Table of Contents

As filed with the Securities and Exchange Commission on July 8, 2011

Registration No. 333-175233

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CNL LIFESTYLE PROPERTIES, INC.

(Exact Name of Registrant as Specified in its Charter)

| Maryland | 6798 | 20-0183627 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) | ||

CNL Center at City Commons

450 South Orange Avenue

Orlando, Florida 32801

Telephone: (407) 650-1000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of

Registrant’s Principal Executive Offices)

R. Byron Carlock, Jr.

Chief Executive Officer

CNL Center at City Commons

450 South Orange Avenue

Orlando, Florida 32801

Telephone: (407) 650-1000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies To:

Richard E. Baltz, Esq. Neil M. Goodman, Esq. Arnold & Porter, LLP 555 Twelfth Street, NW Washington, DC 20004-1206 Telephone: (202) 942-5124 Facsimile: (202) 942-5999 | Peter E. Reinert, Esq. Lowndes, Drosdick, Doster, Kantor & Reed, P.A. 215 North Eola Drive Orlando, Florida 32801 Telephone: (407) 843-4600 Facsimile: (407) 843-4444 |

Approximate Date of Commencement of Proposed Sale of the Securities to the Public: As soon as practicable after the effective date of this registration statement.

Table of Contents

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |||

| Non-accelerated filer X | (Do not check if a smaller reporting company) | Smaller reporting company ¨ | ||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered

| Proposed Maximum Offering Price per Unit(1)

| Proposed Maximum Aggregate Offering Price(1)

| Amount of Registration Fee | ||||

7.250 % Senior Notes due 2019

| $400,000,000

| 100%

| $400,000,000

| $46,440

| ||||

Guarantees of the 7.250 % Senior Notes due 2019 (2)

| —

| —

| —

| (3)

| ||||

Total:

| $400,000,000

| 100%

| $400,000,000

| $46,440

|

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(f) under the Securities Act of 1933, as amended. |

| (2) | Certain wholly owned subsidiaries of CNL Lifestyle Properties, Inc. guarantee the 7.250% Senior Notes due 2019. See the table below for a complete list of the guarantors. |

| (3) | Pursuant to Rule 457(n) under the Securities Act, no separate consideration will be received for the Guarantees of the 7.250% Senior Notes due 2019. Therefore, no registration fee is attributed to them. |

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

TABLE OF ADDITIONAL REGISTRANT GUARANTORS

The principal executive offices of, and the agent for service for, each registrant guarantor is R. Byron Carlock, Jr., Chief Executive Officer, CNL Center at City Commons, 450 South Orange Avenue, Orlando, Florida 32801. Each registrant guarantor is organized under the laws of the State of Delaware. The SIC Code for each registrant guarantor is 6798.

Exact Name of Registrant Guarantor as Specified in its Charter | IRS Employer Identification Number | |

| CNL Income Partners, LP | 26-0096762 | |

| CNL Beaver Creek Marina TRS Corp. | 20-8026424 | |

| CNL Burnside Marina TRS Corp. | 20-8026639 | |

| CNL Gatlinburg Partnership, LP | 20-3870347 | |

| CNL Income Bear Creek, LLC | 20-5425115 | |

| CNL Income Beaver Creek Marina, LLC | 20-5883953 | |

| CNL Income Brady Mountain Marina TRS Corp. | 26-0736992 | |

| CNL Income Brady Mountain Marina, LLC | 26-0736989 | |

| CNL Income Brighton TRS Corp. | 20-5707040 | |

| CNL Income Brighton, LLC | 20-5706975 | |

| CNL Income Burnside Marina, LLC | 20-5884004 | |

| CNL Income Canyon Springs, LLC | 20-5809140 | |

| CNL Income Cinco Ranch, LLC | 20-5809086 | |

| CNL Income Clear Creek, LLC | 20-5808997 | |

| CNL Income Colony, LP | 11-3779032 | |

| CNL Income EAGL Las Vegas, LLC | 26-1357213 | |

| CNL Income EAGL Leasehold Golf, LLC | 26-1357150 | |

| CNL Income EAGL Meadowlark, LLC | 26-1357035 | |

| CNL Income EAGL Mideast Golf, LLC | 26-1356967 | |

| CNL Income EAGL Midwest Golf, LLC | 26-1356890 | |

| CNL Income EAGL North Golf, LLC | 26-1356824 | |

| CNL Income EAGL Southwest Golf, LLC | 26-1355754 | |

| CNL Income EAGL West Golf, LLC | 26-1356717 | |

| CNL Income Eagle Cove Marina TRS Corp. | 26-0514136 | |

| CNL Income Eagle Cove Marina, LLC | 26-0513991 | |

| CNL Income Enchanted Village TRS Corp. | 20-8405619 | |

| CNL Income Enchanted Village, LLC | 20-8387318 | |

| CNL Income FEC Bakersfield, LLC | 20-5544125 | |

| CNL Income FEC Charlotte, LLC | 20-5543405 | |

| CNL Income FEC Knoxville, LLC | 20-5543582 | |

| CNL Income FEC North Houston, LLC | 20-5543675 | |

| CNL Income FEC Richland Hills, LLC | 20-5543779 | |

| CNL Income FEC South Houston, LLC | 20-5543843 | |

| CNL Income FEC Tampa, LLC | 20-5544635 | |

| CNL Income FEC Tempe, LLC | 20-5543940 | |

| CNL Income FEC Tucson, LLC | 20-5544049 | |

| CNL Income Fossil Creek, LLC | 20-5807569 | |

| CNL Income Fox Meadow, LLC | 20-5877243 | |

| CNL Income Garland, LP | 11-3779033 | |

| CNL Income Hawaiian Waters TRS Corp. | 26-4267555 | |

| CNL Income Hawaiian Waters, LLC | 26-4267446 | |

| CNL Income Holly Creek Marina TRS Corp. | 26-0515566 | |

| CNL Income Holly Creek Marina, LLC | 26-0513890 | |

| CNL Income Lake Park, LLC | 20-5807491 | |

| CNL Income Lakefront Marina, LLC | 20-5884304 | |

| CNL Income Lakeridge, LLC | 20-5876403 | |

Table of Contents

CNL Income Loon Mountain TRS Corp. | 20-5648120 | |

CNL Income Loon Mountain, LLC | 20-5525265 | |

CNL Income Magic Spring TRS Corp. | 41-2225696 | |

CNL Income Magic Spring, LLC | 20-8339432 | |

CNL Income Mansfield, LLC | 20-5804146 | |

CNL Income Mesa Del Sol, LLC | 20-5876308 | |

CNL Income Northstar Commercial, LLC | 26-0718881 | |

CNL Income Northstar TRS Corp. | 20-5648045 | |

CNL Income Northstar, LLC | 20-5525458 | |

CNL Income Painted Hills, LLC | 20-5877184 | |

CNL Income Palmetto, LLC | 84-1717611 | |

CNL Income Pier 121 Marina, LLC | 20-5888107 | |

CNL Income Plantation, LLC | 20-5799254 | |

CNL Income Royal Meadows, LLC | 20-5876461 | |

CNL Income Sandusky Marina, LLC | 20-5884344 | |

CNL Income Sierra TRS Corp. | 20-5648163 | |

CNL Income Sierra, LLC | 20-5525772 | |

CNL Income Signature of Solon, LLC | 20-5877323 | |

CNL Income Snoqualmie TRS Corp. | 20-5648855 | |

CNL Income Snoqualmie, LLC | 20-5525839 | |

CNL Income South Mountain, LLC | 20-4964835 | |

CNL Income Traditional Golf I, LLC | 26-1916259 | |

CNL Income Valencia, LLC | 33-0927287 | |

CNL Income Weston Hills, LLC | 20-5528390 | |

CNL Income Weymouth, LLC | 20-5877286 | |

CNL Lakefront Marina TRS Corp. | 20-8026549 | |

CNL Pier 121 Marina TRS Corp. | 20-8026901 | |

CNL Sandusky Marina TRS Corp. | 20-8026857 | |

Grapevine Golf Club, L.P. | 75-2837936 |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not complete the exchange offer and issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED July 8, 2011

PRELIMINARY PROSPECTUS

CNL Lifestyle Properties, Inc.

Offer to Exchange

$400,000,000 aggregate principal amount 7.250% Senior Notes due 2019

For

$400,000,000 aggregate principal amount 7.250% Senior Notes due 2019 registered under the Securities Act of 1933, as amended

Material Terms of Exchange Offer

We are offering to exchange all of our outstanding 7.250% Senior Notes due 2019 that were issued in a private placement on April 5, 2011, and which we refer to as the private notes, for an equal aggregate amount of our 7.250% Senior Notes due 2019 and which we refer to as the exchange notes. We refer to the private notes and the exchange notes collectively as the notes. If you participate in the exchange offer, you will receive registered 7.250% Senior Notes due 2019 for your old 7.250% Senior Notes due 2019 that are properly tendered. The terms of the exchange notes are identical to those of the private notes, except that the transfer restrictions and registration rights relating to the private notes will not apply to the exchange notes, and the exchange notes will not provide for the payment of additional interest in the event of a registration default. The exchange notes will represent the same debt as the outstanding notes, and will be issued under the same indenture.

The exchange offer expires at 5:00 p.m., New York City time, on , 2011, unless extended. We do not currently intend to extend the exchange offer.

We will exchange all private notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer. You may withdraw tendered private notes at any time prior to the expiration of the exchange offer.

The exchange offer is not subject to any conditions other than that it not violate applicable law or any applicable interpretation of the staff of the SEC.

Neither we nor any of our subsidiaries will receive any cash proceeds from the exchange offer.

There is no active trading market for the notes and we do not intend to list the exchange notes on any securities exchange or to seek approval for quotations through any automated quotation system.

Broker-dealers who receive exchange notes pursuant to the exchange offer acknowledge that they will deliver a prospectus in connection with any resale of such exchange notes; and broker-dealers who acquired the private notes as a result of market-making or other trading activities may use the prospectus for the exchange offer, as supplemented or amended, in connection with resales of the exchange notes.

The exchange of outstanding notes for exchange notes will not be a taxable event for United States federal income tax purposes.

Investing in the exchange notes involves risks. See “Risk Factors” beginning on page 9 of this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE EXCHANGE NOTES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is , 2011

Table of Contents

| Page | ||||

| iv | ||||

| 1 | ||||

| 9 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 38 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 47 | |||

| 79 | ||||

| 99 | ||||

| 104 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 104 | |||

| 105 | ||||

| 107 | ||||

| 112 | ||||

| 114 | ||||

| 116 | ||||

| 152 | ||||

| 153 | ||||

| 166 | ||||

| 166 | ||||

| 166 | ||||

FINANCIAL INFORMATION | F-1 | |||

ii

Table of Contents

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state or other jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

Unless otherwise indicated or unless the context requires otherwise, all references in this prospectus to “we,” “us,” “our,” the “Issuer” or “the Company” refer to CNL Lifestyle Properties, Inc., a Maryland corporation, together with its consolidated subsidiaries. Unless otherwise indicated or unless the context requires otherwise, all references in this prospectus to “our operating partnership” refer to CNL Income Partners, LP, a Delaware limited partnership that is a wholly-owned subsidiary of the Company.

Each broker-dealer that receives exchange notes for its own account in the exchange offer for private notes that were acquired as a result of market-making or other trading activities must acknowledge that it will comply with the prospectus delivery requirements of the Securities Act in connection with any offer to resell or other transfer of the exchange notes issued in the exchange offer. The accompanying letter of transmittal relating to the exchange offer states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act of 1933, as amended, or the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in the exchange offer for private notes that were acquired by such broker-dealer as a result of market-making or other trading activities.

Any statements in this prospectus concerning the provisions of any document are not complete. References made to the copy of that document filed or incorporated or deemed to be incorporated by reference as an exhibit to the registration statement of which this prospectus is a part or otherwise filed with the Securities and Exchange Commission, or the SEC. Each statement concerning the provisions of any document is qualified in its entirety by reference to the document so filed.

iii

Table of Contents

This prospectus contains forward-looking statements that can be identified by the use of such words as “may,” “plan,” “expect,” “anticipate,” “intend,” “estimate,” “continue,” “believe,” predict,” “potential,” “would,” “should,” “could,” “seeks,” “approximately,” “projects” or the negative of such words. You can also identify forward-looking statements by discussions of strategy, objectives, plans or intentions of management for future operations or economic performance and related assumptions and forecasts.

We caution you that forward-looking statements are not guarantees. We believe that our expectations reflected in the forward-looking statements are based on our reasonable beliefs, assumptions and expectations of our future performance, and have taken into account all information currently available to us. Such beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of future economic, competitive and market conditions, all of which are difficult or impossible to predict accurately and many of which are beyond our control.

Important factors that could cause our actual results of operations and execution of our business strategy to differ materially from the expectations reflected in our forward-looking statements include, but are not limited to:

| • | general economic, business and market conditions, and the real estate financing and securities markets in particular; |

| • | changes in federal, state and local laws and regulations; |

| • | increased competitive pressures; |

| • | our ability to invest the proceeds from this offering in a timely manner and our ability to locate suitable tenants and operators |

| • | interest rates; |

| • | the ability of our operators to operate our properties successfully and to fulfill their obligations; and |

| • | changing consumer habits and demographics. |

We can give no assurance that any of the events anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial condition. In evaluating our forward-looking statements, you should specifically consider the risks and uncertainties discussed in the “Risk Factors” section of this prospectus. Except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the date of this prospectus.

iv

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all the information that you should consider before exchanging the notes. You should read this entire document carefully, including the information under the heading “Risk Factors,” before making a decision to exchange your outstanding notes for exchange notes.

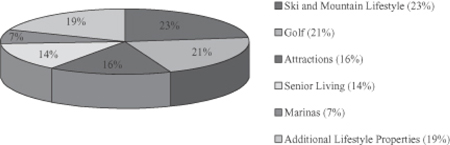

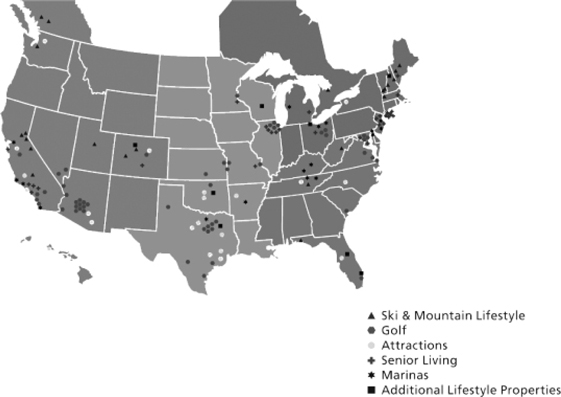

Our Company

We are a leading owner of lifestyle properties across the United States that we believe have the strong potential for long-term growth and income generation. We define lifestyle properties as those properties that reflect or are impacted by the social, consumption and entertainment values and choices of our society. Our investment thesis is supported by attractive demographic trends that we believe drive consumer demand for the various lifestyle asset classes on which we focus. As of March 31, 2011, we had a portfolio of 150 lifestyle properties, consisting of ski and mountain lifestyle properties, golf facilities, senior living facilities, attractions, marinas and additional lifestyle properties. Thirty-seven of our 150 properties are owned through unconsolidated joint ventures. For the year ended December 31, 2010, we generated total revenue of $304.4 million and had total assets of $2.7 billion.

We were organized on August 11, 2003. We operate as a real estate investment trust, or REIT. Our principal executive offices are located at 450 South Orange Avenue within the CNL Center at City Commons in Orlando, Florida 32801. Our telephone number is (407) 650-1000 and our internet address is www.cnllifestylereit.com. The information contained in or available through our website is not included or incorporated by reference in this prospectus.

Our Advisor

We have retained CNL Lifestyle Advisor Corporation, a Florida corporation, or the Advisor, as our advisor and have entered into an advisory agreement with the Advisor to provide us with management, advisory and administrative services. The Advisor has a fiduciary responsibility to us and to our stockholders. See “The Advisor and Advisory Agreement” of this prospectus for more information regarding our Advisor. References to CFG in this prospectus refer to CNL Financial Group, LLC, the parent of our Advisor.

1

Table of Contents

Summary of the Terms of the Exchange Offer

The following summary contains basic information about the exchange offer. It does not contain all the information that may be important to you. For a more complete description of the exchange offer, you should read the discussions under the heading “The Exchange Offer.”

Exchange Notes | $400,000,000 aggregate principal amount of 7.250% Senior Notes due 2019. The terms of the exchange notes are identical to those of the private notes, except that the transfer restrictions and registration rights relating to the private notes will not apply to the exchange notes, and the exchange notes will not provide for the payment of additional interest in the event of a registration default. |

Private Notes | $400,000,000 aggregate principal amount of 7.250% Senior Notes due 2019, which were issued in a private placement on April 5, 2011. |

The Exchange Offer | We are offering to exchange the exchange notes for a like principal amount of the private notes. |

| In the exchange offer, we will exchange registered 7.250% Senior Notes due 2019 for the previously issued private 7.250% Senior Notes due 2019. |

| We will accept any and all private notes validly tendered and not withdrawn prior to 5:00 p.m., New York City time, on , 2011. Holders may tender some or all of their private notes pursuant to the exchange offer. However, private notes may be tendered only in denominations of $2,000 and integral multiples of $1,000. |

| In order to be exchanged, an outstanding old note must be properly tendered and accepted. All private notes that are validly tendered and not withdrawn will be exchanged. As of the date of this prospectus, there are $400,000,000 aggregate principal amount of 7.250% Senior Notes due 2019 outstanding. We will issue exchange notes promptly after the expiration of the exchange offer. See “The Exchange Offer—Terms of the Exchange Offer.” |

Registration Rights Agreement | In connection with the private placement of the private notes, we entered into a registration rights agreement with Jefferies & Company, Inc. and Merrill, Lynch, Pierce, Fenner & Smith Incorporated as representative of the initial purchasers. Under the registration rights agreement, you are entitled to exchange your private notes for exchange notes with substantially identical terms. This exchange offer is intended to satisfy these rights. After the exchange offer is complete, except as set forth in the next paragraph, you will no longer be entitled to any exchange or registration rights with respect to your private notes. |

| The registration rights agreement requires us to file a registration statement for a continuous offering in accordance with Rule 415 under the Securities Act for your benefit upon certain conditions, including if you are ineligible to participate in the exchange offer, provided that you indicate that you wish to have your private notes registered under the Securities Act. |

Resales of the Exchange Notes | We believe that the exchange notes issued in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act as long as: |

| (1) | you are acquiring the exchange notes in the ordinary course of your business; |

| (2) | you are not engaging in and do not intend to engage in a distribution of the exchange notes; |

2

Table of Contents

| (3) | you do not have an arrangement or understanding with any person or entity to participate in the distribution of the exchange notes; and |

| (4) | you are not our “affiliate” as that term is defined in Rule 405 under the Securities Act. |

| Our belief is based on interpretations by the staff of the SEC, as set forth in no-action letters issued to third parties unrelated to us. We have not asked the staff for a no-action letter in connection with this exchange offer, however, and we cannot assure you that the staff would make a similar determination with respect to the exchange offer. |

| If you are an affiliate of ours, or are engaging in or intend to engage in or have any arrangement or understanding with any person to participate in the distribution of the exchange notes: |

| • | you cannot rely on the applicable interpretations of the staff of the SEC; |

| • | you will not be entitled to participate in the exchange offer; and |

| • | you must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. |

| Furthermore, any broker-dealer that acquired any of its private notes directly from us, in the absence of an exemption therefrom: |

| • | may not rely on the applicable interpretation of the staff of the SEC’s position contained inExxon Capital Holdings Corp., SEC no-action letter (April 13, 1988),Morgan, Stanley & Co. Inc., SEC no-action letter (June 5, 1991) andShearman & Sterling, SEC no-action letter (July 2, 1993); and |

| • | must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the exchange notes. See “Plan of Distribution.” |

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, on , 2011, unless we decide to extend the exchange offer. We do not intend to extend the exchange offer, although we reserve the right to do so. |

Conditions to the Exchange Offer | The exchange offer is subject to customary conditions, including that it not violate any applicable law or any applicable interpretation of the staff of the SEC. The exchange offer is not conditioned upon any minimum principal amount of private notes being tendered for exchange. See “The Exchange Offer—Conditions.” |

Procedures for Tendering Private Notes | The private notes were issued as global securities in fully registered form without coupons. Beneficial interests in the private notes that are held by direct or indirect participants in The Depository Trust Company, or DTC, through certificateless depositary interests are shown on, and transfers of the private notes can be made only through, records maintained in book-entry form by DTC with respect to its participants. |

| If you wish to exchange your private notes for exchange notes pursuant to the exchange offer, you must transmit to Wilmington Trust FSB, as exchange agent, on or prior to the expiration of the exchange offer, either: |

| • | a computer-generated message transmitted through DTC’s Automated Tender Offer Program system, or ATOP, and received by the exchange agent and forming a part of a confirmation of book-entry transfer in which you acknowledge and agree to be bound by the terms of the letter of transmittal; or |

3

Table of Contents

| • | a properly completed and duly executed letter of transmittal, which accompanies this prospectus, or a facsimile of the letter of transmittal, together with your private notes and any other required documentation, to the exchange agent at its address listed in this prospectus and on the front cover of the letter of transmittal. |

| If you cannot satisfy either of these procedures on a timely basis, then you should comply with the guaranteed delivery procedures described below. |

| By delivering a computer-generated message through DTC’s ATOP system, you will represent to us, as set forth in the letter of transmittal, among other things, that: |

| • | you are acquiring the exchange notes in the exchange offer in the ordinary course of your business; |

| • | you are not engaging in and do not intend to engage in a distribution of the exchange notes; |

| • | you do not have an arrangement or understanding with any person or entity to participate in the distribution of the exchange notes; and |

| • | you are not our affiliate. |

Special Procedures for Beneficial Owners | If you are the beneficial owner of private notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender your private notes in the exchange offer, you should promptly contact the person in whose name your private notes are registered and instruct that person to tender on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your notes, either make appropriate arrangements to register ownership of the private notes in your name or obtain a properly completed bond power from the person in whose name your private notes are registered. The transfer of registered ownership may take considerable time. See “The Exchange Offer—Procedures for Tendering.” |

Guaranteed Delivery Procedures | If you wish to tender your private notes and time will not permit the documents required by the letter of transmittal to reach the exchange agent before the expiration date for the exchange offer, or the procedure for book-entry transfer cannot be completed on a timely basis, you must tender your private notes according to the guaranteed delivery procedures described in this prospectus under the heading “The Exchange Offer—Guaranteed Delivery.” |

Acceptance of Private Notes and Delivery of Exchange Notes | Except under the circumstances summarized above under “Conditions to the Exchange Offer,” we will accept for exchange any and all private notes that are properly tendered in the exchange offer prior to 5:00 p.m., New York City time, on the expiration date for the exchange offer. The exchange notes to be issued to you in an exchange offer will be delivered promptly following the expiration of the exchange offer. See “The Exchange Offer—Terms of the Exchange Offer.” |

Withdrawal Rights | You may withdraw any tender of your private notes at any time prior to 5:00 p.m., New York City time, on the expiration date of the exchange offer. We will return to you any private notes not accepted for exchange for any reason without expense to you as promptly as we can after the expiration or termination of the exchange offer. See “The Exchange Offer—Withdrawal of Tenders.” |

Exchange Agent | Wilmington Trust FSB, the trustee under the indenture governing the notes, is serving as the exchange agent, or the Exchange Agent, in connection with the exchange offer. |

4

Table of Contents

Consequences of Failure to Exchange | If you do not participate or properly tender your private notes in the exchange offer: |

| • | you will retain private notes that are not registered under the Securities Act and that will continue to be subject to restrictions on transfer that are described in the legend on the private notes; |

| • | you will not be able, except in very limited instances, to require us to register your private notes under the Securities Act; |

| • | you will not be able to offer to resell or transfer your private notes unless they are registered under the Securities Act or unless you offer to resell or transfer them pursuant to an exemption under the Securities Act; and |

| • | the trading market for your private notes will become more limited to the extent that other holders of private notes participate in the exchange offer. |

Federal Income Tax Consequences | Your exchange of private notes for exchange notes in the exchange offer will not result in any gain or loss to you for U.S. federal income tax purposes. See “Material United States Federal Income Tax Consequences.” |

5

Table of Contents

Summary of the Terms of the Exchange Notes

The summary below describes the principal terms of the exchange notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of Exchange Notes” section of this prospectus contains a more detailed description of the terms and conditions of the exchange notes.

Issuer | CNL Lifestyle Properties, Inc. |

Notes Offered | $400,000,000 aggregate principal amount of 7.250% Senior Notes due 2019. |

Maturity Date | The exchange notes will mature on April 15, 2019. |

Interest Rate | The exchange notes bear interest at a rate of 7.250% per annum, accruing from the issue date of the notes. |

Interest Payment Dates | Interest on the exchange notes is payable on April 15 and October 15 of each year, beginning on October 15, 2011. |

Ranking | The exchange notes are our senior unsecured obligations and: |

| • | will be our general unsecured obligations; |

| • | will be pari passu in right of payment with all of our existing and future unsecured senior indebtedness; |

| • | will be senior in right of payment to any of our future subordinated indebtedness; and |

| • | will be unconditionally guaranteed by the guarantors. |

| However, the notes will be effectively subordinated to our guarantee of borrowings under our existing credit agreement to the extent of certain assets of Issuer that secure the payment of amounts due under our revolving credit facility. |

| Each guarantee of the notes: |

| • | will be a general unsecured obligation of the guarantor; |

| • | will be pari passu in right of payment with all existing and future unsecured senior indebtedness of the guarantor; and |

| • | will be senior in right of payment to any future subordinated indebtedness of that guarantor. |

| However, each guarantee of the notes will be effectively subordinated to all borrowings of that guarantor which are secured by certain assets of that guarantor that do not secure the notes. As of March 31, 2011, after giving effect to the offering of the private notes, we and our guarantors would have had approximately $176.2 million of secured indebtedness. In addition, not all of our subsidiaries will guarantee the notes. Also, CNL Village Retail Partnership, LP, a Delaware limited partnership, CNL Dallas Market Center, L.P., a Delaware limited partnership, and CC3 Acquisition LLC, a Delaware limited liability company, and their respective subsidiaries (which are not consolidated subsidiaries of ours as of the date the indenture) are not guarantors and are not subject to any of the obligations and covenants described hereunder. In the event of a bankruptcy, liquidation or reorganization of any of these non-guarantor subsidiaries, the non-guarantor subsidiaries will pay the holders of their debt and their trade creditors before they will be able to distribute any of their assets to us. |

Optional Redemption | On or after April 15, 2015, we may redeem some or all of the notes at redemption prices that decrease over time, plus accrued and unpaid interest and special interest, if any, to the redemption date as further described under the |

6

Table of Contents

| heading “Description of Exchange Notes — Optional Redemption” of this prospectus. |

| We may redeem some or all of the notes prior to April 15, 2015, at a price equal to 100% of the principal amount of the notes redeemed plus accrued and unpaid interest and special interest to the date of redemption and a “make whole” premium, as described in this prospectus. |

| In addition, prior to April 15, 2014, we may redeem up to 35% of the aggregate principal amount of the outstanding notes with the net proceeds of one or more equity offerings at a redemption price equal to 107.250% of the principal amount thereof, plus accrued and unpaid interest and special interest, if any, to the date of redemption, provided that, following such redemption, at least 65% of the aggregate principal amount of the notes originally issued under the indenture remains outstanding. |

Change of Control | If we experience a change of control (as defined in the indenture governing the notes), each holder of notes will have the right to require us to repurchase all or any part of its notes at a price equal to 101% of their principal amount, plus accrued and unpaid interest and special interest, if any, to the date of purchase. See “Description of Exchange Notes — Repurchase at the Option of Holders — Change of Control.” |

Asset Sale Offer | If we engage in certain asset sales, and within 360 days of receipt of the net proceeds from such asset sale we do not reinvest such proceeds in the business or otherwise use such proceeds as required by the indenture, we may be required to use the net cash proceeds from such sales to make an offer to repurchase notes with such proceeds. The purchase price of each note so purchased will be 100% of its principal amount, plus accrued and unpaid interest and special interest, if any, to the date of purchase, prepayment or redemption. See “Description of Exchange Notes — Repurchase at the Option of Holders — Asset Sales.” |

Certain Covenants | The indenture governing the notes contains covenants that, among other things, limit our and any restricted subsidiaries’ ability to: |

| • | transfer or sell assets; |

| • | pay dividends or make certain distributions, buy subordinated indebtedness or securities, make certain investments or make other restricted payments; |

| • | incur or guarantee additional indebtedness or issue preferred stock; |

| • | incur dividend or other payment restrictions affecting restricted subsidiaries; |

| • | consummate a merger, consolidation or sale of all or substantially all our assets; |

| • | enter into transactions with affiliates; |

| • | engage in business other than a business that is the same or similar to our current business or a reasonably related extension thereof; and |

| • | make certain acquisitions or investments. |

| Additionally, the indenture requires us to maintain at all times total unencumbered assets of not less than 150% of the aggregated principal amount of our and our restricted subsidiaries unsecured indebtedness. These covenants are subject to a number of important exceptions and qualifications. See “Description of Exchange Notes — Repurchase at the Option of Holders” and “Description of Exchange Notes — Certain Covenants” in this prospectus. |

7

Table of Contents

Use of Proceeds | We will not receive any cash proceeds from the issuance of the exchange notes pursuant to the exchange offer. In consideration for issuing the exchange notes as contemplated in this prospectus, we will receive in exchange a like principal amount of outstanding private notes, the terms of which are identical in all material respects to the exchange notes. The outstanding private notes surrendered in exchange for the exchange notes will be retired and cancelled and cannot be reissued. We have agreed to bear the expenses of the exchange offer. No underwriter is being used in connection with the exchange offer. See “Use of Proceeds.” |

No Public Market; No Listing | The exchange notes are new issues of securities and will not be listed on any securities exchange or included in any automated quotation system. There is currently no established market for the notes. The exchange notes will generally be freely transferable. Accordingly, a market for the notes, or, if issued, the exchange notes, may not develop, or if one does develop, it may not provide adequate liquidity. The initial purchasers have advised us that they currently intend to make a market for the notes as permitted by applicable laws and regulations. However, the initial purchasers are not obligated to do so and may discontinue any such market making activities without any notice. |

Risk Factors | Investing in the exchange notes involves substantial risks. See “Risk Factors” beginning on page 9 for a discussion of certain factors you should consider in evaluating an investment in the exchange notes. |

For additional information regarding the exchange notes, see the “Description of Exchange Notes” section of this prospectus.

8

Table of Contents

You should carefully consider the following risk factors in addition to the other information included in this prospectus before tendering your outstanding notes in the exchange offer. If any of the following risks actually occur, our business, financial condition, prospects, results of operations or cash flow could be materially and adversely affected. Additional risks or uncertainties not currently known to us, or that we currently deem immaterial, may also impair our business operations. We cannot assure you that any of the events discussed in the risk factors below will not occur and if such events do occur, you may lose all or part of your investment in the notes.

Risks Related to the Exchange Notes

Our substantial level of indebtedness could adversely affect our financial condition and prevent us from fulfilling our obligations under the notes.

As of March 31, 2011, after giving effect to the offering of the private notes and the application of the net proceeds therefrom, (i) on a consolidated basis, we would have had (a) approximately $863.2 million of debt outstanding, including the notes, of which approximately $463.2 million would have ranked effectively senior to the notes to the extent of the value of the assets securing such debt and (b) $85.0 million of availability under our revolving credit facility; and (ii) our non-guarantor subsidiaries would have had approximately $348.7 million in secured debt. Borrowings under our revolving credit facility effectively rank senior to the notes to the extent of the value of the assets securing such debt. The notes are also effectively subordinated to existing and future indebtedness of our non-guarantor subsidiaries and have no direct claim against such subsidiaries or their assets. Our substantial level of indebtedness increases the risk that we may be unable to generate cash sufficient to pay amounts due in respect of our indebtedness, including the notes. Our substantial level of indebtedness could have other important consequences for your investment in the notes and significant effects on our business. For example, our level of indebtedness and the terms of our debt agreements may:

| • | make it more difficult for us to satisfy our financial obligations under the notes, our other indebtedness and our contractual and commercial commitments and increase the risk that we may default on our debt obligations; |

| • | prevent us from raising the funds necessary to repurchase notes tendered to us if there is a change of control, which would constitute a default under the indenture governing the notes; |

| • | heighten our vulnerability to downturns in our business, our industry or in the general economy and restrict us from exploiting business opportunities or making acquisitions; |

| • | limit management’s discretion in operating our business; |

| • | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, and other general corporate purposes; |

| • | place us at a competitive disadvantage compared to our competitors that have less debt; |

| • | limit our ability to borrow additional funds; and |

| • | limit our flexibility in planning for, or reacting to, changes in our business, the industry in which we operate or the general economy. |

Each of these factors may have a material and adverse effect on our financial condition and viability. Our ability to make payments with respect to the notes and to satisfy our other debt obligations will depend on our future operating performance, which will be affected by prevailing economic conditions and financial, business and other factors affecting our Company and industry, many of which are beyond our control. In addition, the indenture contains financial and other restrictive covenants that will limit our ability to engage in activities that may be in our long-term best interests. Our failure to comply with those covenants could result in an event of default that, if not cured or waived, could result in the acceleration of all of our debts.

Despite existing debt levels, we may still be able to incur substantially more debt, which would increase the risks associated with our leverage.

Even with our existing debt levels, we and our subsidiaries may be able to incur substantial amounts of additional debt in the future, including debt under existing and future credit facilities, some or all of which may be secured and therefore would rank effectively senior to the notes. As of March 31, 2011 after giving effect to the offering of the private

9

Table of Contents

notes, we would have had $85.0 million of availability under our revolving credit facility. In addition, the indenture governing the notes allows us to issue additional notes under certain circumstances, which will also be guaranteed by the guarantors. Although the terms of the notes will limit our ability to incur additional debt, these terms do not and will not prohibit us from incurring substantial amounts of additional debt for specific purposes or under certain circumstances. If new debt is added to our and our subsidiaries’ current debt levels, the related risks that we and they now face could intensify and could further exacerbate the risks associated with our leverage.

We may not be able to generate sufficient cash flow to meet our debt service and other obligations, including the notes, due to events beyond our control.

Our ability to generate cash flows from operations and to make scheduled payments on or refinance our indebtedness, including the notes, and to fund working capital needs and planned capital expenditures will depend on our future financial performance and our ability to generate cash in the future. Our future financial performance will be affected by a range of economic, financial, competitive, business and other factors that we cannot control, such as general economic, legislative, regulatory and financial conditions in our industry, the economy generally or other risks summarized here. A significant reduction in operating cash flows resulting from changes in economic, legislative or regulatory conditions, increased competition or other events beyond our control could increase the need for additional or alternative sources of liquidity and could have a material adverse effect on our business, financial condition, results of operations, prospects and our ability to service our debt and other obligations, including the notes. If we are unable to service our indebtedness or to fund our other liquidity needs, we may be forced to adopt an alternative strategy that may include actions such as reducing or delaying capital expenditures, selling assets, restructuring or refinancing our indebtedness, seeking additional capital, or any combination of the foregoing. If we raise additional debt, it would increase our interest expense, leverage and our operating and financial costs. We cannot assure you that any of these alternative strategies could be effected on satisfactory terms, if at all, or that they would yield sufficient funds to make required payments on the notes and our other indebtedness or to fund our other liquidity needs. Reducing or delaying capital expenditures or selling assets could delay future cash flows. In addition, the terms of existing or future debt agreements, including the indenture governing the notes, may restrict us from adopting any of these alternatives. We cannot assure you that our business will generate sufficient cash flows from operations or that future borrowings will be available in an amount sufficient to enable us to pay our indebtedness, including the notes, or to fund our other liquidity needs.

The failure to generate sufficient cash flow or to effect any of these alternatives could significantly adversely affect the value of the notes and our ability to pay amounts due under the notes. If for any reason we are unable to meet our debt service and repayment obligations, including under the notes, we would be in default under the terms of the agreements governing our indebtedness, which would allow our creditors at that time to declare all outstanding indebtedness to be due and payable. This would likely in turn trigger cross-acceleration or cross-default rights between our applicable debt agreements. Under these circumstances, our lenders could compel us to apply all of our available cash to repay our borrowings or they could prevent us from making payments on the notes. In addition, these lenders could then seek to foreclose on our assets that are their collateral. If the amounts outstanding under the notes were to be accelerated, or were the subject of foreclosure actions, we cannot assure you that our assets would be sufficient to repay in full the money owed to the lenders or to our other debt holders, including you as a noteholder.

The indenture governing the notes imposes significant operating and financial restrictions on us and our subsidiaries that may prevent us from pursuing certain business opportunities and restrict our ability to operate our business.

The indenture governing the notes contains covenants that restrict our and our restricted subsidiaries’ ability to take various actions, such as:

| • | transferring or selling assets; |

| • | paying dividends or distributions, buying subordinated indebtedness or securities, making certain investments or making other restricted payments; |

| • | incurring or guaranteeing additional indebtedness or issuing preferred stock; |

| • | incurring dividend or other payment restrictions affecting restricted subsidiaries; |

| • | consummating a merger, consolidation or sale of all or substantially all our assets; |

| • | entering into transactions with affiliates; |

| • | engaging in business other than a business that is the same or similar to our current business or a reasonably related extension thereof; and |

| • | designating subsidiaries as unrestricted subsidiaries. |

10

Table of Contents

Additionally, the indenture requires us to maintain at all times total unencumbered assets of not less than 150% of the aggregated principle amount of our and our restricted subsidiaries unsecured indebtedness.

We may also be prevented from taking advantage of business opportunities that arise if we fail to meet certain ratios or because of the limitations imposed on us by the restrictive covenants under the indenture governing the notes. The restrictions contained in the indenture governing the notes may also limit our ability to plan for or react to market conditions, meet capital needs or otherwise restrict our activities or business plans and adversely affect our ability to finance our operations, enter into acquisitions, execute our business strategy, effectively compete with companies that are not similarly restricted or engage in other business activities that would be in our interest. In the future, we may also incur debt obligations that might subject us to additional and different restrictive covenants that could affect our financial and operational flexibility. We cannot assure you that we will be granted waivers or amendments to the indenture governing the notes if for any reason we are unable to comply with the indenture, or that we will be able to refinance our debt on acceptable terms or at all should we seek to do so.

Our ability to comply with these covenants will likely be affected by events beyond our control, and we cannot assure you that we will satisfy those requirements. A breach of any of these provisions could result in a default under our credit facility, the indenture governing the notes or any future credit facilities we may enter into, which could allow all amounts outstanding thereunder to be declared immediately due and payable, subject to the terms and conditions of the documents governing such indebtedness. If we were unable to repay the accelerated amounts, our secured lenders could proceed against the collateral granted to them to secure such indebtedness. This would likely in turn trigger cross-acceleration and cross-default rights under any other credit facilities and indentures, if any then exist governing the notes and the terms of our other indebtedness outstanding at such time. If the amounts outstanding under the notes or any other indebtedness outstanding at such time were to be accelerated or were the subject of foreclosure actions, we cannot assure you that our assets would be sufficient to repay in full the money owed to the lenders or to our other debt holders, including you as a holder of notes.

We may not be able to repurchase the notes upon a change of control or to make an offer to repurchase the notes in connection with an asset sale as required by the indenture.

Upon the occurrence of specific types of change of control events, we will be required to offer to repurchase all of the outstanding notes at a price equal to 101% of the aggregate principal amount of the notes repurchased, plus accrued and unpaid interest and additional interest, if any, up to, but not including the date of repurchase. In addition, in connection with certain asset sales, we will be required to offer to repurchase all of the notes at a price equal to 100% of the principal amount, plus accrued and unpaid interest and additional interest, if any, up to, but not including the date of repurchase. We may not have sufficient funds available to repurchase all of the notes tendered pursuant to any such offer and any other debt that would become payable upon a change of control or in connection with such an asset sale offer. Any of our current or future debt agreements may also limit our ability to repurchase the notes until all such debt is paid in full. Our failure to purchase the notes would be a default under the indenture, which would in turn likely trigger a default under any future credit facility and the terms of our other indebtedness outstanding at such time. Any requirement to offer to repurchase outstanding notes may therefore require us to refinance our other outstanding debt, which we may not be able to accomplish on commercially reasonable terms, if at all. These repurchase requirements may also delay or make it more difficult for others to obtain control of our Company. Finally, the definition of change of control includes a phrase relating to the sale or other transfer of “all or substantially all” of the properties or assets of the Company and its subsidiaries, taken as a whole. There is no precise definition of that phrase under applicable law. Accordingly, in certain circumstances there may be a degree of uncertainty in ascertaining whether a particular transaction would involve a disposition of “all or substantially all” of the assets of the Company, and therefore it may be unclear as to whether a change of control has occurred and whether the holders of the notes have the right to require us to repurchase such notes. In addition, certain important corporate events, such as leveraged recapitalizations that would increase the level of our indebtedness, would not constitute a “Change of Control” under the indenture. See “Description of Exchange Notes — Repurchase at the Option of Holders.”

The notes and the guarantees will be effectively subordinated to our and the guarantors’ existing and future secured debt to the extent of the value of the collateral securing such debt.

The notes will be our senior unsecured obligations and the indebtedness evidenced by the subsidiary guarantees will be the senior unsecured indebtedness of the applicable guarantor. The notes rank equal in right of payment with all of our existing and future senior indebtedness and senior to all of our existing and future subordinated indebtedness. However, the notes will be effectively subordinated to all of our existing and future indebtedness, including our obligations under our revolving credit facility and any future secured credit facility, to the extent of the value of the assets securing

11

Table of Contents

such secured liabilities and indebtedness, and the notes will also be effectively subordinated to the existing and future indebtedness of our non-guarantor subsidiaries. The guarantees will rank equal in right of payment with all existing and future indebtedness of such guarantor, and senior to all existing and future subordinated indebtedness of such guarantor. The guarantees will also be effectively subordinated to any secured liabilities and indebtedness of such guarantor, including the obligations of such guarantor under our credit facility and any future secured credit facility (including related hedging obligations), to the extent of the value of such guarantor’s assets securing such secured indebtedness, and the guarantees will also be effectively subordinated to the existing and future indebtedness of our non-guarantor subsidiaries. Debt outstanding under any future secured credit facility will generally be secured by a first priority security interest in the assets securing such indebtedness. As of March 31, 2011, after giving effect to the offering of the private notes and the use of proceeds therefrom, we and the guarantors would have had approximately $176.2 million of secured indebtedness.

In the event of any distribution or payment on our assets in a bankruptcy, liquidation, reorganization, dissolution or other winding up involving us or any of our subsidiaries, holders of secured indebtedness will have a prior claim to those assets that constitute their collateral, and the holders of the notes will participate in the distribution or payment of our or our guarantor’s remaining assets ratably with all holders of our unsecured indebtedness that is deemed to be of the same class as the notes, and potentially with all of our other general creditors, based upon the respective amounts owed to each holder or creditor. Upon the occurrence of any of these events, there may not be sufficient funds to pay amounts due on the notes.

The notes are effectively subordinated to the liabilities of our subsidiaries that do not guarantee the notes.

Many of our subsidiaries will not guarantee the notes. To the extent that any of our subsidiaries do not guarantee the notes, the notes will be structurally subordinated to all existing and future obligations, including indebtedness, of such non-guarantor subsidiaries. The claims of creditors of the non-guarantor subsidiaries, including trade creditors, will have priority as to the assets of those subsidiaries.

As of March 31, 2011 after giving effect to the offering of the private notes, and the application of the proceeds therefrom, the notes would have been effectively subordinated to approximately $404.4 million of liabilities (including trade payables) of our non-guarantor subsidiaries.

We are permitted to create unrestricted subsidiaries, which will not be subject to any of the covenants in the indenture, and we may not be able to rely on the cash flow or assets of those unrestricted subsidiaries to pay our indebtedness.

Unrestricted subsidiaries are not subject to the covenants under the indenture governing the notes. Unrestricted subsidiaries may enter into financing arrangements that limit their ability to make loans or other payments to fund payments in respect of the notes. Accordingly, we may not be able to rely on the cash flow or assets of unrestricted subsidiaries to pay any of our indebtedness, including the notes.

We may choose to redeem the notes when prevailing interest rates are relatively low.

We may choose to redeem the notes from time to time, especially when prevailing interest rates are lower than the rate borne by the notes. If prevailing rates are lower at the time of redemption, you would not be able to reinvest the redemption proceeds in a comparable security at an effective interest rate as high as the interest rate on the notes being redeemed. Our redemption right also may adversely impact your ability to sell your notes as the optional redemption date or period approaches.

Federal, state and foreign fraudulent transfer laws may permit a court to avoid the notes and the guarantees, subordinate claims in respect of the notes and the guarantees and require noteholders to return payments received. If this occurs, noteholders may not receive any payments on the notes.

Federal, state and foreign fraudulent transfer and conveyance statutes may apply to the issuance of the notes and the incurrence of any guarantees. Under federal bankruptcy law and comparable provisions of state fraudulent transfer or conveyance laws, which may vary from state to state and be different from other applicable foreign jurisdictions, the notes or guarantees could be avoided as a fraudulent transfer or conveyance if, among other things, (1) we or any of the guarantors, as applicable, issued the notes or incurred the guarantees with the intent of hindering, delaying or defrauding creditors or (2) we or any of the guarantors, as applicable, received less than reasonably equivalent value or fair consideration in return for either issuing the notes or incurring the guarantees and, in the case of (2) only, one of the following is also true at the time thereof:

| • | we or any of the guarantors, as applicable, were insolvent or rendered insolvent by reason of the issuance of the notes or the incurrence of the guarantees; |

12

Table of Contents

| • | the issuance of the notes or the incurrence of the guarantees left us or any of the guarantors, as applicable, with an unreasonably small amount of capital to carry on the business; |

| • | we or any of the guarantors intended to, or believed that we or such guarantor would, incur debts beyond our or such guarantor’s ability to pay such debts as they mature; or |

| • | we or any of the guarantors was a defendant in an action for money damages, or had a judgment for money damages docketed against us or such guarantor if, in either case, after final judgment, the judgment is unsatisfied. |

A court would likely find that we or a guarantor did not receive reasonably equivalent value or fair consideration for the notes or such guarantees if we or such guarantor did not substantially benefit directly or indirectly from the issuance of the notes or the applicable guarantees. As a general matter, value is given for a transfer or an obligation if, in for the transfer or obligation, property is transferred or an antecedent debt is secured or satisfied. A debtor will generally not be considered to have received value in connection with a debt offering if the debtor uses the proceeds of that offering to make a dividend payment or otherwise retire or redeem equity securities issued by the debtor. We cannot be certain as to the standards a court would use to determine whether or not we or the guarantors were solvent at the relevant time or, regardless of the standard that a court uses, that the issuance of the guarantees would not be further subordinated to our other debt or the debt of the guarantors. Generally, however, an entity would be considered insolvent if, at the time it incurred indebtedness:

| • | the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all its assets; |

| • | the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| • | it could not pay its debts as they become due. |

On the basis of historical financial information, recent operating history and other factors, we believe that each guarantor, after giving effect to its guarantee of the notes, will not be insolvent, will not have unreasonably small capital for the business in which it is engaged and will not have incurred debts beyond its ability to pay such debts as they mature. We cannot assure you, however, as to what standard a court would apply in making these determinations or that a court would agree with our conclusions in this regard.

If a court were to find that the issuance of the notes or the incurrence of the guarantee was a fraudulent transfer or conveyance, the court could avoid the payment obligations under the notes or such guarantee or further subordinate the notes or such guarantee to our presently existing and future indebtedness or of the related guarantor, or require the holders of the notes to repay any amounts received with respect to such guarantee. In the event of a finding that a fraudulent transfer or conveyance occurred, noteholders may not receive any repayment on the notes. Further, the avoidance of the notes could result in an event of default with respect to our other debt that could result in acceleration of such debt.

Although the guarantee entered into by the guarantor will contain a provision intended to limit that guarantor’s liability to the maximum amount that it could incur without causing the incurrence of obligations under its guarantee to be a fraudulent transfer, this provision may not be effective to protect that guarantee from being avoided under fraudulent transfer law, or may reduce the guarantor’s obligation to an amount that effectively makes its guarantee worthless.

If the guarantee by the subsidiary guarantor is not enforceable, the notes would be effectively subordinated to all liabilities of the subsidiary guarantor, including trade payables. In the event of a bankruptcy, liquidation or reorganization of any of our non-guarantor subsidiaries, holders of their indebtedness and their trade creditors will generally be entitled to payment of their claims from the assets of those subsidiaries before any assets are made available for distribution to us.

An active trading market may not develop for the exchange notes.

The failure of a market developing for the exchange notes could affect the liquidity and value of the exchange notes and you may not be able to sell the exchange notes readily, or at all, or at or above the price that you paid. We do not intend to apply for listing the exchange notes on any securities exchange and we cannot assure you that an active trading market will develop for the exchange notes. We cannot assure you that any market for the exchange notes will develop, or if one does develop, that it will be liquid. If the notes are traded, they may trade at a discount from their initial offering price, depending on prevailing interest rates, the market for similar securities, our credit rating, our operating performance and financial condition and other factors. If an active trading market does not develop, the market price and liquidity of the notes may be adversely affected. As a result, we cannot ensure you that you will be able to sell any of the notes at a particular time, at attractive prices, or at all. Thus, you may be required to bear the financial risk of your investment in the notes indefinitely.

13

Table of Contents

If a trading market were to develop, future trading prices of the exchange notes may be volatile and will depend on many factors, including:

| • | our operating performance and financial condition or prospects; |

| • | the prospects for companies in our industry generally; |

| • | the number of holders of the exchange notes; |

| • | prevailing interest rates; |

| • | the interest of securities dealers in making a market for them; and |

| • | the market for similar securities and the overall securities market. |

The trading prices of the exchange notes and the availability, costs and terms and conditions of our debt will be directly affected by our credit rating.

The exchange notes will be, and any of our future debt instruments may be, publicly rated by Moody’s Investors Service, Inc., or Moody’s, Standard & Poor’s Rating Services, or S&P, and other independent rating agencies. A security rating is not a recommendation to buy, sell or hold securities. These public debt ratings may affect our ability to raise debt. Any future downgrading of the exchange notes or our debt by Moody’s and S&P or another rating agency may affect the cost and terms and conditions of our financings and could adversely affect the value and trading price of the exchange notes.

Credit rating agencies continually revise their ratings for companies that they follow, including us. Any ratings downgrade could adversely affect the trading price of the exchange notes or the trading market for the notes to the extent a trading market for the exchange notes develops.

Our management will have broad discretion in allocating the net proceeds of the offering of the private notes and we will pay fees to our Advisor on acquisitions made with such net proceeds.

Our management has significant flexibility in applying the net proceeds we received in the offering of the private notes. Because the net proceeds are not required to be allocated to any specific investment or transaction, you cannot determine at this time the value or propriety of our application of the net proceeds, and you may not agree with our decisions. In addition, our use of the net proceeds from this offering may not yield a significant return or any return at all. The failure by our management to apply these funds effectively could have a material adverse effect on our financial condition, results of operations, business or prospects. See “Use of Proceeds.” Under the terms of the Advisory Agreement, our Advisor is entitled to receive a fee of 3% of the loan proceeds received by us for services in connection with the incurrence of debt from lines of credit and other financing that is used to acquire properties or to make or acquire loans or other permitted investments. We paid our Advisor a fee of $7.3 million in connection with the net proceeds we received from the offering and sale of the private notes.

The trading price of the exchange notes may be volatile.

Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the notes. Any such disruptions could adversely affect the prices at which you may sell your notes or the exchange notes, if they are issued. In addition, subsequent to their initial issuance, the exchange notes may trade at a discount from the initial offering price of the notes or the exchange notes, if they are issued, depending on the prevailing interest rates, the market for similar notes, our performance and other factors, many of which are beyond our control.

If a bankruptcy petition were filed by or against us, holders of exchange notes may receive a lesser amount for their claim than they would have been entitled to receive under the indenture governing the exchange notes.

If a bankruptcy petition were filed by or against us under the U.S. Bankruptcy Code after the issuance of the exchange notes, the claim by any holder of the exchange notes for the principal amount of the notes may be limited to an amount equal to the original issue price for the exchange notes. Accordingly, holders of the exchange notes under these circumstances may receive a lesser amount than they would be entitled to receive under the terms of the indenture governing the exchange notes, even if sufficient funds are available.

14

Table of Contents

Risks Related to the Exchange Offer

If you fail to exchange your private notes, they will continue to be restricted securities and may become less liquid.

Notes that you do not tender or that we do not accept will, following the exchange offer, continue to be restricted securities, and you may not offer to sell them except under an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. We will issue the exchange notes in exchange for the private notes in the exchange offer only following the satisfaction of the procedures and conditions set forth in “The Exchange Offer—Procedures for Tendering.” Because we anticipate that most holders of the private notes will elect to exchange their outstanding notes, we expect that the liquidity of the market for the private notes remaining after the completion of the exchange offer will be substantially limited. Any private notes tendered and exchanged in the exchange offer will reduce the aggregate principal amount of the outstanding private notes at maturity. Further, following the exchange offer, if you did not tender your private notes, you generally will not have any further registration rights, and such notes will continue to be subject to certain transfer restrictions.

Broker-dealers may become subject to the registration and prospectus delivery requirements of the Securities Act, and any profit on the resale of the exchange notes may be deemed to be underwriting compensation under the Securities Act.

Any broker-dealer that acquires exchange notes in the exchange offer for its own account in exchange for private notes that it acquired through market-making or other trading activities must acknowledge that it will comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction by that broker-dealer. Any profit on the resale of the exchange notes and any commission or concessions received by a broker-dealer may be deemed to be underwriting compensation under the Securities Act.

You may not receive the exchange notes in the exchange offer if the exchange offer procedures are not properly followed.

We will issue the exchange notes in exchange for your private notes only if you properly tender such notes before expiration of the exchange offer. Neither we nor the exchange agent is under any duty to give notification of defects or irregularities with respect to the tenders of the private notes for exchange. If you are the beneficial holder of private notes that are held through your broker, dealer, commercial bank, trust company or other nominee, and you wish to tender such notes in the exchange offer, you should promptly contact the person through whom your private notes are held and instruct that person to tender on your behalf.

Risks Related to the Company

Because we rely on affiliates of our Advisor for advisory and property management, if these affiliates or their executive officers and other key personnel are unable to meet their obligations to us, we may be required to find alternative providers of these services, which could disrupt our business.

CFG, through one or more of its respective affiliates or subsidiaries, owns and controls our Advisor. In the event that any of these affiliates are unable to meet their obligations to us, we might be required to find alternative service providers, which could disrupt our business by causing delays and/or increasing our costs.

A loss of our key personnel could delay or hinder implementation of certain investment strategies, which could adversely affect our ability to pay amounts due on our indebtedness, including the notes.

Our success depends to a significant degree upon the contributions of James M. Seneff, Jr., our chairman, Robert A. Bourne, our vice chairman, R. Byron Carlock, Jr., our chief executive officer, and Joseph T. Johnson, our chief accounting officer and principal financial officer, each of whom would be difficult to replace. If any of these key personnel were to cease their affiliation with us or our affiliates, we may be unable to find suitable replacement personnel, and our operating results could suffer as a result. We believe that our future success depends, in large part, upon our Advisor’s ability to hire and retain highly skilled managerial, operational and marketing personnel. Competition for such personnel is intense, and our Advisor may be unsuccessful in attracting and retaining such skilled personnel.

There may be conflicts of interest because of interlocking boards of directors with affiliated companies.

Mr. Seneff and Mr. Bourne serve as our chairman and vice chairman, respectively, and as directors of our board, and concurrently serve as directors of CNL Properties Trust, Inc., or CPT, a newly formed corporation that intends to operate as a REIT and is sponsored by CFG. CPT has similar investment strategies and objectives and intends to acquire

15

Table of Contents

assets in several of the asset classes in which we invest. CPT has currently filed a registration statement with the SEC for the sale of shares of its common stock to the public. Mr. Seneff also currently serves as chairman and a director for CNL Macquarie Global Growth Trust, Inc. and for Macquarie CNL Global Income Trust, Inc, two other non-traded REITs which are co-sponsored by CFG. These directors may experience conflicts of interest in managing us because they also have management responsibilities for these affiliated entities, which invest in and may invest in properties in the same markets as our properties.

There will be competing demands on our officers and directors and they may not devote all of their attention to us which could have a material adverse effect on our business and financial condition.

Our directors, Mr. Seneff and Mr. Bourne are also officers and directors of our Advisor and other affiliated entities and may experience conflicts of interest in managing us because they also have management responsibilities for other companies including companies that may invest in some of the same types of assets in which we may invest. In addition, substantially all of the other companies that they work for are affiliates of us and/or our Advisor. Our independent directors also are independent directors of CPT. For these reasons, all of these individuals will share their management time and services among those companies and us and will not devote all of their attention to us and could take actions that are more favorable to the other companies than to us.