Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

Table of Contents

Filed Pursuant to Rule 424(b)(1)

Registration No. 333-174492

PROSPECTUS

30,000,000 Common Units

SandRidge Permian Trust

Representing Beneficial Interests

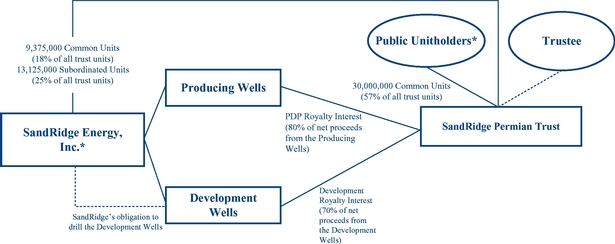

This is an initial public offering of common units representing beneficial interests in SandRidge Permian Trust. The trust is selling all of the units offered hereby. SandRidge Energy, Inc. ("SandRidge") will convey to the trust certain royalty interests in exchange for the net proceeds of this offering, as well as common and subordinated units collectively representing a 43% beneficial interest in the trust (without giving effect to the exercise of the underwriters' over-allotment option).

The common units representing beneficial interests have been approved for listing on the New York Stock Exchange under the symbol "PER."

The Trust Units. Trust units, consisting of the common and subordinated units, are units representing beneficial interests in the trust and represent undivided beneficial interests in the property of the trust. They do not represent any interest in SandRidge.

The Trust. The trust will own term and perpetual royalty interests in certain of SandRidge's properties in the Permian Basin in Andrews County, Texas. These royalty interests will entitle the trust to receive, after the deduction of certain costs, (a) 80% of the proceeds attributable to SandRidge's net revenue interest in the sale of production from 509 producing wells and (b) 70% of the proceeds attributable to SandRidge's net revenue interest in the sale of production from 888 development wells to be drilled on drilling locations included within an area of mutual interest consisting of approximately 16,800 gross acres (15,900 net acres) held by SandRidge. The trust will not be responsible for any costs related to the drilling of the development wells. The trust will be treated as a partnership for U.S. federal income tax purposes.

The Trust Unitholders. As a trust unitholder, you will receive quarterly distributions of cash from the proceeds that the trust receives from SandRidge's sale of oil, natural gas and natural gas liquids subject to the royalty interests to be held by the trust. The distributions will also reflect hedges entered into pursuant to a derivatives agreement between the trust and SandRidge, as well as hedges entered into by the trust directly with unaffiliated hedge counterparties. For information on target distributions and related matters pertinent to trust unitholders, please see "Target Distributions and Subordination and Incentive Thresholds."

Investing in the common units involves risks. See "Risk Factors" beginning on page 18.

These risks include the following:

- •

- Drilling risks could delay the anticipated drilling schedule for the development wells to be drilled by SandRidge, which could adversely affect future production and decrease distribution to unitholders.

- •

- Oil and natural gas price fluctuations could reduce proceeds to the trust and cash distributions to unitholders.

- •

- Actual reserves and future production may be less than current estimates.

- •

- Estimates of target distributions to unitholders are based on assumptions that are inherently subjective and are subject to significant risks and uncertainties.

- •

- The hedging arrangements will cover only a portion of the expected production attributable to the trust, and such arrangements will limit the trust's ability to benefit from commodity price increases for hedged volumes above the corresponding hedge price.

- •

- If the trust were treated as a corporation for U.S. federal income tax purposes, then its cash available for distribution to unitholders would be substantially reduced.

- •

- If the IRS contests the tax positions the trust takes, the value of the trust units may be adversely affected, the cost of any IRS contest will reduce the trust's cash available for distribution and income, gain, loss and deduction may be reallocated among trust unitholders.

- •

- The tax treatment of an investment in trust units could be affected by potential legislative changes, possibly on a retroactive basis.

PRICE$18.00A COMMON UNIT

| | | | | | |

| | Price to

Public | | Underwriting

Discounts and

Commissions(1) | | Proceeds to

Trust(2) |

|---|

| Per Common Unit | | $18.00 | | $1.08 | | $16.92 |

| Total | | $540,000,000 | | $32,400,000 | | $507,600,000 |

- (1)

- Excludes a structuring fee equal to 0.50% of the gross proceeds of this offering, or approximately $2.7 million, payable to Morgan Stanley & Co. LLC.

- (2)

- The trust will deliver all of the proceeds it receives in this offering to one or more SandRidge subsidiaries. See "Use of Proceeds."

The trust has granted the underwriters the right to purchase up to an additional 4,500,000 common units to cover over-allotments.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common units to purchasers on August 16, 2011.

| | | | | | |

| MORGAN STANLEY | | RAYMOND JAMES | | RBC CAPITAL MARKETS | | WELLS FARGO SECURITIES |

| Deutsche Bank Securities | | Goldman, Sachs & Co. | | J.P. Morgan |

| Baird | | Oppenheimer & Co. | | Morgan Keegan | | Sanders Morris Harris Inc. |

| Wunderlich Securities | | SunTrust Robinson Humphrey | | Johnson Rice & Company L.L.C. | | Tuohy Brothers |

August 10, 2011

Table of Contents

TABLE OF CONTENTS

| | | | |

| | Page | |

|---|

IMPORTANT NOTICE ABOUT INFORMATION IN THIS PROSPECTUS | | | i | |

SUMMARY | | | 1 | |

RISK FACTORS | | | 18 | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | | | 40 | |

USE OF PROCEEDS | | | 41 | |

SANDRIDGE ENERGY, INC. | | | 42 | |

THE TRUST | | | 44 | |

TARGET DISTRIBUTIONS AND SUBORDINATION AND INCENTIVE THRESHOLDS | | | 50 | |

SELECTED HISTORICAL AND PRO FORMA FINANCIAL AND OPERATING DATA | | | 62 | |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | | 65 | |

THE UNDERLYING PROPERTIES | | | 72 | |

DESCRIPTION OF THE ROYALTY INTERESTS | | | 87 | |

DESCRIPTION OF THE TRUST AGREEMENT | | | 91 | |

DESCRIPTION OF THE TRUST UNITS | | | 97 | |

TRUST UNITS ELIGIBLE FOR FUTURE SALE | | | 101 | |

U.S. FEDERAL INCOME TAX CONSIDERATIONS | | | 103 | |

STATE TAX CONSIDERATIONS | | | 119 | |

ERISA CONSIDERATIONS | | | 120 | |

UNDERWRITERS | | | 121 | |

LEGAL MATTERS | | | 127 | |

EXPERTS | | | 127 | |

WHERE YOU CAN FIND MORE INFORMATION | | | 128 | |

GLOSSARY OF CERTAIN OIL AND NATURAL GAS TERMS AND TERMS RELATED TO THE TRUST | | | 129 | |

INDEX TO FINANCIAL STATEMENTS | | | F-1 | |

ANNEX A: SUMMARY RESERVE REPORTS | | | A-1 | |

ANNEX B: CALCULATION OF TARGET DISTRIBUTIONS | | | B-1 | |

IMPORTANT NOTICE ABOUT INFORMATION IN THIS PROSPECTUS

You should rely only on the information contained in this prospectus or in any free writing prospectus the trust may authorize to be delivered to you. Until September 4, 2011 (25 days after the date of this prospectus), federal securities laws may require all dealers that effect transactions in the common units, whether or not participating in this offering, to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The trust and SandRidge have not, and the underwriters have not, authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell or a solicitation of an offer to buy the common units in any jurisdiction where such offer and sale would be unlawful. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this document. The trust's and SandRidge's business, financial condition, results of operations and prospects may have changed since such date.

i

Table of Contents

SUMMARY

This summary provides a brief overview of information contained elsewhere in this prospectus. To understand this offering fully, you should read the entire prospectus carefully, including the risk factors and the financial statements and notes to those statements. Definitions for terms relating to the oil and natural gas business can be found in "Glossary of Certain Oil and Natural Gas Terms and Terms Related to the Trust." Netherland, Sewell & Associates, Inc., referred to in this prospectus as "Netherland Sewell," an independent engineering firm, provided the estimates of proved oil, natural gas and natural gas liquids reserves as of March 31, 2011 included in this prospectus. These estimates are contained in summaries prepared by Netherland Sewell of their reserve reports for (1) the Underlying Properties held by SandRidge, dated May 23, 2011, and (2) the royalty interests to be held by the trust, dated May 24, 2011. These summaries are included as Annex A to this prospectus and are referred to in this prospectus as the "reserve report."

References to "SandRidge" in this prospectus are to SandRidge Energy, Inc. and, where the context requires, its subsidiaries. The term "Arena Properties" refers to all of the oil and natural gas properties owned by Arena Resources, Inc. ("Arena") at the time of its acquisition by SandRidge in July 2010. The term "Underlying Properties" means the portion of the Arena Properties from which SandRidge will convey the royalty interests to the trust. The royalty interests to be conveyed to the trust are sometimes referred to as the "trust properties."

Unless otherwise indicated, all information in this prospectus assumes no exercise of the underwriters' over-allotment option.

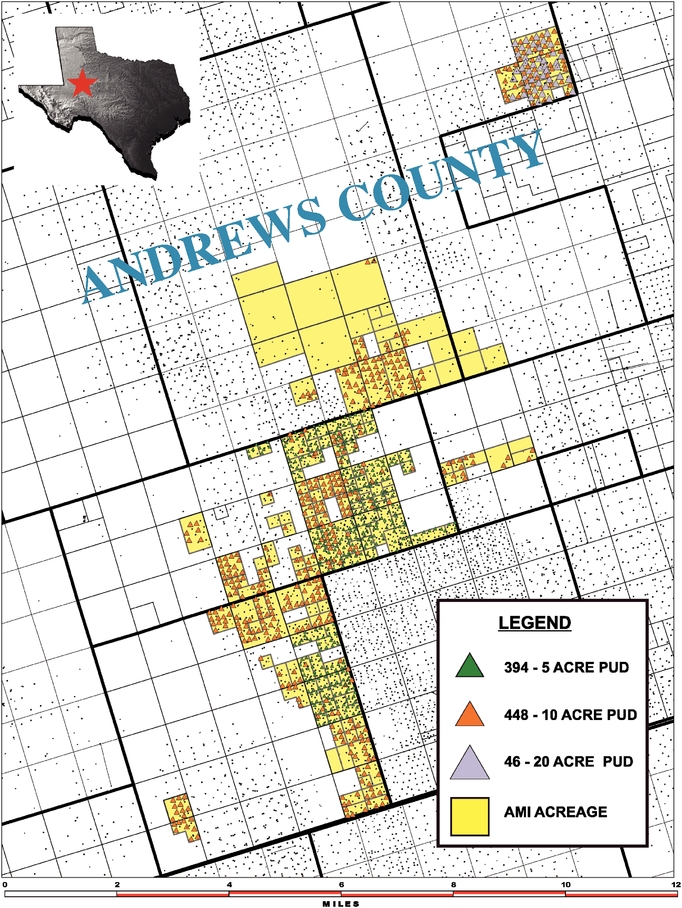

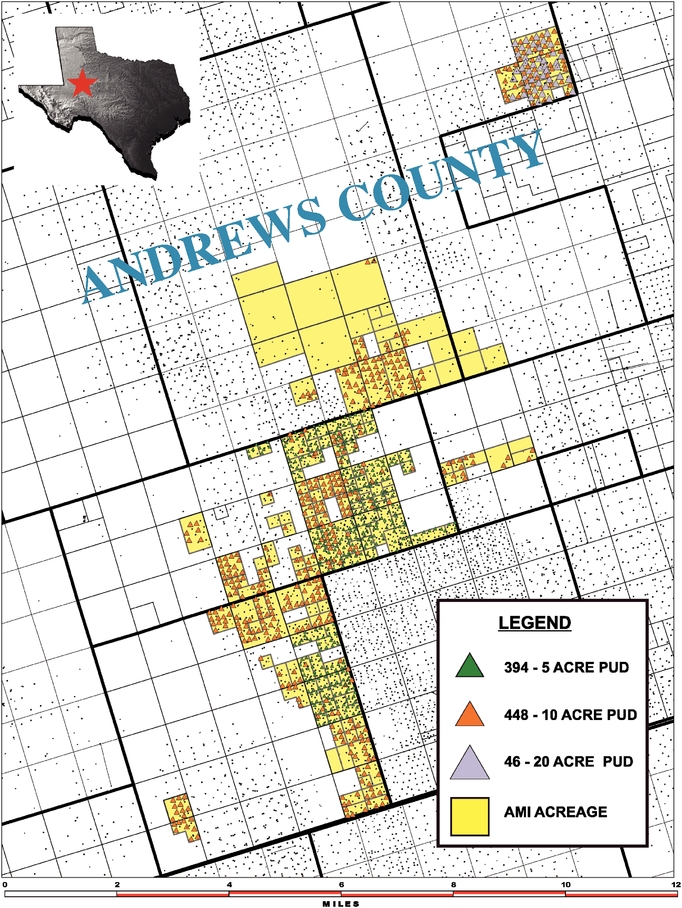

SandRidge Permian Trust

SandRidge Permian Trust is a Delaware statutory trust formed to own royalty interests to be conveyed to the trust by SandRidge in (a) 509 producing wells, including 13 wells currently awaiting completion (the "Producing Wells"), and (b) 888 development wells to be drilled (the "Development Wells") within an "Area of Mutual Interest," or "AMI." The AMI consists of the Grayburg/San Andres formation in the Permian Basin in Andrews County, Texas on the acreage identified on the inside front cover of this prospectus. SandRidge presently holds approximately 16,800 gross acres (15,900 net acres) in the AMI. SandRidge is obligated to drill, or cause to be drilled, the Development Wells from drilling locations in the AMI on or before March 31, 2016. Except in limited circumstances, until SandRidge has satisfied its drilling obligation to the trust, it will not be permitted to drill and complete any wells for its own account within the AMI. See "The Trust—Development Agreement and Drilling Support Lien—Additional Provisions."

SandRidge acquired the Underlying Properties in July 2010 and expects to operate substantially all of the Underlying Properties. The royalty interest in the Producing Wells (the "PDP Royalty Interest") entitles the trust to receive 80% of the proceeds (exclusive of any production or development costs but after deducting post-production costs and any applicable taxes) from the sale of production of oil, natural gas and natural gas liquids attributable to SandRidge's net revenue interest in the Producing Wells. The royalty interest in the Development Wells (the "Development Royalty Interest") entitles the trust to receive 70% of the proceeds (exclusive of any production or development costs but after deducting post-production costs and any applicable taxes) from the sale of oil, natural gas and natural gas liquids production attributable to SandRidge's net revenue interest in the Development Wells.

As of March 31, 2011 and after giving effect to the conveyance of the PDP Royalty Interest and the Development Royalty Interest to the trust, the total reserves estimated to be attributable to the trust were 21.8 million barrels of oil equivalent ("MMBoe"). This amount includes 5.8 MMBoe attributable to the PDP Royalty Interest and 16.0 MMBoe attributable to the Development Royalty Interest. The reserves consist of 96% liquids (87% oil and 9% natural gas liquids) and 4% natural gas.

The percentage of production proceeds to be received by the trust with respect to a well will equal the product of (a) the percentage of proceeds to which the trust is entitled under the terms of the conveyances

1

Table of Contents

(80% for the Producing Wells and 70% for the Development Wells) multiplied by (b) SandRidge's net revenue interest in the well. SandRidge on average owns a 73.0% net revenue interest in the Producing Wells. Therefore, the trust will have an average 58.4% net revenue interest in the Producing Wells. SandRidge on average owns a 69.3% net revenue interest in the properties in the AMI on which the Development Wells will be drilled, and based on this net revenue interest, the trust would have an average 48.5% net revenue interest in the Development Wells. SandRidge's actual net revenue interest in any particular Development Well may differ from this average.

The trust will not be responsible for any costs related to the drilling of the Development Wells or any other operating and capital costs, except for certain taxes and other post-production costs. The trust's cash receipts in respect of the trust properties will be determined after deducting post-production costs and any applicable taxes associated with the PDP Royalty Interest and the Development Royalty Interest. Post-production costs and applicable taxes will generally consist of production and severance taxes and costs incurred to gather, store, compress, transport, process, treat, dehydrate and market the oil, natural gas and natural gas liquids produced. Cash distributions to unitholders will reflect hedging arrangements, as well as trust general and administrative expenses.

Hedging arrangements covering a portion of expected production will be implemented in two ways. First, SandRidge will enter into a derivatives agreement with the trust to provide the trust with the effect of specified hedge contracts entered into between SandRidge and third parties. Under the derivatives agreement, SandRidge will pay the trust amounts it receives from its hedge counterparties, and the trust will pay SandRidge any amounts that SandRidge is required to pay such counterparties. Second, the trust will enter into hedge contracts directly with unaffiliated hedge counterparties. As a party to these contracts, the trust will receive payments directly from its counterparties, and be required to pay any amounts owed directly to its counterparties. Under the combined hedging arrangements, approximately 73% of the expected production and 79% of the expected revenues upon which the target distributions are based from August 1, 2011 through March 31, 2015 will be hedged. Under the derivatives agreement, as Development Wells are drilled, SandRidge will have the right to assign or novate to the trust any of the SandRidge-provided hedges in certain circumstances. Please see "The Trust—Hedging Arrangements" and "Target Distributions and Subordination and Incentive Thresholds."

The trust will make quarterly cash distributions of substantially all of its cash receipts, after deducting the trust's administrative expenses, on or about 60 days following the completion of each quarter through (and including) the quarter ending March 31, 2031. The first distribution, which will cover the second and third quarters of 2011 (consisting of proceeds attributable to five months of production), is expected to be made on or about November 30, 2011 to record unitholders as of November 15, 2011. The trustee intends to withhold $1.0 million from the first distribution to establish a cash reserve available for trust administrative expenses. The trust will dissolve and begin to liquidate on March 31, 2031 (the "Termination Date") and will soon thereafter wind up its affairs and terminate. At the Termination Date, 50% of the PDP Royalty Interest and 50% of the Development Royalty Interest will revert automatically to SandRidge. The remaining 50% of each of the PDP Royalty Interest and the Development Royalty Interest will be retained by the trust at the Termination Date and thereafter sold, and the net proceeds of the sale, as well as any remaining trust cash reserves, will be distributed to the unitholders in accordance with their interests. SandRidge will have a right of first refusal to purchase the royalty interests retained by the trust at the Termination Date.

SandRidge will retain 20% of the proceeds from the sale of oil, natural gas and natural gas liquids attributable to its net revenue interest in the Producing Wells, as well as 30% of the proceeds from the sale of future production attributable to its net revenue interest in the Development Wells. SandRidge initially will own 43% of the trust units (without giving effect to the exercise of the underwriters' over-allotment option). By virtue of SandRidge's retained interest in the Producing Wells and the Development Wells, as well as its ownership of 43% of the trust units, it will have an effective average net revenue interest of 39.6% in the Producing Wells and 41.6% in the Development Wells, compared with an effective average

2

Table of Contents

net revenue interest for the holders of trust units other than SandRidge of 33.4% in the Producing Wells and 27.7% in the Development Wells.

SandRidge operates all of the Producing Wells. SandRidge owns a majority working interest in substantially all of the drilling locations on which it expects to drill the Development Wells, and expects to operate such wells during the subordination period described herein. In addition, for those wells it operates, SandRidge has agreed to operate the properties and cause to be marketed oil, natural gas and natural gas liquids produced from these properties in the same manner it would if such properties were not burdened by the royalty interests.

The business and affairs of the trust will be managed by The Bank of New York Mellon Trust Company, N.A., as trustee. The trustee will have no ability to manage or influence the operation of the Underlying Properties. SandRidge expects to operate substantially all of the Underlying Properties, but will have no ability to manage or influence the management of the trust except through its limited voting rights as a holder of trust units and its limited ability to manage the hedging program. Please see "The Trust—Hedging Arrangements," "The Trust—Administrative Services Agreement" and "Description of the Trust Units—Voting Rights of Trust Unitholders."

The Development Wells

Pursuant to a development agreement with the trust, SandRidge is obligated to drill, or cause to be drilled, 888 Development Wells in the AMI on or before March 31, 2015. In the event of delays, SandRidge will have until March 31, 2016 to fulfill its drilling obligation. SandRidge will be credited for drilling one full Development Well if the well is drilled and completed in the Grayburg/San Andres formation and SandRidge's net revenue interest in the well is equal to 69.3%. For wells in which SandRidge has a net revenue interest greater than or less than 69.3%, SandRidge will receive credit for such well in the proportion that its net revenue interest in the well bears to 69.3%. As a result, SandRidge may be required to drill more or less than 888 wells in order to fulfill its drilling obligation. In addition, in certain circumstances, SandRidge may receive additional Development Well credit for drilling horizontal wells. See "The Trust—Development Agreement and Drilling Support Lien."

SandRidge is required to adhere to a reasonably prudent operator standard, which requires that it act with respect to the Underlying Properties as it would act with respect to its own properties, disregarding the existence of the royalty interests as burdens affecting such properties. Accordingly, SandRidge expects that the drilling and completion techniques used for the Development Wells will be generally consistent with those used for the Producing Wells within the AMI and other producing wells outside of the AMI that have targeted the Grayburg/San Andres formation. The proved undeveloped reserves reflected in the reserve report assume that SandRidge will drill and complete the 888 Development Wells with the same completion technique, and bearing the same capital and other costs, as the 509 Producing Wells.

SandRidge Exploration and Production, LLC ("SandRidge E&P"), a wholly owned subsidiary of SandRidge, will grant to the trust a lien on its interest in the AMI (except the Producing Wells and any other wells which are already producing and not subject to the royalty interests) in order to secure the estimated amount of the drilling costs for the trust's interests in the Development Wells (the "Drilling Support Lien"). The amount obtained by the trust pursuant to the Drilling Support Lien may not exceed approximately $295 million. As SandRidge fulfills its drilling obligation over time, the total dollar amount that may be recovered will be proportionately reduced and the drilled Development Wells will be released from the lien. After SandRidge has satisfied its drilling obligation under the development agreement, it may sell, without the consent or approval of the trust unitholders, all or any part of its interest in the Underlying Properties, as long as such sale is subject to and burdened by the royalty interests.

As of the date of this prospectus, SandRidge's drilling activity with respect to the Development Wells is consistent with the drilling schedule contemplated by the development agreement.

3

Table of Contents

Underlying Properties

The Underlying Properties are located in the greater Fuhrman-Mascho field area, a region in Andrews County, Texas that primarily produces oil from the Grayburg/San Andres formation within the Permian Basin. SandRidge currently operates three drilling rigs within the AMI and, as of March 31, 2011, had drilled 101 wells since acquiring the properties in July 2010. Within the AMI, SandRidge operates 509 wells and has 888 proven undeveloped locations as of March 31, 2011. These 888 proven locations are a combination of 5-acre, 10-acre and 20-acre infill spacing locations. As of March 31, 2011, average daily production from the Underlying Properties was approximately 3,400 Boe/d.

Permian Basin. The Permian Basin extends throughout southwest Texas and southeast New Mexico over an area approximately 250 miles wide and 300 miles long. It is one of the largest, most active and longest-producing oil basins in the United States. In 2010, production from the Permian Basin accounted for approximately 17% of total U.S. crude oil production, making this basin the second largest oil producing area after the Gulf of Mexico. The Permian Basin has been producing oil for over 80 years resulting in cumulative production of approximately 29 billion barrels.

SandRidge currently operates approximately 2,600 gross producing wells in the Permian Basin, with an average working interest of 94%. SandRidge's average daily net production for the month of March 2011 in the Permian Basin was approximately 28,800 Boe/d. SandRidge was operating 16 rigs in the basin as of March 2011. SandRidge drilled 484 wells in this area in 2010 and expects to drill over 800 wells in 2011.

Fuhrman-Mascho Field. The Fuhrman-Mascho field is located near the center of the Central Basin Platform in the Permian Basin. The field produces from the Grayburg/San Andres formation from average depths of approximately 4,000 to 5,000 feet. The Fuhrman-Mascho field is the fifth largest producing field in the Permian Basin and since its discovery in 1930, the field has produced approximately 142 MMBoe. SandRidge currently operates eight drilling rigs in the area and has drilled 307 wells as of March 31, 2011 since acquiring the properties in July 2010.

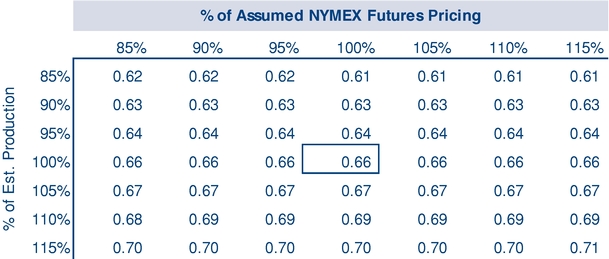

Target Distributions and Subordination and Incentive Thresholds

SandRidge has calculated quarterly target levels of cash distributions to unitholders for the life of the trust as set forth on Annex B to this prospectus. The amount of actual quarterly distributions may fluctuate from quarter to quarter, depending on the proceeds received by the trust, payments under the hedge arrangements, the trust's administrative expenses and other factors. Annex B reflects that while target distributions initially increase as SandRidge completes its drilling obligation and production increases, over time target distributions decline as a result of the depletion of the reserves in the Underlying Properties. While these target distributions do not represent the actual distributions you will receive with respect to your common units, they were used to calculate the subordination and incentive thresholds described in more detail below. The target distributions were derived by assuming that oil, natural gas and natural gas liquids production from the trust properties will equal the volumes reflected in the reserve report attached as Annex A to this prospectus, adjusted for actual volumes realized in April, May and June 2011, and that prices received for such production will be consistent with settled NYMEX pricing for April through June 2011, monthly NYMEX forward pricing as of July 15, 2011 for the remainder of the period ending March 31, 2014, and assumed price increases after March 31, 2014 of 2.5% annually, capped at $120.00 per Bbl of oil and $7.00 per MMBtu of natural gas. Using these assumptions, the price of oil would reach the $120.00 per Bbl cap in 2023, and the price of natural gas would reach the $7.00 per MMBtu cap in 2022. The target distributions also give effect to estimated post-production expenses and assumed trust general and administrative expenses.

In order to provide support for cash distributions on the common units, SandRidge has agreed to subordinate 13,125,000 of the trust units it will retain following this offering, which will constitute 25% of the total trust units outstanding. The subordinated units will be entitled to receive pro rata distributions

4

Table of Contents

from the trust each quarter if and to the extent there is sufficient cash to provide a cash distribution on the common units that is no less than the applicable quarterly subordination threshold. If there is not sufficient cash to fund such a distribution on all of the common units, the distribution to be made with respect to the subordinated units will be reduced or eliminated for such quarter in order to make a distribution, to the extent possible, of up to the subordination threshold amount on all the common units, including the common units held by SandRidge. Each quarterly subordination threshold is 20% below the target distribution level for the corresponding quarter (each, a "subordination threshold").

In exchange for agreeing to subordinate a majority of its trust units, and in order to provide additional financial incentive to SandRidge to satisfy its drilling obligation and perform operations on the Underlying Properties in an efficient and cost-effective manner, SandRidge will be entitled to receive incentive distributions equal to 50% of the amount by which the cash available for distribution on all of the trust units in any quarter is 20% greater than the target distribution for such quarter (each, an "incentive threshold"). The remaining 50% of cash available for distribution in excess of the incentive thresholds will be paid to trust unitholders, including SandRidge, on a pro rata basis.

By way of example, if the target distribution per unit for a particular quarterly period is $.55, then the subordination threshold would be $.44 and the incentive threshold would be $.66 for such quarter. This means that if the cash available for distribution to all holders for that quarter would result in a per unit distribution below $.44, the distribution to be made with respect to subordinated units will be reduced or eliminated in order to make a distribution, to the extent possible, up to the amount of the subordination threshold, on the common units. If, on the other hand, the cash available for distribution to all holders would result in a per unit distribution above $.66, then SandRidge would receive 50% of the amount by which the cash available for distribution on all the trust units exceeds $.66, with all trust unitholders (including SandRidge on a pro rata basis) sharing in the other 50% of such excess amount. See "Target Distributions and Subordination and Incentive Thresholds."

At the end of the fourth full calendar quarter following SandRidge's satisfaction of its drilling obligation with respect to the Development Wells, the subordinated units will automatically convert into common units on a one-for-one basis and SandRidge's right to receive incentive distributions will terminate. After such time, the common units will no longer have the protection of the subordination threshold, and all trust unitholders will share on a pro rata basis in the trust's distributions. SandRidge currently expects that it will complete its drilling obligation on or before March 31, 2015 and that, accordingly, the subordinated units will convert into common units on or before March 31, 2016. In the event of delays, SandRidge will have until March 31, 2016 under its contractual obligation to drill all the Development Wells, in which event the subordinated units would convert into common units on or before March 31, 2017. The period during which the subordinated units are outstanding is referred to as the "subordination period."

SandRidge's management has prepared the prospective financial information set forth below to present the target distributions to the holders of the trust units based on the estimates and assumptions described under "Target Distributions and Subordination and Incentive Thresholds." The accompanying prospective financial information was not prepared with a view toward complying with the guidelines of the U.S. Securities and Exchange Commission ("SEC") or the guidelines established by the American Institute of Certified Public Accountants with respect to preparation and presentation of prospective financial information. More specifically, such information omits items that are not relevant to the trust. SandRidge's management believes the prospective financial information was prepared on a reasonable basis, reflects the best currently available estimates and judgments, and presents, to the best of management's knowledge and belief, the expected course of action and the expected future financial performance of the royalty interests. However, this information is based on estimates and judgments, and readers of this prospectus are cautioned not to place undue reliance on the prospective financial information.

5

Table of Contents

The prospective financial information included in this prospectus has been prepared by, and is the responsibility of, SandRidge's management. Neither PricewaterhouseCoopers LLP, the trust's and SandRidge's independent registered public accountant, nor Hansen Barnett & Maxwell, P.C., Arena Resources, Inc.'s independent registered public accountant, has examined, compiled or performed any procedures with respect to the accompanying prospective financial information and, accordingly, neither PricewaterhouseCoopers LLP nor Hansen Barnett & Maxwell, P.C. expresses an opinion or any other form of assurance with respect thereto. The reports of PricewaterhouseCoopers LLP included in this prospectus relate to the Statement of Assets and Trust Corpus of the trust and the historical Statements of Revenues and Direct Operating Expenses of the Arena Properties, and the report of Hansen Barnett & Maxwell, P.C. included in this prospectus relates to the historical consolidated financial statements of Arena Resources, Inc. The foregoing reports do not extend to the prospective financial information and should not be read to do so.

The following table sets forth the target distributions and subordination and incentive thresholds for each calendar quarter through the first quarter of 2017. The effective date of the conveyance of the royalty interests is April 1, 2011, which means that the trust will be credited with the proceeds of production attributable to the royalty interests from that date even though the trust properties will not be conveyed to the trust until the closing of this offering. Please see "—Calculation of Target Distributions" below. The first distribution, which will cover the second and third quarters of 2011, is expected to be made on or about November 30, 2011 to record unitholders as of November 15, 2011. Due to the timing of the payment of production proceeds to the trust, the trust expects that the first distribution will include sales for oil, natural gas and natural gas liquids for five months. Thereafter, quarterly distributions will generally include royalties attributable to sales of oil, natural gas and natural gas liquids for three months, including

6

Table of Contents

one month of the prior quarter. The trustee intends to withhold $1.0 million from the first distribution to establish a cash reserve available for trust administrative expenses.

| | | | | | | | | | |

Period | | Subordination

Threshold(1) | | Target

Distribution | | Incentive

Threshold(1) | |

|---|

| | (per unit)

| |

|---|

2011: | | | | | | | | | | |

Second and Third Quarters(2) | | $ | .53 | | $ | .66 | | $ | .79 | |

Fourth Quarter | | | .39 | | | .49 | | | .59 | |

2012: | | | | | | | | | | |

First Quarter | | | .42 | | | .53 | | | .63 | |

Second Quarter | | | .44 | | | .55 | | | .66 | |

Third Quarter | | | .47 | | | .58 | | | .70 | |

Fourth Quarter | | | .49 | | | .62 | | | .74 | |

2013: | | | | | | | | | | |

First Quarter | | | .51 | | | .64 | | | .77 | |

Second Quarter | | | .53 | | | .66 | | | .80 | |

Third Quarter | | | .56 | | | .70 | | | .84 | |

Fourth Quarter | | | .58 | | | .73 | | | .87 | |

2014: | | | | | | | | | | |

First Quarter | | | .61 | | | .76 | | | .91 | |

Second Quarter | | | .63 | | | .79 | | | .95 | |

Third Quarter | | | .65 | | | .82 | | | .98 | |

Fourth Quarter | | | .66 | | | .82 | | | .98 | |

2015: | | | | | | | | | | |

First Quarter | | | .64 | | | .80 | | | .96 | |

Second Quarter | | | .61 | | | .77 | | | .92 | |

Third Quarter | | | .56 | | | .70 | | | .85 | |

Fourth Quarter | | | .54 | | | .68 | | | .81 | |

2016: | | | | | | | | | | |

First Quarter | | | .53 | | | .67 | | | .80 | |

Second Quarter | | | .52 | | | .65 | | | .78 | |

Third Quarter | | | .51 | | | .64 | | | .77 | |

Fourth Quarter | | | .50 | | | .63 | | | .75 | |

2017: | | | | | | | | | | |

First Quarter | | | .49 | | | .61 | | | .74 | |

- (1)

- The subordination and incentive thresholds terminate after the fourth full calendar quarter following SandRidge's completion of its drilling obligation.

- (2)

- Includes proceeds attributable to the first five months of production from April 1, 2011 to August 31, 2011, and gives effect to $1.0 million of reserves for general and administrative expenses withheld by the trustee and additional administrative costs relating to the formation of the trust.

For additional information with respect to the subordination and incentive thresholds, please see "Target Distributions and Subordination and Incentive Thresholds" and "Description of the Royalty Interests."

7

Table of Contents

Calculation of Target Distributions

The following table presents the calculation of the target distributions for each quarter through and including the quarter ending June 30, 2012. The target distributions were prepared by SandRidge based on assumptions of production volumes, pricing and other factors. The production forecasts used to calculate target distributions are based on estimates by Netherland Sewell. Payments to unitholders will generally be made 60 days following each calendar quarter. SandRidge will make payments to the trust that will include cash from production from the first two months of the quarter just ended as well as the last month of the immediately preceding quarter. Actual cash distributions to the trust unitholders will fluctuate quarterly based on the quantity of oil, natural gas and natural gas liquids produced from the Underlying Properties, the prices received for oil, natural gas and natural gas liquids production, when SandRidge receives payment for such production and other factors. Please read "Target Distributions and Subordination and Incentive Thresholds—Significant Assumptions Used to Calculate the Target Distributions."

8

Table of Contents

On a pro forma basis, the trust's distributable income was $60.7 million ($1.16 per unit) for the year ended December 31, 2010, and $19.7 million ($0.37 per unit) for the three months ended March 31, 2011. See "Unaudited Pro Forma Financial Information."

| | | | | | | | | | | | | | | |

| | September 30,

2011(1) | | December 31,

2011 | | March 31,

2012 | | June 30,

2012 | |

|---|

| | (In thousands, except volumetric and per unit data)

| |

|---|

Estimated production from trust properties | | | | | | | | | | | | | |

| | Oil sales volumes (MBbl) | | | 384 | | | 278 | | | 294 | | | 306 | |

| | Natural gas sales volumes (MMcf) | | | 107 | | | 74 | | | 78 | | | 80 | |

| | Natural gas liquids volumes (MBbl) | | | 40 | | | 29 | | | 30 | | | 32 | |

| | Total sales volumes (MBoe) | | |

441 | | |

319 | | |

337 | | |

351 | |

| | | % Proved developed producing (PDP) sales volumes | | | 88 | % | | 57 | % | | 48 | % | | 42 | % |

| | | % Proved undeveloped (PUD) sales volumes | | | 12 | % | | 43 | % | | 52 | % | | 58 | % |

| | | % Oil volumes | | |

87 |

% | |

87 |

% | |

87 |

% | |

87 |

% |

| | | % Natural gas volumes | | | 4 | % | | 4 | % | | 4 | % | | 4 | % |

| | | % Natural gas liquids volumes | | | 9 | % | | 9 | % | | 9 | % | | 9 | % |

Commodity price and derivative contract positions | | | | | | | | | | | | | |

| | NYMEX futures price(2) | | | | | | | | | | | | | |

| | | Oil ($/Bbl) | | $ | 99.33 | | $ | 98.03 | | $ | 99.48 | | $ | 100.70 | |

| | | Natural gas ($/MMBtu) | | $ | 4.40 | | $ | 4.57 | | $ | 4.88 | | $ | 4.81 | |

| | | Natural gas liquids ($/Bbl) | | $ | 49.61 | | $ | 49.01 | | $ | 49.74 | | $ | 50.35 | |

| | Assumed realized weighted unhedged price(3) | | | | | | | | | | | | | |

| | | Oil ($/Bbl) | | $ | 95.97 | | $ | 93.76 | | $ | 95.21 | | $ | 96.43 | |

| | | Natural gas ($/Mcf) | | | 3.17 | | | 3.29 | | | 3.51 | | | 3.46 | |

| | | Natural gas liquids ($/Bbl) | | | 47.97 | | | 47.40 | | | 48.10 | | | 48.69 | |

| | Assumed realized weighted hedged price | | | | | | | | | | | | | |

| | | Oil ($/Bbl) | | | 96.53 | | | 95.34 | | | 97.04 | | | 97.85 | |

| | | Natural gas ($/Mcf) | | | 3.17 | | | 3.29 | | | 3.51 | | | 3.46 | |

| | Percent of oil volumes hedged | | | 98 | %(4) | | 89 | % | | 93 | % | | 95 | % |

| | Oil hedged price ($/Bbl) | | | 99.80 | | | 99.80 | | | 101.46 | | | 102.20 | |

| | Percent of natural gas volumes hedged | | | 0 | % | | 0 | % | | 0 | % | | 0 | % |

| | Natural gas hedged price ($/MMBtu) | | | — | | | — | | | — | | | — | |

Estimated cash available for distribution | | | | | | | | | | | | | |

| | Oil sales revenues | | $ | 36,814 | | $ | 26,067 | | $ | 27,982 | | $ | 29,552 | |

| | Natural gas sales revenues | | | 338 | | | 243 | | | 273 | | | 279 | |

| | Natural gas liquids sales revenue | | | 1,916 | | | 1,374 | | | 1,463 | | | 1,536 | |

| | Realized gains (losses) from derivative contracts | | | 215 | | | 441 | | | 539 | | | 436 | |

| | | Operating revenues and realized gains (losses) from derivative contracts | | $ | 39,283 | | $ | 28,125 | | $ | 30,257 | | $ | 31,803 | |

| | Production taxes | | | (1,862 | ) | | (1,320 | ) | | (1,417 | ) | | (1,496 | ) |

| | Ad valorem taxes | | | (977 | ) | | (692 | ) | | (743 | ) | | (784 | ) |

| | Franchise taxes | | | (137 | ) | | (98 | ) | | (106 | ) | | (111 | ) |

| | Trust administrative expenses | | | (1,750 | )(5) | | (325 | ) | | (325 | ) | | (325 | ) |

| | | | | | | | | | |

| | | Total trust expenses | | | (4,727 | ) | | (2,436 | ) | | (2,591 | ) | | (2,716 | ) |

| | | | | | | | | | |

| | Cash available for distribution | |

$ |

34,556 | |

$ |

25,689 | |

$ |

27,666 | |

$ |

29,087 | |

| | | | | | | | | | |

| | Trust units outstanding | | |

52,500 | | |

52,500 | | |

52,500 | | |

52,500 | |

| | Target distribution per trust unit | | $ | .66 | | $ | .49 | | $ | .53 | | $ | .55 | |

| | | | | | | | | | |

| | Subordination threshold per trust unit | |

$ |

..53 | |

$ |

..39 | |

$ |

..42 | |

$ |

..44 | |

| | | | | | | | | | |

| | Incentive threshold per trust unit | |

$ |

..79 | |

$ |

..59 | |

$ |

..63 | |

$ |

..66 | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

- (1)

- Includes proceeds attributable to the first five months of production from April 1, 2011 to August 31, 2011.

- (2)

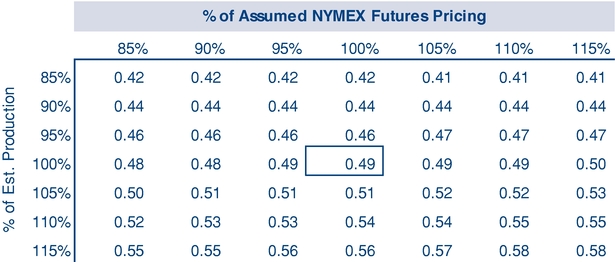

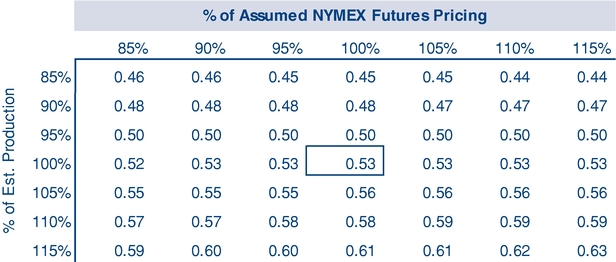

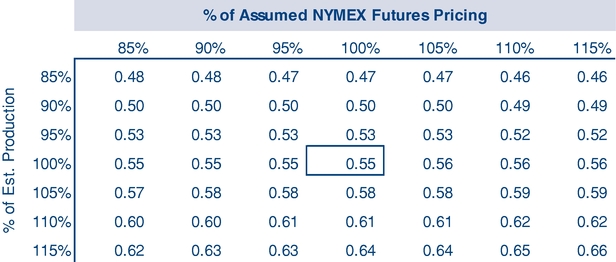

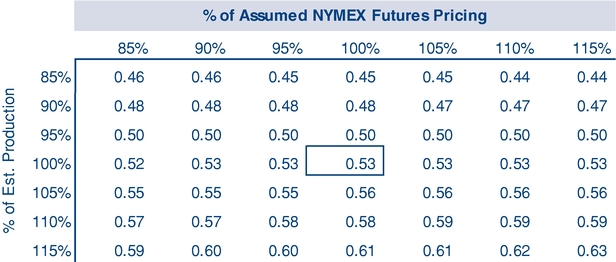

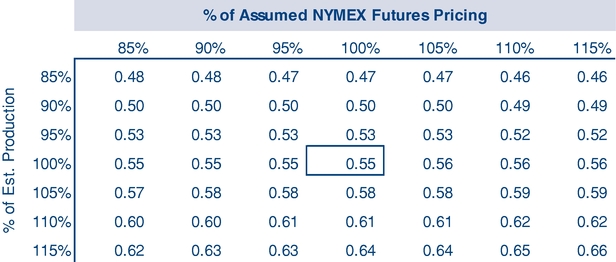

- Average NYMEX futures prices, as reported July 15, 2011. For a description of the effect of lower NYMEX prices on target distributions, please read "Target Distributions and Subordination and Incentive Thresholds—Sensitivity of Target Distributions to Changes in Oil, Natural Gas and Natural Gas Liquids Prices and Volumes."

- (3)

- Sales price net of forecasted quality, Btu content, transportation costs, and marketing costs. For information about the estimates and assumptions made in preparing the table above, see "Target Distributions and Subordination and Incentive Thresholds—Significant Assumptions Used to Calculate the Target Distributions."

- (4)

- Hedging percentage excludes production from April 1, 2011 to July 31, 2011.

- (5)

- Includes trustee cash reserve of $1.0 million and additional administrative costs relating to the formation of the trust.

9

Table of Contents

SandRidge Energy, Inc.

SandRidge is a publicly traded, independent oil and natural gas company concentrating on development and production activities related to the exploitation of its significant holdings in West Texas and the Mid-Continent area of Oklahoma and Kansas. As of July 28, 2011, its market capitalization was approximately $4.8 billion, and as of December 31, 2010 it had total estimated net proved reserves of 545.9 MMBoe. SandRidge has approximately 210,000 net acres in the Permian Basin. SandRidge also owns and operates other interests in the Mississippian Formation, Mid-Continent, Cotton Valley Trend in East Texas, Gulf Coast and Gulf of Mexico. SandRidge also owns and operates gas gathering and processing facilities, CO2 treating and transportation facilities, and drilling rig, oil field service and oil and gas marketing businesses.

SandRidge's principal executive offices are located at 123 Robert S. Kerr Avenue, Oklahoma City, Oklahoma 73102 and its telephone number is (405) 429-5500. Its website ishttp://www.sandridgeenergy.com. The principal offices of the trust are located at 919 Congress Avenue, Suite 500, Austin, Texas 78701, and its telephone number is (512) 236-6599.

Key Investment Considerations

The following are some key investment considerations related to the Underlying Properties, the royalty interests and the common units:

- •

- Well established production history in the region. The Underlying Properties are located in the greater Fuhrman-Mascho field area in the Permian Basin. The Fuhrman-Mascho field is the 34th largest U.S. oil field based on U.S. Energy Information Association estimates of 2009 proved reserves. The field was discovered in 1930 and produced approximately 4.1 MMBbls in 2009, up 24% from 2007 production of 3.3 MMBbls. Since acquiring Arena in July 2010, SandRidge has drilled 101 wells and currently operates 496 producing wells in the AMI.

- •

- Royalty interests not burdened by operating or capital costs. The trust will not be responsible for any operating or capital costs associated with the Underlying Properties, including the costs to drill the Development Wells. The trust will bear post-production costs, certain taxes and trust administrative expenses.

- •

- Exposure to oil price volatility mitigated through March 31, 2015. Hedging arrangements covering a portion of expected production will be implemented both pursuant to a derivatives agreement between the trust and SandRidge and hedges entered into by the trust directly with unaffiliated hedge counterparties. Under the combined hedging arrangements, approximately 73% of the expected production and approximately 79% of the expected revenues upon which the target distributions are based from August 1, 2011 through March 31, 2015 will be hedged. These hedging arrangements should reduce commodity price risk inherent in holding interests in oil through March 31, 2015.

- •

- Potential for initial depletion to be offset by results of development drilling. SandRidge is obligated to drill the Development Wells by March 31, 2015 or, in the event of delays, March 31, 2016. Based on the anticipated drilling schedule, the average daily production net to the trust is expected to increase from 2,700 Boe/d for March 2011 to 5,700 Boe/d for July 2014, after which time production will decline until the termination of the trust.

10

Table of Contents

- •

- Alignment of interests between SandRidge and the trust unitholders. SandRidge has significant incentives to complete its drilling obligation and increase production from the Underlying Properties as a result of the following factors:

- •

- By virtue of SandRidge's 20% retained interest in the Producing Wells and its 30% retained interest in the Development Wells, as well as its ownership of 43% of the trust units, it will have an effective average net revenue interest of 39.6% in the Producing Wells and 41.6% in the Development Wells, compared with an effective average net revenue interest for the holders of trust units other than SandRidge of 33.4% in the Producing Wells and 27.7% in the Development Wells.

- •

- A majority of the trust units that SandRidge will own, constituting 25% of the total trust units outstanding, will be subordinated units that will not be entitled to receive distributions unless there is sufficient cash to pay the amount of the subordination threshold to the common units. These subordinated units will only convert into common units at the end of the fourth full calendar quarter following SandRidge's satisfaction of its drilling obligation to the trust.

- •

- To the extent that the trust has cash available for distribution in excess of the incentive thresholds during the subordination period, SandRidge will be entitled to receive 50% of such cash as incentive distributions, plus its pro rata share of the remaining 50% of such cash by virtue of its ownership of 22,500,000 trust units.

- •

- Except in limited circumstances, SandRidge will not be permitted to drill and complete any wells for its own account within the AMI or sell the Underlying Properties until it has satisfied its drilling obligation.

- •

- SandRidge's experience as an operator in the Permian Basin. Since 2009, SandRidge has drilled, as operator, 315 wells targeting the Grayburg/San Andres formation in the Permian Basin. The majority of the wells drilled in the Grayburg/San Andres formation have been drilled in Andrews County, the location of the Underlying Properties. SandRidge operates all of the Producing Wells. SandRidge owns a majority working interest in substantially all of the locations on which it expects to drill the Development Wells, and it expects to operate such wells during the subordination period, allowing SandRidge to control the timing and amount of discretionary expenditures for operational and development activities with respect to substantially all of the Development Wells.

- •

- Rigs and services readily available to allow timely drilling and completion of wells. As of March 31, 2011, SandRidge had eight rigs operating in the greater Fuhrman-Mascho field area and plans to drill more than 450 wells targeting the Grayburg/San Andres formations in 2011, some of which are in the AMI. SandRidge estimates that only three rigs will be required to complete its drilling obligation within its contractual commitment to the trust. SandRidge owns and operates drilling rigs and a related oil field services business that provides pulling units, trucking, rental tools, location and road construction and roustabout services. As of March 31, 2011, SandRidge owned 31 drilling rigs, which it uses to drill wells for its own account as well as that of other oil and natural gas companies. SandRidge will use a combination of its own rigs and oil field services business and third party rigs and services to drill and complete the Development Wells. SandRidge's direct access to drilling rigs and related oil field services should substantially mitigate any potential shortage of drilling and completion equipment and enable SandRidge to achieve its projected drilling schedule.

- •

- Recognized sponsor with a successful track record and experienced management. SandRidge has a history of active and successful drilling. From the beginning of 2007 through December 31, 2010, SandRidge drilled 1,542 gross (1,404 net) oil and gas wells, investing $4.5 billion in exploration and production activity. During this same period, SandRidge produced over 65 MMBoe of oil and gas. SandRidge currently operates approximately 5,000 wells. SandRidge's executive management team averages over 25 years of experience in the oil and gas industry, and SandRidge's field personnel have extensive operational experience.

11

Table of Contents

Proved Reserves

Proved Reserves of Underlying Properties and Royalty Interests. The following table sets forth certain estimated proved reserves and the PV-10 value as of March 31, 2011 attributable to the Underlying Properties, the PDP Royalty Interest and the Development Royalty Interest, in each case derived from the reserve report. The reserve report was prepared by Netherland Sewell in accordance with criteria established by the SEC.

Proved reserve quantities attributable to the royalty interests are calculated by multiplying the gross reserves for each property attributable to SandRidge's interest by the royalty interest assigned to the trust in each property. The reserves related to the Underlying Properties include all proved reserves expected to be economically produced during the life of the properties. The reserves and revenues attributable to the trust's interests include only the reserves attributable to the Underlying Properties that are expected to be produced within the 20-year period in which the trust owns the term royalty interest as well as the residual interest in the reserves that the trust will own on the Termination Date. A summary of the reserve report is included as Annex A to this prospectus.

| | | | | | | | | | | | | | | |

| | Proved Reserves(1) | |

| |

|---|

| | Oil

(MBbl)(2) | | Natural Gas

(MMcf) | | Total

(MBoe) | | PV-10

Value(3) | |

|---|

| |

| |

| |

| | (Dollars in millions)

| |

|---|

Underlying Properties | | | 30,644 | | | 7,215 | | | 31,847 | | $ | 580.8 | |

Royalty Interests: | | | | | | | | | | | | | |

| | PDP Royalty Interests (80%)(4) | | | 5,577 | | | 1,375 | | | 5,806 | | $ | 213.7 | |

| | Development Royalty Interests (70%) | | | 15,401 | | | 3,570 | | | 15,996 | | $ | 555.8 | |

| | | | | | | | | | |

| | | Total | | | 20,977 | | | 4,945 | | | 21,802 | | $ | 769.5 | |

| | | | | | | | | | |

- (1)

- The proved reserves were determined using a 12-month unweighted arithmetic average of the first-day-of-the-month prices for oil and natural gas for the period from April 1, 2010 through March 1, 2011, without giving effect to derivative transactions, and were held constant for the life of the properties. The prices used in the reserve report, as well as SandRidge's internal reports, yield weighted average prices at the wellhead, which are based on first-day-of-the-month reference prices and adjusted for transportation and regional price differentials. The reference prices and the equivalent weighted average wellhead prices are both presented in the table below.

| | | | | | | | | | | | | |

| | Reference prices | | Weighted average wellhead prices | |

|---|

| | Oil

(per Bbl) | | Natural gas

(per Mcf) | | Oil

(per Bbl) | | Natural gas

(per Mcf) | |

|---|

March 31, 2011 | | $ | 80.04 | | $ | 4.102 | | $ | 75.58 | | $ | 3.003 | |

- (2)

- Includes natural gas liquids.

- (3)

- PV-10 is the present value of estimated future net revenue to be generated from the production of proved reserves, discounted using an annual discount rate of 10%, calculated without deducting future income taxes. PV-10 is a non-GAAP financial measure and generally differs from standardized measure of discounted net cash flows, or Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effects of income taxes on future net revenues. Because the historical financial information related to the Underlying Properties consists solely of revenues and direct operating expenses and does not include the effect of income taxes, we expect the PV-10 and Standardized Measure attributable to the Underlying Properties for each period to be equivalent. Because the trust will not bear federal income tax expense, we also expect the PV-10 and Standardized Measure attributable to the royalty interests for each period to be

12

Table of Contents

equivalent. Neither PV-10 nor Standardized Measure represents an estimate of the fair market value of the Underlying Properties or the royalty interests. We and others in the industry use PV-10 as a measure to compare the relative size and value of proved reserves held by companies without regard to the specific tax characteristics of such entities.

- (4)

- Includes reserves associated with wells in the process of being completed.

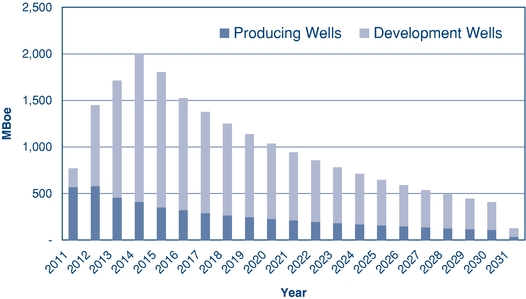

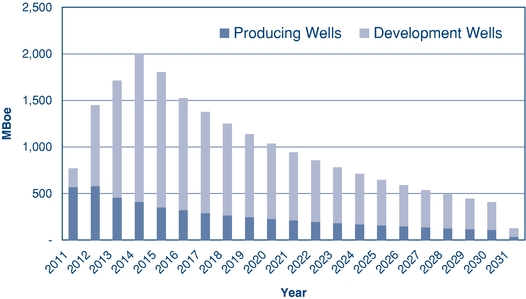

Annual Production Attributable to Royalty Interests. The following bar graph shows estimated annual production from the Producing Wells and the Development Wells based on the pricing and other assumptions set forth in the reserve report. The production estimates include the impact of additional production that is expected as a result of the drilling of the Development Wells.

Key Risk Factors

Below is a summary of certain key risk factors related to the Underlying Properties, the royalty interests and the common units. This list is not exhaustive. Please also read carefully the full discussion of these risks and other risks described under "Risk Factors" beginning on page 18.

- •

- Drilling for and producing oil, natural gas and natural gas liquids on the Underlying Properties are high risk activities with many uncertainties that could delay the anticipated drilling schedule for the Development Wells and adversely affect future production from the Underlying Properties. Any such delays or reductions in production could decrease future revenues that are available for distribution to unitholders.

- •

- Oil, natural gas and natural gas liquids prices fluctuate due to a number of factors that are beyond the control of the trust and SandRidge, and lower prices could reduce proceeds to the trust and cash distributions to unitholders.

- •

- Actual reserves and future production may be less than current estimates, which could reduce cash distributions by the trust and the value of the trust units.

- •

- In certain circumstances the trust may have to make cash payments under the hedging arrangements and these payments could be significant.

- •

- Estimates of target distributions to unitholders, subordination thresholds and incentive thresholds are based on assumptions that are inherently subjective and are subject to significant business,

13

Table of Contents

economic, financial, legal, regulatory and competitive risks and uncertainties that could cause actual cash distributions to differ materially from those estimated.

- •

- The subordination of certain trust units held by SandRidge does not assure that you will in fact receive any specified return on your investment in the trust.

- •

- The hedging arrangements will cover only a portion of the expected production attributable to the trust, and such contracts limit the trust's ability to benefit from commodity price increases for hedged volumes above the corresponding hedge price. In addition, the trust may be required to pay its counterparties under the hedging arrangements. Following this offering, the trust will not have the ability to enter into additional hedges on its own, except in the limited circumstances involving the restructuring of an existing hedge.

- •

- Conflicts of interest could arise between SandRidge and the trust unitholders.

- •

- The trust's tax treatment depends on its status as a partnership for U.S. federal income tax purposes. If the U.S. Internal Revenue Service ("IRS") were to treat the trust as a corporation for U.S. federal income tax purposes, then its cash available for distribution to unitholders would be substantially reduced.

- •

- The tax treatment of an investment in trust units could be affected by recent and potential legislative changes, possibly on a retroactive basis.

- •

- The trust will adopt positions that may not conform to all aspects of existing Treasury Regulations. If the IRS contests the tax positions the trust takes, the value of the trust units may be adversely affected, the cost of any IRS contest will reduce the trust's cash available for distribution and income, gain, loss and deduction may be reallocated among trust unitholders.

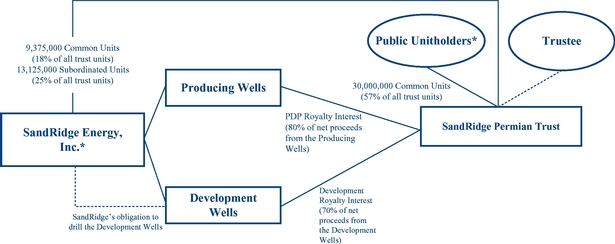

Structure of the Trust

The following chart shows the relationship of SandRidge, the trust and the public unitholders (without giving effect to the exercise of the underwriters' over-allotment option).

- *

- SandRidge will have an effective average net revenue interest of 39.6% in the Producing Wells and 41.6% in the Development Wells. Public unitholders (that is, holders of trust units other than SandRidge) will have an effective average net revenue interest of 33.4% in the Producing Wells and 27.7% in the Development Wells.

14

Table of Contents

THE OFFERING

| | |

Common units offered to public | | 30,000,000 common units (34,500,000 common units, if the underwriters exercise their over-allotment option in full) |

Trust units owned by SandRidge after the offering | | 9,375,000 common units and 13,125,000 subordinated units |

| | (4,875,000 common units and 13,125,000 subordinated units, if the underwriters exercise their over-allotment option in full) |

| | See "The Trust—Formation Transactions." |

Total units outstanding after the offering | | 52,500,000 trust units, consisting of 39,375,000 common units and 13,125,000 subordinated units |

Over-allotment option | | 4,500,000 common units will be issued and retained by the trust at the initial closing, to be used to satisfy (if necessary) the over-allotment option granted to the underwriters. If the over-allotment option is exercised, the trust will sell to the underwriters such number of the retained units as is necessary to satisfy the over-allotment option, and will then deliver the net proceeds of such sale, together with any remaining unsold units, to SandRidge (or a SandRidge subsidiary) as partial consideration for the conveyance of the perpetual royalty interests. If the over-allotment option is not exercised by the underwriters, the retained units will be delivered to SandRidge (or a SandRidge subsidiary), as partial consideration for the conveyance of the perpetual royalty interests, promptly following the 30th day after the initial closing. |

Directed unit program | | The underwriters have reserved up to 5% of the common units being offered by this prospectus for sale to SandRidge's directors, officers, and certain other persons associated with SandRidge, at the initial public offering price. The sales will be made by Morgan Stanley & Co. LLC through a directed unit program. See "Underwriters—Directed Unit Program." |

Use of proceeds | | The trust is offering the common units to be sold in this offering. Assuming no exercise of the underwriters' over-allotment option, the estimated net proceeds of this offering will be approximately $502.6 million, after deducting underwriting discounts and commissions and offering expenses. The trust will deliver the net proceeds to one or more wholly-owned subsidiaries of SandRidge as full consideration for the conveyance of the term royalty interests and, if applicable, as partial consideration for the conveyance of the perpetual royalty interests. |

| | SandRidge intends to use the offering proceeds, including proceeds from any exercise of the underwriters' over-allotment option, to repay borrowings under its credit facility and for general corporate purposes, which may include the funding of the drilling obligation. |

15

Table of Contents

| | |

| | Affiliates of Morgan Stanley & Co. LLC, Deutsche Bank Securities Inc., Goldman, Sachs & Co., J.P. Morgan Securities LLC, RBC Capital Markets, LLC, SunTrust Robinson Humphrey, Inc. and Wells Fargo Securities, LLC are lenders under the SandRidge credit facility being repaid with the offering proceeds being paid to SandRidge and will therefore receive a portion of the proceeds of the offering. See "Use of Proceeds" and "Underwriters." |

NYSE symbol | | "PER" |

Trustee | | The Bank of New York Mellon Trust Company, N.A. |

Quarterly cash distributions | | Quarterly cash distributions during the term of the trust will be made by the trustee on or about the 60th day following the end of each calendar quarter to unitholders of record on or about the 45th day following each calendar quarter. The first distribution, which will cover the second and third quarters of 2011, is expected to be made on or about November 30, 2011 to record unitholders as of November 15, 2011. Due to the timing of the payment of production proceeds to the trust, the trust expects that the first distribution will include sales for oil, natural gas and natural gas liquids for five months. The trustee intends to withhold $1.0 million from the first distribution to establish a cash reserve available for trust administrative expenses. |

| | Actual cash distributions to the trust unitholders will fluctuate quarterly based on the quantity of oil, natural gas and natural gas liquids produced from the Underlying Properties, the prices received for oil, natural gas and natural gas liquids production and other factors. Because payments to the trust will be generated by depleting assets and production from the Underlying Properties will diminish over time, a portion of each distribution will represent a return of your original investment. Given that the production from the Underlying Properties is expected to initially increase and then subsequently decline over time, the target distributions are also expected to initially increase before declining over time. |

Voting rights in the trust | | Matters voted on by trust unitholders will generally be subject to approval by holders of a majority of the common units (excluding common units owned by SandRidge and its affiliates) and holders of a majority of the trust units, in each case voting in person or by proxy at a meeting of such holders at which a quorum is present. SandRidge will not be entitled to vote on the removal of the trustee or appointment of a successor trustee. However, at any time SandRidge and its affiliates own less than 10% of the total trust units outstanding, matters voted on by trust unitholders will be subject to approval by a majority of the trust units, including units owned by SandRidge, voting in person or by proxy at a meeting of such holders at which a quorum is present. |

16

Table of Contents

| | |

Termination of the trust | | The trust will dissolve and begin to liquidate on the Termination Date, which is March 31, 2031, and will soon thereafter wind up its affairs and terminate. At the Termination Date, 50% of the PDP Royalty Interest and 50% of the Development Royalty Interest will revert automatically to SandRidge. The remaining 50% of each of the PDP Royalty Interest and the Development Royalty Interest will be retained by the trust at the Termination Date and thereafter sold, and the net proceeds of the sale, as well as any remaining trust cash reserves, will be distributed to the unitholders in accordance with their interests. SandRidge will have a right of first refusal to purchase the royalty interests retained by the trust at the Termination Date. |

U.S. federal income tax considerations | | The trust will be treated as a partnership for U.S. federal income tax purposes. Consequently, the trust will not incur any U.S. federal income tax liability. Instead, trust unitholders will be allocated an amount of the trust's income, gain, loss or deductions corresponding to their interest in the trust, which amounts may differ in timing or amount from actual distributions. |

| | The Term PDP Royalty will, and the Term Development Royalty should, be treated as debt instruments for U.S. federal income tax purposes. The trust will be required to treat a portion of each payment it receives with respect to each such royalty interests as interest income in accordance with the "noncontingent bond method" under the original issue discount rules contained in the Internal Revenue Code of 1986, as amended, and the corresponding IRS regulations. |

| | The Perpetual PDP Royalty and the Perpetual Development Royalty will be granted on a perpetual basis. The Perpetual PDP Royalty will and the Perpetual Development Royalty should be treated as mineral royalty interests for U.S. federal income tax purposes, generating ordinary income subject to depletion. |

| | Please read "U.S. Federal Income Tax Considerations" for more information. |

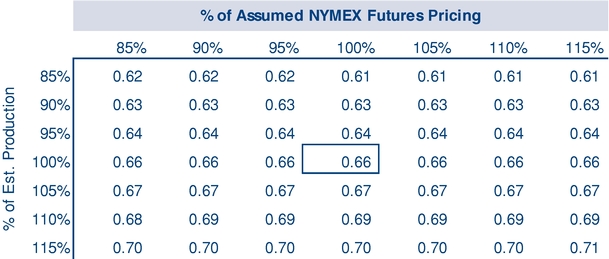

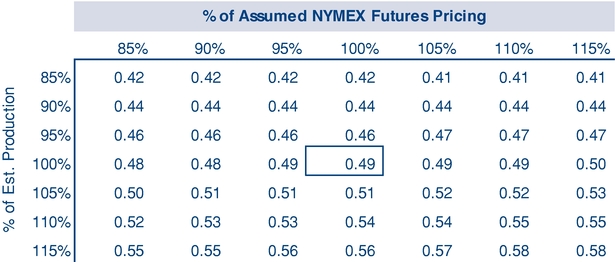

Estimated ratio of taxable income to distributions | | SandRidge estimates that if you own the units you purchase in this offering through the record date for distributions for the period ending December 31, 2013, you will be allocated, on a cumulative basis, an amount of federal taxable income for that period that will be approximately 60% of the cash distributed to you with respect to that period. For example, if you receive an annual distribution of $1.00 per unit, the trust estimates that your average allocable federal taxable income per year will be approximately $.60 per unit. |

| | Please read "U.S. Federal Income Tax Considerations" for more information. |

17

Table of Contents

RISK FACTORS

You should carefully consider the risks described below before making an investment decision. The trust's cash available for distribution could be materially adversely affected by any of these risks. The trading price of the common units could decline due to any of these risks, or you may lose all or part of your investment.

Risks Related to the Units

Drilling for and producing oil, natural gas and natural gas liquids on the Underlying Properties are high risk activities with many uncertainties that could delay the anticipated drilling schedule for the Development Wells and adversely affect future production from the Underlying Properties. Any such delays or reductions in production could decrease future revenues that are available for distribution to unitholders.

The drilling and completion of the Development Wells are subject to numerous risks beyond SandRidge's and the trust's control, including risks that could delay the current drilling schedule for the Development Wells and the risk that drilling will not result in commercially viable oil, natural gas and natural gas liquids production. Drilling for oil, natural gas and natural gas liquids can be unprofitable if dry wells are drilled and if productive wells do not produce sufficient revenues to return a profit. SandRidge's and third-party operators' decisions to develop or otherwise exploit certain areas within the AMI will depend in part on the evaluation of data obtained through geophysical and geological analyses, production data and engineering studies, the results of which are often inconclusive or subject to varying interpretations. The costs of drilling, completing and operating wells are often uncertain before drilling commences. Overruns in budgeted expenditures are common risks that can make a particular project uneconomical. There can be no assurance that a Development Well that is successfully completed will pay out the capital costs spent to drill it. Drilling and production operations on the Underlying Properties may be curtailed, delayed or canceled as a result of various factors, including the following:

- •

- delays imposed by or resulting from compliance with regulatory requirements including permitting;

- •

- unusual or unexpected geological formations and miscalculations;

- •

- shortages of or delays in obtaining equipment and qualified personnel;

- •

- equipment malfunctions, failures or accidents;

- •

- lack of available gathering facilities or delays in construction of gathering facilities;

- •

- lack of available capacity on interconnecting transmission pipelines;

- •

- lack of adequate electrical infrastructure;

- •

- unexpected operational events and drilling conditions;

- •

- pipe or cement failures and casing collapses;

- •

- pressures, fires, blowouts, and explosions;

- •

- lost or damaged drilling and service tools;

- •

- loss of drilling fluid circulation;

- •

- uncontrollable flows of oil, natural gas and natural gas liquids water or drilling fluids;

- •

- natural disasters;

- •

- environmental hazards, such as oil, natural gas and natural gas liquids leaks, pipeline ruptures and discharges of toxic gases or fluids;

- •

- adverse weather conditions such as extreme cold, fires caused by extreme heat or lack of rain, and severe storms or tornadoes;

18

Table of Contents

- •

- reductions in oil, natural gas and natural gas liquids prices;

- •

- oil and natural gas property title problems; and

- •

- market limitations for oil, natural gas and natural gas liquids.

In the event that drilling of Development Wells is delayed or the Producing Wells or Development Wells have lower than anticipated production due to one of the factors above or for any other reason, cash distributions to unitholders may be reduced. In addition, wells drilled in the Permian Basin in the AMI typically produce a large volume of water, which requires the drilling of saltwater disposal wells. SandRidge's inability to drill these wells or otherwise dispose of the water produced from the Producing Wells and Development Wells in an efficient manner could delay production and therefore the trust's receipt of proceeds from the royalty interests.

Oil, natural gas and natural gas liquids prices fluctuate due to a number of factors that are beyond the control of the trust and SandRidge, and lower prices could reduce proceeds to the trust and cash distributions to unitholders.

The trust's reserves and quarterly cash distributions are highly dependent upon the prices realized from the sale of oil, natural gas and natural gas liquids. The markets for these commodities are very volatile. Oil, natural gas and natural gas liquids prices can fluctuate widely in response to a variety of factors that are beyond the control of the trust and SandRidge. These factors include, among others:

- •

- regional, domestic and foreign supply, and perceptions of supply, of oil, natural gas and natural gas liquids;

- •

- the price of foreign imports;

- •

- U.S. and worldwide political and economic conditions;

- •

- the level of demand, and perceptions of demand, for oil, natural gas and natural gas liquids;

- •

- weather conditions and seasonal trends;

- •

- anticipated future prices of oil, natural gas and natural gas liquids, alternative fuels and other commodities;

- •

- technological advances affecting energy consumption and energy supply;

- •

- the proximity, capacity, cost and availability of pipeline infrastructure, treating, transportation and refining capacity;

- •

- acts of force majeure;

- •

- domestic and foreign governmental regulations and taxation;

- •

- energy conservation and environmental measures; and

- •

- the price and availability of alternative fuels.

For oil, from 2007 through 2010, the highest monthly NYMEX settled price was $140.00 per Bbl and the lowest was $41.68 per Bbl. For natural gas, from 2007 through 2010, the highest monthly NYMEX settled price was $13.35 per MMBtu and the lowest was $2.98 per MMBtu. In addition, the market price of oil and natural gas is generally higher in the winter months than during other months of the year due to increased demand for oil and natural gas for heating purposes during the winter season.

Lower oil, natural gas and natural gas liquids prices will reduce proceeds to which the trust is entitled and may ultimately reduce the amount of oil, natural gas and natural gas liquids that is economic to produce from the Underlying Properties. As a result, SandRidge or any third-party operator of any of the Underlying Properties could determine during periods of low oil, natural gas and natural gas liquids prices to shut in or curtail production from wells on the Underlying Properties. In addition, the operator of the

19

Table of Contents

Underlying Properties could determine during periods of low oil and natural gas prices to plug and abandon marginal wells that otherwise may have been allowed to continue to produce for a longer period under conditions of higher prices. Specifically, SandRidge or any third party operator may abandon any well or property if it reasonably believes that the well or property can no longer produce oil, natural gas and natural gas liquids in commercially economic quantities. This could result in termination of the portion of the royalty interest relating to the abandoned well or property, and SandRidge would have no obligation to drill a replacement well. The volatility of oil, natural gas and natural gas liquids prices also reduces the accuracy of target distributions to trust unitholders. For a discussion of certain risks related to the trust's hedging arrangements, see "—The hedging arrangements for the trust will cover only a portion of the production attributable to the trust, and such arrangements will limit the trust's ability to benefit from commodity price increases for hedged volumes above the corresponding hedge price."

Actual reserves and future production may be less than current estimates, which could reduce cash distributions by the trust and the value of the trust units.

The value of the trust units and the amount of future cash distributions to the trust unitholders will depend upon, among other things, the accuracy of the future production estimated to be attributable to the trust's royalty interests. See "The Underlying Properties—Oil, Natural Gas and Natural Gas Liquids Reserves" for a discussion of the method of allocating proved reserves to the trust. It is not possible to measure underground accumulations of oil, natural gas and natural gas liquids in an exact way, and estimating reserves is inherently uncertain. Ultimately, actual production and revenues for the Underlying Properties could be materially less than estimated amounts. Petroleum engineers are required to make subjective estimates of underground accumulations of oil, natural gas and natural gas liquids based on factors and assumptions that include:

- •

- historical production from the area compared with production rates from other producing areas;

- •

- oil, natural gas and natural gas liquids prices, production levels, Btu content, production expenses, transportation costs, severance and excise taxes and capital expenditures; and

- •

- the assumed effect of governmental regulation.

Changes in these assumptions or actual production costs incurred and results of actual development could materially decrease reserve estimates. As with all drilling programs, there is a risk that the quality of the target reservoir is less than that assumed for purposes of the reserve report. As a result, you may not receive the benefit of the total amount of proved undeveloped reserves reflected in the reserve report, notwithstanding the fact that SandRidge has satisfied its drilling obligation. See "Summary—The Development Wells."

In certain circumstances the trust may have to make cash payments under the hedging arrangements and these payments could be significant.