Investor Presentation May 2014

1 When used in this presentation, and in any other oral statements made with the approval of an authorized executive officer, the words or phrases “may,” “could,” “should,” “hope,” “might,” “believe,” “expect,” “plan,” “assume,” “intend,” “estimate,” “anticipate,” “project,” “likely,” or similar expressions are intended to identify “forward-looking statements” within the meaning of such term in the Private Securities Litigation Reform Act of 1995. Such statements are subject to risks and uncertainties, including, without limitation, changes in economic conditions in the market area of FBIZ, changes in policies by regulatory agencies, fluctuation in interest rates, demand for loans in the market area of FBIZ, borrowers defaulting in the repayment of loans and competition. These risks could cause actual results to differ materially from what FBIZ has anticipated or projected. These risk factors and uncertainties should be carefully considered by potential investors. See, Item 1A “RISK FACTORS” in our Annual Report on Form 10-K for the year ended December 31, 2013, as well as elsewhere in our other documents filed with the Securities and Exchange Commission, for discussion relating to risk factors impacting FBIZ. Investors should not place undue reliance on any such forward-looking statement, which speaks only as of the date on which it was made. The factors described within the filings could affect our financial performance and could cause actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods. Where any such forward-looking statement includes a statement of the assumptions or bases underlying such forward-looking statement, FBIZ cautions that, while its management believes such assumptions or bases are reasonable and are made in good faith, assumed facts or bases can vary from actual results, and the differences between assumed facts or bases and actual results can be material, depending on the circumstances. Where, in any forward-looking statement, an expectation or belief is expressed as to future results, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the statement of expectation or belief will be achieved or accomplished. FBIZ does not intend to, and specifically disclaims any obligation to, update any forward-looking statements. Forward-Looking Statements

2 Company Profile • Headquarters: Madison, WI • Total assets at March 31, 2014: $1.3 Billion • Experienced leadership • Entrepreneurial management style • Insider ownership of 10%(1) • Business-focused model • Client relationship focus with high touch service • 100% organic growth 1. As of March 19, 2014. Insider ownership consists of shares owned by directors and executive officers. Assumes exercise of all outstanding options exercisable or exercisable within 60 days of March 19, 2014. • Mission: build long-term shareholder value as an entrepreneurial financial services provider to businesses, executives, and high net worth individuals

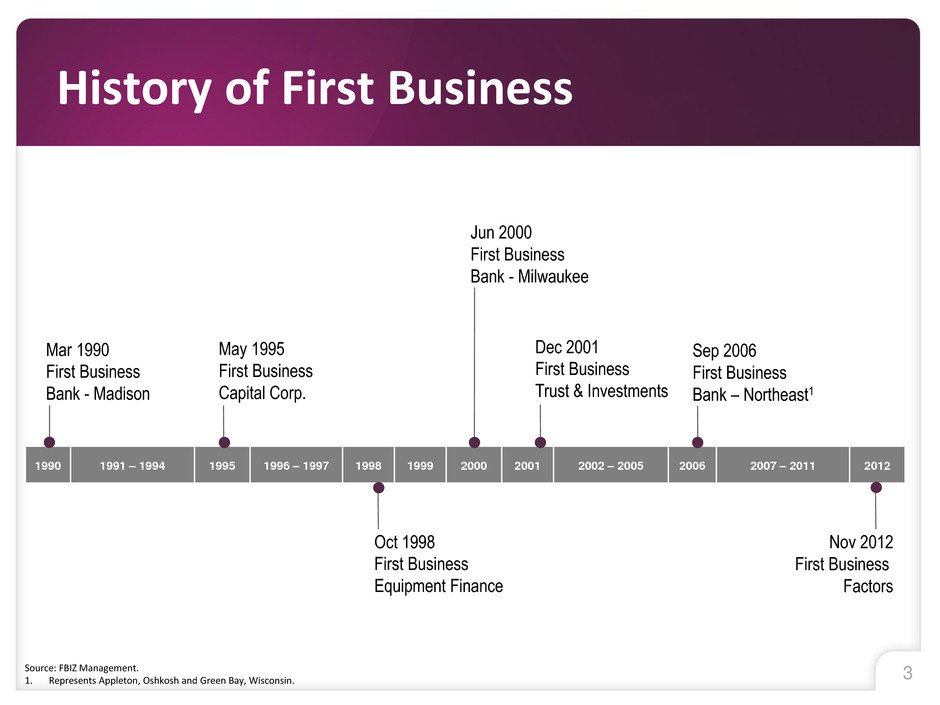

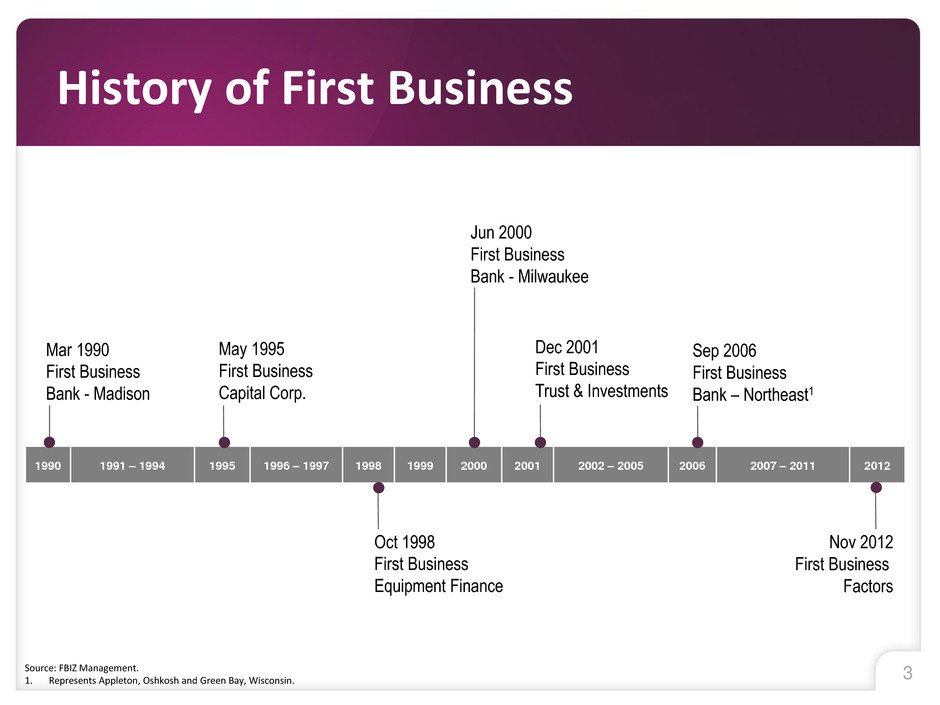

3 1990 1991 – 1994 1995 1996 – 1997 1998 1999 2000 2001 2002 – 2005 2006 2007 – 2011 2012 Jun 2000 First Business Bank - Milwaukee History of First Business Mar 1990 First Business Bank - Madison May 1995 First Business Capital Corp. Oct 1998 First Business Equipment Finance Dec 2001 First Business Trust & Investments Sep 2006 First Business Bank – Northeast1 Source: FBIZ Management. 1. Represents Appleton, Oshkosh and Green Bay, Wisconsin. Nov 2012 First Business Factors

4 Footprint Source: FBIZ Management.

5 Senior Executive Team • President & Chief Executive Officer of First Business Financial Services, Inc. • Over 25 years of commercial banking experience specializing in commercial lending & cash management • 20 years with First Business • Prior to joining First Business, Mr. Chambas held various senior lending positions with M&I Bank, now part of BMO Harris Bank Corey Chambas Jim Ropella Michael Losenegger • Chief Financial Officer • Over 30 years of experience in finance and accounting primarily in the banking industry • 13 years with First Business • Prior to joining First Business, Mr. Ropella was Treasurer of a consumer products company, which followed an 18 year career with Firstar Corporation, now known as US Bancorp • Chief Credit Officer • Over 25 years of commercial banking experience • 11 years with First Business • Prior to joining First Business, Mr. Losenegger held various senior lending positions with M & I Bank, now part of BMO Harris Bank Mark Meloy • President & Chief Executive Officer of First Business Bank • Over 25 years of commercial banking experience • 14 years with First Business • Prior to First Business, Mr. Meloy was a senior relationship manager with Firstar Bank, now part of US Bank Source: SEC filings and FBIZ management. Chuck Batson • President & Chief Executive Officer of First Business Capital Corp. • Over 30 years of asset-based lending experience • 8 years with First Business • Prior to joining First Business, Mr. Batson was a senior member of Wells Fargo Business Credit, Inc. Dave Vetta • President & Chief Executive Officer of First Business Bank – Milwaukee • Over 30 years of banking experience • 7 years with First Business • Prior to joining First Business, Mr. Vetta was a senior member of JP Morgan Asset Management overseeing institutional investment sales and the regional private client group

6 Senior Executive Team Joan Burke • President of First Business Trust & Investments • Over 30 years of experience in providing trust and investment services • 12 years with First Business • Prior to joining First Business, Ms. Burke was the President, Chief Executive Officer and Chairperson of the Board of Johnson Trust Company and certain of its affiliates Source: SEC filings and FBIZ management. • President of First Business Equipment Finance – National Division • Over 25 years of equipment finance and leasing experience • 2 years with First Business • Prior to joining First Business, Mr. Shumate was the President of Midland Capital Partners, LLC, a middle market equipment leasing company, which followed a 19 year career in the equipment finance and lease divisions of ITT Capital and Transamerica Commercial Finance Randy Shumate Mickey Noone • President of First Business Bank – Northeast Region • Over 20 years of commercial banking experience • 7 years with First Business • Prior to joining First Business, Mr. Noone was Senior Vice President with First National Bank – Fox Valley and prior to that position he was a Vice President of M & I First American Bank in Wausau, Wisconsin, now part of BMO Harris Bank Jodi Chandler • Senior Vice President – Human Resources & Administration • Over 25 years of experience in human resources • 21 years with First Business • Prior to joining First Business, Ms. Chandler was Office Manager for an insurance agency • General Counsel and Corporate Secretary • Juris Doctor, University of Wisconsin Law School, magna cum laude, Member of the State Bar of Wisconsin • Over 30 years of commercial banking experience • 6 years with First Business • Prior to joining First Business, Ms. Conley held various senior lending positions with Associated Bank Barbara Conley

7 Corporate Strategy • High efficiency “Business Bank” operating model – Limited branch network – Invest in technology to serve our clients – Products tailored to serve small businesses and their owners • Commitment to expansion – Organic growth from existing business development talent key to sustainable growth – Opportunistically invest in new business development talent – Market to business clients looking for local, value-added, relationship- based bankers – Potential niche business acquisitions Efficiency Ratio vs. WI Peers Source: SEC filings and FDIC.gov. Data is for all WI-based FDIC-insured institutions. 2013 data for WI-based depositories as of 12/31/13. “Efficiency Ratio” is a non-GAAP measure. See Appendix for non-GAAP reconciliation schedules. 65.8% 61.0% 60.3% 57.7% 59.8% 50.0% 55.0% 60.0% 65.0% 70.0% 75.0% 80.0% 2010 2011 2012 2013 YTD 3/31/14 FBIZ WI-Based Depositories

Strategic Objectives

9 • Drive top line revenue growth • Achieve additional improvement in pre-tax adjusted earnings • Continue to leverage operating model to maintain efficiency • Continue to capture transaction deposits to strengthen our mix of in-market funding and reduce our cost of funds • Maintain strong asset quality • Maintain strong ROA • Opportunistically invest in talent for future growth and profitability Strategic Objectives

10 $31.36 $34.48 $38.69 $42.52 $46.58 $50.55 $12.18 $13.12 $0 $10 $20 $30 $40 $50 $60 2008 2009 2010 2011 2012 2013 YTD 3/31/13 YTD 3/31/14 Mil lio n s Top Line Revenue1 Compound Annual Growth Rate From 12/31/08 – 12/31/13 = 10.0% 12.2% 13.7% 10.0% 9.9% Source: SEC Filings and FBIZ Management. 1. Top line revenue calculated as net interest income + total non-interest income (including realized gains on securities). Percentages represent year-over-year change. Consistent annualized organic revenue growth of approximately 10% over the past 5 years 9.5% 8.5% 7.7%

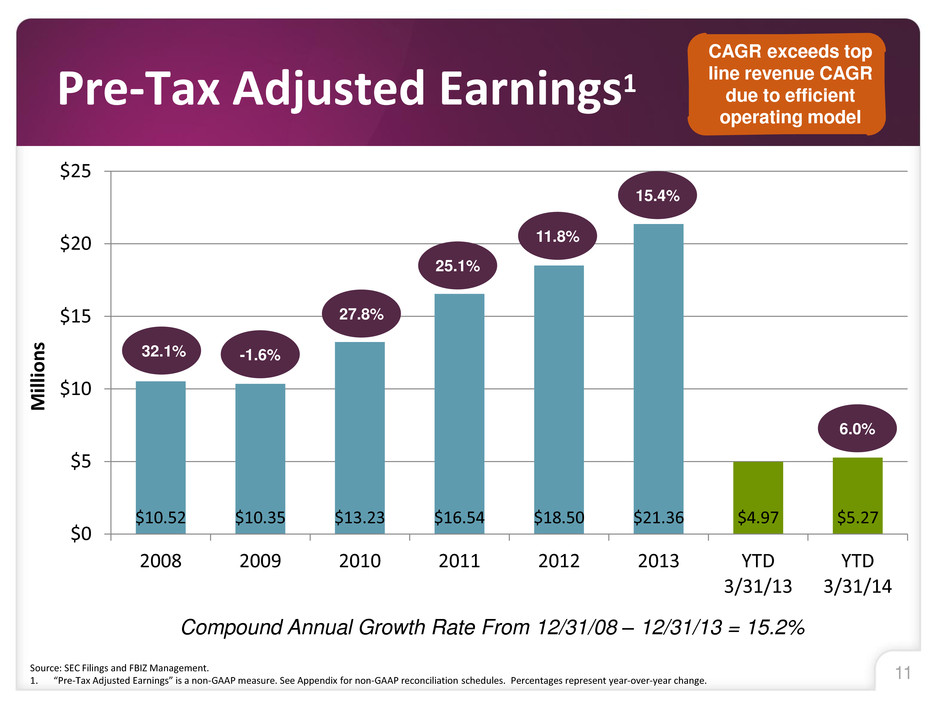

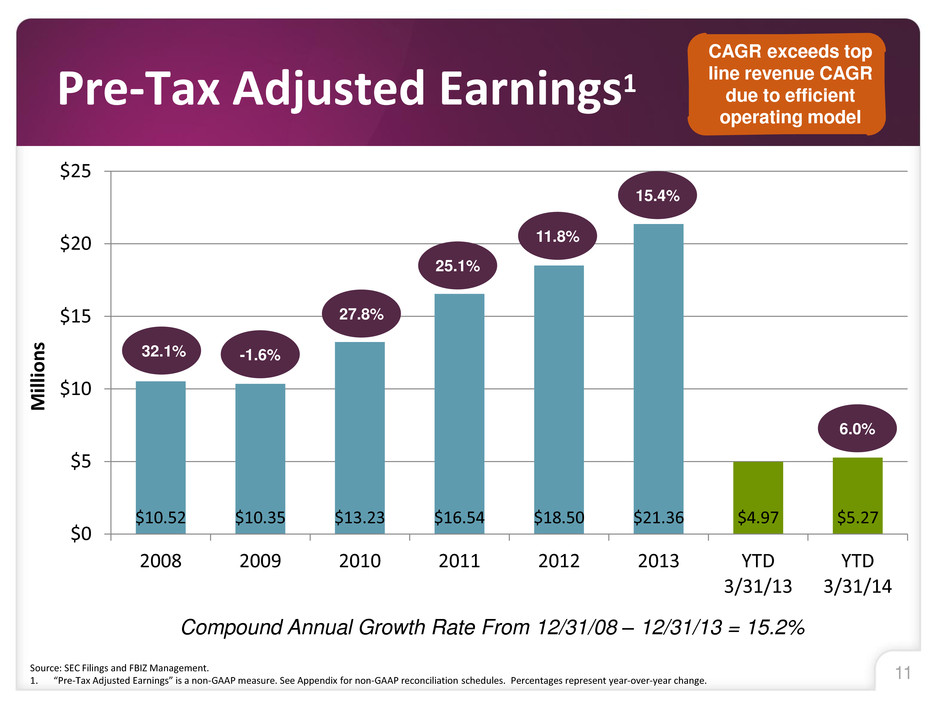

11 $10.52 $10.35 $13.23 $16.54 $18.50 $21.36 $4.97 $5.27 $0 $5 $10 $15 $20 $25 2008 2009 2010 2011 2012 2013 YTD 3/31/13 YTD 3/31/14 Mil lio n s Pre-Tax Adjusted Earnings1 Compound Annual Growth Rate From 12/31/08 – 12/31/13 = 15.2% 27.8% 32.1% -1.6% 25.1% Source: SEC Filings and FBIZ Management. 1. “Pre-Tax Adjusted Earnings” is a non-GAAP measure. See Appendix for non-GAAP reconciliation schedules. Percentages represent year-over-year change. CAGR exceeds top line revenue CAGR due to efficient operating model 11.8% 15.4% 6.0%

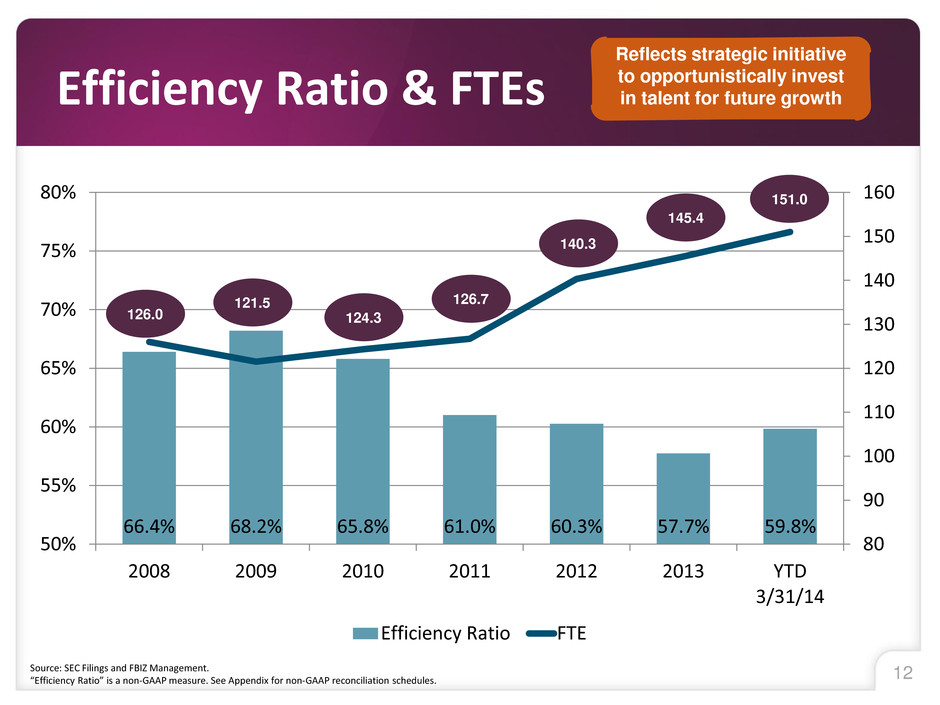

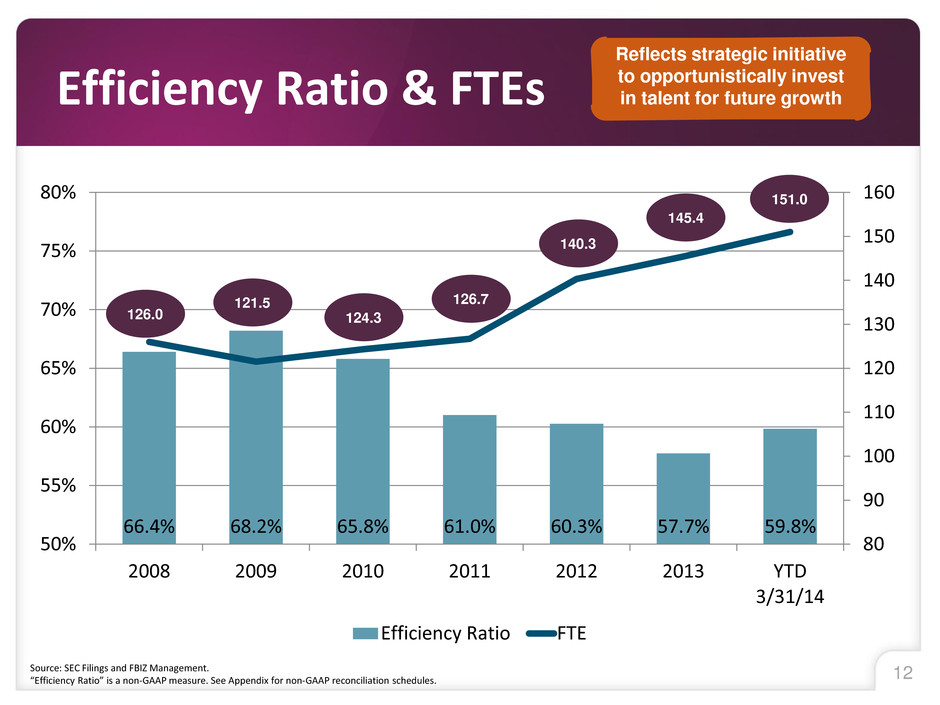

12 66.4% 68.2% 65.8% 61.0% 60.3% 57.7% 59.8% 80 90 100 110 120 130 140 150 160 50% 55% 60% 65% 70% 75% 80% 2008 2009 2010 2011 2012 2013 YTD 3/31/14 Efficiency Ratio FTE Efficiency Ratio & FTEs Source: SEC Filings and FBIZ Management. “Efficiency Ratio” is a non-GAAP measure. See Appendix for non-GAAP reconciliation schedules. 126.0 121.5 126.7 124.3 140.3 145.4 151.0 Reflects strategic initiative to opportunistically invest in talent for future growth

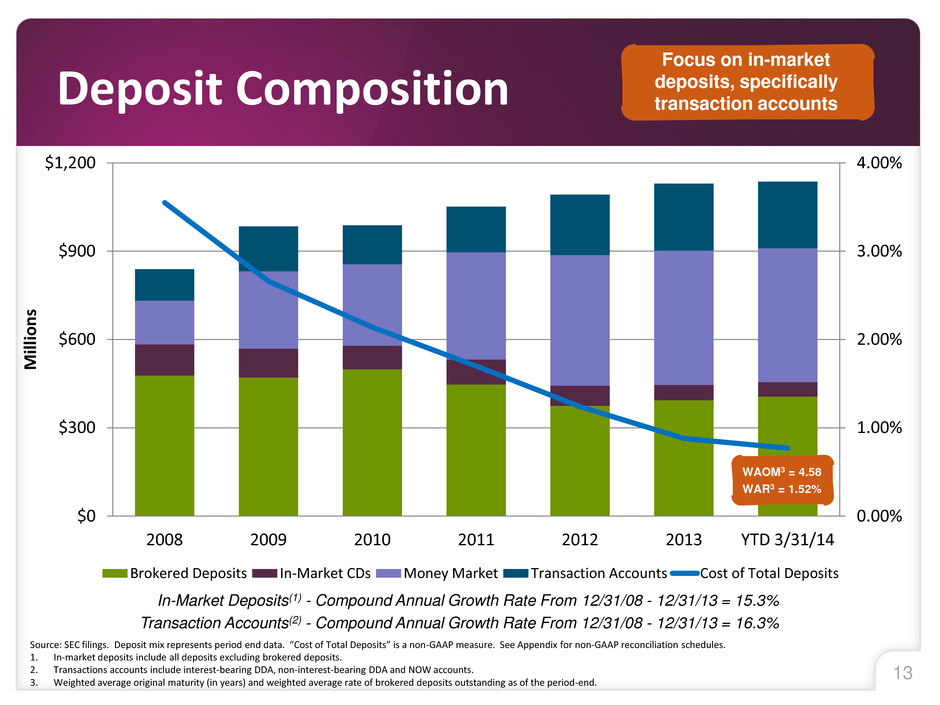

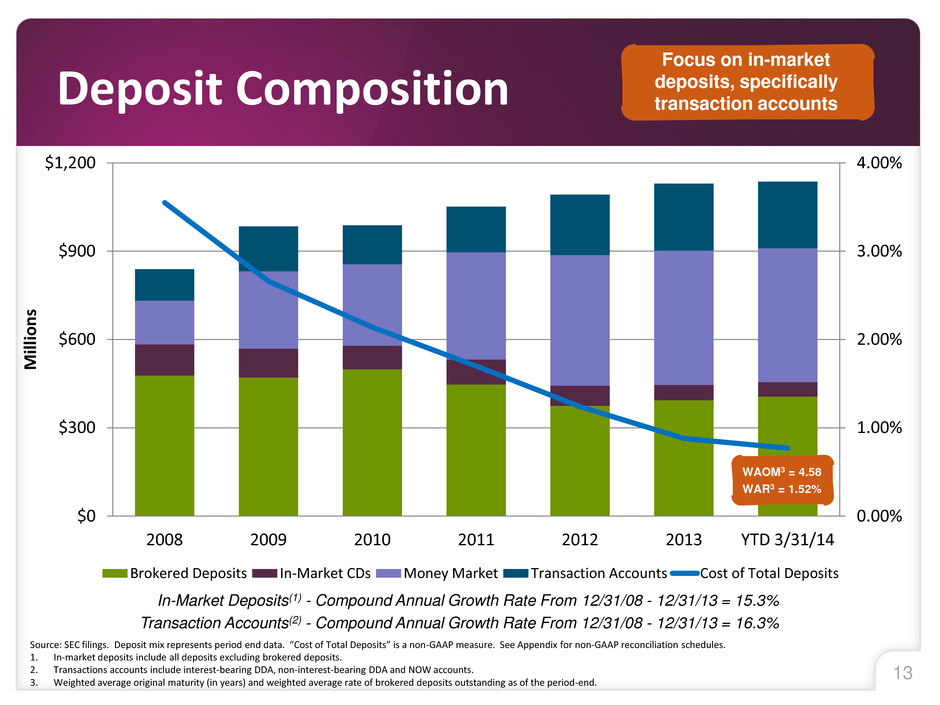

13 0.00% 1.00% 2.00% 3.00% 4.00% $0 $300 $600 $900 $1,200 2008 2009 2010 2011 2012 2013 YTD 3/31/14 Mil lio n s Brokered Deposits In-Market CDs Money Market Transaction Accounts Cost of Total Deposits Deposit Composition Source: SEC filings. Deposit mix represents period end data. “Cost of Total Deposits” is a non-GAAP measure. See Appendix for non-GAAP reconciliation schedules. 1. In-market deposits include all deposits excluding brokered deposits. 2. Transactions accounts include interest-bearing DDA, non-interest-bearing DDA and NOW accounts. 3. Weighted average original maturity (in years) and weighted average rate of brokered deposits outstanding as of the period-end. In-Market Deposits(1) - Compound Annual Growth Rate From 12/31/08 - 12/31/13 = 15.3% Transaction Accounts(2) - Compound Annual Growth Rate From 12/31/08 - 12/31/13 = 16.3% Focus on in-market deposits, specifically transaction accounts WAOM3 = 4.58 WAR3 = 1.52%

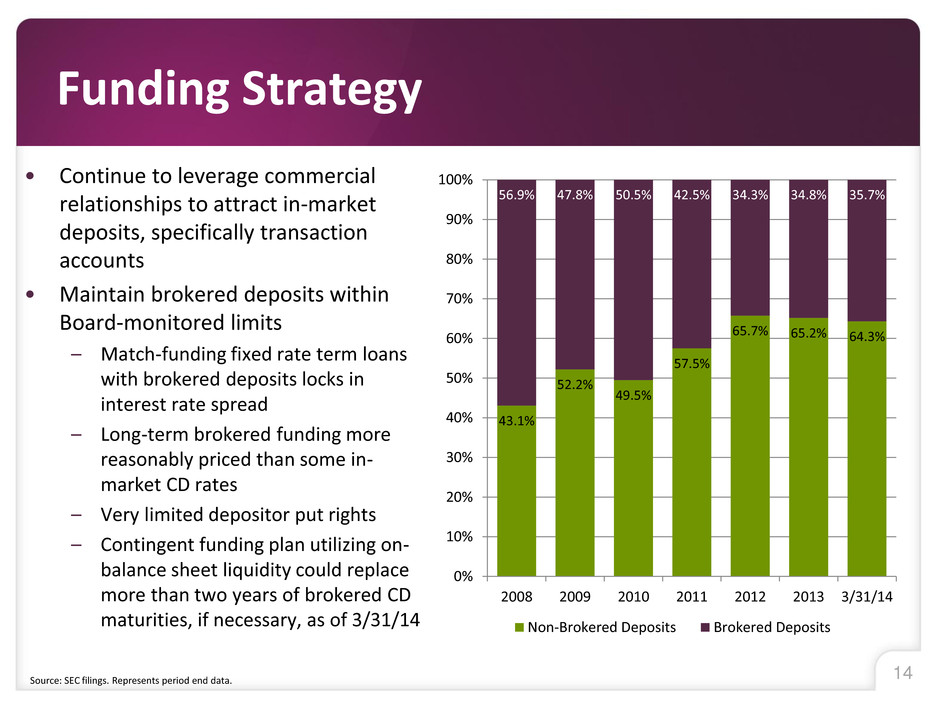

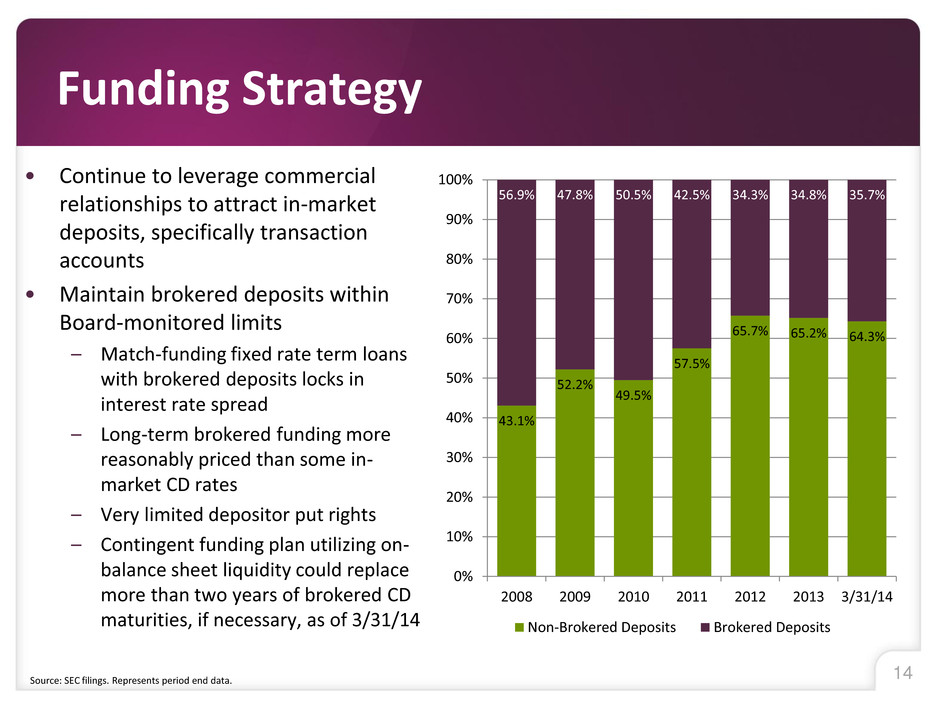

14 • Continue to leverage commercial relationships to attract in-market deposits, specifically transaction accounts • Maintain brokered deposits within Board-monitored limits – Match-funding fixed rate term loans with brokered deposits locks in interest rate spread – Long-term brokered funding more reasonably priced than some in- market CD rates – Very limited depositor put rights – Contingent funding plan utilizing on- balance sheet liquidity could replace more than two years of brokered CD maturities, if necessary, as of 3/31/14 Source: SEC filings. Represents period end data. Funding Strategy 43.1% 52.2% 49.5% 57.5% 65.7% 65.2% 64.3% 56.9% 47.8% 50.5% 42.5% 34.3% 34.8% 35.7% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2008 2009 2010 2011 2012 2013 3/31/14 Non-Brokered Deposits Brokered Deposits

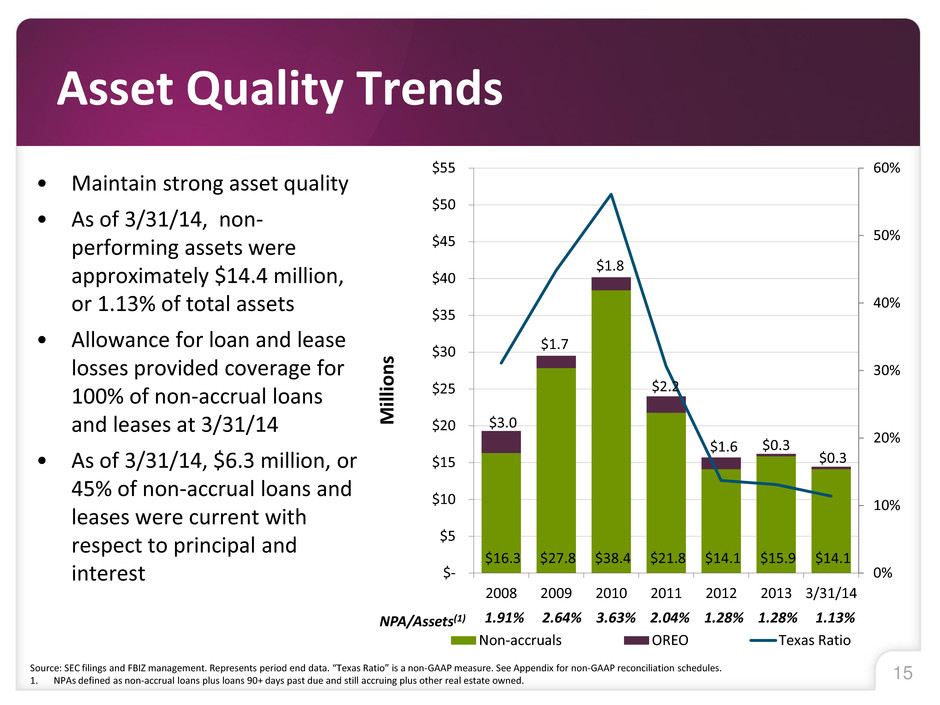

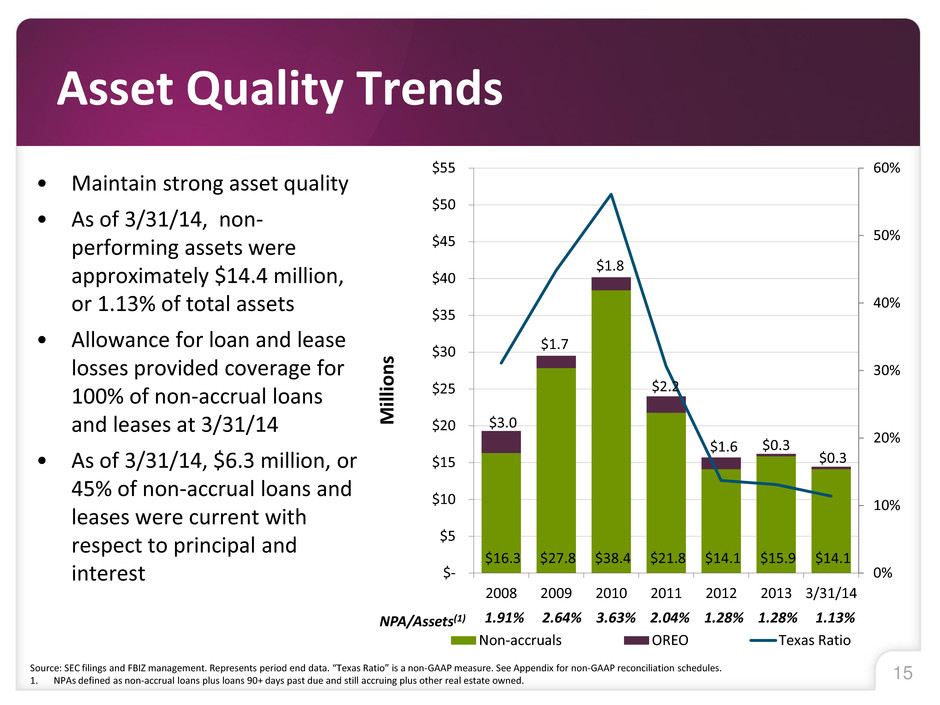

15 $16.3 $27.8 $38.4 $21.8 $14.1 $15.9 $14.1 $3.0 $1.7 $1.8 $2.2 $1.6 $0.3 $0.3 0% 10% 20% 30% 40% 50% 60% $- $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 $55 2008 2009 2010 2011 2012 2013 3/31/14 Mil lio n s Non-accruals OREO Texas Ratio • Maintain strong asset quality • As of 3/31/14, non- performing assets were approximately $14.4 million, or 1.13% of total assets • Allowance for loan and lease losses provided coverage for 100% of non-accrual loans and leases at 3/31/14 • As of 3/31/14, $6.3 million, or 45% of non-accrual loans and leases were current with respect to principal and interest Source: SEC filings and FBIZ management. Represents period end data. “Texas Ratio” is a non-GAAP measure. See Appendix for non-GAAP reconciliation schedules. 1. NPAs defined as non-accrual loans plus loans 90+ days past due and still accruing plus other real estate owned. Asset Quality Trends 1.91% 2.64% 3.63% 2.04% 1.28% 1.28% 1.13% NPA/Assets(1)

16 0.30% 1.06% 1.68% 2.50% 2.88% 2.95% 2.95% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 2008 2009 2010 2011 2012 2013 2014 FBIZ All BHCs WI-Based BHCs Cumulative Net Charge-Offs as a Percentage of 12/31/07 Loans and Leases Source: SNL Financial and SEC Filings. “Cumulative Net Charge-off Percentage” is a non-GAAP measure. See Appendix for non-GAAP reconciliation schedules. All BHCs group comprised of all BHCs, excluding FBIZ, reporting consolidated regulatory financial data as of 12/31/13. All BHC and WI BHC data, excluding FBIZ, includes currently operating institutions and excludes institutions not reporting total loans as of 12/31/07. 2014 period for FBIZ is through 3/31/14. 2013 period for All BHC and WI-Based BHC groups is through 12/31/13. Relative net charge-off comparison substantiates superior credit quality

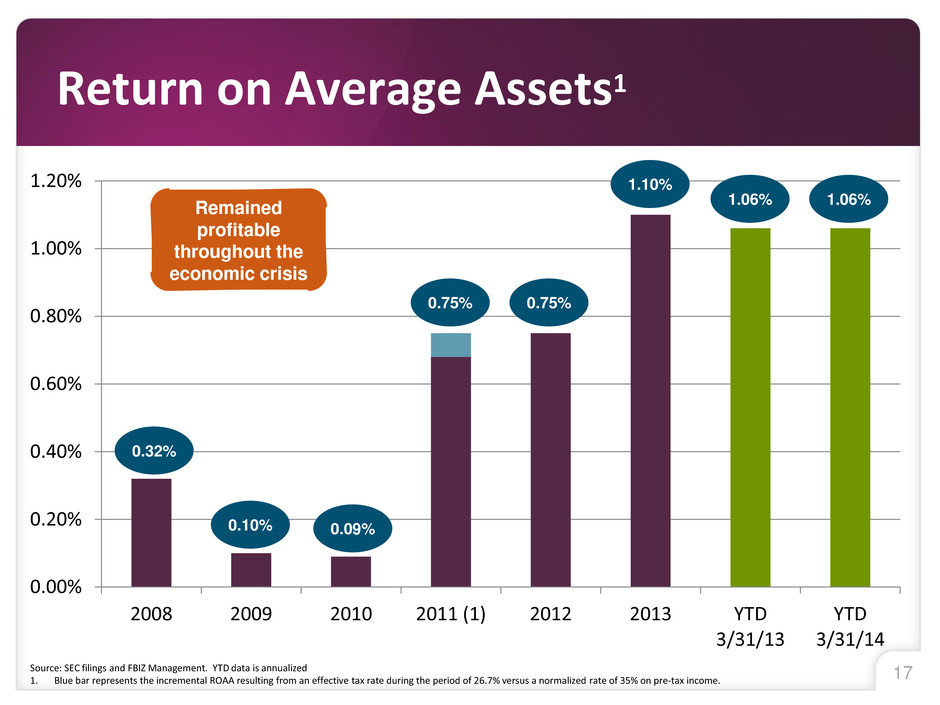

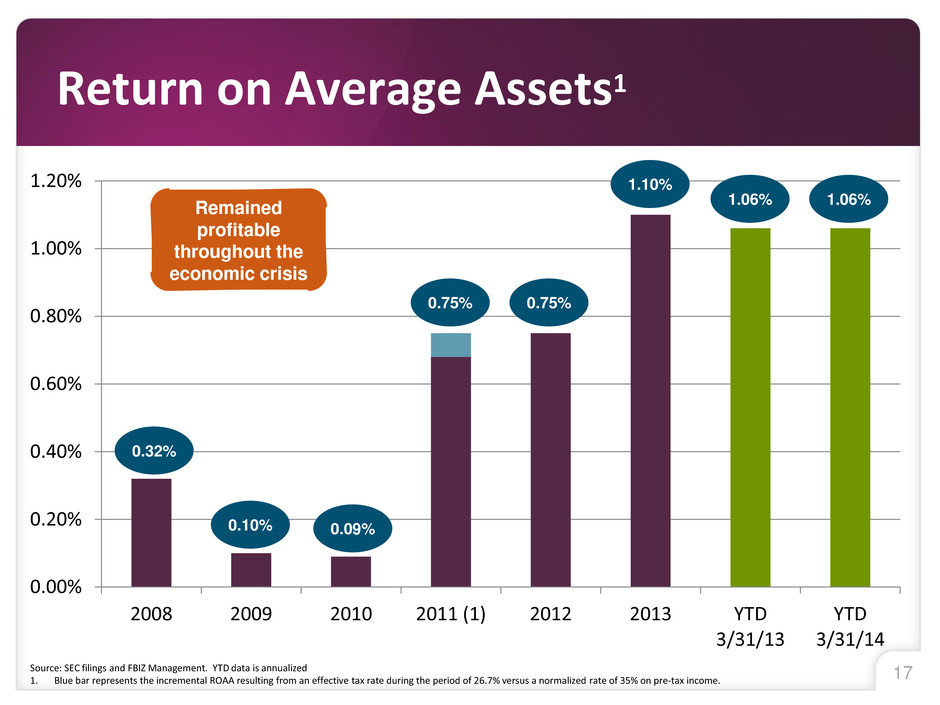

17 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 2008 2009 2010 2011 (1) 2012 2013 YTD 3/31/13 YTD 3/31/14 1.06% Return on Average Assets1 Source: SEC filings and FBIZ Management. YTD data is annualized 1. Blue bar represents the incremental ROAA resulting from an effective tax rate during the period of 26.7% versus a normalized rate of 35% on pre-tax income. 0.09% 0.75% 0.10% 0.32% 0.75% 1.10% Remained profitable throughout the economic crisis 1.06%

18 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 2008 2009 2010 2011 (1) 2012 2013 YTD 3/31/13 YTD 3/31/14 Return on Average Equity1 Source: SEC filings and FBIZ Management. YTD data is annualized. 1. Blue bar represents the incremental ROAE resulting from an effective tax rate during the period of 26.7% versus a normalized rate of 35% on pre-tax income. 1.67% 14.03% 1.90% 6.11% 12.65% 13.12% Maintained 12%+ ROAE even after the December 2012 equity offering 12.80% 12.01%

Financial Performance Highlights

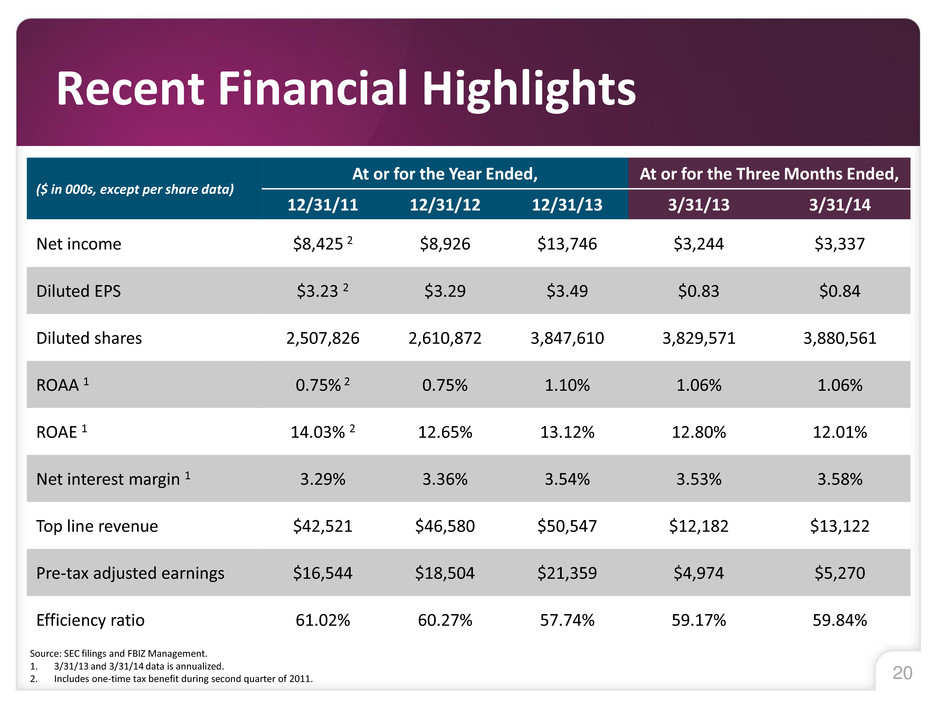

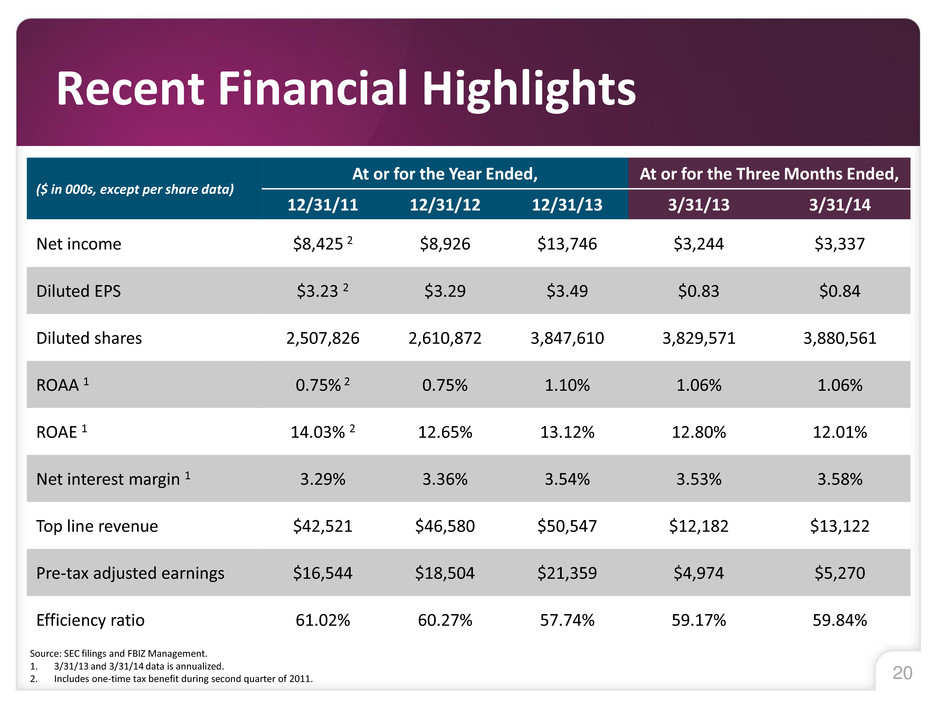

20 Source: SEC filings and FBIZ Management. 1. 3/31/13 and 3/31/14 data is annualized. 2. Includes one-time tax benefit during second quarter of 2011. Recent Financial Highlights ($ in 000s, except per share data) At or for the Year Ended, At or for the Three Months Ended, 12/31/11 12/31/12 12/31/13 3/31/13 3/31/14 Net income $8,425 2 $8,926 $13,746 $3,244 $3,337 Diluted EPS $3.23 2 $3.29 $3.49 $0.83 $0.84 Diluted shares 2,507,826 2,610,872 3,847,610 3,829,571 3,880,561 ROAA 1 0.75% 2 0.75% 1.10% 1.06% 1.06% ROAE 1 14.03% 2 12.65% 13.12% 12.80% 12.01% Net interest margin 1 3.29% 3.36% 3.54% 3.53% 3.58% Top line revenue $42,521 $46,580 $50,547 $12,182 $13,122 Pre-tax adjusted earnings $16,544 $18,504 $21,359 $4,974 $5,270 Efficiency ratio 61.02% 60.27% 57.74% 59.17% 59.84%

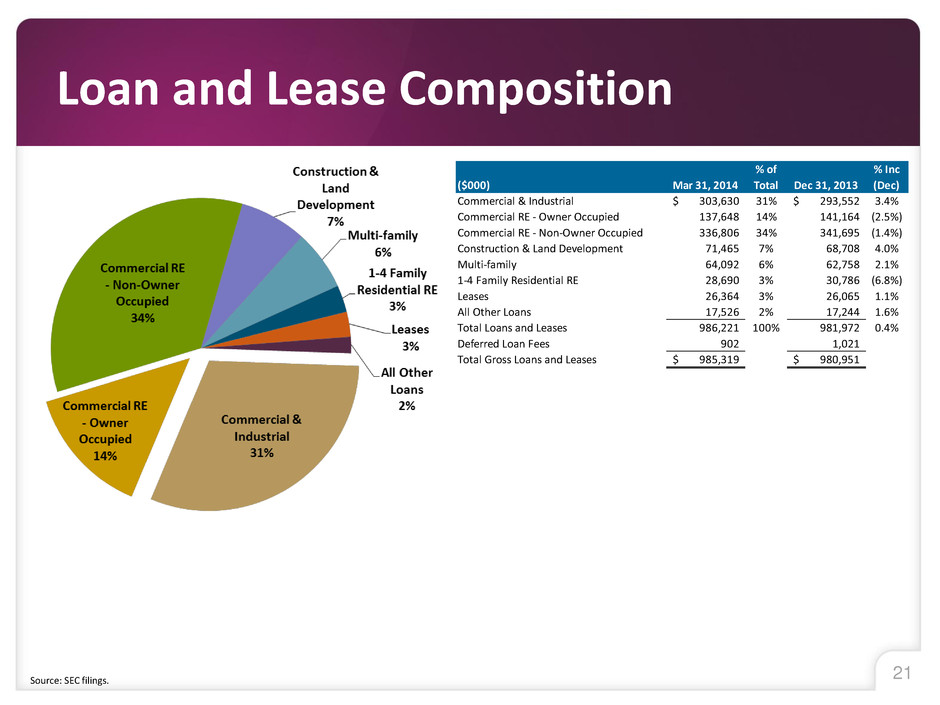

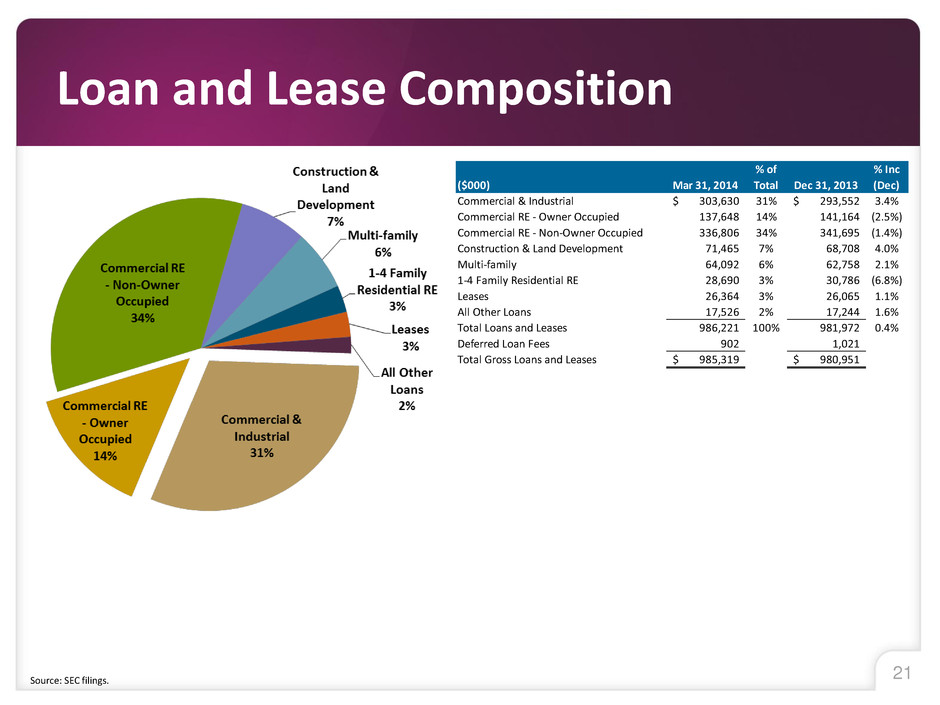

21 Loan and Lease Composition Source: SEC filings. ($000) Mar 31, 2014 % of Total Dec 31, 2013 % Inc (Dec) Commercial & Industrial 303,630$ 31% 293,552$ 3.4% Commercial RE - Owner Occupied 137,648 14% 141,164 (2.5%) Commercial RE - Non-Owner Occupied 336,806 34% 341,695 (1.4%) Construction & Land Development 71,465 7% 68,708 4.0% Multi-family 64,092 6% 62,758 2.1% 1-4 Family Residential RE 28,690 3% 30,786 (6.8%) Leases 26,364 3% 26,065 1.1% All Other Loans 17,526 2% 17,244 1.6% Total Loans and Leases 986,221 100% 981,972 0.4% Deferred Loan Fees 902 1,021 Total Gross Loans and Leases 985,319$ 980,951$

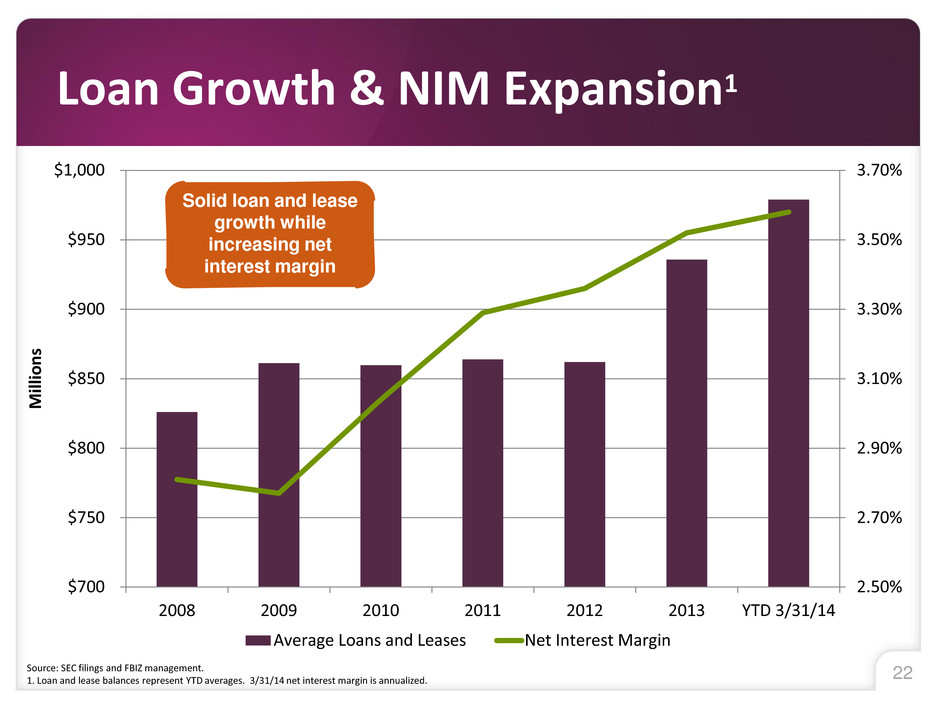

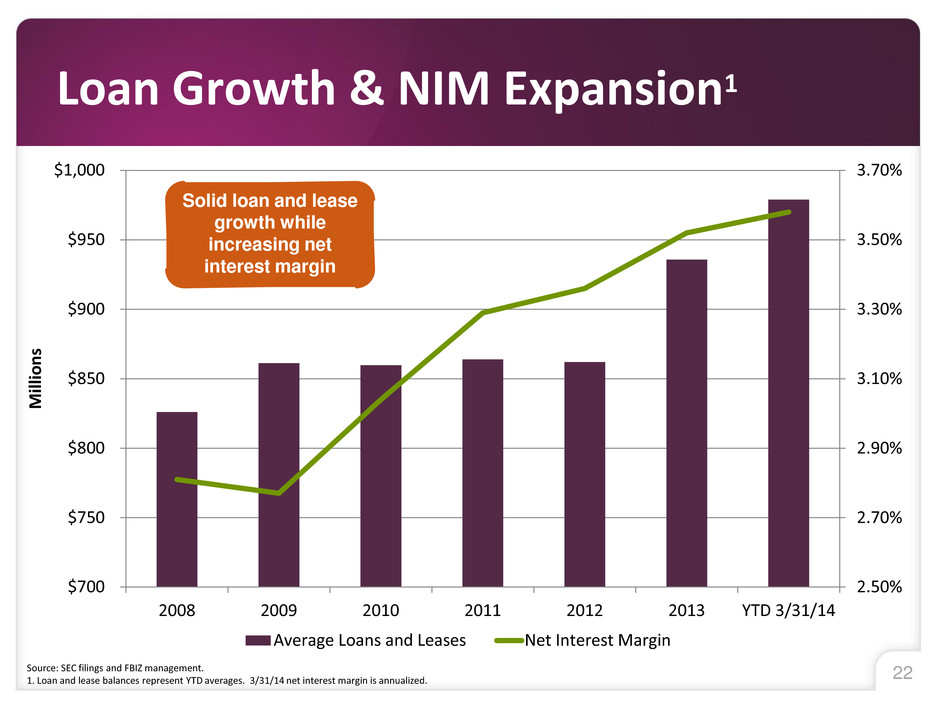

22 2.50% 2.70% 2.90% 3.10% 3.30% 3.50% 3.70% $700 $750 $800 $850 $900 $950 $1,000 2008 2009 2010 2011 2012 2013 YTD 3/31/14 Mil lio n s Average Loans and Leases Net Interest Margin Loan Growth & NIM Expansion1 Source: SEC filings and FBIZ management. 1. Loan and lease balances represent YTD averages. 3/31/14 net interest margin is annualized. Solid loan and lease growth while increasing net interest margin

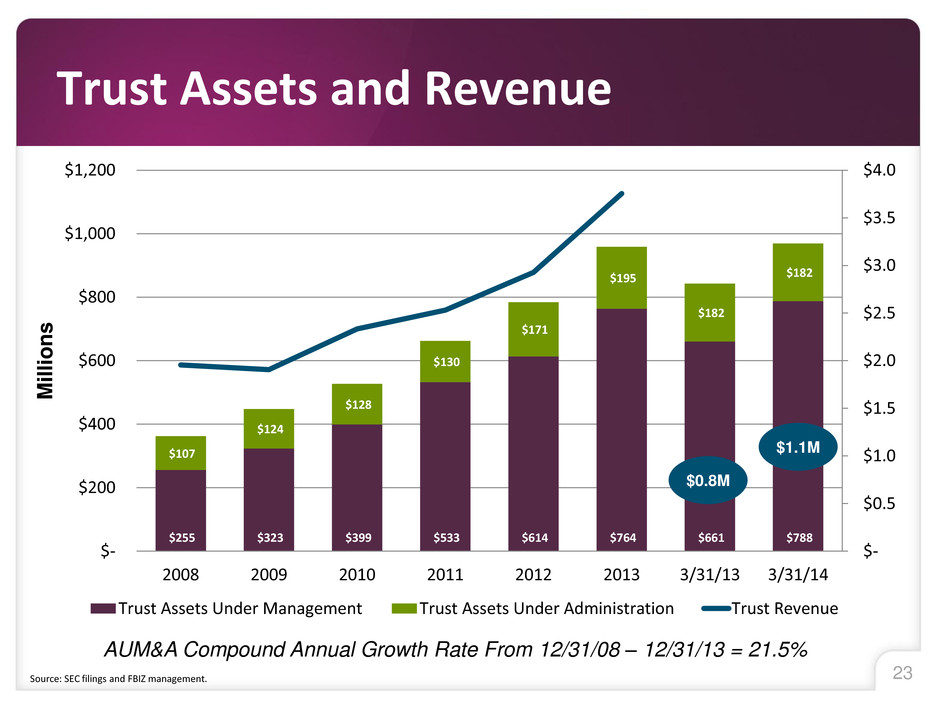

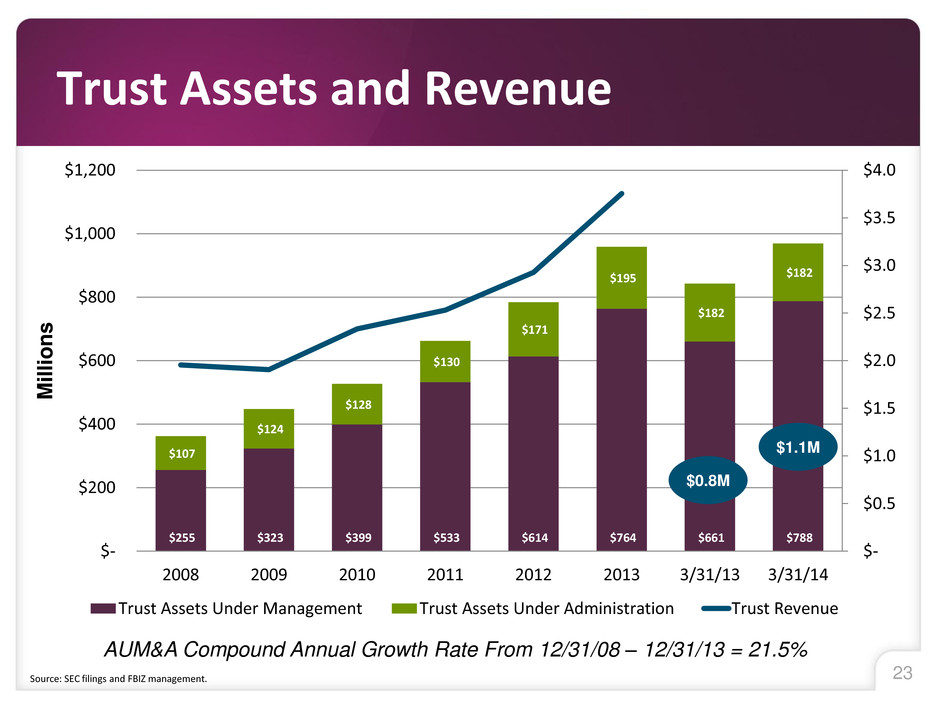

23 Trust Assets and Revenue Source: SEC filings and FBIZ management. AUM&A Compound Annual Growth Rate From 12/31/08 – 12/31/13 = 21.5% $255 $323 $399 $533 $614 $764 $661 $788 $107 $124 $128 $130 $171 $195 $182 $182 $- $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $- $200 $400 $600 $800 $1,000 $1,200 2008 2009 2010 2011 2012 2013 3/31/13 3/31/14 Million s Trust Assets Under Management Trust Assets Under Administration Trust Revenue $0.8M $1.1M

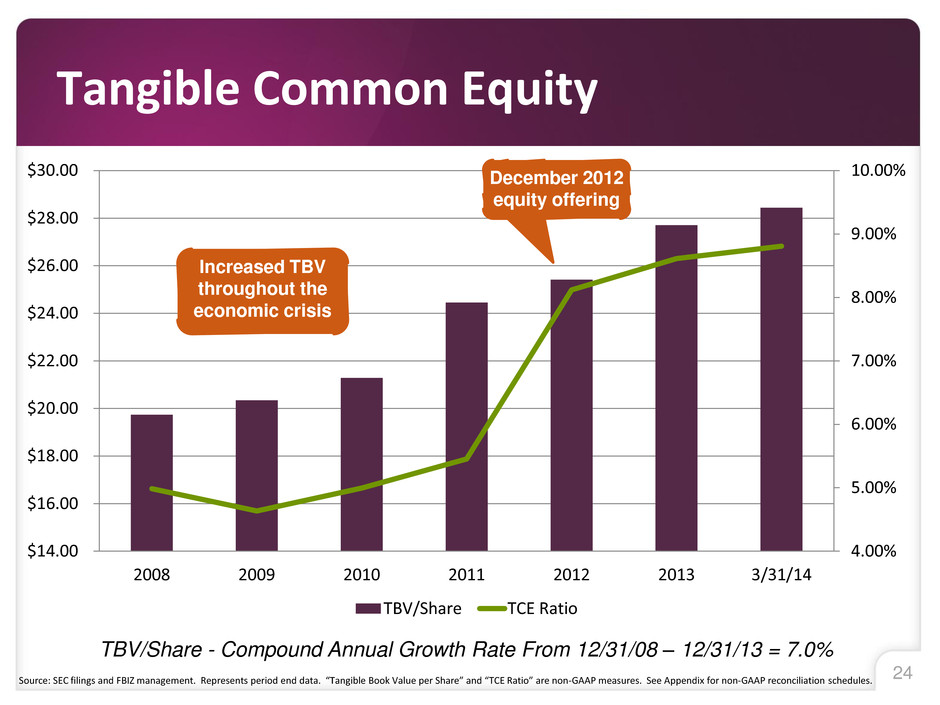

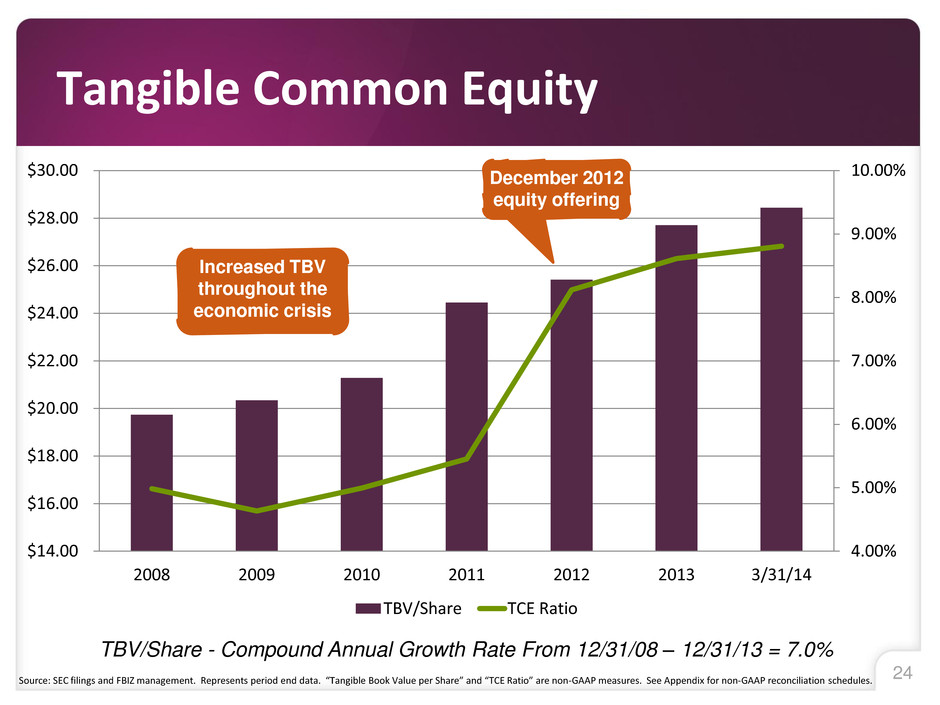

24 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% $14.00 $16.00 $18.00 $20.00 $22.00 $24.00 $26.00 $28.00 $30.00 2008 2009 2010 2011 2012 2013 3/31/14 TBV/Share TCE Ratio Tangible Common Equity Source: SEC filings and FBIZ management. Represents period end data. “Tangible Book Value per Share” and “TCE Ratio” are non-GAAP measures. See Appendix for non-GAAP reconciliation schedules. TBV/Share - Compound Annual Growth Rate From 12/31/08 – 12/31/13 = 7.0% Increased TBV throughout the economic crisis December 2012 equity offering

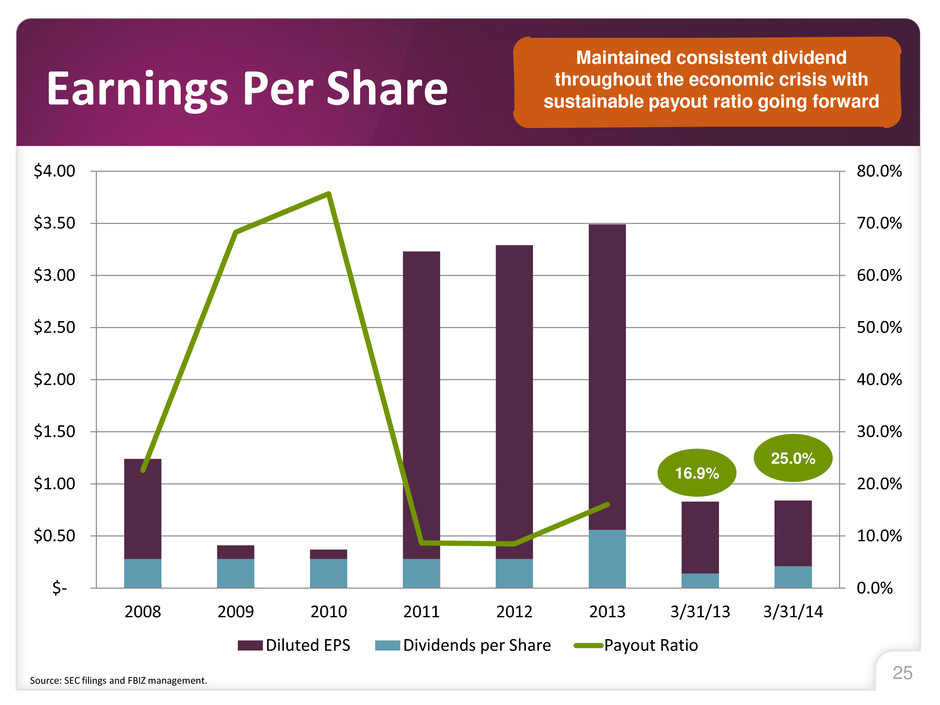

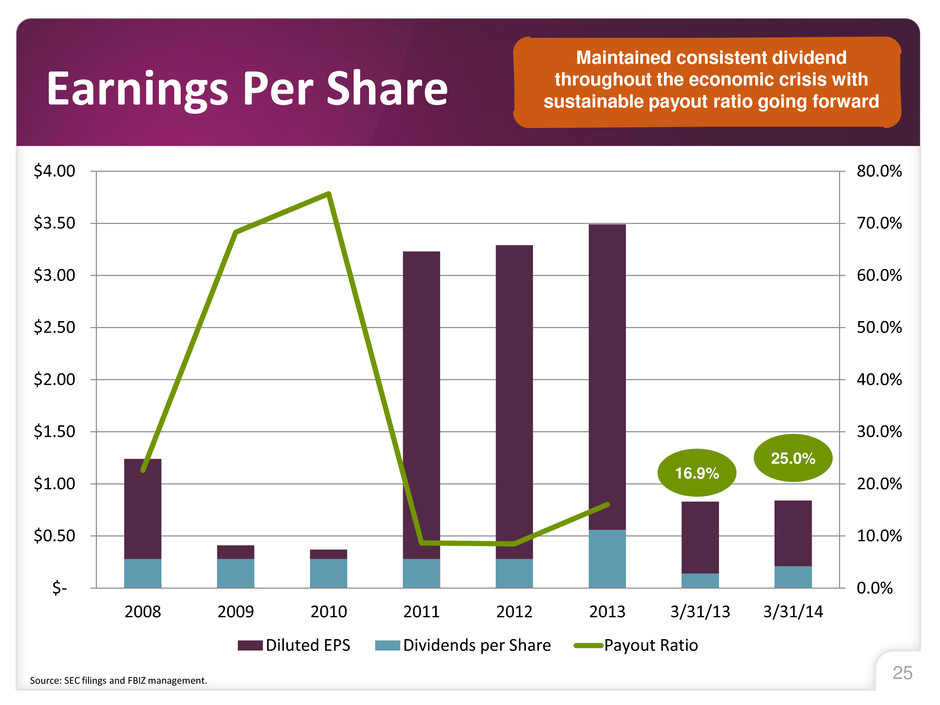

25 Earnings Per Share Source: SEC filings and FBIZ management. Maintained consistent dividend throughout the economic crisis with sustainable payout ratio going forward 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% $- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 2008 2009 2010 2011 2012 2013 3/31/13 3/31/14 Diluted EPS Dividends per Share Payout Ratio 25.0% 16.9%

Investment Considerations

27 Investment Highlights • Market opportunities available for locally based institutions with strong balance sheets • Profitable throughout the economic cycle with strong underlying fundamental trends • Strong asset quality with low historical charge-off levels • Focus on strengthening mix of in-market core funding base • Experienced management team trained at larger institutions • Growth opportunity • Historically proven growth with record performance • Positioned well for continued growth with recent investments in key talent in support of strategic initiatives • Loan and lease growth opportunity • Composition • Geography • Business lines • Significant in-market deposit growth opportunity • Value opportunity

28 Loan and Lease Growth Opportunity Source: SEC filings and FBIZ management. Data as of March 31, 2014. 1. Represents loan and lease balances based on geographic location responsible for origination. 2. Fox Valley represents loans originated in Brown, Outagamie and Winnebago county. Composition Geography1 Business Lines Specialty financing represents 19% of the total loan and lease portfolio 28% of loans and leases originated in Waukesha County and Fox Valley C&I represents 31% of the total loan and lease portfolio

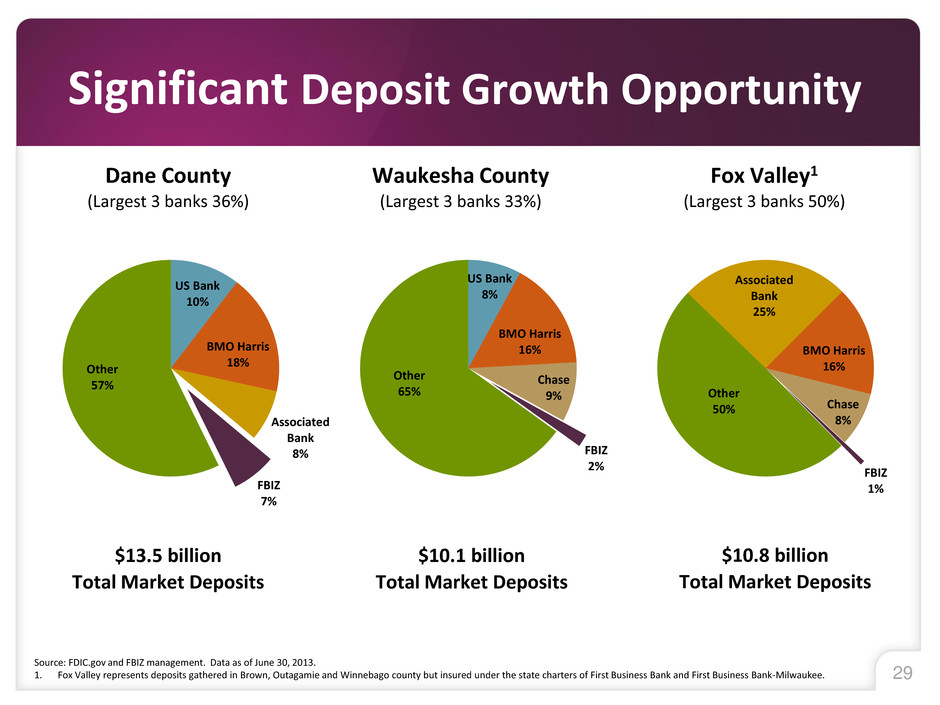

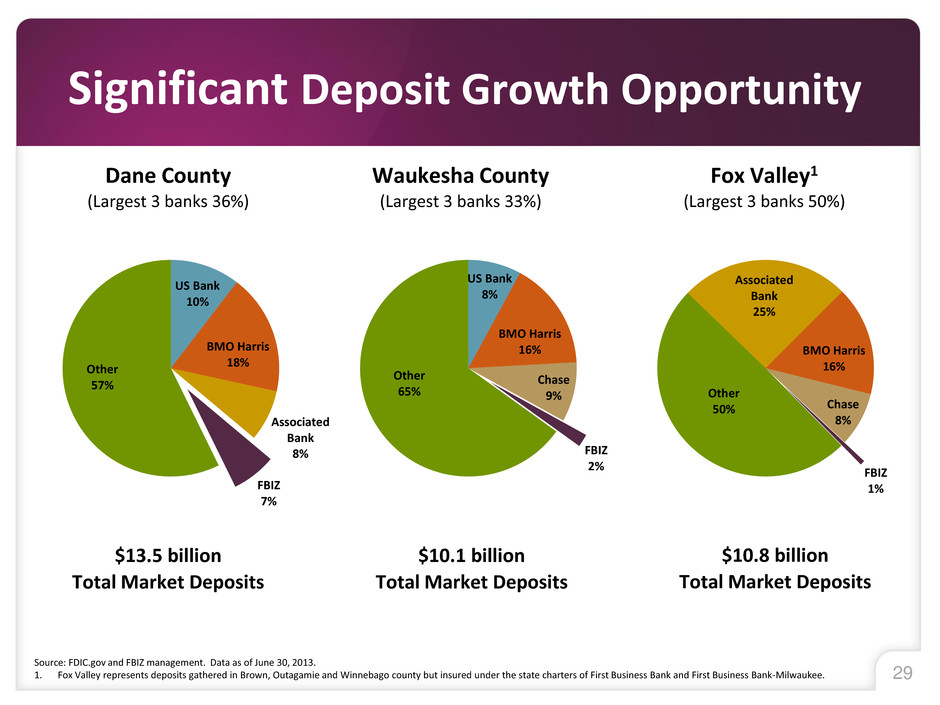

29 Significant Deposit Growth Opportunity Dane County (Largest 3 banks 36%) Waukesha County (Largest 3 banks 33%) Fox Valley1 (Largest 3 banks 50%) $13.5 billion Total Market Deposits $10.1 billion Total Market Deposits $10.8 billion Total Market Deposits Source: FDIC.gov and FBIZ management. Data as of June 30, 2013. 1. Fox Valley represents deposits gathered in Brown, Outagamie and Winnebago county but insured under the state charters of First Business Bank and First Business Bank-Milwaukee. US Bank 10% BMO Harris 18% Associated Bank 8% FBIZ 7% Other 57% US Bank 8% BMO Harris 16% Chase 9% FBIZ 2% Other 65% Associated Bank 25% BMO Harris 16% Chase 8% FBIZ 1% Other 50%

30 FBIZ Valuation Source: SNL Financial 100% 33% 40% -20% 0% 20% 40% 60% 80% 100% 120% Dec-12 Mar-13 Jun-13 Sep-13 Dec-13 Mar-14 % Price Increase Since 2012 Common Stock Offering (December 3, 2012 - March 31, 2014) FBIZ-US SNL Micro Cap U.S. Bank SNL Small Cap U.S. Bank

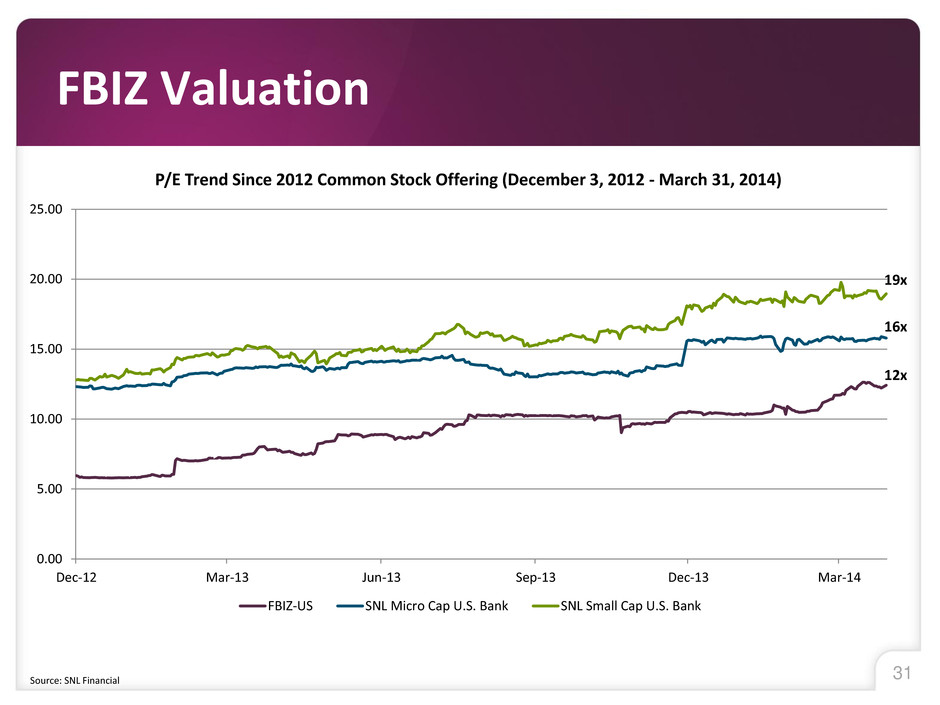

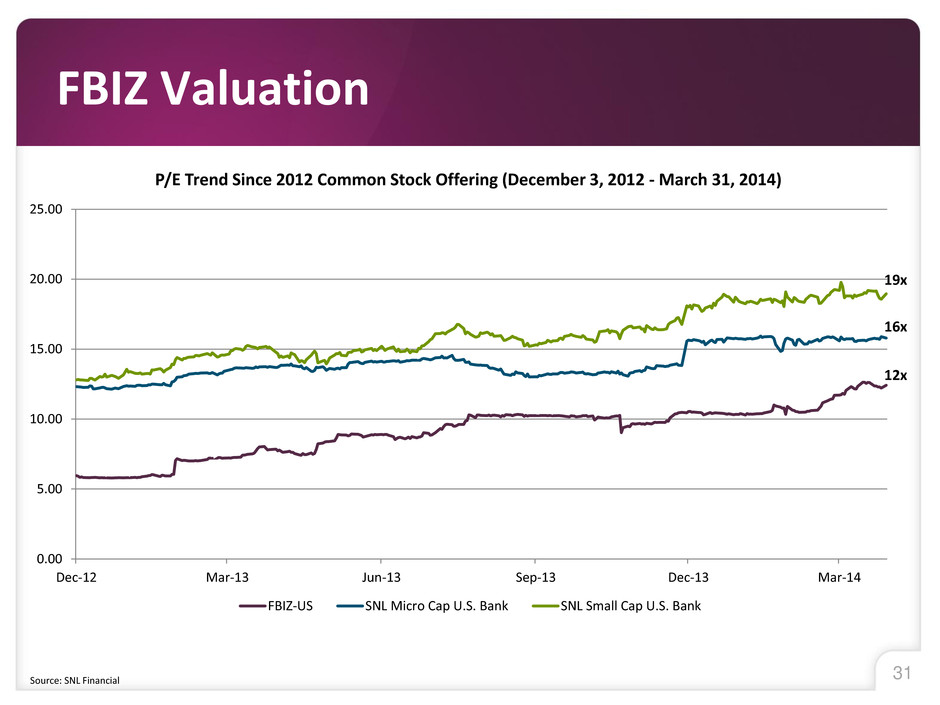

31 FBIZ Valuation Source: SNL Financial 12x 16x 19x 0.00 5.00 10.00 15.00 20.00 25.00 Dec-12 Mar-13 Jun-13 Sep-13 Dec-13 Mar-14 P/E Trend Since 2012 Common Stock Offering (December 3, 2012 - March 31, 2014) FBIZ-US SNL Micro Cap U.S. Bank SNL Small Cap U.S. Bank

Appendix Supplemental Data & Non-GAAP Reconciliations

33 Source: SEC filings and FBIZ Management. 1. “Efficiency Ratio” is a non-GAAP measure. See non-GAAP reconciliation schedules. Financial Highlights (dollars in thousands) As of and for the Year Ended December 31, As of and for the Three Months Ended, 2008 2009 2010 2011 2012 2013 3/31/13 3/31/14 Income Statement Net interest income 26,258$ 28,034$ 31,951$ 35,461$ 37,881$ 42,105$ 10,229$ 10,801$ Provision for loan and lease losses 4,299 8,225 7,044 4,250 4,243 (959) 80 180 Non-interest income 5,105 6,128 6,743 7,060 8,699 8,442 1,953 2,321 Gain on sale of securities - 322 - - - - - - Goodwill impairment - - 2,689 - - - - - Non-interest expense 21,884 24,501 25,671 26,397 28,661 30,371 7,178 7,852 Income before taxes 5,180 1,758 3,290 11,874 13,676 21,135 4,924 5,090 Income tax expense 2,056 717 2,349 3,449 4,750 7,389 1,680 1,753 Net income 3,124$ 1,041$ 941$ 8,425$ 8,926$ 13,746$ 3,244$ 3,337$ Summary Balance Sheet Data Total assets 1,010,786$ 1,117,436$ 1,107,057$ 1,177,165$ 1,226,108$ 1,268,655$ 1,220,287$ 1,273,772$ AFS securities 109,124 122,286 155,379 170,386 200,596 180,118 201,804 185,547 Gross loans and leases 852,392 853,931 877,206 850,842 911,960 980,951 916,656 985,319 Total deposits 838,874$ 984,374$ 988,298$ 1,051,312$ 1,092,254$ 1,129,855$ 1,071,786$ 1,136,700$ Junior subordinated debt 10,315 10,315 10,315 10,315 10,315 10,315 10,315 10,315 Subordinated debt 39,000 39,000 39,000 39,000 11,926 11,926 11,926 7,926 Total stockholders' equity 53,006 54,393 55,335 64,214 99,539 109,275 102,147 112,195 Key Metrics ROAA 0.32% 0.10% 0.09% 0.75% 0.75% 1.10% 1.06% 1.06% ROAE 6.11% 1.90% 1.67% 14.03% 12.65% 13.12% 12.80% 12.01% Efficiency ratio1 66.4% 68.2% 65.8% 61.0% 60.3% 57.7% 59.2% 59.8% Net interest margin 2.81% 2.77% 3.04% 3.29% 3.36% 3.54% 3.53% 3.58%

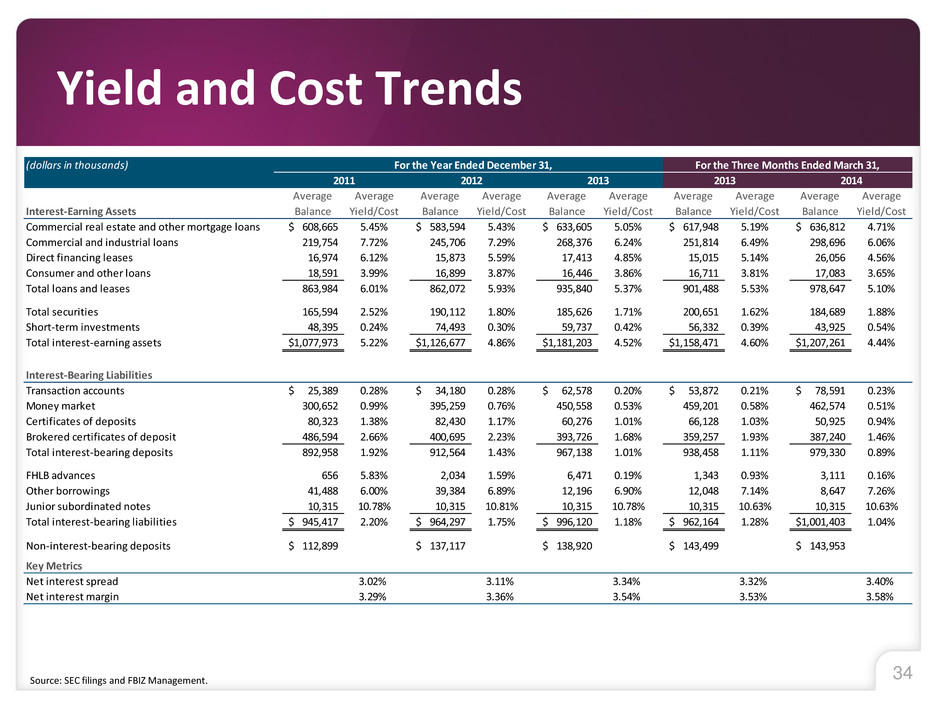

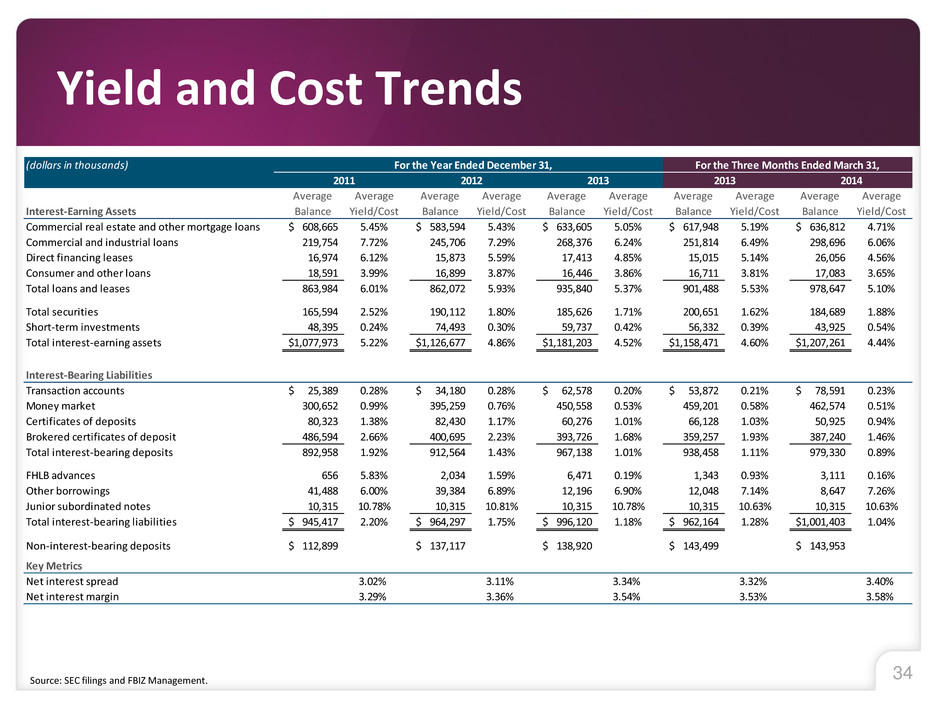

34 Source: SEC filings and FBIZ Management. Yield and Cost Trends (dollars in thousands) For the Year Ended December 31, For the Three Months Ended March 31, 2011 2012 2013 2013 2014 Interest-Earning Assets Average Balance Average Yield/Cost Average Balance Average Yield/Cost Average Balance Average Yield/Cost Average Balance Average Yield/Cost Average Balance Average Yield/Cost Commercial real estate and other mortgage loans 608,665$ 5.45% 583,594$ 5.43% 633,605$ 5.05% 617,948$ 5.19% 636,812$ 4.71% Commercial and industrial loans 219,754 7.72% 245,706 7.29% 268,376 6.24% 251,814 6.49% 298,696 6.06% Direct financing leases 16,974 6.12% 15,873 5.59% 17,413 4.85% 15,015 5.14% 26,056 4.56% Consumer and other loans 18,591 3.99% 16,899 3.87% 16,446 3.86% 16,711 3.81% 17,083 3.65% Total loans and leases 863,984 6.01% 862,072 5.93% 935,840 5.37% 901,488 5.53% 978,647 5.10% Total securities 165,594 2.52% 190,112 1.80% 185,626 1.71% 200,651 1.62% 184,689 1.88% Short-term investments 48,395 0.24% 74,493 0.30% 59,737 0.42% 56,332 0.39% 43,925 0.54% Total interest-earning assets 1,077,973$ 5.22% 1,126,677$ 4.86% 1,181,203$ 4.52% 1,158,471$ 4.60% 1,207,261$ 4.44% Interest-Bearing Liabilities Transaction accounts 25,389$ 0.28% 34,180$ 0.28% 62,578$ 0.20% 53,872$ 0.21% 78,591$ 0.23% Money market 300,652 0.99% 395,259 0.76% 450,558 0.53% 459,201 0.58% 462,574 0.51% Certificates of deposits 80,323 1.38% 82,430 1.17% 60,276 1.01% 66,128 1.03% 50,925 0.94% Brokered certificates of deposit 486,594 2.66% 400,695 2.23% 393,726 1.68% 359,257 1.93% 387,240 1.46% Total interest-bearing deposits 892,958 1.92% 912,564 1.43% 967,138 1.01% 938,458 1.11% 979,330 0.89% FHLB advances 656 5.83% 2,034 1.59% 6,471 0.19% 1,343 0.93% 3,111 0.16% Other borrowings 41,488 6.00% 39,384 6.89% 12,196 6.90% 12,048 7.14% 8,647 7.26% Junior subordinated notes 10,315 10.78% 10,315 10.81% 10,315 10.78% 10,315 10.63% 10,315 10.63% Total interest-bearing liabilities 945,417$ 2.20% 964,297$ 1.75% 996,120$ 1.18% 962,164$ 1.28% 1,001,403$ 1.04% Non-interest-bearing deposits 112,899$ 137,117$ 138,920$ 143,499$ 143,953$ Key Metrics Net interest spread 3.02% 3.11% 3.34% 3.32% 3.40% Net interest margin 3.29% 3.36% 3.54% 3.53% 3.58%

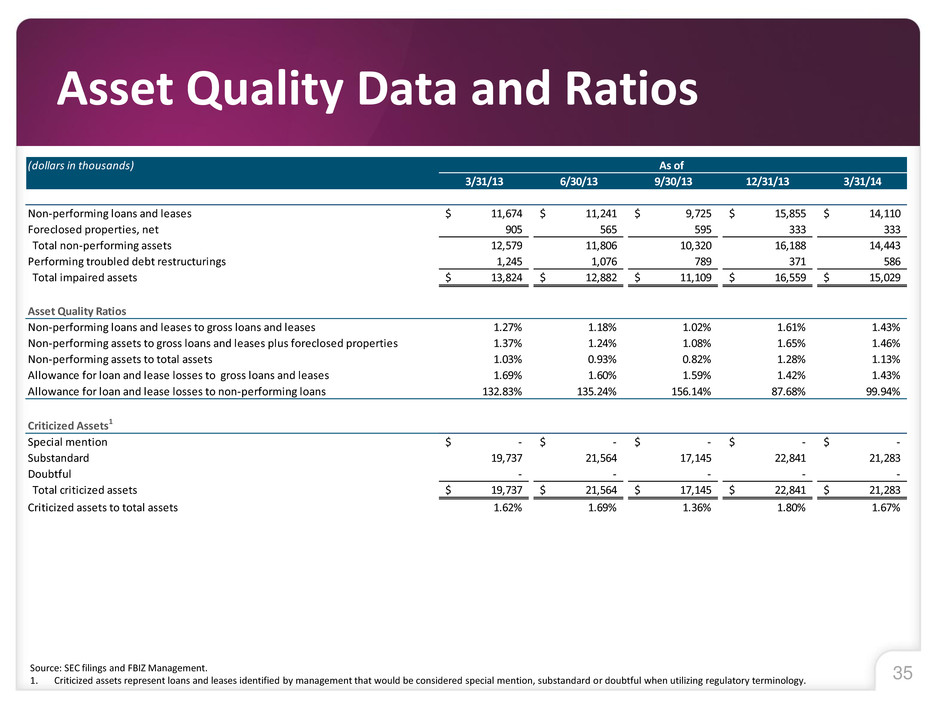

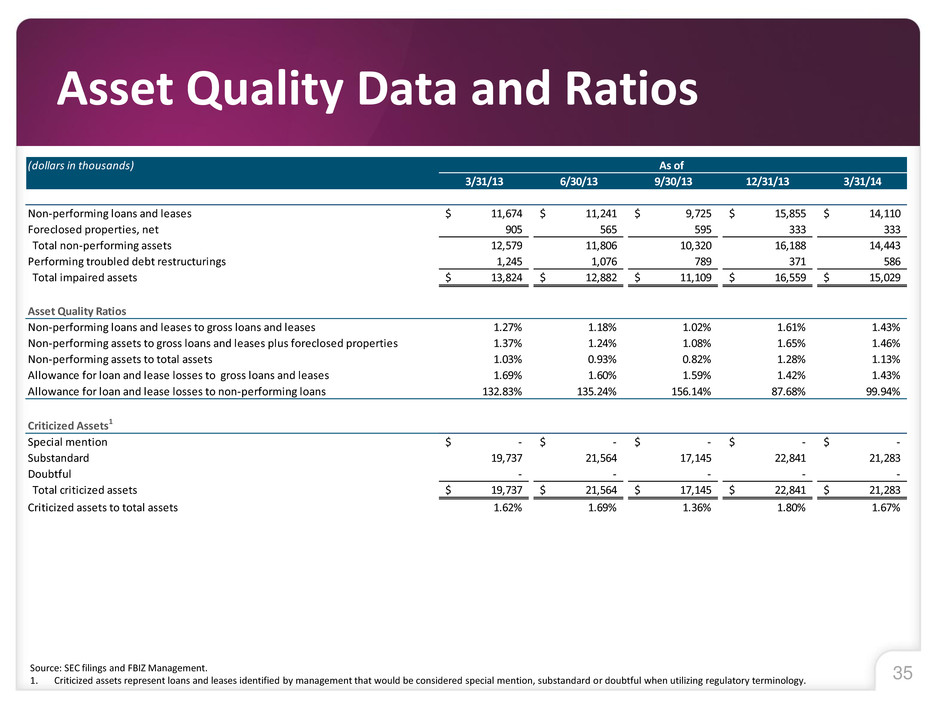

35 Asset Quality Data and Ratios Source: SEC filings and FBIZ Management. 1. Criticized assets represent loans and leases identified by management that would be considered special mention, substandard or doubtful when utilizing regulatory terminology. (dollars in thousands) 3/31/13 6/30/13 9/30/13 12/31/13 3/31/14 Non-performing loans and leases 11,674$ 11,241$ 9,725$ 15,855$ 14,110$ Foreclosed properties, net 905 565 595 333 333 Total non-performing assets 12,579 11,806 10,320 16,188 14,443 Performing troubled debt restructurings 1,245 1,076 789 371 586 Total impaired assets 13,824$ 12,882$ 11,109$ 16,559$ 15,029$ Asset Quality Ratios Non-performing loans and leases to gross loans and leases 1.27% 1.18% 1.02% 1.61% 1.43% Non-performing assets to gross loans and leases plus foreclosed properties 1.37% 1.24% 1.08% 1.65% 1.46% Non-performing assets to total assets 1.03% 0.93% 0.82% 1.28% 1.13% Allowance for loan and lease losses to gross loans and leases 1.69% 1.60% 1.59% 1.42% 1.43% Allowance for loan and lease losses to non-performing loans 132.83% 135.24% 156.14% 87.68% 99.94% Criticized Assets1 Special mention -$ -$ -$ -$ -$ Substandard 19,737 21,564 17,145 22,841 21,283 Doubtful - - - - - Total criticized assets 19,737$ 21,564$ 17,145$ 22,841$ 21,283$ Criticized assets to total assets 1.62% 1.69% 1.36% 1.80% 1.67% As of

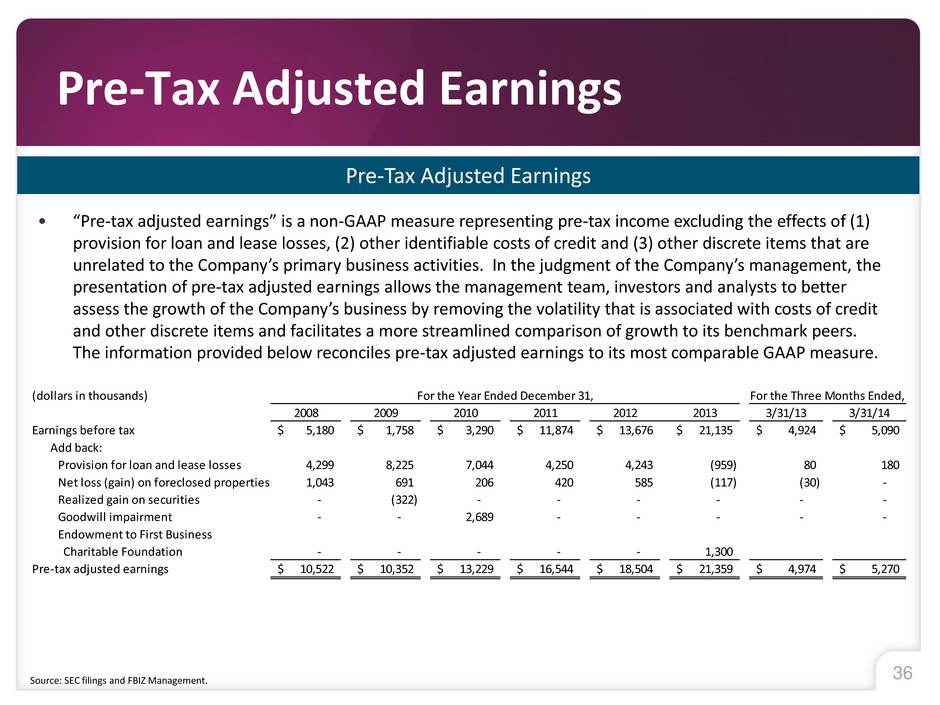

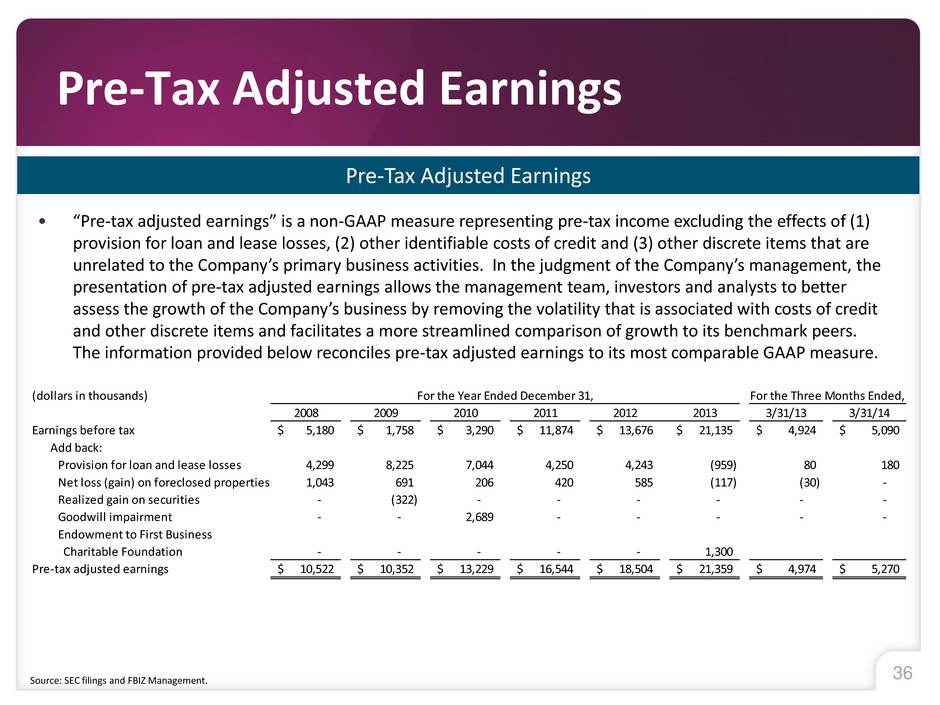

36 Pre-Tax Adjusted Earnings Pre-Tax Adjusted Earnings • “Pre-tax adjusted earnings” is a non-GAAP measure representing pre-tax income excluding the effects of (1) provision for loan and lease losses, (2) other identifiable costs of credit and (3) other discrete items that are unrelated to the Company’s primary business activities. In the judgment of the Company’s management, the presentation of pre-tax adjusted earnings allows the management team, investors and analysts to better assess the growth of the Company’s business by removing the volatility that is associated with costs of credit and other discrete items and facilitates a more streamlined comparison of growth to its benchmark peers. The information provided below reconciles pre-tax adjusted earnings to its most comparable GAAP measure. Source: SEC filings and FBIZ Management. (dollars in thousands) For the Three Months Ended, 2008 2009 2010 2011 2012 2013 3/31/13 3/31/14 E r ings before tax 5,180$ 1,758$ 3,290$ 11,874$ 13,676$ 21,135$ 4,924$ 5,090$ Ad back: Provision for loan and lease losses 4,299 8,225 7,044 4,250 4,243 (959) 80 180 N l ss (gain) on foreclosed properties 1,043 691 206 420 585 (117) (30) - Realized gain on securities - (322) - - - - - - Goodwill impairment - - 2,689 - - - - - Endowment to First Business Charitable Foundation - - - - - 1,300 Pre-tax adjusted earnings 10,522$ 10,352$ 13,229$ 16,544$ 18,504$ 21,359$ 4,974$ 5,270$ For the Year Ended December 31,

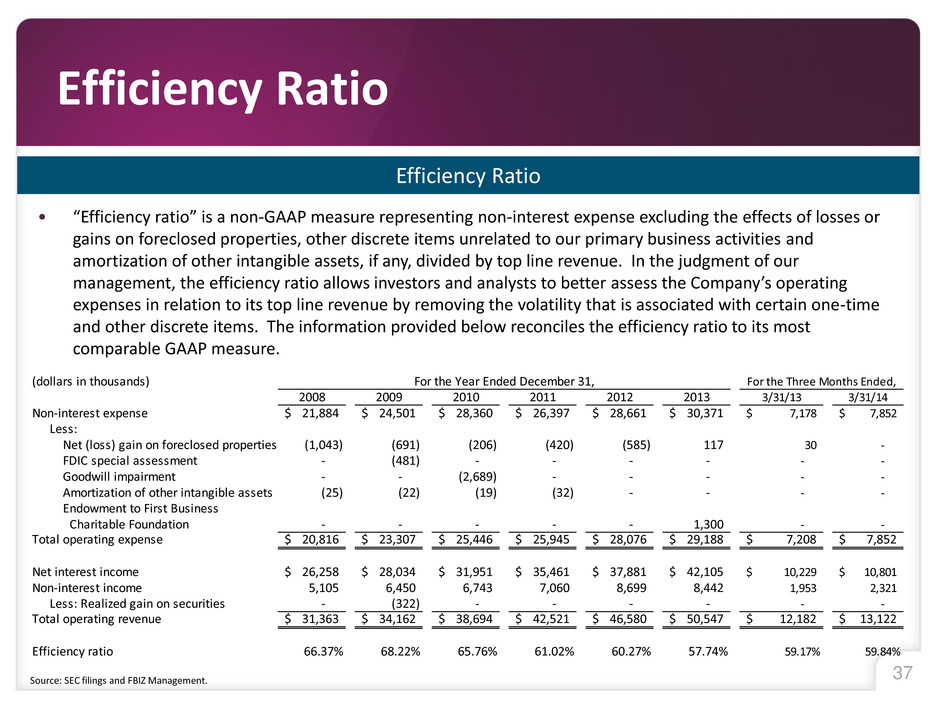

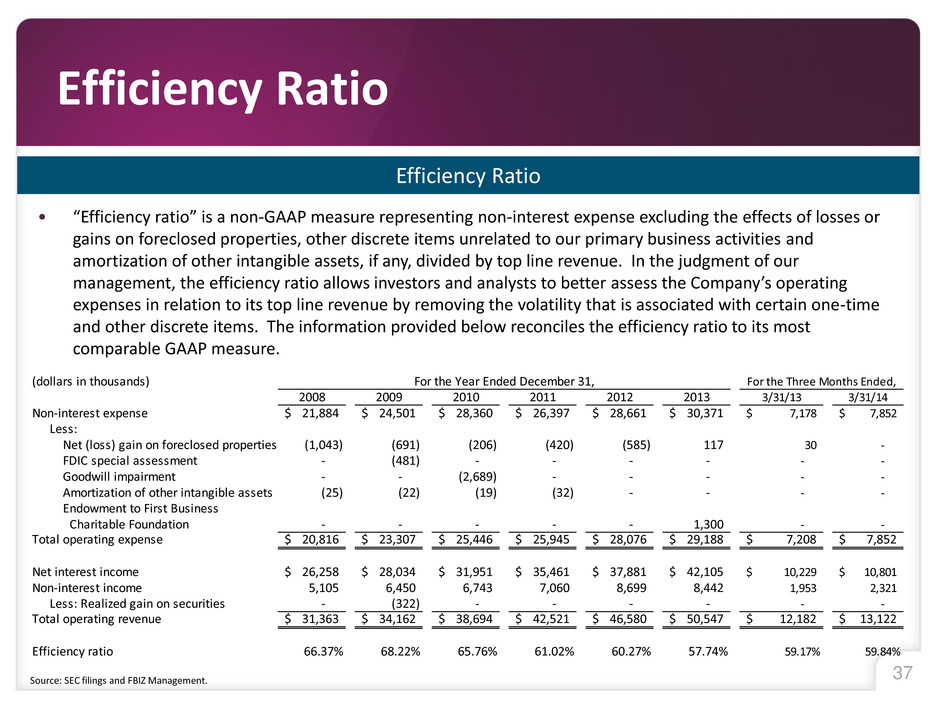

37 Efficiency Ratio Efficiency Ratio • “Efficiency ratio” is a non-GAAP measure representing non-interest expense excluding the effects of losses or gains on foreclosed properties, other discrete items unrelated to our primary business activities and amortization of other intangible assets, if any, divided by top line revenue. In the judgment of our management, the efficiency ratio allows investors and analysts to better assess the Company’s operating expenses in relation to its top line revenue by removing the volatility that is associated with certain one-time and other discrete items. The information provided below reconciles the efficiency ratio to its most comparable GAAP measure. Source: SEC filings and FBIZ Management. (dollars in thousands) For the Three Months Ended, 2008 2009 2010 2011 2012 2013 3/31/13 3/31/14 Non-interest expense 21,884$ 24,501$ 28,360$ 26,397$ 28,661$ 30,371$ 7,178$ 7,852$ Less: Net (loss) gain on foreclosed properties (1,043) (691) (206) (420) (585) 117 30 - FDIC special assessment - (481) - - - - - - Goodwill impairment - - (2,689) - - - - - Amortization of other intangible assets (25) (22) (19) (32) - - - - Endowment to First Business Charitable Foundation - - - - - 1,300 - - T t l op rati g expense 20,816$ 23,307$ 25,446$ 25,945$ 28,076$ 29,188$ 7,208$ 7,852$ Net interest income 26,258$ 28,034$ 31,951$ 35,461$ 37,881$ 42,105$ 10,229$ 10,801$ Non-interest income 5,105 6,450 6,743 7,060 8,699 8,442 1,953 2,321 Less: Realized gain on securities - (322) - - - - - - Total operating revenue 31,363$ 34,162$ 38,694$ 42,521$ 46,580$ 50,547$ 12,182$ 13,122$ Efficiency ratio 66.37% 68.22% 65.76% 61.02% 60.27% 57.74% 59.17% 59.84% For the Year Ended December 31,

38 Tangible Book Value Per Share Tangible Book Value Per Share • “Tangible book value per share” is a non-GAAP measure representing tangible equity divided by total common shares outstanding. “Tangible common equity” itself is a non-GAAP measure representing common stockholders’ equity reduced by intangible assets, if any. The Company’s management believes that this measure is important to many investors in the marketplace who are interested in period-to-period changes in book value per common share exclusive of changes in intangible assets. The information provided below reconciles tangible book value per share and tangible common equity to their most comparable GAAP measures. Source: SEC filings and FBIZ Management. (dollars i thousands, except per share data) 2008 2009 2010 2011 2012 2013 3/31/13 3/31/14 Commo t ckholders' equity 53,006$ 54,393$ 55,335$ 64,214$ 99,539$ 109,275$ 102,147$ 112,195$ Intangible assets (2,762) (2,740) (32) - - - - - Tangible common equity 50,244$ 51,653$ 55,303$ 64,214$ 99,539$ 109,275$ 102,147$ 112,195$ Common shares outstanding 2,545,546 2,539,306 2,597,820 2,625,569 3,916,667 3,943,997 3,918,758 3,944,795 Tangible book value per share 19.74$ 20.34$ 21.29$ 24.46$ 25.41$ 27.71$ 26.07$ 28.44$ As ofAs of December 31,

39 Tangible Common Equity to Tangible Assets TCE Ratio • ‘‘Tangible common equity to tangible assets’’ is defined as the ratio of common stockholders’ equity reduced by intangible assets, if any, divided by total assets reduced by intangible assets, if any. The Company’s management believes that this measure is important to many investors in the marketplace who are interested in the relative changes from period-to-period in common equity and total assets, each exclusive of changes in intangible assets. The information below reconciles tangible common equity and tangible assets to their most comparable GAAP measures. Source: SEC filings and FBIZ Management. (dollars in thousands) 2008 2009 2010 2011 2012 2013 3/31/13 3/31/14 Common stockholders' equity 53,006$ 54,393$ 55,335$ 64,214$ 99,539$ 109,275$ 102,147$ 112,195$ In a gibl assets (2,762) (2,740) (32) - - - - - Ta g bl common equity 50,244$ 51,653$ 55,303$ 64,214$ 99,539$ 109,275$ 102,147$ 112,195$ Total assets 1,010,786$ 1,117,436$ 1,107,057$ 1,177,165$ 1,226,108$ 1,268,655$ 1,220,287$ 1,273,772$ Intangible assets (2,762) (2,740) (32) - - - - - Tangible assets 1,008,024$ 1,114,696$ 1,107,025$ 1,177,165$ 1,226,108$ 1,268,655$ 1,220,287$ 1,273,772$ TCE Ratio 4.98% 4.63% 5.00% 5.45% 8.12% 8.61% 8.37% 8.81% As ofAs of December 31,

40 Deposit Cost Source: SEC filings and FBIZ Management. 1. Average non-interest-bearing deposits for 2008 is equal to the average of the period end balances for each of the four calendar quarters in 2008. Cost of Total Deposits • ‘‘Cost of Total Deposits’’ is defined as total interest expense on deposits divided by average total deposits. We believe that this measure is important to many investors in the marketplace who are interested in the trends in our deposit funding costs. (dollars in thousands) For the Three Months Ended, 2008 2009 2010 2011 2012 2013 3/31/13 3/31/14 Interest expense on total interest-bearing deposits 29,431$ 24,398$ 20,747$ 17,115$ 13,026$ 9,739$ 2,598$ 2,169$ Average interest-bearing deposits 777,280$ 864,304$ 898,890$ 892,958$ 912,564$ 967,138$ 938,458$ 979,330$ Average non-interest-bearing deposits (1) 51,390 51,665 68,430 112,899 137,117 138,920 143,499 143,953 Denominator 828,670$ 915,969$ 967,320$ 1,005,857$ 1,049,681$ 1,106,058$ 1,081,957$ 1,123,283$ Cost of total deposits 3.55% 2.66% 2.14% 1.70% 1.24% 0.88% 0.96% 0.77% For the Year Ended December 31,

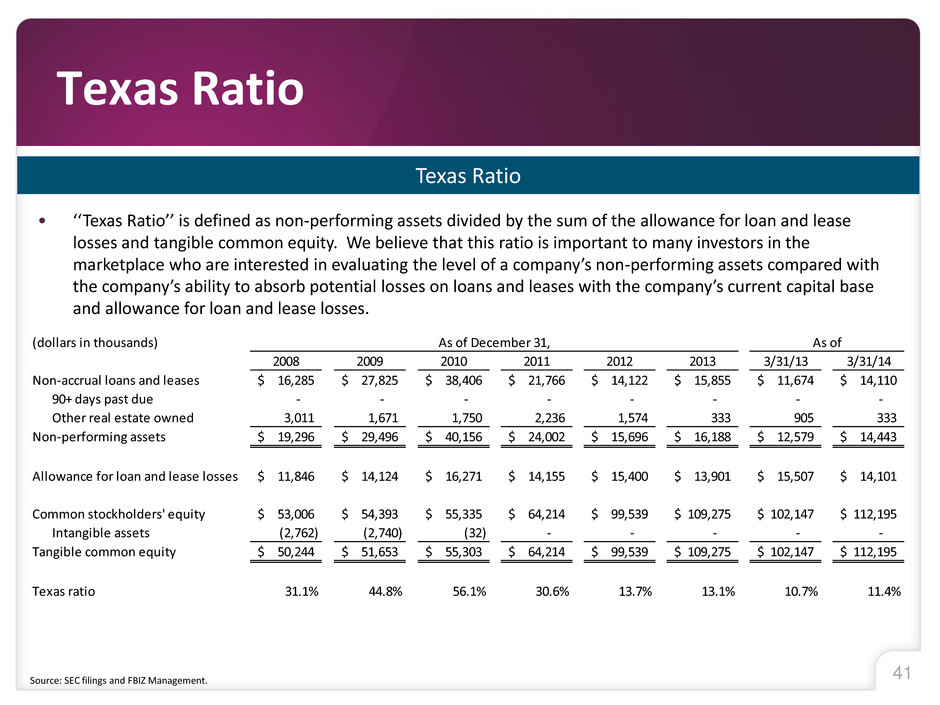

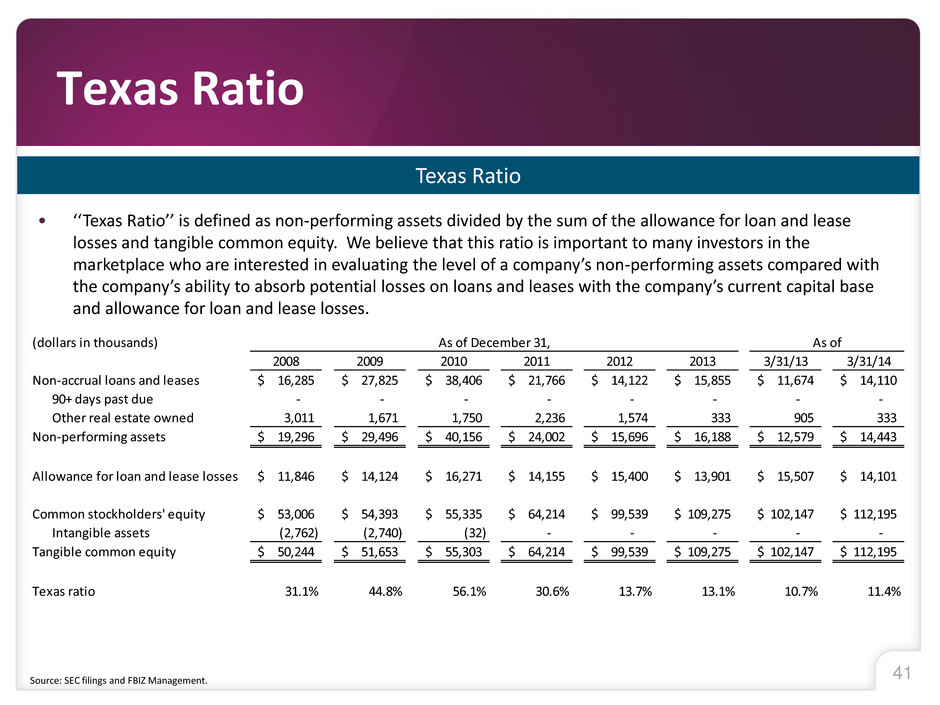

41 Texas Ratio Texas Ratio • ‘‘Texas Ratio’’ is defined as non-performing assets divided by the sum of the allowance for loan and lease losses and tangible common equity. We believe that this ratio is important to many investors in the marketplace who are interested in evaluating the level of a company’s non-performing assets compared with the company’s ability to absorb potential losses on loans and leases with the company’s current capital base and allowance for loan and lease losses. Source: SEC filings and FBIZ Management. (dollars in thousands) 2008 2009 2010 2011 2012 2013 3/31/13 3/31/14 Non-accrual loans and leases 16,285$ 27,825$ 38,406$ 21,766$ 14,122$ 15,855$ 11,674$ 14,110$ 90+ days past due - - - - - - - - Other real estate owned 3,011 1,671 1,750 2,236 1,574 333 905 333 Non-performing assets 19,296$ 29,496$ 40,156$ 24,002$ 15,696$ 16,188$ 12,579$ 14,443$ Allowance f r loan and lease losses 11,846$ 14,124$ 16,271$ 14,155$ 15,400$ 13,901$ 15,507$ 14,101$ Common stockholders' equity 53,006$ 54,393$ 55,335$ 64,214$ 99,539$ 109,275$ 102,147$ 112,195$ Intangible assets (2,762) (2,740) (32) - - - - - Tangible common equity 50,244$ 51,653$ 55,303$ 64,214$ 99,539$ 109,275$ 102,147$ 112,195$ Texas ratio 31.1% 44.8% 56.1% 30.6% 13.7% 13.1% 10.7% 11.4% As ofAs of December 31,

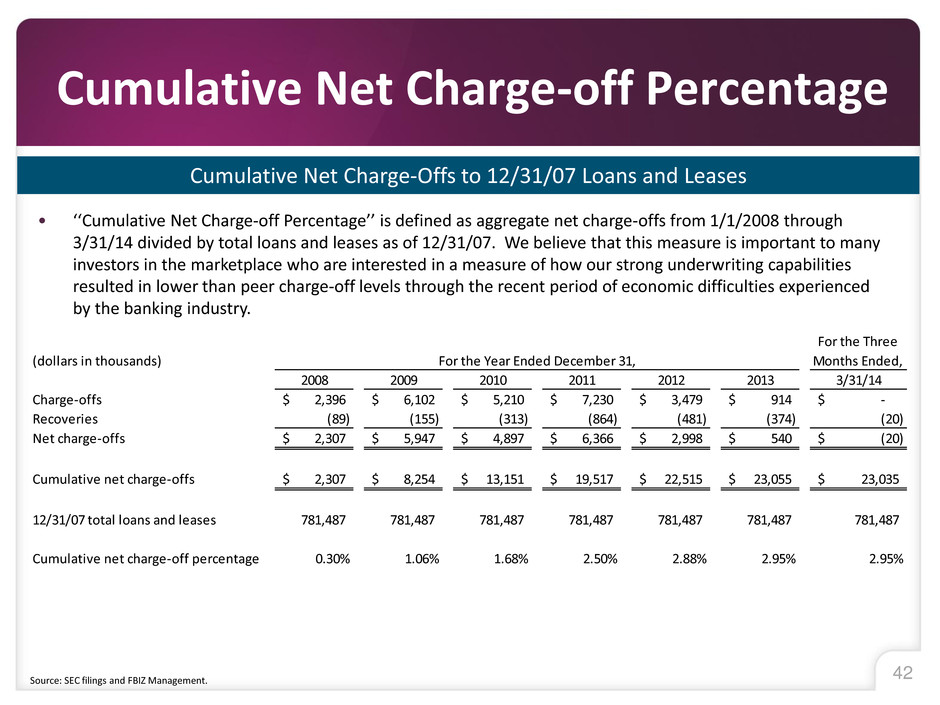

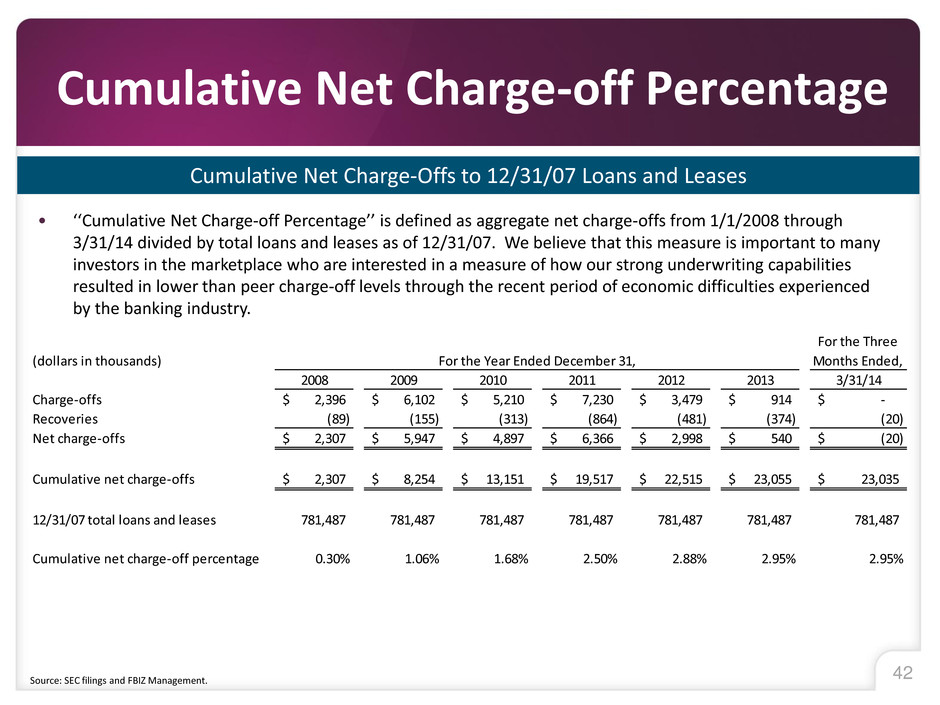

42 Cumulative Net Charge-off Percentage Cumulative Net Charge-Offs to 12/31/07 Loans and Leases • ‘‘Cumulative Net Charge-off Percentage’’ is defined as aggregate net charge-offs from 1/1/2008 through 3/31/14 divided by total loans and leases as of 12/31/07. We believe that this measure is important to many investors in the marketplace who are interested in a measure of how our strong underwriting capabilities resulted in lower than peer charge-off levels through the recent period of economic difficulties experienced by the banking industry. Source: SEC filings and FBIZ Management. (dollars in thousands) For the Three Months Ended, 2008 2009 2010 2011 2012 2013 3/31/14 Charge-offs 2,396$ 6,102$ 5,210$ 7,230$ 3,479$ 914$ -$ Recov rie (89) (155) (313) (864) (481) (374) (20) Ne harg -offs 2,307$ 5,947$ 4,897$ 6,366$ 2,998$ 540$ (20)$ Cumulative net charge-offs 2,307$ 8,254$ 13,151$ 19,517$ 22,515$ 23,055$ 23,035$ 12/31/07 total loans and leases 781,487 781,487 781,487 781,487 781,487 781,487 781,487 Cumulative net charge-off percentage 0.30% 1.06% 1.68% 2.50% 2.88% 2.95% 2.95% For the Year Ended December 31,