Exhibit 99.1

\

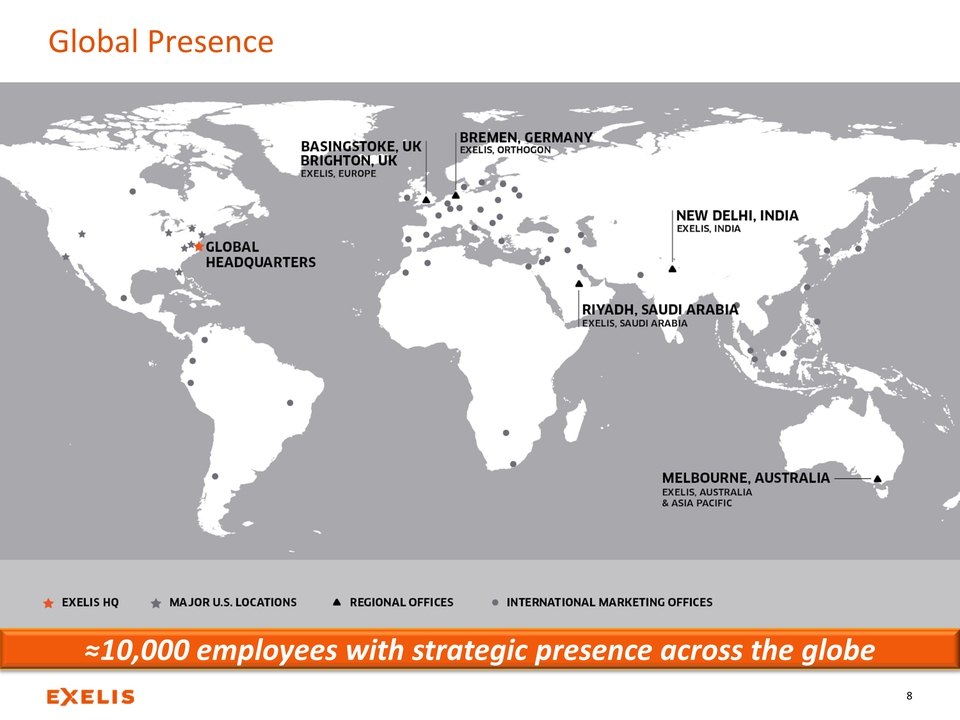

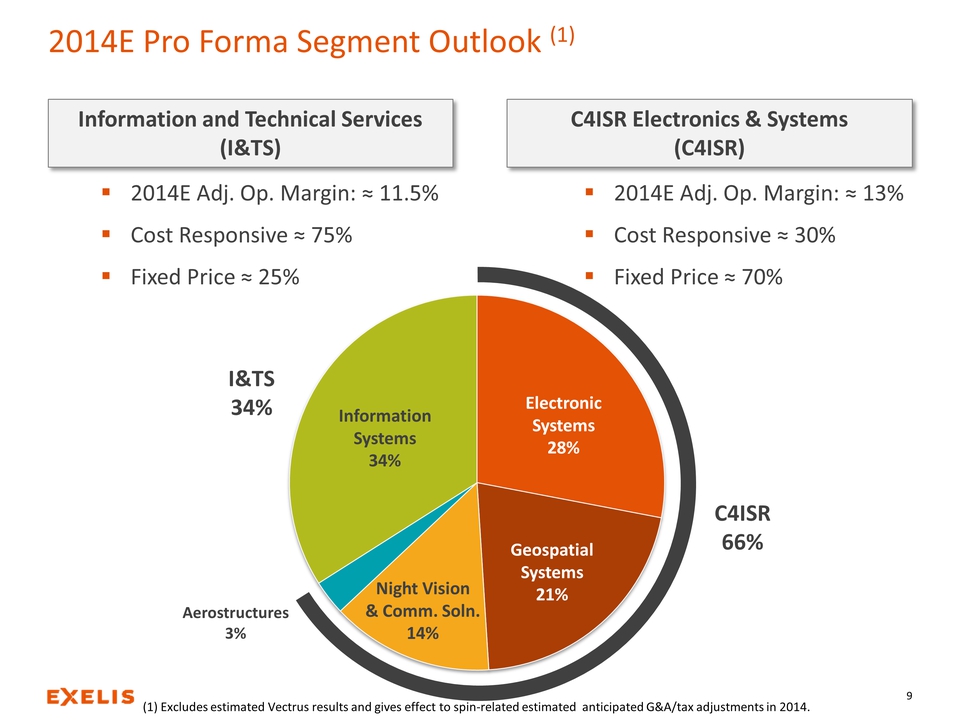

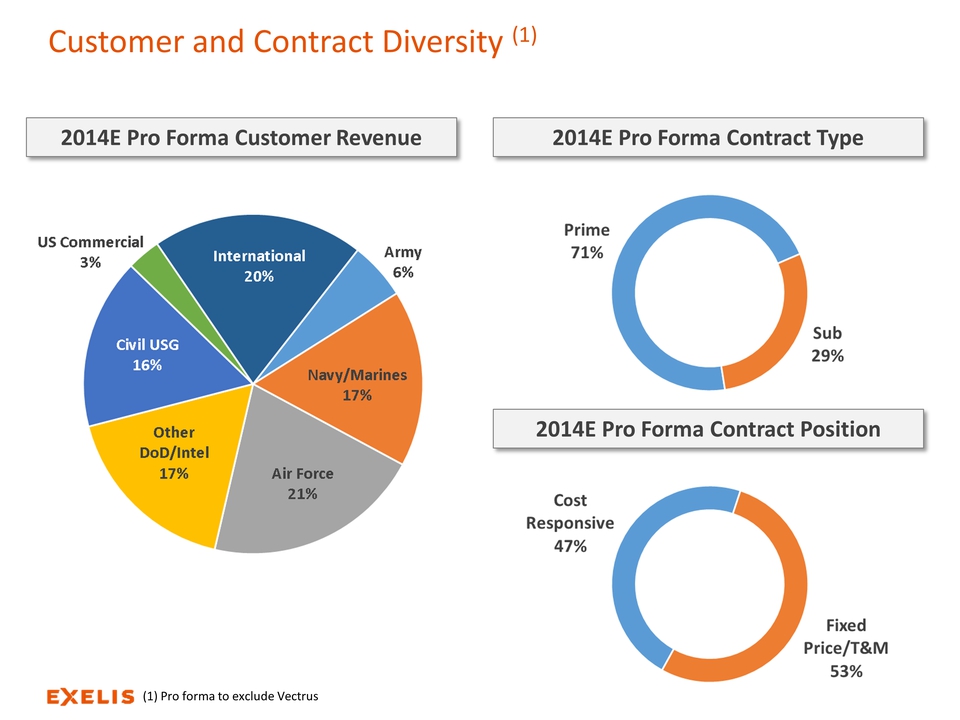

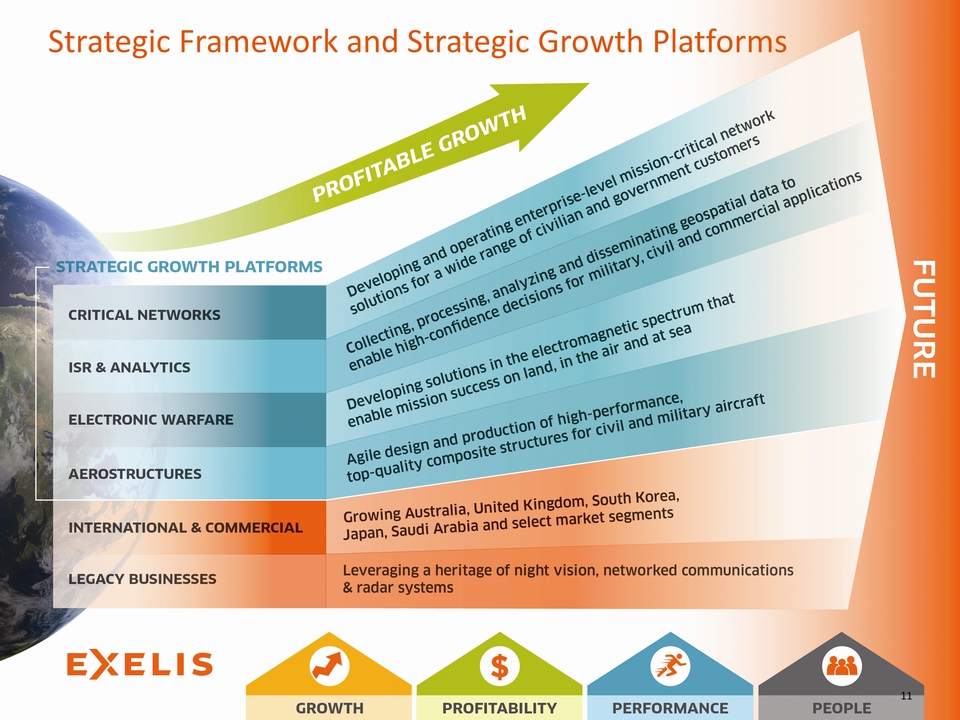

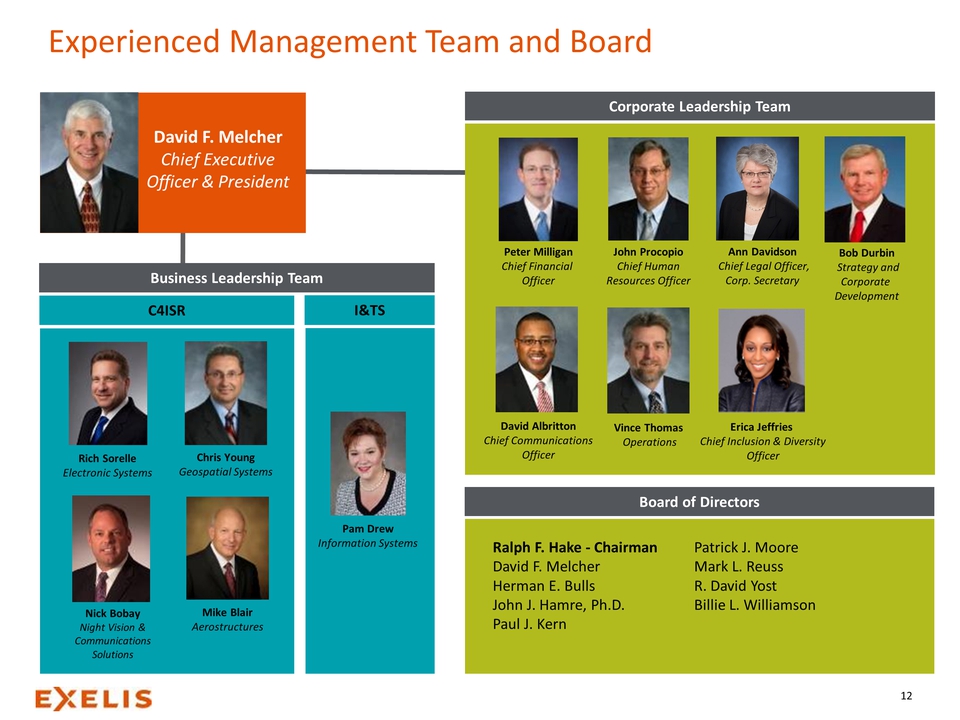

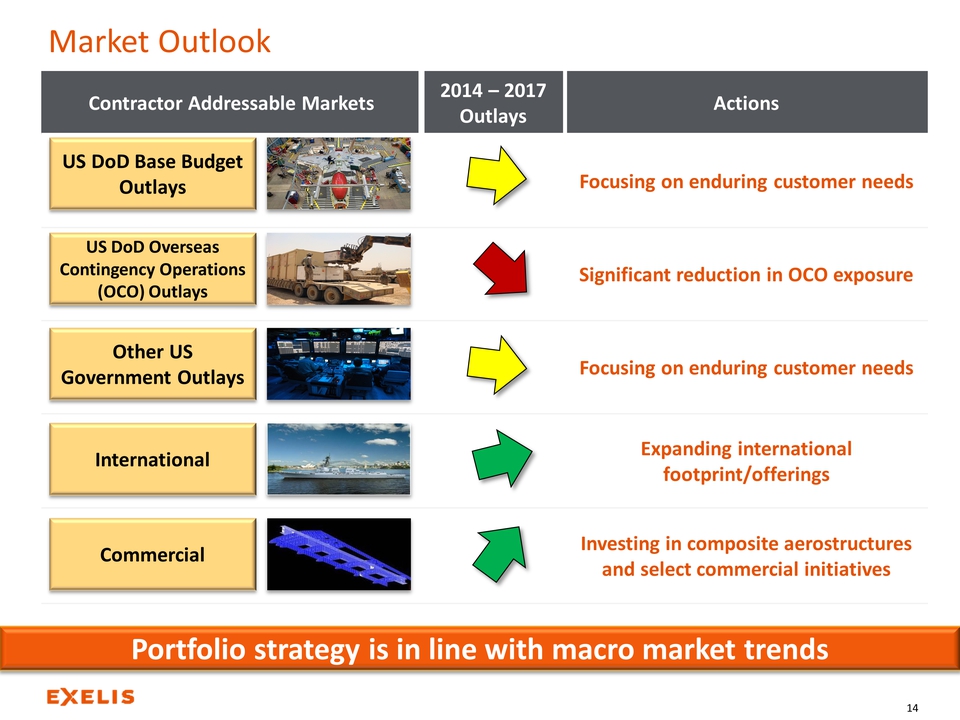

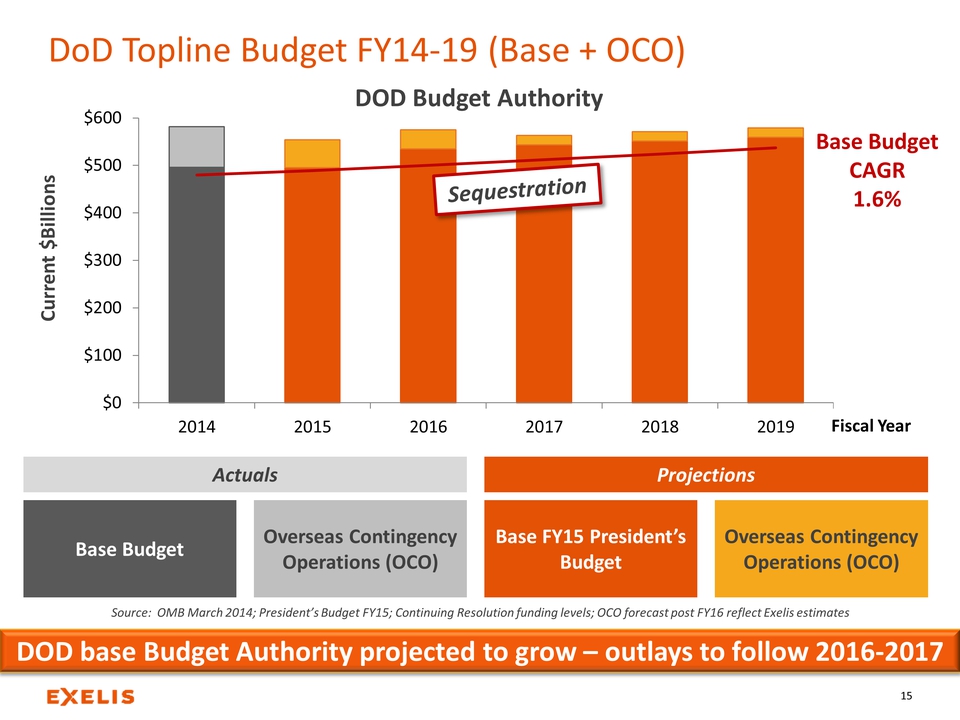

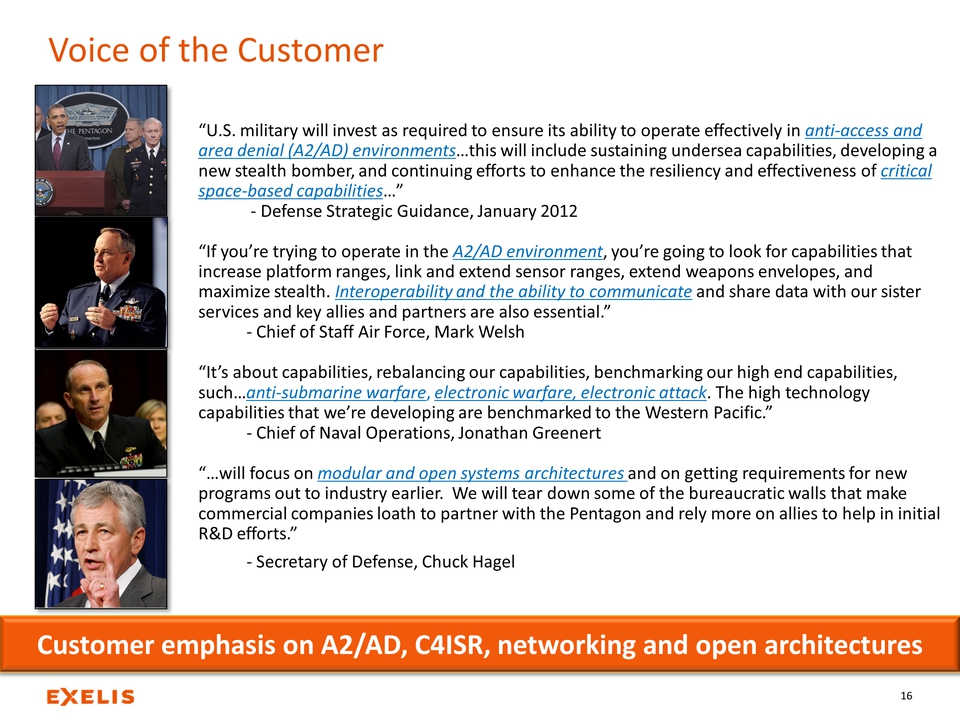

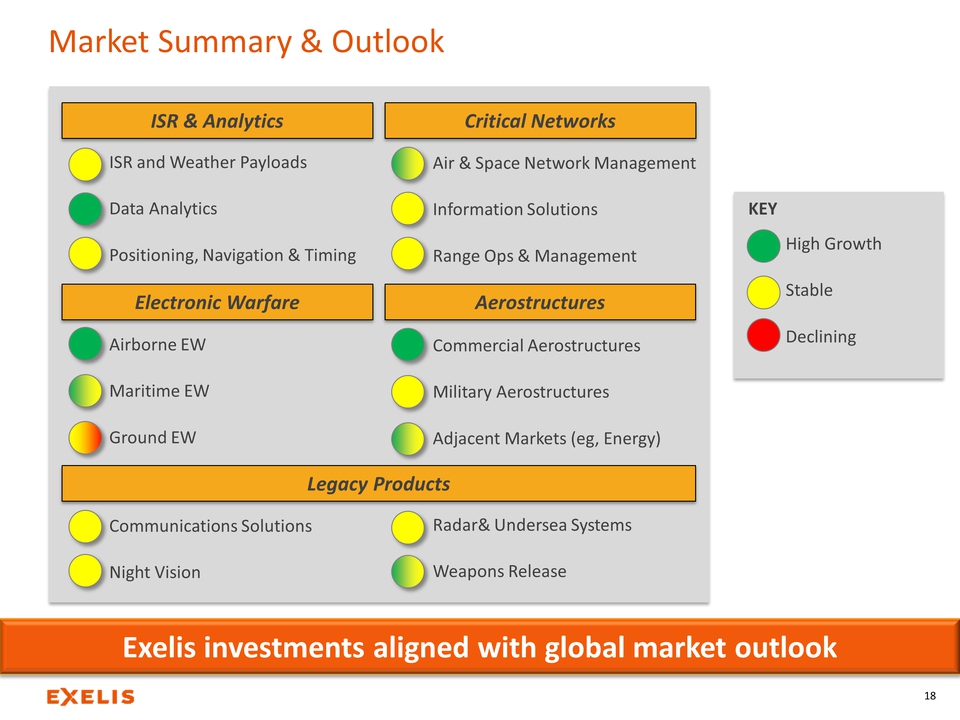

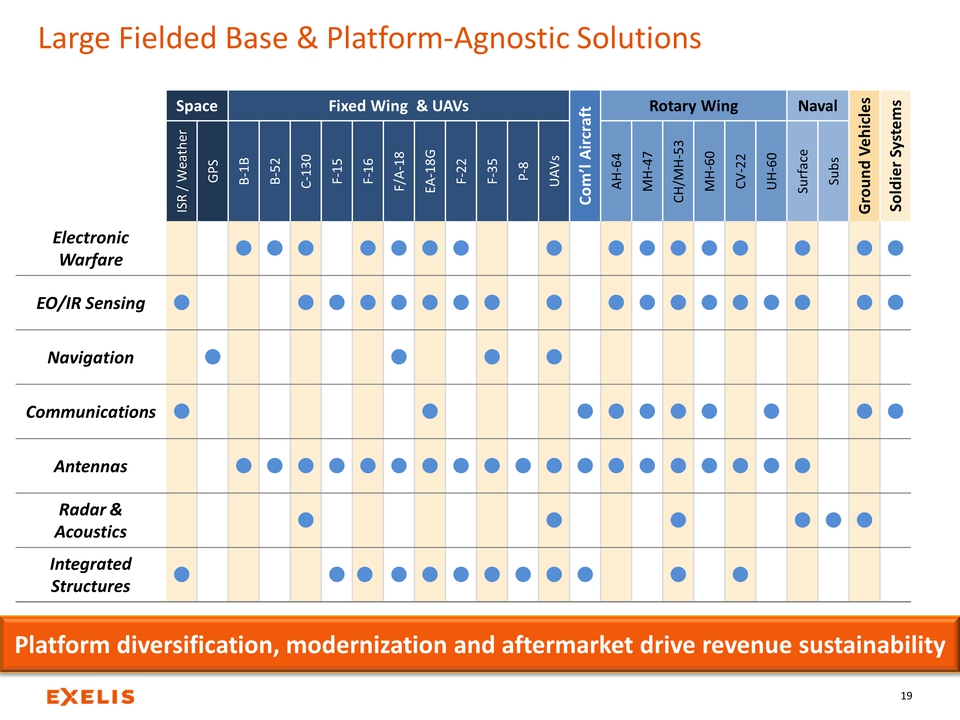

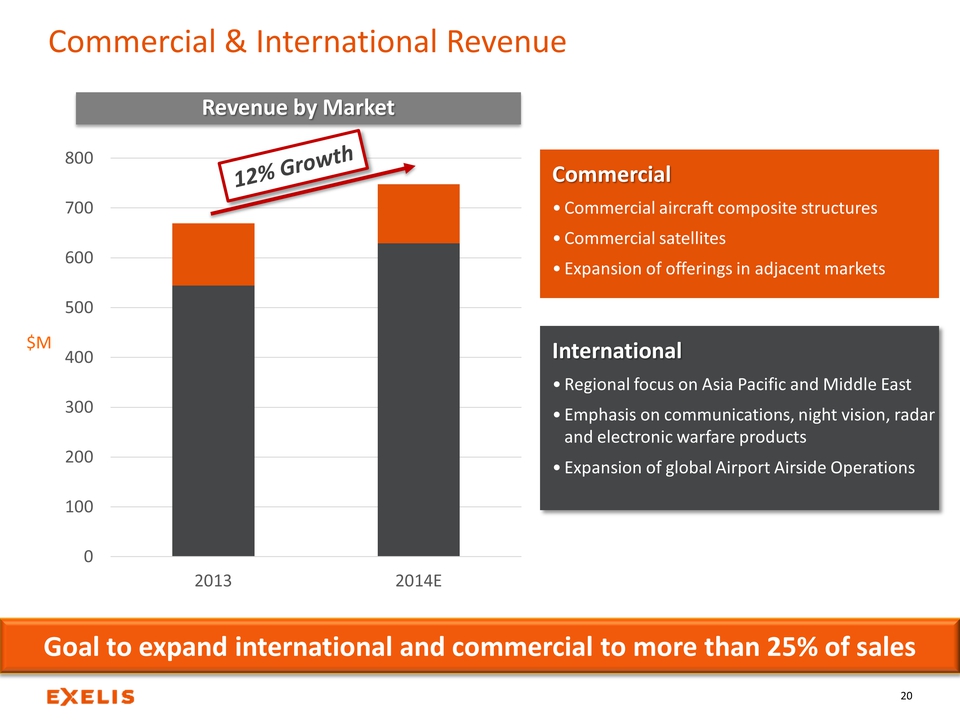

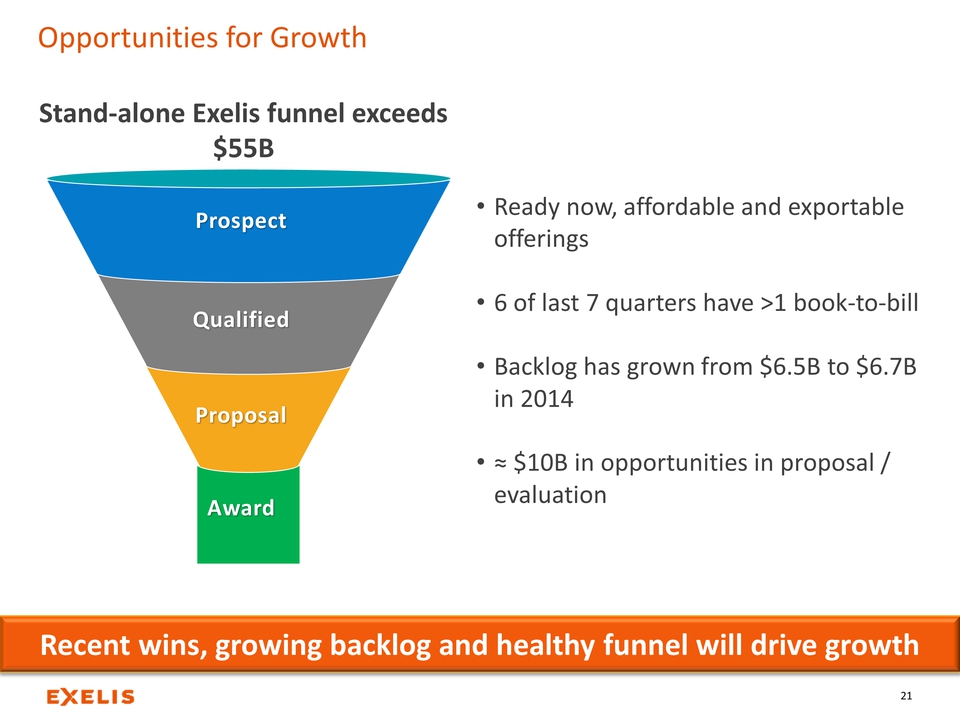

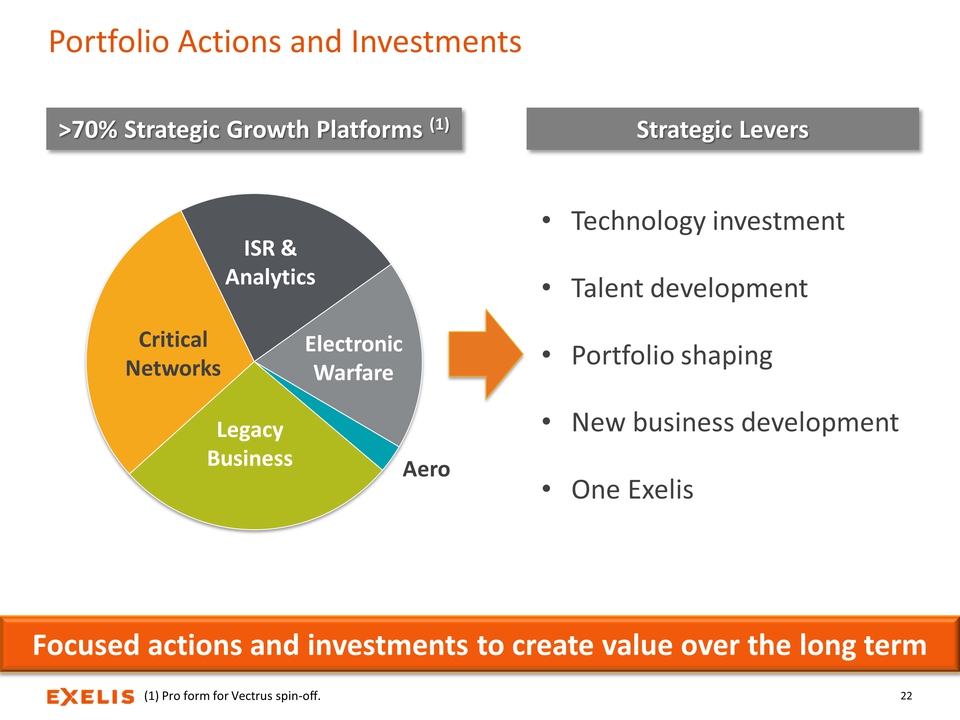

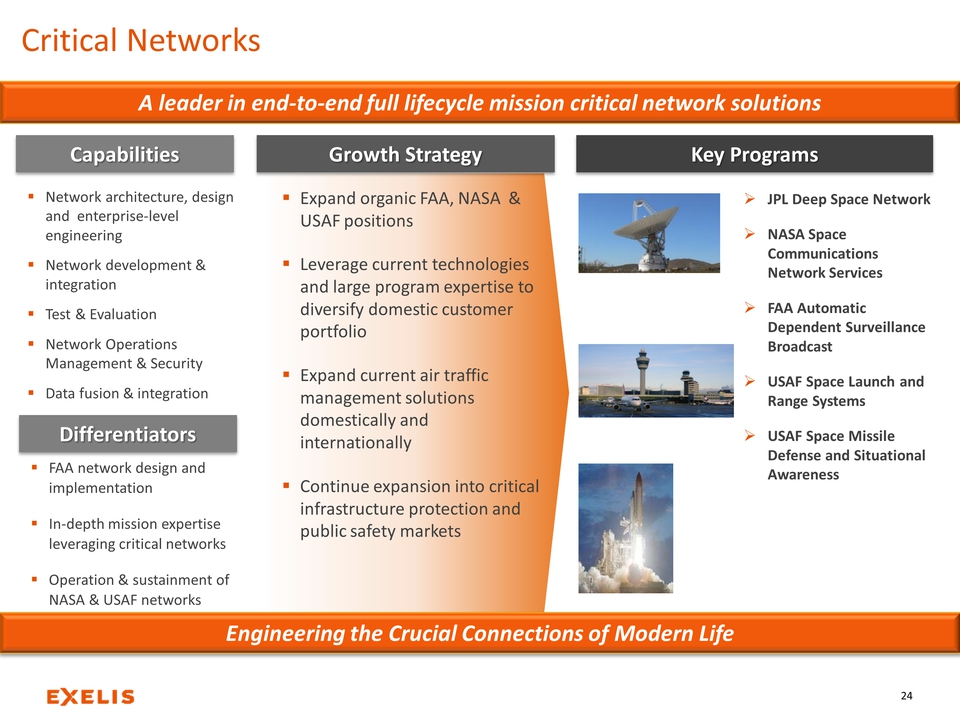

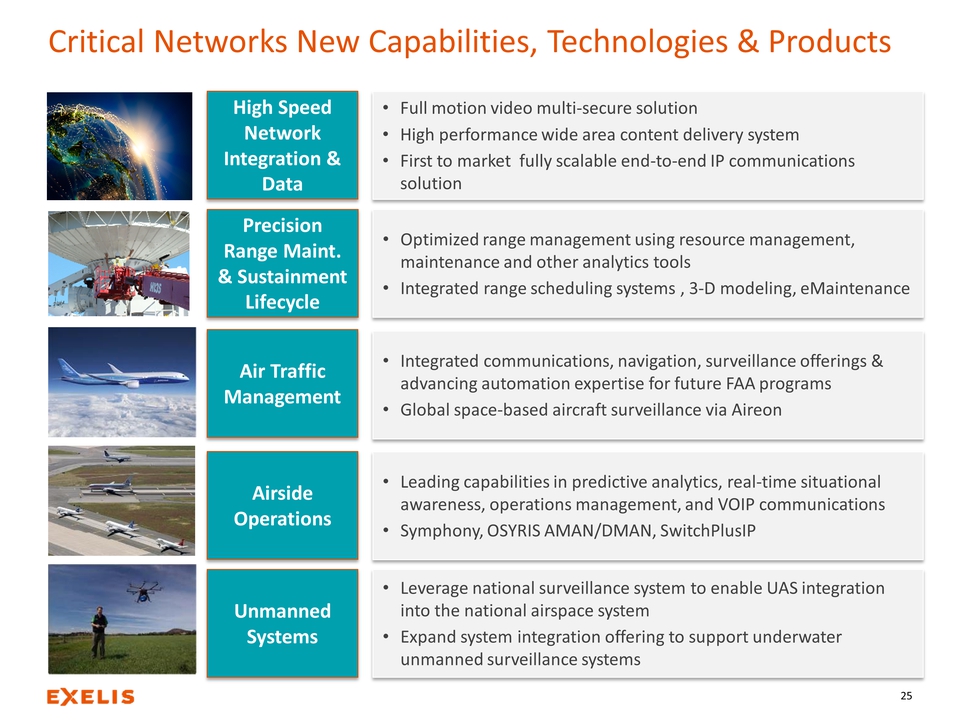

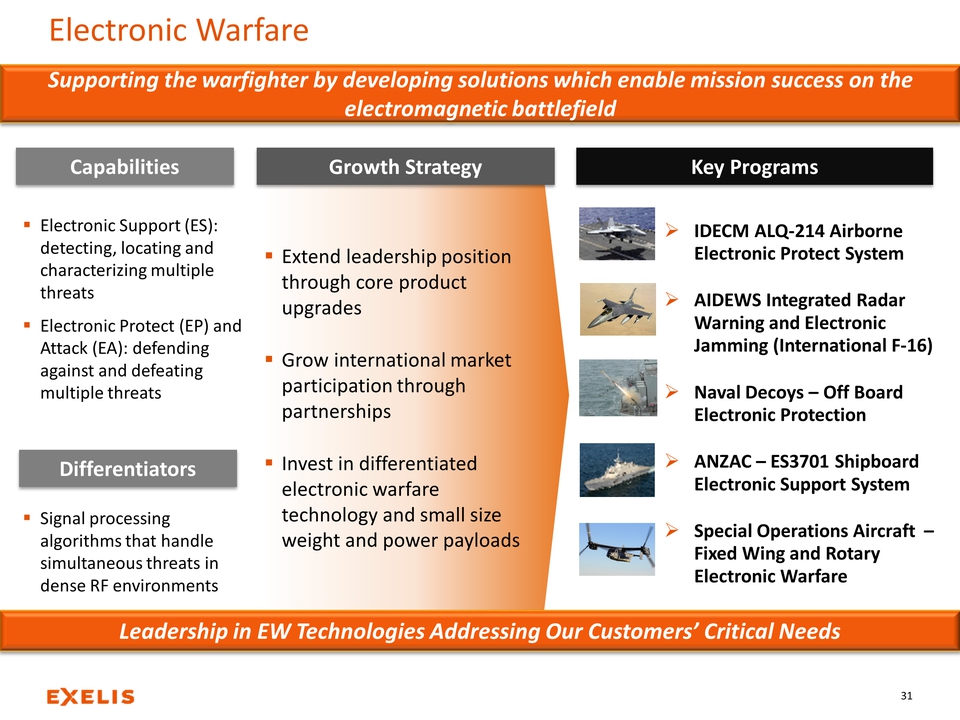

Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Investor and Analyst Meeting November 4, 2014 Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Forward-Looking Statements 2 Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 (the “Act”): Some of the information included herein includes forward-looking statements intended to qualify for the safe harbor from liability established by the Act. Whenever used, words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “may,” “could,” “outlook” and other terms of similar meaning are intended to identify such forward-looking statements. Forward-looking statements are uncertain and to some extent unpredictable, and involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed in, or implied from, such forward-looking statements. The company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward- looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the company’s historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to: The forward-looking statements in this presentation are made as of the date hereof and the company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the company’s historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to, those described in the Exelis Inc. Form 10-K for the fiscal year ended December 31, 2013, and those described from time to time in our future reports filed with the Securities and Exchange Commission. .Our dependence on the defense industry and the business risks peculiar to that industry, including changing priorities or reductions in the U.S. Government or international defense budgets; .Government regulations and compliance therewith, including changes to the Department of Defense procurement process; .Our international operations, including sales to foreign customers; .Competition, industry capacity and production rates; .Misconduct of our employees, subcontractors, agents and business partners; .The level of returns on postretirement benefit plan assets and potential employee benefit plan contributions and other employment and pension matters; .Changes in interest rates and other factors that affect earnings and cash flows; .The mix of our contracts and programs, our performance, and our ability to control costs; .Governmental investigations; .Our level of indebtedness and our ability to make payments on or service our indebtedness; .Subcontractor performance; .Economic and capital markets conditions; .The availability and pricing of raw materials and components; .Ability to retain and recruit qualified personnel; .Protection of intellectual property rights; .Changes in technology; .Contingencies related to actual or alleged environmental contamination, claims and concerns; .Security breaches and other disruptions to our information technology and operations; .Unanticipated changes in our tax provisions or exposure to additional income tax liabilities; and .Ability to execute our internal performance plans including restructuring, productivity improvements and cost reduction initiatives. Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Agenda 9:30 – 9:35 a.m. Opening Remarks: Katy Herr, VP, Investor Relations 9:35 – 9:55 Business Overview: David Melcher, CEO and President 9:55 – 10:10 Strategy & Business Development: Bob Durbin, SVP, Strategy & Corporate Development 10:10 – 10:25 Critical Networks: Pam Drew, President, Information Systems 10:25 – 10:40 ISR & Analytics: Christopher Young, President, Geospatial Systems 10:40 – 10:55 BREAK 10:55 – 11:10 Electronic Warfare: Rich Sorelle, President, Electronic Systems 11:10 – 11:25 Aerostructures: Mike Blair, VP and General Manager 11:25 – 11:40 Night Vision and Communications Solutions: Nick Bobay, President 11:40 – 12:00 p.m. Financial Overview: Peter Milligan, SVP and Chief Financial Officer 12:00 – 12:30 Question & Answer 3 Introduction & Business Overview David Melcher, Chief Executive Officer and President Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Investment Highlights 5 .Post-Vectrus spin, well positioned to focus on strategic growth platforms .Differentiated portfolio with attractive positions in enduring market segments .Growing backlog provides visibility .Proven record of program performance and operational excellence .Cash generation supports capital allocation strategy Announced ˜ 10% net share repurchase over 24 months Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Z:\Images and Photography\ITT Defense Images_Pre 2011\Night Vision Imaes 770.jpg Z:\Images and Photography\iStock Archive\iStock_000000123354Medium.jpg http://www.cars-images.com/images/wallpapers-aircraft-carrier.jpg 6 Exelis Vision Z:\Images and Photography\ITT Defense Images_Pre 2011\10018086.jpg H:\DocumentsPROJECTS2014-2018 Stratplan (2013)Corp Stratplan\Pix\Composite Aero_01.png http://www.exelisinc.com/solutions/corvuseye1500/PublishingImages/CorvusEye%201500/cover_Image_small.jpg We will be the most agile C4ISR, aerospace and information solutions provider by leveraging deep customer knowledge and technology expertise to deliver affordable, mission-critical products and services for our global customers Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png CyberCommand copy 2.jpg 89614765.jpg Exelis Today 7 Providing Customers With: Next-generation imaging that integrates space, airborne and ground sensors into broader, coordinated systems with advanced data analytics. Providing Customers With: End-to-end, full life-cycle provider of mission-critical network development and sustainment solutions. Information & Technical Services (I&TS) C4ISR Electronics & Systems (C4ISR) Geospatial Systems Information Systems 89614765.jpg plane2.jpg Providing Customers With: Networked communications and night vision systems, test and support capabilities, and interference mitigation solutions. Providing Customers With: Precision composite manufacturing and assembly solutions for complex aerospace applications, including primary airframe and wing structures, and components for missiles, spacecraft and engines. Night Vision & Communications Solutions Aerostructures Providing Customers With: The ability to sense and deny multispectral threats to manned and unmanned aircraft, ships, submarines, ground vehicles and personnel. Electronic Systems Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Exelis Geographic Footprint_v2_crop.jpg ˜10,000 employees with strategic presence across the globe Global Presence 8 Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png 2014E Pro Forma Segment Outlook (1) 9 I&TS 34% C4ISR 66% .2014E Adj. Op. Margin: ˜ 11.5% .Cost Responsive ˜ 75% .Fixed Price ˜ 25% Information and Technical Services (I&TS) C4ISR Electronics & Systems (C4ISR) .2014E Adj. Op. Margin: ˜ 13% .Cost Responsive ˜ 30% .Fixed Price ˜ 70% (1) Excludes estimated Vectrus results and gives effect to spin-related estimated anticipated G&A/tax adjustments in 2014. Aerostructures 3% Information Systems 34% Geospatial Systems 21% Electronic Systems 28% Night Vision & Comm. Soln. 14% Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Customer and Contract Diversity (1) 2014E Pro Forma Customer Revenue 2014E Pro Forma Contract Type 2014E Pro Forma Contract Position 10 (1) Pro forma to exclude Vectrus Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Strategic Framework and Strategic Growth Platforms 11 Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Experienced Management Team and Board 12 David F. Melcher Chief Executive Officer & President Dave Melcher Pam Drew Information Systems Chris Young Geospatial Systems 07 Rich Sorelle Electronic Systems Business Leadership Team Vince Thomas Operations Peter Milligan Chief Financial Officer 06 John Procopio Chief Human Resources Officer 26 Ann Davidson Chief Legal Officer, Corp. Secretary Albritton, David David Albritton Chief Communications Officer Bob Durbin Strategy and Corporate Development Corporate Leadership Team Board of Directors C4ISR I&TS Mike Blair Aerostructures Nick Bobay Night Vision & Communications Solutions Ralph F. Hake - Chairman David F. Melcher Herman E. Bulls John J. Hamre, Ph.D. Paul J. Kern Patrick J. Moore Mark L. Reuss R. David Yost Billie L. Williamson https://one.exelisinc.com/news/Exelis%20News%20Pictures/1312%20Short%20Report%20HQ/Jeffries%20for%20web.PNG Erica Jeffries Chief Inclusion & Diversity Officer Strategy and Business Development Bob Durbin, Senior Vice President, Strategy and Corporate Development Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Market Outlook Contractor Addressable Markets 2014 – 2017 Outlays Actions Focusing on enduring customer needs Significant reduction in OCO exposure Focusing on enduring customer needs Expanding international footprint/offerings Investing in composite aerostructures and select commercial initiatives 14 US DoD Base Budget Outlays US DoD Overseas Contingency Operations (OCO) Outlays Other US Government Outlays International Commercial Portfolio strategy is in line with macro market trends Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png $0 $100 $200 $300 $400 $500 $600 2014 2015 2016 2017 2018 2019 Base Budget Base FY15 President’s Budget Current $Billions DOD Budget Outlook 15 Overseas Contingency Operations (OCO) Fiscal Year Overseas Contingency Operations (OCO) Actuals Projections Sequestration Source: OMB March 2014; President’s Budget FY15; Continuing Resolution funding levels; OCO forecast post FY16 reflect Exelis estimates DoD Topline Budget FY14-19 (Base + OCO) Base Budget CAGR 1.6% * Assumes FY14 Actual Base Budget as base year and 2019 Sequestration level base spending as final year DOD base Budget Authority projected to grow – outlays to follow 2016-2017 DOD Budget Authority Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png DOD Budget Outlook 16 Voice of the Customer Customer emphasis on A2/AD, C4ISR, networking and open architectures “U.S. military will invest as required to ensure its ability to operate effectively in anti-access and area denial (A2/AD) environments…this will include sustaining undersea capabilities, developing a new stealth bomber, and continuing efforts to enhance the resiliency and effectiveness of critical space-based capabilities…” - Defense Strategic Guidance, January 2012 “If you’re trying to operate in the A2/AD environment, you’re going to look for capabilities that increase platform ranges, link and extend sensor ranges, extend weapons envelopes, and maximize stealth. Interoperability and the ability to communicate and share data with our sister services and key allies and partners are also essential.” - Chief of Staff Air Force, Mark Welsh “It’s about capabilities, rebalancing our capabilities, benchmarking our high end capabilities, such…anti-submarine warfare, electronic warfare, electronic attack. The high technology capabilities that we’re developing are benchmarked to the Western Pacific.” - Chief of Naval Operations, Jonathan Greenert “…will focus on modular and open systems architectures and on getting requirements for new programs out to industry earlier. We will tear down some of the bureaucratic walls that make commercial companies loath to partner with the Pentagon and rely more on allies to help in initial R&D efforts.” - Secretary of Defense, Chuck Hagel Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png http://www.cars-images.com/images/wallpapers-aircraft-carrier.jpg http://www.cars-images.com/images/wallpapers-aircraft-carrier.jpg 17 H:\DocumentsPROJECTS2014-2018 Stratplan (2013)Corp Stratplan\Pix\Composite Aero_01.png H:\Documents\_PROJECTS2014-2018 Stratplan (2013)Corp Stratplan\Pix\iStock_000003169170Large-IS ATM.jpg FIIV_079.jpg K:\Strategy Files\Graphics\Jeff selections\Soldier Afghan mountains 110520-A-AR883-030SPC George Hunt.jpg DAY3_Tim_1887-GS nightvision.jpg K:\Strategy Files\Graphics\Jeff selections\Soldier Afghan mountains 110520-A-AR883-030SPC George Hunt.jpg H:\DocumentsPROJECTS2014-2018 Stratplan (2013)Corp Stratplan\Pix\Composite Aero_01.png Strategic Growth Platforms are aligned with our customers’ critical and enduring needs Electronic Warfare Critical Networks ISR & Analytics Aerostructures Strategic Growth Platforms Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Market Summary & Outlook 18 Legacy Products Radar& Undersea Systems Weapons Release ISR & Analytics Critical Networks Electronic Warfare Aerostructures Airborne EW Maritime EW Ground EW ISR and Weather Payloads Data Analytics Positioning, Navigation & Timing Air & Space Network Management Information Solutions Range Ops & Management Commercial Aerostructures Military Aerostructures Adjacent Markets (eg, Energy) Exelis investments aligned with global market outlook Communications Solutions Night Vision High Growth Stable Declining KEY Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Large Fielded Base & Platform-Agnostic Solutions 19 Platform diversification, modernization and aftermarket drive revenue sustainability Space Fixed Wing & UAVs Com’l Aircraft Rotary Wing Naval Ground Vehicles Soldier Systems ISR / Weather ISR / Weather GPS B-1B B-52 C-130 F-15 F-16 F/A-18 EA-18G F-22 F-35 P-8 UAVs AH-64 MH-47 CH/MH-53 MH-60 CV-22 UH-60 Surface Subs Electronic Warfare . . . . . . . . . . . . . . . . EO/IR Sensing . . . . . . . . . . . . . . . . . . Navigation . . . . Communications . . . . . . . . . . Antennas . . . . . . . . . . . . . . . . . . . Radar & Acoustics . . . . . . Integrated Structures . . . . . . . . . . . . Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Commercial & International Revenue 20 $M Revenue by Market Revenue by Market Goal to expand international and commercial to more than 25% of sales 0 100 200 300 400 500 600 700 800 2013 2014E Commercial Commercial •Commercial aircraft composite structures •Commercial satellites •Expansion of offerings in adjacent markets International International •Regional focus on Asia Pacific and Middle East •Emphasis on communications, night vision, radar and electronic warfare products •Expansion of global Airport Airside Operations 12% Growth Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Opportunities for Growth 21 Prospect Prospect Qualified Qualified Proposal Proposal Award Award •Ready now, affordable and exportable offerings •6 of last 7 quarters have >1 book-to-bill •Backlog has grown from $6.5B to $6.7B in 2014 •˜ $10B in opportunities in proposal / evaluation Stand-alone Exelis funnel exceeds $55B Recent wins, growing backlog and healthy funnel will drive growth Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Portfolio Actions and Investments 22 Critical Networks ISR & Analytics Electronic Warfare Legacy Business Strategic Levers Strategic Levers Focused actions and investments to create value over the long term •Technology investment •Talent development •Portfolio shaping •New business development •One Exelis Aero >70% Strategic Growth Platforms (1) >70% Strategic Growth Platforms (1) (1) Pro form for Vectrus spin-off. Strategic Growth Platform: Critical Networks Pam Drew, President, Information Systems Division Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Critical Networks 24 .Network architecture, design and enterprise-level engineering .Network development & integration .Test & Evaluation .Network Operations Management & Security .Data fusion & integration Capabilities Capabilities Key Programs Key Programs Growth Strategy Growth Strategy Differentiators Differentiators .FAA network design and implementation .In-depth mission expertise leveraging critical networks .Operation & sustainment of NASA & USAF networks Engineering the Crucial Connections of Modern Life .Expand organic FAA, NASA & USAF positions .Leverage current technologies and large program expertise to diversify domestic customer portfolio .Expand current air traffic management solutions domestically and internationally .Continue expansion into critical infrastructure protection and public safety markets .JPL Deep Space Network .NASA Space Communications Network Services .FAA Automatic Dependent Surveillance Broadcast .USAF Space Launch and Range Systems .USAF Space Missile Defense and Situational Awareness Description Goldstone Deep Space Network - Deep Space Station 14.jpg A leader in end-to-end full lifecycle mission critical network solutions Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Critical Networks New Capabilities, Technologies & Products 25 Unmanned Systems •Leverage national surveillance system to enable UAS integration into the national airspace system •Expand system integration offering to support underwater unmanned surveillance systems High Speed Network Integration & Data •Full motion video multi-secure solution •High performance wide area content delivery system •First to market fully scalable end-to-end IP communications solution Precision Range Maint. & Sustainment Lifecycle •Optimized range management using resource management, maintenance and other analytics tools •Integrated range scheduling systems , 3-D modeling, eMaintenance Airside Operations •Leading capabilities in predictive analytics, real-time situational awareness, operations management, and VOIP communications •Symphony, OSYRIS AMAN/DMAN, SwitchPlusIP Air Traffic Management •Integrated communications, navigation, surveillance offerings & advancing automation expertise for future FAA programs •Global space-based aircraft surveillance via Aireon Strategic Growth Platform: ISR & Analytics Christopher Young, President, Geospatial Systems Division Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Intelligence, Surveillance, Reconnaissance & Analytics (ISR&A) 27 27 .Space based and airborne imaging and sensors .Combined image science and software development expertise .Assured location/timing fusion elements Capabilities Capabilities Key Programs Key Programs Growth Strategy Growth Strategy .Defend and expand superiority in capture technologies: high- resolution, multi-intelligence imaging sensors .Invest in ISR Analytics: •Ground based data exploitation •Real-time onboard processing and analysis .Invest in positioning, navigation and timing assurance .Partner with key commercial players to drive adjacent opportunities .WorldView -3 . GOSAT 2 . GPS III . Wide Area Airborne Surveillance (WAAS) . Autonomous & Real Time Geospatial Analytics http://www.afcea.org/content/sites/default/files/styles/large/public/field/image/GIS-GovtBigData-Hurricane-JAN13.jpg Differentiators Differentiators .Ability to weave all the capabilities together enabling higher confidence decisions Leader in space and airborne sensing, with growing positions in analytics solutions http://launch.geoeye.com/LaunchSite/assets/images/GE2-Home-Page-Rendering.png jag3fade.png MissionControl.png Collecting, processing, analyzing and disseminating geospatial data and information to enable high confidence decisions for military, civil or commercial applications Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png ISR&A New Capabilities, Technologies & Products 28 CorvusEye Airborne Platform •Combines sensor technologies for wide area motion imagery and real time processing in a small, lightweight package for persistent surveillance applications Satellite Technology Advances •Migrating our advanced optics, sensor and structures capabilities to smaller, more cost effective platforms for small satellite market and next generation large telescope applications picture Assured GPS Technology •Advancing timekeeping and digital solutions for next-gen GPS •Developing technologies to protect the GPS signal and restore time – Signal Sentry; Tempus Rescue picture Ground Sensor Networks •Aggregating ground camera data & advanced analytics to extract local information – Helios •Entering new markets for connected devices Emerging Technologies •Developing advanced capabilities to measure wind •Developing cognitive network s – patterns of life analytics •Developing new stand-off sensing for dangerous materials Break Strategic Growth Platform: Electronic Warfare Rich Sorelle, President, Electronic Systems Division Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png .IDECM ALQ-214 Airborne Electronic Protect System .AIDEWS Integrated Radar Warning and Electronic Jamming (International F-16) .Naval Decoys – Off Board Electronic Protection .ANZAC – ES3701 Shipboard Electronic Support System .Special Operations Aircraft – Fixed Wing and Rotary Electronic Warfare Electronic Warfare Capabilities Key Programs Growth Strategy Differentiators .Electronic Support (ES): detecting, locating and characterizing multiple threats .Electronic Protect (EP) and Attack (EA): defending against and defeating multiple threats .Extend leadership position through core product upgrades .Grow international market participation through partnerships .Invest in differentiated electronic warfare technology and small size weight and power payloads .Signal processing algorithms that handle simultaneous threats in dense RF environments 31 Leadership in EW Technologies Addressing Our Customers’ Critical Needs Supporting the warfighter by developing solutions which enable mission success on the electromagnetic battlefield Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png New Capabilities, Technologies & Products Disruptor SRx Low Size Weight and Power (SWAP) EW Architecture •Provides adaptive architecture for Electronic Warfare missions throughout the electromagnetic spectrum and addresses emerging need for Unmanned Systems and multifunction capability Cognitive EW Countermeasures •Strengthens market position as a premier developer of next generation advanced Cognitive EW countermeasures against emerging threats Signal Protection •Protects critical signals from detection and geo-location and positions Exelis as a provider of Low Probability Intercept (LPI) technology Advanced Decoy •Directly solves a customer hard problem and positions Exelis to enter larger expendables market Celestech Acquisition •Maintains Exelis as a key Iridium equipment provider by expanding capabilities through Iridium NEXT technology http://www.nrl.navy.mil/tew/images/image4.jpeg 32 Strategic Growth Platform: Aerostructures Mike Blair, Vice President and General Manager Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Aerostructures 34 .Automated Material Placement .Design, Build and Assemble .Technologies and Processes that enable shorter lead times in development and production .Focus on partnership with Airbus, Boeing and their Tier 1 suppliers to gain position and volume on new platforms Capabilities Capabilities Key Programs Growth Strategy Growth Strategy Differentiators Differentiators .Experience .Qualifications and Infrastructure .Breadth of integrated capabilities .State-of-the Industry lean Differentiated mid-tier position in commercial and military aerostructures http://lexleader.net/wp-content/uploads/2012/03/F-35C-JSF-turn.jpg F-WWDD Airbus Industrie Airbus A380-861 taken 15. Jul 2012 at Farnborough (FAB / EGLF) airport, United Kingdom by Przemyslaw Burdzinski 737 MAX 7,8,9 artwork Supplier of high performance composite structures and assemblies of the highest quality with short lead-times in both development and production .A380 •Main Deck Floor Beam Struts .787-9/-10 •Fuselage Frames for Section 41 & 43 .B737, 747, 757, 767, 777 •Vacuum Waste Tanks .CH-53K •Right & Left Sponsons •Tail Rotor Pylon •Horizontal Stabilizer .F-35 Lightning II •Outboard Wing Skins •Fixed Skins & Access Covers •Blade Seals & Bull Noses Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Aerostructures New Capabilities, Technologies & Products 35 Automated Fiber Placement •For large, highly contoured surfaces ���Fast material deposition •Reduced labor and scrap •High barrier to entry Contoured Automated Tape Laying •For large surfaces with minimal contour •Hot drape formed spars and floor beams •Fastest deposition for carbon fiber material Struts, Tubes and Rods (STaR) •Struts, mainly metallic, are on every commercial aircraft •Improved performance and weight compared to legacy parts •From drawing to prototype product within 4 weeks Co-cured Hat Stiffened Skins •The current “state-of-the-art” for stiffened wing skins •Leverages the benefits of composite materials •Currently being used on several commercial platforms Braiding & RTM •Suitable for high-rate production •Lower cost structures •Highly complex geometries •Vertical integration – braiding and infusion Night Vision & Communications Solutions Nick Bobay, President Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Night Vision & Communications Solutions Capabilities Key Programs Growth Strategy Growth through innovation and cross-divisional collaboration 37 Differentiators .Strong international relationships .Strong incumbent positions with large installed base .Image tube expertise .Operational excellence .Pursue international and commercial opportunities .Continue to leverage synergies across NVCS and Exelis (e.g. Individual Soldier System) .Cost effective manufacture of high reliability products .Complex electro-optic system development .Individual Soldier System .I2 Sensors & Near Infrared Fluorescence (NIRF) .Interference Mitigation .Networked Systems .SINCGARS Upgrades Affordable, mission-critical night vision and communications solutions that enhance situational awareness and enable rapid decision making Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png NVCS Innovative Capabilities, Technologies & Products 38 Individual Soldier System (ISS) •New solution provides better night ops situational awareness •Quality video and messaging streamed to/from each Soldier •Cross-divisional program between NVCS, GS, and IS Banded Digital Adaptive Canceller •Cancellers prevent interference between co-located radios •New digital canceller is lower cost with more flexibility •Reduces NRE and recurring costs in custom solutions Integrated Comms •Complete capability offering of comms products •Provides top-to-bottom solutions for brigade level •Market-leading voice command and control with data SINCGARS Upgrades •Army leadership committed to retention of >300K SINCGARS •SideHat provides robust second channel data networking •Position Location Information available to 400K fielded radios SATCOM on the Move Tri-Band Antenna •Upgraded Global SATCOM antenna; X, Ka, Ku band capable •Less bandwidth antenna leads to greater efficiency •Reduced size, weight, power and cooling Financial Overview Peter Milligan, Senior Vice President & Chief Financial Officer Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Financial Overview .Growing backlog supports revenue visibility .Diversified product, service and customer base .Aggressive cost management .Manageable pension requirements .30%+ dividend payout ratio Meaningful capital available for deployment 40 Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Growing Backlog Enables Revenue Visibility .Significant success in the international and commercial markets .Book-to-Bill > 1.0x in 6 of the past 7 quarters .Key awards among multiple dimensions .Recompete NASA Deep Space Network .New Products Over $100M in orders for the TM-NVG / Individual Soldier System .International Advanced Geostationary Weather Imager to South Korea / AIDEWS .Follow-on Electronic Support Measures for the Royal Australian Navy / IDECM / GPS III .Commercial Adjacency Aerostructures work with Boeing and Airbus $2.8 $3.0 41 $6.5 $6.7 (1) (1) (1) Excludes estimated backlog amounts attributable to Vectrus as of 12/31/13 and 9/30/14. Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Aggressive Cost Management .$100M+ in restructuring over the last 3 years .Since spin-off from ITT,(1) .Facility locations. 23% Total footprint (sqft) . 18%; Leased footprint (sqft) . 23% .Headcount . 25% .Expanded shared services .ERP implementation initiated / rationalizing back office systems Cost structure management enables investment in future growth (1) Pro forma for Vectrus spin-off 42 Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Investment Strategy (1) .Increase in 2014 IR&D .Anticipate continued growth over the next 3 years .Targeting ˜ 3.0% of C4ISR revenue .CapEx down ˜ 50% since 2012 .Declining requirements as ADS-B / Aero investments wind down .Lower facility footprint helps drive savings (1) Excludes estimated Vectrus results and gives effect to spin-related estimated anticipated G&A/tax adjustments in 2014. 43 IR&D Selling / B&P M&A CapEx .Aligning resources to the SGPs .Investing in infrastructure to enable cross-collaboration .Recruiting and deploying the right talent to engage adjacent markets .˜ $80M in M&A since ITT spin-off .Focus to date on “capitalized” R&D and enhanced distribution channels .Robust pipeline in evaluation Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Pension Update 44 .Highway and Transportation Funding Act of 2014 (HATFA) .Lowers ERISA near-term funding requirements .Extends timing of CAS recoverable expenses .Lower cash contributions increase GAAP expense .Updated mortality tables .Increases the actuarial liability .Increases GAAP expense .Increases CAS recoverable costs Projected Pension Expense Projected Pension Expense 2014 2015 (1) FAS Expense ˜ $65M ˜ $80M CAS Expense ˜ $110M (-5%) (2) ˜ 125M (1) Pending final year-end true up of pension liability. Incorporates estimates for new mortality tables applied in 2015 and lower ERISA funding requirements resulting from HATFA implementation. (2) Reflects lower CAS expense due to retroactive application of HATFA Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Vectrus Dividend ($225M) Uses of Cash Uses of Cash 2014 2014 2015 2015 2016 2016 2017 2017 Dividend Pension ˜ $150M ˜ $175-200M ˜ $150-175M ˜ $150-175M M&A Share Repurchase $350M/2-year share repurchase authorization Capital Allocation Minimum estimated ERISA Contributions (1) (˜ $80M/yr.) 30%+ payout ratio (1) Includes estimated OPEB Free cash flow projections enable flexible, multi-tier capital allocation strategy Aligned to Strategic Growth Platform requirements and market opportunities 45 Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Preliminary 2015 Outlook (1) Revenue Stable Operating Margin 12.0 – 12.5% (2) EPS . mid-single digits Free Cash Flow (3) ˜ $250M Focused portfolio apparent in 2015 outlook 46 (1)Preliminary 2015 expectations for stand-alone Exelis. (2)Pending final true-up of pension liability for 12/31/14. (3)Free Cash Flow = Net Cash Provided by Operating Activities less Capital Expenditures. Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Summary .Backlog supports improving revenue trend .Continual cost improvement .Increased investment in R&D and Selling .Strong balance sheet .Year-end cash balance > $0.5B (1) 47 > $750M FCF generation 2015 – 2017(2) enables value creation (1)Reflects 2014 expectations for stand-alone Exelis (2)Free Cash Flow = Net Cash Provided by Operating Activities less Capital Expenditures. Reflects preliminary expectations 2015-2017 for stand-alone Exelis. Exelis_PPT_cover2.jpg Select an image that relates to the presentation subject. Do not use more than one image! Changing a photo in the image area In your menu bar select “View” > “Master” > “Slide Master” Go to the Title Slide Master you wish to change Select the image and delete Insert new image/photo on page and crop/resize to fit image area Once the new image placement is finalized, select “Arrange” > “Send to back” Delete these instructions before final use. Exelis_w_PPT.png Exelis_PPT_cover2.jpg Exelis_w_PPT.png Questions & Answers Appendix Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Acronyms & Abbreviations A2/AD Anti-Access/Area Denial ENVG Enhanced Night Vision Goggle ADS-B Automatic Dependent Surveillance-Broadcast EP Electronic Protect AIDEWS Advanced Integrated Defensive Electronic Warfare Suite EPS Earnings per Share AIMS Advanced Interference Mitigation System ERISA Employee Retirement Income Security Act AMAN Aircraft Arrival Manager ERP Enterprise Resource Planning ANZAC Australia Navy and New Zealand Army Corp ES Electronic Support ARC Adaptive Radar Countermeasures ES Electronic Systems ASCM Anti-ship Cruise Missile EW Electronic Warfare ATM Air Traffic Management FAA Federal Aviation Administration B&P Bid and Proposal FCF Free Cash Flow C4ISR Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance Segment GNOMAD Global Network on the Move Active Distribution CAGR Compound Annual Growth Rate GOSAT 2 Greenhouse Gases Observing Satellite CapEx Capital Expenditure GPS Global Positioning System CLASS Computational Leverage Against Surveillance Systems GS Geospatial Solutions CNAS Center for New American Security HATFA Highway and Transportation Funding Act CNO Chief of Naval Operations I&TS Information and Technology Solutions Segment DARPA Defense Advanced Research Projects Agency I2 Image Intensifier DMAN Aircraft Departure Manager IDECM Integrated Defensive Electronic Countermeasure DoD U.S. Department of Defense INCANS Interference Cancellation System DSN Deep Space Network IP Internet Protocol EA Electronic Attack IR&D Independent Research and Development ENVG Enhanced Night Vision Goggle IS Information Solutions EP Electronic Protect ISR Intelligence, Surveillance and Reconnaissance EPS Earnings per Share ISS Individual Soldier System ERISA Employee Retirement Income Security Act ITAR International Traffic in Arms Regulations ERP Enterprise Resource Planning JPL Jet Propulsion Laboratory 50 Exelis_orange_PPTfooter.png Exelis_orange_PPTfooter.png Acronyms Ka K-above Ku K-under LPI Low Probability Intercept M&A Mergers and Acquisitions MiMMC Microsat Manportable Mission Command NASA National Aeronautics and Space Administration NIRF Near Infrared Fluorescence NRE Non-Recurring Engineering NVCS Night Vision & Communications Solutions OCO Overseas Contingency Operations OPEB Other Postemployment Benefits RF Radio Frequency RFDS Radio Frequency Distribution System RTM Resin Transfer Molding SATCOM Satellite Communications SINCGARS Single Channel Ground and Airborne Radio System Srx Smart Response Transmitter Receiver STaR Struts, Tubes and Rods SWAP Size, Weight and Power TM-NVG Tactical Mobility-Night Vision Goggle UAS Unmanned Aerial System UAV Unmanned Aerial Vehicle USAF United States Air Force VOIP Voice over Internet Protocol WAAS Wide Area Airborne System XLS New York Stock Exchange Symbol for Exelis 51