UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22561

SkyBridge G II Fund, LLC

(Exact name of registrant as specified in charter)

527 Madison Avenue-4th Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

Marie Noble

SkyBridge Capital II, LLC

527 Madison Avenue-4th Floor

New York, NY 10022

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 485-3100

Date of fiscal year end: March 31

Date of reporting period: March 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| | (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

The Report to Shareholders is attached herewith.

SkyBridge G II Fund, LLC

Annual Report

March 31, 2023

Important Notice to Shareholders

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Company’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Company. Instead, the reports will be made available on www.skybridge.com and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Company electronically by contacting the Company at 1-855-631-5474.

You may elect to receive all future reports in paper free of charge. You can inform the Company that you wish to continue receiving paper copies of your shareholder reports by contacting the Company at 1-855-631-5474.

SkyBridge G II Fund, LLC

| | |

SkyBridge G II Fund, LLC Portfolio Manager’s Comments (unaudited) | |  |

OVERVIEW

For the twelve months ended March 31, 2023, SkyBridge G II Fund, LLC (“GII” or the “Fund”) returned -15.45%, while the HFRI Fund of Funds Composite Index returned -1.93%.

The Fund generated a 0.69% return for the month of March 2023 and an 1.88% return for the first quarter of 2023.

MARKET REVIEW AND OUTLOOK

Despite bank failures and rate hikes, we find ourselves reporting market gains in Q1 2023. The S&P 500 total return gained 7.5%, and the volatility index (VIX) finished the quarter at lows rarely seen over the course of this rate-hike cycle. The market sorted itself for companies best positioned to survive higher interest rates – least dependent on debt – and cash-rich technology leaders led the market. The Information Technology Sector was up 22% in Q1. Apple stock was up 26%. And the embattled Financials Sector lost only 6%, as the mega-cap banks which dominate that index were beneficiaries of deposit flows to safety. Sentiment also helped the market, having reached negative extremes.

The primary driver of the Fund’s Q1 performance is our Macro book, 7% of the Fund, which was up 58% on the quarter led by our investment in Bitcoin, expressed through underlying funds. Bitcoin rallied 71% in Q1.

We are confident in our long-term thesis on Bitcoin, but we never try to time the investment because predicting any short-term price change is impossible. It is not obvious even in retrospect that the events of Q1 would have driven up the price of Bitcoin. Bitcoin rallied despite rising rate-hike expectations, a banking crisis, and regulatory hostility. We remain focused on the long-term investment thesis.

PORTFOLIO AND POSITIONING

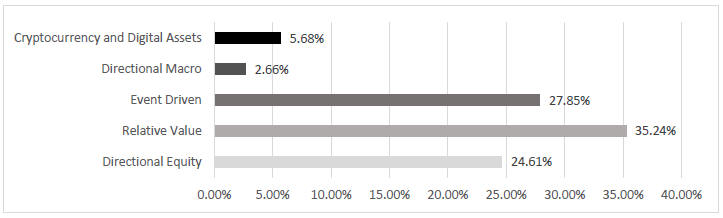

The Fund gives investors access to a cross section of alternative investment strategies that offer unique types of risks that are difficult to access directly and are different from those offered by stocks and bonds. The fund is thematic, dynamic and takes concentrated positions in its highest conviction ideas. As of March 31, 2023, The Fund’s strategy allocations are (approximately) as follows: Multi-Strategy 33%, Equities 27%, Structured Credit 9%, Convertible Arbitrage 11%, Macro 7%, and Cash 13%.

Whilst our Macro book drove performance in the first quarter of 2023, our allocation to late-stage private equity issuers also provided a tailwind. Our largest allocation remains to Multi-Strategy at 33% of the Fund. Anchored by Point72 and Millennium, this allocation has produced strong and steady returns while reducing the Fund’s volatility in good times and bad. We are confident in these allocations.

We are actively assessing new investment opportunities with a particular focus on distressed credit and artificial intelligence. As financial stress mounts, we are looking for investment opportunities in orphaned debt instruments – the kind of opportunities which typically appear fleetingly at the end of a crisis. As to artificial intelligence, despite the collective acknowledgement of its potential, we are convinced the implications are massively underappreciated. The ensuing changes will far exceed our imaginations. We are acutely focused on deploying capital to capture the enormous value we believe it will create.

This commentary reflects the viewpoints of SkyBridge Capital II, LLC as of March 31, 2023, and is not intended as a forecast or guarantee of future results.

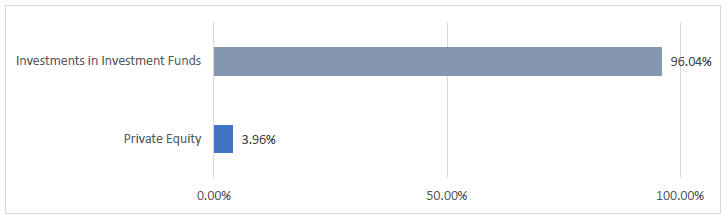

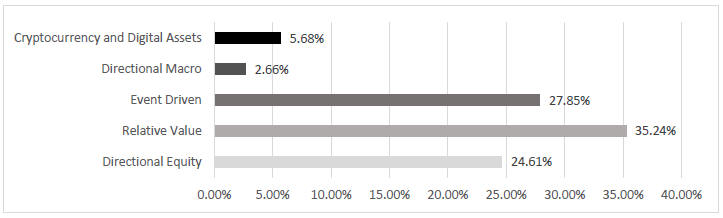

Investment and Strategy Allocations

Breakdown of Investments in Investment Funds 1 2

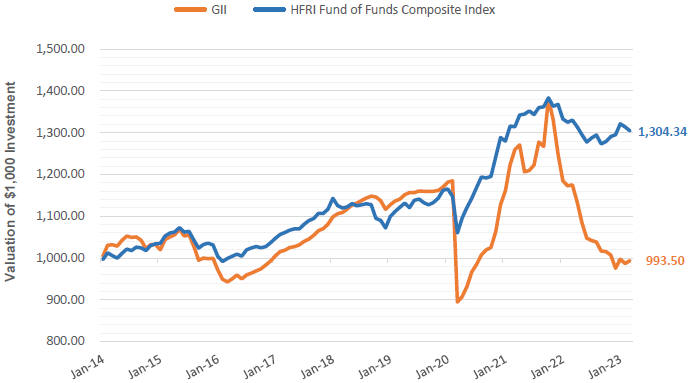

CUMULATIVE TOTAL RETURN PERFORMANCE

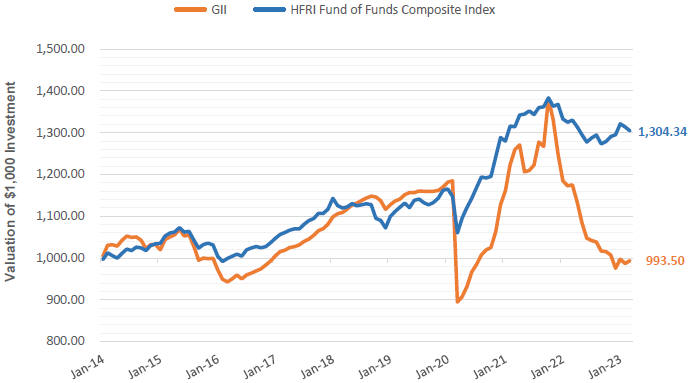

SkyBridge G II Fund, LLC’s total return is based on the monthly change in net asset value (NAV) and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $1,000 investment made in the Fund’s units on January 1, 2014 to a $1,000 investment made in the HFRI Fund of Hedge Funds Index for the same period. The graph and table do not reflect the deduction of taxes that an investor unitholder would pay on a Fund distribution or redemption of units. The listed returns for the Fund are net of expenses and the returns for the index include expenses. Total returns would have been lower had certain expenses not been reduced.

| 1 | Portfolio strategy allocations and strategy classifications are subject to change at any time at the Adviser’s sole discretion. |

| 2 | Allocations shown reflect rebalancing activity at month-end, but may change at any time. Allocations within the Fund may not total 100% if it is not fully invested. The percentages above are reflective of the underlying managers held by the Fund, not of securities held by the underlying managers. |

The table below shows the annualized total returns for SkyBridge G II Fund, LLC and HFRI Fund of Funds Composite Index for the same time periods ended March 31, 2023.

| | | | |

| Annualized Total Returns 3 | | GII | | HFRI Fund of Funds Composite Index 4 5 |

| | | |

One Year | | -15.45% | | -1.93% |

| | | |

Five Years | | -2.17% | | 3.10% |

| | | |

Since GII’s Inception (1/14) | | -0.07% | | 2.91% |

| 3 | Total return equals income yield plus unit price charge and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by unitholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses. All returns are in U.S. dollars ($). |

| 4 | The HFRI Fund of Funds Composite Index includes over 500 domestic and offshore constituent funds. Only fund of funds are included in the index. The index is equal-weighted and all funds report assets in USD net of all fees on a monthly basis. Funds must have at least $50 Million under management or have been actively trading for at least twelve (12) months. Unlike the Fund, HFRI Fund of Funds Composite is unmanaged, is not available for investment and does not incur fees. |

| 5 | HFR Indices are compiled by Hedge Fund Research, Inc. (“HFR”), an industry service provider. The HFRI Indices were incepted in January 1990, and are based on information self-reported by hedge fund managers that decide on their own, at any time, whether or not they want to provide, or continue to provide, information to HFR Asset Management, L.L.C. While the HFRI Indices are frequently used, they have limitations (some of which are typical of other widely used indices). These limitations include survivorship bias (the returns of the indices may not be representative of all the hedge funds in the universe because of the tendency of lower performing funds to leave the index); heterogeneity (not all hedge funds are alike or comparable to one another, and the index may not accurately reflect the performance of a described style); and limited data (many hedge funds do not report to indices, and the index may omit funds, the inclusion of which might significantly affect the performance shown. |

| | The HFRI Indices are based on information self-reported by hedge fund managers that decide on their own, at any time, whether or not they want to provide, or continue to provide, information to HFR Asset Management, L.L.C. Therefore, these indices may not be complete or accurate representations of the hedge fund universe and may be biased in several ways. Results for funds that go out of business are included in the index until the date that they cease operations. All are net of all fees, denominated in U.S. dollars and equal-weighted. The information underlying the indices and the classification of the underlying funds have not been independently verified by either HFR or SkyBridge, and neither HFR nor SkyBridge make any representation as to their accuracy. Past performance does not guarantee future results. Actual results may vary. |

| | The HFRI Indices are first published as estimates & then not finalized until 4 months have elapsed. The indices are updated 3 times per month, see www.hedgefundresearch.com for schedule. |

| | |

| | KPMG LLP 345 Park Avenue New York, NY 10154-0102 |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors

SkyBridge G II Fund, LLC:

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated statement of assets and liabilities of SkyBridge G II Fund, LLC (the Company), including the consolidated schedule of investments, as of March 31, 2023, the related consolidated statements of operations and cash flows for the year then ended, the consolidated statements of changes in shareholders’ capital for each of the years in the two-year period then ended, and the related notes (collectively, the consolidated financial statements) and the financial highlights for each of the years in the five-year period then ended. In our opinion, the consolidated financial statements and financial highlights present fairly, in all material respects, the financial position of the Company as of March 31, 2023, the results of its operations and its cash flows for the year then ended, the changes in its shareholders’ capital for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These consolidated financial statements and financial highlights are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements and financial highlights. Such procedures also included confirmation of securities owned as of March 31, 2023, by correspondence with custodians and brokers; when replies were not received from brokers, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements and financial highlights. We believe that our audits a reasonable basis for our opinion.

|

| We have served as the Company’s auditor since 2014. |

|

| New York, New York |

| May 26, 2023 |

| | | | |

| | KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee | | |

SkyBridge G II Fund, LLC

Consolidated Statement of Assets and Liabilities

March 31, 2023

| | | | |

Assets | | | | |

| |

Investments in Investment Funds, at fair value (cost $34,604,178) | | $ | 34,426,542 | |

Investments in securities, at fair value (cost $3,213,454) | | | 1,420,468 | |

Cash | | | 4,861,843 | |

Receivable for redemptions from Investment Funds | | | 1,234,184 | |

Investments in Investment Funds paid in advance | | | 500,000 | |

Interest receivable | | | 20,304 | |

Other assets | | | 34,552 | |

| | | | |

| |

Total assets | | | 42,497,893 | |

| | | | |

| |

Liabilities | | | | |

| |

Redemptions payable | | | 4,216,931 | |

Professional fees payable | | | 251,640 | |

Management fee payable | | | 29,891 | |

Directors’ fees payable | | | 11,135 | |

Accounts payable and other accrued expenses | | | 35,958 | |

| | | | |

| |

Total liabilities | | | 4,545,555 | |

| | | | |

| |

Commitments and contingencies (see Note 3) | | | – | |

| |

Shareholders’ Capital (51,075.630 Shares Outstanding) | | $ | 37,952,338 | |

| | | | |

| |

Net asset value per share | | $ | 743.06 | |

| | | | |

| |

Composition of Shareholders’ Capital | | | | |

| |

Paid-in capital | | $ | 60,492,129 | |

Distributable earnings (loss) | | | (22,539,791 | ) |

| | | | |

| |

Shareholders’ Capital | | $ | 37,952,338 | |

| | | | |

See accompanying notes to consolidated financial statements.

- 5 -

SkyBridge G II Fund, LLC

Consolidated Schedule of Investments

March 31, 2023

| | | | | | | | | | | | | | |

| | | First | | | | | | % of |

| | | Acquisition | | | | | | Shareholders’ |

| | | Date | | Cost | | Fair Value | | Capital |

| | | | |

Investments in Investment Funds - ‡ | | | | | | | | | | | | | | |

| | | | |

Cryptocurrency and Digital Assets | | | | | | | | | | | | | | |

Galaxy Institutional Ethereum Fund, LP Class B - e,f | | 07/01/2021 | | $ | 459,045 | | | $ | 364,174 | | | | 0.96 | % |

Multicoin Capital Offshore SPC - b,d | | 12/01/2021 | | | 676,508 | | | | 149,972 | | | | 0.40 | |

Multicoin Capital Offshore SPC - side pocket - c | | 12/01/2021 | | | 743,492 | | | | 54,278 | | | | 0.14 | |

NYDIG Institutional Bitcoin Fund LP - e,f | | 12/11/2020 | | | 1,298,879 | | | | 1,466,653 | | | | 3.86 | |

| | | | | | | | | | | | | | |

Total Cryptocurrency and Digital Assets | | | | | 3,177,924 | | | | 2,035,077 | | | | 5.36 | |

| | | | | | | | | | | | | | |

Directional Equity | | | | | | | | | | | | | | |

Armistice Capital Offshore Fund Ltd. - b | | 11/01/2020 | | | 991,422 | | | | 1,318,858 | | | | 3.48 | |

Coatue Offshore Fund Ltd - b,d | | 01/01/2021 | | | 5,800,000 | | | | 5,380,409 | | | | 14.18 | |

Harvest Claro, LLC - c | | 04/01/2021 | | | 454,995 | | | | 76,285 | | | | 0.20 | |

MW Alpha Plus Fund SP - a,b | | 02/01/2023 | | | 1,000,000 | | | | 982,382 | | | | 2.59 | |

Redmile Capital Offshore Fund, Ltd. Class C - c | | 11/01/2020 | | | 283,588 | | | | 34,079 | | | | 0.09 | |

Redmile Strategic Offshore Fund, Ltd Class E - a,b | | 11/01/2022 | | | 1,001,396 | | | | 870,808 | | | | 2.29 | |

Whale Rock Flagship Fund Ltd - side pocket - c | | 11/01/2020 | | | 343,722 | | | | 157,398 | | | | 0.41 | |

| | | | | | | | | | | | | | |

Total Directional Equity | | | | | 9,875,123 | | | | 8,820,219 | | | | 23.24 | |

| | | | | | | | | | | | | | |

Directional Macro | | | | | | | | | | | | | | |

AHL Alpha (Cayman) Limited - k | | 02/01/2023 | | | 1,000,000 | | | | 954,513 | | | | 2.52 | |

| | | | | | | | | | | | | | |

Total Directional Macro | | | | | 1,000,000 | | | | 954,513 | | | | 2.52 | |

| | | | | | | | | | | | | | |

Event Driven | | | | | | | | | | | | | | |

Axonic Credit Opportunities Fund L.P. - b | | 01/01/2014 | | | 2,142,965 | | | | 2,046,534 | | | | 5.39 | |

Axonic Credit Opportunities Overseas Fund, Ltd. - b | | 01/01/2016 | | | 439,736 | | | | 523,857 | | | | 1.38 | |

Medalist Partners Harvest SPV Ltd - c,g | | 04/01/2021 | | | 399,166 | | | | 193,482 | | | | 0.51 | |

Seer Capital Partners Fund L.P. - c | | 01/01/2014 | | | 56,665 | | | | 65,250 | | | | 0.17 | |

Seer Capital Partners Offshore Fund Ltd. - c | | 04/01/2016 | | | 744,019 | | | | 937,618 | | | | 2.47 | |

Third Point Offshore Fund, Ltd. - b | | 09/01/2020 | | | 6,374,999 | | | | 6,216,973 | | | | 16.38 | |

| | | | | | | | | | | | | | |

Total Event Driven | | | | | 10,157,550 | | | | 9,983,714 | | | | 26.30 | |

| | | | | | | | | | | | | | |

Relative Value | | | | | | | | | | | | | | |

Context Partners Fund, L.P. - b | | 02/01/2019 | | | 4,266,834 | | | | 4,836,893 | | | | 12.75 | |

Millennium International, Ltd. - a,b | | 08/01/2015 | | | 869,781 | | | | 1,245,765 | | | | 3.28 | |

ShoreBridge Point72 Select, Ltd. - a,b | | 06/01/2020 | | | 5,256,966 | | | | 6,550,361 | | | | 17.26 | |

| | | | | | | | | | | | | | |

Total Relative Value | | | | | 10,393,581 | | | | 12,633,019 | | | | 33.29 | |

| | | | | | | | | | | | | | |

Total Investments in Investment Funds - * | | | | $ | 34,604,178 | | | $ | 34,426,542 | | | | 90.71 | |

| | | | | | | | | | | | | | |

See accompanying notes to consolidated financial statements.

- 6 -

SkyBridge G II Fund, LLC

Consolidated Schedule of Investments (continued)

March 31, 2023

| | | | | | | | | | | | | | |

| | | First | | | | | | % of |

| | | Acquisition | | | | | | Shareholders’ |

| | | Date | | Cost | | Fair Value | | Capital |

| | | | |

Investments in Securities | | | | | | | | | | | | | | |

| | | | |

United States | | | | | | | | | | | | | | |

| | | | |

Private Equity - ‡ | | | | | | | | | | | | | | |

| | | | |

Chime Financial, Inc. - h | | | | | | | | | | | | | | |

| | | | |

Series F preferred stock (13,030 shares) | | 11/24/2021 | | $ | 899,982 | | | $ | 579,938 | | | | 1.53 | % |

| | | | |

Homebrew Ventures I, L.P. - h,i | | 07/01/2021 | | | 312,402 | | | | 140,176 | | | | 0.37 | |

| | | | |

New York Digital Investment Group LLC Class B2 (43 shares) - j | | 08/19/2021 | | | 1,040,000 | | | | 262,675 | | | | 0.69 | |

| | | | |

Payward, Inc. - j | | | | | | | | | | | | | | |

| | | | |

Series A preferred stock (9,705 shares) | | 12/01/2021 | | | 497,570 | | | | 226,597 | | | | 0.60 | |

| | | | |

Series seed preferred stock (9,000 shares) | | 11/01/2021 | | | 463,500 | | | | 211,082 | | | | 0.55 | |

| | | | | | | | | | | | | | |

| | | | |

Total Investments in Securities - * | | | | $ | 3,213,454 | | | $ | 1,420,468 | | | | 3.74 | |

| | | | | | | | | | | | | | |

| | | | |

Other Assets, less Liabilities | | | | | | | | | 2,105,328 | | | | 5.55 | |

| | | | | | | | | | | | | | |

| | | | |

Shareholders’ Capital | | | | | | | | $ | 37,952,338 | | | | 100.00 | % |

| | | | | | | | | | | | | | |

Note: Investments in underlying Investment Funds are categorized by investment strategy.

| a | As of March 31, 2023, subject to gated redemptions (these are investor-level percentage limitations on redemption). |

| b | Redemptions permitted quarterly. |

| c | Illiquid, redeemable only when underlying investment is realized or converted to liquid interest in Investment Fund. The Company held $1,518,390 (4.41% of total Investments in Investment Funds) of illiquid investments at March 31, 2023. |

| d | Subject to a current lock-up on liquidity provisions on a greater than quarterly basis. |

| e | The Investment Fund is held by SkyBridge G II Sub-Fund I Ltd. (the “Sub-Fund”), a wholly-owned subsidiary of the Company. Investment Funds held by the Sub-Fund represent 5.32% of the total Investments in Investment Funds. |

| f | Redemptions permitted daily. |

| g | The investment is a restructuring of the Company’s interest in Medalist Partners Harvest Fund, LP and Medalist Partners Harvest Fund Ltd, which were first acquired on 8/1/2016 and 7/1/2017, respectively. |

| h | The industry for these securities is financial technology. |

| i | Forward agreement to receive shares of Plaid Inc. at a future date. |

| j | The industry for these securities is digital asset trading & servicing. |

| k | Redemptions permitted monthly. |

| ‡ | The Company’s Investments in Investment Funds and private equities are exempt from registration under the Securities Act of 1933, as amended, and contain restrictions on resale and cannot be sold publicly. |

| * | All Investments in Investment Funds and securities are non-income producing. |

See accompanying notes to consolidated financial statements.

- 7 -

SkyBridge G II Fund, LLC

Consolidated Statement of Operations

Year Ended March 31, 2023

| | | | |

Investment income | | | | |

Interest income | | $ | 43,745 | |

Dividend income | | | 2,289 | |

| | | | |

| |

Total investment income | | | 46,034 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 393,085 | |

Professional fees | | | 371,340 | |

Administration fees | | | 154,969 | |

Underwriting fees | | | 96,000 | |

Filing fees | | | 73,741 | |

Directors’ fees and expenses | | | 48,519 | |

Interest expense | | | 9,857 | |

Custodian fees | | | 6,225 | |

Risk monitoring fees | | | 39,272 | |

Miscellaneous expenses | | | 207,648 | |

| | | | |

| |

Total expenses | | | 1,400,656 | |

| | | | |

| |

Net investment loss | | | (1,354,622 | ) |

| | | | |

| |

Net realized loss and net change in unrealized depreciation on investments in Investment Funds and securities | | | | |

| |

Net realized loss on sales of investments in Investment Funds | | | (3,794,864 | ) |

Net realized loss from securities | | | (276,913 | ) |

Net change in unrealized depreciation on investments in Investment Funds | | | (1,051,355 | ) |

Net change in unrealized depreciation on investments in securities | | | (1,997,475 | ) |

| | | | |

| |

Net realized loss and net change in unrealized depreciation on investments in Investment Funds and securities | | | (7,120,607 | ) |

| | | | |

| |

Net decrease in Shareholders’ Capital from operations | | $ | (8,475,229 | ) |

| | | | |

See accompanying notes to consolidated financial statements.

- 8 -

SkyBridge G II Fund, LLC

Consolidated Statements of Changes in Shareholders’ Capital

| | | | | | | | |

| | | Year Ended

March 31, 2023

| | Year Ended

March 31, 2022

|

| | |

Operations | | | | | | | | |

| | |

Net investment loss | | $ | (1,354,622 | ) | | $ | (1,537,611 | ) |

Net realized gain/(loss) on sales of investments in Investment Funds | | | (3,794,864 | ) | | | 10,303,613 | |

Net realized loss from securities | | | (276,913 | ) | | | (370,272 | ) |

Net change in unrealized depreciation on investments in Investment Funds | | | (1,051,355 | ) | | | (12,987,125 | ) |

Net change in unrealized appreciation/(depreciation) on investments in securities | | | (1,997,475 | ) | | | 204,489 | |

| | | | | | | | |

| | |

Net decrease in Shareholders’ Capital from operations | | | (8,475,229 | ) | | | (4,386,906 | ) |

| | | | | | | | |

| | |

Distributions | | | | | | | | |

| | |

Distributions from distributable earnings | | | (4,803,511 | ) | | | (1,842,326 | ) |

| | | | | | | | |

| | |

Decrease in Shareholders’ Capital from Distributions to Shareholders | | | (4,803,511 | ) | | | (1,842,326 | ) |

| | | | | | | | |

| | |

Shareholders’ Capital Transactions | | | | | | | | |

| | |

Capital contributions | | | – | | | | 125,000 | |

Reinvestment of distributions | | | 4,708,436 | | | | 1,840,303 | |

Capital redemptions | | | (9,022,115 | ) | | | (13,591,327 | ) |

| | | | | | | | |

| | |

Decrease in Shareholders’ Capital from Capital Transactions | | | (4,313,679 | ) | | | (11,626,024 | ) |

| | | | | | | | |

| | |

Shareholders’ Capital at beginning of year | | | 55,544,757 | | | | 73,400,013 | |

| | | | | | | | |

| | |

Shareholders’ Capital at end of year (51,075.630 and 55,883.119 shares outstanding at March 31, 2023 and March 31, 2022, respectively) | | $ | 37,952,338 | | | $ | 55,544,757 | |

| | | | | | | | |

See accompanying notes to consolidated financial statements.

- 9 -

SkyBridge G II Fund, LLC

Consolidated Statement of Cash Flows

Year Ended March 31, 2023

| | | | |

Cash flows from operating activities | | | | |

| |

Net decrease in Shareholders’ capital from operations | | $ | (8,475,229 | ) |

| Adjustments to reconcile net decrease in shareholders’ capital from operations to net cash provided by operating activities: | | | | |

Purchases of investments in Investment Funds | | | (6,780,000 | ) |

Proceeds from disposition of investments in Investment Funds | | | 23,526,244 | |

Proceeds from disposition of investments in securities | | | 1,222,962 | |

Net realized loss on sales of investments in Investment Funds | | | 3,794,864 | |

Net realized loss from securities | | | 276,913 | |

Net change in unrealized depreciation on investments in Investment Funds | | | 1,051,355 | |

Net change in unrealized depreciation on investments in securities | | | 1,997,475 | |

Changes in operating assets and liabilities: | | | | |

Increase in interest receivable | | | (20,304 | ) |

Decrease in other assets | | | 4,968 | |

Decrease in redemption from Investment Funds received in advance | | | (62,500 | ) |

Increase in professional fees payable | | | 81,168 | |

Decrease in management fee payable | | | (13,710 | ) |

Increase in directors’ fee payable | | | 372 | |

Decrease in interest payable | | | (2,275 | ) |

Increase in accounts payable and other accrued expenses | | | 2,450 | |

| | | | |

| |

Net cash provided by operating activities | | | 16,604,753 | |

| | | | |

| |

Cash flows from financing activities | | | | |

| |

Distributions paid | | | (95,075 | ) |

Capital redemptions, net of change in redemptions payable | | | (10,770,478 | ) |

Proceeds from loan payable | | | 2,600,000 | |

Payments for loan payable | | | (3,800,000 | ) |

| | | | |

| |

Net cash used in financing activities | | | (12,065,553 | ) |

| | | | |

| |

Net increase in cash | | | 4,539,200 | |

| |

Cash at beginning of year | | | 322,643 | |

| | | | |

Cash at end of year | | $ | 4,861,843 | |

| | | | |

| |

Supplemental disclosure of financing activities: | | | | |

| |

Decrease in redemptions payable | | $ | (1,748,363 | ) |

| | | | |

Reinvestment of distributions | | $ | 4,708,436 | |

| | | | |

| |

Supplemental disclosure of cash flow information: | | | | |

| |

Interest paid during the year | | $ | 12,132 | |

| | | | |

See accompanying notes to consolidated financial statements.

- 10 -

SkyBridge G II Fund, LLC

Consolidated Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended

March 31, 2023

| | Year Ended

March 31, 2022

| | Year Ended

March 31, 2021

| | Year Ended

March 31, 2020

| | Year Ended

March 31, 2019

|

| | | | | |

Net Asset Value per Share, beginning of year: | | $ | 993.95 | | | $ | 1,096.66 | | | $ | 778.49 | | | $ | 1,022.51 | | | $ | 1,028.00 | |

| | | | | |

Income/(loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment (loss)* | | | (24.91 | ) | | | (24.09 | ) | | | (18.39 | ) | | | (15.12 | ) | | | (15.52 | ) |

Net realized and unrealized gain/(loss) from investments | | | (130.47 | ) | | | (47.92 | ) | | | 336.56 | | | | (198.60 | ) | | | 44.52 | |

| | | | | | | | | | | | | | | | | | | | |

Total income/(loss) from investment operations | | | (155.38 | ) | | | (72.01 | ) | | | 318.17 | | | | (213.72 | ) | | | 29.00 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (95.51 | ) | | | (30.70 | ) | | | – | | | | (30.30 | ) | | | (34.49 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total distributions | | | (95.51 | ) | | | (30.70 | ) | | | – | | | | (30.30 | ) | | | (34.49 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value per Share, end of year: | | $ | 743.06 | | | $ | 993.95 | | | $ | 1,096.66 | | | $ | 778.49 | | | $ | 1,022.51 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total return | | | (15.45 | %) | | | (6.73 | %) | | | 40.87 | % | | | (21.60 | %) | | | 2.89 | % |

| | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Shareholders’ capital, end of year: | | $ | 37,952,338 | | | $ | 55,544,757 | | | $ | 73,400,013 | | | $ | 97,934,363 | | | $ | 118,213,136 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Portfolio turnover | | | 14.43 | % | | | 55.78 | % | | | 56.75 | % | | | 30.74 | %(b) | | | 29.99 | % |

| | | | | |

Ratio of expenses to average Shareholders’ capital** | | | 3.03 | % | | | 2.26 | % | | | 1.95 | %(a) | | | 1.50 | %(a) | | | 1.50 | %(a) |

| | | | | |

Ratio of net investment loss to average Shareholders’ capital** | | | (2.93 | %) | | | (2.26 | %) | | | (1.95 | %) | | | (1.49 | %) | | | (1.48 | %) |

The above ratios and total returns may vary for individual investors based on the timing of capital transactions during the year.

| (a) | Effective November 1, 2020, the Adviser no longer waives these fees. The ratio of expenses for previous years includes management fee waiver and administration fee waiver in the amounts of $316,441 and $54,758, respectively, for the year ended March 31, 2021, $319,035 and $100,597 for the year ended March 31, 2020, $111,269 and $55,491 for the year ended March 31, 2019. Had the Company not included the waivers, the ratio of expenses to average Shareholders’ capital would have been 2.39%, 1.84% and 1.65% for each of the above years, respectively. |

| (b) | The portfolio turnover excludes ETF transactions, had ETF transactions been included, the portfolio turnover would be 35.98%. |

| * | Per share data of net investment loss is computed using the total of monthly income and expense divided by beginning of month shares. |

| ** | The ratios of expenses and net investment loss to average Shareholders’ capital do not include the impact of expenses and incentive allocations or incentive fees related to the underlying Investment Funds or the impact of any placement fees paid by the Shareholder. |

See accompanying notes to consolidated financial statements.

- 11 -

SkyBridge G II Fund, LLC

Notes to Consolidated Financial Statements

March 31, 2023

SkyBridge G II Fund, LLC (the “Company”) was organized as a Delaware limited liability company on May 9, 2011 and commenced operations on January 2, 2014. The Company is registered under the Investment Company Act of 1940 as amended (the “1940 Act”), as a closed-end, non-diversified management investment company. The Company is also registered under the Securities Act of 1933 as amended (the “1933 Act”).

The investment objective of the Company is to achieve capital appreciation principally through investing in investment funds (“Investment Funds”) managed by third-party investment managers (“Investment Managers”) that employ a variety of alternative investment strategies. These investment strategies allow Investment Managers the flexibility to use leveraged and/or short-sale positions to take advantage of perceived inefficiencies across the global markets, often referred to as “alternative” strategies. Because the Investment Funds following alternative investment strategies are often described as hedge funds, the investment program of the Company can be described as a fund of hedge funds.

The Company has a Sub-Fund, SkyBridge G II Sub-Fund I Ltd. (the “Sub-Fund”), which was organized as an exempted company organized under the laws of the Cayman Islands on December 9, 2020 and is a wholly owned subsidiary of the Company. The Sub-Fund pursues its investment objectives by investing in certain Investment Funds.

Shares of the Company (“Shares”) are sold to eligible investors (referred to as “Shareholders”). The minimum initial investment in the Company from each Shareholder is $25,000; the minimum additional investment is $10,000.

SkyBridge Capital II, LLC (the “Adviser” or “SkyBridge”), a Delaware limited liability company, serves as the Company’s investment adviser. The Adviser is registered as an investment adviser under the Investment Advisers Act of 1940, as amended, and, among other things, is responsible for the allocation of the Company’s assets to various Investment Funds. Under the Company’s governing documents, the Company has delegated substantially all authority to oversee the management of the operations and assets of the Company to the Board of Directors (each member a “Director” and collectively, the “Board of Directors”).

| 2. | Significant Accounting Policies |

The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and are expressed in United States dollars. The Company and its subsidiary are considered investment companies under GAAP and follow the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 946, Financial Services – Investment Companies (“ASC 946”). The following is a summary of significant accounting and reporting policies used in preparing the consolidated financial statements.

- 12 -

SkyBridge G II Fund, LLC

Notes to Consolidated Financial Statements (continued)

March 31, 2023

The Company accounts for its investments in accordance with GAAP, and fair values its investments in accordance with the provisions of the FASB ASC Topic 820 Fair Value Measurements and Disclosures (“ASC 820”), which defines fair value, establishes a framework for measuring fair value and requires enhanced disclosures about fair value measurements. Investments are reflected in the consolidated financial statements at fair value. Fair value is the estimated amount that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date.

The Company has formal valuation procedures approved by the Board of Directors. The Adviser performs its duties under the procedures principally through an internal valuation body, which meets at least monthly. The Valuation Committee, which is under the purview of the Board of Directors, receives valuation reports from the Adviser on a quarterly basis and determines if valuation procedures are operating as expected and the outcomes are reliable.

Investments in Investment Funds are subject to the terms of the respective limited partnership agreements, limited liability company agreements, offering memoranda and such negotiated “side letter” or similar arrangements as the Adviser may have entered into with the Investment Fund on behalf of the Company. The Company’s investments in the Investment Funds are carried at fair value as determined by the Company’s interest in the net assets of each Investment Fund using net asset value, or its equivalent, (“NAV”) as a practical expedient or as otherwise determined in accordance with the Company’s valuation procedures.

Prior to investing in any Investment Fund, the Adviser will conduct a due diligence review of the valuation methodology utilized by the Investment Fund and will perform ongoing monitoring due diligence. The results of ongoing, post-investment diligence reviews are used to assess the reasonableness of continued reliance on the valuations reported by the Investment Funds. The NAV supplied by Investment Funds are net of management and performance incentive fees or other allocations payable to the Investment Funds’ managers as required by the Investment Funds’ agreements. Each Investment Manager to which the Adviser allocates assets will charge the Company, as an investor in an underlying Investment Fund, an asset-based fee, and some or all of the Investment Managers will receive performance-based compensation in the form of an incentive fee. The asset-based fees of the Investment Managers are generally expected to range from 1% to 3% annually of the net assets under their management and the incentive fee is generally expected to range from 10% to 25% of net profits annually. These management and incentive fees are accounted for in the valuations of the Investment Funds and are neither included in the management fee reflected in the Consolidated Statement of Operations nor in expenses and net investment loss ratios reflected in the Consolidated Financial Highlights.

The Company may invest in Investment Funds that may designate certain investments within those Investment Funds, typically those that are especially illiquid and/or hard to value, as “special situation” (often called “Side-Pocket”) investments with additional redemption limitations. Such a Side-Pocket is, in effect, similar to a private equity fund that requires its investors to remain invested

- 13 -

SkyBridge G II Fund, LLC

Notes to Consolidated Financial Statements (continued)

March 31, 2023

for the duration of the fund and distributes returns on the investment only when liquid assets are generated within the fund, typically through the sale of the fund’s illiquid assets in exchange for cash.

As a general matter, the fair value of the Company’s investment in an Investment Fund represents the amount that the Company can reasonably expect to receive if the Company’s investment was sold at its reported NAV. Determination of fair value involves subjective judgment and amounts ultimately realized may vary from estimated values. The Investment Funds generally provide for periodic redemptions ranging from daily to semi-annual, subject to various lock-up on liquidity provisions and redemption gates. Investment Funds generally require advance notice of a shareholder’s intent to redeem its interest, and may, depending on the Investment Funds’ governing agreements, deny or delay a redemption request. The Company considers whether a liquidity discount on any Investment Fund should be taken due to redemption restrictions or suspensions by the Investment Fund. No liquidity discount was applied when determining the fair value of the Investment Funds as of March 31, 2023. The underlying investments of each Investment Fund are accounted for at fair value as described in each Investment Fund’s financial statements. The Investment Funds may invest a portion of their assets in restricted securities and other investments that are illiquid.

The accompanying consolidated financial statements include the accounts of the Sub-Fund, which was established to hold and manage certain Investment Funds. As of March 31, 2023, the Company owns 100% of the Sub-Fund. The Company’s investments held in the Sub-Fund, including the results of its operations, have been consolidated and all intercompany accounts and transactions have been eliminated in consolidation.

| | c. | Net Asset Value Determination |

The net asset value of the Company is determined as of the close of business at the end of each month in accordance with the valuation principles set forth below or as may be determined from time to time pursuant to policies established by the Board of Directors.

Retroactive adjustments to the Company’s net asset value might be made after the valuation date, based on information which becomes available after a previous valuation date, which could impact the net asset value per share at which Shareholders purchase or sell Company Shares. For example, fiscal year-end net asset values of an Investment Fund may be revised as a result of a year-end audit performed by the independent auditors of that Investment Fund. Other adjustments to the Company’s net asset value may also occur from time to time, such as from the misapplication by the Company or its agents of the valuation policies described in the Company’s valuation procedures.

Retroactive adjustments to the Company’s net asset value and Shareholder accounts, which are caused by adjustments to the Investment Funds values or by a misapplication of the Company’s valuation policies, that are able to be made within 90 days of the valuation date(s) to which the adjustment would apply will be made automatically unless determined to be immaterial. Other potential retroactive adjustments, regardless of whether their impact increases or decreases the Company’s net asset value, are evaluated qualitatively and quantitatively by management of the

- 14 -

SkyBridge G II Fund, LLC

Notes to Consolidated Financial Statements (continued)

March 31, 2023

Company in determining if adjustment is to be made. All retroactive adjustments are reported to the Company’s Valuation Committee and reported to affected Shareholders.

The Company follows a policy which permits revisions to the number of Shares purchased or sold by Shareholders due to retroactive adjustments made under the circumstances described above which occur within 90 days of the valuation date. In circumstances where a retroactive adjustment is not made under the circumstances described above, Shares purchased or sold by Shareholders will not be adjusted. As a result, to the extent that the subsequent impact of the event which was not adjusted adversely affects the Company’s net asset value, the outstanding Shares of the Company will be adversely affected by prior repurchases made at a net asset value per Share higher than the adjusted value. Conversely, any increases in net asset value per Share resulting from such subsequent impact will be to the benefit of the holders of the outstanding Shares of the Company and to the detriment of Shareholders who previously had their Shares repurchased at a net asset value per Share lower than the post-impact value. New Shareholders may be affected in a similar way, because the same principles apply to the purchase of Shares.

| | d. | Income Recognition and Expenses |

Interest income is recognized on an accrual basis as earned. Expenses are recognized on an accrual basis as incurred. Income, expenses and realized and unrealized gains and losses are recorded monthly.

Securities transactions are accounted for on a trade-date basis. Realized gains and losses on securities transactions are determined using cost calculated on a specific identification basis. Dividends are recorded on the ex-dividend date and interest is recognized on an accrual basis.

The change in an Investment Fund’s net asset value is included in net change in unrealized appreciation/(depreciation) on investments in Investment Funds on the Consolidated Statement of Operations. The Company accounts for realized gains and losses from Investment Fund transactions based on the pro-rata ratio of the fair value and cost of the underlying investment at the date of redemption. For tax purposes, the Company uses the cost recovery method with respect to sales of Investment Funds that are classified as partnerships for U.S. federal tax purposes, and the first-in-first-out method with respect to sales of Investment Funds that are classified as corporations for U.S. federal tax purposes.

The Company bears all expenses incurred in the course of its operations, including, but not limited to, the following: all costs and expenses related to portfolio transactions and positions for the Company’s account; professional fees; costs of insurance; registration expenses; and expenses of meetings of the Board of Directors.

It is the Company’s intention to meet the requirements of the Internal Revenue Code applicable to regulated investment companies (“RICs”) and distribute substantially all of its taxable net investment income and capital gains, if any, to Shareholders each year. While the Company intends to distribute

- 15 -

SkyBridge G II Fund, LLC

Notes to Consolidated Financial Statements (continued)

March 31, 2023

substantially all of its taxable net investment income and capital gains, in the manner necessary to avoid imposition of the 4% excise tax, it is possible that some excise tax will be incurred. In such event, the Company will be liable for the tax only on the amount by which it does not meet the foregoing distribution requirements. During the year ended March 31, 2023, the Company did not incur any excise tax.

The Company has analyzed tax positions taken or expected to be taken in the course of preparing the Company’s tax return for all open tax years and has concluded, as of March 31, 2023, no provision for income tax is required in the Company’s consolidated financial statements. The Company’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue. The Company recognizes tax related interest and penalties, if any, as income tax expense in the Consolidated Statement of Operations. During the year ended March 31, 2023, the Company did not incur any interest or penalties.

The Sub-Fund is a Cayman Islands exempted company and not subject to U.S federal, state and local income tax.

Cash represents cash in a sweep account. Cash held at financial institutions may exceed the amount insured by the Federal Deposit Insurance Corporation. The Company has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such bank deposits.

| | g. | Use of Estimates and Reclassifications |

The preparation of consolidated financial statements in conformity with GAAP requires management of the Company to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Changes in the economic environment, financial markets, and any other parameters used in determining these estimates could cause actual results to differ materially.

The Company uses the NAV, as a practical expedient, provided by Investment Funds as its measure of fair value of an investment in an Investment Fund when (i) the Company’s investment does not have a readily determinable fair value and (ii) the NAV of the Investment Fund is calculated in a manner consistent with the measurement principles of investment company accounting, including measurement of the underlying investments at fair value. In evaluating the level at which the fair value measurement of the Company’s investments have been classified, the Company has assessed factors including, but not limited to, price transparency, the ability to redeem at NAV at the measurement date and the existence or absence of certain redemption restrictions at the measurement date.

- 16 -

SkyBridge G II Fund, LLC

Notes to Consolidated Financial Statements (continued)

March 31, 2023

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the Company discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level 3 measurement). The guidance establishes three levels of fair value as listed below.

Level 1- Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date;

Level 2- Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active;

Level 3- Inputs that are unobservable.

The notion of unobservable inputs is intended to allow for situations in which there is little, if any, market activity for the asset or liability at the measurement date. Under Level 3, the owner of an asset must determine valuation based on their own assumptions about what market participants would take into account in determining the fair value of the asset, using the best information available.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

A financial instrument’s level within the fair value hierarchy is based upon the lowest level of any input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Adviser. The Adviser considers observable data to be market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market.

The following is a summary of the Company’s assets measured at fair value as of March 31, 2023, by ASC 820 fair value hierarchy levels:

| | | | | | | | | | | | | | | | | | | | |

| Description | | Level 1 Quoted Prices | | | Level 2 Significant

Observable Inputs | | | Level 3 Significant

Unobservable

Inputs | | | Investments

Measured at Net

Asset Value | | | Total Fair Value

at March 31, 2023 | |

Investments in Investment Funds | | $ | — | | | $ | — | | | $ | 76,285 | | | $ | 34,350,257 | | | $ | 34,426,542 | |

Investments in Securities | | | | | | | | | | | | | | | | | | | | |

Private Equity | | $ | — | | | $ | — | | | $ | 1,420,468 | | | $ | — | | | $ | 1,420,468 | |

The Company’s investments in Investment Funds for which fair value is measured using NAV per share as a practical expedient, in the amount of $34,350,257 have not been categorized in the fair value hierarchy. This amount includes $1,830,827 held by the Sub-Fund. $76,285 of the total investments in Investment Funds previously not categorized in the fair value hierarchy transferred during the period to Level 3 as a result of a change in valuation methodology used to value the Company’s investment in Harvest Claro, LLC. The Company also has investments in securities in the amount of $1,420,468.

- 17 -

SkyBridge G II Fund, LLC

Notes to Consolidated Financial Statements (continued)

March 31, 2023

The following table details purchases, sales and in-kind transfer of the investments in which significant unobservable inputs (Level 3) were used in determining value:

| | | | | | | | | | | | |

| | | Fair Value Measurements Using Level 3 Inputs | |

| | | |

| | | Directional Equity | | | Private Equity | | | Total Investments | |

| | | | |

| | | |

Purchases | | $ | - | | | $ | - | | | $ | - | |

There was $(378,710) and $(1,792,986) unrealized depreciation on directional equity and private equity respectively, for the year ending March 31, 2023.

The following table summarizes the valuation methodology and significant unobservable inputs used to estimate the fair value of Level 3 investments as of March 31, 2023.

| | | | | | | | | | |

| Type of Level 3 Investment | | Fair Value as of March 31, 2023 | | | Valuation Technique | | Unobservable Input | | Input (weighted average) |

| | | | |

| Investments in Investment Funds Directional Equity | | $ | 76,285 | | | Market comparable companies | | Revenue Multiple | | 3.5x-4.0x |

| | | | |

| Investments in Securities Private Equity | | $ | 1,420,468 | | | Market comparable companies | | Revenue Multiple | | 10.6x-12.1x |

The following is a summary of the investment strategies, their liquidity and redemption notice periods and any restrictions on the liquidity provisions of the investments in Investment Funds held by the Company as of March 31, 2023 and measured at fair value using the NAV per share practical expedient. Investment Funds with no current redemption restrictions may be subject to future gates, lock-up provisions or other restrictions, in accordance with their offering documents which would be considered in fair value measurement and disclosure.

Cryptocurrency and Digital Assets Investment Managers may pursue a variety of investment strategies in managing digital assets of an Investment Fund, and the Company may invest in Investment Funds that provide access to a particular digital asset or assets without a discretionary investment strategy. The Company may also invest in Investment Funds whose Investment Managers have discretion to manage a diversified portfolio of digital assets. The Company and Investment Funds may hold long and short positions in digital assets. The Company and Investment Funds may also invest in securities of companies related, in whole or in part, to digital assets or digital asset technologies (including digital asset miners, payment technologies, digital security, or crypto trading exchanges), or that otherwise have direct or indirect exposure to emerging technologies. The Company and Investment Funds may invest in derivative contracts on digital assets, including cryptocurrency swap agreements, for hedging purposes and non-hedging purposes. The Company may use its assets to offset the carbon footprint associated with the Company’s exposure to Bitcoin and other digital assets. The Investment Funds within this strategy have daily to quarterly liquidity, subject to a 1 to 30 day notice period. An Investment Fund in this strategy, representing

- 18 -

SkyBridge G II Fund, LLC

Notes to Consolidated Financial Statements (continued)

March 31, 2023

approximately 3 percent of the Investment Funds in this strategy is an illiquid or side pocket investment with a suspended redemption. Approximately 7 percent of the Investment Funds in this strategy are subject to hard lock provisions to be lifted after 12 months. The remaining approximately 90 percent of the Investment Funds in this strategy can be redeemed with no restrictions as of the measurement date.

Directional Equity funds take long and short stock positions. The manager may attempt to profit from both long and short stock positions independently, or profit from the relative outperformance of long positions against short positions. The stock picking and portfolio construction process is usually based on bottom-up fundamental stock analysis, but may also include top-down macro-based views, market trends and sentiment factors. Directional equity managers may specialize by region (e.g., global, U.S., Europe or Japan) or by sector. No assurance can be given that the managers will be able to correctly locate profitable trading opportunities, and such opportunities may be adversely affected by unforeseen events. In addition, short selling creates the risk of loss if the security that has been sold short appreciates in value. Generally, the Investment Funds within this strategy have quarterly liquidity, subject to a 45 to 60 day notice period. An Investment Fund in this strategy, representing approximately 3 percent of the Investment Funds in this strategy is an illiquid or side pocket investment with a suspended redemption. Approximately 61 percent of the Investment Funds in this strategy are subject to hard lock provisions to be lifted after 12 months. Approximately 21 percent of the Investment Funds in this strategy have gated redemptions, which are estimated to be lifted after 12 months. The remaining approximately 15 percent of the Investment Funds in this strategy can be redeemed with no restrictions as of the measurement date.

Directional Macro strategies require well developed risk management procedures due to the frequent employment of leverage. Investment managers may trade futures, options on future contracts and foreign exchange contracts and may trade in diversified markets or focus on one market sector. Two types of strategies employed by directional macro managers are discretionary and systematic trading. Discretionary trading strategies seek to dynamically allocate capital to relatively short-term trading opportunities around the world. Directional strategies (seeking to participate in rising and declining markets when the trend appears strong and justified by fundamentals) and relative value approaches (establishing long positions in undervalued instruments and short positions in related instruments believed to be over valued) or in “spread” positions in an attempt to capture changes in the relationships between instruments. Systematic trading strategies generally rely on computerized trading systems or models to identify and capitalize on trends in financial and commodity markets. This systematic approach allows investment managers to seek to take advantage of price patterns in very large number of markets. The trading models may be focused on technical or fundamental factors or combination of factors. Also included in the Directional Macro strategy is the Company’s exposure to digital assets, including its passively-managed exposure in bitcoin. Digital assets (also known as “virtual currencies,” “cryptocurrencies,” “coins” or “tokens” or similar terms) are assets that are issued and/or transferred using technological innovations such as distributed ledger or blockchain technology and include, but are not limited to, bitcoin. The Investment Fund in this strategy has monthly liquidity, subject to a 10 day notice period. The Investment Fund in this strategy can be redeemed with no restrictions as of the measurement date.

- 19 -

SkyBridge G II Fund, LLC

Notes to Consolidated Financial Statements (continued)

March 31, 2023

Event Driven strategies involve investing in opportunities created by significant transactional events such as spin-offs, mergers and acquisitions, bankruptcies, recapitalizations and share buybacks. Event driven strategies include “merger arbitrage” and “distressed securities”. Generally, the Investment Funds within this strategy have quarterly liquidity, subject to a 90 day notice period. Investment Funds in this strategy, representing approximately 12 percent of the Investment Funds in this strategy are illiquid or side pocket investments with suspended redemptions. The remaining approximately 88 percent of the Investment Funds in this strategy can be redeemed with no restrictions as of the measurement date.

Relative Value strategies seek to take advantage of specific pricing anomalies, while also seeking to maintain minimal exposure to systematic market risk. This may be achieved by purchasing one security previously believed to be undervalued, while selling short another security perceived to be overvalued. Relative value arbitrage strategies include equity market neutral, statistical arbitrage, convertible arbitrage, and fixed income arbitrage. Some investment managers classified as multi-strategy relative value arbitrage use a combination of these substrategies. Generally, the Investment Funds within this strategy have quarterly liquidity, subject to a 55 to 90 day notice period. Approximately 62 percent of the Investment Funds in this strategy have gated redemptions, which are estimated to be lifted after 12 months. The remaining approximately 38 percent of the Investment Funds in this strategy can be redeemed with no restrictions as of the measurement date.

Private Equity Investments: The Company also makes private investments in emerging portfolio companies (e.g., venture capital and growth equity investments) and may, on occasion, purchase and hold public equities. Equity investments are valued at initial transaction price and may subsequently be valued using valuation models in the absence of readily observable market prices. Valuation models are generally based on (i) earnings before interest, taxes, depreciation and amortization (EBITDA) multiples analysis, (ii) the value attributable to the equity instrument from the enterprise value of the portfolio company or the proceeds that would be received if the portfolio company liquidated, and (iii) market and income (discounted cash flow) approaches, in which various internal and external factors are considered. Factors include key financial inputs and recent public and private transactions for comparable investments. Key inputs used for the discounted cash flow approach include the weighted average cost of capital and investment terminal values derived from EBITDA multiples. An illiquidity discount may be applied where appropriate.

The availability of valuation techniques and observable inputs can vary from investment to investment and are affected by a wide variety of factors, including the type of investment, whether the investment is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the investment. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, determining fair value requires more judgment. Because of the inherent uncertainty of valuation, those estimated values may be materially higher or lower than the values that would have been used had a readily available market existed for such assets or liabilities and the values that may ultimately be realized. Accordingly, the degree of judgment exercised by the Manager in determining fair value is greatest for assets or liabilities categorized as Level 3.

- 20 -

SkyBridge G II Fund, LLC

Notes to Consolidated Financial Statements (continued)

March 31, 2023

The Company follows the authoritative guidance under GAAP on determining fair value when the volume and level of activity for the asset or liability have significantly changed and identifying transactions that are not orderly. Accordingly, if the Company determines that either the volume and/or level of activity for an asset or liability has significantly changed (from normal conditions for that asset or liability) or price quotations or observable inputs are not associated with orderly transactions, increased analysis and management judgment will be required to estimate fair value. Valuation techniques such as an income approach might be appropriate to supplement or replace a market approach in those circumstances.

The guidance also provides a list of factors to determine whether there has been a significant change in relation to normal market activity. Regardless of the valuation technique and inputs used, the objective for the fair value measurement in those circumstances is unchanged from what it would be if markets were operating at normal activity levels and/or transactions were orderly; that is, to determine the current exit price.

The Company had no unfunded commitments to Investment Funds as of March 31, 2023.

| 4. | Management Fee, Administrative Fee, Related Party Transactions and Other |

The Adviser provides investment management services to the Company. The Adviser acts primarily to evaluate and select Investment Managers, to allocate assets, to establish and apply risk management procedures, and to monitor overall investment performance. In consideration for such services, the Company pays the Adviser a monthly management fee of 0.071% (0.85% annually) based on end of month Shareholders’ capital.

Hastings Capital Group, LLC (“Hastings”), an affiliate of the Adviser, has been appointed to serve as the Company’s principal underwriter (the “Principal Underwriter”) with authority to sell Shares directly and to appoint placement agents to assist the Principal Underwriter in selling Shares. Underwriting fees in the amount of $8,000 are accrued on a monthly basis. Total amounts expensed related to underwriting fees by the Company for the year ended March 31, 2023 were $96,000 included on the Consolidated Statement of Operations of which $8,000 remains payable and is included in accounts payable and other accrued expenses on the Consolidated Statement of Assets and Liabilities. Placement agents may be retained by the Company to assist in the placement of the Company’s Shares. The Adviser or its affiliates, including the Principal Underwriter, may pay from their own resources compensation to the placement agents in connection with placement of Shares or servicing of investors. As to each investor referred by a placement agent to date, such additional compensation will be in the range of 0.1% to 0.2% of the value of the Shares held by the investor per annum.

The Adviser and BNY Mellon Investment Servicing (US) Inc. (“BNYM”) have separate agreements with the Company and act as co-administrators to the Company. BNYM provides certain accounting, recordkeeping, tax and investor related services and charges fees for their services based on a rate applied to the average Shareholders’ capital and are charged directly to the Company. Total amount expensed relating to administration services provided by BNYM for the year ended March 31, 2023 was $86,812 and is included in administration fees on the Consolidated Statement of Operations of

- 21 -

SkyBridge G II Fund, LLC

Notes to Consolidated Financial Statements (continued)

March 31, 2023

which $7,329 remains payable and is included in accounts payable and other accrued expenses on the Consolidated Statement of Assets and Liabilities.

The Adviser provides a variety of administrative and shareholder services under an administrative services agreement with the Company. The Adviser is paid an annual fee, payable monthly and, as of April 1, 2020, calculated at 0.10% of the Company’s monthly net assets. Effective October 1, 2022, the Adviser administrative service fee increased to 0.20%. Total amount expensed relating to administrative services provided by the Adviser for the year ended March 31, 2023 was $68,157 and is included in administration fees on the Consolidated Statement of Operations of which none remains payable.

Certain Directors of the Company are also directors and/or officers of other investment companies that are advised by the Adviser, including SkyBridge Multi-Adviser Hedge Fund Portfolios LLC.

Each Director who is not an “interested person” of the Company, as defined by the 1940 Act, receives, for his service as Director of the Company and SkyBridge Multi-Adviser Hedge Fund Portfolios LLC, an annual retainer effective July 1, 2018, of $90,000, a fee per telephonic meeting of the Board of Directors of $500 and a fee per in person meeting of the Board of Directors of $1,000 plus reasonable out of pocket expenses. The Chair of the Audit Committee will receive a $10,000 per year supplemental retainer. Directors will be reimbursed by the Company for their travel expenses related to Board meetings. A portion of such fees and costs will be allocated to each fund according to its relative net assets and a portion will be split equally between each fund. Additional information about the directors may be found in the Company’s prospectus.

Total amounts expensed related to Directors by the Company for the year ended March 31, 2023 were $48,519, of which $11,135 remains payable.

The Bank of New York Mellon serves as custodian of the Company’s assets and provides custodial services for the Company. Fees payable to the custodian and reimbursement for certain expenses are paid by the Company. Total amounts expensed related to custodian fees by the Company for the year ended March 31, 2023 were $6,225 of which $442 remains payable and is included in accounts payable and other accrued expenses on the Consolidated Statement of Assets and Liabilities.

The Company has elected to, and intends to meet the requirements necessary to, qualify as a RIC under Subchapter M of the Internal Revenue Code of 1986, as amended. As such, the Company must satisfy, among other requirements, certain ongoing asset diversification, source-of-income and annual distribution requirements imposed by Subchapter M. To facilitate compliance with certain asset diversification requirements, the Company retains an independent third-party service provider. The primary roles of the third-party service provider are to collect and aggregate information with respect to the Investment Funds’ holdings and to test the Company’s compliance with certain asset diversification requirements each quarter. Total amount expensed relating to these services for the year ended March 31, 2023 was $35,189 and is included in risk monitoring fees on the Consolidated Statement of Operations of which $2,618 remains payable and is included as accounts payable and other accrued expenses on the Consolidated Statement of Assets and Liabilities.

- 22 -

SkyBridge G II Fund, LLC

Notes to Consolidated Financial Statements (continued)

March 31, 2023

| 5. | Securities Transactions |

The following table lists the aggregate purchases and proceeds from sales of Investment Funds and Securities for the year ended March 31, 2023, gross unrealized appreciation, gross unrealized depreciation and net unrealized depreciation as of March 31, 2023.

| | | | | | | | |

Cost of purchases* | | $ | 7,709,284 | | | | | |

| | | | | | | | |

Proceeds from sales* | | $ | 19,806,911 | | | | | |

| | | | | | | | |

| | |

Gross unrealized appreciation | | $ | 3,020,953 | | | | | |

Gross unrealized depreciation | | | (4,991,573 | ) | | | | |

| | | | | | | | |

Net unrealized depreciation | | $ | (1,970,620 | ) | | | | |

| | | | | | | | |

| | * | Cost of purchases and proceeds from sales include non-cash transfers of $1,429,284, representing transfers between investment in Investment Funds for the year ended March 31, 2023, representing transfers between share classes within the same Investment Fund, onshore and offshore Investment Funds under the same manager, and Investment Funds under the same manager. |

Line of Credit

On August 26, 2022, the Company renewed an uncommitted line of credit (the “Line of Credit”) with an unaffiliated bank, expiring on August 25, 2023. Subject to the terms of the Line of Credit Agreement, the Company may borrow up to $5,000,000 (the “Maximum Amount”). The Company pays interest on the unpaid principal balance at a rate per annum for each day equal to the sum of (a) two percent (2%) per annum, plus (b) the higher of (i) the Federal Funds Effective Rate in respect of such day, and (ii) to the extent reasonably ascertainable by the bank, the secured overnight financing rate in respect of such day, but in any case not in excess of the maximum rate permitted by law. In addition, the Company will pay to the lender an administration fee in an amount equal to $20,000 per annum, payable quarterly in arrears commencing June 27, 2019, and on the termination of the agreement. The administration fee for the year ended March 31, 2023 was $20,000 and is included in miscellaneous expenses on the Consolidated Statement of Operations of which $10,000 remains payable and is included in accounts payable and other accrued expenses on the Consolidated Statement of Assets and Liabilities.

For the year ended March 31, 2023, the Company’s average interest rate paid on the Line of Credit was 4.39% per annum and the average loan outstanding was $788,462 during the periods whereby the Company had a loan outstanding. The Company had no outstanding amount of under the Line of Credit at March 31, 2023. Interest expense for the year ended March 31, 2023 was $9,857 of which none remains payable.

- 23 -

SkyBridge G II Fund, LLC

Notes to Consolidated Financial Statements (continued)

March 31, 2023

| 7. | Contributions, Redemptions, and Allocation of Income |

The Company is authorized to issue an unlimited number of Shares, all at $0.00001 par value per Share. Such par value is included in paid-in capital in the Consolidated Statement of Assets and Liabilities. Generally, initial and additional subscriptions for Shares may be accepted as of the first day of each month. The Adviser has been authorized by the Board of Directors of the Company to accept or reject any initial and additional subscriptions for Shares in the Company. The Board of Directors from time to time and in its complete and exclusive discretion, may determine to cause the Company to repurchase Shares from Shareholders pursuant to written tenders by Shareholders on such terms and conditions as it may determine. The Adviser expects that it typically will recommend to the Board of Directors that the Company offer to repurchase 5% to 25% of total outstanding Shares from Shareholders semi-annually, on each March 31 and September 30 (or, if any such date is not a business day, on the immediately preceding business day).

As of March 31, 2023, a tender offer with a 10% limit was oversubscribed. As a result, the Company purchased shares on a pro rata basis of 11.13% of the total shares submitted for tender.

Transactions in Shares were as follows for the years ended March 31, 2023 and March 31, 2022:

| | | | | | | | |

| | | March 31, 2023 | | March 31, 2022 |

Shares outstanding, beginning of year | | | 55,883.119 | | | | 66,930.417 | |

Shares purchased | | | – | | | | 125.760 | |

Shares issued for reinvestment of distributions | | | 6,455.898 | | | | 1,742.653 | |

Shares redeemed | | | (11,263.387 | ) | | | (12,915.711 | ) |

| | | | | | | | |

Shares outstanding, end of year | | | 51,075.630 | | | | 55,883.119 | |

| | | | | | | | |

In the normal course of business, the Investment Funds in which the Company invests trade various financial instruments and enter into various investment activities with off-balance sheet risk. These include, but are not limited to, short selling activities, writing option contracts and entering into equity swaps. The Company’s risk of loss in these Investment Funds is limited to the value of its investment in the respective Investment Funds.