SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. ______)

Filed by the Registrant¢

Filed by a Party other than the Registrant£

Check the appropriate box:

| £ | Preliminary Proxy Statement |

| £ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¢ | Definitive Proxy Statement |

| £ | Definitive Additional Materials |

| £ | Soliciting Material Pursuant to § 240.14a-12 |

BSB Bancorp, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¢ | No fee required. |

| £ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

N/A

| (2) | Aggregate number of securities to which transactions applies: |

N/A

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule |

0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

N/A

| (4) | Proposed maximum aggregate value of transaction: |

N/A

| (5) | Total fee paid: |

N/A

| £ | Fee paid previously with preliminary materials. |

| £ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the |

filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: N/A |

| (2) | Form, Schedule or Registration Statement No.: N/A |

| (3) | Filing Party: N/A |

| (4) | Date Filed: N/A |

April 12, 2018

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of BSB Bancorp, Inc. The meeting will be held at the Belmont Town Hall, Board of Selectman’s Meeting Room, 455 Concord Avenue, 2nd Floor, Belmont, Massachusetts on Wednesday, May 23, 2018 at 10:00 a.m., Eastern Daylight Time.

The notice of annual meeting and proxy statement appearing on the following pages describe the formal business to be transacted at the meeting. Directors and officers of the Company, as well as a representative of Baker Newman & Noyes, LLC, the Company’s independent registered public accounting firm, are expected to be present to respond to appropriate questions of stockholders.

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to vote online, by telephone or request, complete and mail a proxy card or voting instruction card promptly. If you attend the meeting, you may vote in person even if you have previously voted online, by telephone or mailed a proxy card or voting instruction card.

We look forward to seeing you at the meeting.

| Sincerely, | |

| /s/ Robert M. Mahoney | |

| Robert M. Mahoney | |

| President and Chief Executive Officer |

BSB Bancorp, Inc.

2 Leonard Street

Belmont, Massachusetts 02478

617-484-6700

________________________

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

______________________

| TIME AND DATE | 10:00 a.m., Eastern Daylight Time, on Wednesday, May 23, 2018 | ||

| PLACE | Belmont Town Hall, Board of Selectman’s Meeting Room, 455 Concord Avenue, 2nd Floor, Belmont, Massachusetts | ||

| ITEMS OF BUSINESS | (1) | The election of four directors, each to serve for a term of three years. | |

| (2) | The ratification of the selection of Baker Newman & Noyes, LLC as our independent registered public accounting firm for fiscal year 2018. | ||

| (3) | An advisory, non-binding vote to approve the executive compensation described in the proxy statement. | ||

| (4) | The transaction of such other business as may properly come before the meeting and any adjournment or postponement thereof. | ||

| RECORD DATE | To vote, you must have been a stockholder at the close of business on April 2, 2018. | ||

| PROXY VOTING | It is important that your shares be represented at the annual meeting whether or not you plan to attend. You may vote online, by telephone, or by requesting, completing, signing and dating the proxy card or voting instruction card and promptly returning it in the envelope provided. | ||

| By Order of the Board of Directors, | |||

| /s/ John A. Citrano | |||

| John A. Citrano | |||

| Corporate Secretary | |||

Belmont, Massachusetts

April 12, 2018

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 23, 2018—THE PROXY STATEMENT AND BSB BANCORP, INC.’S 2017 ANNUAL REPORT TO STOCKHOLDERS ARE EACH AVAILABLE AT http://www.edocumentview.com/BLMT

BSB Bancorp, Inc.

Proxy Statement

General Information

We are providing this proxy statement to you in connection with the solicitation of proxies by the Board of Directors of BSB Bancorp, Inc. (“BSB Bancorp” or the “Company”) for the 2018 annual meeting of stockholders (the “annual meeting”) and for any adjournment or postponement of the meeting. The Company is the holding company for Belmont Savings Bank (“Belmont Savings” or the “Bank”).

Because we are soliciting your proxy, we are required to send you either our proxy materials or a Notice of Internet Availability of Proxy Materials (described in the next section). Our proxy materials include this proxy statement and our annual report to stockholders, which contains audited consolidated financial statements for our fiscal year ended December 31, 2017. If you received a printed copy of our proxy materials by mail (rather than through electronic delivery), you also received a proxy card or voting instruction form for the annual meeting.

How We Are Distributing Proxy Materials; Internet Availability

To expedite delivery, reduce our costs and decrease the environmental impact of our proxy materials, we used “Notice and Access” in accordance with a Security and Exchange Commission (“SEC”) rule that permits us to provide proxy materials to our stockholders over the Internet. In most cases, we are mailing only a brief Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”), rather than a full set of printed materials. The Notice of Internet Availability contains instructions on how to access our proxy materials and vote online. It also includes instructions on how to request a paper copy or email delivery of our proxy materials. If you previously chose to receive our proxy materials electronically, you will continue to receive access to these materials via email until you elect otherwise. Our proxy materials may also be viewed on our website, www.belmontsavings.com, under the investor relations header and then “SEC Filings.”

We are holding the annual meeting at the Belmont Town Hall, Board of Selectman’s Meeting Room, 455 Concord Avenue, 2nd Floor, Belmont, Massachusetts, 02478 on Wednesday, May 23, 2018 at 10:00 a.m., Eastern Daylight Time. We intend to mail and make available electronically to stockholders of record as of April 2, 2018 our proxy materials beginning on or about April 12, 2018.

Information about Voting

Who Can Vote at the Meeting

You are entitled to vote the shares of BSB Bancorp common stock that you owned as of the close of business on April 2, 2018. As of the close of business on April 2, 2018, a total of 9,741,471 shares of BSB Bancorp, Inc. common stock were outstanding. Except as described in the paragraph below, each share of common stock is entitled to one vote.

The Company’s Articles of Incorporation provide that record owners of Company common stock that is beneficially owned (as defined in the Articles of Incorporation) by a person who beneficially owns in excess of 10% of the Company’s outstanding common stock (a “10% beneficial owner”), shall not be entitled to vote, in the aggregate, shares beneficially owned by the 10% beneficial owner in excess of 10% of the Company’s outstanding common stock.

Ownership of Shares; Attending the Meeting

You may own shares of BSB Bancorp in one of the following ways:

| · | Directly in your name as the stockholder of record; or |

| · | Indirectly through a broker, bank or other holder of record in “street name.” |

If your shares are registered directly in your name, you are the holder of record of these shares and we are sending these Proxy Materials, or a Notice of Internet Availability, directly to you. As the holder of record, you have the right to give your proxy directly to us by any of the following methods:

| · | In person – Attend the annual meeting and vote in person. |

| · | Mail – If you received a proxy card, mark, date and sign the proxy card and mail it to Proxy Services, c/o Computershare Investor Services, P.O. Box 505008, Louisville, Kentucky, 40233-5008, using the accompanying pre-addressed, stamped envelope, so that it is received no later than the close of business on May 22, 2018. |

| · | Internet or telephone – Visit www.investorvote.com/blmt to vote over the Internet or call toll free 1-800-652-VOTE (8683) to vote using a touchtone telephone, in either case no later than 12:00 a.m. Eastern Daylight Time, May 23, 2018. You will need the control number found on the Notice of Internet Availability or the proxy card. |

If you hold your shares in street name, your broker or other holder of record is sending to you a Notice of Internet Availability or, if you have so requested, a paper copy of these proxy materials. As the beneficial owner, you have the right to direct your broker or other holder of record how to vote. For instructions on how to have your shares voted, please see the Notice of Internet Availability or instruction form provided by your broker or other holder of record. If you hold your shares in street name, you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or a letter from a broker or bank are examples of proof of ownership. If you want to vote your shares of BSB Bancorp common stock held in street name in person at the meeting, you must obtain a written proxy in your name from your broker or other holder of record.

Quorum and Vote Required

Quorum. We will have a quorum and will be able to conduct the business of the annual meeting if the holders of a majority of the outstanding shares of common stock entitled to vote are present at the meeting, either in person or by proxy.

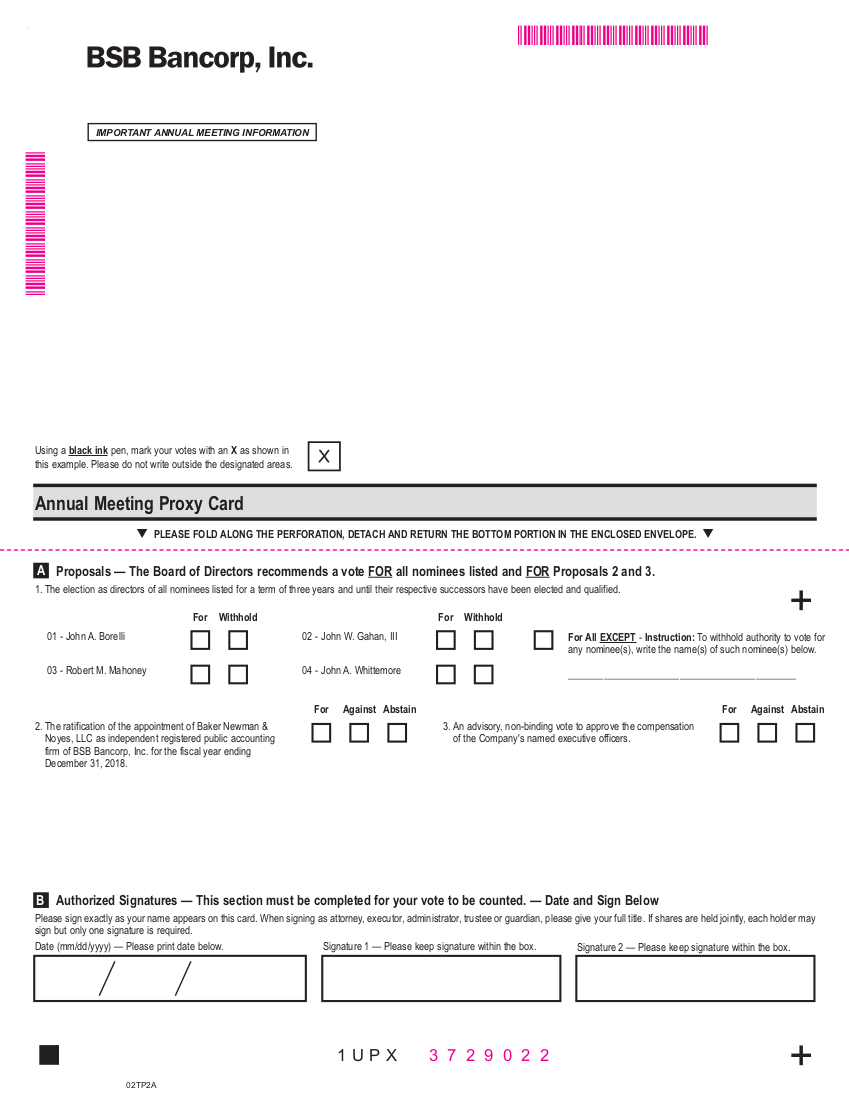

Votes Required for Proposals. At this year’s annual meeting, stockholders will elect four directors, each to serve for a term of three years and until their respective successors have been elected and qualified. In voting on the election of directors, you may vote in favor of the nominees, withhold votes as to all nominees, or withhold votes as to specific nominees. There is no cumulative voting for the election of directors. Directors are elected by a plurality of the votes cast at the annual meeting. This means that the nominees receiving the greatest number of votes will be elected.

In voting on the ratification of the appointment of Baker Newman & Noyes, LLC as the Company’s independent registered public accounting firm, you may vote in favor of the proposal, vote against the proposal or abstain from voting. To ratify the selection of Baker Newman & Noyes, LLC as our independent registered public accounting firm for fiscal year 2018, the affirmative vote of a majority of the votes cast on the proposal is required.

In voting on the advisory, non-binding proposal to approve the executive compensation described in this proxy statement, you may vote in favor of the advisory proposal, vote against the advisory proposal or abstain from voting. Approval of this proposal requires the affirmative vote of a majority of the votes cast on the proposal.

While this vote is required by law, it will neither be binding on the Board of Directors, nor will it create or imply any change in the fiduciary duties of or impose any additional fiduciary duty on the Board of Directors.

Broker Non-Votes.If you do not provide your broker or other holder of record with voting instructions on certain non-routine matters (e.g., the election of directors and the advisory vote on executive compensation matters), your broker or other holder of record will not have discretion to vote your shares on these matters. A “broker non-vote” occurs when your broker or other holder of record submits a proxy for the meeting with respect to routine matters, but does not vote on non-routine matters because you did not provide voting instructions on these matters. In the case of routine matters (e.g., the ratification of the independent auditors), your broker or other holder of record is permitted to vote your shares in the record holder’s discretion if you have not provided voting instructions.

How We Count Votes. If you return valid proxy instructions or attend the meeting in person, we will count your shares for purposes of determining whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted for purposes of determining the existence of a quorum.

In the election of directors, votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In counting votes on the proposal to ratify the selection of the independent registered public accounting firm, abstentions will have no impact on the outcome of the proposal.

In counting votes on the advisory, non-binding proposal to approve the executive compensation described in this proxy statement, abstentions and broker non-votes will have no effect on the outcome of the vote.

Voting by Proxy

The Company’s Board of Directors is sending you this proxy statement to request that you allow your shares of Company common stock to be represented at the annual meeting by the persons named in the enclosed proxy card. All shares of Company common stock represented at the meeting by properly executed and dated proxies will be voted according to the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors. The Board of Directors recommends that you vote:

| • | foreach of the nominees for director; |

| • | for ratification of the appointment of Baker Newman & Noyes, LLC as the Company’s independent registered public accounting firm for fiscal year 2018; and |

| • | forapproval of the advisory, non-binding proposal to approve the executive compensation described in this proxy statement. |

If any matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy card will use their judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the meeting to solicit additional proxies. If the annual meeting is postponed or adjourned, your Company common stock may be voted by the persons named in the proxy card on the new meeting date, provided you have not revoked your proxy. The Company does not currently know of any other matters to be presented at the meeting.

You may revoke your proxy at any time before the vote is taken at the meeting. To revoke your proxy, you must advise the Corporate Secretary of the Company in writing before your common stock has been voted at the annual meeting, deliver a later dated proxy, vote on a later date by telephone or the Internet or attend the meeting and vote your shares in person by ballot. Attendance at the annual meeting will not in itself constitute revocation of your proxy.

Participants in the Belmont Savings Bank Employee Stock Ownership Plan

If you participate in the Belmont Savings Bank Employee Stock Ownership Plan (the “ESOP”), you will receive a voting instruction card for the plan that reflects all shares you may vote under the plan. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but each ESOP participant may direct the trustee how to vote the shares of common stock allocated to the participant’s account. The ESOP trustee, subject to the exercise of its fiduciary responsibilities, will vote all unallocated shares of Company common stock held by the ESOP and allocated shares for which no voting instructions are received in the same proportion as shares for which it has received timely voting instructions.The deadline for returning your voting instructions to the ESOP Trustee is May 16, 2018.

Corporate Governance and Board Matters

Directors of BSB Bancorp

BSB Bancorp has eleven directors. Directors of BSB Bancorp serve three-year staggered terms so that approximately one-third of the directors are elected at each annual meeting. The following table sets forth each director’s name, age as of December 31, 2017, the year he or she began serving as a director, including service as a director of Belmont Savings, and when his or her term expires.

| Name | Position(s) Held with BSB Bancorp, Inc. | Age | Director Since | Current Term Expires | ||||

| Robert J. Morrissey | Chairman of the Board | 78 | 1990 | 2019 | ||||

| Robert M. Mahoney | Director, President and Chief Executive Officer | 69 | 2010 | 2018 | ||||

| Hal R. Tovin | Director, Executive Vice President and Chief Operating Officer | 62 | 2010 | 2019 | ||||

| John A. Borelli | Director | 58 | 2006 | 2018 | ||||

| M. Patricia Brusch | Director | 70 | 2017 | 2020 | ||||

| S. Warren Farrell | Director | 82 | 1987 | 2020 | ||||

| Richard J. Fougere | Director | 68 | 2004 | 2019 | ||||

| John W. Gahan, III | Director | 69 | 2006 | 2018 | ||||

| John A. Greene | Director | 72 | 1990 | 2020 | ||||

| Paul E. Petry | Director | 72 | 2014 | 2020 | ||||

| John A. Whittemore | Director | 73 | 1998 | 2018 |

Additional biographical information regarding each director is provided below under “Proposal 1 — Election of Directors.”

Executive Officers of BSB Bancorp

The following table sets forth information regarding the executive officers of BSB Bancorp as of December 31, 2017. The officers of BSB Bancorp and Belmont Savings are elected annually.

Name | Age | Positions Held |

| Robert M. Mahoney | 69 | President and Chief Executive Officer of BSB Bancorp, Inc. and Belmont Savings Bank |

| John A. Citrano | 54 | Executive Vice President, Chief Financial Officer, Corporate Secretary and Treasurer of BSB Bancorp, Inc. and Executive Vice President and Chief Financial Officer of Belmont Savings Bank |

| Hal R. Tovin | 62 | Executive Vice President and Chief Operating Officer of BSB Bancorp, Inc. and Belmont Savings Bank |

| Christopher Y. Downs | 67 | Executive Vice President—Consumer Lending of Belmont Savings Bank |

| Carroll M. Lowenstein, Jr. | 58 | Executive Vice President—Commercial Real Estate Lending of Belmont Savings Bank |

Below is information regarding our executive officers who are not also directors. Except as indicated below, each executive officer has held his current position for at least the last five years.

John A. Citrano.Mr. Citrano is Executive Vice President, Chief Financial Officer, Treasurer and Corporate Secretary of BSB Bancorp, and Executive Vice President and Chief Financial Officer of Belmont Savings Bank. He is responsible for the leadership, direction and management of our accounting and finance operations. Mr. Citrano began his career with Belmont Savings Bank in 1987 as an Internal Auditor. He was named Treasurer in 1994, Senior Vice President and Chief Financial Officer in 2000 and Executive Vice President and Chief Financial Officer in 2012. He serves on many of the Bank’s internal committees. Mr. Citrano received his Bachelor of Science in Business Administration degree from Merrimack College and his Master of Business Administration degree from Bentley University. Mr. Citrano is a member of the Boston CFO Leadership Council, the Financial Managers Society and Treasurers Club of Boston. Mr. Citrano served as a volunteer for Junior Achievement, a non-profit organization that strives to inspire and prepare young people to succeed in the global economy.

Christopher Y. Downs.Mr. Downs is Executive Vice President for Consumer Lending at Belmont Savings Bank. He is responsible for all of the Bank’s consumer lending activities including Residential Mortgage, Home Equity, Indirect Auto and support functions. Prior to joining Belmont in July, 2010, Mr. Downs was Group Executive Vice President of Citizens Financial Group, Inc. (“CFG”). CFG is one of the 20 largest commercial bank holding companies in the United States ranked by assets and deposits. In addition, Mr. Downs lead the core servicing support units for all consumer real estate and installment lending products as well as Merchant Processing. He was also a member of CFG’s Executive Policy Committee, the company’s senior management team. Before joining CFG in 1994, Mr. Downs spent 12 years at Chase Manhattan Corporation. As a regional banking and consumer finance executive, Mr. Downs was responsible for the sale of all consumer loan products distributed through Chase’s five regional banking divisions. Mr. Downs graduated with a B.A. from Middlebury College in Vermont, and received his M.B.A. from the University of New Hampshire’s Whittemore School of Business and Economics. He is a recently retired member of the board of directors of Lincoln School of Providence, where he co-chaired the development committee and was a member of the finance committee. Mr. Downs also served on the Advisory Board for the International Institute of Rhode Island and has worked in the Rhode Island Mentoring Program.

Carroll M. Lowenstein, Jr. Mr. Lowenstein is Executive Vice President for Commercial Real Estate Lending at Belmont Saving Bank. He manages the Bank’s Commercial Real Estate Lending and related deposit gathering functions and provides oversight for all of the Bank’s commercial lending and portfolio management activities. Prior to joining Belmont Savings Bank in September, 2010, he held similar roles at Citizens Financial Group, Inc. (seven years) managing the Suburban Massachusetts Team of Commercial Real Estate Lenders and Portfolio Managers and Cambridgeport Bank (fifteen years) as Director of Commercial Lending. Earlier in his career, Mr. Lowenstein was the Commercial Credit Manager and Commercial Loan Operations Manager at USTrust/Essex. He is a graduate of Harvard College and is also a licensed Real Estate Broker in the Commonwealth of Massachusetts.

Board Independence

The Board of Directors has determined that each director, with the exception of director Mahoney and director Tovin, is “independent” as defined in the rules of the Nasdaq Stock Market, Inc. (“Nasdaq”). Messrs. Mahoney and Tovin are not independent because they are executive officers of BSB Bancorp.

In determining the independence of our directors, the Board of Directors considered relationships between BSB Bancorp and our directors including relationships that are not required to be reported under “Other Information Relating to Directors and Executive Officers—Transactions With Certain Related Persons,” including loan and deposit accounts that our directors maintain at Belmont Savings.

Board Leadership Structure

The positions of Chairman of the Board and President and Chief Executive Officer of the Company are held by different individuals. By maintaining the separate positions of Chairman and Chief Executive Officer, the Company believes it enhances the ability of the Board of Directors to provide strong, independent oversight of the Company’s management and affairs.

Risk Oversight

The Board of Directors has an active role, as a whole and at the committee level, in overseeing management of the Company’s risks. The Board of Directors regularly reviews information regarding the Company’s credit, cyber and information technology exposure, compliance, liquidity, interest rate exposure and operations, as well as the risks associated with each of these matters. The Company’s Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and arrangements. The Audit Committee oversees management of accounting and financial reporting risks. The Nominating Committee is responsible for establishing our corporate governance guidelines and for evaluating the independence of the Board of Directors and potential conflicts of interest. The Company and Belmont Savings Bank maintain additional committees, such as the Community Reinvestment Act (“CRA”) & Compliance Committee, which include members of the Board of Directors and management and assist the Board of Directors in the oversight of specific risks. The CRA & Compliance Committee is composed of five directors and thirteen officers who are not directors, and oversees the management of compliance risks. While each committee is responsible for evaluating certain risks, and overseeing the management of such risks, the full Board of Directors is regularly informed regarding all such risks.

Meetings and Committees of the Board of Directors

We conduct business through meetings of our Board of Directors and its Committees. During the year ended December 31, 2017, the Board of Directors of BSB Bancorp Inc. met six times, and the Board of Directors of Belmont Savings Bank met six times. Each of our directors attended at least 93% of the total number of BSB Bancorp Board meetings held and committee meetings on which such director served during 2017.

The Board of Directors of BSB Bancorp has established standing committees, including a Compensation Committee, a Nominating Committee and an Audit Committee. Each of these committees is comprised solely of independent directors as defined by Nasdaq rules and operates under a written charter that governs its composition, responsibilities and operations. The charters of these committees are available in the Corporate Information—Governance Documents portion of the Investor Relations section of the Company’s website atwww.belmontsavings.com.

The table below sets forth the directors serving on each of the listed committees of our Board of Directors at March 30, 2018, and the number of meetings held by such committee during the year ended December 31, 2017.

Name | Nominating | Compensation | Audit |

| John A. Borelli | X | ||

| M. Patricia Brusch | X | ||

| S. Warren Farrell | X | X | |

| Richard J. Fougere | X* | ||

| John W. Gahan, III | X | ||

| John A. Greene | X | ||

| Robert J. Morrissey | X* | X | |

| Paul E. Petry | X | ||

| John A. Whittemore | X | X* | |

Number of Meetings of BSB Bancorp committee in 2017 | 4 | 8 | 8 |

____________________

* Denotes Chair of each listed committee of the BSB Bancorp Board of Directors.

Audit Committee. Among other activities, the Audit Committee assists the Board of Directors in its oversight of the Company’s accounting and financial reporting practices, the quality and integrity of the Company’s financial reports and the Company’s compliance with applicable financial laws and regulations. The Audit Committee is also responsible for the Company’s internal audit function and engaging the Company’s independent registered public accounting firm and monitoring its conduct and independence. The Board of Directors has designated director Richard Fougere as an “Audit Committee Financial Expert” for the Audit Committee, as that term is defined by the rules and regulations of the SEC. The report of the Audit Committee required by the rules of the SEC is included in this proxy statement under the heading“Audit Committee Report.”

Compensation Committee. The Compensation Committee approves the compensation objectives for the Company and the Bank and recommends to the Board the compensation for the Chief Executive Officer and other executive officers and the members of the Board. The Compensation Committee reviews all compensation components including base salary, bonus, benefits, equity compensation, retirement plans and other perquisites. Decisions by the Compensation Committee with respect to the compensation of executive officers are approved by the full Board of Directors. See“Compensation Discussion and Analysis” for more information regarding the role of the Compensation Committee, management and compensation consultants in determining the amount and form of executive compensation. The report of the Compensation Committee as required by the rules of the SEC is included in this proxy statement under the heading“Compensation Committee Report.”

Nominating Committee. The Company’s Nominating Committee identifies individuals qualified to become Board members, selects nominees for election as directors and assists the Board of Directors in developing and maintaining corporate governance guidelines. The procedures of the Nominating Committee required to be disclosed by the rules of the SEC are set forth below under “Nominating Committee Procedures.”

Nominating Committee Procedures

Qualifications. The Nominating Committee has adopted a set of criteria that it considers when it selects individuals to be nominated for election to the Board of Directors. First, a candidate must meet the eligibility requirements set forth in the Company’s bylaws, which include a residency requirement, an age requirement and a requirement that the candidate not have been subject to certain criminal or regulatory actions. A candidate also must meet any qualification requirements for service on the Board of Directors set forth in any Board governing documents.

The Nominating Committee will consider the following criteria in selecting nominees for initial election or appointment to the Board: contributions to the range of talent, skill and expertise for the Board; financial, regulatory

and business experience and skills; familiarity with and participation in the local community; integrity, honesty and reputation in connection with upholding a position of trust with respect to customers; dedication to the Company and its stockholders; independence; and any other factors the Nominating Committee deems relevant, including diversity, size of the Board of Directors and regulatory disclosure obligations. We do not maintain a specific diversity policy, but the diversity of the Board is considered in our review of candidates. Diversity includes not only gender, race and ethnicity, but the various perspectives that come from having differing viewpoints, geographic and cultural backgrounds, and life experiences.

In addition, prior to nominating an existing director for re-election to the Board of Directors, the Nominating Committee will consider and review an existing director’s Board and committee attendance and performance; length of Board service; experience, skills and contributions that the existing director brings to the Board; and independence.

Director Nomination Process. The process that the Nominating Committee follows to identify and evaluate individuals to be nominated for election to the Board of Directors is as follows:

Identification. For purposes of identifying nominees for the Board of Directors, the Nominating Committee relies on personal contacts of the committee members and other members of the Board of Directors, as well as its knowledge of members of the communities served by Belmont Savings Bank. The Nominating Committee will also consider director candidates recommended by stockholders in accordance with the policy and procedures set forth below. The Nominating Committee has not previously used an independent search firm to identify nominees.

Evaluation. In evaluating potential nominees, the Nominating Committee determines whether the candidate is eligible and qualified for service on the Board of Directors by evaluating the candidate under the selection criteria, set forth above. In addition, the Nominating Committee will interview the candidate and conduct a check of the candidate’s background.

Consideration of Recommendations by Stockholders. It is the policy of the Nominating Committee of the Board of Directors of the Company to consider director candidates recommended by stockholders who appear to be qualified to serve on the Company’s Board of Directors. The Nominating Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Nominating Committee does not perceive a need to increase the size of the Board. To avoid the unnecessary use of the Nominating Committee’s resources, the Nominating Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Procedures to be Followed by Stockholders. To submit a recommendation of a director candidate to the Nominating Committee, a stockholder should submit the following information in writing, addressed to the Chairperson of the Nominating Committee, care of the Corporate Secretary, at the main office of the Company:

| 1. | The name of the person recommended as a director candidate; |

| 2. | All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934; |

| 3. | The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| 4. | As to the stockholder making the recommendation, the name and address of such stockholder as it appears on the Company’s books; provided, however, that if the stockholder is not a registered holder of the Company’s common stock, the stockholder should submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of the Company’s common stock; and |

| 5. | A statement disclosing whether such stockholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

In order for a director candidate to be considered for nomination at the Company’s annual meeting of stockholders (regardless of whether the stockholder recommending the nomination seeks to have the nominee included in the Company’s proxy statement), the recommendation must be received by the Nominating Committee at least 150 calendar days before the date the Company’s proxy statement was released to stockholders in connection with the previous year’s annual meeting, advanced by one year.

Attendance at the Annual Meeting

The Board of Directors encourages each director to attend annual meetings of stockholders. All of BSB Bancorp’s directors attended last year’s annual meeting of stockholders of BSB Bancorp.

Code of Ethics and Business Conduct

BSB Bancorp and Belmont Savings have adopted a Joint Code of Ethics and Conflict of Interest Policy (the “Code of Ethics”) that is designed to ensure that our directors, officers and other employees, including our chief executive officer, chief financial officer, chief accounting officer and controller, or persons performing similar functions, meet the highest standards of ethical conduct. The Code of Ethics is available in the Corporate Information—Governance Documents portion of the Investor Relations section of the Company’s website atwww.belmontsavings.com. Amendments to and waivers from the Code of Ethics with respect to directors and executive officers will also be disclosed on our website.

Audit Committee Report

Management is responsible for the Company’s internal controls and financial reporting process. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements and issuing two opinions, one on the conformity of those consolidated financial statements with accounting principles generally accepted in the United States of America and a second opinion addressing the Company’s internal controls over financial reporting. The Audit Committee oversees the Company’s internal controls and financial reporting process on behalf of the Board of Directors.

In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard No. 1301,“Communications with Audit Committees”, including the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of the disclosures in the consolidated financial statements.

In addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning the independent registered public accounting firm’s independence. In concluding that the registered public accounting firm is independent, the Audit Committee considered, among other factors, whether the non-audit services provided by the firm were compatible with its independence.

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for its audit. The Audit Committee met with the independent registered public accounting firm, with and without management present, to discuss the results of its examination, its evaluation of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent registered public accounting

firm that, in its report, expresses an opinion on the conformity of the Company’s consolidated financial statements with accounting principles generally accepted in the United States of America. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting practices or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management, the internal audit department and the independent registered public accounting firm do not assure that the Company’s consolidated financial statements are presented in accordance with accounting principles generally accepted in the United States of America, that the audit of the Company’s consolidated financial statements has been carried out in accordance with the standards of the Public Company Accounting Oversight Board or that the Company’s independent registered public accounting firm is in fact “independent.”

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, for filing with the Securities and Exchange Commission. The Audit Committee also has approved, subject to stockholder ratification, the selection of the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018.

Audit Committee of the Board of Directors of

BSB Bancorp, Inc.

Richard J. Fougere (Chairman)

John W. Gahan, III

John A. Greene

Paul E. Petry

Director Compensation

Director Compensation Summary

Set forth in the table below is a summary of the compensation for each of our non-employee directors for the year ended December 31, 2017. Director compensation paid to directors who are also Named Executive Officers is reflected below under “Executive Compensation—Summary Compensation Table.”

Director Compensation

| Fees Earned or Paid in Cash | Stock Awards | Option Awards | Change in Pension Value ($) | All Other Compensation | Total | |

| Name | ($)(1) | ($)(2) (3) | ($)(4) | ($) | ($) | |

| Robert J. Morrissey | 89,550 | 660,156 | — | 58,410 | — | 808,116 |

| John A. Borelli | 28,950 | 176,015 | — | — | — | 204,965 |

| M. Patricia Brusch | 15,100 | — | — | — | — | 15,100 |

| S. Warren Farrell | 72,400 | 660,156 | — | — | — | 732,556 |

| Richard J. Fougere | 35,800 | 396,094 | — | — | — | 431,894 |

| John W. Gahan, III | 42,100 | 396,094 | — | — | — | 438,194 |

| John A. Greene | 38,725 | 176,015 | — | — | — | 214,740 |

| Paul E. Petry | 25,800 | 176,015 | — | — | — | 201,815 |

| John A. Whittemore | 81,450 | 660,156 | — | — | — | 741,606 |

| (1) | See table below under “Director Fees” for a breakdown of fees earned in 2017. |

| (2) | The directors have the following number of shares of restricted stock outstanding at December 31, 2017: Mr. Morrissey, 24,360; Mr. Borelli, 6,495; Ms. Brusch, 0; Mr. Farrell, 24,360; Mr. Fougere, 14,616; Mr. Gahan III, 14,616; Mr. Greene, 6,495; Mr. Petry, 8,095; and Mr. Whittemore, 24,360. These restricted stock awards were granted under the 2017 Equity Incentive Plan (except for 1,600 unvested shares granted in 2014 under the 2012 Equity Incentive Plan to Mr. Petry). All restricted stock awards granted under the 2017 Equity Incentive Plan vest in approximately equal installments over a 10-year period commencing one year after the date of grant and only accelerate in the event of the directors’ termination of service due to death, disability or involuntary termination of service at or following a change in control. For further information on these director grants see Director Compensation—Director Plans—2017 Equity Awards. |

| (3) | Reflects the aggregate grant date fair value of restricted stock awards granted to each director on March 15, 2017, with a grant date market value of $27.10 per share. |

| (4) | The directors have the following number of stock options outstanding at December 31, 2017: Mr. Morrissey, 45,864; Mr. Borelli, 11,933; Ms. Brusch, 0; Mr. Farrell, 45,864; Mr. Fougere, 27,110; Mr. Gahan III, 24,164; Mr. Greene, 23,217; Mr. Petry, 10,000; and Mr. Whittemore, 45,864. |

Director Fees

Non-employee directors were paid an annual retainer of $10,000. In addition, non-employee directors received fees per Board and committee meetings attended in 2017. Executive Committee Members and Committee Chairs received annual retainers for holding those positions. The table below identifies the meetings, by type, for which each non-employee director received compensation during the year ended December 31, 2017. It is expected that directors will continue to receive the same retainers and fees per Board and committee meeting attended in 2018.

| Name | Annual | Board | Executive Committee | Audit Committee | Compensation Committee | Nominating Committee | Other Committee |

| Retainer(s) | Meetings | Meetings | Meetings | Meetings | Meetings | Meetings | |

| ($) | ($) | ($) | ($) | ($) | ($) | ($)(10) | |

| Robert J. Morrissey, Chairman(1) | 52,500 | 5,700 | 19,000 | — | 6,650 | 3,800 | 1,900 |

| John A. Borelli(2) | 13,750 | 5,700 | — | — | 7,600 | — | 1,900 |

| M. Patricia Brusch(3) | 7,500 | 2,850 | — | — | 2,850 | — | 1,900 |

| S. Warren Farrell(4) | 32,500 | 5,700 | 20,900 | — | 7,600 | 3,800 | 1,900 |

| Richard J. Fougere(5) | 22,500 | 5,700 | — | 7,600 | — | — | — |

| John W. Gahan, III(6) | 25,000 | 5,700 | — | 7,600 | — | — | 3,800 |

| John A. Greene(7) | 16,875 | 5,700 | — | 7,600 | 4,750 | — | 3,800 |

| Paul E. Petry(8) | 12,500 | 5,700 | — | 7,600 | — | — | — |

| John A. Whittemore(9) | 42,500 | 5,700 | 19,950 | — | 7,600 | 3,800 | 1,900 |

| (1) | Annual Retainer amount includes a $17,500 retainer as a member of the Executive Committee, a $20,000 retainer for serving as Chairman of the Board, a $2,500 retainer as a member of the Nominating Committee and a $2,500 retainer as a member of the Compensation Committee. |

| (2) | Annual Retainer amount includes a $2,500 retainer as a member of the Compensation Committee and a $1,250 retainer as a member of the CRA & Compliance Committee for the second half of the year ended December 31, 2017. |

| (3) | Ms. Brusch was appointed as a director on June 15, 2017. Annual Retainer includes both a $1,250 retainer as a member of the Compensation Committee and a $1,250 retainer as a member of the CRA & Compliance Committee for the second half of the year ended December 31, 2017. |

| (4) | Annual Retainer includes a $17,500 retainer as a member of the Executive Committee, a $2,500 retainer as a member of the Nominating Committee and a $2,500 retainer as a member of the Compensation Committee. |

| (5) | Annual Retainer includes a $10,000 retainer for chairing the Audit Committee and a $2,500 retainer as a member of the Audit Committee. |

| (6) | Annual Retainer includes a $10,000 retainer for chairing the CRA & Compliance Committee, a $2,500 retainer as a member of the Audit Committee and a $2,500 retainer as a member of the CRA & Compliance Committee. |

| (7) | Annual Retainer includes a $2,500 retainer as a member of the Audit Committee, a $2,500 retainer as a member of the CRA & Compliance Committee and a $1,875 retainer as a member of the Compensation Committee through September 30, 2017. |

| (8) | Annual Retainer includes a $2,500 retainer as a member of the Audit Committee. |

| (9) | Annual Retainer includes a $17,500 retainer as a member of the Executive Committee, a $10,000 retainer for chairing the Compensation Committee, a $2,500 retainer as a member of the Nominating Committee and a $2,500 retainer as a member of the Compensation Committee. |

| (10) | Fees payable as a result of meetings of the Fiduciary (401k) Committee, BSB Investment Corporation Committee and CRA & Compliance Committee. |

Director Plans

Deferred Compensation Plan for Members of the Board of Investment. Effective January 1, 2005, Belmont Savings Bank adopted the Deferred Compensation Plan for Members of the Bank’s then existing Board of Investment. The Bank no longer has a Board of Investment, and Mr. Morrissey is the only active participant in the plan. Upon Mr. Morrissey’s separation from service on the Board for any reason other than death, Mr. Morrissey will be entitled to an annual benefit equal to 41% of his average compensation utilizing the three highest years of compensation paid to Mr. Morrissey. The annual benefit will be paid in quarterly installments for a period equal to

Mr. Morrissey’s completed years of service as a member of the Board. In the event of Mr. Morrissey’s death, his beneficiary will receive a lump sum payment equal to the present value of the benefits that would have been paid to Mr. Morrissey under the plan if he had retired on his date of death.

Deferred Compensation Agreements. Belmont Savings Bank entered into deferred compensation agreements with Mr. Morrissey, Mr. Borelli, Mr. Farrell and Mr. Gahan. Each agreement allows for the director to elect to defer a portion of his director fees to an individual deferred compensation account established by Belmont Savings Bank. The Belmont Savings Bank Deferred Compensation Plan is administered through Fidelity Investments and permits directors to select from a number of investment options, including mutual fund investments, for the investment of their account balances. Each director is always 100% vested in his deferred compensation account balance.

2017 Equity Awards. In 2017, the Compensation Committee made grants to employees and directors under the 2017 Equity Incentive Plan, which was approved by the stockholders. The awards to directors’ vest over a 10-year time frame and are within the limits approved by the stockholders, i.e., the maximum grant to any director is 24,360 shares. Three directors, Messrs. Farrell, Morrissey and Whittemore, received this level of award due to their significant additional time commitment to the Company and Belmont Savings Bank through their service on the Executive Committee, which meets at least twice monthly. However, of this number, only 2,436 will vest for each of these three directors per year over the next 10 years of service commencing one year from the date of grant. Directors Richard J. Fougere and John W. Gahan, III, who chair the Audit Committee and the CRA & Compliance Committee, respectively, were each granted 14,616 shares of restricted stock vesting over 10 years (at the approximate rate of 1,462 shares per year), in consideration of the important roles that they play in the supervision of these important functions. The remaining directors, Messrs. Borelli, Green and Petry were granted 6,495 shares of restricted stock also vesting over a 10-year period (at the approximate rates of 650 shares per year). Ms. Brusch, who became a director in June 2017, did not receive any restricted stock awards. No director will vest in any unvested awards in the event of his or her retirement or following the failure to be re-nominated or re-elected to the Board. Acceleration of vesting will only occur in the event of the directors’ death, disability, or involuntary termination of service due to a change in control.

Stock Ownership

The following table provides information with respect to persons known by the Company to be the beneficial owners of more than 5% of the Company’s outstanding common stock. A person may be considered to own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investment power. Percentages are based upon 9,741,471 shares outstanding as of March 30, 2018.

Name and Address | Number of Shares Owned | Percent of Common |

Banc Fund VII L.P. (1) Banc Fund VIII L.P. Banc Fund IX L.P. 20 North Wacker Drive Suite 3300 Chicago, IL 60606 |

941,460 |

9.66% |

Wellington Management Group, LLP (2) Wellington Group Holdings LLP Wellington Investment Advisors Holdings LLP Wellington Management Company LLP 280 Congress Street Boston, MA 02210 |

725,752 |

7.45% |

| (1) | On a Schedule 13G/A filed on February 13, 2018, Banc Fund VII L.P. reported sole voting and dispositive power with respect to 206,964 shares of the Company’s common stock, Banc Fund VIII L.P. reported sole voting and dispositive power with respect to 461,226 shares of the Company’s common stock and Banc Fund IX L.P. reported sole voting and dispositive power with respect to 273,270 shares of the Company’s common stock. |

| (2) | On a Schedule 13G/A filed on February 8, 2018, the entities listed (“Wellington”) other than Wellington Management Company LLP (“WMC”) reported shared dispositive power with respect to 725,752 shares of the Company’s common stock and shared voting power with respect to 583,163, shares of the Company’s common stock. WMC reported shared dispositive power with respect to 671,648 shares and shared voting power with respect to 572,925 shares. Wellington also reported that the securities as to which the Schedule 13G/A was filed by Wellington, in its capacity as investment adviser, are owned of record by clients of Wellington Management. |

The following table provides information as of March 30, 2018 about the shares of Company common stock that may be considered to be beneficially owned by each director or nominee for director of the Company, by the executive officers named in the Summary Compensation Table under the heading “Executive Compensation” and by all directors, nominees for director and executive officers of the Company as a group. A person may be considered to own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investment power, as well as shares underlying options which are exercisable within 60 days of March 30, 2018. Unless otherwise indicated, none of the shares listed are pledged as security and each of the named individuals has sole voting and investment power with respect to the shares shown. Percentages are based upon 9,741,471 shares outstanding as of March 30, 2018.

| Name | Number of Shares | Percent of Common Stock Outstanding | ||

| Directors and Nominees: | ||||

| Robert J. Morrissey, Chairman | 156,845(3) | 1.60% | ||

| John A. Borelli | 37,200(4) | * | ||

| M. Patricia Brusch | — | * | ||

| S. Warren Farrell | 130,184(5) | 1.33% | ||

| Richard J. Fougere | 71,270 | * | ||

| John W. Gahan, III | 57,246 | * | ||

| John A. Greene | 39,799 | * | ||

| Robert M. Mahoney | 412,725(6) | 4.23% | ||

| Paul E. Petry | 19,495 | * | ||

| Hal R. Tovin | 160,337(7) | 1.64% | ||

| John A. Whittemore | 96,856 | * | ||

| Named Executive Officers Other Than Directors: | ||||

| John A. Citrano | 64,663(8) | * | ||

| Christopher Y. Downs | 69,350(9) | * | ||

| Carroll M. Lowenstein, Jr. | 81,604(10) | * | ||

| All Executive Officers, Directors and Nominees, as a Group (14 persons) | 1,397,574 | 14.35% |

* Represents less than 1% of the Company’s outstanding shares.

| (1) | The directors and named executive officers have the following number of shares of unvested restricted stock at March 30, 2018: Mr. Morrissey, 21,924; Mr. Borelli, 5,845; Ms. Brusch, 0; Mr. Farrell, 21,924; Mr. Fougere, 13,154; Mr. Gahan III, 13,154; Mr. Greene, 5,845; Mr. Petry, 7,445; Mr. Whittemore, 21,924; Mr. Mahoney, 87,696; Mr. Citrano, 21,924; Mr. Tovin, 30,693; Mr. Downs; 21,924 and Mr. Lowenstein, 21,924. |

| (2) | This amount reflects shares underlying options which are exercisable within 60 days of March 30, 2018. The shares underlying options which are exercisable within 60 days of March 30, 2018 are as follows; Mr. Morrissey, 45,864; Mr. Borelli, 11,933; Ms. Brusch, 0, Mr. Farrell, 45,864; Mr. Fougere, 25,610; Mr. Gahan III, 22,964; Mr. Greene 23,217; Mr. Petry, 8,000; Mr. Whittemore, 45,864; Mr. Mahoney, 25,684; Mr. Citrano, 18,346; Mr. Tovin, 11,007; Mr. Downs, 3,669; and Mr. Lowenstein, 18,346. |

| (3) | Includes 29,311 shares held by Mr. Morrissey’s spouse and 5,000 shares held in a retirement plan for Mr. Morrissey. |

| (4) | Includes 3,000 shares held by Mr. Borelli’s spouse. |

| (5) | Includes 15,000 shares held by Mr. Farrell’s spouse, 9,000 shares held in a limited liability company, and 3,900 shares held by a Trust. |

| (6) | Includes 3,212 shares held in the Belmont Savings Bank Employee Stock Ownership Plan. Also, includes 13,400 shares held in IRAs and 35,224 shares held by Mr. Mahoney’s spouse. |

| (7) | Includes 2,965 shares held in the Belmont Savings Bank Employee Stock Ownership Plan. Also, includes 3,000 shares held by a Trust, 2,040 shares held by Mr. Tovin’s Spouse and 10,000 shares held in an IRA for Mr. Tovin. |

| (8) | Includes 3,171 shares held in the Belmont Savings Bank Employee Stock Ownership Plan. |

| (9) | Includes 2,965 shares held in the Belmont Savings Bank Employee Stock Ownership Plan. |

| (10) | Includes 2,965 shares held in the Belmont Savings Bank Employee Stock Ownership Plan. |

Proposal 1 — Election of Directors

The Board of Directors is divided into three classes with three-year staggered terms, with approximately one-third of the directors elected each year. We currently have eleven directors. The Board of Directors has nominated our four directors with terms expiring in 2018, Robert M. Mahoney, John A. Borelli, John W. Gahan, III, and John A. Whittemore for election as directors at this year’s annual meeting to serve for a term of three years and until their respective successors have been elected and qualified.

It is intended that the proxies solicited by the Board of Directors will be voted for the election of the Board of Director’s nominees named above. If any nominee is unable to serve, the persons named in the proxy card will vote your shares to approve the election of any substitute proposed by the Board of Directors. Alternatively, the Board of Directors may adopt a resolution to reduce the size of the Board of Directors. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve.

The Board of Directors recommends a vote “FOR” the election of all nominees.

The business experience of each of our directors is set forth below. Information is also provided regarding the person’s experience, qualifications, attributes or skills that caused the Nominating Committee and Board of Directors to determine that the person should serve as a director. Unless otherwise indicated, directors have held their positions for the past five years.

Nominees for Election of Directors

The nominees standing for election to serve for a three-year term are:

Robert M. Mahoney. Mr. Mahoney is President and Chief Executive Officer of BSB Bancorp Inc., and Belmont Savings Bank. Prior to joining Belmont Savings Bank in May 2010, Mr. Mahoney was Executive Vice Chairman of Citizens Financial Group, Inc. (“CFG”) until retiring in 2008. He joined CFG in 1993 as President and CEO of Citizens Bank of Massachusetts after serving 22 years in various domestic and international management positions at Bank of Boston. During his five years as President of Citizens in Massachusetts, Mr. Mahoney led the new bank through significant expansion. Mr. Mahoney has held several community leadership positions in Massachusetts. He is a past chairman of the United Way Board of Directors and Executive Committee and serves on the University of Massachusetts Amherst Foundation Board. Mr. Mahoney also is Chair of the Financial Services Committee of the Finance Council of the Roman Catholic Archdiocese of Boston. Mr. Mahoney received his M.B.A. from Columbia Business School and is a graduate of the University of Massachusetts, where he earned a Bachelor of Science degree in Chemistry. He received the 1996 Distinguished Alumnus Award from the University of Massachusetts, the 2006 Columbia University, School of Business Leadership Award and is the recipient of the 2009 Henry L. Shattuck Boston City Champion Award for public service. Recently, Mr. Mahoney was selected by Boston Business Journal readers as the “most-admired CEO of a small or mid-sized company in Massachusetts.”

Mr. Mahoney’s extensive executive management experience at other financial institutions, including CFG, a subsidiary of a major publicly-traded banking organization, was instrumental in the Board of Directors’ decision to appoint him as President and Chief Executive Officer and as a member of the board of Belmont Savings Bank for its transition to public stock ownership. In particular, Mr. Mahoney’s demonstrated record in assembling an integrated management team with a record of achieving significant growth at other financial institutions was important to the

board in light of the significant growth called for in Belmont Savings Bank’s business plan following the conversion. Finally, Mr. Mahoney’s broad industry knowledge and experience, as well as his knowledge of Belmont Savings Bank’s market area, were important to the board in its decision to appoint Mr. Mahoney as President and Chief Executive Officer and as a member of the board.

John A. Borelli. Mr. Borelli is a licensed Insurance Agent & Real Estate Broker. He is President of Borelli Insurance Agency Inc., an independently owned & operated, full service, Property & Casualty Insurance Agency, with 35 years of Service to Belmont and surrounding communities. He holds the Chartered Property Casualty Underwriter (CPCU) designation and is a graduate of Boston University. He is a member of the Insurance Advisory Committee for the Town of Belmont and is also a Town Meeting Member.

Mr. Borelli’s lengthy experience as owner and operator of an insurance agency brings valuable business and leadership skills and financial acumen to the board. Further, his longtime experience as a business owner in the Belmont community provides the board with an important perspective on the development and delivery of product offerings to such business owners.

John W. Gahan, III.Mr. Gahan is a partner in the law firm of Sullivan and Worcester LLP. He is a graduate of both Yale University and Boston University Law School. For twenty-five years, Mr. Gahan was a member of the Board of Appeals in the Town of Belmont and served as the Board Chairman during most of those years. Currently, Mr. Gahan serves on the Board of Directors of the National Housing & Rehabilitation Association and both the Board of Directors and Executive Committee of Preservation Massachusetts, an advocacy organization devoted to preserving historic structures. Mr. Gahan also serves, or has served, on the boards of a number of local banks, hospitals and other social organizations, including serving as Secretary and President of Winchester Country Club. Mr. Gahan is a frequent speaker at national conferences on subjects relating to the development of residential housing communities. Mr. Gahan is Ms. Brusch’s sibling.

Mr. Gahan’s extensive legal experience assists the board in assessing legal and regulatory matters involving Belmont Savings Bank.

John A. Whittemore. Mr. Whittemore was President of Partners Financial Insurance Agency, which focuses on employee benefits, insurance and investments, since 1970. A major portion of Partners Financial was merged with National Financial Partners, a New York Stock Exchange company, in September 2012. Mr. Whittemore remained active in the company until his retirement at the end of 2015. He graduated from Colgate University in 1966, and then spent 4 years on active duty with the US Air Force followed by 7 years in the Reserves. He was honorably discharged as a Captain in 1976. His professional affiliations include the Boston Estate Planning & Business Council, the Boston Life Underwriters Association (BLUA), the National Association of Life Underwriters (NALU), the Association for Advanced Life Underwriters (AALU), and the National Association of CLU & CPCU. He has also served on the Board of both Winchester Country Club and the Kittansett Club.

Mr. Whittemore’s extensive executive management experience for an insurance agency, focusing on employee benefits, insurance and investments, has provided the board valuable insights into the development and marketing of such products for Belmont Savings Bank and developing such benefits for Belmont Savings Bank employees.

The following directors have terms ending in 2019:

Robert J. Morrissey. Mr. Morrissey, Chairman of the Board, has been a Partner in the law firm of Morrissey, Hawkins & Lynch since 1990. Prior to that time, Mr. Morrissey was a Partner with Withington, Cross, Park & Groden. He served as Belmont Town Counsel from 1974 to 2004. He is a graduate of Boston College and Harvard Law School. He serves on the Dean’s Board, Harvard Law School; the Society of Jesus, International Investment Advisory Committee, Vatican City; is Chair of the Investment and Endowment Committee of the Boston College Board of Trustees; and is Chair of the Investment Committee of the Finance Council of the Roman Catholic Archdiocese of Boston. He also serves as a director or trustee of several public and private funds, trusts and foundations.

Mr. Morrissey’s extensive legal experience assists the board in assessing legal and regulatory matters involving Belmont Savings Bank. Moreover, his longtime experience as counsel to the town of Belmont has provided the board with valuable insight into local community development and political issues.

Richard J. Fougere.Mr. Fougere is a licensed CPA practicing with O’Connor & Drew P.C. since September 1, 2012. Previously he had been president of Fougere & Associates, Incorporated since its incorporation in 1987 and until the firm merged with O’Connor & Drew P.C. He graduated Magna Cum Laude from the School of Management of Boston College in 1971 and became a licensed C.P.A. in 1974. Mr. Fougere has over 40 years of experience in business, financial, tax and retirement planning matters for both businesses and individuals. Mr. Fougere has served as a member of the advisory committee to the New England Division of the PGA. He also served as Treasurer and President of the Winchester Country Club, as Treasurer for the Winchester Chamber of Commerce, and as Chairman of the Winchester Hospital Foundation Advisory Council. In addition, he is a member of the American Institute of Certified Public Accountants and the Massachusetts Society of Certified Public Accountants.

Mr. Fougere’s significant expertise and background with regard to accounting matters, internal controls, the application of generally accepted accounting principles, and business finance provide the board with valuable insight into accounting issues faced by Belmont Savings Bank.

Hal R. Tovin. Mr. Tovin is Executive Vice President and Chief Operating Officer for BSB Bancorp Inc., and Belmont Savings Bank. He is responsible for the bank’s Retail, Small Business, Deposit Operations, and Technology activities. In addition, he leads all Marketing and Public Relations initiatives on behalf of the Bank. Prior to joining Belmont Savings in July 2010, Mr. Tovin was Group Executive Vice President and Managing Director of the Retail Partnership Delivery Group at Citizens Financial Group, Inc. (“CFG”). He was a member of CFG’s Executive Leadership Group, the company’s senior leadership team. He was the driving force behind the development of CFG’s 500 branch in-store program. Mr. Tovin is a graduate of Brown University and has an M.B.A. from the Wharton School of Business. He is an overseer at the Boston Museum of Science, former chairman of the marketing committee and a member of the executive and finance committees. He was a former chairman of the board of the Boston Ad Club.

Mr. Tovin’s extensive senior management experience in marketing, retail and business banking and operations at CFG was instrumental in his appointment to the Board of Directors of Belmont Savings Bank.

The following directors have terms ending in 2020:

S. Warren Farrell. Mr. Farrell is a private investor and Managing Partner of A. W. Farrell Associates, LLP, a real estate holding company. He retired after 26 years of service as a Managing Director for Smith Barney where he was responsible for the firm’s sales efforts in New England in institutional fixed income. Mr. Farrell is a graduate of Harvard College and has an MBA from Boston University. He is a Member of the Belmont Capital Endowment Fund, Overseer and former Trustee of the Mount Auburn Hospital, and sits on the Advisory Board of Lexington Wealth Advisors. He has been an active member of the Belmont community including Chairman of the Belmont School Committee, Town Meeting Member, Chairman of the Cable Advisory Committee, Founding Board Member of the Foundation for Belmont Education, and Founding Board Member of the Alumni and Friends of Belmont High School.

Mr. Farrell’s experience with a major brokerage firm and as a private investor has been of significant benefit to the Board of Directors in analyzing financial transactions and assessing securities investment and asset management strategies for Belmont Savings Bank. Further, his years of experience at the brokerage firm as well as his extensive community activities have provided Belmont Savings Bank with valuable business contacts and insights.

John A. Greene. Mr. Greene was co-owner of the former John J. Greene Funeral Home in Belmont for nearly four decades. A graduate of New England Institute, Mr. Greene semi-retired in 2013, and is affiliated with the Brown and Hickey Funeral Home, also in Belmont. A lifelong resident of Belmont, Mr. Greene served as a Town Meeting Member for many years. He was past Treasurer of the Rotary Club of Belmont, and former President of the Belmont Town Club. He was a member of Belmont’s Sesquicentennial Anniversary Planning Committee, lent his

expertise to the Belmont Fire Station Reuse Committee, and currently serves on the Belmont Fire Station Building Committee. Mr. Greene was active in the Belmont Boosters Club for more than 20 years and chaired their annual golf tournament to raise funds for Belmont High School Athletics. While his children were active in town sports, Mr. Greene coached numerous teams, including soccer, basketball and baseball.

Mr. Greene’s years of experience as co-owner and operator of a small business in the Belmont community brings valuable business skills and insights to the Board of Directors. Moreover, his community contacts through his business operations and through his community service have been beneficial to Belmont Savings Bank’s business development activities.

Paul E. Petry.Mr. Petry is retired from the Boston Mutual Life Insurance Company where he served as President from 1996 to 2011, Chief Executive Officer from 2001 to 2014, and Chairman of the Board from 2001 to April 2016. Mr. Petry graduated from Holy Cross in 1968. He served for 3 years in the United States Coast Guard as an officer including a tour in Vietnam where he was awarded the Navy Commendation Medal. Mr. Petry is a Fellow of the Society of Actuaries and a Chartered Life Underwriter. He has completed the Advanced Management Program (1988) at the Harvard Business School. Mr. Petry's extensive executive management experience in the financial services industry provides valuable business and leadership skills to the Board of Directors.

M. Patricia Brusch. Ms. Brusch has served as a professional nurse, and holds a Bachelor of Science in Nursing from Georgetown University. She is a Town of Belmont Town Meeting Member, a Member and former Chair of the Town of Belmont Capital Budget Committee and Chair of the Town of Belmont Permanent Building Committee. She is also a member or former member of many other Massachusetts, Belmont town and community boards and organizations, including the building committee in Belmont. She has served as Treasurer of the Belmont Savings Bank Foundation since 2011.

Ms. Brusch's extensive experience with the local government and building community provides the Board with a comprehensive understanding of developments in the Belmont community. Ms. Brusch is Mr. Gahan’s sibling.

Proposal 2 — Ratification of Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has appointed Baker Newman & Noyes, LLC (“BNN”) to be the Company’s independent registered public accounting firm for the 2018 fiscal year, subject to ratification by stockholders. A representative of BNN is expected to be present at the annual meeting to respond to appropriate questions from stockholders and will have the opportunity to make a statement should he or she desire to do so.

If the ratification of the appointment of BNN is not approved by a majority of the votes cast by stockholders at the annual meeting, other independent registered public accounting firms may be considered by the Audit Committee of the Board of Directors.

The Board of Directors recommends that stockholders vote “FOR” the ratification of the appointment of Baker Newman & Noyes, LLC as the Company’s independent registered public accounting firm.

Audit Fees

The following table sets forth the fees billed to the Company for the fiscal years ending December 31, 2017 and December 31, 2016 by Baker Newman & Noyes, LLC.

| 2017 | 2016 | |||||||

| Audit Fees | $ | 201,000 | $ | 199,000 | ||||

| Audit-Related Fees(1) | 30,845 | 10,647 | ||||||

| Tax Fees(2) | 30,500 | 24,200 | ||||||

| All Other Fees(3) | — | 2,250 | ||||||

| (1) | Audit-Related Fees represent the fees associated with the audit of the Belmont Savings Bank 401(k) Plan, Belmont Savings Bank ESOP, review of the Form S-8 and discussions and research on various matters. |

| (2) | Tax fees consist of fees billed for professional services related to the preparation of U.S. federal and state income tax returns as well as tax compliance and tax planning services. |

| (3) | All other fees consist of fees billed for professional services related to the review of the 2017 Equity Incentive Plan information included in the proxy statement filed on January 3, 2017. |

Pre-Approval of Services by the Independent Registered Public Accounting Firm

The Audit Committee is responsible for appointing, setting compensation and overseeing the work of the independent registered public accounting firm. In accordance with its charter, the Audit Committee approves, in advance, all audit and permissible non-audit services to be performed by the independent registered public accounting firm. Such approval process ensures that the independent registered public accounting firm does not provide any non-audit services to the Company that are prohibited by law or regulation.

In addition, the Audit Committee has established a policy regarding pre-approval of all audit and permissible non-audit services provided by the independent registered public accounting firm. Requests for services by the independent registered public accounting firm for compliance with the auditor services policy must be specific as to the particular services to be provided. The request may be made with respect to either specific services or a type of service for predictable or recurring services. During the year ended December 31, 2017, all services were approved, in advance, by the Audit Committee in compliance with these procedures.

Proposal 3 — Advisory Vote On Executive Compensation

The compensation of our Named Executive Officers listed in the Summary Compensation Table under the heading “Executive Compensation”, is described below under the headings “Compensation Discussion and Analysis” and “Executive Compensation.” Shareholders are urged to read these sections of this proxy statement.

In accordance with Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”), shareholders will be asked at the 2018 Annual Meeting to provide their support with respect to the compensation of our Named Executive Officers by voting on the following advisory, non-binding resolution:

RESOLVED, that the compensation paid to the Company’s Named Executive Officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is herebyAPPROVED.

This advisory vote, commonly referred to as a “say-on-pay” advisory vote, is non-binding on the Board of Directors. Although non-binding, the Board of Directors and the Compensation Committee value constructive dialogue on executive compensation and other important governance topics with our shareholders and encourages all shareholders to vote their shares on this matter. The Board of Directors and the Compensation Committee will review the results of the vote and take them into consideration when making future decisions regarding our executive compensation programs.

Unless otherwise instructed, validly executed proxies will be voted “FOR” this resolution.

The Board of Directors unanimously recommends that you vote “FOR” the resolution set forth in Proposal 3.

Compensation Discussion and Analysis

Our Strategic Accomplishments

We continued to make strong progress in 2017 in executing our strategic plan to grow your bank in a prudent and profitable manner. Our 2017 highlights include the following:

2017 Balance Sheet Growth Results. As a result of our continued strong organic growth, Belmont Savings Bank is a larger, more profitable company. As of December 31, 2017, total assets were $2.7 billion and total loans were $2.3 billion, which represented growth of $517.9 million and $430.9 million, respectively, over December 31, 2016. We increased total assets and total loans by 24.0% and 23.1%, respectively, through organic growth. Total deposits were $1.8 billion, compared to $1.5 billion a year ago representing a 19.2% increase.

Rising Profitability. For the year ended December 31, 2017, net income was $14.4 million, or $1.55 per diluted share, compared to net income of $12.0 million, or $1.33 per diluted share for the same period in 2016. This represented a 20.1% increase in net income year over year. Also, important to note is that our 2017 results include a $2.6 million charge to earnings related to remeasuring our deferred tax assets as a result of the Tax Cuts and Jobs Act. Excluding the impact of that one-time adjustment, net income would have been $17.0 million or 42% over 2016.

Improving Operating Efficiency. The Company’s efficiency ratio was 51.4% for the year ended December 31, 2017, compared to 56.5% for the year ended December 31, 2016. Our efficiency ratio of 48.3% for the quarter ended December 31, 2017 represented the lowest efficiency ratio that we have reported since our initial public offering in 2011.

Strong Asset Quality. Our continued focus on prudently growing the balance sheet with high quality assets has paid off. The ratio of non-performing assets to total assets was 0.05% at December 31, 2017. In addition, charge offs amounted to only $35,000 for the year ended December 31, 2017.

Effective Capital Management. We continue to operate with capital in excess of the amounts required to be well capitalized under the regulatory guidelines.

Stock Performance. As we have shown in our Annual Report, over the five-year period ending on December 31, 2017, our stock has outperformed both the Russell 2000 and the SNL Thrift NASDAQ index.