Exhibit 99.1

DEAR SHAREHOLDERS AND FRIENDS OF FIRST BUSINESS:

This year is proving to be a defining year for the economy, our country, and consequently for our company. In the months since the health crisis began, the U.S. economy has become increasingly strained. The economic challenges we are facing as a nation are made all the more difficult by the limitations that the health crisis creates for businesses, resulting in a situation even more complicated than the Great Recession.

Against this backdrop, First Business achieved record operating performance in the second quarter, which was offset by a significant build of our reserve for loan and lease losses — appropriate and prudent in the current environment. At the same time, we grew loans to more than $2 billion while strengthening our liquidity position with record period-end in-market deposits.

While we cannot predict exactly how the remainder of the year will unfold and what additional challenges it will bring, we are not sitting idly by. In the entrepreneurial spirit that drives us, we are taking action to control what we can. We are doing all we can to support our clients as we continue to execute our strategic plan and manage our business. This, combined with our unique business model and history of strong performance through challenging economic environments, positions us well to weather this storm and thrive in the long term.

Nimble, Adaptable, and Scalable Business Model

For 30 years, First Business has leveraged its unique and nimble model to adapt and grow for the benefit of our clients, employees, investors, and community.

A critical component to our success is our highly focused approach: we exclusively focus our concierge-style service on well-defined market niches delivered through a single location in each of our banking markets. We believe these elements of our model are differentiators in the current environment.

As a financial services provider to businesses, executives, and high net worth individuals, First Business has never provided traditional consumer banking products or services, a fact we believe positions us well relative to peers and the industry today. As unemployment rises and consumer confidence falls, products like credit cards and other consumer lending products — none of which we offer — are widely believed to be at risk of deterioration.

Our client-centric approach to business also means that our relationship managers are highly engaged with our borrowers. We have been proactive with them in understanding the challenges to their respective businesses in this environment and, as a result, have good insight into the health of our loan portfolios entering the current credit cycle.

We also view our limited number of locations as a positive. When we first opened our doors in 1990, we did so from a single location in Madison. In the 30 years since, as we’ve grown total assets to $2.5 billion and deposits to $1.7 billion, we have added just three additional locations. As evidenced by our ability to profitably grow First Business without the traditional, ever-expanding branch networks of community, super-regional, and national competitors, our infrastructure is highly scalable. In fact, our average deposits per branch are nearly six times greater than the median bank our size1.

The high level of service our clients have come to expect has never been compromised by our lack of an expansive branch network. If anything, the opposite is true, as our approach is to go to and conduct business at our clients' locations, which has guided the types of businesses we chose to serve. For example, when our company first began serving the Greater Madison area 30 years ago, we leveraged couriers to pick up deposits and engage with our customers at their convenience at their places of business. Just as they are now, the safety and well-being of our employees, partners, and clients were top priorities and as such, we did not allow couriers to pick up large cash deposits. As a result of this, we were naturally precluded from banking heavy coin and currency-type businesses, including many of the retail businesses, restaurants, and bars that have been most impacted by the ongoing pandemic.

History of Strong Performance

From our limited number of offices to the types of clients we serve and the way we interact with them, our model is designed to operate efficiently and profitably in a variety of environments.

That model was put to the test during the Great Recession, just a few years after we became a public company. Importantly, our company has generated profits and paid cash dividends to common stockholders every single year since we went public, including during the height of the Great Recession in 2009 and 2010, when many banks cut their dividends and nearly 300 U.S. banks failed2. We outperformed peer banks with respect to asset quality during that same two-year period, reporting a net charge-offs to average loans ratio less than half the level of U.S. commercial banks with assets between $1 billion and $3 billion reported3.

Our experience through the last financial crisis informs our actions and gives us confidence as we enter the next downturn. This is further reinforced by our notably stronger capital position today as compared to 2008. As of June 30, 2020, we continued to exceed the highest levels of regulatory requirements for well-capitalized institutions.

Second Quarter 2020 Financial Performance

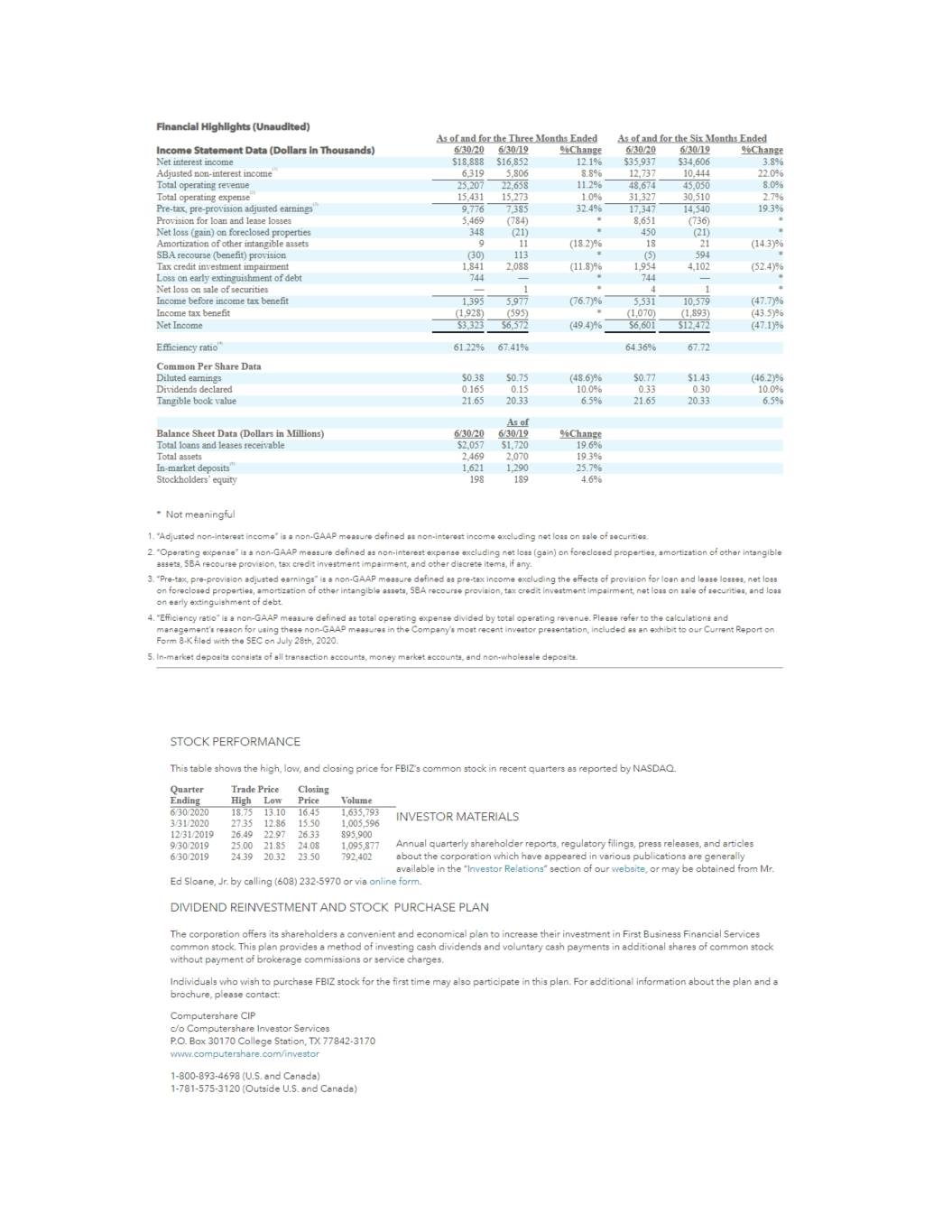

Our team continued to deliver strong fundamental operating performance in the second quarter, which was highlighted by record pre-tax, pre-provision adjusted earnings4.

Reported net income was $3.3 million, $0.38 per share, reflecting continued and appropriate increases to our loan loss reserve in the second quarter of 2020 due to the ongoing pandemic and economic crisis, which muted the strength of our fundamental financial performance. Pre-tax, pre-provision adjusted earnings grew a robust 32.4% year-over-year to an all-time quarterly high of $9.8 million, driven by solid double-digit net interest income growth and strong non-interest income. Second quarter 2020 top line revenue, the sum of net interest income and non-interest income, was $25.2 million, an increase of 11.3% from the year-ago quarter.

Net interest income of $18.9 million for the second quarter of 2020 reflected growth of 12.1% from the second quarter of 2019 on increased average loans and leases, lower deposit costs, and strong loan fees5. These fees, which can vary significantly between periods, accounted for about half of our net interest income growth year-over-year, benefiting from a portion of the processing fees received from the Small Business Administration (SBA) related to our Paycheck Protection Program (PPP) lending.

Adjusted net interest margin6 was 3.33%, up one basis point from 3.32% in the linked first quarter and up two basis points compared to the second quarter last year. Given the current extremely low rate environment, as well as overall industry trends, we view the stability in our adjusted net interest margin as highly positive and we will continue to work hard to support our margin going forward. To that end, we made the strategic decision to pay off $59.5 million in Federal Home Loan Bank (FHLB) term advances early in order to lower our borrowing costs, requiring a one-time prepayment fee of $744,000 that is reflected in non-interest expense for the second quarter 2020. Importantly, this early redemption will strengthen our margin moving forward and is just one of the ways we are controlling what we can in an uncertain time.

Non-interest income was $6.3 million in the second quarter and continued to make up more than 25% top line revenue, one of our strategic objectives. This quarter, non-interest income was highlighted by increases in swap fee income and gains on the sale of SBA loans.

Our prudent expense management resulted in operating expenses7 of $15.4 million, down 2.9% from first quarter. As we noted last quarter, we continue to expect only modest growth in operating expenses in the coming months as business travel and new hires remain limited in the near term.

Supporting our Clients Through COVID-19

We continue to be inspired by our clients and stand ready to help them. Our team’s incredible work processing more than 700 applications from new and existing clients allowed us to fund $327.9 million in loans through the PPP as of June 30, 2020. These PPP loans funded small- and medium-sized businesses employing more than 26,000 people in our markets, and we are incredibly proud to be able to support our communities in such a tremendous way.

We also continue to support our clients as they navigate the challenging environment by providing loan modifications of up to six months to certain borrowers who have been impacted by COVID-19. As of June 30, 2020, we had processed 448 deferral requests on loans totaling $323.2 million, or 18.6% of gross loans and leases. Importantly, most of these deferred balances are well collateralized and secured by real estate. While we expect deferrals to continue through 2020 and asset quality to be pressured into 2021, we believe our loan portfolio is healthy, diverse, and well-managed by our team, who are in close contact with our clients on a regular basis.

PPP loans were a driving force in our 19.6% annual loan growth to $2.057 billion at June 30, 2020. Conversely, clients’ access to PPP loan proceeds enabled many to pay down lines of credit, which tempered total loan growth as line utilizations declined $105.3 million from June 30, 2019. Excluding PPP loans and line of credit utilizations, commercial and industrial loans increased 25.0% since June 30, 2019. Commercial real estate loans increased 6.3% over the same time period.

Period-end in-market deposits8 grew by a record 25.6% year-over-year to $1.621 billion and now represent more than 75% of our total funding sources. A significant portion of our in-market deposit growth reflects clients’ PPP funds, which they entrusted to First Business, until they need to deploy their cash in the months ahead.

Asset Quality

As noted previously, we continue to build our reserve for loan and lease losses. In the second quarter of 2020, we recorded a provision for loan and lease losses of $5.5 million. Our reserve for loan and lease losses at June 30, 2020 was $27.5 million, or 1.58% of total gross loans and leases when excluding PPP loans guaranteed by the U.S. government, and represents a 21% increase in the reserve over the prior quarter.

Non-performing assets declined during the second quarter and now make up 1.03% of total assets, or 1.19% of total assets excluding PPP loans, primarily due to payoffs of impaired legacy SBA loans that our team continues to work out. Net charge-offs made up a modest 17 basis points of average gross loans and leases excluding PPP loans in the second quarter.

Positioned for the Future

I firmly believe that First Business is well positioned to handle these challenging circumstances. Our model was built with efficiency and a unique client base, and has been tested through a variety of difficult environments. Each and every member of our team is focused on controlling what they can. From driving revenues to controlling expenses, the people of First Business understand their roles and how they have the potential to help our clients succeed and positively impact our operating results. That all-hands-on-deck mentality is what will ensure we continue to drive performance through the current credit cycle and deliver value to our shareholders. On behalf of our entire team, I thank you for your continued trust and confidence in First Business.

Corey Chambas, President and CEO

First Business Financial Services, Inc.

This letter includes “forward-looking statements” related to First Business Financial Services, Inc. (the “Company”) that can generally be identified as describing the Company’s future plans, objectives, goals or expectations. Such forward-looking statements are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those currently anticipated. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. For further information about the factors that could affect the Company’s future results, please see the Company’s most recent annual report on Form 10-K, quarterly reports on Form 10-Q, and other filings with the Securities and Exchange Commission. We do not intend to, and specifically disclaim any obligation to, update any forward-looking statements.

| |

| 1. | First Business’s average deposits per FDIC-insured branch was $427.6 million in the second quarter, compared to $73.6 million for the median publicly traded U.S. commercial bank with assets of $1 billion to $5 billion in the most recent quarter, according to S&P Global Market Intelligence. |

| |

| 2. | A combined 297 banks failed during 2009-2010 according to FDIC data (https://www.fdic.gov/bank/historical/bank/). |

| |

| 3. | During 2009 and 2010, U.S. commercial banks with assets between $1 billion and $3 billion reported net charge-offs to average loans of 3.64%, compared to the 1.26% reported by First Business, based on data from S&P Global Market Intelligence. |

| |

| 4. | “Pre-tax, pre-provision adjusted earnings” is a non-GAAP measure defined as pre-tax income excluding the effects of provision for loan and leases losses, net loss on foreclosed properties, amortization of other intangible assets, SBA recourse provision, tax credit investment impairment, net loss on sale of securities, and loss on early extinguishment of debt. |

| |

| 5. | Also known as "Fees in Lieu of Interest" and defined as prepayment fees, asset-based loan fees, loan fee amortization, and non-accrual interest. |

| |

| 6. | "Adjusted net interest margin" is a non-GAAP measure representing net interest income excluding fees in lieu of interest and other recurring but volatile components of net interest margin divided by interest-earning assets less average PPP loans and other recurring, but volatile components of average interest-earning assets. |

| |

| 7. | “Operating expenses" is a non-GAAP measure defined as non-interest expense excluding the effects of the SBA recourse provision, impairment of tax credit investments, losses or gains on foreclosed properties, amortization of other intangible assets, and other discrete items, if any. |

| |

| 8. | "In-market deposits" are defined as all transaction accounts, money market accounts, and non-wholesale deposits. |

DEAR SHAREHOLDERS AND FRIENDS OF FIRST BUSINESS:

As dramatic changes unfolded affecting how Americans live and work as a result of the COVID-19 pandemic, our people have truly dedicated themselves to supporting one another and our clients in exceptional ways. Leveraging our advanced technology, they shifted quickly to work remotely to serve clients and effectively assisted them with the stimulus programs, truly representing the First Business culture. I simply could not be more proud of them all.

While the human aspects of what is happening in our world have resulted in unprecedented challenges, our ability to deliver solid fundamental operating performance in the current environment is a testament to the strength of our business. During the first quarter, we reported record period-end loans and deposits, strong fee income, and well-managed operating expenses, which helped to offset the COVID-19 related i

While it’s clear that t