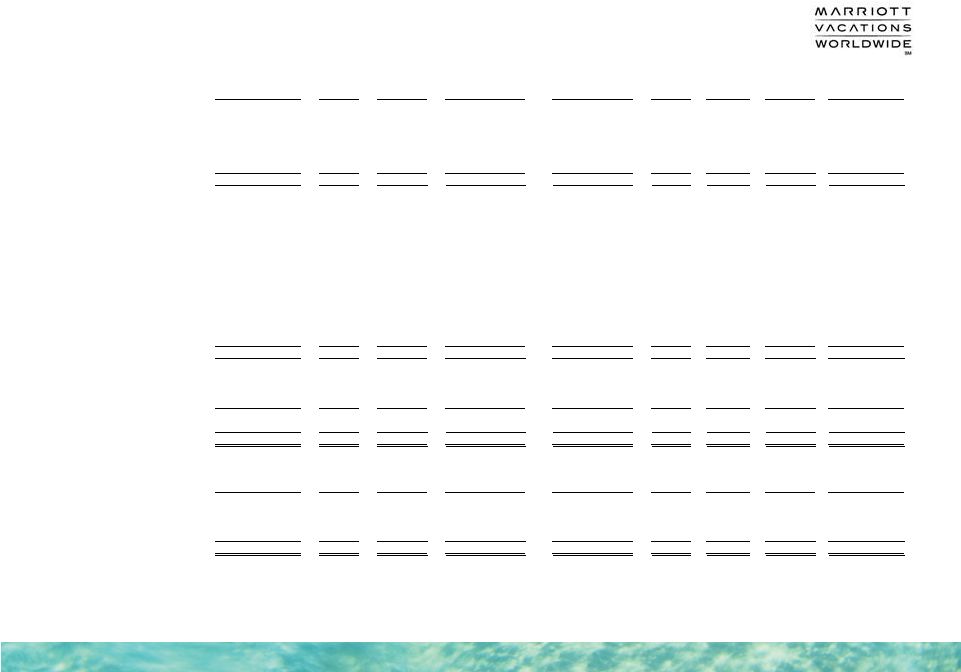

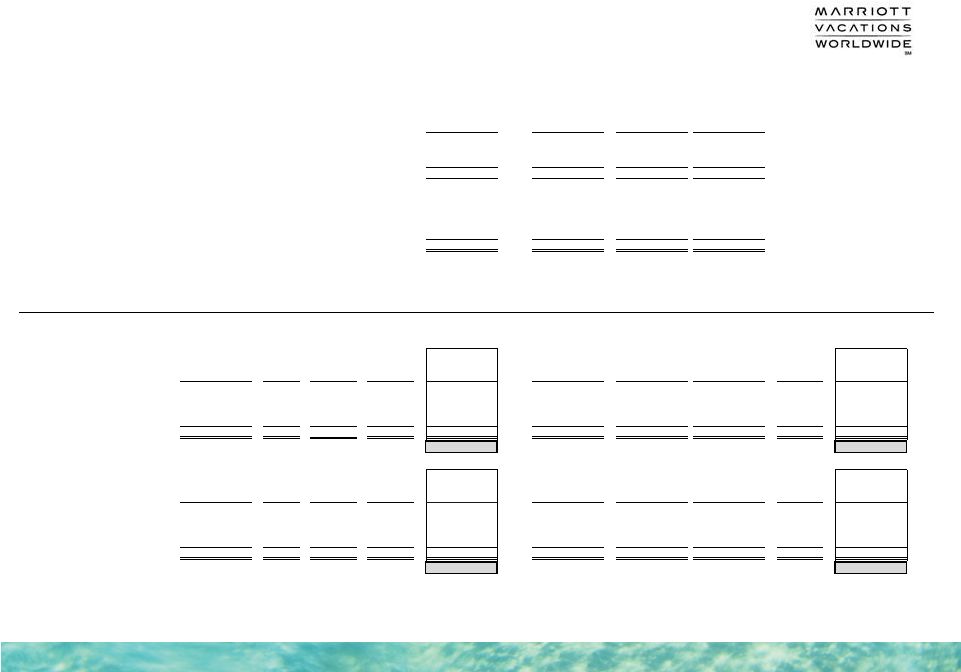

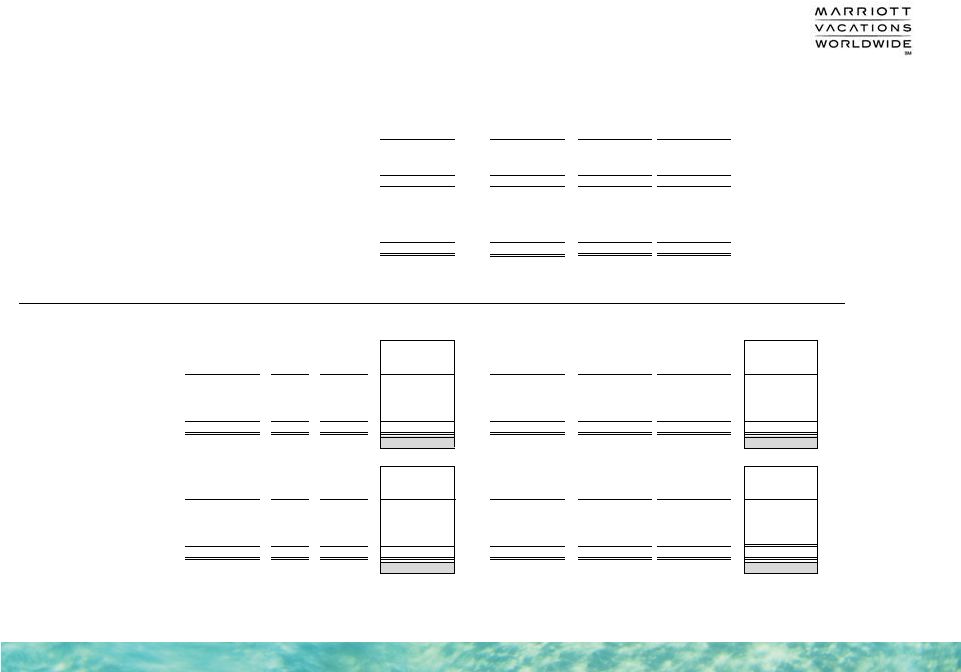

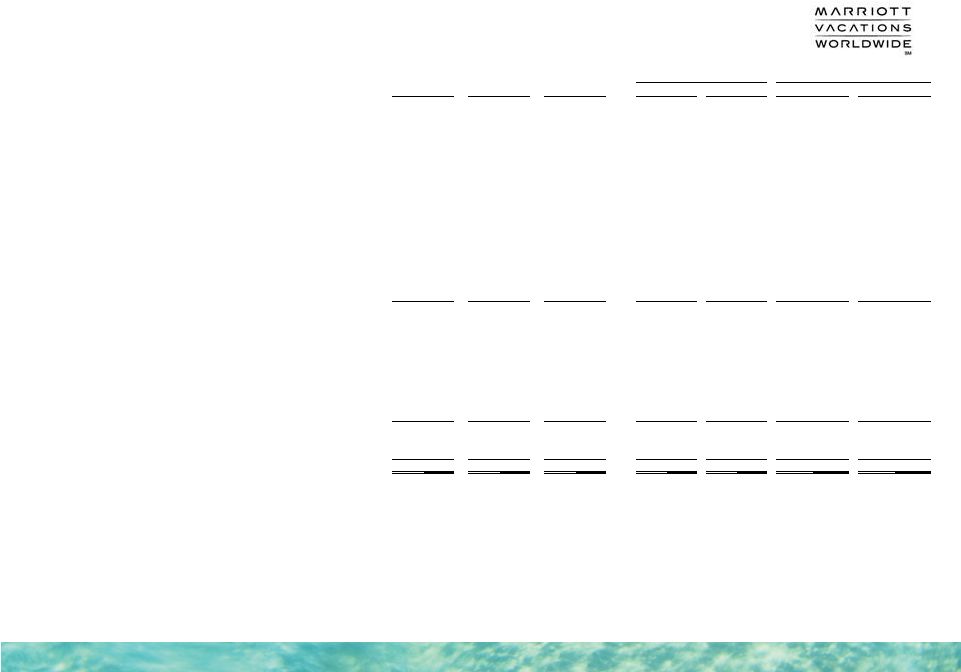

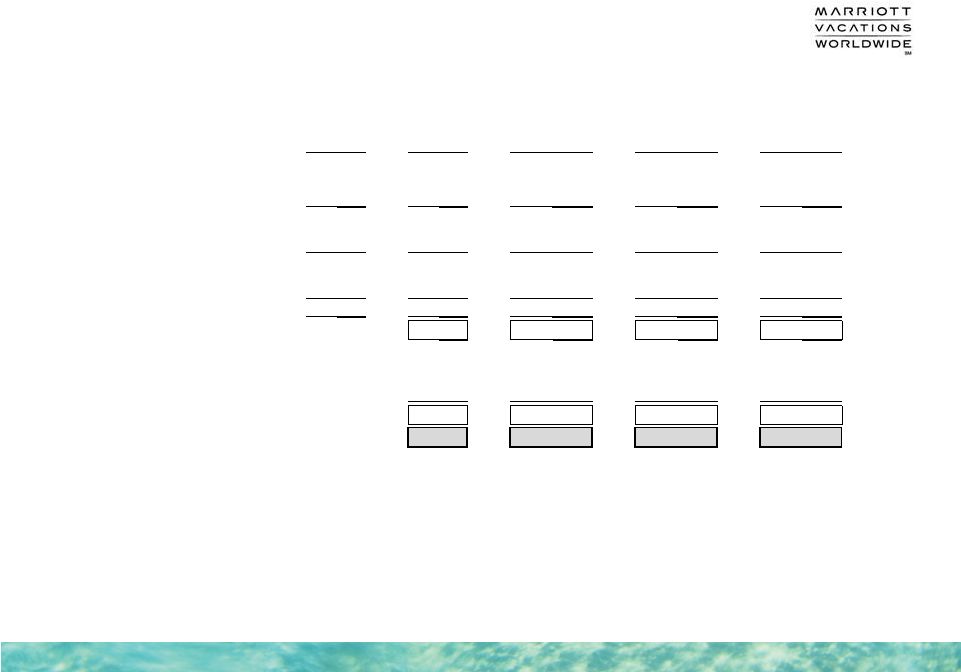

113 A-2 Non-GAAP Financial Measures In this presentation we report certain financial measures that are not prescribed or authorized by United States Generally Accepted Accounting Principles (“GAAP”). We discuss our reasons for reporting these non-GAAP financial measures below, and reconcile the most directly comparable GAAP financial measure to each non-GAAP financial measure that we report (identified by a double asterisk ("**") on the preceding pages). Although we evaluate and present these non-GAAP financial measures for the reasons described below, please be aware that these non-GAAP financial measures have limitations and should not be considered in isolation or as a substitute for revenues, net income, earnings per share or any other comparable operating measure prescribed by GAAP. In addition, these non-GAAP financial measures may be calculated and / or presented differently than measures with the same or similar names that are reported by other companies, and as a result, the non-GAAP financial measures we report may not be comparable to those reported by others. charges incurred in the 52 weeks ended January 2, 2015, the 53 weeks ended January 3, 2014 and the 52 weeks ended December 28, 2012 and December 30, 2011, (2) exclude non-cash impairment charges in the 52 weeks ended December 30, 2011, (3) exclude gains on dispositions in the 52 weeks ended January 2, 2015 and December 28, 2012, (4) include pro forma adjustments for the 52 weeks ended December 30, 2011 to reflect results as if we were a standalone public company throughout each period, and (5) exclude adjustments related to the extension of rescission periods in our Europe segment discussed below (“Europe Rescission Adjustments”) in the 53 weeks ended January 3, 2014 and the 52 weeks ended December 28, 2012 and December 30, 2011, because these non-GAAP financial measures allow for period-over-period comparisons of our on-going core operations before the impact of certain charges, non-cash impairment charges, gains and Europe Rescission Adjustments, and reflect results as if we were a standalone public company throughout each period. These adjustments are itemized below and on the following pages for fiscal years 2011 through 2014; to the extent certain charges, non-cash impairment charges or gains occur in fiscal years 2015 through 2018, similar adjustments would be made. These non-GAAP financial measures also facilitate our comparison of results from our on-going core operations before certain charges, non-cash impairment charges, gains and Europe Rescission Adjustments with results from other vacation ownership companies. included a $24 million non-cash loss associated with the disposition of partially developed land, an operating golf course, spa and clubhouse and related facilities at a former resort in our North America segment and settlement of related litigation under the "Litigation settlement" caption, $3 million of organizational and separation related costs recorded under the "Organizational and separation related" caption, a $3 million litigation settlement in our North America segment recorded under the "Litigation settlement" caption, and a $1 million impairment charge associated with a project in our North America segment recorded under the "Impairment" caption, partially offset by $8 million of income associated with the settlement of a dispute with a former service provider in our North America segment recorded under the "Litigation settlement" caption. $12 million of organizational and separation related costs recorded under the "Organizational and separation related" caption, an $8 million increase in our accrual for remaining costs we expected to incur in connection with our interest in an equity method investment in a joint venture project in our North America segment recorded under the "Impairment (charges) reversals on equity investment" caption, $5 million for a litigation settlement in our Europe segment recorded under the "Litigation settlement" caption, $2 million of severance costs in our Europe segment recorded under the "Marketing and sales" caption, and a $1 million pre-tax non-cash impairment charge related to a leased golf course at a project in our Europe segment recorded under the "Impairment" caption, partially offset by a $7 million gain for cash received in payment of fully reserved receivables in connection with an equity method investment in a joint venture project in our North America segment recorded under the "Impairment (charges) reversals on equity investment" caption, and a $1 million reversal of a previously recorded litigation settlement related to a project in our North America segment, based upon an agreement to settle the matter for an amount less than our accrual, recorded under the "Litigation settlement" caption. Adjusted Net Income. We evaluate non-GAAP financial measures including Adjusted Net Income, Adjusted EBITDA and Adjusted Development Margin, that (1) exclude certain Certain Charges - 52 weeks ended January 2, 2015. In our Statement of Income for the 52 weeks ended January 2, 2015,we recorded $23 million of net pre-tax charges, which Certain Charges - 53 weeks ended January 3, 2014. In our Statement of Income for the 53 weeks ended January 3, 2014,we recorded $20 million of pre-tax charges, which included |