We anticipate that we will be initially offering our securities in the State of California. Once this Registration Statement is effective, and if Ms. Olsen believes that there is sufficient interest in our company to offer our securities in the state of California, we will register with the state of California under ‘blue sky’ laws. However, we have not yet applied for ‘blue sky’ registration in the state of California, or any other state, and there can be no assurance that we will be able to apply, or that our application will be approved and our securities will be registered, in California or any other state in the US. For further discussion regarding ‘blue sky’ registration please see ‘Risk Factors’ elsewhere in this Prospectus.

Ms. Olsen will not register as a broker-dealer pursuant to Section 15 of the Securities Exchange Act of 1934, in reliance upon Rule 3a4-1, which sets forth those conditions under which a person associated with an issuer may participate in the offering of the issuer’s securities and not be deemed to be a broker-dealer.

Our officer, director, control persons and affiliates do not intend to purchase any shares in this offering.

If applicable, the shares may not be offered or sold in certain jurisdictions unless they are registered or otherwise comply with the applicable securities laws of such jurisdictions by exemption, qualification or otherwise. We intend to sell the shares only in the states in which this offering has been qualified or an exemption from the registration requirements is available, and purchases of shares may be made only in those states.

In addition and without limiting the foregoing, we will be subject to applicable provisions, rules and regulations under the Exchange Act with regard to security transactions during the period of time when this Registration Statement is effective.

We will not use public solicitation or general advertising in connection with the offering. The shares will be offered at a fixed price of $0.01 per share for the duration of the offering. There is no minimum number of shares required to be sold to close the offering. This offering will terminate upon the earlier to occur of (i) 270 days after this registration statement becomes effective with the Securities and Exchange Commission, or (ii) the date on which all 3,000,000 shares registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 90 days. In any event, the offering will end within six months of this Registration Statement being declared effective

This is a direct participation offering since we, and not an underwriter, are offering the stock. We will receive all of the proceeds from such sales of securities and are bearing all expenses in connection with the registration of our shares.

The following table sets forth, as of the date of this prospectus, the total number of shares owned beneficially by our sole officer and director, and key employees, individually and as a group, and the present owners of 5% or more of our total outstanding shares. The stockholder listed below has direct ownership of his shares and possesses sole voting and dispositive power with respect to the shares.

(2) The person named above may be deemed to be a “parent” and “promoter” of our company, within the meaning of such terms under the Securities Act of 1933, Danielle Olsen is the only “parent” and “promoter” of the company.

For the period ended May 31, 2013 , a total of 9,000,000 shares of common stock were issued to our sole officer and director, all of which are restricted securities, as defined in Rule 144 of the Rules and Regulations of the SEC promulgated under the Securities Act. Under Rule 144, the shares can be publicly sold, subject to volume restrictions and restrictions on the manner of sale, commencing one year after their acquisition. Under Rule 144, a shareholder can sell up to 1% of total outstanding shares every three months in brokers’ transactions. Note that the resale of shares sold in a 144(i), clarifies that holders of securities of shell companies may not use Rule 144 for resales until 12 months after the company has reported Form 10 information reflecting the company’s status as no longer being a shell company Shares purchased in this offering, which will be immediately resalable, and sales of all of our other shares after applicable restrictions expire, could have a depressive effect on the market price, if any, of our common stock and the shares we are offering.

Our sole officer and director will continue to own the majority of our common stock after the offering, regardless of the number of shares sold. Since she will continue control our company after the offering, investors in this offering will be unable to change the course of our operations. Thus, the shares we are offering lack the value normally attributable to voting rights. This could result in a reduction in value of the shares you own because of their ineffective voting power. None of our common stock is subject to outstanding options, warrants, or securities convertible into common stock.

The company is hereby registering 3,000,000 of its common shares, in addition to the 9,000,000 shares currently issued and outstanding. The price per share is $0.01 (please see “Plan of Distribution” above).

The 9,000,000 shares currently issued and outstanding were acquired by our sole officer and director for the period ended, May 31, 2013 . We issued a total of 9,000,000 common shares for consideration of $9,000, which was accounted for as a purchase of common stock. The Company received $9,000 cash.

DESCRIPTION OF SECURITIES

Common Stock

The authorized common stock is four hundred eighty million (480,000,000) shares with a par value of $0.0001. Shares of our common stock:

| | |

| · | have equal ratable rights to dividends from funds legally available if and when declared by our Board of Directors; |

| | |

| · | are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs; |

| | |

| · | do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights; and |

| | |

| · | are entitled to one non-cumulative vote per share on all matters on which stockholders may vote. |

We refer you to our Bylaws, our Articles of Incorporation, and the applicable statutes of the State of Florida for a more complete description of the rights and liabilities of holders of our securities.

Non-Cumulative Voting

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the holders of the remaining shares will not be able to elect any of our directors. After this offering is completed, present stockholders will own approximately 75% of our outstanding shares.

Cash Dividends

As of the date of this Prospectus, we have not declared or paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of our Board of Directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

- 20 -

INTEREST OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this Prospectus as having prepared or certified any part thereof or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of our common stock was employed on a contingency basis or had or is to receive, in connection with the offering, a substantial interest, directly or indirectly, in us. Additionally, no such expert or counsel was connected with us as a promoter, managing or principal underwriter, voting trustee, director, officer or employee.

Pearlman Schneider, LLP, 2200 Corporate Boulevard, Suite 201, Boca Raton, Florida 33431, has passed upon certain legal matters in connection with the validity of the issuance of the shares of common stock.

ZBS Group, LLP, Certified Public Accountant, of 115 Broad Hollow Road, Suite 350, Melville, New York 11747, 516-394-3344 has audited our Financial Statements for the period May 18, 2011 (date of inception) through May 31, 2013 and to the extent set forth in its report, which are included herein in reliance upon the authority of said firm as experts in accounting and auditing. There were no disagreements related to accounting principles or practices, financial statement disclosure, internal controls or auditing scope or procedure from date of appointment as our independent registered accountant through the period of audit inception May 18, 2011 through May 31, 2013 .

BUSINESS DESCRIPTION

We were incorporated in the State of Florida on May 18, 2011, as a for-profit company with a fiscal year end of May 31.

We have not accomplished any of our intended efforts to date. We have not generated any revenues to date and our activities have been limited to the completion of our business and financial plan. We will not have the necessary capital to develop our Business Plan until we are able to secure additional financing. There can be no assurance that such financing will be available on suitable terms. Please see “Risk Factors” elsewhere in this Prospectus for full discussion on this potential business risk.

We have no plans to change our business activities or to combine with another business and are not aware of any events or circumstances that might cause us to change our plans. We have no revenues, have incurred losses since inception, have no operations, have been issued a going concern opinion from our auditors and rely upon the sale of our securities to fund operations.

We have not established a schedule for the completion of specific tasks or milestones contained in our business plan. With the clear exception of the costs associated with this offering ($5,000) virtually all aspects of our business plan are scalable in terms of size, quality, and effectiveness, and the timing of their execution must be concurrent or near concurrent and progressive over a eighteen month period. We anticipate that we will require $700,000 in order to generate significant revenues within an 18 month period, subsequent to this $30,000 offering.

Mobile Vault, Inc. is a development stage company to provide mobile security and privacy protection. The Company plans to provide mobile users the ability to check where files have come from, securely back up the data on their mobile phones, check social networks for bad links and other threats, and provide warning of unsafe websites and monitors the phone for suspicious behavior to quickly detect attacks, viruses, and malware activities.

The Company plans to provide a set of software applications to protect the privacy and security when using any mobile application. The Company’s plan is to develop products that will allow the user to automatically back up their files to disc, USB device or a cloud-based data center. This would allow the user to recover any data and files if their mobile device crashes. The software applications would also securely and automatically manage usernames and passwords to prevent cybercriminals from stealing this information. In addition, the Company plans to create additional software applications to block unsafe and malicious websites, including phishing sites, scan your social networks for suspicious links and malware, and provide the consumer the ability to email, chat and download files while detecting and blocking spyware and other threats before they can do damage.

Mobile Vault, Inc. is in the early stage of developing its business plan. The Company does not have any products, customers and has not generated any revenues. The Company must complete the business plan, develop the product and attract customers before it can start generating revenues.

PRODUCT OVERVIEW

Mobile Vault, Inc. products plan to provide mobile users the essential tools for security and privacy protection of their personal data on their smartphones.

- 21 -

On the Internet, users can control the level of their privacy via their web browser. They can have zero privacy, some or full privacy. Internet browsers allow websites to track you with cookies. That’s why when you search for hamburgers, you’ll get ads for food like McDonalds or Burger King. Cookies are stored on your browser and the user has the ability to disallow cookies, delete cookies or selectively use them. Websites also track your behavior only when you are on their sites using tools like Google Analytics, StatCounter and Woopra. They track you starting from what web site you came from, all your activity in their site and where you go to after you leave their site. Most people would be surprised that merely going to a website, the operator of the site (e.g. Facebook) can discern what prior website you came from, what operating system you use, the monitor resolution that you use, date and time of the visit, how long you’re on their site, all your click behaviors and anything you write on the site. The sites do not know who you are unless you explicitly tell them through registration and “opting in”. Applications perform limited tracking - mainly to make sure you have the most current or legal version of software. Also the information is anonymized when it is sent back to the software application

vendor. This is how the application provider ensures trust with their customers.

On the mobile device, the same challenges exist. Therefore, the Company’s product will feature will address the following:

Automated backup;

Easy recovery;

Social Media security for the smartphones;

Blocks unsafe and malicious websites;

Blocks unsafe and malicious downloads;

Simple installation and ease of use.

Mobile Vault plans to address the needs and desires of smartphone users with a simple, convenient way to secure their data.

Mobile Vault will be an integrated application that will ensure your privacy and security when using a smartphone. It will allow users to have ease of mind that their personal data and privacy are secure when using their smartphone, to surf the web, email, chat or safely use any other application they have downloaded. It will also block unsafe websites and malicious downloads and social media

security.

The Company believes there are two primary uncertainties in our product development schedule, capital and qualified developers. The Company must secure the necessary capital and thereafter, must recruit qualified programmers to develop the products.

SALES & DISTRIBUTION

Mobile Vault products will be marketed initially via the Internet and application stores (App Store, Android Market). In addition, the Company plans to build relationships with resellers, value added resellers(VAR) and original equipment manufacturers(OEM) to market and sell through these indirect channels. At the current time, the Company does not anticipate developing a direct sales force to market the product to consumers. Much of Mobile Vault’s market success will occur through the combination of the App Stores, direct mail marketing, print media marketing and Internet advertising.

MARKET OPPORTUNITY / BENEFITS

The rapid growth in the smartphone market has provided consumers tremendous opportunity to access the internet for a variety of information at any time. They can shop online, get real time news, sports, and weather, check email, all at a push of the button in the palm of their hand. This functionality is of significant value not only to the consumer, but also businesses and advertiser that want access to the consumer market 7x24.

Apple and Google have been very successful with their mobile products. According to Gartner, Apple sold over 38 million iPhones and others sold 156 million Android phones in the first quarter of 2013 (Source: http://techcrunch.com/2013/05/14/android-nearly-75-of-all-smartphones-shipped-in-q1-samsung-tops-30-mobile-sales-overall-nearly-flat-says-gartner/). Both operating systems (iOS and Android) benefit from the product sales, but what is more critical is to understand the consumer’s habits and behaviors. This information is invaluable not only to both companies, but also their ecosystem which include advertisers, application developers, and other third party marketers. The sharing of personal information is handled by privacy policies that exist between the consumer and carriers, application providers, and device manufacturers.

- 22 -

According to online privacy service provider TRUSTe and Harris Interactive2, the top concern among US smartphone users was privacy, followed by security.

Smartphone owners are very concerned about sharing information via applications, and even with passwords and privacy policies, 64% of respondents said they felt they had no control over their personal information when they used their mobile devices. In addition, almost 75% of the mobile users did not like being tracked by advertisers.

“People understand that the phone is extremely personal, that it’s tied to them and that it has a lot of data about them,” TRUSTe president Fran Maier told eMarketer (Source: http://www.truste.com/why_TRUSTe_privacy_services/harris-mobile-survey/).

These mobile security and privacy issues are a critical issue for the industry. Recently, Apple was accused of obtaining a log file that continually tracks the location of an iPhone--and makes that data available in unencrypted form to anyone who has possession of the physical phone--made dozens of headlines. The Government has taken a strong position on online privacy protection and has called for investigations into Apple and Google regarding their mobile privacy policies. Even with these Government actions, users are still very concerned about their privacy and protection.

According to MEF, over 70% of consumers say it is important to them to understand what data is being collected and how it is being shared. In addition, only 37% of consumers are comfortable with sharing their information and 33% are NOT comfortable at all. This group (33%) avoid apps because they do not trust them. (Source: http://venturebeat.com/2013/04/20/a-wakeup-call-for-the-app-economy-mobile-consumers-want-privacy/).

Consumers view the phone as a very personal device with their own personal data. There can be value sharing the data, but this decision needs to be made by the consumer, not the advertiser, device manufacturer, or carrier.

The consumer knows that application providers want their location to provide them additional value (ex. local store location, local restaurant specials, directions/maps). Marketing company and application developers must be transparent with their intentions to maintain and build consumer trust. Education will be an important component to maintain customer loyalty, and most importantly, the value the consumer receives must outweigh the drawback of sharing location specific data, otherwise consumers will shut down these services and turn away advertisers and marketers.

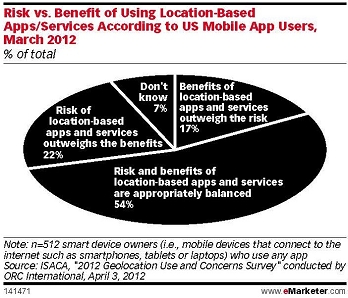

With location based services, consumers are becoming more concerned about their data being exposed. According to eMarketer, the top three concerns on LBS applications are 1) lack of protection about consumer’s activities, 2) sharing information to marketers, and 3) personal safety. This privacy concern is increasing all the time from the data analytics companies collect and remarket without consumer consent.

- 23 -

The fundamental question between the consumer and the mobile service provider is the reward greater than the risk. According to eMarketer, only 17% of the consumers believe the rewards are greater than the risks. Mobile application service providers need to instill more transparency to prove to the consumer they can be trusted. Once there is a level of transparency and trust, the LBS application experiences will drive stronger consumer behavior, trust and confidence with location based services (Source: http://iviutech.com/downloads/eMarketer_Location-Based_Marketing-Driving_Sales_in_a_Whats_Around_Me_World.pdf)

Competition

The competition for privacy and security mobile solutions is growing at this point. The Android device competition includes BullGuard Mobile Security, SMobile Security, Lookout Mobile Security, and ESET Mobile Security. On Apple, the competition includes Mobclix, Pinchmedia, Flurry, and Medialets who are software vendors that provide “tracking tools” for iPhone developers. Some may say these companies are no more innocuous than Google Analytics but it’s very different. Google Analytics tracks your behavior on the specific website it was installed on and there is no provision to track a unique identifier. So if you’re at neighborhood coffee shop’s WiFi, Google Analytics knows a computer signed in from the coffee shop WiFi address but cannot specifically attribute a nasty anonymous blog post to you and your specific computer.

Although the market competition is expanding, we feel there is not an existing product that meets the security and privacy protection needs along with Malware protection that works not only with the Internet but also with social networks.

The Company will face competitive challenges because the Company has not developed the product, does not have any revenues, and lacks the necessary capital to fund operations. The Company must overcome these challenges to be successful in the marketplace.

The Company believes that Mobile Vault’s strength in the security and privacy market will come from its integrated approach to work across the web, applications and social networks, along with an easy to use interface. The Company believes that users want a simple and secure solution that runs in the background. This type of solution will allow users to enjoy their phone for work and play and not worry about their personal data and privacy.

Employees and Employment Agreements

As of May 31, 2013 , we have no employees other than Ms. Olsen, our sole officer and director. Ms. Olsen has the flexibility to work on our business up to 25 to 30 hours per week. She is prepared to devote more time to our operations as may be required and we do not have any employment agreements with her .

- 24 -

We do not presently have pension, health, annuity, insurance, stock options, profit sharing, or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our sole director and officer.

During the initial implementation of our business plan, we intend to hire independent consultants to assist in the development and execution of our business operations.

Government Regulations

We are unaware of and do not anticipate having to expend significant resources to comply with any local/ state and governmental regulations of the market. We are subject to the laws and regulations of those jurisdictions in which we plan to offer our services’ which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes. In general, the development and operation of our business is not subject to special regulatory and/or supervisory requirements.

Intellectual Property

We do not currently hold rights to any intellectual property and have not filed for copyright or trademark protection for our name or intended website.

Research and Development

Since our inception to the date of this Prospectus, we have not spent any money on research and development activities.

Reports to Security Holders

We intend to furnish annual reports to stockholders, which will include audited financial statements reported on by our Certified Public Accountants. In addition, we will issue unaudited quarterly or other interim reports to stockholders, as we deem appropriate or required by applicable securities regulations.

Any member of the public may read and copy any materials filed by us with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street, N.E. Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the Securities and Exchange Commission at 1-800-732-0330. The Securities and Exchange Commission maintains an internet website (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Securities and Exchange Commission.

DESCRIPTION OF PROPERTY

As our office space needs are limited at the current time, we are currently operating out of our sole director and officer’s office located at 3384 La Canada Drive, Suite 1, Cameron Park, CA 95682. This space usage is donated free of charge by our sole director and officer.

LEGAL PROCEEDINGS

We know of no materials, active or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceedings or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any beneficial shareholder are an adverse party or has a material interest adverse to us.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

Our common stock is not traded on any exchange. We intend to apply to have our common stock quoted on the OTC Bulletin Board once this Prospectus has been declared effective by the SEC; however, there is no guarantee that we will obtain a listing.

There is currently no trading market for our common stock and there is no assurance that a regular trading market will ever develop. OTC Bulletin Board securities are not listed and traded on the floor of an organized national or regional stock exchange. Instead, OTC Bulletin Board securities transactions are conducted through a telephone and computer network connecting dealers. OTC Bulletin Board issuers are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

- 25 -

To have our common stock listed on any of the public trading markets, including the OTC Bulletin Board, we will require a market maker to sponsor our securities. We have not yet engaged any market maker to sponsor our securities, and there is no guarantee that our securities will meet the requirements for quotation or that our securities will be accepted for listing on the OTC Bulletin Board. This could prevent us from developing a trading market for our common stock.

Holders

As of the date of this Prospectus there were 1 holder of record of our common stock.

Dividends

To date, we have not paid dividends on shares of our common stock and we do not expect to declare or pay dividends on shares of our common stock in the foreseeable future. The payment of any dividends will depend upon our future earnings, if any, our financial condition, and other factors deemed relevant by our Board of Directors.

Equity Compensation Plans

As of the date of this Prospectus we did not have any equity compensation plans.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

This section of the prospectus includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: “believe”, “expect”, “estimate”, “anticipate”, “intend”, “project” and similar expressions, or words that, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this prospectus. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

Our financial statements are stated in United States Dollars (USD or US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. All references to “common shares” refer to the common shares in our capital stock.

Overview

We are a development-stage company, incorporated in the State of Florida on May 18, 2011, as a for-profit company, and an established fiscal year of May 31. We have not yet generated or realized any revenues from business operations. Our auditor has issued a going concerned opinion. This means there is substantial doubt that we can continue as an on-going business for the next eighteen (18) months unless we obtain additional capital to pay our bills. Accordingly, we must raise cash from other sources other than loans we undertake.

From inception (May 18, 2011) through May 31, 2013 , our business operations have primarily been focused on completing our business plan, positioning ourselves for the software development and raise additional capital. We have spent a total of approximately $17,068 on general expenses, legal, accounting and SEC filing costs. We have not generated any revenue from business operations. All cash held by us is the result of the sale of common stock to our sole director and officer and a note payable to an accredited, non-affiliate investor.

The proceeds from this offering will satisfy our cash requirements for up to 24 months. If we are unable to raise additional monies, we only have enough capital to cover the costs of this offering and to begin implementing the business plan. The expenses of this offering include the preparation of this prospectus, the filing of this registration statement and transfer agent fees and developing the software prototype application. As of May 31, 2013 we had $1,228 cash on hand.

Plan of Operations

We anticipate that the $30,000 we intend to raise in this offering will be sufficient to enable us to develop the mobile security protection prototype and part of the commercial product design. Efforts will be proportional to funds raised to achieve these results. Raising less than the $30,000 will decrease funds for the product development. The first money raised, of course, will be set aside and used for meeting our reporting requirements to the Securities Exchange Commission and the State of Florida.

- 26 -

Our business plan and allocation of proceeds will vary to accommodate the amount of proceeds raised by the sale of securities hereunder and through other financing efforts. The Use of Proceeds table shows an increase in funds allocated to each category of expenses under our business plan somewhat in proportion to the percentage of shares sold (whether 33%, 50%, 75% or 100%). Initially, we intend to develop the prototype retail shopping application. We intend to interview technical consultants in the development of the prototype, but would not engage these technical consultants unless and until sufficient funds were raised. Initially, Ms. Olsen will provide her office computer and office equipment at no cost. However, we estimate that we will require as much as $700,000 ($700,000 in addition to the maximum of $30,000 that we are seeking to raise through this offering) in order to establish operations of a sufficient size and quality to ensure the competitiveness of our business and to generate significant revenues to support an office outside Ms. Olsen’s residential office. Nevertheless, if our potential to raise capital appears exhausted, our management may decide to modify our business plan on a reduced scale and quality. A decision by management to implement our business plan on a reduced scale and quality may occur at any juncture during the early stages of our business development, whether we have raised 35%, 50%, 75% or 100% of the proceeds that we will be seeking to raise through this offering.

We believe we do not have adequate funds to satisfy our working capital requirements for the next twelve months. We will need to raise additional capital to continue our operations. During the 18 months following the completion of this offering, we intend to implement our business and marketing plan. We believe we must raise an additional $700,000 (in addition to this $30,000 capital raise) to pay for expenses associated with our development over the next 18 months and to support company operations.

As of May 31, 2013 , we had cash on hand of $1,228 .

During the next eighteen month we intend to develop a mobile security protection application business. Consumer spending accounts for approximately 70% of the US GDP according to the US Government. The mobile security market is extremely competitive and consumers always pay attention to prices. Consumers are always looking for protection from malware, fraud, and viruses. In addition, with the proliferation of mobile devices (both smartphones and tablets), consumers now have multiple devices and need protection across all of them.

The following description of our business is intended to provide an understanding of our company and the direction of our strategy.

Mobile Vault, Inc. products plan to provide mobile users the essential tools for security and privacy protection of their personal data on their smartphones.

On the Internet, users can control the level of their privacy via their web browser. They can have zero privacy, some or full privacy. Internet browsers allow websites to track you with cookies. That’s why when you search for hamburgers, you’ll get ads for food like McDonalds or Burger King. Cookies are stored on your browser and the user has the ability to disallow cookies, delete cookies or selectively use them. Websites also track your behavior only when you are on their sites using tools like Google Analytics, StatCounter and Woopra. They track you starting from what web site you came from, all your activity in their site and where you go to after you leave their site. Most people would be surprised that merely going to a website, the operator of the site (e.g. Facebook) can discern what prior website you came from, what operating system you use, the monitor resolution that you use, date and time of the visit, how long you’re on their site, all your click behaviors and anything you write on the site. The sites do not know who you are unless you explicitly tell them through registration and “opting in”. Applications perform limited tracking - mainly to make sure you have the most current or legal version of software. Also the information is anonymized when it is sent back to the software application vendor. This is how the application provider ensures trust with their customers.

On the mobile device, the same challenges exist. Therefore, the Company’s product will feature will address the following:

| | |

| · | Automated backup; |

| | |

| · | Easy recovery; |

| | |

| · | Social Media security for the smartphones; |

| | |

| · | Blocks unsafe and malicious websites; |

| | |

| · | Blocks unsafe and malicious downloads; |

| | |

| · | Simple installation and ease of use. |

| | |

| · | Mobile Vault plans to address the needs and desires of smartphone users with a simple, convenient way to secure their data. |

- 27 -

During product prototype and development, the Company plans to create a product prototype to show and attract customers and is expected to be completed within six (6) months after this capital of $30,000 is secured. Although the Company plans to use the prototype to attract customers, the Company does not expect to start generating revenues until twelve (12) months after the successful completion of this offering. The timeline for the prototype is subject to change and is based on securing the necessary financing and retaining qualified resources for the product development.

Opportunity / Benefits

The rapid growth in the mobile security software market is expected to reach $2.9 billion by 2017 according to Infonetics Research. The market grew 58% in 2012 and the consumer client software market is expected to grow at 28% annually through 2017. (Source: http://www.infonetics.com/pr/2013/2H12-Mobile-Security-Client-Software-Market-Highlights.asp).

Since inception, we have incurred a net loss of approximately $17,068.

We believe that it will cost approximately $700,000 (subsequent to the $30,000 capital raise) to execute the business plan. There can be no assurance that we will be able to secure financing or if offered that it will be on terms acceptable to us. In the event we are unable to secure adequate financing we will not be able to develop the business.

We intend to pursue capital through public or private financing in order to finance our businesses activities. We cannot guarantee that additional funding will be available on favorable terms, if at all. If adequate funds are not available, then our ability to continue our operations may be significantly hindered.

We have not yet begun the development of any of our product prototyping or development and even if we do secure adequate financing, there can be no assurance that our products will be accepted by the marketplace and that we will be able to generate revenues. Our management does not plan to hire any employees at this time. Our sole officer and director will be responsible for the business plan development.

Results of Operations

There is no historical financial information about us upon which to base an evaluation of our performance. We have incurred expenses of $17,068 on our operations as of May 31, 2013 and our only other activity consisted of the sale of 9,000,000 shares of our common stock to our sole director and officer for aggregate proceeds of $9,000 and a note payable in the amount of $9,816.

We have not generated any revenues from our operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including the financial risks associated with the limited capital resources currently available to us for the implementation of our business strategies. (See “Risk Factors”). To become profitable and competitive, we must develop the business plan and execute the plan. Our management will attempt to secure financing through various means including borrowing and investment from institutions and private individuals.

Since inception, the majority of our time has been spent refining its business plan and preparing for a primary financial offering.

Our results of operations are summarized below:

| | | | |

| | May 18, 2011 (Inception) | |

| | To May 31, 2013 | |

| | (Audited) | |

Revenue | | | — | |

Cost of Revenue | | | — | |

Expenses | | $ | 21,475 | |

Net Loss - | | $ | 21,475 | |

Net Loss per Share - Basic and Diluted | | | (0.00 | ) |

Weighted Average Number Shares Outstanding - Basic and Diluted | | | 9,000,000 | |

Liquidity and Capital Resources

As of the date of this prospectus, we had yet to generate any revenues from our business operations. For the period ended May 31, 2013 , we issued 9,000,000 shares of common stock to our sole officer and director for cash proceeds of $9,000 and a note payable in the amount for $9,816 to an accredited, non-affiliate investor.

- 28 -

Our current cash on hand is $1,228 which will be used to meet our current obligations. However, our current cash is not sufficient to meet the new obligations associated with being a company that is fully reporting with the SEC. Based on our disclosure above under “Use of Proceeds,” we anticipate that any level of capital raised above 75% will allow us minimal operations for a eighteen month period while meeting our state and SEC required compliance obligations. Nonetheless, even the sale of 100% of the securities in this offering will not provide sufficient capital to fully implement the business plan, but it will provide for vetting of the business plan to support pursuing investment capital.

Our current cash on hand is $1,228 , which is allocated to cover the expenses associated with this offering. Accordingly, we anticipate that our current cash on hand is not sufficient to meet the new obligations associated with being a company that is fully reporting with the SEC. However, to the extent that we do not expend the entire cash on hand on this offering, the remaining cash will be allocated to cover these new reporting company obligations, and our “Use of Proceeds” would be adjusted accordingly. Nonetheless, based on our disclosure above under “Use of Proceeds,” which is based on utilizing the entire cash on hand for this offering, we anticipate that any level of capital raised above 60% will allow us minimal operations for a twelve month period while meeting our State and SEC required compliance obligations. Although, the sale of 100% of the securities in this offering will not provide sufficient capital to fully implement the business plan, it will provide for vetting of the business plan to support pursuing investment capital.

We anticipate needing $700,000 (subsequent to this $30,000 capital raise) in order to effectively execute our business plan over the next eighteen months. Currently available cash is not sufficient to allow us to commence full execution of our business plan. Our business expansion will require significant capital resources that may be funded through the issuance of common stock or of notes payable or other debt arrangements that may affect our debt structure. Despite our current financial status we believe that we may be able to issue notes payable or debt instruments in order to start executing our business plan. However, there can be no assurance that we will be able to raise money in this fashion and have not entered into any agreements that would obligate a third party to provide us with capital.

Through May 31, 2013 , we spent $ 21,475 on general and administrative operating expenses. We raised the cash amounts to be used in these activities from the sale of common stock to our sole officer and director. We raised $9,816 in a note payable from an accredited, non-affiliated investor. We currently have accrued interest of $ 387 and a working capital deficit of $ 12,475 .

To date, the Company has managed to keep our monthly cash flow requirement low for two reasons. First, our sole officer does not draw a salary at this time. Second, the Company has been able to keep our operating expenses to a minimum by operating in space owned by our sole officer.

As of the date of this registration statement, the current funds available to the Company will not be sufficient to continue maintaining a reporting status. Management believes if the Company cannot maintain its reporting status with the SEC it will have to cease all efforts directed towards the Company. As such, any investment previously made would be lost in its entirety.

The Company currently has no external sources of liquidity such as arrangements with credit institutions or off-balance sheet arrangements that will have or are reasonably likely to have a current or future effect on our financial condition or immediate access to capital.

The Sole director and officer has made no written commitments with respect to providing a source of liquidity in the form of cash advances, loans and/or financial guarantees.

If the Company is unable to raise the funds partially through this offering the Company will seek alternative financing through means such as borrowings from institutions or private individuals. There can be no assurance that the Company will be able to keep costs from being more than these estimated amounts or that the Company will be able to raise such funds. Even if we sell all shares offered through this registration statement, we expect that the Company will seek additional financing in the future. However, the Company may not be able to obtain additional capital or generate sufficient revenues to fund our operations. If we are unsuccessful at raising sufficient funds, for whatever reason, to fund our operations, the Company may be forced to seek a buyer for our business or another entity with which we could create a joint venture. If all of these alternatives fail, we expect that the Company will be required to seek protection from creditors under applicable bankruptcy laws.

Our independent auditor has expressed doubt about our ability to continue as a going concern and believes that our ability is dependent on our ability to implement our business plan, raise capital and generate revenues. See Note 2 of our financial statements.

- 29 -

Recent Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or The NASDAQ Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address board of directors’ independence, audit committee oversight, and the adoption of a code of ethics. Our Board of Directors is comprised of one individual who is also our executive officer. Our executive officer makes decisions on all significant corporate matters such as the approval of terms of the compensation of our executive officer and the oversight of the accounting functions.

Although the Company has adopted a Code of Ethics and Business Conduct the Company has not yet adopted any of these other corporate governance measures and, since our securities are not yet listed on a national securities exchange, the Company is not required to do so. The Company has not adopted corporate governance measures such as an audit or other independent committees of our board of directors as we presently do not have any independent directors. If we expand our board membership in future periods to include additional independent directors, the Company may seek to establish an audit and other committees of our board of directors. It is possible that if our Board of Directors included independent directors and if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. For example, in the absence of audit, nominating and compensation committees comprised of at least a majority of independent directors, decisions concerning matters such as compensation packages to our senior officer and recommendations for director nominees may be made by a majority of directors who have an interest in the outcome of the matters being decided. Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Inflation

The effect of inflation on our revenues and operating results has not been significant.

Significant Accounting Policies

Our financial statements are affected by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete listing of these policies is included in Note 3 of the notes to our financial statements for the year ended May 31, 2013 . We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

The Company has elected to use the extended transition period for complying with new or revised financial accounting standards available under Section 102(b)(2)(B) of the Act. Among other things, this means that the Company’s independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company’s internal control over financial reporting so long as it qualifies as an emerging growth company, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an emerging growth company, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers, that would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Research and Development Expenses: Expenditures for research and development will be expensed as incurred.

- 30 -

Earnings (Loss) Per Share: Basic loss per share is computed by dividing net loss attributable to common stockholders by the weighted average common shares outstanding for the period. Diluted loss per share is computed giving effect to all potentially dilutive common shares. Potentially dilutive common shares may consist of incremental shares issuable upon the exercise of stock options and warrants and the conversion of notes payable to common stock. In periods in which a net loss has been incurred, all potentially dilutive common shares are considered antidilutive and thus are excluded from the calculation. At May 31, 2013 the Company did not have any potentially dilutive common shares.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING

AND FINANCIAL DISCLOSURE

ZBS Group, LLP, our CPA auditors, has audited our Financial Statements for the period from May 18, 2011 (date of inception) through May 31, 2013 and to the extent set forth in its report, which are included herein in reliance upon the authority of said firm as experts in accounting and auditing. There were no disagreements related to accounting principles or practices, financial statement disclosure, internal controls or auditing scope or procedure during the two fiscal years and interim period.

CODE OF BUSINESS CONDUCT AND ETHICS

On May 18, 2011 we adopted a Code of Ethics and Business Conduct which is applicable to our employees and which also includes a Code of Ethics for our CEO and principal financial officer and persons performing similar functions. A code of ethics is a written standard designed to deter wrongdoing and to promote

| | |

| · | honest and ethical conduct, |

| | |

| · | full, fair, accurate, timely and understandable disclosure in regulatory filings and public statements, |

| | |

| · | compliance with applicable laws, rules and regulations, |

| | |

| · | the prompt reporting violation of the code, and |

| | |

| · | accountability for adherence to the code. |

A copy of our Code of Business Conduct and Ethics has been filed with the Securities and Exchange Commission as an exhibit to this S-1 filing. Any person desiring a copy of the Code of Business Conduct and Ethics, can obtain one by going to Edgar and looking at the attachments to this S-1 filing.

MANAGEMENT

Officer and Director

Our sole officer and director will serve until her successor is elected and qualified. Our officers are elected by the board of directors to a term of one (1) year and serve until their successor is duly elected and qualified, or until they are removed from office. The board of directors has no nominating, auditing or compensation committees.

The name, address, age and position of our president, secretary/treasurer, and director and vice president is set forth below:

| | | | |

NAME AND ADDRESS | | AGE | | POSITION(S) |

Danielle Olsen

3384 La Canada Drive, Suite 1

Cameron Park, CA 95682 | | 28 | | President, Secretary/ Treasurer,

Principal Executive Officer,

Principal Financial Officer and sole member of the Board of Directors |

The person named above has held her offices/positions since the inception of our company and is expected to hold her offices/positions until the next annual meeting of our stockholders.

- 31 -

Business Experience

DANIELLE OLSEN, SOLE OFFICER AND DIRECTOR

Ms. Olsen is our founder and has served as our sole officer and director since our inception. She 6 years of marketing and software design and programming experience. She is currently working at Sage Software, an applications development company. She has designed and programmed inventory management systems, integrated software for various application protocols, interfaces disparate accounting software systems, and customized reporting. Previously, she was a purchasing manager for Lawson Medical. Ms. Olsen earned a bachelor of science in computer science from Florida Atlantic University.

Currently Ms. Olsen devotes approximately 20-30 hours per week for the Company. The balance of her time is spent at Sage Software, Inc.

Ms. Olsen is not an officer or director of any other reporting company.

CONFLICTS OF INTEREST

As of May 31, 2013 , we have no employees. Ms. Olsen, our founder, Sole officer and director, currently devotes 25 to 30 hours per week to our business as required from time to time without compensation. We have not entered into any formal agreement with Ms. Olsen regarding the provision of her services to the Company.

Ms. Olsen is not obligated to commit her full time and attention to our business and accordingly, she may encounter a conflict of interest in allocating her time between our operations and those of other businesses. Presently, Ms. Olsen earns her livelihood as an employee of Sage Software, Inc.

Although Ms. Olsen is presently able to devote 25 to 30 hours per week to our business while maintaining her own livelihood, this may change. Also, if we require Ms. Olsen to devote more than 25 to 30 hours per week to our business on a regular basis for an extended period, it is uncertain that she will be able to satisfy our requirements unless we have sufficient resources to compensate her for any lost income from her livelihood.

In general, officers and directors of a corporation are required to present business opportunities to the corporation if:

| | |

| · | the corporation could financially undertake the opportunity; |

| | |

| · | the opportunity is within the corporation’s line of business; and |

| | |

| · | it would be unfair to the corporation and its stockholders not to bring the opportunity to the attention of the corporation. |

COMMITTEES OF THE BOARD OF DIRECTORS

Our sole director has not established any committees, including an Audit Committee, a Compensation Committee or a Nominating Committee, or any committee performing a similar function. The functions of those committees are being undertaken by our sole director. Because we do not have any independent directors, our sole director believes that the establishment of committees of the Board would not provide any benefits to our company and could be considered more form than substance.

We do not have a policy regarding the consideration of any director candidates that may be recommended by our stockholders, including the minimum qualifications for director candidates, nor has our sole director established a process for identifying and evaluating director nominees. We have not adopted a policy regarding the handling of any potential recommendation of director candidates by our stockholders, including the procedures to be followed. Our sole director has not considered or adopted any of these policies as we have never received a recommendation from any stockholder for any candidate to serve on our Board of Directors.

Given our relative size and lack of directors and officers insurance coverage, we do not anticipate that any of our stockholders will make such a recommendation in the near future. While there have been no nominations of additional directors proposed, in the event such a proposal is made, all current members of our Board will participate in the consideration of director nominees.

- 32 -

Our sole director is not an “audit committee financial expert” within the meaning of Item 401(e) of Regulation S-K. In general, an “audit committee financial expert” is an individual member of the audit committee or Board of Directors who:

| | |

| · | understands generally accepted accounting principles and financial statements, |

| | |

| · | is able to assess the general application of such principles in connection with accounting for estimates, accruals and reserves, |

| | |

| · | has experience preparing, auditing, analyzing or evaluating financial statements comparable to the breadth and complexity to our financial statements, |

| | |

| · | understands internal controls over financial reporting, and |

| | |

| · | understands audit committee functions. |

Our Board of Directors is comprised of solely of Ms. Olsen who was integral to our business and who is involved in our day to day operations. While we would prefer to have an audit committee financial expert on our board of directors, Ms. Olsen does not have a professional background in finance or accounting. As with most small, early stage companies until such time our company further develops its business, achieves a stronger revenue base and has sufficient working capital to purchase directors and officers insurance, the Company does not have any immediate prospects to attract independent directors. When the Company is able to expand our Board of Directors to include one or more independent directors, the Company intends to establish an Audit Committee of our Board of Directors. It is our intention that one or more of these independent directors will also qualify as an audit committee financial expert. Our securities are not quoted on an exchange that has requirements that a majority of our Board members be independent and the Company is not currently otherwise subject to any law, rule or regulation requiring that all or any portion of our Board of Directors include “independent” directors, nor are we required to establish or maintain an Audit Committee or other committee of our Board of Directors.

Wedo not have any independent directors and the Companyhas not voluntarily implemented various corporate governance measures, in the absence of which, stockholders may have more limited protections against interested director transactions, conflicts of interest and similar matters.

INDEMNIFICATION OF DIRECTORS AND OFFICERS

Title XXXVI, Chapter 607, of the Florida Statutes (the “Florida Business Corporation Act”) permits, but does not require, corporations to indemnify a director, officer or control person of the corporation for any liability asserted against him and liability and expenses incurred by him in her capacity as a director, officer, employee or agent, or arising out of her status as such, if he or she acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the corporation, and, unless the Articles of Incorporation provide otherwise, whether or not the corporation has provided for indemnification in its Articles of Incorporation. Our Articles of Incorporation have no separate provision for indemnification of directors, officers, or control persons.

Regarding indemnification for liabilities arising under the Securities Act of 1933, which may be permitted to directors or officers under Florida law, we are informed that, in the opinion of the Securities and Exchange Commission, indemnification is against public policy, as expressed in the Act and is, therefore, unenforceable.

EXECUTIVE COMPENSATION

We have made no provisions for paying cash or non-cash compensation to our sole officer and director. No salaries are being paid at the present time, no salaries or other compensation were paid in cash, or otherwise, for services performed prior to May 18, 2011 our date of inception, and no compensation will be paid unless and until our operations generate sufficient cash flows.

The table below summarizes all compensation awarded to, earned by, or paid to our named executive officer for all services rendered in all capacities to us for the period from inception May 18, 2011 through May 31, 2013 .

- 33 -

Summary Compensation Table

| | | | | | | | | | | | | | | | | | |

Name | | | | | | | | | | | | Non-Equity | | Nonqualified | | | | |

and | | | | | | | | Stock | | Option | | Incentive Plan | | Deferred | | All Other | | |

principal | | | | Salary | | Bonus | | Awards | | Awards | | Compensation | | Compensation | | Compensation | | Total |

position | | Year | | ($) | | ($) | | ($) | | ($) | | ($) | | Earnings ($) | | ($) | | ($) |

Danielle Olsen CEO | | 2013 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 |

Danielle Olsen CEO | | 2012 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 |

We have not paid any salaries to our sole director and officer as of the date of this Prospectus. We do not anticipate beginning to pay salaries until we have adequate funds to do so. There are no other stock option plans, retirement, pension, or profit sharing plans for the benefit of our officer and director other than as described herein.

Outstanding Equity Awards at Fiscal Year-End

The table below summarizes all unexercised options, stock that has not vested, and equity incentive plan awards for each named executive officer as of May 31, 2013 .

| | | | | | | | | | | |

| Option Awards | | Stock Awards |

Name | Number of Securities Underlying Unexercised Option (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity

Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration

Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity

Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity

Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

Danielle Olsen | — | — | — | — | — | — | — | — | — |

There were no grants of stock options since inception to the date of this Prospectus.

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance.

Our sole director has not adopted a stock option plan. We have no plans to adopt a stock option plan, but may choose to do so in the future. If such a plan is adopted, this may be administered by the board or a committee appointed by the board (the “Committee”). The committee would have the power to modify, extend or renew outstanding options and to authorize the grant of new options in substitution therefore, provided that any such action may not impair any rights under any option previously granted. We may develop an incentive based stock option plan for our officer and director and may reserve up to 10% of our outstanding shares of common stock for that purpose.

Options Grants during the Last Fiscal Year / Stock Option Plans

We do not currently have a stock option plan in favor of any director, officer, consultant or employee of our company. No individual grants of stock options, whether or not in tandem with stock appreciation rights known as SARs or freestanding SARs have been made to our Sole director and officer since our inception; accordingly, no stock options have been granted or exercised by our sole director and officer since we were founded.

Aggregated Options Exercises in Last Fiscal Year

No individual grants of stock options, whether or not in tandem with stock appreciation rights known as SARs or freestanding SARs have been made to our sole director and officer since our inception; accordingly, no stock options have been granted or exercised by our sole director and officer since we were founded.

- 34 -

Long-Term Incentive Plans and Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance. No individual grants or agreements regarding future payouts under non-stock price-based plans have been made to our sole director and officer or any employee or consultant since our inception; accordingly, no future payouts under non-stock price-based plans or agreements have been granted or entered into or exercised by our Sole director and officer or employees or consultants since we were founded.

Compensation of Directors

Our sole director is not compensated by us for acting as such. She is reimbursed for reasonable out-of-pocket expenses incurred. There are no arrangements pursuant to which our Sole director is or will be compensated in the future for any services provided as a director.

We do not have any agreements for compensating our directors for their services in their capacity as directors, although such directors are expected in the future to receive stock options to purchase shares of our common stock as awarded by our board of directors.

Employment Contracts, Termination of Employment, Change-In-Control Arrangements

There are no employment contracts or other contracts or arrangements with our officer or director other than those disclosed in this report. There are no compensation plans or arrangements, including payments to be made by us, with respect to Ms. Olsen that would result from her resignation, retirement or any other termination. There are no arrangements for directors, officers or employees that would result from a change-in-control.

Indebtedness of Directors, Senior Officers, Executive Officers and Other Management

Neither our sole director and officer nor any associate or affiliate of our company during the last two fiscal years is or has been indebted to our company by way of guarantee, support agreement, letter of credit or other similar agreement or understanding currently outstanding.

Director Compensation

The table below summarizes all compensation awarded to, earned by, or paid to our sole director for all services rendered in all capacities to us for the period from inception May 18, 2011 through May 31, 2013 .

Director Compensation

| | | | | | | |

Name | Fees

Earned

or Paid

in Cash

($) | Stock

Awards

($) | Option

Awards

($) | Non-Equity

Incentive Plan

Compensation

($) | Change in

Pension Value

and

Non-Qualified

Deferred

Compensation

Earnings

($) | All Other

Compensation

($) | Total

($) |

Danielle Olsen | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

At this time, we have not entered into any employment agreements with our sole officer and director. If there is sufficient cash flow available from our future operations, we may enter into employment agreements with our sole officer and director or future key staff members.

- 35 -

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth, as of the date of this prospectus, the total number of shares owned beneficially by our Sole officer and director, and key employees, individually and as a group, and the present owners of 5% or more of our total outstanding shares. The table also reflects what her ownership will be assuming completion of the sale of all shares in this offering. The stockholder listed below has direct ownership of her shares and possesses sole voting and dispositive power with respect to the shares.

| | | | | | | |

Title of Class | | Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | Percent of

Class | |

Common Stock | | Danielle Olsen | | 9,000,000 | | 100 | % |

| | 3384 La Canada Drive, Suite 1

Cameron Park, CA 95682 | | | | | |

| | | | | | | |

| | All Officers and Directors as a Group | | 9,000,000 | | 100 | % |

| | (1 person) | | | | | |

The following table sets forth the beneficial ownership table after the anticipated 100% completion of the offering.

After completion of the offering

| | | | | | | |

Title of Class | | Name and Address of Shareholders | | Amount and Nature of

Shareholders Ownership | | Percent of

Class | |

Common Stock | | Danielle Olsen | | 9,000,000 | | 75 | % |

| | 3384 La Canada Drive, Suite 1

Cameron Park, CA 95682 | | | | | |

| | | | | | | |

| | All other Shareholders | | 3,000,000 | | 25 | % |

Change in Control

We are not aware of any arrangement that might result in a change in control of our company in the future.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

On May 18, 2011 we issued 9,000,000 shares of our common stock to our sole director and officer at $0.001 per share for aggregate proceeds of $9,000. We also issued a note payable in the amount of $9,816 to an accredited, non-affiliated investor.

There have been no other transactions since our inception May 18, 2011, or any currently proposed transactions in which we are, or plan to be, a participant and in which any related person had or will have a direct or indirect material interest.

Director Independence

We intend to quote our securities on the OTC Bulletin Board which does not have any director independence requirements. Once we engage further directors and officers, we plan to develop a definition of independence and scrutinize our Board of Directors with regard to this definition.

Legal Proceedings

We know of no material, active or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceedings or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered beneficial shareholder are an adverse party or has a material interest adverse to us.

We intend to furnish annual reports to stockholders, which will include audited financial statements reported on by our Certified Public Accountants. In addition, we will issue unaudited quarterly or other interim reports to stockholders, as we deem appropriate or required by applicable securities regulations.

- 36 -

REPORTS TO SECURITY HOLDERS

As a result of this offering, we will become subject to the information and reporting requirements of the Exchange Act and, in accordance with this law, will file periodic reports, proxy statements and other information with the SEC. These periodic reports, proxy statements and other information will be available for inspection and copying at the SEC’s Public Reference Room at 100 F Street, NE, Washington DC 20549. If we fail to meet the Exchange Act’s reporting requirements we will lose our status as a reporting Issuer with the SEC. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can receive copies of these documents upon payment of a duplicating fee by writing to the SEC. The public may also read any materials filed by us with the SEC through the SEC’s website at www.sec.gov. In addition to documents related to the registration statement of which this prospectus forms a part, you may access our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act with the SEC free of charge at www.sec.gov.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the Securities and Exchange Commission, 100 F Street NE, Washington, D.C. 20549, under the Securities Act of 1933 a registration statement on Form S-1 of which this prospectus is a part, with respect to the shares offered hereby. We have not included in this prospectus all the information contained in the registration statement, and you should refer to the registration statement and our exhibits for further information.

In the Registration Statement, certain items of which are contained in exhibits and schedules as permitted by the rules and regulations of the Securities and Exchange Commission. You can obtain a copy of the Registration Statement from the Securities and Exchange Commission by mail from the Public Reference Room of the Securities and Exchange Commission at 100 F Street, NE, Washington, D.C. 20549, at prescribed rates. In addition, the Securities and Exchange Commission maintains a Web site at http://www.sec.gov containing reports, proxy and information statements and other information regarding registrants that file electronically with the Securities and Exchange Commission. The Securities and Exchange Commission’s telephone number is 1-800-SEC-0330 (1-800-732-0330). These SEC filings are also available to the public from commercial document retrieval services.

You should rely only on the information contained in this prospectus. No finder, dealer, sales person or other person has been authorized to give any information or to make any representation in connection with this offering other than those contained in this prospectus and, if given or made, such information or representation must not be relied upon as having been authorized by Mobile Vault, Inc.. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any of the securities offered hereby by anyone in any jurisdiction in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation.

STOCK TRANSFER AGENT

We have not engaged the services of a transfer agent at this time. However, within the next twelve months we anticipate doing so. Until such a time a transfer agent is retained, we will act as our own transfer agent.

DEALER PROSPECTUS DELIVERY OBLIGATION

Until a date, which is 270 days after the date of this prospectus, all dealers that effect transactions in these securities whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

- 37 -

Mobile Vault, Inc.

Audited Financial Statements for the years ended May 31, 2013 and 2012.

| |

| Page |

| |

Report of independent registered public accounting firm | F-1 |

| |

Balance sheets May 31, 2013 and May 31, 2012 | F-2 |

| |

Statements of operations For the Years ended May 31, 2013, May 31, 2012 and for the period from inception

(May 18, 2011 through May 31, 2013 | F-3 |

| |

Statements of stockholder’s equity May 18, 2011 through May 31, 2013 | F-4 |

| |

Statements of cash flows For the Years ended May 31, 2013, May 31, 2012 and for the period from inception

(May 18, 2011 through May 31, 2013 | F-5 |

| |

Notes to financial statements for the years ended May 31, 2013 and May 31, 2012 | F-7 – F-11 |

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholder’s of

Mobile Vault, Inc.

We have audited the accompanying balance sheets of Mobile Vault, Inc. (a development stage company) as of May 31, 2013 and May 31, 2012, and the related statements of operations, stockholder’s equity (deficiency), and cash flows for each of the years ended May 31, 2013 and May 31, 2012, and for the period from inception (May 18, 2011) through May 31, 2013. Mobile Vault, Inc.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.