Filed Pursuant to Rule 424(b)(2)

Registration No. 333-249370

PROSPECTUS SUPPLEMENT

(To prospectus dated October 7, 2020)

Ordinary Participation Certificates

in the form of American Depositary Shares

We are offering 134,000,000 Series A shares of common stock of Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (Volaris Aviation Holding Company) in an international offering of our Ordinary Participation Certificates (Certificados de Participación Ordinarios), or CPOs, in the form of American Depositary Shares, or ADSs, in the United States and other countries outside of Mexico. The CPOs have been issued by Nacional Financiera, Sociedad Nacional de Crédito, Institución de Banca de Desarrollo, or the CPO trustee. Each ADS represents ten CPOs and each CPO represents a financial interest in one Series A share. The CPOs do not grant voting rights and consequently the ADSs do not grant voting rights.

The ADSs are listed on the New York Stock Exchange under the symbol “VLRS” and the Series A shares are listed on the Bolsa Mexicana de Valores, S.A.B. de C.V., or the Mexican Stock Exchange, under the symbol “VOLAR.” On December 4, 2020, the last reported closing price of the ADSs on the New York Stock Exchange was US$11.30 per ADS and the last reported closing price of the shares on the Bolsa Mexicana de Valores, S.A.B. de C.V., or the Mexican Stock Exchange, was Ps. 22.21 per share.

Neither the CPOs or ADSs may be offered or sold publicly or otherwise be the subject of any intermediation activity in Mexico. We will notify the CNBV of the terms and conditions of this offering outside of Mexico. Such notice will be submitted to the CNBV to comply with Mexican applicable law and for statistical and informational purposes only. Delivery to, or receipt by, the CNBV of such notice does not constitute or imply a certification as to the investment quality of the ADSs, the CPOSs, the Series A shares, our solvency, liquidity or credit quality or the accuracy or completeness of the information set forth in this prospectus.

The Series A shares underlying the CPOs are registered in the Mexican National Securities Registry (Registro Nacional de Valores), or RNV, maintained by the Comisión Nacional Bancaria y de Valores, or CNBV. Registration of the Series A shares is not a certification as to the investment quality of the securities, the solvency of the issuer or the accuracy or completeness of the information contained in this prospectus. The CPOs are not required to be and are not registered in the RNV.

Investing in the CPOs in the form of ADSs involves risks. See “Risk Factors” beginning on page S-18 and the “Risk Factors” section of our Annual Report on Form 20-F for the fiscal year ended December 31, 2019 (our “2019 Annual Report’’) filed on April 28, 2020 with the Securities and Exchange Commission (the “SEC”).

Price U.S.$11.25 per ADS

| | | Price to public | | | Underwriting

discounts and

commissions | | | Net proceeds to us | |

| | | (in U.S. dollars) | |

| Per ADS | | $ | 11.25 | | | $ | 0.455625 | | | $ | 10.794375 | |

| Total | | $ | 150,750,000 | | | $ | 6,105,375 | | | $ | 144,644,625 | |

We have agreed to reimburse the underwriters for certain expenses in connection with the offering. See “Underwriters.”

We have granted to the underwriters an option, exercisable for 30 days from the date of this prospectus, to purchase up to an aggregate of 20,100,000 additional CPOs in the form of ADSs at the public offering prices listed above, less underwriting discounts and commissions.

Neither the SEC, the CNBV, nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. Morgan Stanley & Co. LLC, Evercore Group L.L.C., Santander Investment Securities Inc., Citigroup Global Markets Inc. and BofA Securities, Inc. expect to deliver the CPOs, in the form of ADSs, to purchasers on or about December 11, 2020.

| | | | |

| Morgan Stanley | Evercore ISI | Santander | Citigroup |

| | | | |

| BofA Securities |

The date of this prospectus supplement is December 8, 2020.

TABLE OF CONTENTS

About This Prospectus Supplement

This document is in two parts. The first is this prospectus supplement, which describes the specific terms of this offering. The second part, the accompanying prospectus, gives more general information, some of which may not apply to this offering. This prospectus supplement also adds to, updates and changes information contained in the accompanying prospectus. If the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement. The accompanying prospectus is part of a registration statement on Form F-3 that we filed with the SEC on October 7, 2020, as amended by the first amendment to the registration statement filed on November 27, 2020, using a “shelf” registration process. Under the shelf registration process, we may sell our CPOs in the form of ADSs and rights to subscribe for CPOs in the form of ADSs that are described in the prospectus from time to time in one or more offerings.

In this prospectus supplement, we use the term:

| · | “Volaris” to refer to Controladora Vuela Compañía de Aviación, S.A.B. de C.V., |

| · | “Volaris Opco” to refer to Concesionaria Vuela Compañía de Aviación, S.A.P.I. de C.V., |

| · | “Comercializadora” to refer to Comercializadora Volaris, S.A. de C.V., |

| · | “Servicios Corporativos” to refer to Servicios Corporativos Volaris, S.A. de C.V., |

| · | “Servicios Administrativos” to refer to Servicios Administrativos Volaris, S.A. de C.V., |

| · | “Servicios Earhart” to refer to Servicios Earhart, S.A., |

| · | “Vuela” to refer to Vuela, S.A., |

| · | “Vuela Aviación” to refer to Vuela Aviación, S.A., |

| · | “Viajes Vuela” to refer to Viajes Vuela, S.A. de C.V., |

| · | “Comercializadora Frecuenta” to refer to Comercializadora V. Frecuenta, S.A. de C.V., and |

| · | “Vuela El Salvador” to refer to Vuela El Salvador, S.A. de C.V. |

Volaris Opco, Comercializadora, Servicios Corporativos, Servicios Administrativos, Vuela, Vuela Aviación, Viajes Vuela, Comercializadora Frecuenta and Vuela El Salvador are wholly-owned subsidiaries of Volaris. The terms “we,” “our” and “us” in this prospectus supplement refer to Volaris, together with its subsidiaries, and to properties and assets that they own or operate, unless otherwise specified. References to “Series A shares” refer to Series A shares of Volaris. We have not authorized anyone to provide any information or to make any representation other than those contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or in any free writing prospectus that we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein or in any free writing prospectus is accurate as of any date other than the respective dates of such documents. Our business, financial condition, results of operations and prospects may have changed since such dates.

Some of the market and industry data contained or incorporated by reference in this prospectus supplement are based on independent industry publications or other publicly available information, while other information is based on internal studies. Although we believe that these independent sources and our internal data are reliable as of their respective dates, the information contained in them has not been independently verified. As a result, you should be aware that the market and industry data contained in this prospectus supplement, and beliefs and estimates based on such data, may not be reliable.

Cautionary Statement Concerning Forward-Looking Statements

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein contain both historical and forward-looking statements. All statements that are not statements of historical fact are, or may be deemed to be, forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. Forward-looking statements should not be read as a guarantee or assurance of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| · | the competitive environment in our industry; |

| · | ability to keep cost low; |

| · | changes in our fuel cost, the effectiveness of our fuel cost, hedges and our ability to hedge fuel costs; |

| · | the impact of worldwide economic conditions, including the impact of the economic recession on customer travel behavior; |

| · | actual or threatened terrorist attacks, global instability, geopolitical risks and potential U.S. military actions or activities; |

| · | ability to generate non-ticket revenues; |

| · | external conditions, including air traffic congestion, weather conditions and outbreak of disease and pandemics (and the effect that pandemics have on air travel and demand); |

| · | ability to maintain slots in the airports that we operate and service provided by airport operators; |

| · | ability to operate through new airports that match our operative criteria; |

| · | labor disputes, employee strikes and other labor-related disruptions, including in connection with our negotiations with our union; |

| · | ability to attract and retain qualified personnel; |

| · | aircraft-related fixed obligations; |

| · | dependence on cash balances and operating cash flows; |

| · | our aircraft utilization rate; |

| · | our reliance on automated systems and the risks associated with changes made to those systems; |

| · | lack of marketing alliances; |

| · | government regulation and interpretation and supervision of compliance with applicable law; |

| · | maintaining and renewing our permits and concessions; |

| · | our ability to execute our growth strategy; |

| · | operational disruptions; |

| · | our reliance on third-party vendors and partners; |

| · | our reliance on a single fuel provider in Mexico; |

| · | an aircraft accident or incident; |

| · | our aircraft and engine suppliers; |

| · | changes in the Mexican and VFR (passengers who are visiting friends and relatives) markets; |

| · | environmental regulations; |

| · | our ability to respond to global health crises, such as the outbreak of the coronavirus disease (COVID-19); and |

| · | other factors described in our news releases and filings with the SEC, including our 2019 Annual Report and our periodic current reports on Form 6-K and in the section entitled “Risk Factors” beginning on page S-18 of this prospectus supplement. |

In addition, in this prospectus supplement, the words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “predict,” “potential” and similar expressions, as they relate to our company, our business and our management, are intended to identify forward-looking statements. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus supplement may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date of this prospectus supplement. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

NOTICE TO PROSPECTIVE INVESTORS IN THE EUROPEAN ECONOMIC AREA AND THE UNITED KINGDOM

This communication is only being distributed to and is only directed at:

(i) persons who are outside the United Kingdom;

(ii) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or

(iii) high net worth companies, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”).

The ADSs are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such ADSs will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

PRIIPs Regulation/Prospectus Directive/Prohibition of Sales to EEA Retail Investors – The ADSs are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of MiFID II; or (ii) a customer within the meaning of Directive 2002/92/EC (“IMD”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II. Consequently, no key information document required by the PRIIPs Regulation for offering or selling the ADSs or otherwise making them available to retail investors in the EEA has been prepared, and, therefore, offering or selling the ADSs or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation.

Summary

This section summarizes key information contained elsewhere, or incorporated by reference, in this prospectus supplement and the accompanying prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere, or incorporated by reference, in this prospectus supplement and the accompanying prospectus. You should carefully review the entire prospectus supplement, including the risk factors, the financial statements and the notes related thereto and the other documents incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision. Summaries in this prospectus supplement and the accompanying prospectus of certain documents that are filed as exhibits to the registration statement of which this prospectus supplement is a part are qualified in their entirety by reference to such documents.

Overview

We are an ultra-low-cost carrier, or ULCC, incorporated under the laws of Mexico. We were founded on October 27, 2005 under the name Controladora Vuela Compañía de Aviación, S.A. de C.V. Since we began operations in 2006, we have increased our routes from five to more than 171 and grown our cost-efficient Airbus A320 family aircraft from four to 85, which is scheduled to increase to 86 by the end of the year. We currently operate up to 350 daily flight segments on routes that connect 43 cities in Mexico as well as 25 cities in the United States and Central America. We have substantial market presence in the top five airports in Mexico, based on number of passengers, comprising Cancún, Guadalajara, Mexico City, Monterrey and Tijuana. The main cities we currently serve are home to some of the most populous Mexican communities in the United States based on data from the Pew Hispanic Research Center. Additionally, our operating subsidiary in Costa Rica, Vuela Aviación, has been operating since December 1, 2016. We seek to replicate our ultra-low-cost model in Central America by offering ultra-low base fares and point-to-point service in the region. On January 16, 2018, we signed a codeshare agreement with U.S. ultra-low-cost carrier Frontier, which started operations on August 23, 2018. We expect this agreement, one of the first ever between ULCCs, to open additional ultra-low-fare travel options between Mexico and the United States. In particular, we currently serve 25 destinations in the U.S. and 43 in Mexico, of which 19 coincide with Frontier destinations in both countries. We believe that the codeshare agreement will enhance the potential for connecting itineraries.

We are one of the lowest unit cost operators worldwide, based on cost per available seat mile or CASM. In 2019 and for the nine month period ended on September 30, 2020, our CASM was Ps. 124.30 cents (U.S.$6.45 cents) and Ps. 151.40 cents (U.S.$6.90 cents), respectively, compared to an average non-stage-length adjusted CASM of U.S.$10.93 cents and U.S.$16.10 cents, respectively, for the other Latin American publicly traded airlines. We also have lower costs than our U.S.-based publicly traded target market competitors, including Alaska Air, American, Delta, JetBlue, Southwest Airlines and United, which had an average non-stage-length adjusted CASM of U.S.$13.10 cents and U.S.$17.22 cents in 2019 and for the nine month period ended on September 30, 2020, respectively. With our ULCC business model, we have grown significantly while maintaining a low CASM over the last five years. We have achieved this through our efficient and uniform fleet, high asset utilization, our emphasis on direct sales and distribution and our variable, performance-based compensation structure. We have a relentless focus on ultra-low costs as part of our organizational culture, and we believe that we can further lower our CASM by deploying additional sharklet technology equipped Airbus A320 family aircraft and leveraging our existing infrastructure to drive economies of scale. We believe that further reductions to our CASM will allow us to continue to lower base fares, stimulate market demand and increase non-ticket revenue opportunities.

Our ULCC business model and low CASM, allow us to compete principally through offering ultra-low base fares to stimulate demand. We use our yield management system to set our fares in an effort to achieve appropriate yields and load factors on each route we operate. We use promotional fares to stimulate demand and our base fares are priced to compete with long-distance bus fares in Mexico.

During 2019 and the nine month period ended on September 30, 2020, our average base fare was Ps. 1,053.00 (U.S.$54.65) and Ps. 862.00 (U.S.$39.56), respectively. We regularly offered promotional base fares of down to Ps. 309.00 and U.S.$32.60 during 2019 and Ps. 299.00 and U.S.$49.00 during the nine month period ended September 30, 2020. Since May 2012, we have unbundled certain components of our air travel service as part of a strategy to enable our passengers to select and pay for the products and services they want to use. This unbundling strategy has allowed us to significantly grow our non-ticket and total revenue. We plan to continue to use ultra-low base fares to

stimulate additional passenger demand, shift bus passengers to air travel and increase our load factor. In 2019 and the nine month period ended on September 30, 2020, our average load factor was 85.9% and 79.7%, respectively, compared to an average load factor of 83.1% and 58.4%, respectively, for the other Latin American publicly traded airlines and 84% and 59.3%, respectively, for our U.S.-based publicly traded target market competitors. Higher load factors help us generate additional non-ticket and total revenue, which in turn, allow us to further lower base fares and stimulate new demand.

In addition to ultra-low-fares, we also aim to deliver a high-quality flying experience to our passengers. We strive to deliver on-time performance to our customers, with an 87.4% on-time performance rate for the nine month period ended on September 30, 2020. We believe that we have developed strong brand recognition due to our focus on delivering good value and a positive traveling experience to our customers. We believe that our corporate culture of positive “customer relationship management” has also been a key element of our success.

Our primary corporate offices and headquarters are located in Mexico City at Av. Antonio Dovalí Jaime No. 70, 13th Floor, Tower B, Colonia Zedec Santa Fe, Mexico, Mexico City, 01210. Our telephone number is +52-55-5261-6400. Our website is www.volaris.com. The information and contents on our website are not a part of, and are not incorporated by reference into, this prospectus supplement.

Please read Item 4, “Information on the Company” in our 2019 Annual Report for further information on our Company.

Our Business Model

Our business model is based on that of other ULCCs operating elsewhere in the world, such as Allegiant, Frontier and Spirit in the United States, Ryanair and Wizz in Europe and AirAsia in Asia. We utilize our ULCC business model and efficient operations to offer ultra-low base fares and to stimulate demand while aiming to provide high quality customer service. Our unbundled pricing strategy allows us to provide ultra-low base fares and enables our passengers to select and pay for a range of optional products and services for additional fees. We target visiting friends and relatives (“VFR”), cost-conscious business people and leisure travelers in Mexico and to select destinations in the United States.

Since May 2012, we have unbundled certain components of our air travel service as part of a strategy to enable our passengers to select and pay for the products and services they want to use. This unbundling strategy has allowed us to significantly grow our non-ticket and total revenue. We plan to continue to use ultra-low base fares to stimulate additional passenger demand, shift bus passengers to air travel and increase our load factor. We believe a small percentage shift of bus passengers to air travel would dramatically increase the number of airline passengers. Higher load factors help us generate additional non-ticket and total revenue, which in turn, allow us to further lower base fares and stimulate new demand.

We have a relentless focus on ultra-low-costs as part of our organizational culture. We are the lowest cost airline carrier in Latin America, based on CASM, compared to the other Latin American publicly traded airlines. We are also the lowest cost carrier in our target markets in Mexico and the United States, compared to our target market competitors, according to public information available from such competitors. We are able to keep our costs low due to our efficient and uniform fleet, high asset utilization, our emphasis on direct sales and distribution and our variable, performance-based compensation structure.

We were established and are operated to achieve the following goals: (i) to create a profitable and sustainable business model; (ii) to successfully compete by creating structural advantages over other carriers serving Mexico through our ULCC business model; (iii) to provide affordable air travel with a high quality experience for our customers; and (iv) to create a dynamic, cost conscious and entrepreneurial working culture for our employees. We believe that our strengths are:

Lowest Cost Structure. We believe that for the nine month period ended on September 30, 2020 we had one of the lowest cost structures globally, with CASM of Ps. 151.40 cents (U.S.$6.90 cents). We also have lower costs than our U.S.-based publicly traded target market competitors, including Alaska Air at U.S.$14.30 cents, American at U.S.$19.30 cents, Delta at U.S.$25.30 cents, JetBlue at U.S.$14.69 cents, Southwest Airlines at U.S.$12.15 cents and

United at U.S.$17.55 cents. Moreover, we have the lowest cost relative to other Latin American publicly traded airlines, compared to Avianca at U.S.$23.20 cents, Azul at U.S. $10.90 cents, Copa at U.S.$17.90 cents, Gol at U.S.$8.40 cents, Grupo Aeroméxico at U.S.$19.00 cents and LATAM at U.S.$17.20 cents, according to publicly available financial information. We achieve our low operating costs in large part due to:

| · | Efficient and Uniform Fleet. We operate a uniform and efficient fleet of Airbus A320 family aircraft, which is the youngest fleet in Mexico, with an average aircraft age of 5.3 years as of November 30, 2020. |

| · | High Asset Utilization. Our fleet has a uniform, high density seat configuration and we had one of the highest worldwide average aircraft utilization rates of 12.9 and 11.1 block hours per day in 2019 and the nine month period ended September 30, 2020, respectively. |

| · | Direct Sales Distribution. We encourage our customers to purchase tickets via our website, call center or airport service desks as these distribution channels are the lowest cost alternatives, which in turn allow us to provide lower fares to our passengers. We sell 81.0% of our tickets through these channels. We do not use global distribution systems, or GDS. |

| · | Variable, Performance-Based Compensation Structure. We compensate our employees on the basis of their performance, and we reward them for the contribution they make to the success of the company rather than their seniority. |

Ancillary Revenue Generation. We have been able to grow our non-ticket revenue by allowing our passengers to choose what additional products and services they purchase and use. Thanks to our “Tú Decides” (“You Decide”) strategy, we have increased average non-ticket revenue per passenger flight segment from approximately Ps. 119.10 (U.S.$6.92) in 2009 to Ps. 532.00 (U.S.$28.20) in 2019 and Ps. 591.00 (U.S.$27.10) in the nine month period ended September 30, 2020 by, among other things:

| · | charging for excess baggage (over the 25 kilograms of free checked luggage required by Mexican regulations), and starting March 1, 2017, we began charging for the first piece of checked luggage on routes to and from the United States; |

| · | utilizing our excess aircraft belly space to transport cargo; |

| · | passing through all distribution-related expenses; |

| · | charging for advance seat selection, extra legroom, and carriage of sports equipment; |

| · | consistently enforcing ticketing policies, including change fees; |

| · | generating subscription fees from our ultra-low-fare subscription service, V-Club; |

| · | deriving brand-based fees from proprietary services, such as our Volaris affinity credit card program; |

| · | selling itinerary attachments, such as hotel and car rental reservations and airport parking, and making available trip interruption insurance commercialized by third parties, through our website; and |

| · | selling onboard advertising. |

Core Focus on VFR, Cost-conscious Business People and Leisure Travelers in High Growth Markets. We primarily target VFR, cost-conscious business people and leisure travelers in Mexico and the United States. We believe this demographic represents the highest potential for growth in our target markets. By offering low promotional fares, we stimulate demand for VFR and leisure travel, and attract new customers, including those who previously may have only traveled by bus. We use our yield management system to set prices based on the time of booking. We regularly manage yield and load factor, including through targeted promotional fares that can be as low as Ps. 299.00

and U.S.$44.00 or Ps. 249.00 and U.S.$39.00 for Vclub members. We have found that many Mexicans and Mexican Americans living in the United States buy airline tickets for themselves and their family members in Mexico. In addition, we have over 20,000 points of payment throughout Mexico and the United States that allow travelers, particularly in Mexico, who do not have credit cards, or are reluctant to provide credit card information over the web or call center, to reserve seats using the web or call center and pay with cash the next day. Furthermore, we offer night flights, which appeal to our domestic and international customer base that seek to save on lodging expenses.

Disciplined Approach to Market and Route Selection. We select target markets and routes where we believe we can achieve profitability within a reasonable timeframe, and we only continue operating on routes where we can achieve and maintain our target level of profitability. When developing our route network, we focus on gaining market share on routes that have been underserved or are served primarily by higher cost airlines where we have a competitive cost advantage. We thereby stimulate new demand with ultra-low base fares and attempt to shift market share from incumbent operators. We have developed a profitable route network and built a leading market share in several of our markets. As of December 31, 2019, we had more than 20.3% passenger market share in 200 of our 217 routes. As of September 30, 2020, approximately 40% of our routes compete only with bus transportation. We entered the U.S. market in July 2009 and during the nine months ended September 30, 2020 derived 33.0% of our passenger revenues from our U.S. routes and attributed 25.0% of our ASMs to U.S. routes.

Market Leading Efficiency and Performance. We believe we are one of the most efficient airline carriers in Latin America. In 2019 and the nine months ended September 30, 2020, we achieved an average passenger load factor of 85.9% and 79.7%, respectively, and an average aircraft utilization rate of 12.9 and 11.1 block hours per day, respectively, with a standard turnaround time between flights of approximately 65 and 68 minutes, respectively. Based on data available from Airbus, we believe that our aircraft utilization is among the highest worldwide. For the year ended December 31, 2019 and the nine months ended September 30, 2020, our average aircraft utilization rate of 10.94 and 8.97 flight hours per day, respectively, was higher than the industry average for A319s, A320s and A321s. The high-density, single-class seating configurations on our aircraft allow us to increase ASMs and reduce fixed costs per seat as compared to a lower density configuration flown by certain of our competitors. In addition, we strive for market-leading operational performance, with an 87.4% on-time performance rate, a 97.9% flight completion rate and a mishandled baggage rate of only 0.74 bags per 1,000 passengers in the nine months ended September 30, 2020.

Brand Recognition with a Fast Growing Fan Base. We believe that we have developed strong brand recognition due to our focus on delivering good value and a positive traveling experience to our customers. As of September 30, 2020, we had approximately 4.3 million fans on Facebook and 1.9 million followers on Twitter, both of which we primarily use for marketing, customer service and promotion. Our social media reach has been a very low cost, yet effective, marketing tool for us and has afforded us the capability to develop highly effective, targeted marketing promotions on a very short notice. We have also established various programs to make air travel more inviting for first time travelers and other passengers who may desire extra services, such as an unaccompanied senior program.

Balance Sheet Positioned for Growth. We have a low level of financial debt, since we have principally financed our operations through equity and operating cash flows and we have only used operating leases for our aircraft. We believe that our strong financial position enables us to prudently finance the emerging growth opportunities in our markets and to defend our existing network from our competitors. As of September 30, 2020, we had a balance of Ps. 8,202 million in unrestricted cash and cash equivalents, representing 34.5% of the last twelve-month operating revenues. As of September 30, 2020, we had financial debt of Ps. 5,814 million (excluding aircraft operating leases). As of November 30, 2020, our cash and cash equivalents were approximately Ps. 7.5 billion. Additionally, at November 30, 2020, our credit lines totaled Ps. 9.3 billion, of which Ps. 6.9 billion were related to financial debt and Ps. 2.4 billion were related to letters of credit (and of which Ps. 1.8 billion were undisbursed).

Strong Company Culture, Experienced Management Team and Principal Shareholders. We have developed a strong company culture among our employees that is focused on safety, meritocracy, efficiency and profitability, with a significant component of performance-based variable compensation. Our management team has been assembled with experienced executives in their respective fields, including in the aviation, sales and marketing, finance and IT industries in Latin America. In addition, our principal shareholders have extensive prior experience in funding, establishing and leading airline carriers around the world. Their expertise has helped us develop our ULCC business model and allowed us to benefit from their procurement power and relationships with key vendors.

Our Growth Strategy

We believe Volaris has successfully navigated the current market environment, demonstrating one of the strongest recoveries worldwide. With our monthly capacity levels, based on ASMs, returning to our 2019 levels, we believe that we are well positioned for the next stage of growth. While our competitors are still operating at depressed levels relative to their 2019 performance, we believe there are several unique growth opportunities that remain available to us to serve our target customers.

The key elements of our growth strategy include:

Expand Existing Market Leadership. Volaris currently maintains a leading position in 24 out of Mexico’s 56 largest airports, as defined as having A320 capable runways. There remain several new routes and destinations that we believe represent profitable expansion opportunities that we do not currently serve. In the second half of 2020 alone, we have launched domestic service into three new stations in southern and eastern Mexico. Moreover, as it relates to future growth opportunities, we have identified 69 routes within Mexico serving markets in excess of 250,000 inhabitants and other leisure destinations. We will continue to apply a disciplined approach and rigorous selection criteria as we evaluate entry into new markets. In addition, we plan to continue to maintain strong labor relations so that we can successfully manage an increase in the scale of our operations.

Capitalize on Current Market Commercial Opportunities. Based on our domestic competitors’ disclosures, we believe approximately one third of Mexico’s narrow body fleet will come offline by December 31, 2020. As such, we believe there is a significant near-term opportunity for Volaris to serve these customers and expand our network, including at slot constrained airports such as the Mexico City Airport As described above, we have already demonstrated our ability to act swiftly on these opportunities as we started operating a number of new slots at the Mexico City Airport that have been temporarily vacated by our competitors and launched five new domestic routes and seven new international routes from Mexico City since the start of the COVID-19 pandemic. We believe that there remains significant opportunity for continued expansion.

Continue International Expansion Opportunities. We believe that our low cost coupled with our VFR and cost conscious business and leisure traveler model presents a unique opportunity to continue international expansion. Applying our rigorous selection criteria and disciplined approach, we believe that there are over 125 routes internationally that would complement our existing network and be accretive to our bottom line. These routes include continued penetration into niche VFR markets across the United States, where we currently have strong network presence in key markets such as California and Illinois, as well as potential expansion across Central America and potentially South America. We believe these international expansion opportunities present a unique opportunity for growth and meet the needs of our target customers. These expansion opportunities should allow us to optimize our fleet financing schedule.

Remain the Ultra-Low-Cost Carrier of Choice. We believe that by deploying additional cost-efficient Airbus A320 and A321 aircraft with higher seat density and improved fuel efficiency, spreading our low fixed cost infrastructure over a larger scale of operations, outsourcing operating functions and keeping sales and marketing overhead low, we can continue to improve operating efficiencies while maintaining ultra-low-costs. Our ULCC business model enables us to operate profitably at ultra-low fare levels, and we intend to continue to maintain ultra-low-fares to stimulate demand and deliver attractive margins. We also strive to remain the low-cost carrier of choice for our existing and new customers as we continue to focus on providing an affordable and high quality travel experience to our customers across our expanding operations in Mexico, the United States and Central America.

Grow Non-ticket Revenue while Maintaining Ultra-Low Base Fare to Stimulate Demand. We intend to increase our non-ticket revenues by further unbundling our fare structure and by offering our passengers new and innovative products and services. Through our multiple points of interaction with our customers during each stage of their travel, from ticket purchase through flight and post-trip, we have the opportunity to offer third party products, such as hotel rooms, car rentals and trip interruption insurance, on which we receive commissions. In addition, we sell in-flight products and we plan to introduce and expand upon products and services that are unrelated to passenger travel. In June 2012, we started a membership based ultra-low-fare subscription service called V-Club which had approximately 306,489 members as of September 30, 2020. We intend to generate additional fees from proprietary brand-based services such as the Volaris affinity card which was introduced in January 2013. We also continue to expand the cargo

transportation services we provide on our aircraft. As we broaden our ancillary products and services and increase our non-ticket revenue, we believe that we will be able to further lower base fares and continue to stimulate demand.

Continue our Disciplined Fleet Growth and Favorable Lease Terms. As of the date of this prospectus supplement, we have firm commitments for 99 Airbus A320 family aircraft equipped with sharklet technology that will be delivered over the next eight years, including 59 of the next generation Airbus A320 NEO and 40 of the next generation Airbus A321 NEO, the delivery of which commended in 2016 and 2018, respectively. We have obtained committed financing for the pre-delivery payments for the deliveries through 2022. During 2019, we incorporated seven aircraft into our fleet (five A320 NEO and two A321 NEO). During 2020 year to date, we have incorporated five A320 NEO aircraft into our fleet. In December 2017, we entered into an agreement with Airbus to purchase 80 aircraft, which we are committed to receive from 2022 to 2026. The new order includes 46 A320NEO and 34 A321NEO. In July and October 2020, we amended the agreement with Airbus to reschedule 26 fleet deliveries between 2023 and 2028. In February 2020, we entered into an agreement with one lessor to lease two A320 NEOs from their own order book. These two aircraft are scheduled to be delivered during the fourth quarter of 2022.

Our fleet reached 85 aircraft as of the date of this prospectus supplement, of which approximately 35% are NEOs. We believe that a disciplined ramp-up in young and efficient aircraft as our market share expands reduces our exposure to market conditions. We intend to maintain our commitment to a common fleet type and to increase the percentage of NEOs in our fleet because we believe it is the most efficient option for our markets and operations.

Grow Passenger Volume by Profitably Establishing New Routes. We believe our focus on low fares and customer service will stimulate growth in overpriced, underserved and inefficient new markets. We will continue our disciplined approach to domestic and international market entry by using our rigorous selection process where we identify and survey possible target markets that have the potential to be profitable within our business model. For example, in 2019, we added the following 29 new routes: four domestic routes from Guadalajara, six domestic routes from Mexico City, three domestic routes from Tijuana, 11 domestic routes from other cities within Mexico and five international routes from other cities to the United Sates. As part of our continuous monitoring of routes and markets for profitability, we have a proven track record of withdrawing routes that do not meet our profitability expectations. For our future growth opportunities, we have identified approximately 69 routes within Mexico serving markets in excess of 250,000 inhabitants and other leisure destinations, and that have stage lengths of at least 170 miles, and approximately 138 routes internationally that have stage lengths of at least 500 miles.

Recent Developments

COVID-19 Pandemic Update

The SARS-CoV-2 (“COVID-19”) pandemic has drastically reduced demand for air travel and caused major disruptions and volatility in global financial markets, resulting in the fall of stock prices (including the price of our stock), both trends which may continue. There are other broad and continuing concerns related to the potential effects of the COVID-19 pandemic on international trade (including supply chain disruptions and export levels), travel, restrictions on our ability to access our facilities or aircraft, requirements to collect additional passenger data, employee productivity, employee illness, increased unemployment levels, securities markets, and other economic activities, particularly for airlines, that may have a destabilizing effect on financial markets and economic activity.

From a macroeconomic point of view, the impact of the COVID-19 pandemic in Mexico is uncertain. The Mexican Central Bank’s (Banco de México) initial pre-COVID-19 estimates indicated that Mexico’s GDP was predicted to grow between 0.5% and 1.5% in 2020. In the Mexican Central Bank’s latest quarterly report, Mexico’s GDP expectations are based on one central COVID-19 pandemic scenario in which Mexican GDP is predicted to contract approximately 8.7% in 2020. Economic stagnation, the depreciation of the peso, contraction of demand and decreased income levels and increased unemployment levels could result in decreased passenger demand and lower net income in the long term, even after any potential COVID-19 related travel restrictions and border closures are lifted. For example, according to the Mexican Social Security Institute (Instituto Mexicano del Seguro Social) for the period from March 30, 2020 to September 30, 2020, 780,751 formal jobs were lost in Mexico. Furthermore, the COVID-19 pandemic has also resulted in increased volatility in both the local and the international financial markets and economic indicators, such as exchange rates, interest rates, credit spreads and commodity prices. Any shocks or unexpected movements in these market factors could result in additional financial losses.

The COVID-19 pandemic has had a negative impact on the Mexican airline industry, particularly in terms of passenger traffic. The following chart sets forth passenger traffic for the Mexican airline industry in each of the first three quarters of 2020 as compared to the same first three quarters of 2019, as reported by the Mexican Federal Agency of Civil Aviation (Agencia Federal de Aviación Civil, or “AFAC”):

| | | 2019 | | | 2020 | | | Variation | |

| | | (In thousands, except for %) | |

| First Quarter | | | 15,753.9 | | | | 15,229.4 | | | | (3.3 | %) |

| Second Quarter | | | 17,966.2 | | | | 1,868.5 | | | | (89.6 | %) |

| Third Quarter | | | 18,427.2 | | | | 6,983.7 | | | | (62.1 | %) |

| Total | | | 52,147.3 | | | | 24,081.6 | | | | (53.8 | %) |

In terms of the impact on us, we reduced our capacity as compared to the same months in 2019 as measured by available seat miles (“ASMs”) by approximately 82% for the month of April, approximately 88% for the month of May, approximately 59% for the month of June, approximately 37% for the month of July, approximately 21% for the month of August, approximately 16% for the month of September, approximately 16% for the month of October and approximately 2% for the month of November. Additionally, we suspended service on certain routes. In particular, Costa Rica, Guatemala and El Salvador imposed operational and migration restrictions that made it impossible to operate international passenger flights to those countries. In order to mitigate the impact of the COVID-19 pandemic on us, we took the following measures:

| · | Preserving liquidity and cash. We implemented a strict liquidity preservation program, which has resulted in approximately U.S. $266 million of savings as of September 30, 2020 through items such as cost reductions and deferral agreements with suppliers. For example, we deferred approximately 80% of our aircraft lease payments due in 2020 to 2021, and postponed U.S.$246 million in pre-delivery payments that were due in the years 2020 to 2022. In addition, we negotiated cost reductions and payment deferrals with more than 360 suppliers and cut non-essential expenses. We also implemented online training and leave of absence programs in order to reduce costs. We expect to continue reducing costs with the aim of reaching a CASM ex-fuel (calculated based on total operating expenses, net excluding fuel expense divided by ASMs) similar to 2019 levels by the end of 2020. As of November 30, 2020, our cash and cash equivalents were approximately Ps. 7.5 billion. Additionally, at November 30, 2020 our credit lines totaled Ps. 9.3 billion, of which Ps. 6.9 billion were related to financial debt and Ps. 2.4 billion were related to letters of credit (and of which Ps. 1.8 billion were undisbursed). |

| · | Defending ourselves against sales declines. We decreased scheduled capacity in order to protect our profitability. We also strengthened our relationships with customers by revamping our website and maintaining close communications via social media and email. |

| · | Developing commercial and network growth opportunities. We are closely monitoring capacity reductions from competitors for possible opportunities, testing new ancillary products and running targeted promotions to test potential stimulation of air travel. Certain of our competitors are facing financial difficulties which has led them to stop utilizing certain slots at the Mexico City airport. We have been allowed to use some of these slots to open new destinations and increase operations at this airport, and currently hold 26% of the market share by ASMs. However, since the Mexico City airport has issued a waiver to the minimum usage requirement due to the COVID-19 pandemic, we will not be granted historical priority of such slots unless (i) the waiver is terminated, (ii) the slots are not reclaimed by their prior holders and (iii) we continue operating the slots in accordance with certain conditions, including usage at least 85% of the time and conducting on time operations at least 85% of the time (operations are considered on time if they fall within 15 minutes of the assigned slot time). We can offer no assurance that our competitors will not reclaim the use of such slots prior to the expiration of the waiver on March 27, 2021, or that the waiver will not be extended. If our competitors do reclaim the slots prior to the expiration of the waiver, we may lose the preferential use of such slots almost immediately. Since the start of the COVID-19 pandemic, we have launched five new domestic routes and seven new international routes, now operating 107 domestic and 64 international routes in total. |

| · | Reviewing our fleet plan. Our new contractual fleet plan with Airbus allows us to maintain a “cautiously” sized fleet that will remain at approximately 88 aircraft, net of new deliveries and redeliveries, until 2023. |

| · | Protecting our customers and employees. We launched a new biosecurity and cleaning protocol and are communicating proactively with all staff, especially with crews and airport staff, regarding health and COVID-19 developments. For employees who are able to work remotely, we have activated home office technologies and protocols. |

Furthermore, a gradual opening of the economy and easing of lockdown measures in Mexico and the other countries in which we operate led to a recovery in our ASMs and route operation during the summer of 2020. In June, our load factor was 73.1%, and our capacity in terms of ASMs was 825 million. We were able to ramp up to 63% of July 2019 service in July, and expanded further to 79% of August 2019 service in August. Our load factor for July and August was 73.1% and 72.6%, respectively, and our capacity in terms of ASMs was 1,387 million and 1,690 million, respectively. September is typically a low travel month so we prudently increased capacity to 84% of prior year while focusing on increasing total revenue per available seat mile. Our load factor for September was 74.4% and our capacity in terms of ASMs was 1,686 million. For the full nine month period ended September 30, 2020, we operated 68% of ASMs compared to the same period in 2019. The Mexican domestic market led the capacity recovery, where we operated 73% ASMs as compared to the same period in 2019. In the international market, we operated 56% ASMs as compared to the same period in 2019. In the third quarter of 2020, our CASM ex-fuel was U.S.$5.03 cents, our average base fare was U.S.$32.00 and we flew around 3.6 million passengers. For the third quarter of 2020, our load factor was 73.4% and our capacity in terms of ASMs was 75.1% of our capacity in terms of ASMs for the third quarter of 2019. Ancillary revenues made up 45% of our total revenues for the third quarter of 2020, with average ancillary revenue of U.S.$27.00 per passenger. For October 2020, we operated 84.3% of ASMs as compared to the same month in 2019 and for November 2020 we operated 98% of ASMs as compared to the same month in 2019. Our load factor for October and November was 82.1% and 80.5%, respectively, and our capacity in terms of ASMs was 1,731 million and 1,998 million, respectively. During those months, our Central American operations remained closed. However, we resumed our Central American operations on November 23, 2020. Based on scheduled flights, our load factor for December 2020 is expected to be 80.5% and we expect to operate at approximately 100% capacity as compared to December 2019. Based on flights operated in October and November and flights scheduled in December, our capacity in terms of ASMs for the fourth quarter of 2020 is expected to be approximately 95% of fourth quarter capacity in 2019. Since the start of the COVID-19 pandemic, we have transported approximately 6.7 million passengers.

We are focused on taking advantage of the current situation and see opportunities to rebuild core market presence, expand existing market leadership, increase our domestic network overlap against distressed competitors to appropriately serve customer demand, continue United States expansion through visiting friends and relatives niches and selected Mexico City-U.S. routes, eventually increasing capacity in central America and initiating operations in South America.

Despite the gradual recovery we have seen in ASMs and route operation, the ongoing COVID-19 pandemic is likely to continue to have a negative impact on our financial condition and results of operations, as a result of the following indicators:

| · | A resurgence of COVID-19 infection rates could lead Mexico and the countries in which we operate to return to partial or total lockdowns, which would most likely result in a decrease in demand for our flights (which in turn may require reductions to our ASMs at levels similar to the early months of the pandemic) and aircraft utilization rate and consequently a decrease in our total operating revenue; |

| · | Any further downward volatility in the international capital markets could result in (i) the fall of stock prices, including the price of our stock and (ii) financial losses associated with our financial portfolio, which may cause a deterioration of our financial condition or limitations on our ability to meet our liabilities; |

| · | If our revenues decrease for a significant portion of time, we may have less cash available to meet our obligations under our aircraft and engine lease agreements and additional sources of financing may be difficult to obtain at favorable rates; and |

| · | Even after the COVID-19 pandemic eases, there is a risk that we will experience reduced demand in the near to mid-term due to the potential economic impact of the pandemic on the travel industry (business and leisure) and on our customers, as well as customer health concerns about the safety of air travel. |

Operational and Other Developments

We currently operate at 43 of the 56 airports in Mexico, three of which we began serving in the second half of 2020. Of these 43 airports, we have a leadership position at 24. We have strong network positions in large VFR networks in the United States, including California and Illinois, and see significant opportunities for growth in Central America. We are also making certain changes to our fleet, transitioning to Airbus A320 and A321 NEOs to contribute to fuel efficiency and to allow us to take advantage of upgauging opportunities. For the years ended December 31, 2016, 2017, 2018 and 2019, our fleet was comprised of 1%, 8%, 21%, and 28% Airbus A320 and A321 NEOs, respectively. Based on our contractual order book, for the years ended December 31, 2020, 2021, 2022 and 2023, our fleet will be comprised of 35%, 39%, 52% and 60% Airbus A320 and A321 NEOs, respectively, with 86, 87, 93 and 85 Airbus A320 and A321 NEOs in our fleet at each respective calendar year end.

In addition to the opportunities we see to gain market share in light of the impact of the COVID-19 pandemic, discussed above, we also plan to use our low fares to continue gaining market share from the bus transportation market. This represents a substantial growth opportunity for us, as the air travel market represents just 3.4% of the bus market in Mexico. On approximately 40% of our routes, we operate without air competition and compete only with buses. We pioneered air service on 68 routes, and 6% of our passengers (1.2 million for the year ended December 31, 2019) were first time flyers. Low prices have stimulated demand historically and our fares are lower than bus fares in many markets. In addition, remittances to Mexico rose to a new twelve-month record in August 2020, increasing disposable income for Mexican families. The following chart shows comparisons of our fares and travel times against bus fares on certain of the routes we operate, which we believe present a clear and favorable value proposition:

| (1) | Fares by segment observed in December 2019 as reported by Volaris based on information from individual company websites. |

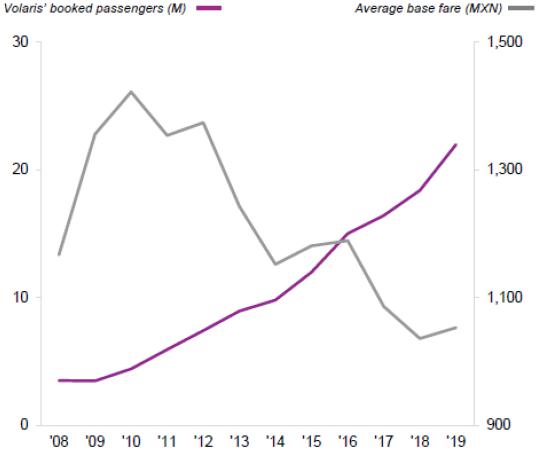

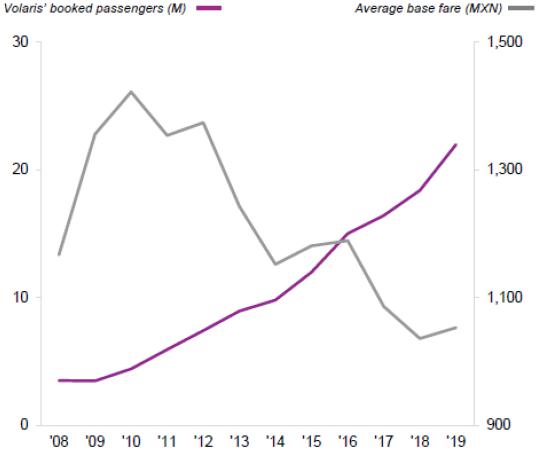

We believe that our strategy of low base fares has stimulated air travel, which is further evidenced by the following chart that shows the inverse relationship between our fares and the number of passengers we have carried over the last ten years:

The Mexican tax authority is currently performing an audit of our fiscal years 2013 and 2014. We are cooperating fully in respect of any requests for information, which have thus far focused on our deduction of certain expenses, such as maintenance and aircraft lease expenses. As of the date of this current report, such audits remain ongoing.

Recent Developments in the Mexican Airline Industry

Our competitors and the Mexican airline industry as a whole have also been significantly impacted by the COVID-19 pandemic. According to information published by AFAC, as of September 30, 2020, the number of commercial aircraft in service in Mexico had decreased to 258, as compared to 355 as of December 31, 2019. This 27% reduction was comprised mainly of narrow body aircraft, including 49 Airbus A320s, 20 Boeing 737s, and 12 Airbus A321s. On June 30, 2020, Grupo Aeroméxico, our largest competitor by domestic and international market share in 2019, announced that it was filing for Chapter 11 bankruptcy protection in the United States. According to its public filings with the CNBV, Grupo Aeroméxico has maintained regular operations during the restructuring process but has received court approval to return at least 19 aircraft to lessors, which would reduce its fleet size by around 15%. As of September 30, 2020, AFAC reports indicate that Grupo Aeroméxico’s subsidiaries Aeroméxico and Aeroméxico Connect had fleets of 51 and 43 aircraft, respectively, as compared to 69 and 56, respectively, as of December 30, 2019. In addition, Interjet, our second largest competitor by international market share in 2019, has been unable to resume international flights since suspending the routes in March 2020. Interjet’s fleet decreased by almost 90% in 2020, from 67 aircraft as of December 30, 2019 to seven as of September 30, 2020, according to information published by the AFAC. While VivaAerobus, our second largest competitor by domestic market share

in 2019, has increased their fleet from 37 as of December 30, 2019 to 39 as of September 30, 2020, this increase does not compensate for the reductions observed in the market. In addition to these changes in fleet size, our market share has also increased. As of October 2020, our domestic market share had increased 9.4 percentage points to 40.5% and our international market share had increased 6.0 percentage points to 14.9%, in each case as compared to our market shares as of October 2019.

The Offering

| Company | Controladora Vuela Compañía de Aviación, S.A.B. de C.V. |

| | |

| International offering | We are offering 134,000,000 CPOs in the form of ADSs through the underwriters in the United States and countries other than Mexico. |

| | |

| Offering price | U.S.$11.25 per ADS. |

| | |

| Option to Purchase Additional ADSs | We have granted to the underwriters an option, exercisable for 30 days from the date of this prospectus supplement, to purchase up to an aggregate of 20,100,000 additional CPOs in the form of ADSs at the public offering prices listed above, less underwriting discounts and commissions. |

| | |

| CPOs | Each CPO represents a financial interest in one Series A share. The CPO trustee, Nacional Financiera, Sociedad Nacional de Crédito, Institución de Banca de Desarrollo, or NAFIN, issued the CPOs as trustee under the CPO trust agreement and pursuant to a CPO trust deed and may, from time to time, release CPOs in respect of ADSs or Series A shares acquired by non-Mexican investors. |

| | |

| ADSs | Each ADS represents ten CPOs. The ADSs are evidenced by one or more ADRs. The ADSs have been issued under a deposit agreement among us, The Bank of New York Mellon, as depositary, and the registered holders and beneficial owners from time to time of ADSs issued thereunder. |

| | |

| Use of proceeds | The net proceeds to us from the sale of the ADSs in the offering are expected to be approximately U.S.$142,722,540.79 after deducting estimated discounts and commissions and expenses payable by us. We currently intend to use the net proceeds from the offering for general corporate purposes. See “Use of Proceeds.” |

| | |

| Listing and registry | The ADSs are listed on the New York Stock Exchange under the symbol “VLRS.” The Series A shares are listed on the Mexican Stock Exchange under the symbol “VOLAR.” The Series A shares are registered in the RNV maintained by the CNBV. Our Series B Shares are not listed or registered, and the CPOs are only registered with the SEC and will not be listed. |

| | |

| Voting rights of our shares | Holders of ADSs or CPOs are not entitled to vote the underlying Series A shares. Mexican holders of Series A shares are entitled to vote their shares on all matters. The CPO trustee will vote the Series A shares underlying the CPOs in accordance with the vote of the majority of the outstanding Series A shares voted by Mexican holders at the relevant shareholders’ meeting. Holders of Series A shares have the right to elect one director for each 10% block of our outstanding capital stock. |

| Ownership limitations | As required by Mexican law, our by-laws provide that no transfer of shares of our capital stock to or acquisition or subscription of shares of our capital stock by an investor deemed to be non-Mexican will be permitted if such transfer, acquisition or subscription would result in non-Mexicans holding directly (not considering non-Mexicans holding ADSs or CPOs having underlying Series A shares) in excess of 49% of the total number of shares of our capital stock then outstanding not held by the CPO trustee (i.e., both Series A and Series B shares). Series B shares do not exceed such limit and are held by our non-Mexican principal shareholders. Non-Mexicans will not be entitled to directly hold Series A shares, but may hold CPOs granting financial interests, but no voting rights, in respect of underlying Series A shares (that are released if a non-Mexican investor were to acquire Series A shares). Mexican holders of ADSs will be entitled to withdraw the underlying CPOs and exchange such CPOs for Series A shares. See “Description of the Securities—Description of Capital Stock—Ownership Restrictions,” “Description of the Securities—Description of Capital Stock—Other Provisions—Foreign Investment Regulations” and “Description of the Securities—Description of CPOs” in the accompanying prospectus. |

| | |

| Change of Control | Provisions of Mexican law and our by-laws may make it difficult and costly for a third-party to pursue a tender offer or takeover attempt resulting in a change of control. Our by-laws contain provisions which, among other things, require approval of our board of directors prior to any person or group of persons acquiring, directly or indirectly, (i) 5% or more of our shares (whether directly or by acquiring ADSs or CPOs), or (ii) 20% or more of our shares (whether directly or by acquiring ADSs or CPOs) and in the case of this item (ii) if such approval is obtained, require the acquiring person to make a tender offer to purchase 100% of our shares and CPOs (or other securities that represent them) at a substantial premium over the market price of our shares to be determined by our board of directors, based upon the advice of a financial advisor. These provisions could substantially impede the ability of a third party to control us, and could be detrimental to shareholders willing to benefit from any change of control premium paid on the sale of the company in connection with a tender offer. See “Description of the Securities—Description of Capital Stock—Change of Control Provisions,” “Description of the Securities—Description of Capital Stock—Ownership Restrictions,” “Description of the Securities—Description of Capital Stock—Voting Rights” and “Description of the Securities—Description of Capital Stock— Other Provisions—Foreign Investment Regulations” in the accompanying prospectus. |

| | |

| Dividends | We have not paid any cash dividends in the past and do not expect to pay any cash dividends on our common stock for the foreseeable future. We currently intend to retain any additional future earnings to finance our operations and growth. In addition, our revolving line of credit with Banco Santander (México) S.A., Institución de Banca Múltiple, Grupo Financiero Santander México, or Banco Santander México, and Banco Nacional de Comercio Exterior, S.N.C., or Bancomext, may limit our ability to declare and pay dividends in the event that we fail to comply with the payment terms thereunder. |

| Taxation | Under current Mexican law, dividends paid to holders of ADSs who are not residents of Mexico for tax purposes will generally be subject to a 10% income tax withholding. However, such dividends will be exempt from Mexican withholding taxes if they correspond to profits that were subject to taxation prior to January 1, 2014. In addition to the foregoing, any such dividends generally will be subject to corporate taxes if not paid from a net after-tax profits account. We currently intend that any dividends we pay will come from such account. The sale of our ADSs or Series A shares by holders who are non-residents of Mexico for tax purposes (through CPOs) will generally be subject to a 10% Mexican income tax withholding if the sale is conducted through the Mexican Stock Exchange or any other recognized market. See “Taxation.” |

| | |

| Lock-up agreement | We, our executive officers and directors and certain shareholders, who beneficially own a substantial portion of the shares of our common stock, have agreed that, subject to certain limited exceptions, we and they will not offer, pledge, sell, lend or otherwise transfer until, in our case and the case of our executive officers and directors, 90 days, and in the case of the certain shareholders, 75 days, after the date of this prospectus supplement any ADSs, CPOs, Series A shares or Series B shares or any options or warrants to purchase the ADSs, CPOs, Series A shares or Series B shares, or any securities convertible into, or exchangeable for, or that represent the right to receive, ADSs, CPOs, Series A shares or Series B shares. See “Underwriting.” |

| | |

| Risk factors | See “Risk Factors” beginning on page S-18, the “Risk Factors” section of our 2019 Annual Report and the other information included in this prospectus supplement for a discussion of factors you should consider before deciding to invest in the ADSs. |

Summary Selected Consolidated Financial And Operating Data

The following table sets forth, for the periods and at the dates indicated, our summary historical financial data, which have been derived from our unaudited interim financial statements, presented in Mexican pesos, and selected operating data. The information included below and elsewhere in this prospectus supplement is not necessarily indicative of our future performance. The tables set forth below are derived from, and should be read in conjunction with, our unaudited interim financial statements as of September 30, 2020 and for the nine month periods ended September 30, 2020 and 2019 and the accompanying notes included in the current report on Form 6-K filed with the SEC on December 7, 2020 and incorporated by reference in this prospectus supplement.

| | | As of and for the Nine Months Ended September 30, | |

| | | 2019 | | | 2020 | | | 2020 | |

| | | (unaudited in thousands of pesos,

except share and per share

data and operating data) | | | (unaudited in

thousands of U.S.

dollars, except

per share data

and operating

data)(1) | |

| CONSOLIDATED STATEMENTS OF OPERATIONS | | | | | | | | | |

| Operating revenues | | | | | | | | | | | |

| Passenger revenues: | | | | | | | | | | | |

| Fare revenues | | 16,562,053 | | | | 8,491,208 | | | | 378,105 | |

| Other passenger revenues | | 7,723,539 | | | | 5,132,658 | | | | 228,552 | |

| Non-passenger revenues: | | | | | | | | | | | |

| Other passenger revenues | | 612,631 | | | | 555,312 | | | | 24,727 | |

| Cargo | | 164,900 | | | | 132,287 | | | | 5,891 | |

| Non-derivatives financial instruments | | (39,713 | ) | | | (237,438 | ) | | | (10,573 | ) |

| Total operating revenues | | 25,023,410 | | | | 14,074,027 | | | | 626,702 | |

| Other operating income | | (264,118 | ) | | | (568,169 | ) | | | (25,300 | ) |

| Fuel | | 8,653,888 | | | | 4,613,905 | | | | 205,453 | |

| Landing, take-off and navigation expenses | | 3,724,625 | | | | 2,942,623 | | | | 131,032 | |

| Depreciation of right of use assets | | 3,522,130 | | | | 3,751,958 | | | | 167,071 | |

| Salaries and benefits | | 2,647,710 | | | | 2,470,210 | | | | 109,996 | |

| Maintenance expenses(2) | | 1,128,348 | | | | 714,038 | | | | 31,795 | |

| Sales, marketing and distribution expenses | | 1,038,344 | | | | 1,505,708 | | | | 67,048 | |

| Aircraft and engine variable lease expenses | | 768,592 | | | | 1,337,873 | | | | 59,574 | |

| Other operating expenses | | 948,129 | | | | 869,463 | | | | 38,716 | |

| Depreciation and amortization(3) | | 467,694 | | | | 649,762 | | | | 28,933 | |

| | | 22,635,342 | | | | 18,287,371 | | | | 814,318 | |

| Operating income (loss) | | 2,388,068 | | | | (4,213,344 | ) | | | (187,616 | ) |

| Finance income | | 152,608 | | | | 93,108 | | | | 4,146 | |

| Finance cost | | (1,594,394 | ) | | | (2,523,404 | ) | | | (112,365 | ) |

| Exchange gain (loss), net | | 984,747 | | | | (418,751 | ) | | | (18,646 | ) |

| | | (457,039 | ) | | | (2,849,047 | ) | | | (126,865 | ) |

| Income (loss) before income tax | | 1,931,029 | | | | (7,062,391 | ) | | | (314,481 | ) |

| Income tax (expense) benefit | | (579,309 | ) | | | 1,871,534 | | | | 83,337 | |

| Net income (loss) | | 1,351,720 | | | | (5,190,857 | ) | | | (231,144 | ) |

| Attributable to: | | | | | | | | | | | |

| Equity holders of the parent | | 1,351,720 | | | | (5,190,857 | ) | | | (231,144 | ) |

| Non-controlling interest | | - | | | | - | | | | - | |

| Net income (loss) | | 1,351,720 | | | | (5,190,857 | ) | | | (231,144 | ) |

| Weighted average shares outstanding Basic and diluted | | 1,011,876,677 | | | | 1,011,876,677 | | | | 1011,876,677 | |

| | | As of and for the Nine Months Ended September 30, | |

| | | 2019 | | | 2020 | | | 2020 | |

| | | (unaudited in thousands of pesos,

except share and per share

data and operating data) | | | (unaudited in

thousands of U.S.

dollars, except

per share data

and operating

data)(1) | |

| Earnings (loss) per share Basic and diluted(4) | | 1.34 | | | | (5.13 | ) | | | (0.23 | ) |

| Earnings (loss) per ADS Basic and diluted(5) | | 13.36 | | | | (51.3 | ) | | | (2.28 | ) |

| CONSOLIDATED STATEMENTS OF FINANCIAL POSITION | | | | | | | | | | | |

| Cash and cash equivalents | | 7,809,602 | | | | 8,201,566 | | | | 365,207 | |

| Accounts receivable, net | | 2,265,781 | | | | 2,415,842 | | | | 107,576 | |

| Guarantee deposits—current portion | | 780,626 | | | | 1,443,943 | | | | 64,297 | |

| Total current assets | | 11,739,161 | | | | 13,119,657 | | | | 584,206 | |

| Total assets | | 61,854,086 | | | | 67,430,266 | | | | 3,002,600 | |

| Total short-term liabilities | | 16,562,899 | | | | 24,346,497 | | | | 1,084,125 | |

| Long-term liabilities | | 41,146,951 | | | | 48,492,537 | | | | 2,159,321 | |

| Total liabilities | | 57,709,850 | | | | 72,839,034 | | | | 3,243,446 | |

| Capital stock | | 2,973,559 | | | | 2,973,559 | | | | 132,409 | |

| Total equity | | 4,144,236 | | | | (5,408,768 | ) | | | (240,846 | ) |

| CASH FLOW DATA | | | | | | | | | | | |

| Net cash flows provided by operating activities | | 7,464,746 | | | | 3,289,563 | | | | 146,482 | |

| Net cash flows used in investing activities | | (1,279,621 | ) | | | (144,515 | ) | | | (6,435 | ) |

| Net cash flows used in financing activities | | (4,238,918 | ) | | | (4,405,049 | ) | | | (196,151 | ) |

| OTHER FINANCIAL DATA | | | | | | | | | | | |

| EBITDA(6) | | 7,362,639 | | | | (230,375 | ) | | | (10,258 | ) |

| Adjusted EBITDA(6) | | 6,377,892 | | | | 188,376 | | | | 8,388 | |

| Adjusted EBITDAR(6) | | 7,146,484 | | | | 1,526,249 | | | | 67,962 | |

| OPERATING DATA(7) | | | | | | | | | | | |

| Aircraft at end of period | | 80 | | | | 84 | | | | - | |

| Average daily aircraft utilization (block hours) | | 13.0 | | | | 11.1 | | | | - | |

| Average daily aircraft utilization (flight hours) | | 11.0 | | | | 9.5 | | | | - | |

| Airports served at end of period | | 66 | | | | 62 | | | | - | |

| Departures(8) | | 102,823 | | | | 66,167 | | | | - | |

| Passenger flight segments (thousands)(8) | | 15,472 | | | | 8,818 | | | | - | |

| Booked passengers (thousands)(8) | | 16,237 | | | | 9,852 | | | | - | |

| Revenue passenger miles (RPMs) (thousands)(8) | | 15,511,199 | | | | 9,799,915 | | | | - | |

| Available seat miles (ASMs) (thousands)(8) | | 18,198,975 | | | | 12,295,462 | | | | - | |

| Load factor(9) | | 85 | % | | | 80 | % | | | - | |

| Average ticket revenue per booked passenger(9) | | 1,022 | | | | 862 | | | | 38 | |

| Total operating revenue per ASM (TRASM) (cents)(8)(10) | | 137.7 | | | | 116.4 | | | | 5.2 | |

| Passenger revenue per ASM (RASM) (cents)(8)(10) | | 91.0 | | | | 69.1 | | | | 3.1 | |

| Operating expenses per ASM (CASM) (cents)(8)(10) | | 124.6 | | | | 151.4 | | | | 6.7 | |

| CASM ex fuel (cents)(8)(10) | | 76.8 | | | | 111.21 | | | | 5.0 | |

| Fuel gallons consumed (thousands) | | 186,564 | | | | 119,886 | | | | - | |

| Average economic fuel cost per gallon | | 46.6 | | | | 41.2 | | | | 1.8 | |

| Employees per aircraft at end of period | | 61 | | | | 57 | | | | - | |

| (1) | Peso amounts were converted to U.S. dollars solely for the convenience of the reader at the rate of Ps. 22.4573 per U.S.$1.00 as the rate for the payment of obligations denominated in foreign currency payable in Mexico in effect on September 30, 2020. Such conversions should not be construed as a representation that the peso amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated, or at all. |

| (2) | Includes routine and ordinary maintenance expenses only. See Item 5: “Operating and Financial Review and Prospects—Operating Results” in our 2019 Annual Report. |

| (3) | Includes, among other things, major maintenance expenses, which are capitalized and subsequently amortized. See Item 5: “Operating and Financial Review and Prospects—Operating Results” in our 2019 Annual Report. |

| (4) | Basic earnings per share is calculated by dividing profit or loss attributable to ordinary equity holders of the parent entity by the weighted average number of ordinary shares outstanding during the period. |

| (5) | The basis used for the computation of the information is to multiply the earnings per basic and diluted share obtained pursuant to footnote (4) above by ten, which is the number of CPOs represented by each ADS. Each CPO, in turn, represents a financial interest in one Series A share of our common stock. |

| (6) | EBITDA, Adjusted EBITDA and Adjusted EBITDAR are included as supplemental disclosures because we believe they are useful indicators of our operating performance. Derivations of EBITDA, Adjusted EBITDA and Adjusted EBITDAR are well recognized performance measurements in the airline industry that are frequently used by investors, securities analysts and other interested parties in comparing the operating performance of companies in our industry. However, because derivations of EBITDA, Adjusted EBITDA and Adjusted EBITDAR are not determined in accordance with IFRS, such measures are susceptible to varying calculations and not all companies calculate the measures in the same manner. As a result, derivations of EBITDA, Adjusted EBITDA and Adjusted EBITDAR as presented may not be directly comparable to similarly titled measures presented by other companies. |

| (7) | See “Glossary of Airlines and Airline Terms” in the 2019 Annual Report for definitions of terms used in this table. |

| (8) | Includes scheduled & charter. |

| (10) | Excludes no-derivative financial instruments. |

The following table sets forth the reconciliation of EBITDA, Adjusted EBITDA and Adjusted EBITDAR to net (loss) income for the periods indicated below:

| | | For the Nine Months Ended September 30, | |

| | | 2019 | | | 2020 | | | 2020 | |

| Reconciliation: | | (unaudited in thousands of pesos) | | | (unaudited in

thousands of

U.S. dollars)(1) | |

| Net income (loss) | | | 1,351,720 | | | | (5,190,857 | ) | | | (231,144 | ) |

| Plus (minus): | | | | | | | | | | | | |

| Finance cost | | | 1,594,394 | | | | 2,523,404 | | | | 112,365 | |

| Finance income | | | (152,608 | ) | | | (93,108 | ) | | | (4,146 | ) |

| Provision/(Benefit) for income tax | | | 579,309 | | | | (1,871,534 | ) | | | (83,337 | ) |

| Depreciation and amortization | | | 3,989,824 | | | | 4,401,720 | | | | 196,004 | |

| EBITDA | | | 7,362,639 | | | | (230,375 | ) | | | (10,258 | ) |

| Exchange (gain) loss, net | | | (984,747 | ) | | | 418,751 | | | | 18,646 | |

| Adjusted EBITDA | | | 6,377,892 | | | | 188,376 | | | | 8,388 | |

| Aircraft and engine variable lease expenses | | | 768,592 | | | | 1,337,873 | | | | 59,574 | |

| Adjusted EBITDAR | | | 7,146,484 | | | | 1,526,249 | | | | 67,962 | |

| (1) | Peso amounts were converted to U.S. dollars solely for the convenience of the reader at the rate of Ps. 22.4573 per U.S.$1.00 as the rate for the payment of obligations denominated in foreign currency payable in Mexico in effect on September 30, 2020. Such conversions should not be construed as a representation that the peso amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated, or at all. |

Risk Factors