Exhibit 99.4

American Midstream to Merge with JP Energy, Creating a Diversified Midstream Business October 2016

2 2 Legal Disclaimer This release includes “forward-looking” statements. Forward-looking statements are identified as any statement that does not relate strictly to historical or current facts. Statements using words such as “anticipate,” “believe,” “intend,” “project,”

“plan,” “expect,” “continue,” “estimate,” “goal,” “forecast,” “may,” “will” or similar expressions help identify forward-looking statements. American Midstream and JP Energy cannot give any assurance that expectations and projections about future events will prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions. These risks and uncertainties include the risks that the proposed transaction may not be consummated or the benefits contemplated therefrom may not be realized. Additional risks include the following: the ability to obtain requisite regulatory and unitholder approval and the satisfaction of the other conditions to the consummation of the proposed transaction, the ability of American Midstream to successfully integrate JP Energy’s operations and employees and realize anticipated synergies and cost savings, actions by third parties, the potential impact of the announcement or consummation of the proposed transaction on relationships, including with employees, suppliers, customers, competitors and credit rating agencies, and the ability to achieve revenue and other financial growth, and volatility in the price of oil, natural gas, and natural gas liquids and the credit market. Actual results and outcomes may differ materially from those expressed in such forward-looking statements. These and other risks and uncertainties are discussed in more detail in filings made by American Midstream and JP Energy with the Securities and Exchange Commission (the “SEC”), which are available for free at www.sec.gov. American Midstream and JP Energy undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

3 3 Note: Pro-forma enterprise value as of 10/21/2016. Pro-forma leverage based on debt / LTM Adjusted EBITDA as of 6/30/2016 based on partnership’s respective covenant calculation A Strategic Merger AMID and JPEP to merge forming a ~$2 billion midstream business AMID and JPEP to merge, creating a diversified midstream partnership • American Midstream Partners (“AMID”) and JP Energy Partners (“JPEP”) have executed a merger agreement whereby AMID will merge with JPEP in a unit-for-unit exchange • Transformational combination creates diversified partnership with ~$2 billion enterprise value Transaction improves financial position, consolidates GP ownership, accelerates growth trajectory • Combines JPEP general partner interest owned by ArcLight affiliates into AMID general partner • Increased scale enhances access to capital and improves ability to pursue accretive acquisitions; pro-forma leverage of 3.8x • Larger platform enhances ability to drive efficiencies; complementary business activities provide attractive synergy opportunities • Establishes path to mid-single digit distribution growth over the long-term Expect transaction to close late 2016 / early 2017 • Merger has been unanimously approved by special committee of AMID plus full Board of AMID and JPEP • Targeting late 2016 / early 2017 closing, pending required approvals, credit facility amendments and JPEP unitholder vote Merger creates an expanded midstream platform with strong sponsorship from ArcLight

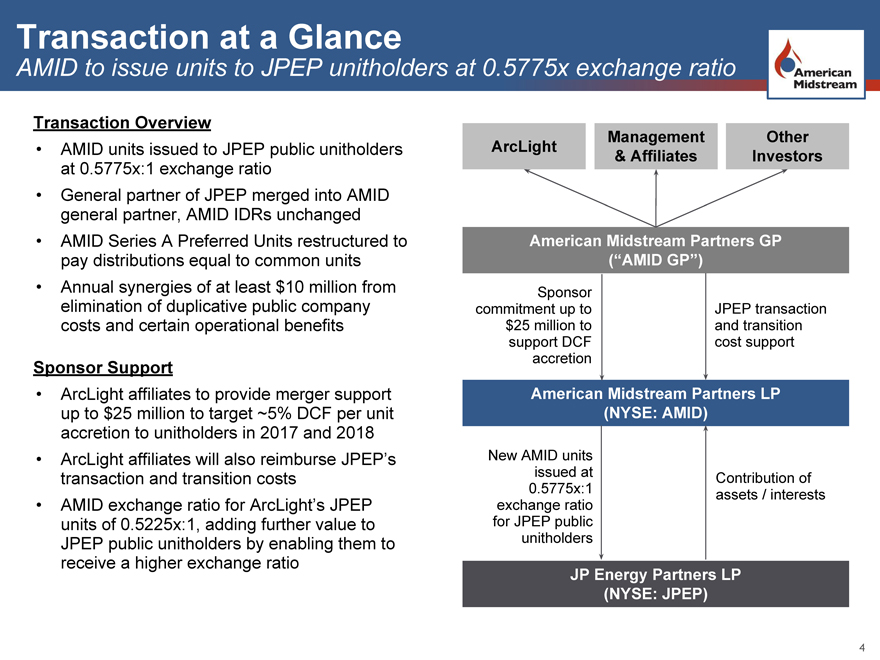

4 4 Transaction at a Glance AMID to issue units to JPEP unitholders at 0.5775x exchange ratio Transaction Overview • AMID units issued to JPEP public unitholders at 0.5775x:1 exchange ratio • General partner of JPEP merged into AMID general partner, AMID IDRs unchanged • AMID Series A Preferred Units restructured to pay distributions equal to common units • Annual synergies of at least $10 million from elimination of duplicative public company costs and certain operational benefits Sponsor Support • ArcLight affiliates to provide merger support up to $25 million to target ~5% DCF per unit accretion to unitholders in 2017 and 2018 • ArcLight affiliates will also reimburse JPEP’s transaction and transition costs • AMID exchange ratio for ArcLight’s JPEP units of 0.5225x:1, adding further value to JPEP public unitholders by enabling them to receive a higher exchange ratio ArcLight Management & Affiliates Other Investors American Midstream Partners GP (“AMID GP”) American Midstream Partners LP (NYSE: AMID) JP Energy Partners LP (NYSE: JPEP) Sponsor commitment up to $25 million to support DCF accretion JPEP transaction and transition

cost support New AMID units issued at 0.5775x:1 exchange ratio for JPEP public unitholders Contribution of assets / interests

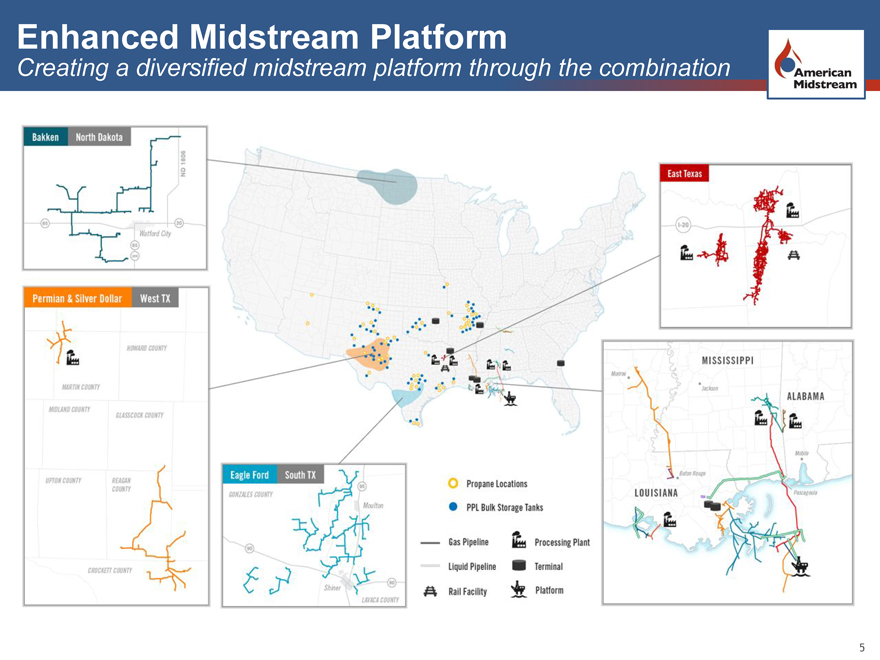

5 5

Enhanced Midstream Platform

Creating a diversified midstream platform through the combination

6 6

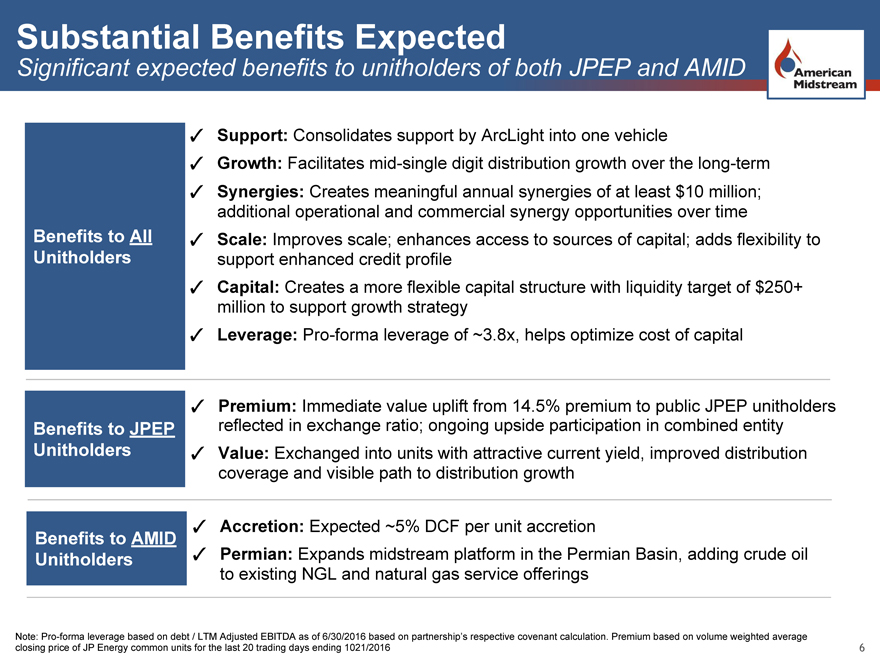

Substantial Benefits Expected

Significant expected benefits to unitholders of both JPEP and AMID

Note: Pro-forma leverage based on debt / LTM Adjusted EBITDA as of 6/30/2016 based on partnership’s respective covenant calculation. Premium based on volume weighted average

closing price of JP Energy common units for the last 20 trading days ending 1021/2016

Benefits to JPEP

Unitholders

? Premium: Immediate value uplift from 14.5% premium to public JPEP unitholders

reflected in exchange ratio; ongoing upside participation in combined entity

? Value: Exchanged into units with attractive current yield, improved distribution

coverage and visible path to distribution growth

? Accretion: Expected ~5% DCF per unit accretion

? Permian: Expands midstream platform in the Permian Basin, adding crude oil

to existing NGL and natural gas service offerings

Benefits to All

Unitholders

? Support: Consolidates support by ArcLight into one vehicle

? Growth: Facilitates mid-single digit distribution growth over the long-term

? Synergies: Creates meaningful annual synergies of at least $10 million;

additional operational and commercial synergy opportunities over time

? Scale: Improves scale; enhances access to sources of capital; adds flexibility to

support enhanced credit profile

? Capital: Creates a more flexible capital structure with liquidity target of $250+

million to support growth strategy

? Leverage: Pro-forma leverage of ~3.8x, helps optimize cost of capital

Benefits to AMID

Unitholders

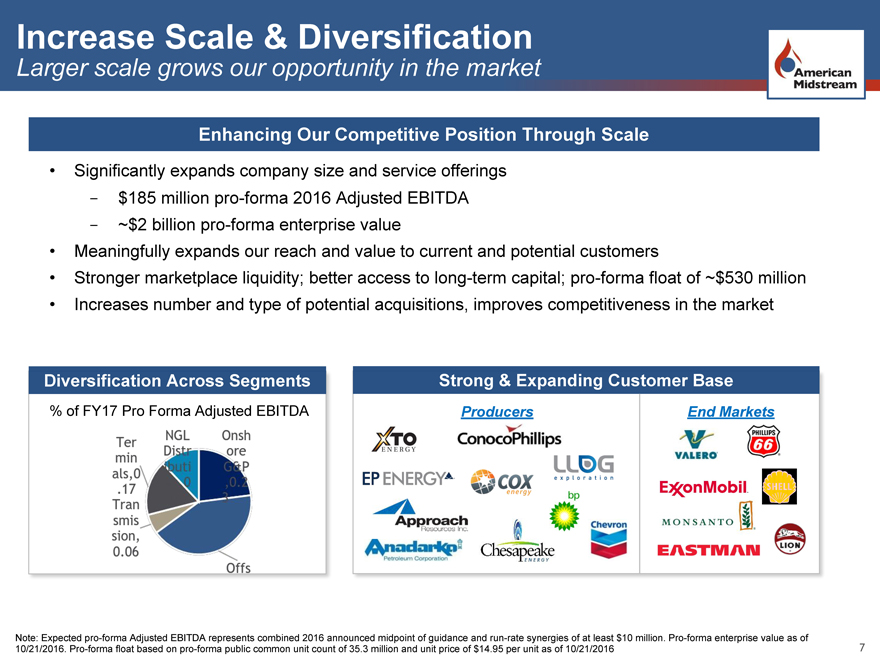

7 7 Increase Scale & Diversification Larger scale grows our opportunity in the market • Significantly expands company size and service offerings - $185 million pro-forma 2016 Adjusted EBITDA - ~$2 billion pro-forma enterprise value • Meaningfully expands our reach and value to current and potential customers • Stronger marketplace liquidity; better access to long-term capital; pro-forma float of ~$530 million • Increases number and type of potential acquisitions, improves competitiveness in the market Enhancing Our Competitive Position Through Scale Diversification Across Segments % of FY17 Pro Forma Adjusted EBITDA Strong & Expanding Customer Base Producers End Markets Note: Expected pro-forma Adjusted EBITDA represents combined 2016 announced midpoint of guidance and run-rate synergies of at least $10 million. Pro-forma enterprise value as of 10/21/2016. Pro-forma float based on pro-forma public common unit count of 35.3 million and unit price of $14.95 per unit as of 10/21/2016

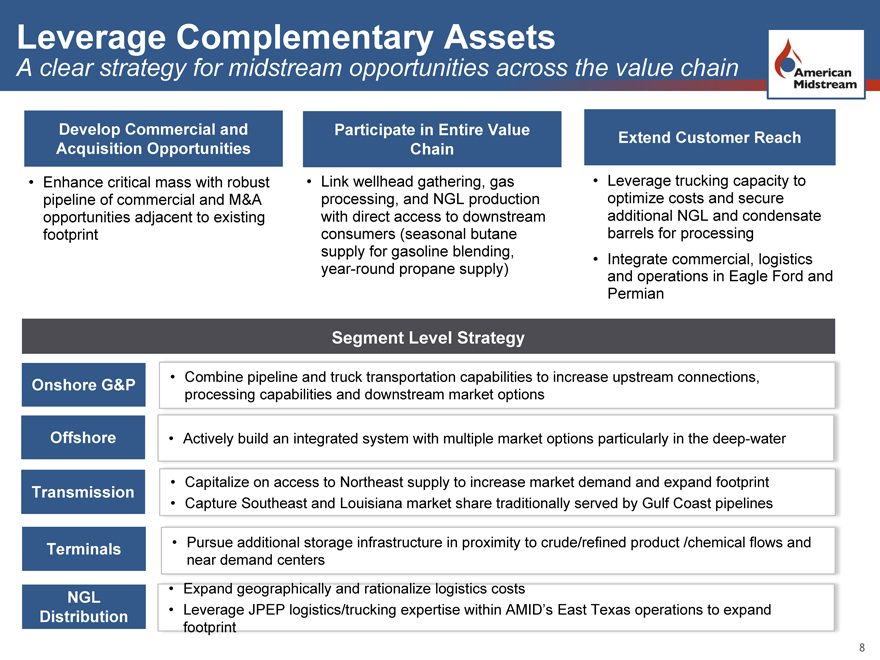

8 8 Transmission Terminals • Capitalize on access to Northeast supply to increase market demand and expand footprint • Capture Southeast and Louisiana market share traditionally served by Gulf Coast pipelines • Pursue additional storage infrastructure in proximity to crude/refined product /chemical flows and near demand centers • Expand geographically and rationalize logistics costs • Leverage JPEP logistics/trucking expertise within AMID’s East Texas operations to expand footprint Develop Commercial and Acquisition Opportunities • Combine pipeline and truck transportation capabilities to increase upstream connections, processing capabilities and downstream market options Offshore • Actively build an integrated system with multiple market options particularly in the deep-water Leverage Complementary Assets A clear strategy for midstream opportunities across the value chain NGL Distribution • Enhance critical mass with robust pipeline of commercial and M&A opportunities adjacent to existing

footprint • Link wellhead gathering, gas processing, and NGL production with direct access to downstream consumers (seasonal butane supply for gasoline blending, year-round propane supply) • Leverage trucking capacity to optimize costs and secure

additional NGL and condensate barrels for processing • Integrate commercial, logistics and operations in Eagle Ford and Permian Onshore G&P Participate in Entire Value Chain Extend Customer Reach Segment Level Strategy

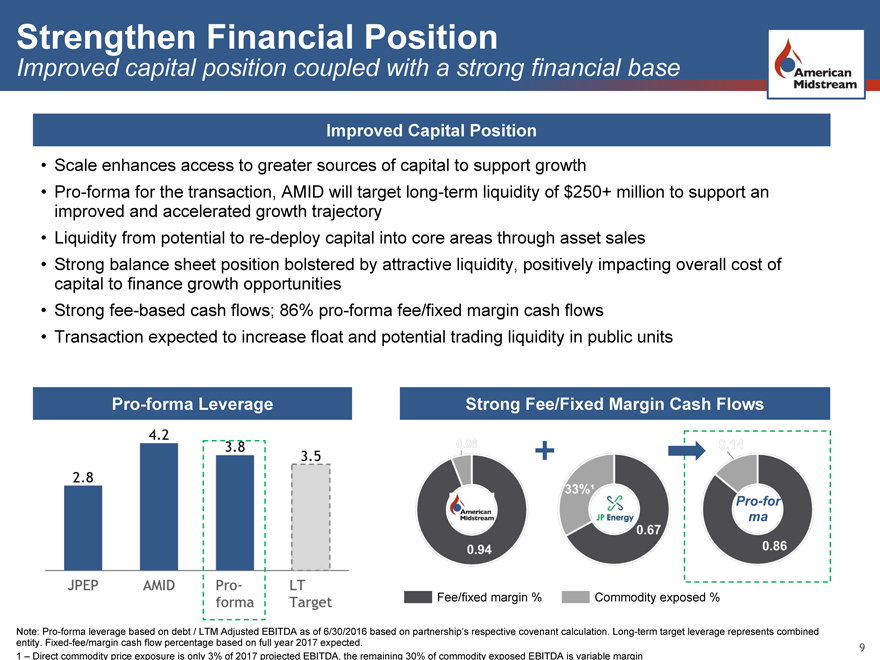

9 9

Strengthen Financial Position

Improved capital position coupled with a strong financial base

Note: Pro-forma leverage based on debt / LTM Adjusted EBITDA as of 6/30/2016 based on partnership’s respective covenant calculation. Long-term target leverage represents combined

entity. Fixed-fee/margin cash flow percentage based on full year 2017 expected.

1 – Direct commodity price exposure is only 3% of 2017 projected EBITDA, the remaining 30% of commodity exposed EBITDA is variable margin

Improved Capital Position

• Scale enhances access to greater sources of capital to support growth

• Pro-forma for the transaction, AMID will target long-term liquidity of $250+ million to support an

improved and accelerated growth trajectory

• Liquidity from potential to re-deploy capital into core areas through asset sales

• Strong balance sheet position bolstered by attractive liquidity, positively impacting overall cost of

capital to finance growth opportunities

• Strong fee-based cash flows; 86% pro-forma fee/fixed margin cash flows

• Transaction expected to increase float and potential trading liquidity in public units

Pro-forma Leverage

Pro-for

ma

Strong Fee/Fixed Margin Cash Flows

Fee/fixed margin % Commodity exposed %

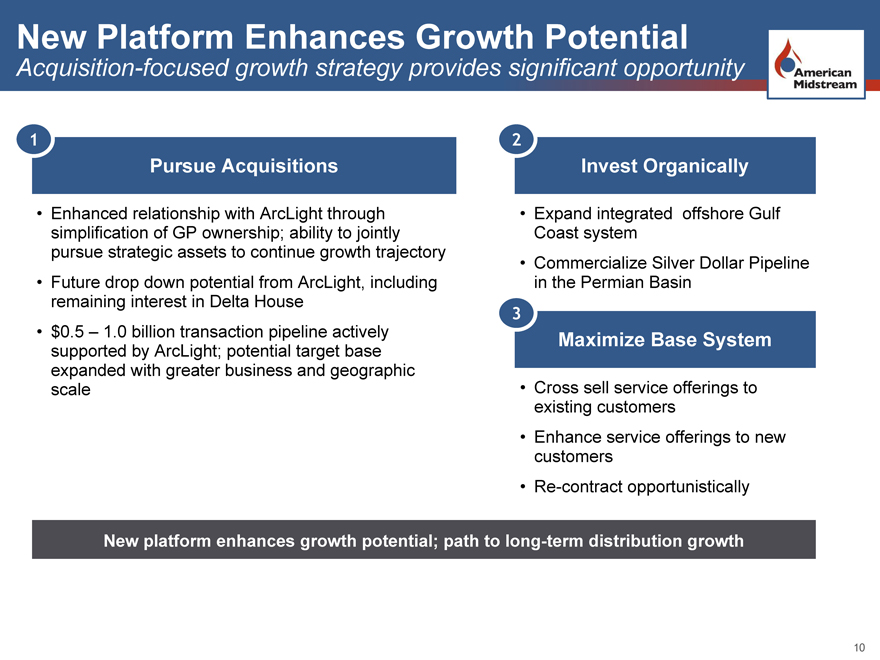

10 10

New Platform Enhances Growth Potential

Acquisition-focused growth strategy provides significant opportunity

Pursue Acquisitions

• Enhanced relationship with ArcLight through

simplification of GP ownership; ability to jointly

pursue strategic assets to continue growth trajectory

• Future drop down potential from ArcLight, including

remaining interest in Delta House

• $0.5 – 1.0 billion transaction pipeline actively

supported by ArcLight; potential target base

expanded with greater business and geographic

scale

1

Invest Organically

2

Maximize Base System

3

• Expand integrated offshore Gulf

Coast system

• Commercialize Silver Dollar Pipeline

in the Permian Basin

• Cross sell service offerings to

existing customers

• Enhance service offerings to new

customers

• Re-contract opportunistically

New platform enhances growth potential; path to long-term distribution growth

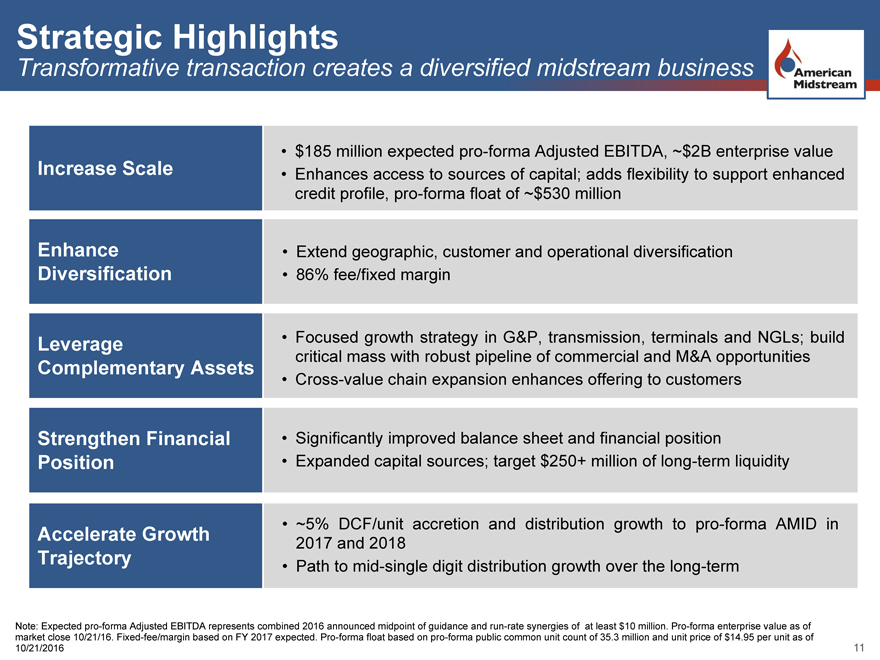

11 11

Strategic Highlights

Transformative transaction creates a diversified midstream business

Note: Expected pro-forma Adjusted EBITDA represents combined 2016 announced midpoint of guidance and run-rate synergies of at least $10 million. Pro-forma enterprise value as of

market close 10/21/16. Fixed-fee/margin based on FY 2017 expected. Pro-forma float based on pro-forma public common unit count of 35.3 million and unit price of $14.95 per unit as of

10/21/2016

Increase Scale

Enhance

Diversification

Leverage

Complementary Assets

Strengthen Financial

Position

Accelerate Growth

Trajectory

• $185 million expected pro-forma Adjusted EBITDA, ~$2B enterprise value

• Enhances access to sources of capital; adds flexibility to support enhanced

credit profile, pro-forma float of ~$530 million

• Extend geographic, customer and operational diversification

• 86% fee/fixed margin

• Focused growth strategy in G&P, transmission, terminals and NGLs; build

critical mass with robust pipeline of commercial and M&A opportunities

• Cross-value chain expansion enhances offering to customers

• Significantly improved balance sheet and financial position

• Expanded capital sources; target $250+ million of long-term liquidity

• ~5% DCF/unit accretion and distribution growth to pro-forma AMID in

2017 and 2018

• Path to mid-single digit distribution growth over the long-term

12 12

Additional Information

Additional Information and Where to Find it

This communication relates to a proposed business combination between American Midstream and JP Energy. In connection with the

proposed transaction, American Midstream and/or JP Energy expect to file a proxy statement/prospectus and other documents with

the Securities and Exchange Commission (“SEC”). WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE PROXY

STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY

AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. Any definitive proxy statement(s) (if and when available) will be mailed to unitholders of JP Energy. Investors and

security holders will be able to obtain these materials (if and when they are available) free of charge at the SEC’s website,

www.sec.gov. In addition, copies of any documents filed with the SEC may be obtained free of charge from JP Energy’s internet

website for investors at http://ir.jpenergypartners.com, and from American Midstream’s investor relations website at

http://www.americanmidstream.com/investor-relations. Investors and security holders may also read and copy any reports, statements

and other information filed by American Midstream and JP Energy with the SEC at the SEC public reference room at 100 F Street,

N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public

reference room.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or

approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means

of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participation in the Solicitation of Votes

American Midstream and JP Energy and their respective directors and executive officers may be considered participants in the

solicitation of proxies in connection with the proposed transaction. Information regarding JP Energy’s directors and executive officers is

available in its Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on February 29, 2016.

Information regarding American Midstream’s directors and executive officers is available in its Annual Report on Form 10-K for the year

ended December 31, 2016, filed with the SEC on March 7, 2016. Other information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy

statement/prospectus and other relevant materials to be filed with the SEC when they become available.