| As filed with the Securities and Exchange Commission | on Registration No. 333-179493 |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

FORM S-1/A

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

GREENPOWER INTERNATIONAL GROUP LIMITED

(Exact name of registrant as specified in its charter)

BOXWOOD ACQUISITION CORPORATION

(Former Name of Registrant)

| Delaware | 3646 | 45-1877342 | ||

| State or other jurisdiction | Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization | Classification Code Number) | Identification Number) |

1311 S. Bromley Ave.

West Covina, CA 91790

(312) 622-7670

(Address, including zip code, and telephone number, including area code

of registrant’s principal executive offices)

Mia Yu

1311 S. Bromley Ave.

West Covina, CA 91790

(312) 622-7670

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

with copies to

Lee W. Cassidy, Esq.

Anthony A. Patel, Esq.

Cassidy & Associates

9454 Wilshire Boulevard

Beverly Hills, California 90212

(202) 387-5400 (949) 673-4525 (fax)

Approximate Date of Commencement of proposed sale to the public:As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions “large accelerated filer,”“accelerated file,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filed | ¨ | |

| Non-accelerated filed | ¨ | Smaller reporting company | x |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

CALCULATION OF REGISTRATION FEE

| Proposed | Proposed | |||||||||||||

| Amount | Maximum | Maximum | Amount of | |||||||||||

| Title of Each Class of | to be | Offering Price | Aggregate | Registration | ||||||||||

| Securities to be Registered | Registered | Per Unit (1) | Offering Price | Fee (2) | ||||||||||

| Common Stock held by Selling Shareholders | 11,000,000 shares | $ | 4.00 | $ | 44,000,000 | $ | 5,043 | |||||||

(1) There is no current market for the securities and the price at which the Shares are being offered has been arbitrarily determined by the Company and used for the purpose of computing the amount of the registration fee in accordance with Rule 457 under the Securities Act of 1933, as amended.

(2) $5,043 previously paid by electronic transfer.

EXPLANATORY NOTE

This registration statement and the prospectus therein cover the registration of 11,000,000 shares of common stock offered by the holders thereof.

The information contained in this prospectus is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission and these securities may not be sold until that registration statement becomes effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PROSPECTUS | Subject to Completion, Dated ______, 2012 |

GREENPOWER INTERNATIONAL GROUP LIMITED

11,000,000 shares of Common Stock offered by selling shareholders at $4.00 per share

This prospectus relates to the offer and sale of 11,000,000 shares of common stock (the “Shares”) of Greenpower International Group Limited (the “Company”), $0.0001 par value per share, offered by the holders thereof (the “Selling Shareholder Shares”), who are deemed to be statutory underwriters. The selling shareholders will offer their shares at a price of $4.00 per share, until (i) the offering of shares by the Company is closed, or (ii) the Company's common stock is listed on a national securities exchange or is quoted on the OTC Bulletin Board (or a successor) or a national quotation platform; after which, the selling shareholders may sell their shares at prevailing market or privately negotiated prices, including (without limitation) in one or more transactions that may take place by ordinary broker's transactions, privately-negotiated transactions or through sales to one or more dealers for resale.

The maximum number of Shares that can be sold pursuant to the terms of this offering by the selling shareholders is (in aggregate) 11,000,000. Funds received by the selling shareholders will be immediately available to such selling shareholders for use by them. The Company will not receive any proceeds from the sale of the Selling Shareholder Shares.

The Company intends to maintain the current status and accuracy of this prospectus and to allow selling shareholders to offer and sell the Shares for a period of up to two (2) years, unless earlier completely sold, pursuant to Rule 415 of the General Rules and Regulations of the Securities and Exchange Commission. All costs incurred in the registration of the Shares are being borne by the Company.

Prior to this offering, there has been no public market for the Company’s common stock. No assurances can be given that a public market will develop following completion of this offering or that, if a market does develop, it will be sustained. The offering price for the Shares has been arbitrarily determined by the Company and does not necessarily bear any direct relationship to the assets, operations, book or other established criteria of value of the Company. The Shares will become tradable on the effective date of the registration statement of which this prospectus is a part.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act which became law in April, 2012 and will be subject to reduced public company reporting requirements. See “The Company: Jumpstart Our Business Startups Act” contained herein.

Neither the Company nor any selling shareholders has any current arrangements or has entered into any agreements with any underwriters, broker-dealers or selling agents for the sale of the Shares. If the selling shareholders can locate and enter into any such arrangement(s), the Shares will be sold through such licensed underwriter(s), broker-dealer(s) and/or selling agent(s).

| Assumed Price | |||

| To Public | |||

| Per Common Stock Share | |||

| Offered by Company | $4.00 per share |

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

These securities involve a high degree of risk. See “RISK FACTORS” contained in this prospectus beginning on page 9.

1311 S. Bromley Ave.

West Covina, CA 91790

(312) 622-7670

Prospectus dated __________________, 2012

| 2 |

TABLE OF CONTENTS

| Prospectus Summary | 4 |

| Risk Factors | 9 |

| Forward Looking Statements | 21 |

| Determination of Offering Price | 21 |

| Dividend Policy | 22 |

| Selling Shareholders Sales | 22 |

| Plan of Distribution | 22 |

| Description of Securities | 23 |

| The Business | 24 |

| The Company | 40 |

| Plan of Operation | 46 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 47 |

| Management | 55 |

| Executive Compensation | 57 |

| Security Ownership of Certain Beneficial Owners and Management | 58 |

| Certain Relationships and Related Transactions | 59 |

| Selling Shareholders | 59 |

| Shares Eligible for Future Sales | 61 |

| Legal Matters | 61 |

| Experts | 61 |

| Disclosure of Commission Position of Indemnification for Securities Act Liabilities | 62 |

| Financial Statements | 63 |

| 3 |

PROSPECTUS SUMMARY

This summary highlights some information from this prospectus, and it may not contain all the information important to making an investment decision. A potential investor should read the following summary together with the more detailed information regarding the Company and the common stock being sold in this offering, including “Risk Factors” and the financial statements and related notes, included elsewhere in this prospectus.

The Company

History

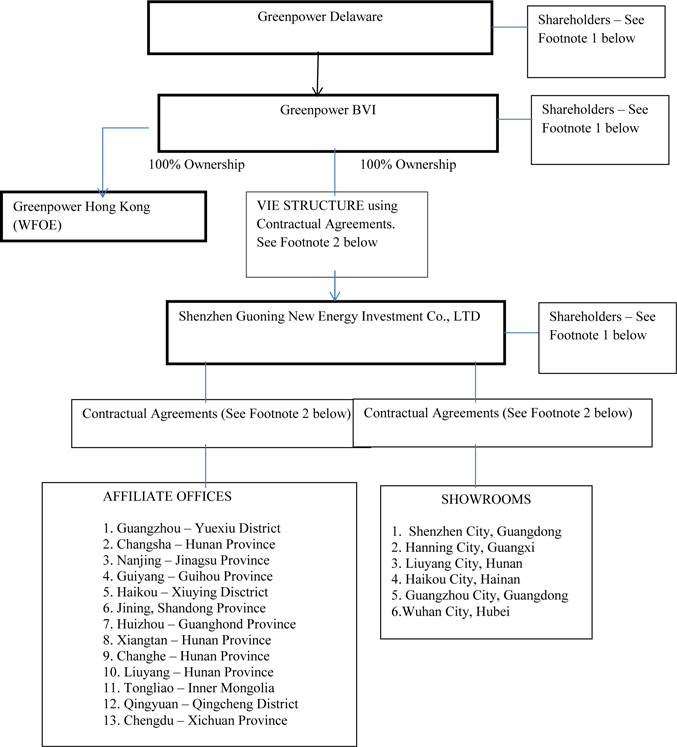

The Company is an electrical-use manager that provides light emitting diode (LED) lights, products and energy management services to customers in the People’s Republic of China (“China” or the “PRC”). The Company was incorporated in the State of Delaware in April 2011 and was formerly known as Boxwood Acquisition Corporation (“Boxwood”). On October 28, 2011, Boxwood changed its name to Greenpower International Group Limited (“Greenpower Delaware”). Thereafter, in February 2012, the Company acquired Greenpower International Group Limited, a company incorporated in the British Virgin Islands (“Greenpower BVI”) in a stock-for-stock transaction (the “Acquisition”). Prior to the Acquisition, Greenpower Delaware had no ongoing business or operations and was established for the purpose of completing a business combination with a target company, such as Greenpower BVI and Guoning (as defined below).

Greenpower BVI has management and voting control of Shenzhen Guoning New Energy Investment Co., Ltd, a company formed under the laws of Guangdong, China (“Guoning”), through a variable investment entity structure. Greenpower BVI was incorporated in the British Virgin Islands in September 2011. The operations of the Company and its business are conducted through Guoning. The Company holds management and voting control in Guoning via Greenpower BVI through contractual arrangements between Guoning and Greenpower BVI. The Company does not, however, own the equity of Guoning, and instead exercises its control in Guoning through the variable investment entity structure involving Greenpower BVI.

The entities comprising the Company have no material assets or revenues other than from Guoning. Aside from Guoning, the Company will not regularly maintain sizeable assets or generate consistent revenues (other than from Guoning, via the VIE Agreements with Guoning, or indirectly, as a seller of Guoning's products).

Guoning was formed in January 2011 and was formerly known as Shenzhen Muren Technology Industry Co., Ltd. (“Muren”). Muren was incorporated in March 2004 in the Guangdong Province, Shenzhen City of the PRC as a limited liability company. Prior to January 2011, Muren was in the business of purchasing, assembling, and furnishing customized, made to customer order laboratory equipment, furniture and lighting instruments. In January 2011, in connection with the execution of an equity transfer agreement, one of Muren’s two shareholders, transferred his ownership to the other shareholder, with the latter shareholder becoming the Chairman of a newly registered entity, Guoning. Pursuant to that agreement, Muren’s prior business in laboratory equipment and furniture was divested to the transferring shareholder, leaving a focus on the LED lighting business going forward in Guoning.

Following the separation of the entities, both Muren and Guoning exist as independent companies and manage their own independent, respective businesses. The separation of the entities, Muren and Guoning, was conducted under the supervision of the administrative bureau of industry and commerce in China. The two companies now coexist in the marketplace and are fully independent in all respects, including in their personnel, operations and finance. There are no current or prospective business relationships between the companies or their personnel. Moreover, the personnel of each of Guoning and Muren, respectively, do not participate in any management or operations of the other entity (and vice-versa).

Greenpower Delaware is located at 1311 S. Bromley Avenue, West Covina, CA 91790. The main phone number of Greenpower Delaware is (312) 622-7670. Guoning is located at Room 701-702, Changhong Science and Technology Building, Southern District in High-tech Industrial Park, Nanshan District, Shenzhen, China.

Business

The Company is in the business of energy management, with the primary objective of commercializing energy-saving lighting products and services in China. The Chinese government is sponsoring tax and other government incentives for companies to enter into energy management contracts (“EMC”) (alternatively known as energy performance contracts (“EPC”)). A typical EMC is an agreement whereby an industrial business or large user of electricity hires a company to manage their electrical use. The Company presently focuses on entering into EMCs with outdoor advertising (billboard) companies, essentially replacing the traditional lights on the outdoor advertising with LED lights. The Company receives a share of the reduction in the electrical bill received by the customer. The Company also sells LED lights to consumers and businesses via direct sales or wholesale to other retailers.

| 4 |

Guoning began a new LED-centric business model after divesting in its separation with Muren its prior laboratory equipment and furniture business component in 2011. After seven years of concentrating in LED product research and development and related sales, Guoning undertook a new strategic development positioning in 2010, developed ‘Guoning Mode’ based on energy management contracts (EMC) and is transitioning its business model to a professional energy saving service provider. By pursuing this niche market opportunity in the EMC arena, Guoning, which initially focused in 2011 on the field of outdoor advertisement lighting energy saving products, now has developed the capability to become a diversified national energy saving service provider.

The Company has found its product specialty in the pillar billboard lighting marketplace, and plans to steadily penetrate into interior lighting (e.g. factories, large shopping malls, offices, hotels, banks and families etc.), and functional lighting (e.g. direction lighting, decorating lighting, traffic lighting, special lighting such as fish-gathering lamp, etc.) markets based on its anticipated strength of product research capabilities. The Company aims to be a professional, comprehensive lighting energy saving service operator and smart energy saving lighting product seller around the world. The Company eventually intends to expand into all areas of lighting products via strategic partnerships with lighting manufacturers.

The Company’s new LED business model focuses essentially on energy performance sharing via replacing customers’ current illumination equipment with energy efficient LED lights and charges based on an agreed percentage of monthly utility bills saved. Currently, the Company’s main services business is through the EMC agreements to market these products and services in China. The Company provides customers with LED lights free-of-charge in exchange for entering into five-year or six-year EMC contracts whereby the Company with be entitled to a percentage of the energy savings achieved by the customer on a decreasing scale year –over-year. In the first year, the Company will typically receive 85% of the energy savings, with its share thereafter decreasing by five percentage points (5%) each year over the next four years through the end of the five-year term.

In addition, the Company has increased its LED product sales. To date, the Company’s LED product sales have generated substantial revenue for the Company and such future revenue may exceed the Company’s EMC revenue over the short term. However, the LED product sales revenue is not consistent and may represent one-time sales revenue. The majority of the past LED product sales revenue is a result of one large commission sales with customers in Japan (Komeri) and the balance of the past LED are with smaller customers in China. The Company, through Greenpower BVI, may enter into additional LED sales contracts for sales outside of China.

The Company entered into its first contract for EMC services in 2011, and has not completed its performance under such contract (the Company also entered into two other EMC service agreements during 2011, but the contracts were subsequently renegotiated with the customers during 2012. During 2012, the Company has added numerous other EMC contracts, and now has approximately 58 EMC agreements in effect. The Company has also begun to bid on EMC contracts that are outside of the billboard lighting marketplace. In addition, the Company has recently begun to enter into direct LED product sales contracts. Both the EMC and the LED business lines are still unproven and the Company is a new entrant to both markets. Moreover, the EMC service model is a new concept that was just recently introduced to the marketplace, and accordingly, this market has limited history and no long-term track record.

The Chinese Government has been promoting the use of LED lighting and the EMC system. The Chinese government has indicated that it would provide a grant and/or reward by an organization, such as the Company, that has entered the EMC business. The Chinese government has also expressed that tax benefits, which include no taxes for the first three years to companies in the energy-savings sector are appropriate.

The Company has 13 affiliate locations and expects to maintain at least 6 showroom locations. The Company has entered into written agreements with 21 such agencies to provide showrooms, and 6 of these agents are already in the process of setting up and designing the actual showroom locations to provide fixed office locations in most provinces in China and in major cities. All of the affiliate locations and the showrooms have entered into written contractual agreements with Guoning to act in their respective capacities. All showrooms operate under a written franchise agreement with Guoning which may or may not require that the showrooms sell Guoning products exclusively. Each affiliate location has been registered consistent with PRC laws and the showroom locations are not yet operational and will not be operational until registration consistent with PRC laws occurs. Sales are expected to be spread evenly through cities in most Chinese provinces. The Company plans to have customers that are government, private individuals and entities. The Company is currently in the process of developing new products, such as LED lights for tunnels, street lights and fishing boat lights (underwater).

Based on contractual arrangements, the showrooms expected to be maintained by the Company are proposed for several core functions, including: (a) offering a unique experience of high-end technology products to customers who run businesses involved in energy conservation; and (b) product marketing (i.e. users can experience products from Guoning directly to see the effects of energy conservation). Guoning plans to require that the showrooms use the Company’s logo(s) and insignia, and that the showrooms only manage products from Guoning. Further, the showrooms are expected to be responsible for their own respective management, financial affairs and operations. The showroom agents are expected to purchase products from Guoning directly and then sell these products in order to make a profit and/or sell products of Guoning on a traditional commission-based arrangement.

| 5 |

The Company plans to market directly to the customer without substantial use of traditional media or advertising campaigns. The Company believes that based on its innovative business model, many companies may try to imitate the model once introduced into the marketplace, and that imitators will potentially bring a negative influence to this new business model (if, for example, these imitators do not operate their business well). Hence, the Company does not plan to conduct heavy traditional advertising, but instead plans to reach target customers directly through limited, targeted media activities. For example, recently, Guoning released a promotion in a major media magazine in China to reach significant expressway customers that are likely to read this publication. In addition, Guoning was a title sponsor of the World Miss Pageant Conference in China. The Company also plans other targeted advertising and media blitzes that are likely to directly reach target customers for the Company’s products.

Guoning has established an affiliate office structure staffed with non-employees rather than directly owned subsidiaries in order to develop franchisees and encourage contractor partners to provide timely and comprehensive services to localized customers in order to promote Guoning. The Company undertakes comprehensive training in all of its affiliate offices, and contractors must ensure professional operation work flow. The Company ranks service quality as its top priority to ensure operational quality by providing the best product mix of lighting equipment materials and quality service.

Pursuant to the Company’s contracts with its affiliates, the affiliate office locations are not independent legal entities, and all of their operations and business shall be subject to authorization by the Company management through contractual agreements between the affiliates and Guoning. Affiliate offices shall have the authority to enter into contracts and business agreements pursuant to defined authority granted by the Company. Further, the Company has adopted and plans to maintain a set of policies and procedures (such as, for example, with respect to file management, contract management, use of Company insignia and seals, etc.) that internally govern its management and supervision of affiliate offices. Each affiliate office possesses a license to operate (in the name personally of the Chairman of the Board of Guoning) issued by the Chinese government.

Pursuant to the Company’s contracts with its affiliates, affiliate offices will be managed by their respective financial departments, each of which report to the Company’s finance department. The Company will select affiliate office general and financial managers based on meeting at least a minimum set of suitable education and work experience. Initially, and on an ongoing basis, the Company is expected to provide training and skills assessment evaluations with affiliate office personnel. The affiliate office general and financial managers will report directly to the Company management and will be responsible for affiliate office management.

In managing affiliate offices, the Company plans for each affiliate location to have its own bank account and accounting statements as an affiliate office of Guoning. The affiliate offices will be dedicated solely to the Company and will not transfer monies or assets or perform other services or work, without the consent of Guoning. Affiliate offices will be required to obtain approval from Guoning prior to opening a bank account, and Guoning may directly access and/or manage such accounts at any time and on a regular, ongoing basis. Affiliate offices may use the Guoning corporate name as well as corporate insignia and seals, provided that such use must strictly be controlled by the affiliate management and comply with acceptable use standards issued by Guoning. Each affiliate office is only permitted to sell products and services of Guoning, and it may not sell products or services of any other company.

Generally, affiliate offices are contractually required to finish the improvement of energy saving of 900 lamps of LED floodlights within two months of the affiliate office’s establishment. If this timeline cannot be met, the affiliate office may sanction its office management and deduct profit sharing amounts payable to the office. Once the affiliate office location completes its requirement for improvement of energy saving of 900 lamps, the Company shall obtain the first benefit and recoup its startup cost of 30,000 RMB immediately. Then, based on the contract, generally about 8% to 10% (depending on total volume of lamps) of received monies shall be paid to the affiliate office as compensation.

Guoning opens affiliate offices based on marketing conditions that it perceives to be beneficial for its business combined with the need for Guoning to efficiently develop its business across China. Opening affiliate offices allows Guoning an efficient means to enter regional markets by working in cooperation with local individuals that are more familiar with the regional conditions (e.g. geography, marketing, etc.). Guoning believes that this approach is more effective than if Guoning were to enter these markets itself rather than through cooperation with local representatives. The Company hopes that these efforts will be successfully in quickly growing Guoning’s presence across China.

| 6 |

Risks and Uncertainties facing the Company

The Company has a limited operating history in its new LED business since 2011 and has continuously experienced losses. The Company needs to generate revenue or locate additional financing in order to continue its business and operational plans. As a company whose primary focus is building a new business, management of the Company has limited prior experience in building and marketing the LED products similar to that of the Company and in marketing and distributing such products on a mass scale.

One of the biggest challenges facing the Company is identifying and targeting effective sales, marketing and distribution strategies. As a company building a new business in an emerging market, the Company is continuously in the process of identifying and targeting potential distributors and marketers of its products in order to reach the intended end users for the products. To reach potential end customers, the Company will need to have an effective sales, marketing and distribution strategy.

There are also other significant risks and uncertainties that face the Company. The following notes some of these major risks and uncertainties that the Company has identified: (1) discontinuance of government incentives for EMCs, which could significantly reduce demand for the Company’s products and services; (2) decrease in energy prices, which would directly affect the Company’s revenue; (3) increase in labor costs of the Company, which would materially increase expenses and reduce profitability; (4) increased financing costs; (5) increased costs of manufacturing the Company’s products; (6) currency exchange fluctuations, and in particular, in the value of the Chinese remnibi (RMB); (7) an increase in the number of competitors in the Company’s marketplace; (8) difficulties in procuring raw materials critical for the Company’s products and services; (9) rising costs of raw materials; and (10) the ability to manage and fulfill customer requirements in the event of manufacturing backlogs.

Due to financial constraints, the Company has to date conducted limited advertising and marketing to reach end customers. If the Company were unable to develop strong and reliable sources of potential end users and a means to efficiently reach buyers and customers for its products, it is unlikely that the Company could grow its operations to return revenue sufficient to further build its business and execute its long-term plan. Moreover, the above assumes that the Company’s products are met with customer satisfaction in the marketplace and exhibit steady adoption of products amongst the potential customer base, neither of which is currently known or guaranteed.

The Company’s independent auditors have issued a report raising a substantial doubt about the Company’s ability to continue as a going concern.

A significant risk of the Company is that all of the Company’s past revenue and assets have been related to the operations of Guoning, in China. While recently, Greenpower BVI has begun to conduct operations that may start to generate both revenues and assets for the Company, this revenue and/or assets may not represent a consistent source of revenue for the Company and may represent a one-time revenue event. Because the Company’s relationship with Guoning is via contractual arrangements and not a direct equity subsidiary structure, there is a risk associated with Guoning and its shareholder nonperformance under those agreements, which could result in the Company having little to no revenue or assets.

Trading Market

Currently, there is no trading market for the securities of the Company. The Company intends to initially apply for admission to quotation of its securities on the OTC Bulletin Board as soon as possible, which may be while this offering is still in process. There can be no assurance that the Company will qualify for quotation of its securities on the OTC Bulletin Board. See “RISK FACTORS” and “DESCRIPTION OF SECURITIES”.

The Offering

This prospectus relates to the offer and sale by certain shareholders of the Company of up to 11,000,000 Shares (the “Selling Shareholder Shares”), who are deemed to be statutory underwriters. The selling shareholders will offer their shares at a price of $4.00 per share, until (i) the offering of shares by the Company is closed, or (ii) the Company's common stock is listed on a national securities exchange or is quoted on the OTC Bulletin Board (or a successor) or a national quotation platform; after which, the selling shareholders may sell their shares at prevailing market or privately negotiated prices, including (without limitation) in one or more transactions that may take place by ordinary broker's transactions, privately-negotiated transactions or through sales to one or more dealers for resale.

.

| Common stock outstanding before the offering | 21,000,000 | (1) | ||

| Common stock for sale by selling shareholders | 11,000,000 | |||

| Common stock outstanding after the offering | 21,000,000 | |||

| Offering Price | $4.00 per share | |||

| Proceeds to the Company | $ | 0 |

(1) Based on number of shares outstanding as of the date of this prospectus.

| 7 |

The Company will not receive any proceeds from any sale of the Shares.

Concurrent with, or after the effectiveness of, this offering, the Company plans to complete a separate public offering of securities in order to receive capital for the Company’s growth and operations. In addition, whether in connection with or through Greenpower BVI or otherwise, the Company may directly acquire the assets and shares of Guoning; such a transaction would likely need shareholder approval and/or at least approval of the Company’s Board of Directors.

Summary Financial Information

The statements of operations data for the annual periods ending December 31, 2010 and December 31, 2009, respectively, and the balance sheet data at December 31, 2010, are derived from Guoning’s audited financial statements and related notes thereto included elsewhere in this prospectus. The statement of operations data for the period ended September 30, 2011 and September 30, 2010, and the balance sheet data at September 30, 2011, are derived from the Guoning’s unaudited consolidated financial statements and related notes thereto included elsewhere in this prospectus. As the Company had no operations or specific business plan until the acquisition, the information presented below is with respect to Guoning, which is controlled by Greenpower BVI (which was acquired by the Company in February 2012 through the Acquisition).

| Period ending on | Period ending on | Period ending on | ||||||||||

| September 30, 2011 | December 31, 2010 | December 31, 2009 | ||||||||||

| Statement of operations data | ||||||||||||

| Net sales | $ | 47,865 | $ | 43,417 | $ | 38,881 | ||||||

| Operating loss | $ | (205,847 | ) | $ | (1,338 | ) | $ | (527 | ) | |||

| Net loss from continuing operations | $ | (206,438 | ) | $ | (1,301 | ) | $ | (418 | ) | |||

| Net loss | $ | (208,355 | ) | $ | (65,921 | ) | $ | (8,224 | ) | |||

| Foreign current translation adjustment | $ | 46,038 | $ | 11,843 | $ | (273 | ) | |||||

| Net comprehensive loss | $ | (162,317 | ) | $ | (54,078 | ) | $ | (8,517 | ) | |||

| At September 30, 2011 | At December 31, 2010 | At December 31, 2009 | ||||||||||

| Balance sheet data | ||||||||||||

| Cash and cash equivalents | $ | 1,787,243 | $ | 297,205 | $ | 3,053 | ||||||

| Other assets | $ | 983,204 | $ | 536,973 | $ | 517,581 | ||||||

| Total assets | $ | 2,770,447 | $ | 834,178 | $ | 520,634 | ||||||

| Total liabilities | $ | 89,913 | $ | 491,117 | $ | 123,495 | ||||||

| Total stockholders’ equity | $ | 2,680,534 | $ | 343,061 | $ | 397,139 | ||||||

The statements of operations data for the period from September 16, 2011 (inception) through December 31, 2011, and the balance sheet data at December 31, 2011, are derived from the Company’s audited consolidated financial statements and related notes thereto included elsewhere in this prospectus. The statement of operations data for the quarter ended September 30, 2012, and the balance sheet data at September 30, 2012, are derived from the Company’s unaudited consolidated financial statements and related notes thereto included elsewhere in this prospectus.

| Period ending on | Period ending on | |||||||

| September 30, 2012 | December 31, 2011 | |||||||

| Statement of operations data | ||||||||

| Net sale | $ | 445,153 | $ | 34,483 | ||||

| Operating loss | $ | (1,259,802 | ) | $ | (400,592 | ) | ||

| Net loss | $ | (1,271,254 | ) | $ | (400,593 | ) | ||

| Foreign current translation adjustment | $ | 3,595 | $ | 31,688 | ||||

| Net comprehensive loss | $ | (1,267,659 | ) | $ | (368,905 | ) | ||

| 8 |

| At September 30, 2012 | At December 31, 2011 | |||||||

| Balance sheet data | ||||||||

| Cash and cash equivalents | $ | 12,977 | $ | 76,850 | ||||

| Other assets | $ | 3,086,698 | $ | 2,273,600 | ||||

| Total assets | $ | 3,099,675 | $ | 2,350,450 | ||||

| Total liabilities | $ | 2,024,722 | $ | 146,852 | ||||

| Total stockholders’ equity | $ | 1,074,953 | $ | 2,203,598 | ||||

RISK FACTORS

A purchase of any Shares is an investment in the Company’s common stock and involves a high degree of risk. Investors should consider carefully the following information about these risks, together with the other information contained in this prospectus, before the purchase of the Shares. If any of the following risks actually occur, the business, financial condition or results of operations of the Company would likely suffer. In this case, the market price of the common stock could decline, and investors may lose all or part of the money they paid to buy the Shares.

The Company’s revenues to date from its new LED business are still insufficient .

The Company has begun to generate increased revenues to date from its new LED business. However, the Company’s revenues are still insufficient to meet the Company’s operational and capital needs. Specifically, the Company’s EMC business model requires the Company to make a capital investment in each contract and the Company’s revenues have not to date been sufficient to meet its needs.

The Company’s independent auditors have issued a report raising a substantial doubt about the Company’s ability to continue as a going concern.

In their audited financial report, the company’s independent auditors have issued a comment that unless the Company is able to develop and market its products or obtain financing from other sources, there is a substantial doubt about its ability to continue as a going concern.

The Company has not consistently sold a meaningful quantity of products in its new LED business to date.

Since the inception of its new LED business, the Company has heretofore not consistently sold a meaningful quantity of products. Other than sales made in late 2011 and August 2012, the Company has not demonstrated a stable LED sales business. While both the 2011 and 2012 sales were of a meaningful quantity, these sales cannot be taken as a prediction of future sales.

No assurance of commercial feasibility or success.

Even if the Company can successfully develop a strategy to market and sell its products or services, there can be no assurance that such products or services will have any commercial advantages. Also, there is no assurance that the products will perform as intended in the marketplace or that the Company’s sales and marketing strategy will be successful.

The Company has limited operating history since commencing its new LED business and EMC business, and as such, any prospective investor cannot presently assess the Company’s profitability or performance.

Because the Company has limited operating history in its new LED or EMC business, it is impossible for an investor to assess the performance of the Company or to determine whether the Company will meet its projected business plan. The Company has limited financial results upon which an investor may judge its potential. As a company emerging from the development-stage, the Company may in the future experience under-capitalization, shortages, setbacks and many of the problems, delays and expenses encountered by any early stage business. An investor will be required to make an investment decision based solely on the Company management’s history and its projected operations in light of the risks, expenses and uncertainties that may be encountered by engaging in the Company’s industry.

The Company has a small financial and accounting organization. Being a public company strains the Company's resources, diverts management’s attention and affects its ability to attract and retain qualified officers and directors.

As a reporting company, the Company is already subject to the reporting requirements of the Securities Exchange Act of 1934. However, the requirements of these laws and the rules and regulations promulgated thereunder entail significant accounting, legal and financial compliance costs which are potentially prohibitive to the Company as it develops its business plan, products and scope. These costs have made, and will continue to make, some activities more difficult, time consuming or costly and may place significant strain on its personnel, systems and resources. In addition, because the Company’s Chief Financial Officer has limited experience with U.S. GAAP matters, the Company has needed to hire consultants and other outside experts in order to ensure compliance with GAAP, further straining the Company’s limited resources.

| 9 |

The Securities Exchange Act requires, among other things, that companies maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain the requisite disclosure controls and procedures and internal control over financial reporting, significant resources and management oversight are required. As a result, management’s attention may be diverted from other business concerns, which could have a material adverse effect on the development of the Company's business, financial condition and results of operations.

These rules and regulations may also make it difficult and expensive for the Company to obtain director and officer liability insurance. If the Company is unable to obtain adequate director and officer insurance, its ability to recruit and retain qualified officers and directors, especially those directors who may be deemed independent, will be significantly curtailed.

Various Risks of Deconsolidation and Otherwise May Render the Company Having No Material Revenues or Assets

The entities comprising the Company have no material assets or revenues other than from Guoning. Aside from Guoning, the Company will not regularly maintain sizeable assets or generate consistent revenues (other than from Guoning, via the VIE Agreements with Guoning, or indirectly, as a seller of Guoning's products). Because of the nature of this relationship and the associated risk, the Company is exposed to the uncertainties and risks that the Company may not be able to secure and recover assets of the Company in the event of a deconsolidation with Guoning.

A significant risk of the Company is that all of the Company’s past revenue and assets have been related to the operations of Guoning, in China. While recently, Greenpower BVI has begun to conduct operations that may start to generate both revenues and assets for the Company, this revenue and/or assets may not represent a consistent source of revenue for the Company and may represent a one-time revenue event. Because the Company’s relationship with Guoning is via contractual arrangements and not a direct equity subsidiary structure, there is a risk associated with Guoning and its shareholder nonperformance under those agreements, which could result in the Company having little to no revenue or assets.

The Company's election not to opt out of JOBS Act extended accounting transition period may not make its financial statements easily comparable to other companies.

Pursuant to the JOBS Act of 2012, as an emerging growth company the Company can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. The Company has elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the standard for the private company. This may make comparison of the Company's financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

The recently enacted JOBS Act will also allow the Company to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies. The Company meets the definition of an emerging growth company and so long as it qualifies as an “emerging growth company,” it will, among other things:

be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

be exempt from the “say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the “say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of the Dodd-Frank Act and certain disclosure requirements of the Dodd- Frank Act relating to compensation of its chief executive officer;

be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934 and instead provide a reduced level of disclosure concerning executive compensation; and

be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

| 10 |

Although the Company is still evaluating the JOBS Act, it currently intends to take advantage of some or all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company,”. The Company has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b) of the JOBS Act. Among other things, this means that the Company's independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company's internal control over financial reporting so long as it qualifies as an emerging growth company, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an emerging growth company, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers that would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

The Company has little experience in commercializing products.

The Company has little experience in commercializing products and managing a public company. Such lack of experience may result in the Company experiencing difficulty in adequately operating and growing its business. Further, the Company may be hampered by lack of experience in addressing the issues and considerations which are common to growing product companies. If the Company’s operating or management abilities consistently perform below expectations, the Company’s business is unlikely to thrive. In addition, although the Company is already a reporting company, the Company’s lack of experience may result, in spite of the successful product development and commercialization, in difficulty in managing the operations and finances of a public company.

The Company entered its first significant EMC contract only in late September 2011.

The Company only recently entered into its first significant EMC contract and has not yet fully performed the entire agreement. Although the Company delivered LED equipment and set up the EMC relationship with this customer, there is no certainty that the Company can perform satisfactorily during the duration of the entire contract term. If the Company is unable to complete its performance, it will not receive the revenues expected and such incomplete performance may hinder its ability to enter into any similar contracts or arrangements in the future.

EMC is still a new model and remains broadly untested.

While the Company believes (in its own judgment) that the EMC business and service model holds promise, the model is still not firmly established in the marketplace. It is possible that customers may not adopt this model and/or the Company’s service offering. In addition, there is an inherent customer risk involved in the EMC model, in that customers may not be able to pay on time or may go bankrupt, resulting in prolonged capital recovery times and/or the possibility of contracts being discontinued. Furthermore, changes to government policy in China (or other applicable jurisdictions) may result in losses or reductions of EMC projects and business.

The Company may not be able to adequately track energy usage metrics under its EMC contracts.

The long-term success and viability of the EMC programs depends to a great degree on the ability of the Company to track and monitor usage, and perform audits where necessary. If the Company is unable to perform such tracking or has systems and processes in effect that make such tracking auditing difficult, the EMC business may be difficult for the Company to effectively manage. The inability to perform reliable tracking and/or auditing may stem from inaccurate energy measurements, customer fraud or error in setting measurement counts, and calculation errors made in computing usage and/or pricing metrics.

The Company may not accurately assess baseline energy amounts or unforeseen circumstances may render baseline forecast outdated or obsolete

In its EMC customer agreements, the Company plans to derive revenues based on energy savings achieved over baseline amounts calculated by the Company. Typically, the Company uses formulas to measure energy conservation from projects. A major part of these formulas involve measuring energy data through measuring lamps by power testers and illuminometers. Testing of energy usage is conducted by Guoning and its customer in accordance with current prevailing standards of power measurement. Once the measurement is performed, both parties sign the agreement attesting the energy saving rate. If the Company improperly estimates baseline amounts or if energy costs, usage or other external factors result in a customer not achieving energy savings, the Company may not receive revenues from such customer even though the Company has attempted in good faith to perform the contract with the customer. For example, the Company and/or customer may make a calculation error in setting the baseline value amount from which the energy savings are calculated. In addition, even with accurate baseline computations, substantial fluctuations in the price of energy or in the use of energy may drive the baseline forecast to be less accurate. Also, equipment errors or inadequacies may result in the entire baseline reading being inaccurate.

| 11 |

The EMC model is a contingent compensation model that links the Company’s fees and compensation to achievement of energy savings in the future.

The EMC model is a contingent compensation model in that the Company typically earns fees based on performance in future periods. If energy savings are not achieved, whether due to reasons in the Company’s control or external factors, the Company may not receive compensation (or may receive compensation less than expected) and ultimately may not be profitable even though it has entered into customer contracts in the EMC line of business.

Reliance on third party agreements and relationships is necessary for development of the Company's business.

The Company will need strategic partners and third party relationships in order to develop and grow its business. The Company will be substantially dependent on these strategic partners and third party relationships. The loss of any strategic partnership(s) or supplier(s) could materially and seriously harm the Company. For example, the loss of the relationship with the Company’s manufacturer would be a significant setback for the Company.

Unregistered Affiliates and Showrooms Create a Potential for Risk

Although currently all operational affiliate locations are registered appropriately under PRC law, if such registrations were to lapse or be invalidated, and the affiliates continue to operate in such status the Company could face potential fines or penalties under PRC law. If the showrooms were to operate without appropriate registration, the Company could face fines and penalties under PRC law.

Chinese politics may exert a significant influence in how the business develops.

China is expected to introduce a new President to the PRC in the new future. As both the LED market and the EMC service model are significantly dependent on the support of the Chinese government for success, any change in policy by the Chinese government could be a major impediment to the development and growth of the Company’s business.

The Company expects to incur additional expenses and may ultimately never be profitable.

As of September 30, 2012, the Company had accumulated losses (i.e. an accumulated deficit) of $1,671,847. The Company will need to begin generating revenue to achieve and maintain profitability. To become profitable, the Company must successfully market and sell its products, a process that involves many factors that are beyond the Company’s control, including the type of competition that the Company may encounter. Ultimately, in spite of the Company’s best or reasonable efforts, the Company may never actually generate revenues or become profitable.

If the Company is unable to generate sufficient cash from operations, it may find it necessary to curtail operational activities.

The Company has an extensive business plan hinged on its ability to market and commercialize its products. If the Company is unable to market and/or commercialize its products, then it would not be able to proceed with its business plan or possibly to successfully develop its planned operations at all.

The proposed operations of the Company are speculative.

The success of the proposed business plan of the Company will depend to a great extent on the operations, financial condition and management of the Company. Although the Company has a business plan and intends to execute its overall business strategy, limited operations with respect to the LED business have been conducted to date. As only minimal revenues have been finalized or consummated as of yet, the proposed operations of the Company remain speculative.

The Company’s executive officers and directors beneficially owns and will continue to own a significant amount of the Company’s common stock and, as a result, can exercise control over stockholder and corporate actions.

The Company’s executive officers and directors are currently the beneficial owner of approximately 81% of the Company’s outstanding common stock and assuming the sale of all 11,000,000 shares offered for sale in this offering, the Company’s officers and directors will own 39% of the Company's outstanding common stock. As such, they will be able to exercise significant control over most matters requiring approval by stockholders, including the election of directors and approval of significant corporate transactions. This concentration of ownership may also have the effect of delaying or preventing a change in control, which in turn could have a material adverse effect on the market price of the Company’s common stock or prevent stockholders from realizing a premium over the market price for their Shares.

| 12 |

Executive officers and directors of the Company will retain voting control after the offering, which will allow them to exert substantial influence over major corporate decisions.

The Company anticipates that its executive officers and directors will, in the aggregate, beneficially own approximately 39% of its issued and outstanding capital stock following the completion of this offering, assuming the sale of all Shares hereby offered by such executive officers and directors. Accordingly, the executive officers and directors, by virtue of their percentage share ownership established by the certificate of incorporation and by-laws of the Company for the election of its directors, may effectively control the board of directors and the policies of the Company. As a result, these stockholders will retain substantial control over matters requiring approval by the Company’s stockholders, such as (without limitation) the election of directors and approval of significant corporate transactions. This concentration of ownership may also have the effect of delaying or preventing a change in control, which in turn could have a material adverse effect on the market price of the Company’s common stock or prevent stockholders from realizing a premium over the market price for their Shares.

The Company depends on its management team to manage its business effectively.

The Company's future success is dependent in large part upon its ability to understand and develop the business plan and to attract and retain highly skilled management, operational and executive personnel. In particular, due to the relatively early stage of the Company's business, its future success is highly dependent on its officers, to provide the necessary experience and background to execute the Company's business plan. The loss of any officer’s services could impede, particularly initially as the Company builds a record and reputation, its ability to develop its objectives, particularly in its ability to develop a successful strategy to develop, market and sell its products, and as such would negatively impact the Company's possible development.

Government regulation could negatively impact the business.

The Company’s products may be subject to various government regulations in the jurisdictions in which they will operate. Due to the potential wide geographic scope of the Company’s operations, the Company could be subject to regulation by political and regulatory entities throughout the PRC, including various local and municipal agencies and government sub-divisions, and various other foreign governments and political subdivisions thereof. The Company may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply. The Company’s operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to its business or industry.

The Company believes that the Chinese government advocates energy conservation, emission reductions and low carbon environmental protection. Each such policy issued by the Chinese government, which supports energy saving, is expected to have positive effects on Guoning’s business. In addition, the Chinese government may pass regulations that accelerate the application of LED lighting. The Chinese government is also expected to enact various favorable tax measures for energy saving projects.

There has been no prior public market for the Company’s securities and the lack of such a market may make resale of the stock difficult.

No prior public market has existed for the Company’s securities and the Company cannot assure any investor that a market will develop subsequent to this offering. An investor must be fully aware of the long-term nature of an investment in the Company. The Company intends to apply for quotation of its common stock on the OTC Bulletin Board as soon as possible which may be while this offering is still in process. However, the Company does not know if it will be successful in such application, how long such application will take, or, that if successful, that a market for the common stock will ever develop or continue on the OTC Bulletin Board. If for any reason the common stock is not listed on the OTC Bulletin Board or a public trading market does not otherwise develop, investors in the offering may have difficulty selling their common stock should they desire to do so. If the Company is not successful in its application for quotation on the OTC Bulletin Board, it will apply to have its securities quoted by the Pink OTC Markets, Inc., real-time quotation service for over-the-counter equities.

The Company does not intend to pay dividends to its stockholders, so investors will not actually receive any return on investment in the Company prior to selling their interest in it.

The Company does not project paying dividends but anticipates that it will retain future earnings for funding the Company’s growth and development. Therefore, investors should not expect the Company to pay dividends at any time in the foreseeable future. As a result, investors may not receive any return on their investment prior to selling their Shares in the Company, if and when a market for such Shares develops. Furthermore, even if a market for the Company’s securities does develop, there is no guarantee that the market price for the shares would be equal to or more than the initial per share investment price paid by any investor. There is a possibility that the Shares could lose all or a significant portion of their value from the initial price paid in this offering.

| 13 |

The Company’s stock may be considered a penny stock and any investment in the Company’s stock will be considered a high-risk investment and subject to restrictions on marketability.

If the Shares commence trading, the trading price of the Company's common stock may be below $5.00 per share. If the price of the common stock is below such level, trading in its common stock would be subject to the requirements of certain rules promulgated under the Securities Exchange Act of 1934, as amended. These rules require additional disclosure by broker-dealers in connection with any trades generally involving any non-NASDAQ equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Such rules require the delivery, before any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith, and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and accredited investors (generally institutions). For these types of transactions, the broker-dealer must determine the suitability of the penny stock for the purchaser and receive the purchaser’s written consent to the transactions before sale. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in the Company’s common stock which could impact the liquidity of the Company’s common stock.

The Company may face significant competition from companies that serve its industries.

The Company may face competition from other companies that offer similar products, ranging from local suppliers to large multinational manufacturers and companies. Some of these potential competitors may have longer operating histories, greater brand recognition, larger client bases and significantly greater financial, technical and marketing resources than the Company does. These advantages may enable such competitors to respond more quickly to new or emerging technologies and changes in customer preferences. These advantages may also allow them to engage in more extensive research and development, undertake extensive far-reaching marketing campaigns, adopt more aggressive pricing policies and make more attractive offers to potential customers, employees and strategic partners. It is possible that potential competitors may have or may rapidly acquire significant market share. Increased competition may result in price reductions, reduced gross margin and loss of market share. The Company may not be able to compete successfully, and competitive pressures may adversely affect its business, results of operations and financial condition.

Price competition is expected to increase in the marketplace.

The Company expects that competitors in the sector, especially in China, will continue to compete aggressively on the basis of price. With continued price competition, the overall pricing in the LED sector of products may continue to fall, thus adversely affecting the revenues and profitability of many competitors (including potentially the Company) in the industry.

Products have not completed marketing.

The Company has not completed the marketing of a full product line, and further, it anticipates a continuing need to market additional products. No assurance can be given that the products can be successfully marketed or that the products will achieve commercially viable sales levels.

No formal market survey has been conducted.

No independent marketing survey has been performed to determine the potential demand for the Company’s products or its business model. The Company has conducted only limited marketing studies, which indicate that its products would potentially be marketable. However, no assurances can be given that upon marketing, sufficient markets can be developed to sustain the Company's operations on a continued basis.

The Company may have limited ability to control product quality and deliver times as the manufacturing of products in controlled by a third party.

The Company employs an outsourced manufacturing model and is heavily dependent upon third-party manufacturers in order to produce products. Accordingly, in the event that the manufacturer encounters delay or difficulty in making products, the Company will have limited ability to control the actual ability of the manufacturing, and consequently, may be limited in its ability to set the ultimate product timelines and quality standards for its customers.

| 14 |

The Company has authorized the issuance of preferred stock with certain preferences.

The board of directors of the Company is authorized to issue up to 20,000,000 shares of $0.0001 par value preferred stock. The board of directors has the power to establish the dividend rates, liquidation preferences, and voting rights of any series of preferred stock, and these rights may be superior to the rights of holders of the Shares. The board of directors may also establish redemption and conversion terms and privileges with respect to any shares of preferred stock. Any such preferences may operate to the detriment of the rights of the holders of the Shares, and further, could be used by the board of directors as a device to prevent a change in control of the Company. No such preferred shares or preferences have been issued to date, but such shares or preferences may be issued at a later time, subject to the sole discretion of the board of directors.

The Company does not maintain certain insurance, including errors and omissions and indemnification insurance.

The Company has limited capital and, therefore, does not currently have a policy of insurance against liabilities arising out of the negligence of its officers and directors and/or deficiencies in any of its business operations. Even assuming that the Company obtained insurance, there is no assurance that such insurance coverage would be adequate to satisfy any potential claims made against the Company, its officers and directors, or its business operations or products. Any such liability which might arise could be substantial and may exceed the assets of the Company. The certificate of incorporation and by-laws of the Company provide for indemnification of officers and directors to the fullest extent permitted under Delaware law. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons, it is the opinion of the Securities and Exchange Commission that such indemnification is against public policy, as expressed in the Act, and is therefore, unenforceable.

The intellectual property protection of the Company may be inadequate.

The Company’s intellectual property rights in its products are based on the contractual agreement between Guoning and its partner (Dongguan). Dongguan has applied for certain patents in the PRC. There can be no assurance that the Company can obtain effective protection against unauthorized duplication or the introduction of substantially similar products or that existing trade secret or other intellectual property protection (if any) adequately protects (and will continue to protect) the Company.

The Company may file for intellectual property protection, but such efforts may be inadequate.

Through a written agreement between Guoning and Dongguan, Dongguan is contractually bound to assign and transfer all rights to identified patents and intellectual property to Guoning. The Company may file and attempt to obtain intellectual protection for its products in most countries. However, even if the Company files required applications in foreign countries, there can be no assurance that any such applications will be granted or, if granted, that the validity of such applications will not be contested in the courts. To the extent that such intellectual property protection application is valid, there can further be no assurance the application will fully protect the Company and that a third party may not find other ways to exploit the intellectual property that the application purports to protect.

Although the Company’s partner (Dongguan) has applied for certain patents in the PRC, there can be no assurance that the Company can obtain effective protection against unauthorized duplication or the introduction of substantially similar products or that existing trade secret or other intellectual property protection (if any) adequately protects (and will continue to protect) the Company

The Company is subject to the potential factors of obsolescence and technological change.

The business of the Company is susceptible to rapidly changing technology and the Company's market development and sales process is subject to constant change. Although the Company intends to continue to market and sell its products and services, there can be no assurance that funds for such expenditures will be available or that the Company's competition will not develop similar or superior capabilities or that the Company will be successful in its internal efforts. The future success of the Company will depend in part on its ability to respond effectively to rapidly changing technologies, industry standards and customer requirements by adapting and improving the performance features, pricing and reliability of its offered products and services. In particular, the Company may be exposed to a significant risk of novel products and technologies from competitors to address the expected growth and demand in the worldwide energy-saving sector.

The offering price of the Shares has been arbitrarily determined by the Company and such offering should not be used by an investor as an indicator of the fair market value of the Shares.

Currently there is no public market for the Company’s common stock. The offering price for the Shares has been arbitrarily determined by the Company and does not necessarily bear any direct relationship to the assets, operations, book or other established criteria of value of the Company. Thus an investor should be aware that the offering price does not reflect the fair market price of the Shares.

| 15 |

The Company may complete a primary offering for Shares in parallel with or immediately following this offering.

The Company may conduct a primary offering for Shares to receive proceeds for the Company. Such an offering may be conducted in parallel with or immediately following this offering. Sales of additional Shares will dilute the percentage ownership of existing shareholders in the Company.

The Company may conduct a transaction with Guoning shareholders that could have a dilutive effect.

It is possible, but not anticipated in the next 12 months, that the Company could exercise the option agreements, or enter into a new agreement, with Guoning shareholders that could result in Guoning shareholders receiving shares in the Company in consideration for their shares of Guoning. If this transaction were to occur, it would result in a dilution of all shareholders of the Company. This option would be exercised by the Company if the Company determined that it would benefit by making Guoning a direct subsidiary of the Company.

Indirect management organization may pose weak organization structure.

The Company is building its business by developing affiliate offices through franchisees, which may result in a weak management structure. Also, the Company may have indirect management of research and development efforts, weakening product development efforts and activities. As the Company sets up affiliate offices which are under supervision from headquarters for business development, there is a risk of management difficulty.

The affiliate office structure exposes the Company to liabilities that it may not be able to adequately mitigate .

The Company is building its business by developing affiliate offices. The Company is liable for the acts and omissions of affiliate offices, even though the Company’s management will have limited oversight over each individual affiliate office. As affiliate offices are not subsidiaries, the Company has essentially no limited liability protection against the activities and operations of its affiliate offices.

The affiliate office structure exposes the Company to potential finance risk in the selection of customers .

As affiliate offices will primarily function in a sales and development capacity, they will have an incentive to boost sales, even at the expense of the risk of attracting unsuitable customers. As the Company’s management will not directly be involved in the supervision of all affiliate office activities, there is a risk of the affiliate offices obtain unattractive customers (such as, without limitation, those customers that cannot meet their financial obligations to the Company).

There is no guarantee that the Company will be able to obtain high-quality lighting equipment at a suitable cost.

The Company is in great need of high-quality lighting equipment to fulfill the needs of customers. The Company could experience major problems if the quality of available lighting equipment is not satisfactory or if the costs of purchasing quality equipment increase. In addition, the LED manufacturing has had incidences of counterfeit goods produced; inadvertently purchasing counterfeit LED manufactured goods could subject the Company to significant risks.

The Company will constantly be exposed to potential government/political risks and Acts of God.

National and regional government policies and political factors are expected to continue to have a significant impact on the energy sector, and in particular, the energy-saving industry in which the Company operates. Further, the Company’s products, services and overall business model will continuously be susceptible to the impacts of global warming, climate anomalies, weather conditions and natural disasters, any and/or all of which would affect energy consumption and utilization.

The Company may incur liability for counterfeit products sold at its website.

The Company offers products from different manufacturers and distributors across China. Those manufacturers and distributors are separately responsible for sourcing the products that the Company sells. Although the Company has adopted measures to verify the authenticity of the products sold and minimize potential infringement of third-party intellectual property rights in the course of sourcing and selling products, the Company may not always be successful. In the event that counterfeit or infringing products are sold, the Company could face claims that the Company should be held liable for selling counterfeit products or infringing on others’ intellectual property rights. If there is a successful claim, the Company might be required to pay substantial damages or refrain from further sale of the relevant products. Moreover, regardless of whether the Company successfully defends against such claims, the Company’s reputation could be severely damaged. Successful claims of infringement of third-party intellectual property rights against the Company is a violation by the sellers of products and services on the Company’s website of agreements the Company have with such sellers, which automatically terminates such agreement, and any damages obtained against the Company may be deducted from sales by such sellers. Any of these events could have a material adverse effect on the Company’s business, results of operations, or financial condition.

| 16 |

The Company’s inability to obtain capital, use internally generated cash, or use shares of the Company’s common stock or debt to finance future expansion efforts could impair the growth and expansion of the Company’s business.

Reliance on internally generated cash or debt to finance the Company’s operations or complete business expansion efforts could substantially limit the Company’s operational and financial flexibility. The extent to which the Company will be able or willing to use shares of common stock to consummate expansions will depend on the Company’s market value from time to time and the willingness of potential sellers to accept it as full or partial payment. Using shares of common stock for this purpose also may result in significant dilution to the Company’s then existing stockholders. To the extent that the Company is unable to use common stock to make future expansions, the Company’s ability to grow through expansions may be limited by the extent to which the Company is able to raise capital for this purpose through debt or equity financings. No assurance can be given that the Company will be able to obtain the necessary capital to finance a successful expansion program or the Company’s other cash needs. If the Company is unable to obtain additional capital on acceptable terms, the Company may be required to reduce the scope of any expansion. In addition to requiring funding for expansions, the Company may need additional funds to implement the Company’s internal growth and operating strategies or to finance other aspects of the Company’s operations. The Company’s failure to (i) obtain additional capital on acceptable terms, (ii) use internally generated cash or debt to complete expansions because it significantly limits the Company’s operational or financial flexibility, or (iii) use shares of common stock to make future expansions may hinder the Company’s ability to actively pursue any expansion program the Company may decide to implement and negatively impact the Company’s stock price.