| | |

| | | Filed by Exelis Inc. Commission File No. 001-35228 Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Exelis Inc. Commission File No. 001-35228 |

Harris Transaction Executive Update Briefing

May 7, 2015

Transaction overview & value proposition

Strengthens core franchises Builds stronger platform for growth Creates scale and more balanced earnings Generates meaningful cost synergies Creates significant value for all stakeholders

Combination creates a significantly stronger and more competitive company that is better positioned with its key customers to compete for and win new contracts

Copyright 2015, Exelis Inc.

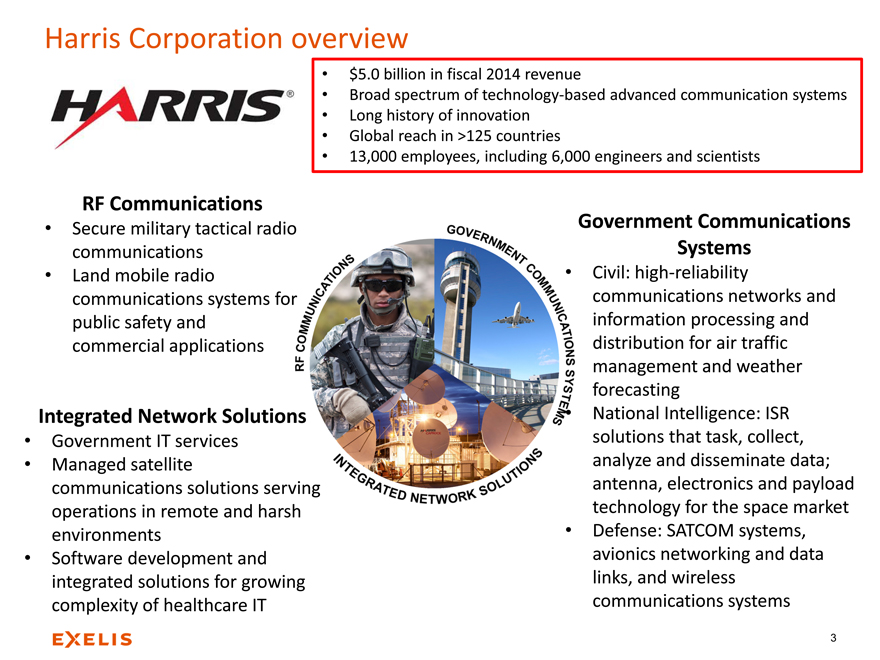

Harris Corporation overview

$5.0 billion in fiscal 2014 revenue

Broad spectrum of technology based advanced communication systems Long history of innovation Global reach in >125 countries 13,000 employees, including 6,000 engineers and scientists

RF Communications

Secure military tactical radio communications Land mobile radio communications systems for public safety and commercial applications

Integrated Network Solutions

Government IT services Managed satellite communications solutions serving operations in remote and harsh environments Software development and integrated solutions for growing complexity of healthcare IT

Government Communications Systems

Systems

Civil: high reliability communications networks and information processing and distribution for air traffic management and weather forecasting National Intelligence: ISR solutions that task, collect, analyze and disseminate data; antenna, electronics and payload technology for the space market Defense: SATCOM systems, avionics networking and data links, and wireless communications systems

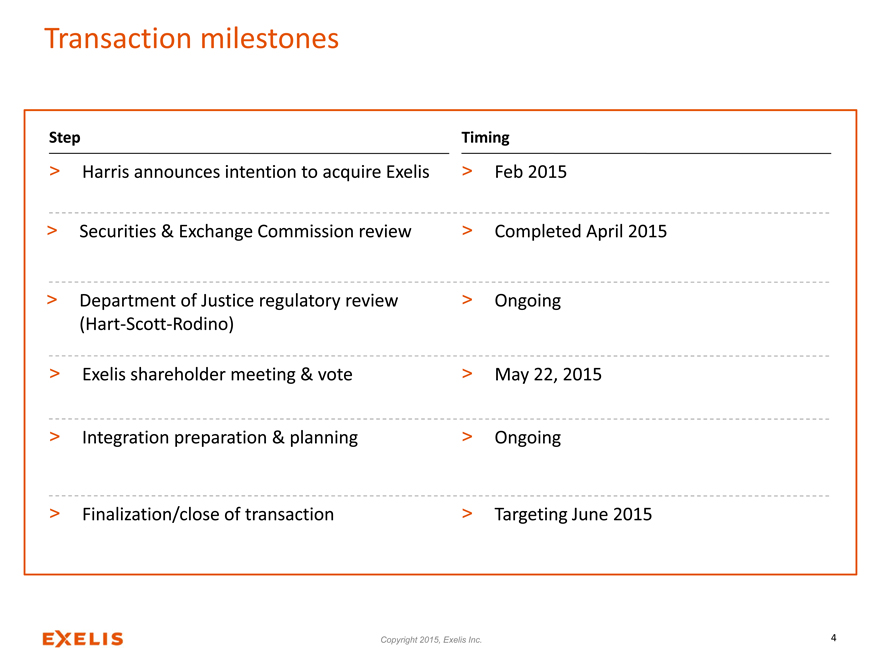

Transaction milestones

Step Timing

Harris announces intention to acquire Exelis

Securities & Exchange Commission review

Department of Justice regulatory review (Hart Scott Rodino)

Exelis shareholder meeting & vote

Integration preparation & planning

Finalization/close of transaction

Feb 2015

Completed April 2015

Ongoing

May 22, 2015

Ongoing

Targeting June 2015

Copyright 2015, Exelis Inc.

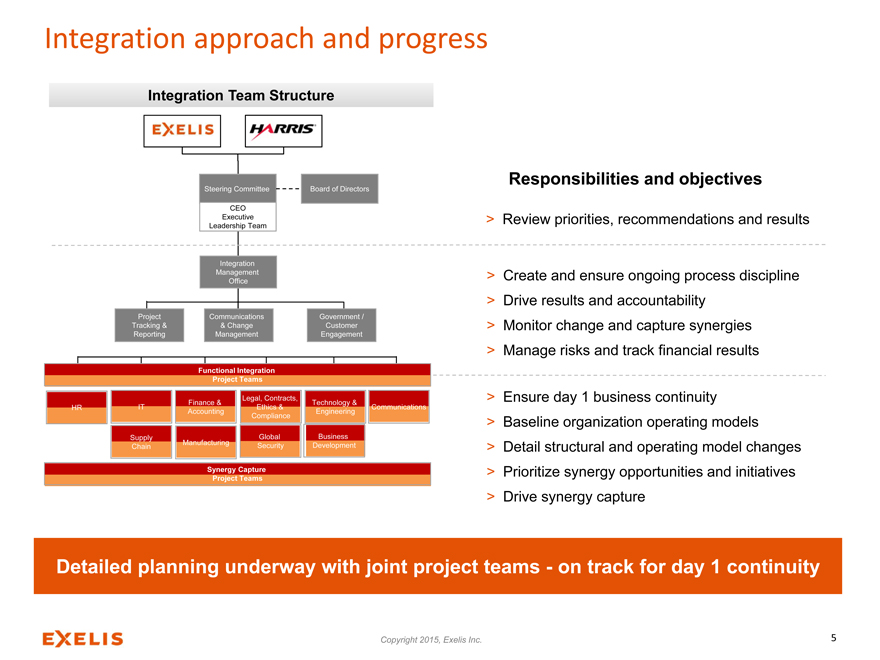

Integration approach and progress

Integration Team Structure

Steering Committee Board of Directors

CEO Executive Leadership Team

Integration Management Office

Project Communications Government / Tracking & & Change Customer Reporting Management Engagement

Functional Integration Project Teams

Legal, Contracts,

Finance & Technology &

HR IT Ethics & Communications Accounting Engineering Compliance

Supply Manufacturing Global Business Chain Security Development

Synergy Capture Project Teams

Responsibilities and objectives

Review priorities, recommendations and results

Create and ensure ongoing process discipline Drive results and accountability Monitor change and capture synergies Manage risks and track financial results

Ensure day 1 business continuity Baseline organization operating models Detail structural and operating model changes Prioritize synergy opportunities and initiatives Drive synergy capture

Detailed planning underway with joint project teams—on track for day 1 continuity

Copyright 2015, Exelis Inc.

Exelis Integration Management Team

Executive Sponsor: Bob Durbin Integration Manager: Jeff Ryder

Functional Teams

Finance: Chris Knight IT: Ray DeLuke Legal: Rachel Semanchik HR: Elizabeth Gay Facilities: Tina Zinger

Communications: B.J. Talley

Supply Chain: Beth Sowers ESH & Security: Alan Leibowitz Contracts: Bridge Littleton Mfg. Operations: Mike Ognenovski

Synergy Project Teams

Technology & Revenue Growth: Sanjay Parthasarathy

Business Consolidation: Jeff Ryder

Benefits: Allison Oncel FAA Programs: Ed Sayadian Supply Chain: Beth Sowers IT: Ray DeLuke

Facilities Consolidation: Tina Zinger Shared Services: Mike Heller

Tax/Insurance: Clayton Young & Charmaine Pavelko Operations: Mike Ognenovski

Matrixed team structure ensures functional continuity and value capture

Copyright 2015, Exelis Inc.

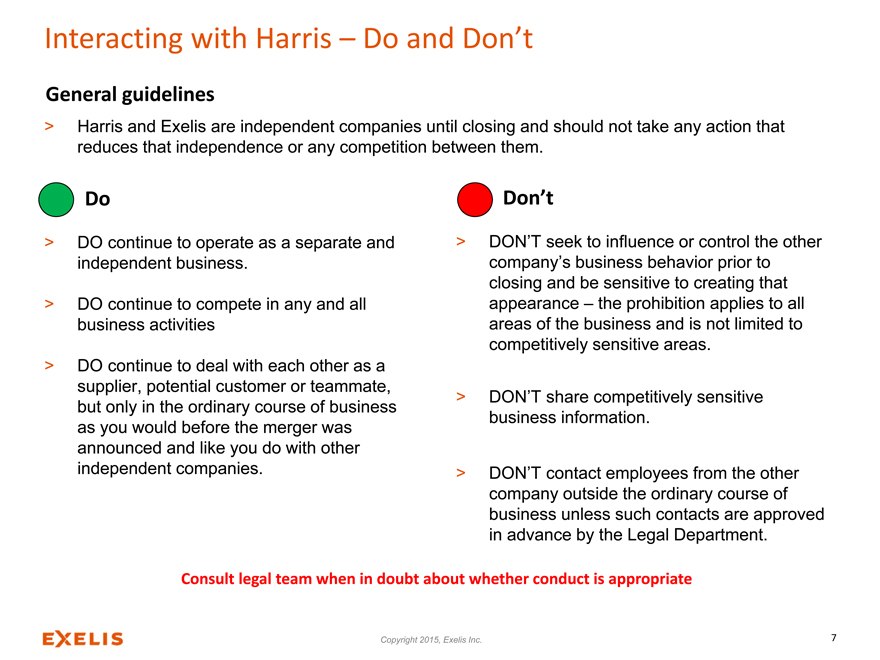

Interacting with Harris – Do and Don’t

General guidelines

Harris and Exelis are independent companies until closing and should not take any action that reduces that independence or any competition between them.

Do

DO continue to operate as a separate and independent business.

DO continue to compete in any and all business activities

DO continue to deal with each other as a supplier, potential customer or teammate, but only in the ordinary course of business as you would before the merger was announced and like you do with other independent companies.

Don’t

DON’T seek to influence or control the other company’s business behavior prior to closing and be sensitive to creating that appearance – the prohibition applies to all areas of the business and is not limited to competitively sensitive areas.

DON’T share competitively sensitive business information.

DON’T contact employees from the other company outside the ordinary course of business unless such contacts are approved in advance by the Legal Department.

Consult legal team when in doubt about whether conduct is appropriate

Copyright 2015, Exelis Inc.

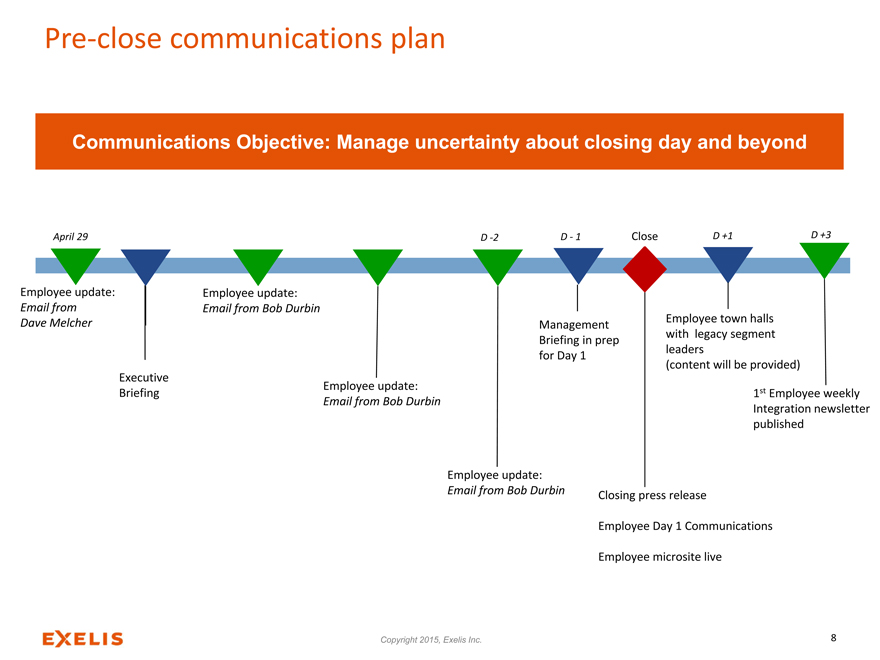

Pre close communications plan

Communications Objective: Manage uncertainty about closing day and beyond

April 29 D 2 D 1 Close D +1 D +3

Employee update: Employee update:

Email from Email from Bob Durbin

Dave Melcher Employee town halls Management with legacy segment Briefing in prep leaders for Day 1 (content will be provided) Executive Employee update:

Briefing 1st Employee weekly

Email from Bob Durbin

Integration newsletter published

Employee update:

Email from Bob Durbin

Closing press release

Employee Day 1 Communications

Employee microsite live

Copyright 2015, Exelis Inc.

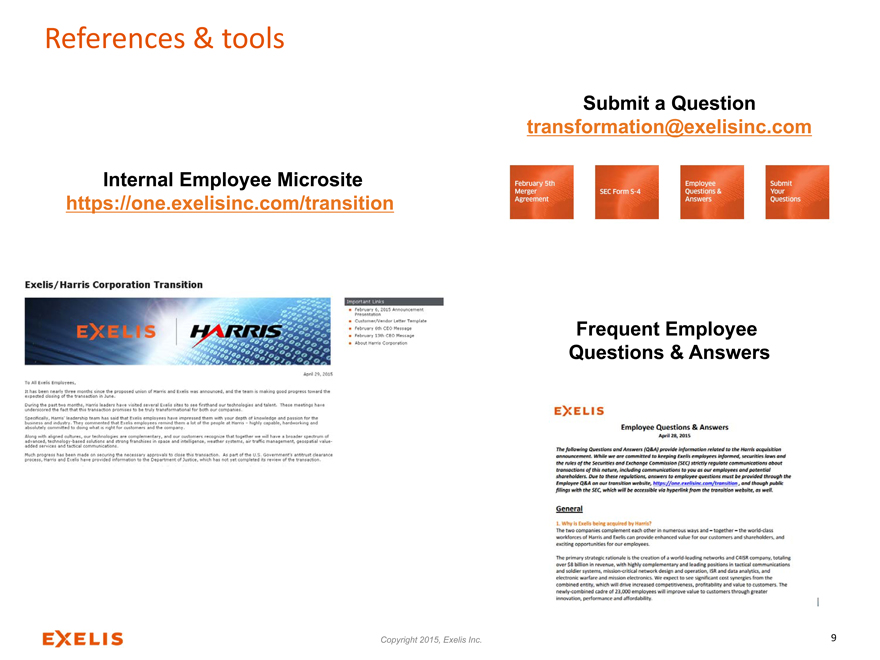

References & tools

Submit a Question transformation@exelisinc.com

Internal Employee Microsite https://one.exelisinc.com/transition

Frequent Employee Questions & Answers

Copyright 2015, Exelis Inc.

9

Your role as an Exelis leader

Discuss the facts as they are announced via official channels – do not improvise or deviate from the messages that have been vetted and approved by our legal counsel.

There will likely be questions for which you do not have the answer. Acknowledge that there will be uncertainty and do not speculate.

Refer employees to the Exelis transition website (https://one.exelisinc.com/transition) Elevate questions to your supervisor or submit them to transformation@exelisinc.com

Encourage employees to remain focused on serving customers and emphasize Harris has indicated that “Day 1” post closing will bring few significant changes for the vast majority of staff

Reiterate to customers that Harris anticipates the transition process will have no effect on normal operations in the near term.

As Exelis executives, our language sets the tone from the top for the future

Copyright 2015, Exelis Inc.

QUESTIONS

Copyright 2015, Exelis Inc.

Legend

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995

This communication contains “forward looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, known as the PSLRA. These statements, as they relate to

Exelis and Harris, the management of either such company or the proposed transaction between Exelis and Harris, involve risks and uncertainties that may cause results to differ materially from those set forth in the statements. These statements are based on current plans, estimates and projections, and

therefore, you are cautioned not to place undue reliance on them. No forward looking statement can be guaranteed, and actual

results may differ materially from those projected. Exelis and Harris undertake no obligation to publicly update any forward looking

statement, whether as a result of new information, future events or otherwise, except to the extent required by law. Forward looking

statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the

business and future financial results, and other legal, regulatory and economic developments. We use words such as “anticipates,”

“believes,” “plans,” “expects,” “projects,” “future,” “intends,” “may,” “will,” “should,” “could,” “estimates,” “predicts,” “potential,”

“continue,” “guidance,” and similar expressions to identify these forward looking statements that are intended to be covered by the

safe harbor provisions of the PSLRA. Actual results could differ materially from the results contemplated by these forward looking

statements due to a number of factors, including: the risk that the businesses will not be integrated successfully; the risk that the

cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected;

disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the failure to obtain governmental approvals of the transaction on the proposed terms and

schedule, and any conditions imposed on the combined company in connection with consummation of the merger; the failure to

obtain approval of the merger by the shareholders of Exelis and the failure to satisfy various other conditions to the closing of the merger contemplated by the merger agreement;

and the risks that are described from time to time in Exelis’ and Harris’ respective reports filed with the SEC, including Exelis’

Annual Report on Form 10 K for the year ended December 31, 2014 (as amended by Annual Report on Form 10 K/A filed on April 6, 2015), and Harris’ annual report on Form 10 K for the year ended June 27, 2014 and quarterly reports on Form

10 Q for the quarters ended September 26, 2014, and January 2, 2015, in each case, as such reports may have been amended. This document speaks only as of its date, and Exelis and Harris each disclaims any duty to update the information herein.

Additional Information and Where to Find It

In connection with the proposed transaction, Harris has filed with the SEC, and the SEC has declared effective, a Registration

Statement on Form S 4 (Reg. No. 333 202539), containing a proxy statement/prospectus regarding the proposed merger. SHAREHOLDERS OF EXELIS ARE ENCOURAGED TO READ THE

REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING

THE DEFINITIVE PROXY STATEMENT/ PROSPECTUS THAT IS PART OF THE REGISTRATION STATEMENT, BECAUSE THEY CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED MERGER. The definitive proxy statement/prospectus has been mailed to shareholders of Exelis. Investors and security holders may obtain the documents free of charge at

the SEC’s web site, www.sec.gov, from Harris at its web site, www.Harris.com, or from Exelis at its web site, www.Exelisinc.com,

or 1650 Tysons Blvd. Suite 1700, McLean, VA 22102, attention: Corporate Secretary.

Participants In Solicitation

Exelis and Harris and their respective directors and executive officers, other members of management and employees and the

proposed directors and executive officers of the combined company, may be deemed to be participants in the solicitation of

proxies in respect of the proposed transaction. Information concerning the proposed directors and executive officers of the combined company, Exelis’ and

Harris’ respective directors and executive officers and other participants in the proxy solicitation, including a description of their

interests, is included in the definitive proxy statement/prospectus contained in the above referenced Registration Statement on Form S 4 (Reg. No. 333 202539), as amended, and in

Exelis’ and Harris’ respective Form 10 Ks, as amended, for the year ended December 31, 2014 in respect of Exelis and for the

year ended June 27, 2014 in respect of Harris.

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be

made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Copyright 2015, Exelis Inc.

12