As filed with the Securities and Exchange Commission on May 26, 2023

Securities Act File No. 333-[__]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment No.

Post-Effective Amendment No.

(Check appropriate box or boxes)

BROOKFIELD INVESTMENT FUNDS

(Exact name of registrant as specified in charter)

Brookfield Place, 250 Vesey Street

New York, New York 10281-1023

(Address of Principal Executive Offices)

Registrant’s Telephone Number, Including Area Code: (855) 777-8001

Brian F. Hurley, Esq.

Brookfield Public Securities Group LLC

Brookfield Place, 250 Vesey Street

New York, New York 10281-1023

(Name and Address of Agent for Service)

Copies to:

Craig Ruckman, Esq. New York, New York 10281-1023 | Michael R. Rosella, Esq. Thomas D. Peeney, Esq. |

Approximate Date of Proposed Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933.

Title of securities being registered: Shares of beneficial interest.

Calculation of Registration Fee under the Securities Act of 1933: No filing fee is required because of reliance on Section 24(f) and Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement is organized as follows:

| 1. | Letter to Shareholders of Center Coast Brookfield MLP & Energy Infrastructure Fund |

| 2. | Questions and Answers for Shareholders of Center Coast Brookfield MLP & Energy Infrastructure Fund |

| 3. | Notice of Special Meeting of Shareholders of Center Coast Brookfield MLP & Energy Infrastructure Fund |

| 4. | Proxy Statement/Prospectus relating to the proposed reorganization of Center Coast Brookfield MLP & Energy Infrastructure Fund into the Center Coast Brookfield Midstream Focus Fund, a series of Brookfield Investment Funds |

| 5. | Statement of Additional Information relating to the proposed reorganization of Center Coast Brookfield MLP & Energy Infrastructure Fund into the Center Coast Brookfield Midstream Focus Fund, a series of Brookfield Investment Funds |

| 6. | Part C Information |

| 7. | Exhibits |

CENTER COAST BROOKFIELD MLP & ENERGY INFRASTRUCTURE FUND

Brookfield Place

250 Vesey Street

New York, New York 10281-1023

(855) 777-8001

[___], 2023

Dear Shareholder:

You are cordially invited to attend a special meeting of shareholders (the “Special Meeting”) of Center Coast Brookfield MLP Energy & Infrastructure Fund (“CEN” or the “Target Fund”), which will be held virtually, on August 16, 2023, at 8:30 a.m., Eastern Time, to consider and vote on the proposal discussed in the enclosed Proxy Statement/Prospectus. The Meeting will be held in a virtual meeting format only. Shareholders will not be able to attend the Meeting in person. In order to participate in and vote at the Special Meeting, shareholders of record as of the close of business on May 26, 2023 (the “Record Date”) need to register for the Meeting. If you are a registered holder, and wish to attend and vote at the Meeting, please send an email including your full name and address to the Fund’s proxy solicitor, AST Fund Solutions, LLC (“AST”), at attendameeting@astfinancial.com with “Center Coast Brookfield MLP & Energy Infrastructure Fund virtual meeting” in the subject line. After receiving this information, AST will then email you the virtual meeting access information and instructions for voting during the Meeting. If you hold common shares of beneficial interest through a bank or broker, you will receive information regarding how to instruct your bank or broker to cast your vote. If you wish to attend and vote at the Meeting, you must first obtain a legal proxy from your financial intermediary reflecting the Fund’s name, the number of shares you held as of the Record Date, as well as your name and address. You may forward an email from your intermediary containing the legal proxy or attach an image of the legal proxy via email to AST at attendameeting@astfinancial.com with “Legal Proxy” in the subject line. After receiving this information, AST will then email you the virtual meeting access information and instructions for voting during the Meeting. Before the Special Meeting, I would like to provide you with additional background and ask for your vote on an important proposal affecting CEN.

At the Special Meeting, shareholders will be asked to consider and vote upon a proposal to approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) providing for the reorganization of CEN, a Delaware statutory trust and a closed-end management investment company, into Center Coast Brookfield Midstream Focus Fund (“FOCUS” or the “Acquiring Fund”), a series of Brookfield Investment Funds, a Delaware statutory trust and an open-end management investment company (the “Reorganization”). The Acquiring Fund has a substantially similar investment objective and substantially similar investment strategies, policies and restrictions as the Target Fund, although there are some differences. The Reorganization has been proposed, among other things, to provide shareholders of the Target Fund with daily liquidity through an open-end fund. Brookfield Public Securities Group LLC (“Brookfield” or the “Adviser”), the Target Fund’s investment adviser, believes that the proposed Reorganization is in the best interests of shareholders of the Target Fund who would benefit more from the daily redemption feature of an open-end fund than by continuing to operate the Target Fund as a closed-end fund.

The proposed Reorganization is described in more detail in the enclosed Proxy Statement/Prospectus. You should review the Proxy Statement/Prospectus carefully and retain it for future reference. If the shareholders of the Target Fund approve the Reorganization Agreement at the Special Meeting, the Reorganization is expected to be completed in the fourth quarter of 2023. A vote to approve the Reorganization will also constitute a vote to dissolve the Target Fund. Shareholders of record as of the close of the Record Date are entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof. You are being asked to participate at the Special Meeting either virtually or by proxy. If you attend the Special Meeting and are a shareholder of record as of the close of business on the Record Date, you may vote your shares at the Special Meeting. The Board recommends that you cast your vote FOR the proposed Reorganization. Regardless of whether you plan to attend the Special Meeting, please complete, date, sign and return promptly in the enclosed envelope the accompanying proxy. This is important to ensure a quorum at the Special Meeting.

In addition to authorizing a proxy to vote by mail, you may also authorize a proxy to vote your shares via the Internet or telephone as follows:

To vote by the Internet:

(1) Read the Proxy Statement/Prospectus and have the enclosed proxy card at hand.

(2) Go to the website that appears on the enclosed proxy card.

(3) Enter the control number set forth on the enclosed proxy card and follow the simple instructions.

To vote by telephone:

(1) Read the Proxy Statement/Prospectus and have the enclosed proxy card at hand.

(2) Refer to the toll-free number that appears on the enclosed proxy card.

(3) Follow the instructions.

We encourage you to authorize a proxy to vote your shares via the Internet using the control number that appears on your enclosed proxy card. Use of Internet voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed Proxy Statement/Prospectus carefully before you vote. If you should have any questions, we encourage you to call us at (855) 777-8001. As always, we appreciate your support.

| Sincerely, | |

| BRIAN F. HURLEY | |

| President of Center Coast Brookfield MLP & Energy Infrastructure Fund |

QUESTIONS & ANSWERS

Important Information for Shareholders

Although we recommend that you read the entire Proxy Statement/Prospectus, for your convenience, we have provided a brief overview of the issues to be voted on.

| Q: | Why am I receiving the enclosed Proxy Statement/Prospectus? |

| A: | You are a shareholder of Center Coast Brookfield MLP & Energy Infrastructure Fund (the “Target Fund” or “CEN”), a closed-end management investment company formed as a Delaware statutory trust. The Target Fund’s shareholders are being asked to vote on a proposal to approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) between the Target Fund and Brookfield Investment Funds (the “Acquiring Trust”), on behalf of Center Coast Brookfield Midstream Focus Fund (the “Acquiring Fund” or “FOCUS” and, together with the Target Fund, the “Funds”), providing for the reorganization of the Target Fund into the Acquiring Fund. The Acquiring Fund is an existing series of the Acquiring Trust, an open-end management investment company organized as a Delaware statutory trust. |

The Acquiring Fund, following completion of the Reorganization, may be referred to herein as the “Combined Fund.”

The Target Fund’s Board of Trustees (the “Target Board”) recommends that you vote “FOR” the proposed Reorganization Agreement.

| Q: | Why is the Reorganization being recommended by the Target Board? |

| A: | After careful consideration, the Trustees of the Target Board have determined that the proposed Reorganization is in the best interests of the Target Fund and that the interests of existing shareholders of the Target Fund will not be diluted as a result of the Reorganization. In particular, the Target Board has determined, among other things, that shareholders of the Target Fund may benefit from (i) the ability to achieve liquidity for their shares at net asset value, while being invested in the Acquiring Fund, which has a substantially similar investment objective and substantially similar investment strategies as the Target Fund, (ii) the combination of the Target Fund’s assets would be combined with the significantly larger asset base of the Acquiring Fund, (iii) continuity of management of shareholder assets by the same management team, and (iv) potential operational cost savings over time as a result of the larger size of the Combined Fund. |

See “Synopsis—Background and Reasons for the Proposed Reorganization” and “Information About the Reorganization—Board Approval of the Reorganization” in the enclosed Proxy Statement/Prospectus for additional information regarding the Target Board’s considerations in approving the Reorganization.

| Q: | How will the Reorganization work? |

| A: | Subject to the approval of the shareholders of the Target Fund, the Reorganization Agreement provides for the reorganization of the Target Fund into the Acquiring Fund, pursuant to which the Acquiring Fund will acquire all of the assets of the Target Fund on the closing date in consideration for the assumption by the Acquiring Fund of all liabilities of the Target Fund and Class I Shares of the Acquiring Fund. |

Shareholders of the Target Fund at the time of the Reorganization will become holders of shares of the Acquiring Fund.

If the Reorganization Agreement is approved by the Target Fund’s shareholders at the Special Meeting of Shareholders to be held on August 16, 2023, at 8:30 a.m., Eastern Time (the “Special Meeting”), the Reorganization is expected to occur during the fourth quarter of 2023.

As soon as practicable following the completion of the Reorganization, the Target Fund will dissolve.

| Q: | Who is eligible to vote on the Reorganization? |

| A: | Shareholders of record of the Target Fund at the close of business on May 26, 2023, (the “Record Date”) are entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof. If you held Target Fund shares on the Record Date, you have the right to vote even if you later sold your shares. Each share is entitled to one vote. Shares represented by properly executed proxies, unless the proxies are revoked before or at the Special Meeting, will be voted according to shareholders’ instructions. If you date, sign and return a proxy but do not fill in a vote, your shares will be voted “FOR” the Reorganization. If any other business properly comes before the Special Meeting, your shares will be voted at the discretion of the persons named as proxies. |

| Q: | How will the Reorganization affect Target Fund shareholders? |

| A: | Upon the closing of the Reorganization, shareholders of the Target Fund, a closed-end investment company, will become holders of Class I Shares of the Acquiring Fund, a series of an open-end investment company (commonly referred to as a “mutual fund”). The number of Class I Shares that shareholders of the Target Fund receive will be based on the net asset value of the Target Fund relative to the net asset value of Class I Shares of the Acquiring Fund. The aggregate net asset value of the Acquiring Fund’s Class I Shares |

i

received by Target Fund shareholders will be equal to the aggregate net asset value of the shares of the Target Fund held by its shareholders, in each case as of the close of business on the business day immediately prior to the closing date of the Reorganization.

Shares of the Target Fund are no longer offered for purchase and are not redeemable at a shareholder’s option like shares of a mutual fund. Shares of the Acquiring Fund can be purchased and sold (redeemed) directly from the Acquiring Fund or through financial intermediaries at net asset value, less any applicable charges. Following the completion of the Reorganization, Target Fund shareholders (as shareholders of the Acquiring Fund), will be able to redeem shares received in the Reorganization at net asset value on each day the Acquiring Fund is open for business.

| Q: | What are the principal differences between an open-end investment company and a closed-end investment company? |

| A: | Closed-end investment companies typically do not engage in a continuous offering of new shares, and the common shares of closed-end funds are not redeemable. |

In contrast, open-end investment companies, such as the Acquiring Fund, engage in a continuous offering of new shares. Shares of open-end funds can be purchased and sold (redeemed) directly from the fund, or through financial intermediaries, at net asset value, less any applicable charges.

Certain additional differences exist between how closed-end funds and open-end funds are permitted to operate under the Investment Company Act of 1940, as amended (the “1940 Act”). Open-end funds, such as the Acquiring Fund, are subject to Rule 22e-4 under the 1940 Act, which prohibits them from investing more than 15% of their net assets in illiquid investments (the “15% Illiquid Investment Limit”). Closed-end funds are not subject to Rule 22e-4, and the Target Fund may invest in illiquid investments without limit, although the Target Fund currently does not have more than 15% of its assets invested in illiquid investments. Following the Reorganization, the Combined Fund’s illiquid investments will not exceed the 15% Illiquid Investment Limit.

In addition, closed-end funds are permitted to use leverage to a greater extent than open-end funds and may issue preferred shares and debt securities in addition to common shares. The Acquiring Fund, as an open-end fund, is managed utilizing less leverage and with higher cash balances than the Target Fund, which is a closed-end fund. Due to limitations on the use of leverage by open-end funds, the Combined Fund’s yield is expected to be lower than the Target Fund’s current yield.

| Q: | Will Target Fund shareholders who redeem Acquiring Fund shares after the Reorganization be charged a redemption fee? |

| A: | No. Shareholders of the Target Fund who receive Class I Shares of the Acquiring Fund in the Reorganization will not be charged a redemption fee when redeeming those shares of the Acquiring Fund. |

| Q: | Will I have to pay any sales charge, commission or other similar fee in connection with the Reorganization? |

| A: | No. You will not have to pay any sales charge, commission or other similar fee in connection with the Reorganization. As more fully discussed in the Proxy Statement/Prospectus, no initial sales charge or contingent deferred sales charges will be imposed on the Class I Shares of the Acquiring Fund received in connection with the Reorganization. Class I Shares or any other class of shares of the Combined Fund purchased after the Reorganization will be subject to the standard fee structure applicable to such class. |

| Q: | How do the Funds’ investment objectives and principal investment strategies compare? |

| A: | The Acquiring Fund’s investment objective is substantially similar to that of the Target Fund. The investment objective of the Acquiring Fund is to seek maximum total return with an emphasis on providing cash distributions to shareholders. The investment objective of the Target Fund is to provide a high level of total return with an emphasis on distributions to shareholders. The “total return” sought by the Target Fund includes appreciation in the net asset value of the Target Fund’s common shares and all distributions made by the Target Fund to its common shareholders, regardless of tax characterization of such distributions, including distributions paid out of the distributions received by the Target Fund from its portfolio investments, but characterized as a return of capital for U.S. federal income tax purposes as a result of the tax characterization of the distributions received by the Target Fund from the MLPs (as defined below) in which the Target Fund invests. |

Each Fund’s principal investment strategies and principal investment risks are substantially similar, although there are some differences.

Under normal circumstances, the Acquiring Fund invests at least 80% of its net assets (including amounts borrowed for investment purposes) in a portfolio of master limited partnerships (“MLPs”) and in other investments that have economic characteristics similar to such securities. The Acquiring Fund also concentrates (i.e., invests more than 25% of its total assets) in securities of companies in the energy infrastructure industry and the energy industry. Under normal market conditions, the Target Fund invests at least 80% of its Managed Assets in securities of MLPs (including investments that offer economic

ii

exposure to public and private MLPs) and energy infrastructure companies. “Managed Assets” means the total assets of the Fund, including the assets attributable to the proceeds from any forms of financial leverage (including reverse repurchase agreements, dollar rolls or similar transactions or through a combination of the foregoing), minus liabilities, other than liabilities related to any financial leverage. The Target Fund also endeavors, under normal market conditions, to invest a significant portion of its investments in “midstream” MLPs.

Both the Acquiring Fund and the Target Fund consider “midstream investments” to encompass a wide range of companies engaged in the energy infrastructure industry and include companies engaged in midstream activities, such as the treatment, gathering, compression, processing, transportation, transmission, fractionation, storage and terminalling of natural gas, natural gas liquids, crude oil and refined products, as well as other energy infrastructure companies including electrical transmission companies and utilities, and companies engaged in owning, storing and transporting alternative energy sources, such as renewables (e.g., wind, solar, hydrogen, geothermal, biomass).

Both Funds may invest in non-investment grade bonds (high yield or junk bonds) and foreign securities, which may include depositary receipts. While not part of their principal investment strategies, both Funds may invest in exchange-traded notes and are permitted to utilize derivatives. Both Funds are also permitted to invest in securities of other open- or closed-end investment companies, subject to applicable regulatory limits. Each Fund is non-diversified, which means they both may focus their investments in a limited number of issuers.

While the Acquiring Fund may invest up to 15% of its net assets in illiquid securities, the Target Fund may invest up to 20% of its Managed Assets in unregistered or restricted securities, including securities issued by private energy infrastructure companies.

While both Funds’ strategies focus on investments in MLPs and “midstream investments,” the Target Fund may employ a more opportunistic strategy in which it seeks to invest in special situations, including private opportunistic investments, as the Target Fund may allocate up to 20% of its portfolio to private investment opportunities. The Acquiring Fund does not have a similar principal investment strategy.

The Target Fund, as a closed-end fund, is permitted to use leverage to a greater extent than the Acquiring Fund. The Target Fund may use leverage by investing in reverse repurchase agreements or other derivative instruments with leverage embedded in them and by borrowing funds from banks or other financial institutions. The Acquiring Fund may also use derivatives for leverage.

The Acquiring Fund generally sells an investment if it determines that the characteristics that resulted in the original purchase decision have changed materially, the investment is no longer earning a return commensurate with its risk, it identifies other investments with more attractive valuations and return characteristics, or the Fund requires cash to meet redemption requests. The Target Fund does not have a similar principal investment strategy.

See “Synopsis––Comparison of the Funds” and “Synopsis––Comparative Risk Information” in the enclosed Proxy Statement/Prospectus for a more complete discussion of the similarities and differences between the Funds’ investment objectives, principal investment strategies and principal investment risks.

Each of the Target Board and the Board of Trustees of the Acquiring Trust (the “Acquiring Board,” and together with the Target Board, the “Boards”) considered the principal differences in the investment strategies and risks between the Target Fund and the Acquiring Fund.

| Q: | Who manages the Acquiring Fund? |

| A: | Brookfield serves as investment adviser to the Acquiring Fund and the Target Fund and will serve as investment adviser to the Combined Fund. The management of, and investment decisions for, the Acquiring Fund and the Acquired Fund are made by Messrs. Tom Miller, Boran Buturovic, and Joe Herman, each of whom will serve as a portfolio manager of the Combined Fund. |

The Acquiring Board is comprised of the same individuals who serve on the Target Board.

| Q: | How will the Reorganization impact fees and expenses? |

| A: | The fee and expense structure of the Funds differ, in part, because of operational and regulatory differences between open-end funds and closed-end funds. Nevertheless, both Funds are similar in that each pay a contractual advisory fee of 1.00% and an administration fee (payable monthly) at an annual rate of 0.15% of each of their net assets (including amounts borrowed for investment purposes). However, Class A and Class C shares of the Acquiring Fund are subject to an ongoing Rule 12b-1 service fee at an annual rate of 25 basis points (0.25%) and 100 basis points (1.00%) respectively, while no shares of the Target Fund are subject to such ongoing Rule 12b-1 fees. The fee and expense structure of the Acquiring Fund will apply following the Reorganization. |

Assuming the Reorganization had taken place on September 30, 2022, the Acquiring Fund’s shares would have (A) total annual fund operating expenses that are estimated to be lower than those of the Target Fund’s shares prior to the Reorganization, and

iii

(B) after giving effect to all contractual fee and expense waivers and/or reimbursements that Brookfield has agreed to continue through January 30, 2024, net annual fund operating expenses that are estimated to be lower than those of the Target Fund’s shares prior to the Reorganization. See “Synopsis––Comparative Fee and Expense Information” on page [__] of the Proxy Statement/Prospectus. See also “Will the Funds have to pay any fees or expenses in connection with the Reorganization?” on page [__] below.

| Q: | Will the portfolio of the Target Fund be repositioned in connection with the Reorganization? |

| A: | The portfolio managers of the Acquiring Fund have reviewed the portfolio holdings of the Target Fund and, as of September 30, 2022, all the securities held by the Target Fund comply with the compliance guidelines and/or investment restrictions of the Acquiring Fund. As of September 30, 2022, approximately [__]% of the Target Fund’s total assets were invested in securities held by the Acquiring Fund. Approximately [__]% of the securities of the Target Fund are anticipated to be sold in order to reposition the Target Fund’s portfolio prior to the Reorganization, and [__]% of the securities of the Acquiring Fund are anticipated to be sold in connection with the Reorganization. |

Brookfield has estimated that the brokerage commission and other transaction costs associated with the pre-Reorganization and post-Reorganization purchases and sales of portfolio securities (including sales of Target Fund portfolio securities in order to reposition the Target Fund’s portfolio prior to Reorganization) will be approximately $[__] and $[__], respectively, [__]% and [__]%, respectively, or based on shares outstanding as of September 30, 2022, $[__] per share and $[__] per share, respectively. [In addition, Brookfield has estimated that there will be no capital gains generated by the pre-Reorganization and post-Reorganization sales of portfolio securities.]

| Q: | Will the Reorganization constitute a taxable event for the Target Fund’s shareholders? |

| A: | No. The Reorganization is intended to qualify as a tax-free “reorganization” for federal income tax purposes. It is expected that shareholders of the Target Fund who receive Acquiring Fund shares pursuant to the Reorganization will recognize no gain or loss for federal income tax purposes as a direct result of the Reorganization. Prior to the closing of the Reorganization, the Target Fund expects to declare a distribution of all of its net investment income and net capital gains, if any. All or a portion of such a distribution may be taxable to the Target Fund’s shareholders for federal income tax purposes. To the extent the Target Fund realizes net losses from the sale of portfolio securities in connection with the portfolio repositioning described above (or otherwise), the net capital gain to be distributed by the Target Fund will be reduced. In the event the Target Fund realizes income or gain as a result of such sales, the net capital gain to be distributed by the Target Fund will be increased if such income or gain cannot be offset by available capital loss carryforwards. To the extent that additional portfolio investments of the Acquiring Fund are sold after the Reorganization in order to meet redemption requests from former shareholders of the Target Fund, the Acquiring Fund may recognize gains or losses, which may result in taxable distributions to shareholders of the Acquiring Fund (including former shareholders of the Target Fund). |

If you choose to tender your shares before the Reorganization takes place, the tender will generally be a taxable transaction.

You may wish to consult with your tax adviser concerning the tax consequences of the Reorganization.

| Q: | Will the Funds have to pay any fees or expenses in connection with the Reorganization? |

| A: | The Acquiring Fund and the Target Fund will each bear, in proportion to their net assets, the costs associated with the Reorganization, which are estimated to be $541,000 (including auditor and legal fees and the costs of preparing and filing the enclosed Proxy Statement/Prospectus). These estimated expenses, in addition to the estimated brokerage commission and other transaction costs associated with the pre-Reorganization and post-Reorganization purchases and sales of portfolio securities described above, will be borne indirectly by the Funds’ shareholders regardless of whether the Reorganization is consummated. |

| Q: | What happens if shareholders of the Target Fund do not approve the Reorganization Agreement? |

| A: | If shareholders of the Target Fund do not approve the Reorganization Agreement, the Reorganization will not occur and the Target Fund would continue to operate as a closed-end fund. The Target Board may consider other alternatives for the Target Fund, which may include seeking a reorganization with a different fund, the liquidation of the Target Fund or continuing current operations of the Target Fund. |

| Q: | How does the Target Board suggest that I vote? |

| A: | As stated above, the Target Board recommends that you vote “FOR” the Reorganization Agreement. |

| Q: | When and where will the Special meeting be held? |

| A: | The Special Meeting will be held in a virtual-only format on August 16, 2023, at 8:30 a.m., Eastern Time. |

The meeting will be a virtual meeting. If you are a registered holder, and wish to attend and vote at the Meeting, please send an email including your full name and address to the Fund’s proxy solicitor, AST Fund Solutions, LLC (“AST”), at attendameeting@astfinancial.com with “Center Coast Brookfield MLP & Energy Infrastructure Fund virtual meeting” in the

iv

subject line. After receiving this information, AST will then email you the virtual meeting access information and instructions for voting during the Meeting. If you hold common shares of stock beneficially through a bank or broker, you will receive information regarding how to instruct your bank or broker to cast your vote. If you wish to attend and vote at the Meeting, you must first obtain a legal proxy from your financial intermediary reflecting the Fund’s name, the number of shares you held as of the date of record, May 26, 2023, as well as your name and address. You may forward an email from your intermediary containing the legal proxy or attach an image of the legal proxy via email to AST at attendameeting@astfinancial.com with “Legal Proxy” in the subject line. After receiving this information, AST will then email you the virtual meeting access information and instructions for voting during the Meeting.

| Q: | How do I vote my shares? |

| A: | If your shares are held in “Street Name” by a broker or bank, you will receive information regarding how to instruct your bank or broker to cast your votes. If you are shareholders of record, you may authorize a proxy to vote your shares by mail, phone, or internet or you may vote at the Special Meeting. To authorize a proxy to vote your shares by mail, please mark your vote on the enclosed proxy card and sign, date and return the card in the postage-paid envelope provided. If you choose to authorize a proxy to vote your shares by phone or internet, please refer to the instructions found on the proxy card accompanying this Proxy Statement/Prospectus. To authorize a proxy to vote your shares by phone or internet, you will need the “control number” that appears on the proxy card. |

| Q: | Whom do I contact for further information? |

| A: | If you need any assistance or have any questions regarding the proposals or how to vote your shares, please call AST Fund Solutions, LLC (“AST Fund Solutions”), the Funds’ proxy solicitor, at (855) 777-8001 with your proxy material. |

| Q: | Will anyone contact me? |

| A: | You may receive a call from AST Fund Solutions to verify that you received your proxy materials, to answer any questions you may have about the proposals and to encourage you to vote your proxy. |

Please authorize your proxy now. Your vote is very important.

To avoid the wasteful and unnecessary expense of further solicitation, we urge you to indicate your voting instructions on the enclosed proxy card(s), date and sign it and return it promptly in the envelope provided, or record your voting instructions by telephone or via the Internet, no matter how large or small your holdings may be. If you submit a properly executed proxy but do not indicate how you wish your shares of common stock to be voted, your shares will be voted “FOR” each Proposal, as applicable. If your shares are held through a broker, you must provide voting instructions to your broker about how to vote your shares in order for your broker to vote your shares of common stock at the Special Meeting.

|

v

CENTER COAST BROOKFIELD MLP & ENERGY INFRASTRUCTURE FUND

Brookfield Place, 250 Vesey Street

New York, New York 10281-1023

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 16, 2023

To the Shareholders of Center Coast Brookfield MLP & Energy Infrastructure Fund:

Notice is hereby given that a Special Meeting of Shareholders (the “Special Meeting”) of Center Coast Brookfield MLP & Energy Infrastructure Fund (“CEN” or the “Target Fund”), a closed-end management investment company formed as a Delaware statutory trust, will be held virtually on August 16, 2023, at 8:30 a.m., Eastern Time, for the following purposes:

| · | To consider and approve an Agreement and Plan of Reorganization, as it may be amended from time to time (the “Reorganization Agreement”), which provides for (i) the transfer of all of the assets of the Target Fund to the Center Coast Brookfield Midstream Focus Fund (the “Acquiring Fund” or “FOCUS”), a series of Brookfield Investment Funds, in exchange for the assumption by the Acquiring Fund of all liabilities of the Target Fund and the issuance to the Target Fund of shares of the Acquiring Fund; (ii) the distribution of such shares of the Acquiring Fund to the shareholders of the Target Fund; and (iii) the termination, dissolution and complete liquidation of the Target Fund; and |

| · | To transact such other business as may properly come before the Special Meeting. |

The Meeting will be held in a virtual meeting format only. Shareholders will not be able to attend the Meeting in person. In order to participate in and vote at the Special Meeting, shareholders of record as of the close of business on May 26, 2023 (the “Record Date”) need to register for the Meeting. If you are a registered holder, and wish to attend and vote at the Meeting, please send an email including your full name and address to the Fund’s proxy solicitor, AST Fund Solutions, LLC (“AST”), at attendameeting@astfinancial.com with “Center Coast Brookfield MLP & Energy Infrastructure Fund virtual meeting” in the subject line. After receiving this information, AST will then email you the virtual meeting access information and instructions for voting during the Meeting. If you hold common shares of beneficial interest through a bank or broker, you will receive information regarding how to instruct your bank or broker to cast your vote. If you wish to attend and vote at the Meeting, you must first obtain a legal proxy from your financial intermediary reflecting the Fund’s name, the number of shares you held as of the Record Date, as well as your name and address. You may forward an email from your intermediary containing the legal proxy or attach an image of the legal proxy via email to AST at attendameeting@astfinancial.com with “Legal Proxy” in the subject line. After receiving this information, AST will then email you the virtual meeting access information and instructions for voting during the Meeting.

Shareholders of record as of the close of the Record Date are entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof. You are being asked to participate in the Special Meeting either virtually or by proxy. If you attend the Special Meeting and are a shareholder of record as of the close of business on the Record Date, you may vote your shares at the Special Meeting. The Board recommends that you cast your vote FOR the proposed Reorganization. Regardless of whether you plan to attend the Special Meeting, please complete, date, sign and return promptly in the enclosed envelope the accompanying proxy. This is important to ensure a quorum at the Special Meeting. Regardless of whether you plan to attend the Special Meeting, please complete, date, sign and return promptly in the enclosed envelope the accompanying proxy. This is important to ensure a quorum at the Special Meeting.

In addition to authorizing a proxy to vote by mail, you may also authorize a proxy to vote your shares via the Internet or telephone as follows:

To vote by the Internet:

(1) Read the Proxy Statement/Prospectus and have the enclosed proxy card at hand.

(2) Go to the website that appears on the enclosed proxy card.

(3) Enter the control number set forth on the enclosed proxy card and follow the simple instructions.

To vote by telephone:

(1) Read the Proxy Statement/Prospectus and have the enclosed proxy card at hand.

(2) Refer to the toll-free number that appears on the enclosed proxy card.

(3) Follow the instructions.

ii

We encourage you to authorize a proxy to vote your shares via the Internet using the control number that appears on your enclosed proxy card. Use of Internet voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed Proxy Statement/Prospectus carefully before you vote. If you should have any questions, we encourage you to call us at (855) 777-8001.

| By Order of the Board of Trustees of the Target Fund | |

| Craig Ruckman | |

| Secretary of the Target Fund | |

| [__], 2023 | |

iii

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING

OF SHAREHOLDERS TO BE HELD ON AUGUST 16, 2023

The Fund’s Notice of Special Meeting of Shareholders, Proxy Statement and Form of Proxy are available on the Internet at https://publicsecurities.brookfield.com/en.

WE NEED YOUR PROXY VOTE IMMEDIATELY.

YOU MAY THINK YOUR VOTE IS NOT IMPORTANT, BUT IT IS VITAL. AT THE MEETING OF SHAREHOLDERS THE FUND WILL BE UNABLE TO CONDUCT ANY BUSINESS IF LESS THAN A MAJORITY OF THE VOTES ENTITLED TO VOTE ARE REPRESENTED. IN THAT EVENT, THE MEETING MAY BE ADJOURNED AND THE FUND, AT THE SHAREHOLDERS’ EXPENSE, WOULD CONTINUE TO SOLICIT VOTES IN AN ATTEMPT TO ACHIEVE A QUORUM. CLEARLY, YOUR VOTE COULD BE CRITICAL TO ENABLE THE FUND TO HOLD THE MEETING AS SCHEDULED, SO PLEASE RETURN YOUR PROXY CARD IMMEDIATELY. YOU AND ALL OTHER SHAREHOLDERS WILL BENEFIT FROM YOUR COOPERATION.

Instructions for Signing Proxy Cards

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts. Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts. Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration.

3. All Other Accounts. The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

| Registration | Valid Signature |

Corporate Accounts

| (1) ABC Corp. | ABC Corp. (by John Doe, Treasurer) |

| (2) ABC Corp. | John Doe, Treasurer |

| (3) ABC Corp. c/o John Doe, Treasurer | John Doe |

| (4) ABC Corp. Profit Sharing Plan | John Doe, Director |

Trust Accounts

| (1) ABC Trust | Jane B. Doe, Director |

| (2) Jane B. Doe, Director u/t/d 12/28/78 | Jane B. Doe |

Custodial or Estate Accounts

| (1) John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA | John B. Smith |

| (2) John B. Smith | John B. Smith, Jr., Executor |

YOUR VOTE IS IMPORTANT.

PLEASE AUTHORIZE A PROXY TO VOTE YOUR SHARES PROMPTLY, NO MATTER HOW MANY SHARES YOU OWN.

|

iv

The information contained in this Proxy Statement/Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Proxy Statement/Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 26, 2023

PROXY STATEMENT/PROSPECTUS

Dated [___], 2023

relating to the reorganization of

CENTER COAST BROOKFIELD MLP & ENERGY INFRASTRUCTURE FUND

into

CENTER COAST BROOKFIELD MIDSTREAM FOCUS FUND,

a series of Brookfield Investment Funds

Brookfield Place

250 Vesey Street

New York, New York 10281-1023

(855) 777-8001

This Proxy Statement/Prospectus is being furnished to shareholders of Center Coast Brookfield MLP & Energy Infrastructure Fund (the “Target Fund” or “CEN”), a closed-end management investment company, in connection with the solicitation of proxies by the Target Fund’s Board of Trustees (the “Target Board”) for use at the Special Meeting of Shareholders of the Target Fund to be held on August 16, 2023, at 8:30 a.m. (Eastern Time) and at any and all adjournments or postponements thereof (the “Special Meeting”), to consider a proposal to approve an Agreement and Plan of Reorganization, as it may be amended from time to time (the “Reorganization Agreement”), pursuant to which the Target Fund would transfer all of its assets to the Center Coast Brookfield Midstream Focus Fund (the “Acquiring Fund” or “FOCUS”), a series of Brookfield Investment Funds (the “Acquiring Trust”), an open-end management investment company, in exchange for the assumption by the Acquiring Fund of all liabilities of the Target Fund and shares of the Acquiring Fund, as detailed in the Reorganization Agreement, which shares will be distributed by the Target Fund to the holders of its shares on a pro rata basis in complete liquidation thereof. The Target Fund and the Acquiring Trust were each formed as a Delaware statutory trust. The Target Fund and the Acquiring Fund are referred to herein collectively as the “Funds” and each individually as a “Fund.” Because the Target Board and the Board of Trustees of the Acquiring Trust (the “Acquiring Board”) are each comprised of the same persons, the Target Board and the Acquiring Board are referred to herein collectively as the “Board” when acting on behalf of both the Target Fund and the Acquiring Fund, and the members of the Board are referred to herein as the “Trustees” and each individually as a “Trustee.” The enclosed proxy card or voting instruction form and this Proxy Statement/Prospectus are first being sent to shareholders of the Target Fund on or about [ ], 2023. Shareholders of record of the Target Fund as of the close of business on May 26, 2023 (the “Record Date”) are entitled to notice of and to vote at the Special Meeting and any and all adjournments or postponements thereof.

The Proxy Statement/Prospectus explains concisely what you should know before voting on the proposed Reorganization Agreement described in the Proxy Statement/Prospectus, and constitutes an offering of shares of beneficial interest of the Acquiring Fund. Please read it carefully and keep it for future reference.

This Proxy Statement/Prospectus is only being delivered to shareholders of the Target Fund.

The securities offered by this Proxy Statement/Prospectus have not been approved or disapproved by the Securities and Exchange Commission (“SEC”), nor has the SEC passed upon the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

On the matters coming before the Special Meeting as to which a choice has been specified by shareholders on the accompanying proxy card or voting instruction form, the Target Fund’s shares will be voted accordingly where such proxy card or voting instruction form is properly executed, timely received and not properly revoked (pursuant to the instructions below). If a proxy is returned and no choice is specified, the shares will be voted FOR the proposal. Shareholders of the Target Fund who execute proxies or provide voting instructions by telephone or by Internet may revoke them at any time before a vote is taken on a proposal by filing with the Target Fund a written notice of revocation, by delivering a duly executed proxy bearing a later date or by attending the Special Meeting and voting at the Special Meeting. A prior proxy can also be revoked by voting again through the toll-free number or the Internet address listed in the proxy card or voting instruction form. However, merely attending the Special Meeting will not revoke any previously submitted vote.

ii

At the Special Meeting, the Target Fund’s shareholders will be asked to approve the proposal described below:

| 1. | To consider and approve the Reorganization Agreement which provides for (i) the transfer of all of the assets of the Target Fund to the Acquiring Fund, a series of the Acquiring Trust, in exchange for the assumption by the Acquiring Fund of all liabilities of the Target Fund and the issuance to the Target Fund of shares of the Acquiring Fund; (ii) the distribution of such shares of the Acquiring Fund to the shareholders of the Target Fund; and (iii) the termination, dissolution and complete liquidation of the Target Fund. |

A quorum of shareholders is required to take action at the Special Meeting. The holding of a majority of the Target Fund’s shares entitled to vote at the Special Meeting, present at the Special Meeting or by proxy, will constitute a quorum of shareholders at the Special Meeting. Votes cast at the Special Meeting or by proxy will be tabulated by the inspectors of election appointed for the Special Meeting. The inspectors of election will determine whether or not a quorum is present at the Special Meeting. The inspectors of election will treat abstentions and “broker non-votes” (i.e., shares held by brokers or nominees, typically in “street name,” as to which (1) instructions have not been received from the beneficial owners or persons entitled to vote and (2) the broker or nominee does not have discretionary voting power on a particular matter), if any, as present for purposes of determining a quorum.

The Reorganization Agreement is required to be approved by the affirmative vote of (i) 67% or more of the Target Fund’s voting securities present at the Special Meeting, if the holders of more than 50% of the Target Fund’s outstanding voting securities are present or represented by proxy, or (ii) more than 50% of the Target Fund’s outstanding voting securities, whichever is less. As of the Record Date, there were [__] shares of the Target Fund outstanding.

Those persons who were shareholders of record of the Target Fund as of the close of business on the Record Date will be entitled to one vote for each share held and a proportionate fractional vote for each fractional share held.

Shareholders will not be able to attend the Meeting in person. In order to participate in and vote at the Special Meeting, shareholders of record as of the close of business on May 26, 2023, (the “Record Date”) need to register for the Meeting. If you are a registered holder, and wish to attend and vote at the Meeting, please send an email including your full name and address to the Fund’s proxy solicitor, AST Fund Solutions, LLC (“AST”), at attendameeting@astfinancial.com with “Center Coast Brookfield MLP & Energy Infrastructure Fund virtual meeting” in the subject line. After receiving this information, AST will then email you the virtual meeting access information and instructions for voting during the Meeting. If you hold common shares of beneficial interest through a bank or broker, you will receive information regarding how to instruct your bank or broker to cast your vote. If you wish to attend and vote at the Meeting, you must first obtain a legal proxy from your financial intermediary reflecting the Fund’s name, the number of shares you held as of the Record Date, as well as your name and address. You may forward an email from your intermediary containing the legal proxy or attach an image of the legal proxy via email to AST at attendameeting@astfinancial.com with “Legal Proxy” in the subject line. After receiving this information, AST will then email you the virtual meeting access information and instructions for voting during the Meeting. Before the Special Meeting, I would like to provide you with additional background and ask for your vote on an important proposal affecting CEN.

Even if you plan to attend the Special Meeting, please promptly follow the enclosed instructions to submit voting instructions by telephone or via the Internet. Alternatively, you may submit voting instructions by signing and dating each proxy card or voting instruction form you receive, and if received by mail, returning it in the accompanying postage-paid return envelope.

The following documents containing additional information about each Fund, each having been filed with the SEC, are incorporated by reference into (legally form a part of) this Proxy Statement/Prospectus:

| · | the Statement of Additional Information dated [ ], 2023, relating to this Proxy Statement/Prospectus; |

| · | the Annual Report to the shareholders of the Target Fund for the fiscal year ended September 30, 2022; |

| · | the Prospectus relating to the shares of the Acquiring Fund, dated January 30, 2023, as supplemented (the “Acquiring Fund Prospectus”); |

| · | the Statement of Additional Information relating to shares of the Acquiring Fund, dated January 30, 2023, as supplemented (the “Acquiring Fund SAI”); and |

| · | the Annual Report to shareholders of the Acquiring Fund for the fiscal year ended September 30, 2022; |

No other parts of the Funds’ or any other fund’s Annual Reports are incorporated by reference herein.

Copies of the foregoing may be obtained without charge by calling (855) 777-8001 or writing to the Fund are Brookfield Place, 250 Vesey Street, New York, New York 10281-1023. The foregoing documents are available on the EDGAR Database on the SEC’s website at www.sec.gov.

Each Fund is subject to the informational requirements of the Securities Act of 1933, as amended (the “1933 Act”), the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act” or the “Investment

iii

Company Act”), and in accordance therewith, files reports, information statements, proxy materials and other information with the SEC. Materials filed with the SEC can be viewed and downloaded from the SEC’s website at www.sec.gov.

Please note that only one copy of shareholder documents, including annual or semi-annual reports and proxy materials, maybe delivered to two or more shareholders of the Target Fund who share an address, unless the Target Fund has received instructions to the contrary. This practice is commonly called “householding” and it is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. To request a separate copy of any shareholder document or for instructions as to how to request a separate copy of these documents or as to how to request a single copy if multiple copies of these documents are received, shareholders should contact the Target Fund at the address and phone number set forth above.

Shares of the Acquiring Fund, an open-end fund, are purchased and redeemed directly from the Acquiring Fund, or through financial intermediaries, at net asset value, less any applicable charges. Target Fund shares are no longer available for purchase and are not redeemable.

This Proxy Statement/Prospectus serves as a prospectus of the Acquiring Fund in connection with the issuance of the shares of the Acquiring Fund in the Reorganization. In this connection, no person has been authorized to give any information or make any representation not contained in this Proxy Statement/Prospectus and, if so given or made, such information or representation must not be relied upon as having been authorized. This Proxy Statement/Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

The date of this Proxy Statement/Prospectus is [__], 2023.

iv

TABLE OF CONTENTS

Page

v

vi

The following is a summary of, and is qualified by reference to, the more complete information contained in this Proxy Statement/Prospectus and the information attached hereto or incorporated herein by reference, including the Form of Agreement and Plan of Reorganization attached as Appendix A. As discussed more fully below and elsewhere in this Proxy Statement/Prospectus, the Board believes the proposed Reorganization is in the best interests of the Target Fund and that the interests of the Target Fund’s existing shareholders would not be diluted as a result of the Reorganization, and the Board believes the proposed Reorganization is in the best interests of the Acquiring Fund and that the interests of the Acquiring Fund’s existing shareholders would not be diluted as a result of the Reorganization. If the Reorganization is approved and completed, shareholders of the Target Fund, a closed-end investment company, will become holders of Class I shares of the Acquiring Fund, an open-end investment company and a series of the Acquiring Trust.

The Acquiring Fund, following completion of the Reorganization, may be referred to as the “Combined Fund” in this Proxy Statement/Prospectus.

Shareholders should read the entire Proxy Statement/Prospectus carefully. See “Synopsis—Comparison of the Funds” beginning on page [__] and “Synopsis—Comparative Fee and Expense Information” beginning on page [__] for a comparison of investment policies, fees and expenses, and other matters. This Proxy Statement/Prospectus constitutes an offering of shares of the Acquiring Fund.

Background and Reasons for the Proposed Reorganization

At a meeting held on March 30, 2023 (the “Approval Meeting”), the Board considered the approval of the Reorganization Agreement with respect to each Fund. The Board, including all of the Trustees who are not “interested persons,” as defined in the1940 Act, of the Funds (the “Independent Board Members”), have approved the Reorganization Agreement. The Board has determined that the Reorganization is in the best interests of the Funds and that the interests of the Funds’ shareholders will not be diluted as a result of the Reorganization. The Board’s determinations were based on a comprehensive evaluation of the information provided to it. During the review, the Board did not identify any particular information or consideration that was all-important or controlling.

The Reorganization seeks to combine two funds that have substantially similar, but not identical, investment objectives. The Board, based upon its evaluation of all relevant information, anticipates that the Reorganization would benefit shareholders of CEN.

In considering the Reorganization, the Board reviewed substantial information provided by Brookfield Public Securities Group LLC (“Brookfield” or the “Adviser”), the investment adviser to the Funds. In considering such information, the Board took into account that in presenting this recommendation the Adviser may be subject to a conflict of interest, as the Adviser would realize certain operating efficiencies (such as reduced administrative and oversight burdens in managing one portfolio rather than two portfolios) and economies (such as the need for only one audit) if the Reorganization is consummated.

The Board also received a memorandum outlining, among other things, the legal standards and certain other considerations relevant to the Board’s deliberations. The Independent Trustees also discussed these matters in detail with its own independent counsel.

During the course of its deliberations in evaluating the proposed Reorganization, the Board acknowledged that, in collaboration with Brookfield, it had considered various strategic options for CEN seeking to advance and maximize shareholder value. This includes, without limitation, fund reorganizations within the Brookfield fund complex, reorganization opportunities with third parties, and strategic portfolio repositioning, including a potential sale of all or a part of CEN’s holding in KKR Eagle Co-Invest LP (“KKR Eagle”). At the Approval Meeting, Brookfield reported to the Board that, following an extensive process with a strategic advisor regarding potential sale opportunities for KKR Eagle, it had signed a purchase and sale agreement to sell CEN’s interest in KKR Eagle (which was later consummated on March 31, 2023). The Board determined, among other things, that following the sale of KKR Eagle, the proposed Reorganization was in the best interests of CEN shareholders. At the Approval Meeting, it was noted that Brookfield had entered into an agreement with CEN and Saba Capital Management, L.P. (“Saba”), CEN’s largest shareholder, on behalf of itself and other entities or accounts that it manages, whereby Saba has agreed to vote its shares in favor of the Reorganization.

After consideration of the above and several other factors, the Board, including all of the Independent Trustees, approved the Reorganization at a meeting held on March 30, 2023. In approving the proposed Reorganization, the Board, including the Independent Trustees, determined that the proposed Reorganization is in the best interests of the Funds and their shareholders and that the interests of the Funds’ shareholders will not be diluted with respect to the net asset value of the Funds as a result of the Reorganization. Before reaching these conclusions, the Board, including the Independent Trustees, engaged in a thorough review process relating to the proposed Reorganization.

In reaching its determinations with respect to the Reorganization, the Board considered a number of factors presented at the time of the Approval meeting, including, but not limited to, the following:

1

| · | the Acquiring Fund’s investment objective is substantially similar to that of the Target Fund. Each Fund’s principal investment strategies are and principal investment risks are substantially similar. The Board considered the investment objective, strategies and risks of each Fund in approving the Reorganization. See “Synopsis––Comparison of the Funds”; |

| · | the Reorganization would provide an opportunity for liquidity to all of the Target Fund shareholders; |

| · | there would be continuity in portfolio management for shareholders of the Target Fund because the Adviser to the Target Fund will continue to manage the Combined Fund’s assets on a day-to-day basis, and that there is not expected to be any diminution in the nature, quality and extent of the services provided to shareholders after the Reorganization; |

| · | the Reorganization may generate a higher distribution rate for Target Fund shareholders, given the Acquiring Fund’s current distribution rate; |

| · | the Target Fund shareholders may benefit from the elimination of a persistent trading discount that the Target Fund has experienced over the last few years; |

| · | the Acquiring Fund shareholders may benefit from the increased capitalization of the Combined Fund, as it will offer the benefits of economies of scale; |

| · | the Reorganization may potentially result in operational cost savings over time as a result of the larger size of the Combined Fund. It is anticipated that Target Fund shareholders will experience a reduction in total annual fund operating expenses and that the Acquiring Fund shareholders will also see a modest reduction; |

| · | the Combined Fund is projected to have a return profile that is comparable to the Acquiring Fund; |

| · | the Reorganization would provide similar benefits as the conversion of the Target Fund into an open-end structure: namely, Target Fund shareholders who become shareholders of the Combined Fund would be permitted to redeem, purchase or exchange shares of the Combined Fund received in the Reorganization at the then-current net asset value; |

| · | assuming the Reorganization had taken place on September 30, 2022, the Combined Fund’s shares would have (A) total annual fund operating expenses that are estimated to be lower than those of the Target Fund’s shares prior to the Reorganization, and (B) after giving effect to all contractual fee and expense waivers and/or reimbursements that Brookfield has agreed to continue through January 30, 2024, net annual fund operating expenses are estimated to be lower than those of the Target Fund’s shares prior to the Reorganization; |

| · | the shareholders of the Target Fund will not pay an initial sales charge in connection with the receipt of shares of the Acquiring Fund in the Reorganization and such shares will not be subject to any redemption fees or contingent deferred sales charge. See “Synopsis––Comparison of the Funds”; |

| · | the Acquiring Fund, as an open-end fund rather than a closed-end fund, is managed utilizing less leverage than the Target Fund due to limitations on the use of leverage by an open-end fund. As a result, the Combined Fund’s yield is expected to be lower than the Target Fund’s current yield; |

| · | the Acquiring Fund, as an open-end fund, is prohibited from investing more than 15% of its net assets in illiquid investments and will normally be required to maintain higher cash balances than the Target Fund; |

| · | there is expected to be no gain or loss recognized by shareholders for U.S. federal income tax purposes as a result of the Reorganization, because the Reorganization is expected to be a tax-free reorganization for U.S. federal income tax purposes. Prior to the Reorganization, the Target Fund will distribute to its shareholders all net investment taxable income and net realized capital gains not previously distributed to shareholders, and such distribution of net investment taxable income and net realized capital gains will be taxable to shareholders in non-tax qualified accounts. The Combined Fund may recognize gains that, upon distribution, are taxable to shareholders as a result of sales of portfolio securities after the Reorganization to satisfy expected redemption requests; |

| · | the aggregate net asset value of the shares of the Acquiring Fund that shareholders of the Target Fund will receive in the Reorganization is expected to equal the aggregate net asset value of the shares that shareholders of the Target Fund own immediately prior to the Reorganization, and the interests of the shareholders of the Target Fund will not be diluted as a result of the Reorganization; |

| · | the Acquiring Fund and the Target Fund will each bear, in proportion to their net assets, the costs associated with the Reorganization, which are estimated to be $541,000 (including auditor and legal fees and the costs of preparing and filing this Proxy Statement/Prospectus). These estimated expenses, in addition to the estimated brokerage commission and other transaction costs associated with the pre-Reorganization and post-Reorganization purchases |

2

and sales of portfolio securities described above, will be borne indirectly by the Funds’ shareholders regardless of whether the Reorganization is consummated;

| · | shareholders will benefit from the continuing experience and expertise of the portfolio management team designated for the Combined Fund, and the team’s commitment to the investment style and strategies to be used in managing the assets of the Combined Fund; and |

| · | shareholders will receive the same level and quality of services after the Reorganization. |

For a more complete discussion of the factors to be considered by the Board in approving the Reorganization, see “Information About the Reorganization––Board Approval of the Reorganization.”

If the Reorganization is not approved by shareholders of the Target Fund, the Reorganization will not occur and the Target Fund would continue to operate as a closed-end fund. The Board may consider other alternatives for the Target Fund, which may include seeking a reorganization with a different fund, the liquidation of the Target Fund or continuing current operations of the Target Fund.

The Board, including all of the Independent Trustees, recommends that you vote “FOR” the proposed Reorganization.

The Reorganization Agreement provides for: (i) the transfer of all of the assets of the Target Fund to the Acquiring Fund in exchange for the assumption by the Acquiring Fund of all liabilities of the Target Fund and the issuance to the Target Fund of Class I shares of the Acquiring Fund; (ii) the distribution of such shares of the Acquiring Fund to Target Fund shareholders; and (iii) the termination, dissolution and complete liquidation of the Target Fund.

The aggregate net asset value of the Acquiring Fund’s shares issued to each Target Fund shareholder in the Reorganization will equal, as of the Valuation Time (as defined in the Reorganization Agreement), the aggregate net asset value of Target Fund shares held by the shareholder of the Target Fund as of such time.

If the Reorganization is consummated, current Target Fund shareholders, as shareholders of the Combined Fund, may be able to exchange their shares received in the Reorganization for shares of another class of the Combined Fund for which they are eligible. Such shareholders should consult their tax advisers regarding the potential tax consequences of such an exchange.

Material Federal Income Tax Consequences of the Reorganization

As a condition to closing, the Funds will receive an opinion of Paul Hastings LLP, substantially to the effect that, based on certain facts, assumptions and representations of the parties, the proposed Reorganization will qualify as a tax-free reorganization under Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that the Target Fund will recognize no gain or loss for federal income tax purposes as a direct result of the Reorganization. It is also expected that shareholders of the Target Fund who receive Acquiring Fund shares pursuant to the Reorganization will recognize no gain or loss for federal income tax purposes.

The portfolio managers of the Acquiring Fund have reviewed the portfolio holdings of the Target Fund and, as of September 30, 2022, all the securities held by the Target Fund comply with the compliance guidelines and/or investment restrictions of the Acquiring Fund. As of September 30, 2022, approximately [__]% of the Target Fund’s total assets were invested in securities held by the Acquiring Fund. Approximately [__]% of the securities of the Target Fund are anticipated to be sold in order to reposition the Target Fund’s portfolio prior to the Reorganization, and approximately [__]% of the securities of the Acquiring Fund are anticipated to be sold in connection with the Reorganization. For information about the anticipated transaction costs associated with the pre-Reorganization and post-Reorganization purchases and sales of portfolio securities, see “Information About the Reorganization––Reorganization Expenses.”

Prior to the closing of the Reorganization, the Target Fund will declare a distribution of all of its net capital gains, if any. All or a portion of such a distribution may be taxable to the Target Fund’s shareholders for federal income tax purposes. To the extent the Target Fund realizes net losses from the sale of portfolio securities in connection with the portfolio repositioning described above (or otherwise), the net capital gain to be distributed by the Target Fund will be reduced. In the event the Target Fund realizes income or gain as a result of such sales, the net capital gain to be distributed by the Target Fund will be increased if such income or gain cannot be offset by available capital loss carryforwards.

For a more detailed discussion of the federal income tax consequences of the Reorganization, please see “Information About the Reorganization—Material Federal Income Tax Consequences” below.

Investment Objectives and Principal Investment Strategies

3

Investment Objectives. The Funds’ investment objectives are substantially similar. The investment objective of the Acquiring Fund is to seek maximum total return with an emphasis on providing cash distributions to shareholders. The investment objective of the Target Fund is to provide a high level of total return with an emphasis on distributions to shareholders. The “total return” sought by the Target Fund includes appreciation in the net asset value of the Fund’s common shares and all distributions made by the Fund to its common shareholders, regardless of the tax characterization of such distributions, including distributions characterized as a return of capital. The Acquiring Fund’s investment objective is non-fundamental and may be changed without shareholder approval. The Target Fund’s investment objective is fundamental and may not be changed without the approval of a majority of the outstanding voting securities (as defined in the 1940 Act) of the Fund.

Principal Investment Strategies. The principal investment strategies of the Acquiring Fund and the Target Fund are substantially similar; however, there are certain differences. Under normal circumstances, the Acquiring Fund invests at least 80% of its net assets (including amounts borrowed for investment purposes) in a portfolio of master limited partnerships (“MLPs”) and in other investments that have economic characteristics similar to such securities. The Acquiring Fund also concentrates (i.e., invests more than 25% of its total assets) in securities of companies in the energy infrastructure industry and the energy industry. Under normal market conditions, the Target Fund invests at least 80% of its net assets (including amounts borrowed for investment purposes) in securities of MLPs (including investments that offer economic exposure to public and private MLPs) and energy infrastructure companies. The Target Fund also endeavors, under normal market conditions, to invest a significant portion of its investments in “midstream” MLPs.

Both the Acquiring Fund and the Target Fund consider “midstream investments,” to encompass a wide range of companies engaged in the energy infrastructure industry and include companies engaged in midstream activities, such as the treatment, gathering, compression, processing, transportation, transmission, fractionation, storage and terminalling of natural gas, natural gas liquids, crude oil and refined products, as well as other energy infrastructure companies including electrical transmission companies and utilities, and companies engaged in owning, storing and transporting alternative energy sources, such as renewables (e.g., wind, solar, hydrogen, geothermal, biomass).

Both Funds may invest in non-investment grade bonds (high yield or junk bonds) and foreign securities, which may include depositary receipts. While not part of their principal investment strategies, both Funds may invest in exchange-traded notes and are permitted to utilize derivatives. Both Funds are also permitted to invest in securities of other open- or closed-end investment companies, subject to applicable regulatory limits. Each Fund is non-diversified, which means they both may focus their investments in a limited number of issuers.

While the Acquiring Fund may invest up to 15% of its net assets in illiquid securities, the Target Fund may invest up to 20% of its Managed Assets in unregistered or restricted securities, including securities issued by private energy infrastructure companies.

While both Funds’ strategies focus on investments in MLPs and “midstream investments,” the Target Fund may employ a more opportunistic strategy in which it seeks to invest in special situations, including private opportunistic investments, as the Target Fund may allocate up to 20% of its portfolio to private investment opportunities. The Acquiring Fund does not have a similar principal investment strategy.

The Target Fund, as a closed-end fund, is permitted to use leverage to a greater extent than the Acquiring Fund. The Target Fund may use leverage by investing in reverse repurchase agreements or other derivative instruments with leverage embedded in them and by borrowing funds from banks or other financial institutions. The Acquiring Fund may also use derivatives for leverage.

The Acquiring Fund generally sells an investment if it determines that the characteristics that resulted in the original purchase decision have changed materially, the investment is no longer earning a return commensurate with its risk, it identifies other investments with more attractive valuations and return characteristics, or the Fund requires cash to meet redemption requests. The Target Fund does not have a similar principal investment strategy.

Fundamental and Non-Fundamental Investment Restrictions

Each Fund has adopted certain investment restrictions that are “fundamental,” meaning such investment restrictions cannot be changed without approval by holders of a “majority of the Fund’s outstanding voting securities” as defined in the 1940 Act. As defined in the 1940 Act, this phrase means the vote of (1) 67% or more of the voting securities present at a meeting, if the holders of more than 50% of the outstanding voting securities are present or represented by proxy, or (2) more than 50% of the outstanding voting securities, whichever is less. The fundamental investment restrictions of the Funds, which are similar although there are some differences, as well as certain non-fundamental investment restrictions of the Funds, are set forth in Appendix B to this Proxy Statement/Prospectus. Following completion of the Reorganization, the Combined Fund will have the same fundamental and non-fundamental investment restrictions as the Acquiring Fund.

In evaluating the Reorganization, each Target Fund shareholder should consider the risks of investing in the Acquiring Fund.

4

The principal risks of investing in the Acquiring Fund are described in the section below entitled “Comparative Risk Information.”

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Examples, affect a Fund’s performance. During its most recent fiscal year, each Fund had the following portfolio turnover rate as a percentage of the average value of its portfolio:

| Fund | Fiscal Year Ended | Rate | ||

| Target Fund | 09/30/22 | 40% | ||

| Acquiring Fund | 09/30/22 | 61% |

Investment Adviser

Brookfield Public Securities Group LLC (the “Adviser” or “Brookfield”), a Delaware limited liability company and a registered investment adviser under the 1940 Act serves as the investment adviser and administrator to the Funds. Founded in 1989, the Adviser is an indirect wholly-owned subsidiary of Brookfield Asset Management ULC, an unlimited liability company formed under the laws of British Columbia, Canada (“BAM ULC”). Brookfield Corporation, a publicly traded company (NYSE: BN, TSX: BN), holds a 75% interest in BAM ULC, while Brookfield Asset Management Ltd., a publicly traded company (NYSE: BAM; TSX: BAM) (“Brookfield Asset Management”), holds a 25% interest in BAM ULC. Brookfield Asset Management is a leading global alternative asset manager focused on real estate, renewable power, infrastructure and private equity with assets under management over $750 billion as of December 31, 2022. In addition to the Trust, the Adviser’s clients include financial institutions, public and private pension plans, insurance companies, endowments and foundations, sovereign wealth funds, high net-worth investors and closed end funds. The Adviser specializes in global listed real assets strategies and its investment philosophy incorporates a value-based approach towards investment. The Adviser provides advisory services to several other registered investment companies. As of December 31, 2022, the Adviser and its affiliates had approximately $22 billion in assets under management. The business address of the Adviser and its officers and directors is Brookfield Place, 250 Vesey Street, New York, New York 10281.

From time to time, a manager, analyst, or other employee of Brookfield or its affiliates may express views regarding a particular asset class, company, security, industry, or market sector. The views expressed by any such person are the views of only that individual as of the time expressed and do not necessarily represent the views of Brookfield or any other person within the Brookfield organization. Any such views are subject to change at any time based upon market or other conditions and Brookfield disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for the Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of the Funds.

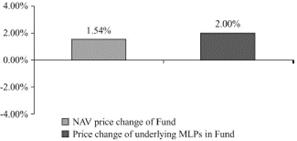

Portfolio Managers