- APTV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Aptiv (APTV) DEF 14ADefinitive proxy

Filed: 14 Mar 22, 4:02pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

Aptiv PLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

To our Shareholders:

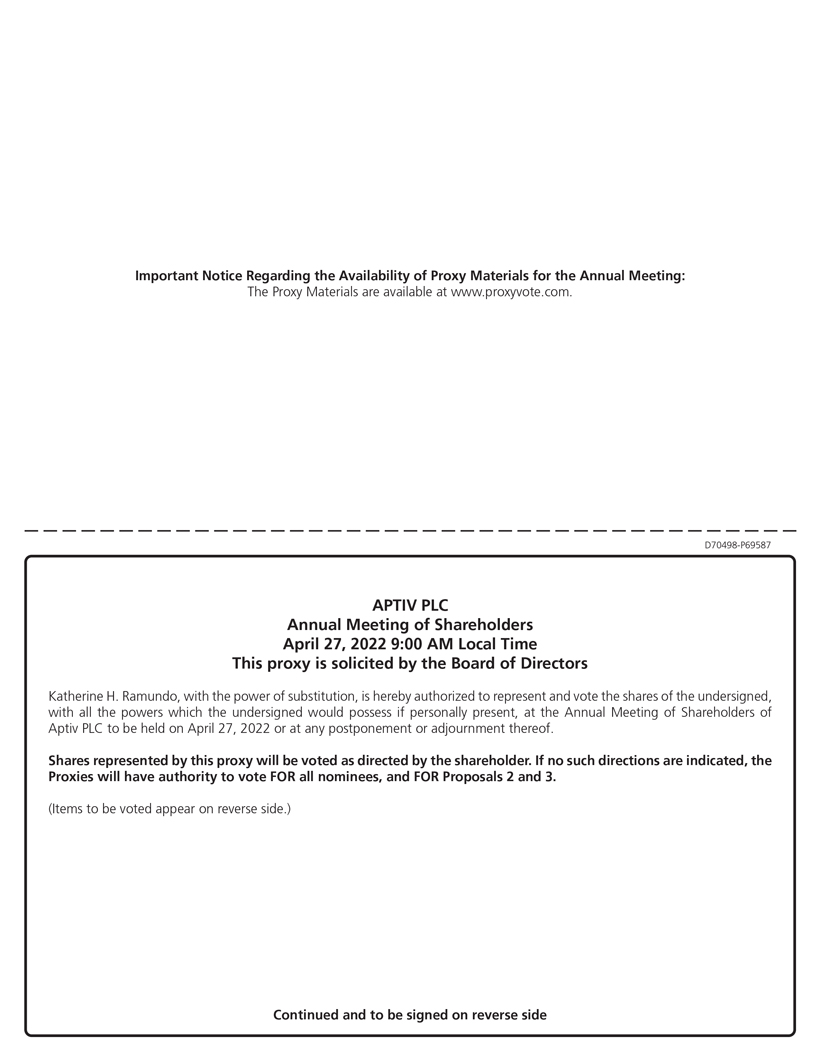

I am pleased to invite you to Aptiv PLC’s Annual General Meeting of Shareholders to be held on Wednesday, April 27, 2022, at 9:00 a.m. local time, at Powerscourt Hotel, Powerscourt Estate, Enniskerry, Co. Wicklow, A98 DR12, Ireland.

The following Notice of Annual General Meeting of Shareholders and Proxy Statement describes the business that will be conducted at the Annual Meeting. You can find financial and other information about Aptiv in the accompanying Form 10-K for the fiscal year ended December 31, 2021. These materials are also available on our website, aptiv.com.

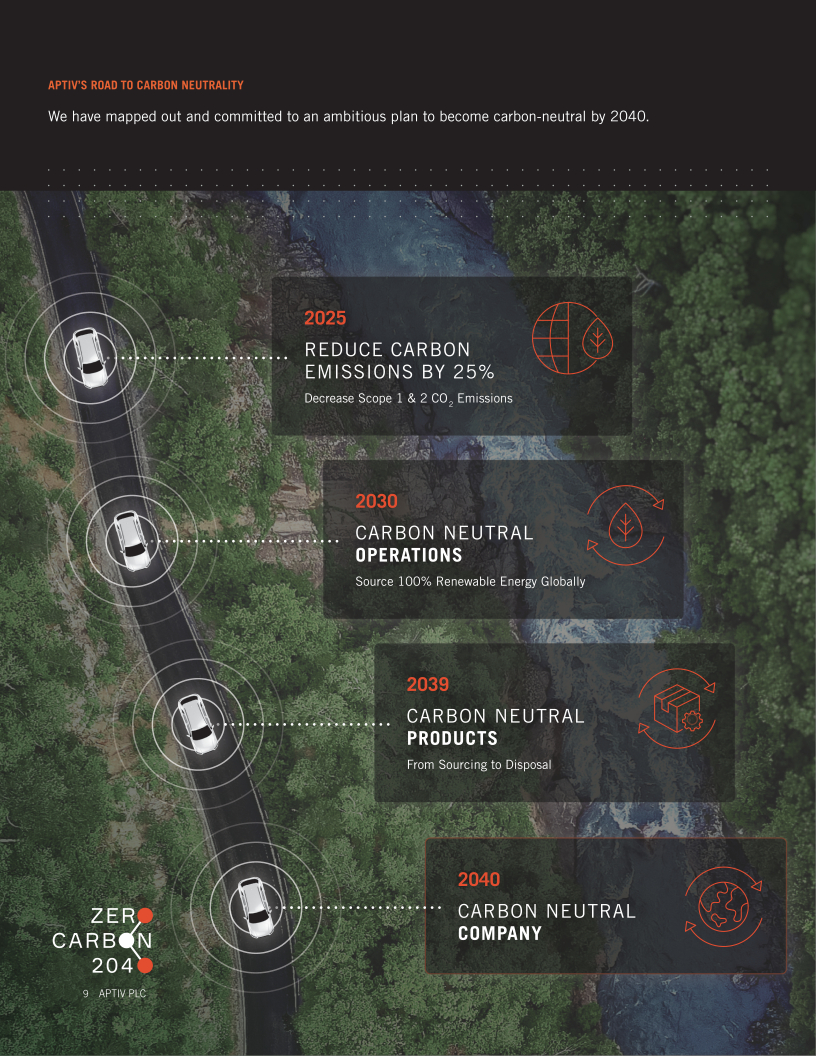

Aptiv is a global technology company that develops safer, greener and more connected solutions enabling the future of mobility. We envision a future with zero vehicle-related injuries or fatalities and have developed active safety technologies that have the potential to meaningfully save lives. We also see an acceleration in the adoption of vehicle electrification and have industry-leading high-voltage solutions that reduce CO2 emissions and enable our customers’ electrified vehicle designs. Our dedication to a sustainable future of our planet goes beyond just our products with our proud commitment to being carbon neutral by 2040. Lastly, our software enables seamless connectivity between vehicles, their passengers and the environments in which they operate. In short, Aptiv’s success emanates from a strong, sustainable business that makes the world a better place.

Despite the continued industry disruptions in 2021, our commitment to our mission and values has allowed us to effectively execute on our strategy, continue to proactively position Aptiv for the future and enhance the resiliency of our business model. These efforts have translated into greater value for all of our stakeholders.

Your vote is very important to us. I encourage you to sign and return your proxy card or use telephone or Internet voting so that your shares will be represented and voted at the meeting.

Thank you for your continued support. We look forward to seeing you on April 27, 2022.

Sincerely,

Kevin P. Clark

President and Chief Executive Officer

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Notice of Annual General Meeting of Shareholders

Wednesday, April 27, 2022 9:00 a.m. Local Time | Powerscourt Hotel Resort & Spa Powerscourt Estate, Enniskerry, Co. Wicklow, A98 DR12, Ireland

| Record Date The close of business March 2, 2022 |

Meeting Agenda

Presenting the Company’s accounts and auditors’ reports for the fiscal year ended December 31, 2021 to the shareholders, passing the following resolutions, and transacting such other business as may properly come before the Annual Meeting:

| • | Ordinary Resolutions |

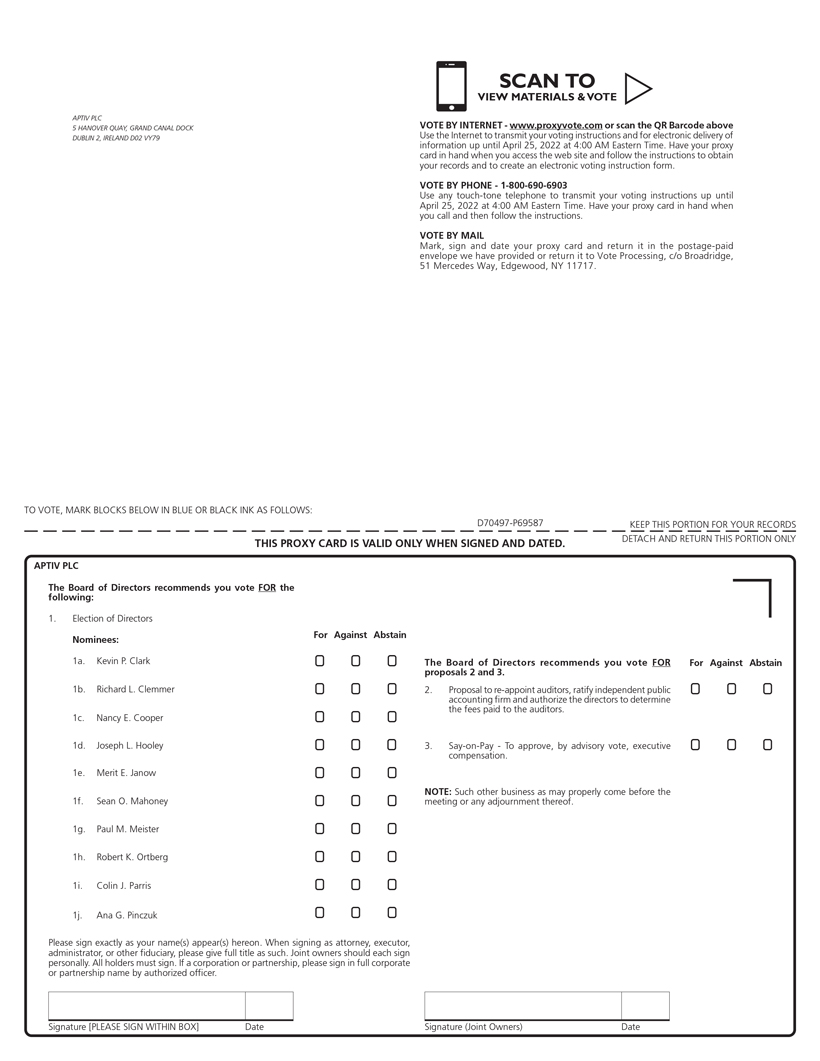

Election of Directors

THAT the following directors be elected as directors of the Company: |

| 1) | Kevin P. Clark |

| 2) | Richard L. Clemmer |

| 3) | Nancy E. Cooper |

| 4) | Joseph L. Hooley |

| 5) | Merit E. Janow |

| 6) | Sean O. Mahoney |

| 7) | Paul M. Meister |

| 8) | Robert K. Ortberg |

| 9) | Colin J. Parris |

| 10) | Ana G. Pinczuk |

Auditors

| 11) | THAT Ernst & Young LLP be re-appointed as the auditors of the Company until the Annual Meeting of the Company to be held in 2023, that the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm is ratified and that directors are authorized to determine the fees to be paid to the auditors. |

| • | Advisory, Non-Binding Resolution |

Executive Compensation

| 12) | THAT the Company’s shareholders approve, on an advisory, non-binding basis, the Company’s executive compensation. |

Resolutions 1 to 11 will be proposed as ordinary resolutions, and Resolution 12 will be proposed as an advisory, non-binding resolution.

| • | Record Date |

You are entitled to vote only if you were a shareholder of Aptiv PLC at the close of business on March 2, 2022. Holders of ordinary shares of Aptiv are entitled to one vote for each share held of record on the record date.

| • | Attendance at the Annual Meeting |

We hope you will be able to attend the Annual Meeting in person. If you expect to attend, please check the appropriate box on the proxy card when you return your proxy or follow the instructions on your proxy card to vote and confirm your attendance by telephone or Internet.

APTIV PLC 1

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Notice of Annual General Meeting of Shareholders (continued)

| • | Where to Find More Information about the Resolutions and Proxies |

Additional information regarding the business to be conducted and the resolutions is set out in the proxy statement (the “Proxy Statement”) and other proxy materials, which can be accessed by following the instructions on the Notice of Internet Availability of Proxy Materials that accompanies this Notice of Annual Meeting of Shareholders.

You are entitled to appoint one or more proxies to attend the Annual Meeting and vote on your behalf. Your proxy does not need to be a shareholder of the Company. Instructions on how to appoint a proxy are set out in the Proxy Statement and on the proxy card.

BY ORDER OF THE BOARD OF DIRECTORS

Katherine H. Ramundo,

Senior Vice President,

Chief Legal Officer, Chief

Compliance Officer and

Secretary

PLEASE NOTE THAT YOU WILL NEED PROOF THAT YOU OWN APTIV SHARES AS OF THE RECORD DATE TO BE ADMITTED TO THE ANNUAL MEETING.

This Notice of Annual Meeting of Shareholders and the Proxy Statement are being distributed or made available on or about March 14, 2022.

| 2 | APTIV PLC |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

| APTIV PLC | 3 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Table of Contents (continued)

| 43 | ||||

| 44 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION (RESOLUTION 12) | 56 | |||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 4 | APTIV PLC |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Table of Contents (continued)

| 60 | ||||

|

| 60

|

| |

|

| 60

|

| |

Shareholder Proposals for the 2023 Annual Meeting

|

| 60

|

| |

|

| 60

|

| |

|

| 60

|

| |

Voting prior to the Annual Meeting

|

| 60

|

| |

Changing Your Vote before the Annual Meeting

|

| 60

|

| |

|

| 61

|

| |

|

| 61

|

| |

|

| 61

|

| |

|

| 61

|

| |

|

| 61

|

| |

Accessing Proxy Materials on the Internet

|

| 61

|

| |

|

| 61

|

| |

|

| 61

|

| |

Corporate Governance Information

|

| 62

|

| |

Voting Results for the Annual Meeting

|

| 62

|

| |

Requests for Copies of Annual Report

|

| 62

|

| |

|

| 62

|

| |

| A-1 | ||||

| APTIV PLC | 5 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

2022 Proxy Statement — Summary

This summary highlights information contained elsewhere in the Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

ANNUAL MEETING OF SHAREHOLDERS

Date: April 27, 2022

Time: 9:00 a.m. local time

Location: Powerscourt Hotel Powerscourt Estate, Enniskerry, Co. Wicklow, A98 DR12, Ireland

Record Date: March 2, 2022

GENERAL INFORMATION

Stock Symbol: APTV

Exchange: NYSE

Ordinary Shares Outstanding (as of the record date): 270,915,354 shares

Registrar & Transfer Agent: Computershare Investor Services

Corporate Website: aptiv.com

Investor Relations Website: ir.aptiv.com

SHAREHOLDER VOTING MATTERS

| Proposal | Board’s Voting Recommendation | |

Election of Directors |

FOR EACH

| |

Ratification of Appointment of Independent Registered Public Accounting Firm

| FOR

| |

Advisory Vote to Approve Named Executive Officer Compensation

| FOR

|

BOARD MEETING INFORMATION

Board Meetings in 2021: 9

Standing Board Committee Meetings in 2021:

Audit (5), Compensation and Human Resources (6), Finance (8), Innovation and Technology (5), Nominating and Governance (5)

DIRECTOR NOMINEES

| Name | Director Since | Independent | ||

Kevin P. Clark | 2015 | |||

Richard L. Clemmer | 2020 | X | ||

Nancy E. Cooper | 2018 | X | ||

Joseph L. Hooley | 2020 | X | ||

Merit E. Janow | 2021 | X | ||

Sean O. Mahoney | 2009 | X | ||

Paul M. Meister | 2019 | X | ||

Robert K. Ortberg | 2018 | X | ||

Colin J. Parris | 2017 | X | ||

Ana G. Pinczuk | 2016 | X |

Two long-standing directors, our Executive Chairman, Rajiv L. Gupta and Nicholas M. Donofrio, are retiring from the Aptiv Board of Directors, and not standing for re-election. Aptiv thanks them for their years of valuable service.

NAMED EXECUTIVE OFFICERS

| • | Kevin P. Clark - President and Chief Executive Officer |

| • | Joseph R. Massaro - Chief Financial Officer and Senior Vice President, Business Operations |

| • | William T. Presley - Senior Vice President and President, Signal & Power Solutions |

| • | Katherine H. Ramundo - Senior Vice President, Chief Legal Officer, Chief Compliance Officer and Secretary |

| • | Mariya K. Trickett - Senior Vice President and Chief Human Resources Officer |

CORPORATE GOVERNANCE BEST PRACTICES

| ✓ | 11 of 12 Independent Directors and 9 of 10 Independent Nominees | |

| ✓ | Non-Executive Chairman, transitioning to a Lead Independent Director | |

| ✓ | Annual Election of Directors | |

| ✓ | Board Diversity and Experience | |

| ✓ | Annual Board and Committee Evaluations |

COMPENSATION BEST PRACTICES

| ✓ | Robust Stock Ownership Guidelines | |

| ✓ | Clawback Policy | |

| ✓ | Restrictive Covenants for Executives | |

| ✓ | No Excise Tax Gross-Ups | |

| ✓ | No Hedging/No Pledging |

| APTIV PLC | 6 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

(Resolutions 1 to 10)

All of our current directors, other than Nicholas M. Donofrio and Rajiv L. Gupta, who are retiring as of the Annual Meeting, consistent with Aptiv’s director retirement policy, are nominated for one-year terms to serve until the 2023 annual meeting, or until such director’s earlier resignation, retirement or other termination of service. The Board extends its appreciation to Mr. Donofrio and Mr. Gupta for their years of service and thanks them for giving generously of their time. Mr. Donofrio’s significant technology focus and expertise has provided Aptiv and its Board and management with valuable insight regarding our technology and innovation strategies. Mr. Gupta, in his role as Chairman of the Board and Chair of the Nominating and Governance Committee, as well as stints as Chair of the Compensation and Human Resources Committee, has consistently provided Aptiv with independent insight and advice. His expertise in corporate governance and executive compensation has been invaluable to the Board and to Aptiv. The Board will miss their camaraderie, commitment, insight and perspective.

The Board believes that the combination of the various qualifications, skills, and breadth and depth of experiences of the director nominees contributes to an effective and well-functioning Board. The Board and the Nominating and Governance Committee believe that, individually and as a whole, the directors possess the necessary qualifications to provide effective oversight of the business and quality advice and counsel to the Company’s management. Included in each director nominee’s biography below is an assessment of each of their specific qualifications, attributes, skills and experience. Committee memberships listed below are as of the date of this Proxy Statement.

The Board has been informed that each nominee is willing to continue to serve as a director. If a director does not receive a majority of the vote for his or her election, then that director will not be elected to the Board, and the Board may fill the vacancy with a different person, or the Board may reduce the number of directors to eliminate the vacancy. Mr. Mahoney was a member of the Board prior to the Company’s initial public offering in 2011, and information included in this Proxy Statement as to his tenure on our Board reflects that service.

Kevin P. Clark

In March 2015, Mr. Clark became Aptiv’s President and Chief Executive Officer. In 2014, Mr. Clark was appointed Chief Operating Officer responsible for Aptiv’s business divisions, as well as the Global Supply Management function. Mr. Clark joined Aptiv in 2010 as Chief Financial Officer, responsible for all financial activities including strategic planning, corporate development, financial planning and analysis, treasury, accounting, and tax. Before coming to Aptiv, he was a founding partner of Liberty Lane Partners, LLC, a private equity investment firm focused on investing in and building and improving middle-market companies. Mr. Clark served as Chief Financial Officer of Fisher-Scientific International Inc., a manufacturer, distributor and service provider to the global healthcare market, from the company’s initial public offering in 2001 through the completion of its merger with Thermo Electron Corporation in 2006. He also held a number of senior management positions at Fisher-Scientific. Mr. Clark began his career in the financial organization of Chrysler Corporation. He has both a bachelor’s degree in financial administration and a master’s degree in finance from Michigan State University.

| Non-Independent Director

Director since: March 2015

Committee Membership: None

Qualifications: Mr. Clark is a proven leader with notable success in creating and implementing Aptiv’s business and technology strategies. As our CEO and former COO and CFO, Mr. Clark provides the Board significant strategic, financial and industry expertise.

Other Current Public Boards: None

Age: 59

| |

| APTIV PLC | 10 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Election of Directors (continued)

Richard L. Clemmer

Mr. Clemmer is a global technology CEO, most recently leading the turnaround of NXP Semiconductors N.V. as Chief Executive Officer and President, a position he held from 2009 to May 2020. Prior to NXP, he was a senior advisor to Kohlberg Kravis Roberts & Co., a private equity firm, from 2007 to 2008. He also served as President and Chief Executive Officer of Agere Systems Inc., an integrated circuits components company from 2005 to 2007. Prior to joining Agere Systems, Mr. Clemmer held a number of executive leadership positions at Texas Instruments and Quantum Corporation. He holds a bachelor’s degree in business administration from Texas Tech University and a master of business administration from Southern Methodist University. | Independent Director

Director since: July 2020

Committee Membership: Finance Committee and Innovation and Technology Committee

Qualifications: Mr. Clemmer brings to the Board significant leadership experience in the high-tech industry, including experience with semiconductor and software companies, and valuable experience leading organizations through strategic transactions.

Other Current Public Boards: HP Inc.

Former Public Boards: NCR Corporation (2008-2020), NXP Semiconductors N.V. (2009-2020)

Age: 70 | |

| ||

Nancy E. Cooper

Ms. Cooper is the former Executive Vice President and Chief Financial Officer of CA Technologies (“CA”), an IT management software provider, a position she held from August 2006 until she retired in May 2011. Prior to joining CA, Ms. Cooper served as the Chief Financial Officer of IMS Health, Inc. from 2001 to 2006 and, prior to that, as Chief Financial Officer for Reciprocal, Inc. from 2000 to 2001. Ms. Cooper began her career at IBM Corporation in 1976, where she held positions of increasing responsibilities over a 22-year period that focused on technology strategy and financial management. Ms. Cooper received a bachelor of arts degree in both economics and political science from Bucknell University and a master of business administration from the Harvard Graduate School of Business.

| Independent Director

Director since: February 2018

Committee Membership: Audit Committee (Chair) and Innovation and Technology Committee

Qualifications: Ms. Cooper brings to the Board significant experience leading a global public finance organization, and contributes financial, risk management, technology and strategy expertise.

Other Current Public Boards: Brunswick Corporation

Former Public Boards: The Mosaic Company (2011-2021) and Teradata Corporation (2009-2017)

Age: 68 | |

| 11 | APTIV PLC |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Election of Directors (continued)

Joseph L. Hooley

Mr. Hooley is the former Chairman of the Board and Chief Executive Officer of State Street Corporation, one of the world’s leading providers of financial services to institutional investors. He retired as the non-executive Chairman of the Board of State Street, effective December 31, 2019, and as its Chief Executive Officer on December 31, 2018. He served as State Street’s Chairman from 2011 to 2019, Chief Executive Officer from 2010 to 2018 and President and Chief Operating Officer from 2008 to 2014. From 2002 to 2008, Mr. Hooley served as Executive Vice President and head of the Investor Services Division of State Street and, in 2006, was appointed Vice Chairman and Global Head of Investment Servicing and Investment Research and Trading of State Street. Mr. Hooley holds a bachelor of science degree from Boston College.

| Independent Director

Director since: January 2020

Committee Membership: Audit Committee and Compensation and Human Resources Committee

Qualifications: Mr. Hooley’s long tenure as a public company executive leading a global financial services organization provides the Board significant expertise in management, strategic planning, corporate governance and a global business perspective.

Other Current Public Boards: Exxon Mobil Corporation �� Former Public Boards: State Street Corporation (2009-2019)

Age: 64 | |

| ||

Merit E. Janow

Professor Janow is the Former Dean of the Faculty (from 2013-2021) and ongoingly Professor of Practice, School of International and Public Affairs (SIPA) at Columbia University, a position she has held since 1993. Previously, she directed the graduate program in international finance and economic policy. Professor Janow regularly teaches graduate courses in international economic policy and law both at SIPA and Columbia Law School. She has published numerous articles and several books. Professor Janow has had three periods of government service, serving as one of seven members of the WTO’s Appellate Body from 2003 to 2007, as the Executive Director, the International Competition Policy Advisory Committee of the U.S. Department of Justice, Antitrust Division from 1997 to 2000, and Deputy Assistant U.S. Trade Representative for Japan and China from 1990 to 1993. Professor Janow served on the board of directors and as chair of the Nasdaq Stock Markets LLC of the Nasdaq OMX Group from 2005 to 2016. She holds a bachelor of arts degree from the University of Michigan and a juris doctorate from Columbia Law School.

| Independent Director

Director since: April 2021

Qualifications: Professor Janow is qualified to serve as director of the Company based on her extensive knowledge and experience in international trade, economics, policy and regulatory matters which provide valuable insight to the Company given the global nature of its business.

Other Current Public Boards: Mastercard Inc.

Former Public Boards: Trimble Inc. (2008-2021)

Age: 63 | |

| APTIV PLC | 12 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Election of Directors (continued)

Sean O. Mahoney

Mr. Mahoney is a private investor with over three decades of experience in investment banking and finance. Mr. Mahoney spent 17 years in investment banking at Goldman, Sachs & Co., where he was a partner and head of the Financial Sponsors Group, followed by four years at Deutsche Bank Securities, where he served as Vice Chairman, Global Banking. During his banking career, Mr. Mahoney acted as an advisor to companies across a broad range of industries and product areas. He earned his undergraduate degree from the University of Chicago and his graduate degree from Oxford University, where he was a Rhodes Scholar. | Independent Director

Director since: November 2009

Committee Membership: Finance Committee and Nominating and Governance Committee

Qualifications: Through his experience in investment banking and finance, Mr. Mahoney provides the Board with expertise in financial and business strategy, capital markets, financing, and mergers and acquisitions.

Other Current Public Boards: None

Former Public Boards: Alcoa Inc. (2016), Cooper-Standard Holdings, Inc. (2015-2018), Howmet Aerospace Inc. (formerly Arconic Inc.) (2016-2020) and iHeartMedia, Inc. (2019-2021)

Age: 59 | |

Paul M. Meister

Mr. Meister is a partner in Novalis LifeSciences, a life science venture firm and is also co-founder, and Chief Executive Officer of Liberty Lane Partners, LLC, a private investment company with investment holdings in healthcare, technology and distribution-related industries. From 2014 to 2018, he was President of MacAndrews & Forbes Incorporated (“M&F”), a private company that owns or controls a diverse set of businesses. During 2018, Mr. Meister also served, on an interim basis, as Executive Vice Chairman of Revlon, Inc. a leading beauty products company, and acted as Revlon’s principal executive officer. Mr. Meister served from 2010 to 2014 as Chairman and Chief Executive Officer of inVentiv Health (now Syneos Health), a leading provider of commercial, consulting and clinical research services to the pharmaceutical and biotech industries. Mr. Meister was Chairman of Thermo Fisher Scientific, Inc., a scientific instruments equipment and supplies company, from November 2006 to April 2007. He was previously an Executive Officer of Fisher Scientific International, Inc., a predecessor of Thermo Fisher Scientific from 1991 to 2006. Mr. Meister holds a bachelor of arts degree from the University of Michigan and a master of business administration from Northwestern University. | Independent Director

Director since: July 2019

Committee Membership: Compensation and Human Resources Committee and Finance Committee

Qualifications: Mr. Meister’s extensive public company experience, as both an executive and a board member, provides the Board with significant expertise in management, strategy, finance and capital markets, operations and mergers and acquisitions.

Other Current Public Boards: Amneal Pharmaceuticals, Inc., Oaktree Acquisition Corp. II and Quanterix Corporation

Former Public Boards: LKQ Corporation (1999-2018), Revlon, Inc. (2016-2018), Scientific Games Corporation (2012-2020) and vTv Therapeutics Inc. (2015-2018)

Age: 69 | |

| 13 | APTIV PLC |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Election of Directors (continued)

Robert K. Ortberg

Mr. Ortberg is the former Chief Executive Officer of Collins Aerospace, a United Technologies company, a position he held from December 2018 to February 2020. Following his retirement from Collins Aerospace, he served as a Special Advisor to the office of the Chief Executive Officer for Raytheon Technologies Corporation, an aerospace and defense company that provides advanced systems and services for commercial, military and government customers worldwide until March 2021. He previously served as the Chief Executive Officer of Rockwell Collins from 2013 to 2018 and served as its President from 2012 to 2018. He served as Rockwell Collins’ Executive Vice President, Chief Operating Officer, Government Systems from 2010 to 2012 and as its Executive Vice President, Chief Operating Officer, Commercial Systems from 2006 to 2010. Prior to that time, he held other executive positions at Rockwell Collins, which he joined in 1987. Mr. Ortberg has a bachelor of science degree in mechanical engineering from the University of Iowa. | Independent Director

Director since: September 2018

Committee Membership: Audit Committee and Innovation and Technology Committee

Qualifications: Mr. Ortberg brings to the Board a track record of operational and technology leadership, accelerating company growth and creating shareholder value, coupled with a strong background in transformation and innovation.

Other Current Public Boards: Raytheon Technologies Corporation

Former Public Boards: Rockwell Collins, Inc. (2013-2018)

Age: 61 | |

Colin J. Parris

Dr. Parris currently serves as the Senior Vice President and Chief Technology Officer at GE Digital, a position he has held since May 2020. He joined the General Electric Company in 2014 as the Vice President, GE Software Research. Prior to joining GE, he spent two decades at IBM in a variety of executive roles, serving most recently as Vice President, Systems Research in the IBM T.J. Watson Research Division from 2013 to 2014 and General Manager for IBM’s Power Systems business from 2010 to 2013. Dr. Parris received a bachelor’s degree in electrical engineering from Howard University, a master’s degree in management from Stanford University, and master’s degrees in electrical engineering and computer science, and a doctorate in electrical engineering from the University of California, Berkeley. | Independent Director

Director since: December 2017

Committee Membership: Audit Committee and Innovation and Technology Committee

Qualifications: Dr. Parris has an extensive technology background with significant experience in software and leading digital transformations. His current focus on data software and artificial intelligence provides valuable knowledge to the Board.

Other Current Public Boards: None

Age: 60 | |

| APTIV PLC | 14 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Election of Directors (continued)

Ana G. Pinczuk

Ms. Pinczuk serves as the Chief Development Officer for Anaplan, Inc., a position she has held since August 2019. Anaplan provides a cloud-based connected planning platform that helps connect organizations and people to make better and faster decisions. She joined Anaplan in February 2019 as the Chief Transformation Officer. Prior to that, she held positions as the President of Hewlett Packard Enterprise’s Pointnext technology services organization, the Executive Vice President and Chief Product Officer of Veritas Technologies LLC, a data management provider specializing in information protection, availability, and insight solutions, and Senior Vice President and General Manager, Backup and Recovery for Symantec Corporation, all in the period from 2015 to 2018. From 2000 until 2015, Ms. Pinczuk served in various executive positions with Cisco Systems, Inc., including serving as Senior Vice President, Sales from 2014 to 2015, Senior Vice President, Services Transformation and Chief Operating Officer from 2013 to 2014, and Vice President, Global Technical Services from 2009 until 2013. Prior to joining Cisco, Ms. Pinczuk spent 15 years with AT&T, Inc., in positions of increasing responsibility. Ms. Pinczuk earned both undergraduate and graduate mechanical engineering degrees from Cornell University, an executive master’s degree in technology management from the University of Pennsylvania and a master’s degree in software management from Carnegie Mellon University. | Independent Director

Director since: November 2016

Committee Membership: Audit Committee and Innovation and Technology Committee

Qualifications: Ms. Pinczuk’s broad technology background spans mobile, IP networking, software, data storage and security, making her a strong contributor to the Board as Aptiv accelerates its innovation in new mobility technologies.

Other Current Public Boards: Five9, Inc.

Former Public Boards: KLA–Tencor Corporation (2018-2019)

Age: 58 | |

The Board of Directors recommends a vote “FOR” each of the 10 director nominees named above. If you complete the enclosed proxy card, unless you direct otherwise on that card, the shares represented by that proxy will be voted FOR the election of all 10 nominees.

| 15 | APTIV PLC |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Board and Governance Information

The Company is committed to good corporate governance, which we believe is important to the success of our business and to advancing shareholder interests. Highlights include:

Board Independence and Accountability

Board Independence | ✓ 9 of 10 director nominees are independent. Our Chief Executive Officer is the only non-independent director. | |

Board Leadership | ✓ Current Board leadership structure is comprised of a Non- Executive Chairman of the Board and independent chairs of each Board committee. As of the Annual Meeting, we will transition to a Lead Independent Director and Executive Chair. | |

Board Engagement | ✓ Attendance:

• All directors attended more than 75% of Board and their respective Committee meetings in 2021; in fact, director attendance in 2021 averaged 99%.

• All director nominees are expected to attend the Annual Meeting.

✓ Independent directors meet in executive session at every regular Board and Board committee meeting. | |

Board Composition and Diversity | ✓ Directors have a diversity of experience that spans a broad range of industries.

✓ Directors have a broad array of attributes and skills directly relevant to the Company.

✓ 4 of our 10 director nominees are female and/or racially/ethnically diverse.

✓ No director should stand for election if the director has reached age 75, unless the Board determines that such director’s continued service is in the Company’s interest. | |

Board Committees | ✓ Fully independent Audit, Compensation and Human Resources, Finance, Innovation and Technology and Nominating and Governance Committees.

✓ Each Committee has a written charter that is reviewed on an annual basis and is available on our website. | |

Board Accountability | ✓ Annual elections of all directors.

✓ Majority voting standards for election of directors.

✓ Annual Say-on-Pay vote.

✓ Annual shareholder ratification of the Audit Committee’s selection of our independent auditor.

✓ Code of Ethical Business Conduct applies to all directors and employees. | |

Responsiveness to Shareholders | ✓ Following each Annual Meeting, the appropriate committees of the Board consider the vote outcomes of the management and shareholder proposals and, depending on those vote outcomes, may recommend proposed courses of action. | |

Stock Ownership | ✓ Non-employee directors are subject to robust stock ownership guidelines of $500,000 in Aptiv shares. Effective as of this Annual Meeting, the stock ownership guidelines will be increasing to $600,000 in Aptiv shares. | |

| APTIV PLC | 16 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Board Practices (continued)

Board Effectiveness

| ||

Board, Committee and Director Evaluations | ✓ Annual Board and Committee self-evaluation process.

✓ Annual director performance evaluations.

✓ Ongoing assessment of corporate governance best practices appropriate for Aptiv. | |

Overboarding Limits | ✓ Directors are subject to overboarding limitations as a general rule:

• Directors who are not actively employed should limit the number of public company boards on which they serve to a total of four.

• Directors who are actively employed as executives of other companies should limit the number of public company boards on which they serve to a total of three.

• Members of the Audit Committee should limit the number of public company audit committees on which they serve to a total of three. | |

Shareholder Engagement | ✓ Directors are committed to meaningful engagement with shareholders and welcome their input and suggestions.

✓ Board members routinely meet with top shareholders for conversations focused on a variety of topics, including compensation, human capital management, and environmental, social and governance (“ESG”) matters. | |

Board Oversight of Risk and ESG Programs | ✓ Our full Board is responsible for risk oversight and the Board committees oversee certain key risks relating to their areas of responsibility.

✓ The Board has delegated oversight of management’s handling of ESG matters of importance to the Company, including risks, policies, strategies and programs to the Nominating and Governance Committee.

✓ The Company publishes an annual Sustainability Report, which can be found at www.aptiv.com/en/about/sustainability. | |

Succession Planning | ✓ The Board oversees and engages in Board and executive succession planning. | |

The Nominating and Governance Committee regularly reviews the following Board practices and adopts governance practices that serve the interests of our shareholders.

As of the date of this mailing, the Board consists of 12 directors. Following the Annual Meeting and assuming all nominated directors are elected, the Board will consist of 10 directors. Our Memorandum and Articles of Association provide that our Board must consist of a minimum of two directors. The exact number of directors will be determined from time to time by our full Board.

| 17 | APTIV PLC |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Board Practices (continued)

This year, in connection with the retirement of Messrs. Donofrio and Gupta from the Board, the Board assessed its leadership structure and determined that it is in the best interests of the Company and its shareholders for Mr. Clark to serve as Chairman and CEO, effective April 27, 2022, following the election of directors at the Annual Meeting. The Board believes that this structure will provide the Company with strong leadership, continuity and strategic vision. In making this decision, the Board considered the Company’s performance, operating and governance environment, as well as the Board’s composition, functioning and effectiveness.

The Board believes that Mr. Clark has the skills, experience and character to provide the Company with strong and effective leadership as well as provides necessary strategic and cultural continuity to the Board as it goes through its leadership transition. In making this decision, the Board considered, among other things, the following factors:

| • | Mr. Clark’s deep experience at Aptiv, first as CFO, leading Aptiv through its initial public offering, then as Chief Operating Officer, and finally, as CEO, following his successful transition into that role in March 2015; |

| • | Mr. Clark’s notable success in the CEO role, driving Aptiv’s relentless execution of its business and technology strategies, expanding its portfolio, creating value for shareholders and positioning Aptiv as a highly sustainable business; |

| • | His critical knowledge of the Company, its customers, its businesses, as well as its industries, operations and strategy; |

| • | His extensive industry knowledge and expertise; and |

| • | His proven leadership skills necessary to lead the Board and Aptiv, as demonstrated by his strong track record. |

The leadership structure of the Board and Company is further strengthened by:

| • | The leadership provided by our Lead Independent Director (“LID”), and the LID’s defined roles and responsibilities as set forth in our Corporate Governance Guidelines; |

| • | Continual and thoughtful Board refreshment, as demonstrated by adding six new independent directors since 2018, providing leadership in a variety of areas of importance to Aptiv; |

| • | The independence of all members of the Audit, Compensation and Human Resources, Finance, Innovation and Technology and Nominating and Governance Committees; |

| • | Our Corporate Governance Guidelines and Board practices; |

| • | Our robust and regular processes for evaluating the Board, Committees, directors and senior management; and |

| • | Our strong commitment to compliance with the highest standards of legal and ethical conduct. |

The Board’s independent oversight function is further enhanced by the following: the Board’s direct unfettered access to management, the Board’s and the Committees’ ability to retain their own advisors, and the Board’s annual evaluation of our CEO’s performance against predetermined goals.

The Board believes this leadership structure is the most appropriate for the Company at this time, providing effective independent oversight of management and a highly independent, engaged, and functioning Board.

To further strengthen the leadership of the Company and effectiveness of the Board, and in accordance with our Corporate Governance Guidelines, the Board has appointed Mr. Meister to serve as the Company’s LID, effective April 27, 2022, following the election of directors at the Annual Meeting. Mr. Meister is an experienced director having served as chairman of the board of several public companies, and as an independent director on numerous public company boards over the course of his career. In addition, he has developed deep industry knowledge over the course of his career. Moreover, Mr. Meister has been an independent director of Aptiv since July 2019, where he has served on the Compensation and Human Resources and Finance Committees and as Chair of the Finance Committee. As a result, he has a keen understanding of the Company and its industry, as well as a strong appreciation of the governance and oversight required by the Board and its Committees. Following the Annual Meeting, Mr. Meister will step down as the Finance Committee Chair and will become Chair of the Nominating and Governance Committee.

The duties and responsibilities of the LID as set forth in our Corporate Governance Guidelines include:

| • | Presiding at meetings of the Board when the Executive Chair is not present, including executive sessions of the independent directors; |

| • | Serving as a liaison between the Executive Chair and the independent directors; |

| • | Working with the Executive Chair to develop meeting agendas and schedules for the Board to ensure that the appropriate topics are covered and given sufficient time for discussion; |

| • | Working with the Executive Chair to ensure that appropriate information is being shared and discussed with the Board in a timely manner; |

| APTIV PLC | 18 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Board Practices (continued)

| • | Leading the Board’s annual evaluation of the Executive Chair and CEO; |

| • | Having the authority to call meetings of the independent directors; and |

| • | If requested by major shareholders, ensuring that he or she is available to communicate with them. |

The Board believes that a substantial majority of its members should be independent, non-employee directors. Mr. Clark, our President and Chief Executive Officer, is the only non-independent director. The current non-employee directors of the Company are Richard L. Clemmer, Nancy E. Cooper, Nicholas M. Donofrio, Rajiv L. Gupta, Joseph L. Hooley, Merit. E. Janow, Sean O. Mahoney, Paul M. Meister, Robert K. Ortberg, Colin J. Parris, and Ana G. Pinczuk. The Board has determined that all of its non-employee directors meet the requirements for independence under the New York Stock Exchange (“NYSE”) listing standards. Furthermore, the Board limits membership on the Audit, Compensation and Human Resources, and Nominating and Governance Committees to independent directors.

Audit Committee Financial Experts

The Board has determined that all of the members of the Audit Committee are financially literate and meet the independence rules required for Audit Committee members by the Securities and Exchange Commission (“SEC”). Ms. Cooper, Mr. Hooley and Mr. Ortberg meet the qualifications of audit committee financial experts, as defined under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Evaluation of Board Performance

The Board believes that a robust and constructive Board, committee and director performance evaluation process is an essential component of board effectiveness. The Board conducts a comprehensive evaluation process annually, overseen by the Nominating and Governance Committee, of its own performance, as well as the performance of each Committee and each director, as outlined below.

Each year, the Nominating and Governance Committee reviews the evaluation format and process. Each director is then asked to complete an anonymous evaluation of the Board and each committee on which they serve. Evaluation topics include number and length of meetings, topics covered and materials provided, committee structure and activities, Board composition and expertise, succession planning, director participation and interaction with management, and promotion of the Company’s values and ethical behavior.

Board and committee evaluation results are compiled and summarized by the Corporate Secretary’s Office. Directors receives the summary results of these evaluations. Committee evaluation results are discussed by the applicable committee, and Board evaluation results are discussed by the full Board. Our Board considers the results when making decisions on the structure of our Board and its committees, agendas and meeting schedules for our Board and its committees, and changes in the performance or functioning of our Board and identifies opportunities for improvement.

The Board also conducts individual director and peer assessments. All directors complete an anonymous evaluation of each director. The Chairman receives summary results of these director evaluations. The Chairman then conducts individual interviews with each director to obtain his or her assessment of director performance, Board dynamics and the effectiveness of the Board and its committees, and to provide feedback about that director’s performance. These discussions are designed to help assess the competencies and skills each director is expected to bring to the Board. These evaluations have consistently revealed that the Board and its committees are operating effectively, while identifying opportunities to improve the way the Board and its committees operate. As a result of the evaluations, the Board takes concrete steps to optimize Board and committee effectiveness.

Director Qualifications, Nominations and Diversity

The Nominating and Governance Committee recommends individuals for membership on the Board. The Nominating and Governance Committee considers a candidate’s character and expertise, performance, personal characteristics, diversity (inclusive of gender, race, ethnicity and age) and professional responsibilities, and also reviews the composition of the Board relative to the long-term business strategy and the challenges and needs of the Board at that time. The Board is committed to searching for the best available candidates to fill vacancies and fully appreciates the value of diversity, viewed in its broadest sense, including gender, race, ethnicity, experience, leadership qualities, and education when evaluating prospective candidates. The Nominating and Governance Committee uses the same selection process and criteria for evaluating all nominees.

Ensuring the Board is composed of Directors who bring diverse viewpoints and perspectives, exhibit a variety of skills, professional experience and backgrounds, and effectively represent the long-term interests of shareholders, is a top priority of the Board and the Nominating and Governance Committee. The Board is strong in its collective knowledge and diversity of accounting and finance, management and leadership, vision and strategy, business operations, business

| 19 | APTIV PLC |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Board Practices (continued)

judgment, technology, crisis management, risk assessment, industry knowledge, corporate governance and global markets.

The Board is designed to operate swiftly and effectively in making key decisions and when facing major challenges. Board meetings should be conducted in an environment of trust, and confidentiality, open dialogue, mutual respect and constructive commentary.

The Nominating and Governance Committee retains the services of independent executive search firms to help identify director prospects, perform candidate outreach, assist in reference and background checks, and provide other related services. In addition to using search firms, the Nominating and Governance Committee also receives candidate recommendations from members of the Board. The recruiting process typically involves contacting a prospect to gauge his or her interest and availability after which a candidate meets with several members of the Nominating and Governance Committee. References for the candidate are contacted and a back-

ground check is completed before a final recommendation is made to the Board to appoint a candidate to the Board.

In accordance with the procedures in our Memorandum and Articles of Association, shareholders holding at least ten percent of the ordinary shares outstanding and who have the right to vote at general meetings of the Company may propose, and the Nominating and Governance Committee will consider, nominees for election to the Board at the next annual meeting by giving timely written notice to the Corporate Secretary, which must be received at our principal executive offices no later than the close of business on March 7, 2023, and no earlier than November 27, 2022. The notice periods may change in accordance with the procedures set out in our Memorandum and Articles of Association. Any such notice must include the name of the nominee, a biographical sketch and resume, contact information and such other background materials as the Nominating and Governance Committee may request.

| APTIV PLC | 20 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Board Practices (continued)

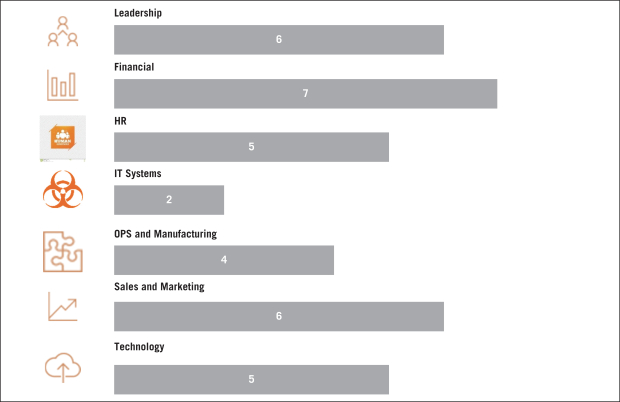

Diversity, Skills and Experience of Our Director Nominees

The table below summarizes some of the experience, qualifications, attributes and skills of our director nominees. This high-level summary is not intended to be an exhaustive list of each of our director nominee’s skills or contributions to the Board; we look to directors to be knowledgeable in these areas as it relates to Aptiv. We have identified below the areas in which each director has specific expertise or prominence that he or she brings to the Board. Further information on each director nominee, including some of each of their specific experience, qualifications, attributes or skills is set forth in the biographies in “Election of Directors” above.

|

|

|

| 21 | APTIV PLC |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Board Practices (continued)

Our Corporate Governance Guidelines provide that the retirement age for directors is 75, unless waived by the Board. No director who is or would be over 75 at the expiration of his or her current term may be nominated to a new term, unless the Board waives the retirement age for the director. Once granted, such waiver must be reviewed and, if appropriate, renewed annually.

Our Corporate Governance Guidelines also provide that non-employee directors who significantly change their primary employment during their tenure as Board members must offer to tender their resignation to the Nominating and Governance Committee. The Nominating and Governance Committee will evaluate the continued appropriateness of Board membership under the new circumstances and make a recommendation to the Board as to any action to be taken with respect to such offer.

We believe that Board refreshment is critical as the mobility industry changes and the Company’s business strategy evolves. In the last four years, we have added six new independent directors, providing leadership in a variety of areas of importance to Aptiv. At the same time, we believe that we benefit from having seasoned directors on our Board who are well-versed in the Company’s business and help facilitate the transfer of institutional knowledge. We believe the average tenure for our independent directors of approximately four and one-half years reflects the balance the Board seeks between different perspectives brought by long-serving and new directors.

Independent directors meet in executive session each Board meeting, without the CEO or any other employees in attendance. The Chairman presides over each executive session of the Board. Each Committee meeting also includes an executive session at which Committee members meet without the CEO or any other employees in attendance.

| APTIV PLC | 22 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Board Practices (continued)

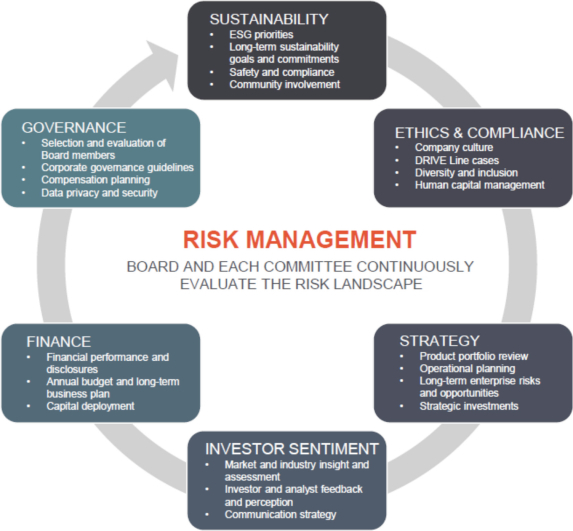

Board’s Role in Risk Oversight

At Aptiv, we always strive to do the right thing, the right way. Our long-term success depends on ensuring that we demonstrate the highest ethical standards in everything we do, everywhere we operate. We believe an effective risk oversight and compliance program is critical to a company’s long-term success and future growth. The Board takes an active role in risk oversight related to the Company, both as a full Board and through its Committees, each of which has primary risk oversight responsibility with respect to all matters within the scope of its duties as described in its charter and as set forth below. While the Company’s management is responsible for day-to-day management of the various risks facing the Company, including those set forth below, the Board is responsible for monitoring management’s actions and decisions.

Role of the Audit Committee: The Audit Committee reviews our guidelines and policies with respect to risk assessment and management and our major financial and information technology risk exposures, including internal controls, disclosure, litigation, compliance and cybersecurity, along with the monitoring and mitigation of these exposures. On a regular

basis, the Audit Committee reviews the Company’s enterprise risk management program.

Role of the Compensation and Human Resources Committee: The Compensation and Human Resources Committee reviews and discusses with management, management’s assessment of certain risks, including whether any risks arising from the Company’s compensation programs.

| 23 | APTIV PLC |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Board Practices (continued)

Role of the Finance Committee: The Finance Committee reviews and discusses with management financial-related risks facing the Company, including foreign exchange, liquidity-related risks, major acquisitions, and the Company’s tax planning.

Role of the Innovation and Technology Committee: The Innovation and Technology Committee reviews and discusses with management product cyber risks facing the Company.

Role of the Nominating and Governance Committee: The Nominating and Governance Committee evaluates the overall effectiveness of the Board and its committees, including the Board’s focus on the most critical issues and risks, and monitors evolving ESG risks, as part of their oversight of Aptiv’s sustainability initiatives.

Board’s Role in Sustainability

As a global company, we understand how interconnected the world is, and how our commitment to environmental and social responsibility — and our commitment to always do the right thing the right way — is directly connected to our success.

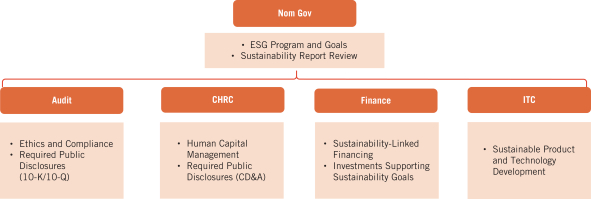

Sustainability at Aptiv is driven from the top by our Board and CEO and is embedded at every level of Aptiv. The Board has delegated to the Nominating and Governance Committee oversight of management’s handling of ESG matters of importance to the Company, including risks, policies, strategies and programs. In addition, the Nominating and Governance Committee reviews the goals the Company establishes with respect to ESG matters and its progress against those goals, as well as the Company’s Sustainability Report. The Nominating and Governance Committee ensures that the other Committees of the Board, as appropriate, receive updates relevant to their continuing oversight on specific ESG topics that otherwise fall within the charter of those Committees, as shown below.

The Board believes that each director should hold a meaningful equity position in the Company, and it has established equity holding requirements for our non-employee directors. The holding requirement for each non-employee director is $500,000 in Aptiv shares. Effective as of April 27, 2022, the holding requirement will be raised to $600,000. Each new director has up to five years from his or her date of appointment to fulfill this holding requirement. As of the 2021 measurement of ownership, all non-employee directors, except for Professor Janow who joined the Aptiv Board in 2021, were at or above the ownership requirement.

The Board has adopted Corporate Governance Guidelines, which set forth the corporate governance practices for Aptiv.

The Corporate Governance Guidelines are available on our website at aptiv.com by clicking on the tab “Investors”, then the heading “Governance” and then the caption “Governance Documents”.

Code of Ethical Business Conduct

The Company has adopted a Code of Ethical Business Conduct, which applies to all employees and directors, including the principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing similar functions. The Code of Ethical Business Conduct is available on our website at aptiv.com by clicking on the tab “Investors”, then the heading “Governance” and then the caption “Code of Conduct”.

Copies of our Code of Ethical Business Conduct are also available to any shareholder who submits a request to the

| APTIV PLC | 24 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Board Practices (continued)

Corporate Secretary at Aptiv PLC, 5 Hanover Quay, Grand Canal Dock, Dublin 2, Ireland D02 VY79 or by email at corporatesecretary@aptiv.com. We intend to satisfy any disclosure requirement under Item 5.05 of Form 8-K by posting on our website any amendments to, or waivers from, a provision of our Code of Ethical Business Conduct that applies to our directors or officers.

Communications with the Board of Directors

Anyone who wishes to communicate with the Board or any individual member of the Board (or independent directors as a group) may do so by sending an email to corporatesecretary@aptiv.com or a letter addressed to the director or directors in care of the Corporate Secretary at Aptiv PLC, 5 Hanover Quay, Grand Canal Dock, Dublin 2, Ireland D02 VY79. All correspondence, other than items such as junk mail that are unrelated to a director’s duties and responsibilities, will be forwarded to the appropriate director or directors.

| 25 | APTIV PLC |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

During 2021, the Board held 9 meetings. All of our directors attended at least 75% of the Board and Committee meetings on which they serve and director attendance in 2021 averaged 99%. In addition, all directors are expected to attend the Annual Meeting, and in 2021, all directors virtually attended the Annual Meeting.

Our Board has the following five committees: Audit; Compensation and Human Resources (CHRC); Finance; Innovation and Technology (ITC); and Nominating and Governance (Nom Gov). Committee charters are available on our website at aptiv.com by clicking on the tab “Investors”, then the heading “Governance” and then the caption “Governance Documents”. Committee membership for 2021 is set forth below:

| Board Committees | ||||||||||||||||||||

| Name | Audit | CHRC | Finance | ITC | Nom Gov | |||||||||||||||

Kevin P. Clark |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Richard L. Clemmer |

|

|

|

|

|

| X | X |

|

|

| |||||||||

Nancy E. Cooper | C |

|

|

|

|

|

| X |

|

|

| |||||||||

Nicholas M. Donofrio |

|

|

|

|

|

|

|

|

| X | X | |||||||||

Rajiv L. Gupta |

|

|

| X |

|

|

|

|

|

| C | |||||||||

Joseph L. Hooley | X | C |

|

|

|

|

|

|

|

|

| |||||||||

Merit E. Janow |

|

|

| X |

|

|

|

|

|

| X | |||||||||

Sean O. Mahoney |

|

|

|

|

|

| X |

|

|

| X | |||||||||

Paul M. Meister |

|

|

| X | C |

|

|

|

|

|

| |||||||||

Robert K. Ortberg | X |

|

|

|

|

|

| X |

|

|

| |||||||||

Colin J. Parris | X |

|

|

|

|

|

| C |

|

|

| |||||||||

Ana G. Pinczuk | X |

|

|

|

|

|

| X |

|

|

| |||||||||

“C” = Chair of Committee

“X” = Member of Committee

During 2021, the following changes to Board Committees were made:

| • | Professor Janow was appointed to the Compensation and Human Resources Committee and the Nominating and Governance Committee upon her election as director. |

| • | In anticipation of Mr. Gupta’s retirement, Mr. Hooley was appointed Chair of the Compensation and Human Resources Committee. |

| • | In anticipation of Mr. Donofrio’s retirement, Dr. Parris was appointed Chair of the Innovation and Technology Committee. |

| APTIV PLC | 26 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Board Committees (continued)

| Committee | Primary Responsibilities | Number of Meetings in 2021 | ||

Audit | ||||

Responsible for the engagement of the registered independent public accounting firm and the review of the scope of the audit to be undertaken by the registered independent public accounting firm. Responsible for oversight of the adequacy of our internal accounting and financial controls and the accounting principles and auditing practices and procedures to be employed in preparation and review of our financial statements. Responsible for oversight of risk-related matters broadly, including the Company’s enterprise risk management program, compliance program and cybersecurity.

| 5

| |||

Compensation and Human Resources | ||||

Responsible for the oversight of the Company’s compensation philosophy and reviews and approves compensation for executive officers (including cash compensation, equity incentives and benefits). Responsible for oversight of human capital management, including succession planning.

| 6

| |||

Finance | ||||

Responsible for oversight of corporate finance matters, including capital structure, financing transactions, acquisitions and divestitures, minority investments, share repurchase and dividend programs, employee retirement plans, interest rate policies, commodity and currency hedging, tax strategy and the annual business plan, including review of capital expenditures and restructurings.

| 8

| |||

Innovation and Technology | ||||

Responsible for oversight of the Company’s technology roadmaps and the technology landscape, product cybersecurity and assessing the overall skill set of the engineering organization.

| 5

| |||

Nominating and Governance | ||||

Responsible for reviewing, recommending and overseeing policies and procedures relating to director and board committee nominations and corporate governance policies, conducting director searches, overseeing board and committee self-evaluations and overseeing management’s handling of ESG matters of importance to the Company, including risks, policies, strategies and programs.

| 5

| |||

| 27 | APTIV PLC |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Our directors (other than Mr. Clark, who does not receive additional compensation for his Board service) received the following annual compensation for service in 2021, which is paid in cash and time-based restricted stock units (“RSUs”). Each director may elect, on an annual basis, to receive 60%, 80% or 100% of his or her compensation in RSUs, with the remainder paid in cash. The Chairman of the Board receives $500,000 annually, and all other directors receive $265,000 annually. In 2021, Chairs of our Board committees received the following additional annual compensation:

| Committee | Additional Annual Compensation | |||

Audit | $ | 25,000 |

| |

Compensation and Human Resources |

| 20,000 |

| |

Finance |

| 15,000 |

| |

Innovation and Technology |

| 15,000 |

| |

Nominating and Governance(1) |

| 15,000 |

| |

| (1) | The Chairman of the Nominating and Governance Committee is also the Chairman of the Board; he does not receive an additional fee for his service as the Nominating and Governance Committee Chairman. |

An annual grant of RSUs is made on the day of the Annual Meeting, which vests on the day before the next annual meeting. Cash compensation is paid quarterly at the end of each fiscal quarter. Any director who joins the Board, other than in connection with the Annual Meeting, will receive prorated cash compensation and a prorated grant of RSUs, based on the date the director joins the Board. These RSUs vest on the day before the next annual meeting.

Changes to Board Compensation for 2022

In 2021, the Nominating and Governance Committee conducted a review of the compensation paid to our non-employee directors for their service on the Board and its committees. The Nominating and Governance Committee considered the results of an analysis prepared by the independent compensation consultant, Semler Brossy Consulting Group (“Semler Brossy”). After the review, the Nominating and Governance Committee approved changes to the compensation program for directors for 2022, as follows:

Effective April 27, 2022, the annual compensation paid to directors will increase to $300,000, an increase of $35,000, and the additional annual compensation paid to Chairs of the

Committees will increase by $5,000. In addition, the LID will receive a premium of $50,000 and will be eligible for the additional annual compensation paid to Chairs of the Committees.

The table below shows cash and equity compensation paid to each member of the Board in 2021:

| Name | Fees Earned or Paid in Cash($) | Stock Awards($)(1) | Total($) |

| ||||||||||||

Richard L. Clemmer | $ | — |

| $ | 265,045 |

| $ | 265,045 |

|

|

|

| ||||

Nancy E. Cooper |

| 87,000 |

|

| 174,107 |

|

| 261,107 |

|

|

|

| ||||

Nicholas M. Donofrio |

| — |

|

| 280,010 |

|

| 280,010 |

|

|

|

| ||||

Rajiv L. Gupta |

| 154,333 |

|

| 312,097 |

|

| 466,430 |

|

|

|

| ||||

Joseph L. Hooley |

| — |

|

| 265,045 |

|

| 265,045 |

|

|

|

| ||||

Merit E. Janow |

| 39,750 |

|

| 212,094 |

|

| 251,844 |

|

|

|

| ||||

Sean O. Mahoney |

| 79,500 |

|

| 159,142 |

|

| 238,642 |

|

|

|

| ||||

Paul M. Meister |

| — |

|

| 280,010 |

|

| 280,010 |

|

|

|

| ||||

Robert K. Ortberg |

| 79,500 |

|

| 159,142 |

|

| 238,642 |

|

|

|

| ||||

Colin J. Parris |

| 90,750 |

|

| 159,142 |

|

| 249,892 |

|

|

|

| ||||

Ana G. Pinczuk |

| — |

|

| 265,045 |

|

| 265,045 |

|

|

|

| ||||

| (1) | Reflects the grant date fair value of the equity awards granted to directors on April 30, 2021, which was the date of grant for all directors. The values set forth in the table were determined in accordance with FASB ASC Topic 718. For assumptions used in determining the fair value of the awards, see Note 21. Share-Based Compensation to the Consolidated Financial Statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021. As of December 31, 2021, all outstanding Aptiv RSU awards held by our directors were unvested; they vest in full on April 26, 2022. The year-end RSU balances for our directors are: |

| Name | Unvested RSUs 12/31/2021 | |||

Richard L. Clemmer |

| 1,842 |

| |

Nancy E. Cooper |

| 1,210 |

| |

Nicholas M. Donofrio |

| 1,946 |

| |

Rajiv L. Gupta |

| 2,169 |

| |

Joseph L. Hooley |

| 1,842 |

| |

Merit E. Janow |

| 1,474 |

| |

Sean O. Mahoney |

| 1,106 |

| |

Paul M. Meister |

| 1,946 |

| |

Robert K. Ortberg |

| 1,106 |

| |

Colin J. Parris |

| 1,106 |

| |

Ana G. Pinczuk |

| 1,842 |

| |

| APTIV PLC | 28 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation and Human Resources Committee (the “Compensation Committee”), composed entirely of independent directors, works with management and its independent compensation consultant to oversee the Company’s executive compensation philosophy and to review and approve compensation for executive officers.

In this section, we describe and analyze:

| (1) | the material components of our executive compensation programs for the “named executive officers”, or “NEOs”; |

| (2) | the material compensation decisions the Compensation Committee made for 2021; and |

| (3) | the key factors considered in making those decisions, including 2021 Company performance. |

Our Named Executive Officers

For fiscal year 2021, the NEOs were:

| ||

Kevin P. Clark |

President and Chief Executive Officer (“CEO”) | |

Joseph R. Massaro |

Chief Financial Officer (“CFO”) and Senior Vice President, Business Operations | |

William T. Presley |

Senior Vice President and President, Signal & Power Solutions | |

Katherine H. Ramundo |

Senior Vice President, Chief Legal Officer, Chief Compliance Officer and Secretary | |

Mariya K. Trickett

|

Senior Vice President and Chief Human Resources Officer

| |

Compensation Governance and Alignment with Shareholders

Aptiv’s executive compensation program is designed to attract, retain and motivate the leaders who drive the successful execution of our business strategies, which seek to balance achievement of targeted near-term results with building long-term shareholder value through sustained performance. Our focus on pay-for-performance and corporate governance aims to help ensure alignment with the interests of our shareholders, as highlighted below:

Pay for Performance

| More information

| |||

| 90% of 2021 total target annual compensation for the CEO is at risk and 76% is granted in equity, while, on average, 80% of 2021 total target annual compensation for the other NEOs is at risk and 62% is granted in equity.

|

36

| ||

|

We target executive compensation to provide market competitive compensation that allows us to attract and retain the best global talent and use incentive compensation to drive superior performance.

|

32

| ||

|

We use a structured goal-setting process for performance incentives, with multiple levels of review. |

37

| ||

|

NEOs’ annual incentives in typical years are based on achievement of Corporate, Segment and individual performance goals.

|

38

| ||

|

60% of the NEOs’ long-term incentive compensation consists of performance-based RSUs, which deliver value based on achievement of financial and relative TSR goals. The value of the remaining 40% of the NEOs’ long-term incentive compensation is awarded in the form of time-based RSUs and fluctuates with Aptiv’s share price.

|

39

| ||

|

We review and analyze our pay-for-performance alignment on an annual basis. |

— |

| 29 | APTIV PLC |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Compensation Discussion and Analysis (continued)

Compensation Governance

| More information

| |||

|

We actively engage with our shareholders by conducting regular meetings with our major shareholders to discuss governance and executive compensation matters.

| 34

| ||

|

We disclose our performance metrics.

| 31

| ||

|

We maintain a reasonable severance practice with market appropriate post-employment provisions.

| 41

| ||

|

We maintain stock ownership guidelines for our NEOs and directors.

| 41

| ||

|

We maintain clawback, anti-hedging and anti-pledging policies.

| 42

| ||

|

We offer no excise tax gross-ups or tax assistance unique to our NEOs.

| 42

| ||

|

Our Compensation Committee utilizes an independent compensation consultant.

| 42

| ||

|

Our compensation programs are designed to discourage imprudent risk.

| 42

| ||

|

We devote focused time to leadership development and succession planning efforts.

|

—

| ||

|

Our equity grant practices, including burn rate, dilution, and consistent grant dates are prudent.

|

—

| ||

|

The Compensation Committee is provided tally sheets to assess total compensation for our NEOs.

|

—

|

Company Financial and Business Performance Highlights. The global supply chain disruptions currently impacting the industry created unprecedented operating challenges in 2021. Our 2021 performance reflects our commitment to executing flawlessly for our customers despite these and other headwinds, while positioning the Company for continued outperformance as industry conditions improve. Our recent financial and business achievements include the following:

| • | Generating strong results despite the continuing impacts of the COVID-19 pandemic and global supply chain disruptions limiting global vehicle production capacity |

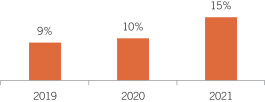

| • | Delivering sustained outperformance, with above-market sales growth of 15%, as strong demand across our portfolio continued despite the challenging operating environment; |

| • | Generating record new business awards of $24 billion, based on expected volumes and prices, validating our industry leading portfolio of advanced technologies; |

| • | Generating $1,189 million of operating income or $1,230 million of adjusted operating income and cash flow from operations of $1.2 billion, despite supply chain disruptions and material inflation; and |

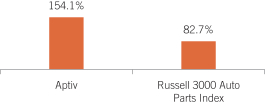

| • | Achieving 154.1% total shareholder return over the period 2019 through 2021, illustrating execution of our long-term strategy and sustainable value creation. |

| • | Enhancing our software capabilities and enabling the industry’s transition to software-defined vehicles |

| • | Announcing the proposed acquisition of Wind River, a global leader in delivering software for the intelligent edge and announcing our planned investment in TTTech Auto AG, a leading provider of automotive safety-critical middleware solutions. These actions accelerate our software strategy, broaden our portfolio of technology solutions and enable us to capitalize on opportunities requiring comprehensive software solutions. |

| • | Leveraging our investment grade credit metrics to further enhance our capital structure and increase our financial flexibility |

| • | Successfully issuing $1.5 billion of 30-year, 3.10% senior unsecured notes, utilizing the proceeds to redeem our $700 million, 4.15% senior notes and our $650 million, 4.25% senior notes; and |

| • | Extending the maturity of our existing Credit Agreement to August 2026 and being one of the first companies to integrate sustainability metrics into our financing structure. |

| APTIV PLC | 30 |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Compensation Discussion and Analysis (continued)

| • | Continuing our relentless focus on cost structure and operational optimization |

| • | Maximizing our operational flexibility and profitability at all points in the normal automotive business cycle, by having approximately 97% of our hourly workforce based in best cost countries, and approximately 22% of our hourly workforce composed of temporary employees. |

| • | Recruiting and retaining top talent from various industries, including technology |

| • | Advancing a culture of diversity and inclusion, improving access to opportunities and ensuring equal pay for equal work within markets; and |

| • | Promoting employee health and safety through our strong safety culture and consistently achieving best-in-class lost workday case rates compared with industry peers. |

| • | Continuing to execute on our long-term Safe, Green and Connected strategy to enable a more sustainable future |

| • | Expanding our market relevant portfolio to address the industry’s top challenges, including high voltage electrification and active safety technologies; |

| • | Capturing value across the entire technology stack with the commercialization of Smart Vehicle ArchitectureTM; and |

| • | Announcing new carbon emissions targets to help ensure a more sustainable future which includes a commitment to become a carbon-neutral company by 2040. |

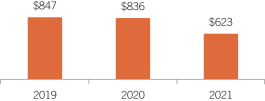

Our strategic, operational and financial performance over time is reflected in our results and returns to shareholders. This performance is shown in the following financial metrics and total shareholder return charts. We have aligned our 2021 performance-based annual and long-term incentive plans for executives with these metrics:

Adjusted Net Income (In Millions)

| Cash Flow Before Financing (In Millions)

| |

|  |

Adjusted EBITDA (In Millions)

| Growth over Market

| |

|  |

| 31 | APTIV PLC |

2022 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT |

Compensation Discussion and Analysis (continued)

Return on Net Assets

| Total Shareholder Return (2019 through 2021)

| |

|  |

| * | The increase in return on net assets in 2020 is attributable to the $1.4 billion gain recognized on the formation of the Motional autonomous driving joint venture. Excluding the gain on the Motional joint venture, return on net assets was 14.0% in 2020, reflecting continued investments for revenue growth and profitability, as well as the impacts of the COVID-19 pandemic on the Company’s industry and operations. |

Adjusted EBITDA represents net income before depreciation and amortization (including asset impairments), interest expense, income tax (expense) benefit, other income (expense), net, equity income (loss), net of tax, restructuring and other special items.

Adjusted Net Income represents net income attributable to Aptiv before restructuring and other special items, including the tax impact thereon.

Cash Flow Before Financing represents cash provided by (used in) operating activities plus cash provided by (used in) investing activities, adjusted for the purchase price of business acquisitions and net proceeds from the divestiture of discontinued operations and other significant businesses.