© 2025 Lantheus. All rights reserved. Lantheus to Acquire Evergreen Theragnostics Solidifies Capabilities as a Fully Integrated Radiopharmaceutical Company January 28, 2025 Exhibit 99.2

Acquisition Overview & Strategic Rationale Transaction Summary Manufacturing Capabilities, Pipeline and Development Platform Growth Strategy Q&A Agenda © 2025 Lantheus. All rights reserved.

Safe Harbor Statements Cautionary Statement Regarding Forward-Looking Statements This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by their use of terms such as "continue,” “may,” “poised,” “potential,” “will,” and other similar terms and include, among other things, statements about the potential benefits and results of the acquisition; the anticipated timing of the closing of the acquisition; the potential regulatory approval of OCTEVYTM; the potential for OCTEVYTM and PNT2003 to be used as a theranostic pair; and Evergreen’s ability to generate novel radiotherapeutic programs. Such forward-looking statements are based upon current plans, estimates and expectations that are subject to risks and uncertainties that could cause actual results to materially differ from those described in the forward-looking statements. The inclusion of forward-looking statements should not be regarded as a representation that such plans, estimates and expectations will be achieved. Readers are cautioned not to place undue reliance on the forward-looking statements contained herein, which speak only as of the date hereof. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Risks and uncertainties that could cause our actual results to materially differ from those described in the forward-looking statements include: Lantheus’ and Evergreen’s ability to complete the acquisition on the proposed terms or on the anticipated timeline, or at all, including risks and uncertainties related to securing the necessary regulatory approvals and satisfaction of other closing conditions to consummate the acquisition; the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive transaction agreement relating to the proposed transaction; risks related to diverting the attention of Evergreen’s and Lantheus’ management from ongoing business operations; failure to realize the expected benefits of the acquisition; significant transaction costs and/or unknown or inestimable liabilities; the risk that Evergreen’s business will not be integrated successfully or that such integration may be more difficult, time-consuming or costly than expected; risks related to future opportunities and plans for the combined company, including the uncertainty of expected future regulatory filings, financial performance and results of the combined company following completion of the acquisition; pharmaceutical product development and the uncertainty of clinical success; the regulatory approval process, including the risks that Evergreen may be unable to obtain regulatory approval for OCTEVYTM on the timeframe anticipated, or at all, or that Evergreen may be unable to obtain regulatory approvals of any of its other product candidates in a timely manner or at all; disruption from the proposed acquisition, making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; effects relating to the announcement of the acquisition or any further announcements or the consummation of the acquisition on the market price of Lantheus’ common stock; the possibility that, if Lantheus does not achieve the perceived benefits of the acquisition as rapidly or to the extent anticipated by financial analysts or investors, the market price of Lantheus’ common stock could decline; potential litigation associated with the possible acquisition; and the risks and uncertainties discussed in our filings with the Securities and Exchange Commission (including those described in the Risk Factors section in our most recently filed Annual Report on Form 10-K and Quarterly Reports on Form 10-Q). All trademarks, logos and service marks used in this presentation are the property of their respective owners. Non-GAAP Financial Measures The Company uses non-GAAP financial measures, such as adjusted net income and its line components; adjusted net income per share - fully diluted; adjusted operating income and free cash flow. The Company’s management believes that the presentation of these measures provides useful information to investors. These measures may assist investors in evaluating the Company’s operations, period over period. However, these measures may exclude items that may be highly variable, difficult to predict and of a size that could have a substantial impact on the Company’s reported results of operations for a particular period. Management uses these and other non-GAAP measures internally for evaluation of the performance of the business, including the allocation of resources and the evaluation of results relative to employee performance compensation targets. Investors should consider these non-GAAP measures only as a supplement to, not as a substitute for or as superior to, measures of financial performance prepared in accordance with GAAP. © 2025 Lantheus. All rights reserved.

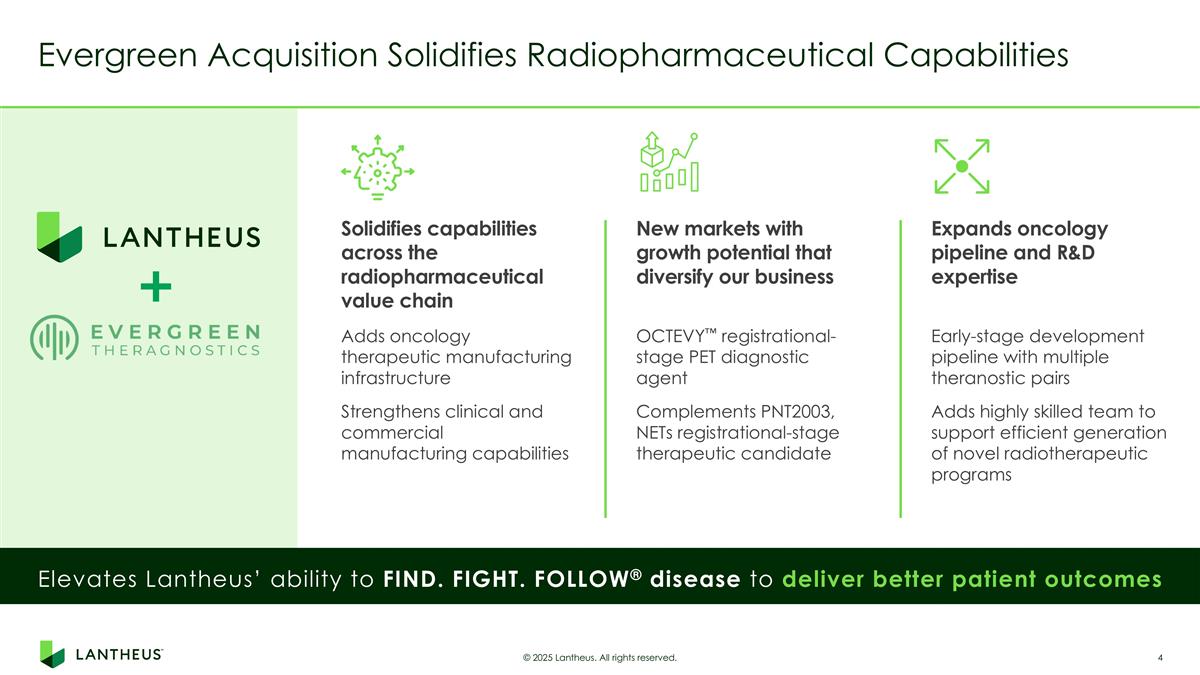

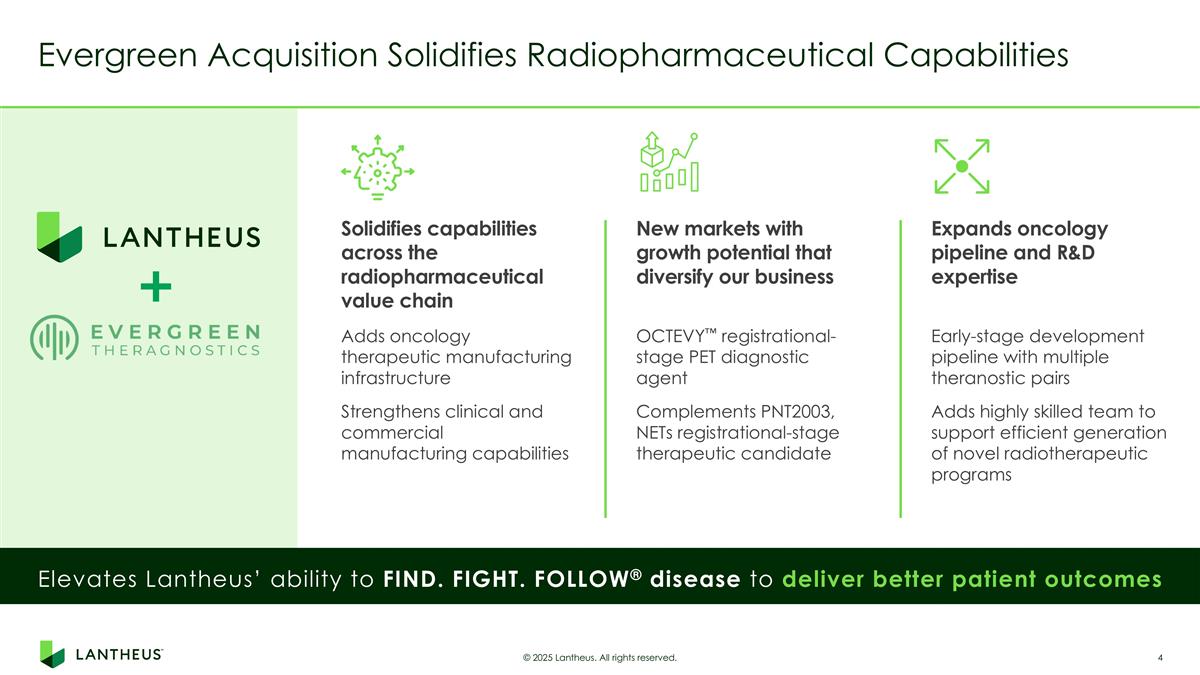

Evergreen Acquisition Solidifies Radiopharmaceutical Capabilities © 2025 Lantheus. All rights reserved. Solidifies capabilities across the radiopharmaceutical value chain Adds oncology therapeutic manufacturing infrastructure Strengthens clinical and commercial manufacturing capabilities OCTEVY™ registrational-stage PET diagnostic agent Complements PNT2003, NETs registrational-stage therapeutic candidate New markets with growth potential that diversify our business Early-stage development pipeline with multiple theranostic pairs Adds highly skilled team to support efficient generation of novel radiotherapeutic programs Expands oncology pipeline and R&D expertise Elevates Lantheus’ ability to FIND. FIGHT. FOLLOW® disease to deliver better patient outcomes

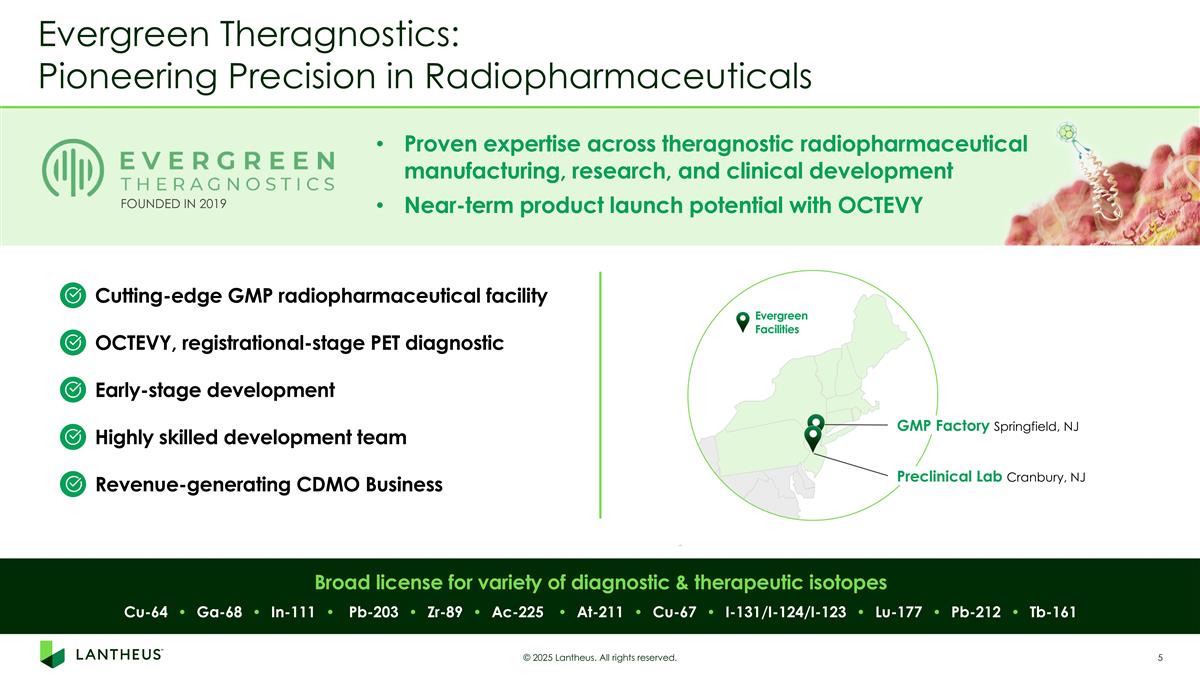

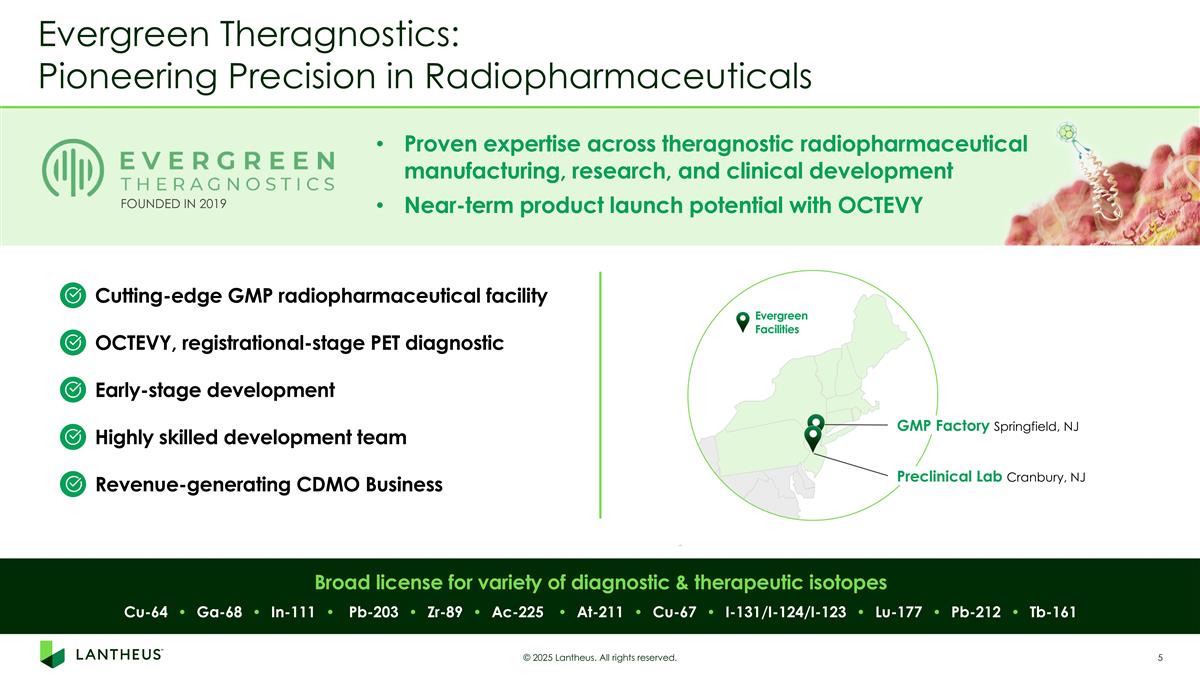

GMP Factory Springfield, NJ Preclinical Lab Cranbury, NJ Evergreen Facilities Evergreen Theragnostics: Pioneering Precision in Radiopharmaceuticals © 2025 Lantheus. All rights reserved. Cu-64 • Ga-68 • In-111 • Pb-203 • Zr-89 • Ac-225 • At-211 • Cu-67 • I-131/I-124/I-123 • Lu-177 • Pb-212 • Tb-161 Proven expertise across theragnostic radiopharmaceutical manufacturing, research, and clinical development Near-term product launch potential with OCTEVY FOUNDED IN 2019 Broad license for variety of diagnostic & therapeutic isotopes Cutting-edge GMP radiopharmaceutical facility Revenue-generating CDMO Business OCTEVY, registrational-stage PET diagnostic Highly skilled development team Early-stage development

© 2025 Lantheus. All rights reserved. Timing and Approvals Anticipated to close in the second half of 2025, subject to customary closing conditions, including regulatory clearances Transaction expectations: Accelerate & derisk critical pathways by internalizing Evergreen’s scalable manufacturing infrastructure that would otherwise have to be outsourced Accretive ~18 months post close taken together with recently announced deal with Life Molecular Imaging1 Drive near-term revenue potential with acquisition of OCTEVY, enhancing Lantheus’ presence in NETs, and CDMO operations TRANSACTION SUMMARY Acquiring Evergreen Theragnostics ALL CASH TRANSACTION with upfront payment of $250 million, payable in cash at closing Up to potential $752.5 million in development and sales milestones related to OCTEVY and Evergreen’s clinical and pre-clinical pipeline 1. Low single digit percent dilutive to Lantheus stand-alone EPS due mainly to anticipated R&D investment in the acquired pipeline as well as pre- and post-launch investments to prepare OCTEVY for commercial success

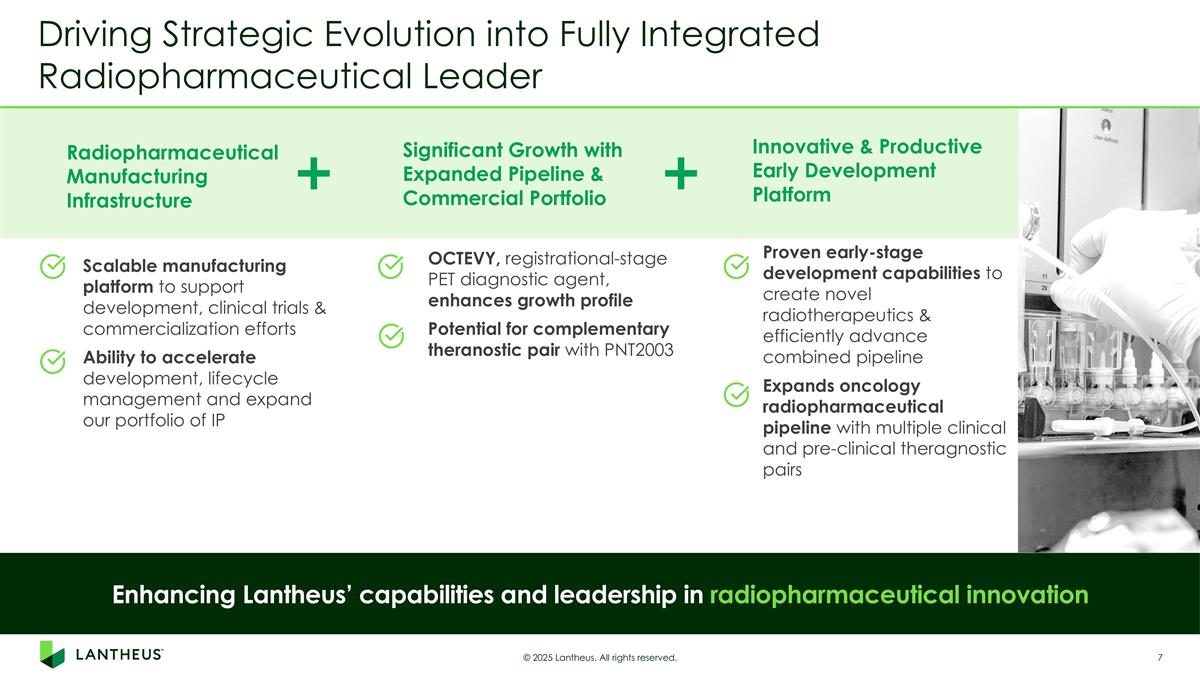

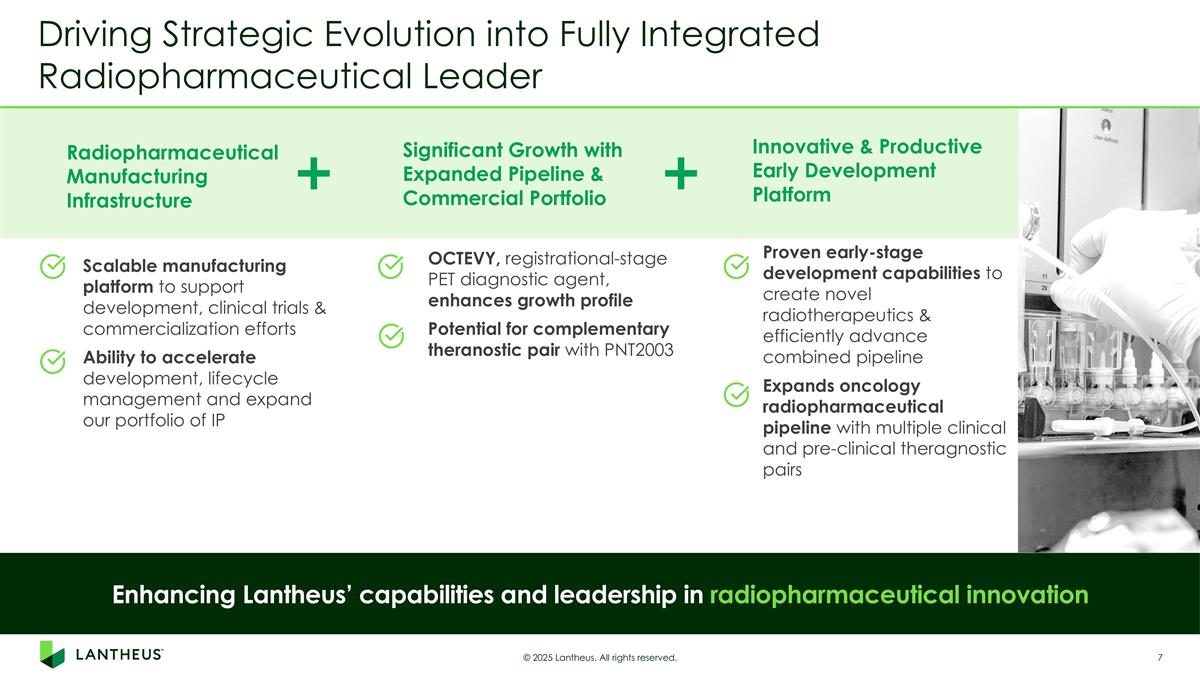

Driving Strategic Evolution into Fully Integrated Radiopharmaceutical Leader © 2025 Lantheus. All rights reserved. Enhancing Lantheus’ capabilities and leadership in radiopharmaceutical innovation Scalable manufacturing platform to support development, clinical trials & commercialization efforts Ability to accelerate development, lifecycle management and expand our portfolio of IP Radiopharmaceutical Manufacturing Infrastructure Innovative & Productive Early Development Platform Proven early-stage development capabilities to create novel radiotherapeutics & efficiently advance combined pipeline Expands oncology radiopharmaceutical pipeline with multiple clinical and pre-clinical theragnostic pairs Significant Growth with Expanded Pipeline & Commercial Portfolio OCTEVY, registrational-stage PET diagnostic agent, enhances growth profile Potential for complementary theranostic pair with PNT2003

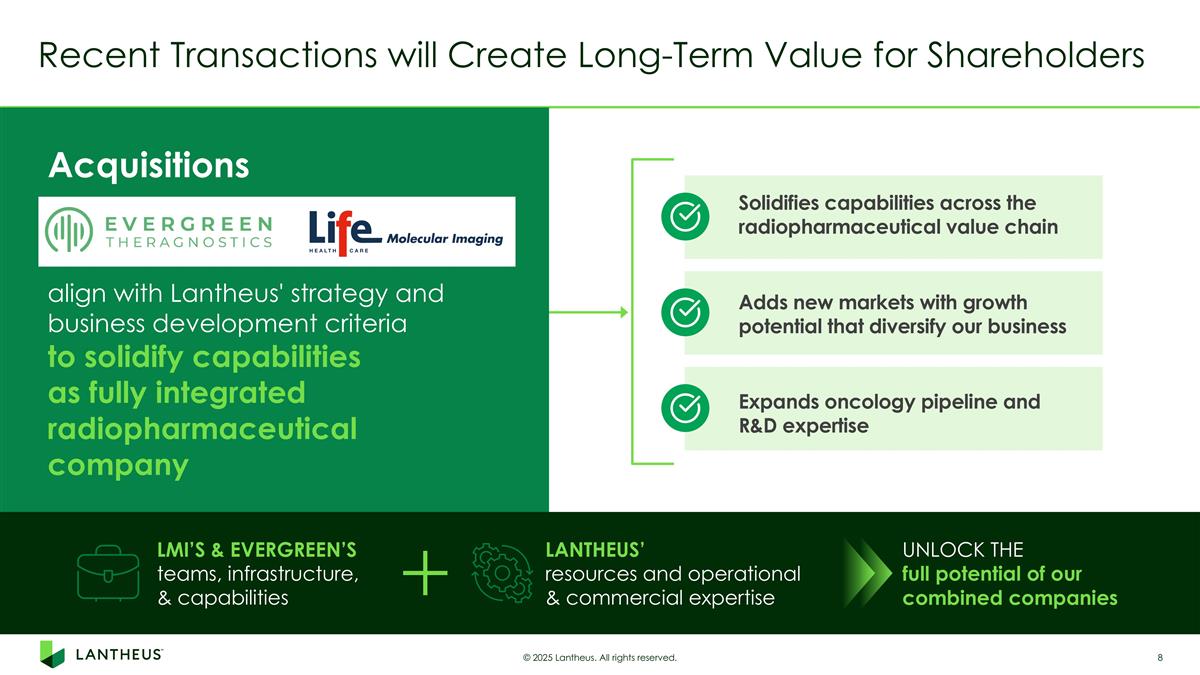

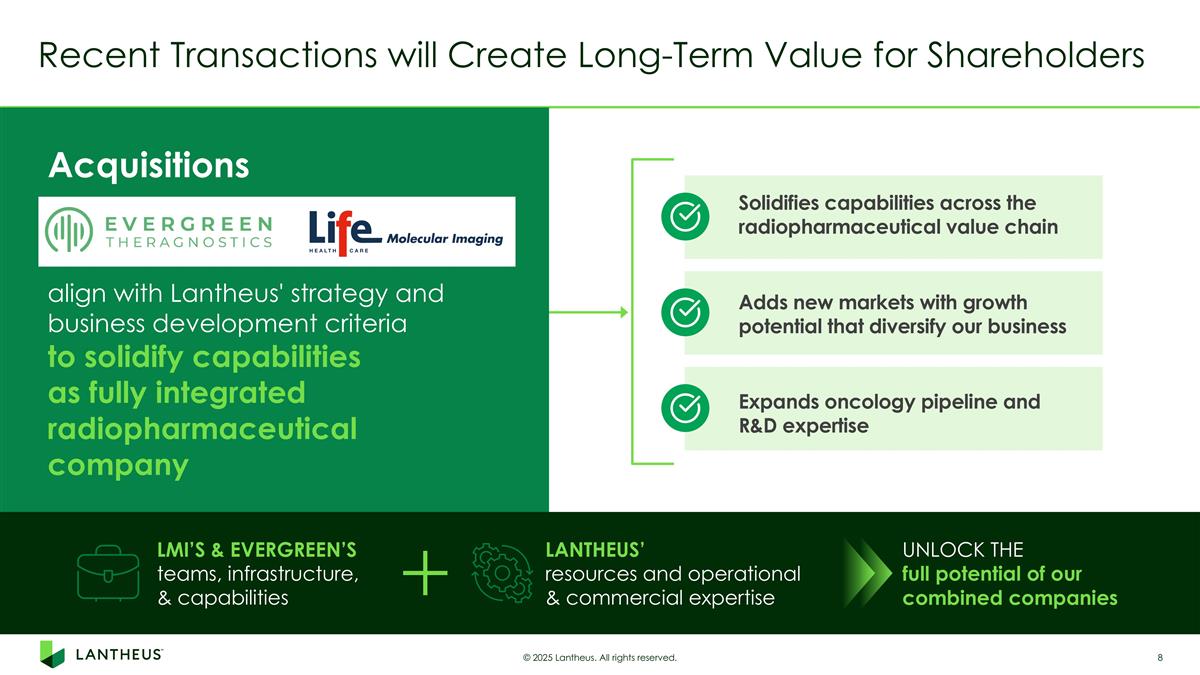

Recent Transactions will Create Long-Term Value for Shareholders © 2025 Lantheus. All rights reserved. LANTHEUS’ resources and operational & commercial expertise LMI’S & EVERGREEN’S teams, infrastructure, & capabilities UNLOCK THE full potential of our combined companies Solidifies capabilities across the radiopharmaceutical value chain Adds new markets with growth potential that diversify our business Expands oncology pipeline and R&D expertise align with Lantheus' strategy and business development criteria to solidify capabilities as fully integrated radiopharmaceutical company Acquisitions