UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

___________________________________

FORM 10-K

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-35355

___________________________________

MANNING & NAPIER, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | 45-2609100 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

| 290 Woodcliff Drive | | |

| Fairport, | New York | | 14450 |

| (Address of principal executive offices) | | (Zip code) |

(585) 325-6880

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange in which registered |

| Class A common stock, $0.01 par value per share | MN | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

___________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ¨ | | Accelerated filer | x |

| Non-accelerated filer | ¨ | | Smaller reporting company | x |

| | | Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ¨ No ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the

effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant's common equity held by non-affiliates of the registrant (assuming for purposes of this computation only that the directors and executive officers may be affiliates) at June 30, 2021, which was the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $123.8 million based on the closing price of $7.87 for one share of Class A common stock, as reported on the New York Stock Exchange on that date.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding at March 10, 2022 |

| Class A common stock, $0.01 par value per share | | 19,124,332 |

| | |

__________________________________

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2022 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

| | | | | | | | |

| | |

| | | Page |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| |

| |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| |

| |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| |

| |

| Item 15. | | |

| Item 16. | |

|

In this Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (the "Annual Report"), “we,” “our,” “us,” the “Company,” “Manning & Napier” and the “Registrant” refers to Manning & Napier, Inc. and, unless the context otherwise requires, its direct and indirect subsidiaries and predecessors on a consolidated basis.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which reflect the views of Manning & Napier, Inc. ("we," "our," or "us") with respect to, among other things, our future operations and financial performance. Words like "believes," "expects," "may," "estimates," "will," "should," "could," "intends," "likely," "plans," or "anticipates" or the negative thereof or other variations thereon or comparable terminology, are used to identify forward-looking statements, although not all forward-looking statements contain these words. Although we believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know about our business and operations, there can be no assurance that our actual results will not differ materially from what we expect or believe. Some of the factors that could cause our actual results to differ materially from our expectations or beliefs are disclosed in the “Risk Factors” section, as well as other sections of this report which include, without limitation: changes in securities or financial markets or general economic conditions; a decline in the performance of our products; client sales and redemption activity; any loss of an executive officer or key personnel; changes in our business related to strategic acquisitions and other transactions; our ability to successfully deploy new technology platforms and upgrades; impacts from our share repurchase program and changes of government policy or regulations. All forward-looking statements speak only as of the date on which they are made and we undertake no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

SUMMARY OF PRINCIPAL RISKS

The following factors are among the principal risks we face. For a more detailed description of the risks material to our business, see "Part I-Item 1A-Risk Factors" in this Annual Report on Form 10-K. The following summary should not be

considered an exhaustive summary of the material risks we face and should be read in conjunction with the “Risk Factors”

section and the other information in this Annual Report. Some of the factors that could cause our results to differ materially from our expectations or beliefs include, without limitation;

•the impact of the COVID-19 pandemic on the U.S. and global economy and our assets under management ("AUM");

•the termination of contracts or relationships upon short or no notice or high rates of client sales and redemption activity;

•the inability to realize the expected benefits of our restructuring plan and other operational improvement initiatives;

•difficult market conditions, like those during the COVID-19 pandemic, impacting the performance of our strategies, impacting our ability to obtain attractive returns, or reducing our ability to deploy capital;

•any loss of key investment and sales professionals or members of senior management, or difficulty integrating new executives;

•the impact on our portfolios of foreign currency exchange risk and the impact of any foreign tax, political, social and economic uncertainty on any non-U.S. issuers in which our portfolios have invested;

•a reduction in the fees we are able to charge, increased expenses or reduced fee income from new products, or potential losses or failure of new products or portfolios;

•concentration of our AUM in certain investment strategies or in certain geographic areas;

•future results of our existing portfolios or portfolios we develop in the future not achieving the historical returns of our portfolios;

•changes in key distribution relationships that reduce our revenues or increase the influence of third-party intermediaries on our mutual fund assets;

•failure to comply with investment guidelines set by our clients or limitations imposed by law;

•the impact of a technical change of control under federal and state law on our investment advisory agreements;

•the occurrence of operational or trading errors due to the failure, interruption or cessation of our or third-party financial, accounting, trading, custodial, clearing, compliance and other data processing systems;

•the failure to effectively maintain, enhance and modernize our information technology systems and develop or deploy new technology platforms and upgrades;

•cybersecurity breaches impacting our operations or the failure to implement effective information and cybersecurity policies;

•reputational harm caused by employee misconduct or the failure to properly address conflicts of interest;

•the inability to insure our business and otherwise manage risks;

•the failure to comply with extensive regulatory requirements and changes in government policy;

•the inability to effectively compete in the investment management industry;

•the financial and reputational impact of litigation in the investment management industry;

•our dependence on Manning & Napier Group, LLC (“Manning & Napier Group”) for distributions to pay expenses and dividends, if any, to our stockholders;

•our obligation to make payments to holders of units of Manning & Napier Group for tax benefits we receive as a result of our structure pursuant to a tax receivable agreement;

•provisions in our corporate documents and Delaware law that could discourage, delay or prevent a change in control of the Company that some stockholders might consider to be in their best interests; and

•catastrophic and unpredictable events, such as the COVID-19 pandemic, terrorist attacks and natural disasters.

PART I

Item 1. Business.

Overview

Manning & Napier, Inc. is an independent investment management firm that provides our clients with a broad range of financial solutions and investment strategies for both wealth and asset management. Founded in 1970 and headquartered in Fairport, New York, we serve a diversified client base of high-net-worth individuals and institutions. The institutions we serve include 401(k) plans, pension plans, Taft-Hartley multi-employer plans, endowments and foundations. We serve clients through our Wealth and Asset Management divisions. Our Wealth Management private clients are primarily composed of individual investors and families, small businesses and business owners, and small- to mid-sized non-profit organizations, endowments, and foundations. Our Asset Management division includes our Intermediary Distribution Group, focused on delivering our investment strategies and expertise to third-party financial advisors, our dedicated Taft-Hartley team, and our Institutional and Consultant Relations teams, serving 401(k) plans, pension plans, large organizations, institutional investors, and third-party investment consultants.

Our objective is to create and provide financial solutions to help our clients meet their needs. We believe our differentiation is based on delivering comprehensive solutions, high-touch service, and effective investment strategies in a custom-tailored, highly integrated manner.

We have built a diverse client base of high-net-worth individuals, small business owners, middle market institutions, larger institutions, defined contribution plans, and unions, as well as clients via investment consultants and other intermediaries. Although our client base is national, we are primarily focused in certain targeted geographic regions, including the northeastern and southeastern regions of the United States. Clients access our solutions and strategies via separately managed accounts, mutual funds, and collective investment trusts.

Our investment strategies are powered by multiple research engines, employing fundamental and quantitative approaches, and are offered as both single- and multi-asset class portfolios. While the mechanics of these processes may differ depending on the strategy, all of our strategies work from the underlying belief that active management is the best investment approach for meeting long-term client objectives. All of our multi-asset strategies fully incorporate dynamic asset allocation processes, and most strategies deliver active security selection as well.

We believe personalized financial advice is necessary to retain existing relationships and attract new clients. Our service approach is centered around our financial and advisor consultants, who manage the relationship and leverage internal subject matter experts for specific areas including financial planning, endowment and foundation consulting, qualified plan and pension plan services, and custody and trust advice and administration, depending on client need. We believe this team-based client service approach, value-added consultative services, and competitive long-term investment performance have allowed us to achieve a high average annual separate account retention rate.

The consistent philosophy and disciplined processes of our team-based, client-centric approach to investing has been central to delivering excellent investment outcomes to our clients for over 50 years. As of December 31, 2021, we have 20 publicly-available mutual fund share classes rated with four or five stars by Morningstar, and a number of our investment strategies have built value-added track records over multiple decades.

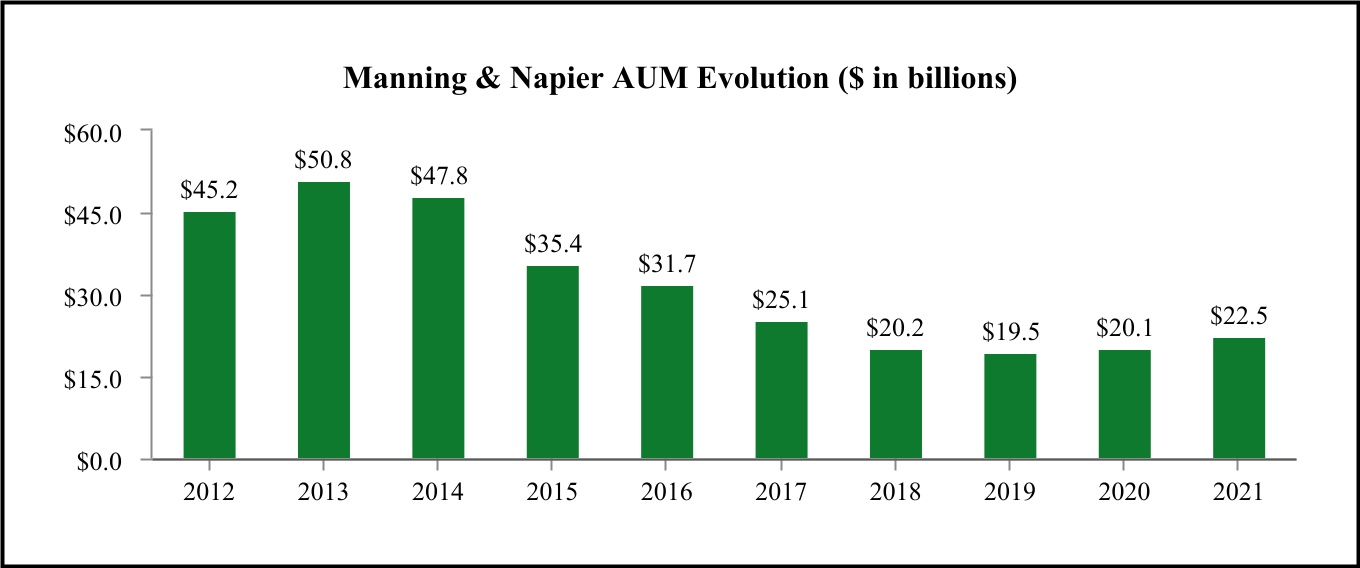

At times, our active approach to investment management can cause material deviations in portfolio positioning versus competitors and/or popular benchmarks. Over the long-term, we fervently believe our independent, truly active investment disciplines add value for clients, but over the short-run, periods of underperformance can occur. These short-term performance deviations, coupled with challenging industry trends, especially among institutional investors, can lead to changes in assets under management ("AUM") trends over time. The following chart reflects our AUM for each of the last 10 years:

As of December 31, 2021, our investment management offerings include 38 distinct separate account composites and 32 mutual funds and collective investment trusts. We believe we have cultivated a robust menu of actively managed strategies that allow us to address client needs.

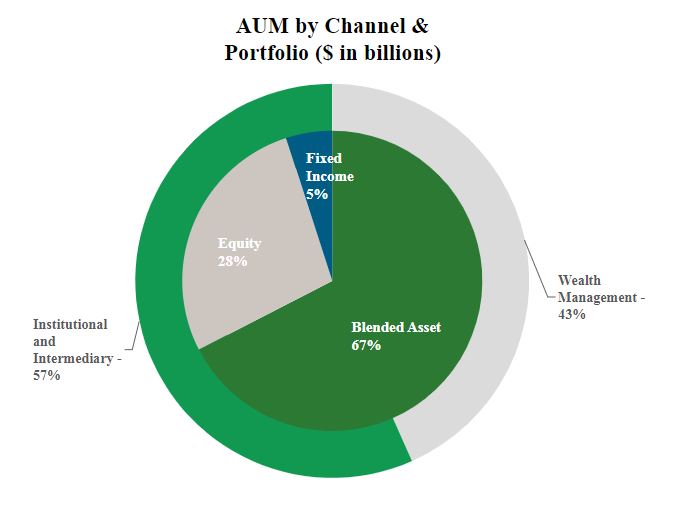

Our AUM as of December 31, 2021 by sales channel and portfolio were as follows:

The following table summarizes the annualized returns for several of our key investment strategies and relevant benchmarks. Since inception and over long-term periods, we believe our strategies have generated attractive returns on both an absolute and relative basis. These key strategies are used across separate account, mutual fund and collective investment trust vehicles, and represent approximately 78% of our AUM as of December 31, 2021. This table is provided for illustrative purposes only. The performance reflected in the table below is not necessarily indicative of the future results of our investment strategies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Key Strategies | AUM as of December 31, 2021 (in millions) | Inception Date | | Annualized Returns as of December 31, 2021 (1) |

| One Year | | Three Year | | Five Year | | Ten Year | | Inception | | |

Long-Term Growth (30%-80% Equity Exposure)

| $ | 6,179.9 | | 1/1/1973 | | 11.7% | | 16.3% | | 11.8% | | 9.4% | | 9.7% | | |

Blended Index (3) | | | | 10.3% | | 14.5% | | 10.4% | | 9.0% | | 9.0% | | |

| Core Non-U.S. Equity | $ | 805.2 | | 10/1/1996 | | 12.0% | | 21.4% | | 12.9% | | 8.7% | | 8.2% | | |

| Benchmark: ACWIxUS Index | | | | 7.8% | | 13.2% | | 9.6% | | 7.3% | | 5.6% | | |

| Growth with Reduced Volatility (20%-60% Equity Exposure) | $ | 3,012.4 | | 1/1/1973 | | 8.3% | | 13.3% | | 9.6% | | 7.6% | | 8.8% | | |

Blended Index (4) | | | | 7.2% | | 11.6% | | 8.4% | | 7.3% | | 8.4% | | |

| Equity-Oriented (70%-100% Equity Exposure) | $ | 1,634.7 | | 1/1/1993 | | 18.4% | | 22.9% | | 16.9% | | 12.8% | | 10.8% | | |

| Blended Benchmark: 65% Russell 3000® / 20% ACWIxUS / 15% Bloomberg U.S. Aggregate Bond | | | | 17.7% | | 20.1% | | 14.2% | | 12.6% | | 9.3% | | |

| Equity-Focused Blend (50%-90% Equity Exposure) | $ | 1,273.1 | | 4/1/2000 | | 14.4% | | 18.9% | | 13.7% | | 10.7% | | 8.1% | | |

| Blended Benchmark: 53% Russell 3000/ 17% ACWIxUS/ 30% Bloomberg U.S. Aggregate Bond | | | | 14.0% | | 17.4% | | 12.4% | | 10.9% | | 6.6% | | |

| Core Equity-Unrestricted (90%-100% Equity Exposure) | $ | 741.9 | | 1/1/1995 | | 20.9% | | 24.8% | | 18.5% | | 14.5% | | 12.0% | | |

| Blended Benchmark: 80% Russell 3000® / 20% ACWIxUS | | | | 21.9% | | 23.2% | | 16.3% | | 14.5% | | 10.1% | | |

| Core U.S. Equity | $ | 324.5 | | 7/1/2000 | | 25.7% | | 27.7% | | 20.7% | | 15.9% | | 9.8% | | |

| Benchmark: Russell 3000® Index | | | | 25.7% | | 25.8% | | 18.0% | | 16.3% | | 8.0% | | |

| Conservative Growth (5%-35% Equity Exposure) | $ | 626.8 | | 4/1/1992 | | 3.3% | | 8.3% | | 6.0% | | 4.7% | | 6.0% | | |

| Blended Benchmark:15% Russell 3000/ 5% ACWIxUS/ 80% Bloomberg U.S. Intermediate Aggregate Bond | | | | 2.9% | | 7.4% | | 5.5% | | 4.8% | | 6.1% | | |

| Aggregate Fixed Income | $ | 204.2 | | 1/1/1984 | | (1.8)% | | 5.2% | | 3.7% | | 3.0% | | 6.9% | | |

| Benchmark: Bloomberg U.S. Aggregate Bond | | | | (1.5)% | | 4.8% | | 3.6% | | 2.9% | | 6.8% | | |

| Rainier International Small Cap | $ | 1,269.5 | | 3/28/2012 | | 13.9% | | 26.1% | | 18.3% | | N/A (2) | | 14.6% | | |

| Benchmark: MSCI ACWIxUS Small Cap Index | | | | 12.9% | | 16.5% | | 11.2% | | 9.5% | | 8.2% | | |

| Disciplined Value US | $ | 1,440.3 | | 1/1/2013 | | 22.5% | | 16.1% | | 13.0% | | 13.2% | | 14.2% | | |

| Benchmark: Russell 1000 Value | | | | 25.2% | | 17.6% | | 11.2% | | 13.0% | | 14.0% | | |

__________________________

(1)Key investment strategy returns are presented net of fees. Benchmark returns do not reflect any fees or expenses.

(2)Performance not available given the product's inception date.

(3)Benchmark shown uses the 55/45 Blended Index from 01/01/1973-12/31/1987 and the 40/15/45 Blended Index from 01/01/1988-12/31/2021. The 55/45 Blended Index is represented by 55% S&P 500 Total Return Index ("S&P 500") and 45% Bloomberg U.S. Government/Credit Bond Index ("BGCB"). The 40/15/45 Blended Index is 40% Russell 3000 Index ("Russel 3000"), 15% MSCI ACWI ex USA Index ("ACWxUS"), and 45% Bloomberg U.S. Aggregate Bond Index ("BAB").

(4)Benchmark shown uses the 40/60 Blended Index from 01/01/1973-12/31/1987, the 30/10/60 Blended Index from 01/01/1988-12/31/2019, and the 30/10/30/30 Blended Index from 01/01/2020 to 12/31/2021. The 40/60 Blended Index is represented by 40% S&P 500 and 60% BGCB. The 30/10/60 Blended Index is represented by 30% Russell 3000, 10% ACWxUS, and 60% BAB. The 30/10/30/30 Blended Index is represented by 30% Russell 3000, 10% ACWxUS, 30% BAB, and 30% Intermediate Aggregate Bond Index.

Response to the COVID-19 Pandemic

See "Item 7. Management's Discussion and Analysis" in this Annual Report for a discussion of the impact of COVID-19 on our business operations.

Our Strategy

Our mission is to provide financial solutions that enable clients to achieve their long-term goals and objectives. Our success will be measured by the success of our clients. We must effectively execute in delivering investment results, financial advice, and a superior client experience in order to retain business and attract new business.

Our strategy is focused on continuous refinement and improvement. Our industry is continuously evolving, and we must relentlessly adapt our capabilities, talent, and culture to clients’ ever increasing expectations. This includes the performance of our investment strategies, the comprehensiveness of our financial advice, and the quality of our client service. These three areas form the foundation of our business and require constant evolution.

To meet these goals, our firm has a number of strategic initiatives in place that we believe are designed to position our firm for sustainable, lasting success. For more detail on where we stand with our ongoing strategic initiatives, see "Item 7. Management's Discussion and Analysis" in this Annual Report for this discussion.

Investments

We believe that skillfully deployed active management, in all of its many forms, is an effective investment approach to achieving client goals across changing market environments. Whether investing in a country, industry, or individual company, we hold a strong belief that price matters across all of our strategies. We are focused on helping our clients avoid permanent loss of capital over long time horizons, which is different than managing day-to-day volatility.

All of our research engines deploy investment processes that are team-based in nature. By focusing on research teams instead of individuals, we believe we are better able to emphasize repeatable processes instead of star personalities, while helping protect clients from staff turnover. Our investment processes are designed to allow teams to collaborate and combine top-down, bottom-up, and quantitative research.

Additionally, we view environmental, social and governance ("ESG") integration as necessary for the future success of any investment manager. We have consistently considered ESG factors in our research analyses and risk assessments, and during 2021 we fully implemented ESG analysis throughout our fundamental, core investment processes for equities and credits. ESG integration is also part of our quantitative strategies, including our ESG multi-asset class exchange-traded fund ("ETF") strategies. We believe that in-depth insights on ESG factors, coupled with active engagement with companies and thoughtful voting in shareholder meetings, can be helpful in generating the investment outcomes our clients desire.

We believe our research department of several dozen primarily home-grown investment professionals enhance the consistency of our investment processes. As warranted, we may add to or supplement our research teams with additional investment professionals.

Dynamic financial markets result in a fast-changing industry, and we recognize the need for our investment strategies to continuously evolve. We regularly review seeded portfolios to ensure that we are supporting competitive strategies that resonate with clients, while simultaneously closing portfolios that are no longer viable. As of December 31, 2021, we have approximately $7.6 million invested in seed capital with our research teams in new strategy concepts and expect to continue to deploy capital to support innovation in the future.

Client Experience

Our business is based on confidence and trust. We believe we must deliver a client experience that communicates clearly, is collaborative, and is accountable to clients. We view our clients as our partners, and we recognize that building successful client-partner relationships leads to a natural expansion of our business.

As of December 31, 2021, we have approximately 50 client-facing professionals, who are responsible for maintaining existing relationships and cultivating new business. Referrals are also a key source of new business, further highlighting the importance of our comprehensive client service and solutions. Our clients and client-facing professionals are supported by our client service and custody teams who provide ongoing administrative support and are an important component to maintaining relationships.

Our client-facing professionals focus on specific areas of expertise. Our Wealth Management group specializes in individuals and middle market relationships, including non-profits, small businesses, and other organizations, using a team-approach organized by region. In Asset Management, our Intermediary and Institutional teams cover wider territories and concentrate on larger institutions, consultants, and Taft-Hartley relationships, as well as third-party intermediaries.

Alongside these professionals, our Advisory Services team of internal subject-matter experts provide consultative advice tailored to individual client needs. For example, our experts have capabilities ranging from estate plan and trust review for families, retirement plan design analysis for employers, and donor relations and planned giving services for endowments and foundations.

Our marketing strategy is focused on finding new ways to connect and engage with clients and prospects via targeted content on products, services, and topics that are most relevant to our various audiences. We have dedicated resources creating engaging and relevant content that positions Manning & Napier as a thought leader and a trusted resource. This content strategy focuses on educating investors, and it mirrors the consultative nature of our firm. We disseminate content in various ways, including through print publications, email, webinars, live events, our website, and social media.

In order for our investment teams and client-centric personnel to be most effective, we believe we must also have excellence in our middle- and back-office functions. These include our technology, operations, human resources, and compliance functions, each of which play a critical role in forming the foundation of business success.

In particular, our technological strategy is focused on using software-as-a-service solutions while retaining in-house capabilities as needed. We believe that by leveraging the robust expertise of external providers, we can improve the nimbleness and efficiency of our organization. This approach provides the most up-to-date technology enabling a superior client experience, improving the employee experience, and streamlining operational processes.

Competition

Historically, we have competed to attract business on the basis of:

•the breadth of financial solutions we offer clients in an integrated manner;

•the investment excellence and long-term track records of our strategies;

•the consultative advice we provide addressing clients’ unique challenges and needs;

•the quality of the client experience and the duration of our relationships with them; and

•the pricing of our solutions compared to competitors.

Our ability to continue to compete effectively will depend upon our ability to retain our current investment and client-facing professionals and employees, as well as to attract highly qualified new professionals and employees. We compete in all aspects of our business with a large number of investment management firms, commercial banks, broker-dealers, insurance companies and other financial institutions.

Structure

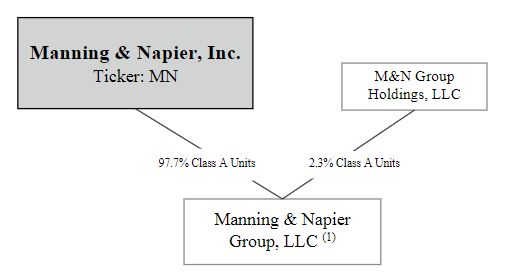

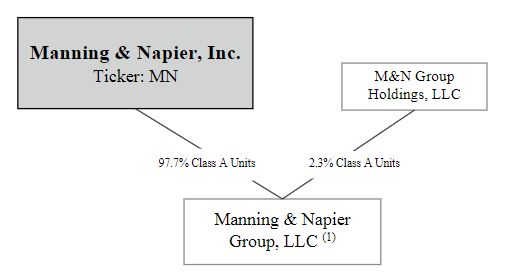

The Company was incorporated in 2011 as a Delaware corporation, and is the sole managing member of Manning & Napier Group, LLC and its subsidiaries (“Manning & Napier Group”), a holding company for the investment management businesses conducted by its operating subsidiaries. The diagram below depicts our organizational structure as of December 31, 2021. The Company completed the exchange of 1,562,959 Class A units held by M&N Group Holdings, LLC ("M&N Group Holdings") and 30,010 Class A units held by Manning & Napier Capital Company, LLC ("MNCC"), the entirety of its ownership in Manning & Napier Group, on June 30, 2021 through the issuance of 1,592,969 shares of Class A Common Stock of the Company. As a result, Manning & Napier acquired an equivalent number of Class A units of Manning & Napier Group and its ownership of Manning & Napier Group increased from approximately 89.0% to 97.7%. The diagram below depicts the Company's organizational structure as of December 31, 2021.

______________________

(1)The consolidated operating subsidiaries of Manning & Napier Group include Manning & Napier Advisors, LLC ("MNA"), Manning & Napier Investor Services, Inc., Exeter Trust Company and Rainier Investment Management, LLC ("Rainier").

As of December 31, 2021, we had 279 employees, 270 of which are full-time, most of whom are based in our Fairport, New York office. During the COVID-19 pandemic almost all of our employees have been working remotely.

Regulation

Our business is subject to extensive regulation in the United States at the federal level and, to a lesser extent, the state level and by self-regulatory organizations. We are also subject to regulations outside of the United States. Under certain of these laws and regulations, agencies that regulate our business have broad administrative powers, including the power to limit, restrict or prohibit regulated entities from carrying on business in the event that they fail to comply with such laws and regulations. Possible sanctions that may be imposed include the suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of registrations, censures and fines.

SEC Regulation

MNA and Rainier are registered with the U.S. Securities and Exchange Commission, (the "SEC"), as an investment adviser under the U.S. Investment Advisers Act of 1940, as amended, (the "Advisers Act"). The Manning & Napier Fund, Inc., (the "Fund"), which is managed by MNA except for the Rainier International Discovery Series, for which Rainier serves as the sub-advisor, is registered under the U.S. Investment Company Act of 1940, (the "1940 Act"). Additionally, Manning & Napier Investor Services, Inc. (“MNBD”), distributor for the Fund, is registered with the SEC, as a broker-dealer under the Exchange Act.

The Advisers Act, the 1940 Act and the Exchange Act, together with the SEC’s regulations and interpretations thereunder, impose substantive and material restrictions and requirements on the operations of advisers, mutual funds and broker-dealers. The SEC is authorized to institute proceedings and impose sanctions for violations of the Advisers Act, the 1940 Act, and the Exchange Act, ranging from fines and censures to termination of registration.

As an investment adviser, we have fiduciary duties to our clients that are broad and apply to our entire relationship with our clients. These duties require us to serve the best interest of our clients and not subordinate the client's interest to our own. The SEC has interpreted these duties to impose standards, requirements and limitations on, among other things:

•trading for proprietary, personal and client accounts;

•allocations of investment opportunities among clients;

•use of soft dollars;

•execution of transactions; and

•recommendations to clients.

We manage accounts for a majority of our clients on a discretionary basis, which typically affords us the authority to buy and sell securities for each portfolio, select broker-dealers to execute trades and negotiate brokerage commission rates. In connection with designated trade executions, we receive soft dollar credits from broker-dealers, which effectively reduces certain of our expenses. We believe all of our soft dollar arrangements comply with the safe harbor provided by Section 28(e) of the Exchange Act. Constraints on our ability to use soft dollars as a result of statutory amendments or new regulations would increase our operating expenses and potentially hamper our investment process by limiting or eliminating access to vital research.

As a registered adviser, we are subject to many additional requirements that cover, among other things:

•disclosure of information about our business to clients;

•maintenance of formal policies and procedures;

•maintenance of extensive books and records;

•restrictions on the types of fees we may charge;

•custody of client assets;

•client privacy;

•advertising; and

•solicitation of clients.

The SEC has authority to inspect any investment adviser and typically inspects a registered adviser periodically to determine whether the adviser is conducting its activities (i) in accordance with applicable laws, (ii) consistent with disclosures made to clients and (iii) with adequate policies, procedures and systems to ensure compliance.

For the year ended December 31, 2021, 15% of our revenues were derived from our advisory services to investment companies registered under the 1940 Act, including 15% derived from our advisory services to the Fund. The 1940 Act imposes significant requirements and limitations on a registered fund, including with respect to its capital structure, investments and transactions. While we exercise broad discretion over the day-to-day management of the business and affairs and investment portfolios of the Fund and the investment portfolios of the funds we sub-advise, our own operations are subject to oversight and management by each fund’s board of directors. Under the 1940 Act, a majority of the directors must not be “interested persons” with respect to us (sometimes referred to as the “independent director” requirement). The responsibilities of the board include, among other things, approving our investment management agreement with the Fund; approving other service providers; determining the method of valuing assets; and monitoring transactions involving affiliates. Our investment management agreements with the Fund may be terminated by the funds on not more than 60 days’ notice, and are subject to annual renewal by the Fund board after their initial term.

The 1940 Act also imposes on the investment adviser to a mutual fund a fiduciary duty with respect to the receipt of the adviser’s investment management fees. That fiduciary duty may be enforced by the SEC through administrative action or litigation by investors in the fund pursuant to a private right of action.

Under the Advisers Act, our investment management agreements may not be assigned without the client’s consent. Under the 1940 Act, investment management agreements with registered funds (such as the mutual funds we manage) terminate automatically upon assignment. The term “assignment” is broadly defined and includes direct assignments as well as assignments that may be deemed to occur upon the transfer, directly or indirectly, of a controlling interest in us.

MNBD as an SEC-registered broker-dealer and distributor for the Fund, is subject to SEC rules and regulations, including the Uniform Net Capital Rule, which requires MNBD to maintain a certain level of liquid assets. MNBD complied with its net capital requirements during the year ended December 31, 2021.

As a limited purpose broker-dealer, MNBD primarily acts as distributor of the Fund and offers only limited brokerage services to certain customers of the Fund. MNBD does not offer or sell securities, other than the Fund, provide investment advice or carry customer accounts. While MNBD and its financial professionals do not act in a fiduciary capacity, they are subject to the full scope of Regulation Best Interest. Under Regulation Best Interest, MNBD and its financial professionals must adhere to a higher standard of care and act in a customer’s best interest when making security, strategy or account type recommendations, including recommendations to invest in the Fund.

FINRA Regulation

MNBD is a member of the Financial Industry Regulatory Authority ("FINRA") and as such is subject to the various industry and professional regulations, standards, and reporting requirements established by FINRA.

ERISA-Related Regulation

We are a fiduciary under the Employee Retirement Income Security Act of 1974, as amended ("ERISA"), with respect to assets that we manage for benefit plan clients subject to ERISA. ERISA, regulations promulgated thereunder and applicable provisions of the Internal Revenue Code of 1986, as amended (the "IRC"), impose certain duties on persons who are fiduciaries under ERISA, prohibit certain transactions involving ERISA plan clients and provide monetary penalties for violations of these prohibitions.

The fiduciary duties under ERISA may be enforced by the U.S. Department of Labor by administrative action or litigation and by our benefit plan clients pursuant to a private right of action. The IRS may also assess excise taxes against us if we engage in prohibited transactions on behalf of or with our benefit plan clients.

New Hampshire Banking Regulation

Exeter Trust Company is a state-chartered non-depository trust company subject to the laws of the State of New Hampshire and the regulations promulgated thereunder by the New Hampshire Bank Commissioner.

Non-U.S. Regulation

Our sales and trading practices also subject us to certain foreign regulations. We have claimed an exemption from registration in Canada but are subject to those provincial regulations that apply to our limited operations in select Canadian provinces. Additionally, we invest globally and must adhere to country specific equity ownership reporting requirements in those foreign jurisdictions in which we invest. Our relationship with foreign domiciled clients or our sales and marketing efforts also could subject us to certain foreign regulations. We expect this trend to persist as such regulations increasingly have transnational application.

Human Capital Management

We believe that our employees are the lifeblood of our business, and the long-term success of our clients and shareholders is highly dependent on the accomplishments of our people. To that end, we are heavily invested in the success of our people and work to ensure that there is strong economic alignment between our people and our clients and shareholders.

We believe deeply that character matters and that firms with great cultures and strongly held values stand a better chance of delivering excellent results for all stakeholders. We are fiduciaries, and for over 50 years, we have always understood in the most profound ways what it means to put clients' interests first.

As of December 31, 2021, we had 279 employees, the majority of whom are based in Fairport, New York. Women represented 42% of our workforce, while people of color represented 10%. The Executive Committee that is responsible for day-to-day operations of the firm is comprised of 33% female members, while 22% are people of color. Increasing the diversity of our firm, its leadership and its board is a stated objective for our management team and the board.

We are committed to a workplace of belonging, and our Committee for Diversity and Inclusion is a critical component in setting a tone where diversity is embraced, celebrated and utilized to drive better decision making and outcomes for all stakeholders. Our long-term goal is to have a workforce and a leadership team whose makeup is similar to the demographics of our country and the communities in which we do business. This will take time, but we are committed to making consistent progress. To that end, we have established goals against which we can measure our progress, specifically that 20% of new employees hired annually will be racially or ethnically diverse, and 50% will be women.

Our goal is to foster a creative and innovative workplace that is a reflection of our values and the communities in which we operate. We are committed to attracting, developing and retaining a diverse team of highly talented and engaged employees to deliver superior solutions and provide excellent service to our clients. We want to be a destination of choice for the most capable and promising talent.

We devote significant resources to ensure that we have a deep bench of talented employees that have the necessary training to perform their duties, including firm-sponsored training and development activities, assistance for continuing professional education and tuition assistance for academic programs.

We strive for high levels of employee engagement to support our values-based culture. We provide employees with the tools and flexibility to maintain a healthy work-life balance. We are committed to frequent and meaningful communication with employees, and solicit regular feedback from them, both informally and via survey data. We employ a comprehensive objective setting and performance review process to ensure clear feedback is given and people know what is expected and how they are doing. Consistent with our values, we encourage openness and healthy debate.

Our compensation philosophy is designed to achieve alignment between our employees' interests and those of our clients and shareholders. Our investment professionals receive incentive compensation that is directly tied to the results they achieve for clients. While substantial outperformance allows our research personnel to earn more than their target bonuses, as they did in 2020, substantial underperformance yields a negative bonus that must be earned back in future years. Beginning in 2021, for our more highly compensated personnel, those making more than $150,000 in total compensation, a portion of their incentive compensation is deferred and invested in Manning & Napier mutual funds, ensuring that we are investing alongside our clients. We also award long term incentive compensation to about a third of our employees in the form of investments in Manning & Napier mutual funds that vest over 5 years. We utilize competitive benchmarking data to ensure that our compensation packages are fair and competitive.

We are committed to the communities in which we operate. We strongly encourage engagement of our staff in their efforts to give back and support our communities, providing them with paid days off for volunteering. Our corporate giving supports philanthropies delivering essential services to the most vulnerable, focusing on education, housing, food, and healthcare.

Available Information

All annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports, we file or furnish with the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act are available free of charge from the SEC’s website at http://www.sec.gov/.

We also make the documents listed above available without charge through the Investor Relations section of our website at http://ir.manning-napier.com/. Such documents are available as soon as reasonably practicable after the electronic filing of the material with the SEC. The contents of, or information that can be accessed through, our website are not incorporated by reference into this Annual Report.

Item 1A. Risk Factors.

Risks Related to our Business

Our revenues are dependent on the market value and composition of our AUM, which are subject to significant fluctuations and have been impacted by the novel coronavirus (COVID-19) pandemic and its effect on the U.S. and global economy.

We derive the majority of our revenue from investment management fees, typically calculated as a percentage of the market value of our AUM. As a result, our revenues are dependent on the value and composition of our AUM, all of which are subject to fluctuation due to many factors, including:

•Declines in prices of securities in our portfolios. The prices of the securities held in the portfolios we manage may decline due to any number of factors beyond our control, including, among others, the impacts of the novel coronavirus (COVID-19) pandemic on the companies whose securities are held in the portfolios we manage, political instability and uncertainty, including the Russian invasion of Ukraine, inflation, declining stock or commodities markets, changes in interest rates, a general economic downturn, U.S. and global export controls and sanctions, pandemics or other health crises, or acts of terrorism. The U.S. and global financial markets continue to be subject to uncertainty and instability. Such factors could cause an unusual degree of volatility and price declines for securities in the portfolios we manage;

•Redemptions and other withdrawals. Our clients generally may withdraw their funds at any time, on very short notice and without any significant penalty. A substantial portion of our revenue is derived from investment advisory agreements that are terminable by clients upon short notice or no notice and investors in the mutual funds we advise can redeem their investments in those funds at any time without prior notice. Also, new clients and portfolios may not have the same client retention characteristics as we have experienced in the past. In a declining stock market, the pace of redemptions could accelerate;

•Investment performance. Our ability to deliver strong investment performance depends in large part on our ability to identify appropriate investment opportunities in which to invest client assets. If we are unable to identify sufficient appropriate investment opportunities for existing and new client assets on a timely basis, our investment performance could be adversely affected. The risk that sufficient appropriate investment opportunities may be unavailable is influenced by a number of factors including general market conditions. If our portfolios perform poorly, even over the short-term, as compared with our competitors or applicable third-party benchmarks, or the rankings of mutual funds we manage decline, we may lose existing AUM and have difficulty attracting new assets; and

•Competition from passive strategies. There has been an increasing preference for passive investment products, such as index and ETFs over active strategies managed by asset managers. If this market preference continues, existing and prospective clients may choose to invest in passive investment products, our growth strategy may be impaired and our AUM may be negatively impacted.

The market disruption caused by COVID-19 may continue for as long or longer than the restrictions on in-person interactions imposed by federal, state and local governments. The acts of war in Ukraine and impact of sanctions on Russia and Russian companies may impact global markets and cause a decline in our AUM, which would result in lower investment management revenues. If this period of economic disruption and volatility continues or worsens, our AUM could be reduced, and if we are unable to reduce expenses, our net income will be reduced in the near term. Should the war in Ukraine and collateral effects of the COVID-19 pandemic continue for an extended period of time, our business, financial condition, results of operations and cash flows may likewise be materially adversely impacted for an extended period of time.

If any of the factors described above cause a decline in our AUM, it would result in lower investment management revenues. If our revenues decline without a commensurate reduction in our expenses, our net income will be reduced and our business will be adversely affected.

We derive substantially all of our revenues from contracts and relationships that may be terminated upon short or no notice.

We derive substantially all of our revenues from investment advisory and sub-advisor agreements, all of which are terminable by clients upon short notice or no notice and without any significant penalty.

Our mutual fund and collective investment trust relationships may be terminated or not renewed for any number of reasons. Our investment management agreements with mutual funds, as required by law, are generally terminable by the funds’ board of directors or a vote of the majority of the funds’ outstanding voting securities on not more than 60 days’ written notice. After an initial term, each fund’s investment management agreement must be approved and renewed annually by such fund’s board, including by its independent members. Similarly, our investment management agreements with the collective investment trusts may be terminated at any time by Exeter Trust Company's board of directors, which includes independent members. As of December 31, 2021, mutual fund and collective investment trust relationships represent 28% of our AUM and 23% of our revenue for the year ended December 31, 2021.

To the extent that there is continued economic uncertainty, or significant volatility in the stock or bond markets, clients may withdraw their funds from our investment solutions. Regardless of the performance of our products, if similar products offered by competitors perform poorly, our clients could lose confidence in our products and withdraw their funds from our investment solutions. If a significant proportion of our clients withdraw their funds, our AUM and results of operations could be materially adversely impacted.

The decrease in revenues that could result from the termination of a material client relationship or group of client relationships could have an adverse effect on our business. During the fiscal year ended December 31, 2021, other than our relationship with the Fund, there were no customers that provided over 10 percent of our total revenue.

We may not realize the expected benefits from our operational improvement initiatives relating

to our strategic review of our business.

We commenced a strategic review of our business upon the appointment of our new Chief Executive, Marc Mayer, in early 2019. Our comprehensive review resulted in changes to our overall distribution strategy, our suite of investment offerings, and our operational platform. The objective of this review was to improve financial results for stockholders and investment results for clients by more clearly prioritizing our strengths, eliminating distractions and sub-scale offerings, and increasing productivity across the firm through improved technology. There can be no assurance that the costs of undertaking our operational improvement initiatives will be offset by future earnings that may result from the improvements, and it is possible that we will not realize the expected benefits from our operational improvement initiatives to the extent we anticipate or at all.

Our portfolios may not obtain attractive returns under certain market conditions or at all.

The goal of our investment process is to provide competitive absolute returns over full market cycles. Accordingly, our portfolios may not perform well compared to benchmarks or other investment managers’ strategies during certain periods of time, under certain market conditions, or after specific market shocks. Underperformance may negatively affect our ability to retain clients and attract new clients. We are likely to be most out of favor when the markets are running on positive or negative price momentum and market prices become disconnected from underlying investment fundamentals. During and shortly following such periods of relative under performance, we are likely to see our highest levels of client turnover, even if our absolute returns are positive. Loss of client assets and the failure to attract new clients could adversely affect our revenues and growth.

Difficult market conditions, like those during the current COVID-19 pandemic and related to the Russian invasion of Ukraine, can adversely affect our strategies in many ways, including by negatively impacting their performance and reducing their ability to raise or deploy capital, which could materially reduce our revenues and adversely affect our business, financial condition or results of operations.

Significant disruptions and volatility in the global financial markets and economies, like the current conditions caused by the Russian invasion of Ukraine and the COVID-19 pandemic, could impair the investment performance of our strategies. Although we seek to generate consistent, positive, absolute returns across all market cycles, our strategies have been and may be materially affected by conditions in the global financial markets and economic conditions. The global market and economic climate may become increasingly uncertain due to numerous factors beyond our control, including but not limited to, the effectiveness and acceptance of vaccines to prevent COVID-19, impacts on business operations in the U.S. related to the COVID-19 pandemic, such as supply chain disruptions and inflation, concerns related to unpredictable global market and economic factors, uncertainty in U.S. federal fiscal, tax, trade or regulatory policy and the fiscal, tax, trade or regulatory policy of foreign governments, rising interest rates, inflation or deflation, the availability of credit, performance of financial markets, terrorism, natural or biological catastrophes, public health emergencies, or political uncertainty.

A general market downturn, a specific market dislocation or deteriorating economic conditions may cause a material reduction in our revenues and adversely affect our business, financial condition or results of operations by causing:

•A decline in AUM, resulting in lower management fees and incentive income.

•An increase in the cost of financial instruments, executing transactions or otherwise doing business.

•Lower or negative investment returns, which may reduce AUM and potential incentive income.

•Reduced demand for assets held by our funds, which would negatively affect our funds’ ability to realize value from such assets.

•Increased investor redemptions or greater demands for enhanced liquidity or other terms, resulting in a reduction in AUM, lower revenues and potential increased difficulty in raising new capital.

During the first quarter of 2020 when the COVID-19 pandemic began, there was a global market downturn which caused a decline in our AUM primarily due to market depreciation. While there has been significant market volatility since the COVID-19 pandemic began, our AUM as of December 31, 2021 has since increased by $5.5 billion since March 31, 2020, driven by market appreciation of approximately $8.0 billion. However, if conditions causing a widespread market downturn were to occur again, our business, financial condition, results of operations and cash flows may be materially adversely impacted for an extended period of time.

Furthermore, while difficult market and economic conditions and other factors can potentially increase investment opportunities over the long term, such conditions and factors also increase the risk of increased investment losses and additional regulation, which may impair our business model and operations. Our strategies may also be adversely affected by difficult market conditions if we fail to assess the adverse effect of such conditions, which would likely result in significant reductions in the returns of those strategies. Moreover, challenging market conditions may prompt industry-wide reductions in fees. In response to competitive pressures or for any other reason, we may reduce or change our fee structures, which could reduce the amount of fees and income that we may earn relative to AUM.

An investment in our Class A common stock is not an alternative to investing in our strategies, and the returns of our strategies should not be considered as indicative of any returns expected on our Class A common stock, although if our strategies perform poorly, our revenue could be materially adversely impacted, which may in turn impact the returns on our Class A common stock.

The returns on our Class A common stock are not directly linked to the historical or future performance of our investment strategies. Even if our strategies experience positive performance and our AUM increases, holders of our Class A common stock may not experience a corresponding positive return on their Class A common stock.

However, poor performance of our strategies could cause a decline in our revenues, and may therefore have a negative effect on our performance and the returns on our Class A common stock. If we fail to meet the expectations of our clients or otherwise experience poor performance, whether due to difficult economic and financial conditions or otherwise, our ability to retain existing AUM and attract new clients could be materially adversely affected. In turn, the fees that we would earn would be reduced and our business, financial condition or results of operations would suffer, thus negatively impacting the price of our Class A common stock. Furthermore, even if the investment performance of our strategies is positive, our business, financial condition or results of operations and the price of our Class A common stock could be materially adversely affected if we are unable to attract and retain additional AUM consistent with our past experience, industry trends or investor and market expectations.

The loss of key investment and sales professionals, members of our senior management team, or difficulty integrating new executives, could have an adverse effect on our business.

We depend on the skills, expertise and institutional knowledge of our key employees, including qualified investment and sales professionals and members of our senior management team, and our success depends on our ability to retain such key employees. Our investment professionals possess substantial experience in investing and have been primarily responsible for the historically attractive investment performance we have achieved. We particularly depend on our executive officers as well as senior members of our research department. We may not be able to recruit, retain and motivate the investment professionals necessary for our success given the extremely competitive market for these professionals over the last year, and we may experience upward pressure on compensation packages because of the competitive environment for talent. If we are unable to retain our current employees or to recruit talented professionals, we may lose expertise and institutional knowledge,which could adversely affect our business.

In addition, difficulty integrating new executives, or the loss of key individuals could limit our ability to successfully execute our business strategy and could have an adverse effect on our overall financial condition.

Competition for qualified investment, sales and top level management professionals is intense. Attracting qualified personnel, including top level management, may take time and we may fail to attract and retain qualified personnel including top level management in the future. Our ability to attract and retain our executive officers and other key employees will depend heavily on our business strategy, corporate culture and the amount and structure of compensation. We have historically utilized a compensation structure that uses a combination of cash and long-term incentives as appropriate. However, our compensation may not be effective to recruit and retain the personnel we need if our overall compensation packages are not competitive in the marketplace. Any cost-reduction initiative or adjustments or reductions to compensation could negatively impact our ability to retain key personnel, as could changes to our management structure, corporate culture and corporate governance arrangements.

We may be required to reduce the fees we charge, or our fees may decline due to changes in our AUM composition, which could have an adverse effect on our profit margins and results of operations.

Our current fee structure may be subject to downward pressure due to a variety of factors, including a trend in recent years toward lower fees in the investment management industry. We may be required to reduce fees with respect to both the separate accounts we manage and the mutual funds and collective trust funds we advise. We may charge lower fees in order to attract future new business, which may result in us having to also reduce our fees with respect to our existing business. Any further fee reductions on existing or future new business could have an adverse effect on our profit margins and results of operations.

Our AUM may be concentrated in certain strategies or in certain geographic areas.

Client purchase and redemption activity may result in AUM concentrations with certain of our investment strategies. As a result, a substantial portion of our operating results may depend upon the performance of these strategies. If we sustain poor investment performance or adverse market conditions, clients may withdraw their investments or terminate their investment management agreements. To the extent any of these strategies is concentrated in an industry or geographic area that is disproportionately negatively impacted by the COVID-19 pandemic, the concentration of our AUM in those strategies will likely have a disproportionately negative impact on our revenues. These conditions would result in a reduction in our revenues from these strategies, which could have an adverse effect on our earnings and financial condition.

Our business is primarily focused in certain targeted geographic regions making us vulnerable to risks associated with having geographically concentrated operations.

Although our client base is national, we are primarily focused in certain targeted geographic regions, including the northeastern and southeastern regions of the United States. Furthermore, our review of our intermediary and institutional distribution strategy resulted in changes to our territory coverage and servicing efforts in order to more effectively service our existing clients with our team, while concentrating on geographies with the greatest chances for growth. This could have the effect of increasing the risks associated with having geographically concentrated operations, including increasing the risk that our business will be negatively impacted by the COVID-19 pandemic if its impacts are concentrated in any of these geographic

areas. Our business, financial condition and results of operations may be susceptible to regional economic downturns and other regional factors.

Several of our portfolios involve investing principally in the securities of non-U.S. companies, which involve foreign currency exchange risk, and tax, political, social and economic uncertainties and risks.

As of December 31, 2021, approximately 21% of our AUM across all of our portfolios was invested in securities of non-U.S. companies. Fluctuations in foreign currency exchange rates could negatively affect the returns of our clients who are invested in these strategies. An increase in the value of the U.S. dollar relative to non-U.S. currencies is likely to result in a decrease in the U.S. dollar value of our AUM, which, in turn, could result in lower revenue since we report our financial results in U.S. dollars.

Investments in non-U.S. issuers may also be affected by tax positions taken in countries or regions in which we are invested as well as political, social and economic uncertainty. Declining tax revenues may cause governments to assert their ability to tax the local gains and/or income of foreign investors (including our clients), which could adversely affect clients’ interests in investing outside their home markets. Many financial markets are not as developed, or as efficient, as the U.S. financial markets, and as a result, those markets may have limited liquidity and higher price volatility and may lack established regulations. Liquidity may also be adversely affected by political or economic events, government policies, social or civil unrest within a particular country, and our ability to dispose of an investment may also be adversely affected if we increase the size of our investments in smaller non-U.S. issuers. Non-U.S. legal and regulatory environments, including financial accounting standards and practices, may also be different, and there may be less publicly available information about such companies. These risks could adversely affect the performance of our strategies that are invested in securities of non-U.S. issuers and may be particularly acute in the emerging or less developed markets in which we invest.

The historical returns of our existing portfolios may not be indicative of their future results or of the portfolios we may develop in the future.

The historical returns of our portfolios and the ratings and rankings we or the mutual funds that we advise have earned in the past should not be considered indicative of the future results of these portfolios or of any other portfolios that we may develop in the future. The investment performance we achieve for our clients varies over time and the variance can be wide. The ratings and rankings we or the mutual funds we advise have earned are typically revised monthly. The historical performance and ratings and rankings included in this report are as of December 31, 2021 and for periods then ended except where otherwise stated. The performance we have achieved and the ratings and rankings earned at subsequent dates and for subsequent periods may be higher or lower and the difference could be material. Our portfolios’ returns have benefited during some periods from investment opportunities and positive economic and market conditions. In other periods, general economic and market conditions have negatively affected our portfolios’ returns. These negative conditions may occur again, and in the future we may not be able to identify and invest in profitable investment opportunities within our current or future portfolios.

Support provided to new products may reduce fee income, increase expenses and expose us to potential loss on invested capital.

We may support the development of new investment products by waiving all or a portion of the fees we receive for managing such products, by subsidizing expenses or by making seed capital investments. Seed investments in new products utilize Company capital that would otherwise be available for general corporate purposes and expose us to capital losses to the extent that realized investment losses are not offset by hedging gains. The risk of loss may be greater for seed capital investments that are not hedged, or if an intended hedge does not perform as expected. Failure to have or devote sufficient capital to support new products could have on adverse impact on our future growth.

Assets influenced by third-party intermediaries have a higher risk of redemption and are subject to changes in fee structures, which could reduce our revenues.

Investments in our mutual funds made through third-party intermediaries, as opposed to mutual fund investments resulting from sales by our own representatives can be more easily moved to investments in funds other than ours. Third-party intermediaries are attractive to investors because of the ease of accessibility to a variety of funds, but this causes the investments to be more sensitive to fluctuations in performance, especially in the short-term. If we were unable to retain the assets of our mutual funds held through third-party intermediaries, our AUM would be reduced. As a result, our revenues could decline and our business, results of operations and financial condition could be materially adversely affected.

We may elect to pursue growth in the United States and abroad through acquisitions or joint ventures, which would expose us to risks inherent in assimilating new operations, expanding into new jurisdictions, and making non-controlling minority investments in other entities.

In order to maintain and enhance our competitive position, we may review and pursue acquisition and joint venture opportunities. We cannot assure we will identify and consummate any such transactions on acceptable terms or have sufficient resources to accomplish such a strategy. Any strategic transaction can involve a number of risks, including:

•additional demands on our staff;

•unanticipated problems regarding integration of investor account and investment security recordkeeping, operating facilities and technologies, and new employees;

•adverse effects in the event acquired intangible assets or goodwill become impaired;

•the existence of liabilities or contingencies not disclosed to or otherwise known by us prior to closing such a transaction; and

•dilution to our public stockholders if we issue shares of our Class A common stock, or units of Manning & Napier Group with exchange rights, in connection with future acquisitions.

A portion of our separate account business, mutual funds, and collective investment trusts are distributed through intermediaries, platforms, and consultants. Changes in key distribution relationships could reduce our revenues and adversely affect our profitability.

Given that a portion of our product offerings are distributed through intermediaries, platforms, and investment consultants, a share of our success is dependent on access to these various distribution systems. These distributors are not contractually required to distribute or consider our products for placement within advisory programs, on platforms’ approved lists, or in active searches conducted by investment consultants. Additionally, these intermediaries typically offer their clients various investment products and services, in addition to and in competition with our products and services. If we are unable to cultivate and build strong relationships within these distribution channels, the sales of our products could lead to a decline in revenues and profitability. Additionally, increasing competition for these distribution channels could cause our distribution costs to rise, which could have an adverse effect on our profitability.

Our efforts to establish new portfolios or new products or services may be unsuccessful and could negatively impact our results of operations and our reputation.

As part of our growth strategy, we may seek to take advantage of opportunities to develop new portfolios consistent with our philosophy of managing portfolios to meet our clients’ objectives and using a team-based investment approach. The initial costs associated with establishing a new portfolio likely will exceed the revenues that the portfolio generates. If any such new portfolio performs poorly or fails to attract sufficient assets to manage, our results of operations could be negatively impacted. Further, a new portfolio’s poor performance may negatively impact our reputation and the reputation of our other portfolios within the investment community. We have developed and may seek from time to time to develop new products and services to take advantage of opportunities involving technology, insurance, participant and plan sponsor education and other products beyond investment management. The development of these products and services could involve investment of financial and management resources and may not be successful in developing client relationships, which could have an adverse effect on our business. The cost to develop these products initially will likely exceed the revenue they generate and additional investment in these products could negatively impact short term financial results. If establishing new portfolios or offering new products or services requires hiring new personnel, to the extent we are unable to recruit and retain sufficient personnel, we may not be successful in further diversifying our portfolios, client assets and business, which could have an adverse effect on our business and future prospects.

Our failure to comply with investment guidelines set by our clients and limitations imposed by applicable law, could result in damage awards against us and a loss of our AUM, either of which could adversely affect our reputation, results of operations or financial condition.

When clients retain us to manage assets on their behalf, they generally specify certain guidelines regarding investment allocation that we are required to follow in managing their portfolios. We are also required to invest the mutual funds’ assets in accordance with limitations under the 1940 Act, and applicable provisions of the IRC. Other clients, such as plans subject to ERISA, or non-U.S. funds, require us to invest their assets in accordance with applicable law. Our failure to comply with any of these guidelines and other limitations could result in losses to clients or investors in our products which, depending on the circumstances, could result in our obligation to make clients whole for such losses. If we believed that the circumstances did not justify a reimbursement, or clients believed the reimbursement we offered was insufficient, clients could seek to recover damages from us, withdraw assets from our products or terminate their investment management agreement with us. Any of these events could harm our reputation and adversely affect our business.

A change of control of our company could result, and in the past has resulted, in termination of our investment advisory agreements.

Under the 1940 Act, each of the investment advisory agreements for SEC registered mutual funds that our affiliate, MNA, advises automatically terminates in the event of its assignment, as defined under the 1940 Act. If such an assignment were to occur, MNA could continue to act as adviser to any such fund only if that fund’s board of directors and stockholders approved a new investment advisory agreement, except in the case of certain of the funds that we sub-advise for which only board approval would be necessary. Under the Advisers Act each of the investment advisory agreements for the separate accounts we manage may not be assigned without the consent of the client. An assignment may occur under the 1940 Act and the Advisers Act if, among other things, MNA undergoes a change of control, such as in 2020, when we redeemed Class A Units of Manning & Napier Group, increasing our ownership of Manning & Napier Group from 19.5% to 88.2%. In certain other cases, the investment advisory agreements for the separate accounts we manage require the consent of the client for any assignment. If such an assignment occurs, we cannot be certain that MNA will be able to obtain the necessary approvals from the boards and stockholders of the mutual funds that it advises or the necessary consents from separate account clients.

New Hampshire banking laws applicable to our trust company include change in control restrictions.

Our subsidiary, Exeter Trust Company (“ETC”), is established under the laws of New Hampshire. The New Hampshire Revised Statutes Annotated require that an application be filed with the Bank Commissioner for prior approval in the event of a change of ownership or a change of control. If any person intends to acquire directly or indirectly 10 percent or more of the voting shares of the Company, then a “change of ownership” of ETC will occur. Likewise, the direct or indirect transfer of ownership of more than 50 percent of the voting shares of the Company will result in a “change of control” of ETC. Approval of the application by the Bank Commissioner may take 90 days or longer.

Operational risks may disrupt our business, result in losses or limit our growth.

We are heavily dependent on the capacity and reliability of the communications, information and technology systems supporting our operations, whether developed, owned and operated by us or by third parties. Operational risks such as trading or operational errors or interruption of our financial, accounting, trading, compliance and other data processing systems, whether caused by fire, natural disaster or pandemic, power or telecommunications failure, political or civil unrest, act of terrorism or war or otherwise, could result in a disruption of our business, liability to clients, regulatory intervention or reputational damage, and thus adversely affect our business. Some types of operational risks, including, for example, trading errors, may be increased in periods of increased volatility, which can magnify the cost of an error. Although we have back-up systems in place, our back-up procedures and capabilities in the event of a failure or interruption may not be adequate, and the fact that we operate our business out of multiple physical locations may make such failures and interruptions difficult to address on a timely and adequate basis.

We depend on our headquarters in Fairport, New York, where a majority of our employees, administration and technology resources are located, for the continued operation of our business. During the COVID-19 pandemic almost all of our employees are working remotely, which may impact the level of service that is provided to our clients. Any significant disruption to our headquarters could have an adverse effect on our business.

A failure to effectively maintain, enhance and modernize our information technology systems, and effectively develop and deploy new technologies, could adversely affect our business.