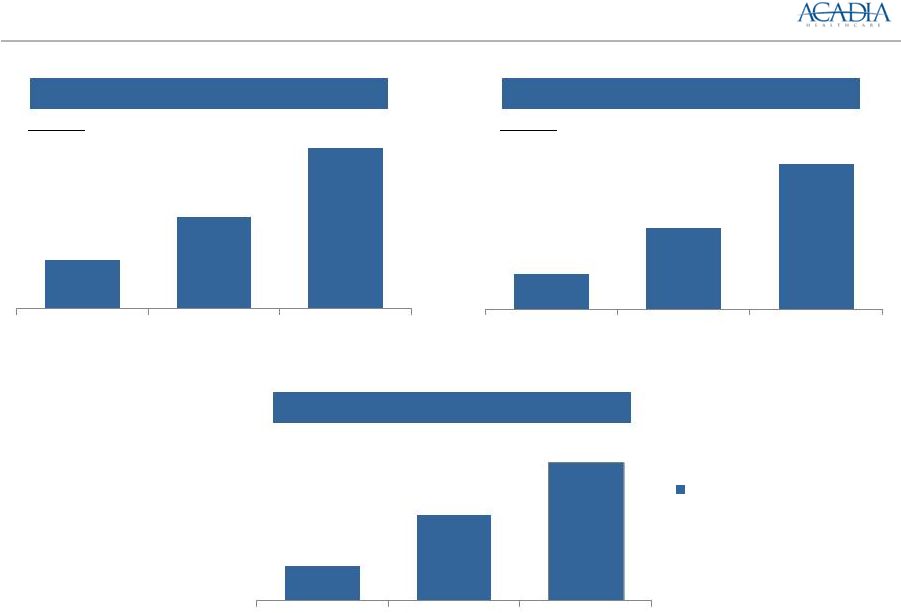

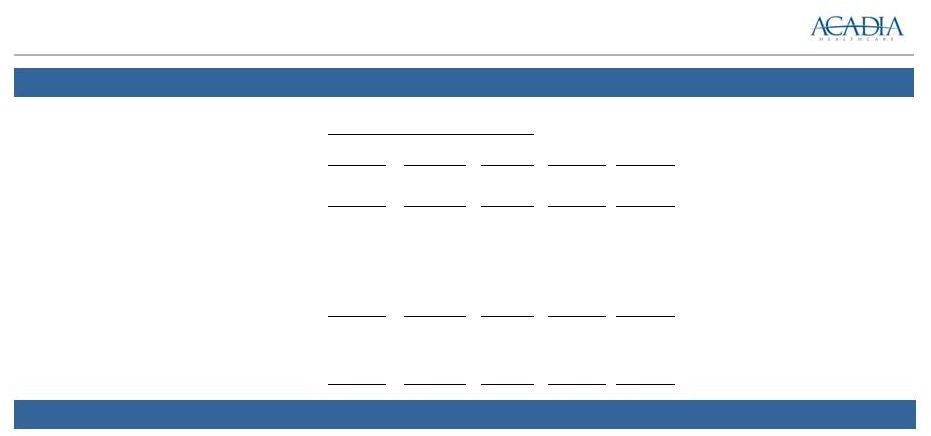

Adjusted EBITDA Reconciliation (1) Approximately $17.3 million of equity-based compensation was recognized in 2011 related to equity units issued in conjunction with the acquisition of YFCS (2) Includes headcount reduction associated with duplicative functions and the integration of PHC’s, AmiCare’s and BCA’s corporate functions into Acadia’s headquarters in Franklin, TN (3) Represents (1) the increased revenue that would have resulted from an increased rate on one of PHC’s contracts that became effective in March 2011, assuming such increased rate had been effective throughout the twelve month period ended December 31, 2011. The increased rate was estimated by multiplying the historical plan enrollment by the newly-contracted rate, and (2) the increased revenue of AmiCare facilities for the Arkansas Medicaid rate increases effective July 1, 2012 (4) Reflects integration costs incurred through 12/31/11 for the acquisition of YFCS by Acadia (5) Represents rent expense incurred prior to the purchase of the real estate assets of (1) PHC’s Capstone Academy, (2) the six facilities that were previously leased by Acadia and purchased in 2012 and (3) BCA’s Stone Crest facility purchased in December 2011 (6) Includes run-rate effect of the expansion of an existing PHC contract, normalized operating income for PHC’s Seven Hills Facility, a legal settlement at PHC, the impact of start up losses for new programs and facilities opened by PHC, AmiCare and BCA, reimbursement adjustments, divestiture costs, policy changes, management fees and other transaction related expenses already incurred (7) In connection with the redemption of $52.5 million of the Company’s 12.875% Senior Notes, Acadia recorded a debt extinguishment charge of $9.4 million in the first quarter ended March 31, 2013. Description of Adjustments 22 Pro Forma Adjusted EBITDA Reconciliation FYE December 31, 2011 2012 Pro Forma Results Income (Loss) from Continuing Operations $8.9 $34.3 Interest expense, net 34.6 34.9 Income tax provision (benefit) 16.6 23.2 Depreciation and amortization 11.1 12.4 Other expense, net 0.0 0.6 Pro Forma EBITDA $71.2 $105.4 Adjustments (1) Equity-based compensation expense 17.4 2.3 (2) Cost savings/synergies 9.8 6.9 (3) Rate increases 0.7 0.2 (4) Integration and closing costs 0.9 0.0 (6) Other 0.5 9.1 Total Pro Forma Adjusted EBITDA $105.2 $127.2 $ millions (5) Rent elimination 4.7 3.3 2013 $44.3 37.9 27.0 17.6 0.0 $126.8 5.2 0.0 0.0 0.0 7.2 $148.6 0.0 (7) Debt extinguishment costs 0.0 0.0 9.4 TTM 3/31/14 $52.7 38.5 31.6 19.1 0.0 $141.9 6.4 0.0 0.0 0.0 7.2 $155.5 0.0 0.0 |