UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22558

Brookfield Investment Funds

(Exact name of registrant as specified in charter)

Brookfield Place

225 Liberty Street, 35th Floor

New York, New York 10281-1048

(Address of principal executive offices) (Zip code)

Brian F. Hurley, Esq.

Brookfield Public Securities Group LLC

Brookfield Place

225 Liberty Street, 35th Floor

New York, New York 10281-1048

(Name and address of agent for service)

(855) 777-8001

Registrant’s telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

| | |

| Brookfield Global Listed Infrastructure Fund | |

| Class A | BGLAX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Brookfield Global Listed Infrastructure Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.brookfieldoaktree.com/fund/brookfield-global-listed-infrastructure-fund. You can also request this information by contacting us at 855-244-4859.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $62 | 1.25% |

HOW DID THE FUND PERFORM AND WHAT AFFECTED ITS PERFORMANCE?

For the 6-month period ended June 30, 2024, the Fund underperformed its benchmark, the FTSE Global Core Infrastructure 50/50 Index (USD).

WHAT FACTORS INFLUENCED PERFORMANCE

Overweight positions in select U.S. midstream operators focused on natural gas and natural gas liquids contributed, as the sector continued to outperform. Within the gas utilities sector, positive security selection across the U.S. and Asia contributed during the period.

Select ports in emerging markets rallied meaningfully during the period. Zero exposure detracted from relative performance. Underperforming positions in U.S. and European communication tower operators detracted from returns during the period.

Within the utilities sector, we’re focused on companies that we believe operate the best assets located in the best jurisdictions. Our portfolio positioning is focused on pro-growth environments, favorable regulatory backdrops and management teams that have a strong history of deploying capital to its highest and best use. Within transports, we are focused on markets where toll road traffic is supported by population and economic growth. Tower companies are grappling with a variety of headwinds, but we think discounted valuations among select companies reflect these headwinds, and we’re optimistic that increasing mobile traffic, moderating interest rates and limited new supply of towers can help close the valuation gap. Lastly, within energy midstream, we think the sector continues to offer an attractive investment proposition. Supply and demand tailwinds for U.S. hydrocarbons remain quite strong, and balance sheets appear well positioned to meet dividend obligations.

| |

Top Contributors |

| ↑ | Midstream |

| ↑ | Gas Utilities |

| ↑ | Toll Roads |

| |

Top Detractors |

| ↓ | Ports |

| ↓ | Towers |

| ↓ | Airports |

| Brookfield Global Listed Infrastructure Fund | PAGE 1 | TSR_SAR_112740501 |

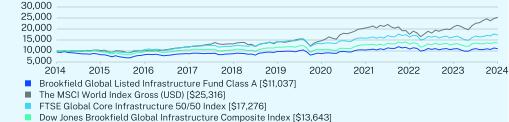

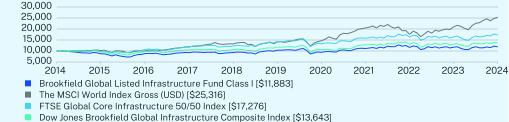

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class A (without sales charge) | 0.81 | 2.50 | 1.48 |

Class A (with sales charge) | -3.98 | 1.50 | 0.99 |

The MSCI World Index Gross (USD) | 20.75 | 12.32 | 9.73 |

FTSE Global Core Infrastructure 50/50 Index | 5.29 | 3.88 | 5.62 |

Dow Jones Brookfield Global Infrastructure Composite Index | 3.77 | 3.01 | 3.16 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-listed-infrastructure-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $295,694,446 |

Number of Portfolio Holdings | 41 |

Portfolio Turnover | 33% |

Total Advisory Fees Paid | $950,547 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-listed-infrastructure-fund for more recent performance information.

| Brookfield Global Listed Infrastructure Fund | PAGE 2 | TSR_SAR_112740501 |

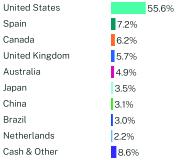

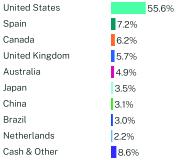

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Holdings | (%)1 |

NextEra Energy, Inc. | 8.1% |

Transurban Group | 4.9% |

Duke Energy Corp. | 4.9% |

Sempra | 4.3% |

Crown Castle, Inc. | 3.7% |

Cheniere Energy, Inc. | 3.3% |

National Grid PLC | 3.1% |

Public Service Enterprise Group, Inc. | 3.0% |

Entergy Corp. | 2.9% |

PG&E Corp. | 2.9% |

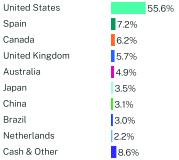

Geographic Breakdown (%)1

| 1 | Represents percent of total investments. |

| 2 | Represents percent of total net assets. |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://brookfield.onlineprospectus.net/Brookfield/funds

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brookfield Public Securities Group LLC documents not be householded, please contact Brookfield Public Securities Group LLC at 855-244-4859, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brookfield Public Securities Group LLC or your financial intermediary.

| Brookfield Global Listed Infrastructure Fund | PAGE 3 | TSR_SAR_112740501 |

9527830783608741878697578793104321088110949110371000010197997311854132411415914640204491759820965253161000097441069311842122671428513238158031638016409172761000095269741104341055711761105991280913042131471364355.67.26.25.74.93.53.13.02.28.627.618.112.98.37.97.26.65.92.53.0

| | |

| Brookfield Global Listed Infrastructure Fund | |

| Class C | BGLCX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Brookfield Global Listed Infrastructure Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.brookfieldoaktree.com/fund/brookfield-global-listed-infrastructure-fund. You can also request this information by contacting us at 855-244-4859.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $99 | 2.00% |

HOW DID THE FUND PERFORM AND WHAT AFFECTED ITS PERFORMANCE?

For the 6-month period ended June 30, 2024, the Fund underperformed its benchmark, the FTSE Global Core Infrastructure 50/50 Index (USD).

WHAT FACTORS INFLUENCED PERFORMANCE

Overweight positions in select U.S. midstream operators focused on natural gas and natural gas liquids contributed, as the sector continued to outperform. Within the gas utilities sector, positive security selection across the U.S. and Asia contributed during the period.

Select ports in emerging markets rallied meaningfully during the period. Zero exposure detracted from relative performance. Underperforming positions in U.S. and European communication tower operators detracted from returns during the period.

Within the utilities sector, we’re focused on companies that we believe operate the best assets located in the best jurisdictions. Our portfolio positioning is focused on pro-growth environments, favorable regulatory backdrops and management teams that have a strong history of deploying capital to its highest and best use. Within transports, we are focused on markets where toll road traffic is supported by population and economic growth. Tower companies are grappling with a variety of headwinds, but we think discounted valuations among select companies reflect these headwinds, and we’re optimistic that increasing mobile traffic, moderating interest rates and limited new supply of towers can help close the valuation gap. Lastly, within energy midstream, we think the sector continues to offer an attractive investment proposition. Supply and demand tailwinds for U.S. hydrocarbons remain quite strong, and balance sheets appear well positioned to meet dividend obligations.

| |

Top Contributors |

| ↑ | Midstream |

| ↑ | Gas Utilities |

| ↑ | Toll Roads |

| |

Top Detractors |

| ↓ | Ports |

| ↓ | Towers |

| ↓ | Airports |

| Brookfield Global Listed Infrastructure Fund | PAGE 1 | TSR_SAR_112740600 |

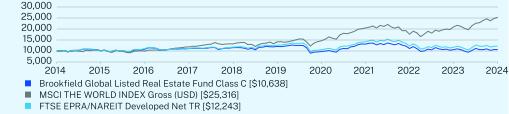

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class C (without sales charge) | 0.09 | 1.72 | 0.72 |

Class C (with sales charge) | -0.89 | 1.72 | 0.72 |

The MSCI World Index Gross (USD) | 20.75 | 12.32 | 9.73 |

FTSE Global Core Infrastructure 50/50 Index | 5.29 | 3.88 | 5.62 |

Dow Jones Brookfield Global Infrastructure Composite Index | 3.77 | 3.01 | 3.16 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-listed-infrastructure-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $295,694,446 |

Number of Portfolio Holdings | 41 |

Portfolio Turnover | 33% |

Total Advisory Fees Paid | $950,547 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-listed-infrastructure-fund for more recent performance information.

| Brookfield Global Listed Infrastructure Fund | PAGE 2 | TSR_SAR_112740600 |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Holdings | (%)1 |

NextEra Energy, Inc. | 8.1% |

Transurban Group | 4.9% |

Duke Energy Corp. | 4.9% |

Sempra | 4.3% |

Crown Castle, Inc. | 3.7% |

Cheniere Energy, Inc. | 3.3% |

National Grid PLC | 3.1% |

Public Service Enterprise Group, Inc. | 3.0% |

Entergy Corp. | 2.9% |

PG&E Corp. | 2.9% |

Geographic Breakdown (%)1

| 1 | Represents percent of total investments. |

| 2 | Represents percent of total net assets. |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://brookfield.onlineprospectus.net/Brookfield/funds

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brookfield Public Securities Group LLC documents not be householded, please contact Brookfield Public Securities Group LLC at 855-244-4859, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brookfield Public Securities Group LLC or your financial intermediary.

| Brookfield Global Listed Infrastructure Fund | PAGE 3 | TSR_SAR_112740600 |

10000865186408970894798628816103821075310731107411000010197997311854132411415914640204491759820965253161000097441069311842122671428513238158031638016409172761000095269741104341055711761105991280913042131471364355.67.26.25.74.93.53.13.02.28.627.618.112.98.37.97.26.65.92.53.0

| | |

| Brookfield Global Listed Infrastructure Fund | |

| Class I | BGLYX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Brookfield Global Listed Infrastructure Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.brookfieldoaktree.com/fund/brookfield-global-listed-infrastructure-fund. You can also request this information by contacting us at 855-244-4859.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $50 | 1.00% |

HOW DID THE FUND PERFORM AND WHAT AFFECTED ITS PERFORMANCE?

For the 6-month period ended June 30, 2024, the Fund underperformed its benchmark, the FTSE Global Core Infrastructure 50/50 Index (USD).

WHAT FACTORS INFLUENCED PERFORMANCE

Overweight positions in select U.S. midstream operators focused on natural gas and natural gas liquids contributed, as the sector continued to outperform. Within the gas utilities sector, positive security selection across the U.S. and Asia contributed during the period.

Select ports in emerging markets rallied meaningfully during the period. Zero exposure detracted from relative performance. Underperforming positions in U.S. and European communication tower operators detracted from returns during the period.

Within the utilities sector, we’re focused on companies that we believe operate the best assets located in the best jurisdictions. Our portfolio positioning is focused on pro-growth environments, favorable regulatory backdrops and management teams that have a strong history of deploying capital to its highest and best use. Within transports, we are focused on markets where toll road traffic is supported by population and economic growth. Tower companies are grappling with a variety of headwinds, but we think discounted valuations among select companies reflect these headwinds, and we’re optimistic that increasing mobile traffic, moderating interest rates and limited new supply of towers can help close the valuation gap. Lastly, within energy midstream, we think the sector continues to offer an attractive investment proposition. Supply and demand tailwinds for U.S. hydrocarbons remain quite strong, and balance sheets appear well positioned to meet dividend obligations.

| |

Top Contributors |

| ↑ | Midstream |

| ↑ | Gas Utilities |

| ↑ | Toll Roads |

| |

Top Detractors |

| ↓ | Ports |

| ↓ | Towers |

| ↓ | Airports |

| Brookfield Global Listed Infrastructure Fund | PAGE 1 | TSR_SAR_112740709 |

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class I (without sales charge) | 1.16 | 2.77 | 1.74 |

The MSCI World index Gross (USD) | 20.75 | 12.32 | 9.73 |

FTSE Global Core Infrastructure 50/50 Index | 5.29 | 3.88 | 5.62 |

Dow Jones Brookfield Global Infrastructure Composite Index | 3.77 | 3.01 | 3.16 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-listed-infrastructure-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $295,694,446 |

Number of Portfolio Holdings | 41 |

Portfolio Turnover | 33% |

Total Advisory Fees Paid | $950,547 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-listed-infrastructure-fund for more recent performance information.

| Brookfield Global Listed Infrastructure Fund | PAGE 2 | TSR_SAR_112740709 |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Holdings | (%)1 |

NextEra Energy, Inc. | 8.1% |

Transurban Group | 4.9% |

Duke Energy Corp. | 4.9% |

Sempra | 4.3% |

Crown Castle, Inc. | 3.7% |

Cheniere Energy, Inc. | 3.3% |

National Grid PLC | 3.1% |

Public Service Enterprise Group, Inc. | 3.0% |

Entergy Corp. | 2.9% |

PG&E Corp. | 2.9% |

Geographic Breakdown (%)1

| 1 | Represents percent of total investments. |

| 2 | Represents percent of total net assets. |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://brookfield.onlineprospectus.net/Brookfield/funds

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brookfield Public Securities Group LLC documents not be householded, please contact Brookfield Public Securities Group LLC at 855-244-4859, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brookfield Public Securities Group LLC or your financial intermediary.

| Brookfield Global Listed Infrastructure Fund | PAGE 3 | TSR_SAR_112740709 |

100008746882192469313103679360111381165411747118831000010197997311854132411415914640204491759820965253161000097441069311842122671428513238158031638016409172761000095269741104341055711761105991280913042131471364355.67.26.25.74.93.53.13.02.28.627.618.112.98.37.97.26.65.92.53.0

| | |

| Brookfield Global Listed Real Estate Fund | |

| Class A | BLRAX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Brookfield Global Listed Real Estate Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.brookfieldoaktree.com/fund/brookfield-global-listed-real-estate-fund. You can also request this information by contacting us at 855-244-4859.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $58 | 1.20% |

HOW DID THE FUND PERFORM AND WHAT AFFECTED ITS PERFORMANCE?

For the 6-month period ended June 30, 2024, the Fund underperformed its benchmark, the FTSE EPRA Nareit Developed Index Net (USD).

WHAT FACTORS INFLUENCED PERFORMANCE

Singapore was the leading regional contributor to relative performance. Outperformance was driven by not owning underperforming securities across property types during the period. Within the U.S., the net lease sector was the leading contributor to relative performance. Overweight positions to retail-focused landlords outperformed.

Overall, the U.S. was the leading detractor from relative performance. Relative underperformance was primarily due to underweight positions to regional malls, which outperformed early in the year. The U.K. was also a regional detractor. Overweight positions in student housing and office landlords lagged during the period.

In the U.S., we maintain a preference for needs-based real estate, which includes residential, health care and select retail assets. We have increased exposure to Europe and have a favorable view broadly, particularly among residential, retail and specialty landlords in continental Europe. In Asia Pacific, we believe Japanese property values may benefit as some private investors indicated they’re likely to deploy meaningful amounts of capital in the region over the next several years.

| |

Top Contributors |

| ↑ | U.S. Net Lease |

| ↑ | Singapore |

| ↑ | Australia |

| |

Top Detractors |

| ↓ | U.S. Retail |

| ↓ | U.K. |

| ↓ | Japan |

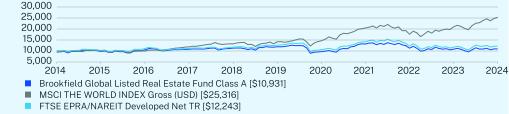

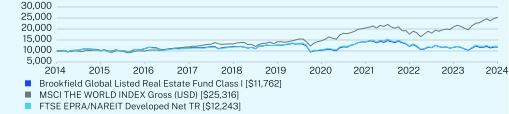

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

| Brookfield Global Listed Real Estate Fund | PAGE 1 | TSR_SAR_112740105 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class A (without sales charge) | 0.83 | -1.73 | 1.38 |

Class A (with sales charge) | -3.99 | -2.68 | 0.89 |

MSCI THE WORLD INDEX Gross (USD) | 20.75 | 12.32 | 9.73 |

FTSE EPRA/NAREIT Developed Net TR | 4.54 | -0.69 | 2.04 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-listed-real-estate-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $209,569,325 |

Number of Portfolio Holdings | 56 |

Portfolio Turnover | 73% |

Total Advisory Fees Paid | $904,678 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-listed-real-estate-fund for more recent performance information.

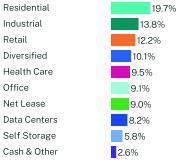

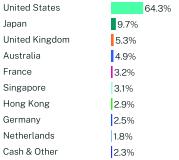

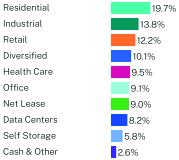

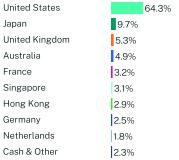

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Holdings | (%)1 |

Prologis, Inc. | 7.5% |

Extra Space Storage, Inc. | 3.9% |

Welltower, Inc. | 3.8% |

Digital Realty Trust, Inc. | 3.7% |

Equinix, Inc. | 3.6% |

Simon Property Group, Inc. | 3.4% |

Essex Property Trust, Inc. | 3.1% |

UDR, Inc. | 2.9% |

Equity LifeStyle Properties, Inc. | 2.7% |

VICI Properties, Inc. | 2.7% |

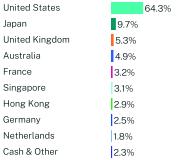

Geographic Breakdown (%)1

| 1 | Represents percent of total investments. |

| 2 | Represents percent of total net assets. |

| Brookfield Global Listed Real Estate Fund | PAGE 2 | TSR_SAR_112740105 |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://brookfield.onlineprospectus.net/Brookfield/funds

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brookfield Public Securities Group LLC documents not be householded, please contact Brookfield Public Securities Group LLC at 855-244-4859, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brookfield Public Securities Group LLC or your financial intermediary.

| Brookfield Global Listed Real Estate Fund | PAGE 3 | TSR_SAR_112740105 |

952896991051710806113251192997081317911278108411093110000101979973118541324114159146402044917598209652531610000996411118111411177012673106141417512270117111224364.39.75.34.93.23.12.92.51.82.319.713.812.210.19.59.19.08.25.82.6

| | |

| Brookfield Global Listed Real Estate Fund | |

| Class C | BLRCX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Brookfield Global Listed Real Estate Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.brookfieldoaktree.com/fund/brookfield-global-listed-real-estate-fund. You can also request this information by contacting us at 855-244-4859.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $95 | 1.95% |

HOW DID THE FUND PERFORM AND WHAT AFFECTED ITS PERFORMANCE?

For the 6-month period ended June 30, 2024, the Fund underperformed its benchmark, the FTSE EPRA Nareit Developed Index Net (USD).

WHAT FACTORS INFLUENCED PERFORMANCE

Singapore was the leading regional contributor to relative performance. Outperformance was driven by not owning underperforming securities across property types during the period. Within the U.S., the net lease sector was the leading contributor to relative performance. Overweight positions to retail-focused landlords outperformed.

Overall, the U.S. was the leading detractor from relative performance. Relative underperformance was primarily due to underweight positions to regional malls, which outperformed early in the year. The U.K. was also a regional detractor. Overweight positions in student housing and office landlords lagged during the period.

In the U.S., we maintain a preference for needs-based real estate, which includes residential, health care and select retail assets. We have increased exposure to Europe and have a favorable view broadly, particularly among residential, retail and specialty landlords in continental Europe. In Asia Pacific, we believe Japanese property values may benefit as some private investors indicated they’re likely to deploy meaningful amounts of capital in the region over the next several years.

| |

Top Contributors |

| ↑ | U.S. Net Lease |

| ↑ | Singapore |

| ↑ | Australia |

| |

Top Detractors |

| ↓ | U.S. Retail |

| ↓ | U.K. |

| ↓ | Japan |

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

| Brookfield Global Listed Real Estate Fund | PAGE 1 | TSR_SAR_112740204 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class C (without sales charge) | 0.08 | -2.48 | 0.62 |

Class C (with sales charge) | -0.90 | -2.48 | 0.62 |

MSCI THE WORLD INDEX Gross (USD) | 20.75 | 12.32 | 9.73 |

FTSE EPRA/NAREIT Developed Net TR | 4.54 | -0.69 | 2.04 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-listed-real-estate-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $209,569,325 |

Number of Portfolio Holdings | 56 |

Portfolio Turnover | 73% |

Total Advisory Fees Paid | $904,678 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-listed-real-estate-fund for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Holdings | (%)1 |

Prologis, Inc. | 7.5% |

Extra Space Storage, Inc. | 3.9% |

Welltower, Inc. | 3.8% |

Digital Realty Trust, Inc. | 3.7% |

Equinix, Inc. | 3.6% |

Simon Property Group, Inc. | 3.4% |

Essex Property Trust, Inc. | 3.1% |

UDR, Inc. | 2.9% |

Equity LifeStyle Properties, Inc. | 2.7% |

VICI Properties, Inc. | 2.7% |

Geographic Breakdown (%)1

| 1 | Represents percent of total investments. |

| 2 | Represents percent of total net assets. |

| Brookfield Global Listed Real Estate Fund | PAGE 2 | TSR_SAR_112740204 |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://brookfield.onlineprospectus.net/Brookfield/funds

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brookfield Public Securities Group LLC documents not be householded, please contact Brookfield Public Securities Group LLC at 855-244-4859, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brookfield Public Securities Group LLC or your financial intermediary.

| Brookfield Global Listed Real Estate Fund | PAGE 3 | TSR_SAR_112740204 |

10000100941087311090115371206397441312611142106291063810000101979973118541324114159146402044917598209652531610000996411118111411177012673106141417512270117111224364.39.75.34.93.23.12.92.51.82.319.713.812.210.19.59.19.08.25.82.6

| | |

| Brookfield Global Listed Real Estate Fund | |

| Class I | BLRYX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Brookfield Global Listed Real Estate Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.brookfieldoaktree.com/fund/brookfield-global-listed-real-estate-fund. You can also request this information by contacting us at 855-244-4859.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $46 | 0.95% |

HOW DID THE FUND PERFORM AND WHAT AFFECTED ITS PERFORMANCE?

For the 6-month period ended June 30, 2024, the Fund underperformed its benchmark, the FTSE EPRA Nareit Developed Index Net (USD).

WHAT FACTORS INFLUENCED PERFORMANCE

Singapore was the leading regional contributor to relative performance. Outperformance was driven by not owning underperforming securities across property types during the period. Within the U.S., the net lease sector was the leading contributor to relative performance. Overweight positions to retail-focused landlords outperformed.

Overall, the U.S. was the leading detractor from relative performance. Relative underperformance was primarily due to underweight positions to regional malls, which outperformed early in the year. The U.K. was also a regional detractor. Overweight positions in student housing and office landlords lagged during the period.

In the U.S., we maintain a preference for needs-based real estate, which includes residential, health care and select retail assets. We have increased exposure to Europe and have a favorable view broadly, particularly among residential, retail and specialty landlords in continental Europe. In Asia Pacific, we believe Japanese property values may benefit as some private investors indicated they’re likely to deploy meaningful amounts of capital in the region over the next several years.

| |

Top Contributors |

| ↑ | U.S. Net Lease |

| ↑ | Singapore |

| ↑ | Australia |

| |

Top Detractors |

| ↓ | U.S. Retail |

| ↓ | U.K. |

| ↓ | Japan |

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

| Brookfield Global Listed Real Estate Fund | PAGE 1 | TSR_SAR_112740303 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class I (without sales charge) | 1.11 | -1.48 | 1.64 |

MSCI THE WORLD INDEX Gross (USD) | 20.75 | 12.32 | 9.73 |

FTSE EPRA/NAREIT Developed Net TR | 4.54 | -0.69 | 2.04 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-listed-real-estate-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $209,569,325 |

Number of Portfolio Holdings | 56 |

Portfolio Turnover | 73% |

Total Advisory Fees Paid | $904,678 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-listed-real-estate-fund for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Holdings | (%)1 |

Prologis, Inc. | 7.5% |

Extra Space Storage, Inc. | 3.9% |

Welltower, Inc. | 3.8% |

Digital Realty Trust, Inc. | 3.7% |

Equinix, Inc. | 3.6% |

Simon Property Group, Inc. | 3.4% |

Essex Property Trust, Inc. | 3.1% |

UDR, Inc. | 2.9% |

Equity LifeStyle Properties, Inc. | 2.7% |

VICI Properties, Inc. | 2.7% |

Geographic Breakdown (%)1

| 1 | Represents percent of total investments. |

| 2 | Represents percent of total net assets. |

| Brookfield Global Listed Real Estate Fund | PAGE 2 | TSR_SAR_112740303 |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://brookfield.onlineprospectus.net/Brookfield/funds

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brookfield Public Securities Group LLC documents not be householded, please contact Brookfield Public Securities Group LLC at 855-244-4859, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brookfield Public Securities Group LLC or your financial intermediary.

| Brookfield Global Listed Real Estate Fund | PAGE 3 | TSR_SAR_112740303 |

100001019511082114161200412675103371406012066116321176210000101979973118541324114159146402044917598209652531610000996411118111411177012673106141417512270117111224364.39.75.34.93.23.12.92.51.82.319.713.812.210.19.59.19.08.25.82.6

| | |

| Brookfield Global Renewables & Sustainable Infrastructure Fund | |

| Class I | GRSIX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Brookfield Global Renewables & Sustainable Infrastructure Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.brookfieldoaktree.com/fund/brookfield-global-renewables-sustainable-infrastructure-fund. You can also request this information by contacting us at 855-244-4859.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $49 | 1.00% |

HOW DID THE FUND PERFORM AND WHAT AFFECTED ITS PERFORMANCE?

For the six-month period ended June 30, 2024, the Fund underperformed the MSCI World Net Index (USD).

WHAT FACTORS INFLUENCED PERFORMANCE

Top contributors included:

Clean Technology: Positions in manufacturers of commercial and residential heating, ventilation, and air conditioning (HVAC) systems contributed positively during the period. A position in a smart meter solutions company also contributed positively.

Water & Waste Infrastructure: Positions in waste management companies continued to rally, following strong performance in 2023.

Renewable Power & Infrastructure: Underperformance among non-U.S. power producers detracted from returns during the period.

Thus far in 2024 we have seen sentiment toward listed renewables and sustainable infrastructure continue to fluctuate in response to the outlook for interest rates. Overall, however, we believe the fundamental outlook continues to set up well for returns over the next several years. Input costs continue to decline and global renewable power capacity growth continues to set records. We continue to highlight the importance of diversity within the renewables and sustainable infrastructure universe. Beyond “pure-play” renewables companies like power generators, wind turbines and solar panels, the universe includes waste management companies tied to the concept of a circular economy. We believe these companies have shown their ability to provide diversification to a renewables portfolio.

| |

Top Contributors |

| ↑ | Water & Waste Infrastructure (Infrastructure-Like) |

| ↑ | Clean Technology |

| ↑ | Water & Waste Infrastructure (Broader value chain) |

| |

Top Detractors |

| ↓ | Renewable Power & Infrastructure (Infrastructure-Like) |

| ↓ | Renewable Power & Infrastructure (Broader value chain) |

| ↓ | Other Sustainable Infrastructure |

| Brookfield Global Renewables & Sustainable Infrastructure Fund | PAGE 1 | TSR_SAR_112740519 |

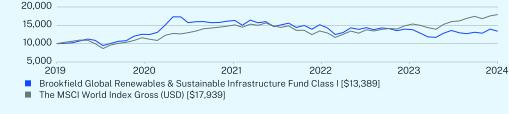

HOW DID THE FUND PERFORM SINCE INCEPTION?*,1

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(10/01/2019) |

Class I (without sales charge) | -4.10 | 6.34 |

MSCI THE WORLD INDEX Gross (USD) | 20.75 | 13.10 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-renewables-sustainable-infrastructure-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| 1 | On February 4, 2022, the Fund acquired all of the assets, subject to liabilities, of Brookfield Global Renewables & Sustainable Infrastructure LP (the “Predecessor Fund”) through a tax-free reorganization (the “Reorganization”). In connection with the Reorganization, shares of the Predecessor Fund were exchanged for Class I Shares of the Fund. As a result of the Reorganization, the Fund’s Class I Shares adopted the Predecessor Fund’s performance and accounting history. Prior to February 4, 2022, the performance information quoted reflects the performance information from the inception date of the Predecessor Fund (October 1, 2019). The Predecessor Fund’s past performance is not an indication of how the Fund will perform in the future. The MSCI World Index references the Predecessor Fund’s inception date. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $45,727,464 |

Number of Portfolio Holdings | 33 |

Portfolio Turnover | 30% |

Total Advisory Fees Paid | $97,831 |

Visit https://www.brookfieldoaktree.com/fund/brookfield-global-renewables-sustainable-infrastructure-fund for more recent performance information.

| Brookfield Global Renewables & Sustainable Infrastructure Fund | PAGE 2 | TSR_SAR_112740519 |

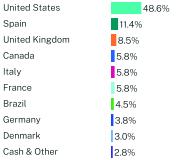

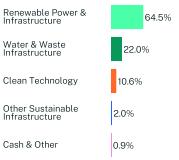

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Holdings | (%)1 |

Enel SpA | 5.8% |

Iberdrola SA | 5.3% |

CMS Energy Corp. | 4.6% |

Public Service Enterprise Group, Inc. | 4.5% |

NextEra Energy, Inc. | 4.3% |

Waste Connections, Inc. | 4.1% |

Boralex, Inc. | 4.0% |

American Water Works Company, Inc. | 3.9% |

E.ON SE | 3.8% |

Redeia Corp. SA | 3.5% |

Geographic Breakdown (%)1

| 1 | Represents percent of total investments. |

| 2 | Represents percent of total net assets. |

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://brookfield.onlineprospectus.net/Brookfield/funds

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brookfield Public Securities Group LLC documents not be householded, please contact Brookfield Public Securities Group LLC at 855-244-4859, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brookfield Public Securities Group LLC or your financial intermediary.

| Brookfield Global Renewables & Sustainable Infrastructure Fund | PAGE 3 | TSR_SAR_112740519 |

1081315779139371396113389103741449012470148561793948.611.48.55.85.85.84.53.83.02.864.522.010.62.00.9

| | |

| Oaktree Emerging Markets Equity Fund | |

| Class A | OEQAX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Oaktree Emerging Markets Equity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.brookfieldoaktree.com/fund/oaktree-emerging-markets-equity-fund. You can also request this information by contacting us at 855-244-4859.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $60 | 1.22% |

HOW DID THE FUND PERFORM AND WHAT AFFECTED ITS PERFORMANCE?

For the 6-month period ended June 30, 2024, the Fund underperformed its benchmark, the MSCI Emerging Markets Index.

WHAT FACTORS INFLUENCED PERFORMANCE

Our underperformance during the period was mostly attributable to our stock selection in China and Brazil, combined with our overweight allocation to Brazil. Meanwhile, our selection in Taiwan had the largest positive impact on our performance.

At the sector level, our stock selection in materials contributed the most to our performance, while our selection in consumer discretionary was the biggest detractor.

Our largest overweights by country are China and Brazil, while India and Taiwan are our largest underweights. At the sector level, the portfolio is overweight materials, consumer discretionary, and energy, and is underweight information technology and health care.

We have adjusted the make-up of our China portfolio, adding higher-quality names that have recently become attractive. We also added some India exposure, largely still looking at infrastructure-related names given the need for public spending. South Africa was an area where we saw volatility into the elections, but the results positively surprised the market. We identified a short list of quality companies early on that we would buy should a better-than-expected outcome occur, and we were able to act quickly.

| |

Top Contributors |

| ↑ | Taiwan Selection |

| ↑ | Materials Selection |

| |

Top Detractors |

| ↓ | China Selection |

| ↓ | Brazil Selection & Overweight |

| ↓ | Consumer Discretionary Selection |

The Fund posted a small loss for the reported period as our selection and positioning in China and Brazil provided the biggest overhang.

| Oaktree Emerging Markets Equity Fund | PAGE 1 | TSR_SAR_112740568 |

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(05/16/2022) |

Class A (without sales charge) | -0.56 | 2.28 |

Class A (with sales charge) | -5.31 | -0.06 |

MSCI EM (EMERGING MARKETS) Net (USD) | 12.55 | 6.65 |

Visit https://www.brookfieldoaktree.com/fund/oaktree-emerging-markets-equity-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $261,564,871 |

Number of Portfolio Holdings | 81 |

Portfolio Turnover | 62% |

Total Advisory Fees Paid | $871,262 |

Visit https://www.brookfieldoaktree.com/fund/oaktree-emerging-markets-equity-fund for more recent performance information.

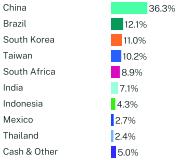

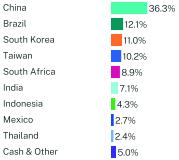

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Holdings | (%)1 |

Taiwan Semiconductor Manufacturing Co. Ltd. | 8.6% |

Tencent Holdings Ltd. | 6.0% |

Anglogold Ashanti PLC | 3.9% |

Alibaba Group Holding Ltd. | 3.7% |

iShares MSCI India ETF | 3.5% |

Samsung Electronics Co. Ltd. | 3.4% |

Vale SA | 2.9% |

Freeport-McMoRan, Inc. | 2.9% |

KB Financial Group, Inc. | 2.6% |

Aluminum Corp. of China Ltd. | 2.3% |

Geographic Breakdown (%)1

| 1 | Represents percent of total investments. |

| Oaktree Emerging Markets Equity Fund | PAGE 2 | TSR_SAR_112740568 |

Changes to Shareholder Fees (fees paid directly from your investment).

Effective January 24, 2024, Oaktree Fund Advisors, LLC (the “Adviser”), contractually agreed to reduce the Fund’s annual expense cap by 0.15% for each share class to 1.20% for Class A Shares, 1.95% for Class C Shares, and 0.95% for Class I Shares. Prior to January 24, 2024, the Fund’s annual expense cap was 1.35% for Class A Shares, 2.10% for Class C Shares, and 1.10% for Class I Shares.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://brookfield.onlineprospectus.net/Brookfield/funds

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brookfield Public Securities Group LLC documents not be householded, please contact Brookfield Public Securities Group LLC at 855-244-4859, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brookfield Public Securities Group LLC or your financial intermediary.

| Oaktree Emerging Markets Equity Fund | PAGE 3 | TSR_SAR_112740568 |

934410045998810011101861146436.312.111.010.28.97.14.32.72.45.0

| | |

| Oaktree Emerging Markets Equity Fund | |

| Class I | OEQIX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Oaktree Emerging Markets Equity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://www.brookfieldoaktree.com/fund/oaktree-emerging-markets-equity-fund. You can also request this information by contacting us at 855-244-4859.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $48 | 0.97% |

HOW DID THE FUND PERFORM AND WHAT AFFECTED ITS PERFORMANCE?

For the 6-month period ended June 30, 2024, the Fund underperformed its benchmark, the MSCI Emerging Markets Index.

WHAT FACTORS INFLUENCED PERFORMANCE

Our underperformance during the period was mostly attributable to our stock selection in China and Brazil, combined with our overweight allocation to Brazil. Meanwhile, our selection in Taiwan had the largest positive impact on our performance.

At the sector level, our stock selection in materials contributed the most to our performance, while our selection in consumer discretionary was the biggest detractor.

Our largest overweights by country are China and Brazil, while India and Taiwan are our largest underweights. At the sector level, the portfolio is overweight materials, consumer discretionary, and energy, and is underweight information technology and health care.

We have adjusted the make-up of our China portfolio, adding higher-quality names that have recently become attractive. We also added some India exposure, largely still looking at infrastructure-related names given the need for public spending. South Africa was an area where we saw volatility into the elections, but the results positively surprised the market. We identified a short list of quality companies early on that we would buy should a better-than-expected outcome occur, and we were able to act quickly.

| |

Top Contributors |

| ↑ | Taiwan Selection |

| ↑ | Materials Selection |

| |

Top Detractors |

| ↓ | China Selection |

| ↓ | Brazil Selection & Overweight |

| ↓ | Consumer Discretionary Selection |

The Fund posted a small loss for the reported period as our selection and positioning in China and Brazil provided the biggest overhang.

| Oaktree Emerging Markets Equity Fund | PAGE 1 | TSR_SAR_112740543 |

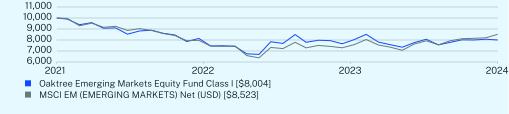

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(06/03/2021) |

Class I (without sales charge) | -0.31 | -6.99 |

MSCI EM (EMERGING MARKETS) Net (USD) | 12.55 | -5.07 |

Visit https://www.brookfieldoaktree.com/fund/oaktree-emerging-markets-equity-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $261,564,871 |

Number of Portfolio Holdings | 81 |

Portfolio Turnover | 62% |

Total Advisory Fees Paid | $871,262 |

Visit https://www.brookfieldoaktree.com/fund/oaktree-emerging-markets-equity-fund for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Holdings | (%)1 |

Taiwan Semiconductor Manufacturing Co. Ltd. | 8.6% |

Tencent Holdings Ltd. | 6.0% |

Anglogold Ashanti PLC | 3.9% |

Alibaba Group Holding Ltd. | 3.7% |

iShares MSCI India ETF | 3.5% |

Samsung Electronics Co. Ltd. | 3.4% |

Vale SA | 2.9% |

Freeport-McMoRan, Inc. | 2.9% |

KB Financial Group, Inc. | 2.6% |

Aluminum Corp. of China Ltd. | 2.3% |

Geographic Breakdown (%)1

| 1 | Represents percent of total investments. |

| Oaktree Emerging Markets Equity Fund | PAGE 2 | TSR_SAR_112740543 |

Changes to Shareholder Fees (fees paid directly from your investment).

Effective January 24, 2024, Oaktree Fund Advisors, LLC (the “Adviser”), contractually agreed to reduce the Fund’s annual expense cap by 0.15% for each share class to 1.20% for Class A Shares, 1.95% for Class C Shares, and 0.95% for Class I Shares. Prior to January 24, 2024, the Fund’s annual expense cap was 1.35% for Class A Shares, 2.10% for Class C Shares, and 1.10% for Class I Shares.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://brookfield.onlineprospectus.net/Brookfield/funds

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Brookfield Public Securities Group LLC documents not be householded, please contact Brookfield Public Securities Group LLC at 855-244-4859, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Brookfield Public Securities Group LLC or your financial intermediary.

| Oaktree Emerging Markets Equity Fund | PAGE 3 | TSR_SAR_112740543 |

100007458802980041000074427573852336.312.111.010.28.97.14.32.72.45.0

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7(a) of this Form. |

| | | |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

TABLE OF CONTENTS

| | | | |

Schedules of Investments:

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Financial Highlights:

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

TABLE OF CONTENTS

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Schedule of Investments

June 30, 2024 (Unaudited)

| | | | | | | | | |

| | COMMON STOCKS — 97.0%

| |

| | AUSTRALIA — 4.7%

| |

| | Toll Roads — 4.7%

| |

| | Transurban Group | | | 1,689,733 | | | $ 13,936,162 | |

| | Total AUSTRALIA | | | | | | 13,936,162 | |

| | BRAZIL — 2.9%

| |

| | Electricity Transmission & Distribution — 1.4%

| |

| | Equatorial Energia SA | | | 778,681 | | | 4,269,436 | |

| | Rail — 1.5%

| |

| | Rumo SA | | | 1,183,813 | | | 4,373,041 | |

| | Total BRAZIL | | | | | | 8,642,477 | |

| | CANADA — 6.0%

| |

| | Midstream — 4.1%

| |

| | AltaGas Ltd. | | | 225,656 | | | 5,098,518 | |

| | TC Energy Corp. | | | 186,003 | | | 7,050,996 | |

| | Total Midstream | | | | | | 12,149,514 | |

| | Rail — 1.9%

| |

| | Canadian Pacific Kansas City Ltd. | | | 70,025 | | | 5,514,779 | |

| | Total CANADA | | | | | | 17,664,293 | |

| | CHINA — 3.1%

| |

| | Gas Utilities — 3.1%

| |

| | China Resources Gas Group Ltd. | | | 1,511,557 | | | 5,291,927 | |

| | ENN Energy Holdings Ltd. | | | 451,615 | | | 3,720,095 | |

| | Total Gas Utilities | | | | | | 9,012,022 | |

| | Total CHINA | | | | | | 9,012,022 | |

| | DENMARK — 0.9%

| |

| | Integrated Utilities/Renewables — 0.9%

| |

| | Orsted A/S(a)(b) | | | 49,887 | | | 2,650,070 | |

| | Total DENMARK | | | | | | 2,650,070 | |

| | GERMANY — 1.9%

| |

| | Integrated Utilities/Renewables — 1.9%

| |

| | RWE AG | | | 162,454 | | | 5,573,042 | |

| | Total GERMANY | | | | | | 5,573,042 | |

| | HONG KONG — 1.7%

| |

| | Integrated Utilities/Renewables — 1.7%

| |

| | CLP Holdings Ltd. | | | 612,169 | | | 4,951,295 | |

| | Total HONG KONG | | | | | | 4,951,295 | |

| | JAPAN — 3.4%

| |

| | Airports — 1.6%

| |

| | Japan Airport Terminal Co. Ltd. | | | 137,740 | | | 4,709,428 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | | | |

| | COMMON STOCKS (Continued)

| |

| | JAPAN (Continued)

| |

| | Rail — 1.8%

| |

| | East Japan Railway Co. | | | 324,763 | | | $ 5,407,193 | |

| | Total JAPAN | | | | | | 10,116,621 | |

| | MEXICO — 1.9%

| |

| | Airports — 1.9%

| | | | | | | |

| | Grupo Aeroportuario del Pacifico SAB de CV | | | 357,805 | | | 5,623,181 | |

| | Total MEXICO | | | | | | 5,623,181 | |

| | NETHERLANDS — 2.1%

| |

| | Midstream — 1.0%

| | | | | | | |

| | Koninklijke Vopak NV | | | 73,588 | | | 3,057,298 | |

| | Toll Roads — 1.1%

| | | | | | | |

| | Ferrovial SE | | | 80,478 | | | 3,126,400 | |

| | Total NETHERLANDS | | | | | | 6,183,698 | |

| | NEW ZEALAND — 2.0%

| |

| | Airports — 2.0%

| | | | | | | |

| | Auckland International Airport Ltd. | | | 1,287,490 | | | 5,983,511 | |

| | Total NEW ZEALAND | | | | | | 5,983,511 | |

| | SPAIN — 6.9%

| |

| | Airports — 2.8%

| | | | | | | |

| | Aena SME SA(b) | | | 40,341 | | | 8,168,942 | |

| | Electricity Transmission & Distribution — 1.2%

| | | | | | | |

| | Redeia Corp. SA | | | 213,098 | | | 3,726,322 | |

| | Toll Roads — 0.8%

| |

| | Sacyr SA | | | 646,895 | | | 2,281,273 | |

| | Towers — 2.1%

| |

| | Cellnex Telecom SA(b) | | | 195,156 | | | 6,347,348 | |

| | Total SPAIN | | | | | | 20,523,885 | |

| | UNITED KINGDOM — 5.6%

| |

| | Electricity Transmission & Distribution — 3.1%

| | | | | | | |

| | National Grid PLC | | | 811,456 | | | 9,060,793 | |

| | Water — 2.5%

| | | | | | | |

| | Pennon Group PLC | | | 449,224 | | | 3,261,757 | |

| | Severn Trent PLC | | | 135,543 | | | 4,079,735 | |

| | Total Water | | | | | | 7,341,492 | |

| | Total UNITED KINGDOM | | | | | | 16,402,285 | |

| | UNITED STATES — 53.9%

| |

| | Electricity Transmission & Distribution — 12.4%

| | | | | | | |

| | CenterPoint Energy, Inc. | | | 263,245 | | | 8,155,330 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | | | |

| | COMMON STOCKS (Continued)

| |

| | UNITED STATES (Continued)

| |

| | Eversource Energy | | | 139,308 | | | $7,900,156 | |

| | PG&E Corp. | | | 475,893 | | | 8,309,092 | |

| | Sempra | | | 160,966 | | | 12,243,074 | |

| | Total Electricity Transmission & Distribution | | | | | | 36,607,652 | |

| | Gas Utilities — 2.8%

| | | | | | | |

| | NiSource, Inc. | | | 284,517 | | | 8,196,935 | |

| | Integrated Utilities/Renewables — 23.1%

| | | | | | | |

| | CMS Energy Corp. | | | 130,197 | | | 7,750,628 | |

| | Duke Energy Corp. | | | 138,956 | | | 13,927,560 | |

| | Entergy Corp. | | | 79,187 | | | 8,473,009 | |

| | NextEra Energy, Inc. | | | 328,879 | | | 23,287,922 | |

| | Public Service Enterprise Group, Inc. | | | 117,570 | | | 8,664,909 | |

| | Xcel Energy, Inc. | | | 115,830 | | | 6,186,480 | |

| | Total Integrated Utilities/Renewables | | | | | | 68,290,508 | |

| | Midstream — 7.8%

| |

| | Cheniere Energy, Inc. | | | 53,633 | | | 9,376,657 | |

| | Targa Resources Corp. | | | 53,842 | | | 6,933,773 | |

| | Williams Cos., Inc./The | | | 158,451 | | | 6,734,168 | |

| | Total Midstream | | | | | | 23,044,598 | |

| | Rail — 2.0%

| |

| | CSX Corp. | | | 182,778 | | | 6,113,924 | |

| | Towers — 5.8%

| |

| | Crown Castle, Inc. | | | 109,344 | | | 10,682,909 | |

| | SBA Communications Corp. | | | 33,321 | | | 6,540,912 | |

| | Total Towers | | | | | | 17,223,821 | |

| | Total UNITED STATES | | | | | | 159,477,438 | |

| | TOTAL COMMON STOCKS

(Cost $271,204,020) | | | | | | 286,739,980 | |

| | Total Investments — 97.0%

(Cost $271,204,020) | | | | | | 286,739,980 | |

| | Other Assets in Excess of Liabilities — 3.0% | | | | | | 8,954,466 | |

| | TOTAL NET ASSETS — 100.0% | | | | | | $295,694,446 | |

| | | | | | | | | |

The following notes should be read in conjunction with the accompanying Schedule of Investments.

(a)

| Non-income producing security. |

(b)

| Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional buyers. As of June 30, 2024, the total value of all such securities was $17,166,360 or 5.8% of net assets. |

Abbreviations:

PLC Public Limited Company

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Schedule of Investments

June 30, 2024 (Unaudited)

| | | | | | | | | |

| | COMMON STOCKS — 100.2%

| |

| | AUSTRALIA — 5.0%

| |

| | Diversified — 4.0%

| |

| | Charter Hall Group | | | 186,626 | | | $ 1,387,749 | |

| | GPT Group | | | 1,667,910 | | | 4,446,935 | |

| | Stockland | | | 896,237 | | | 2,482,365 | |

| | Total Diversified | | | | | | 8,317,049 | |

| | Industrial — 1.0%

| |

| | Goodman Group | | | 89,027 | | | 2,053,838 | |

| | Total AUSTRALIA | | | | | | 10,370,887 | |

| | CANADA — 1.3%

| |

| | Residential — 1.3%

| |

| | Boardwalk Real Estate Investment Trust | | | 21,683 | | | 1,117,078 | |

| | InterRent Real Estate Investment Trust | | | 183,537 | | | 1,597,840 | |

| | Total Residential | | | | | | 2,714,918 | |

| | Total CANADA | | | | | | 2,714,918 | |

| | FRANCE — 3.2%

| |

| | Office — 1.2%

| |

| | Gecina SA | | | 27,177 | | | 2,508,743 | |

| | Retail — 2.0%

| |

| | Unibail-Rodamco-Westfield | | | 54,245 | | | 4,286,825 | |

| | Total FRANCE | | | | | | 6,795,568 | |

| | GERMANY — 2.5%

| |

| | Residential — 2.5%

| |

| | TAG Immobilien AG(a) | | | 111,658 | | | 1,632,031 | |

| | Vonovia SE | | | 127,096 | | | 3,616,951 | |

| | Total Residential | | | | | | 5,248,982 | |

| | Total GERMANY | | | | | | 5,248,982 | |

| | HONG KONG — 2.9%

| |

| | Diversified — 1.8%

| |

| | Sun Hung Kai Properties Ltd. | | | 440,257 | | | 3,814,626 | |

| | Office — 1.1%

| |

| | Hongkong Land Holdings Ltd. | | | 677,500 | | | 2,182,758 | |

| | Total HONG KONG | | | | | | 5,997,384 | |

| | JAPAN — 9.7%

| |

| | Diversified — 2.1%

| |

| | Activia Properties, Inc. | | | 1,040 | | | 2,355,981 | |

| | Star Asia Investment Corp. | | | 1,496 | | | 555,767 | |

| | Tokyu Fudosan Holdings Corp. | | | 229,610 | | | 1,541,263 | |

| | Total Diversified | | | | | | 4,453,011 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | | | |

| | COMMON STOCKS (Continued)

| |

| | JAPAN (Continued)

| |

| | Hotel — 1.0%

| |

| | Invincible Investment Corp. | | | 5,175 | | | $ 2,103,429 | |

| | Industrial — 0.8%

| |

| | Mitsubishi Estate Logistics REIT Investment Corp. | | | 705 | | | 1,671,759 | |

| | Office — 4.4%

| |

| | KDX Realty Investment Corp. | | | 1,070 | | | 1,048,579 | |

| | Mitsubishi Estate Co. Ltd. | | | 161,152 | | | 2,537,083 | |

| | Mitsui Fudosan Company Ltd. | | | 611,001 | | | 5,623,603 | |

| | Total Office | | | | | | 9,209,265 | |

| | Residential — 1.4%

| |

| | Comforia Residential REIT, Inc. | | | 1,440 | | | 2,847,434 | |

| | Total JAPAN | | | | | | 20,284,898 | |

| | NETHERLANDS — 1.8%

| |

| | Industrial — 1.5%

| |

| | CTP NV(b) | | | 186,383 | | | 3,180,541 | |

| | Retail — 0.3%

| |

| | Eurocommercial Properties NV | | | 25,291 | | | 610,206 | |

| | Total NETHERLANDS | | | | | | 3,790,747 | |

| | SINGAPORE — 3.1%

| |

| | Data Centers — 0.9%

| |

| | Keppel DC REIT | | | 1,441,434 | | | 1,910,997 | |

| | Diversified — 2.2%

| | | | | | | |

| | CapitaLand Integrated Commercial Trust | | | 3,127,200 | | | 4,553,044 | |

| | Total SINGAPORE | | | | | | 6,464,041 | |

| | SWEDEN — 1.0%

| |

| | Residential — 1.0%

| |

| | Fastighets AB Balder(a) | | | 317,059 | | | 2,176,506 | |

| | Total SWEDEN | | | | | | 2,176,506 | |

| | UNITED KINGDOM — 5.3%

| |

| | Industrial — 3.0%

| |

| | Segro PLC | | | 327,214 | | | 3,702,131 | |

| | Tritax Big Box REIT PLC | | | 1,280,396 | | | 2,503,424 | |

| | Total Industrial | | | | | | 6,205,555 | |

| | Residential — 1.2%

| |

| | UNITE Group PLC | | | 228,424 | | | 2,576,912 | |

| | Retail — 1.1%

| |

| | Shaftesbury Capital PLC | | | 1,320,455 | | | 2,309,319 | |

| | Total UNITED KINGDOM | | | | | | 11,091,786 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | | | |

| | COMMON STOCKS (Continued)

| |

| | UNITED STATES — 64.4%

| |

| | Data Centers — 7.3%

| |

| | Digital Realty Trust, Inc. | | | 51,251 | | | $ 7,792,714 | |

| | Equinix, Inc. | | | 10,028 | | | 7,587,185 | |

| | Total Data Centers | | | | | | 15,379,899 | |

| | Health Care — 9.5%

| |

| | CareTrust REIT, Inc. | | | 141,456 | | | 3,550,546 | |

| | Omega Healthcare Investors, Inc. | | | 126,605 | | | 4,336,221 | |

| | Ventas, Inc. | | | 77,783 | | | 3,987,157 | |

| | Welltower, Inc. | | | 76,609 | | | 7,986,488 | |

| | Total Health Care | | | | | | 19,860,412 | |

| | Hotel — 0.6%

| |

| | DiamondRock Hospitality Co. | | | 147,094 | | | 1,242,944 | |

| | Industrial — 7.5%

| |

| | Prologis, Inc. | | | 139,676 | | | 15,687,011 | |

| | Net Lease — 9.0%

| |

| | Agree Realty Corp. | | | 84,696 | | | 5,246,070 | |

| | Essential Properties Realty Trust, Inc. | | | 204,739 | | | 5,673,318 | |

| | NETSTREIT Corp. | | | 135,437 | | | 2,180,536 | |

| | VICI Properties, Inc. | | | 198,519 | | | 5,685,584 | |

| | Total Net Lease | | | | | | 18,785,508 | |

| | Office — 2.4%

| |

| | BXP, Inc. | | | 48,029 | | | 2,956,665 | |

| | Cousins Properties, Inc. | | | 90,527 | | | 2,095,700 | |

| | Total Office | | | | | | 5,052,365 | |

| | Residential — 12.3%

| |

| | American Homes 4 Rent | | | 130,483 | | | 4,848,748 | |

| | Equity LifeStyle Properties, Inc. | | | 88,732 | | | 5,779,115 | |

| | Essex Property Trust, Inc. | | | 23,881 | | | 6,500,408 | |

| | Mid-America Apartment Communities, Inc. | | | 18,854 | | | 2,688,769 | |

| | UDR, Inc. | | | 146,783 | | | 6,040,121 | |

| | Total Residential | | | | | | 25,857,161 | |

| | Retail — 8.8%

| |

| | Kite Realty Group Trust | | | 183,345 | | | 4,103,261 | |

| | Regency Centers Corp. | | | 76,171 | | | 4,737,836 | |

| | Simon Property Group, Inc. | | | 47,124 | | | 7,153,423 | |

| | Tanger, Inc. | | | 86,511 | | | 2,345,314 | |

| | Total Retail | | | | | | 18,339,834 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | | | |

| | COMMON STOCKS (Continued)

| |

| | UNITED STATES (Continued)

| |

| | Self Storage — 5.8%

| |

| | Extra Space Storage, Inc. | | | 52,915 | | | $8,223,520 | |

| | Public Storage | | | 13,615 | | | 3,916,355 | |

| | Total Self Storage | | | | | | 12,139,875 | |

| | Specialty — 1.2%

| |

| | Iron Mountain, Inc. | | | 29,190 | | | 2,616,008 | |

| | Total UNITED STATES | | | | | | 134,961,017 | |

| | TOTAL COMMON STOCKS

(Cost $190,264,599) | | | | | | 209,896,734 | |

| | Total Investments — 100.2%

(Cost $190,264,599) | | | | | | 209,896,734 | |

| | Liabilities in Excess of Other Assets — (0.2)% | | | | | | (327,409) | |

| | TOTAL NET ASSETS — 100.0% | | | | | | $209,569,325 | |

| | | | | | | | | |

The following notes should be read in conjunction with the accompanying Schedule of Investments.

(a)

| Non-income producing security. |

(b)

| Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional buyers. As of June 30, 2024, the total value of all such securities was $3,180,541 or 1.5% of net assets. |

Abbreviations:

PLC Public Limited Company

REIT Real Estate Investment Trust

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

BROOKFIELD GLOBAL RENEWABLES & SUSTAINABLE INFRASTRUCTURE FUND

Schedule of Investments

June 30, 2024 (Unaudited)

| | | | | | | | | |

| | COMMON STOCKS — 99.1%

| | | | | | | |

| | BRAZIL — 4.5%

| | | | | | | |

| | Renewable Power & Infrastructure — 4.5%

| | | | | | | |

| | Equatorial Energia SA | | | 179,523 | | | $984,308 | |

| | Serena Energia SA(a) | | | 662,772 | | | 1,049,271 | |

| | Total Renewable Power & Infrastructure | | | | | | 2,033,579 | |

| | TOTAL BRAZIL | | | | | | 2,033,579 | |

| | CANADA — 5.8%

| | | | | | | |

| | Renewable Power & Infrastructure — 5.8%

| | | | | | | |

| | Boralex, Inc. | | | 74,513 | | | 1,825,175 | |

| | Fortis, Inc. | | | 20,936 | | | 813,689 | |

| | Total Renewable Power & Infrastructure | | | | | | 2,638,864 | |

| | TOTAL CANADA | | | | | | 2,638,864 | |

| | DENMARK — 2.9%

| | | | | | | |

| | Renewable Power & Infrastructure — 2.9%

| | | | | | | |

| | Orsted A/S(a)(b) | | | 11,810 | | | 627,365 | |

| | Vestas Wind Systems A/S(a) | | | 30,816 | | | 714,560 | |

| | Total Renewable Power & Infrastructure | | | | | | 1,341,925 | |

| | TOTAL DENMARK | | | | | | 1,341,925 | |

| | FRANCE — 5.7%

| | | | | | | |

| | Clean Technology — 2.9%

| | | | | | | |

| | Nexans SA | | | 11,989 | | | 1,319,487 | |

| | Water & Waste Infrastructure — 2.8%

| | | | | | | |

| | Veolia Environnement SA | | | 43,275 | | | 1,296,210 | |

| | TOTAL FRANCE | | | | | | 2,615,697 | |

| | GERMANY — 3.8%

| | | | | | | |

| | Renewable Power & Infrastructure — 3.8%

| | | | | | | |

| | E.ON SE | | | 132,585 | | | 1,742,524 | |

| | TOTAL GERMANY | | | | | | 1,742,524 | |

| | ITALY — 5.7%

| | | | | | | |

| | Renewable Power & Infrastructure — 5.7%

| | | | | | | |

| | Enel SpA | | | 378,204 | | | 2,624,280 | |

| | TOTAL ITALY | | | | | | 2,624,280 | |

| | NEW ZEALAND — 2.8%

| | | | | | | |

| | Renewable Power & Infrastructure — 2.8%

| | | | | | | |

| | Mercury NZ Ltd. | | | 314,377 | | | 1,257,110 | |

| | TOTAL NEW ZEALAND | | | | | | 1,257,110 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

BROOKFIELD GLOBAL RENEWABLES & SUSTAINABLE INFRASTRUCTURE FUND

Schedule of Investments

June 30, 2024 (Unaudited)(Continued)

| | | | | | | | | |

| | COMMON STOCK (Continued)

| |

| | SPAIN — 11.3%

| | | | | | | |

| | Renewable Power & Infrastructure — 11.3%

| | | | | | | |

| | EDP Renovaveis SA | | | 85,818 | | | $1,199,155 | |

| | Iberdrola SA | | | 185,018 | | | 2,400,595 | |

| | Redeia Corp. SA | | | 89,960 | | | 1,573,079 | |

| | Total Renewable Power & Infrastructure | | | | | | 5,172,829 | |

| | TOTAL SPAIN | | | | | | 5,172,829 | |

| | UNITED KINGDOM — 8.4%

| | | | | | | |

| | Renewable Power & Infrastructure — 5.6%

| | | | | | | |

| | National Grid PLC | | | 126,911 | | | 1,417,100 | |

| | SSE PLC | | | 51,864 | | | 1,171,271 | |

| | Total Renewable Power & Infrastructure | | | | | | 2,588,371 | |

| | Water & Waste Infrastructure — 2.8%

| | | | | | | |

| | Severn Trent PLC | | | 42,009 | | | 1,264,437 | |

| | TOTAL UNITED KINGDOM | | | | | | 3,852,808 | |

| | UNITED STATES — 48.2%

| | | | | | | |

| | Clean Technology — 7.7%

| | | | | | | |

| | Carrier Global Corp. | | | 23,905 | | | 1,507,927 | |

| | Itron, Inc.(a) | | | 9,710 | | | 960,902 | |

| | Trane Technologies PLC | | | 3,235 | | | 1,064,089 | |

| | Total Clean Technology | | | | | | 3,532,918 | |

| | Other Sustainable Infrastructure — 2.0%

| | | | | | | |

| | Crown Castle, Inc. | | | 9,280 | | | 906,656 | |

| | Renewable Power & Infrastructure — 22.1%

| | | | | | | |

| | Clearway Energy, Inc. | | | 34,594 | | | 854,126 | |

| | CMS Energy Corp. | | | 35,524 | | | 2,114,744 | |

| | Eversource Energy | | | 26,275 | | | 1,490,055 | |

| | First Solar, Inc.(a) | | | 3,211 | | | 723,952 | |

| | NextEra Energy, Inc. | | | 27,818 | | | 1,969,792 | |

| | NEXTracker, Inc.(a) | | | 19,450 | | | 911,816 | |

| | Public Service Enterprise Group, Inc. | | | 27,518 | | | 2,028,077 | |

| | Total Renewable Power & Infrastructure | | | | | | 10,092,562 | |

| | Water & Waste Infrastructure — 16.4%

| | | | | | | |

| | American Water Works Company, Inc. | | | 13,744 | | | 1,775,175 | |

| | Republic Services, Inc. | | | 7,539 | | | 1,465,129 | |

| | Waste Connections, Inc. | | | 10,609 | | | 1,861,393 | |

| | Waste Management, Inc. | | | 7,076 | | | 1,509,594 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

BROOKFIELD GLOBAL RENEWABLES & SUSTAINABLE INFRASTRUCTURE FUND

Schedule of Investments

June 30, 2024 (Unaudited)(Continued)

| | | | | | | | | |

| | COMMON STOCK (Continued)

| |

| | Xylem, Inc. | | | 6,726 | | | $912,247 | |

| | Total Water & Waste Infrastructure | | | | | | 7,523,538 | |

| | TOTAL UNITED STATES | | | | | | 22,055,674 | |

| | TOTAL COMMON STOCKS

(Cost $44,356,552) | | | | | | 45,335,290 | |

| | Total Investments — 99.1%

(Cost $44,356,552) | | | | | | 45,335,290 | |

| | Other Assets in Excess of Liabilities — 0.9% | | | | | | 392,174 | |

| | TOTAL NET ASSETS — 100.0% | | | | | | $45,727,464 | |

| | | | | | | | | |

The following notes should be read in conjunction with the accompanying Schedule of Investments.

(a)

| Non-income producing security. |

(b)