Exhibit 99(a)(1)(B)

|

| |

LETTER OF TRANSMITTAL PURSUANT TO THE OFFER TO PURCHASE DATED | |

| MAY 23, 2017 |

THIS OFFER WILL EXPIRE AT 11:59 PM, EASTERN TIME, ON

JUNE 23, 2017, UNLESS THE OFFER IS EXTENDED

ANY QUESTIONS CONCERNING THE OFFER OR THIS LETTER OF TRANSMITTAL

CAN BE DIRECTED TO THE FOLLOWING ADDRESS:

Website: www.sierraincomecorp.com

Telephone: (888) 292-3178

|

| |

| Regular Mail | Overnight Mail |

| Investment Processing Department | Investment Processing Department |

| c/o DST Systems, Inc. | c/o DST Systems, Inc. |

| P.O. Box 219731 | 430 W. 7th Street |

| Kansas City, MO 64121-9731 | Kansas City, MO 64105 |

DELIVERY OF THIS LETTER OF TRANSMITTAL AND ALL OTHER DOCUMENTS TO AN ADDRESS OTHER THAN AS SET FORTH ABOVE WILL NOT CONSTITUTE A VALID DELIVERY TO SIERRA INCOME CORPORATION (THE “COMPANY”).

THE OFFER TO PURCHASE AND THIS ENTIRE LETTER OF TRANSMITTAL, INCLUDING THE ACCOMPANYING INSTRUCTIONS, SHOULD BE READ CAREFULLY BEFORE THIS LETTER OF TRANSMITTAL IS COMPLETED.

IF YOU WANT TO RETAIN YOUR SHARES, YOU DO NOT NEED TO TAKE ANY ACTION.

LIST THE NUMBER OF SHARES BELOW TO WHICH THIS LETTER OF TRANSMITTAL RELATES, THE NAMES AND ADDRESSES OF THE PERSON(S) SHOULD BE PRINTED, IF NOT ALREADY PRINTED BELOW, EXACTLY AS THEY APPEARED ON THE SUBSCRIPTION AGREEMENT ACCEPTED IN CONNECTION WITH THE PURCHASE OF THE SHARES.

|

| |

| TOTAL SHARES TO BE TENDERED: | |

| | |

NOTE: SIGNATURES MUST BE PROVIDED BELOW. PLEASE READ THE ACCOMPANYING INSTRUCTIONS CAREFULLY. |

|

| |

LETTER OF TRANSMITTAL PURSUANT TO THE OFFER TO PURCHASE DATED | |

| MAY 23, 2017 | |

LADIES AND GENTLEMEN:

This letter of transmittal is provided in connection with the Company’s offer dated May 23, 2017 to purchase up to 876,277 shares of common stock of the Company (“Shares”). This amount represents the lesser of (i) the number of shares the Company can repurchase with the proceeds it received from the issuance of Shares under the Company’s distribution reinvestment plan during the three months ended March 31, 2017 or (ii) 2.5% of the weighted average number of Shares outstanding in the prior four calendar quarters. During any calendar year, we intend to limit the number of shares we repurchase to 10% of the weighted average number of shares outstanding during the prior calendar year. The person(s) signing this Letter of Transmittal (the “Signatory”) hereby tender(s) to the Company, which is an externally managed, non-diversified, closed-end management investment company incorporated in Maryland, the number of Shares specified above for purchase by the Company at the price equal to $8.10 per share, which represents the Company’s net asset value per share as of March 31, 2017 (the “Purchase Price”), in cash, under the terms and subject to the conditions set forth in the Offer to Purchase, receipt of which is hereby acknowledged, and in this Letter of Transmittal (which Offer to Purchase and Letter of Transmittal together with any amendments or supplements thereto collectively constitute the “Offer”).

Subject to, and effective upon, acceptance for payment of, or payment for, Shares tendered herewith in accordance with the terms and subject to the conditions of the Offer (including, if the Offer is extended or amended, the terms or conditions of any such extension or amendment), the Signatory hereby sells, assigns and transfers to, or upon the order of, the Company, all right, title and interest in and to all of the Shares that are being tendered hereby that are purchased pursuant to the Offer, and hereby irrevocably constitutes and appoints the Company as attorney-in-fact of the Signatory with respect to such Shares, with full power of substitution (such power of attorney being deemed to be an irrevocable power coupled with an interest), to receive all benefits and otherwise exercise all rights of beneficial ownership of such Shares all in accordance with the terms and subject to the conditions set forth in the Offer.

The name(s) and address(s) of the registered owner(s) should be printed exactly as on the subscription agreement accepted by the Company in connection with the purchase of the Shares.

The Signatory recognizes that, under certain circumstances as set forth in the Offer to Purchase, the Company may amend, extend or terminate the Offer or may not be required to purchase any of the Shares tendered hereby. In any such event, the Signatory understands that the Shares not purchased, if any, will continue to be held by the Signatory and will not be tendered.

The Signatory understands that acceptance of Shares by the Company for payment will constitute a binding agreement between the Signatory and the Company upon the terms and subject to the conditions of the Offer.

The Signatory understands that the payment of the Purchase Price for the Shares accepted for purchase by the Company will be made as promptly as practicable by the Company following the conclusion of the Offer and that in no event will the Signatory receive any interest on the Purchase Price. Payment of the Purchase Price for the Shares tendered by the undersigned will be made on behalf of the Company by check or wire transfer to the account identified by the undersigned below.

All authority herein conferred or agreed to be conferred shall survive the death or incapacity of the Signatory and all obligations of the Signatory hereunder shall be binding upon the heirs, personal representatives, successors and assigns of the Signatory. Except as stated in the Offer, this tender is irrevocable.

The Signatory hereby acknowledges that capitalized terms not defined in the Letter of Transmittal shall have the meanings ascribed to them in the Offer to Purchase.

Signatures

IMPORTANT: Please sign exactly as your name is printed (or corrected) above, and insert your Taxpayer Identification Number or Social Security Number in the space provided below your signature. For joint owners, each joint owner must sign (see Instruction 1).

|

| |

| Signature of Owner | Date(mm/dd/yyyy) |

| | |

| Social Security Number or Taxpayer Identification: | |

| | |

| Signature of Owner | Date(mm/dd/yyyy) |

| | |

| Social Security Number or Taxpayer Identification: | |

|

| |

LETTER OF TRANSMITTAL PURSUANT TO THE OFFER TO PURCHASE DATED | |

| MAY 23, 2017 | |

The Signatory authorizes and instructs the Company to make a cash payment (payable by check or wire transfer) of the Purchase Price for Shares accepted for purchase by the Company, less any applicable withholding taxes, to which the undersigned is entitled in the name of the registered holder(s) appearing on page 2 of this Letter of Transmittal (unless a different name is indicated in Box 1 “Special Registration and Payment Instructions” below), for delivery by mail to the address shown in Box 2 below (unless a different address or method of payment is indicated in Box 1 “Special Registration and Payment Instructions” below).

THE PURCHASE PRICE WILL BE PAID BY CHECK UNLESS OTHERWISE INDICATED IN BOX

1. Special Registration & Payment Instructions (See Instructions 1, 3, 5 and 6)

IMPORTANT: To be completed ONLY if the Purchase Price is to be made payable in the name of someone other than the name(s) of the registered holder(s), or if the payment of the Purchase Price is to be delivered by mail to an address different than the address(es) of the registered holder(s) provided on the subscription agreement accepted by the Company in connection with the purchase of the Shares, or if the Purchase Price is to be made payable by wire.

¨ Check here and fill out the wire transfer instructions below to receive the Purchase Price via wire transfer

|

| | | | |

| Bank: | | | | |

| ABA Routing Number: | | | | |

| Account Holder: | | | | |

| Account Number: | | | | |

Reference: Sierra Income Corporation

¨ Check here to receive the Purchase Price via check

Make checks payable to and mail to:

|

| | | | |

| Name of Registered Holder: | | | | |

| Mailing Address: | | | | |

| City, State, Zip: | | | | |

| Social Security Number (or) Tax Identification Number: | | | | |

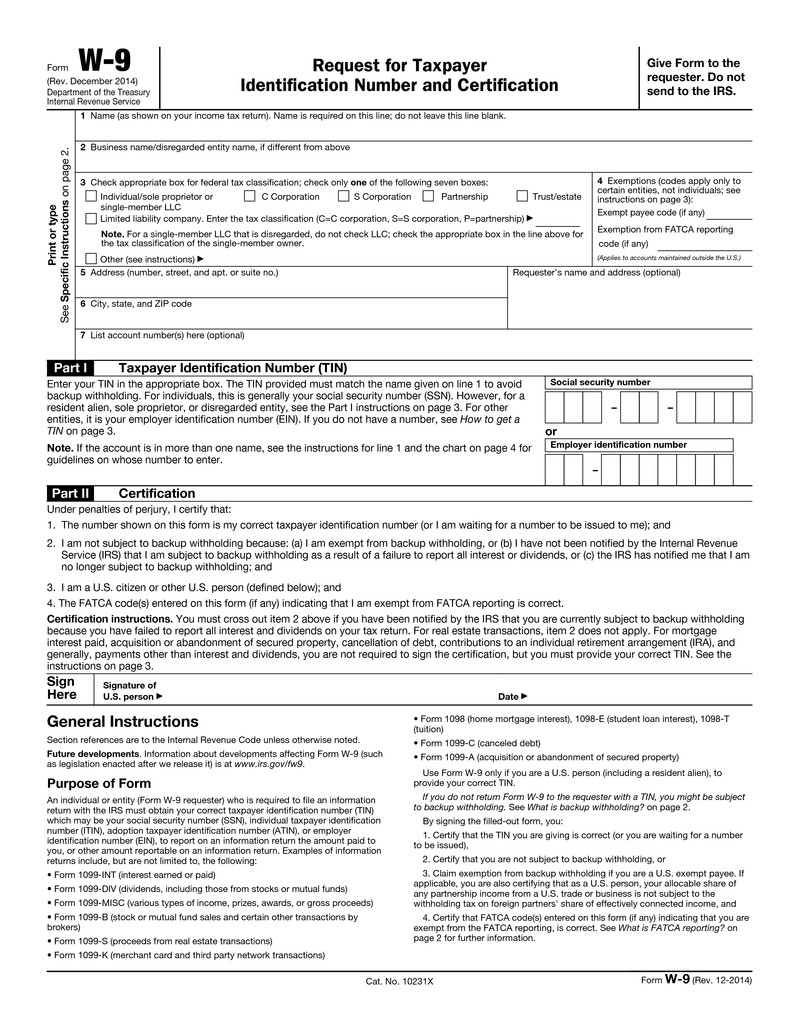

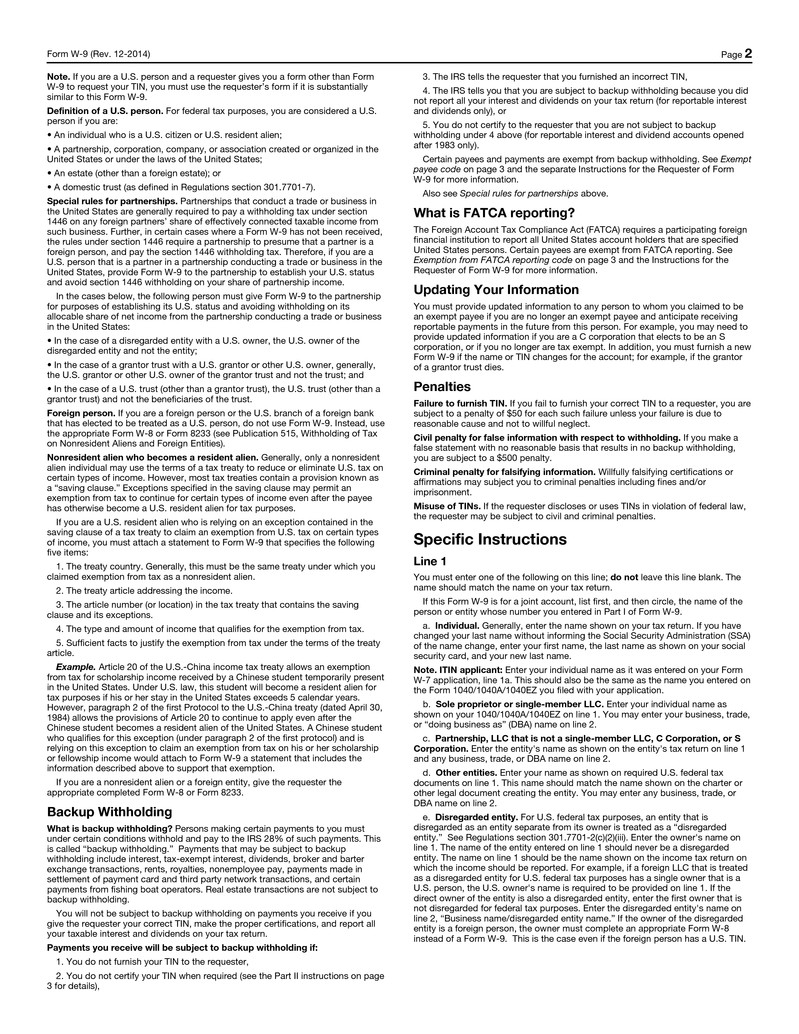

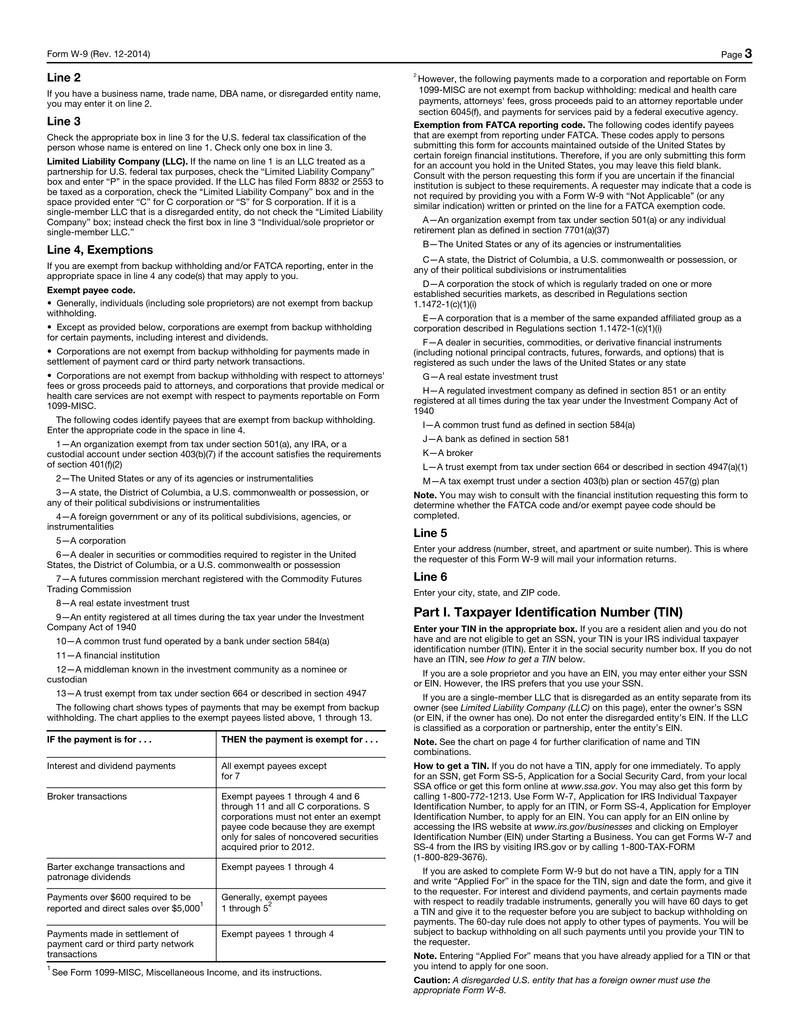

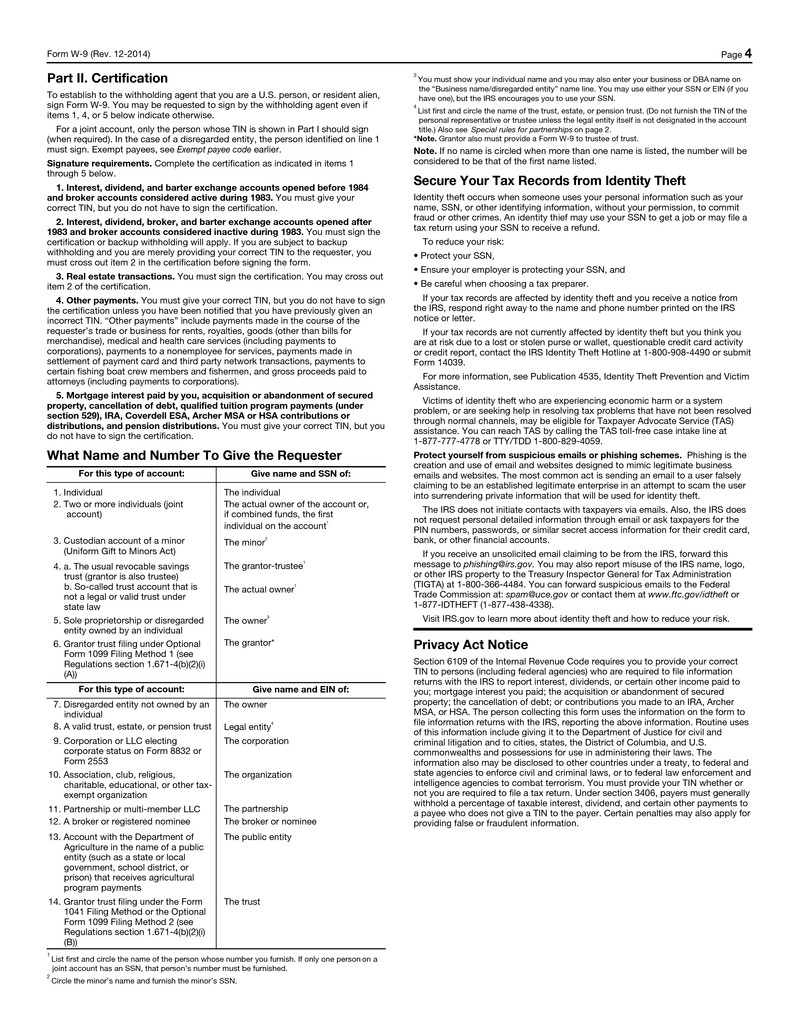

(In Addition, Complete Substitute Form W-9)

2. Sign Here To Tender Your Shares (See Instructions 1 and 3)

(IN ADDITION, COMPLETE SUBSTITUTE FORM W-9)

By executing this Letter of Transmittal, the undersigned hereby delivers to the Company in connection with the Offer to Purchase the number of shares of common stock indicated in the box entitled “Total Shares to be Tendered.”

|

| | | |

| Signature(s) of Registered Holder(s) | | | Date (mm/dd/yyyy) |

| | | | |

| Signature(s) of Registered Holder(s) | | | Date (mm/dd/yyyy) |

|

| | | | |

| Name(s) (Please print): | | | | |

| Name(s) (Please print): | | | | |

| Capacity (list full title): | | | | |

| Address: | | | | |

| City, State, Zip: | | | | |

| Daytime Phone #: ( ) | | | | |

| Social Security Number or Taxpayer Identification Number: | | | | |

3. Signature(s) Guaranteed By: (To Be Completed Only If Required By Instructions 1 and 3)

The undersigned hereby guarantees the signature(s) which appear(s) on this Letter of Transmittal for Shares tendered pursuant to this Letter of Transmittal.

|

| | |

| Name of Institution Issuing Guarantee | |

| Authorized Signature By | |

|

| | | | |

| Title: | | | | |

| Address of Guaranteeing Firm: | | | | |

| City, State, Zip: | | | | |

| Dated: | | | | |

|

| |

LETTER OF TRANSMITTAL PURSUANT TO THE OFFER TO PURCHASE DATED | |

| MAY 23, 2017 | |

INSTRUCTIONS TO LETTER OF TRANSMITTAL

FORMING PART OF TERMS AND CONDITIONS OF THIS LETTER OF TRANSMITTAL

1. Guarantee of Signatures. Signatures on this Letter of Transmittal must be guaranteed in Box 3 in accordance with Rule 17Ad-15 (promulgated under the Securities Exchange Act of 1934, as amended) by an eligible guarantor institution which is a participant in a stock transfer association recognized program, such as a firm that is a member of a registered national securities exchange, a member of the Financial Industry Regulatory Authority, by a commercial bank or trust company having an office or correspondent in the United States or by an international bank, securities dealer, securities broker or other financial institution licensed to do business in its home country (an “Eligible Institution”) unless (i) the Letter of Transmittal is signed by the registered holder(s) of the Shares tendered therewith and such holder(s) have not completed Box 1 “Special Registration and Payment Instructions” above or (ii) the Shares described above are delivered for the account of an Eligible Institution. IN ALL OTHER CASES ALL SIGNATURES MUST BE GUARANTEED BY AN ELIGIBLE INSTITUTION.

2. Delivery of Letter of Transmittal. This Letter of Transmittal, properly completed and duly executed, should be sent by mail or courier or delivered by hand to the Company, in each case at the address set forth on the front page of this Letter of Transmittal, in order to make an effective tender.

A properly completed and duly executed Letter of Transmittal must be received by the Company at the address set forth on the front page of this Letter of Transmittal by 11:59 PM, Eastern Time, on June 23, 2017 unless the Offer is extended. The Purchase Price will be paid and issued in exchange for the Shares tendered and accepted for purchase by the Company pursuant to the Offer to Purchase in all cases only after receipt by the Company of a properly completed and duly executed Letter of Transmittal.

The method of delivery of all documents is at the option and risk of the undersigned and the delivery will be deemed made only when actually received. If delivery is by mail, registered mail with return receipt requested, properly insured, is recommended.

3. Signatures on this Letter of Transmittal, Powers of Attorney and Endorsements.

(a) If this Letter of Transmittal is signed by the registered holder(s) of the Shares to be tendered, the signature(s) of the holder on this Letter of Transmittal must correspond exactly with the name(s) on the subscription agreement accepted by the Company in connection with the purchase of the Shares, unless such Shares have been transferred by the registered holder(s), in which event this Letter of Transmittal should be signed in exactly the same form as the name of the last transferee indicated on the stock ledger maintained

in book-entry form by DST Systems, Inc., the Company’s transfer agent.

(b) If any Shares tendered with this Letter of Transmittal are owned of record by two are more joint owners, all such owners must sign this Letter of Transmittal.

(c) If this Letter of Transmittal is signed by a trustee, executor, administrator, guardian, attorney-in-fact, officer of corporation or other person acting in a fiduciary or representative capacity, such person must so indicate when signing, and proper evidence satisfactory to the Company of their authority to so act must be submitted.

(d) If this Letter of Transmittal is signed by a person other than the registered holder(s) of the Shares listed, the Letter of Transmittal must be endorsed or accompanied by appropriate stock powers, in either case signed exactly as the name(s) of the registered holder(s) appear(s) on the subscription agreement accepted by the Company in connection with the purchase of the Shares. Signatures must be guaranteed in Box 3 by an Eligible Institution (unless signed by an Eligible Institution).

4. Withholding. The Company is entitled to deduct and withhold from the Purchase Price otherwise payable to any holder of Shares whose Shares are accepted for purchase by the Company any amounts that the Company is required to deduct and withhold with respect to the making of such payment under the Internal Revenue Code of 1986, as amended (the “Code”), or any provision of state, local or foreign tax law. To the extent that amounts are withheld, the withheld amounts shall be treated for all purposes as having been paid and issued to the holder of Shares in respect of which such deduction and withholding was made.

5. Transfer Taxes. The Company will pay any transfer taxes payable on the transfer to it of Shares purchased pursuant to the Offer; provided, however, that if payment of the Purchase Price is to be made to, or (in the circumstances permitted by the Offer) unpurchased Shares are to be registered in the name(s) of, any person(s) other than the registered owner(s), the amount of any transfer taxes (whether imposed on the registered owner(s) or such other person(s)) payable on account of the transfer to such person(s) will be deducted from the Purchase Price unless satisfactory evidence of the payment of such taxes, or exemption therefrom, is submitted herewith.

6. Special Registration and Payment Instructions and Special Delivery Instructions. If the Purchase Price is to be paid and issued to a person other than the person(s) signing the Letter of Transmittal, then Box 1 must be completed. If the Purchase Price is to be mailed or wired to someone other than the person(s) signing the Letter of Transmittal, or to the person(s) signing the Letter of Transmittal at an address other than that shown above, then Box 1 must be completed.

|

| |

LETTER OF TRANSMITTAL PURSUANT TO THE OFFER TO PURCHASE DATED | |

| MAY 23, 2017 | |

INSTRUCTIONS TO LETTER OF TRANSMITTAL

(CONTINUED)

7. Determinations of Validity. All questions as to the form of documents and the validity of Shares will be resolved by the Company in its sole discretion whose determination shall be final and binding. The Company reserves the absolute right to reject and deliveries of any Shares that are not in proper form, or the acceptance of which would, in the opinion of the Company or its counsel, be unlawful. The Company reserves the absolute right to waive any defect irregularity of delivery for exchange with regard to any Shares, provided that any such waiver shall apply to all tenders of Shares.

NEITHER THE COMPANY, ITS BOARD OF DIRECTORS, SIC ADVISORS, LLC, NOR ANY OTHER PERSON IS OR WILL BE OBLIGATED TO GIVE ANY NOTICE OF ANY DEFECT OR IRREGULARITY IN ANY TENDER, AND NONE OF THEM WILL INCUR ANY LIABILITY FOR FAILURE TO GIVE ANY SUCH NOTICE.

8. Requests for Assistance of Additional Copies. Requests for assistance or for additional copies of this Letter of Transmittal may be directed to the Company at the address or the telephone number set forth on the cover page of this Letter of Transmittal. Stockholders who do not own Shares directly may also obtain such information and copies from their broker, dealer, commercial bank, trust company or other nominee. Stockholders who do not own Shares directly are required to tender their Shares through their broker, dealer, commercial bank, trust company or other nominee and should NOT submit this Letter of Transmittal to the Company.

9. Backup Withholding. Each holder that desires to tender Shares must, unless an exemption applies, provide the Company with the holder’s taxpayer identification number on the Substitute Form W-9 set forth in this Letter of Transmittal, with the required certifications being made under penalties of perjury. If the holder is an individual, the taxpayer identification number is his or her social security number. If the Company is not provided with the correct taxpayer identification number, the holder may be subject to a $50 penalty imposed by the Internal Revenue Service in addition to being subject to backup withholding.

Holders are required to give the Company the taxpayer identification number of the record owner of the Shares by completing the Substitute Form W-9 included with this Letter of Transmittal. If the Shares are registered in more than one name or are not in the name of the actual owner, consult the “Part II. Certification,” which immediately follows the Substitute Form W-9.

If backup withholding applies, the Company is required to withhold a portion of any payment made to the Stockholder with respect to Shares tendered. Backup withholding is not an additional tax. Rather, the U.S. federal income tax liability of persons subject to

backup withholding will be reduced by the amount of tax withheld. If withholding results in an overpayment of taxes, a refund may be obtained by the holder from the Internal Revenue Service. See Section 13 of the Offer to Purchase dated May 23, 2017 for more information.

Certain holders (including, among others, most corporations and certain foreign persons) are exempt from backup withholding requirements. To qualify as an exempt recipient on the basis of foreign status, a foreign holder (a “Non-U.S. holder “), must generally submit a properly completed Form W-8BEN, Form W-8BEN-E, Form W-8IMY or Form W-8ECI, signed under penalties of perjury, attesting to that person’s exempt status. A Non-U.S. holder would use a Form W-8BEN (or, in the case of a Non-U.S. holder that is a foreign entity, a Form W-8BEN-E) to certify that it is neither a citizen nor a resident of the United States and would use a Form W-8ECI to certify that (1) it is neither a citizen nor resident of the United States, and (2) the proceeds of the sale of the Shares are effectively connected with a U.S. trade or business. A Non-U.S. holder (including a foreign branch of a U.S. person) would use a Form W-8IMY to establish that it is a qualified intermediary that is not acting for its own account. A Non-U.S. holder may also use a Form W-8BEN or W-8BEN-E to certify that it is eligible for benefits under a tax treaty between the United States and such foreign person’s country of residence. To claim treaty benefits, a Non-U.S. holder will generally be required to provide a taxpayer identification number issued by the Internal Revenue Service.

A HOLDER SHOULD CONSULT HIS OR HER TAX ADVISOR AS TO HIS OR HER QUALIFICATION FOR EXEMPTION FROM THE BACKUP WITHHOLDING REQUIREMENTS OR FOR TREATY BENEFITS AND THE PROCEDURE FOR OBTAINING AN EXEMPTION OR TREATY BENEFIT, INCLUDING THE APPROPRIATE FORM TO PROVIDE TO CLAIM SUCH EXEMPTION OR TREATY BENEFIT.

* * *

IMPORTANT: THIS LETTER OF TRANSMITTAL PROPERLY COMPLETED AND BEARING ORIGINAL SIGNATURE(S) AND THE ORIGINAL OF ANY REQUIRED SIGNATURE GUARANTEE(S) MUST BE RECEIVED BY THE COMPANY PRIOR TO THE EXPIRATION OF THE OFFER.