M† Expect gross-to-net deductions of ~40% in FY’22

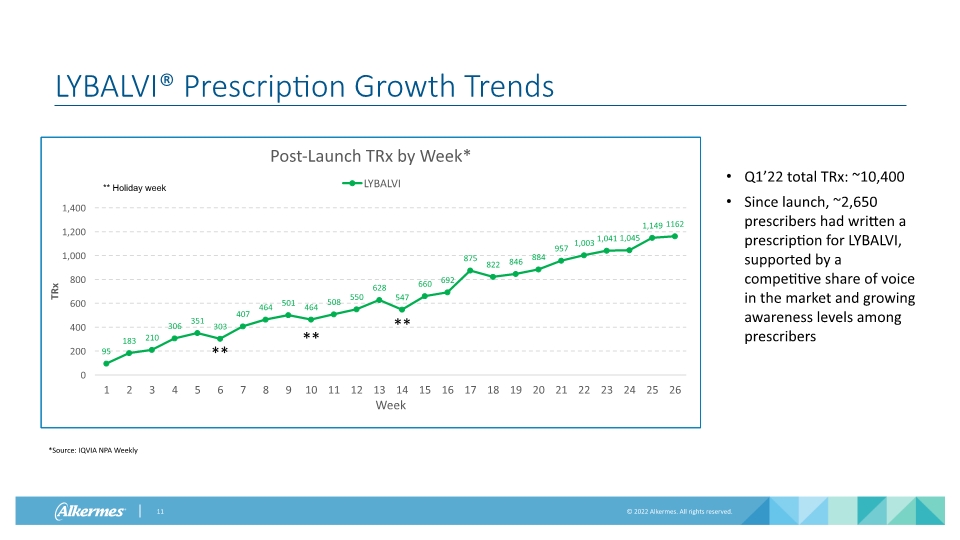

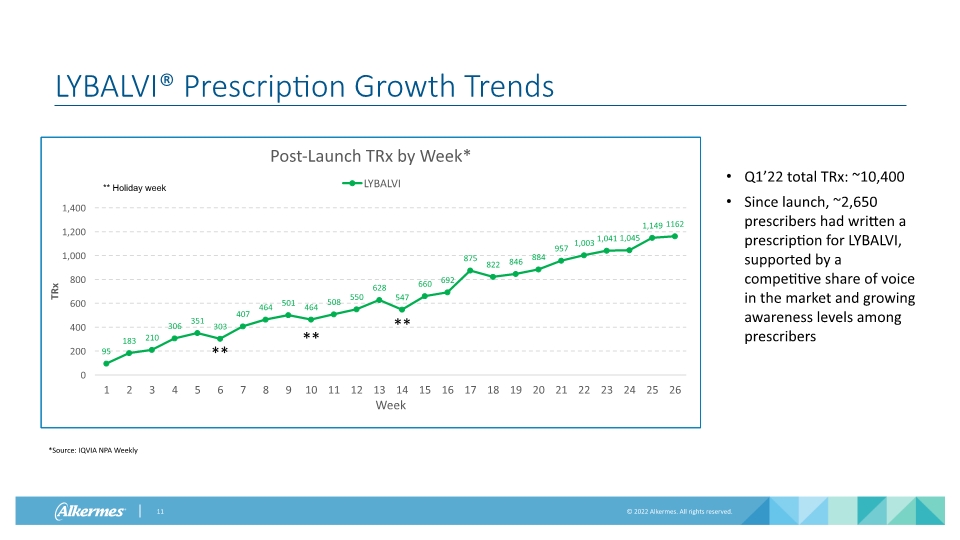

LYBALVI® Prescription Growth Trends *Source: IQVIA NPA Weekly ** ** ** ** Holiday week Q1’22 total TRx: ~10,400 Since launch, ~2,650 prescribers had written a prescription for LYBALVI, supported by a competitive share of voice in the market and growing awareness levels among prescribers

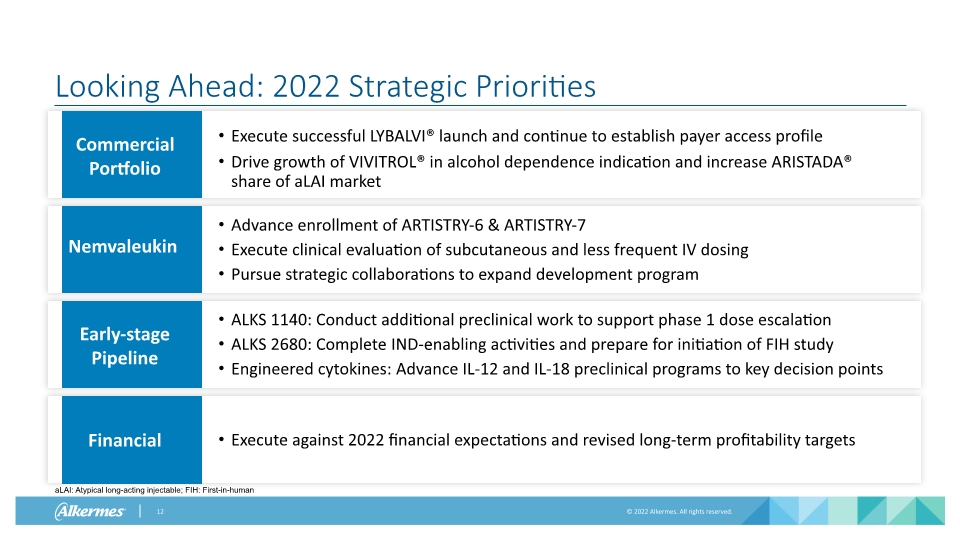

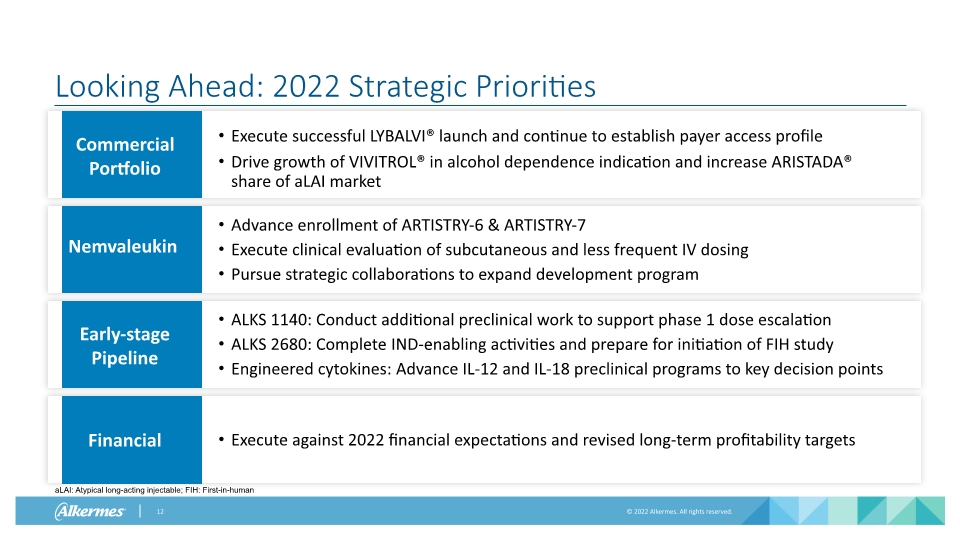

Looking Ahead: 2022 Strategic Priorities Execute successful LYBALVI® launch and continue to establish payer access profile Drive growth of VIVITROL® in alcohol dependence indication and increase ARISTADA® share of aLAI market Commercial Portfolio Nemvaleukin Early-stage Pipeline Financial Advance enrollment of ARTISTRY-6 & ARTISTRY-7 Execute clinical evaluation of subcutaneous and less frequent IV dosing Pursue strategic collaborations to expand development program ALKS 1140: Conduct additional preclinical work to support phase 1 dose escalation ALKS 2680: Complete IND-enabling activities and prepare for initiation of FIH study Engineered cytokines: Advance IL-12 and IL-18 preclinical programs to key decision points Execute against 2022 financial expectations and revised long-term profitability targets aLAI: Atypical long-acting injectable; FIH: First-in-human

Appendix Confidential, Internal Use Only

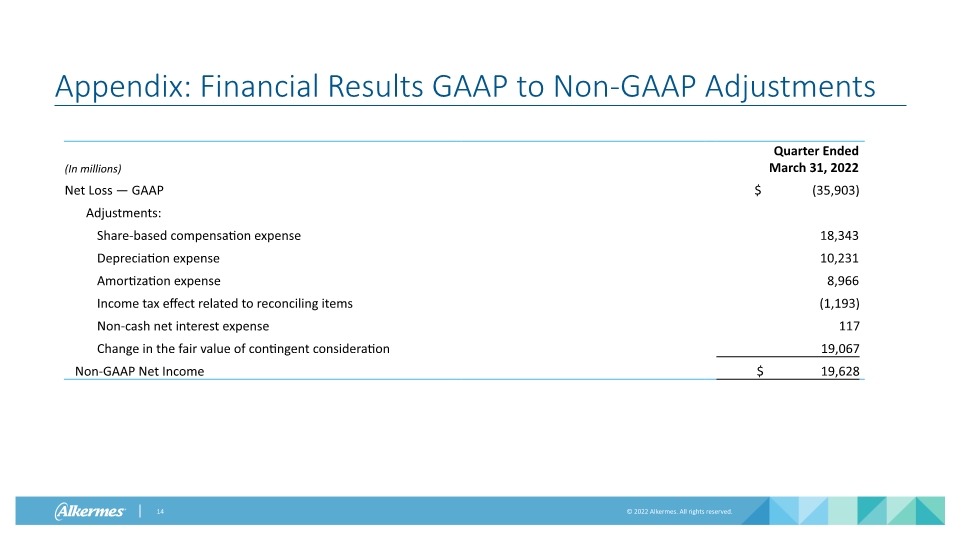

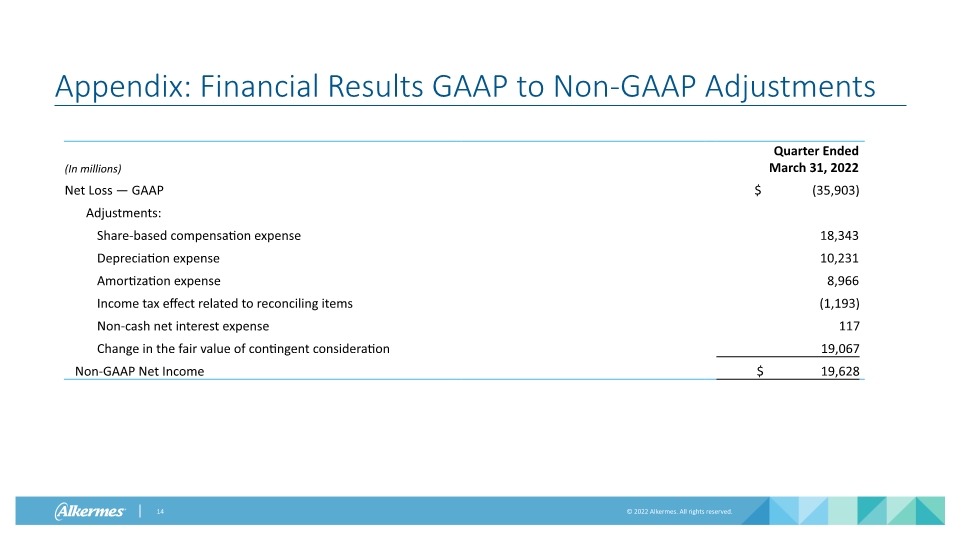

Appendix: Financial Results GAAP to Non-GAAP Adjustments

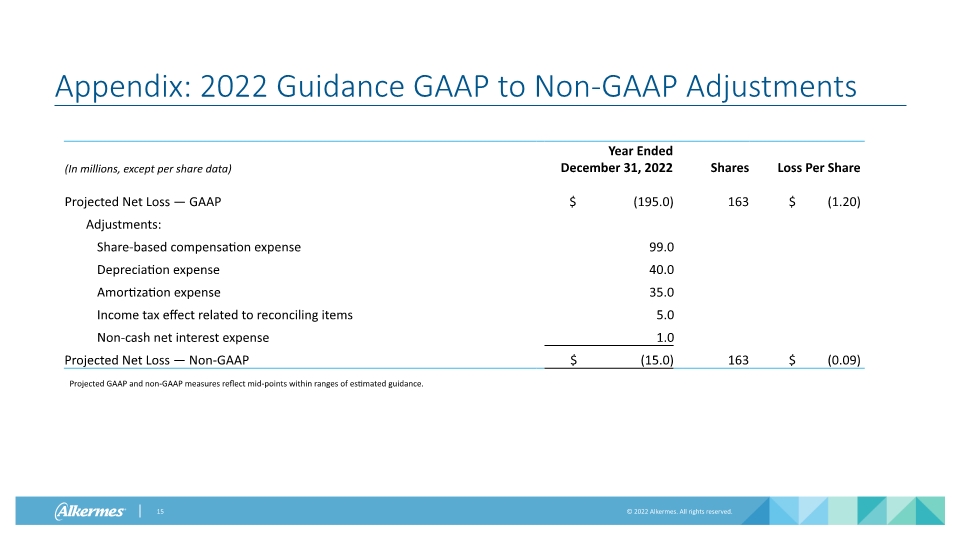

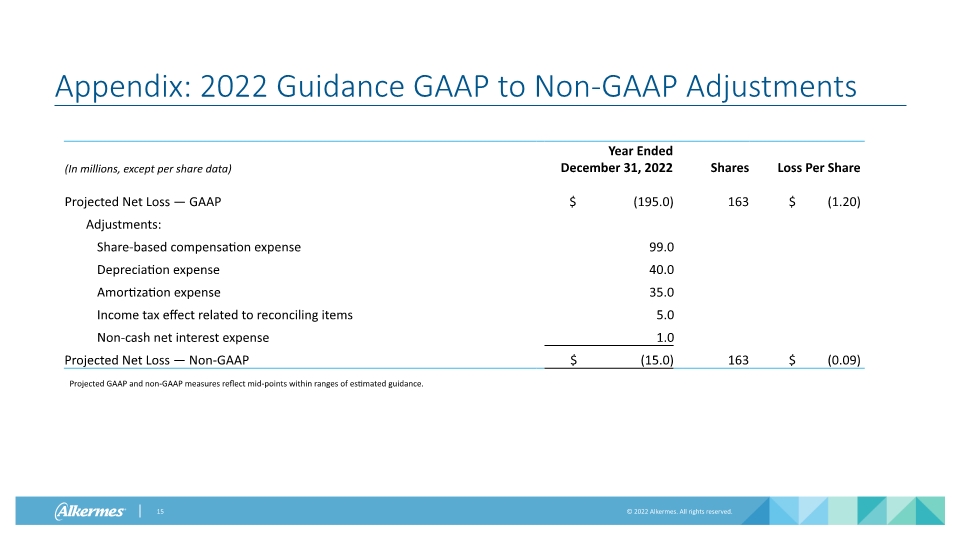

Appendix: 2022 Guidance GAAP to Non-GAAP Adjustments Projected GAAP and non-GAAP measures reflect mid-points within ranges of estimated guidance.

www.alkermes.com