BROOKFIELD INVESTMENT FUNDS

Brookfield Global Listed Infrastructure Fund

Brookfield Global Listed Real Estate Fund

Brookfield Global Renewables & Sustainable Infrastructure Fund

Brookfield Real Assets Securities Fund

Center Coast Brookfield Midstream Focus Fund

Oaktree Emerging Markets Equity Fund

Dear Shareholder:

You are receiving this notice because you are a shareholder in one or more of the funds listed above (the "Funds"), each of which is a series of Brookfield Investment Funds (the "Trust"). Your Fund's Board of Trustees is requesting your vote on a proposal regarding the Trust that will be presented to shareholders at a Special Meeting of Shareholders to be held on May 20, 2022 (the "Meeting"). We encourage you to read the Questions and Answers section at the beginning of the enclosed Proxy Statement as well as the entire Proxy Statement, which describes the proposal to be presented at the Meeting. At the Meeting, shareholders of all Funds will be asked to elect two Trustees to serve on the Board of Trustees until their resignation, retirement, death or removal or until their respective successors are duly elected and qualified (the "Proposal").

Your vote is important to us. Please take a few minutes to review the enclosed Proxy Statement and complete, sign, date and return the enclosed proxy card(s), or vote your shares by Internet or telephone, as described on the enclosed proxy card(s), unless you plan to attend the Meeting. Your Fund's Board of Trustees has unanimously approved the Proposal and urges you to vote "FOR" the election of each Trustee nominee in the Proposal.

If you have any questions about the Proposal, please call (855) 777-8001.

Thank you for your response and we look forward to preserving your trust as a valued shareholder.

Sincerely,

/s/ Brian F. Hurley

Brian F. Hurley

President

Brookfield Investment Funds

BROOKFIELD INVESTMENT FUNDS

Brookfield Global Listed Real Estate Fund

Class A – (BLRAX)

Class C – (BLRCX)

Class I – (BLRIX)

Brookfield Global Listed Infrastructure Fund

Class A – (BGLAX)

Class C – (BGLCX)

Class I – (BGLIX)

Brookfield Real Assets Securities Fund

Class A – (RASAX)

Class C – (RASCX)

Class I – (RASIX)

Brookfield Global Renewables & Sustainable Infrastructure Fund

Class A – (GRSAX)

Class C – (GRSCX)

Class I – (GRSIX)

Center Coast Brookfield Midstream Focus Fund

Class A – (CCCAX)

Class C – (CCCCX)

Class I – (CCCNX)

Oaktree Emerging Markets Equity Fund

Class A – (OEQAX)

Class C – (OEQCX)

Class I – (OEQIX)

Brookfield Place

250 Vesey Street, 15th Floor

New York, New York 10281-1023

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held on May 20, 2022

Notice is hereby given that a Special Meeting of Shareholders of Brookfield Investment Funds (the "Trust," each separate series thereof, a "Fund") will be held at the offices of the Funds' investment adviser, Brookfield Public Securities Group LLC, at Brookfield Place, 250 Vesey Street, 15th Floor, New York, New York 10281-1023, on Friday, May 20, 2022 at 8:45 a.m. Eastern

Time (together with any adjournments or postponements thereof, the "Meeting"). The Meeting is being held for the following purposes:

1. To elect two (2) Trustees to serve on the Board of Trustees until their resignation, retirement, death or removal or until their respective successors are duly elected and qualified (the "Proposal").

2. To transact such other business as may properly come before the Meeting or any adjournments, postponements or delays thereof.

Shareholders of all Funds will vote together as a single class on the Proposal.

THE BOARD OF TRUSTEES OF THE FUNDS, INCLUDING ALL OF THE INDEPENDENT TRUSTEES, RECOMMENDS THAT YOU VOTE "FOR" THE ELECTION OF EACH TRUSTEE NOMINEE IDENTIFIED IN THE PROPOSAL.

The Board of Trustees has fixed the close of business on March 11, 2022, as the record date for the determination of shareholders entitled to notice of, and to vote at, the Meeting.

Due to the public health impact of the coronavirus pandemic (COVID-19), and to support the health and well-being of Fund shareholders, the Meeting will be held in a virtual meeting format only. Shareholders will not be able to attend the Meeting in person. In order to participate in and vote at the Meeting, shareholders of record as of the close of business on March 11, 2022 (the "Record Date") need to register for the Meeting. If you owned shares as of the Record Date and wish to participate in the Meeting, you must email AST Fund Solutions, LLC ("AST'') at attendingameeting@astfinancial.com or call AST toll-free at 1-866-387-9392, in order to register to attend the Meeting, obtain the credentials to access the Meeting, and verify that you were a shareholder on the Record Date. If you are a record owner of shares, please have your 15-digit control number on your proxy card available when you call or include it in your email. You may vote during the Meeting by following the instructions that will be available on the Meeting website during the Meeting.

If you hold your shares through an intermediary, such as a bank or broker, as of the Record Date, you must provide a legal proxy from that institution in order to vote your shares at the Meeting. You may forward an email from your intermediary or attach an image of your legal proxy and transmit it via email to AST at attendingameeting@astfinancial.com and you should label the email "Legal Proxy" in the subject line. If you hold your shares through an intermediary as of the Record Date and wish to attend, but not vote at, the Meeting, you must verify to AST that you owned shares as of the Record Date through an account statement or some other similar means.

Requests for registration must be received by AST no later than 5:00 p.m., Eastern Time, on May 19, 2022. You will then receive a confirmation email from AST of your registration and a control number that will allow you to vote at the Meeting.

Shareholders of record as of the close of the Record Date are entitled to notice of, and to vote at, the Meeting or any adjournment or postponement thereof. You are being asked to participate at the Meeting either virtually or by proxy. If you attend the Meeting and are a shareholder of record as of the close of business on the Record Date, you may vote your Shares at the Meeting. Regardless of whether you plan to attend the Meeting, please complete, date, sign and return promptly in the enclosed envelope the accompanying proxy. This is important to ensure a quorum at the Meeting.

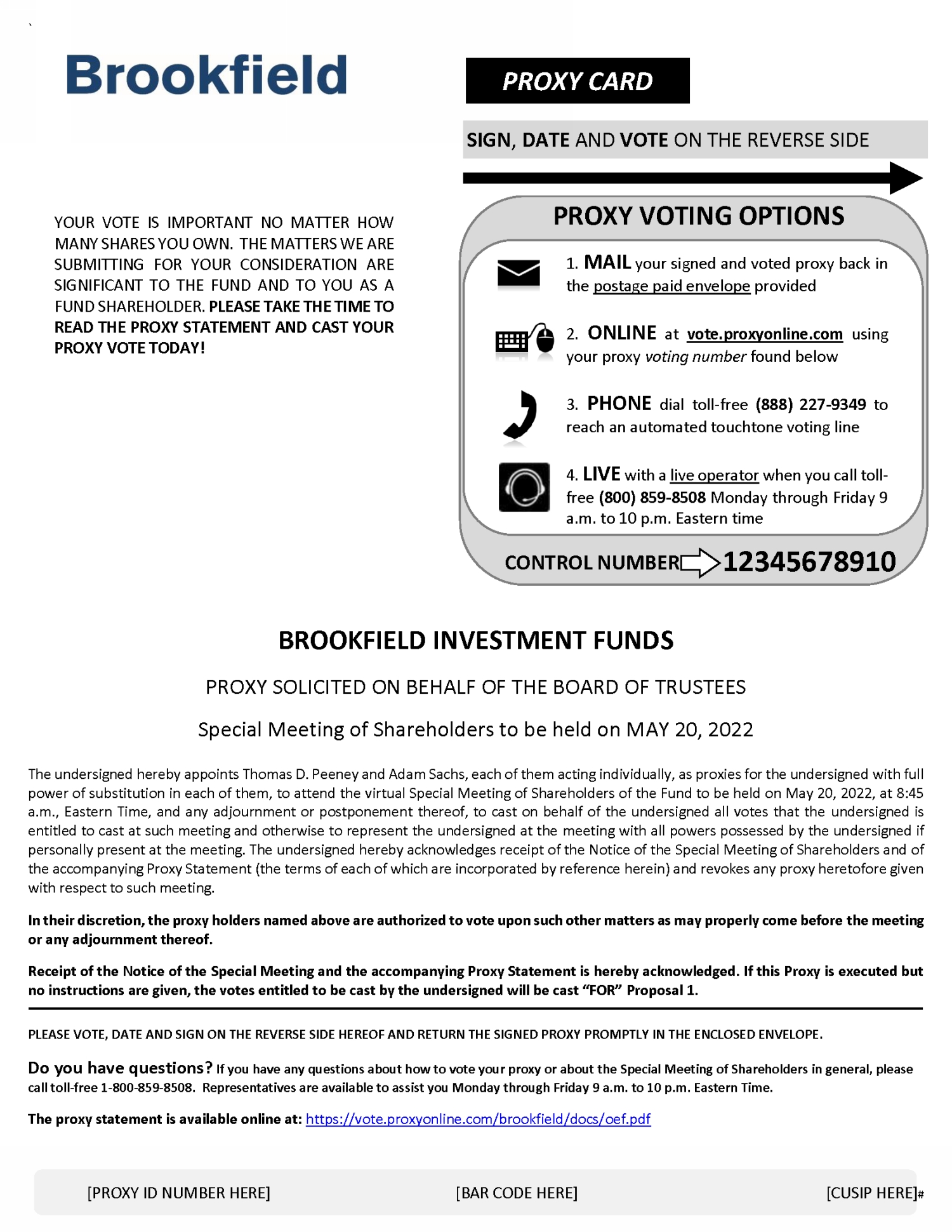

In addition to authorizing a proxy to vote by mail, you may also authorize a proxy to vote your Shares via the Internet or telephone, as follows:

To vote by the Internet:

(1) Read the Proxy Statement and have the enclosed proxy card at hand.

(2) Go to the website that appears on the enclosed proxy card.

(3) Enter the control number set forth on the enclosed proxy card and follow the simple instructions.

To vote by telephone:

(1) Read the Proxy Statement and have the enclosed proxy card at hand.

(2) Refer to the toll-free number that appears on the enclosed proxy card.

(3) Follow the instructions.

We encourage you to authorize a proxy to vote your Shares via the Internet using the control number that appears on your enclosed proxy card. Use of Internet voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed Proxy Statement carefully before you vote. If you should have any questions about this Notice or the proxy materials, we encourage you to call us at (855) 777-8001.

By Order of the Board of Trustees,

/s/ Thomas D. Peeney

Thomas D. Peeney

Secretary

April 14, 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE SHAREHOLDER MEETING

TO BE HELD ON MAY 20, 2022.

The Notice of Special Meeting, Proxy Statement and Form of Proxy are available at www.publicsecurities.brookfield.com. For more information, shareholders may contact the Funds at (855) 777-8001.

WE NEED YOUR PROXY VOTE IMMEDIATELY.

YOU MAY THINK YOUR VOTE IS NOT IMPORTANT, BUT IT IS VITAL. AT THE MEETING OF SHAREHOLDERS, THE FUND WILL BE UNABLE TO CONDUCT ANY BUSINESS IF LESS THAN A MAJORITY OF THE VOTES ENTITLED TO BE CAST ARE REPRESENTED. IN THAT EVENT, THE MEETING MAY BE ADJOURNED AND THE TRUST, AT THE SHAREHOLDERS' EXPENSE, WOULD CONTINUE TO SOLICIT VOTES IN AN ATTEMPT TO ACHIEVE A QUORUM. CLEARLY, YOUR VOTE COULD BE CRITICAL TO ENABLE THE TRUST TO HOLD THE MEETING AS SCHEDULED, SO PLEASE RETURN YOUR PROXY CARD IMMEDIATELY. YOU AND ALL OTHER SHAREHOLDERS WILL BENEFIT FROM YOUR COOPERATION.

Instructions for Signing Proxy Cards

The following general rules for signing proxy cards may be of assistance to you and may avoid the time and expense to the Trust involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Account. Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Account. Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card.

3. All Other Accounts. The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

Registration | | Valid Signature | |

Corporate Accounts

| (1) ABC Corp. | | ABC Corp. | |

| (2) ABC Corp. | | John Doe, Treasurer | |

| (3) ABC Corp. c/o John Doe, Treasurer | | John Doe | |

| (4) ABC Corp. Profit Sharing Plan | | John Doe, Trustee | |

Trust Accounts

| (1) ABC Trust | | Jane B. Doe, Trustee | |

| (2) Jane B. Doe, Trustee u/t/d 12/28/78 | | Jane B. Doe | |

Custodial or Estate Accounts

(1) John B. Smith, Cust.

f/b/o John B. Smith, Jr.

UGMA | | John B. Smith | |

| (2) Estate of John B. Smith | | John B. Smith, Jr., Executor | |

1

INSTRUCTIONS FOR VOTING BY TOUCH-TONE TELEPHONE OR THROUGH THE INTERNET

1. Read the proxy statement, and have your proxy card handy.

2. Call the toll-free number or visit the web site indicated on your proxy card.

3. When prompted, enter the control number found on your proxy card.

4. Follow the recorded or on-line instructions to cast your vote.

2

QUESTIONS AND ANSWERS

Why am I receiving this Proxy Statement?

This Proxy Statement seeks your approval as a shareholder of a Fund that is a series of the Trust regarding the election of certain Trustees to the Trust's Board of Trustees (the "Board" or the "Trustees"). On March 11, 2022, you owned shares of beneficial interest ("Shares") of a Fund or Funds and, as a result, have a right to vote on the proposal.

What proposals am I being asked to vote on?

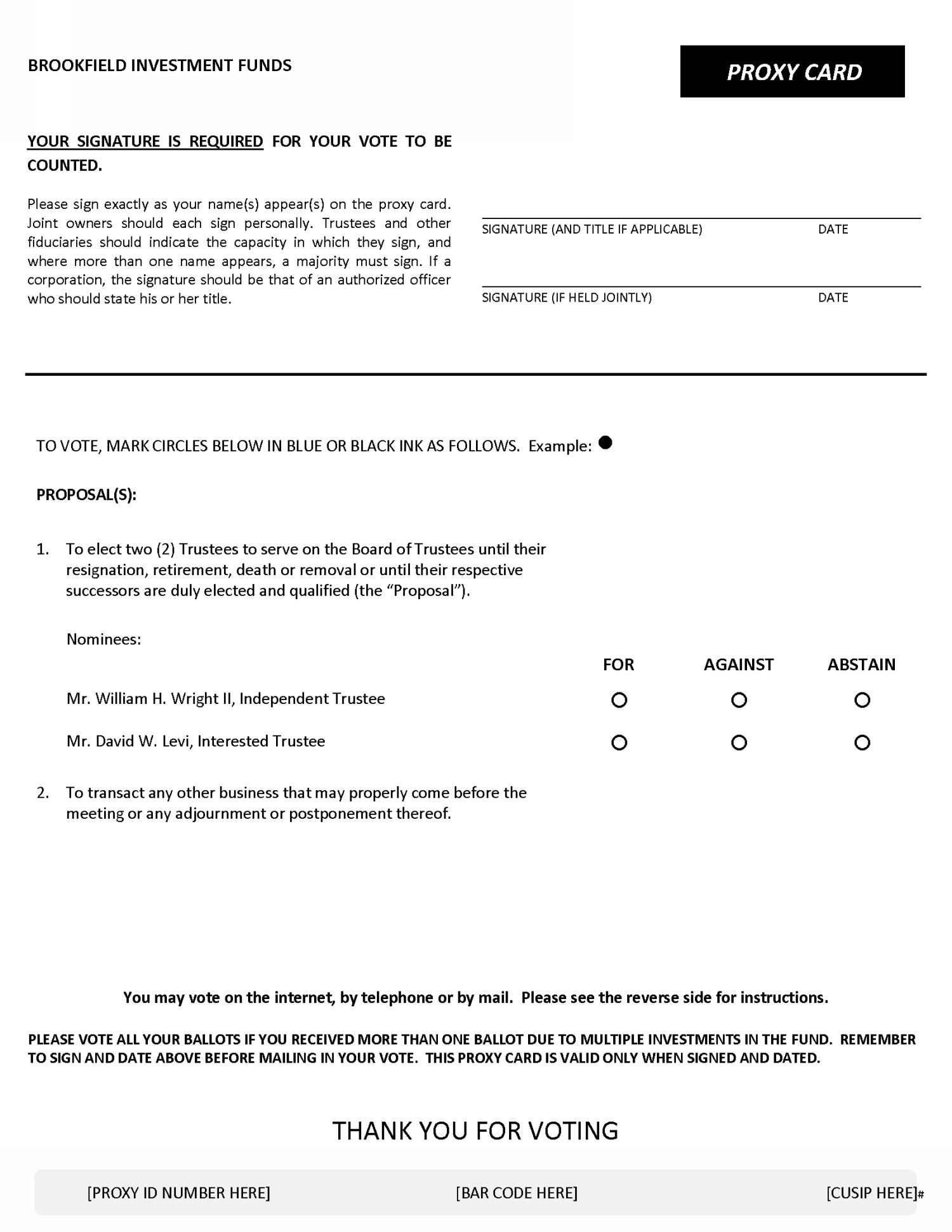

You are being asked to vote on the proposal to elect two (2) Trustees, Messrs. William H. Wright II and David W. Levi (the "Nominees") to the Trust's Board. The Proxy Statement describes the proposal in more detail.

Why am I being asked to elect Trustees?

The Trust and each Fund are governed by the Board. Although the Board can ordinarily appoint new trustees without a shareholder vote, the Board cannot do so if it no longer meets certain requirements under the Investment Company Act of 1940, as amended (the "1940 Act"). Due to the recent resignation of a Trustee who was elected by shareholders, a shareholder meeting is required to elect certain Trustees who were not previously elected by shareholders. Furthermore, electing the Nominees would give the Board the additional flexibility in the future to appoint a limited number of additional new Trustees, if necessary, without incurring the costs of holding one or more shareholder meetings. The Board is recommending that shareholders of each Fund elect to the Board two nominees, one of whom is not an "interested person" of the Funds within the meaning of Section 2(a)(19) of the 1940 Act and one of whom is considered to be "interested person" of the Funds. Therefore, if elected, the non-interested Nominee would serve on the Board as "Independent Trustee" under the 1940 Act and the Nominee that is interested person would be considered an "Interested Trustee."

What role does the Board play?

The Trustees serve as your representatives. They are fiduciaries and have an obligation to serve the best interests of shareholders. The Trustees review each Fund's performance, oversee the Trust and the Funds' activities and review contractual arrangements with companies that provide services to the Trust and Funds.

Do Trustees receive compensation for their services?

Each Independent Trustee receives compensation for his or her service on the Board. The Interested Trustees do not receive compensation for their service on the Board. The Proxy Statement provides details about each Nominee and compensation to be paid to the Independent Trustees.

3

Who is paying for my shareholder meeting and Proxy Statement?

The Funds will bear the costs, fees and expenses incurred in connection with the Proxy Statement. Brookfield Public Securities Group LLC (the "Adviser" or "Brookfield"), the investment adviser to each Fund with the exception of the Oaktree Emerging Markets Equity Fund, and Oaktree Fund Advisors, LLC ("Oaktree"), the investment adviser to the Oaktree Emerging Markets Equity Fund, have contractually agreed to limit certain expenses of the Fund(s) as part of operating expense limitation agreements and to the extent that such an agreement applies to a Fund, either Brookfield or Oaktree, as the case may be, will indirectly pay the proxy costs incurred by that Fund.

What is the required vote?

The proposal to elect two (2) Trustees to the Board requires the affirmative vote of a plurality of the Shares voted at the Meeting in person or by proxy.

How does the Board suggest I vote in connection with the Proposal?

After careful consideration, the Board unanimously recommends that you vote "FOR" the approval of the Proposal.

How do I vote my Shares?

You can vote in any of the following ways:

Internet: Have your proxy card available. Vote on the Internet by accessing the website address on your proxy card. Enter your control number from your proxy card. Follow the instructions found on the website;

Telephone: Have your proxy card available. You may vote by telephone by calling the number on your proxy card. Enter the control number on the proxy card and follow the instructions provided (A confirmation of your telephone vote will be mailed to you.);

Mail: Vote, sign, date and return the enclosed proxy card in the enclosed postage-paid envelope.

When and where will the Meeting be held?

The Meeting will be held on May 20, 2022, at 8:45 a.m. Eastern Time. Due to the public health impact of the coronavirus pandemic (COVID-19), and to support the health and well-being of Fund shareholders, the Meeting will be held in a virtual meeting format only. Shareholders will not be able to attend the Meeting in person. If you owned shares as of the Record Date and wish to participate in the Meeting, you must email AST Fund Solutions, LLC ("AST'') at attendingameeting@astfinancial.com or call AST toll-free at 1-866-387-9392, in order to register to attend the Meeting, obtain the credentials to access the Meeting, and verify that you were a shareholder on the Record Date. If you are a record owner of shares, please have your 15-digit control

4

number on your proxy card available when you call or include it in your email. You may vote during the Meeting by following the instructions that will be available on the Meeting website during the Meeting.

If you hold your shares through an intermediary, such as a bank or broker, as of the Record Date, you must provide a legal proxy from that institution in order to vote your shares at the Meeting. You may forward an email from your intermediary or attach an image of your legal proxy and transmit it via email to AST at attendingameeting@astfinancial.com and you should label the email "Legal Proxy" in the subject line. If you hold your shares through an intermediary as of the Record Date and wish to attend, but not vote at, the Meeting, you must verify to AST that you owned shares as of the Record Date through an account statement or some other similar means.

Requests for registration must be received by AST no later than 5:00 p.m., Eastern Time, on May 19, 2022. You will then receive a confirmation email from AST of your registration and a control number that will allow you to vote at the Meeting.

Whom should I call for more information about the Proxy Statement?

For more information regarding the Proxy Statement for the Meeting, please call (855) 777-8001.

5

April 14, 2022

BROOKFIELD INVESTMENT FUNDS

Brookfield Global Listed Real Estate Fund

Class A – (BLRAX)

Class C – (BLRCX)

Class I – (BLRIX)

Brookfield Global Listed Infrastructure Fund

Class A – (BGLAX)

Class C – (BGLCX)

Class I – (BGLIX)

Brookfield Real Assets Securities Fund

Class A – (RASAX)

Class C – (RASCX)

Class I – (RASIX)

Brookfield Global Renewables & Sustainable Infrastructure Fund

Class A – (GRSAX)

Class C – (GRSCX)

Class I – (GRSIX)

Center Coast Brookfield Midstream Focus Fund

Class A – (CCCAX)

Class C – (CCCCX)

Class I – (CCCNX)

Oaktree Emerging Markets Equity Fund

Class A – (OEQAX)

Class C – (OEQCX)

Class I – (OEQIX)

Brookfield Place

250 Vesey Street, 15th Floor

New York, New York 10281-1023

SPECIAL MEETING OF SHAREHOLDERS

To be held on May 20, 2022

PROXY STATEMENT

This is a Proxy Statement for the above listed funds (each, a "Fund" and collectively, the "Funds"), each of which is a series of Brookfield Investment Funds (the "Trust"). Proxies for a Special Meeting of Shareholders of each

6

Fund are being solicited by the Board of Trustees (the "Board," "Board of Trustees" or the "Trustees") of the Trust to approve a proposal that has already been approved by the Board.

The Special Meeting of Shareholders will be held virtually at the offices of the Funds' investment adviser, Brookfield Public Securities Group LLC, at Brookfield Place, 250 Vesey Street, 15th Floor, New York, New York 10281-1023, on Friday, May 20, 2022 at 8:45 a.m. Eastern Time (together with any adjournments or postponements thereof, the "Meeting"). As noted, Shareholders will not be able to attend the Meeting in person.

At the Meeting, shareholders of all Funds, voting together as a single class, will be asked:

1. To elect two (2) Trustees to serve on the Board of Trustees until their resignation, retirement, death or removal or until their respective successors are duly elected and qualified (the "Proposal").

2. To transact such other business as may properly come before the Meeting or any adjournments, postponements or delays thereof.

All properly executed proxies received prior to the Meeting will be voted at the Meeting in accordance with the instructions marked on the proxy card. Unless instructions to the contrary are marked on the proxy card, proxies submitted by holders of the Funds' shares of beneficial interest ("Shares") will be voted "FOR" the Proposal. The persons named as proxy holders on the proxy card will vote in their discretion on any other matters that may properly come before the Meeting or any adjournments or postponements thereof. Any shareholder executing a proxy has the power to revoke it prior to its exercise by submission of a properly executed, subsequently dated proxy, by voting in person, or by written notice to the Secretary of the Trust (addressed to the Secretary of the Funds, Brookfield Place, 250 Vesey Street, 15th Floor, New York, New York 10281-1023). However, attendance at the Meeting, by itself, will not revoke a previously submitted proxy. Unless the proxy is revoked, the Shares represented thereby will be voted in accordance with specifications therein.

Only shareholders or their duly appointed proxy holders can attend the Meeting and any adjournment or postponement thereof. Photographic identification and proof of ownership will be required for admission to the Meeting. For directions to the meeting, please contact the Funds at (855) 777-8001. If you are planning to attend the Meeting, please RSVP to funds@brookfield.com at least one day prior to the Meeting. If a broker or other nominee holds your Shares and you plan to attend the Meeting, you should bring a recent brokerage statement showing your ownership of the Shares, as

7

well as a form of personal identification. If you are a beneficial owner and plan to vote at the Meeting, you should also bring a proxy card from your broker.

The record date for determining shareholders entitled to notice of, and to vote at, the Meeting and at any adjournment or postponement thereof has been fixed at the close of business on March 11, 2022 (the "Record Date"), and each shareholder of record at that time is entitled to cast one vote for each full Share, and a proportionate fractional vote for each fractional Share, registered in his or her name. As of the Record Date, the following number of Shares were outstanding and entitled to be voted:

Fund | | Number of Shares | |

Brookfield Global Listed Real Estate Fund | | | 48,420,081.126 | | |

Brookfield Global Listed Infrastructure Fund | | | 31,080,681.640 | | |

Brookfield Real Assets Securities Fund | | | 5,315,740.674 | | |

Brookfield Global Renewables & Sustainable

Infrastructure Fund | | | 1,638,921.241 | | |

Center Coast Brookfield Midstream Focus Fund | | | 256,566,723.425 | | |

Oaktree Emerging Markets Equity Fund | | | 3,261,102.806 | | |

Total | | | 346,283,250.912 | | |

You should read the entire Proxy Statement before voting. If you have any questions, please contact the Funds at (855) 777-8001. The Proxy Statement, Notice of Special Meeting and the proxy card(s) are first being mailed to shareholders on or about April 15, 2022.

The most recent Annual and Semi-Annual Reports for the Funds, including financial statements, previously have been furnished to shareholders. If you would like to receive additional copies of these reports free of charge, please write to the Brookfield Investment Funds, c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, Wisconsin 53201-0701 or call toll-free at 1-855-244-4859. The reports also are available on the Fund's website at www.publicsecurities.brookfield.com and the website of the Securities and Exchange Commission ("SEC") at www.sec.gov.

PROPOSAL: ELECTION OF TRUSTEES FOR THE TRUST

The proposal relates to the election of two (2) Trustees to the Trust's Board. At a meeting on February 23-24, 2022, the Board approved the nomination of two individuals (each an individual "Nominee", and collectively, the "Nominees") for election as Trustees of the Trust. Shareholders are asked to elect the Nominees as Trustees, effective May 20, 2022 or upon shareholder approval, whichever is later, each to hold office until his resignation, retirement, death or removal or until his respective successor is duly elected and qualified.

8

The Nominees are Messrs. William H. Wright, II and David W. Levi. Mr. Wright is an independent or disinterested person, which means he is not an "interested person" of the Trust, as defined in the 1940 Act. Such individuals are commonly referred to as "Independent Trustees." Mr. Levi, if elected, would serve as an "Interested Trustee."

The Trust's Nominating and Compensation Committee, which consists solely of Independent Trustees, considered recommendations for Trustee nominees, and considered the qualifications, experience and background of each of the Nominees. Based upon this review, the Nominating and Compensation Committee recommended the Nominees to the Trust's Board as a candidate for nomination as an Independent Trustee or Interested Trustee. After discussion and consideration of the matter, the Board voted to nominate the Nominees for election by shareholders. Each Nominee has consented to serve as a Trustee and to being named in this Proxy Statement.

Information about the Nominees

The Trustee Nominees and their backgrounds are shown on the following pages. This information includes each Trustee Nominee's name, age, principal occupation(s) during the past five years and other information about the Trustee Nominee's professional background, including other directorships the Trustee Nominee holds.

9

Trustee Nominees

Name, Position(s)

Address1 and

Year of Birth | | Term of

Office and

Length of

Time

Served2 | | Number of

Funds in

Fund

Complex

Overseen

by Trustee3 | | Principal

Occupation(s)

During Past Five

Years | | Other Directorships

Held by Trustee4 | |

INDEPENDENT NOMINEE5 | |

William H.

Wright II Trustee, Chairman of the Audit Committee, Member of the Nominating and Compensation

Committee Born: 1960 | | Since 2021 | | | 9 | | | Retired. Prior to that, Managing Director, Morgan Stanley (1982-2010). | | Director/Trustee of several investment companies advised by Brookfield Public Securities Group (2020-Present); Director of Alcentra Capital Corporation (1940 Act BDC) (2018-2019); Advisory Director of Virtus Global Dividend & Income Fund, Virtus Global Multi-Sector Income Fund, Virtus Total Return Fund and Duff & Phelps Select Energy MLP Fund (2016-2019);Director of The Zweig Fund, Inc. and The Zweig Total Return Fund (2013-2019); Director of the Carlyle Group, TCG BDC, Inc., TCG BDC II, Inc. and Carlyle Secured Lending III (2020-Present). | |

10

Name, Position(s)

Address1 and

Year of Birth | | Term of

Office and

Length of

Time

Served2 | | Number of

Funds in

Fund

Complex

Overseen

by Trustee3 | | Principal

Occupation(s)

During Past Five

Years | | Other Directorships

Held by Trustee4 | |

INTERESTED NOMINEE | |

David W. Levi

Trustee

Born: 1971 | | Since 2017 | | | 9 | | | Chief Executive Officer of the Investment Adviser (2019-Present); President of the Investment Adviser (2016-2019); Managing Partner of Brookfield Asset Management Inc. (2015-Present). | | Director/Trustee of several investment companies advised by the Investment Adviser (2017-Present). | |

(1) Address: Brookfield Place, 250 Vesey Street, 15th Floor, New York, New York, 10281-1023, unless otherwise noted.

(2) The Trustee will hold office for an indefinite term until the earliest of (i) the next meeting of shareholders if any, called for the purpose of considering the election or re-election of such Trustee and until the election and qualification of his successor, if any, elected at such meeting, or (ii) the date a Trustee resigns or retires, or a Trustee is removed by the Board or shareholders, in accordance with the Trust's By-Laws and Amended and Restated Agreement and Declaration of Trust dated as of September 27, 2011 (the "Declaration of Trust"). Each officer will hold office for an indefinite term or until the date he resigns or retires or until his successor is elected and qualified.

(3) The Fund Complex is comprised of Brookfield Investment Funds (six series of underlying portfolios), Brookfield Real Assets Income Fund Inc., Oaktree Diversified Income Fund Inc. and Center Coast Brookfield MLP & Energy Infrastructure Fund.

(4) This column includes only directorships of companies required to report to the SEC under the 1934 Act, (i.e., public companies) or other investment companies registered under the 1940 Act.

(5) Trustees who are not considered to be "interested persons" of the Trust as defined in the 1940 Act are considered to be "Independent Trustees."

Additional Information about the Board of Trustees and Trustee Nominees

The Role of the Board

The Board provides oversight of the management and operations of the Trust. As is the case with virtually all investment companies (as distinguished from operating companies), the day-to-day management and operation of the Trust is the responsibility of various service providers to the Trust, such as the Trust's investment adviser and administrator, the sub-administrator, custodian and transfer agent, each of whom are discussed in greater detail in the Trust's Statement of Additional Information. The Board approves all significant

11

agreements between the Trust and its service providers. The Board has appointed various senior individuals of certain of these service providers as officers of the Trust, with responsibility to monitor and report to the Board on the Trust's day-to-day operations. In conducting this oversight, the Board receives regular reports from these officers and service providers regarding the Trust's operations. The Board has appointed a Chief Compliance Officer who administers the Trust's compliance program and regularly reports to the Board as to compliance matters. Some of these reports are provided as part of formal "Board meetings" which are typically held quarterly, in person, and involve the Board's review of recent Trust operations. From time to time, one or more members of the Board also may meet with management in less formal settings, between scheduled "Board meetings," to discuss various topics. In all cases, however, the role of the Board and of any individual Trustee is one of oversight and not of management of the day-to-day affairs of the Trust and its oversight role does not make the Board a guarantor of the Trust's investments, operations or activities.

Board Leadership Structure

The Board has structured itself in a manner that it believes allows it to effectively perform its oversight function. It has established three standing committees, an Audit Committee, a Nominating and Compensation Committee, and a Qualified Legal Compliance Committee (the "QLCC") (collectively, the "Committees"), which are discussed in greater detail below. Currently, four of the five members of the Board are Independent Trustees, which are Trustees that are not affiliated with the Adviser or its affiliates, and each of the Audit Committee, Nominating and Compensation Committee and QLCC are comprised entirely of Independent Trustees. Each of the Independent Trustees helps identify matters for consideration by the Board and the Chairman of the Board has an active role in the agenda setting process for Board meetings. The Audit Committee Chairman also has an active role in the agenda setting process for the Audit Committee meetings. The Trust has adopted Fund Governance Policies and Procedures to ensure that the Board is properly constituted in accordance with the 1940 Act and to set forth examples of certain of the significant matter for consideration by the Board and/or its Committees in order to facilitate the Board's oversight function.

The Board has determined that its leadership structure is appropriate. In addition, the Board also has determined that the structure, function and composition of the Committees are appropriate means to provide effective oversight. The Independent Trustees have engaged their own independent counsel to advise them on matters relating to their responsibilities to the Trust.

Board Oversight of Risk Management

As part of its oversight function, the Board receives and reviews various risk management reports and assessments and discusses these matters with

12

appropriate management and other personnel. Because risk management is a broad concept comprised of many elements, Board oversight of different types of risks is handled in different ways. For example, the full Board receives and reviews reports from senior personnel of the Adviser (including senior compliance, financial reporting and investment personnel) or their affiliates regarding various types of risks, including, but not limited to, operational, compliance, investment, and business continuity risks, and how they are being managed. From time to time, the full Board meets with the Trust's Chief Compliance Officer to discuss compliance risks relating to the Funds, the Adviser and the Trust's other service providers. The Audit Committee supports the Board's oversight of risk management in a variety of ways, including meeting regularly with the Trust's Treasurer and with the Trust's independent registered public accounting firm and, when appropriate, with other personnel employed by the Adviser to discuss, among other things, the internal control structure of the Trust's financial reporting function and compliance with the requirements of the Sarbanes-Oxley Act of 2002. The Audit Committee also meets regularly with the Trust's Chief Compliance Officer to discuss compliance and operational risks and receives reports from the Adviser's internal audit group as to these and other matters.

Information about Each Trustee's Qualification, Experience, Attributes or Skills

The Board believes that each of the Trustees have the qualifications, experience, attributes and skills ("Trustee Attributes") appropriate to serve as a Trustee of the Trust in light of the Trust's business and structure. Certain of these business and professional experiences are set forth in detail in the table above. The Trustees have substantial board experience or other professional experience and have demonstrated a commitment to discharging their oversight responsibilities as Trustees. The Board, with the assistance of the Nominating and Compensation Committee, annually conducts a "self-assessment" wherein the performance of the Board and the effectiveness of the Board and the Committees are reviewed.

In addition to the information provided in the table above, below is certain additional information regarding each particular Trustee and certain of their Trustee Attributes. The information provided below, and in the table above, is not all-inclusive. Many Trustee Attributes involve intangible elements, such as intelligence, integrity, work ethic, the ability to work together, the ability to communicate effectively, the ability to exercise judgment, the ability to ask incisive questions, and commitment to shareholder interests. In conducting its self-assessment, the Board has determined that the Trustees have the appropriate attributes and experience to serve effectively as Trustees of the Trust.

• William H. Wright II – Mr. Wright has extensive experience in executive leadership, investment banking and corporate finance. He

13

previously served as a Managing Director of Morgan Stanley until his retirement in 2010, having joined the firm in 1982. During his career in investment banking at Morgan Stanley, Mr. Wright headed the corporate finance execution group where he was responsible for leading and coordinating teams in the execution of complex equity offerings for multinational corporations. Following his career in investment banking, Mr. Wright served on the board of directors/trustees for various other investment management companies and non-profit entities. Mr. Wright serves as Chairman of the Audit Committee and is a member of the Nominating and Compensation Committee.

• David W. Levi – Mr. Levi is Chief Executive Officer of the Investment Adviser and a Managing Partner of Brookfield Asset Management. He has over 26 years of industry experience in asset management. Mr. Levi's background includes extensive strategy-related, client-facing and business development experience globally within both the institutional and high net worth markets. Prior to joining the Investment Adviser in 2014, Mr. Levi was Managing Director and Head of Global Business Development at Nuveen Investments, after holding similar positions at AllianceBernstein Investments and Legg Mason and senior strategy roles within J.P. Morgan Asset Management. Mr. Levi is a Fellow of the 2019 class of Aspen Finance Leaders Fellowship, is a member of the Aspen Global Leadership Network, and holds the Chartered Financial Analyst® designation. He earned a Master of Business Administration degree from Columbia University and a Bachelor of Arts degree from Hamilton College. His position of responsibility at the Investment Adviser, in addition to his knowledge of the firm and experience in financial services, has been determined to be valuable to the Boards in their oversight of the Funds.

Board Meetings

The Trust's Board held four regular meetings and eight special meetings during the 12 month period ended December 31, 2021. During the fiscal year ended December 31, 2021, each Trustee attended at least 75% of the meetings of the Trust's Board of Directors. The Trust's Fund Governance Policies and Procedures provide that the Chairman of the Board of Trustees, who is elected by the Independent Trustees, will preside at each executive session of the Board, or if one has not been designated, the chairperson of the Nominating and Compensation Committee shall serve as such.

Board Committees

The Trust has established the following three standing committees and the membership of each committee to assist in its oversight functions, including its

14

oversight of the risks the Trust faces: the Audit Committee, the QLCC, and the Nominating and Compensation Committee. There is no assurance, however, that the Board's committee structure will prevent or mitigate risks in actual practice. The Trust's committee structure is specifically not intended or designed to prevent or mitigate the Fund's investment risks. Each Fund is designed for investors that are prepared to accept investment risk, including the possibility that as yet unforeseen risks may emerge in the future.

The Audit Committee currently consists of Messrs. Wright, Kuczmarski, McFarland and Ms. Goldman, all of whom are Independent Trustees. It does not include any Interested Trustees. The Audit Committee meets regularly with respect to the various series of the Trust. The function of the Audit Committee, with respect to each Fund, is to review the scope and results of the audit and any matters bearing on the audit or the Funds' financial statements and to ensure the integrity of the Funds' pricing and financial reporting. During the fiscal year ended December 31, 2021, the Audit Committee met four times. Mr. Wright serves as Chairman of the Audit Committee, and the Board has determined that each member of the Audit Committee is an "audit committee financial expert," as defined in Item 401(h) of Regulation S-K promulgated by the Securities and Exchange Commission. The Trust's Board of Trustees has adopted a written charter for its Audit Committee, which is attached as Appendix A.

The Audit Committee also serves as the QLCC for the Trust for the purpose of compliance with Rules 205.2(k) and 205.3(c) of the Code of Federal Regulations, regarding alternative reporting procedures for attorneys retained or employed by an issuer who appear and practice before the SEC on behalf of the issuer (the "issuer attorneys"). An issuer's attorney who becomes aware of evidence of a material violation by the Trust, or by any officer, director, employee, or agent of the Trust, may report evidence of such material violation to the QLCC as an alternative to the reporting requirements of Rule 205.3(b) (which requires reporting to the chief legal officer and potentially "up the ladder" to other entities).

The Nominating and Compensation Committee currently consists of Messrs. Edward Kuczmarski, Stuart McFarland and William Wright and Ms. Heather Goldman. all of whom are Independent Trustees. The Nominating and Compensation Committee is responsible for seeking and reviewing candidates for consideration as nominee for Trustee, as is considered necessary from time to time and meets only as necessary. The Declaration of Trust does not permit shareholders to nominate persons for election as Trustees. During the fiscal year ended December 31, 2021, the Nominating and Compensation Committee met two times. Ms. Goldman serves as Chairman of the Nominating and Compensation Committee. The Trust's Board of Trustees has adopted a written charter for its Nominating and Compensation Committee, which is attached as Appendix B.

15

Share Ownership of the Adviser, Distributor or Affiliates

As of December 31, 2021, neither the Independent Trustees nor members of their immediate family, own securities beneficially or of record in the Adviser, Quasar Distributors, LLC, the Funds' distributor (the "Distributor"), or an affiliate of the Adviser or Distributor. Accordingly, neither the Independent Trustees nor members of their immediate family, have direct or indirect interest, the value of which exceeds $120,000, in the Adviser, the Distributor or any of their affiliates. In addition, during the two most recently completed calendar years, neither the Independent Trustees nor members of their immediate families have conducted any transactions (or series of transactions) in which the amount involved exceeds $120,000 and to which the Adviser, the Distributor or any affiliate thereof was a party.

Share Ownership of the Funds

The table below sets forth the dollar range of equity securities of each Fund beneficially owned as of December 31, 2021 by each Trustee standing for re-election at the Meeting. As of December 31, 2021, the officers and Trustees, as a group, owned beneficially less than 1% of the Shares (aggregating all classes) of each of the Funds.

Name of

Trustee or Nominee | | Dollar Range of

Equity Securities

in the Funds* | | Aggregate

Dollar Range of

Equity Securities

Held in Fund

Complex** | |

Independent Nominee | | | | | | | | | |

William H. Wright II | | | A | | | | A | | |

Interested Nominee | | | | | | | | | |

David W. Levi | | | A | | | | A | | |

* Key to Dollar Ranges:

A. None

B. $1 – $10,000

C. $10,001 – $50,000

D. $50,001 – $100,000

E. Over $100,000

** The aggregate dollar range of equity securities owned by the Trustees of the Funds and of all funds overseen by each Trustee in the Adviser's family of investment companies (the "Fund Complex") as of December 31, 2021. The Fund Complex is comprised of Brookfield Investment Funds (six series of underlying portfolios), Brookfield Real Assets Income Fund Inc., Oaktree Diversified Income Fund Inc., and Center Coast Brookfield MLP & Energy Infrastructure Fund.

16

Trustee and Officer Compensation

No remuneration was paid by the Trust to persons who were directors, officers or employees of the Adviser or any affiliate thereof for their services as Trustees or officers of the Funds. Each Trustee of the Trust, other than those who are officers or employees of the Adviser or any affiliate thereof, was entitled to receive from the Trust a Fund Complex fee. For the fiscal year ended December 31, 2021, the aggregate annual retainer paid to each Independent Trustee of the Board for the Fund Complex was $190,000. Effective January 1, 2022, the aggregate annual retainer paid to each Independent Trustee of the Board for the Fund Complex is $205,000. The Independent Chairman of the Fund Complex and the Chairman of the Audit Committee each receive an additional payment of $30,000 per year, and the Chairman of the Nominating and Compensation Committee receives an additional payment of $10,000 per year. The following table sets forth information concerning the compensation received by Trustees for the calendar year ended December 31, 2021.

Name of Person

and Position | | Aggregate

Compensation

from the Funds | | Aggregate

Compensation

from the Funds

and Fund Complex* | |

Independent Nominee | | | | | |

William H. Wright II | | $ | 101,694 | | | $ | 203,333 | | |

Interested Nominee | | | | | |

David W. Levi | | | N/A | | | | N/A | | |

* Represents the total compensation paid to such persons for the calendar year ended December 31, 2021. The parenthetical number represents the number of investment companies (including the Funds) or portfolios thereof from which such person receives compensation, and which are considered part of the Fund Complex.

Officers

Name, Position(s)

Address1 and

Year of Birth | | Term of

Office and

Length of

Time Served2 | | Principal Occupation(s)

During Past Five Years | |

Brian F. Hurley

President

Born: 1977 | | Since 2014 | | President of several investment companies advised by the Investment Adviser (2014-Present); Managing Director (2014-Present); Assistant General Counsel (2010-2017) and General Counsel (2017-Present) of the Investment Adviser; Managing Partner of Brookfield Asset Management Inc. (2016-Present); Director of Brookfield Soundvest Capital Management (2015-2018). | |

17

Name, Position(s)

Address1 and

Year of Birth | | Term of

Office and

Length of

Time Served2 | | Principal Occupation(s)

During Past Five Years | |

Casey P. Tushaus

Treasurer

Born: 1982 | | Since 2016 | | Treasurer of several investment companies advised by the Investment Adviser (February 2021-Present); Assistant Treasurer of several investment companies advised by the Investment Adviser (2016-2021); Director of the Adviser (2021-Present); Vice President of the Investment Adviser (2014-2021). | |

Thomas D. Peeney

Secretary

Born: 1973 | | Since 2018 | | Secretary of several investment companies advised by the Investment Adviser (2018-Present); Director of the Investment Adviser (2018-Present); Vice President of the Investment Adviser (2017-2018); Vice President and Assistant General Counsel of SunAmerica Asset Management, LLC (2013-2017). | |

Adam R. Sachs

Chief Compliance

Officer ("CCO")

Born: 1975 | | Since 2017 | | Chief Compliance Officer of several investment companies advised by the Investment Adviser (2017-Present); Director of the Investment Adviser (2017-Present); CCO of Brookfield Investment Management (Canada) Inc. (2017-Present); Senior Compliance Officer of Corporate Legal and Compliance at the Investment Adviser (2011-2017). | |

Mohamed S. Rasul

Assistant Treasurer

Born: 1981 | | Since 2016 | | Assistant Treasurer of several investment companies advised by the Investment Adviser (2016-Present); Vice President of the Investment Adviser (2019-Present); Assistant Vice President of the Investment Adviser (2014-2019). | |

(1) Address: Brookfield Place, 250 Vesey Street, 15th Floor, New York, New York, 10281-1023, unless otherwise noted.

(2) Each officer will hold office for an indefinite term or until the date he resigns or retires or until his successor is elected and qualified.

18

Quorum and Voting

Each holder of a whole Share shall be entitled to one vote for each such whole Share, and each holder of a fractional Share shall be entitled to a proportionate fractional vote for each such fractional Share, held in such shareholder's name. Shares of each Fund issued and outstanding as of the Record Date are indicated in the following table:

Fund | | Number of Shares | |

Brookfield Global Listed Real Estate Fund | | | 48,420,081.126 | | |

Brookfield Global Listed Infrastructure Fund | | | 31,080,681.640 | | |

Brookfield Real Assets Securities Fund | | | 5,315,740.674 | | |

Brookfield Global Renewables & Sustainable

Infrastructure Fund | | | 1,638,921.241 | | |

Center Coast Brookfield Midstream Focus Fund | | | 256,566,723.425 | | |

Oaktree Emerging Markets Equity Fund | | | 3,261,102.806 | | |

Total | | | 346,283,250.912 | | |

If you are not the owner of record, but your Shares are instead held for your benefit by a financial intermediary such as a retirement plan service provider, broker-dealer, bank trust department, insurance company or other financial intermediary, that financial intermediary may request that you instruct it how to vote the Shares you beneficially own. Your financial intermediary will provide you with additional information.

If you hold Shares of a Fund through a bank or other financial institution or intermediary (called a service agent) that has entered into a service agreement with the Fund or a distributor of the Fund, the service agent may be the record holder of your Shares. At the Meeting, a service agent will vote Shares for which it receives instructions from its customers in accordance with those instructions. A signed proxy card or other authorization by a shareholder that does not specify how the shareholder's Shares should be voted on a proposal may be deemed to authorize a service provider to vote such Shares in favor of the applicable proposal. Depending on its policies, applicable law or contractual or other restrictions, a service agent may be permitted to vote Shares with respect to which it has not received specific voting instructions from its customers. In those cases, the service agent may, but may not be required to, vote such Shares in the same proportion as those Shares for which the service agent has received voting instructions. This practice is commonly referred to as "echo voting."

Shareholders of the Trust will vote collectively on the election of the Trustee Nominees. The presence in person or by proxy of one-third of the Trust's Shares that are entitled to vote constitutes a quorum. The Trustee Nominees must receive a plurality of the votes cast in person or by proxy at the Meeting

19

at which a quorum exists, which means that two Trustee Nominees receiving the highest number of affirmative votes cast at the Meeting will be elected. In the event that the necessary quorum to transact business is not obtained at the Meeting with respect to the Trust as to one or more Funds, as applicable, the persons named as proxies may propose one or more adjournments of the Meeting, in accordance with applicable law, to permit further solicitation of proxies with respect to the Proposal. Any such adjournment as to a matter will require the affirmative vote of the holders of a majority of the Shares of the Trust or the applicable Fund, present in person or by proxy at the Meeting. The persons named as proxies will vote the proxies (including broker non-votes and abstentions) in favor of adjournment if they determine additional solicitation is warranted and in the interests of shareholders of the Trust or the applicable Fund.

"Broker non-votes" are Shares held by a broker or nominee for which an executed proxy is received by the Trust, but are not voted as to the Proposal because instructions have not been received from beneficial owners or persons entitled to vote and the broker or nominee does not have discretionary voting power. For purposes of determining the presence of a quorum for transacting business at the Meeting, abstentions and "broker non-votes" are treated as Shares that are present, but will not be voted for or against any adjournment or the Proposal. Abstentions and "broker non-votes" will not be counted in favor of, but will have no other effect on, the Proposal, for which the required vote is a plurality (the greatest number) of the votes cast.

The Board of Trustees, including all of the Independent Trustees, recommends that shareholders of each Fund vote FOR each Trustee Nominee identified in the Proposal.

20

ADDITIONAL INFORMATION

Fund Service Providers

Investment Adviser and Administrator

Brookfield Public Securities Group LLC, with principal offices at Brookfield Place, 250 Vesey Street, 15th Floor, New York, New York 10281-1023, serves as the investment adviser of certain Funds pursuant to investment advisory agreements and serves as the administrator for each Fund pursuant to administration agreements.

Distributor

Quasar Distributors, LLC, with principal offices at 615 East Michigan Street, Milwaukee, Wisconsin 53202, serves as the Distributor of each Fund's Shares pursuant to a distribution agreement.

Sub-administrator

U.S. Bancorp Fund Services, LLC ("USBFS"), with principal offices at 615 East Michigan Street, Milwaukee, Wisconsin 53202, serves as the sub-administrator for each Fund pursuant to a sub-administration agreement. USBFS also acts as fund accountant, transfer agent and dividend disbursing agent to each Fund under separate agreements.

Custodian

U.S. Bank National Association, with principal offices at 1555 North River Center Drive, Suite 302, Milwaukee, Wisconsin 53212, serves as the custodian of the Funds' assets pursuant to a custody agreement.

Independent Registered Public Accounting Firm

Deloitte & Touche LLP ("Deloitte") serves as the Trust's independent registered public accounting firm. Each Fund's financial statements for the year ended December 31, 2021 have been audited by Deloitte. In addition, Deloitte has also been selected to perform the audit for each Fund's financial books and records for the year ending December 31, 2021. Representatives of Deloitte are not expected to be present at the Meeting.

Audit Fees

For the fiscal years ended December 31, 2021 and December 31, 2020, Deloitte & Touche LLP billed the Trust aggregate fees of $142,000 and $107,000, respectively. Each bill was for professional services rendered for the audit of the Trust's annual financial statements and the review of financial statements that are included in the Trust's annual and semi-annual reports to shareholders.

21

Audit-Related Fees

There were no fees billed by Deloitte to the Funds in its two recent fiscal years for services rendered for assurance and related services that are reasonably related to the performance of the audit or review of the Fund's financial statements, but are not reported as Audit Fees ("Audit-Related Fees").

Tax Fees

For the fiscal years ended December 31, 2021 and December 31, 2020, Deloitte & Touche LLP billed the Trust aggregate fees of $36,600 and $26,800, respectively. Each bill was for professional services rendered for tax compliance, tax advice and tax planning. The nature of the services comprising the Tax Fees was the review of the Trust's income tax returns and tax distribution requirements.

All Other Fees

For the fiscal years ended December 31, 2021 and December 31, 2020, there were no other fees.

Pre-Approval Policies and Procedures

The Trust's Audit Committee Charter provides that the Audit Committee (comprised of the Independent Trustees of the Trust) is responsible for pre-approval of all auditing services performed for the Trust. The Audit Committee report to the Board regarding its approval of the engagement of the auditor and the proposed fees for the engagement, and the majority of the Board (including the members of the Board who are Independent Trustees) must approve the auditor at an in-person meeting. The Audit Committee also is responsible for pre-approval (subject to the de minimis exception for non-audit services described in the Securities Exchange Act of 1934, as amended, and applicable rule thereunder) of all non-auditing services performed for the Trust or for any service affiliate of the Trust. The Trust's Audit Committee pre-approved all fees described above which Deloitte & Touche LLP billed to each Fund within the Trust.

Share Ownership

A principal shareholder is any person who owns of record or beneficially 5% or more of the outstanding Shares of a Fund. A control person is one who owns beneficially or through controlled companies more than 25% of the voting securities of a company or acknowledges the existence of control. Shareholders with a controlling interest could affect the outcome of voting or the direction of management of a Fund.

As of March 11, 2022, the officers and Trustees, as a group, owned beneficially less than 1% of the Shares (aggregating all classes) of each of the Funds.

22

As of March 11, 2021, the following persons were known to own of record or beneficially 25% or more of the outstanding Shares of the indicated Funds:

Brookfield Global Listed Real Estate Fund

| Name and Address | | % of

Shares | | Parent

Company | | Jurisdiction | | Nature of

Ownership | |

National Financial Services LLC

499 Washington Blvd. FL 4

Jersey City, NJ 07310 | | | 26.64 | % | | Wells Fargo & Company | | DE | | Record | |

SEI Private Trust Company

One Freedom Valley Drive

Oaks, PA 19456 | | | 30.04 | % | | Simulated Investments Inc. | | PA | | Record | |

Brookfield Global Listed Infrastructure Fund

| Name and Address | | % of

Shares | | Parent

Company | | Jurisdiction | | Nature of

Ownership | |

Bon Secours Mercy Health

1701 Mercy Health Pl

Cincinnati, OH 45237 | | | 31.84 | % | | | | DE | | Beneficial | |

Brookfield Real Assets Securities Fund

| Name and Address | | % of

Shares | | Parent

Company | | Jurisdiction | | Nature of

Ownership | |

Brookfield Asset Management Inc.

181 Bay Street, Suite 300

Toronto, Ontario M5J 2T3

Canada | | | 46.22 | % | | Brookfield Asset Management Inc. | | DE | | Beneficial | |

Pershing LLC

PO Box 2052

Jersey City, NJ 07303 | | | 27.31 | % | | BNY Mellon | | DE | | Record | |

Brookfield Global Renewables & Sustainable Infrastructure Fund

| Name and Address | | % of

Shares | | Parent

Company | | Jurisdiction | | Nature of

Ownership | |

BIM US Holdings LP

181 Bay Street, Ste 300

Toronto, ON M5J 2T3

Canada | | | 88.13 | % | | Brookfield Asset Management Inc. | | DE | | Beneficial | |

23

Center Coast Brookfield Midstream Focus Fund

| Name and Address | | % of

Shares | | Parent

Company | | Jurisdiction | | Nature of

Ownership | |

Morgan Stanley Smith Barney LLC

1 New York Plz Fl 12

New York, NY 10004 | | | 37.14 | % | | Morgan Stanley Smith Barney LLC | | DE | | Record | |

Wells Fargo Clearing LLC Saint Louis, MO 63103 | | | 31.46 | % | | Wells Fargo & Company | | DE | | Record | |

Oaktree Emerging Markets Equity Fund

| Name and Address | | % of

Shares | | Parent

Company | | Jurisdiction | | Nature of

Ownership | |

Charles Schwab & Co Inc.

211 Main Street

San Francisco, CA 94105 | | | 46.27 | % | | Charles Schwab & Co Inc. | | TX | | Record | |

SEI Private Trust Company

One Freedom Valley Drive

Oaks, PA 19456 | | | 26.90 | % | | Simulated Investments Inc. | | PA | | Record | |

As of March 11, 2022, the following persons were known to own of record or beneficially 5% or more of the outstanding Shares of the Share class and Fund indicated:

Brookfield Global Listed Real Estate Fund

Class A

| Name and Address | | % of Shares | | Nature of

Ownership | |

Morgan Stanley Smith Barney LLC

1 New York Plz Fl 12

New York, NY 10004 | | | 54.36 | % | | Record | |

Wells Fargo Clearing Services LLC

2801 Market Street

Saint Louis, MO 63103 | | | 22.88 | % | | Record | |

Charles Schwab & Co Inc

211 Main Street

San Francisco, CA 94105 | | | 9.22 | % | | Record | |

Class C

| Name and Address | | % of Shares | | Nature of

Ownership | |

Morgan Stanley Smith Barney LLC

1 New York Plz Fl 12

New York, NY 10004 | | | 42.68 | % | | Record | |

24

| Name and Address | | % of Shares | | Nature of

Ownership | |

Merrill Lynch Pierce Fenner & Smith

4800 Deer Lake Dr E

Jacksonville, FL 32246 | | | 26.87 | % | | Record | |

UBS WM USA

1000 Harbor Blvd

Weehawken, NJ 07086 | | | 10.10 | % | | Record | |

Raymond James

880 Carillon Pkwy

St. Petersburg, FL 33716 | | | 6.58 | % | | Record | |

Class I

| Name and Address | | % of Shares | | Nature of

Ownership | |

SEI Private Trust Company

One Freedom Valley Drive

Oaks, PA 19456 | | | 30.91 | % | | Record | |

National Financial Services LLC

499 Washington Blvd

Jersey City, NJ 07310 | | | 27.39 | % | | Record | |

Princeton Theological Seminary

64 Mercer St

Princeton, NJ 08540 | | | 6.32 | % | | Beneficial | |

Brookfield Global Listed Infrastructure Fund

Class A

| Name and Address | | % of Shares | | Nature of

Ownership | |

Wells Fargo Clearing Services LLC

2801 Market Street

Saint Louis, MO 63103 | | | 32.85 | % | | Record | |

Morgan Stanley Smith Barney LLC

1 New York Plz Fl 12

New York, NY 10004 | | | 19.74 | % | | Record | |

Merrill Lynch Pierce Fenner & Smith

4800 Deer Lake Dr E

Jacksonville, FL 32246 | | | 11.12 | % | | Record | |

Ameriprise Financial Services LLC

707 2nd Ave S

Minneapolis, MN 55402 | | | 8.79 | % | | Record | |

25

| Name and Address | | % of Shares | | Nature of

Ownership | |

RBC Capital Markets LLC

60 S 6th Street, Ste 700 #P08

Minneapolis, MN 55402 | | | 7.36 | % | | Record | |

Raymond James

880 Carillon Pkwy

St. Petersburg, FL 33716 | | | 6.34 | % | | Record | |

Class C

| Name and Address | | % of Shares | | Nature of

Ownership | |

Wells Fargo Clearing Services LLC

2801 Market Street

Saint Louis, MO 63103 | | | 45.74 | % | | Record | |

UBS WM USA

1000 Harbor Blvd

Weehawken, NJ 07086 | | | 27.19 | % | | Record | |

Charles Schwab & Co Inc

211 Main Street

San Francisco, CA 94105 | | | 7.51 | % | | Record | |

Raymond James

880 Carillon Pkwy

St. Petersburg, FL 33716 | | | 6.07 | % | | Record | |

Class I

| Name and Address | | % of Shares | | Nature of

Ownership | |

Bon Secours Mercy Health

1701 Mercy Health Pl

Cincinnati, OH 45237 | | | 32.64 | % | | Beneficial | |

The Northern Trust Company

PO Box 92956

Chicago, IL 60675 | | | 19.64 | % | | Record | |

Charles Schwab & Co Inc.

211 Main Street

San Francisco, CA 94105 | | | 11.07 | % | | Record | |

Saxon & Co

PO Box 94597

Cleveland, OH 44101 | | | 8.96 | % | | Record | |

National Financial Services LLC

499 Washington Blvd

Jersey City, NJ 07310 | | | 7.31 | % | | Record | |

26

Brookfield Real Assets Securities Fund

Class A

| Name and Address | | % of Shares | | Nature of

Ownership | |

Raymond James

880 Carillon Pkwy

St. Petersburg, FL 33716 | | | 51.67 | % | | Record | |

RBC Capital Markets LLC

60 S 6th Street, Ste 700 #P08

Minneapolis, MN 55402 | | | 33.51 | % | | Record | |

Stifel Nicoloaus & Company Inc.

501 N Broadway

Saint Louis, MO 63102 | | | 10.10 | % | | Record | |

Class C

| Name and Address | | % of Shares | | Nature of

Ownership | |

RBC Capital Markets LLC

60 S 6th Street, Ste 700 #P08

Minneapolis, MN 55402 | | | 56.15 | % | | Record | |

Raymond James

880 Carillon Pkwy

St. Petersburg, FL 33716 | | | 43.85 | % | | Record | |

Class I

| Name and Address | | % of Shares | | Nature of

Ownership | |

Brookfield Asset Management Inc.

181 Bay Street, Ste 300

Toronto, ON M5J 2T3

Canada | | | 46.58 | % | | Beneficial | |

Pershing LLC

PO Box 2052

Jersey City, NJ 07303 | | | 27.52 | % | | Record | |

Brookfield Partners Foundation

181 Bay Street, Ste 300

Toronto, ON M5J 2T3

Canada | | | 15.59 | % | | Beneficial | |

27

Brookfield Global Renewables & Sustainable Infrastructure Fund

Class I

| Name and Address | | % of Shares | | Nature of

Ownership | |

BIM US Holdings LP

181 Bay Street, Ste 300

Toronto, ON M5J 2T3

Canada | | | 88.13 | % | | Beneficial | |

Brookfield Public Securities Group LLC

110 N Wacker Dr, Ste 2700

Chicago, IL 60606 | | | 7.47 | % | | Beneficial | |

Center Coast Brookfield Midstream Focus Fund

Class A

| Name and Address | | % of Shares | | Nature of

Ownership | |

Morgan Stanley Smith Barney LLC

1 New York Plz Fl 12

New York, NY 10004 | | | 41.25 | % | | Record | |

Wells Fargo Clearing Services LLC

2801 Market Street

Saint Louis, MO 63103 | | | 23.72 | % | | Record | |

UBS WM USA

1000 Harbor Blvd

Weehawken, NJ 07086 | | | 8.49 | % | | Record | |

Raymond James

880 Carillon Pkwy

St. Petersburg, FL 33716 | | | 7.07 | % | | Record | |

Charles Schwab & Co Inc.

211 Main Street

San Francisco, CA 94105 | | | 5.61 | % | | Record | |

Class C

| Name and Address | | % of Shares | | Nature of

Ownership | |

Wells Fargo Clearing Services LLC

2801 Market Street

Saint Louis, MO 63103 | | | 36.64 | % | | Record | |

Morgan Stanley Smith Barney LLC

1 New York Plz Fl 12

New York, NY 10004 | | | 27.95 | % | | Record | |

28

| Name and Address | | % of Shares | | Nature of

Ownership | |

UBS WM USA

1000 Harbor Blvd

Weehawken, NJ 07086 | | | 8.32 | % | | Record | |

Raymond James

880 Carillon Pkwy

St. Petersburg, FL 33716 | | | 7.56 | % | | Record | |

Charles Schwab & Co Inc.

211 Main Street

San Francisco, CA 94105 | | | 6.33 | % | | Record | |

Class I

| Name and Address | | % of Shares | | Nature of

Ownership | |

Morgan Stanley Smith Barney LLC

1 New York Plz Fl 12

New York, NY 10004 | | | 37.98 | % | | Record | |

Wells Fargo Clearing Services LLC

2801 Market Street

Saint Louis, MO 63103 | | | 32.99 | % | | Record | |

UBS WM USA

1000 Harbor Blvd

Weehawken, NJ 07086 | | | 8.39 | % | | Record | |

Oaktree Emerging Markets Equity Fund

Class I

| Name and Address | | % of Shares | | Nature of

Ownership | |

Charles Schwab & Co Inc.

211 Main Street

San Francisco, CA 94105 | | | 46.27 | % | | Record | |

SEI Private Trust Company

One Freedom Valley Drive

Oaks, PA 19456 | | | 26.90 | % | | Record | |

Capinco c/o US Bank NA

1555 NRivercenter Dr., Ste 302

Milwaukee, WI 53212 | | | 7.43 | % | | Record | |

Northern Trust Company

PO Box 92956

Chicago, IL 60675 | | | 6.85 | % | | Beneficial | |

National Financial Services LLC

499 Washington Blvd

Jersey City, NJ 07310 | | | 6.34 | % | | Record | |

29

Expenses and Proxy Solicitation

The estimated total cost of the Proposal, which is to be paid by the Funds pro rata based on each Fund's net assets, is set forth in the table below.

Fund Name | | Estimated

Solicitation

Cost | | Estimated

Total Cost | | Estimated

Total Cost

to be Paid

by the Fund | |

Brookfield Global Listed

Real Estate Fund | | $ | 476 | | | $ | 14,715 | | | $ | 14,715 | | |

Brookfield Global Listed

Infrastructure Fund | | $ | 1,874 | | | $ | 53,046 | | | $ | 53,046 | | |

Brookfield Real Asset

Securities Fund | | $ | 74 | | | $ | 3,706 | | | $ | 3,706 | | |

Brookfield Global

Renewables & Sustainable

Infrastructure Fund | | $ | 45 | | | $ | 2,890 | | | $ | 2,890 | | |

Center Coast Brookfield

Midstream Focus Fund | | $ | 469 | | | $ | 14,512 | | | $ | 14,512 | | |

Oaktree Emerging

Markets Equity Fund | | $ | 45 | | | $ | 2,890 | | | $ | 2,890 | | |

The total cost of the Proposal includes legal fees, expenses related to the printing and mailing of this Proxy Statement, and fees associated with the proxy solicitation.

The Trust has engaged the services of AST Fund Solutions, LLC (the "Solicitor") to assist in the solicitation of proxies for the Meeting. Proxies are expected to be solicited principally by mail, but the Funds or the Solicitor may also solicit proxies by telephone, facsimile or personal interview. The Trust's officers may also solicit proxies but will not receive any additional or special compensation for any such solicitation.

Shareholder Communications

The Trustees provide for shareholders to send written communications to the Trustees via regular mail. Written communications to the Trustees, or to an individual Trustee, should be sent to the attention of the Trust's Secretary at the address of the Trust's principal executive office. All such communications received by the Trust's Secretary shall be promptly forwarded to the individual Trustee to whom they are addressed or to the full Board, as applicable. If a communication does not indicate a specific Trustee, it will be sent to the Chair of the Nominating and Compensation Committee and the outside counsel to the Independent Trustees for further distribution as deemed appropriate by such persons. The Trustees may further develop and refine this process as deemed necessary or desirable.

30

Shareholder Proposals for Subsequent Meetings

The Trust is not required to hold annual meetings of shareholders but will hold special meetings of shareholders of a series or class when, in the judgment of the Trustees, it is necessary or desirable to submit matters for a shareholder vote. Any shareholder who wishes to submit proposals to be considered at a special meeting of the Funds' shareholders should send such proposals to the Fund's Secretary at Brookfield Investment Funds, Brookfield Place, 250 Vesey Street, 15th Floor, New York, New York 10281-1023. Any such proposal must be received a reasonable time before the proxy solicitation for that meeting is made. Shareholder proposals that are submitted in a timely manner will be provided to Board members for their consideration but not necessarily be included in the Funds' proxy materials. Inclusion of such proposals is subject to limitations under the federal securities laws.

Householding

To avoid sending duplicate copies of materials to households, the Funds mail only one copy of each report to shareholders having the same last name and address on the Funds' records. The consolidation of these mailings benefits the Funds through reduced mailing expenses. If a shareholder wants to receive multiple copies of these materials or to receive only one copy in the future, the shareholder should contact the Funds' transfer agent, USBFS, at (855) 244-4859 or notify the Funds' transfer agent in writing at 615 East Michigan Street, 4th floor, Milwaukee, Wisconsin 53202.

Other Matters To Come Before The Meeting

The Board of Trustees is not aware of any matters that will be presented for action at the Meeting other than the matters described in this Proxy Statement. Should any other matters requiring a vote of shareholders arise, the proxy in the accompanying form will confer upon the person or persons entitled to vote the Shares represented by such proxy the discretionary authority to vote the Shares as to any other matters in accordance with their best judgment in the interest of the Trust and/or Fund.

Please complete, sign and return the enclosed proxy card(s) or vote by Internet or telephone promptly. No postage is required if you mail your proxy card(s) in the United States.

By Order of the Board of Trustees,

/s/ Thomas D. Peeney

Thomas D. Peeney

Secretary

Brookfield Investment Funds

31

APPENDIX A

AUDIT COMMITTEE CHARTER

1. Requirements for Membership: The Audit Committee shall consist of at least three Directors/Trustees, each of whom has no relationship to the Fund or its management that may interfere with the exercise of their independence from management and the Fund ("Independent"). The restrictions contained in Attachment A to this Charter with respect to the definition of Independent shall apply to every Audit Committee member. Each member of the Audit Committee must also meet the independence requirements of audit committee members, as currently set forth in Section 303.01 of the New York Stock Exchange's listing standards. In the event an audit committee member simultaneously serves on the audit committees of more than three public companies, the Boards of Directors/Trustees must determine that such simultaneous service would not impair the ability of such member to effectively serve on the Fund's audit committee.

The Boards of Directors/Trustees for each Fund will determine annually whether there is at least one member of the Audit Committee who is an audit committee financial expert as defined in Item 3 of Form N-CSR. Each member of the Audit Committee shall be financially literate; as such qualification is interpreted by the Boards of Directors/Trustees in its business judgment, or must become financially literate within a reasonable period of time after appointment to the Audit Committee. At least one member of the Audit Committee must have accounting or related financial management expertise as such qualification is interpreted by the Boards of Directors/Trustees in its business judgment.

2. Purposes: The purposes of the Audit Committee are:

a. oversight of the Fund's accounting and financial reporting policies and practices, its internal control over financial reporting and, as appropriate, to inquire into the internal control over financial reporting of certain third-party service providers;

b. oversight of the quality and integrity of the Fund's financial statements and the independent audit thereof;

c. oversight, or, as appropriate, assist the Boards of Directors/Trustees with oversight of, the Fund's compliance with legal and regulatory requirements that relate to the Fund's accounting and financial reporting, internal control over financial reporting and independent audits;

d. responsibility for the appointment, compensation, retention and oversight of the work of any registered public accounting firm

32

engaged (including resolution of disagreements between management and the auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Fund;

e. maintenance of a liaison between the independent auditors and the Boards of Directors/Trustees;

f. establishment of procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, including procedures for the confidential, anonymous submission by employees of the Fund, its investment adviser, administrator, principal underwriter (if any), or any other provider of accounting related services for the Fund of concerns regarding questionable accounting or auditing matters (see Attachment B); and

g. preparation of an Audit Committee report as required by Item 306 of Regulation S-K to be included in proxy statements relating to the election of Directors/Trustees.

The independent auditors for the Fund shall report directly to the Audit Committee and the Audit Committee shall regularly report to the Boards of Directors/Trustees.

3. Duties and Powers: The duties and powers of the Audit Committee are:

a. to approve prior to appointment the engagement of auditors to annually prepare and issue an audit report or related work or perform other audit, review or attest services for the Fund and to review and evaluate matters potentially affecting the independence and capabilities of the auditors. In evaluating the auditor's qualifications, performance and independence, the Audit Committee must, among other things, obtain and review a report by the auditor, at least annually, describing the following items:

(i) all relationships between the independent auditor and the Fund, as well as the Fund's investment adviser or any control affiliate of the adviser that provides ongoing services to the Fund;

(ii) any material issues raised by the most recent internal quality control review, or peer review, of the audit firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with such issues; and

(iii) the audit firm's internal quality-control procedures.

33

b. to approve prior to appointment the engagement of the auditor to provide non-audit services to the Fund, its investment adviser or any entity controlling, controlled by, or under common control with the investment adviser ("Adviser Affiliate") that provides ongoing services to the Fund, if the engagement relates directly to the operations and financial reporting of the Fund;

c. to develop, to the extent deemed appropriate by the Audit Committee, policies and procedures for pre-approval of the engagement of the Fund's auditors to provide any of the services described in (a) or (b) above;

d. to consider the controls applied to the auditors and any measures taken by management in an effort to assure that all items requiring pre-approval by the Audit Committee are identified and referred to the Audit Committee in a timely fashion;

e. to consider whether the non-audit services provided by the Fund's auditor to the Fund's investment adviser or any Adviser Affiliate that provides ongoing services to the Fund, which services were not pre-approved by the Audit Committee, are compatible with maintaining the auditor's independence;