UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-35710

Nuveen Long/Short Commodity

Total Return Fund

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 45-2470177 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| |

333 West Wacker Drive

Chicago Illinois | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

(877) 827-5920

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Units of Beneficial Interest | | NYSE MKT |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated file, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | |

| Large accelerated filer | | ¨ | | | | Accelerated filer | | x |

| | | | |

| Non-accelerated filer | | ¨ | | (Do not check if smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of March 13, 2014, the registrant had 17,755,840 shares outstanding.

As of June 30, 2013, the aggregate market value of the shares held by non-affiliates was approximately $373,367,235.

NUVEEN LONG/SHORT COMMODITY TOTAL RETURN FUND

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

TABLE OF CONTENTS

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This annual report on Form 10-K (the “Annual Report”) includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. These forward-looking statements are based on current expectations, estimates and projections and are subject to a number of risks, uncertainties and other factors, both known (such as those described in “Risk Factors” and elsewhere in this Annual Report) and unknown, that could cause the actual results, performance, prospects or opportunities of the registrant to differ materially from those expressed in, or implied by, these forward-looking statements.

You should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws or otherwise, the registrant undertakes no obligation to publicly update or revise any forward-looking statements or the risks, uncertainties or other factors described in this Annual Report, as a result of new information, future events or changed circumstances or for any other reason after the date of this Annual Report.

1

PART I

Item 1. Business

Organization

The Nuveen Long/Short Commodity Total Return Fund (the “Fund”) was organized as a Delaware statutory trust on May 25, 2011, to operate as a commodity pool and commenced operations on October 25, 2012, with the public offering of 18,800,000 shares. The Fund’s shares represent units of fractional undivided beneficial interest in, and ownership of, the Fund. Fund shares trade on the NYSE MKT (formerly known as NYSE Amex) under the ticker symbol “CTF”. The Fund operates pursuant to an Amended and Restated Trust Agreement (the “Trust Agreement”). The Fund is not a mutual fund, a closed-end fund, or any other type of “investment company” within the meaning of the Investment Company Act of 1940, as amended (the “1940 Act”), and is not subject to regulation thereunder.

Prior to its initial public offering, the Fund had no operations other than those related to organizational matters and the recording of organization expenses ($452,000) and their reimbursement by Nuveen Securities, LLC (“Nuveen”), a wholly-owned subsidiary of Nuveen Investments, Inc. (“Nuveen Investments”). On August 31, 2011, the Fund received a $20,055 initial capital contribution from, and issued 840 shares to, Nuveen Commodities Asset Management, LLC, the Fund’s manager (“NCAM” or the “Manager”). NCAM, awholly-owned subsidiary of Nuveen Investments, is a Delaware limited liability company registered as a commodity pool operator (“CPO”) with the Commodity Futures Trading Commission (the “CFTC”) and is a member of the National Futures Association (“NFA”). The Manager has the power and authority, without shareholder approval, to cause the Fund to issue shares from time to time as it deems necessary or desirable. The number of shares authorized is unlimited.

The Manager has selected its affiliate, Gresham Investment Management LLC (“Gresham LLC”), acting through its Near Term Active division (“Gresham NTA”), as the Fund’s commodity sub-advisor, which is referred to in this Annual Report in that capacity as “Gresham” or the “Commodity Sub-advisor.” Gresham LLC is a Delaware limited liability company, the successor to Gresham Investment Management, Inc., formed in July 1992. Gresham LLC is registered with the CFTC as a commodity trading advisor (“CTA”) and a CPO, is a member of the NFA and is registered with the Securities Exchange Commission (“SEC”) as an investment adviser.

The Manager has selected its affiliate, Nuveen Asset Management, LLC (“Nuveen Asset Management” or the “Collateral Sub-advisor”), to manage the Fund’s collateral invested in cash equivalents, U.S. government securities and other short-term, high grade debt securities. Nuveen Asset Management is a Delaware limited liability company and is registered with the SEC as an investment adviser.

Investment Objective and Investment Strategy

The Fund’s investment objective is to generate attractive total returns. The Fund is actively managed and seeks to outperform its benchmark, the Morningstar® Long/Short Commodity IndexSM (the “Index”). In pursuing its investment objective, the Fund invests directly in a diverse portfolio of exchange-traded commodity futures contracts that represent the main commodity sectors and are among the most actively traded futures contracts in the global commodity markets. The Fund’s investment strategy has three principal elements:

| | • | | An actively managed long/short portfolio of exchange-traded commodity futures contracts; |

| | • | | A portfolio of exchange-traded commodity option contracts; and |

| | • | | A collateral portfolio of cash equivalents, U.S. government securities and other short-term, high grade debt securities. |

2

During temporary defensive periods or during adverse market circumstances, the Fund may deviate from its investment objective and policies.

Long/Short Commodity Investment Program. The Fund’s long/short commodity investment program is an actively managed, fully collateralized, rules-based commodity investment strategy that seeks to capitalize on opportunities in both up and down commodity markets. “Fully collateralized” means that the Fund will maintain as collateral cash equivalents, U.S. government securities and other short-term, high grade debt securities in an aggregate amount corresponding to the full notional value of its commodity investments. “Long/short” means that the Fund’s commodity futures contracts may be invested on both a long basis, seeking to profit from potential increases in commodity prices, and a short basis, seeking to profit from declines in commodity prices. “Rules-based” means that the Fund will manage its commodity investments consistent with program rules which specify minimum liquidity requirements for commodity futures contract investing and other parameters such as eligible commodity futures contracts, contract term, commodity weightings and annual and interim rebalancing of individual commodities and the long/short portfolio.

The Fund makes investments in the most actively traded commodity futures contracts in the four main commodity sectors in the global commodities markets:

Generally, the program rules are used to determine the specific commodity futures contracts in which the Fund will invest, the relative weighting for each commodity and whether a position is either long or short (or flat in the case of energy futures contracts).

The commodity markets are dynamic and as such the long/short commodity investment program may require frequent adjustments in the Fund’s commodity positions. The Commodity Sub-advisor expects to trade each position no less frequently than once per month. The relative balance of the Fund’s long/short commodity investments may vary significantly over time, and at certain times, the Fund’s aggregate exposure may be all long, all short and flat, or may consist of various combinations (long, short, and/or flat) thereof. Gresham will manage its overall strategy so that the notional amount of the Fund’s combined long, short and flat futures positions will not exceed 100% of the Fund’s net assets.

The Fund will not short energy futures contracts and will instead hold a flat position, because the prices of energy futures contracts are generally more sensitive to geopolitical events than to economic factors and, as a result, significant price variations are often driven by factors other than supply-demand imbalances. References to a flat position mean that instead of shorting an energy futures contract when market signals dictate, the Fund will not have a futures contract position for that energy commodity, and will instead move that position to cash. In that circumstance, the sum of the notional value of the portfolio’s futures contracts will be less than the sum of the collateral assets.

The specific commodities and the total number of futures contracts in which the Fund will invest, and the relative weighting of those contracts, will be determined annually by the Commodity Sub-advisor based upon the composition of the Index at that time. The selected commodity futures contracts are expected to remain unchanged until the next annual reconstitution each December. Upon annual reconstitution, the target weight of any individual commodity futures contract will be set and will be limited to 10% of the Fund’s net assets to provide for diversification. The Commodity Sub-advisor expects the actual portfolio weights to vary during the year due to market movements. If price movements cause an individual commodity contract to represent more than 10% of the Index at any time between monthly rebalancing, the Fund would seek to match the target

3

weighting at the time of the monthly rebalancing. Generally, the Fund expects to invest in short-term commodity futures contracts with terms of one to three months, but may invest in commodity futures contracts with terms of up to six months.

Integrated Options Strategy. The Fund employs a commodity option writing strategy that seeks to produce option premiums for the purpose of enhancing the Fund’s risk-adjusted total return over time. Option premiums generated by this strategy may also enable the Fund to more efficiently implement its distribution policy. There can be no assurance that the Fund’s options strategy will be successful.

A call option gives its owner (buyer) the right but not the obligation to buy the underlying futures contract at a particular price, known as the strike price, at any time between the purchase date and the expiration date of the option. The person who sells the call option to the buyer is thus required to fulfill the contractual obligation (by selling the underlying futures contract to the buyer at the strike price) should the call option be exercised. A put option gives its owner (buyer) the right but not the obligation to sell the underlying futures contract at the strike price, at anytime between the purchase date and the expiration date of the option. The person who sells the put option to the buyer is thus required to fulfill the contractual obligation (by buying the underlying futures contract from the seller at the strike price) should the put option be exercised.

Pursuant to the options strategy, the Fund may sell exchange-traded commodity call or put options on a continual basis on up to approximately 25% of the notional value of each of its commodity futures contracts that, in Gresham’s determination, have sufficient option trading volume and liquidity. If Gresham buys the commodity futures contract, they will sell a call option on the same underlying commodity futures contract. If Gresham shorts the commodity futures contract, they will sell a put option on the same underlying commodity futures contract (except in the case of energy futures contracts). Gresham may exercise discretion with respect to commodity futures contract selection. Due to trading and liquidity considerations, Gresham may determine that it is in the best interest of Fund shareholders to sell options on like commodities (for example, gas oil and heating oil are like commodities) and not matched commodity futures contracts.

Generally, the Fund expects to sell short-term commodity options with terms of one to three months. Subject to the foregoing limitations, the implementation of the options strategy will be within Gresham’s discretion. Over extended periods of time, the “moneyness” of the commodity options may vary significantly. Upon sale, the commodity options may be “in-the-money,” “at-the-money” or “out-of-the-money.” A call option is said to be “in-the-money” if the exercise price is below current market levels, “out-of-the-money” if the exercise price is above current market levels and “at-the-money” if the exercise price is at current market levels. Conversely, a put option is said to be “in-the-money” if the exercise price is above the current market levels and “out-of-the-money” if the exercise price is below current market levels. The Fund sells commodity options that are U.S. exchange-traded and that are typically “American-Style” (exerciseable at any time prior to expiration). The Fund also may sell commodity options that are non-U.S. exchange traded and that are typically “European-style” (exerciseable only at the time of expiration). The Fund’s risk-adjusted return over any particular period may be positive or negative.

When initiating new trades, the Fund expects to sell covered in-the-money options and will not sell uncovered options. Because the Fund will maintain options positions until expiration, the Fund may have uncovered out-of-the-money options in its portfolio depending on price movements of the underlying futures contracts. In certain circumstances, the Fund may hold out-of-the-money option positions that due to subsequent trades by the Fund become uncovered. An out-of-the-money option is worthless and there is no expectation that it will be exercised. As long as the option remains out-of-the-money, there is no additional exposure for the Fund. For example, if the Fund is long wheat futures and sells covered call options on wheat futures, subsequent price movements (i.e., price declines) in wheat futures may result in Gresham, on behalf of the Fund, reversing from a long wheat futures contract position to a short wheat futures contract position. In this example, Gresham would then sell the long wheat futures contracts and continue to hold what would then be an out-of-the-money call option. At the same time, to effect its short position Gresham would short wheat futures contracts and sell covered put options

4

on wheat futures. Due to market impact and other trading considerations, the Fund will hold the out-of-the-money call option instead of incurring additional trading costs to exit the position. The Fund will rebalance its positions no less often than monthly and as a result it is anticipated that no out-of-the-money option position would be uncovered for longer than one month. This element of the Fund’s options strategy increases the Fund’s gap risk, which is the risk that a commodity price will change from one level to another with no trading in between. In the event of an extreme market change or gap move in the price of a single commodity, the Fund’s options strategy may result in increased exposure to that commodity from any uncovered options. Continuing the wheat example above, if a gap move causes the out-of-the-money call option position to become in-the-money, the Fund may temporarily have exposure on the wheat call option position but no corresponding long position in the underlying wheat futures contracts. In response to such a gap move, Gresham would attempt to quickly move to implement appropriate offsetting trades consistent with its unleveraged commodity investment strategy. Gap risk could adversely affect the Fund’s performance and may negatively impact the trading price of the Fund’s shares. See “Item 1A. Risk Factors—Options Strategy Risks.”

If the Commodity Sub-advisor determines the Fund should have long exposure to an individual commodity futures contract, it will invest long in the commodity futures contract and sell a call option on the same underlying commodity futures contract with the same strike price and expiration date. In up markets where commodity prices increase, the portion of the Fund on which call options have been sold will forego potential appreciation in the value of the underlying contracts to the extent the price of those contracts exceeds the exercise price of call options sold plus the premium collected by selling the options. In flat or sideways markets, the portion of the Fund on which call options have been sold will generate current gains from the call option premiums collected by selling the options. In down markets where commodity prices decrease, the call options sold by the Fund will expire worthless. Regardless of the price performance of the long commodity futures position, the Fund will retain the net call option premiums received by the Fund.

If the Commodity Sub-advisor determines the Fund should have short exposure to an individual commodity futures contract, it will short the commodity futures contract and sell a put option on the same underlying commodity futures contract with the same strike price and expiration date. In down markets where commodity prices decrease, the portion of the Fund on which put options have been sold will forego potential appreciation in the value of the underlying futures contracts to the extent that the price of those contracts exceeds the exercise price of put options sold plus the premium collected by selling the options. In flat or sideways markets, the portion of the Fund on which put options have been sold will generate current gains from the put option premiums collected by selling the options. In up markets where commodity prices increase, the put options sold by the Fund will expire worthless. Regardless of the price performance of the short commodity futures position, the Fund will retain the net put option premiums received by the Fund.

Collateral Portfolio. The Fund’s commodity investments generally do not require significant outlays of principal. Currently, in the normal course of business, approximately 15% of the Fund’s net assets are committed as “initial” and “variation” margin to secure the Fund’s futures contracts. These assets are placed in one or more commodity futures accounts maintained by the Fund at Barclays Capital Inc. (“BCI”), the Fund’s clearing broker, and are invested by BCI in high-quality instruments permitted under CFTC regulations. The remaining collateral (approximately 85% of the Fund’s net assets) is held in a separate collateral investment account managed by the Collateral Sub-advisor.

The Fund’s assets held in this separate collateral account are invested in cash equivalents, U.S. government securities and other short-term, high grade debt securities with final terms not exceeding one year at the time of investment. These collateral investments (other than U.S. government securities) shall be rated at all times at the applicable highest short-term or long-term debt or deposit rating or money market fund rating as determined by at least one nationally recognized statistical rating organization (“NRSRO”) or, if unrated, judged by the Collateral Sub-advisor to be of comparable quality. These collateral investments consist primarily of direct and guaranteed obligations of the U.S. government and senior obligations of U.S. government agencies and may also

5

include, among others, money market funds and bank money market accounts invested in U.S. government securities as well as repurchase agreements collateralized with U.S. government securities.

While the principal investment objective for the separate collateral account is the preservation of capital, the assets in the collateral account also provide the potential for returns that may supplement the returns from the Fund’s commodity investments. The assets in the separate collateral account may only be used for the purposes of making distributions to shareholders, payment of operating expenses and to replenish the Fund’s margin account, if necessary (and if there are excess funds in the margin account, those will be transferred to the separate collateral account). No parties other than the Fund have any access to, rights to, or ability to control the assets in the collateral account, and those assets will not be pledged. The Fund may not pledge any of its assets except to collateralize its investments in accordance with its investment objectives (i.e., for margin purposes), and only the assets maintained by the Fund with BCI will be used for this purpose. Any declines in the value of the assets held in the Fund’s collateral account would negatively affect the net asset value of the Fund’s shares.

Management of the Fund

Trustee

Wilmington Trust Company (the “Delaware Trustee”), a Delaware trust company, is the resident Delaware trustee of the Fund. The Delaware Trustee is unaffiliated with the Manager. The Delaware Trustee’s duties with respect to the Fund’s management are limited to its express obligations under the Trust Agreement. In particular, the Delaware Trustee will accept service of legal process on the Fund in the State of Delaware and will make certain filings as required under the Delaware Statutory Trust Act, as amended (the “Delaware Statutory Trust Act”). The rights and duties of the Delaware Trustee, the Independent Committee (as defined below), the Manager and the shareholders are governed by the provisions of the Delaware Statutory Trust Act and by the Trust Agreement. Except for the limited duties described herein and in the Trust Agreement that are exercised by the Delaware Trustee and the Independent Committee, all duties and responsibilities to manage the business and affairs of the Fund are vested in the Manager, pursuant to the Trust Agreement and Delaware Statutory Trust Act.

Independent Committee

The Manager has established the independent committee, comprised of four members who are unaffiliated with the Manager (the “Independent Committee”), which fulfills the audit committee and nominating committee functions for the Fund, as well as any other functions required under the NYSE MKT listing standards or as set forth in the Trust Agreement. Each member of the Independent Committee receives an annual fee of $30,000, and each member of the Independent Committee also receives (a) a fee of $1,250 per meeting per fund for attendance in person or by telephone at a regularly scheduled quarterly meeting of the Independent Committee; and (b) a fee of $1,500 per meeting for attendance in person or by telephone at any special, non-regularly scheduled meeting of the Independent Committee. In addition to the payments described above, the Independent Committee chair receives an additional annual fee of $6,000. The Independent Committee members will also be compensated for out-of-pocket costs in connection with attending Independent Committee meetings. The fees of the Independent Committee members are paid by NCAM, which will be reimbursed for such fees on a pro rata basis by each fund managed by NCAM. NCAM currently manages two funds, the Fund and the Nuveen Diversified Commodity Fund (“CFD”).

The Independent Committee does not have any duties (including fiduciary duties) or responsibilities to manage the Fund, all of which the Trust Agreement vests in the Manager, except those functions required under the listing standards of the NYSE MKT. Consequently, the Independent Committee does not have the wide-ranging duties and powers similar to a board of directors of an investment company. The Trust Agreement provides that the members of the Independent Committee will be indemnified by the Fund against liabilities arising out of the performance of their duties pursuant to the Trust Agreement, except to the extent that any such liabilities result

6

from actual fraud or willful misconduct by such member of the Independent Committee. The Fund also provides Directors’ and Officers’ Insurance coverage to the members of the Independent Committee. The Independent Committee has the authority to remove any member of the Independent Committee who either ceases to be an “independent director” pursuant to the NYSE MKT listing standards or is subject to statutory disqualification under Sections 8a(2) or 8a(3) of the Commodities Exchange Act (“CEA”). The Independent Committee may appoint new members of the Independent Committee in the event of any vacancy caused by death, resignation or removal.

Manager

NCAM is the manager of the Fund, and is responsible for determining the Fund’s overall investment strategy and its implementation, including:

| | • | | the selection and ongoing monitoring of: |

| | • | | the Commodity Sub-advisor, which invests the Fund’s assets in commodity futures contracts and options on commodity futures contracts; and |

| | • | | the Collateral Sub-advisor, which invests the Fund’s collateral in cash equivalents, U.S. government securities and other short-term, high grade debt securities; |

| | • | | assessment of performance and potential needs to modify strategy or change sub-advisors; |

| | • | | the determination of the Fund’s administrative policies; |

| | • | | the management of the Fund’s business affairs; and |

| | • | | the provision of certain clerical, bookkeeping and other administrative services for the Fund. |

The Manager is registered with the CFTC as a CPO (effective date of registration January 4, 2006) and is a member of the NFA. The Manager was previously registered as a CTA, but withdrew its CTA registration effective as of March 5, 2013. Except to the extent carried out by the Independent Committee, the Manager has complete responsibility to ensure that the Fund complies with all obligations under the CEA. The Manager, Commodity Sub-advisor and Collateral Sub-advisor act in a similar capacity for CFD, a commodity pool traded on the NYSE MKT. Neither the Fund nor the Manager has established formal procedures to resolve potential conflicts of interest related to managing the investments and operations of the Fund.

The Manager may change, or temporarily deviate from, the Fund’s investment strategy and the manner in which the strategy is implemented if the Manager determines that it is in the best interests of Fund shareholders to do so based on existing market conditions or otherwise. For instance, the Manager could change or deviate from the Fund’s investment strategy or the manner in which it is implemented if, among other things, the Manager determined to replace Gresham (in which case the Fund would no longer employ the long/short commodity investment program because the long/short commodity investment program is proprietary to Gresham), or if the commodity option markets experienced a lack of volatility or liquidity so that it was no longer in the best interest of the Fund and its shareholders for the Fund to employ the options strategy, or if other unforeseen circumstances arose that necessitated a change in the Fund’s strategy or its implementation. In addition, the Manager has the rights and obligations with respect to the Fund as described under the Trust Agreement. As permitted under Delaware law, the Trust Agreement provides that the Manager does not owe any duties (including fiduciary duties) to the Fund, other than the implied contractual covenant of good faith and fair dealing.

The Manager is a wholly-owned subsidiary of Nuveen Investments, a Delaware corporation. Founded in 1898, Nuveen Investments and its affiliates had approximately $220.5 billion of assets under management as of December 31, 2013. Nuveen Investments is a listed principal of the Manager.

7

Commodity Sub-advisor

The Manager has selected Gresham to manage the Fund’s commodity futures investment strategy and options strategy. Gresham LLC is a Delaware limited liability company, the successor to Gresham Investment Management, Inc., formed in July 1992. Gresham LLC is registered with the CFTC as a CTA (effective date of registration August 17, 1994) and as a CPO (effective date of registration August 17, 1994) and is a member of the NFA. Gresham LLC also is registered with the SEC as an investment adviser since April 2005. As of December 31, 2013, Gresham LLC had approximately $14.7 billion of client assets under management, including approximately $6.7 billion under management by Gresham NTA and approximately $8.0 billion under management by Gresham LLC’s other division, the Term Structure Monetization division (“Gresham TSM”). Gresham LLC’s senior management team has extensive experience in overall supervision of commodities portfolio management and trading operations. Gresham LLC’s sole business activity is to render commodity investment advisory services and manage assets on behalf of its clients and in doing so it administers several commodity investment programs.

Gresham LLC offers investment management services through two independent divisions, Gresham NTA and Gresham TSM. Gresham NTA and Gresham TSM operate independently of each other under the independent account controller exemption under CFTC Regulation 150.3(a). Each division implements independent trading decisions and positions, and is restricted from having access to, or knowledge of, the other division’s trading decisions and positions, and is physically and technologically separated from the other division. See “Item 1A. Risk Factors—Commodity Investment Strategy Risks” for further discussion.

On December 31, 2011, Nuveen Investments completed its acquisition of a 60% stake in Gresham LLC. As part of the acquisition, Gresham LLC’s management and investment teams maintained a significant minority ownership stake in the firm, and will operate independently while leveraging the strengths of certain shared resources of Nuveen Investments.

Collateral Sub-advisor

The Manager has selected Nuveen Asset Management to invest the Fund’s collateral (excluding the initial and variation margin maintained at BCI) in short-term, high grade debt securities. Nuveen Asset Management, a registered investment adviser, is a subsidiary of Nuveen Investments. As of December 31, 2013, Nuveen Asset Management had approximately $117.0 billion of assets under management. The Fund’s collateral is invested in cash equivalents, U.S. government securities and other short-term, high grade debt securities, including corporate obligations. Such securities are common investments for Nuveen Asset Management in several of its investment strategies.

Management Fees

For the services and facilities provided by the Manager, the Fund pays the Manager an annual fee based on the Fund’s average daily net assets, payable on a monthly basis, according to the following schedule:

| | | | |

Average Daily Net Assets | | Management Fee | |

For the first $500 million | | | 1.250 | % |

For the next $500 million | | | 1.225 | |

For the next $500 million | | | 1.200 | |

For the next $500 million | | | 1.175 | |

For net assets over $2 billion | | | 1.150 | |

8

Pursuant to an agreement among the Manager, the Fund, and the Commodity Sub-advisor, the Commodity Sub-advisor receives from the Manager an annual fee based on the Fund’s average daily net assets, payable on a monthly basis, according to the following schedule:

| | | | |

Average Daily Net Assets | | Management Fee | |

For the first $250 million | | | .500 | % |

For the next $250 million | | | .475 | |

For the next $250 million | | | .450 | |

For the next $250 million | | | .425 | |

For net assets over $1 billion | | | .400 | |

Pursuant to an agreement among the Manager, the Fund, and the Collateral Sub-advisor, the Collateral Sub-advisor receives from the Manager an annual fee based on the Fund’s average daily net assets, payable on a monthly basis, according to the following schedule:

| | | | |

Average Daily Net Assets | | Management Fee | |

For the first $250 million | | | .150 | % |

For the next $250 million | | | .140 | |

For the next $250 million | | | .130 | |

For the next $250 million | | | .120 | |

For net assets over $1 billion | | | .110 | |

“Average daily net assets” means the total assets of the Fund, minus the sum of its total liabilities.

The fees of the Commodity Sub-advisor and Collateral Sub-advisor (collectively, the “Sub-advisors”) are paid by the Manager out of the fees the Manager receives from the Fund, and the Fund does not reimburse the Manager for those fees.

In addition to the fee of the Manager, the Fund pays all other costs and expenses of its operations, including, but not limited to, custody fees, transfer agent expenses, legal fees, expenses of independent auditors, expenses of preparing, printing and distributing shareholder reports, notices, proxy statements and reports to governmental agencies, and taxes, if any.

The agreements with each of the Sub-advisors may be terminated at any time, without penalty, by either the Manager or a Sub-advisor upon 120 days written notice. Also, the agreement with the Commodity

Sub-advisor can be terminated by the Commodity Sub-advisor in certain circumstances on 90 days notice. Each of the agreements provides that each of the Sub-advisors will not be liable to the Fund in connection with the performance of its duties, and the Fund will indemnify the Sub-advisor for losses and costs arising out of its status as a Sub-advisor to the Fund if the Sub-advisor acted in good faith and in a manner it reasonably believed to be in, or not opposed to, the best interests of the Fund, except, in each case, for a loss resulting from theSub-advisor’s willful misfeasance, bad faith or gross negligence or reckless disregard of its duties and obligations under the agreement. The Sub-advisors will indemnify the Fund and the Manager for losses and costs attributable to such willful misfeasance, bad faith, gross negligence or reckless disregard.

If the Manager determines it is in the best interests of shareholders to select additional CTAs or replace a sub-advisor, the Manager will consider certain information with respect to each new CTA, including the following:

| | • | | general information, including the identity of its affiliates and key personnel; |

| | • | | investment strategy and risk management of the CTA; |

| | • | | the CTA’s financial condition; |

| | • | | relevant performance history and the quality of services provided; |

9

| | • | | capacity to take on new business. |

None of the foregoing agreements, or any extensions or replacements of such agreements, are subject to the approval of the Independent Committee or the Fund’s shareholders. As a result, the Manager may amend, extend or replace any such agreement in its sole discretion, and therefore may increase the fees of the Manager and either sub-advisor without any approval by the Independent Committee or the Fund’s shareholders.

Employees

The Fund has no employees.

Available Information

The Fund files with or submits to the SEC annual and quarterly reports and other information meeting the information requirements pursuant to Section 13(a) and 15(d) of the Exchange Act. These reports are available on the Fund’s website athttp://www.nuveen.com/CommodityInvestments. Investors may also inspect and copy any materials the Fund files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Investors may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a website (http://www.sec.gov) which contains reports, proxy statements and other information filed electronically with the SEC. The Fund also posts on its website an information statement and certain daily and monthly reports required by CFTC regulations, all of which may contain information, including performance information of the Fund and the Commodity Sub-advisor, that is disclosed only through such website posting.

An investment in the Fund involves a high degree of risk. Investors should be aware of the various risks, including those described below. Investors should consider carefully the risks described below before making an investment decision. Investors should also refer to the other information included in this Annual Report, including the Fund’s financial statements and the related notes and the Fund’s other filings with the SEC. Additional risks and uncertainties not presently known by the Fund or not presently deemed material by the Fund may also impair the Fund’s operations and performance. If any of the following events occur, the Fund’s performance could be materially and adversely affected. In such case, the Fund’s net asset value and the trading price of the Fund’s shares may decline and you may lose all or part of your investment.

An investment in the Fund involves a high degree of risk. You should not invest in shares unless you can afford to lose all of your investment.

Commodity Investment Strategy Risks

You may lose all of your investment. An investment in the Fund’s shares is subject to investment risk, including the possible loss of the entire amount that you invest. An investment in the Fund’s shares represents an indirect investment in the commodity futures contracts owned by the Fund, the prices of which can be volatile, particularly over short time periods. Investments in individual commodity futures contracts and options on futures contracts historically have had a high degree of price variability and may be subject to rapid and substantial price changes. These price changes may be magnified by computer-driven algorithmic trading, which is becoming more prevalent in the commodities markets. The Fund could incur significant losses on its investments in those commodity futures contracts. If the Fund experiences greater losses than gains during the period you hold shares, you will experience a loss for the period even if the Fund’s historical performance is positive. The Fund’s risk-adjusted returns over any particular period may be positive or negative. Movements in commodity investment prices are outside of the Fund’s control, are extremely difficult to predict, and may not be anticipated by the Commodity Sub-advisor. Price movements may be influenced by, among other things:

| | • | | governmental, agricultural, trade, fiscal, monetary and exchange control programs and policies; |

10

| | • | | weather and climate conditions; |

| | • | | changing supply and demand relationships; |

| | • | | changes in international balances of payments and trade; |

| | • | | U.S. and international rates of inflation; |

| | • | | currency devaluations and revaluations; |

| | • | | U.S. and international political and economic events; |

| | • | | changes in interest and foreign currency/exchange rates; |

| | • | | changes in philosophies and emotions of market participants. |

The Fund’s shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other governmental agency.

The changing interests of investors, hedgers and speculators in the commodity markets may influence whether futures prices are above or below the expected future spot price. In order to induce investors or speculators to take the corresponding long side of a futures contract, commodity producers must be willing to sell futures contracts at prices that are below the present value of expected future spot prices. Conversely, if the predominant participants in the futures market are the ultimate purchasers of the underlying commodity futures contracts in order to hedge against a rise in prices, then speculators should only take the short side of the futures contract if the futures price is greater than the present value of the expected future spot price of the commodity. This can have significant implications for the Fund when it is time to reinvest the proceeds from a maturing futures contract into a new futures contract. If the interests of investors, hedgers and speculators in futures markets have shifted such that commodity purchasers are the predominant participants in the market, the Fund will be constrained to reinvest at higher futures prices which could have a negative effect on the Fund’s returns and may cause the Fund to suffer losses on its short positions. Conversely, if commodity sellers are the predominant participants in the market, the Fund will be constrained to reinvest at lower prices which could have a negative effect on the Fund’s returns and may cause it to suffer losses on its long positions.

Regulatory developments could significantly and adversely affect the Fund. Commodity markets are subject to comprehensive statutes and regulations promulgated not only by the CFTC but also by self-regulatory organizations such as the NFA. Among other things, the CFTC and the exchanges on which futures contracts are traded are authorized to take extraordinary actions in the event of a market emergency, including, for example, the retroactive implementation of speculative position limits or higher margin requirements, the establishment of daily limits, and the suspension of trading. Any of these actions, if taken, could adversely affect the returns of the Fund by limiting or precluding investment decisions the Fund might otherwise make. The regulation of commodity transactions in the U.S. is a rapidly changing area of law and is subject to ongoing modification by government, self-regulatory and judicial action. In addition, various national governments have expressed concern regarding the disruptive effects of speculative trading in the currency markets and the need to regulate the derivatives markets in general. The effect of any future regulatory change on the Fund is impossible to predict, but could be substantial and adverse to the Fund.

Daily trading limits imposed by the exchanges and position limits established by the CFTC may adversely affect the Fund. The CFTC and U.S. commodities exchanges limit the amount of fluctuation permitted in futures contract prices during a single trading day by regulations referred to as “daily price fluctuation limits” or “daily trading limits.” Once the daily trading limit has been reached in a particular futures contract, no trades may be made that day at a price beyond that limit or trading may be suspended for specified periods during the trading day. Futures contract prices could move to the limit for several consecutive trading days with little or no trading, thereby preventing prompt liquidation of futures positions and potentially disguising substantial losses the Fund may ultimately incur.

11

Separately, the CFTC and the U.S. commodities exchanges and certain non-U.S. exchanges have established limits referred to as “speculative position limits” or “accountability levels” on the maximum net long or short futures positions that any person may hold or control in contracts traded on such exchanges. In October 2011, the CFTC adopted final regulations pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) that would have imposed position limits on 28 individual agricultural, metal and energy commodity futures and options contracts and on swaps that are economically equivalent to such contracts in order to prevent excessive speculation and manipulation in the commodity markets. On September 28, 2012, the U.S. District Court for the District of Columbia vacated the new position limit regulations and remanded the matter to the CFTC for further consideration consistent with the court’s opinion. The CFTC originally appealed the court’s decision, but in November 2013, the CFTC withdrew its appeal and re-proposed position limit regulations substantially as outlined above, with a few modifications. In addition, the CFTC proposed regulations that would expand certain exemptions from aggregation of accounts of related parties for these purposes. The public comment period for these proposed regulations closed on February 10, 2014. It remains to be seen whether the CFTC will modify the proposed regulations in response to public comments.

The CFTC’s existing position limit regulations require that a trader aggregate all positions in accounts over which the trader controls trading. However, a trader is not required to aggregate positions in multiple accounts or commodity pools if such trader (or its applicable divisions/subsidiaries) qualifies as an “independent account controller” under applicable CFTC regulations and avails itself of the independent account controller exemption under such regulations. In February 2013, Gresham NTA began operating under the independent account controller exemption available under the CFTC’s existing position limit regulations such that Gresham NTA is not required to aggregate its positions with Gresham’s other division. The re-proposed regulations would maintain the independent account controller exemption. However, if the CFTC does not adopt or renew the independent account controller exemption, or if the exemption were modified or otherwise unavailable, Gresham NTA would be required to aggregate its positions with Gresham LLC’s other division for purposes of the CFTC’s position limits regulations. In that case, it is possible that investment decisions of the Commodity Sub-advisor would be modified and that positions held by the Fund would have to be liquidated to avoid exceeding such position limits, potentially resulting in substantial losses to the Fund and the value of your investment. In addition, failure to comply with the requirements of the independent account controller exemption could lead to an enforcement proceeding against Gresham LLC and could adversely affect the Fund.

The re-proposed regulations are extremely complex and, if ultimately implemented, whether in their current or an alternative form, may require further guidance and interpretation by the CFTC to determine in all respects how they apply to the Fund. The full implementation of the Fund’s investment strategy could be negatively impacted by the existing or any future position limits regulations.

Any deflation or unanticipated changes in inflation may negatively affect the expected future spot price of underlying commodities. Deflation or unanticipated changes in the rate of inflation may result in changes in the future spot price of the underlying commodities that could negatively affect the Fund’s profitability and result in potential losses. In addition, reduced economic growth may lead to reduced demand for the underlying commodities and put downward pressure on the future spot prices, adversely affecting the Fund’s operations and profitability, to the extent the Fund has taken a long position in the affected commodities.

Options Strategy Risks

There can be no assurance that the Fund’s options strategy will be successful. The Fund employs a commodity option writing strategy that seeks to produce option premiums for the purpose of enhancing the Fund’s risk-adjusted total return over time. Option premiums generated by this strategy may also enable the Fund to more efficiently implement its distribution policy. The Fund’s use of options, however, may not provide any, or only partial, protection from adverse commodity price changes.

Specific price movements of the commodities or futures contracts underlying an option cannot be accurately predicted. There may be imperfect correlation between the changes in the market value of the futures contracts

12

and the corresponding options contracts held by the Fund. Accordingly, the return performance of the Fund’s commodity futures contracts may not parallel the performance of the commodities that serve as the basis for the options bought or sold by the Fund; this basis risk may reduce the Fund’s overall returns. Investing in options is volatile and requires an accurate assessment of the market and the underlying instrument. Factors such as increased or reduced volatility, limited dollar value traded and timing of placing and executing orders may preclude the Fund from achieving the desired results of the options strategy and could affect the Fund’s ability to generate income and gains and limit losses. Because of the volatile nature of the commodities markets, the writing (selling) of commodity options involves a high degree of risk.

The Fund may forego gains (i.e., capital appreciation above the option exercise price for sold call options) on up to 25% of its long commodity futures contracts as a result of selling commodity call options. The Fund may forego gains on up to 25% of its short commodity futures contracts as a result of selling commodity put options. The Fund expects to sell short-term commodity call or put options with terms of up to twelve months on a continual basis on up to approximately 25% of the notional value of each of its commodity futures contracts that, in Gresham’s determination, have sufficient option trading volume and liquidity. Accordingly, the Fund is effectively limiting its potential for gains from price increases on long commodity futures positions and effectively limiting its potential for gains from price declines on short commodity futures positions during the option term on up to 25% of the notional value of its portfolio invested in commodity futures contracts. The extent of foregone capital appreciation depends on the value of the commodity futures contract relative to the exercise price of each such option and option premium realized.

The Fund is subject to gap risk, which is the risk that a commodity price will change from one level to another with no trading in between. Usually such movements occur when there are adverse news announcements, which can cause a commodity price to drop substantially from the previous day’s closing price. In the event of an extreme market change or gap move in the price of a single commodity when Gresham is unable to trade, the Fund’s exposure to that commodity will increase in proportion to the Fund’s option exposure. The Fund’s option strategy increases the Fund’s gap risk and could adversely affect the Fund’s performance in the event that the price of an individual commodity futures contract drops or increases substantially. Gap risk may also negatively impact the trading price of the Fund’s shares.

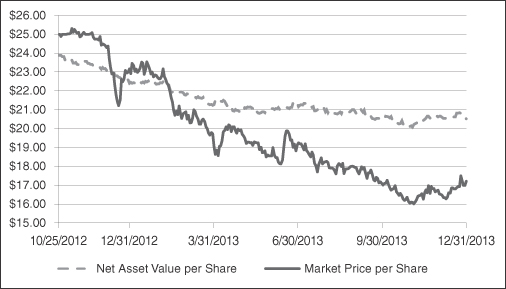

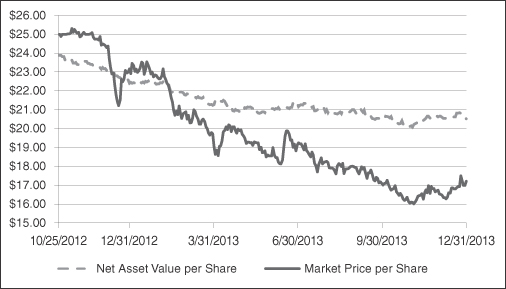

Risk that the Fund’s Shares May Trade at a Discount to Net Asset Value

There is a risk that the Fund’s shares may trade at prices other than the Fund’s net asset value per share. The net asset value of each share will change as fluctuations occur in the market value of the Fund’s portfolio. Investors should be aware that the public trading price of a share may be different from the net asset value of a share and that shares may trade at a discount from their net asset value (which could be significant). The price difference may be due to the fact that supply and demand forces at work in the secondary trading market for shares are not necessarily the same as the forces influencing the prices of the commodity futures contracts and other instruments held by the Fund at any point in time.

Risks Related to an Exchange Listing

NYSE MKT may halt trading in the shares which would adversely impact your ability to sell shares. The Fund’s shares are listed on the NYSE MKT under the market symbol “CTF.” Trading in shares may be halted due to market conditions or, in light of the NYSE MKT rules and procedures, for reasons that, in the view of the NYSE MKT, make trading in shares inadvisable. In addition, trading is subject to trading halts caused by extraordinary market volatility pursuant to “circuit breaker” rules that require trading to be halted for a specified period based on a specified market decline. There can be no assurance that the requirements necessary to maintain the listing of the shares will continue to be met or will remain unchanged.

The lack of an active trading market for shares may result in losses on your investment at the time of disposition of your shares. Although the Fund’s shares are listed on the NYSE MKT, there can be no guarantee that an active

13

trading market for the shares will be maintained. If you need to sell your shares at a time when no active market for them exists, the price you receive for your shares, assuming that you are able to sell them, likely will be lower than that you would receive if an active market did exist.

Commodity Sub-advisor Risks

Past performance is no assurance of future results. The Fund’s performance to date is due in part to the proprietary commodity investment methodology employed by Gresham. Any subsequent commodity sub-advisor to the Fund may employ a different commodity investment methodology than Gresham. Neither Gresham’s proprietary methodology nor the investment methodology that may be used by any subsequent commodity sub-advisor takes into account unanticipated world events that may cause losses to the Fund. In any event, past performance does not assure future results.

Descriptions of the Commodity Sub-advisor’s strategies may not be applicable in the future. The Commodity Sub-advisor or any subsequent commodity sub-advisor may make material changes to the investment strategy it uses in investing the Fund’s assets with the consent of the Manager, who has the sole authority to authorize any material changes. If this happens, the descriptions in this document would no longer be accurate or useful. The Manager does not anticipate that this will occur frequently, if at all. You will be informed of any changes to the Commodity Sub-advisor’s strategy that the Manager deems to be material; however, you may not be notified until after a change occurs. Non-material changes may be made by the Commodity Sub-advisor or any subsequent commodity sub-advisor without the Manager’s consent. Such potential changes may nevertheless affect the Fund’s performance.

Speculative position limits and daily trading limits may reduce profitability and result in substantial losses. All accounts owned or managed by a commodity trading advisor, such as the Commodity Sub-advisor, its principals and its affiliates, are typically combined for speculative position limit purposes unless an exemption from aggregation is available.

It is possible that the Commodity Sub-advisor will approach or reach position limits for accounts managed within the Gresham NTA division, irrespective of the independent account controller exemption. If so, the Commodity Sub-advisor may have a conflict of interest with respect to allocating limited positions among various accounts it manages. Further, the investment decisions of the Commodity Sub-advisor may be modified to avoid exceeding regulatory position limits, potentially subjecting the Fund to substantial losses and forcing the Fund to forego certain opportunities. The Commodity Sub-advisor may have to reduce the size of positions that would otherwise be taken for the Fund, liquidate commodity futures contracts at disadvantageous times or prices, or not trade in certain markets on behalf of the Fund in order to avoid exceeding such limits.

Modification of trades that would otherwise be made by the Fund, if required, could adversely affect the Fund’s operations as well as profitability compared to the Index. In addition, a violation of speculative position limits by the Commodity Sub-advisor could lead to regulatory or self-regulatory action resulting in mandatory liquidation of certain positions held by the Commodity Sub-advisor on behalf of its accounts. There can be no assurance that the Commodity Sub-advisor will liquidate positions held on behalf of all the Commodity Sub-advisor’s accounts, including the Commodity Sub-advisor’s own accounts, in a proportionate manner. In the event the Commodity Sub-advisor chooses to liquidate a disproportionate number of positions held on behalf of the Fund at unfavorable prices, the Fund may incur substantial losses.

Increased competition could adversely affect the Fund. The Commodity Sub-advisor believes that there has been, over time, an increase in interest in commodity investing. As Gresham’s capital under management increases, an increasing number of traders may attempt to initiate or liquidate substantial positions at or about the same time as the Commodity Sub-advisor, or otherwise alter historical trading patterns or affect the execution of trades, to the detriment of the Fund.

14

Other Risks of the Fund’s Investment Strategy

Shares may be adversely affected if Gresham makes changes to the Fund in response to changes in the composition and/or valuation of the Index. The composition of the Index may change over time as the commodity futures contracts in the Index are added or replaced. In addition, Index positions, and, therefore, positions taken by the Fund, may change quickly and frequently in response to changes in the commodities markets, which would result in greater trading expenses being incurred by the Fund. Furthermore, the Index sponsor may modify the method for determining the composition and weightings of the Index and for calculating its value in order to ensure that the Index represents a measure of the performance over time of the markets for the underlying commodities. Because the Index is serving as a benchmark measure for the Fund, the composition and weighting of their respective portfolios, while not identical, are likely to largely resemble each other. If the method for determining the Index composition and/or weighting were to change over time, any such changes could adversely impact the ability of the Fund to continue to track the Index.

An investment in the Fund may not necessarily diversify an investor’s overall portfolio. The investment performance of the Index, the benchmark against which the Fund compares its performance, has shown little long-term historical correlation to the performance of other asset classes such as U.S. equities and U.S. bonds. Little correlation means that there is a low statistical relationship between the performance of the Index, on the one hand, and U.S. equities and U.S. bonds, on the other hand. Because there is little long-term historical correlation, the Fund cannot be expected to be automatically profitable during unfavorable periods in the stock or bond markets, or vice versa. If, during a particular period of time, the Fund’s performance moves in the same general direction as the other financial markets, or the Fund does not perform successfully relative to overall commodity markets, you may obtain little or no diversification benefits during that period from an investment in the Fund’s shares. In such a case, the Fund may have no gains to offset your losses from such other investments, and you may suffer losses on your investment in the Fund at the same time losses on your other investments are increasing.

The concentration of certain commodities in the Index may result in greater volatility.As of December 31, 2013, the Index had its highest weightings in the energy and agriculture sectors (53.12% and 26.09%, respectively). As a result, the Fund may invest a substantial portion of its net assets in long positions in the energy and agriculture sectors. A downturn in the energy and agriculture sectors could have a larger impact on the Fund than on a fund that does not concentrate in these sectors. In addition, the Fund may invest a substantial portion of its net assets in short positions in the agriculture sector and this concentration could negatively impact the Fund if prices of agricultural commodities trend up.

During a period when commodity prices are fairly stable, the absence of “backwardation” in the prices of commodity futures contracts held long by the Fund and the absence of “contango” in the prices of commodity futures contracts held short may cause the price of your shares to decrease.As the futures contracts included in the Index and held by the Fund near expiration, they are replaced by contracts that have a later expiration. For example, a contract purchased and held (long or short) in March 2013 may have an expiration date in June 2013. As this contract nears expiration, a long position in the contract may be replaced by selling the June 2013 contract and purchasing a contract expiring in September 2013, or a short position may be replaced by covering or purchasing the June 2013 contract and selling short the September 2013 contract. This process is known as “rolling.” Historically, the prices of some futures contracts (generally those relating to commodities such as crude oil, heating oil and sugar, that are typically consumed immediately rather than stored) have often been higher for contracts with near-term expirations than for contracts with longer-term expirations. This circumstance is referred to as “backwardation.” Absent other factors, in these circumstances, the sale of a long position in the June 2013 contract would be made at a higher price than the purchase of the September 2013 contract, thereby allowing the Fund to purchase a greater quantity of the September 2013 contract. Conversely, a “contango” market is one in which the prices of commodity futures contracts in the near-term months are lower than the prices of contracts in the longer-term months due to long-term storage costs and other factors. Commodities that

have historically traded in a “contango” market are wheat, corn, gold, natural gas, coffee, lean hogs and soybean

15

oil. Absent other factors, covering a short position in the September 2013 contract by purchasing that contract at a lower price than the price of replacing it with a short position in the December 2013 contract would allow the Fund to sell short a greater quantity of the December 2013 contract. Because the Fund’s strategy is based in part on taking advantage of such “backwardation” and “contango” situations, the absence of “backwardation” or “contango” in certain commodities in which the Fund is long or short could adversely affect the value of the Fund’s portfolio and consequently decrease the value of your shares.

The Fund is subject to “whipsaw” risk, which is the risk that commodity price trends will rapidly change adversely to long or short positions taken by the Fund. Price momentum is an important factor in determining the Fund’s long and short/flat positions. As a result, “whipsaw” markets, in which significant price movements develop but then rapidly reverse, could cause substantial losses to the Fund. For example, price patterns in the commodity markets may indicate upward momentum, causing the Fund to shift from short or flat positions to long positions. However, such patterns may reverse rapidly, forcing the Fund to shift from long positions back to short or flat positions, leading to losses on such positions by the Fund. An unexpected change in government economic policy, a significant political or economic event, a surprise change in monetary policy, or a sudden shift in supply or demand could cause a severe reversal in a number of the Fund’s long or short positions, resulting in significant losses to the Fund.

There may be a loss on investments in short-term debt securities.When the Fund purchases a futures contract, the Fund is required to deposit with its futures commission merchant only a portion of the value of the contract. This deposit is known as “initial margin.” If and when the market moves against the position, the Fund is required to make additional deposits known as “variation margin.” The Fund invests its assets, other than the amount of margin required to be maintained by the Fund, in short-term, high grade debt securities. The value of these high grade debt securities generally moves inversely with movements in interest rates (declining as interest rates rise). The value of these high grade debt securities might also decline if the credit quality of the issuer deteriorates, or if the issuer defaults on its obligations. If the Fund is required to sell short-term debt securities before they mature when the value of the securities has declined, the Fund will realize a loss. This loss may adversely impact the price of the Fund’s shares.

Daily disclosure of portfolio holdings could allow replication of the Fund’s portfolio and could have a negative effect on the Fund’s holdings.Because the Fund’s total portfolio holdings are disclosed on a daily basis, other investors may attempt to replicate the Fund’s portfolio or otherwise use the information in a manner that could have a negative effect on the Fund’s individual portfolio holdings and the Fund’s portfolio as a whole.

Certain of the Fund’s investments may become illiquid.The Fund may not always be able to liquidate its investments at the desired price. It is difficult to execute a trade at a specific price when there is a relatively small volume of buy and sell orders in a market. Recently, some institutional investors have scaled back or exited their commodity trading business, which has resulted, and may continue to result, in reduced liquidity and significantly increased spreads in the commodity markets. A market disruption, such as a foreign government taking political actions that disrupt the market in its currency or in a major export, can also make it difficult to liquidate a position. Alternatively, limits imposed by futures exchanges or other regulatory organizations, such as speculative position limits and daily price fluctuation limits, may contribute to a lack of liquidity with respect to some commodity investments.

Market illiquidity and higher spreads may cause losses to investors. The large stated value of the Fund’s commodity investments increases the risk of illiquidity by both making those investments more difficult to liquidate at favorable prices and increasing the losses incurred while trying to do so.

The Fund is subject to short exposure when it sells short a futures contract or writes a put option.Short sales are transactions in which the Fund initiates a position by selling a futures contract short. A short futures position allows the short seller to profit from declines in the price of the underlying commodity to the extent such declines exceed the transaction costs. In a short sale transaction, the Fund must deliver the underlying commodity at the contract price to a buyer of the contract who stands for delivery under the rules of the exchange that lists the contract or must offset the contract by entering into an opposite and offsetting transaction in the market.

16

Likewise, the writer of a call option is required to deliver the underlying futures contract at the strike price or offset the option by entering into an opposite and offsetting transaction in the market. The price at such time may be higher or lower than the price at which the futures contract was sold short or the strike price of the call option when the option was written. If the underlying price of the futures contract goes down between the time that the Fund sells the contract short and offsets the contract, the Fund will realize a gain on the transaction. If the price of the underlying futures contract drops below the strike price of the call option written, the option will expire worthless and the Fund also will realize a gain to the extent of the option premium received. Conversely, if the price of the underlying short futures contract goes up during the period, the Fund will realize a loss on the transaction. If the price of the underlying futures contract is higher than the strike price of a call option written, the option will become in-the-money and the Fund may realize a loss less any premium received for writing the option. A short sale creates the risk of an unlimited loss since the price of the underlying commodity in a futures contract or the underlying futures contract in a call option written could theoretically increase without limit, thus increasing the cost of covering the short positions. In circumstances where a market has reached its maximum price limits imposed by the exchange, the short seller may be unable to offset its short position until the next trading day, when prices could increase again in rapid trading.

Investments in futures contracts will expose the Fund to the risk of temporary aberrations or distortions in the commodity markets.The Fund is subject to the risk that temporary aberrations or distortions in the markets (such as war, strikes, geopolitical events and natural disasters) will occur that impact commodity prices and negatively impact the value of the Fund’s long and/or short positions, thereby adversely affecting the value of your shares.

Because futures contracts have no intrinsic value, the positive performance of your investment is wholly dependent upon an equal and offsetting loss.Futures trading is a risk transfer economic activity. For every gain there is an equal and offsetting loss rather than an opportunity to participate over time in general economic growth. Unlike most alternative investments, an investment in shares of the Fund does not involve acquiring any asset with intrinsic value. Overall stock and bond prices could rise significantly and the economy as a whole prosper while shares of the Fund trade unprofitably.

Because the Fund may invest a substantial portion of its net assets in the energy sector, it is subject to certain risks.A downturn in the energy sector could have a larger impact on the Fund than on a fund that does not concentrate in the sector. At times, the performance of commodities in the energy sector may lag the performance of other sectors or the broader commodity market. The prices of commodities in the energy sector may be adversely effected by weather and other catastrophic events such as leaks, fires, explosions, damage to facilities and equipment resulting from natural disasters, inadvertent damage to facilities and equipment, and terrorist acts.

Recent market conditions.The recent financial crisis in the U.S. and global economies, including the European sovereign debt crisis, has resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both domestic and foreign. Liquidity in some markets has decreased and credit has become scarcer worldwide. Recent regulatory changes, including the Dodd-Frank Act and the introduction of new international capital and liquidity requirements under Basel III, may cause lending activity within the financial services sector to be constrained for several years as Basel III rules phase in and rules and regulations are promulgated and interpreted under the Dodd-Frank Act. In response to the crisis, the U.S. and other governments, and the Federal Reserve and certain foreign central banks, have taken steps to support financial markets. Withdrawal of this support (even when anticipated and done gradually, as in the case of the Federal Reserve’s tapering of its bond purchases), failure of efforts in response to the crisis, or investor perception that such efforts are not succeeding, could adversely impact the value and liquidity of certain securities and futures contracts.

In addition, since 2010, the risks of investing in certain foreign government debt have increased dramatically as a result of the European debt crisis, which began in Greece and spread to various other European countries. These debt crises and the ongoing efforts of governments around the world to address these debt crises have also resulted in increased volatility and uncertainty in the global financial markets. It is impossible to predict the effects of these or similar events in the future on the Fund, though it is possible that these or similar events could have a significant adverse impact on the value and risk of investments held by the Fund.

17

In the United States, on August 5, 2011, Standard & Poor’s Financial Services, LLC, a subsidiary of The McGraw-Hill Companies, Inc. (“S&P”), lowered its long-term sovereign credit rating on the U.S. federal government debt to “AA+” from “AAA.” Any further credit rating downgrade could increase volatility in financial markets, and could result in higher interest rates and higher Treasury yields and increase the costs of capital and financing. In addition, global economies and financial markets are becoming increasingly interconnected, which increases the possibilities that conditions in one country or region might adversely impact issuers in a different country or region.

Risk of Investing in Non-U.S. Markets

Investing in non-U.S. markets will expose the Fund to additional credit and regulatory risk.The Fund may invest in commodity futures contracts and options on commodity futures contracts in non-U.S. markets. Some non-U.S. markets present risks because they are not subject to the same degree of regulation as their U.S. counterparts. None of the SEC, CFTC, NFA or any domestic exchange regulate activities of any foreign boards of trade or exchanges, including the execution, delivery and clearing of transactions, nor do they have the power to compel enforcement of the rules of a foreign board of trade or exchange or of any applicable non-U.S. laws or regulations. Similarly, the rights of market participants, such as the Fund, in the event of the insolvency or bankruptcy of a non-U.S. exchange or broker are also likely to be more limited than in the case of U.S. exchanges or brokers. As a result, in these markets, the Fund would have less legal and regulatory protection than it does when it invests domestically.

Investing through non-U.S. exchanges is subject to the risks presented by exchange controls, expropriation, increased tax burdens and exposure to local economic declines and political instability. An adverse development with respect to any of these variables could reduce the profit or increase the loss on investments of the Fund in the affected international markets.

Regulatory and Operating Risks

The Fund is not a regulated investment company.Unlike other Nuveen Investments-sponsored funds, the Fund is not a mutual fund, a closed-end fund, or any other type of investment company within the meaning of the 1940 Act. Accordingly, you do not have the protections afforded by that statute which, among other things, regulates the relationship between the investment company and its investment adviser and mandates certain authority to be held by the board of directors of an investment company.

The Fund has a limited operating history.Therefore, the Fund has a limited performance history to serve as a basis for you to evaluate an investment in the Fund.

Manager and Commodity Sub-advisor experience.The Manager, Commodity Sub-advisor, and Collateral Sub-advisor act in similar capacities for CFD, which is a Nuveen Investments-sponsored commodity pool traded on the NYSE MKT that completed its initial public offering on September 30, 2010. Prior to the initial public offering of CFD, the Manager had not previously operated a commodity pool or selected a commodity trading advisor. Prior to the completion of the Fund’s initial public offering, the Commodity Sub-advisor had not previously managed client accounts utilizing the long/short commodity investment program.