Exhibit 99.5

Incorporated in China with limited liability

HONG KONG BRANCH

HONG KONG BRANCH

Private and Confidential

AOGANG International (Hong Kong) Corporation Limited Our RefNo. CP-150487

Attn: Mr. WANG Zhentao, Director

15 July 2015

Dear Sirs,

FACILITY LETTER

Agricultural Bank of China Limited Hong Kong Branch (the “Bank”) is pleased to inform you that it will consider requests made by the Borrower(s) specified below for the following banking facilities (the “Facilities”) on the following terms and conditions.

Unless otherwise defined herein, the terms defined in the Bank’s Standard Terms for Banking Facilities (executed by the Borrower(s) at any time) shall have the same meanings when used in this facility letter.

A. BORROWER(S):

AOGANG International (Hong Kong) Corporation Limited

B. FACILITIES AND LIMITS: I. General Banking Facilities

Type(s) of Facility Facility Limit(s)

1. Revolving Loan Facility USD60,000,000.00

Total Facility Limit: USD60,000,000.00

Remarks:

The aggregate outstanding from the Borrower(s) under a particular Facility shall not at any time exceed the Facility Limit of that Facility.

The aggregate outstandings of all the above Facilities shall not at any time exceed the Total

Facility Limit.

Agricultural Bank of China Limited, Hong Kong Branch

25/F., Agricultural Bank of China Tower, 50 Connaught Road Central , Ho ng Kong

Tel: (852) 2861 8000

SW IFT: ABOCH KHH

Fax : (852) 2866 0 1 33

HONG KONG BRANCH

Incorporated in China with limited liability

AOGANG International (Hong Kong) Corporation Limited Our Ref: CP-150487

C. FACILITIES CONDITIONS I. General Banking Facilities

1. Revolving Loan Facility

Purpose: For equity investment in LightlnTheBox Holding Co., Ltd. (a listed company in New York Stock Exchange). According to the Foreign Exchange Regulations of the People’s Republic of China, the usage of the Facility is not allowed for capital investment in Mainland China directly or through third parties in any forms.

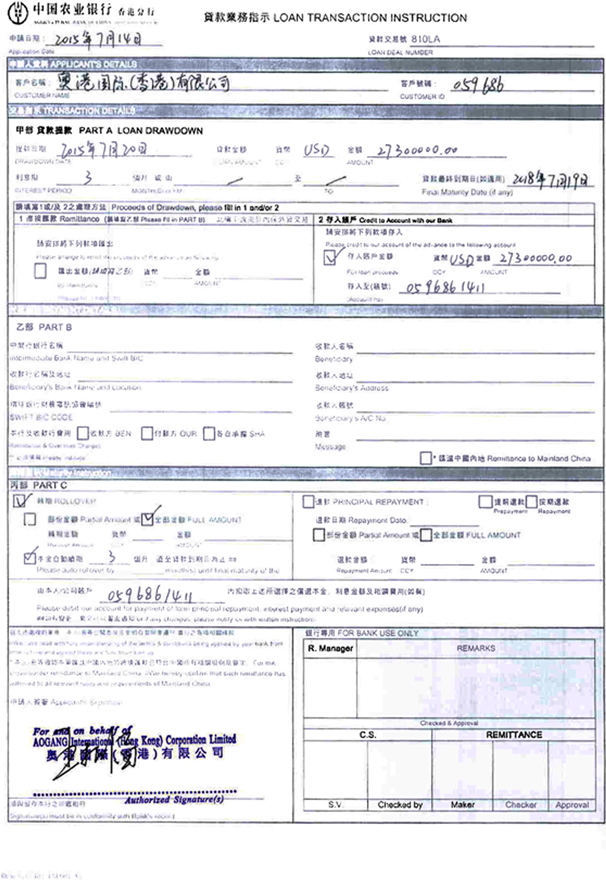

Drawdown: Written notice of a loan drawdown under this Facility shall be received by the Bank one (1) banking day before the proposed drawdown date.

If there is more than one loan under each Standby LIC, the Borrower is required to specify, in each written notice stated above, the reference number of the Standby LIC under which the loan is made.

The aggregate loans amount of this Facility available for drawing shall not, at any time, exceed any of the following:-

(1) 93% of the Equivalent Value (as defined below) of all Standby LIC(s) already issued and not yet expired (where (I) the currency of the loan(s) is different from the corresponding Standby LIC(s) and (2) the currencies of the loan(s) and the Standby L/C(s) are JPY, EUR, AUD, HKD, USD, CNY and/or other currency), or

(2) 95% of the Equivalent Value (as defined below) of all Standby L/C(s) already issued and not yet expired (where (1) the currency of the loan(s) is different from the corresponding Standby LIC(s) and (2) the currencies of the loan(s) and the Standby L/C(s) are CNY, HKD, USD only), or

(3) 97% of all Standby LIC(s) already issued and not yet expired (for currency of the loan(s) being the same as the corresponding Standby L/C(s));

(4) Notwithstanding the above mentioned, the aggregate amount of loans available for drawdown plus the applicable interest must not exceed the aggregate amount (or its Equivalent Value) of Standby Letter(s) of Credit iss ued I to be issued by Agricultural Bank of China Limited Zhejiang Branch.

A vai labi Iity Period : For so long as the existing Standby L/C(s) remain valid and s ubject to terms and conditions of this letter, the Borrower may

2

Agricultural Bank of China Limited , Hong Kong Branch

25/F., Agricultural Bank of China Tower, 50 Connaught Road Central, Hong Kong

Tel: (852) 2861 8000

S WIFT: A BOCHKI-!H

Fa x: (852) 2866 0133

HONG KON G BRANCH

Incorporated in China with limited liability

AOGANG International (Hong Kong) Corporation Limited Our Ref: CP-150487

request utilization ofthis Facility. [GRAPHIC APPEARS HERE] Maximum upto 3 years.

Interest Period: Loans will be made for periods of 1 to 3 months (subject to

availability) as selected by the Borrower(s). Full or partial rollover of each loan is at the Bank’s discretion.

The interest period for each loan under this Facility shall not, in any case, be later than 15 days before the expiry date of the Standby LIC.

Interest: HIBOR or LIBOR or the Bank’s Cost of Funds to be fixed by the Bank at its sole discretion for the term of the loans plus 1.6% p.a., payable on the end date of each Interest Period.

Repayment: Every loan shall be repaid on the end date of each interest period, but loans repaid may be reborrowed (subject to all other terms and conditions hereof). Unless otherwise agreed, the Borrower(s) shall, by no later than 15 days before the expiry date of that corresponding Standby LIC(s), repay all outstanding loan(s) (together with the accrued interest) drawn under the corresponding Standby L/C(s).

Prepayment: Permitted with two banking days’ prior written notice and subject to payment of break funding cost to the Bank.

Equivalent Value: in relation to the Standby LIC or cash margin (if applicable), means their equivalent value (in the currency of the loan amount) as conclusively determined by the Bank at its sole discretion from time to time in accordance with the market prevailing exchangt: rate between the currency of the Standby LIC or cash margin and the currency of the loan, which value may change from time to time due to fluctuation of the prevailing exchange rate.

Top-Up Provision: The Borrower(s) shall at all times maintain the outstanding loan amount under this Facility not exceeding:-

(1) 93% of the Equivalent Value of the Standby LIC (where (1 ) the currency of the loan(s) is different from the corresponding Standby L/C(s) and (2) the currencies of the loan(s) and the Standby L/C(s) are JPY, EUR, AUD, HKD, USD, CNY and/or other currency); or

(2) 95% of the Equivalent Value of the Standby LIC (where (1) the currency of the loan(s) is different from the corresponding Standby LIC(s) and (2) the currencies of the loan(s) and the Standby LIC(s) are CNY, HKD, USD only).

If the outstanding loan amount under this Facility exceeds: -

3

Agricultural Bank of China Limited , Hong Kong Branch

25/F., Agricultural Bank of China Tower, 50 Connaught Road Central, Hong Kong

Tel: (852) 2861 8000

SWIFT: A B OC I-IKHH

Fax: (852) 2866 0133

AOGANG International (Hong Kong) Corporation Limited Our Ref: CP-150487

(I) 97% ofthe Equivalent Value of Standby LIC amount (ifthe

Standby LIC and the loan are in different currencies); or

the Borrower(s) shall pay additional cash margin in such amount and in such manner at the Bank’s sole discretion within 3 banking days to maintain the outstanding loan amount at less than or equal to:-

(1) 93% of the Equivalent Value of the Standby L/C plus the relevant cash margin (if the currencies of the loan(s) and the Standby LIC(s) are JPY, EUR, AUD, HKD, USD, CNY and/or other currency) or;

(2) 95% of the Equivalent Value of the Standby LIC plus the relevant cash margin (if the currencies of loan(s) and Standby L/C(s) are CNY, HKD and/or USD only).

The Bank has the right at any time to demand immediate repayment of the loans and present the claim against the Standby LIC without prior notice to the Borrower if the outstanding loan amount exceeds 98% of the Equivalent Value of the corresponding Standby LIC.

Control Over Loan

Proceeds:

All the loan proceeds shall first be paid into the designated account of the Borrower(s) maintained with the Bank. The Borrower(s) may only withdraw the loan proceeds for the intended purpose of this Facility and in compliance with the provisions of this letter.

Default Interest

Time shall be of essence of any payment/repayment to be made by the Borrower(s) and/or the security provider(s) (if any). If any sum is not paid when due or is in excess of the relevant facility limit of the Facilities, the sum overdue or in excess shall bear interest at 5% p.a. above the respective applicable interest rates from time to time charged by the Bank to the Borrower(s). Such default interest shall accrue and be calculated from the date when the relevant payment is due (or the relevant facility limit is exceeded) and up to (but excluding) the date when the relevant overdue payment is repaid in full (or the relevant facility limit is complied with) on daily basis.

Cost and Expenses

All costs and expenses incurred by the Bank (including but not limited to legal fees and expenses) in respect of the Facilities shall be paid by the Borrower(s), whether or not any of the Facilities is/are utilized.

4

Agricultural Bank of China Limited , Hong Kong Branch

25/F., Agricultura l Bank of China Tower, 50 Cotmaught Road Central , Ho ng Kong

Tel : (852) 2861 8000

S WIFT: ABOC H K HH

Fax: (852) 2866 0133

D. SECURITY AND CONDITIONS PRECEDENT

The following documents, items and evidence (both in the form and substance satisfactory to the Bank) shall be delivered to the Bank prior to submitting any request for utilization of the Facilities to the Bank:-

1. A copy of the duplicate of this facility letter duly executed by the Borrower(s).

2. Standard Terms for Banking Facilities duly executed by the Borrower(s) (form attached).

3. Cash Margin Agreement or any other relevant security agreement which the Bank may require from time to time (form attached).

4. Irrevocable and unconditional Standby LIC, the contents of which is acceptable to the Bank, issued or to be issued by Agricultural Bank of China Limited Zhejiang Branch in favour of the Bank (“Standby L/C”).

5. Original I certified copies of all necessary consents, approvals or other authorization (including board resolutions and shareholders’ resolution, if necessary) in connection with the execution, delivery and performance of this facility letter and all other documents mentioned in this part, if applicable.

6. Such other documents, items or evidence that the Bank may require from time to time.

In addition to the delivery of the abovementioned documents, items and evidence (both in the form and substance satisfactory to the Bank) to the Bank, any utilization under the Facilities may only be made by the Borrower(s) after the Bank has completed “know your customer” or similar identification procedures in respect of the Borrower(s).

E. UNDERTAKINGS

1. A s igned original copy of audited financial statements of the Borrower(s) shall be provided to the Bank within 180 days from the end of each accounting year.

2. The Borrower(s) represent(s), declare(s) and undertake(s) to the Bank that the utilization of the Facilities or use of proceeds drawn under this letter including the flow of loan proceeds do not and will not conflict with any law or regulation applicable to the Borrower(s) (including without limitation those in force in the Mainland China). In particular, the loan proceeds drawn under the Facilities will not directly or indirectly be transferred to the Mainland China for investment by way of share acquisition or for fulfillment of any debt obligations, such including but not limited to:

(i) for use or refinancing of the existing banking facilities of which the loan purpose was originally for use of share acquisition or settlement of debt obligations of which the loan proceeds was transferred to the Mainland China; or

(ii) for use directly or indirectly to acquire shares of companies which are incorporated outside the Mainland China but the principal business and assets of the companies are in the Mainland China.

In case of any transfer of loan proceeds to the Mainland China, it must be under th e

5

Agricultural Bank of China Limited, Hong Kong Branch

25/F., Agricultural Bank of China Tower, 50 Connaught Road Central, Hong Kong

Tel: (852) 2861 8000

S WI FT: ABOCHKHH

Fax: (852) 2866 01 33

recognised way of transfer of funds to the Mainland China by the State Administration of Foreign Exchange and in compliance with all legal and regulatory requirements for transfer of funds to the Mainland China. The above representation and declaration are deemed to be made by each Borrower by reference to the facts then existing during the period where the Facilities or any part thereof remain outstanding.

3. The Borrower(s) undertake(s) with the Bank that it shall comply with all laws or regulations applicable to it in the Mainland China in particular of the regulatory rules and guidelines as set out by the State Administration of Foreign Exchange. In case of approval or registration from the State Administration of Foreign Exchange is required, the Borrower(s) is/are obliged to obtain and complete the relevant approval or registration and provide the evidence of such approval or registration to the Bank in order for the Banks to arrange payment to the Mainland China under the relevant Facility(ies).

4. The Borrower(s) shall furnish upon demand cash cover or other security or further security in such form and value as may be required by the Bank from time to time in amounts and/or values sufficient at all times in the Bank’s opinion to secure all or any of the outstanding liabilities of the Borrower(s) under the Facilities and, if required by the Bank, shall register or procure the registration of the relevant security with the appropriate authority(ies).

F. OTHER TERMS AND CONDITIONS

1. Each request or application made by the Borrower(s) to use any of the Facilities in whole or in part shall be a request by the Borrower(s) to the Bank to extend financing on the terms and conditions set out or referred to in this letter. No commitment by the Bank to extend any financing shall arise until any application by the Borrower(s) for such financing is accepted by the Bank either expressly or by its extending such financing to the Borrower(s).

2. Notwithstanding any provision to the contrary stated in this letter and in any other document (whether express or implied), the Facilities are repayable on demand by the Bank. The Bank has the overriding right at any time to require the Borrower(s) to immediately make payment and/or cash collateralization of all or any sums actually or contingently owing to the Bank under the Facilities (whether such sums are due or scheduled to mature in the future). This letter stipulates the terms and conditions applicable to the Facilities, if granted, and does not oblige the Bank to extend or continue any financing to the Borrower(s).

3. The Bank may at any time immediately modify, terminate, cancel, withdraw or suspend the Facilities or vary the terms applicable to the Facilities without the consent of any party and without subject to any condition.

4. If the Bank from time to time determines that any or all of the interest rates otherwise stated in this letter to be applicable to the Facility(ies) does not reflect its Cost of Funds, the Bank may apply its Cost of Funds (as determined by the Bank at its sole discretion, and expressed as a rate per annum) plus the applicable margin stated in this letter (in stead of such interst rate(s)) to calculate the interest payable by the Borrower(s). Such alternative interest calculation will apply until the Bank determines otherwise and notifies the Borrower(s) accordingly.

5. A certificate or determination by the Bank of an interest rate, its Cost of Funds, an amount payable by the Borrower(s) under this letter or any other matter provided for in this letter and

6

Agricultural Bank of China Limited , Hong Kong Branch

25/F., Agricultural Bank o f China Tower, 50 Connaught Road Central, Hong Kong

Te l: (852) 2861 8000

SW I FT: ABOC H K HH

Fax: (852) 2866 0133

other facility documents is, save to the extent of manifest error, conclusive evidence against the Borrower(s) of the matter(s) covered thereby.

6. This facility letter shall be governed by and construed in accordance with the laws of Hong Kong Special Administrative Region (“Hong Kong”) and the Borrower(s) agree(s) to subm it to the non-exclusive jurisdiction ofthe Hong Kong courts.

Please confirm your acceptance to the terms and conditions of this letter (incorporating the Bank’s Standard Terms for Banking Facilities) by signing and returning to us the enclosed copy of this letter on or before 17 August 2015, after which this offer shall lapse unless extended, which will be at the sole discretion of the Bank.

In case of any queries, please feel free to contact Ms. Viann Lam, Relationship Manager of our Trade Finance Department at (852) 2861 7958, who will assist you in the execution of the required documentation. Please return the executed documents to 25/F, Agricultural Bank of China Tower, 50

Connaught Road Central, Hong Kong.

Yours faithfully,

For and on behalf of

Agricultural Bank of China Limited

Hong Kong Branch

7

Agricultural Bank of China Limited , Hon g Kong Branch

25/F., Agricultural Bank of China Tower, 50 Connaught Road Central, Hong Kong

Tel: (852) 2861 8000

SWIFT: ABOC J-J KHH

Fax: (852) 2866 0133

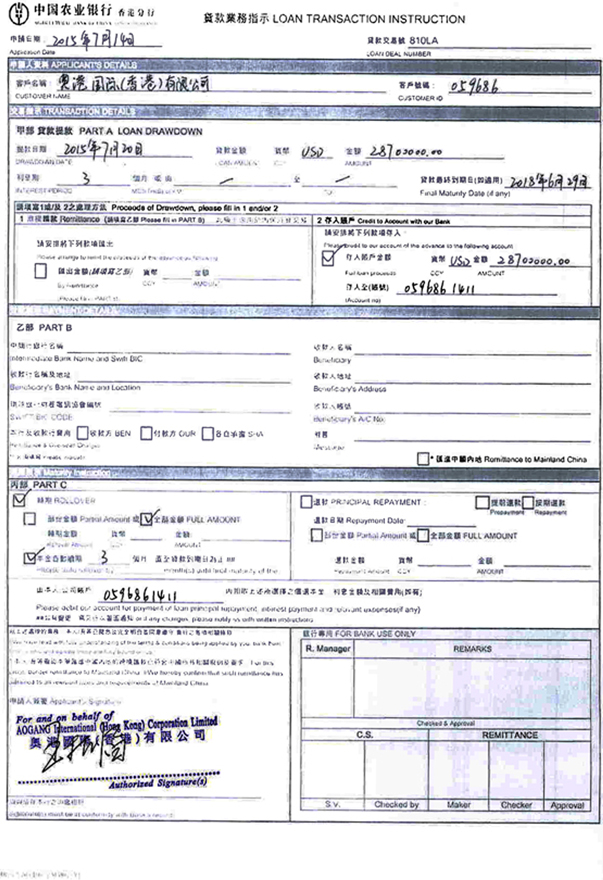

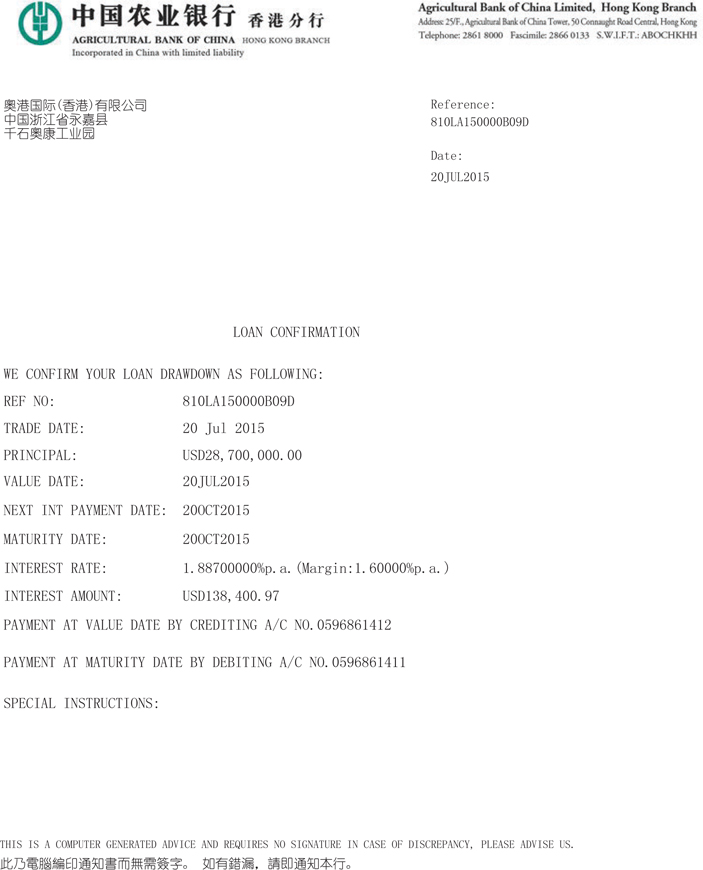

Reference:

81OLA150000DO9D

Date:

20JUL2015

LOAN CONFIRM.4TION

WE CONFIRM YOUR LOAN DRAWDON AS FOLLOWING:

REF NO: S1OLA150000BO9D

TRADE DATE: 20 Jul 2013

PRINCIPAL: USD28, 700, 000. 00

VALUE DATE: 20JUL2015

NEST 1ST PAYMET DATE: 00CT2015

MATURITY DATE: 200CT2015

INTEREST RATE: 1. SST00000%p. a. (Margin: 1. &0000%p a.)

INTEREST AMOUNT: USD138,400.97

PAYENT AT VALUE DATE BY CREDITING AIC NO. 0596861412

PAY!.ENT AT MATURITY DATE BY DEBITING A,’C NO. 0596861411

SPECIAL INSTRUCTIONS:

This is a computer generated advice and requires no signature in case of discrepancy, please advise us.

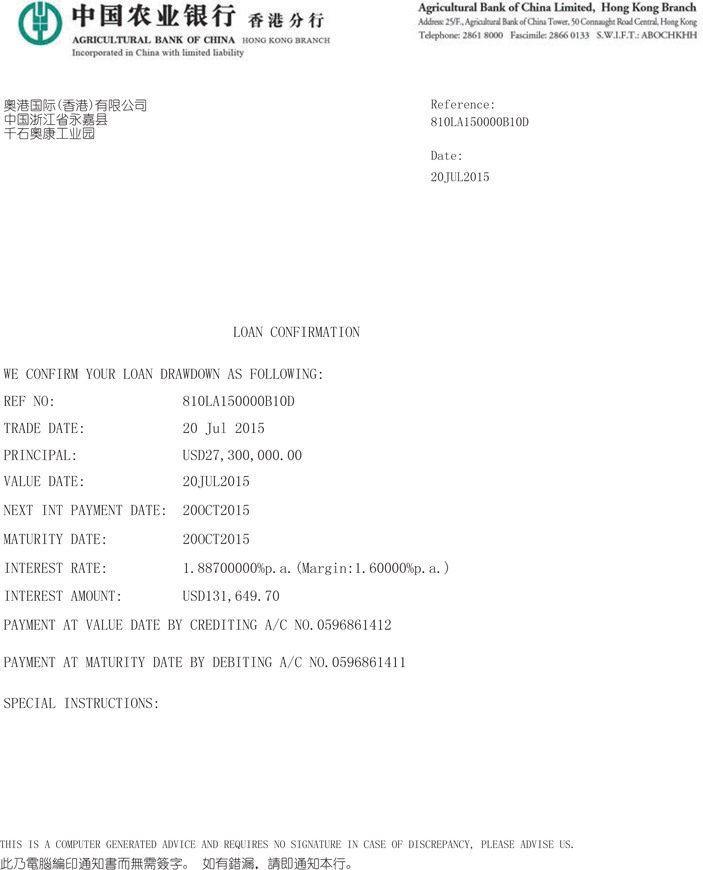

Reference:

SICLA15030CE:CD

Date:

20 Jul 2015

LOAN CONFIRMATION

WE CONFIRM YOUR LOAN DRAWDOWN AS FOLLOWING:

REF NO: 81OLAI50000B1OD

TRADE DATE: 20 Jul 2015

PRINCIPAL: USX7, 300, 000. 00

VALUE DATE: 2OJUL2O1S

NEXT INT PAYMENT DATE: 200CT2015

MATURITY DATE: 200(12015

INTEREST RATE: 1. 8S700000%p. a. (Margin: 1. 60000%p. a.)

INTEREST AMOUNT: USD131,649.70

PAYMENT AT VALUE DATE BY CREDITING A/C NO. 0596861112

PAYMENT AT MATURITY DATE BY DEBITING A/c NO.0596861411

SPECIAL INSTRUCTIONS:

This is a computer generated advice and requires no signature in case of discrepancy, please advise us.