UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K/A

(Amendment No. 1)

ANNUAL REPORT

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition period from to

Commission File No. 001-35228

EXELIS INC.

(Exact name of registrant as specified in its charter)

| | |

| State of Indiana | | 45-2083813 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

1650 Tysons Boulevard, Suite 1700, McLean, Virginia 22102

(Address of principal executive offices)

(703) 790-6300

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act, all of which are registered on The New York Stock Exchange, Inc.:

COMMON STOCK, $0.01 PAR VALUE

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | x | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the common stock of the registrant held by non-affiliates on the last business day of the registrant’s most recently completed second fiscal quarter (based on the closing price of the stock on the New York Stock Exchange on June 30, 2014) was approximately $3.2 billion. The number of shares of common stock outstanding at February 24, 2015 was 186,481,396.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

We filed our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (“Form 10-K”) with the U.S. Securities and Exchange Commission (“SEC”) on February 27, 2015. We are filing this Amendment No. 1 to the Form 10-K (“Form 10-K/A”) solely for the purpose of including in Part III the information that was to be incorporated by reference from our definitive proxy statement for the 2015 annual meeting of shareholders, because our definitive proxy statement will not be filed with the SEC within 120 days after the end of our fiscal year ended December 31, 2014. This Form 10-K/A hereby amends and restates in their entirety the Form 10-K cover page and Items 10 through 14 of Part III.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended, this Form 10-K/A also contains new certifications by the principal executive officer and the principal financial officer as required by Section 302 of the Sarbanes-Oxley Act of 2002. Accordingly, Item 15(a)(3) of Part IV is amended to include the currently dated certifications as exhibits. Because no financial statements have been included in this Form 10-K/A and this Form 10-K/A does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted.

Except as expressly noted in this Form 10-K/A, this Form 10-K/A does not reflect events occurring after the original filing of our Form 10-K or modify or update in any way any of the other disclosures contained in our Form 10-K including, without limitation, the financial statements. Accordingly, this Form 10-K/A should be read in conjunction with our Form 10-K and our other filings with the SEC.

PART III

| Item 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. |

DIRECTORS

Our Amended and Restated Articles of Incorporation provides for a classified Board of Directors divided into three classes designated Class I, Class II and Class III, each serving staggered three-year terms. On May 7, 2014 shareholders approved a proposal to amend the Company’s Amended and Restated Articles of Incorporation to declassify the Board of Directors. Class I Directors will stand for election on an annual basis beginning in 2015. Class II and III Directors will stand for election on an annual basis beginning in 2016 and 2017, respectively.

Class I Directors with Terms Expiring in 2015

Ralph F. Hake,age 66, has served as a Director of the Company since October 2011. Mr. Hake was Chairman and Chief Executive Officer of Maytag Corporation, an appliance manufacturer and distributor, from June 2001 to March 2006. He served as Executive Vice President and Chief Financial Officer for Fluor Corporation, an engineering and construction firm from 1999 to 2001. From 1987 to 1999, Mr. Hake served in various executive capacities at Whirlpool Corporation, a manufacturer and distributor of home appliances, including Chief Financial Officer and Senior Executive President for global operations. He was a Director of ITT Corporation (“ITT”) from 2002 to November 2011. He has served as a Director of Owens-Corning Corporation, a provider of composites and building materials, since 2006. Mr. Hake was a Director of Maytag Corporation from June 2001 through March 2006. Mr. Hake served as non-executive Chairman of Smurfit-Stone Corporation from 2010 until its acquisition by RockTenn Company on May 28, 2011. Mr. Hake served as a Director of RockTenn through January 25, 2013. Mr. Hake is a 1971 business and economics graduate of the University of Cincinnati and holds an M.B.A. from the University of Chicago. Mr. Hake has extensive global management and financial experience. He served on the Board of Directors for the National Association of Manufacturers and was Chairman of the organization’s taxation and economic policy group.

David F. Melcher, Lieutenant General (Ret.), age 60, has served as a Director, Chief Executive Officer and President of the Company since October 2011. Previously he was President of ITT Defense & Information Solutions and served on the ITT Strategic Council from December 2008 until the Company’s spin-off from ITT on October 31, 2011. Mr. Melcher joined ITT in August 2008 as Vice President of Strategy and Business Development for Defense & Information Solutions following 32 years of distinguished service in the U.S. Army. He served on the National Defense Industrial Association’s Board of Trustees from 2009 to 2014 and currently serves on the Executive Committee of the Board of Directors for the Aerospace Industries Association. In December 2013 Mr. Melcher joined the Board of Directors of C. R. Bard, Inc., a leading multinational developer, manufacturer, and marketer of medical technologies in the vascular, urology, oncology and surgical specialty product fields. Mr. Melcher holds a bachelor’s degree in civil engineering from the U.S. Military Academy at West Point and two masters degrees, including one in business administration from Harvard University and another in public administration from Shippensburg University. As Chief Executive Officer and President, Mr. Melcher has extensive knowledge of our Company’s business and operations. He has more than 25 years of defense community experience in program management, strategy development and finance, working with key decision makers within the Army, Department of Defense, Office of Management and Budget, and Congress. Mr. Melcher has extensive international strategic business, budget, policymaking and defense-related experience, has demonstrated leadership and management experience with the U.S. Army, and has served as the Army’s Military Deputy for Budget and Deputy Chief of Staff for Programs in the Pentagon, and as Commander of the Corps of Engineers, Southwestern Division in Dallas, Texas.

1

Herman E. Bulls, age 59, has served as a Director of the Company since November 2011. Mr. Bulls, is the founder and Chairman of JLL’s Public Institutions specialty, a practice focused on delivering integrated real estate solutions to government entities, nonprofit organizations, transportation facilities, and higher education institutions. He also serves as an International Director of Global Markets at JLL focusing on business developments, mergers and acquisitions. Mr. Bulls serves as Chief Executive Officer of Bulls Advisory Group, a real estate consulting and advisory firm. He also co-founded and served as President and CEO of Bulls Capital Partners, a commercial mortgage banking firm. Before joining JLL, Mr. Bulls completed almost 12 years of active duty service with the United States Army working in the Office of the Assistant Secretary of the Army for Financial Management at the Pentagon and as an Assistant Professor of Economics and Finance at West Point. He retired as a Colonel in the U.S. Army Reserves in 2008. He is a member of the Executive Leadership Council, an organization of senior African American business executives from Fortune 500 companies, and former Chairman of the Board of Directors of the Executive Leadership Foundation. He is a former Vice Chairman and currently serves as a director of the West Point Association of Graduates Board of Directors, and is a member of Leadership Washington, and the Real Estate Executive Council (REEC). Mr. Bulls is a founding member and served as the inaugural President of the African American Real Estate Professionals (AAREP) of Washington, D.C. He is also a member of the Real Estate Advisory Committee for the New York State Teachers’ Retirement System (NYSTRS), one of the largest pension funds in the nation. Mr. Bulls has served on the board of Comfort Systems, USA, Inc., a provider of heating, ventilation and air conditioning services, since February 2001 and Tyco International Ltd. since March 2014. Mr. Bulls has served on the board of USAA, a privately held insurance and financial services company since November 2010. He serves as a Director for Rasmussen, Inc. a for-profit educational services organization. Mr. Bulls received a bachelor of science degree in engineering from the U.S. Military Academy at West Point and a master’s of business administration degree in finance from Harvard Business School. Mr. Bulls brings over 35 years’ experience in development, leadership, operations, teaching, investment management and business development/retention.

Class II Directors with Terms Expiring in 2016

John J. Hamre, age 64, has been a Director of the Company since October 2011. Dr. Hamre was elected President and Chief Executive Officer of Centers for Strategic & International Studies (“CSIS”), a public policy research institution dedicated to strategic, bipartisan global analysis and policy impact, in April 2000. Prior to joining CSIS, he served as U.S. Deputy Secretary of Defense from 1997 to 2000 and Under Secretary of Defense (Comptroller) from 1993 to 1997. He served as a Director of ITT, a diversified leading manufacturer of highly engineered critical components and customized technology solutions for growing industrial end-markets from 2000 to 2011. He has served as a Director of SAIC, Inc. a provider of scientific, engineering, systems integration and technical services to government and commercial markets since 2005. In September 2013 SAIC, Inc. spun off SAIC, as a separate public company, and renamed itself Leidos. Dr. Hamre now serves as a director of the new SAIC and continues to serve as a director of Leidos (formerly SAIC, Inc.). He also served as a Director of Xylem Inc., a leading global water technology provider from October 2011 to May 2013. Dr. Hamre was previously a Director of Choicepoint, Inc., a provider of identification and credential verification services, from May 2002 through September 2008 and Oshkosh Corporation, a designer, manufacturer and marketer of specialty vehicles and vehicle bodies from 2009 through January 2012. He received a B.A. degree, with the highest distinction, from Augustana College in Sioux Falls, South Dakota, was a Rockefeller Fellow at Harvard Divinity School and was awarded a Ph.D., with distinction, from the School of Advanced International Studies, Johns Hopkins University, in 1978. Dr. Hamre has extensive strategic and international experience, particularly with respect to defense related businesses. He has achieved recognized prominence in strategic, international and defense fields. Dr. Hamre is a Director of MITRE Corporation, a not-for-profit organization chartered to work in the public interest, with expertise in systems engineering, information technology, operational concepts, and enterprise modernization and is a member of the Governance Business Division Committee of the Bechtel Corporation board, a leader in engineering, construction, management, and development services.

2

Patrick J. Moore, age 60, has served as a Director of the Company since November 2011. Mr. Moore serves as President and Chief Executive Officer of PJM Advisors, LLC, an investment and advisory firm. He serves as a Director on the Boards of the Metropolitan YMCA of St. Louis, Boys Hope/Girls Hope, St. Louis Zoological Society and the Big Shoulders Fund. In April 2014, he joined the Board of Directors of Rentech Inc., a company that owns and operates wood fiber processing, wood pellet production and nitrogen fertilizer manufacturing businesses. He also has served as a Director of Archer Daniels Midland Company, a global food processing and commodities trading corporation, since November 2003 and was a Director of Ralcorp Holdings, Inc., a manufacturer of private brand food products, until its acquisition by ConAgra Foods, Inc. in January 2013. Mr. Moore was a Director at Smurfit-Stone Corporation from 2002 to 2011. Mr. Moore serves on the North American Review Board of American Air Liquide. Mr. Moore holds a bachelor’s degree in business administration from DePaul University. Mr. Moore has extensive governance, operational and financial experience in multiple industry sectors, including board service at various public companies. He served as the former Chairman and Chief Executive Officer of Smurfit-Stone Container Corporation, an industry leader in the manufacturing of integrated containerboard and corrugated packaging products and one of the world’s largest paper recyclers, and as its Chief Executive Officer from June 2010 to May 2011 when it was acquired by RockTenn Corporation.

R. David Yost, age 67, has served as a Director of the Company since early November 2011. Mr. Yost served as Director and Chief Executive Officer of AmerisourceBergen, a comprehensive pharmaceutical services provider, from August 2001 until his retirement in July 2011. Previously, he served as President of AmerisourceBergen, Chairman and Chief Executive Officer of AmeriSource Health Corporation, and President and Chief Executive Officer of AmeriSource Health. Mr. Yost served as a member of the Board at Penn Medicine, overseeing the University of Pennsylvania School of Medicine and hospital from 2006 to 2012. He serves on the U.S. Air Force Academy Endowment Board. Since 2009, he has served on the board of Tyco International Ltd., a leading provider of electronic security products and services, fire protection and detection products and services. In January 2012, Mr. Yost joined the Board of Directors at Marsh & McLennan Companies, a global professional services firm providing advice and solutions in the areas of risk, strategy, and human capital. In August 2012, Mr. Yost joined the Board of Directors at Bank of America Corporation, a bank holding company and financial holding company. Mr. Yost is a 1969 graduate of the U.S. Air Force Academy and holds a master of business administration from the University of California, Los Angeles (UCLA). Mr. Yost brings over 36 years of experience in business leadership, operations, manufacturing and services in the healthcare equipment and services industry. In the Jan-Feb 2013 issue of the Harvard Business Review, Mr. Yost was named one of the 100 Best Performing CEO’s in the World.

Class III Directors with Terms Expiring in 2017

General Paul J. Kern, U.S. Army (Ret.), age 69, has been a Director of the Company since October 2011. General Kern has served as a Senior Counselor to the Cohen Group since January 2005. He served as President and Chief Operating Officer of AM General LLC, a world leader in the design, engineering, production, and technical and parts support of military and special purpose vehicles from August 2008 to January 2010. In November 2004, General Kern retired from the United States Army as Commanding General, Army Materiel Command (AMC). He was a Director of ITT, a diversified leading manufacturer of highly engineered critical components and customized technology solutions for growing industrial end-markets from August 2008 until 2013. General Kern has served as a Director of iRobot Corporation, a designer and builder of robots, since 2006. From 2005 to 2007, he was a Director of EDO Corporation, a provider of information technology solutions and systems engineering, which was acquired by ITT in December 2007. He was a director of Anteon Corporation, a designer and manufacturer of products for the aerospace, defense, intelligence and commercial markets, from 2005 until 2006 when it was sold to General Dynamics. General Kern graduated from the U.S. Military Academy at West Point. He holds masters degrees in both Civil and Mechanical Engineering from the University of Michigan, and he was a Senior Security Fellow at the John F. Kennedy School at Harvard University. General Kern has extensive international strategic business and

3

defense-related experience. He is a leading figure on defense transformation, as well as a highly decorated combat veteran. General Kern achieved recognized prominence as a four-star general with the Army and spearheaded Army efforts to direct supply chain improvement efforts, modernize weapons systems, and maintain field readiness, while still controlling costs. He serves on the advisory boards of Oakridge National Lab Advisory Board, FNH USA and Merlin Power Systems. General Kern also serves on the Board of Directors of CoVant Technologies LLC, AT Solutions and LGS Innovations LLC, subsidiaries of CoVant Technologies. Mr. Kern is a member of the Defense Science Board and National Academy of Engineering.

Mark L. Reuss, age 51, has served as a Director of the Company since early November 2011. Mr. Reuss serves as General Motors Executive Vice President, Global Product Development, Purchasing and Supply Chain. From 2009 to 2013, Mr. Reuss was GM Vice President and President of GM North America. Before this, he briefly served as Vice President of Engineering, responsible for all engineering for GM worldwide. Mr. Reuss managed GM’s operations in Australia and New Zealand as Chairman and Managing Director of GM Holden Ltd. from February 2008 until July 2009. He also served on the GM Asia Pacific Strategy Board and was President of Australia’s Federal Chamber of Automotive Industries, leading negotiations for long-term government support and a 10-year policy plan to restructure the Australian auto industry. Mr. Reuss previously held numerous engineering and management positions across GM brands. He serves on the Advisory Board of the University of Michigan Ross School of Business, The Advisory Board of Cranbrook Horizon Upward Bound, the Cranbrook Schools Board of Trustees, The Skillman Foundation, and is Vice Chairman of the GM Foundation. Mr. Reuss received a bachelor of engineering degree in mechanical engineering from Vanderbilt University and a master of business administration from Duke University. Mr. Reuss is responsible for the design, engineering, program management, safety and quality of General Motors vehicles around the world. He also oversees GM’s Global Purchasing and Supply Chain organization, and is a member of the GM Executive Leadership Team, as well as a member of the Opel Supervisory Board and the board of Shanghai General Motors (SGM). He brings over 30 years of experience in global business, operations management, engineering and long-term government support contract negotiations. He has served on the GM North America Disclosure and Audit committee since December 2009.

Billie I. Williamson, age 62, has served as Director of the Company since January 2012. Ms. Williamson served as Ernst & Young’s Americas Inclusiveness Officer and Senior Assurance Partner prior to her retirement at the end of 2011. She began her career at Ernst & Young in 1974 and spent the first 19 years in the audit practice, becoming one of only five female partners promoted in 1984. She then left to become CFO of AMX Corp. in Dallas and subsequently Senior Vice President, Finance of Marriott International, Inc. in Washington, D.C. She rejoined Ernst & Young in 1998 where she became a senior client-serving partner. From 2006 to 2008, Ms. Williamson served as a member of Ernst & Young’s Americas Executive Board which functions as the Board of Directors for Ernst & Young. She also served on the U.S. Executive Board, responsible for partnership matters for the firm. Ms. Williamson is on the board of Energy Futures Holdings Corporation, a privately held energy company with a portfolio of competitive and regulated energy companies, and Extrusions, Inc., a privately held company, and is a partner in the Ida Family Ltd. Partnership. Ms. Williamson joined the Board of Janus Capital Group in February 2015. In March 2012, Ms. Williamson joined the Board of Directors of Annie’s Inc., a natural and organic food company, where she was a member of the Compensation and Audit Committees. In October 2014, General Mills completed its acquisition of Annie’s Inc. In May 2014, Ms. Williamson joined the Board of Directors of Pentair Ltd. (“Pentair-Switzerland”) which provides products, services and solutions in water and other fluids, thermal management and equipment protection. In June 2014, Pentair Ltd. completed its change of jurisdiction of incorporation from Switzerland to Ireland by merging with and into its subsidiary, Pentair plc (“Pentair-Ireland”), a public limited company incorporated under the laws of Ireland. The board of directors of Pentair-Switzerland prior to the merger was appointed as Pentair-Ireland’s board of directors. Ms. Williamson is a member of Pentair’s Audit and Finance Committee. Ms. Williamson serves on the Board of Directors and is the Treasurer of the Dallas Holocaust Museum / Center for Education and Tolerance, is the Treasurer and a member of the Board of Trustees for the Dallas Symphony Foundation, and is a member of the Audit and Finance Committee of the Communities

4

Foundation of Texas. Ms. Williamson graduated from Southern Methodist University and was granted her CPA Certificate in the State of Texas in 1976. As a Senior Assurance Partner at Ernst & Young, Ms. Williamson served some of the firm’s largest global accounts in aerospace, technology and other industries. She worked with Chief Executive Officers of major companies to structure acquisitions and determine financial strategy. As a member of Ernst & Young’s Americas Executive Board, Ms. Williamson dealt with strategic and operational matters, providing additional relevant experience.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires that the Company’s executive officers and directors, and any persons beneficially owning more than 10% of a registered class of the Company’s equity securities, file reports of ownership and changes in ownership with the SEC within specified time periods. To the Company’s knowledge, based upon a review of the copies of the reports furnished to the Company and written representations that no other reports were required, all filing requirements were satisfied in a timely manner for the year ended December 31, 2014.

CODE OF CONDUCT

The Company has adopted the Exelis Code of Conduct which applies to all employees, including the Company’s Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer and, where applicable, to its non-management Directors. The Code of Conduct is posted on the Company’s website at: http://investors.exelisinc.com/phoenix.zhtml?c=248208&p=irol-govhighlights. The Company discloses any changes or waivers from the Code of Conduct for the Company’s Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, its non-management Directors and other executive officers on its website. In addition, the Company will disclose within four business days any substantive changes in or waivers of the Code of Conduct granted to our Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer, or persons performing similar functions, by posting such information on our website rather than by filing a Form 8-K. There were no substantive changes in or waivers of the Code of Conduct granted to our Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer, or persons performing similar functions in 2014. A copy of the Code of Conduct will be provided, free of charge, to any shareholder upon request to the Corporate Secretary of Exelis.

AUDIT COMMITTEE

The board has a standing Audit Committee and its members are comprised of Patrick J. Moore, who serves as chairman, Herman E. Bulls, Ralph F. Hake, and Billie I. Williamson. The Board of Directors has affirmatively determined that each of the members of the Audit Committee is independent and financially literate. Further, the Board of Directors has determined that Mr. Moore, Mr. Bulls, Mr. Hake and Ms. Williamson possess accounting or related financial management expertise within the meaning of the NYSE listing standards and that Ms. Williamson qualifies as an “audit committee financial expert” as defined under the applicable SEC rules.

| Item 11. | EXECUTIVE COMPENSATION |

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

Exelis’ Named Executive Officers (“NEOs”) for 2014:

| | |

Name | | Title |

| David F. Melcher | | Chief Executive Officer and President; |

| Peter J. Milligan | | Senior Vice President and Chief Financial Officer; |

| Ann D. Davidson | | Senior Vice President, Chief Legal Officer and Corporate Secretary; |

| Christopher D. Young | | Executive Vice President, Exelis and President of Geospatial Systems; and |

| A. John Procopio | | Senior Vice President and Chief Human Resources Officer |

5

Say on Pay:

On May 7, 2014, we held an advisory vote to approve named executive officer compensation (“Say on Pay”). Approximately 92% of the votes cast were in favor of our named executive officer compensation. The Compensation Committee was advised of the results of this advisory vote. The Compensation Committee considered the results, and based on the support in favor of our named executive compensation, determined to maintain the current compensation philosophy and policies implementing that philosophy.

Compensation Philosophy:

The Compensation Committee established that the Company’s executive compensation program is designed to support Exelis’ business strategy and to be reasonable, fair, fully disclosed and consistently aligned with long-term value creation. The Compensation Committee believes this compensation philosophy encourages individual and group behaviors that balance risk and reward and assists Exelis in achieving steady, sustained growth and earnings performance. To that end, the Compensation Committee adopted what it believes is a best practice executive compensation program that emphasizes Pay for Performance. A substantial portion of executive compensation is tied to the Company’s internal business financial performance and stock price performance. If internal business performance or stock price performance falls below identified thresholds, at-risk incentive compensation is reduced or not paid at all.

2014 NEO Pay:

Pay for Performance: Compensation for our NEOs ties a significant portion of compensation to performance. Pay components include salary, long-term awards, including restricted stock units (“RSUs”), stock options and Total Shareholder Return (“TSR”) awards, and Annual Incentive Plan (“AIP”) awards. Compensation for NEOs discussed in this Compensation Discussion and Analysis reflects Exelis financial performance for 2014. The values of RSU and option grants provide absolute alignment with the growth or decline in Exelis stock price. The AIP provides a cash payout if certain financial metrics, including earnings per share (“EPS”), are met. The TSR award provides for a cash payment based on Exelis TSR performance relative to the two Aerospace/Defense industry peer groups which comprise the Exelis TSR performance index described in this Compensation Discussion and Analysis. 2014 cash-based incentives are described in the table below:

| | | | |

Pay Component | | Performance During 2014 | | Actual/Projected Payout |

| 2014 Annual Incentive Plan (AIP) | | • EPS = $1.23 (versus target of $1.21) • Revenue = $3.27 billion (versus target of $3.3 billion) • Operating Cash Flow = $368.2 million (versus target of $401 million) • Return on Invested Capital = 12.7% (versus > 12.8% target) | | Actual bonus = 97.5% of target |

| | |

| 2012 – 2014 Total Shareholder Return (TSR) Cash Award | | Exelis TSR from 1/1/12 through 12/31/2014: • 73rd percentile of S&P 1500 Aerospace/Defense Index • Fifth within the concentrated peer group | | 2012-2014 TSR Award payout is 146.0% of target based on TSR through the spin-off of Vectrus, Inc. relative to peer groups. The remaining portion is paid at target. |

6

| | | | |

Pay Component | | Performance During 2014 | | Actual/Projected Payout |

| 2013 – 2015 Total Shareholder Return (TSR) Cash Award | | Exelis TSR from 1/1/13 through 12/31/14: • 44th percentile of S&P 1500 Aerospace/Defense Index • Seventh within the concentrated peer group | | 2013-2015 TSR Award projected payout is 44.4% of target based on TSR to date relative to peer groups. |

| | |

2014 – 2016 Total Shareholder Return (TSR) Cash Award | | Exelis TSR from 1/1/14 through 12/31/14: • 39th percentile of S&P 1500 Aerospace/Defense Index | | 2014-2016 TSR Award projected payout is 78.4% of target based on TSR to date relative to peer groups. |

Pay at Risk:

| | • | | The AIP award is an element of NEO compensation which rewards annual operating performance and earnings per share appreciation. |

| | • | | 2014 TSR awards for the 2014-2016 performance period provide an element of executive compensation based on relative stock price performance over three years as measured against an Aerospace and Defense industry peer group index. TSR payments, if any, are made in cash. |

| | • | | 2014 stock option and RSU grants directly tie NEO compensation to absolute stock price performance. |

| | |

| Key Governance Policies Related to Compensation: | | |

| |

We do: | | We do not: |

| |

• use an independent compensation consultant • pay for performance • mitigate compensation risk through oversight, controls and appropriate incentives in our balanced compensation programs • have change of control provisions that only trigger upon consummation of the change of control transaction • have limited perquisites • have an annual Say-on-Pay vote • have a clawback policy • have an anti-hedging policy • have stock ownership guidelines | | • pay dividend equivalents on RSU awards granted to our employees unless and until the RSU vest • reprice stock options • include equity awards in pension calculations • provide tax gross ups for any perquisites or in connection with payments made in the event of change of control |

Compensation Discussion and Analysis

Compensation Committee Interlocks And Insider Participation

There are no Compensation Committee interlocks involving any members of the Compensation Committee. None of the members of the Compensation Committee during fiscal year 2014 or during fiscal year 2015 has been an officer or employee of the Company and no executive officer of the Company served on the Compensation Committee or board of any company that employed any member of the Compensation Committee or Board of Directors.

7

How the Compensation Committee made compensation decisions for the 2014 NEOs:

The Compensation Committee retained an independent consultant, Pay Governance LLC (the “Compensation Consultant”) in 2014 as an advisor for NEO compensation. The Compensation Consultant provided objective expert analyses, assessments, research and recommendations for executive compensation programs, incentives, perquisites, and compensation standards as well as analysis of material prepared by Exelis for the Compensation Committee review. The Compensation Consultant also provided base salary, annual incentive targets and long-term incentive targets for a group of peer companies (the “Exelis Compensation Peer Group”) to be used as a reference.

Independent Compensation Consultant:

The services performed by the independent Compensation Consultant were for and at the direction of the Compensation Committee. The Compensation Committee is directly responsible for the appointment, compensation, and oversight of the Compensation Consultant.

In connection with the engagement of the Compensation Consultant, the Compensation Committee considered various factors bearing on the independence of the Compensation Consultant, including, but not limited to, the following:

| | • | | Provision of other services to Exelis by the Compensation Consultant; |

| | • | | Relationships of the Compensation Consultant with members of the Compensation and Personnel Committee, including business and personal relationships; |

| | • | | Relationships of the Compensation Consultant with executive officers of Exelis, including business and personal relationships; |

| | • | | Stock ownership of Exelis by the Compensation Consultant; and |

| | • | | The amount of fees received by the Compensation Consultant. |

The Compensation Committee affirmatively determined the Compensation Consultant was independent and has no conflicts of interest with the Company or the Board of Directors.

In 2014, the Compensation Consultant also acted as an advisor to the Nominating and Governance Committee in connection with Director compensation. In 2014, Exelis’ human resources, finance and legal departments supported the work of the Compensation Committee, provided information, answered questions and responded to requests from the Compensation Consultant.

The Exelis Compensation Peer Group is described below. The Compensation Committee considered this competitive market data in addition to recommendations from Exelis’ Chief Executive Officer and Senior Vice President, Chief Human Resources Officer in determining executive compensation. The Compensation Committee delegated to the Senior Vice President, Chief Human Resources Officer responsibility for administering the executive compensation program.

Exelis Compensation Peer Group:

The Exelis Compensation Peer Group for compensation comparison consists of select Aerospace / Defense companies with annual revenues greater than $1 billion that were available in the Towers Watson compensation survey database. The Compensation Committee considers these companies as being most representative of the companies which comprise the marketplace in which Exelis competes for business talent. Data from these companies were adjusted, using a regression analysis, to reflect Exelis’ annual revenue. Data reviewed included competitive market information for each compensation component and total compensation.

8

The 2014 Exelis Compensation Peer Group consists of:

| • | | Alliant Techsystems Inc. |

| • | | Curtiss-Wright Corporation |

| • | | General Dynamics Corporation |

| • | | Honeywell International Inc. |

| • | | Huntington Ingalls Industries, Inc. |

| • | | L-3 Communications Holdings, Inc. |

| • | | Lockheed Martin Corporation |

| • | | Northrop Grumman Corporation |

| • | | Space Systems / Loral, Inc. |

| • | | Spirit AeroSystems Holdings, Inc. |

| • | | United Technologies Corporation |

| 1 | In September 2013 SAIC, Inc. spun off its technical, engineering and enterprise information technology services business which was named Science Applications International Corporation (“SAIC”) and renamed itself Leidos. Exelis will continue to use Leidos as part of its compensation peer group. |

Annual Compensation Committee Process for Determining CEO and NEO Compensation:

| | | | | | |

Goals and Objectives Approved | | Mid-year performance assessment | | Year-end Performance Preliminary Review | | Actions Based on Performance |

First Quarter (ending March 31, 2014) | | Third Quarter (ending September 30, 2014) | | Fourth Quarter (ending December 31, 2014) | | First Quarter 2015 (ending March 31, 2015) |

| | | |

• CEO Goals and Objectives | | • Review progress toward goals | | • Performance Review for CEO and NEOs | | • Approve Salaries for 2015 |

| | | |

• Annual Incentive Performance Goals | | | | | | • Certify performance goal results, as applicable, for RSU, Options, TSR awards |

| | | |

| | | | | | • Approve AIP payout for prior year |

Exelis Compensation Cycle:

The Compensation Committee reviews compensation in detail during the first quarter of every year. This review includes:

| | • | | Annual performance reviews for the prior year, |

| | • | | Base salary merit increases — normally provided in March, |

| | • | | Long-term incentive target awards (including stock options, restricted stock units and TSR awards). |

The actual award date of stock options, restricted stock units and target TSR awards is determined on the date the Compensation Committee approves these awards, which is typically the March meeting of the Compensation Committee. (Meeting dates for the following year’s regular Exelis Board and Committee meetings are scheduled during the prior year.) Target TSR awards reflect a three-year performance period starting on January 1 of the year in which the Compensation Committee approves the award. Participants in the Long-Term Incentive Award Program receive notification of their award as soon as reasonably practical after the grant date. The Compensation Committee reviewed and assessed the performance of the NEOs during 2014. The Compensation Committee will continue to review and assess the performance of the Chief Executive Officer and all senior executives and authorize compensation actions it believes are appropriate and commensurate with relevant competitive data and the approved compensation program.

Qualitative Considerations:

The Compensation Committee considered individual performance, including consideration of the following qualitative performance factors, in addition to the quantitative measures discussed in this Compensation Discussion

9

and Analysis. While there is no formal weighting of qualitative factors, the following factors were considered in making compensation decisions:

| | |

Consideration | | Objective |

| Portfolio Repositioning | | Rationalize business around core, attractive market segments |

| Differentiated Organic Growth | | Align strategies and resources around attractive portfolio positions |

| Strategic Execution | | Outperform market expectations |

| Cultural Transformation | | Optimize organization around Exelis Vision and Values |

Compensation Objectives, Principles and Approaches:

The compensation program objectives, principles and approaches reflect Exelis business needs and strategy. The following sections provide more detailed information about the Exelis compensation program.

| | | | |

Objective | | General Principle | | Specific Approach |

| Attract and retain well-rounded, capable leaders. | | Design an executive compensation program to attract and retain high performing executives. | | Target total direct compensation at the competitive median of the Exelis Compensation Peer Group adjusted for revenue size. |

| | |

| Align at-risk compensation with business performance. | | The measures of performance in our compensation programs must be aligned with measures key to the success of our businesses. If our businesses succeed, our shareholders will benefit. | | Provide annual and long-term incentive opportunity based on business performance to drive shareholder value. |

| | |

| Align at-risk compensation with levels of executive responsibility. | | As executives advance in the Company, the leverage of at-risk pay relative to fixed pay increases. | | Structure NEO compensation so that a substantial portion of compensation is at risk for executives with greater levels of responsibility. |

Primary Compensation Components:

| | | | | | | | | | | | |

| | | | | | | |

NEO Compensation | | = | | Base Salary | | + | | Annual Incentive | | + | | Long-Term Incentives |

| 1. | Salary — Base salary comprises the smallest component of total direct compensation, reflecting the Compensation Committee’s commitment to aligning NEO compensation with Exelis performance. Salary is not a risk-based element of compensation. |

| 2. | Annual Incentive Plan Awards (AIP) — AIP payouts are based on annual performance against approved objective corporate financial goals. AIP payouts are not guaranteed. Annual performance must meet minimum performance levels for a payout to be earned. |

| 3. | Long-Term Incentive Awards — Restricted Stock Units, Non-qualified Stock Options and TSR awards comprise the Long-Term Incentive Awards. Equity awards align NEO compensation with shareholder value and are the largest component of NEO compensation. The TSR awards measures Company stock price performance relative to a peer group of companies (the Exelis TSR Performance Index discussed herein) over a three-year period. Performance below the 25th percentile results in zero payout. |

NEO Compensation Comparisons:

Annual base salary, annual incentive targets and long-term incentive targets for Exelis’ NEO positions were compared with those of similar positions in the Exelis Compensation Peer Group. This information was used to provide the market median dollar value for annual base salary, annual incentives and long-term incentives. Compensation levels that are approximately 10% above or below the market median dollar value are considered to be within the market median range. The Compensation Committee considers a position’s strategic value, Exelis’ objectives and strategies and individual experience and performance in the position when making comparative

10

decisions. The Compensation Committee could, but was not required to, consider prior year’s compensation, including short-term or long-term incentive payouts, restricted stock unit vesting or option exercises in compensation decisions for the named executive officers.

NEO Compensation — Percentage of Median:

The following chart sets out the 2014 annual base salary, annual incentive target, long-term incentive target and the total compensation for each NEO relative to the market median dollar value. For Messrs. Melcher and Milligan and Ms. Davidson, the compensation components and overall compensation reflect the relatively short tenure of each individual in their current corporate positions. In 2014, none of our NEOs received a salary increase.

Individual Executive Positions — Percentage of Median

| | | | | | | | | | | | | | | | | | |

Named Executive Officer | | 2014

Annual

Base

Salary

($) | | | 2014 Annual Base

Salary as

Percentage of the

Aerospace/Defense

Median Dollar

Value | | Target

2014

Annual

Incentive

Award | | Target 2014

Annual Incentive

Award as

Percentage of

Aerospace/Defense

Median Dollar

Value | | 2014 Long-

Term

Incentive

Award ($) | | | 2014 Long-Term

Incentive Award

as Percentage of

Aerospace/Defense

Median Dollar Value | | Anticipated Total

Annual

Compensation as

Percentage of

Aerospace/Defense

Median |

David F. Melcher,

Chief Executive Officer and President | | | 930,000 | | | 93.0% | | 110% of Annual Base Salary | | 83.7%

(Below median

range) | | | 4,000,000 | | | 110.2% | | 101.0% |

| | | | | | | |

Peter J. Milligan,

Senior Vice President, Chief Financial Officer | | | 481,800 | | | 82.6%

(Below median range) | | 85% of Annual Base Salary | | 105.6% | | | 1,050,000 | | | 84.2%

(Below median

range) | | 84.7%

(Below median

range) |

| | | | | | | |

Ann D. Davidson,

Senior Vice President, Chief Legal Officer and Corporate Secretary | | | 410,000 | | | 87.4%

(Below median range) | | 65% of Annual Base Salary | | 86.5%

(Below median

range) | | | 685,000 | | | 107.4% | | 92.3% |

| | | | | | | |

Christopher D. Young

Executive Vice President, and President and General Manager of Geospatial Systems | | | 389,600 | | | 106.4% | | 65% of Annual Base Salary | | 107.1% | | | 570,000 | | | 104.8% | | 108.1% |

| | | | | | | |

A. John Procopio,

Senior Vice President, Chief Human Resources Officer | | | 368,500 | | | 101.2% | | 65% of Annual Base Salary | | 96.0% | | | 530,000 | | | 146.4% | | 116.5% |

The following sections, including information supplied in tabular form, provide information about principles and approaches with respect to Base Salary, the AIP and long-term incentive target awards for Exelis. The Compensation Committee developed programs for our Base Salary, AIP and long-term incentive target awards, reflecting what the Compensation Committee considered appropriate measures, goals, and targets based on our competitive marketplace.

BASE SALARY

| | |

General Principle | | Specific Approach |

| A competitive salary provides a necessary element of stability. | | Salary levels reflect comparable competitive market levels among a peer group of Aerospace/Defense companies, adjusted by revenue size, as provided by the Compensation Consultant. Data was adjusted using regression analysis to reflect Exelis’ size. Salary levels are reviewed annually. |

| |

| Base salary should recognize individual performance, market value of a position, and the incumbent’s tenure, experience, responsibilities, contribution to Exelis and growth in his or her role. Mr. Melcher declined a salary increase for the 2014 year in light of challenging conditions in the marketplace and the change in the company structure with the spin-off of the Mission Systems business. | | Merit increases are based on overall performance and relative competitive market position. |

11

ANNUAL INCENTIVE PLAN (AIP)

|

| |

AIP Payment = Annual Base Salary x Target AIP Percent x Approved Performance Factor Subject to Compensation Committee Approval |

Overview of the AIP

| | |

General Principle | | Specific Approach |

The AIP target award for NEOs recognizes contributions to the year’s results and is determined by performance against specific corporate financial metrics, as well as qualitative factors, as described in more detail in “Compensation Discussion and Analysis — Our Executive Compensation Program — Qualitative Considerations.” AIP target awards are structured to achieve competitive compensation levels when targeted performance results are achieved. Objective formulas are used to establish potential AIP performance awards. | | The AIP incorporates metrics critical to achieving optimal operating performance. The AIP provides for a cash payment to participating executives established as a target percentage of base salary. AIP target awards are set with reference to the median of competitive practice based on the Exelis Compensation Peer Group. The Compensation Committee may approve negative discretionary adjustments with respect to NEOs. |

AIP awards to NEOs are made under the Exelis Inc. Annual Incentive Plan for Executive Officers, which first became effective as of October 31, 2011 following the spin-off of Exelis from ITT. The Exelis Inc. Annual Incentive Plan for Executive Officers was subsequently approved by Exelis shareholders on May 8, 2013. 2014 target AIP awards for NEOs were approved by our Compensation Committee in March 2014 under the Exelis Inc. Annual Incentive Plan for Executive Officers.

2014 Performance Metrics

To focus the businesses on the operating performance of the enterprise, 2014 internal performance metric attainment and payout design emphasized corporate performance. The Compensation Committee determined that the metrics noted below would be most closely predictive of optimal operating performance in 2014.

|

| |

Earnings Per Share: Earnings per share measures the return per outstanding diluted common share. This provides a way to align executive compensation with shareholder value creation. |

| |

Revenue:Revenue reflects Exelis’ emphasis on growth. Revenue is defined as reported GAAP revenue excluding the impact of foreign currency fluctuations and contributions from acquisitions and divestitures. |

| |

Operating Cash Flow:Operating cash flow reflects Exelis’ emphasis on cash flow generation. For purposes of AIP, Operating Cash Flow is GAAP net cash flow from operating activities, less capital expenditures plus interest, cash taxes and other expense (income), and adjusted for other non-cash special items. |

| |

Return on Invested Capital: ROIC measures Exelis’ ability to profitably invest available capital. ROIC = Operating Income ÷ Five Point Average Invested Capital. Invested Capital is defined as: Total Assets – Pension Related Deferred Tax Assets – Non-Interest Bearing Current Liabilities. The Five Point Average describes the year-end invested capital position as well as the invested capital position for each of the preceding four quarters. |

2014 Internal Performance Metrics

| | | | |

2014 Metrics | | Percentage Weight | |

Earnings per Share | | | 30 | % |

Revenue | | | 30 | % |

Operating Cash Flow | | | 20 | % |

Return on Invested Capital | | | 20 | % |

12

2014 Internal Performance Metrics and Payout Design

Exelis pays for AIP performance that clearly demonstrates achievement of plan goals. Exelis establishes strong incentives for revenue and earnings per share performance and sets aggressive goals for operating cash flow and ROIC metrics. In order to achieve an AIP payout, each metric must meet a certain threshold for that component to be considered in the calculation. For example, revenue performance below the 90% revenue target would result in the revenue metric being reflected as zero in the AIP calculation. In 2014, each performance component of the AIP and the overall AIP award was capped at 200%. Results between points were interpolated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2014 Metric Attainment and Payout Design | |

| | | Revenue and Earnings per Share | | | ROIC | | | Operating Cash Flow | |

Performance Percentage of Target | | | 90 | % | | | 100 | % | | | 108 | % | | | 85 | % | | | 100 | % | | | 116 | % | | | 80 | % | | | 100 | % | | | 116 | % |

Payout Percentage of Target | | | 50 | % | | | 100 | % | | | 200 | % | | | 50 | % | | | 100 | % | | | 200 | % | | | 50 | % | | | 100 | % | | | 200 | % |

2014 AIP Performance Targets and Performance

The Compensation Committee, after considering management recommendations, established 2014 AIP performance targets for the NEOs based on the applicable performance metrics and Exelis’ approved annual operating plan, taking into consideration Exelis’ aspirational business goals. Successful attainment of both qualitative factors and quantitative factors (described in “Compensation Discussion and Analysis — Our Executive Compensation Program — Qualitative Considerations” and “Compensation Discussion and Analysis — 2014 Internal Performance Metric Attainment and Payout Design”) are achievable only if the enterprise and the individual NEOs perform at levels established by the Compensation Committee. As permitted by the AIP, the Compensation Committee may exclude the impact of acquisitions, dispositions and other special items in computing the AIP payout.

2014 AIP Awards Paid in 2015

On February 18, 2015, the 2014 AIP awards for Messrs. Milligan, Young and Procopio and Ms. Davidson were reviewed and approved by Mr. Melcher in his role as Chief Executive Officer and President of Exelis and 2014 AIP awards for all NEOs, including Mr. Melcher, were reviewed and approved by the Compensation Committee. 2014 AIP Awards for NEOs are included in the Summary Compensation Table below in the “Non-Equity Incentive Plan Compensation” column. The Compensation Committee excluded the impact of acquisitions, dispositions and other special items in computing AIP performance relating to AIP targets. The performance and payout percentages for each component of the AIP were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

Metric (all $ amounts in millions

Except for EPS and ROIC) | | Performance Target at 100%

Payment and Weighting | | | 2014

Performance | | | Performance

Percentage of

Target | | | Payout

Percentage of

Target | | | Weighted

Attainment | |

Earnings Per Share | | $ | 1.21 | | | | 30 | % | | $ | 1.23 | | | | 101.5 | % | | | 102.5 | % | | | 30.8 | % |

Revenue | | $ | 3,300 | | | | 30 | % | | $ | 3271.6 | | | | 99.2 | % | | | 98.6 | % | | | 29.6 | % |

Operating Cash Flow | | $ | 401 | | | | 20 | % | | $ | 368.2 | | | | 91.8 | % | | | 85.5 | % | | | 17.1 | % |

Return on Invested Capital | | | 12.8 | % | | | 20 | % | | | 12.7 | % | | | 99.2 | % | | | 99.2 | % | | | 19.8 | % |

The following table illustrates the calculation of the 2014 AIP Awards paid in 2015. (Sum of Components may differ from Actual Award amounts due to rounding.)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Named Executive Officer | | Base Salary

$ (a) | | | Annual

Incentive

Target

as a

Percentage of

Base Salary

(b) | | | Earnings

Per Share

Percentage

Achieved | | | Revenue

Percentage

Achieved | | | Operating

Cash

Flow

Percentage

Achieved | | | ROIC

Percentage

Achieved | | | Total

Performance

Percentage

Achieved

(c) | | | Actual AIP

2014

Awards

(a) *(b) *(c)

($) | |

David F. Melcher | | | 930,000 | | | | 110 | % | | | 101.5 | % | | | 99.2 | % | | | 91.8 | % | | | 99.2 | % | | | 97.5 | % | | | 997,400 | |

Peter J. Milligan | | | 481,800 | | | | 85 | % | | | 101.5 | % | | | 99.2 | % | | | 91.8 | % | | | 99.2 | % | | | 97.5 | % | | | 399,300 | |

Ann D. Davidson | | | 410,000 | | | | 65 | % | | | 101.5 | % | | | 99.2 | % | | | 91.8 | % | | | 99.2 | % | | | 97.5 | % | | | 259,800 | |

Christopher D. Young | | | 389,600 | | | | 65 | % | | | 101.5 | % | | | 99.2 | % | | | 91.8 | % | | | 99.2 | % | | | 97.5 | % | | | 246,900 | |

A. John Procopio | | | 368,500 | | | | 65 | % | | | 101.5 | % | | | 99.2 | % | | | 91.8 | % | | | 99.2 | % | | | 97.5 | % | | | 233,500 | |

13

Long-Term Incentive Awards Program:

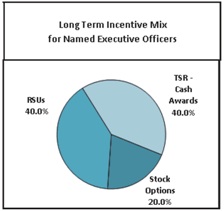

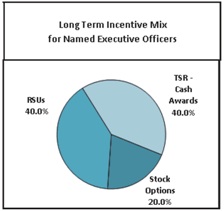

The Exelis long-term incentive award for senior executives has three components, each of which directly ties long-term compensation to long-term value creation and shareholder return. The 2014 long-term incentive program awards were allocated as follows:

2014 Named Executive Officers

Long-Term Incentive Mix

The 2014 awards were granted on March 6, 2014. A valuation based on the March 6, 2014 grant date was used to determine the number of options and restricted stock units to be granted pursuant to this allocation. The number of options to be granted was based on the Black-Scholes value on the March 6, 2014 grant date. The number of restricted stock units to be granted was based on the closing price of Exelis stock on the grant date. TSR awards represented 40% of the total target long-term award.

The Compensation Committee determined to adjust the long-term incentive mix for named executive officers to reduce the percentage of non-qualified options from previous years. Further, restricted stock units awarded in 2014 will vest in one-third annual installments on the anniversary of the grant date. The restricted stock units would vest in full upon an acceleration event. These adjustments reflect current competitive market trends in the Exelis Compensation Peer Group. The Compensation Committee considers the Compensation Consultant’s review and assessment of current competitive practice, as well as individual performance, in determining the individual’s total target award.

Restrictive Covenants for Exelis Long-Term Incentive Awards: Starting in 2012, the Compensation Committee approved modifications to the restricted stock unit, non-qualified stock option and TSR award terms and conditions upon termination of employment by the participant.

| | • | | Non-solicitation: In order for the participant to receive an award the participant must accept the terms and conditions, including a restrictive covenant which provides that the participant will not, within the restricted period, influence or attempt to influence Exelis customers for the purpose of soliciting business or Exelis employees for the purposes of hiring such employees for a period of one year following termination. |

| | • | | Non-competition: In order for the participants who have attained age 60 having completed five years of service, to receive continued vesting of awards following retirement, the participant must accept the terms of a non-competition agreement for a term consistent with the award with respect to continued vesting. If the participant does not accept the terms of the non-competition agreement, the awards will be subject to standard pro-rata vesting upon termination due to retirement. |

Breach of either the non-solicitation or non-competition provisions will result in forfeiture of the award, or if the participant has disposed of all or any portion of the award prior to the date of such forfeiture, recovery of an amount equal to the aggregate after-tax proceeds.

14

Restricted Stock Unit Component

Grants of restricted stock units provide NEOs with stock ownership of unrestricted shares after the restriction lapses. NEOs received restricted stock unit awards because, in the judgment of the Compensation Committee and based on management recommendations, these individuals were in positions most likely to assist in the achievement of Exelis’ long-term value creation goals and to create shareholder value over time. The Compensation Committee reviewed all proposed awards of restricted stock units for NEOs prior to grant, including awards based on performance, retention-based awards and awards contemplated for new executive employees as part of employment offers.

Key elements of the 2014 restricted stock unit award program were:

| | • | | Restricted stock units provide the same economic risk or reward as restricted stock, but recipients do not have voting rights and do not receive cash dividends during the restriction period. Dividend equivalents are accrued and paid in cash upon vesting of the restricted stock units. Vested restricted stock units are generally settled in shares. |

| | • | | Restricted stock units are generally subject to a ratable three-year restriction period. In certain cases, such as for new hires or to facilitate retention, selected employees may receive restricted stock units subject to different vesting terms. Restricted stock units may not be sold, assigned, pledged, exchanged, transferred, hypothecated or encumbered, other than to the Company as a result of forfeiture. |

| | • | | If an acceleration event occurs (as described in “Compensation Tables — Change of Control Arrangements”), restricted stock units vest in full. |

| | • | | If an employee dies or becomes disabled, restricted stock units vest in full. |

| | • | | If an employee leaves Exelis prior to vesting either through resignation or termination for cause, restricted stock units are forfeited. |

| | • | | If an employee retires or is terminated other than for cause, a pro-rata portion of the restricted stock unit award vests. With respect to termination other than for cause, the pro rata portion includes vesting that reflects the applicable severance period. For 2014, restricted stock unit awards continue to vest for employees who are retirement eligible and agree to the non-competition and non-solicitation covenants described in “Compensation Discussion and Analysis — Restrictive Covenants for Exelis Long-Term Incentive Awards”. |

Non-Qualified Stock Options Component

Non-qualified stock options permit optionees to buy Exelis stock in the future at a price equal to the stock’s value on the date the option was granted, which is referred to as the option exercise price. Non-qualified stock option terms were selected after the Compensation Committee’s review and assessment of terms the market and general competitive practice.

For Mr. Melcher, non-qualified stock options granted in 2010 and 2011 prior to the spin-off of Exelis from ITT do not vest until three years after the award date. This delayed vesting is referred to as three-year cliff vesting. Non-qualified stock option awards granted to Mr. Melcher prior to 2010 vest in one-third cumulative annual installments on the anniversary date of the award. Stock options granted to Mr. Melcher on November 11, 2011 and on March 6, 2012 vest in one-third cumulative annual installments on the anniversary date of the award. Stock options awarded to Messrs. Milligan, Young, and Procopio and Ms. Davidson in 2011, 2012, 2013 and 2014 vest in one-third cumulative annual installments on the anniversary date of the award. In 2014, the fair value of stock options granted under the employee stock option program was calculated using a Black-Scholes valuation model.

Key elements of the 2014 non-qualified stock option program were:

| | • | | The option exercise price of stock options awarded was the NYSE closing price of Exelis common stock on the date the award was approved by the Compensation Committee. |

| | • | | For options granted to new executives, the option exercise price of approved stock option awards is the closing price on the grant date, generally five days following the first day of employment. |

| | • | | Options cannot be exercised prior to vesting. |

15

| | • | | Options awarded in 2014 expire ten years after the grant date, as long as employment is not earlier terminated. |

| | • | | If an employee is terminated for cause, vested and unvested portions of the options expire on the date of termination. |

| | • | | The ITT 2003 Equity Incentive Plan (the “ITT 2003 Plan”), the Exelis Inc. 2011 Omnibus Incentive Plan (the “2011 Plan”) and the Amended and Restated Exelis Inc. 2011 Omnibus Incentive Plan (the “Amended 2011 Plan”) prohibit, without shareholder approval, the repricing of, or exchange of, stock options and stock appreciation rights that are priced below the prevailing market price with lower-priced stock options or stock appreciation rights. If an acceleration event occurs (as described in “Compensation Tables — Change of Control Arrangements”), the stock option award vests in full. |

| | • | | There may be adjustments to the post-employment exercise period of an option grant if an employee’s tenure with Exelis is terminated due to death, disability, retirement or termination by Exelis other than for cause. Any post-employment exercise period, however, cannot exceed the original expiration date of the option. If employment is terminated due to an acceleration event or because the option holder believed in good faith that he or she would be unable to discharge his or her duties effectively after the acceleration event, the option would not expire before the earlier of the date seven months after the acceleration event or the normal expiration date. |

The following table provides a summary of some of the main characteristics of restricted stock units and non-qualified stock options.

| | |

Restricted Stock or Restricted Stock Units | | Non-Qualified Stock Options |

| |

| A restricted stock unit award is a promise to deliver to the recipient, upon vesting, shares of Exelis stock. | | Non-qualified stock options provide the opportunity to purchase Exelis stock at a specified price called the “exercise price” at a future date. |

| |

| Holders of restricted stock units are not entitled to vote the shares and do not receive cash dividends during the restriction period. Dividend equivalents are paid in cash upon restricted stock unit vesting. | | Stock option holders do not receive dividends on shares underlying options and cannot vote their shares. |

| |

| Restricted stock and restricted stock units have intrinsic value on the day the award is received and retain some realizable value even if the stock price declines during the restriction period, so each provides strong employee retention value. | | Non-qualified stock options increase focus on activities primarily related to absolute stock price appreciation. If the value of Exelis stock increases and the optionee exercises his or her option to buy at the exercise price, the optionee receives a gain in value equal to the difference between the option exercise price and the price of the stock on the exercise date. If the value of Exelis stock fails to increase or declines, the stock option has no realizable value. Stock options may provide less retention value than restricted stock units since stock options have realizable value only if the stock price appreciates over the option exercise price before the options expire. |

16

TSR Award Component

| | |

Feature | | Implementation |

| TSR awards reward comparative stock price appreciation relative to that of the TSR Performance Index described on under “Compensation Discussion and Analysis — 2014 TSR Performance Index”. | | The Compensation Committee, at its discretion, determines the size and frequency of target TSR awards, performance measures and performance goals, in addition to performance periods. In determining the size of target TSR awards for executives, the Compensation Committee considers comparative data provided by the Compensation Consultant. |

| |

| Three-year performance period | | A three-year TSR performance period encourages behaviors and performance geared to Exelis long-term goals and, in the view of the Compensation Committee, discourages behaviors that might distract from that focus. The three-year performance period allows sufficient time for focus on long-term goals, mitigates market swings not based on performance and is also somewhat independent of short-term market cycles. |

| |

| Performance measurement and award frequency | | Exelis’ performance for purposes of the TSR awards is measured by ranking Exelis performance against the Exelis TSR Performance Index. Payouts, if any, are based on a non-discretionary formula and interpolated for values between the 25th and 75th percentile of performance. The Compensation Committee felt these breakpoints were properly motivational and rewarded the desired behavior. |

| |

| TSR awards are expressed as target cash awards and paid in cash | | Cash awards reward relative performance while reducing share dilution. |

| |

| Components of TSR | | The Compensation Committee considered the components of a measurable return of value to shareholders, reviewed peer practices and received input from the Compensation Consultant. Based on that review the Compensation Committee determined that the most significant factors to measure return of value to shareholders were: • dividend yields, • cumulative relative change in stock price, and • extraordinary shareholder payouts. |

| |

| TSR calculation | | TSR = the percentage change in value of a shareholder’s investment from the beginning to the end of the performance period, assuming reinvestment of dividends and any other shareholder payouts during the performance period. |

2014 TSR awards are weighted as follows:

2014 TSR Performance Index

| | |

| | |

100% | | S&P 1500 Aerospace/Defense Index |

For 2014, the Compensation Committee determined to use the S&P 1500 Aerospace/Defense Index as the sole index for the 2015 TSR performance index, because of the reduced number of companies in the concentrated peer group ranking and the changing business dynamics.

17

Performance Goals and Payments for the TSR Awards

| | | | | | |

| | | Exelis Rank | | Payout of Target Value | |

S&P 1500 Aerospace/Defense Index* | | Below the 25th percentile | | | 0 | % |

| | 25th percentile or above | | | 50 | % |

| | 50th percentile or above | | | 100 | % |

| | 75th percentile or above | | | 200 | % |

| * | Payouts for the S&P 1500 Aerospace / Defense Index are interpolated for intermediate percentiles. |

Amount of target TSR awards. Exelis target TSR awards provided to NEOs are generally based on a participant’s position, competitive market data, individual performance and anticipated potential contributions to Exelis long-term goals. The Compensation Committee considered individual performance and competitive market data in determining individual target TSR awards.

Key elements of 2014 TSR awards include:

| | • | | If a participant’s employment terminates before the end of the three-year performance period, the award is forfeited except in two cases: (1) if a participant dies or becomes disabled, the TSR award vests in full and payment, if any, is made according to its original terms. Vesting in full in the case of death or disability reflects the inability of the participant to control the triggering event and is consistent with benefit plan provisions related to death and disability; and (2) if a participant retires or is terminated by Exelis other than for cause, a pro-rata payout, if any, is provided based on the number of full months of employment during the measurement period divided by 36 months (the term of the three-year TSR performance period). This pro-rated payout, if any, is provided because it reflects the participant’s service during the pro-rated period. For TSR awards granted in 2014, the remaining portion of the awards are not forfeited if certain non-solicitation and non-competition provisions are met for participants who have attained age 60 having completed five years of service (described in “Compensation Discussion and Analysis — Restrictive Covenants for Exelis Long-Term Incentive Awards”). To receive continued vesting of awards following retirement, the participant must accept the terms of a non-competition agreement for a term consistent with the award term respect to continued vesting. If the participant does not accept the terms of the non-competition agreement, the awards will be subject to standard pro-rata vesting upon termination due to retirement. |

| | • | | Exelis performance for purposes of the TSR awards is measured by comparing the average stock price over the trading days in the month of December immediately prior to the start of the TSR three-year performance period to the average stock price over the trading days in the last month of the three-year cycle, including adjustments for dividends and extraordinary payments. |

| | • | | Payment, if any, of cash awards generally is made following the end of the applicable three-year performance period and will be based on Exelis performance measured against the total shareholder return performance of the Exelis TSR Performance Index. |

| | • | | Subject to the provisions of Section 409A of the Internal Revenue Code, which is referred to as the “Code,” in the event of a change of control (described in “Compensation Tables — Change of Control Arrangements”), a pro rata portion of outstanding awards would be paid based on actual performance through the date of the change of control and the balance of the award would be paid at target (100%) within 30 days following the change in control. There could be up to three outstanding TSR awards at any time. |

| | • | | Performance goals for the applicable TSR performance period were established in writing no later than 90 days after the beginning of the applicable performance period. |

18

2014 Long Term Incentive Awards:

The following table describes the 2014 long-term incentive awards for the NEOs, as determined by the Compensation Committee on March 6, 2014.

| | | | | | | | | | | | |

Named Executive Officer | | TSR Award

(Target -

Potential Cash Award) ($) | | | Non-Qualified Stock

Option Award

(# of Options)(1) | | | Restricted

Stock Unit

Awards(1)

(# of Units) | |

David F. Melcher | | | 1,600,000 | | | | 169,849 | | | | 83,497 | |

Peter J. Milligan | | | 420,000 | | | | 44,585 | | | | 21,917 | |

Ann D. Davidson | | | 274,000 | | | | 29,086 | | | | 14,298 | |

Christopher D. Young | | | 228,000 | | | | 24,203 | | | | 11,898 | |

A. John Procopio | | | 212,000 | | | | 22,504 | | | | 11,063 | |

| (1) | The number of options and units represent the non-converted amounts prior to the spin-off of Vectrus, Inc. from Exelis. |

Salaried Investment and Savings Plans and Salaried Retirement Plan:

The Exelis Salaried Investment and Savings Plan (the “ISP”) and the ITT Salaried Retirement Plan, a qualified defined benefit pension plan, renamed the Exelis Salaried Retirement Plan (the “SRP”), were transferred to Exelis in connection with the spin-off of Exelis from ITT. Employees are vested under the SRP after three years of eligibility service.

Effective January 1, 2012 (the “effective date”), the Compensation Committee adopted and implemented modifications to the ISP and the SRP. On that date, all current, eligible U.S. Exelis employees, including the NEOs, had a one-time opportunity to choose participation in the ISP or the SRP. Employees who chose the ISP stopped accruing benefits under the SRP on the effective date. Employees who chose the SRP alternative will not receive any further employer matching or base contributions under the ISP, but they may continue to make their own contributions under the ISP. The SRP is described in detail in the narrative to the Pension Benefits in “Compensation Tables — Pension Benefits” and in the Pension Benefits table. For those employees who chose the ISP, Exelis will continue to credit the employee’s ISP account each pay period throughout the year with a base contribution, regardless of whether the employee makes individual contributions. Effective January 1, 2012, the new base contribution will be based on the following formula:

| | • | | 2% of eligible pay if an employee is less than 35 years of age; |

| | • | | 3% of eligible pay if an employee is at least 35 years of age but less than 45 years of age; and |

| | • | | 4% of eligible pay if an employee is 45 years of age or older. |

In addition, an employee receives a dollar-for-dollar match (100%) on the first 1% of eligible pay contributed by the employee into the ISP and a 50% match on the next 5% of eligible pay contributed into the ISP. An employee will be vested immediately in all individual and company contributions under the ISP. As of the January 1, 2012, contributions to the ISP automatically increased to 6% of eligible pay if an employee is saving less than 6% as of January 1, 2012 or not saving at all. By contributing 6% of eligible pay, an employee will receive the maximum employer matching contribution.

Under the Exelis SRP, employees will continue to earn a pension plan benefit, but only under the Traditional Pension Plan (“TPP”) formula; the Pension Equity Plan (“PEP”) formula will be discontinued as of January 1, 2012.

However, under the PEP formula, any benefit amount employees have accrued under the PEP formula will be credited with interest under the PEP formula. The PEP interest rate will be the greater of the 10-year Treasury bond as of December 31 of the prior year or 3.25%. When an employee leaves Exelis, at any age, the employee receives the PEP amount accrued, if vested. The TPP formula and PEP formula are described herein.