Exhibit 99.1

Reflecting back on the first half of 2018, I am encouraged by what I see relative to the business fundamentals at First Business. While we continue to experience some volatility from the Bank's legacy Small Business Administration ("SBA") portfolio, I am pleased with what we have accomplished so far this year and optimistic about the future.

SECOND QUARTER REVIEW

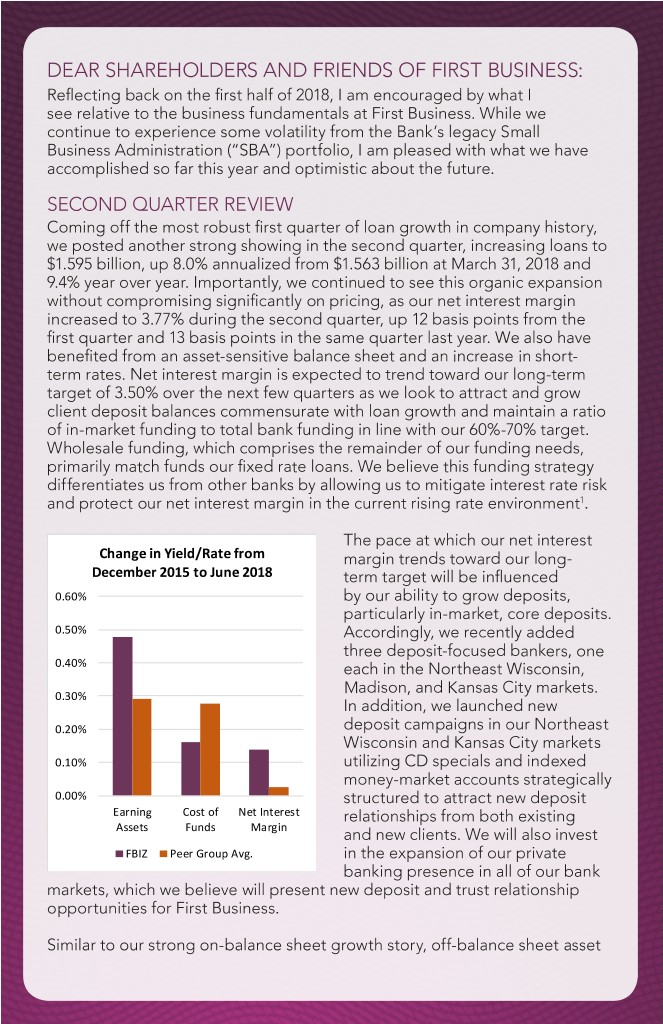

Coming off the most robust first quarter of loan growth in company history, we posted another strong showing in the second quarter, increasing loans to $1.595 billion, up 8.0% annualized from $1.563 billion at March 31, 2018 and 9.4% year over year. Importantly, we continued to see this organic expansion without compromising significantly on pricing, as our net interest margin increased to 3.77% during the second quarter, up 12 basis points from the first quarter and 13 basis points in the same quarter last year. We also have benefited from an asset-sensitive balance sheet and an increase in short-term rates. Net interest margin is expected to trend toward our long-term target of 3.50% over the next few quarters as we look to attract and grow client deposit balances commensurate with loan growth and maintain a ratio of in-market funding to total bank funding in line with our 60%-70% target. Wholesale funding, which comprises the remainder of our funding needs, primarily match funds our fixed rate loans. We believe this funding strategy differentiates us from other banks by allowing us to mitigate interest rate risk and protect our net interest margin in the current rising rate environment.1

The pace at which our net interest margin trends toward our long-term target will be influenced by our ability to grow deposits, particularly in-market, core deposits. Accordingly, we recently added three deposit-focused bankers, one each in the Northeast Wisconsin, Madison, and Kansas City markets. In addition, we launched new deposit campaigns in our Northeast Wisconsin and Kansas City markets utilizing CD specials and indexed money-market accounts strategically structured to attract new deposit relationships from both existing and new clients. We will also invest in the expansion of our private banking presence in all of our bank markets, which we believe will present new deposit and trust relationship opportunities for First Business.

Similar to our strong on-balance sheet growth story, off-balance sheet asset growth continues to hit record levels as our trust and investment division drives top line revenue growth through the addition of new money from both existing and new client relationships. Total trust assets as of June 30, 2018 were $1.645 billion, up 16.8% annualized from $1.579 billion at March 31, 2018 and 25.8% year over year.

The ability to demonstrate earnings growth is fundamental for a high-performing bank franchise. At First Business, our model is predicated on not just earnings growth but efficient earnings growth. While progress to generate positive operating leverage slowed in the second quarter, we believe our ability to improve operating efficiency during the first six months of 2018 bodes well for bottom line performance in the second half of the year and beyond as we strive to reach and maintain our target efficiency ratio range of 58%-62%. With previously disclosed revenue and expense management initiatives now firmly in place, specifically as it relates to our completely rebuilt SBA lending platform, the Bank is positioned to consistently grow operating revenues at a faster pace than operating expenses.

Coming off three straight quarters of declining non-performing assets, unfortunately our credit story took a step back during the second quarter. Non-performing assets increased to $32.6 million at June 30, 2018, compared to $21.5 million and $39.7 million at March 31, 2018 and June 30, 2017, respectively, primarily due to a fully collateralized $9.1 million asset-based loan, which moved to impaired status during the second quarter of 2018. This kind of migration is characteristic of the asset-based lending business, and we believe the collateral will be successfully liquidated and all contractual principal and interest will be received.

In addition, elevated credit costs in the second quarter related to three legacy SBA relationships tempered our otherwise strong operating performance. We are disappointed in the two consecutive quarters of legacy SBA credit noise, but remain resolute in our commitment to SBA lending and continue to believe this will be a future earnings catalyst for us. While the legacy SBA portfolio may be a source of volatility to quarterly earnings, the impact is expected to diminish as the portfolio matures and our team of experts adds new relationships underwritten consistent with First Business’s quality standards. As of June 30, 2018, the total off balance sheet loans related to the legacy SBA portfolio was $68.5 million, compared to $79.0 million at March 31, 2018 and $92.0 million at June 30, 2017.

EARNINGS CATALYST UPDATE

In my letter earlier this year, I discussed three catalysts we believe are pivotal to increasing our earnings growth trajectory:

| |

| 1. | Organic loan and lease growth |

| |

| 2. | SBA lending growth and profitability |

| |

| 3. | Scale high-performing wealth management business |

With the first half of the year in the books, here is a quick update on the progress we are making in these areas.

Organic Loan and Lease Growth

Organic loan growth has been a great success story for us so far in 2018, as noted by our record loan balances as of June 30, 2018. The majority of this growth is coming from conventional commercial lending in our more mature Madison and Milwaukee regions. At the same time, our Northeast Wisconsin and Kansas City markets have yet to achieve their full potential, given staffing changes and anticipated payoffs. We identified this trend during the planning process last year and have since taken steps to improve loan growth in these markets. Specifically, we recently converted our loan production office in Appleton, Wisconsin to a full-service banking location as we further our commitment to the Northeast Wisconsin business community. We believe this change will help us better serve our existing and prospective client base. In addition, we continue to invest in talent in the Kansas City market. Since this time last year, we have hired 10 new employees there as we continue to rebuild our presence in a market we believe presents great opportunity for First Business. Outstanding loan balances in the Kansas City market have stabilized in 2018, compared to a decrease of over $25 million in 2017, and we are confident the team we have in place now will contribute to loan growth moving forward.

While conventional commercial lending business lines have been the primary contributors to our current growth, we have also made significant changes and investments in our accounts receivable financing and equipment financing business lines.

We recently announced a new name for our accounts receivable financing division: First Business Growth Funding. The name change from First Business Factors follows the recent hire of Bill Elliott as President of the division, who brings over 35 years of experience in receivable financing. We are very excited about the wealth of knowledge and expertise that Bill brings to the table as a well-respected name in the industry.

In addition, First Business officially launched a new, homegrown vendor equipment leasing program. This internally developed program leverages technology and industry expertise to meet the needs of a previously unserved client base. As part of this new product launch, we have hired a talented team of proven industry experts, led by Stuart Goddard as Managing Director of Vendor Programs, who brings over 25 years of experience in the industry. We are very excited about this new opportunity and look forward to sharing more with you as it builds momentum through the remainder of the year.

SBA Lending Growth and Profitability

Despite a very modest increase in SBA gains during the quarter, we are confident the team and platform we have built is making good strides. Our SBA pipeline of approved loans continues to grow and we expect SBA gains in the third quarter of 2018 to be our strongest in some time. In general, though, the timing of closings and fundings can be difficult to predict, so we do expect some variability around SBA gains during the platform's early stages of growth.

As we start transitioning to a new era of SBA profitability, we recently turned our attention to expanding the SBA leadership team. We are pleased to announce the hiring of Marty Ferguson as Managing Director of SBA Lending. Marty has over 30 years of experience building and leading successful SBA divisions and we are fortunate to have him join the First Business team this September. We believe we are on the cusp of transitioning the SBA business from a cost center to a profit center and we are confident Marty can help us get there and stay there.

Scale High-Performing Wealth Management Business

Over the past 10 years, assets under management and administration have grown nearly 15% per year, surpassing total loan and lease outstanding balances for the first time ever during the first quarter of 2018. With the majority of this asset growth coming from our Madison market, we believe we still have ample opportunity to continue growing this business within our existing Midwest footprint. We will target growth in the Milwaukee, Northeast Wisconsin, and Kansas City markets, while continuing to opportunistically add talent in the Madison market. During this past quarter, we were fortunate to land two more talented private wealth management professionals, one each in the Madison and Milwaukee markets.

Private wealth management has been and will continue to be a very meaningful part of our business. Our ability to continue generating double-digit growth in assets under management and administration will be critical for First Business, as we look to maintain and grow our diversified revenue sources, increasing fee revenue to at least 25% of total revenue over the long run.

THE BEST TEAM WINS

As I was concluding this quarter's letter, I noticed a common theme. Whether it was the discussion of second quarter performance, organic loan growth, SBA rebuild and profitability, or private wealth expansion, the key to successful outcomes and initiatives is our ability to retain and recruit talented people to First Business. You are only as good as your people. It is easy to get lost in the day-to-day operations and lose sight of this simple fact. While there are a multitude of other determinants in play when growing a successful business within the banking niches in which we compete, we know ultimately the best team wins.

Investing for tomorrow is foundational at First Business. We believe we have built a franchise well positioned to execute on growth prospects in a sustainable and efficient manner, improving shareholder returns and attaining long-term profitability targets.

Finally, I would like to close by conveying my heartfelt appreciation and respect to First Business founder, Jerry Smith. Jerry will be retiring from the board this year and will transition his chairmanship duties to Jerry Kilcoyne, a long-time board member and well-respected business leader in the Madison market. I have had the pleasure of working with Jerry Smith for over 25 years. I will obviously miss working with him, but am happy that he will be able to pursue a well-earned retirement after an amazing 50 years in banking.

As always, thank you for your commitment to First Business.

Sincerely,

Corey Chambas, President and CEO

| |

| 1. | The First Business peer group includes: CoBiz Financial Inc. (COBZ), Community Financial Corporation (TCFC), Guaranty Bancorp (GBNK), Mercantile Bank Corporation (MBWM), Old Line Bancshares, Inc. (OLBK), QCR Holdings, Inc. (QCRH), Southern National Bancorp of Virginia, Inc. (SONA), Stock Yards Bancorp, Inc. (SYBT), West Bancorporation, Inc. (WTBA), Atlantic Capital Bancshares Inc. (ACBI), CapStar Financial Holdings Inc. (CSTR), Paragon Commercial Corporation (PBNC), People's Utah Bancorp (PUB), First Community Corporation (FCCO), Civista Bancshares Inc. (CIVB), Macatawa Bank Corporation (MCBC), Mid Penn Bancorp Inc. (MPB), National Commerce Corporation (NCOM), Franklin Financial Network (FSB) and First Financial Northwest Inc. (FFNW). Represents the change in yield/rate paid for the three months ended June 30, 2018 compared to the three months ended December 31, 2015. Source: S&P Global Market Intelligence. |

| |

| 2. | Operating leverage is defined as the percentage change in operating revenue less the percentage change in operating expense. Operating revenue and expense are defined and reconciled in the Efficiency Ratio table included in the Non-GAAP Reconciliations in the second quarter 2018 earnings release and 10-Q. |

This letter includes “forward-looking statements” related to First Business Financial Services, Inc. (the “Company”) that can generally be identified as describing the Company’s future plans, objectives, goals or expectations. Such forward-looking statements are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those currently anticipated. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. For further information about the factors that could affect the Company’s future results, please see the Company’s most recent annual report on Form 10-K, quarterly reports on Form 10-Q and other filings with the Securities and Exchange Commission.