Exhibit 99.1

Investor Presentation

February 2014

Forward-Looking Statements

FBIZ Company Overview

Company Profile

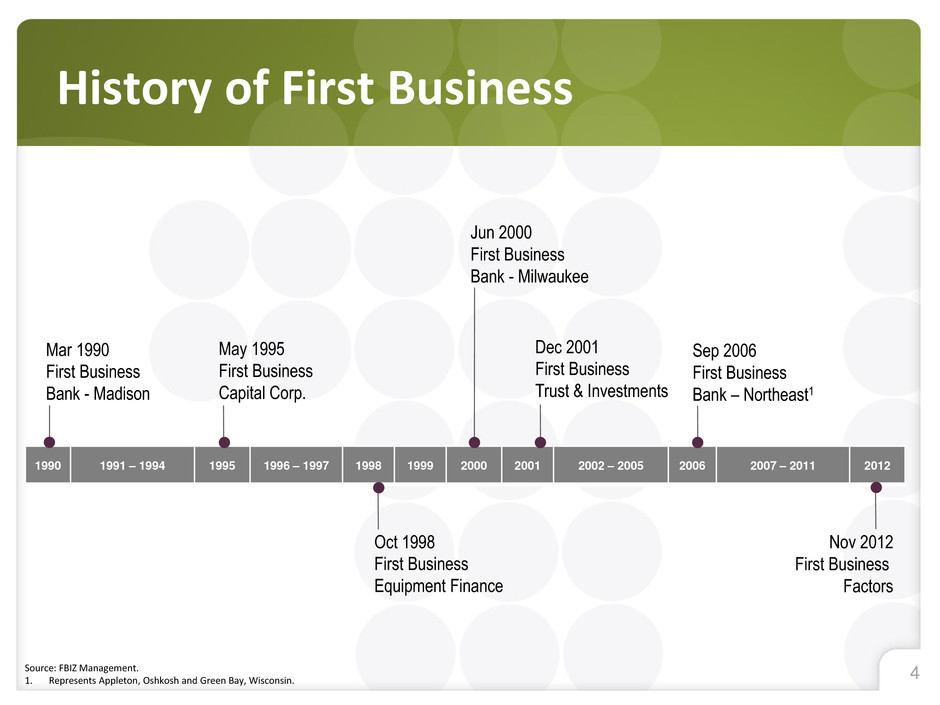

History of First Business

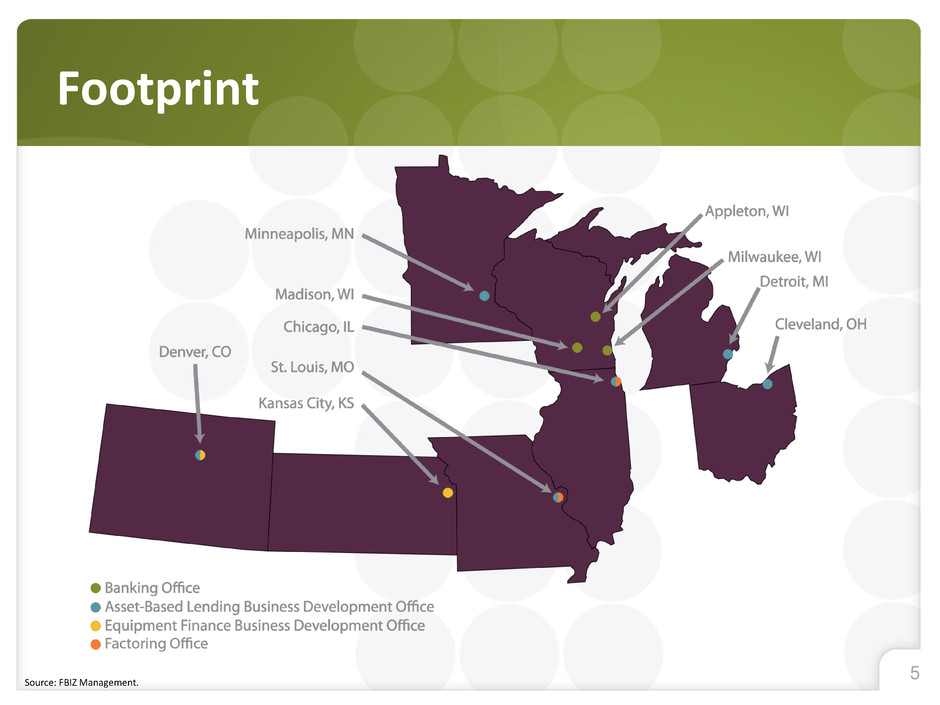

Footprint

Senior Executive Team

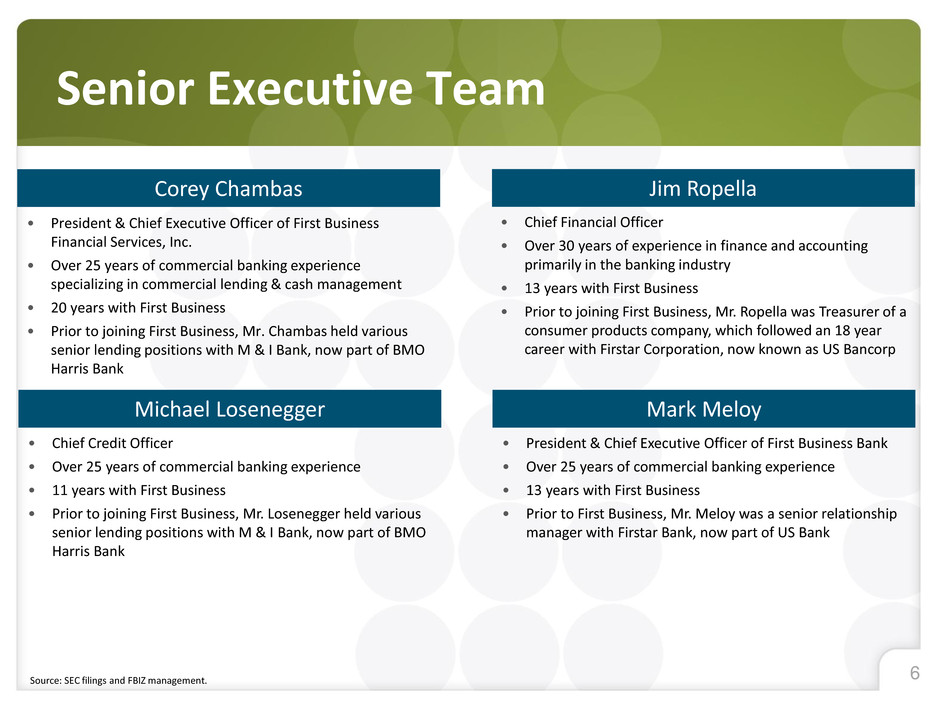

Corey Chambas

Jim Ropella

Michael Losenegger

Mark Meloy

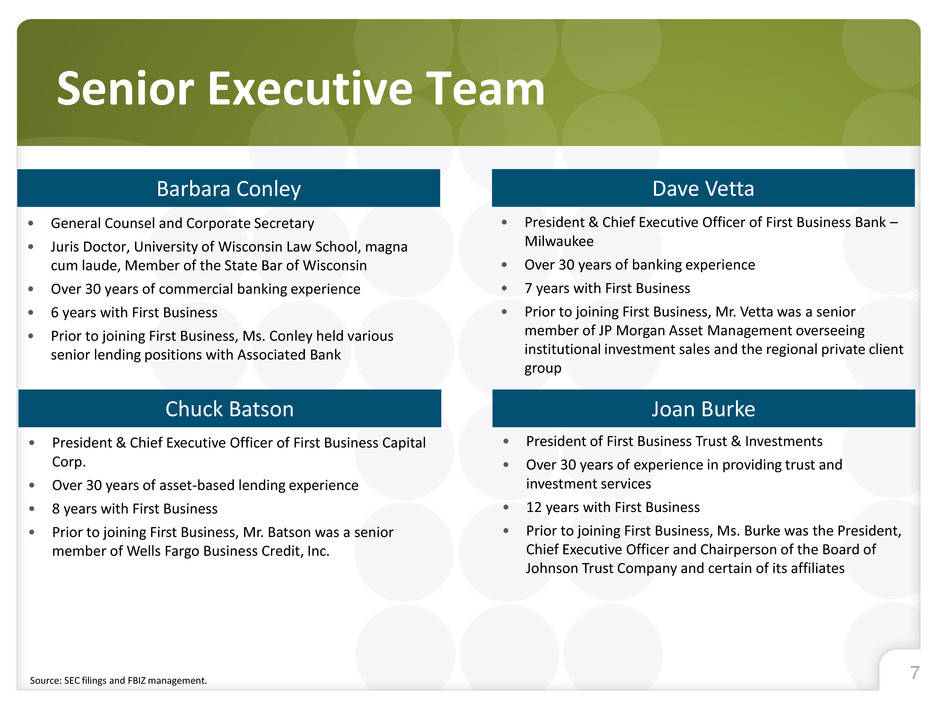

Senior Executive Team

Barbara Conley

Dave Vetta

Chuck Batson

Joan Burke

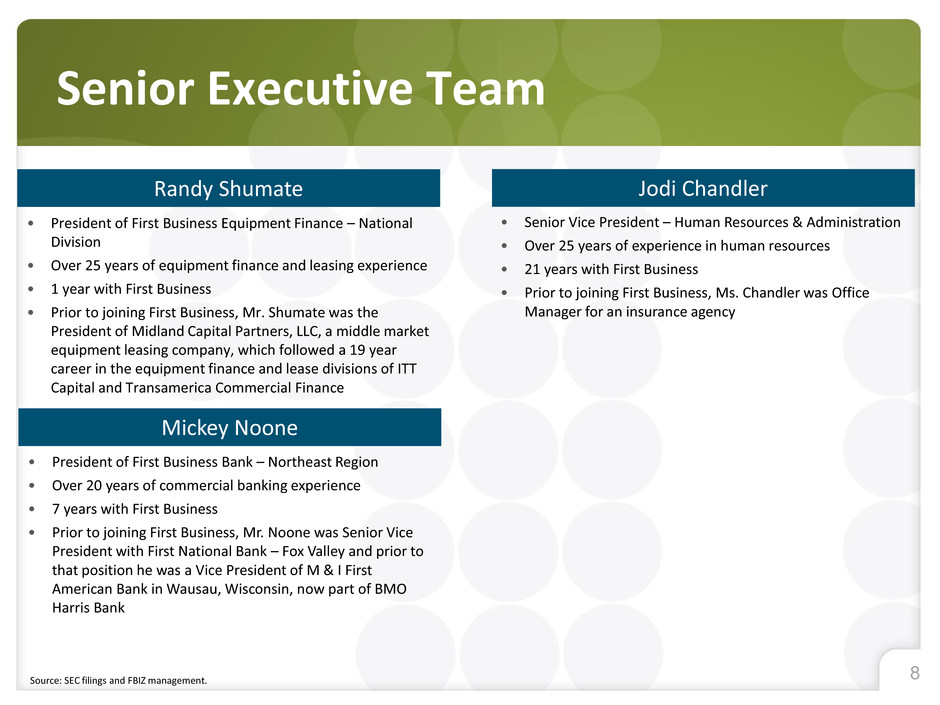

Senior Executive Team

Randy Shumate

Jodi Chandler

Mickey Noone

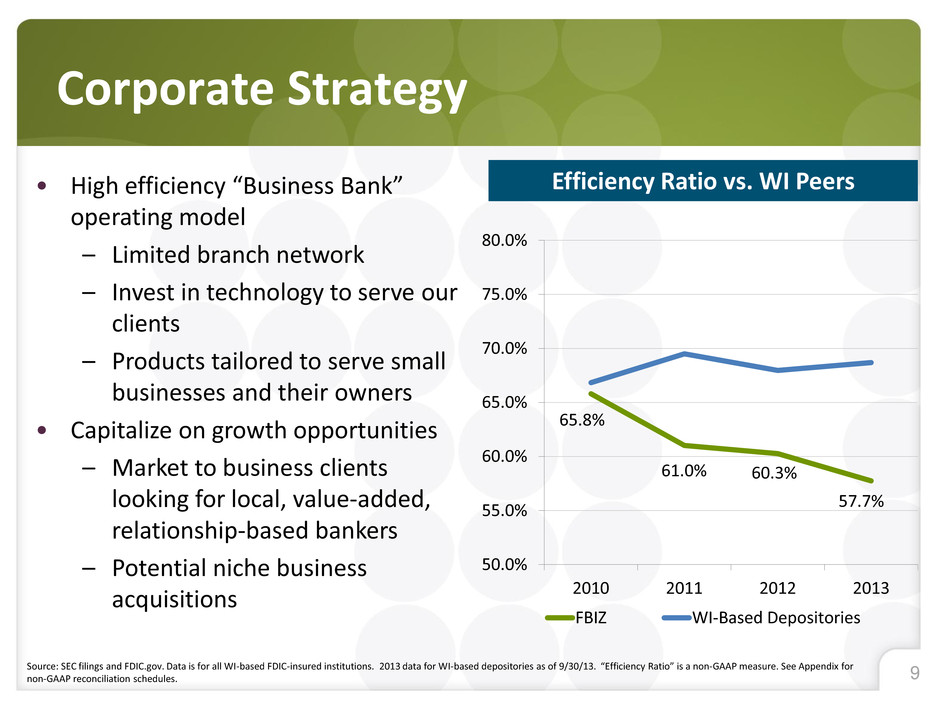

Corporate Strategy

Commitment to Expansion

Strategic Objectives

Strategic Objectives

Drive top line revenue growth

Achieve additional improvement in pre-tax adjusted earnings

Continue to leverage operating model to maintain efficiency

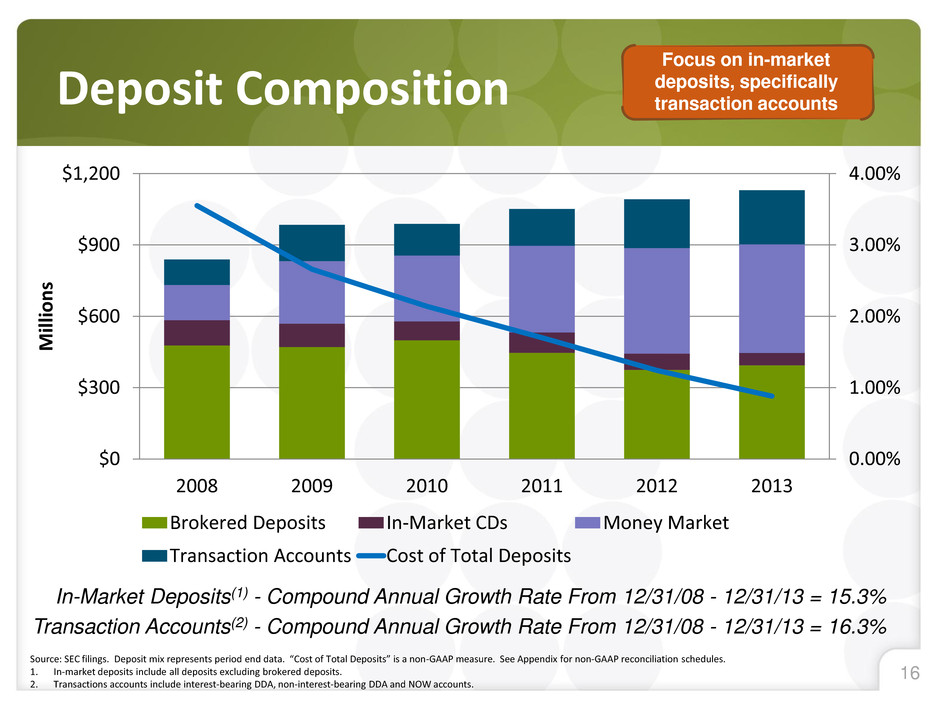

Continue to capture in-market deposits from clients to strengthen our mix of core funding and reduce our cost of funds

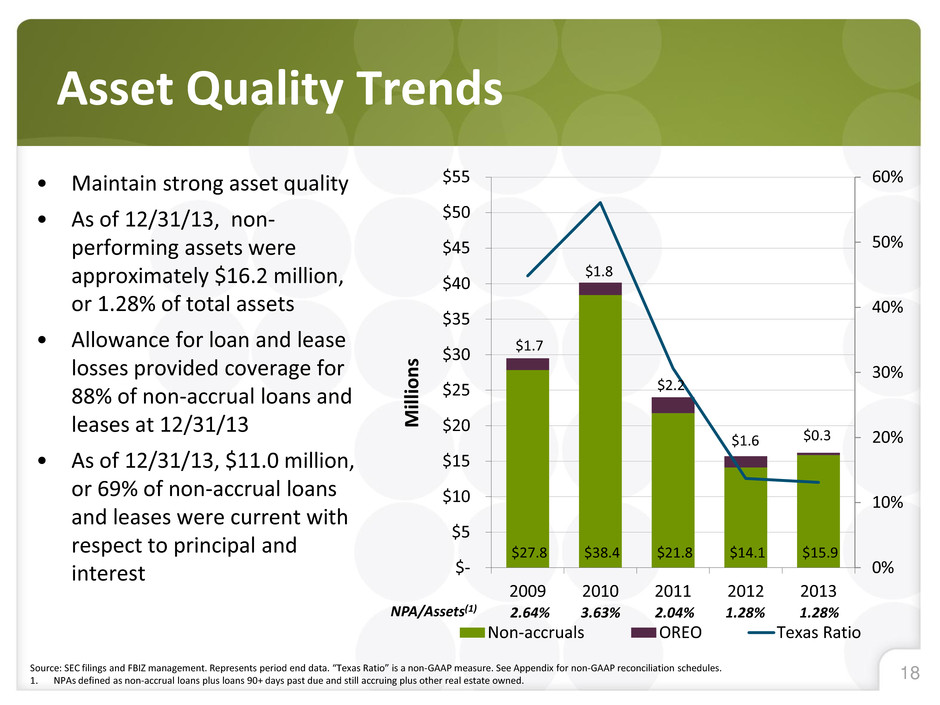

Maintain strong asset quality

Maintain strong profitability

Opportunistically invest in talent for future growth and profitability

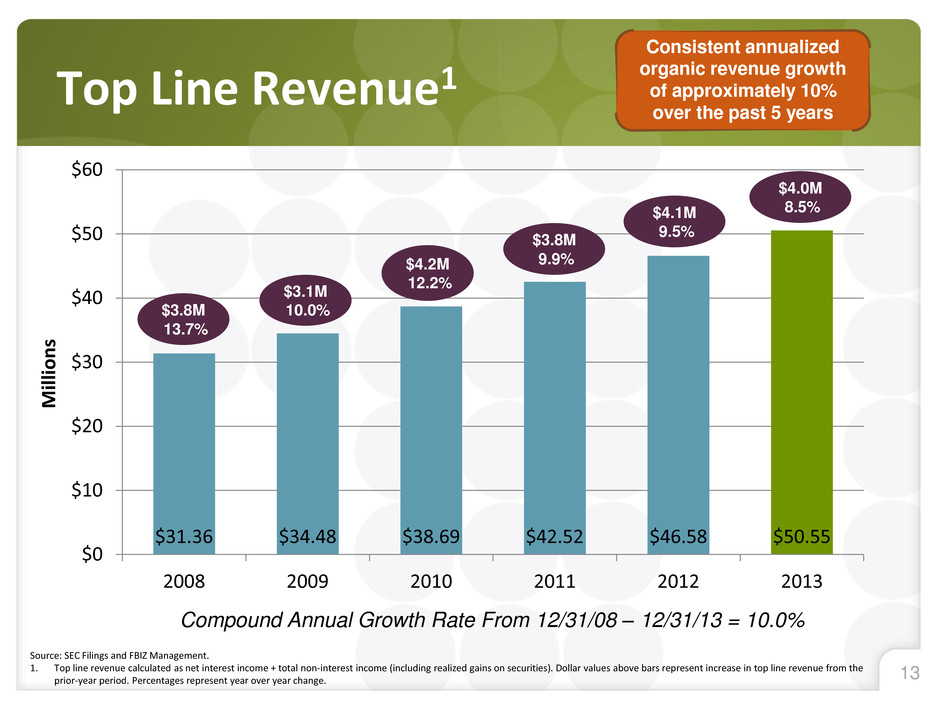

Top Line Revenue

Top Line Revenue

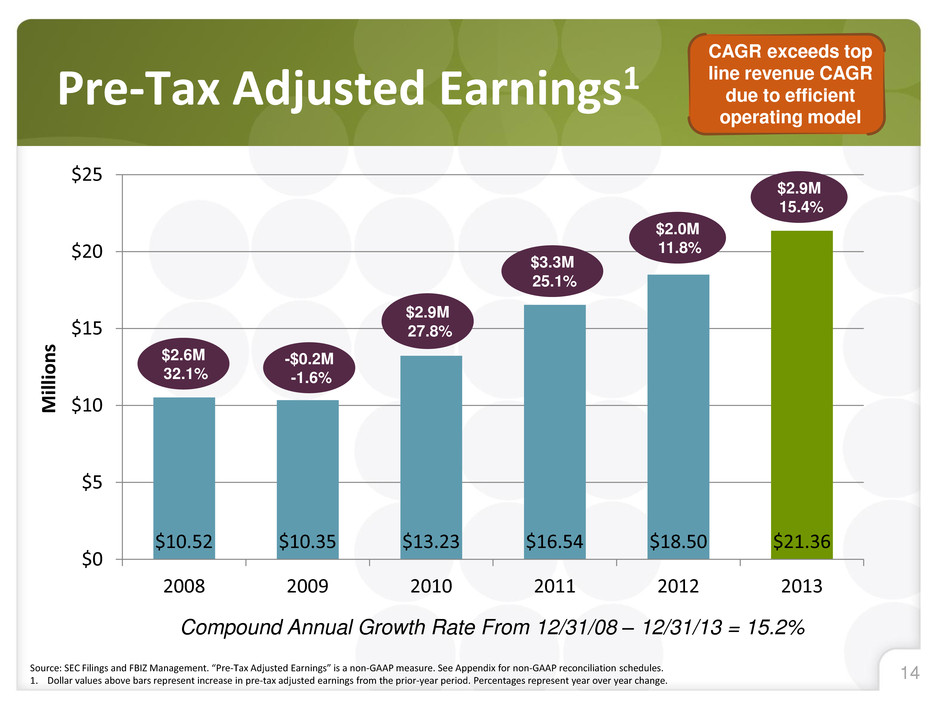

Pre-Tax Adjusted Earnings

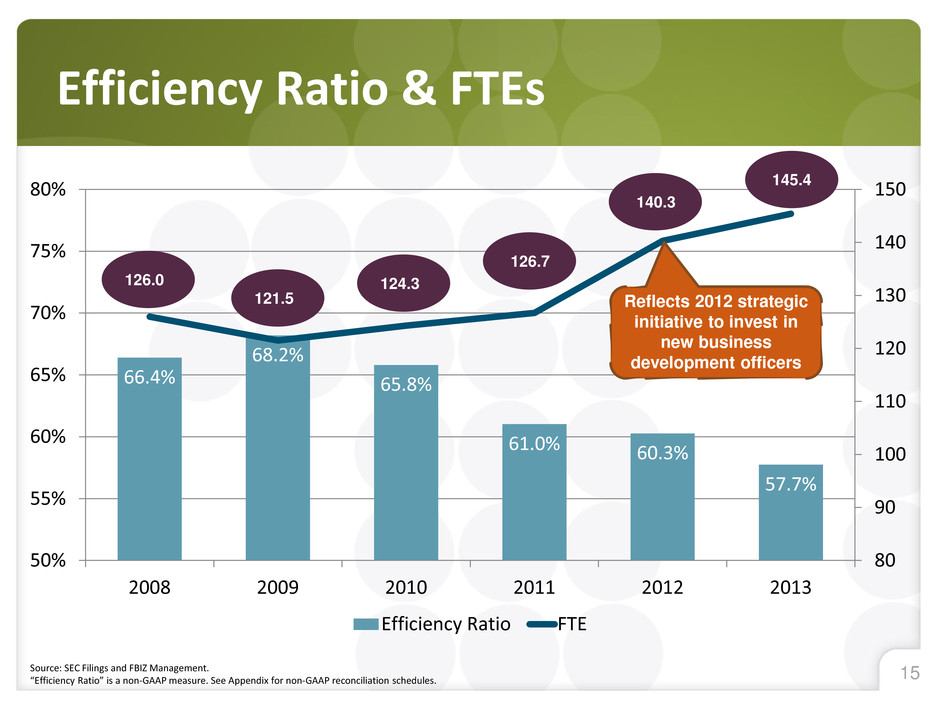

Efficiency Ratio & FTEs

Deposit Composition

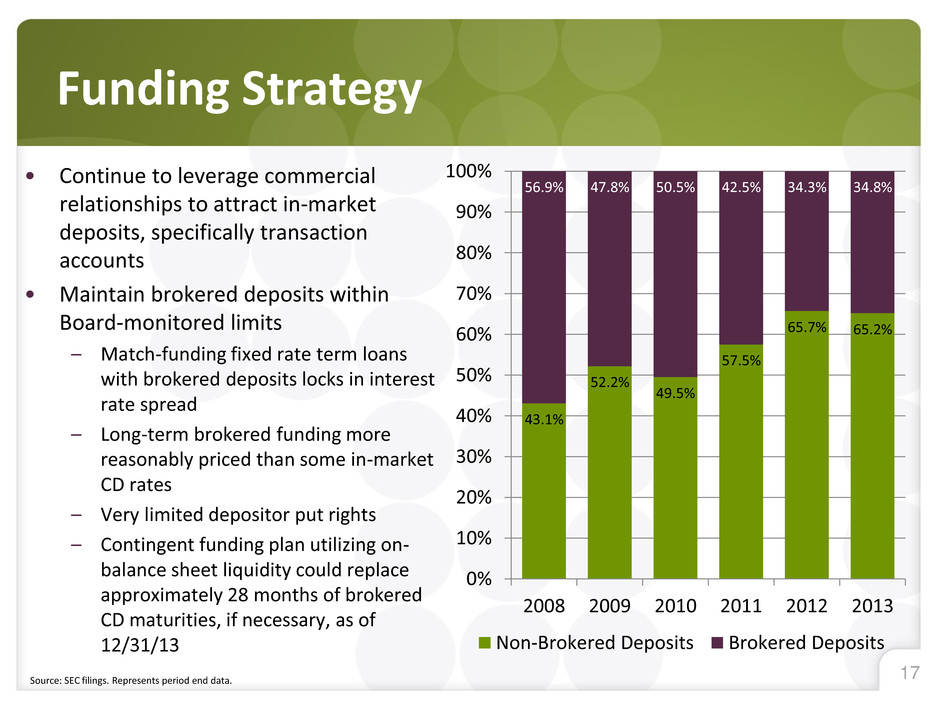

Funding Strategy

Asset Quality Trends

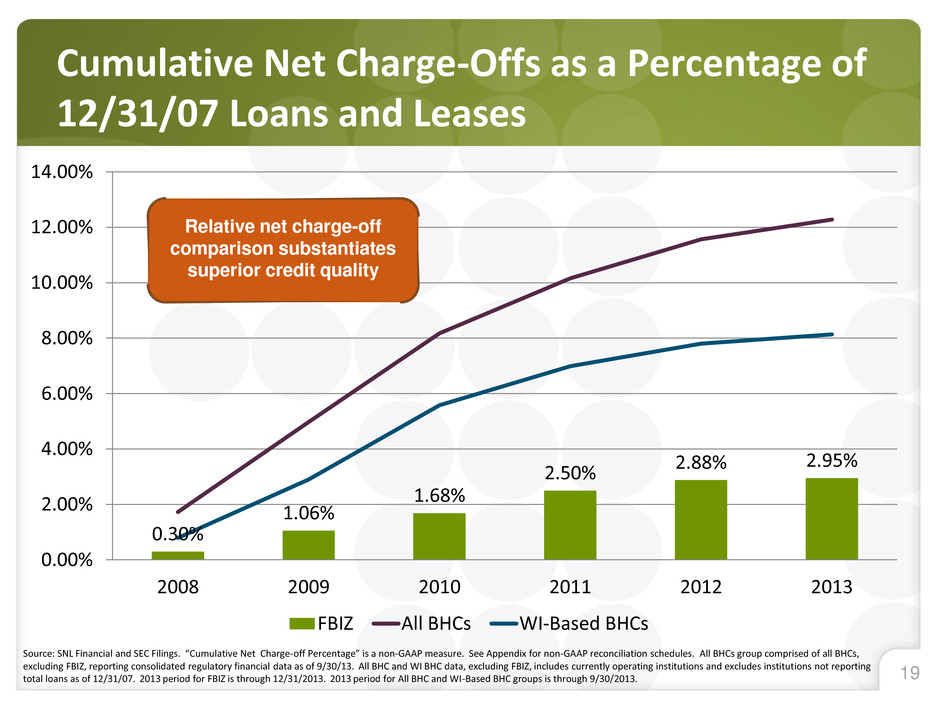

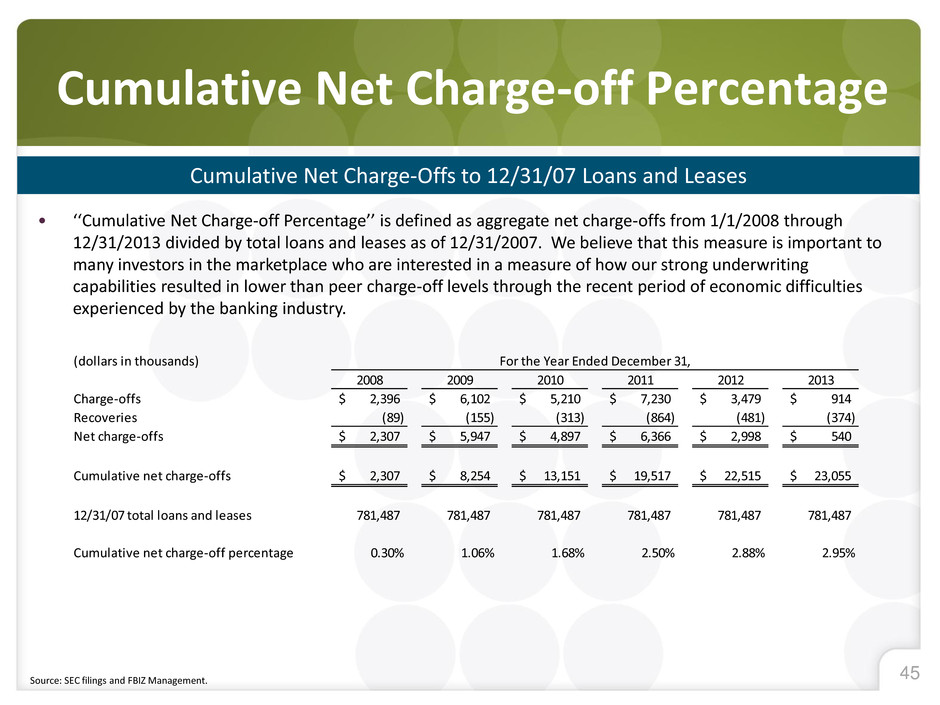

Cumulative Net Charge-Offs as a Percentage of 12/31/07 Loans and Leases

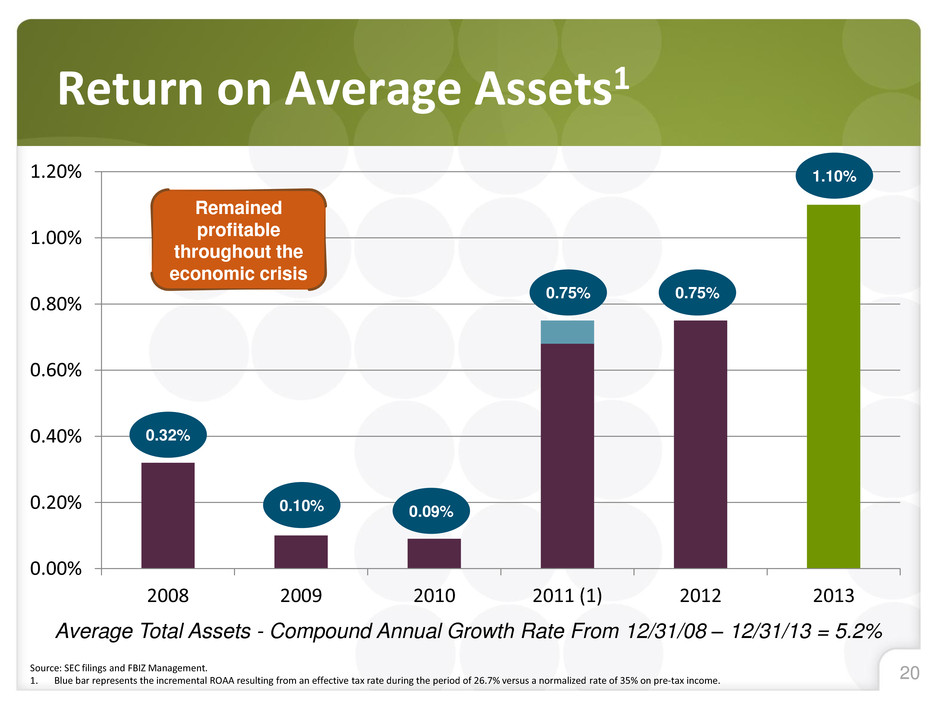

Return on Average Assets

Return on Average Equity

Financial Performance Highlights

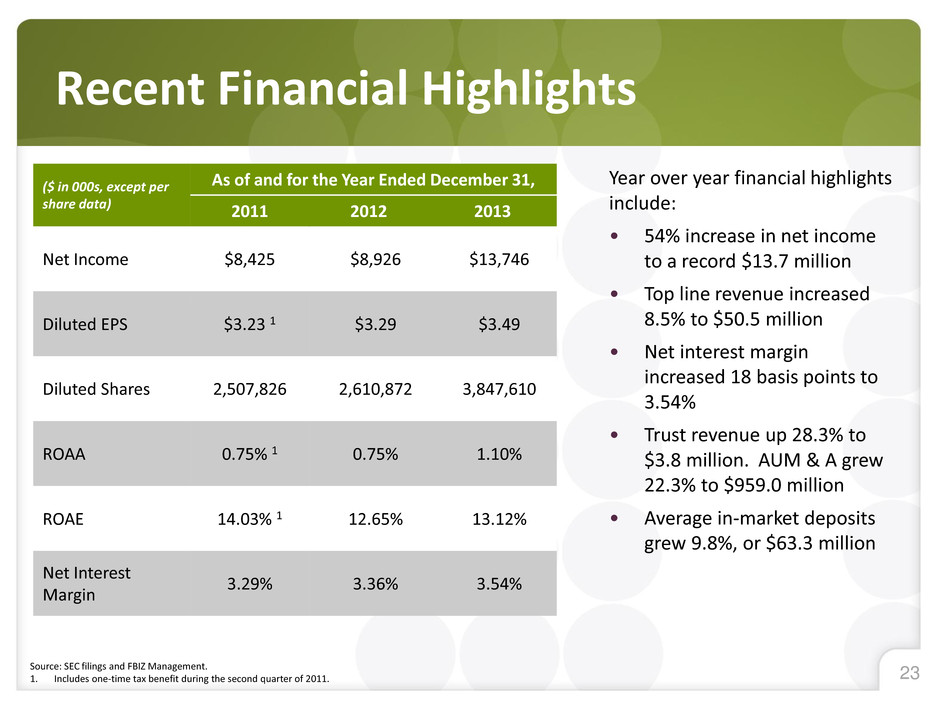

Recent Financial Highlights

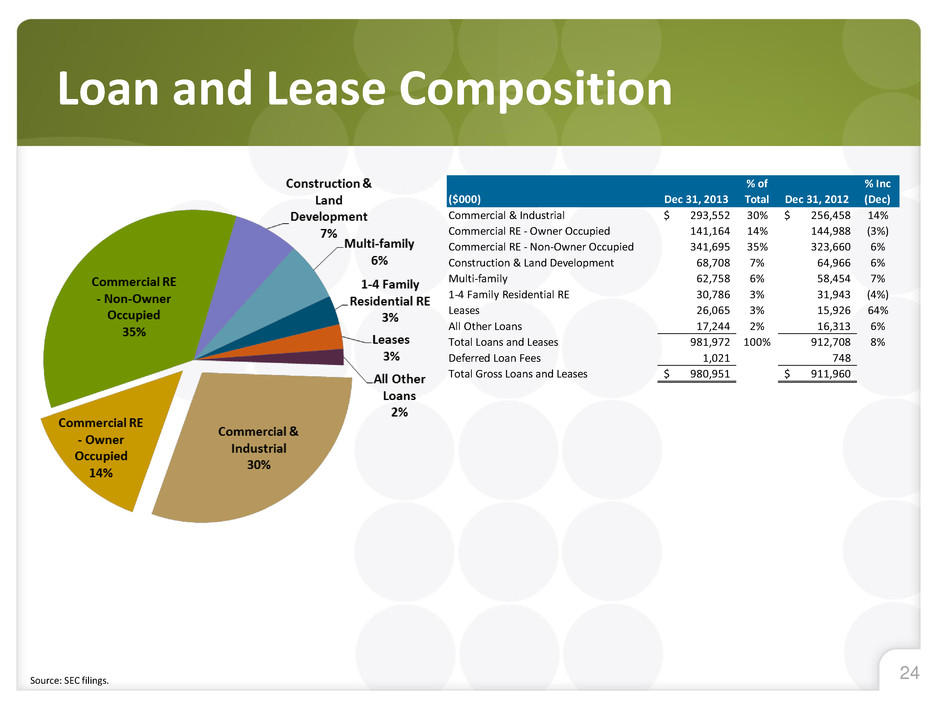

Loan and Lease Composition

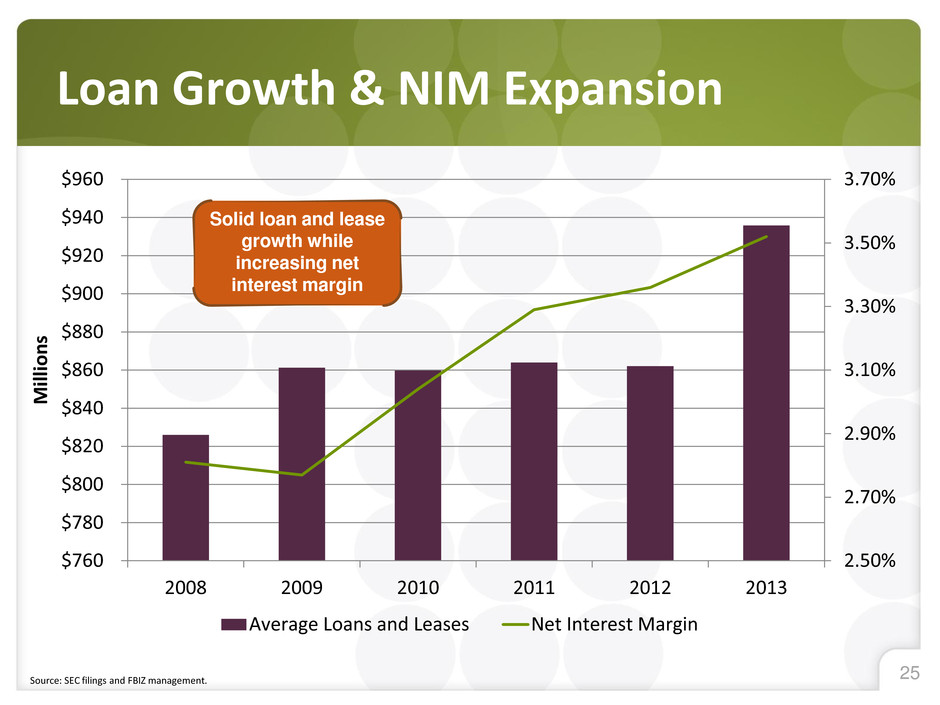

Loan Growth & NIM Expansion

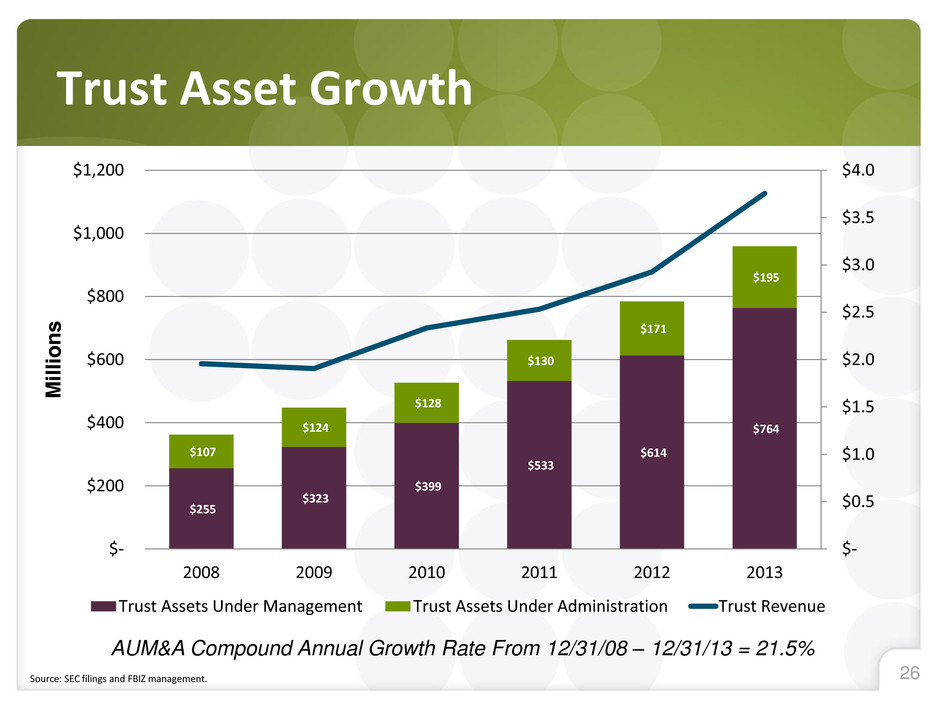

Trust Asset Growth

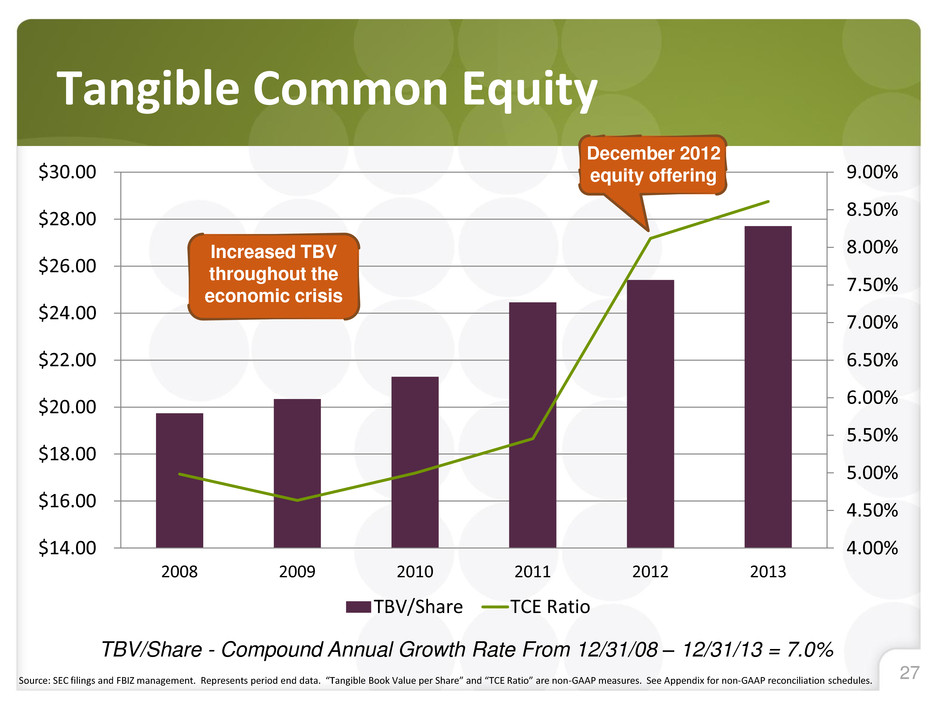

Tangible Common Equity

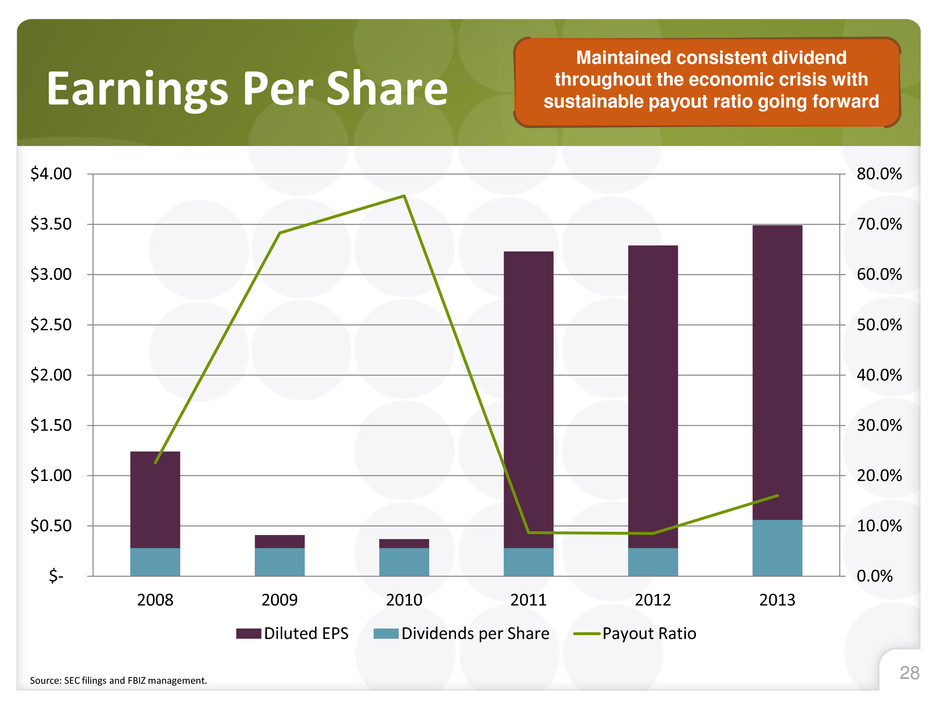

Earnings Per Share

Investment Considerations

Investment Highlights

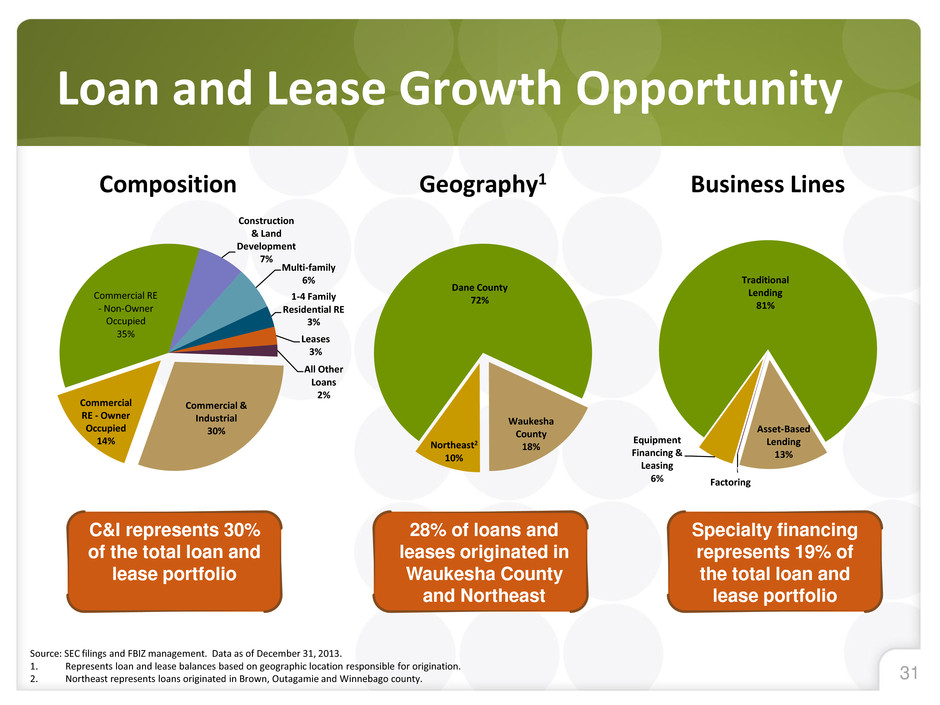

Loan and Lease Growth Opportunity

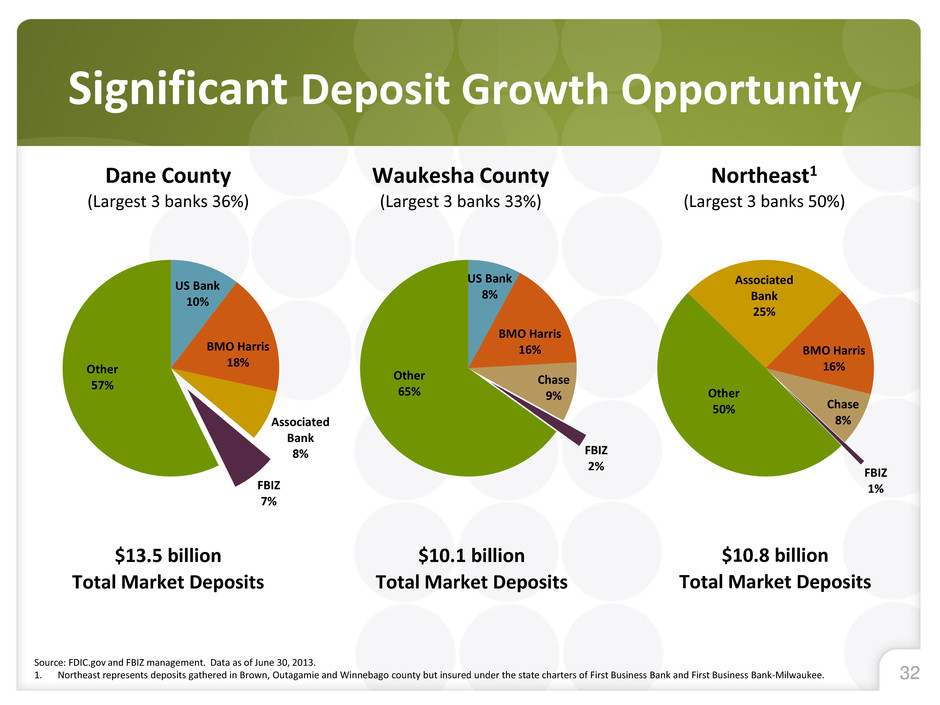

Significant Deposit Growth Opportunity

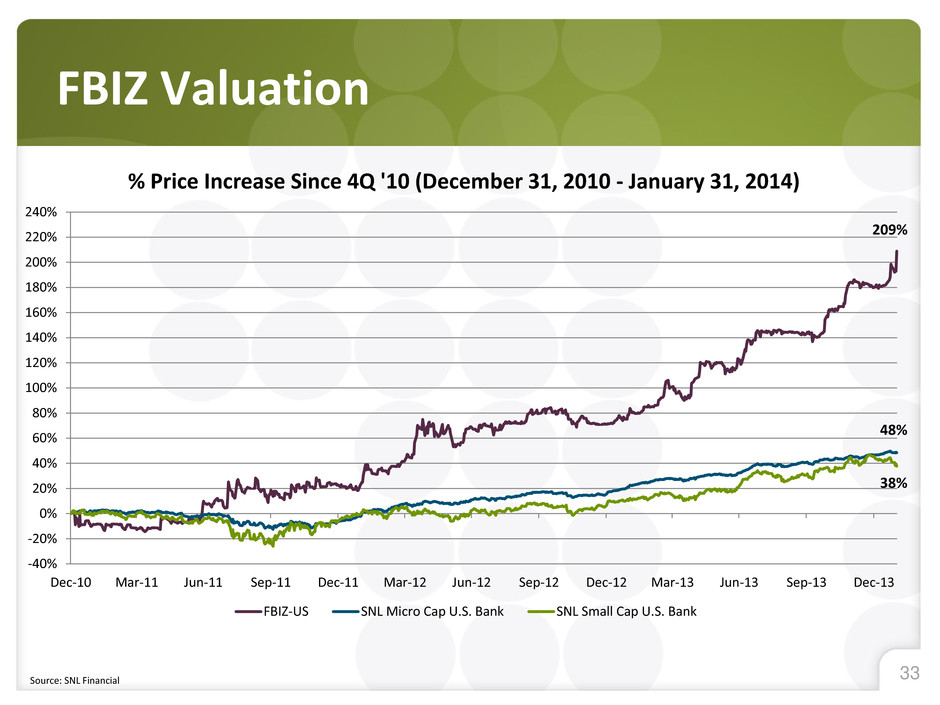

FBIZ Valuation - Price Increase

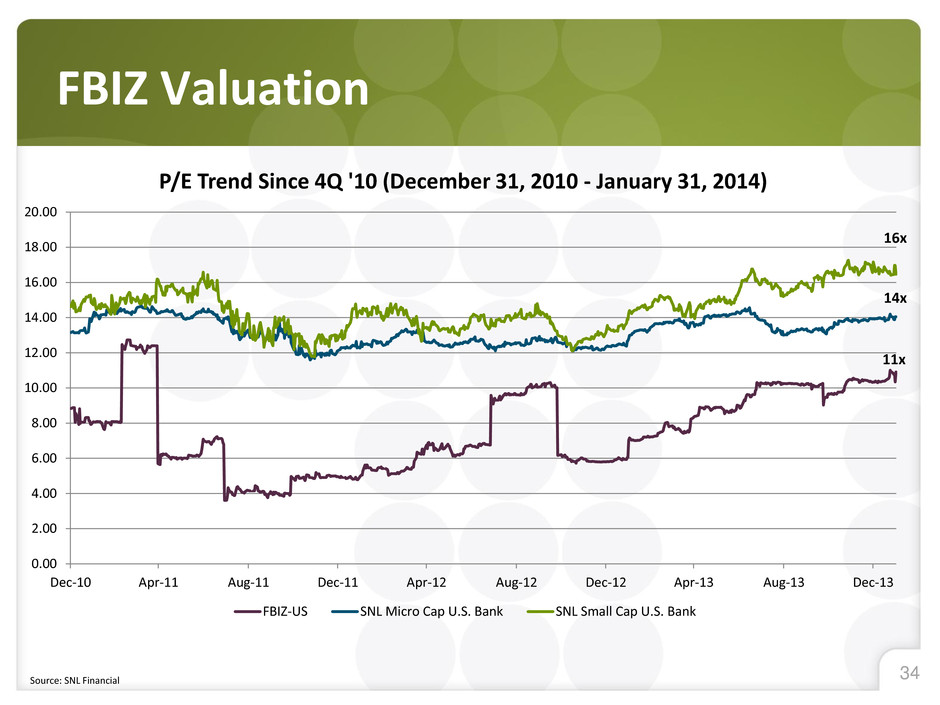

FBIZ Valuation - PE Multiple

Appendix

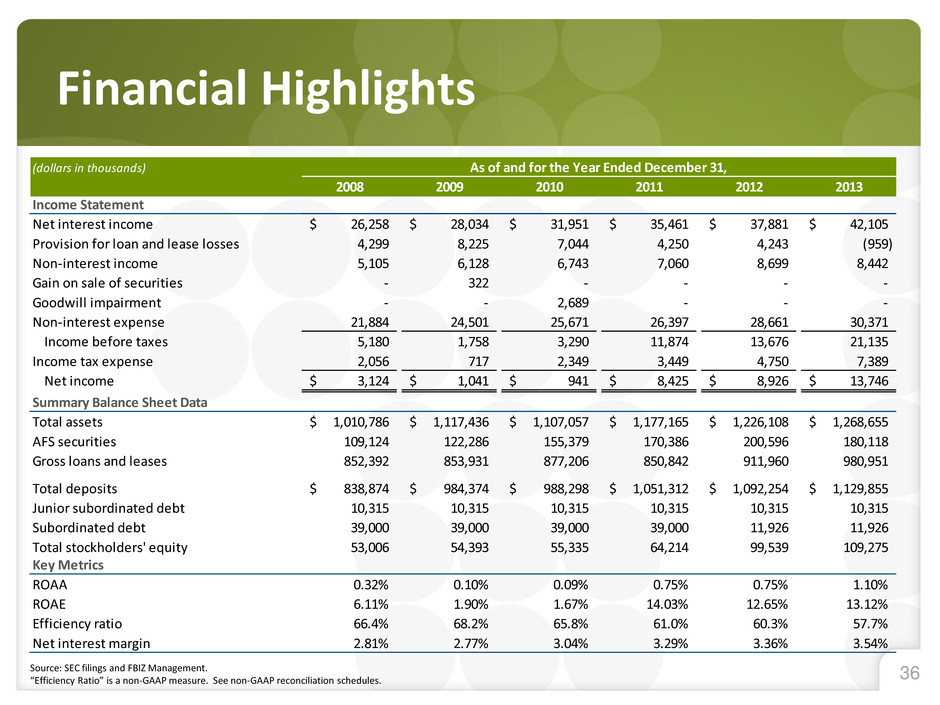

Appendix - Financial Highlights Table

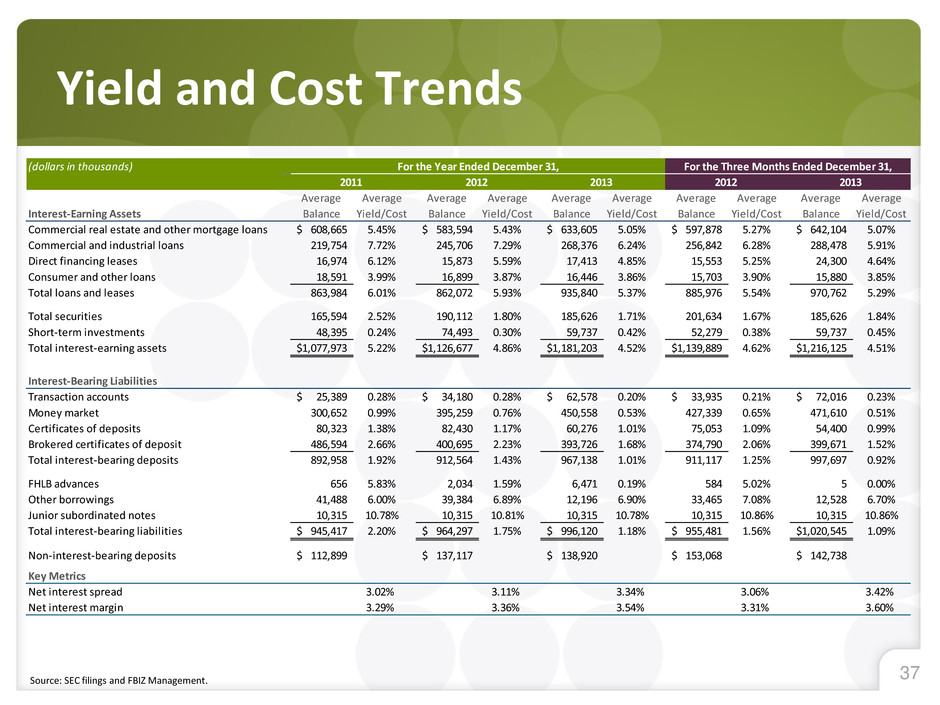

Appendix - Yield and Cost Trends

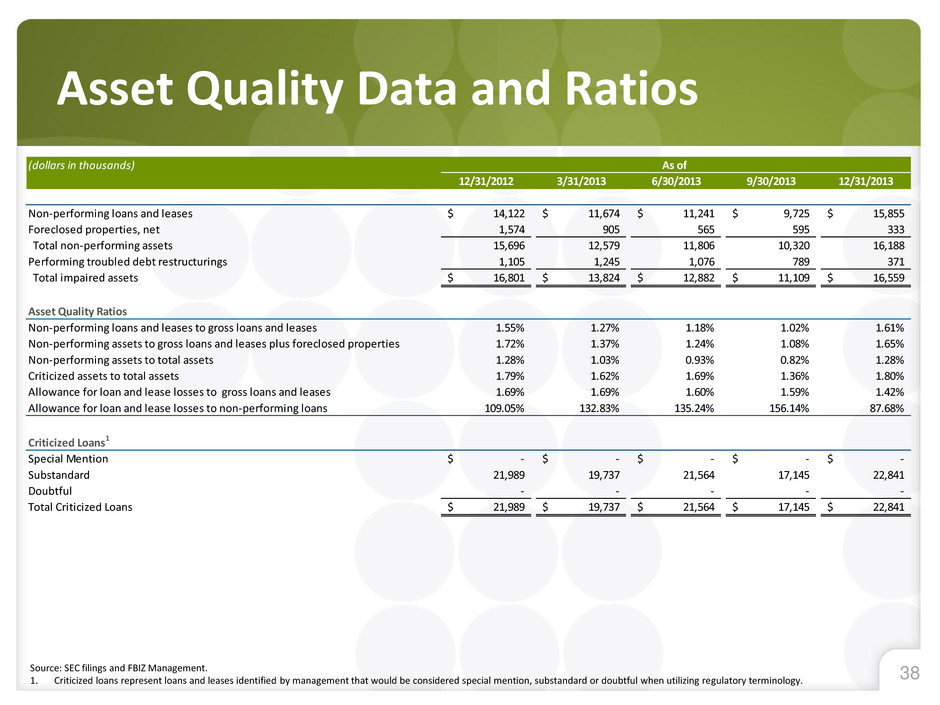

Appendix - Asset Quality Data and Ratios

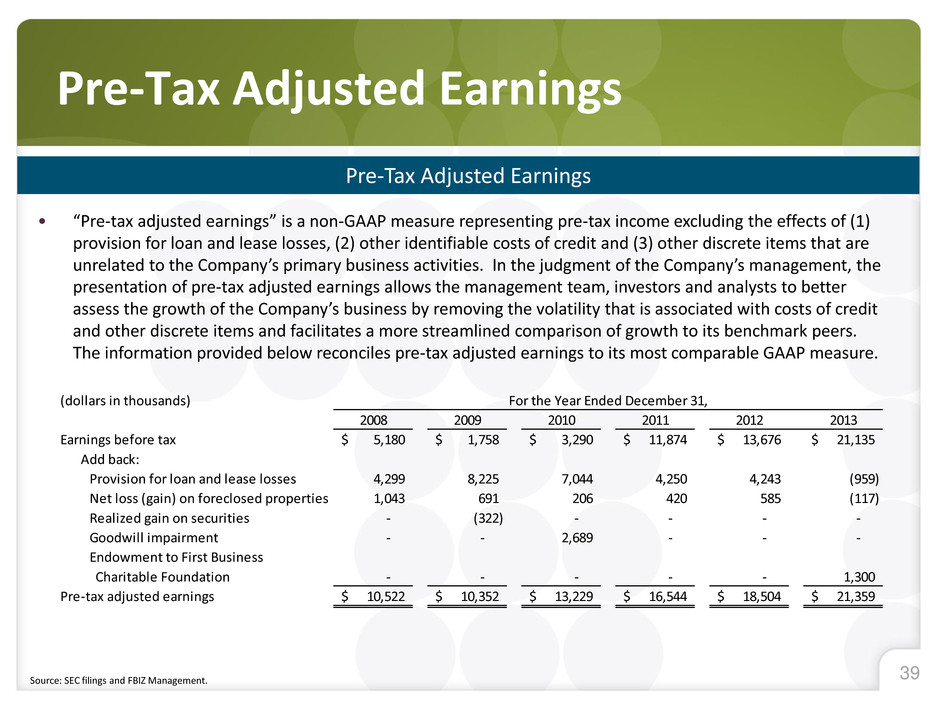

Appendix - Pre-Tax Adjusted Earnings

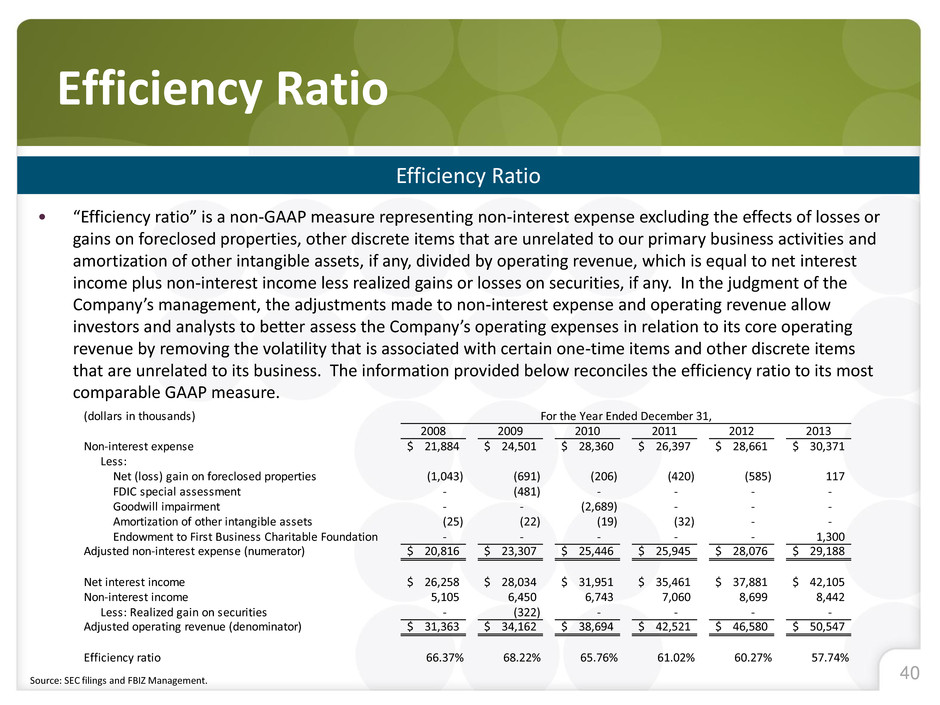

Appendix - Efficiency Ratio

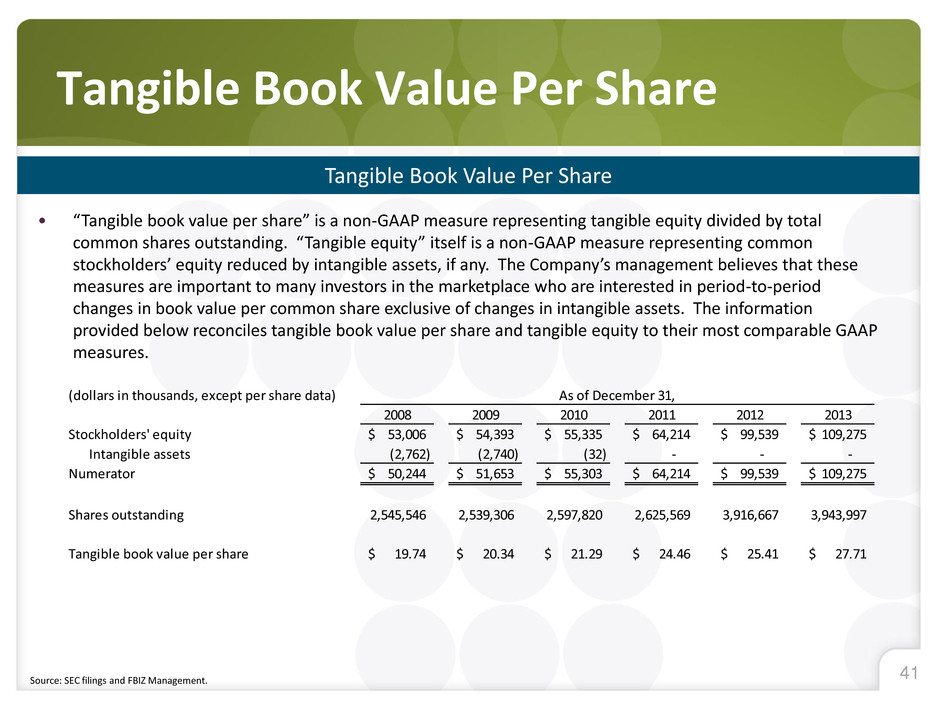

Appendix - Tangible Book Value Per Share

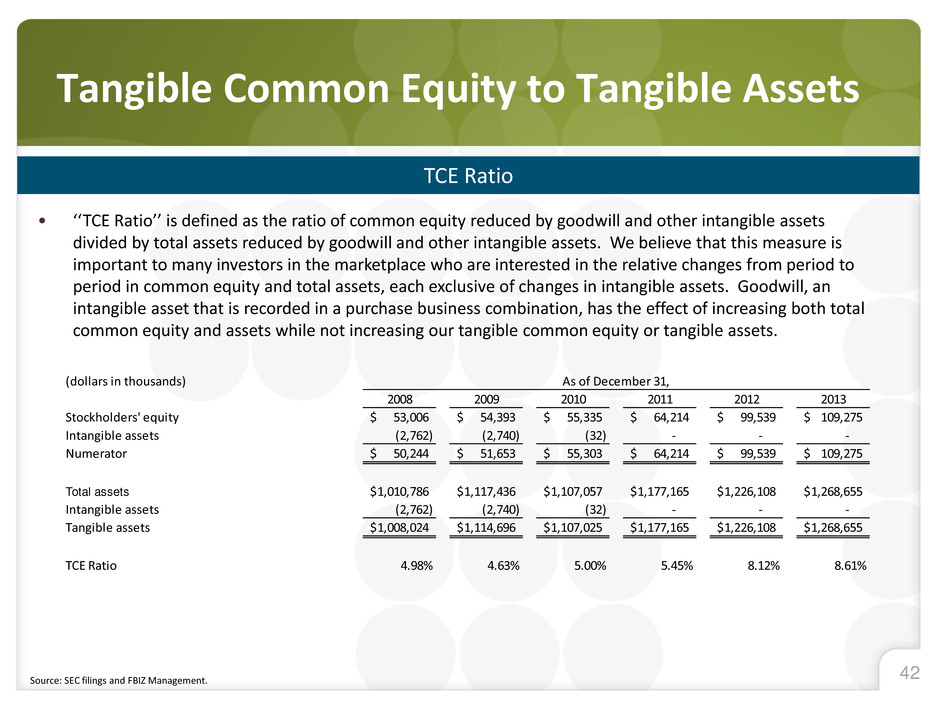

Appendix - Tangible Common Equity to Tangible Assets

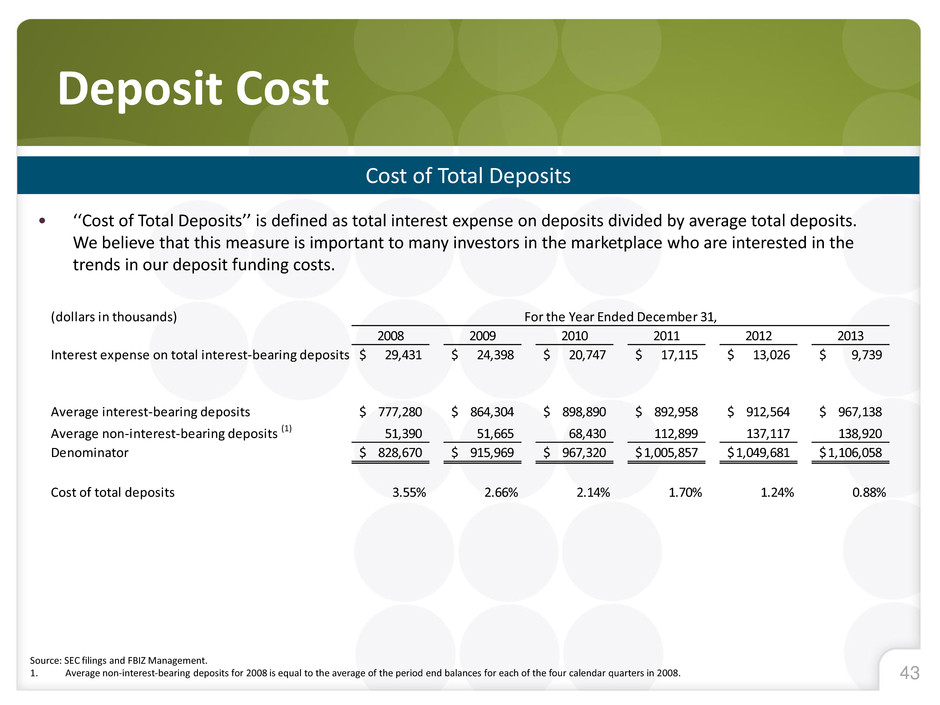

Appendix - Deposit Cost

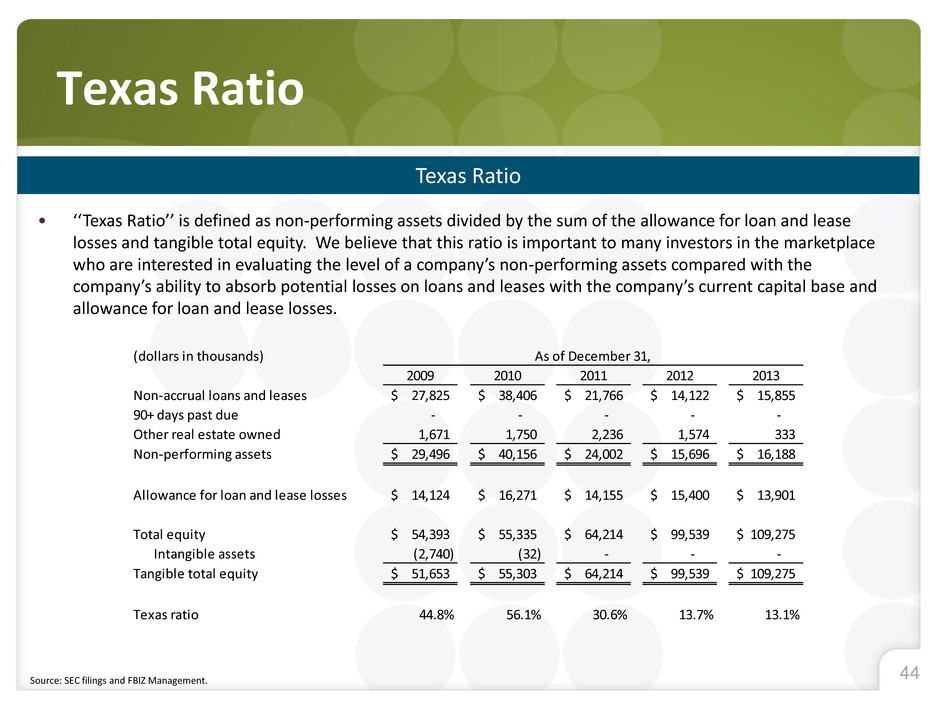

Appendix - Texas Ratio

Appendix - Cumulative Net Charge-off Percentage