Washington, D.C. 20549

China Ceetop.Com, Inc.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

Item 1. Security and Issuer.

The class of equity securities to which this Schedule 13D relates is the common stock of China Ceetop.com, Inc., an Oregon corporation (the “Issuer”). The principal executive offices of the Issuer are located at A2803, Lianhe Guangchang, 5022 Binhe Dadao, Futian District, Shenzhen, China.

Item 2. Identity and Background.

This Schedule 13D is being filed on behalf of Feihua Huang (the “Reporting Person”) with an address at A501, Yuanhua Huangzuo, 65 Xintang Road, Jianggan District, Hangzhou, Zhejiang, China, 310020. The present principle occupation of the Reporting Person is self employed. The Reporting Person is a citizen of China.

During the last five years, the Reporting Person has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors), nor been a party to any civil proceeding of a judicial or administrative body of competent jurisdiction which resulted in a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or a finding of violation of any such laws.

Item 3. Source and Amount of Funds or Other Consideration.

The Reporting Person acquired 2,705,398 shares of Common Stock of the Issuer in exchange for 4,220 shares of common stock of Surry Holdings Limited (“Surry”) pursuant to a Share Exchange Agreement between the Issuer and Surry dated December 30, 2010 (the “Agreement”).

Item 4. Purpose of Transaction.

The transactions contemplated by the Agreement closed on January 27, 2011. Pursuant to the terms and conditions of the Agreement, Reporting Person acquired 2,705,398 shares of Common Stock of the Issuer. There are no material relationships between the Issuer or its affiliates and the Reporting Person, other than the Reporting Person acquiring the shares of Series A Preferred Stock of the Issuer in connection with the Agreement.

The Reporting Person has no definitive or specific plans or proposals that relate to or would result in the occurrence of any of the actions described in Items 4(a) through 4(j).

Item 5. Interest in Securities of the Issuer.

(a) The Reporting Person owns 2,705,398 shares of Common Stock of the Issuer (constituting 8.2% of the Issuer’s issued and outstanding common stock), acquired on January 27, 2011 pursuant to the Agreement.

(b) The Reporting Person has the sole power to vote or to direct the vote and sole power to dispose or to direct the disposition of, the 2,705,398 shares of Common Stock of the Issuer of the Issuer that the Reporting Person owns.

(c) Transactions in the securities effected during the past sixty days: None, other than the transaction described in Item 4 of this Schedule 13D.

(d) No other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the securities beneficially owned by the Reporting Person.

(e) The date on which the Reporting Person ceased to be beneficial owners of more than five percent of the class of securities: Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Except for the Agreement described in Item 4 of this Schedule 13D there are no contracts, arrangements, understandings or relationships (legal or otherwise) among the persons named in Item 2 and between such persons and any person with respect to any securities of the Issuer, including but not limited to transfer or voting of any of the securities, finder's fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or loss, or the giving or withholding of proxies, naming the persons with whom such contracts, arrangements, understandings or relationships have been entered into.

Item 7. Material to Be Filed as Exhibits.

Exhibit A Share Exchange Agreement

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| | | | | |

| July 11, 2011 | Feihua Huang | |

| | /s/ Feihua Huang | |

| | | |

EXHIBIT A

SHARE EXCHANGE AGREEMENT

by and among

Surry Holdings Limited (“Surry Holdings“)

and

the Shareholders of Surry Holdings,

on the one hand;

and

Oregon Gold Inc. (“Oregon Gold”),

an Oregon corporation,

and

the Majority Stockholders of Oregon Gold,

on the other hand

December 30, 2010

SHARE EXCHANGE AGREEMENT

This Share Exchange Agreement, dated as of December 30, 2010 (this “Agreement”), is made and entered into by and among Surry Holdings Limited, a company incorporated in the British Virgin Islands (“Surry Holdings”, which shall include all Surry Holdings Subsidiaries (as defined below)), and the shareholders of Surry Holdings (“Surry Holdings Shareholders”) listed on the Signature Pages for Surry Holdings Shareholders that are attached hereto, on the one hand; and Oregon Gold Inc., an Oregon corporation (“Oregon Gold”), and the stockholders of Oregon Gold listed on Signature Page for Oregon Gold Stockholders that is attached hereto (the “Oregon Gold Stockholders”), on the other hand.

R E C I T A L S

WHEREAS, the Board of Directors of Oregon Gold has adopted resolutions approving Oregon Gold’s acquisition of the equity interests of Surry Holdings held by the Surry Holdings Stockholders (the “Acquisition”) by means of a share exchange with the Surry Holdings Shareholders, upon the terms and conditions hereinafter set forth in this Agreement;

WHEREAS, the Surry Holdings Shareholders own all of the equity interest (in shares of capital stock or otherwise) of Surry Holdings (the “Surry Holdings Equity Interest”);

WHEREAS, the Oregon Gold Stockholders are the majority stockholders of Oregon Gold which hold, collectively, an amount of shares of Oregon Gold common stock which represents approximately 79% of the issued and outstanding capital stock of Oregon Gold;

WHEREAS, the Oregon Gold Stockholders will enter into this Agreement for the purpose of making certain covenants, indemnifications and agreements;

WHEREAS, upon consummation of the transactions contemplated by this Agreement, Surry Holdings will become a 100% wholly-owned subsidiary of Oregon Gold; and

WHEREAS, it is intended that the terms and conditions of this Agreement comply in all respects with Section 368(a)(1)(B) and/or Section 351 of the Code and the regulations corresponding thereto, so that the Acquisition shall qualify as a tax free reorganization under the Code, and that this share exchange transaction shall qualify as a transaction in securities exempt from registration or qualification under the Securities Act of 1933, as amended and in effect on the date of this Agreement.

A G R E E M E N T

NOW, THEREFORE, the parties hereto, intending to be legally bound, agree as follows:

ARTICLE 1

THE ACQUISITION

1.1 The Acquisition. Upon the terms and subject to the conditions hereof, at the Closing (as hereinafter defined) the parties shall do the following:

(a) The Surry Holdings Shareholders will each sell, convey, assign, transfer and deliver to Oregon Gold certificates representing the Surry Holdings Equity Interest held by each Surry Holdings Shareholder as set forth in Column II of Annex I hereto, which in the aggregate shall constitute 100% of the issued and outstanding equity interests of Surry Holdings, accompanied by a properly executed and authenticated stock power or instrument of like tenor.

(b) As consideration for the acquisition of the Surry Holdings Equity Interests, Oregon Gold will issue to each Surry Holdings Shareholder, in exchange for such Surry Holdings Shareholders’ portion of the Surry Holdings Equity Interests, the number of shares of common stock and Series A Preferred Stock set forth opposite such party’s name in Column IV on Annex I attached hereto (collectively, the “Oregon Gold Shares”). The Oregon Gold Shares issued shall equal approximately 97% of the outstanding shares of Oregon Gold’s common stock (on a post reverse split basis), and 100% of Oregon Gold’s Preferred Stock at the time of Closing.

1.2 Closing Date. The closing of the Acquisition (the “Closing”) shall take place on such date as may be mutually agreed upon by the parties. Such date is referred to herein as the “Closing Date.”

1.3 Taking of Necessary Action; Further Action. If, at any time after the Closing, any further action is necessary or desirable to carry out the purposes of this Agreement, the Surry Holdings Shareholders, Surry Holdings, the Oregon Gold Stockholders, and/or Oregon Gold (as applicable) will take all such lawful and necessary action.

1.4 Certain Definitions. The following capitalized terms as used in this Agreement shall have the respective definitions:

“Affiliate” means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control with a Person, as such terms are used in and construed under Rule 405 under the Securities Act.

“Contract” means any contract, lease, license, indenture, note, bond, agreement, permit, concession, franchise or other instrument.

“ERISA” means the Employee Retirement Income Security Act of 1974 or any successor law and the regulations and rules issued pursuant to that act or any successor law.

“FINRA” means Financial Industry Regulatory Authority.

“Knowledge” means the actual knowledge of the officers, directors or advisors of the referenced party.

“Liens” means a lien, charge, security interest, encumbrance, right of first refusal, preemptive right or other restriction.

“Material Adverse Effect” means an adverse effect on either referenced party or the combined entity resulting from the consummation of the transaction contemplated by this Agreement, or on the financial condition, results of operations or business, before or after the consummation of the transaction contemplated in this Agreement, which as a whole is or would be considered material to an investor in the securities of Oregon Gold.

“Non-U.S. Person” means any person who is not a U.S. Person or is deemed not to be a U.S. Person under Rule 902(k)(2).

“Person” means any individual, corporation, partnership, joint venture, trust, business association, organization, governmental authority or other entity.

“Restricted Period” shall have the meaning set forth in Section 3.4(b)(vi).

“Securities Act” means the Securities Act of 1933, as amended.

“Tax Returns” means all federal, state, local and foreign returns, estimates, information statements and reports relating to Taxes.

“Tax” or “Taxes” means any and all applicable central, federal, provincial, state, local, municipal and foreign taxes, including, without limitation, gross receipts, income, profits, sales, use, occupation, value added, ad valorem, transfer, franchise, withholding, payroll, recapture, employment, excise and property taxes, assessments, governmental charges and duties together with all interest, penalties and additions imposed with respect to any such amounts and any obligations under any agreements or arrangements with any other person with respect to any such amounts and including any liability of a predecessor entity for any such amounts.

“Trading Day” means a day on which the principal Trading Market is open for trading.

“Trading Market” means the following markets or exchanges on which Oregon Gold’s common stock is listed or quoted for trading on the date in question: the NYSE Alternext US Exchange, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock Exchange or the OTC Bulletin Board.

“Transaction” means the transactions contemplated by this Agreement, including the share exchange.

“United States” means and includes the United States of America, its territories and possessions, any State of the United States, and the District of Columbia.

“U.S. Person” as defined in Regulation S means: (i) a natural person resident in the United States; (ii) any partnership or corporation organized or incorporated under the laws of the United States; (iii) any estate of which any executor or administrator is a U.S. Person; (iv) any trust of which any trustee is a U.S. Person; (v) any agency or branch of a foreign entity located in the United States; (vi) any nondiscretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary for the benefit or account of a U.S. Person; (vii) any discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary organized, incorporated and (if an individual) resident in the United States; and (viii) a corporation or partnership organized under the laws of any foreign jurisdiction and formed by a U.S. Person principally for the purpose of investing in securities not registered under the Securities Act, unless it is organized or incorporated, owned, by accredited investors (as defined in Rule 501(a) under the Securities Act) who are not natural persons, estates or trusts).

1.5 Tax Consequences. It is intended that the terms and conditions of this Agreement comply in all respects with Section 368(a)(1)(B) and/or Section 351 of the Code and the regulations corresponding thereto, so that the Acquisition shall qualify as a tax-free reorganization under the Code.

ARTICLE 2

REPRESENTATIONS AND WARRANTIES OF SURRY HOLDINGS AND

SURRY HOLDINGS SUBSIDIARIES

Except as otherwise disclosed herein or in a disclosure schedule attached hereto, Surry Holdings (the Surry Holdings Shareholders, as applicable) and each Surry Holdings Subsidiary hereby represents and warrants to Oregon Gold and the Oregon Gold Stockholders as of the date hereof and as of the Closing Date (unless otherwise indicated) as follows:

2.1 Organization. Surry Holdings and each Surry Holdings Subsidiary has been duly incorporated, validly exists as a corporation, and is in good standing under the laws of its jurisdiction of incorporation, and has the requisite power to carry on its business as now conducted. Surry Holdings and each Surry Holdings Subsidiary presently conducts its business, owns, holds and operates its properties and assets in China.

2.2 Capitalization. The authorized capital stock of Surry Holdings consists of 50,000 ordinary shares, US$1.00 par value. The capitalization of Surry and each Surry Holdings Subsidiary is as provided to Oregon Gold, and as of Closing the capitalization of each shall not have changed. All of the issued and outstanding shares of capital stock of Surry Holdings and each Surry Holdings Subsidiary, as of the date of this Agreement are and as of Closing will be, duly authorized, validly issued, fully paid, non-assessable and free of preemptive rights. There are no voting trusts or any other agreements or understandings with respect to the voting of Surry Holding’s (nor of any Surry Holdings Subsidiary) capital stock. Except as set forth in the preceding sentence, no other class of capital stock or other security of Surry Holdings or any Surry Holdings Subsidiary is authorized, issued, reserved for issuance or outstanding. There are no authorized or outstanding options, warrants, equity securities, calls, rights, commitments or agreements of any character by which Surry Holdings and each Surry Holdings Subsidiary or any of the Surry Holdings Shareholders is obligated to issue, deliver or sell, or cause to be issued, delivered or sold, any shares of capital stock or other securities of Surry Holdings and each Surry Holdings Subsidiary. There are no outstanding contractual obligations (contingent or otherwise) of Surry Holdings or any Surry Holdings Subsidiary to retire, repurchase, redeem or otherwise acquire any outstanding shares of capital stock of, or other ownership interests in, Surry Holdings or each Surry Holdings Subsidiary.

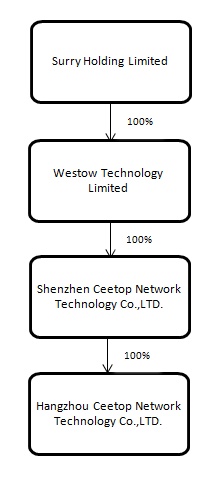

2.3 Subsidiaries. As of the Closing, Surry Holdings has no direct or indirect subsidiaries, except as disclosed in Schedule 2.3 of the disclosure schedules hereto (collectively the “Surry Holdings Subsidiaries,” and each a “Surry Holdings Subsidiary”). Each Surry Holdings Subsidiary is an entity duly organized, validly existing and in good standing under the laws of its respective jurisdiction of formation and has the requisite corporate power and authority to own, lease and to carry on its business as now being conducted. Surry Holdings owns all of the shares of each Surry Holdings Subsidiary, and there are no outstanding options, warrants, subscriptions, conversion rights or other rights, agreements or commitments obligating any Surry Holdings Subsidiary to issue any additional shares of common stock or ordinary stock, as the case may be, of such subsidiary, or any other securities convertible into, exchangeable for or evidence the right to subscribe for or acquire from any Surry Holdings Subsidiary any shares of such subsidiary.

2.4 Certain Corporate Matters. Surry Holdings is duly qualified to do business as a corporation and is in good standing under the laws of the British Virgin Islands and China, and in each other jurisdiction in which the ownership of its property or the conduct of its business requires it to be so qualified, and each Surry Holdings Subsidiary is duly qualified to business as a corporation and is in good standing under the jurisdiction of its incorporation and in each other jurisdiction in which the ownership of its property or the conduct of its business requires it to be so qualified, except where the failure to be so qualified would not have a Material Adverse Effect on Surry Holdings’ or any Surry Holdings Subsidiary’s financial condition, results of operations or business. Surry Holdings and each Surry Holdings Subsidiary has full corporate power and authority and all authorizations, licenses and permits necessary to carry on the business in which it is engaged and to own and use the properties owned and used by it.

2.5 Authority Relative to this Agreement. Surry Holdings has the requisite power and authority to enter into this Agreement and to carry out its respective obligations hereunder. The execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby by Surry Holdings have been duly authorized by Surry Holdings’ Board of Directors and no other actions on the part of Surry Holdings or any Surry Holdings Subsidiary are necessary to authorize this Agreement or the transactions contemplated hereby. This Agreement has been duly and validly executed and delivered by Surry Holdings and constitutes a valid and binding agreement, enforceable against Surry Holdings in accordance with its terms, except as such enforcement may be limited by bankruptcy, insolvency or other similar laws affecting the enforcement of creditors’ rights generally or by general principles of equity.

2.6 Consents and Approvals; No Violations. Except for applicable requirements of federal securities laws and state securities or blue-sky laws, no filing with, and no permit, authorization, consent or approval of, any third party, public body or authority is necessary for the consummation by Surry Holdings of the transactions contemplated by this Agreement. Neither the execution and delivery of this Agreement by Surry Holdings nor the consummation by Surry Holdings of the transactions contemplated hereby, nor compliance by them with any of the provisions hereof, will (a) conflict with or result in any breach of any provisions of the charter or bylaws (or operating agreement) of Surry Holdings or any Surry Holdings Subsidiary, (b) result in a violation or breach of, or constitute (with or without due notice or lapse of time or both) a default (or give rise to any right of termination, cancellation or acceleration) under, any of the terms, conditions or provisions of any note, bond, mortgage, indenture, license, Contract, agreement or other instrument or obligation to which Surry Holdings or any Surry Holdings Subsidiary is a party or by which any of their respective properties or assets may be bound, or (c) violate any order, writ, injunction, decree, statute, rule or regulation applicable to Surry Holdings or any Surry Holdings Subsidiary, or any of its properties or assets, except in the case of clauses (b) and (c) for violations, breaches or defaults which are not in the aggregate material to Surry Holdings taken as a whole.

2.7 Books and Records. The books and records of Surry Holdings and each Surry Holdings Subsidiary delivered to Oregon Gold prior to the Closing fully and fairly reflect the transactions to which Surry Holdings and each Surry Holdings Subsidiary is a party or by which it or its properties are bound, and there shall be no material difference between the unaudited combined financial statements of Surry Holdings given to Oregon Gold and the Oregon Gold Stockholders and the actual reviewed US GAAP results of Surry Holdings for the three-month period ended September 30, 2010.

2.8 Intellectual Property. Surry Holdings has no knowledge of any claim that, or inquiry as to whether, any product, activity or operation of Surry Holdings or any Surry Holdings Subsidiary infringes upon or involves, or has resulted in the infringement of, any trademarks, trade-names, service marks, patents, copyrights or other proprietary rights of any other person, corporation or other entity; and no proceedings have been instituted, are pending or are threatened.

2.9 Litigation. There is no action, suit, inquiry, notice of violation, proceeding or investigation pending or, to the Knowledge of Surry Holdings, threatened against or affecting Surry Holdings any Surry Holdings Subsidiary or any of its properties before or by any court, arbitrator, governmental or administrative agency or regulatory authority (federal, state, county, local or foreign) (collectively, an “Action”) which (i) adversely affects or challenges the legality, validity or enforceability of this Agreement or the Oregon Gold Shares or (ii) could, if there were an unfavorable decision, have or reasonably be expected to result in a Material Adverse Effect. Neither Surry Holdings nor any director or officer thereof or of any Surry Holdings Subsidiary, is or has been the subject of any Action involving a claim of violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty. There has not been, and to the Knowledge of Surry Holdings, there is not pending or contemplated, any investigation by the Securities and Exchange Commission (the “Comnission”) involving Surry Holdings or any Surry Holdings Subsidiary or any current or former director or officer of Surry Holdings or any Surry Holdings Subsidiary .

2.10 Legal Compliance. To the best Knowledge of Surry Holdings, after due investigation, no claim has been filed against Surry Holdings or any of the Surry Holdings Subsidiaries alleging a violation of any applicable laws and regulations of foreign, federal, state and local governments and all agencies thereof. Surry Holdings and each of the Surry Holdings Subsidiaries holds all of the material permits, licenses, certificates or other authorizations of foreign, federal, state or local governmental agencies required for the conduct of their respective businesses as presently conducted.

2.11 Contracts. There are no Contracts that are material to the business, properties, assets, condition (financial or otherwise), results of operations or prospects of the Surry Holdings and each Surry Holdings Subsidiary. Surry Holdings and each Surry Holdings Subsidiary is not in violation of or in default under (nor does there exist any condition which upon the passage of time or the giving of notice would cause such a violation of or default under) any Contract to which they are a party or by which they or any of their properties or assets are bound, except for violations or defaults that would not, individually or in the aggregate, reasonably be expected to result in a Material Adverse Effect.

2.12 Material Changes. Since October 1, 2010: (i) there has been no event, occurrence or development that has had or that could reasonably be expected to result in a Material Adverse Effect, (ii) neither Surry Holdings nor any Surry Holdings Subsidiary has incurred any liabilities (contingent or otherwise) other than (A) trade payables and accrued expenses incurred in the ordinary course of business consistent with past practice, and (B) liabilities not required to be reflected in Surry Holdings’ financial statements pursuant to GAAP, (iii) Surry Holdings has not altered its method of accounting, (iv) neither Surry Holdings nor any Surry Holdings Subsidiary has declared or made any dividend or distribution of cash or other property to its stockholders or purchased, redeemed or made any agreements to purchase or redeem any shares of its capital stock, and (v) neither Surry Holdings nor any Surry Holdings Subsidiary has issued any equity securities to any officer, director or Affiliate.

2.13 Labor Relations. No labor dispute exists or, to the Knowledge of Surry Holdings and the Surry Holdings Shareholders, is imminent with respect to any of the employees of Surry Holdings or any Surry Holdings Subsidiary which could reasonably be expected to result in a Material Adverse Effect. None of Surry Holdings’ or Surry Holdings Subsidiaries’ employees is a member of a union that relates to such employee’s relationship with Surry Holdings or such Surry Holdings Subsidiary, and neither Surry Holdings nor any of the Surry Holdings Subsidiaries is a party to a collective bargaining agreement, and Surry Holdings and the Surry Holdings Subsidiaries believe that their relationships with their employees are good. No executive officer, to the Knowledge of Surry Holdings and the Surry Holdings Shareholders, is, or is now expected to be, in violation of any material term of any employment contract, confidentiality, disclosure or proprietary information agreement or non-competition agreement, or any other contract or agreement or any restrictive covenant in favor of any third party, and the continued employment of each such executive officer does not subject Surry Holdings or any of the Surry Holdings Subsidiaries to any liability with respect to any of the foregoing matters. Surry Holdings and the Surry Holdings Subsidiaries are in compliance with all U.S. federal, state, local and foreign laws and regulations relating to employment and employment practices, terms and conditions of employment and wages and hours, except where the failure to be in compliance could not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

2.14 Title to Assets. Surry Holdings and the Surry Holdings Subsidiaries have good and marketable title in fee simple to all real property owned by them and good and marketable title in all personal property owned by them that is material to the business of Surry Holdings and the Surry Holdings Subsidiaries, in each case free and clear of all Liens, except for Liens that do not materially affect the value of such property and do not materially interfere with the use made and proposed to be made of such property by Surry Holdings and the Surry Holdings Subsidiaries and Liens for the payment of Taxes, the payment of which is neither delinquent nor subject to penalties. Any real property and facilities held under lease by Surry Holdings and the Surry Holdings Subsidiaries are held by them under valid, subsisting and enforceable leases with which Surry Holdings and the Surry Holdings Subsidiaries are in compliance.

2.15 Transactions with Affiliates and Employees. None of the officers or directors of Surry Holdings and Surry Holdings Subsidiaries, and, to the Knowledge of Surry Holdings and the Surry Holdings Shareholders, none of the employees of Surry Holdings or any Surry Holdings Subsidiary is presently a party to any transaction with Surry Holdings or any Surry Holdings Subsidiary (other than for services as employees, officers and directors), including any contract, agreement or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, or otherwise requiring payments to or from any officer, director or such employee or, to the Knowledge of Surry Holdings and the Surry Holdings Shareholders, any entity in which any officer, director, or any such employee has a substantial interest or is an officer, director, trustee or partner, in each case in excess of $60,000, other than for: (i) payment of salary or consulting fees for services rendered, (ii) reimbursement for expenses incurred on behalf of Surry Holdings and Surry Holdings Subsidiaries and (iii) other employee benefits.

2.17 Certain Fees. No brokerage or finder’s fees or commissions are or will be payable by Surry Holdings to any broker, financial advisor or consultant, finder, placement agent, investment banker, bank or other Person with respect to the transactions contemplated by this Agreement.

2.18 Registration Rights. No Person has any right to cause (or any successor) to effect the registration under the Securities Act of any securities of Surry Holdings (or any successor).

2.19 Application of Takeover Protections. Surry Holdings has taken all necessary action, if any, in order to render inapplicable any control share acquisition, business combination, poison pill (including any distribution under a rights agreement) or other similar anti-takeover provision under Surry Holdings’ certificate of incorporation (or similar charter documents) or the laws of its state of incorporation that is or could become applicable as a result of Surry Holdings fulfilling its obligations or exercising its rights under this Agreement.

2.20 Tax Status. Except for matters that would not, individually or in the aggregate, have or reasonably be expected to result in a Material Adverse Effect, Surry Holdings and each Surry Holdings Subsidiary has timely filed all necessary Tax Returns and has paid or accrued all Taxes shown as due thereon, and Surry Holdings has no Knowledge of a tax deficiency which has been asserted or threatened against Surry Holdings or any Surry Holdings Subsidiary.

2.21 No General Solicitation. Neither Surry Holdings nor any person acting on behalf of Surry Holdings has offered or sold securities in connection herewith by any form of general solicitation or general advertising.

2.22 Foreign Corrupt Practices. Neither Surry Holdings nor any Surry Holdings Subsidiary, nor to the Knowledge of Surry Holdings and the Surry Holdings Shareholders, any agent or other person acting on behalf of Surry Holdings or any Surry Holdings Subsidiary, has: (i) directly or indirectly, used any funds for unlawful contributions, gifts, entertainment or other unlawful expenses related to foreign or domestic political activity, (ii) made any unlawful payment to foreign or domestic government officials or employees or to any foreign or domestic political parties or campaigns from corporate funds, (iii) failed to disclose fully any contribution made by Surry Holdings or any Surry Holdings Subsidiary (or made by any person acting on its behalf of which Surry Holdings is aware) which is in violation of law, or (iv) violated in any material respect any provision of the Foreign Corrupt Practices Act of 1977, as amended.

2.23 Obligations of Management. Each officer and key employee of Surry Holdings and each Surry Holdings Subsidiary is currently devoting substantially all of his or her business time to the conduct of business of Surry Holdings and each Surry Holdings Subsidiary. Neither Surry Holdings nor any Surry Holdings Subsidiary is aware that any officer or key employee of Surry Holdings or any Surry Holdings Subsidiary is planning to work less than full time at Surry Holdings or any Surry Holdings Subsidiary, as applicable, in the future. No officer or key employee is currently working or, to Surry Holdings’ or any Surry Holdings Shareholder’s Knowledge, plans to work for a competitive enterprise, whether or not such officer or key employee is or will be compensated by such enterprise.

2.25 Minute Books. The minute books of Surry Holdings and the Surry Holdings Subsidiaries made available to Oregon Gold contain a complete summary of all meetings and written consents in lieu of meetings of directors and stockholders since the time of incorporation.

2.26 Employee Benefits. Surry Holdings and Surry Holdings Subsidiary has (including the two years preceding the date hereof has had) no plans which are subject to ERISA.

2.27 Money Laundering Laws. The operations of Surry Holdings and each Surry Holdings Subsidiary are and have been conducted at all times in compliance with applicable financial record-keeping and reporting requirements of the money laundering statutes of all U.S. and non-U.S. jurisdictions, the rules and regulations thereunder and any related or similar rules, regulations or guidelines, issued, administered or enforced by any governmental body (collectively, the “Money Laundering Laws”) and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving Surry Holdings or any Surry Holdings Subsidiary with respect to the Money Laundering Laws is pending or, to the knowledge of Surry Holdings, threatened.

2.28 Disclosure. The representations and warranties and statements of fact made by Surry Holdings and the Surry Holdings Subsidiaries in this Agreement are, as applicable, accurate, correct and complete and do not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements and information contained herein not false or misleading.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES OF THE SURRY HOLDINGS SHAREHOLDERS

The Surry Holdings Shareholders each hereby represent and warrant to Oregon Gold as follows:

3.1 Ownership of the Surry Holdings Equity Interest. Surry Holdings Shareholders own, beneficially and of record, good and marketable title to the amount of the Surry Holdings Equity Interest, free and clear of all security interests, liens, adverse claims, encumbrances, equities, proxies, options or voting agreements. Surry Holdings Shareholders represent that they each have no right or claims whatsoever to any equity interests of Surry Holdings, other than the Surry Holdings Equity Interest and do not have any options, warrants or any other instruments entitling any of them to exercise or purchase or convert into additional equity interests of Surry Holdings. At the Closing, the Surry Holdings Shareholders will convey to Oregon Gold good and marketable title to the Surry Holdings Equity Interests, free and clear of any security interests, liens, adverse claims, encumbrances, equities, proxies, options, shareholders’ agreements or restrictions.

3.2 Authority Relative to this Agreement. This Agreement has been duly and validly executed and delivered by the Surry Holdings Shareholders and constitutes a valid and binding agreement of such person, enforceable against such person in accordance with its terms, except as such enforcement may be limited by bankruptcy, insolvency or other similar laws affecting the enforcement of creditors’ rights generally or by general principles of equity.

3.3 Purchase of Restricted Securities for Investment. The Surry Holdings Shareholders each acknowledge that the Oregon Gold Shares will not be registered pursuant to the Securities Act or any applicable state securities laws, that the Oregon Gold Shares will be characterized as “restricted securities” under federal securities laws, and that under such laws and applicable regulations the Oregon Gold Shares cannot be sold or otherwise disposed of without registration under the Securities Act or an exemption therefrom. In this regard, each Surry Holdings Shareholder is familiar with Rule 144 promulgated under the Securities Act, as currently in effect, and understands the resale limitations imposed thereby and by the Securities Act. Further, each Surry Holdings Shareholder acknowledges and agrees that:

(a) Each Surry Holdings Shareholder is acquiring the Oregon Gold Shares for investment, for such Surry Holdings Shareholder’s own account and not as a nominee or agent, and not with a view to the resale or distribution of any part thereof, and each Surry Holdings Shareholder has no present intention of selling, granting any participation in, or otherwise distributing the same. Each Surry Holdings Shareholder further represents that he, she or it does not have any Contract, undertaking, agreement or arrangement with any person to sell, transfer or grant participation to such person or to any third person, with respect to any of the Oregon Gold Shares.

(b) Each Surry Holdings Shareholder understands that the Oregon Gold Shares are not registered under the Securities Act on the ground that the sale and the issuance of securities hereunder is exempt from registration under the Securities Act pursuant to Section 4(2) thereof, and that Oregon Gold’s reliance on such exemption is predicated on the each Shareholder’s representations set forth herein.

3.4 Status of Stockholder. Each of the Surry Holdings Shareholders hereby makes the representations and warranties in either paragraph (a) or (b) of this Section 3.4, as indicated on the Signature Page of Surry Holdings Shareholders which is attached and part of this Agreement:

(a) Accredited Investor Under Regulation D. The Surry Holdings Shareholder is an “Accredited Investor” as that term is defined in Rule 501 of Regulation D promulgated under the Securities Act, an excerpt of which is included in the attached Annex II, and such Surry Holdings Shareholder is not acquiring its portion of the Oregon Gold Shares as a result of any advertisement, article, notice or other communication regarding the Oregon Gold Shares published in any newspaper, magazine or similar media or broadcast over television or radio or presented at any seminar or any other general solicitation or general advertisement.

(b) Non-U.S. Person Under Regulation S. The Surry Holdings Shareholder:

(i) is not a “U.S. person” as defined by Rule 902 of Regulation S promulgated under the Securities Act, was not organized under the laws of any U.S. jurisdiction, and was not formed for the purpose of investing in securities not registered under the Securities Act;

(ii) at the time of Closing, the Surry Holdings Shareholder was located outside the United States;

(iii) no offer of the Oregon Gold Shares was made to the Surry Holdings Shareholder within the United States;

(iv) the Surry Holdings Shareholder is either (a) acquiring the Oregon Gold Shares for its own account for investment purposes and not with a view towards distribution, or (b) acting as agent for a principal that has signed this Agreement or has delivered representations and warranties substantially similar to this Section 3.4(b);

(v) all subsequent offers and sales of the Oregon Gold Shares by the Surry Holdings Shareholder will be made outside the United States in compliance with Rule 903 of Rule 904 of Regulation S, pursuant to registration of the Shares under the Securities Act, or pursuant to an exemption from such registration; the Surry Holdings Shareholder understands the conditions of the exemption from registration afforded by section 4(l) of the Securities Act and acknowledges that there can be no assurance that it will be able to rely on such exemption.

(vi) the Surry Holdings Shareholder will not resell the Oregon Gold Shares to U.S. Persons or within the United States until after the end of the one (1) year period commencing on the date of Closing (the “Restricted Period”) or as permitted under Rule 903 promulgated under Regulation S;

(vii) the Surry Holdings Shareholder shall not and hereby agrees not to enter into any short sales with respect to the common stock of Oregon Gold at any time after the execution of this Agreement by the Surry Holdings Shareholder and prior to the expiration of the Restricted Period;

(viii) in the event of resale of the Oregon Gold Shares to non-U.S. Persons outside of the U.S. during the Restricted Period, the Surry Holdings Shareholder shall provide a written confirmation or other written notice to any distributor, dealer, or person receiving a selling concession, fee, or other remuneration in respect of the Shares stating that such purchaser is subject to the same restrictions on offers and sales that apply to the undersigned, and shall require that any such purchase shall provide such written confirmation or other notice upon resale during the Restricted Period;

(ix) the Surry Holdings Shareholder has not engaged, nor is it aware that any party has engaged, and it will not engage or cause any third party to engage in any “directed selling” efforts (as such term is defined in Regulation S) in the United States with respect to the Oregon Gold Shares;

(x) the Surry Holdings Shareholder is not a “distributor” as such term is defined in Regulation S, and it is not a “dealer” as such term is defined in the Securities Act;

(xi) the Surry Holdings Shareholder has not taken any action that would cause any of the parties to this Agreement to be subject to any claim for commission or other or remuneration by any broker, finder, or other person; and

(xii) the Surry Holdings Shareholder hereby represents that it has satisfied fully observed of the laws of the jurisdiction in which it is located or domiciled, in connection with the acquisition of the Oregon Gold Shares or this Agreement, including (i) the legal requirements of the Surry Holdings Shareholder’s jurisdiction for the purchase and acquisition of the Oregon Gold Shares, (ii) any foreign exchange restrictions applicable to such purchase and acquisition, (iii) any governmental or other consents that may need to be obtained, and (iv) the income tax and other tax consequences, if any, which may be relevant to the purchase, holding, redemption, sale, or transfer of the Oregon Gold Shares; and further, the Surry Holdings Shareholder agrees to continue to comply with such laws as long as it shall hold the Oregon Gold Shares.

(c) The Surry Holdings Shareholder understands that the Oregon Gold Shares are being offered and sold to it in reliance on specific provisions of U.S. federal and state securities laws and that the parties to this Agreement are relying upon the truth and accuracy of the representations, warranties, agreements, acknowledgments and understanding of the Surry Holdings Shareholder set forth herein in order to determine the applicability of such provisions. Accordingly, the Surry Holdings Shareholder agrees to notify Oregon Gold of any events which would cause the representations and warranties of the Surry Holdings Shareholder to be untrue or breached at any time after the execution of this Agreement by such Surry Holdings Shareholder and prior to the expiration of the Restricted Period.

3.5 Investment Risk. The Surry Holdings Shareholder is able to bear the economic risk of acquiring the Oregon Gold Shares pursuant to the terms of this Agreement, including a complete loss of such the Surry Holdings Shareholder’s investment in the Oregon Gold Shares.

3.6 Restrictive Legends. The Surry Holdings Shareholder acknowledges that the certificate(s) representing the Surry Holdings Shareholder’s pro rata portion of the Oregon Gold Shares shall each conspicuously set forth on the face or back thereof a legend in substantially the following form, corresponding to the stockholder’s status as set forth in Section 3.4 and the signature pages hereto:

REGULATION D LEGEND:

“THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. THEY MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT AS TO THE SECURITIES UNDER SAID ACT OR PURSUANT TO AN EXEMPTION FROM REGISTRATION OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED.”

REGULATION S LEGEND:

“THE SHARES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND MAY NOT BE SOLD, TRANSFERRED, ASSIGNED, PLEDGED OR HYPOTHECATED EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S PROMULGATED UNDER THE SECURITIES ACT, PURSUANT TO REGISTRATION UNDER THE SECURITIES ACT, OR PURSUANT TO ANOTHER AVAILABLE EXEMPTION FROM REGISTRATION; HEDGING TRANSACTIONS INVOLVING THE SHARES REPRESENTED HEREBY MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE SECURITIES ACT.”

3.7 Disclosure. The representations and warranties and statements of fact made by Surry Holdings Shareholders in this Agreement are, as applicable, accurate, correct and complete and do not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements and information contained herein not false or misleading.

ARTICLE 4

REPRESENTATIONS AND WARRANTIES OF OREGON GOLD

Oregon Gold hereby represents and warrants to Surry Holdings and the Surry Holdings Shareholders as of the date hereof and as of the Closing Date (unless otherwise indicated), as follows:

4.1 Organization and Qualification. Oregon Gold is an entity duly incorporated or otherwise organized, validly existing and in good standing under the laws of the jurisdiction of its incorporation or organization, with the requisite power and authority to own and use its properties and assets and to carry on its business as currently conducted. Oregon Gold is not, to its Knowledge, in violation nor default of any of the provisions of its articles of incorporation, bylaws or other organizational or charter documents (collectively the “Charter Documents”). Oregon Gold is duly qualified to conduct business and is in good standing as a foreign corporation or other entity in each jurisdiction in which the nature of the business conducted or property owned by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, could not have or reasonably be expected to result in a Material Adverse Effect, and no proceeding has been instituted in any such jurisdiction revoking, limiting or curtailing or seeking to revoke, limit or curtail such power and authority or qualification.

4.2 Authorization; Enforcement. Oregon Gold has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and otherwise to carry out its obligations hereunder. The execution and delivery of this Agreement by Oregon Gold and the consummation by it of the transactions contemplated hereby have been duly authorized by all necessary action on the part of Oregon Gold and no further action is required by Oregon Gold, the Board of Directors or Oregon Gold’s stockholders in connection therewith other than in connection with the Required Approvals, as defined in Section 4.4. This Agreement has been (or upon delivery will have been) duly executed by Oregon Gold and, when delivered in accordance with the terms hereof, will constitute the valid and binding obligation of Oregon Gold enforceable against Oregon Gold in accordance with its terms, except: (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be limited by applicable law.

4.3 No Conflicts. The execution, delivery and performance by Oregon Gold of this Agreement and the consummation by Oregon Gold of the other transactions to which it is a party and as contemplated hereby do not and will not: (i) conflict with or violate any provision of Oregon Gold’s certificate or articles of incorporation, bylaws or other organizational or charter documents, (ii) conflict with, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, result in the creation of any Lien upon any of the properties or assets of Oregon Gold, or give to others any rights of termination, amendment, acceleration or cancellation (with or without notice, lapse of time or both) of, any agreement, credit facility, debt or other instrument (evidencing a Oregon Gold debt or otherwise) or other understanding to which Oregon Gold is a party or by which any property or asset of Oregon Gold is bound or affected, or (iii) subject to the Required Approvals, as defined by Section 4.4, conflict with or result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction of any court or governmental authority to which Oregon Gold is subject (including federal and state securities laws and regulations), or by which any property or asset of Oregon Gold is bound or affected; except in the case of each of clauses (ii) and (iii), such as could not have or reasonably be expected to result in a Material Adverse Effect.

4.4 Filings, Consents and Approvals. Oregon Gold is not required to obtain any consent, waiver, authorization or order of, give any notice to, or make any filing or registration with, any court or other federal, state, local or other governmental authority or other Person in connection with the execution, delivery and performance by Oregon Gold of this Agreement, other than the filing of a disclosure document, Current Report on Form 8-K with the Commission and such filings as are required to be made under applicable state securities laws (collectively, the “Required Approvals”).

4.5 Issuance of the Oregon Gold Shares. The Oregon Gold Shares are duly authorized and, when issued and paid for in accordance with this Agreement, will be duly and validly issued, fully paid and nonassessable, free and clear of all Liens imposed on or by Oregon Gold other than restrictions on transfer provided for in this Agreement.

4.6 Capitalization. The capitalization of Oregon Gold is as previously provided to Surry and will remain as of the Closing Date. Oregon Gold has not issued any capital stock since its most recently filed periodic report under the Exchange Act. No Person has any right of first refusal, preemptive right, right of participation, or any similar right to participate in the transactions contemplated by this Agreement. Except for a convertible note in the amount $10,000 which is convertible into 200,000 shares of common stock of Oregon Gold, there are no outstanding options, warrants, scrip rights to subscribe to, calls or commitments of any character whatsoever relating to, or securities, rights or obligations convertible into or exercisable or exchangeable for, or giving any Person any right to subscribe for or acquire any shares of Oregon Gold’s common stock, or Contracts, commitments, understandings or arrangements by which Oregon Gold is or may become bound to issue additional shares of Oregon Gold’s common stock or Common Stock Equivalents. The issuance of the Oregon Gold Shares will not obligate Oregon Gold to issue shares of Oregon Gold’s common stock or other securities to any Person (other than the Surry Holdings Shareholders) and will not result in a right of any holder of Oregon Gold securities to adjust the exercise, conversion, exchange or reset price under any of such securities. All of the outstanding shares of capital stock of Oregon Gold are validly issued, fully paid and nonassessable, have been issued in compliance with all federal and state securities laws, and none of such outstanding shares was issued in violation of any preemptive rights or similar rights to subscribe for or purchase securities. No further approval or authorization of any stockholder or Oregon Gold’s board of directors is required for the issuance of the Oregon Gold Shares. There are no stockholders agreements, voting agreements or other similar agreements with respect to Oregon Gold’s capital stock to which Oregon Gold is a party or, to the Knowledge of Oregon Gold, between or among any of Oregon Gold’s stockholders. “Common Stock Equivalents” means any securities of Oregon Gold which would entitle the holder thereof to acquire at any time Oregon Gold’s common stock, including, without limitation, any debt, preferred stock, rights, options, warrants or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive Oregon Gold’s common stock.

4.7 SEC Reports; Financial Statements. Oregon Gold has filed all reports, schedules, forms, statements and other documents required to be filed by Oregon Gold under the Securities Act and the Exchange Act, including pursuant to Section 13(a) or 15(d) thereof, for the two years preceding the date hereof (or such shorter period as Oregon Gold was required by law or regulation to file such material) (the foregoing materials, including the exhibits thereto and documents incorporated by reference therein, being collectively referred to herein as the “SEC Reports”) on a timely basis or has received a valid extension of such time of filing and has filed any such SEC Reports prior to the expiration of any such extension. To the Knowledge of Oregon Gold, as of their respective dates, the SEC Reports complied in all material respects with the requirements of the Securities Act and the Exchange Act, as applicable, and none of the SEC Reports, when filed, contained any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. Notwithstanding the foregoing Oregon Gold has received a comment letter from the Commission relating to its Form 10-Kfor the fiscal year ended December 31, 2009, which is being researched by Oregon Gold. The financial statements of Oregon Gold included in the SEC Reports (“Financial Statements”) comply in all material respects with applicable accounting requirements and the rules and regulations of the Commission with respect thereto as in effect at the time of filing. Such financial statements have been prepared in accordance with GAAP, except as may be otherwise specified in such financial statements or the notes thereto and except that unaudited financial statements may not contain all footnotes required by GAAP, and fairly present in all material respects the financial position of Oregon Gold as of and for the dates thereof and the results of operations and cash flows for the periods then ended, subject, in the case of unaudited statements, to normal, immaterial, year-end audit adjustments.

4.8 Material Changes. Since the date of the latest audited financial statements included within the SEC Reports, except as specifically disclosed in a subsequent SEC Report filed prior to the date hereof or in connection herewith: (i) there has been no event, occurrence or development that has had or that could reasonably be expected to result in a Material Adverse Effect, (ii) Oregon Gold has not incurred any liabilities (contingent or otherwise) other than (A) trade payables and accrued expenses incurred in the ordinary course of business consistent with past practice and (B) liabilities not required to be reflected in Oregon Gold’s financial statements pursuant to GAAP or disclosed in filings made with the Commission, (iii) Oregon Gold has not altered its method of accounting, (iv) Oregon Gold has not declared or made any dividend or distribution of cash or other property to its stockholders or purchased, redeemed or made any agreements to purchase or redeem any shares of its capital stock, and (v) Oregon Gold has not issued any equity securities to any officer, director or Affiliate. Oregon Gold does not have pending before the Commission any request for confidential treatment of information. Except for the issuance of the Oregon Gold Shares contemplated by this Agreement, no event, liability or development has occurred or exists with respect to Oregon Gold or its business, properties, operations or financial condition, that would be required to be disclosed by Oregon Gold under applicable securities laws at the time this representation is made or deemed made that has not been publicly disclosed at least one (1) Trading Day prior to the date that this representation is made.

4.9 Litigation. There is no action, suit, inquiry, notice of violation, proceeding or investigation pending or, to the Knowledge of Oregon Gold, threatened against or affecting Oregon Gold or any of its properties before or by any court, arbitrator, governmental or administrative agency or regulatory authority (federal, state, county, local or foreign) (collectively, an “Action”) which (i) adversely affects or challenges the legality, validity or enforceability of this Agreement or the Oregon Gold Shares, or (ii) could, if there were an unfavorable decision, have or reasonably be expected to result in a Material Adverse Effect. Neither Oregon Gold nor any current director or officer thereof, is or has been the subject of any Action involving a claim of violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty. There has not been, and to the Knowledge of Oregon Gold, there is not pending or contemplated, any investigation by the Commission involving Oregon Gold or any current director or officer of Oregon Gold. The Commission has not issued any stop order or other order suspending the effectiveness of any registration statement filed by Oregon Gold under the Securities Act.

4.10 Labor Relations. No labor dispute exists or, to the Knowledge of Oregon Gold, is imminent with respect to any of the employees of Oregon Gold which could reasonably be expected to result in a Material Adverse Effect. None of Oregon Gold’s employees is a member of a union that relates to such employee’s relationship with Oregon Gold, and Oregon Gold is not a party to a collective bargaining agreement, and Oregon Gold believes that its relationships with their employees are good. No executive officer, to the Knowledge of Oregon Gold, is, or is now expected to be, in violation of any material term of any employment contract, confidentiality, disclosure or proprietary information agreement or non-competition agreement, or any other Contract or agreement or any restrictive covenant in favor of any third party, and the continued employment of each such executive officer does not subject Oregon Gold to any liability with respect to any of the foregoing matters. Oregon Gold is in compliance with all U.S. federal, state, local and foreign laws and regulations relating to employment and employment practices, terms and conditions of employment and wages and hours, except where the failure to be in compliance could not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

4.11 Compliance. To its Knowledge, Oregon Gold: (i) is not in default under or in violation of (and no event has occurred that has not been waived that, with notice or lapse of time or both, would result in a default by Oregon Gold under), nor has Oregon Gold received notice of a claim that it is in default under or that it is in violation of, any indenture, loan or credit agreement or any other agreement or instrument to which it is a party or by which it or any of its properties is bound (whether or not such default or violation has been waived), (ii) is not n violation of any order of any court, arbitrator or governmental body, or (iii) is or has been in violation of any statute, rule or regulation of any governmental authority, including without limitation all foreign, federal, state and local laws applicable to its business and all such laws that affect the environment, except in each case as could not have or reasonably be expected to result in a Material Adverse Effect.

4.12 Regulatory Permits. Oregon Gold possesses all certificates, authorizations and permits issued by the appropriate federal, state, local or foreign regulatory authorities necessary to conduct its business, except where the failure to possess such permits could not reasonably be expected to result in a Material Adverse Effect (“Material Permits”), and Oregon Gold has not received any notice of proceedings relating to the revocation or modification of any Material Permit.

4.13 Patents and Trademarks. Oregon Gold has, or has rights to use, all patents, patent applications, trademarks, trademark applications, service marks, trade names, trade secrets, inventions, copyrights, licenses and other intellectual property rights and similar rights as described in the SEC Reports as necessary or material for use in connection with their business and which the failure to so have could have a Material Adverse Effect (collectively, the “Intellectual Property Rights”). Oregon Gold has not received a notice (written or otherwise) that any of the Intellectual Property Rights used by Oregon Gold violates or infringes upon the rights of any Person. To the Knowledge of Oregon Gold, all such Intellectual Property Rights are enforceable and there is no existing infringement by another Person of any of the Intellectual Property Rights. Oregon Gold has taken reasonable security measures to protect the secrecy, confidentiality and value of all of their intellectual properties, except where failure to do so could not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

4.14 Transactions with Affiliates and Employees. Except as set forth in the SEC Reports, none of the officers or directors of Oregon Gold and, to the Knowledge of Oregon Gold, none of the employees of Oregon Gold is presently a party to any transaction with Oregon Gold (other than for services as employees, officers and directors), including any Contract, agreement or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, or otherwise requiring payments to or from any officer, director or such employee or, to the Knowledge of Oregon Gold, any entity in which any officer, director, or any such employee has a substantial interest or is an officer, director, trustee or partner, in each case in excess of $120,000, other than for: (i) payment of salary or consulting fees for services rendered, (ii) reimbursement for expenses incurred on behalf of Oregon Gold and (iii) other employee benefits.

4.15 Sarbanes-Oxley; Internal Accounting Controls. Oregon Gold is in material compliance with all provisions of the Sarbanes-Oxley Act of 2002 which are applicable to it as of the Closing Date. Oregon Gold maintains a system of internal accounting controls sufficient to provide reasonable assurance that: (i) transactions are executed in accordance with management’s general or specific authorizations, (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with GAAP and to maintain asset accountability, (iii) access to assets is permitted only in accordance with management’s general or specific authorization, and (iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences. Oregon Gold has established disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for Oregon Gold and designed such disclosure controls and procedures to ensure that information required to be disclosed by Oregon Gold in the reports it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Commission’s rules and forms. Oregon Gold’s certifying officer has evaluated the effectiveness of Oregon Gold’s disclosure controls and procedures as of the end of the period covered by Oregon Gold’s most recently filed periodic report under the Exchange Act (such date, the “Evaluation Date”). Oregon Gold presented in its most recently filed periodic report under the Exchange Act the conclusions of the certifying officer about the effectiveness of the disclosure controls and procedures based on their evaluations as of the Evaluation Date. Since the Evaluation Date, there have been no changes in Oregon Gold’s internal control over financial reporting (as such term is defined in the Exchange Act) that has materially affected, or is reasonably likely to materially affect, Oregon Gold’s internal control over financial reporting.

4.16 Issuance of Oregon Gold Shares. Assuming the accuracy of the Surry Holdings Shareholders’ representations and warranties set forth in Section 3, no registration under the Securities Act is required for the offer and issuance of the Oregon Gold Shares by Oregon Gold to the Surry Holdings Shareholders as contemplated hereby. The issuance of the Oregon Gold Shares hereunder does not contravene the rules and regulations of the applicable Trading Market.

4.17 Investment Company. Oregon Gold is not, and is not an Affiliate of, an “investment company” within the meaning of the Investment Company Act of 1940, as amended.

4.18 Listing and Maintenance Requirements. Oregon Gold’s common stock is currently quoted on FINRA’s Over-the-Counter Bulletin Board Quotation Service (“OTC Bulletin Board”) and Oregon Gold has not, in the 12 months preceding the date hereof, received any notice from the OTC Bulletin Board or FINRA or any trading market on which Oregon Gold’s common stock is or has been listed or quoted to the effect that Oregon Gold is not in compliance with the quoting, listing or maintenance requirements of the OTCBB or such other trading market. Oregon Gold is, and has no reason to believe that it will not, in the foreseeable future continue to be, in compliance with all such quoting, listing and maintenance requirements.

4.19 Application of Takeover Protections. Oregon Gold has taken all necessary action, if any, in order to render inapplicable any control share acquisition, business combination, poison pill (including any distribution under a rights agreement) or other similar anti-takeover provision under Oregon Gold’s certificate of incorporation (or similar charter documents) or the laws of its state of incorporation that is or could become applicable to the Surry Holdings Shareholders as a result of the Surry Holdings Shareholders and Oregon Gold fulfilling their obligations or exercising their rights under this Agreement, including without limitation as a result of Oregon Gold’s issuance of the Oregon Gold Shares and the Surry Holdings Shareholders’ ownership of the Oregon Gold Shares.

4.20 Tax Status. Except for matters that would not, individually or in the aggregate, have or reasonably be expected to result in a Material Adverse Effect, Oregon Gold has filed all necessary Tax Returns and has paid or accrued all Taxes shown as due thereon, and Oregon Gold has no knowledge of a tax deficiency which has been asserted or threatened against Oregon Gold.

4.21 Foreign Corrupt Practices. Neither Oregon Gold, nor to the Knowledge of Oregon Gold, any agent or other person acting on behalf of Oregon Gold, has: (i) directly or indirectly, used any funds for unlawful contributions, gifts, entertainment or other unlawful expenses related to foreign or domestic political activity, (ii) made any unlawful payment to foreign or domestic government officials or employees or to any foreign or domestic political parties or campaigns from corporate funds, (iii) failed to disclose fully any contribution made by Oregon Gold (or made by any person acting on its behalf of which Oregon Gold is aware) which is in violation of law or (iv) violated in any material respect any provision of the Foreign Corrupt Practices Act of 1977, as amended.

4.22 No Disagreements with Accountants and Lawyers. To the Knowledge of Oregon Gold, there are no disagreements of any kind, including but not limited to any disagreements regarding fees owed for services rendered, presently existing, or reasonably anticipated by Oregon Gold to arise, between Oregon Gold and the accountants and lawyers formerly or presently employed by Oregon Gold which could affect Oregon Gold’s ability to perform any of its obligations under this Agreement, and Oregon Gold is current with respect to any fees owed to its accountants and lawyers.

4.23 Regulation M Compliance. Oregon Gold has not, and to the Knowledge of Oregon Gold no one acting on its behalf has, (i) taken, directly or indirectly, any action designed to cause or to result in the stabilization or manipulation of the price of any security of Oregon Gold to facilitate the sale or resale of any of the Oregon Gold Shares, (ii) sold, bid for, purchased, or paid any compensation for soliciting purchases of, any of the securities of Oregon Gold, or (iii) paid or agreed to pay to any Person any compensation for soliciting another to purchase any other securities of Oregon Gold.

4.24 Money Laundering Laws. The operations of Oregon Gold are and have been conducted at all times in compliance with the money laundering statutes of applicable jurisdictions, the rules and regulations thereunder and any related or similar rules, regulations or guidelines, issued, administered or enforced by any applicable governmental agency (collectively, the “Money Laundering Laws”) and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving Oregon Gold with respect to the Money Laundering Laws is pending or, to the best Knowledge of the Oregon Gold, threatened.

4.25 Minute Books. The minute books of Oregon Gold made available to Surry Holdings and the Surry Holdings Shareholders contain a complete summary of all meetings and written consents in lieu of meetings of directors and stockholders since the time of incorporation.

4.26 Employee Benefits. Oregon Gold has not (nor for the two years preceding the date hereof has) had any plans which are subject to ERISA.

4.27 Business Records and Due Diligence. Prior to the Closing, Oregon Gold delivered to Surry Holdings all records and documents relating to Oregon Gold, which Oregon Gold and possesses, including, without limitation, books, records, government filings, Tax Returns, Charter Documents, corporate records, stock records, consent decrees, orders, and correspondence, director and stockholder minutes, resolutions and written consents, stock ownership records, financial information and records, and other documents used in or associated with Oregon Gold and Oregon Gold Subsidiaries.

4.28 Contracts. Except as previously disclosed to Surry there are no Contracts that are material to the business, properties, assets, condition (financial or otherwise), results of operations or prospects of Oregon Gold taken as a whole. Oregon Gold is not in violation of or in default under (nor does there exist any condition which upon the passage of time or the giving of notice would cause such a violation of or default under) any Contract to which it is a party or by which it or any of its properties or assets is bound, except for violations or defaults that would not, individually or in the aggregate, reasonably be expected to result in a Material Adverse Effect.

4.29 No Undisclosed Liabilities. Except as otherwise disclosed in Oregon Gold’s Financial Statements or incurred in the ordinary course of business after the fiscal year ended December 30, 2009, and quarterly reports since such date, Oregon Gold has no other undisclosed liabilities whatsoever, either direct or indirect, matured or unmatured, accrued, absolute, contingent or otherwise. Oregon Gold represents that at the date of Closing, Oregon Gold shall have no liabilities or obligations whatsoever, either direct or indirect, matured or unmatured, accrued, absolute, contingent or otherwise.

4.30 No SEC or FINRA Inquiries. To the Knowledge of Oregon Gold, neither Oregon Gold nor any of its present officers or directors is, or has ever been, the subject of any formal or informal inquiry or investigation by the SEC or FINRA.

4.31 Disclosure. The representations and warranties and statements of fact made by Oregon Gold in this Agreement are, as applicable, accurate, correct and complete and do not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements and information contained herein not false or misleading.

ARTICLE 5

INDEMNIFICATION; SURVIVAL OF REPRESENTATIONS

5.1 Indemnification. Subject to the provisions of this Article 5, the Oregon Gold Stockholders agree to, jointly and severally, indemnify fully in respect of, hold harmless and defend Surry Holdings, the Surry Holdings Shareholders and each of the officers, agents and directors of Surry Holdings or the Surry Holdings Shareholders against any damages, liabilities, costs, claims, proceedings, investigations, penalties, judgments, deficiencies, including taxes, expenses (including, but not limited to, any and all interest, penalties and expenses whatsoever reasonably incurred in investigating, preparing or defending against any litigation, commenced or threatened, or any claim whatsoever) and losses (each, a “Claim” and collectively “Claims”) to which it or they may become subject arising out of or based on either (i) any breach of or inaccuracy in any of the representations and warranties or covenants or conditions made by Oregon Gold and/or the Oregon Gold Stockholders herein in this Agreement; or (ii) any and all liabilities arising out of or in connection with: (A) any of the assets of Oregon Gold prior to the Closing; or (B) the operations of Oregon Gold prior to the Closing. Subject to the provisions of this Article 5, Surry Holdings agrees to indemnify fully in respect of, hold harmless and defend the Oregon Gold Stockholders and each of the officers, agents and directors of the Oregon Gold Stockholders against any Claims to which it or they may become subject arising out of or based on any breach of or inaccuracy in any of the representations and warranties or covenants or conditions made by Surry Holdings and/or the Surry Holdings Shareholders herein in this Agreement. The party claiming indemnification hereunder is hereinafter referred to as the “Indemnified Party” and the party against whom such claims are asserted hereunder is hereinafter referred to as the “Indemnifying Party.”

5.2 Survival of Representations and Warranties. Notwithstanding provision in this Agreement to the contrary, the representations and warranties given or made by Oregon Gold, Oregon Gold Stockholders and Surry Holdings under this Agreement shall survive the date hereof for a period of twenty four (24) months from and after the Closing Date (the last day of such period is herein referred to as the “Expiration Date”), except that any written claim for breach thereof made and delivered prior to the Expiration Date to the party against whom such indemnification is sought shall survive thereafter and, as to any such claim, such applicable expiration will not effect the rights to indemnification of the party making such claim; provided, however, that any representations and warranties that were fraudulently made shall not expire on the Expiration Date and shall survive indefinitely, and claims with respect to fraud by Oregon Gold, the Oregon Gold Stockholders or Surry Holdings may be made at any time.

5.3 Method of Asserting Claims, Etc. All Claims for indemnification by any Indemnified Party under this Article V shall be asserted as follows: