Exhibit 99.4

LOUISIANA PUBLIC SERVICE COMMISSION

ORDER NO. U-31894-B

(Supersedes Orders Nos. U-31894 and U-31894-A)

ENTERGY LOUISIANA, LLC

EX PARTE

______________________________________________________________________________

Docket No. U-31894 In Re: Application of Entergy Louisiana, LLC For Approval To Securitize Investment Recovery Costs Related To The Little Gypsy Unit 3 Repowering Project Authorizing The Company to Finance Its Investment Costs Pursuant To Act 988

______________________________________________________________________________

(Decided at the Business and Executive Session held on August 10, 2011)

FINANCING ORDER

LOUISIANA PUBLIC SERVICE COMMISSION

EX PARTE: APPLICATION OF ENTERGY LOUISIANA, LLC FOR APPROVAL TO SECURITIZE INVESTMENT RECOVERY COSTS RELATED TO THE LITTLE GYPSY UNIT 3 REPOWERING PROJECT AUTHORIZING THE COMPANY TO FINANCE ITS INVESTMENT COSTS PURSUANT TO ACT 988 | §§§§§§§ | DOCKET NO. U-31894 |

FINANCING ORDER

This Financing Order addresses the request of Entergy Louisiana, LLC (“ELL”), under Act No. 988 of the Louisiana Regular Session of 2010, the “Louisiana Electric Utility Investment Recovery Securitization Act” (“Act 988”), codified at La. R.S. 45:1251–1261: (1) to finance, through the issuance of investment recovery bonds, ELL’s investment recovery costs in the amount of $200,000,000.00, as determined in LPSC Docket No. U-30192 (Phase III), plus carrying costs on such investment recovery costs and up-front financing costs associated with the issuance of investment recovery bonds; (2) to approve the proposed financing structure and issuance of investment recovery bonds; (3) to approve the creation of investment recovery property, including the right to impose and collect investment recovery charges sufficient to pay the investment recovery bonds and associated financing costs; (4) to approve a tariff to implement the investment recovery charges; and (5) to approve another tariff to implement ancillary cost offsets and cost recovery relating to the investment recovery cost process.

As discussed in this Financing Order, the Louisiana Public Service Commission (the “Commission” or the “LPSC”) finds that ELL’s application for approval of the securitization transaction should be approved. The Commission also finds that the securitization approved in this Financing Order meets all applicable requirements of Act 988. Accordingly, in accordance with the terms of this Financing Order, the Commission: (1) approves and authorizes the securitization requested by ELL; (2) authorizes the issuance of investment recovery bonds in one or more series in an aggregate principal amount of approximately $206,100,000.00, equal to the sum of: (a) $200,000,000.00 of investment recovery costs, plus approximately $2.7 million of carrying costs between March 31, 2011, through the projected issuance date of the investment recovery bonds of August 1, 2011 calculated at a 4% annual rate, plus (b) up-front financing costs, which are capped and are not to exceed in the financed amount $3,426,027.00 (which includes a contingency of $36,749.00), plus the cost of credit enhancements and other mechanisms designed to promote the credit quality and marketability of the investment recovery bonds (including original issue discount), if any, plus or minus (c) any adjustment, pursuant to the Issuance Advice Letter, to reflect any change in carrying costs necessary to account for the number of days either less than or greater than assumed in the calculation based on the projected issuance date for the investment recovery bonds of August 1, 2011, including (if applicable) carrying costs subsequent to September 30, 2011, calculated from September 30, 2011, to the actual issuance date of the investment recovery bonds at a 6.59% annual rate; (3) approves the structure of the proposed securitization; (4) approves the creation of investment recovery property, including the right to impose and collect investment recovery charges in an amount to be calculated as provided in this Financing Order; and (5) approves the form of tariff to implement those investment recovery charges, and the form of tariff to implement ancillary cost offsets and cost recovery relating to the investment recovery process, attached in Appendix B.

In the Issuance Advice Letter discussed herein, ELL shall update the amount of the up-front financing costs and carrying costs to reflect the actual issuance date of the investment recovery bonds and other relevant current information in accordance with the terms of this Financing Order.

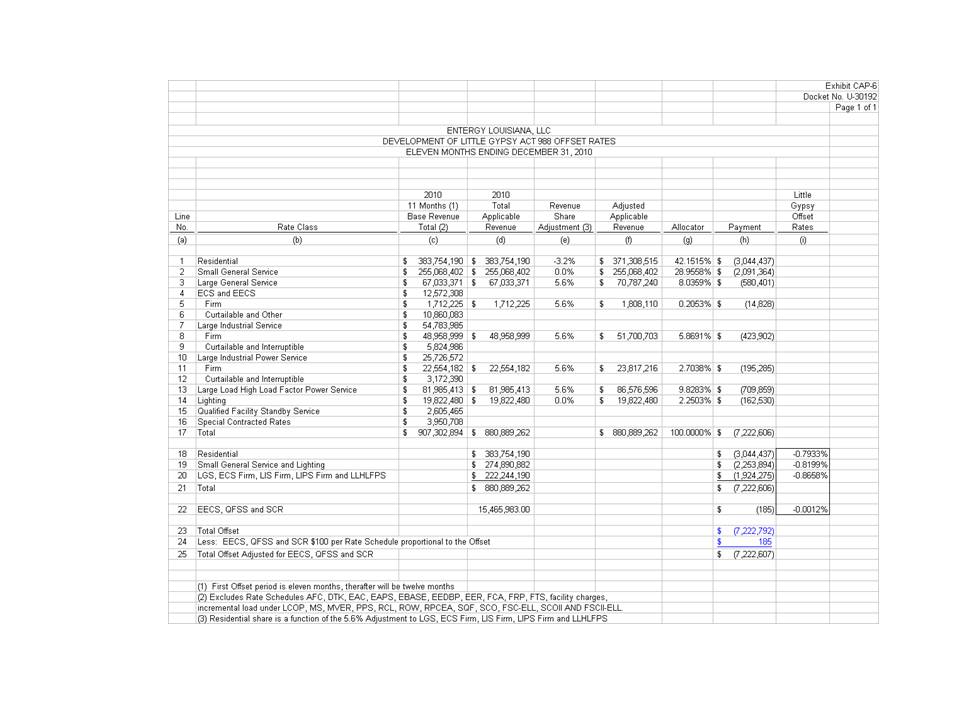

The returns on the deferred tax benefit associated with these recoverable costs, plus any subsequently-determined benefits of cancellation (such as salvage in excess of that known at February 1, 2011) received by ELL after the date of this Financing Order, together with any interest earnings and any adjustment to carrying costs, shall be returned to customers dollar for dollar through the Securitized Little Gypsy Offset Rider (“Rider SLGO”), attached in Appendix B.

ELL is authorized to cause its wholly owned subsidiary, referred to herein as the “SPE,” to issue investment recovery bonds to finance the updated aggregate principal amount reflected in the Issuance Advice Letter in accordance with the terms of this Financing Order.

ELL submitted evidence demonstrating that the proposed securitization is reasonably expected to result in lower overall costs to customers compared to traditional methods of financing or recovering utility investment recovery costs. Based on the amount that ELL requests to be financed, ELL’s financial analysis and testimony indicates that customers will realize significant benefits from securitization on a net present value basis as compared to traditional methods of financing or recovering utility investment recovery costs. Accordingly, the Commission concludes that the benefits for customers set forth in ELL’s evidence are indicative of the benefits that customers will realize from the financing approved hereby, and that these benefits will result in lower overall costs and will mitigate rate impact as compared to traditional financing so long as the weighted average interest rate on all of the tranches of the investment recovery bonds is less than 7.0%.

ELL provided a general description of the proposed transaction structure in its Supplemental and Amending Application of Entergy Louisiana, LLC for Approval to Securitize Investment Recovery Costs Related to the Little Gypsy Unit 3 Repowering Project filed April 13, 2011 (the “Original Securitization Application”) with the Commission and in the testimony and exhibits submitted in support thereof. The proposed transaction structure is consistent with Act 988. Certain details of the final transaction structure, such as any overcollateralization requirements to support payment of the investment recovery bonds, and the final terms of the bonds will depend in part upon the requirements of the nationally-recognized credit rating agencies which will rate the investment recovery bonds and, in part, upon the market conditions that exist at the time the investment recovery bonds are taken to the market.

The Commission recognizes that the final transaction structure and pricing terms of the investment recovery bonds will affect customer costs. Accordingly, this Financing Order provides for a process by which the Commission’s Staff and Advisors, including the Commission’s financial advisor, Sisung Securities Corporation (“Sisung”), and any Commission legal counsel, may review and comment on the bond structure and pricing. This Financing Order also provides for a procedure by which the Commission, acting through a Commission designee, shall approve (or disapprove, with reasons) the final structure and pricing of the investment recovery bonds without further Commission action. The Commission determines that the Commission Executive Secretary, or in her absence the Commission Chairman, should be the Commission’s designee under this Financing Order. This participation and approval process proposed by ELL is in the best interest of customers and provides the necessary timeliness and finality to the issuance process.

On June 24, 2011, the Commission issued Order No. U-31894 and Order No. U-31894-A (collectively the “Prior Orders”) with regard to the Original Securitization Application. On July 21, 2011, ELL filed with the Commission a Supplemental Application of Entergy Louisiana, LLC, for Re-Approval and Re-Issuance of a Financing Order to Securitize Investment Recovery Costs Related to the Little Gypsy Unit 3 Repowering Project and Request for a 15-Day Intervention Period and Approval of Financing Order via LPSC Rule 51 (including its attachments, the “Securitization Application”). This request for re-approval and re-issuance of a securitization Financing Order was made solely to cure a technical error in the publication of the legal notice that occurred in five of the forty-six parishes in which ELL operates and that related to the Original Securitization Application. The Commission exercised its discretion pursuant to Rule 51 of the LPSC Rules of Practice and Procedure and waived the typical procedural mechanisms and considered direct re-approval and re-issuance of the Prior Orders in a single order through the issuance of this Financing Order.

[The remainder of this page is blank intentionally.]

I. DISCUSSION AND STATUTORY OVERVIEW

On July 11, 2007, ELL filed an application with this Commission seeking approval of ELL’s request to repower the Little Gypsy Steam Generating Station’s Unit 3 to be a solid fuel unit (expected mix of fuel was to be petroleum coke and/or coal) (the “Repowering Project” or the “Project”). The Little Gypsy facility is a three-unit gas-fired plant located in St. Charles Parish. That application sought such approval consistent with the requirements of the Commission’s 1983 General Order.1 After extensive discovery and days of hearings, at the November 2007 Business & Executive Meeting, the Commission voted unanimously to grant the application and to certify the Repowering Project pursuant to the 1983 General Order. On March 19, 2008, the Commission made a formal ruling on the application in Order No. U-30192. The Commission found that the Repowering Project did serve “the public convenience and necessity” and that it “is in the public interest, and therefore prudent . . . .”2 The Order further found that the decision of ELL “to undertake the Repowering Project at a presently estimated cost of $1.26 billion, exclusive of construction-related financing costs . . . is hereby deemed prudent, provided such costs are expended to implement and are consistent with the Commission’s certification of the Repowering Project.”3 This Order also adopted a monitoring plan designed to provide the Commission “with frequent information regarding the construction cost and completion schedule, as well as updated economic analysis to validate the ongoing decision to continue with construction”.4

In March, 2008, however, the Project was suspended for approximately two and a half months as a result of a February 2008 federal appeals court decision that led ELL to voluntarily reopen the air permit for the Project to complete a formal Maximum Achievable Control Technology determination for mercury emissions under the federal Clean Air Act. The LPSC recognized this delay in the Project and the reasons for the delay in its Order No. U-30192-A, dated July 2, 2008.

On March 13, 2009, the Commission issued Order No. U-30192-B. This Order approved a Resolution made by then Chairman Lambert Boissiere III, that recognized certain significant changes in the facts underlying the Project’s economics and directed ELL to continue to review the Project’s economics and to “develop a recommendation regarding whether it is appropriate for ELL to make a filing with the Commission to formally delay the Repowering Project for an extended time.”5 That Order required ELL to “immediately suspend, to the extent possible, on a temporary basis, the Repowering Project . . . .”6 It, in addition, directed ELL to continue to review the Project economics.7 On May 9, 2009, ELL filed an unopposed motion asking the Commission to approve a longer-term suspension of the Repowering Project of three years or more. On May 22, 2009, the Commission issued Order No. U-30192-C, which approved the prudence of ELL’s decision to suspend the Project on a longer-term basis, without prejudice to certain related issues:

ELL’s decision at this time to place the Little Gypsy Unit 3 Repowering Project. . . into a longer-term suspension of three years or more be and is hereby declared to be in the public interest and therefore prudent, without prejudice to Commission consideration of: (1) the prudence of the timing of ELL’s decisions; (2) the prudence of ELL’s management of the Project; (3) whether ELL may recover the costs of the Project, including any continuing costs of the Project incurred after the Commission approves the suspension of the Project, from ELL’s retail customers and the manner of that recovery; and (4) whether the Project should be canceled or abandoned as opposed to merely suspended.8

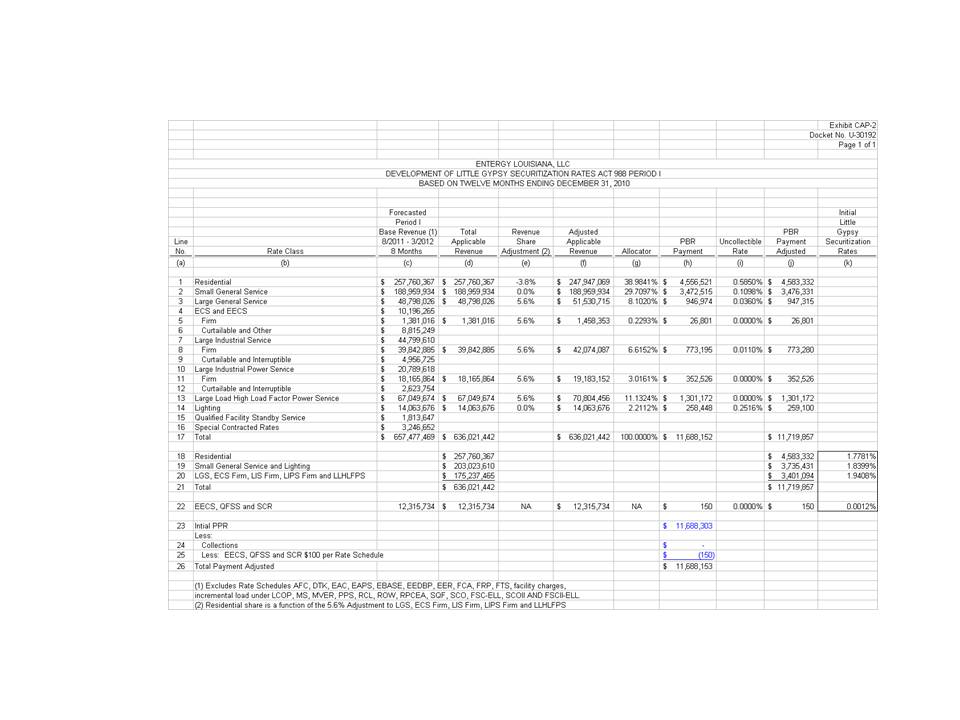

On October 27, 2009, pursuant to the Commission’s directive in its Order No. U-30192-C, ELL submitted its application in Phase III of Docket No. U-30192, seeking authority to cancel the Repowering Project and to recover its prudently-incurred cancellation costs9. On April 20, 2011, the Staff of the Commission, ELL, Marathon Oil Company, the Louisiana Energy Users Group, Occidental Chemical Corporation, and ArcelorMittal LaPlace LLC entered into a Proposed Uncontested Stipulated Settlement. That stipulated settlement (subject to approval by the Commission) resolved all issues among those parties in Phase III, except those related to financing, via securitization or otherwise, of the approved cancelled plant costs. The resolved issues include the cancellation of the Little Gypsy Unit 3 repowering project, the establishment of the quantification of prudently incurred and recoverable cancellation costs, the level(s) at which carrying costs may be accrued on a going forward basis, the appropriate allocation of the recoverable cancellation costs among ELL’s customer classes and customers, and, subject to the issuance of this Financing Order, the framework for the securitization of the recoverable costs.

On June 1, 2011, the Commission issued Order No. U-30192-E (the “Quantification Order”) in Phase III of Docket No. U-30192. The Quantification Order provides that ELL shall be permitted to recover in a securitization the recoverable costs at March 31, 2011, of $200 million, plus between March 31, 2011 and September 30, 2011 carrying charges calculated at a 4% annual rate, plus Commission-approved financing costs as defined in Act 988. The recoverable costs subsequent to September 30, 2011, shall be $200 million plus carrying charges calculated at a 4% annual rate through September 30, 2011, plus carrying charges subsequent to September 30, 2011, calculated from September 30, 2011 to the date securitization occurs at an annual rate of 6.59%.10 The securitized amount shall be securitized with an approximate 10-year term for the debt service recovery of the securitization bonds, to the extent a ten-year term is determined to be feasible and economically attractive.11 That Order, in addition, directed ELL to file an application seeking to securtitize the securitized amount.12

On June 24, 2011, the Commission issued the Prior Orders (Order No. U-31894 and Order No. U-31894-A) with regard to the Original Securitization Application. On July 21, 2011, ELL filed its Securitization Application with the Commission, requesting the re-approval and re-issuance of a securitization Financing Order, to cure a technical error in the publication of the legal notice that occurred in five of the forty-six parishes in which ELL operates and that related to the Original Securitization Application.

Pursuant to its filed Securitization Application, ELL has requested that the Commission grant authorization to securitize the recovery of its investment recovery costs.

In July 2010, the Louisiana Legislature established a financing vehicle by which electric utilities can use securitization financing for investment recovery costs through the issuance of “investment recovery bonds.” Investment recovery bonds must be approved in a financing order. This provision of Louisiana law, Act 988, is codified at La. R.S. 45:1251-1261.13

If investment recovery bonds are approved and issued, the customers of ELL must pay the principal of the investment recovery bonds, together with interest and related financing costs, through investment recovery charges. Investment recovery charges, to the extent provided in Act 988 and this Financing Order, are nonbypassable charges paid by ELL’s LPSC-jurisdictional customers as a component of the monthly charge for electric service. Investment recovery charges will be collected by ELL or its successor, as initial servicer, as provided for in this Financing Order.

Act 988 permits the Commission to consider whether the proposed structuring, expected pricing, and financing costs of the investment recovery bonds are reasonably expected to result in lower overall costs or would avoid or mitigate rate impacts to customers as compared with traditional methods of financing or recovering investment recovery costs.14 The primary benefits of the proposed structure arise from replacing traditional debt and equity of the utility with highly rated debt, the benefits of which are significant.

In this proceeding, ELL’s financial analysis and testimony shows that the financing, as proposed by ELL, will produce benefits to customers in an amount of $25.8 million to $69.8 million on a net present-value basis as compared to traditional financing methods for recovering utility investment recovery costs. Assuming that the investment recovery bonds are issued in a manner consistent with the base case presented by ELL, subject to a 3.22% weighted-average annual interest rate (calculated using the amount requested to be securitized by ELL), the benefit is $69.8 million on a present-value basis compared to conventional financing. Using worst-case market conditions in relation to the amount initially sought to be securitized, ELL’s financial analysis demonstrates that the benefit will be $25.8 million on a net present-value basis under this Financing Order compared to the amount that would be recovered under conventional utility financing methods, assuming that the investment recovery bonds are issued at 7.0% weighted-average annual interest rate. ELL will be required to update the benefit analysis in the Issuance Advice Letter to verify that the final amount securitized provides savings compared to conventional financing methods.

This Financing Order contains terms ensuring that the imposition and collection of investment recovery charges authorized herein shall be from all “Customers”, meaning existing and future LPSC-jurisdictional customers receiving electric transmission or distribution service, or both, from ELL or its successors or assignees under rate schedules approved by the Commission, except in limited circumstances expressly stated in this Financing Order, even if a customer has chosen to switch to self-generation or co-generation.15 These provisions make the investment recovery charges “nonbypassable.”

This Financing Order also includes a mechanism requiring that investment recovery charges be reviewed and adjusted semi-annually (i.e., every six months),16 to correct over-collections or under-collections during the preceding collection period and to ensure the projected recovery of amounts sufficient to provide timely payment of debt service on the investment recovery bonds and related financing costs. In addition to the semi-annual reviews, following the scheduled final maturity, quarterly reviews and adjustments may be required in order to assure the payment of debt service on the investment recovery bonds and related financing costs. In addition, interim adjustments to the investment recovery charges may be requested if necessary to assure timely payment of the investment recovery bonds. These provisions will help to ensure that the amount of investment recovery charges paid by customers is neither more nor less than the amount necessary to cover the costs of this financing.

The State of Louisiana has pledged to and agreed with the investment recovery bondholders, the owners of the investment recovery property, and other financing parties that the State will not:

(1) alter the provisions of Act 988 which authorize the Commission to create an irrevocable contract right by the issuance of this Financing Order, to create investment recovery property, and to make the investment recovery charges imposed by a financing order irrevocable, binding, and nonbypassable charges;

(2) take or permit any action that impairs or would impair the value of the investment recovery property created pursuant to this Financing Order; or

(3) except for adjustments under any true-up mechanism established by the Commission, reduce, alter, or impair investment recovery charges that are to be imposed, collected, and remitted for the benefit of the bondholders and other financing parties, as applicable, until any and all principal, interest, premium, financing costs and other fees, expenses, or charges incurred, and any contracts to be performed, in connection with the investment recovery bonds have been paid and performed in full.

In addition this Commission has covenanted in this Financing Order that after the earlier of the transfer of investment recovery property to an assignee or the issuance of investment recovery bonds authorized by this Financing Order, this Financing Order is irrevocable until the indefeasible payment in full of the investment recovery bonds and the related financing costs. “Indefeasible” in this context does not refer to the potential defeasance in the future of the investment recovery bonds, but rather that the payment and satisfaction of the bonds and costs are permanent and cannot be revoked or made void. Except in connection with a refinancing or refunding17 or to implement the true-up mechanism adopted by the Commission, the Commission may not amend, modify, or terminate this Financing Order by any subsequent action or reduce, impair, postpone, terminate, or otherwise adjust investment recovery charges approved in this Financing Order.

Nothing in the State and Commission agreements described above precludes a limitation or alteration in this Financing Order and the investment recovery property if and when full compensation is made for the full protection of the investment recovery charges collected pursuant to this Financing Order and the full protection of the bondholders and any assignee or financing party.

Investment recovery property constitutes an existing, present contract right susceptible of ownership, sale, assignment, transfer, and security interest, and the property will continue to exist until the investment recovery bonds issued pursuant to this Financing Order are paid in full and all financing costs of the investment recovery bonds have been recovered in full. In addition, the interests of an assignee or secured party in investment recovery property (as well as the revenues and collections arising from the property) are not subject to setoff, counterclaim, surcharge, or defense by ELL or any other person or in connection with the bankruptcy of ELL or any other entity. Except to the extent provided in Act 988, the creation, attachment, granting, perfection, and priority of security interests in investment recovery property to secure investment recovery bonds is governed solely by Act 988 and not by the Louisiana Uniform Commercial Code.

The Commission may adopt a financing order providing for the retiring and refunding of the investment recovery bonds. ELL has not requested and this Financing Order does not grant any authority to refinance investment recovery bonds authorized by this Financing Order. This Financing Order does not preclude ELL from filing a request for a financing order to retire or refund the investment recovery bonds approved in this Financing Order upon a showing that the customers of ELL would benefit and that such a financing is consistent with the terms of the outstanding investment recovery bonds.

To facilitate compliance and consistency with applicable statutory provisions, this Financing Order adopts the definitions in Act 988.

[The remainder of this page is blank intentionally.]

1 LPSC General Order dated September 20, 1983 (In re: In the Matter of the Expansion of Utility Power Plant; Proposed Certification of New Plant by the LPSC) (the “1983 General Order”), as amended by the LPSC General Order in Docket No. R-30517 dated October 29, 2008.

2 Order No. U-30192 at 46.

5 Order No. U-30192-B at 1.

8 Order No. U-30192-C at 2.

9 On April 21, 2011, ELL filed a Notice of Related Docket in both Docket No. U-30192 (Phase III) and Docket No. U-31894. ELL intends that the evidence submitted in support of this Application will stand alone. Nonetheless, the Commission’s Order U-30192-E established the amount of the investment recovery costs that will be subject to securitization pursuant to this Financing Order.

10 Order No. U-30192-E at 13.

13 All references are to Act 988 unless otherwise indicated.

15 As permitted by § 1252(10).

16 As provided by § 1253(C)(4).

17 As permitted in § 1253(F).

II. DESCRIPTION OF PROPOSED TRANSACTION

A brief summary of the proposed transaction is provided in this section. A more detailed description is included in Section III.C, titled “Structure of the Proposed Financing,” and in the Securitization Application (in its Attachment I, the Original Securitization Application).

To facilitate the proposed securitization, ELL proposes that a special purpose investment recovery funding entity (the “SPE”) be created to which will be transferred the investment recovery property, which includes the right to impose, collect, and receive investment recovery charges along with the other rights arising pursuant to this Financing Order. Upon the effectiveness of this Financing Order, these rights are investment recovery property, a vested contract right of ELL.

The SPE will issue investment recovery bonds and will transfer the net proceeds from the sale of the investment recovery bonds to ELL in consideration for the transfer of the investment recovery property. The SPE will be organized and managed in a manner designed to achieve the objective of maintaining the SPE as a bankruptcy-remote entity that would not be affected by the bankruptcy of ELL or any other affiliates of ELL or any of their respective successors or assignees. In addition, the SPE will have at least one independent manager whose approval will be required for major actions or organizational changes by the SPE.

The investment recovery bonds will be issued pursuant to an indenture and administered by an indenture trustee. The investment recovery bonds will be secured by and payable solely out of the investment recovery property created pursuant to this Financing Order and other collateral, described in ELL’s Securitization Application. That collateral will be pledged by the SPE to the indenture trustee for the benefit of the holders of the investment recovery bonds and to secure payment due with respect to the bonds and certain costs and expenses relating to the bonds.

Pursuant to a servicing agreement, ELL will act as the initial servicer of the investment recovery charges for the SPE, and will undertake to collect such charges from the customers of ELL and remit these collections to the indenture trustee on behalf of and for the account of the SPE. The servicer will be responsible for making any required or allowed true-ups of the investment recovery charges. If the servicer defaults on its obligations under the servicing agreement, the indenture trustee may appoint a successor servicer.

Investment recovery charges will be calculated to be sufficient at all times to pay all debt service and other related financing costs for the investment recovery bonds. The investment recovery charges will be calculated pursuant to the method described in Appendix B to this Financing Order. Semi-annual or, following the scheduled final maturity of the investment recovery bonds, quarterly true-ups will be required and performed to ensure that the amount projected to be collected from investment recovery charges is sufficient to service the investment recovery bonds. The methodology for calculating the investment recovery charges is illustrated in Appendix B and the form of true-up notice letter is attached as Appendix D. This methodology includes the allocation of revenue requirements between investment cost recovery groups (defined below) approved by this Commission in this Financing Order.

The Commission determines that ELL’s proposed transaction structure for the investment recovery charges should be utilized. The investment recovery bonds’ amortization schedule is designed to provide for relatively level annual debt service and revenue requirements each year over the life of the investment recovery bonds.

The Commission has considered what degree of flexibility to afford to ELL in establishing the terms and conditions of the investment recovery bonds, including but not limited to repayment schedules, interest rates and financing costs. ELL will be granted flexibility in these matters, subject to the terms of this Financing Order and the Issuance Advice Letter process.

In its Original Securitization Application, filed on April 13, 2011, ELL requested the authority to securitize and to cause investment recovery bonds to be issued in an aggregate principal amount equal to the sum of: (a) $200,000,000.00 of investment recovery costs pursuant to the Quantification Order, plus approximately $2.7 million of carrying costs between March 31, 2011, through the projected issuance date of the investment recovery bonds of August 1, 2011 calculated at a 4% annual rate, plus (b) up-front financing costs, plus the cost of credit enhancements and other mechanisms designed to promote the credit quality and marketability of the investment recovery bonds (including original issue discount), if any, plus or minus (c) any adjustment, pursuant to the Issuance Advice Letter, to reflect any change in carrying costs necessary to account for the number of days either less than or greater than assumed in the calculation based on the projected issuance date for the investment recovery bonds of August 1, 2011, including (if applicable) carrying costs subsequent to September 30, 2011, calculated from September 30, 2011, to the actual issuance date of the investment recovery bonds at a 6.59% annual rate. In its Securitization Application filed on July 21, 2011, ELL requested the re-approval and re-issuance of such a financing order.

The Commission finds that ELL should be permitted to securitize its investment recovery costs and up-front financing costs in accordance with the terms of this Financing Order. The Commission is mindful of the fact that several of the components of these up-front financing costs will vary depending upon the size of the final issuance of the investment recovery bonds. Specifically, the Commission realizes that the SEC registration fee, the rating agency fees and underwriters’ fees typically are proportional to the amount of investment recovery costs actually securitized. In addition, the SEC formula for calculating registration fees changes from time to time. Further, other up-front financing costs, such as legal and accounting fees and expenses, printing expenses and trustee costs will not be known until the issuance of the bonds or even thereafter, when final invoices are submitted. Accordingly, in the Issuance Advice Letter ELL should update the financing costs securitized to reflect any change in the estimates of SEC registration fee, the rating agency fees and underwriters’ fees, as a result of a change in the size of the bond financing or a change in the SEC’s registration fee formula, and should otherwise update the estimates in light of then current information. All up-front financing cost amounts are to be revised and updated through the Issuance Advice Letter, at the time of pricing of the investment recovery bonds. The ELL-controlled up-front financing costs shall be subject to a cap and shall not exceed in the financed amount $3,426,027.00 (which includes a contingency of $36,749.00). If the actual ELL-controlled up-front financing costs exceed that capped amount, ELL retains the right to seek additional amounts through Rider SLGO subject to approval of the Commission. The Commission staff and other parties to this docket retain the right to oppose any such request. The other non-ELL-controlled Commission approved costs (up-front and ongoing) charged to ELL related to this investment recovery bonds financing will be included in Rider SLGO, and such initial up-front costs will be amortized over a three year period.

In addition, ELL has requested that the ongoing financing costs incurred by the SPE in connection with the administration and servicing of the investment recovery bonds should not be included in the principal amount of the Bonds, but instead should be recovered through the investment recovery charges, subject to the periodic true-up of those charges as provided in this Financing Order. ELL presently estimates that these ongoing annual costs (exclusive of debt service on the investment recovery bonds and the servicing fee mentioned below) to be incurred by the SPE will be approximately $405,000.00 for the first year following the issuance of the investment recovery bonds if ELL is the servicer, but many ongoing costs will not be known until they are incurred. The annual servicing fee payable to ELL following the issuance of the investment recovery bonds will be fixed at $145,000.00 and the annual administration fee compensation to ELL for providing administrative and support services to the SPE will be fixed at $100,000.00. In addition, ELL, as initial servicer and administrator, shall be entitled to receive reimbursement for its out-of-pocket costs for external accounting and legal services to the extent such external services are required to comply with SEC reporting requirements. The servicing fee and any expenses incurred by ELL, or by an affiliate of ELL acting as servicer, under the servicing agreement shall be included in any ELL rate case in the manner provided in Ordering Paragraph 41. In the event that a servicer default occurs the indenture trustee for the investment recovery bonds will be permitted to appoint a successor servicer with the consent of the SPE, which shall not be unreasonably withheld. The compensation of the successor servicer will be what is required to obtain the services and will be up to 0.60% of the initial principal balance of investment recovery bonds unless ELL can reasonably demonstrate to the Commission that the services cannot be obtained at that compensation level under the market conditions at that time. Furthermore, the Commission finds that ELL may earn a rate of return on its capital investment in the SPE equal to the rate of interest payable on the longest maturity tranche of the investment recovery bonds, to be paid by means of periodic distributions from the SPE funded solely by the income earned thereon through investment by the indenture trustee in eligible investments and by any deficiency being collected through the true-up adjustments, and further any actual earnings in excess of that rate will be credited to customers. The Commission finds that ELL should be permitted to recover its ongoing financing costs, as ELL requests, in accordance with the terms of this Financing Order.

III. FINDINGS OF FACT

A. Identification and Procedure

| 1. | Identification of Applicant and Application |

| 1. | ELL is a Texas limited liability company duly authorized and qualified to do and doing business in the State of Louisiana, created and organized for the purposes, among others, of manufacturing, generating, transmitting, distributing, and selling electricity for power, lighting, heating and other such uses, and is engaged in the business thereof in forty three of the sixty-four parishes of the State of Louisiana. ELL furnishes retail electric service to approximately 667,000 customers of whom approximately 643,000 are subject to the jurisdiction of the Commission. ELL owns a transmission system comprised of approximately 2,600 miles and associated facilities by which it provides transmission service pursuant to the open access transmission tariff maintained by Entergy Services Inc., its service company affiliate, on file with Federal Energy Regulatory Commission. |

| 2. | ELL is an indirect wholly-owned subsidiary of Entergy Corporation, a Delaware corporation. |

| 3. | On October 27, 2009, ELL filed with the Commission its Application of Entergy Louisiana, LLC for Approval to Recover the Costs of the Little Gypsy Unit 3 Repowering Project in Retail Rates, which was docketed in LPSC Docket No. U-30192. |

| 4. | The following parties intervened in the Phase III of Docket No. U-30192: Marathon Oil Company, the Louisiana Energy Users Group, Occidental Chemical Corporation, and ArcelorMittal LaPlace LLC. |

| 5. | On April 13, 2011, ELL filed its Original Securitization Application for a financing order under Act 988 to securitize and to cause investment recovery bonds to be issued in an aggregate principal amount, equal to the sum of: (a) $200,000,000.00 of investment recovery costs pursuant to the Quantification Order, plus approximately $2.7 million of carrying costs between March 31, 2011, through the projected issuance date of the investment recovery bonds of August 1, 2011 calculated at a 4% annual rate, plus (b) up-front financing costs, plus the cost of credit enhancements and other mechanisms designed to promote the credit quality and marketability of the investment recovery bonds (including original issue discount), if any, plus or minus (c) any adjustment, pursuant to the Issuance Advice Letter, to reflect any change in carrying costs necessary to account for the number of days either less than or greater than assumed in the calculation based on the projected issuance date for the investment recovery bonds of August 1, 2011, including (if applicable) carrying costs subsequent to September 30, 2011, calculated from September 30, 2011, to the actual issuance date of the investment recovery bonds at a 6.59% annual rate. The Original Securitization Application was docketed in LPSC Docket No. U-31894. |

| 6. | On April 20, 2011, the Staff of the Commission, ELL, and the intervenors listed in Finding of Fact Paragraph 4 filed a Proposed Uncontested Stipulated Settlement that, subject to approval by the Commission, resolved all issues in Phase III of Docket No. U-30192. The resolved issues include the cancellation of the Project, the establishment of the quantification of the prudently incurred and recoverable cancellation costs, the level(s) at which carrying costs may be accrued on a going forward basis, the appropriate allocation of the recoverable cancellation costs among ELL’s customer classes and customers, and, subject to the issuance of this Financing Order, the framework for the securitization of the recoverable cancellation costs. |

| 7. | On June 1, 2011, the Commission issued the Quantification Order (concluding Phase III of Docket No. U-30192) approving that April 20, 2011 stipulated settlement and determining that ELL is entitled to recover $200,000,000.00 of investment recovery costs. |

| 8. | On June 3, 2011, the Staff of the Commission, ELL, and the intervenors listed in Finding of Fact Paragraph 4 filed a Proposed Uncontested Stipulated Settlement that, subject to approval by the Commission, would resolve all issues in this docket. The resolved issues include authorization of securitization and issues related to the issuance of this Financing Order, issues related to the approval of the upfront bond issuance costs, and issues related to the approval of Rider SLGR (as defined below in Finding of Fact Paragraph 74) and Rider SLGO. |

| 9. | On June 24, 2011, the Commission issued the Prior Orders (Order No. U-31894 and Order No. U-31894-A), in this Docket No. U-31894 approving the Original Securitization Application and its proposed Financing Order as finalized for approval. |

| 10. | On July 21, 2011, ELL filed its Securitization Application for re-approval and re-issuance of the Prior Orders in a single order, for the reason discussed above pertaining to a technical error in the publication of the legal notices relating to the Original Securitization Application. |

| 11. | The Commission has exercised its discretion pursuant to Rule 51 of the LPSC Rules of Practice and Procedure to consider direct re-approval and re-issuance of the Prior Orders in a single order through the issuance of this Financing Order. |

B. Financing Costs and Amount to be Securitized

| 1. | Investment Recovery Costs |

| 12. | Investment recovery costs are defined by Section 1252(11) to include costs incurred by ELL associated with the cancelled construction of electric generating facilities. |

| 13. | Pursuant to the Quantification Order, the Commission determined that ELL has incurred recoverable investment recovery costs in the aggregate amount of $200,000,000. These costs constitute investment recovery costs under Act 988 and are eligible for recovery pursuant to this Financing Order. |

| 14. | ELL has proposed securitizing the gross cancellation costs before any reduction for the returns on the deferred tax benefits associated with the recoverable costs or any subsequently-determined benefits of cancellation (such as salvage in excess of that known at February 1, 2011). The securitization offsets flowed through to customers shall include the following: |

(a) The returns on the deferred tax benefits associated with the recoverable investment recovery costs. The returns shall be based on a rate of 11.51% for the entirety of the recovery period to be adjusted to reflect changes in the composite tax rate from that in effect at the time the tax deduction was taken. The amount of deferred taxes shall be equal to the recoverable investment recovery costs (including carrying charges) set forth in Finding of Fact Paragraph 5 minus $16,558,000 times the composite tax rate in effect when the deduction is taken. The returns shall be based on the average annual balance of deferred taxes.

(b) Plus any subsequently-determined benefits of cancellation, such as salvage, sales tax refunds, etc. in excess of that known at February 1, 2011.

(c) Less an amount to reflect the fact that the deferred taxes to be amortized are less than the current tax liability associated with the recovery of the principal amount of the securitization investment recovery bonds. The total amount is to be equal to $16,558,000 times the tax rate (38.48%) divided by one minus the tax rate (61.52%) times 97.6%, which produces $10,108,261. The annual amount of $1,010,826 is equal to the total amount divided by an estimated ten year average term of the securitization investment recovery bonds. The actual annual amount shall be based on the actual average term of the securitization investment recovery bonds and the composite tax rate in effect each year during the repayment period.

(d) Plus a levelized annual amount based on the following inputs: Principal amount equal to the securitized amount (being the approved gross (before tax) recoverable costs plus carrying charges plus the approved up-front financing costs) times 2.4%; carrying cost rate equal to the overall rate of return of 8.36%; and, the period equal to the average term of the securitization investment recovery bonds. This amount shall be calculated based on the actual securitized costs and remain constant over the entirety of the recovery period of the investment recovery bonds.

(e) To the extent that the composite federal/state income tax rate changes, any excess (or shortfall) in the jurisdictional portion of deferred income taxes created by such tax rate change, will be returned to (or recovered from) ratepayers over the remaining term of the bond repayment period.

ELL has proposed that the benefits associated with the return on deferred taxes and any other benefits or savings associated with cancellation (such as additional salvage income) inure to the benefit of customers, dollar for dollar, by being reflected in Rider SLGO in a manner consistent with the Quantification Order and the illustrative calculation incorporated on page 2 of Appendix A of the Quantification Order. Any associated accumulated deferred federal income tax benefits will flow through to ELL’s LPSC-jurisdictional customers by means of Rider SLGO. ELL’s proposal is appropriate and should be approved.

| 2. | Up-front and Ongoing Financing Costs |

| 15. | Up-front financing costs are those that will be incurred in advance of, or in connection with, the issuance of the investment recovery bonds, and will be recovered or reimbursed from investment recovery bond proceeds except as otherwise provided in this Financing Order. Consistent with Section 1252(5)(c), up-front financing costs include, without limitation, underwriting costs (fees and expenses), rating agency fees, costs of obtaining additional credit enhancements (if any), costs of entering into swap and hedge transactions (if any), fees and expenses of ELL’s legal advisors, fees and expenses of the financial advisor to ELL, SEC registration fees, original issue discount, external servicing costs, fees and expenses of the Commission’s financial advisor(s), legal advisor and regulatory consultants (in connection with securitization), fees and expenses of the trustee and its counsel (if any), servicer set-up costs, printing and filing costs, set-up costs relating to the SPE, non-legal securitization proceeding costs and expenses of ELL and miscellaneous administrative costs. |

| 16. | Ongoing financing costs are those that will be incurred annually to support and service the investment recovery bonds after issuance, and will be recovered or paid from investment recovery charges. Consistent with Section 1252(5)(c), the ongoing financing costs include, among other costs, servicing fees, administrative fees, fees and expenses of the trustee and its counsel (if any), external accountants’ fees, external legal fees, ongoing costs of additional credit enhancement (if any), costs of swaps and hedges (if any), independent manager’s fees, rating agency fees, printing and filing costs, true-up administration fees, fees and expenses of ELL’s and the Issuer’s (SPE’s) counsel, and other miscellaneous costs. Other than the servicing fee (which will cover servicing costs, other than costs for external accounting and legal services required to comply with SEC reporting requirements), the ongoing costs that will be incurred in connection with a financing under Act 988 are outside the control of ELL, since ELL cannot control the administrative, legal and other fees to be incurred by other parties on an ongoing basis. However, the Commission will have control over some of these ongoing costs through the Issuance Advice Letter process. |

| 17. | The actual up-front financing costs and certain ongoing financing costs will not be known until on or about the date the investment recovery bonds are issued; other up-front and ongoing financing costs may not be known until such costs are incurred. |

| 18. | ELL has provided estimates of up-front financing costs totaling approximately $3,426,027.00 in Appendix C, plus the cost of credit enhancements and other mechanisms designed to promote the credit quality and marketability of the investment recovery bonds (including original issue discount), if any. ELL has also provided in Appendix C estimates of ongoing financing costs for the first year following the issuance of the investment recovery bonds to be approximately $405,000.00 (exclusive of the servicing fee) if ELL is the servicer. ELL shall update the up-front financing costs and ongoing financing costs prior to the pricing of any series of investment recovery bonds pursuant to the Issuance Advice Letter. |

| 19. | Within 90 days of the issuance of the investment recovery bonds, ELL will submit to the Commission a final accounting of its up-front financing costs. If the actual up-front financing costs are less than the up-front financing costs included in the principal amount financed, the periodic billing requirement for the first semi-annual true-up adjustment shall be reduced by the amount of such unused funds (together with income earned thereon through investment by the trustee in eligible investments) and such unused funds (together with income earned thereon through investment by the trustee in eligible investments) shall be available for payment of debt service on the bond payment date next succeeding such true-up adjustment. The ELL-controlled up-front financing costs shall be subject to a cap and shall not exceed in the financed amount $3,426,027.00 (which includes a contingency of $36,749.00). If the actual ELL-controlled up-front financing costs exceed that capped amount, ELL retains the right to seek additional amounts through Rider SLGO subject to approval of the Commission. The Commission staff and other parties to this docket retain the right to oppose any such request. The other non-ELL-controlled Commission approved costs (up-front and ongoing) charged to ELL related to this investment recovery bonds financing will be included in Rider SLGO, and such initial up-front costs will be amortized over a three year period. |

| 3. | Adjustments to Carrying Costs Included in the Amount Financed |

| 20. | In its testimony, exhibits, and schedules, ELL properly calculated the amount of carrying costs. ELL has proposed that if the investment recovery bonds are issued on a date other than August 1, 2011, ELL shall account for the difference in carrying costs resulting therefrom through the Issuance Advice Letter process. ELL’s proposal is appropriate and is approved. |

| 4. | Amount to be Securitized |

| 21. | ELL should be authorized to cause investment recovery bonds to be issued by its SPE in an aggregate principal amount of approximately $206,100,000.00, equal to the sum of: (a) $200,000,000 of investment recovery costs pursuant to the Quantification Order, plus approximately $2.7 million of carrying costs between March 31, 2011, through the projected issuance date of the investment recovery bonds of August 1, 2011 calculated at a 4% annual rate, plus (b) up-front financing costs, which (subject to Finding of Fact Paragraph 19) are capped and are not to exceed in the financed amount $3,426,027.00 (which includes a contingency of $36,749.00), plus (i) the cost of credit enhancements and other mechanisms designed to promote the credit quality and marketability of the investment recovery bonds (including original issue discount), if any, plus or minus (c) any adjustment, pursuant to the Issuance Advice Letter, to reflect any change in carrying costs necessary to account for the number of days either less or greater than assumed in the calculation based on the projected issuance date for the investment recovery bonds of August 1, 2011, including (if applicable) carrying costs subsequent to September 30, 2011, calculated from September 30, 2011, to the actual issuance date of the investment recovery bonds at a 6.59% annual rate. The total principal amount of the investment recovery bonds so issued will be fixed in the Issuance Advice Letter process, consistent with this Financing Order. |

| 5. | Designee Appointment; Issuance Advice Letter Approval Process |

| 22. | Because the actual structure and pricing of the investment recovery bonds and the precise amounts of up-front and ongoing financing costs will not be known at the time that this Financing Order is issued, ELL has proposed a process by which the terms of the investment recovery bonds can be reviewed by Commission staff, its advisors and the Commission designee as they are developed and finalized and by which the final transaction terms and costs can be approved. |

| 23. | ELL has requested that the Commission appoint a designee (the “Designee”) who is authorized to approve the final terms and structure of the transaction as set forth in the final Issuance Advice Letter. The Designee’s approval of such Issuance Advice Letter will be final and incontestable, without need of further action by the Commission. The Designee shall approve the final structure, terms and pricing of the transaction if he or she determines, based upon the advice of the Commission’s staff, financial advisor and/or legal counsel, that (i) the final structure, terms and pricing of the investment recovery bonds in the Issuance Advice Letter are consistent with the criteria established in the Financing Order and (ii) the mathematical calculations are accurate. We find that the appointment of a Designee is a reasonable method to protect customers and to assure ELL and the investing public that all approvals in connection with the issuance of the investment recovery bonds have been obtained. The Commission Executive Secretary Eve Kahao Gonzalez, or in her absence Commission Chairman James M. Field, is appointed as Designee. |

| 24. | Following the determination of the final terms and structure of the investment recovery bonds and prior to the issuance of such bonds, ELL must file with the Commission for each series of bonds issued, and no later than twenty-four hours after the pricing of that series of bonds, an Issuance Advice Letter. The Issuance Advice Letter will include the estimated total up-front financing costs of the investment recovery bonds, the estimated ongoing financing costs of administering and supporting the investment recovery bonds, the required principal amount of the bonds, as well as the bond structure and terms and the interest rates on the investment recovery bonds. If the actual up-front financing costs are less than the up-front financing costs included in the principal amount securitized, the periodic billing requirement for the first semi-annual true-up adjustment shall be reduced by the amount of such unused funds (together with interest earned thereon through investment by the indenture trustee in eligible investments) and such unused funds (together with interest earned thereon through investment by the indenture trustee in eligible investments) shall be available for payment of debt service on the bond payment date next succeeding such true-up adjustment. If the actual up-front financing costs are more than the up-front financing costs included in the amount financed, ELL may seek recovery in accordance with Finding of Fact Paragraph 19. The Issuance Advice Letter will be completed to report the actual dollar amount of the initial investment recovery charges and other information specific to the investment recovery bonds to be issued. The Issuance Advice Letter shall be provided substantially in the form of Appendix A to this Financing Order. |

| 25. | ELL will submit a draft Issuance Advice Letter to the Commission staff for review no later than two weeks prior to the expected date of initial marketing of the investment recovery bonds. Within one week after receipt of the draft Issuance Advice Letter, Commission staff will provide to ELL any comments that staff may have regarding the adequacy of the information provided, in comparison to the required elements of the Issuance Advice Letter. |

| 26. | A second draft Issuance Advice Letter shall be submitted to the Commission staff within 48 hours before the pricing of the investment recovery bonds. |

| 27. | A final Issuance Advice Letter shall be submitted to the Commission staff within 24 hours after the pricing of the investment recovery bonds, which shall contain certificates from ELL and its bookrunning underwriters that include certification that the structuring and pricing of the bonds complies with the terms of this Financing Order. |

| 28. | The Commission staff, the Designee and the Commission advisors shall provide prompt input to ELL on Issuance Advice Letter filings so that any potential objections or issues regarding the information provided, including but not limited to the structuring and pricing of the investment recovery bonds, can be addressed as soon as practicable. The Commission acknowledges that the rejection of any pricing of the bonds after an underwriting agreement is executed could have adverse consequences to ELL in its future financing activities. |

| 29. | The completion and filing of an Issuance Advice Letter in the form of the Issuance Advice Letter attached as Appendix A, is necessary to ensure that any securitization actually undertaken by ELL complies with the terms of this Financing Order. |

| 30. | Within 24 hours of receipt of the final Issuance Advice Letter, the Designee shall either (a) approve the transaction by executing a Concurrence and delivering a copy to ELL, which Concurrence shall (i) evidence the final, binding and irrevocable approval by the Commission of the structure, terms and pricing of the investment recovery bonds and all related documents and security as consistent with the criteria established in the Financing Order and (ii) confirm the mathematical accuracy of the calculations in the Issuance Advice Letter, or (b) reject the Issuance Advice Letter and state the reasons therefore. The Designee shall approve the transaction using the form of Concurrence attached as Attachment 6 to the Issuance Advice Letter. A change in market conditions from the date and time of the actual pricing of the investment recovery bonds shall not constitute grounds for rejecting the Issuance Advice Letter. |

| 31. | The Designee’s approval of the Issuance Advice Letter shall be final, irrevocable and incontestable. The Designee’s approval of the Issuance Advice Letter shall, pursuant to the Commission’s authority under this Financing Order and without the need for further action by the Commission, constitute the affirmative and conclusive authorization for ELL and the SPE to execute the issuance of the investment recovery bonds on the terms set forth in the Issuance Advice Letter. |

| 32. | Act 988 permits the Commission to consider whether the proposed structuring, expected pricing, and financing costs of the investment recovery bonds are reasonably expected to result in lower overall costs or would avoid or mitigate rate impacts to customers as compared with traditional methods of financing or recovering investment recovery costs. The primary benefits of the proposed structure arise from replacing traditional debt and equity of the utility with highly rated debt. In this proceeding, ELL’s financial analysis and testimony shows that the financing as proposed by ELL will produce a significant benefit to customers on a net present value basis as compared to traditional methods of financing or recovering utility investment recovery costs. Even if interest rates increase before the issuance of the investment recovery bonds (from the base-case assumption of 3.22% to a level as high as 7.0%), the benefit for customers will remain significant (an estimated $26.2 million on a net present value basis for ELL). We find these benefits are reasonably expected to result in lower overall costs or would mitigate rate impacts to customers as compared to traditional methods of utility financing or recovering investment recovery costs so long as the weighted averaged interest rate on all of the tranches of the investment recovery bonds is less than 7.0%. |

| 33. | Act 988 recognizes that this securitization financing is a valid public purpose. The Commission acknowledges that the lower interest rate obtainable on the investment recovery bonds requires that the Commission’s obligations under this Financing Order be direct, irrevocable, unconditional and legally enforceable against the Commission. |

C. Structure of the Proposed Financing

| 1. | The Special Purpose Entity (The SPE) |

| 34. | For purposes of this securitization, ELL will create the SPE, a special purpose investment recovery funding entity which will, per Section 1253(D)(2), be a Louisiana limited liability company with ELL as its sole member. The SPE will be formed for the limited purpose of acquiring investment recovery property (which could include, if the transaction documents so permit, any investment recovery property authorized by the Commission in a subsequent financing order), issuing investment recovery bonds in one or more series and in one or more tranches for each series (which could include investment recovery bonds authorized by the Commission in a subsequent financing order), and performing other activities relating thereto or otherwise authorized by this Financing Order. The SPE will not be permitted to engage in any other activities and will have no assets other than investment recovery property and related assets to support its obligations under the investment recovery bonds. Obligations relating to the investment recovery bonds will be the SPE’s only significant liabilities. These restrictions on the activities of the SPE and restrictions on the ability of ELL to take action on the SPE’s behalf are imposed to achieve the objective of ensuring that the SPE will be bankruptcy remote and not affected by a bankruptcy of ELL. The SPE will be managed by a board of managers with rights and duties similar to those of a board of directors of a corporation. As long as the investment recovery bonds remain outstanding, the SPE will have at least one independent manager with no organizational affiliation with ELL other than acting as independent managers for any other bankruptcy-remote subsidiary of ELL or its affiliates. The SPE will not be permitted to amend the provisions of the organizational documents that ensure bankruptcy-remoteness of the SPE without the affirmative vote of a majority of its managers, which vote must include the affirmative vote of all the independent managers. Similarly, the SPE will not be permitted to institute bankruptcy or insolvency proceedings or to consent to the institution of bankruptcy or insolvency proceedings against it, or to dissolve, liquidate, consolidate, convert, or merge without the prior unanimous consent of its managers. 18 Other restrictions to ensure bankruptcy-remoteness may also be included in the organizational documents of the SPE as required by the rating agencies. In addition, the Commission will waive any rights it may have to rescind this Financing Order under La. R.S. 12:1308.2(E) if the SPE becomes delinquent in filing its annual report required under La. R.S. 12:1308.1. ELL may create more than one SPE, in which event the rights, structure and restrictions described in this Financing Order with respect to the SPE would be applicable to each such issuer of investment recovery bonds to the extent of the investment recovery property sold to it and the investment recovery bonds issued by it. |

| 35. | The initial capital of the SPE will be a nominal amount of $100. Concurrently with the issuance of the bonds, not less than 0.5% of the original principal amount of each series of investment recovery bonds will be invested by ELL in the SPE. Adequate funding of the SPE will minimize the possibility that ELL would have to extend funds to the SPE in a manner that could jeopardize the bankruptcy remoteness of the SPE, and is a factor in treating the financing as a borrowing by ELL for federal income tax purposes. A sufficient level of capital is necessary to minimize the risk that the SPE would not be treated as bankruptcy remote from ELL and, therefore, assist in achieving the lowest reasonable cost to customers for the investments’ damage. |

| 36. | The use and proposed structure of the SPE and the limitations related to its organization and management are necessary to minimize risks related to the proposed securitization transaction and to minimize the investment recovery charges. Therefore, the use and proposed structure of the SPE should be approved. The Commission will not exercise any authority to approve or not approve any independent manager of the SPE selected by ELL. |

| 2. | Structure and Documents |

| 37. | The SPE will issue investment recovery bonds in one or more series, and in one or more tranches for each series, in an aggregate amount not to exceed the principal amount approved by this Financing Order and will pledge to the indenture trustee, as collateral for payment of the investment recovery bonds, the investment recovery property, including the SPE’s right to receive the investment recovery charges as and when collected, and certain other collateral described in ELL’s Securitization Application. |

| 38. | Concurrent with the issuance of any of the investment recovery bonds, ELL will transfer to the SPE all of ELL’s rights under this Financing Order, including rights to impose, collect, and receive investment recovery charges approved in this Financing Order, except ELL’s right to seek to recover certain remaining up-front financing costs through Rider SLGO under Ordering Paragraph 3 (the “ELL Retained Rights”). This transfer will be structured so that it will qualify as a true sale within the meaning of Section 1255(1). By virtue of the transfer, the SPE will acquire all of the right, title, and interest of ELL in the investment recovery property arising under this Financing Order. |

| 39. | The payment of the investment recovery charges authorized by this Financing Order will be at all times sufficient to pay the principal of and interest on the bonds, together with related financing costs. The investment recovery bonds will be issued pursuant to the indenture administered by the indenture trustee. The indenture will include provisions for a collection account for each series and subaccounts for the collection and administration of the investment recovery charges and payment or funding of the principal and interest on the investment recovery bonds and other financing costs in connection with the investment recovery bonds, as described in ELL’s Securitization Application. Any investment recovery charge revenues not required for the current payment of principal and interest due on the bonds, together with related financing costs, including but not limited to the funding of any overcollateralization or reserve account, will be available to pay such amounts in a future period. |

| 40. | ELL will prepare a proposed form of an Indenture, a Limited Liability Company Operating Agreement (for the SPE), a Purchase and Sale Agreement, an Administration Agreement, and a Servicing Agreement, which will set out in substantial detail certain terms and conditions relating to the transaction and security structure. Each of these documents will be reviewed and approved by the Commission’s Staff and Advisors consistent with the Issuance Advice Letter process. |

| 41. | ELL will also prepare a proposed form of prospectus and term sheet to be used in connection with the offering and sale of the investment recovery bonds. These offering materials will be subject to review and comment by Commission Staff and Advisors consistent with the Issuance Advice Letter process. |

| 3. | Credit Enhancement and Arrangements to Enhance Marketability |

| 42. | ELL has not requested approval of floating rate bonds or any hedges or swaps which might be used in connection therewith. |

| 43. | In current market conditions, it is uncertain whether the benefits of an interest-rate swap within the investment recovery bond structure will outweigh the costs of researching and preparing the swap and result in lower investment recovery charges. |

| 44. | An interest-rate swap within the investment recovery bond structure could expose customers to higher risks in relation to the investment recovery charges and the ability of the swap counterparty to meet its obligations. |

| 45. | The Commission concurs that the use of floating rate debt and the associated swaps or hedges is not advantageous or cost effective for customers. |

| 46. | The Company proposes to use additional forms of credit enhancement (including letters of credit, reserve or overcollateralization accounts, surety bonds, or guarantees) and other mechanisms designed to promote the credit quality and marketability of the investment recovery bonds if such arrangements are reasonably expected to result in net benefits to customers. ELL also asked that the costs of any credit enhancements as well as the costs of arrangements to enhance marketability be included in the amount of up-front financing costs to be financed. ELL should be permitted to recover the up-front financing and ongoing financing costs of credit enhancements and arrangements to enhance marketability, provided that the Commission’s financial advisor and ELL agree in advance that such enhancements and arrangements provide benefits greater than their tangible and intangible costs. If the use of credit enhancements or other arrangements is proposed by ELL, ELL shall provide the Commission’s financial advisor copies of all cost/benefit analyses performed by or for ELL that support the request to use such arrangements. The cost of credit enhancements provided for herein shall not be subject to the $3,426,027.00 cap on ELL-controlled up-front financing costs. This finding does not apply to the collection account, or its subaccounts, including any reserve account, which are otherwise approved in this Financing Order. |

| 47. | ELL’s proposed use of credit enhancements and arrangements to enhance marketability is reasonable and should be approved if the Commission Designee determines, based upon the advice of the Commission’s financial advisor, that the enhancements or arrangements provide benefits greater than their costs. An overcollateralization subaccount should be included and funded only if either required by the rating agencies to achieve the highest credit rating or if the Commission’s financial adviser and Commission Staff concur that the benefits are expected to outweigh the costs. |

| 4. | Investment Recovery Property |

| 48. | Pursuant to Section 1252(12), the investment recovery property consists of the following: |

| (1) | the rights and interests of ELL or the successor or assignee of ELL under this Financing Order, including the right to impose, bill, charge, collect, and receive investment recovery charges authorized in this Financing Order and to obtain periodic adjustments to such charges as are provided in this Financing Order, except for the ELL Retained Rights, and |

| (2) | all revenues, collections, claims, rights to payments, payments, money, or proceeds arising from the rights and interests specified in the first numbered bullet of this Paragraph, regardless of whether such revenues, collections, claims, rights to payment, payments, money, or proceeds are imposed, billed, received, collected, or maintained together with or commingled with other revenues, collections, rights to payment, payments, money, or proceeds. |

The investment recovery property does not include ELL’s rights and obligations under the investment recovery bonds transaction documents, such as the Servicing Agreement and the Administration Agreement.

| 49. | As of the effective date of this Financing Order, there is created and established for the benefit of ELL investment recovery property, which, pursuant to Section 1254(A) and Section 1255(3) is incorporeal movable property in the form of a vested contract right and is a contractual obligation of irrevocability by the Commission in favor of ELL, its transferees and other financing parties. |

| 50. | Pursuant to Section 1254(B), the investment recovery property created by this Financing Order will continue to exist until the investment recovery bonds issued pursuant to this Financing Order are paid in full and all financing costs of the bonds have been recovered in full. |

| 51. | Investment recovery property and all other collateral will be held (in pledge) and administered by the indenture trustee pursuant to the indenture, as described in ELL’s Securitization Application. This proposal will help ensure the desired highest credit ratings and therefore lower investment recovery charges and should be approved. |

| 5. | Servicer and the Servicing Agreement |

| 52. | ELL will execute a servicing agreement with the SPE. The servicing agreement may be amended, renewed or replaced by another servicing agreement. ELL will be the initial servicer but may be succeeded as servicer by another entity under certain circumstances detailed in the servicing agreement. Pursuant to the servicing agreement, the servicer is required, among other things, to impose and collect the applicable investment recovery charges for the benefit and account of the SPE or its assigns or pledgees, to make the periodic true-up adjustments of investment recovery charges required or allowed by this Financing Order, and to account for and remit the applicable investment recovery charges to or for the account of the SPE or its assigns or pledgees in accordance with the remittance procedures contained in the servicing agreement without any charge, deduction or surcharge of any kind (other than the servicing fee specified in the servicing agreement). Under the terms of the servicing agreement, if any servicer fails to perform its servicing obligations in any material respect, the indenture trustee acting under the indenture to be entered into in connection with the issuance of the investment recovery bonds, or the indenture trustee’s designee, may, or, upon the instruction of the requisite percentage of holders of the outstanding amount of investment recovery bonds, shall appoint an alternate party to replace the defaulting servicer, in which case the replacement servicer will perform the obligations of the servicer under the servicing agreement. The obligations of the servicer under the servicing agreement and the circumstances under which an alternate servicer may be appointed are more fully described in the servicing agreement. The rights of the SPE under the servicing agreement will be included in the collateral pledged by the SPE to the indenture trustee under the indenture for the benefit of holders of the investment recovery bonds. In the event that there is more than one ELL-related issuer of investment recovery bonds (i.e., more than one SPE, as noted in Finding of Fact Paragraph 34 above), ELL may act as initial servicer under a servicing agreement with each such issuer. |

| 53. | The servicer shall remit investment recovery charges to the SPE or the indenture trustee each servicer business day according to the methodology described in the servicing agreement. |

| 54. | The servicer will be entitled to an annual servicing fee fixed at $145,000.00 (inclusive of costs, except as provided in the next sentence). In addition, ELL, as initial servicer, shall be entitled to receive reimbursement for its out-of-pocket costs for external accounting and legal services to the extent external accounting and legal services are required to comply with SEC reporting requirements. The Commission approves the servicing fee as described herein. The Commission also approves, in the event of a default by the initial servicer resulting in the appointment of a successor servicer, a higher annual servicing fee of up to 0.60% of the initial principal balance of the investment recovery bonds unless ELL can reasonably demonstrate to the Commission that the services cannot be obtained at that compensation level under the market conditions at that time. In addition to the servicing fee, ELL will be entitled to an annual administration fee fixed at $100,000.00 for providing administrative and support services to the SPE. The Commission approves the fixed annual administration fee as described herein. |

| 55. | The obligations to continue to provide service and to collect and account for investment recovery charges will be binding upon ELL and any other entity that provides transmission and distribution electric services or, in the event that transmission and distribution electric services are not provided by a single entity, any other entity providing electric distribution services to ELL’s LPSC-jurisdictional customers. The Commission will enforce the obligations imposed by this Financing Order, its applicable substantive rules, and statutory provisions. |

| 56. | To the extent that any interest in the investment recovery property created by this Financing Order is assigned, sold or transferred to an assignee, such as the SPE, or a successor, ELL will enter into a contract with that assignee or successor that will require ELL (or its successor under such contract) to continue to operate ELL’s electric transmission and distribution system providing service to ELL’s LPSC-jurisdictional customers (or, if by law, ELL or its successor is no longer required to own and/or operate both the transmission and distribution systems, then ELL’s distribution system). |

| 57. | No provision of this order shall prohibit ELL from selling, assigning or otherwise divesting any of its transmission or distribution system or any facilities providing service to ELL’s LPSC-jurisdictional customers, by any method whatsoever, including those specified in Ordering Paragraph 55 pursuant to which an entity becomes a successor, so long as the entities acquiring such system or portion thereof agree to continue operating the facilities to provide service to LPSC-jurisdictional customers. |

| 58. | The servicing agreement described in Findings of Fact Paragraphs 52 through 57 is reasonable, will reduce risk associated with the proposed financing and should, therefore, result in lower investment recovery charges and greater benefits to customers and should be approved. |

| 6. | Investment Recovery Bonds |