UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22562

Babson Capital Global Short Duration High Yield Fund

(Exact name of registrant as specified in charter)

550 South Tryon Street, Charlotte, NC 28202

(Address of principal executive offices) (Zip code)

Janice M. Bishop

Secretary and Chief Legal Officer

c/o Babson Capital Management LLC

Independence Wharf

470 Atlantic Avenue

Boston, MA 02210

(Name and address of agent for service)

704-805-7200

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Item 1. Reports to Stockholders.

| | | |

| | | |

| | | |

| | Babson Capital Global Short Duration High Yield Fund | |

| | c / o Babson Capital Management LLC | |

| | 550 South Tryon St. | |

| | Charlotte, NC 28202 | |

| | 704.805.7200 | |

| | http://www.BabsonCapital.com/bgh | |

| | | |

| | ADVISER | |

| | Babson Capital Management LLC | |

| | 550 South Tryon St. | |

| | Suite 3300 | |

| | Charlotte, NC 28202 | |

| | | |

| | SUB-ADVISOR | |

| | Babson Capital Global Advisors Limited | |

| | 61 Aldwych | |

| | London, UK | |

| | WC2B 4AE | |

| | | |

| | COUNSEL TO THE FUND | |

| | Ropes & Gray LLP | |

| | Prudential Tower | |

| | 800 Boylston Street | |

| | Boston, Massachusetts 02110 | |

| | | |

| | INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| | KPMG LLP | |

| | Two Financial Center | |

| | 60 South Street | |

| | Boston, Massachusetts 02111 | |

| | | |

| | CUSTODIAN | |

| | US Bank | |

| | MK-WI-S302 | |

| | 1555 N. River Center Drive | |

| | Milwaukee, WI 53212 | |

| | | |

| | TRANSFER AGENT & REGISTRAR | |

| | U.S. Bancorp Fund Services, LLC | |

| | 615 E. Michigan St. | |

| | Milwaukee, WI 53202 | |

| | | |

| | FUND ADMINISTRATION/ACCOUNTING | |

| | U.S. Bancorp Fund Services, LLC | |

| | 615 E. Michigan St. | |

| | Milwaukee, WI 53202 | |

| | | |

| | | |

| | | |

| | PROXY VOTING POLICIES & PROCEDURES | |

| | The Trustees of Babson Capital Global Short Duration High Yield Fund (the “Fund”) have delegated proxy voting responsibilities relating to the voting of securities held by the Fund to Babson Capital Management LLC (“Babson Capital”). A description of Babson Capital���s proxy voting policies and procedures is available (1) without charge, upon request, by calling, toll-free 1-866-399-1516; (2) on the Fund’s website at http://www.BabsonCapital.com/bgh; and (3) on the U.S. Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov. | |

| | | |

| | FORM N-Q | |

| | The Fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This information is available (i) on the SEC’s website at http://www.sec.gov; and (ii) at the SEC’s Public Reference Room in Washington, DC (which information on their operation may be obtained by calling 1-800-SEC-0330). A complete schedule of portfolio holdings as of each quarter-end is available on the Trust’s website at http://www.BabsonCapital.com/bgh or upon request by calling, toll-free, 1-866-399-1516. | |

OFFICERS OF THE FUND

Russell Morrison

President and Principal Executive Officer

Patrick Hoefling

Chief Financial Officer and Principal Financial

and Accounting Officer

Andrew Lennon

Treasurer

Michael Freno

Vice President

Sean Feeley

Vice President

Scott Roth

Vice President

Melissa LaGrant

Chief Compliance Officer

Janice Bishop

Secretary/Chief Legal Officer

Michele Manha

Assistant Secretary

BABSON CAPITAL GLOBAL SHORT DURATION HIGH YIELD FUND

Babson Capital Global Short Duration High Yield Fund is a closed-end investment company, first offered to the public in 2012, whose shares are traded on the New York Stock Exchange.

INVESTMENT OBJECTIVE & POLICY

Babson Capital Global Short Duration High Yield Fund (the “Fund”) was organized as a business trust under the laws of the Commonwealth of Massachusetts on May 20, 2011, and commenced operations on October 26, 2012. The Fund is registered under the Investment Company Act of 1940, as amended, as a non-diversified, closed-end management investment company with its own investment objective. The Fund’s common shares are listed on the New York Stock Exchange under the symbol “BGH”.

The Fund’s primary investment objective is to seek as high a level of current income as the Adviser (as defined herein) determines is consistent with capital preservation. The Fund seeks capital appreciation as a secondary investment objective when consistent with its primary investment objective. There can be no assurance that the Fund will achieve its investment objectives.

The Fund will seek to take advantage of inefficiencies between geographies, primarily the North American and Western European high yield bond and loan markets and within capital structures between bonds and loans. For example, the Fund will seek to take advantage of differences in pricing between bonds and loans of an issuer denominated in U.S. dollars and substantially similar bonds and loans of the same issuer denominated in Euros, potentially allowing the Fund to achieve a higher relative return for the same credit risk exposure.

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

DEAR FELLOW SHAREHOLDERS,

We are excited to provide you with the Annual Report for the Fund, Babson Capital Management LLC’s most recent closed-end fund offering. It has been over two decades since our last offering in the closed-end fund market and this most recent Fund provides retail investors direct access to the Global High Yield Investments Group within Babson Capital. We believe we have one of the largest global high yield investment teams in the market with the capability to offer investors unique and timely investment products. As our investment experience in the global high yield markets spans multiple credit cycles, we believed that 2012 was an opportune time to offer an attractive portfolio of global high yield assets to fulfill investors’ search for yield in the current low interest rate environment. We believe the global high yield asset class provides investors an adequate risk-reward premium, especially when focusing on the short duration spectrum of the market. This strategy allows investors to take advantage of expected low default rates while reducing interest rate risk.

The global nature of the portfolio, primarily focusing on North American and Western European credits, provides investors with additional benefits compared to a U.S. only portfolio such as higher quality, increased yield, and lower duration credits. We emphasize higher-rated, high yield assets coupled with a limit of 10% on CCC-rated credits. By leveraging over 70 investment professionals in the U.S. and U.K., we are able to primarily focus on North American and Western European credits with a fundamental bottom-up research approach and provide investors with what we believe to be our best relative value opportunities across jurisdictions, industries, credit quality and within corporate capital structures. We believe this approach and our seasoned team of investment professionals can potentially provide investors with attractive dividend yields for years to come.

Market Review

2012 proved to be a challenging market environment for investors. With investors searching for yield in the current low interest rate environment, appetite for the global high yield market increased, which ultimately had a positive effect on performance. Actions by central banks in the U.S. and Europe played a large role in the second half of 2012 and led to risk assets rallying. Specifically, the Federal Reserve made aggressive commitments to open-ended and unlimited asset purchase programs until the labor market strengthens, and pledged to maintain near zero rates for a considerable period of time. In Europe, tail risks were reduced significantly following the European Central Bank’s stance on ‘doing whatever it takes to preserve the Euro’. Both of these actions contributed to the significant rally in the global high yield market.

Yields in the global high yield bond market have reached record lows in recent months. However, spreads remain close to their historical average despite the positive fundamental backdrop. We believe credit fundamentals have remained relatively stable, following significant balance sheet improvements over the last three years, and we expect default rates to remain below their historical averages in the near-term.

Momentum in both supply and demand for global high yield assets has lent to a favorable technical environment. The 2012 new issuance total surpassed the levels experienced in 2011. Retail investors continue to invest in high yield, with recent fund flows remaining positive and holding strong.

Additionally, the European market offers investors more yield and spread, higher ratings, lower leverage profile and shorter durations. The Fund’s non-U.S. dollar dominated securities are hedged back to U.S. dollars, reducing the currency exposure to investors.

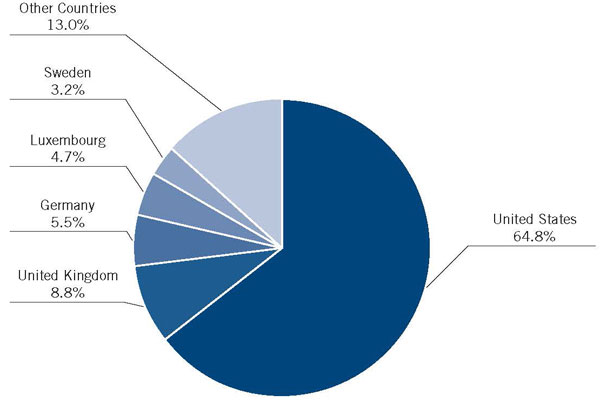

Babson Capital Global Short Duration High Yield Fund Overview and Performance

After the initial public offering of the Fund in October, the portfolio management team prudently invested the capital in both the U.S. and Western European credit markets primarily by taking advantage of attractive relative value opportunities in the secondary market. The Fund ended the year with a well-diversified portfolio of 121 issuers. A majority of the issuers are domiciled in the U.S. (64.5%) followed by the U.K. (8.8%) and Germany (5.5%) - see Country Composition chart on page 4. A focus of this Fund is to find attractive relative value opportunities in the global high yield market and the Fund invested in a number of issuers in the European region with attractive yield potential. From a fundamental bottom-up credit analysis standpoint, many of these issuers are stable credits that exhibit strong free cash flow generation along with global revenue streams, which can potentially help the issuers withstand additional European economic headwinds.

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

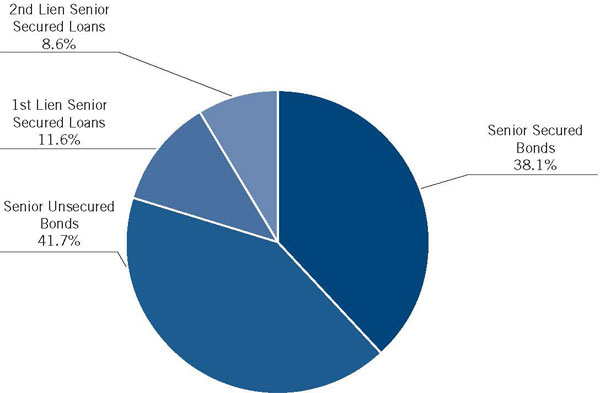

The Fund ended 2012 well positioned from a quality standpoint: 68.3% B-rated, 20.2% BB-rated, and 9.9% CCC-rated, with almost 60% of the portfolio consisting of secured obligations. Within the CCC-rated and below category, the majority of these assets are senior secured 2nd lien loans. Based on our experience within the current market environment, we believe these senior secured 2nd lien loan assets offer a tremendous amount of value and being senior secured by nature offers additional protection to investors. Note that 90% of the Fund’s European exposure consists of secured obligations.

In December, the Fund recorded its first dividend payment of $0.1677 per share, comprised of net investment income. Based on the Fund’s initial public offering price of $25.00 per share, the distribution represents an annualized yield of 8.05% per share. Assets acquired through leverage, which represented 17% at year-end, were accretive to net investment income and benefitted shareholders. From an NAV performance standpoint, the Fund increased +2.69% since inception.

In Conclusion

In general, we believe global high yield credit fundamentals are likely to remain relatively stable. It is our opinion that the central banks’ recent commitments to maintain low interest rates for the foreseeable future will also help sustain solid performance in the high yield market. We also expect global default rates to generally remain below their historical averages and as a result, we believe that the global high yield market will continue to offer attractive opportunities, despite the recent decline in yields.

We continue to believe that our bottom-up fundamental approach to investing will allow us to capture attractive investment opportunities for the Fund. So far, the Fund has gotten off to a strong start since the initial offering and we believe the Fund’s dividend will continue to be attractive for the foreseeable future.

Thank you again for supporting Babson Capital, the Global High Yield Investments Group, and the Fund this year. We look forward to a successful 2013 for our shareholders.

Sincerely,

Russell Morrison

President and Principal Executive Officer

Babson Capital Global Short Duration High Yield Fund

Cautionary Notice: Certain statements contained in this report may be “forward looking” statements. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date in which they are made and which reflect management’s current estimates, projections, expectations or beliefs, and which are subject to risks and uncertainties that may cause actual results to differ materially. These statements are subject to change at any time based upon economic, market or other conditions and may not be relied upon as investment advice or an indication of the Trust’s trading intent. References to specific securities are not recommendations of such securities, and may not be representative of the Fund’s current or future investments. We undertake no obligation to publicly update forward looking statements, whether as a result of new information, future events, or otherwise.

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

PORTFOLIO COMPOSITION (% OF ASSETS*)

COUNTRY COMPOSITION (% OF ASSETS*)

| | |

| * | Percentage of assets are expressed by market value excluding cash and may vary over time. The percentages shown above represent a percentage of the Fund’s invested assets as of December 31, 2012. |

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

This page left intentionally blank.

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | BABSON CAPITAL GLOBAL SHORT DURATION HIGH YIELD FUND | | |

| | | | |

| | Financial Report | | |

| | | | |

| | Statement of Assets and Liabilities | 7 | |

| | | | |

| | Statement of Operations | 8 | |

| | | | |

| | Statement of Cash Flows | 9 | |

| | | | |

| | Statements of Changes in Net Assets | 10 | |

| | | | |

| | Selected Financial Highlights | 11 | |

| | | | |

| | Schedule of Investments | 12-18 | |

| | | | |

| | Notes to Financial Statements | 19-24 | |

| | | | |

| | Report of Independent Registered Public Accounting Firm | 25 | |

| | | | |

| | Independent Trustees | 27 | |

| | | | |

| | Officers of the Fund | 28-29 | |

| | | | |

| | Approval of Investment Management Agreement and Sub-Advisory Agreement | 30 | |

| | | | |

| | Fund Dividend Reinvestment Plan | 31 | |

| | | | |

| | Joint Privacy Notice | 32 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

STATEMENT OF ASSETS AND LIABILITIES | | | | | |

| | | December 31, 2012 | |

| | | | | |

| Assets | | | | |

| Investments, at fair value (cost $573,257,886) | | $ | 584,620,319 | |

| Cash | | | 34,199,451 | |

| Foreign currency, at fair value (cost $6,047,699) | | | 6,039,161 | |

| Receivable for investments sold | | | 2,032,936 | |

| Interest receivable | | | 8,679,103 | |

| Prepaid expenses and other assets | | | 19,660 | |

| Total assets | | | 635,590,630 | |

| | | | | |

| Liabilities | | | | |

| Unrealized depreciation on forward foreign exchange contracts | | | 2,711,229 | |

| Payable for investments purchased | | | 41,213,009 | |

| Payable to adviser | | | 842,094 | |

| Dividend payable | | | 3,361,505 | |

| Accrued expenses and other liabilities | | | 458,186 | |

| Note payable | | | 100,000,000 | |

| Total liabilities | | | 148,586,023 | |

| Total net assets | | $ | 487,004,607 | |

| | | | | |

| Net Assets | | | | |

| Common stock, $0.00001 par value; 20,044,750 shares issued and outstanding (unlimited shares authorized) | | $ | 200 | |

| Additional paid-in capital | | | 477,565,969 | |

| Undistributed net investment income | | | 462,699 | |

| Accumulated net realized gain | | | 302,820 | |

| Net unrealized appreciation | | | 8,672,919 | |

| Total net assets | | $ | 487,004,607 | |

| Net asset value per share | | $ | 24.30 | |

See accompanying Notes to Financial Statements

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

| | | | | |

| | | Period from October 26, 2012 (1) through December 31, 2012 | |

| | | | | |

| Investment Income | | | | |

| Interest income | | $ | 5,109,116 | |

| Total investment income | | | 5,109,116 | |

| | | | | |

| Operating Expenses | | | | |

| Advisory fees | | | 842,094 | |

| Professional fees | | | 175,500 | |

| Administrator fees | | | 252,628 | |

| Interest expense | | | 78,934 | |

| Printing and mailing expense | | | 20,000 | |

Directors’ fees | | | 7l,750 | |

| Total operating expenses | | | 1,440, 906 | |

| Net investment income | | | 3,668,210 | |

| | | | | |

| Realized and Unrealized Gains (Losses) on Investments | | | | |

| Net realized gain on investments | | | 302,820 | |

| Net realized loss on forward foreign exchange contracts | | | (35,846 | ) |

| Net realized gain on foreign currency and translation | | | 191,840 | |

| Net realized gain on investments | | | 458,814 | |

| Net unrealized appreciation of investments | | | 11,362,433 | |

| Net unrealized depreciation of forward foreign exchange contracts | | | (2,711,229 | ) |

| Net unrealized appreciation of foreign currency and translation | | | 21,715 | |

| Net unrealized appreciation on investments | | | 8,672,919 | |

| Net realized and unrealized gains on investments | | | 9,131,733 | |

| Net increase in net assets resulting from operations | | $ | 12,799,943 | |

| (1) | Commencement of operations. |

See accompanying Notes to Financial Statements

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

| | | | |

| | | Period from October 26, 2012 (1) through December 31, 2012 | |

| | | | |

| Reconciliation of net increase in net assets resulting from operations to net cash used in operating activities | | | |

| Net increase in net assets applicable to common shareholders resulting from operations | | $ | 12,799,943 | |

| Adjustments to reconcile net increase in net assets applicable to common shareholders resulting from operations to net cash used in operating activities: | | | | |

| Purchases of long-term investments | | | (590,043,866 | ) |

| Proceeds from sales of long-term investments | | | 17,146,547 | |

| Purchases of foreign currency, net | | | (6,047,699 | ) |

| Forward exchange contracts, net | | | 2,711,229 | |

| Net unrealized depreciation | | | (11,353,895 | ) |

| Net realized gain | | | (448,564 | ) |

| Amortization and acretion | | | 87,997 | |

| Changes in operating assets and liabilities: | | | | |

| Increase in interest receivable | | (8,679,103 | ) |

| Increase in prepaid expenses and other assets | | | (19,660 | ) |

| Increase in receivable for investments sold | | | (2,032,936 | ) |

| Increase in payable for investments purchased | | | 41,213,009 | |

| Increase in payable to adviser | | | 842,094 | |

| Increase in accrued expenses and other liabilities | | | 458,186 | |

| Net cash used in operating activities | | | (543,366,718 | ) |

| | | | | |

| | | | | |

| Cash Flows From Financing Activities | | | | |

| Advances from note payable | | | 100,000,000 | |

| Issuance of common shares | | | 501,013,750 | |

| Common stock issuance costs | | | (23,547,646 | ) |

| Net cash provided by financing activities | | | 577,466,104 | |

| | | | | |

| | | | | |

| Net change in cash | | | 34,099,386 | |

| Cash beginning of period | | | 100,065 | |

| Cash end of period | | $ | 34,199,451 | |

| (1) | Commencement of operations. |

See accompanying Notes to Financial Statements

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

STATEMENT OF CHANGES IN NET ASSETS | | | | | |

| | | Period from October 26, 2012 (1) through December 31, 2012 | |

| | | | | |

| Operations | | | | |

| Net investment income | | $ | 3,668,210 | |

| Net realized gain on investments | | | 458,814 | |

| Net unrealized appreciation on investments | | | 8,672,919 | |

| Net increase in net assets resulting from operations | | | 12,799,943 | |

| | | | | |

| Dividends to Common Shareholders | | | | |

| Net investment income | | | (3,361,505 | ) |

| Total dividends to common shareholders | | | (3,361,505 | ) |

| | | | | |

| Capital Share Transactions | | | | |

| Net proceeds from sale of shares | | | 477,466,104 | (2) |

| Net increase in net assets capital stock transactions | | | 477,466,104 | |

| Total increase in net assets | | | 486,904,542 | |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | | 100,065 | |

| End of period (including undistributed net investment income of 462,699) | | $ | 487,004,607 | |

| (1) | Commencement of operations. |

| (2) | Proceeds from sale of shares of $501,013,750 net of sales load paid and offering costs of $23,547,646. |

See accompanying Notes to Financial Statements

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

| | | | | |

| | | Period From

October 26, 2012 (1)

through

December 31, 2012 | |

| | | | | |

Per Common Share Data (2) | | | | |

| Net asset value, beginning of period | | $ | 23.82 | (3) |

| Income from investment operations: | | | | |

| Net investment income | | | 0.18 | |

| Net realized and unrealized gains on investments | | | 0.47 | |

| Total decrease from investment operations | | | 0.65 | |

| Less dividends to common shareholders: | | | | |

| Net investment income | | | (0.17 | ) |

| Total dividends to common shareholders | | | (0.17 | ) |

| Net asset value, end of period | | $ | 24.30 | |

| Per common share market value, end of period | | $ | 23.77 | |

Total investment return based on net asset value (2)(4) | | | 2.69 | % |

Total investment return based on market value (2)(4) | | | (4.27 | )% |

| Supplemental Data and Ratios | | | | |

| Net assets, end of period (000’s) | | $ | 487,005 | |

Ratio of expenses to average net assets (5) | | | 1.85 | % |

Ratio of net investment income to average net assets (5) | | | 4.70 | % |

Portfolio turnover rate (2) | | | 4.74 | % |

| (1) | Commencement of operations. |

| (2) | Not annualized. |

| (3) | Net asset value at the beginning of the period reflects the deduction of the sales load and offering costs of $1.18 per share paid by the shareholder from the $25.00 offering price. |

| (4) | Total investment return calculation assumes reinvestment of dividends at actual prices pursuant to the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions. |

| (5) | Annualized for periods less than one full year. |

See accompanying Notes to Financial Statements

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

December 31, 2012

| | | | | | | | | | | | | | | | | |

| | | Effective Interest Rate ‡ | | Due Date | | Principal | | Cost | | Fair Value | |

| Fixed Income — 120.04%*: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Bank Loans — 24.20%*§: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Automobile — 1.58%*: | | | | | | | | | | | | | | | | |

| Shaeffler Finance+ | | 5.00 | % | | l/27/2017 | | | $ | 4,500,000 | | $ | 5,870,460 | | $ | 5,976,935 | |

| Shaeffler Finance | | 4.75 | | | 2/27/2017 | | | | 1,690,255 | | | 1,687,719 | | | 1,712,972 | |

| Total Automobile | | | | | | | | | 6,190,255 | | | 7,558,179 | | | 7,689,907 | |

| | | | | | | | | | | | | | | | | |

| Beverage, Food and Tobacco — 0.19%*: | | | | | | | | | | | | | | | | |

| Blue Buffalo Company, Ltd | | 6.50 | | | 8/8/2019 | | | | 922,951 | | | 922,970 | | | 927,953 | |

| Total Beverage, Food and Tobacco | | | | | | | | | 922,951 | | | 922,970 | | | 927,953 | |

| | | | | | | | | | | | | | | | | |

| Broadcasting and Entertainment — 0.30%*: | | | | | | | | | | | | | | | | |

| Deluxe Entertainment Services Group, Inc. | | 8.00 | | | 7/3/2017 | | | | 1,702,076 | | | 1,585,719 | | | 1,458,117 | |

| Total Broadcasting and Entertainment | | | | | | | | | 1,702,076 | | | 1,585,719 | | | 1,458,117 | |

| | | | | | | | | | | | | | | | | |

| Buildings and Real Estate — 0.79%*: | | | | | | | | | | | | | | | | |

| Tomkins Air Distribution | | 9.25 | | | 5/9/2020 | | | | 3,773,513 | | | 3,716,929 | | | 3,848,983 | |

| Total Buildings and Real Estate | | | | | | | | | 3,773,513 | | | 3,716,929 | | | 3,848,983 | |

| | | | | | | | | | | | | | | | | |

| Chemicals, Plastics and Rubber — 1.37%*: | | | | | | | | | | | | | | | | |

| Houghton International Inc. | | 5.25 | | | 11/30/2019 | | | | 2,837,229 | | | 2,808,857 | | | 2,860,296 | |

| Pinnacle Operating Corp | | 11.50 | | | 5/13/2019 | | | | 4,000,000 | | | 3,801,553 | | | 3,800,000 | |

| Total Chemicals, Plastics and Rubber | | | | | | | | | 6,837,229 | | | 6,610,410 | | | 6,660,296 | |

| | | | | | | | | | | | | | | | | |

| Diversified/Conglomerate Manufacturing — 2.98%*: | | | | | | | | | | | | | | | | |

| Alliance Laundry Systems LLC | | 9.50 | | | 11/30/2019 | | | | 2,113,136 | | | 2,092,023 | | | 2,134,268 | |

| Navistar International Corp | | 7.00 | | | 7/30/2017 | | | | 2,571,429 | | | 2,581,007 | | | 2,577,857 | |

| Northern Tool & Equiptment Company, Inc. | | 5.75 | | | 12/6/2018 | | | | 6,000,000 | | | 5,880,000 | | | 6,000,000 | |

| ValleyCrest | | 6.25 | | | 10/5/2016 | | | | 3,840,627 | | | 3,840,627 | | | 3,811,822 | |

| Total Diversified/Conglomerate Manufacturing | | | | | | | | | 14,525,192 | | | 14,393,657 | | | 14,523,947 | |

| | | | | | | | | | | | | | | | | |

| Diversified/Conglomerate Service — 2.40%*: | | | | | | | | | | | | | | | | |

| Endurance International Group Inc. | | 6.25 | | | 10/18/2017 | | | | 6,000,000 | | | 5,940,019 | | | 5,995,020 | |

| Redprarie Corporation | | 6.75 | | | 12/14/2018 | | | | 3,000,000 | | | 2,940,000 | | | 2,996,250 | |

| Redprarie Corporation | | 11.25 | | | 12/14/2019 | | | | 2,702,244 | | | 2,648,199 | | | 2,717,998 | |

| Total Diversified/Conglomerate Service | | | | | | | | | 11,702,244 | | | 11,528,218 | | | 11,709,268 | |

| | | | | | | | | | | | | | | | | |

| Diversified Natural Resources, Precious Metals and Minerals — 0.74%*: | | | | | | | | | | | | | | |

| Osmose Holdings, Inc. | | 5.50 | | | 5/2/2018 | | | | 3,616,486 | | | 3,607,446 | | | 3,616,486 | |

| Total Diversified Natural Resources, | | | | | | | | | | | | | | | | |

| Precious Metals and Minerals | | | | | | | | | 3,616,486 | | | 3,607,446 | | | 3,616,486 | |

| | | | | | | | | | | | | | | | | |

| Electronics — 1.56%*: | | | | | | | | | | | | | | | | |

| Kronos, Inc. | | 9.75 | | | 4/26/2020 | | | | 7,500,000 | | | 7,425,012 | | | 7,579,725 | |

| Total Electronics | | | | | | | | | 7,500,000 | | | 7,425,012 | | | 7,579,725 | |

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

SCHEDULE OF INVESTMENTS(CONTINUED)

December 31, 2012

| | | | | | | | | | | | | | | | | |

| | | Effective Interest Rate ‡ | | Due Date | | Principal | | Cost | | Fair Value | |

Bank Loans (Continued) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Finance — 1.55%*: | | | | | | | | | | | | | | | | |

| Confie Seguros Holding | | 10.25 | % | | 5/8/2019 | | | $ | 1,500,000 | | $ | 1,470,338 | | $ | 1,491,255 | |

| Cunningham Lindsey Group, Inc. | | 9.25 | | | 4/18/2020 | | | | 3,000,000 | | | 3,071,000 | | | 3,052,500 | |

| Transfirst Holdings Inc. | | 9.75 | | | 6/30/2018 | | | | 1,004,072 | | | 973,950 | | | 987,334 | |

| Wall Street Systems Inc. | | 8.00 | | | 4/24/2020 | | | | 2,000,000 | | | 2,010,000 | | | 1,993,340 | |

| Total Finance | | | | | | | | | 7,504,072 | | | 7,525,288 | | | 7,524,429 | |

| | | | | | | | | | | | | | | | | |

| Healthcare, Education and Childcare — 3.39%*: | | | | | | | | | | | | | | | | |

| Air Medical Group Holdings | | 6.50 | | | 6/20/2018 | | | | 2,256,154 | | | 2,233,606 | | | 2,273,075 | |

| Gentiva Health Services Inc. | | 6.50 | | | 8/17/2016 | | | | 3,934,426 | | | 3,885,347 | | | 3,872,459 | |

| PRA International | | 8.00 | | | 11/30/2019 | | | | 1,743,299 | | | 1,708,433 | | | 1,754,195 | |

| Sage Products Holdings Iii, LLC | | 5.25 | | | 11/30/2019 | | | | 2,000,000 | | | 1,980,008 | | | 2,010,000 | |

| Sage Products Holdings Iii, LLC | | 9.25 | | | 5/31/2020 | | | | 3,325,292 | | | 3,275,431 | | | 3,325,292 | |

| TriZetto Group | | 8.50 | | | 3/27/2019 | | | | 3,325,000 | | | 3,309,162 | | | 3,291,750 | |

| Total Healthcare, Education and Childcare | | | | | | | | | 16,584,171 | | | 16,391,987 | | | 16,526,771 | |

| | | | | | | | | | | | | | | | | |

| Leisure, Amusement, Motion Pictures and Entertainment — 0.61%*: | | | | | | | | | | | | | |

| Jacob’s Entertainment | | 6.25 | | | 9/19/2018 | | | | 2,992,500 | | | 2,948,372 | | | 2,962,575 | |

| Total Leisure, Amusement, | | | | | | | | | | | | | | | | |

| Motion Pictures and Entertainment | | | | | | | | | 2,992,500 | | | 2,948,372 | | | 2,962,575 | |

| | | | | | | | | | | | | | | | | |

| Mining, Steel, Iron and Non-Precious Metals — 0.77%*: | | | | | | | | | | | | | | | | |

| Boomerang Tube, LLC | | 11.00 | | | 10/11/2017 | | | | 1,987,500 | | | 1,948,439 | | | 1,957,688 | |

| Constellium Holdco B.V.+ | | 9.25 | | | 5/22/2018 | | | | 1,795,489 | | | 1,795,467 | | | 1,795,489 | |

| Total Mining, Steel, Iron and Non-Precious Metals | | | | | | | | | 3,782,989 | | | 3,743,906 | | | 3,753,177 | |

| | | | | | | | | | | | | | | | | |

| Oil and Gas — 2.67%*: | | | | | | | | | | | | | | | | |

| Chesapeake Energy Corporation | | 5.75 | | | 12/2/2017 | | | | 2,000,000 | | | 1,967,500 | | | 2,000,500 | |

| EP Energy | | 4.50 | | | 4/30/2019 | | | | 5,000,000 | | | 4,987,514 | | | 5,010,700 | |

| Vantage Drilling Company | | 6.25 | | | 10/17/2017 | | | | 2,962,500 | | | 2,886,572 | | | 2,949,554 | |

| Venoco, Inc. | | 8.50 | | | 6/30/2017 | | | | 3,000,000 | | | 3,072,839 | | | 3,048,750 | |

| Total Oil and Gas | | | | | | | | | 12,962,500 | | | 12,914,425 | | | 13,009,504 | |

| | | | | | | | | | | | | | | | | |

| Retail Store — 3.30%*: | | | | | | | | | | | | | | | | |

| Academy, Ltd. | | 4.75 | | | 8/3/2018 | | | | 4,987,500 | | | 4,987,500 | | | 5,013,335 | |

BJ’s Wholesale Club, Inc. | | 9.75 | | | 3/13/2020 | | | | 4,000,000 | | | 4,153,093 | | | 4,095,000 | |

| FleetPride | | 9.25 | | | 5/8/2020 | | | | 3,000,000 | | | 2,940,573 | | | 2,938,140 | |

| Smart & Final Holdings Corp. | | 10.50 | | | 11/8/2020 | | | | 4,000,000 | | | 3,880,697 | | | 4,030,000 | |

| Total Retail Store | | | | | | | | | 15,987,500 | | | 15,961,863 | | | 16,076,475 | |

| | | | | | | | | | | | | | | | | |

| Total Bank Loans | | | | | | | | | 116,583,678 | | | 116,834,381 | | | 117,867,613 | |

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2012

| | | Effective | | | | | | | | | | |

| | | Interest Rate ‡ | | Due Date | | Principal | | Cost | | Fair Value | |

| Corporate Bonds — 95.84%*: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Aerospace and Defense* — 0.59%*: | | | | | | | | | | | | | | | | |

| CPI International, Inc. | | 8.00 | % | | 2/15/2018 | | | $ | 485,000 | | $ | 469,713 | | $ | 473,481 | |

| Ducommun Inc. | | 9.75 | | | 7/15/2018 | | | | 2,230,000 | | | 2,408,465 | | | 2,397,250 | |

| Total Aerospace and Defense | | | | | | | | | 2,715,000 | | | 2,878,178 | | | 2,870,731 | |

| | | | | | | | | | | | | | | | | |

| Automobile — 7.77%*: | | | | | | | | | | | | | | | | |

| Accuride Corp | | 9.50 | | | 8/1/2018 | | | | 2,175,000 | | | 2,114,041 | | | 2,098,875 | |

| Affinia Group, Inc. | | 9.00 | | | 11/30/2014 | | | | 12,000,000 | | | 12,062,195 | | | 12,000,000 | |

| Atu Auto-teile-ung+^ | | 11.00 | | | 5/15/2014 | | | | 4,320,000 | | | 5,397,848 | | | 5,673,706 | |

| Continental Rubber+^ | | 4.50 | | | 9/15/2019 | | | | 5,000,000 | | | 5,030,952 | | | 5,116,970 | |

| J.B. Poindexter & Co. Inc.^ | | 9.00 | | | 4/1/2022 | | | | 4,500,000 | | | 4,624,499 | | | 4,651,875 | |

| Meritor, Inc. | | 10.63 | | | 3/15/2018 | | | | 3,000,000 | | | 3,066,283 | | | 3,127,500 | |

| UCI International, Inc. | | 8.63 | | | 2/15/2019 | | | | 5,215,000 | | | 5,175,888 | | | 5,169,369 | |

| Total Automobile | | | | | | | | | 36,210,000 | | | 37,471,706 | | | 37,838,295 | |

| | | | | | | | | | | | | | | | | |

| Broadcasting and Entertainment — 0.59%*: | | | | | | | | | | | | | | | | |

| CET 21 Spol Sro+^ | | 9.00 | | | 11/1/2017 | | | | 2,000,000 | | | 2,795,855 | | | 2,877,508 | |

| Total Broadcasting and Entertainment | | | | | | | | | 2,000,000 | | | 2,795,855 | | | 2,877,508 | |

| | | | | | | | | | | | | | | | | |

| Buildings and Real Estate — 5.71%*: | | | | | | | | | | | | | | | | |

| Ainsworth Lumber Ltd+^ | | 7.50 | | | 12/15/2017 | | | | 5,750,000 | | | 5,770,831 | | | 6,023,125 | |

| Cemex International Capital LLC+^ | | 8.88 | | | 5/12/2017 | | | | 1,000,000 | | | 1,315,075 | | | 1,399,155 | |

| Cemex International Capital LLC+^ | | 9.88 | | | 4/30/2019 | | | | 2,890,000 | | | 3,820,531 | | | 4,119,814 | |

| Lyon Williams Homes, Inc.^ | | 8.50 | | | 11/15/2020 | | | | 8,000,000 | | | 8,058,546 | | | 8,320,000 | |

| Roofing Supply LLC^ | | 10.00 | | | 6/1/2020 | | | | 4,605,000 | | | 5,094,744 | | | 5,157,600 | |

| Xefin Lux SCA+ | | 8.00 | | | 6/1/2018 | | | | 2,000,000 | | | 2,610,859 | | | 2,798,310 | |

| Total Buildings and Real Estate | | | | | | | | | 24,245,000 | | | 26,670,586 | | | 27,818,004 | |

| | | | | | | | | | | | | | | | | |

| Cargo Transport — 3.81%*: | | | | | | | | | | | | | | | | |

| CEVA Group PLC+^ | | 8.375 | | | 12/1/2017 | | | | 5,000,000 | | | 4,872,933 | | | 4,925,000 | |

| Kenan Advantage Group, Inc.^ | | 8.375 | | | 12/15/2018 | | | | 8,000,000 | | | 8,000,000 | | | 8,160,000 | |

| Moto Hospitality Limited+^ | | 10.25 | | | 3/15/2017 | | | | 2,000,000 | | | 3,087,643 | | | 3,248,916 | |

| Quality Distribution Inc. | | 9.88 | | | 11/1/2018 | | | | 2,040,000 | | | 2,197,109 | | | 2,203,200 | |

| Total Cargo Transport | | | | | | | | | 17,040,000 | | | 18,157,685 | | | 18,537,116 | |

| | | | | | | | | | | | | | | | | |

| Chemicals, Plastics and Rubber — 7.45%*: | | | | | | | | | | | | | | | | |

| Calumet Specialty Products | | 9.38 | | | 5/1/2019 | | | | 7,365,000 | | | 7,937,177 | | | 7,991,025 | |

| Ciech Group Finance+^ | | 9.50 | | | 11/30/2019 | | | | 1,200,000 | | | 1,538,876 | | | 1,734,425 | |

| Omnova Solutions, Inc. | | 7.88 | | | 11/1/2018 | | | | 1,630,000 | | | 1,671,447 | | | 1,680,938 | |

| Perstorp Holding AB+^ | | 9.00 | | | 5/15/2017 | | | | 7,030,000 | | | 9,096,114 | | | 9,650,475 | |

| TPC Group, Inc.^ | | 8.75 | | | 12/15/2020 | | | | 6,065,000 | | | 6,145,416 | | | 6,110,488 | |

| Tronox Worldwide LLC^ | | 6.38 | | | 8/15/2020 | | | | 9,000,000 | | | 8,932,161 | | | 9,090,000 | |

| Total Chemicals, Plastics and Rubber | | | | | | | | | 32,290,000 | | | 35,321,191 | | | 36,257,351 | |

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2012

| | | Effective | | | | | | | | | | | | | |

| | | Interest Rate ‡ | | Due Date | | Principal | | Cost | | Fair Value | |

Corporate Bonds (Continued) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Containers, Packaging and Glass — 1.76%*: | | | | | | | | | | | | | | | | |

| Bormioli Rocco & Figlio S.P.A.+^ | | 10.00 | % | | 8/1/2018 | | | $ | 1,500,000 | | $ | 1,996,919 | | $ | 2,103,683 | |

| Pretium Packaging, LLC | | 11.50 | | | 4/1/2016 | | | | 6,265,000 | | | 6,451,984 | | | 6,460,781 | |

| Total Containers, Packaging and Glass | | | | | | | | | 7,765,000 | | | 8,448,903 | | | 8,564,464 | |

| | | | | | | | | | | | | | | | | |

| Diversified/Conglomerate Manufacturing — 2.01%*: | | | | | | | | | | | | | | | | |

| Milacron LLC^ | | 8.38 | | | 5/15/2019 | | | | 5,800,000 | | | 5,961,673 | | | 5,945,000 | |

| Navistar International Corp | | 8.25 | | | 11/1/2021 | | | | 4,000,000 | | | 3,772,467 | | | 3,860,000 | |

| Total Diversified/Conglomerate Manufacturing | | | | | | | | | 9,800,000 | | | 9,734,140 | | | 9,805,000 | |

| | | | | | | | | | | | | | | | | |

| Diversified/Conglomerate Service — 3.34%*: | | | | | | | | | | | | | | | | |

| Brickman Group Holdings, Inc.^ | | 9.13 | | | 11/1/2018 | | | | 6,670,000 | | | 6,829,500 | | | 6,986,825 | |

| Verisure Holdings+^ | | 6.69 | | | 9/1/2018 | | | | 3,500,000 | | | 4,479,284 | | | 4,596,753 | |

| Verisure Holdings+^ | | 8.75 | | | 9/1/2018 | | | | 3,240,000 | | | 4,456,008 | | | 4,661,563 | |

| Total Diversified/Conglomerate Service | | | | | | | | | 13,410,000 | | | 15,764,792 | | | 16,245,141 | |

| | | | | | | | | | | | | | | | | |

| Diversified Natural Resources, Precious Metals and Minerals — .74%*: | | | | | | | | | | | | | |

| Lecta S.A.+^ | | 8.88 | | | 5/15/2019 | | | | 1,090,000 | | | 1,434,494 | | | 1,543,064 | |

| Lecta S.A.+^ | | 5.69 | | | 5/15/2018 | | | | 1,600,000 | | | 2,036,396 | | | 2,080,253 | |

| Total Diversified Natural Resources, | | | | | | | | | | | | | | | | |

| Precious Metals and Minerals | | | | | | | | | 2,690,000 | | | 3,470,890 | | | 3,623,317 | |

| | | | | | | | | | | | | | | | | |

| Electronics — 1.45%*: | | | | | | | | | | | | | | | | |

| International Wire Group, Inc.^ | | 8.50 | | | 10/15/2017 | | | | 7,000,000 | | | 7,169,215 | | | 7,070,000 | |

| Total Electronics | | | | | | | | | 7,000,000 | | | 7,169,215 | | | 7,070,000 | |

| | | | | | | | | | | | | | | | | |

| Finance — 5.45%*: | | | | | | | | | | | | | | | | |

| Cabot Financial+^ | | 10.38 | | | 10/1/2019 | | | | 5,000,000 | | | 8,441,126 | | | 8,954,824 | |

| Evertec, Inc. | | 11.00 | | | 10/1/2018 | | | | 11,000,000 | | | 12,208,009 | | | 12,155,000 | |

| Lowell Group Financing PLC+^ | | 10.75 | | | 4/1/2019 | | | | 2,000,000 | | | 3,417,872 | | | 3,573,807 | |

| TMF Group Holding+^ | | 5.56 | | | 12/1/2018 | | | | 1,400,000 | | | 1,802,552 | | | 1,847,941 | |

| Total Finance | | | | | | | | | 19,400,000 | | | 25,869,559 | | | 26,531,572 | |

| | | | | | | | | | | | | | | | | |

| Healthcare, Education and Childcare — 5.78%*: | | | | | | | | | | | | | | | | |

| Alere Inc.^ | | 7.25 | | | 7/1/2018 | | | | 6,000,000 | | | 6,035,942 | | | 6,015,000 | |

| Care UK Health+^ | | 9.75 | | | 8/1/2017 | | | | 2,300,000 | | | 3,878,784 | | | 4,025,813 | |

| Crown Newco PLC+ | | 8.88 | | | 2/15/2019 | | | | 4,500,000 | | | 7,391,201 | | | 7,529,362 | |

| Prospect Medical Holdings Inc^ | | 8.38 | | | 5/1/2019 | | | | 5,000,000 | | | 5,098,542 | | | 5,262,500 | |

| Warner Chilcott Company, LLC+ | | 7.75 | | | 9/15/2018 | | | | 5,000,000 | | | 5,276,378 | | | 5,325,000 | |

| Total Healthcare, Education and Childcare | | | | | | | | | 22,800,000 | | | 27,680,847 | | | 28,157,675 | |

| | | | | | | | | | | | | | | | | |

| Hotels, Motels, Inns and Gaming — 1.95%*: | | | | | | | | | | | | | | | | |

| Gala Group Finance+ | | 8.88 | | | 9/1/2018 | | | | 5,500,000 | | | 8,834,303 | | | 9,470,589 | |

| Total Hotels, Motels, Inns and Gaming | | | | | | | | | 5,500,000 | | | 8,834,303 | | | 9,470,589 | |

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2012

| | | Effective | | | | | | | | | | | | | |

| | | Interest Rate ‡ | | Due Date | | Principal | | Cost | | Fair Value | |

Corporate Bonds (Continued) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Leisure, Amusement, Motion Pictures and Entertainment — 1.57%*: | | | | | | | | | | | | | | |

| Odeon & Uci Finco+ | | 9.00 | % | | 8/1/2018 | | | $ | 4,200,000 | | $ | 6,974,912 | | $ | 7,129,745 | |

| WMG Acquisition Corp. | | 11.50 | | | 10/1/2018 | | | | 460,000 | | | 519,207 | | | 531,300 | |

| Total Leisure, Amusement, | | | | | | | | | | | | | | | | |

| Motion Pictures and Entertainment | | | | | | | | | 4,660,000 | | | 7,494,119 | | | 7,661,045 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Machinery (Non-Agriculture, Non-Construct, Non-Electronic) — 2.06%*: | | | | | | | | | | | | | |

| Cleaver-Brooks, Inc.^ | | 8.75 | | | 12/15/2019 | | | | 4,740,000 | | | 4,883,815 | | | 4,894,050 | |

| Hellerman Tyton+^ | | 5.44 | | | 12/15/2017 | | | | 2,370,000 | | | 3,067,299 | | | 3,140,044 | |

| KM Germany Holding+^ | | 8.75 | | | 12/15/2020 | | | | 1,450,000 | | | 1,876,585 | | | 2,009,636 | |

| Total Machinery | | | | | | | | | | | | | | | | |

| (Non-Agriculture, Non-Construct, Non-Electronic) | | | | | | | | | 8,560,000 | | | 9,827,699 | | | 10,043,730 | |

| | | | | | | | | | | | | | | | | |

| Mining, Steel, Iron and Non-Precious Metals — 5.73%*: | | | | | | | | | | | | | |

| Alpha Natural Resources, Inc. | | 9.75 | | | 4/15/2018 | | | | 3,000,000 | | | 3,117,767 | | | 3,240,000 | |

| Ausdrill Finance Pty Ltd.+^ | | 6.88 | | | 11/1/2019 | | | | 6,000,000 | | | 6,000,000 | | | 5,940,000 | |

| Fortescue Metals Group Resources Ltd.+^ | | 6.00 | | | 4/1/2017 | | | | 2,000,000 | | | 1,941,250 | | | 2,040,000 | |

| Fortescue Metals Group Resources Ltd.+^ | | 8.25 | | | 11/1/2019 | | | | 5,000,000 | | | 5,121,270 | | | 5,325,000 | |

| Inmet Mining Corporation+^ | | 7.50 | | | 6/1/2021 | | | | 3,500,000 | | | 3,514,945 | | | 3,631,250 | |

| Kaiser Aluminum Corporation | | 8.25 | | | 6/1/2020 | | | | 800,000 | | | 872,042 | | | 872,000 | |

| New World Resources N.V.+^ | | 7.88 | | | 5/1/2018 | | | | 3,350,000 | | | 4,316,552 | | | 4,569,991 | |

| Rain CII Carbon LLC^ | | 8.25 | | | 1/15/2021 | | | | 1,390,000 | | | 1,390,000 | | | 1,421,275 | |

| Rain CII Carbon LLC^ | | 8.50 | | | 1/15/2021 | | | | 650,000 | | | 855,139 | | | 875,432 | |

| Total Mining, Steel, Iron and Non-Precious Metals | | | | | | | | | 25,690,000 | | | 27,128,965 | | | 27,914,948 | |

| | | | | | | | | | | | | | | | | |

| Oil and Gas — 22.30%*: | | | | | | | | | | | | | | | | |

| Alta Mesa Holdings, LP | | 9.63 | | | 10/15/2018 | | | | 3,500,000 | | | 3,570,598 | | | 3,605,000 | |

| CHC Helicopter+ | | 9.25 | | | 10/15/2020 | | | | 4,620,000 | | | 4,742,334 | | | 4,862,550 | |

| Chesapeake Oilfield Operating LLC^ | | 6.63 | | | 11/15/2019 | | | | 6,000,000 | | | 5,764,028 | | | 5,655,000 | |

| Era Group Inc.^ | | 7.75 | | | 12/15/2022 | | | | 3,000,000 | | | 2,949,330 | | | 2,947,500 | |

| Ferrellgas Partners LP | | 8.63 | | | 6/15/2020 | | | | 7,135,000 | | | 6,989,281 | | | 7,135,000 | |

| Halcon Resources Corporation^ | | 9.75 | | | 7/15/2020 | | | | 8,000,000 | | | 8,472,895 | | | 8,640,000 | |

| Headwaters, Inc. | | 7.63 | | | 4/1/2019 | | | | 3,000,000 | | | 3,133,254 | | | 3,187,500 | |

| Hercules Offshore, Inc.^ | | 10.25 | | | 4/1/2019 | | | | 6,865,000 | | | 7,231,724 | | | 7,517,175 | |

| Magnum Hunter Resources, Corp^ | | 9.75 | | | 5/15/2020 | | | | 3,000,000 | | | 3,059,823 | | | 3,112,500 | |

| Midstates Petroleum Company Inc.^ | | 10.75 | | | 10/1/2020 | | | | 5,000,000 | | | 5,296,487 | | | 5,312,500 | |

| Niska Gas Storage | | 8.88 | | | 3/15/2018 | | | | 6,500,000 | | | 6,744,726 | | | 6,678,750 | |

| Northern Tier Energy LLC^ | | 7.13 | | | 11/15/2020 | | | | 6,000,000 | | | 6,000,000 | | | 6,210,000 | |

| Pbf Holding Company LLC^ | | 8.25 | | | 2/15/2020 | | | | 6,000,000 | | | 6,296,335 | | | 6,465,000 | |

| Quicksilver Resources, Inc. | | 8.25 | | | 8/1/2015 | | | | 3,000,000 | | | 2,795,360 | | | 2,775,000 | |

| Resolute Energy Corp.^ | | 8.50 | | | 5/1/2020 | | | | 7,285,000 | | | 7,449,268 | | | 7,339,638 | |

| Samson Investment Company^ | | 9.75 | | | 2/15/2020 | | | | 6,000,000 | | | 6,385,324 | | | 6,345,000 | |

| Shelf Drilling Holdings Ltd+^ | | 8.63 | | | 11/1/2018 | | | | 6,000,000 | | | 6,083,455 | | | 6,150,000 | |

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2012

| | | | | | | | | | | | | | | | | |

| | | Effective | | | | | | | | | | | | | |

| | | Interest Rate ‡ | | Due Date | | Principal | | Cost | | Fair Value | |

Corporate Bonds (Continued) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Oil and Gas (Continued) | | | | | | | | | | | | | | | | |

| Unit Corporation | | 6.63 | % | | 5/15/2021 | | | $ | 3,000,000 | | $ | 3,089,743 | | $ | 3,078,750 | |

| Venoco, Inc. | | 11.50 | | | 10/1/2017 | | | | 5,500,000 | | | 5,567,518 | | | 5,761,250 | |

| Welltec+^ | | 8.00 | | | 2/1/2019 | | | | 5,500,000 | | | 5,747,106 | | | 5,830,000 | |

| Total Oil and Gas | | | | | | | | | 104,905,000 | | | 107,368,589 | | | 108,608,113 | |

| | | | | | | | | | | | | | | | | |

| Personal and Nondurable Consumer Products (Manufacturing Only) — 1.85%*: | | | | | | | | | | | |

| Grohe Holdings+^ | | 8.75 | | | 12/15/2017 | | | | 6,530,000 | | | 8,663,869 | | | 9,028,742 | |

| Total Personal and Nondurable | | | | | | | | | | | | | | | | |

| Consumer Products (Manufacturing Only) | | | | | | | | | 6,530,000 | | | 8,663,869 | | | 9,028,742 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Printing and Publishing — 2.39%*: | | | | | | | | | | | | | | | | |

| Cenveo Corporation | | 8.88 | | | 2/1/2018 | | | | 5,750,000 | | | 5,211,096 | | | 5,462,500 | |

| R.R. Donnelley & Sons Company | | 7.25 | | | 5/15/2018 | | | | 6,375,000 | | | 6,245,257 | | | 6,151,875 | |

| Total Printing and Publishing | | | | | | | | | 12,125,000 | | | 11,456,353 | | | 11,614,375 | |

| | | | | | | | | | | | | | | | | |

| Retail Store — 5.63%*: | | | | | | | | | | | | | | | | |

| GRD Holding Corp.^ | | 10.75 | | | 6/1/2019 | | | | 2,000,000 | | | 2,059,527 | | | 2,005,000 | |

| HD Supply, Inc.^ | | 11.50 | | | 7/15/2020 | | | | 5,000,000 | | | 5,302,276 | | | 5,631,250 | |

| House Fraser PLC+^ | | 8.88 | | | 8/15/2018 | | | | 4,000,000 | | | 6,497,343 | | | 6,822,723 | |

| Matalan Finance PLC+^ | | 8.88 | | | 4/29/2016 | | | | 4,000,000 | | | 6,471,906 | | | 6,692,766 | |

| Pantry, Inc^ | | 8.38 | | | 8/1/2020 | | | | 875,000 | | | 910,399 | | | 914,375 | |

| Spencer Spirit Holdings, Inc.^ | | 11.00 | | | 5/1/2017 | | | | 5,000,000 | | | 5,388,716 | | | 5,362,500 | |

| Total Retail Store | | | | | | | | | 20,875,000 | | | 26,630,167 | | | 27,428,614 | |

| | | | | | | | | | | | | | | | | |

| Telecommunications — 4.41%*: | | | | | | | | | | | | | | | | |

| Numericable Finance+^ | | 8.08 | | | 10/15/2018 | | | | 5,500,000 | | | 7,088,086 | | | 7,441,262 | |

| Nara Cable FDG Ltd+^ | | 8.88 | | | 12/1/2018 | | | | 8,000,000 | | | 7,543,835 | | | 8,020,000 | |

| Wind Acquisition+^ | | 7.38 | | | 2/15/2018 | | | | 1,000,000 | | | 1,246,206 | | | 1,339,757 | |

| Wind Acquisition+^ | | 7.38 | | | 2/15/2018 | | | | 3,565,000 | | | 4,414,349 | | | 4,670,357 | |

| Total Telecommunications | | | | | | | | | 18,065,000 | | | 20,292,476 | | | 21,471,376 | |

| | | | | | | | | | | | | | | | | |

| Textiles & Leather — 1.50%*: | | | | | | | | | | | | | | | | |

| Perry Ellis International Inc | | 7.88 | | | 4/1/2019 | | | | 7,000,000 | | | 7,293,418 | | | 7,315,000 | |

| Total Textiles & Leather | | | | | | | | | 7,000,000 | | | 7,293,418 | | | 7,315,000 | |

| | | | | | | | | | | | | | | | | |

| Total Corporate Bonds | | | | | | | | | 411,275,000 | | | 456,423,505 | | | 466,752,706 | |

| | | | | | | | | | | | | | | | | |

| Total Fixed Income | | | | | | | | | 527,858,678 | | | 573,257,886 | | | 584,620,319 | |

| | | | | | | | | | | | | | | | | |

| Other liabilities and assets — (20.04)% | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | (97,615,712 | ) |

| | | | | | | | | | | | | | | | | |

| Net Assets — 100% | | | | | | | | | | | | | | $ | 487,004,607 | |

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2012

| ‡ | The effective interest rates are based on settled commitment amount. |

| * | Calculated as a percentage of net assets applicable to common shareholders. |

| + | Foreign security. |

| | Distributions of investments by country of issue (excluding temporary cash investments) as a percentage of total investment in securities, is as follows: |

| | US | United States | 64.8 | % |

| | GB | United Kingdom | 8.8 | % |

| | DE | Germany | 5.5 | % |

| | LU | Luxembourg | 4.7 | % |

| | SE | Sweden | 3.2 | % |

| | CA | Canada | 2.5 | % |

| | AU | Australia | 2.3 | % |

| | NL | Netherlands | 1.9 | % |

| | ES | Spain | 1.4 | % |

| | AE | United Arab Emirates | 1.1 | % |

| | DK | Denmark | 1.0 | % |

| | Other (Individually less than 1%) | 2.8 | % |

| | | | 100.0 | % |

| ^ | Security exempt from registration under Rule 144a of the Securities Act of 1933. These securities may only be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| § | Bank loans are exempt from registration under the Securities Act of 1933, as amended, but contain certain restrictions on resale and cannot be sold publicly. These loans pay interest at rates which adjust periodically. The interest rates shown for bank loans are the current interest rates at December 31, 2012. Bank loans are also subject to mandatory and/or optional prepayment which cannot be predicted. As a result, the remaining maturity may be substantially less than the stated maturity shown. |

See accompanying Notes to Financial Statements

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

NOTES TO THE FINANCIAL STATEMENTS December 31, 2012

| | | |

| 1. | Organization |

| | |

| | Babson Capital Global Short Duration High Yield Fund (the “Fund”) was organized as a business trust under the laws of the Commonwealth of Massachusetts on May 20, 2011, and commenced operations on October 26, 2012. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. |

| | | |

| | Babson Capital Management LLC (the “Adviser”), a wholly-owned indirect subsidiary of Massachusetts Mutual Life Insurance Company, is a registered investment adviser under the Investment Advisers Act of 1940, as amended, and serves as investment adviser to the Fund. |

| | | |

| | Babson Capital Global Advisers Limited (“Sub-Adviser”), an indirect wholly-owned subsidiary of Babson Capital Management LLC will serve as a sub-adviser with respect to the Fund’s European investments. |

| | | |

| | The Fund’s primary investment objective is to seek as high a level of current income as the Adviser (as defined herein) determines is consistent with capital preservation. The Fund seeks capital appreciation as a secondary investment objective when consistent with its primary investment objective. There can be no assurance that the Fund will achieve its investment objectives. The Fund will seek to take advantage of inefficiencies between geographies, primarily the North American and Western European high yield bond and loan markets and within capital structures between bonds and loans. Under normal market conditions, the Fund will invest at least 80% of its managed assets in bonds, loans and other income-producing instruments that are, at the time of purchase, rated below investment grade (below Baa3 by Moody’s Investors Service, Inc. or below BBB- by either Standard & Poor’s Rating Services, a division of the McGraw-Hill Company, Inc. or Fitch, Inc.) or unrated but judged by the Adviser or Sub-Adviser to be of comparable quality. |

| | | |

| 2. | Significant Accounting Policies |

| | | |

| | The following is a summary of significant accounting policies followed consistently by the Fund in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). |

| | | |

| | A. | Valuation of Investments |

| | | |

| | The Fund’s investments in fixed income securities are generally valued using the prices provided directly by independent third party services or provided directly from one or more broker dealers or market makers, each in accordance with the valuation policies and procedures approved by the Fund’s Board of Trustees (the “Board”). |

| | | |

| | The pricing services may use valuation models or matrix pricing, which consider yield or prices with respect to comparable bond quotations from bond dealers or by reference to other securities that are considered comparable in such characteristics as credit rating, interest rates and maturity date, to determine the current value. |

| | |

| | The Fund’s investments in bank loans are normally valued at the bid quotation obtained from dealers in loans by an independent pricing service in accordance with the Fund’s valuation policies and procedures approved by the Board. |

| | |

| | In certain cases authorized pricing service vendors may not provide prices for a security held by the Fund, or the price provided by such pricing service vendor is deemed unreliable by the Adviser. In such cases, the Fund may use market maker quotations provided by an established market maker for that security (i.e., broker quotes) to value the security if the Adviser has experience obtaining quotations from the market maker and the Adviser determines that quotations obtained from the market maker in the past have generally been reliable (or, if the Adviser has no such experience with respect to a market maker, it determines based on other information available to it that quotations to be obtained by it from the market maker are reasonably likely to be reliable). In any such case, the Adviser will review any market quotations so obtained in light of other information in its possession for their general reliability. |

| | |

| | Bank loans in which the Fund may invest have similar risks to lower-rated fixed income securities. Changes in the financial condition of the borrower or economic conditions or other circumstances may reduce the capacity of the borrower to make principal and interest payments on such instruments and may lead to defaults. Senior secured bank loans are supported by collateral; however, the value of the collateral may be insufficient to cover the amount owed to the Fund. By relying on a third party to administer a loan, the Fund is subject to the risk that the third party will fail to perform its obligations. The loans in which the Fund will invest are largely floating rate instruments; therefore, the interest rate risk generally is lower than for fixed-rate debt obligations. However, an increase in interest rates may adversely affect the borrower’s financial condition. Due to the unique and customized nature of loan agreements evidencing loans and the private syndication thereof, loans are not as easily purchased or sold as publicly traded securities. Although the range of investors in loans has broadened in recent years, there can be no assurance that future levels of supply and demand in loan trading will provide the degree of liquidity which currently exists in the market. In addition, the terms of the loans may restrict their transferability without borrower consent. These factors may have an adverse effect on the market price and the Fund’s ability to dispose of particular |

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

December 31, 2012

| | |

| | portfolio investments. A less liquid secondary market also may make it more difficult for the Fund to obtain valuations of the loans in its portfolio. |

| | |

| | Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market for the investment. A three-tier hierarchy is utilized to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. For example, market participants would consider the risk inherent in a particular valuation technique used to measure fair value, such as a pricing model, and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability and are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability and are developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad levels listed below. |

| | |

| | Level 1 – quoted prices in active markets for identical securities |

| | |

| | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | |

| | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| | |

| | The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3. |

| | |

| | The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety. |

| | |

| | The following is a summary of the inputs used as of December 31, 2012 in valuing the Fund’s investments: |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total Investments |

| Assets:* | | | | | | | | | | | |

| Fixed Income: | | | | | | | | | | | |

| Bank Loans | | $ | - | | | $ | 117,867,613 | | | $ | - | | | $ | 117,867,813 | |

| Bonds | | | - | | | | 466,752,706 | | | | - | | | | 466,752,706 | |

| Total Fixed Income | | | - | | | | 584,620,319 | | | | - | | | | 584,620,319 | |

| | | | | | | | | | | | | | | | | |

| Liabilities:* | | | | | | | | | | | | | | | | |

| Derivative Securities: | | | | | | | | | | | | | | | | |

| Foreign Exchange Contracts | | | - | | | | 2,711,229 | | | | - | | | | 2,711,229 | |

| Total Derivative Securities | | | - | | | | 2,711,229 | | | | - | | | | 2,711,229 | |

| | | | | | | | | | | | | | | | | |

| Total Investments | | $ | - | | | $ | 581,909,090 | | | $ | - | | | $ | 581,909,090 | |

| * | There were no transfers between levels during 2012 |

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

December 31, 2012

| | | |

| | B. | Cash and Cash Equivalents |

| | | |

| | Cash and cash equivalents consist principally of short-term investments that are readily convertible into cash and have original maturities of three months or less. At December 31, 2012, all cash and cash equivalents are held by the custodian. |

| | | |

| | C. | Investment Transactions, Related Investment Income and Expenses |

| | | |

| | Investment transactions are accounted for on a trade date basis. Interest income is recognized when earned, including the amortization of premiums and accretion of discounts on bonds held using the yield-to-maturity method. |

| | |

| | Realized gains and losses on investment transactions and unrealized appreciation and depreciation of investments are reported for financial statement and Federal income tax purposes on the identified cost method. |

| | |

| | Expenses are recorded on the accrual basis as incurred. |

| | |

| | D. | Use of Estimates |

| | | |

| | The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. |

| | |

| | E. | Federal Income Taxation |

| | | |

| | The Fund has elected to be taxed as a Regulated Investment Company (“RIC”) under sub-chapter M of the U.S. Internal Revenue Code of 1986, as amended, and intends to maintain this qualification and to distribute substantially all of its net taxable income to its shareholders. |

| | |

| | F. | Dividends and Distributions |

| | | |

| | The Fund intends to declare and pay dividends monthly from net investment income. To the extent that these distributions exceed net investment income, they may be classified as return of capital. The Fund also pays a distribution at least annually from its net realized capital gains, if any. Dividends and distributions are recorded on the ex-dividend date. All common shares of beneficial interest have equal dividend and other distribution rights. A notice disclosing the source(s) of a distribution will be provided if payment is made from any source other than net investment income. Any such notice would be provided only for informational purposes in order to comply with the requirements of Section 19(a) of the 1940 Act and not for tax reporting purposes. The tax composition of the Fund’s distributions for each calendar year is reported on Internal Revenue Service Form 1099-DIV. |

| | |

| | Dividends from net investment income and distributions from realized gains from investment transactions have been determined in accordance with Federal income tax regulations and may differ from net investment income and realized gains recorded by the Fund for financial reporting purposes. These differences, which could be temporary or permanent in nature, may result in reclassification of distributions; however, net investment income, net realized gains and losses, and net assets are not affected. |

| | |

| | G. | Derivative Instruments |

| | | |

| | The following is a description of the derivative instruments that the Fund utilizes as part of its investment strategy, including the primary underlying risk exposures related to the instrument. |

| | |

| | Forward Foreign Exchange Contracts – The Fund is subject to foreign exchange rate risk in the normal course of pursuing its investment objectives. The Fund may use forward foreign exchange contracts to hedge against changes in the value of foreign currencies. The Fund may enter into forward foreign exchange contracts obligating the Fund to deliver or receive a currency at a specified future date. Forward foreign exchange contracts are valued daily and unrealized appreciation or depreciation is recorded daily as the difference between the contract exchange rate and the closing forward rate applied to the face amount of the contract. A realized gain or loss is recorded at the time the forward foreign exchange contract expires. Credit risk may arise as a result of the failure of the counterparty to comply with the terms of the contract. The Fund considers the creditworthiness of each counterparty to a contract in evaluating potential credit risk at least quarterly. The Fund is also subject to credit risk with respect to the counterparties to the derivative contracts which are not cleared through a central counterparty but instead are traded over-the-counter between two counterparties. If a counterparty to an over-the-counter derivative becomes bankrupt or otherwise fails to perform its obligations under a derivative contract due to financial difficulties, the Fund may experience significant delays in obtaining any recovery under the derivative contract in a bankruptcy or other reorganization proceeding. The Fund may obtain only a limited recovery or may obtain no recovery in such circumstances. The counterparty risk for cleared derivatives is generally lower than for uncleared over-the-counter derivative transactions since generally a clearing organization becomes substituted for each counterparty to a cleared derivative contract and, in effect, guarantees the parties’ performance under the contract as each party to a trade looks only to the clearing house for performance of financial |

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

December 31, 2012

| | |

| | obligations. However, there can be no assurance that the clearing house, or its members, will satisfy its obligations to the Fund. In addition, in the event of a bankruptcy of a clearing house, the Fund could experience a loss of the funds deposited with such clearing house as margin and of any profits on its open positions. The counter party risk to the Fund is limited to the net unrealized gain, if any, on the contract. |

| | |

| | The use of forward foreign exchange contracts does not eliminate fluctuations in the underlying prices of the Fund’s investment securities; however, it does establish a rate of exchange that can be achieved in the future. The use of forward foreign exchange contracts involves the risk that anticipated currency movements will not be accurately predicted. A forward foreign exchange contract would limit the risk of loss due to a decline in the value of a particular currency; however it would also limit any potential gain that might result should the value of the currency increase instead of decrease. These contracts may involve market risk in excess of the amount of receivables or payables reflected on the Statement of Assets and Liabilities. |

| | |

| | During the period from October 26, 2012 through December 31, 2012, the Fund’s direct investment in derivatives consisted of forward foreign exchange contracts. |

| | |

| | The following is a summary of the fair value of derivative instruments held directly by the Fund as of December 31, 2012. Fair values of derivative instruments on the Statement of Assets and Liabilities as of December 31, 2012: |

| | | | | | | | | | |

| | | | | Statement of Assets | | | | |

| | | | | and Liabilities | | | | |

| | Derivatives | | | Location | | Fair Value | |

| | Foreign exchange contracts: | | | | | | | |

| | Forward Foreign | | | | | | | |

| | Exchange Contracts | | | Payables | | $ | 2,711,229 | |

| | Total | | | | | $ | 2,711,229 | |

| | | | | | |

| | The effect of derivative instruments on the Statement of Operations for period October 26, 2012 through December 31, 2012: Amount of Realized Gain/(Loss) on Derivatives |

| | | | | | |

| | | | Forward | |

| | | | Exchange Contracts | |

| | | | | | |

| | Derivatives | | | | |

| | Foreign exchange contracts | | $ | (35,846 | ) |

| | Total | | $ | (35,846 | ) |

| | | | | | |

| | Change in Unrealized Appreciation/(Depreciation) on Derivatives | | | | |

| | | | | | |

| | | | Forward | |

| | | | Exchange Contracts | |

| | | | | | |

| | Derivatives | | | | |

| | Foreign exchange contracts | | $ | (2,711,229 | ) |

| | Total | | $ | (2,711,229 | ) |

| | H. | Foreign Securities |

| | | |

| | Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in U.S. companies and the U.S. government. These risks include valuation of currencies and adverse political and economic developments. Moreover, securities of many foreign companies, foreign governments, and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies and the U.S. government. |

| | |

| | I. | Foreign Currency Translation |

| | | |

| | The books and records of the Fund are maintained in U.S. dollars. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) market value of investment securities, assets and liabilities at the daily rates of exchange, and (ii) purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Fund does not isolate changes in the exchange rate of investment securities from the fluctuations arising from changes in the market prices of securities. However, for Federal income tax purposes, the Fund does isolate and treat as ordinary income the effect of changes in foreign exchange rates on realized gain or loss from the sale of investment securities and payables and receivables arising from trade-date and settlement-date differences. |

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

December 31, 2012

| | | |

| | J. | Counterparty Risk |

| | | |

| | The Fund helps manage counterparty credit risk by entering into agreements only with counterparties the Adviser believes have the financial resources to honor their obligations. The Adviser monitors the financial stability of the Fund’s counterparties. |

| | | |

| | K. | Recent Accounting Pronouncement |

| | | |

| | In December 2011, the Financial Accounting Standards Board issued Accounting Standards Update No. 2011-11 Disclosures about Offsetting Assets and Liabilities (“ASU 2011-11”) requiring disclosures of both gross and net information related to offsetting and related arrangements enabling users of the financial statement to understand the effect of those arrangements on the entity’s financial position. The objective of this disclosure is to facilitate comparison between those entities that prepare the financial statements on the basis of U.S. GAAP and those entities that prepare their financial statements on the basis of International Financial Reporting Standards. ASU 2011-11 is effective for public entities for interim and annual periods beginning on or after January 1, 2013. Adoption of ASU 2011-11 will have no effect on the Fund’s net assets. At this time, management is evaluating the impact ASU 2011-11 may have on the Fund’s financial statement disclosures. |

| | | |

| 3. | Advisory Fee |

| | |

| | The Fund has entered into an Investment Management Agreement (the “Agreement”) with the Adviser, a related party. Pursuant to the Agreement, the Fund has agreed to pay the Adviser a fee payable at the end of each calendar month, at an annual rate of 1.00% of the Fund’s average daily managed assets during such month. Managed assets are the total assets of the Fund, which include any assets attributable to leverage such as assets attributable to reverse repurchase agreements or bank loans, minus the sum of the Fund’s accrued liabilities (other than liabilities incurred for the purpose of leverage). Subject to the supervision of the Adviser and the Board, the Sub-Adviser manages the investment and reinvestment of a portion of the assets of the Fund, as allocated from time to time to the Sub-Adviser by a global allocation investment committee composed of representatives of the Adviser and Sub-Adviser. The Adviser (not the Fund) will pay a portion of the fees it receives to the Sub-Adviser in return for its services. |

| | |

| 4. | Administrator Fee |

| | |

| | The Fund has engaged U.S. Bancorp Fund Services, LLC (“US Bank”) to serve as the Fund’s administrator, fund accountant, and transfer agent. The Fund has engaged U.S. Bank, N.A. to serve as the Fund’s custodian. The Fund has agreed to pay US Bank a fee payable at the end of each calendar month, at an annual rate of 0.30% of the Fund’s average daily managed assets. |

| | |

| 5. | Income Taxes |

| | |

| | It is the Fund’s intention to qualify as a Registered Investment Company under sub-chapter M of the Internal Revenue Code and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in the financial statements. The tax character of dividends paid to shareholders during the tax year ended in 2012, as noted below, was as follows: |

| | | | | | | | | | |

| | | | | | | | Total | |

| | | | Net Long Term | | Distributions | |

| | Ordinary Income | | Capital Gains | | Paid | |

| | | | | | | | | | |

| | $ | 3,361,505 | | $ | - | | $ | 3,361,505 | |

| | |

| | The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles. Permanent book and tax basis differences resulted in the reclassifications of $155,944 to accumulated net investment income, $155,944 from accumulated net realized gain. |

| | |

| | The following information is provided on a tax basis as of December 31, 2012: |

| | Cost of investments | | $ | 573,258,100 | |

| | | | | | |

| | Unrealized appreciation | | | 12,624,307 | |

| | Unrealized depreciation | | | (1,262,088 | ) |

| | Net unrealized appreciation (depreciation) | | | 11,362,219 | |

| | | | | | |

| | Undistributed ordinary income | | | 539,870 | |

| | Undistributed long term gains | | | - | |

| | Distributable earnings | | | 539,870 | |

| | | | | | |

| | Other accumulated gain/(loss) | | | (2,463,651 | ) |

| | Total accumulated gain/(loss) | | | 9,438,438 | |

Babson Capital Global Short Duration High Yield Fund 2012 Annual Report

| | |

| | The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on U.S. tax returns and state tax returns filed since inception of the Fund. No income tax returns are currently under examination. All tax years since commencement of operations remain subject to examination by the tax authorities in the United States. Due to the nature of the Fund’s investments, the Fund may be required to file income tax returns in several states. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months. |

| | |

| | At December 31, 2012, the Fund deferred, on a tax basis, post-October losses of $2,485,366. |

| | |

| 6. | Investment Transactions |

| | |

| | For the period from October 26, 2012 through December 31, 2012 the Fund purchased (at cost) and sold securities in the amount of $590,043,866 and $17,146,547 (excluding short term debt securities), respectively. |

| | |