Mairs & Power Funds Trust

W1520 First National Bank Building

332 Minnesota Street

Saint Paul, MN 55101

February 25 , 2015

Dear Shareholder:

We need your help with the upcoming special meeting of shareholders of Mairs & Power Funds Trust (the “Trust”) with respect to all of its portfolios. At the meeting, shareholders are being asked to vote on important proposals affecting the Trust. The Board of Trustees (the “Board”) believes the proposals will benefit you as a shareholder. Accordingly, the Board recommends that you vote “for” each of the proposals described below and in the proxy statement.

Although I am urging you to vote your proxy today, you also are welcome to attend the meeting in person. The meeting will be held at 9:00 a.m. Central Time on Friday, April 10, 2015, at the First National Bank Building Training Room (ground floor), 332 Minnesota Street, Saint Paul, Minnesota 55101.

These are the proposals that will be taken up at the meeting:

First, the shareholders of the Trust are being asked to elect six trustees to the Board, including four current trustees and two trustee nominees.

Second, the shareholders of the Mairs & Power Balanced Fund are being asked to approve an amendment to the Balanced Fund’s investment objective.

Detailed information about each of the proposals is contained in the enclosed materials.

Whether or not you plan to attend the meeting, please complete, sign and return your proxy card in the envelope provided so that your vote may be counted. Alternatively, you also can vote by telephone or by internet, by following instructions on the proxy card. If you attend the meeting, you may, if you wish, withdraw any proxy previously given and vote in person. Please read the entire proxy statement carefully before you vote your proxy.

Thank you for your prompt attention and participation. If you have any questions after considering the enclosed materials, please call 1-866-416-0565. Representatives will be available Monday through Friday 8:00 a.m. to 10:00 p.m., Central Time.

Sincerely,

/s/ Mark L. Henneman

Mark L. Henneman

President, Mairs & Power Funds Trust

MAIRS & POWER FUNDS TRUST

PROXY STATEMENT Q&A

| Q. | Why am I receiving this proxy statement? |

| A. | You are receiving these proxy materials — that include the proxy statement and your proxy card — because you have the right to vote on important proposals concerning Mairs & Power Funds Trust (the “Trust”). |

| Q. | What are the proposals about? |

| A. | This proxy statement presents two proposals. All shareholders of the Trust, consisting of the Mairs & Power Growth Fund, the Mairs & Power Balanced Fund (the “Balanced Fund”) and the Mairs & Power Small Cap Fund, are being asked to vote on Proposal 1. Only shareholders of the Balanced Fund are being asked to vote on Proposal 2. |

Proposal 1

This proposal relates to the election of trustees (each, a “Trustee”) to the Board of Trustees (the “Board”) of the Trust. As part of a succession plan established by the Trust, William B. Frels retired as a Trustee, effective December 31, 2014. There are now two vacancies on the Board. You are being asked to elect two new Trustee nominees, James D. Alt and Patrick A. Thiele, and to elect the incumbent Trustees, Jon A. Theobald, Norbert J. Conzemius, Mary Schmid Daugherty and Bert J. McKasy.

Proposal 2

The shareholders of the Balanced Fund are being asked to approve an amendment to the Balanced Fund’s investment objective. The Balanced Fund’s objective will be amended to read as follows: “the Fund seeks to provide capital growth, current income, and preservation of capital.” The amendment is being proposed to simplify the description of the Balanced Fund’s investment objective and to provide greater flexibility to the Adviser by removing the reference to a particular income yield.

| Q. | How many of the nominees will be Independent Trustees if elected? |

| A. | Five of the six nominees will be Independent Trustees (i.e., Trustees who are not “interested persons” of the Trust as that term is defined in the 1940 Act), if elected. Mr. Theobald would be the only Trustee who is an “interested person” of the Trust, as a result of his position with Mairs and Power Inc., the Funds’ investment adviser. |

| Q. | How long will each Trustee serve? |

| A. | Each incumbent Trustee, and Mr. Alt and Mr. Thiele if elected, may serve on the Board until he or she dies, resigns, is declared incompetent by a court of appropriate jurisdiction or is removed. In accordance with Trust policy, Trustees are subject to mandatory retirement at the end of the year in which they reach age 75. |

| Q. | How will changing the investment objective of the Balanced Fund affect my investment in the Balanced Fund? |

| A. | The proposed change to the investment objective of the Balanced Fund will not affect your investment in that Fund. The principal investment strategies of the Balanced Fund will not change as a result of the change to the investment objective. |

| Q. | How will changing the investment objective of the Balanced Fund affect the risks of investing in the Balanced Fund? |

| A. | The proposed change to the investment objective of the Balanced Fund will not affect the risks of investing in the Balanced Fund. There will be no change to the investment strategies of the Balanced Fund due to the proposed change in the investment objective and consequently, the principal risks of investing in the Balanced Fund will not change. |

| Q. | Why am I receiving information about the Balanced Fund if I do not own shares of the Balanced Fund? |

| A. | Proposal 1 (election of Trustees) is relevant to all of the Funds. Shares of all the Funds will vote in the aggregate and not separately by Fund with respect to Proposal 1. Proposal 2 (change to the Balanced Fund investment objective) is relevant only to the Balanced Fund. Only shareholders of the Balanced Fund will vote on Proposal 2. |

| Q. | Who is entitled to vote at the special meeting? |

| A. | Shareholders of record of the Trust as of the close of business on February 10, 2015 (the “Record Date”) are entitled to be present and to vote at the special meeting or any adjournment thereof. Shareholders of record of the Trust at the close of business on the Record Date will be entitled to cast one vote for each full share and a fractional vote for each fractional share they hold. |

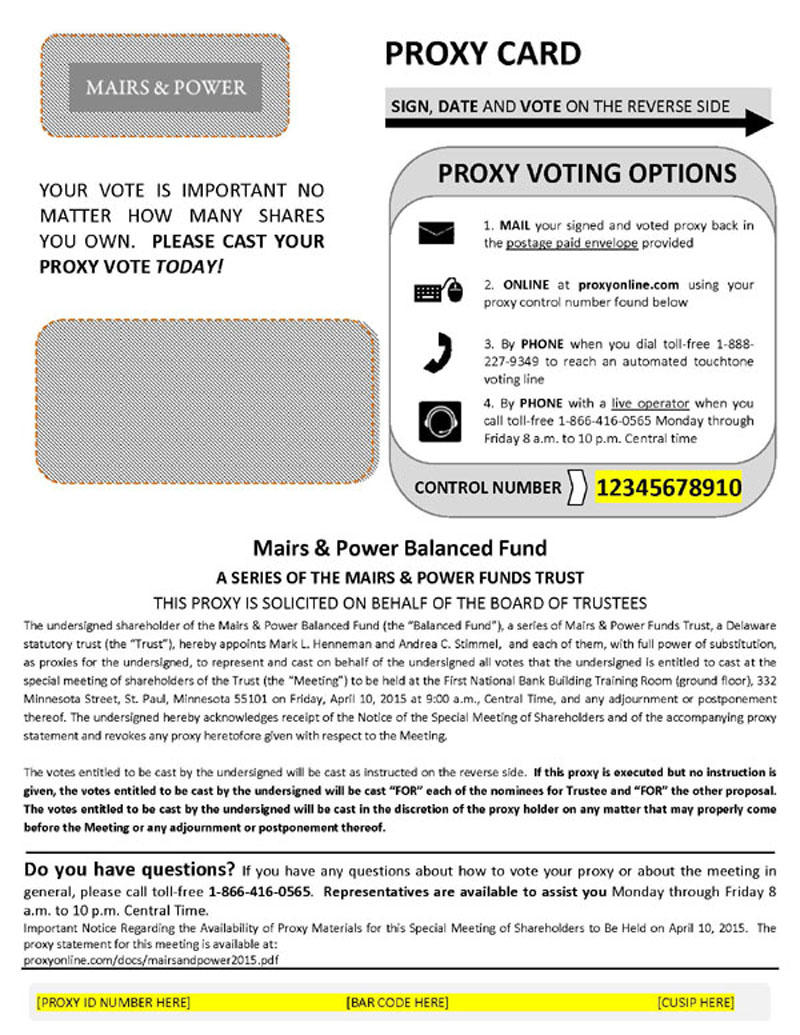

| A. | You may vote on the Internet at the website provided on your proxy card or you may vote by telephone using the toll-free telephone number found on your proxy card. You may also use the enclosed postage prepaid envelope to mail your proxy card to the Trust. Please follow the enclosed instructions to use these methods of voting. You may also vote in person at the special meeting. |

| Q. | What if I cannot attend the special meeting in person? |

| A. | Whether or not you plan to attend the special meeting and regardless of the number of shares that you own, please authorize the proxies to vote your shares by marking, signing and returning the enclosed proxy card in the postage prepaid envelope provided. You also may vote by using the toll-free telephone number or by internet according to the instructions noted on the enclosed proxy card. If a quorum of shareholders is not attained for the special meeting, then the special meeting may be delayed to allow time to solicit additional proxies or the proxy materials may need to be re-issued. |

| Q. | I am a small investor. Why should I bother to vote? |

| A. | Your vote is needed to ensure that a quorum is present at the special meeting so that the proposals can be acted upon. Your immediate response on the enclosed proxy card will help prevent the need for any further proxy solicitations. We encourage all shareholders to participate, including small investors. If other shareholders like you do not vote, the Trust may not receive enough votes to go forward with the special meeting. If this happens, we may need to solicit votes again, which increases costs. |

| Q. | How does the Board recommend that I vote? |

| A. | After careful consideration, the Board, the majority of whom are Independent Trustees, recommends that you vote FOR each of the proposals. |

MAIRS & POWER FUNDS TRUST

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

A special meeting of shareholders of the Mairs & Power Growth Fund (the “Growth Fund”), the Mairs & Power Balanced Fund (the “Balanced Fund”) and the Mairs & Power Small Cap Fund (the “Small Cap Fund”), each a series of Mairs & Power Funds Trust (the “Trust”) will be held on April 10, 2015 at the First National Bank Building Training Room (ground floor), 332 Minnesota Street, Saint Paul, Minnesota 55101 at 9:00 a.m. Central Time.

The meeting is being held so that shareholders can consider the following proposals and transact such other business as may be properly brought before the meeting (and any adjournments or postponements thereof):

| 1. | To elect six trustees to the Trust’s Board of Trustees. |

| 2. | Only with respect to the shareholders of the Balanced Fund, to approve an amendment to the Balanced Fund’s investment objective. |

The Board of Trustees of the Trust unanimously recommends that you vote in favor of the proposals.

Shareholders of record of the Fund at the close of business on the record date, February 10, 2015, are entitled to notice of and to vote at the meeting and any adjournment(s) or postponements thereof. Whether or not you plan to attend the meeting in person, please vote your shares. In order that your shares may be represented at the meeting, please vote your proxy as soon as possible either by mail, telephone or internet as indicated on the enclosed proxy card. If voting by mail, you are requested to:

| · | indicate your votes on the proxy card; |

| · | date and sign the proxy card; |

| · | mail the proxy card promptly in the enclosed envelope which requires no postage if mailed in the United States; and |

| · | allow sufficient time for the proxy card to be received by 11:59 p.m., Central Time, on April 9, 2015. (However, proxies received after this date may still be voted in the event of an adjournment or postponement to a later date.) |

You may also vote either by telephone or via the internet, as follows:

| To vote by telephone: | | To vote by internet: |

| (1) Read the proxy statement and have the enclosed proxy card at hand. | | (1) Read the proxy statement and have the enclosed proxy card at hand. |

| | | |

| (2) Call the toll-free number that appears on the enclosed proxy card. | | (2) Go to the website that appears on the enclosed proxy card. |

| | | |

| (3) Enter the control number set forth on the enclosed proxy card and follow the instructions. | | (3) Enter the control number set forth on the enclosed proxy card and follow the instructions. |

We encourage you to vote by telephone or via the internet using the control number that appears on the enclosed proxy card. Use of telephone or internet voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed proxy statement carefully before you vote.

PLEASE RESPOND – WE ASK THAT YOU VOTE PROMPTLY IN ORDER

TO AVOID THE ADDITIONAL EXPENSE OF FURTHER SOLICITATION.

YOUR VOTE IS IMPORTANT.

By Order of the Board of Trustees,

/s/ Jon A. Theobald

Jon A. Theobald

Secretary, Mairs & Power Funds Trust

February 25 , 2015

PROXY STATEMENT

MAIRS & POWER FUNDS TRUST

W1520 First National Bank Building

332 Minnesota Street

Saint Paul, MN 55101

Relating to a

Special Meeting of Shareholders

to be held on April 10, 2015

This proxy statement is being provided to you in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of Mairs & Power Funds Trust (the “Trust”) with respect to its series the Mairs & Power Growth Fund (the “Growth Fund”), the Mairs & Power Balanced Fund (the “Balanced Fund”) and the Mairs & Power Small Cap Fund (the “Small Cap Fund”) (each a “Fund” and collectively, the “Funds”). The proxies are being solicited for use at a special meeting of shareholders of the Trust to be held on Friday, April 10, 2015 at the First National Bank Building Training Room (ground floor), 332 Minnesota Street, Saint Paul, Minnesota 55101 at 9:00 a.m. Central Time and any adjourned or postponed session thereof, for the purposes set forth in the enclosed notice of special meeting of shareholders (the “Notice”).

The following proposals will be considered and acted upon at the meeting:

Proposal Summary | Fund(s) Voting on the Proposal |

| 1. To elect six trustees to the Board. | All Funds |

| | |

| 2. To approve an amendment to the Balanced Fund’s investment objective. | Balanced Fund |

We anticipate that the Notice, this proxy statement and the proxy card (collectively, the “Proxy Materials”) will be mailed to shareholders beginning on or about February 25, 2015. Only shareholders who beneficially owned any shares in the Funds at the close of business on February 10, 2015 (the “Record Date”) are entitled to vote.

Other Business

The Board knows of no other business to be brought before the meeting. However, if any other matters come before the meeting, proxy cards that do not contain specific restrictions to the contrary will be voted in accordance with the judgment of the persons named as proxies.

General Information

The Trust is an open-end management investment company registered under the Investment Company Act of 1940 (the “1940 Act”). Mairs and Power, Inc. (the “Adviser”) acts as the investment adviser to each of the Funds. The Adviser also provides various administrative services to each of the Funds.

This solicitation is being made primarily by the mailing of this proxy statement and the accompanying proxy cards. Supplementary solicitations may be made by mail or telephone by representatives of the Trust or the Adviser. The Trust will bear the cost of preparing, printing and mailing the proxy statement and soliciting and tabulating proxies. The Funds’ portion of the costs will be allocated to each Fund on the basis of its relative net assets.

In the event that the necessary quorum to transact business or the vote required to approve or reject any proposal is not obtained by the date of the meeting, those present in person or by proxy may, by majority vote, approve one or more adjournments of the meeting to permit further solicitation of proxies. Please be sure to read the entire proxy statement before voting. This proxy statement and proxy cards were first mailed to Fund shareholders on or about February 25, 2015.

The most recent annual reports of the Funds, including financial statements, for the fiscal year ended December 31, 2014 will be mailed to shareholders by March 1, 2015. Additional copies of this annual report and the Funds’ semi-annual report for the period ended June 30, 2014 are available without charge by calling Shareholder Services at 1-800-304-7404, by visiting www.mairsandpower.com, or by sending a written request to U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, Wisconsin 53202.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON APRIL 10, 2015. This proxy statement is available on the internet at proxyonline.com/docs/mairsandpower2015.pdf. You may call 1-866-416-0565 for information on how to obtain directions to be able to attend the meeting and vote in person.

PROPOSAL 1: ELECTION OF TRUSTEES

All shareholders of the Funds are being asked to elect six nominees to constitute the Board. At a meeting held on December 18, 2014, the Board, upon the recommendation of the Nominating and Governance Committee, which consists entirely of trustees who are not “interested persons” of the Trust as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”) (“Independent Trustees”), approved the following nominees: James D. Alt, Norbert J. Conzemius, Mary Schmid Daugherty, Bert J. McKasy, Jon A. Theobald and Patrick A. Thiele (each a “Nominee” and collectively, the “Nominees”). Mr. Conzemius, Mr. McKasy, Mr. Theobald and Dr. Daugherty are currently members of the Board. On December 18, 2014, the Board nominated Mr. Alt and Mr. Thiele to serve as Independent Trustees, subject to their election by shareholders. On December 31, 2014, William B. Frels, a Trustee of the Trust and its predecessor Funds since 1992, retired from the Board. Accordingly, the Board currently consists of four Trustees, and the Trustees have determined to increase the size of the Board to six members. If elected, Mr. Alt and Mr. Thiele will become new Trustees effective as of the adjournment of the special meeting.

Except for Jon A. Theobald, each of the Nominees would be an Independent Trustee. Mr. Theobald is deemed to be an “Interested Trustee” because he has served in several capacities with the Adviser, including as the Adviser’s Chief Executive Officer since 2012. If all of the Nominees are elected, the Board will consist of five Trustees who are Independent Trustees and one Interested Trustee.

If elected, each Trustee will hold office during the lifetime of the Trust until he or she (a) dies, (b) resigns, (c) is declared incompetent by a court of appropriate jurisdiction, or (d) is removed, or, if sooner, until the next meeting of Shareholders called for the purpose of electing Trustees. In accordance with Trust policy, Trustees are subject to mandatory retirement at the end of the year in which they reach age 75.

All Nominees have consented to serve as Trustees. Certain biographical and other information relating to the Nominees, including each Nominee’s experience, qualifications, attributes and skills for Board membership, is set forth below.

Nominees for the Board

Name (Year of Birth) and Address(1) | | Position(s) Held with the Trust and Length of Time Served(2) | | Principal Occupation(s) During Past Five Years | | Number of Portfolios in Fund Complex Overseen by Trustee | | Other Directorships Held by Trustee During Past Five Years |

| INTERESTED TRUSTEE |

Jon A. Theobald (1945) | | Secretary since 2003; Chief Compliance Officer from 2004 to 2012; Trustee since December 2012 | | · Chairman of the Board of the Adviser (January 2015 to present). · Chief Executive Officer of the Adviser (2012 to present). · President of the Adviser (2007 to 2014). · Chief Operating Officer of the Adviser (2007 to 2012). · Chief Compliance Officer of the Adviser (2004 to 2012). | | 3 | | None |

| INDEPENDENT TRUSTEES |

Norbert J. Conzemius (1941) | | Trustee since 2000; Board Chair from February 2006 to December 2014; Nominating and Governance Committee Chair since 2006 . | | · Retired Chief Executive Officer, Road Rescue Incorporated. | | 3 | | Director, Mairs & Power Growth Fund, Inc. (2000 to 2011), Director, Mairs & Power Balanced Fund, Inc. (2000 to 2011) |

| | | | | | | | | |

Name (Year of Birth) and Address(1) | | Position(s) Held with the Trust and Length of Time Served(2) | | Principal Occupation(s) During Past Five Years | | Number of Portfolios in Fund Complex Overseen by Trustee | | Other Directorships Held by Trustee During Past Five Years |

Mary Schmid Daugherty (1958) | | Trustee since December 2010; Audit Committee Chair since December 2012 | | · Associate Professor, Department of Finance, University of St. Thomas (1987 to present). | | 3 | | Director, Mairs & Power Growth Fund, Inc. (2010 to 2011), Director, Mairs & Power Balanced Fund, Inc. (2010 to 2011) |

| | | | | | | | | |

Bert J. McKasy (1942) | | Trustee since September 2006; Board Chair since December 2014 | | · Attorney, Lindquist & Vennum, P.L.L.P. (1994 to present). | | 3 | | Director, Mairs & Power Growth Fund, Inc. (2006 to 2011), Director, Mairs & Power Balanced Fund, Inc. (2006 to 2011) |

James D. Alt (1951) | | Trustee Nominee | | · Adjunct Professor, University of Minnesota Law School (2007 to present); Retired Partner, Dorsey & Whitney LLP(3) (1984 to 2012). | | 3 | | None |

Patrick A. Thiele (1950) | | Trustee Nominee | | · Retired Chief Executive Officer, PartnerRe Ltd. (2000 to 2010). | | 3 | | OneBeacon Insurance Group, Ltd. (2014 to present) |

____________________

(1) The mailing address of each Trustee and Nominee is: W1520 First National Bank Building, 332 Minnesota Street, Saint Paul, MN 55101-1363.

(2) Mr. Conzemius, Dr. Daugherty and Mr. McKasy served as directors of Mairs & Power Growth Fund, Inc. and Mairs & Power Balanced Fund, Inc. (together, the “Predecessor Funds”) prior to the reorganization of the Predecessor Funds into newly formed series of the Trust effective December 31, 2011. Positions listed in this column for trustees and officers prior to 2012 refer to their positions with the Predecessor Funds.

(3) Dorsey & Whitney LLP previously served as legal counsel to the Trust through December 2012.

Experience and Qualifications of Nominees

Jon A. Theobald has served as a Trustee of the Trust since 2012. He has served as Secretary of the Trust and the Predecessor Funds since 2003 and as Chief Compliance Officer from 2004 to 2012. Mr. Theobald has served as a senior executive officer of the Adviser since 2002 and currently serves as Chairman and Chief Executive Officer. Prior to joining the Adviser in 2002, Mr. Theobald served as trust officer and senior vice president with various trust companies in St. Paul for over 30 years. Mr. Theobald holds a law degree from St. Louis University. Through his positions with the Trust and the Adviser and his other employment and educational experience, Mr. Theobald is proficient in legal, regulatory and investment matters impacting the investment management industry.

Norbert Conzemius served as a Board member of the Predecessor Funds from 2000 until 2011, including service as a member of the Predecessor Boards’ Audit Committee and Nominating Committee and service as Independent Chairman of the Predecessor Boards’ Board of Directors for five years. Mr. Conzemius currently serves as a Trustee, is the Chair of the Nominating and Governance Committee and serves as a member of the Audit Committee of the Board. Mr. Conzemius has many years of experience from his previous service as senior executive officer in the financial services industry and CEO of a private manufacturing company. Mr. Conzemius has served on various boards for private companies, financial services companies and non-profit organizations.

Mary Schmid Daugherty, PhD, became a Board member of the Predecessor Funds in December 2010, including service as a member of the Predecessor Boards’ Audit and Nominating Committees. Dr. Daugherty currently serves as a Trustee, is the Chair of the Audit Committee and serves as a member of the Nominating and Governance Committee of the Board. Dr. Daugherty also serves as the Audit Committee’s “audit committee financial expert.” Dr. Daugherty has served as a professor of finance at a private university in St. Paul, Minnesota since 1987 and has also served as an investment officer in the financial services industry in St. Paul. Dr. Daugherty is the author of several publications in the financial field.

Bert J. McKasy served as a Board member of the Predecessor Funds for more than five years, including as a member of the Audit and Nominating Committees. Mr. McKasy currently serves as a Trustee, is Chair of the Board and serves as a member of the Audit Committee and Nominating and Governance Committee of the Board. Mr. McKasy has many years of experience from his previous service as a senior executive officer of various operating companies and as a director of public companies. Mr. McKasy has more than 20 years of private practice experience as an attorney. Mr. McKasy served as a senior executive officer and as a director in the financial services industry, and has substantial experience in public service.

James D. Alt served as a partner at an international law firm headquartered in Minneapolis for more than 25 years. Mr. Alt’s practice focused on corporate, securities and investment company law and corporate governance. Mr. Alt also served as the firm’s general counsel from 2008-2012. Currently, Mr. Alt serves as an adjunct professor at the University of Minnesota Law School.

Patrick A. Thiele served as CEO of an international reinsurer for over ten years. Prior to that, Mr. Thiele held executive roles with two other international insurance companies. Additionally, Mr. Thiele has experience working as a securities analyst, portfolio manager, chief investment officer, and chief financial officer of various entities throughout his career. Mr. Thiele also holds the Chartered Financial Analyst designation.

Principal Officers of the Trust

Information about the officers of the Trust is listed below.

Name (Year of Birth) and Address(1) | | Position(s) Held with the Trust and Length of Time Served(2) | | Principal Occupation(s) During Past Five Years |

Jon A. Theobald (1945) | | Secretary since 2003; Chief Compliance Officer from 2004 to 2012; Trustee since December 2012 | | · Chairman of the Board of the Adviser (January 2015 to present). · Chief Executive Officer of the Adviser (2012 to present). · President of the Adviser (2007 to 2014). · Chief Operating Officer of the Adviser (2007 to 2012). · Chief Compliance Officer of the Adviser (2004 to 2012). |

| Mark L. Henneman (1961) | | President since December 31, 2014; Vice President from 2009 to 2014 | | · President of the Adviser (January 2015 to present). · Chief Investment Officer of the Adviser (January 2015 to present). · Executive Vice President of the Adviser (2012 to 2014). · Vice President of the Adviser (2004 to 2012). |

| Ronald L. Kaliebe (1952) | | Vice President since 2009 | | · Senior Vice President of the Adviser (January 2015 to present). · Director of Fixed Income of the Adviser (January 2015 to present) · Vice President of the Adviser (2001 to 2014). |

| Andrew R. Adams (1972) | | Vice President since 2011 | | · Vice President of the Adviser (2006 to present). |

| Andrea C. Stimmel (1967) | | Treasurer since 2011; Chief Compliance Officer since 2012 | | · Director of Operations and Treasurer of the Adviser (2008 to present). · Chief Compliance Officer of the Adviser (2012 to present). |

____________________

(1) Unless otherwise indicated, the mailing address of each officer is: W1520 First National Bank Building, 332 Minnesota Street, Saint Paul, MN 55101-1363.

(2) Each officer is elected annually and serves until his or her successor has been duly elected and qualified.

Ownership of Nominees in the Funds

As of December 31, 2014, the Funds’ officers, and the Nominees as a group, beneficially owned less than 1% of the outstanding shares of the Growth Fund and Balanced Fund. As of December 31, 2014, the Nominees and officers of the Trust beneficially owned 1.36% of the outstanding shares of the Small Cap Fund. No individual officer or Nominee beneficially owned more than 1% of the outstanding shares of the Small Cap Fund.

The following tables shows the dollar amount range of each Nominee’s beneficial ownership of the Funds as of December 31, 2014, using the following dollar ranges: None, $1-$10,000, $10,001-$50,000, $50,001-$100,000, and over $100,000.

| Independent Trustee Nominees | Growth Fund | Balanced Fund | Small Cap Fund | Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen by Trustee or Trustee Nominee in Family of Investment Companies |

| Norbert J. Conzemius | Over $100,000 | Over $100,000 | Over $100,000 | Over $100,000 |

| Mary Schmid Daugherty | Over $100,000 | Over $100,000 | Over $100,000 | Over $100,000 |

| Bert J. McKasy | None | Over $100,000 | Over $100,000 | Over $100,000 |

| James D. Alt | Over $100,000 | Over $100,000 | Over $100,000 | Over $100,000 |

| Patrick A. Thiele | None | None | None | None |

| | | | | |

| Interested Trustee Nominee | Growth Fund | Balanced Fund | Small Cap Fund | Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen by Trustee or Trustee Nominee in Family of Investment Companies |

| Jon A. Theobald | Over $100,000 | Over $100,000 | Over $100,000 | Over $100,000 |

Certain Transactions

As of December 31, 2014, no Nominee, or any immediate family member of such a Nominee, had any direct or indirect interest in: (i) the Funds’ investment adviser or distributor or (ii) any person (other than a registered investment company or series thereof) directly or indirectly controlling, controlled by, or under common control with the investment adviser or distributor.

Board Leadership Structure

The Board supervises the business and management of the Funds. The Board approves all significant agreements between the Funds and those companies that furnish services to the Funds. Information about the Trustees and Nominees, including their business addresses, ages, principal occupations during the past five years, and other current directorships of publicly traded companies or funds, are set forth in the table above.

The Board has appointed an Independent Trustee as Chair. The Chair presides at meetings of the Trustees and may call meetings of the Board and any Board committee whenever deemed necessary. The Chair also acts as a liaison with the Funds’ management, officers, attorneys, and other Trustees generally between meetings. The Chair may perform such other functions as may be requested by the Board from time to time. The Board has designated a number of standing committees as further described below, each of which has a Chair. The Board also may designate working groups or ad hoc committees as it deems appropriate.

The Board believes that this leadership structure is appropriate because it allows the Board to exercise informed and independent judgment over matters under its control, and it allocates areas of responsibility among committees or working groups of Trustees and the full Board in a manner that enhances effective oversight. The Board also believes that having a majority of Independent Trustees is appropriate and in the best interest of the Funds’ shareholders. In addition, the Board believes that having an Interested Trustee serve on the Board brings corporate and financial viewpoints that are, in the Board’s view, appropriate elements in its decision-making process. The leadership structure of the Board may be changed at any time and in the discretion of the Board, including in response to changes in circumstances or the characteristics of the Funds.

Risk Management

The Board oversees the risk management activities of the Adviser and the Funds’ other service providers. Shareholders should recognize that it may not be possible to identify all of the risks that may affect the Funds or to develop processes and controls to eliminate or mitigate their occurrence or effects. The Board discharges risk oversight as part of its overall activities, with the assistance of its Audit Committee and the Funds’ Chief Compliance Officer (CCO). In addressing issues regarding the Funds’ risk management between meetings, appropriate representatives of the Adviser communicate with the Chair of the Board or the Funds’ CCO, who is directly accountable to the Board. As appropriate, the Trustees confer among themselves, with the Funds’ CCO, the Adviser, other service providers, and counsel to the Funds, to identify and review risk management issues that may be placed on the Audit Committee’s or the full Board’s agenda.

Board Compensation

The following table provides information about compensation paid to the Trustees for the fiscal year ended December 31, 2014. The Independent Trustees receive compensation of $55,000 per year for their service as Trustees. The Board’s Chairperson and the Audit Committee Chairperson each receive an additional $5,000 per year in compensation. Neither the Trust nor the Funds maintain any deferred compensation, pension or retirement plans, and no pension or retirement benefits are accrued as Trust or Fund expenses. The Fund does not pay remuneration to its officers or to trustees who are officers, directors or employees of the Adviser.

| Name of Person, Position | | Aggregate Compensation from Funds | | Pension or Retirement Benefits Accrued as Part of Fund Expenses | | Estimated Annual Benefits Upon Retirement | | Total Compensation From Funds and Fund Complex Paid to Trustees |

| | | | | | | | | |

Norbert J. Conzemius Independent Trustee | | $60,000 | | $0 | | $0 | | $60,000 |

| | | | | | | | | |

| Name of Person, Position | | Aggregate Compensation from Funds | | Pension or Retirement Benefits Accrued as Part of Fund Expenses | | Estimated Annual Benefits Upon Retirement | | Total Compensation From Funds and Fund Complex Paid to Trustees |

Mary Schmid Daugherty Independent Trustee | | $60,000 | | $0 | | $0 | | $60,000 |

| | | | | | | | | |

Bert J. McKasy Independent Trustee | | $55,000 | | $0 | | $0 | | $55,000 |

| | | | | | | | | |

William B. Frels(1) Interested Trustee | | $0 | | $0 | | $0 | | $0 |

| | | | | | | | | |

Jon A. Theobald Interested Trustee | | $0 | | $0 | | $0 | | $0 |

____________________

(1) As part of a succession plan established by the Trust, Mr. Frels retired as a Trustee effective December 31, 2014.

Board Committees

The Board met four times during the fiscal year ended December 31, 2014. The Board has four standing committees. Information about those standing committees is listed in the table below.

| Standing Committees | Functions | | Members | Number of Meetings Held During Last Fiscal Year |

| | | | | |

Audit Committee1 | To make recommendations to the Board of Trustees regarding the selection of an independent registered public accounting firm, and to assist the Board of Trustees in its oversight of the Funds’ financial reporting process. The Audit Committee meets with the independent registered public accounting firm at least semi-annually to review the results of the examination of the Funds’ financial statements and any other matters relating to the Funds. | | Mary Schmid Daugherty (Chairperson) Norbert J. Conzemius Bert J. McKasy | 3 |

| | | | | |

Distribution Committee | To oversee and determine dividend and capital gain distributions for the Funds, including but not limited to calculation and declaration of regular dividend and capital gain distributions and spillover dividends. | | Mark L. Henneman (Chairperson) Jon A. Theobald Ronald L. Kaliebe Andrew R. Adams Andrea C. Stimmel Collyn E. Iblings2 | 4 |

| | | | | |

| Fair Value Committee | To oversee pricing of the Funds and to research and resolve any pricing problems. The Fair Value Committee meets quarterly and on an “as needed” basis. | | Jon A. Theobald (Chairperson) Ronald L. Kaliebe Andrea C. Stimmel Collyn E. Iblings Heidi J. Lynch3 | 4 |

| | | | | |

| Standing Committees | Functions | | Members | Number of Meetings Held During Last Fiscal Year |

Nominating and Governance Committee1 | To nominate individuals qualified to serve as members of the Board and to review, recommend committee appointments for the committees of the Board and oversee matters of governance of the Funds, including the administration of the Funds’ Governance Policy. | | Norbert J. Conzemius (Chairperson) Mary Schmid Daugherty Bert J. McKasy | 3 |

____________________

| (1) | The membership of the Audit and Nominating and Governance Committees consists of all of the Independent Trustees of the Trust. The Board has appointed Mr. Alt and Mr. Thiele to serve on the Audit and Nominating and Governance Committees upon their election by shareholders. |

| (2) | Ms. Iblings is a non-voting member of the Distribution Committee. |

| (3) | Ms. Lynch is a non-voting member of the Fair Value Committee. |

Shareholder Communications

Shareholders may communicate with the Board (or individual Trustees serving on the Board) by sending written communications, addressed to the Board as a group or any individual Trustee, to the Funds at W1520 First National Bank Building, 332 Minnesota Street, Saint Paul, Minnesota 55101. The Funds will ensure that this communication (assuming it is properly marked care of the Board or care of a specific Trustee) is delivered to the Board or the specified Trustee, as the case may be.

Trustee Nomination Process

The Board as a whole is responsible for identifying, evaluating and recommending nominees to serve as trustees of the Trust. The Board has established the Nominating and Governance Committee to develop and recommend guidelines and criteria for the selection of candidates for trustees and to recommend candidates to serve as trustees. The Nominating and Governance Committee operates pursuant to a written charter, which was most recently amended on December 18, 2014. The Nominating and Governance Committee Charter is attached as Exhibit A to the proxy statement. The Nominating and Governance Committee will consider candidates recommended by shareholders provided such recommendations are presented with appropriate background material concerning the candidate that demonstrates his or her ability to serve as a Board member.

Each shareholder wishing to recommend a candidate for election may do so by sending a written notice to the Secretary of the Funds containing the following information:

| | · | the name and address of the shareholder making the recommendation; |

| | · | the number of shares of each Fund which are owned of record and beneficially by such shareholder making the recommendation and the length of time that such shares have been so owned by the shareholder; |

| | · | a description of all arrangements and understandings between the nominating shareholder, the candidate and/or any other person or persons (including their names) pursuant to which the recommendation is being made, and if none, a statement to that effect; |

| | · | the name, age, date of birth, business address and residence address of the person or persons being recommended; |

| | · | a full listing of the proposed candidate’s education, experience and current employment; |

| | · | the written consent of the candidate to be named in the Funds’ proxy statement and to serve as a Trustee of the Funds if so nominated and elected; and |

| | · | any other information that would be helpful to the Committee in evaluating the candidate. |

The Secretary of the Funds shall forward the recommendation and supporting information to the Chair of the Nominating and Governance Committee for consideration by the Committee. The Funds may request additional information about the candidate as may be required in a proxy statement if the candidate were nominated.

The criteria for selecting board nominees set forth in the Nominating and Governance Committee Charter provides that the Board should be composed of:

| | · | trustees who will bring to the Board a variety of experience or backgrounds; |

| | · | trustees who have substantial business experience or financial expertise; |

| | · | trustees who have other skills that would be beneficial to the Funds, such as familiarity with the legal or tax requirements applicable to registered investment companies or knowledge of the investment company industry; and |

| | · | trustees who will represent the best interests of the shareholders as a whole, rather than special interest groups or constituencies. |

The criteria for selecting board nominees further require that each trustee should:

| | · | be an individual of the highest character and integrity and have an inquiring mind, vision and the ability to work well with others; |

| | · | be free of any conflict of interest which would violate any applicable law or regulation or interfere with the proper performance of the responsibilities of a trustee; and |

| | · | have sufficient time available to devote to the affairs of the Funds in order to carry out the responsibilities of a trustee. |

In evaluating nominees, the Nominating and Governance Committee will consider whether the individual’s background, skills and experience will complement the background, skills and experience of other nominees and will contribute to the diversity of the Board. Mr. Alt and Mr. Thiele were approved by the Nominating and Governance Committee as Nominees after being recommended for consideration by officers of the Trust.

Board Recommendation

The Board recommends that shareholders of the Trust vote FOR the election of each of the Nominees.

Required Vote

Trustees are elected by the affirmative vote of a plurality of the votes validly cast in person or by proxy at a meeting at which a quorum exists. This means that the six Nominees who receive the largest number of votes will be elected as Trustees. Abstentions and broker non-votes will not be counted as votes cast, but will be counted for purposes of determining whether a quorum is present. All outstanding shares of the Trust shall be voted in aggregate.

PROPOSAL 2: APPROVAL OF THE AMENDMENT

TO THE BALANCED FUND’S INVESTMENT OBJECTIVE

| | Current Objective | Proposed Objective |

| Balanced Fund | The Fund seeks to provide shareholders with regular current income, the potential for capital appreciation and a moderate level of risk by investing in a diversified portfolio including bonds, preferred stocks, common stocks and other securities convertible into common stock. The objective of the Fund is also to provide a current income yield of at least 25% greater than that of the S&P 500 Index, although there can be no assurance that this objective will be met. | The Fund seeks to provide capital growth, current income, and preservation of capital. |

The Proposal

The Board has approved, and recommends, that shareholders of the Balanced Fund approve amending the investment objective as stated above. The investment objective, as proposed, provides a more concise statement of the Balanced Fund’s investment objective. The investment objective will also be revised to remove the objective of providing a current income yield of at least 25% greater than that of the S&P 500 Index. While the Balanced Fund will continue to seek current income through its investments, the Adviser believes it will have greater flexibility in choosing the optimal investments for the Fund if the Fund’s investments are not tied to seeking a current income yield 25% greater than that of the S&P 500 Index.

The investment strategies and principal risks of the Balanced Fund will not change as a result of the proposed change in the Balanced Fund’s investment objective. The Balanced Fund will continue to emphasize investments in common stock and other securities convertible into common stock as well as fixed income securities such as corporate bonds and United States government securities. In selecting securities for the Balanced Fund, the Adviser gives preference to equity holdings in high quality companies, which are characterized by earnings that are reasonably predictable, have a return on equity that is above-average, hold market dominance and have financial strength. The Adviser gives some emphasis to companies located in the Upper Midwest region of the United States and to small and midcap companies. The Adviser defines a small company as a company with less than two billion dollars in market capitalization at the time of initial purchase, and a midcap company has a market capitalization between two and ten billion dollars at the time of initial purchase. The Adviser will also give preference to higher rated investment-grade fixed income securities (rated Baa or better by Moody’s Investors Service). Lower rated convertible and non-convertible debt securities may be purchased if, in the opinion of the Adviser, the potential rewards outweigh the incremental risks. The Balanced Fund may invest in mortgage-backed securities and may also invest in American Depositary Receipts (“ADRs”) and other foreign securities. The Balanced Fund will seek to keep its assets reasonably fully invested, to maintain modest portfolio turnover rates and to moderate risk by investing in a diversified portfolio of equity and fixed income securities.

Portfolio Managers

Ronald L. Kaliebe, lead portfolio manager since July 1, 2013, and co-manager of the Balanced Fund from January 2006 to June 2013 will continue to serve as lead portfolio manager for the Balanced Fund. Kevin V. Earley, co-manager of the Balanced Fund since January 1, 2015, will serve as co-manager of the Balanced Fund.

Board Recommendation

The Board recommends that shareholders of the Balanced Fund vote FOR the approval of the amendment to the Fund’s investment objective.

Required Vote

In order for the proposal to be approved with respect to the Balanced Fund, it must be approved by the affirmative vote of the holders of a “majority of the outstanding voting securities” of the Balanced Fund. The term “majority of the outstanding voting securities,” as defined in the 1940 Act and as used in this proxy statement, means: the affirmative vote of the lesser of (i) 67% of the voting securities of the Balanced Fund present at the meeting if more than 50% of the outstanding voting securities of the Balanced Fund are present in person or by proxy or (ii) more than 50% of the outstanding voting securities of the Balanced Fund. Abstentions and broker non-votes are counted as present but are not considered votes cast at the meeting. As a result, abstentions and broker non-votes will have the same effect as a vote against the proposal because approval of the proposal requires the affirmative vote of a percentage of either the shares present at the meeting or the outstanding shares of the Fund.

If shareholders approve this proposal, the change in the Balanced Fund’s new investment objective will be implemented as soon as practicable after the meeting. The investment objective will remain a fundamental policy which cannot be changed without shareholder approval. If, on the other hand, shareholders fail to approve this proposal, the Balanced Fund’s investment objective will remain unchanged.

OTHER INFORMATION

Management and Other Service Providers

Set forth below is a description of the current service providers of the Funds.

Adviser. The investment adviser for each Fund is Mairs and Power, Inc. The Adviser is located at W1520 First National Bank Building, 332 Minnesota Street, Saint Paul, Minnesota 55101.

Principal Underwriter and Distributor. ALPS Distributors, Inc., located at 1290 Broadway, Suite 1100, Denver, Colorado 80203, serves as principal underwriter and distributor for the Funds.

Administrator. The Adviser serves as the Administrator pursuant to a Fund Administration Servicing Agreement between the Administrator and the Trust. U.S. Bancorp Fund Services, LLC (“USBFS”), 615 East Michigan Street, Milwaukee, WI 53202, serves as sub-administrator pursuant to a Fund Administration Servicing Agreement between the Trust and USBFS.

Independent Registered Public Accounting Firm

The Audit Committee, composed of the Independent Trustees of the Trust, have selected Ernst & Young LLP (“Ernst & Young”), Suite 1400, 220 South Sixth Street, Minneapolis, Minnesota 55402 as the independent public accounting firm to each Fund. Ernst & Young is subject to annual appointment by the Audit Committee. Ernst & Young conducts an annual audit of each Fund’s financial statements and performs tax and accounting advisory services.

Audit Fees — The aggregate fees billed for professional services rendered by Ernst & Young for the audit of the Funds’ annual financial statements or services normally provided in connection with statutory and regulatory filings or engagements for the last two fiscal years ended December 31, 2013 and December 31, 2014 were $95,450 and $98,400, respectively.

Audit Related Fees — For the last two fiscal years ended December 31, 2013 and December 31, 2014, no fees for assurance and related services that are reasonably related to the performance of the audit or review of financial statements that were not reported as Audit Fees above were billed by Ernst & Young.

Tax Fees — The aggregate fees billed for professional services rendered by Ernst & Young to the Funds for tax compliance, tax advice, tax planning and tax return preparation for the last two fiscal years ended December 31, 2013 and December 31, 2014 were $20,100 and $20,700, respectively. These services consisted of Ernst & Young reviewing the Funds’ excise tax returns, distribution requirements and registered investment company tax returns, as well as consultations regarding the tax consequences of specific investments.

All Other Fees — There were no fees billed for the fiscal years ended December 31, 2013 and December 31, 2014 for products and services provided by Ernst & Young to the Funds, other than the services reported in Audit Fees, Audit Related Fees and Tax Fees above.

For the last two fiscal years ended December 31, 2013 and December 31, 2014, no fees for services rendered to the Funds and the Adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Funds for non-audit services that relate directly to the operations and financial reporting of the Funds were billed by Ernst & Young.

The Audit Committee of the Board meets with the Funds’ independent registered public accounting firm and the Funds’ management to review and pre-approve all audit services to be provided by the independent accountants. The Audit Committee also pre-approves all permitted non-audit services to be provided by the Funds’ independent registered public accounting firm to the Funds.

The Audit Committee, pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X, also pre-approves Ernst & Young’s engagements for non-audit services with the Adviser, and any entity controlling, controlled by, or under common control with the Adviser that provides ongoing services to the Funds, if the engagement relates directly to the operations and financial reporting of the Funds. The aggregate fees billed for non-audit services rendered by Ernst & Young to the Adviser for the last two fiscal years ended December 31, 2013 and December 31, 2014 were $20,350 and $24,600, respectively. None of these services related to the operations or financial reporting of the Funds. The Audit Committee has concluded that the provision of these services to the Adviser is compatible with Ernst & Young’s independence.

Representatives of Ernst & Young are not expected to be present at the special meeting of shareholders. Should any representatives of Ernst & Young attend the meeting they will have an opportunity to make a statement if they so desire.

Proxies

Whether you expect to be personally present at the special meeting or not, we encourage you to vote by proxy. You can do this in one of three ways. You may complete, date, sign and return the accompanying proxy card using the enclosed postage prepaid envelope; you may vote by calling 1-866-416-0565; or you may vote by internet in accordance with the instructions noted on the enclosed proxy card. Your shares will be voted as you instruct. If no choice is indicated, your shares will be voted FOR each proposal and in the discretion of the persons named as proxies on such other matters that may properly come before the special meeting. Any shareholder giving a proxy may revoke it before it is exercised at the special meeting by submitting to the Secretary of the Funds a written notice of revocation or a subsequently signed proxy card, or by attending the special meeting and voting in person. A prior proxy can also be revoked through the website or toll free telephone number listed on the enclosed proxy card. If not so revoked, the shares represented by the proxy will be cast at the special meeting and any adjournments thereof. Attendance by a shareholder at the special meeting does not, in itself, revoke a proxy.

Other Information

Shareholders are entitled to one vote for each full share held and are entitled to fractional votes for fractional shares.

A quorum must be present at the meeting for the transaction of business. Under the Trust’s Declaration of Trust, a quorum is defined as the presence, in person or by proxy, of one-third of the issued and outstanding shares of the Trust entitled to vote on proposal 1. With respect to proposal 2, a quorum is defined as one-third of the issued and outstanding shares of the Balanced Fund entitled to vote on proposal 2.

Adjournment

In the event that a quorum is not present at the meeting, or in the event that a quorum is present but sufficient votes to approve the proposal are not received, the persons named as proxies may propose one or more adjournments of the meeting to a later date to permit further solicitation of votes. Any such adjournment will require the affirmative vote of a majority of shares of the Trust or Fund, as applicable, present or represented by proxy at the meeting to be adjourned. When voting on a proposed adjournment, the persons named as proxies will vote all proxies that they are entitled to vote FOR approval of any proposal in favor of adjournment and will vote all proxies required to be voted AGAINST any such proposal against adjournment.

Solicitation of Proxies

Proxies are solicited primarily by mail. Additional solicitations may be made by telephone by officers or employees of the Funds and the Adviser or by proxy soliciting firms retained by the Funds. The Funds have retained AST Fund Solutions, LLC (the “Solicitor”) to provide proxy solicitation services in connection with the meeting at an estimated cost of up to $199,661. The Solicitor will also be responsible for printing and mailing the proxy statement as well as providing proxy tabulation services. In addition, the Funds may reimburse persons holding shares in their names or names of their nominees for expenses incurred in forwarding solicitation material to their beneficial owners. The Funds will bear the costs of preparing, printing and mailing the proxy statements and soliciting and tabulating proxies.

As the meeting date approaches, the shareholders of the Funds may receive a call from a representative of the Solicitor if the Funds have not yet received their proxies. Authorization to permit the Solicitor to execute proxies may be obtained by telephonic instructions from shareholders. Proxies that are obtained telephonically will be recorded in accordance with the procedures set forth below. Management of the Funds believes that these procedures are reasonably designed to ensure that the identity of the shareholder casting the vote is accurately determined and that the proxies of the shareholders are accurately determined. In all cases where a telephonic proxy is solicited, the Solicitor’s representative is required to ask the shareholder for the shareholder’s full name, address, title (if the person giving the proxy is authorized to act on behalf of an entity, such as a corporation), the number of shares owned and to confirm that the shareholder has received this proxy statement in the mail. If the shareholder solicited agrees with the information provided to the Solicitor by the Funds, the Solicitor’s representative has the responsibility to explain the process, read the proposals listed on the proxy card, and ask for the shareholder’s votes on each proposal. The Solicitor’s representative, although permitted to answer questions about the process, is not permitted to recommend to the shareholder how to vote, other than to read any recommendation set forth in this proxy statement. The Solicitor will record the shareholder’s proxy on the card. Within 72 hours, the Solicitor will send the shareholder a letter to confirm the shareholder’s vote and ask the shareholder to call the Solicitor immediately if the shareholder’s proxy is not correctly reflected in the confirmation.

Record Date and Outstanding Shares

Only shareholders of record of the Funds at the close of business on February 10, 2015 are entitled to notice of and to vote at the meeting and any postponement or adjournment thereof. As of the Record Date, the aggregate number of outstanding shares of the Trust that were entitled to vote at the meeting was 53,674,280.190. On that date, the Growth Fund had 36,674,321.642 shares outstanding and entitled to vote, the Balanced Fund had 8,526,479.377 shares outstanding and entitled to vote and the Small Cap Fund had 8,473,479.171 outstanding and entitled to vote.

Control Persons and Principal Shareholders

A principal shareholder is any person who owns of record or beneficially 5% or more of the outstanding shares of a Fund. A control person is a shareholder that owns beneficially or through controlled companies more than 25% of the voting securities of a Fund or acknowledges the existence of control. Shareholders owning voting securities in excess of 25% may determine the outcome of any matter affecting and voted on by shareholders of a Fund.

As of February 10, 2015, the following shareholders were considered to be either a control person or principal shareholder of a Fund:

Growth Fund

| Name and Address | Number of Shares | % Ownership | Nature of Ownership |

National Financial Services Corp For The Exclusive Benefit of Our Customers 499 Washington Blvd Fl 5 Jersey City, NJ 07310-2010 | 4,047,166.60 | 11.03% | Record |

Charles Schwab 211 Main Street San Francisco, CA 94105-1905 | 3,849,220.93 | 10.50% | Record |

TD Ameritrade Inc. For The Exclusive Benefit of our Clients PO Box 2226 Omaha, NE 68103-2226 | 2,153,077.33 | 5.87% | Record |

Balanced Fund

| Name and Address | Number of Shares | % Ownership | Nature of Ownership |

Charles Schwab 211 Main Street San Francisco, CA 94105-1905 | 1,779,880.86 | 20.87% | Record |

National Financial Services Corp For The Exclusive Benefit of Our Customers 499 Washington Blvd Fl 5 Jersey City, NJ 07310-2010 | 1,418,166.65 | 16.63% | Record |

TD Ameritrade Inc. For The Exclusive Benefit of our Clients PO Box 2226 Omaha, NE 68103-2226 | 845,331.42 | 9.91% | Record |

Pershing, LLC 1 Pershing Plaza, Floor 14 Jersey City, NJ 07399-0002 | 770,744.43 | 9.04% | Record |

Small Cap Fund

| Name and Address | Number of Shares | % Ownership | Nature of Ownership |

National Financial Services Corp For The Exclusive Benefit of Our Customers 499 Washington Blvd Fl 5 Jersey City, NJ 07310-2010 | 1,906,326.47 | 22.50% | Record |

Charles Schwab 211 Main Street San Francisco, CA 94105-1905 | 1,665,198.90 | 19.65% | Record |

Pershing, LLC 1 Pershing Plaza, Floor 14 Jersey City, NJ 07399-0002 | 1,139,285.00 | 13.45% | Record |

Householding. The SEC has adopted rules that permit investment companies, such as the Trust, to satisfy delivery requirements for proxy statements with respect to two or more shareholders sharing the same address by delivering a single proxy statement addressed to those shareholders. This process, which is commonly referred to as “householding,” could result in extra convenience and cost savings for the Funds and their shareholders.

If you participate in householding and unless the Trust has received contrary instructions, only one copy of this proxy statement will be mailed to two or more shareholders who share an address. If you want to receive multiple copies of these materials or request householding in the future, please contact the Trust at 1-800-304-7404, or write to the Trust at Mairs & Power Funds c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, Wisconsin 53201-0701. Once notification to stop householding is received, the Trust will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

FUTURE MEETINGS; SHAREHOLDER PROPOSALS

The Funds do not hold annual or other regular meetings of the shareholders. Since the Funds do not hold regular meetings of shareholders, the anticipated date of the next shareholder meeting of the Funds cannot be provided. To be considered for inclusion in the proxy statement for any subsequent meeting of shareholders, a shareholder proposal must be submitted a reasonable time before the proxy statement for that meeting is mailed. Whether a proposal is included in the proxy statement will be determined in accordance with applicable federal and state laws. The timely submission of a proposal does not guarantee its inclusion.

By Order of the Board of Trustees,

/s/ Jon A. Theobald

Jon A. Theobald

Secretary, Mairs & Power Funds Trust

Saint Paul, Minnesota

February 25 , 2015

EXHIBIT A

MAIRS & POWER FUNDS TRUST

NOMINATING AND GOVERNANCE COMMITTEE CHARTER

December 18, 2014

Purpose

The purpose of the Nominating and Governance Committee of the Board of Trustees of Mairs & Power Funds Trust (the “Funds”) is to:

| · | Nominate individuals qualified to serve as members of the Board of Trustees. |

| · | Review and recommend committee appointments for the committees of the Board of Trustees. |

| · | Oversee matters of governance of the Funds, including the administration of the Funds’ Governance Policy. |

Membership

The Nominating and Governance Committee shall consist of three or more members of the Board of Trustees, none of whom is an “interested person” of the Funds within the meaning of Section 2(a)(19) of the Investment Company Act.

The Board of Trustees will appoint the members of the Nominating and Governance Committee, who shall serve at the pleasure of the Board of Trustees, for such term or terms as the Board of Trustees may determine.

Duties and Responsibilities

The Nominating and Governance Committee shall have the following duties and responsibilities:

| · | Develop and recommend to the Board of Trustees guidelines and criteria for the selection of candidates for trustees. A copy of the guidelines adopted by the Board of Trustees is attached as Exhibit 1. |

| · | Develop policies and procedures for any other aspects of trustee nomination which the Funds’ proxy statements must disclose pursuant to Schedule 14A under the Securities Exchange Act. |

| · | Recommend to the Board of Trustees qualified nominees to serve as trustees of the Funds. As required, make recommendations to the Board of Trustees regarding candidates for election by shareholders or to fill vacancies in the Board of Trustees resulting from death, resignation or other cause, or by reason of an increase in the total number of trustees. |

| · | Review and make recommendations to the Board of Trustees regarding the selection of members to serve on the committees of the Board of Trustees, taking into consideration the charter for such committees, any requirements for independent trustees on such committees, and any other factors the Nominating and Governance Committee deems relevant. |

| · | Review and make recommendations to the Board of Trustees relating to issues pertaining to the effectiveness of the Board in carrying out its responsibilities, including, but not limited to, |

| Ø | Retirement policies relating to Trustees; |

| Ø | Trustee compensation; and |

| Ø | Identification of best practices for the Board of Trustees. |

| · | Oversee the annual self-evaluation of the Board of Trustees and its committees. |

| · | Develop and periodically review succession plans for the trustees and the officers of the Funds and periodically report to the Board of Trustees on these matters. |

| · | Periodically review the Funds’ Governance Policy, and recommend any proposed changes to the Board for approval. |

| · | Maintain minutes of Committee meetings and report its significant activities to the Board of Trustees. |

| · | On an annual basis, review the designation of trustees who are “interested persons” of the Funds within the meaning of Section 2(a)(19) of the Investment Company Act and recommend any change in the composition of the Board (including the relative relationship of interested to independent Board members). |

Structure and Operations

Chair. The Board of Trustees may designate one member of the Nominating and Governance Committee as its chairperson. The chairperson shall serve until the earlier of (a) the last day of the calendar quarter five years after his or her initial appointment and until his or her successor has been duly appointed and qualified by the Board of Trustees; or (b) the date on which he or she resigns as chairperson or is no longer a Trustee, as provided in the Funds’ Declaration of Trust. The five-year term may be extended by the Board of Trustees in certain circumstances.

Meetings. The Nominating and Governance Committee will meet in person or telephonically as determined by the Nominating and Governance Committee chairperson, when deemed necessary or desirable by the Nominating and Governance Committee or its chairperson. The Nominating and Governance Committee may request any officer or employee of the Funds or the Funds’ outside counsel to attend a meeting of the Nominating and Governance Committee or to meet with any members of, or consultants to, the Nominating and Governance Committee.

Quorum. A majority of the members of the Nominating and Governance Committee shall constitute a quorum, and shall be empowered to act on behalf of the Nominating and Governance Committee.

Advisors. The Nominating and Governance Committee shall have the authority to obtain advice and assistance from external legal, accounting or other experts, advisers and consultants, including search firms used to identify trustee candidates, to assist in carrying out its duties and responsibilities, and shall have the authority to retain and approve the fees and other retention terms for any external experts, advisers or consultants.

EXHIBIT 1

GUIDELINES FOR SELECTING BOARD CANDIDATES

The following guidelines set forth (i) the criteria considered by the Nominating and Governance Committee in selecting nominees for trustees of the Funds; and (ii) the appropriate procedures for shareholders of the Funds to submit recommendations to the Nominating and Governance Committee for candidates to the Board.

Criteria for Selecting Board Nominees

The Board of Trustees should be composed of:

| | · | Trustees who will bring to the Board a variety of experience or backgrounds. |

| | · | Trustees who have substantial business experience or financial expertise. |

| | · | Trustees who have other skills that would be beneficial to the Funds, such as familiarity with the legal or tax requirements applicable to registered investment companies or knowledge of the investment company industry. |

| | · | Trustees who will represent the best interests of the shareholders as a whole, rather than special interest groups or constituencies. |

Each trustee should:

| | · | Be an individual of the highest character and integrity and have an inquiring mind, vision and the ability to work well with others. |

| | · | Be free of any conflict of interest which would violate any applicable law or regulation or interfere with the proper performance of the responsibilities of a trustee. |

| | · | Have sufficient time available to devote to the affairs of the Funds in order to carry out the responsibilities of a trustee. |

In evaluating nominees, the Nominating and Governance Committee will consider whether the individual’s background, skills and experience will complement the background, skills and experience of other nominees and will contribute to the diversity of the Board.

Procedures for Submitting Recommendations to the Nominating and Governance Committee

The Nominating and Governance Committee will consider recommendations for Trustee nominees submitted to it by current Board members, Fund management and shareholders so long as such recommendations are presented with appropriate background material concerning the candidate that demonstrates his or her ability to serve as a Board member.

Each shareholder wishing to recommend a candidate for election to the Board may do so by sending a written notice to the Secretary of the Funds containing the following information:

| | a) | the name and address of the shareholder making the recommendation; |

| | b) | the number of shares of each Fund which are owned of record and beneficially by such shareholder and the length of time that such shares have been so owned by the shareholder; |

| | c) | a description of all arrangements and understandings between the nominating shareholder, the candidate and/or any other person or persons (including their names) pursuant to which the recommendation is being made, and if none, a statement to that effect; |

| | d) | the name, age, date of birth, business address and residence address of the person or persons being recommended; |

| | e) | a full listing of the proposed candidate’s education, experience and current employment; |

| | f) | the written consent of the candidate to be named in the Funds’ proxy statement and to serve as a Trustee of the Funds if so nominated and elected; and |

| | g) | any other information that would be helpful to the committee in evaluating the candidate. |

The Secretary of the Funds shall forward the recommendation and supporting information to the Chair of the Nominating and Governance Committee for consideration by the Committee. The Funds may request additional information about the candidate as may be required in a proxy statement if the candidate were nominated.