- XYL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Xylem (XYL) DEF 14ADefinitive proxy

Filed: 24 Mar 15, 12:00am

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

| ¨ | Confidential, for the Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

Xylem Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

XYLEM INC.

2015 Proxy Statement

Notice of Annual Meeting of Shareowners

to be held on May 12, 2015

1 International Drive

Rye Brook, NY 10573

March 24, 2015

Dear Fellow Shareowners:

Enclosed are the Notice of Annual Meeting and Proxy Statement for Xylem’s 2015 Annual Meeting of Shareowners to be held on May 12, 2015 (the “Annual Meeting”). Details of the business to be conducted at the Annual Meeting are provided in the accompanying Notice of Annual Meeting and Proxy Statement.

In accordance with U.S. Securities and Exchange Commission rules, we are using the Internet as our primary means of furnishing proxy materials to shareowners. We believe the use of the Internet makes the proxy distribution process more efficient and helps in conserving natural resources.

If you are a registered owner of Xylem common stock and do not plan to vote in person at the Annual Meeting, you may vote via the Internet, by telephone or, if you receive a paper proxy card in the mail, by mailing the completed proxy card. Voting by any of these methods will ensure your representation at the Annual Meeting.

If you are a beneficial owner, meaning someone else - such as your bank, broker or trustee - is the owner of record, the owner of record will communicate with you about how to vote your shares.

Your vote is important and we encourage you to vote as soon as possible, whether or not you plan to attend the Annual Meeting.

Sincerely,

Markos I. Tambakeras

Chairman

1 International Drive

Rye Brook, NY 10573

March 24, 2015

NOTICE OF 2015 ANNUAL MEETING OF SHAREOWNERS

| Date and Time: | Tuesday, May 12, 2015, at 11:00 a.m. ET | |

| Place: | Xylem World Headquarters 1 International Drive, Rye Brook, New York 10573 | |

| Items of Business: | 1. Election of the three Class I Directors. | |

| 2. Ratification of the appointment of Deloitte & Touche LLP for 2015. | ||

| 3. Advisory Vote to approve compensation of named executive officers. | ||

4. Consider a shareowner proposal titled “Reincorporate in Delaware,” if properly presented at the Annual Meeting. | ||

| 5. Transact such other business as may properly come before the meeting. | ||

| Record Date: | Close of business on March 13, 2015. | |

| Mailing or Availability Date: | Beginning on or about March 24, 2015, this Notice of Annual Meeting and the 2015 Proxy Statement are being mailed or made available, as the case may be, to shareowners of record as of March 13, 2015. | |

| Voting by Proxy: | Your vote is important. Please vote your proxy promptly so your shares can be represented at the meeting. You can vote your shares by Internet, by telephone or by completing and returning your proxy card or voting instruction form. Please see “Proxy Statement – Information About Voting” for details. | |

By Order of the Board of Directors,

Claudia S. Toussaint

SVP, General Counsel & Corporate Secretary

Important Notice Regarding the Availability of Proxy Materials for the 2015 Annual Meeting:

Our 2015 Proxy Statement and Annual Report for the year ended December 31, 2014 will be available online at https://www.proxyvote.com and on our website at www.xyleminc.com under “Investors.”

| PAGE | ||||

| 1 | ||||

| 4 | ||||

| 7 | ||||

| Proposals to be Voted on at the 2015 Annual Meeting | 8 | |||

| 8 | ||||

Proposal 2: Ratification of the appointment of Deloitte & Touche LLP for 2015 | 13 | |||

Proposal 3: Advisory Vote to Approve Compensation of Named Executive Officers. | 15 | |||

Proposal 4: Shareowner Proposal titled “Reincorporate in Delaware” | 16 | |||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

Report of the Leadership Development and Compensation Committee | 26 | |||

| 26 | ||||

| 27 | ||||

Stock Ownership of Directors, Executive Officers and Certain Beneficial Owners | 28 | |||

| 30 | ||||

| 30 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 35 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 51 | ||||

| 53 | ||||

| 57 | ||||

We are providing this Proxy Statement to you in connection with the solicitation of proxies by the Board of Directors of Xylem Inc. (hereinafter referred to as “Xylem” or the “Company”) for the 2015 Annual Meeting of Shareowners (the “Annual Meeting”) and for any adjournment or postponement of the meeting. Below are highlights of certain information in this Proxy Statement. As it is only a summary, please review our complete Proxy Statement and 2014 Annual Report before you vote.

2015 ANNUAL MEETINGOF SHAREOWNERS

Date and Time: May 12, 2015 at 11:00 a.m. ET | Record Date: March 13, 2015 | Location: Xylem Inc. World Headquarters 1 International Drive Rye Brook, New York 10573 |

Agenda Items:

| Proposal | Board Recommendation | Page Reference | ||

1. Election of Directors | FOR | 8 | ||

2. Ratification of the appointment of Deloitte & Touche LLP for 2015 | FOR | 13 | ||

3. Advisory vote to approve compensation of the named executive officers | FOR | 15 | ||

4. Shareowner proposal titled “Reincorporate in Delaware” | AGAINST | 16 |

CORPORATE GOVERNANCE HIGHLIGHTS

| • | Independent Chairman |

| • | Majority of Directors are independent (91%) |

| • | Declassified Board phase-in beginning in 2016 |

| • | Shareowners have the right to call special meetings |

| • | No poison pill |

| • | Majority voting with a Director resignation policy for Directors in uncontested elections |

| • | Senior executive and Director stock ownership guidelines |

| • | Company policy prohibits pledging and hedging Xylem stock |

| • | Executive officers subject to clawback policy |

| • | No re-pricing of stock options |

| • | Restriction on the number of other boards Directors may serve on to avoid overboarding |

| • | Overall Board and committee meeting attendance of 96% in 2014 |

| • | Regular executive sessions of Board and each committee without management present |

| • | Board and committees conduct annual assessments |

| • | Board focus on succession planning |

1

PROXY STATEMENT SUMMARY

SHAREOWNER ENGAGEMENT

We value the views of our shareowners and we believe that building positive relationships with our shareowners is critical to our long-term success. To help management and the Board understand and consider the issues that matter most to our shareowners, we regularly engage with our shareowners on a range of topics related to strategic and operational matters as well as executive compensation and governance matters. See page 34 for more information on our engagement program.

COMMITMENTTO SUSTAINABILITY

At Xylem, we believe that sustainability is a way of thinking about your business and about the world, and considering what is best for both with the same level of commitment. With an understanding of the critical role of water in our society, we are working to provide advanced technologies and services to ensure that we all have safe and sustainable water supplies. As we work to “solve water,” we are dedicated to doing it the right way and employing socially responsible business practices. At Xylem, we believe in:

| • | Safeguarding our planet’s environment and resources |

| • | Smart, sensible growth and development |

| • | Accountability to our customers, employees, suppliers, investors and the communities in which we operate |

For the past three years, Xylem was named to the Dow Jones Sustainability Index for North America. This is a major acknowledgment of all of the work we have done to advance sustainable business practices and report our progress over time transparently. To learn more about our sustainability efforts, please view our annual Sustainability Report available at xylemsustainability.com.

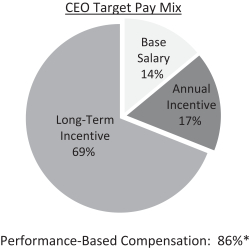

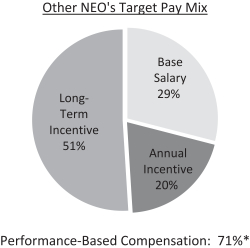

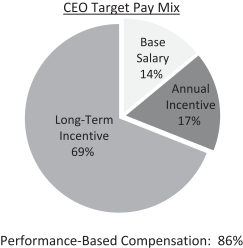

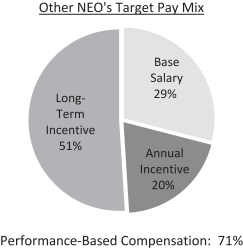

COMPENSATION HIGHLIGHTS (see page 32 for our full Compensation Discussion and Analysis)

| • | A significant portion of our executive pay is linked to performance and is at risk |

| • | Compensation for our named executive officers (“NEOs”) is aligned with shareowner interests through a balanced equity program (mix of restricted stock units, performance share units and stock options) |

| • | Capped incentive payouts |

| • | We conduct regular compensation benchmarking |

| • | We hold an annual advisory vote on executive compensation (98% of our voting shareowners voted in favor of our NEOs’ compensation as described in our 2014 proxy statement) |

| • | We conduct an annual compensation risk assessment |

| • | Our Leadership Development and Compensation Committee is advised by an independent compensation consultant |

2

PROXY STATEMENT SUMMARY

Primary Components of 2014 Compensation for Named Executive Officers:

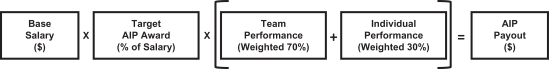

| Compensation Element | Key Role | Purpose | ||

Base Salary | • Fixed component of compensation. | Designed to be competitive with our peers, allowing us to attract and retain the best talent. | ||

Annual Incentive Plan | • Variable component of compensation. • A cash incentive plan intended to recognize results in a single performance year. | Designed to link pay to Xylem’s annual performance and strategic growth objectives, as well as individual performance results. | ||

Long-Term Incentive Plan | • Variable component of compensation. • 33% of the LTIP award was provided as Performance Share Units, based on a pre-set, three-year ROIC metric, 33% was provided as time-based RSUs and 34% was provided as stock options. | Designed to link pay to Xylem’s long-term financial performance, to align executive incentives with shareowner value, and to help facilitate stock ownership and share retention.

|

2014 NEO Target Pay Mix:

|  |

*Percentage of pay is based on annual target compensation and excludes any one-time awards granted upon hire.

3

Who is entitled to vote? You can vote if you owned shares of Xylem’s common stock as of the close of business on March 13, 2015, the record date. On the record date 181,675,657 shares of Xylem common stock were outstanding. Each share is entitled to one vote.

What is the difference between a registered owner and a beneficial owner? If the shares you own are registered in your name directly with our transfer agent, Wells Fargo Shareowner Services, or if the shares you own are held in a Morgan Stanley Smith Barney account for restricted shares, you are the registered owner and the “shareowner of record” with respect to those shares.

If the shares you own are held in a stock brokerage account, bank, one of Xylem’s savings plans or by another holder of record, you are considered the “beneficial owner” because someone else holds the shares on your behalf. As the beneficial owner, you have the right to direct your bank, broker or other nominee on how to vote your shares by using the voting instruction form they provided or by following their instructions for voting by telephone or on the Internet.

How do I vote? We encourage you to vote as soon as possible, even if you plan to attend the meeting in person.

| • | If you are a registered owner, you can vote either in person at the Annual Meeting or by proxy. |

| • | If you are a beneficial owner, you may vote by submitting voting instructions to your bank, broker, trustee or other nominee. If you are a beneficial owner and would like to vote in person at the Annual Meeting, you will need to obtain a written proxy, executed in your favor, from your record holder (bank or broker). |

| • | If your shares are held through any of the Xylem Savings Plans, your shares cannot be voted in person at the Annual Meeting, but your plan trustee will vote the Xylem shares credited to your savings plan account in accordance with your voting instructions. |

If you choose to vote by proxy, you can do so in one of three ways:

| By Internet | By Telephone | By Mail | ||

Vote online at: www.proxyvote.com | In the United States or Canada, you can vote your shares by calling1-800-690-6903. | Mark, date and sign your proxy card or voting instruction form and return it in thepostage-paid envelope provided. | ||

Can I vote by filling out and returning the Notice of Internet Availability of Proxy Materials? No. The Notice only identifies the items to be voted on at the Annual Meeting. You cannot vote by marking the Notice and returning it. The Notice provides instructions on how to cast your vote.

What is broker discretionary voting? Under New York Stock Exchange (“NYSE”) rules, brokerage firms may vote in their discretion on certain routine matters on behalf of beneficial owners who have not provided voting instructions. In contrast, brokerage firms are prevented from voting in their discretion on non-routine matters. Of the matters to be voted on as described in this Proxy Statement, only Proposal 2, the ratification of the selection of our independent registered public accounting firm, is considered to be “routine,” and therefore eligible to be voted on by your bank or brokerage firm without instructions from you.

4

What are the voting requirements to elect the directors and to approve the proposals to be voted on at the Annual Meeting?

| Proposal | Vote Required | Broker Discretionary Voting Allowed | Effect of Abstentions | |||

Election of Directors | Majority of votes cast | No | No effect | |||

| Ratification of the appointment of Deloitte & Touche LLP for 2015 | Votes cast in favor of the proposal must exceed votes cast against the proposal | Yes | No effect | |||

| Advisory vote to approve compensation of the named executive officers | Votes cast in favor of the proposal must exceed votes cast against the proposal | No | No effect | |||

| Shareowner proposal titled “Reincorporate in Delaware” | Votes cast in favor of the proposal must exceed votes cast against the proposal | No | No effect | |||

What if a director nominee fails to be elected by a majority? Our By-laws provide that in uncontested elections, any director nominee who fails to be elected by a majority, but who also is a director at the time, shall promptly provide a written resignation, as a holdover director, to the Chairman of the Board or the Corporate Secretary. The Nominating and Governance Committee shall promptly consider the resignation and all relevant facts and circumstances concerning any vote, and the best interests of the Company and our shareowners, and shall make a recommendation as to whether the Board should accept such resignation. The Board will act on the Nominating and Governance Committee’s recommendation no later than its next regularly scheduled Board meeting or within 90 days after certification of the shareowner vote, whichever is earlier, and the Board will promptly publicly disclose its decision and the reasons for its decision.

How will my shares be voted at the Annual Meeting? If you decide to vote by proxy at the Annual Meeting, the persons indicated on your proxy card or voting instruction form (the “proxies”) will vote your shares in accordance with your instructions. If you appoint the proxies but do not provide voting instructions, they will vote as recommended by the Board of Directors. If any other matters not described in this Proxy Statement are properly brought before the meeting for a vote, the proxies will use their discretion in deciding how to vote on those matters.

Can I revoke my proxy? You can revoke your proxy at any time before it is exercised by mailing a new proxy card with a later date or by casting a new vote on the Internet or by telephone, as applicable. You can also send a written notice of revocation to our Corporate Secretary at our principal executive offices address listed on the Notice of the Annual Meeting. You can also revoke your proxy by voting in person at the Annual Meeting. If you are a registered owner, you can vote your shares in person at the Annual Meeting. If you are a beneficial owner, you will need to first obtain a written proxy executed in your favor from your record holder (bank or broker) to be able to vote in person at the Annual Meeting.

What is a quorum for the Annual Meeting? A quorum is required in order to hold a valid meeting. To have a quorum, shareowners entitled to cast a majority of votes at the Annual Meeting must be present in person or by proxy. Under Indiana law, where the Company is incorporated, broker non-votes and abstentions do not affect the determination of whether a quorum is present.

Who counts the votes?Broadridge Financial Solutions, Inc. (“Broadridge”) will count the votes and an agent of Broadridge will act as one of our Inspectors of Election for the Annual Meeting. The other Inspector of Election will be an employee of the Company.

Who will pay for the costs of this proxy solicitation? We bear all expenses incurred in connection with the solicitation of proxies. We have engaged Mackenzie Partners Inc. to assist with the solicitation of proxies for a

5

fee of $20,000. In addition, we may reimburse brokers, fiduciaries and custodians for their costs in forwarding proxy materials to beneficial owners of our common stock. Our Directors, officers and employees also may solicit proxies in person, by mail, by telephone or through electronic communication. They will not receive any additional compensation for these activities.

How do I vote if I am a participant in Xylem’s savings plans for salaried or hourly employees? If you participate in any of the Xylem savings plans for salaried or hourly employees, your plan trustee will vote the Xylem shares credited to your savings plan account in accordance with your voting instructions. The trustee votes the shares on your behalf because you are the beneficial owner, not the shareowner of record, of the savings plan shares. The trustee votes the savings plan shares for which no voting instructions are received (“Undirected Shares”) in the same proportion as the shares for which the trustee receives voting instructions. Under the savings plans, participants are “named fiduciaries” to the extent of their authority to direct the voting of Xylem shares credited to their savings plan accounts and their proportionate share of Undirected Shares. By submitting voting instructions by telephone, the Internet or by signing and returning the voting instruction card, you direct the trustee of the savings plans to vote these shares, in person or by proxy at the Annual Meeting. Xylem salaried or hourly plan participants should mail their confidential voting instruction card to Broadridge, acting as tabulation agent, at 51 Mercedes Way, Edgewood, New York 11717, or vote by telephone or the Internet. Instructions for Xylem savings plan shares must be received by Broadridge no later than 11:59 p.m. Eastern Time on May 7, 2015.

I participate in the Xylem savings plan for salaried employees and I am a shareowner of record of shares of Xylem common stock. How many proxy cards will I receive? You will receive only one proxy card. Your Xylem savings plan shares and any shares you own as the shareowner of record will be set out separately on the proxy card.

How many shares are held by participants in the Xylem employee savings plans? As of the close of business on March 13, 2015, the record date, JPMorgan Chase & Co., as the trustee for the salaried employee savings plan, held 382,728 shares of Xylem common stock (approximately 0.21% of the outstanding shares) and JPMorgan Chase & Co., as the trustee for the hourly employees savings plan, held 41,892 shares of Xylem common stock (approximately 0.02% of the outstanding shares).

Where can I find the voting results?Preliminary results will be reported at the Annual Meeting. We will report final results in a filing with the Securities and Exchange Commission (“SEC”) on Form 8-K.

INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with SEC rules, we are using the Internet as our primary means of providing proxy materials to shareowners. Because we are using the Internet, most shareowners will not receive paper copies of our proxy materials. We will instead send shareowners a Notice of Internet Availability of Proxy Materials (the “Notice”) with instructions for accessing the proxy materials, including our Proxy Statement and 2014 Annual Report, and voting via the Internet. We expect to mail the Notice and to begin mailing our proxy materials on or about March 24, 2015. We believe that this process will allow us to provide shareowners with the information they need in a timely manner, while conserving natural resources and lowering the costs of printing and distributing our proxy materials.

We also make available, free of charge on our website, all of our filings that are made electronically with the SEC, including Forms 10-K, 10-Q and 8-K. To access these filings, go to our website (www.xyleminc.com) and click on “Financial Information” under the “Investors” heading, and then click on “SEC Filings.” Copies of our Annual Report on Form 10-K for the year ended December 31, 2014, including financial statements and schedules thereto, are also available without charge to shareowners by writing to our Corporate Secretary at Xylem Inc., 1 International Drive, Rye Brook, NY 10573.

6

HOUSEHOLDING – REDUCE DUPLICATE MAILINGS

To reduce duplicate mailings, we have adopted a procedure approved by the SEC called “householding.” Under this procedure, beneficial shareowners who have the same address and same last name and who do not participate in electronic delivery or Internet access of proxy materials, will receive only one copy of the Company’s Annual Report and Proxy Statement unless one or more of these shareowners notifies the Company that they wish to continue to receive individual copies. By reducing duplicate mailings, we are able to conserve natural resources and lower the costs of printing and distributing our proxy materials.

If you are currently receiving multiple copies of these materials and wish to receive a single copy in the future, you will need to contact your broker, bank or other institution if you are a beneficial owner. If you are a registered owner, you may contact us by writing to our Corporate Secretary at Xylem Inc., 1 International Drive, Rye Brook, NY 10573 or by emailing investor.relations@xyleminc.com.

Each shareowner who participates in householding will continue to receive a separate Proxy Card or Notice. Your consent to householding is perpetual unless you revoke it. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement in the future, please contact Broadridge, either by calling toll-free at (800) 542-1061 or by writing to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

Shareowner Proposals for Inclusion in Next Year’s Proxy Statement

To be considered for inclusion in our proxy statement for the 2016 Annual Meeting of Shareowners (the “2016 Annual Meeting”), shareowner proposals must be submitted in accordance with SEC Rule 14a-8 and must be received by the Company’s Corporate Secretary no later November 25, 2015.

Other Shareowner Proposals for Presentation at Next Year’s Annual Meeting

Our By-laws permit shareowners to nominate directors and present other business for consideration at our annual meetings. To make a director nomination or present other business for consideration at the 2016 Annual Meeting, you must submit a timely notice in accordance with the procedures described in our By-laws. Notice of a director nomination or any other business for consideration at the 2016 Annual Meeting must be received by our Corporate Secretary at our principal executive offices between November 25, 2015 and December 25, 2015. In the event that the date of the 2016 Annual Meeting is changed by more than 30 days from the anniversary date of this year’s Annual Meeting, such notice must be received not later than 120 calendar days prior to the 2016 Annual Meeting or 10 calendar days following the date on which public announcement of the 2016 Annual Meeting is first made. SEC rules permit management to vote proxies in its discretion in certain cases if the shareowner does not comply with the advance notice provisions of our By-laws.

7

| PROPOSALS TO BE VOTED ON AT THE 2015 ANNUAL MEETING |

PROPOSAL 1 —Election of Directors

Our Board of Directors currently has 11 members. Our Board of Directors is currently divided into three classes. In 2013, our shareowners voted to support a management proposal to declassify our Board by phasing out the classified board structure beginning in 2016.

As of the date of this Proxy Statement, Patrick K. Decker, Victoria D. Harker and Markos I. Tambakeras constitute a class with a term that will expire at the 2015 Annual Meeting of Shareowners (the “Class I Directors”); Curtis J. Crawford, Robert F. Friel, Surya N. Mohapatra and James P. Rogers constitute a class with a term that will expire at the annual meeting of shareowners in 2016 (the “Class II Directors”); and Sten E. Jakobsson, Steven R. Loranger, Edward J. Ludwig and Jerome A. Peribere constitute a class with a term that will expire at the annual meeting of shareowners in 2017 (the “Class III Directors”). On March 19, 2015, James P. Rogers informed the Company that he intends to resign from the Board of Directors effective May 12, 2015 for personal reasons.

Director Nominees

The Board of Directors has considered and nominated the following slate of Class I nominees for a three-year term expiring in 2018. Each nominee is currently serving as a Director of Xylem. The Board has determined that, other than Mr. Decker, each nominee is independent as discussed below under “Director Independence.”

Each of the nominees has agreed to be named in this proxy statement and to serve as a director if elected. In the event that these nominees should become unavailable for election due to any presently unforeseen reason, the persons named as proxy will have the right to use their discretion to vote for a substitute.

Below are summaries of the background, business experience and a description of the principal occupation of each of the nominees.

Class I — Directors Whose Term Expires in 2015

Patrick K. Decker

President and Chief Executive Officer, Xylem Inc.

Patrick K. Decker, 50, joined Xylem as its President and Chief Executive Officer and as a Director in March of 2014. Prior to joining Xylem, Mr. Decker served as President and Chief Executive Officer of Harsco Corporation, a global industrial services company. From June 2007 until August 2012, Mr. Decker served as President of Tyco Flow Control International Ltd., a key business segment of Tyco International Ltd., a diversified company. Prior to Mr. Decker’s nine-year career at Tyco, he worked for 13 years at Bristol-Myers Squibb Company in a number of operational and finance roles, including nine years in Asia and Latin America. He currently serves on the advisory council for the Dean of Kelley School of Business at Indiana University. Mr. Decker graduated with a Bachelor of Science in Accounting and Finance from Indiana University.

Mr. Decker brings valuable global leadership experience, expertise in business operations and finance and extensive knowledge of the water industry to the Board.

Victoria D. Harker

Chief Financial Officer, Gannett Company Inc.

Victoria D. Harker, 50, has served on our Board of Directors since October 31, 2011. Ms. Harker has served as the Chief Financial Officer of Gannett Company, Inc., a global media and marketing solutions company, since July 2012. Previously, Ms. Harker served as the Chief Financial Officer and President of Global Business Services of the AES Corporation, a multinational power company, until May 2012. She joined AES in 2006 to lead the Global Finance Team in a restructuring of its financial reporting, controls and capitalization. From November 2002 through January 2006, Ms. Harker was the acting Chief Financial Officer and Treasurer of MCI,

8

and she served as Chief Financial Officer of MCI Group, a unit of WorldCom Inc., from 1998 to 2002. Ms. Harker held several positions in finance, information technology and operations at MCI. Ms. Harker is a member of the Board of Directors for Huntington Ingalls Industries, a public company, and she served on the Board of Directors of Darden Restaurants, Inc. from 2009 to 2014. Ms. Harker sits on the American University Advisory Council, and serves as a trustee on the Board of Visitors of the University of Virginia. Ms. Harker holds a bachelor’s degree in English and economics from The University of Virginia and a master of business administration with a concentration in finance from American University.

Ms. Harker has extensive international business experience with a wide-ranging management and financial reporting background. Ms. Harker’s experience as a director of other public companies, provides additional relevant experience in serving on our Board of Directors.

Markos I. Tambakeras

Former Chairman, President and Chief Executive Officer, Kennametal, Inc.

Markos I. Tambakeras, 64, has served on our Board of Directors as Chairman since October 31, 2011. He served on the Boards of ITT Corporation from 2001 until May 2013; Parker Hannifin Corporation from 2005 until October 2011; and Newport Corporation from May 2008 until December 2009. Mr. Tambakeras also served as Chairman of the Board of Directors of Kennametal, Inc. from July 1, 2001 until December 31, 2006, where he was President and Chief Executive Officer from July 1999 through December 31, 2005. From 1995 to June 1999, Mr. Tambakeras served as President, Industrial Controls Business, for Honeywell Incorporated. Mr. Tambakeras serves on the Board of Trustees of Loyola Marymount University and has served for four years on the President’s Council on Manufacturing. He was previously the Chairman of the Board of Trustees of the Manufacturers Alliance/MAPI, which is the manufacturing industry’s leading executive development and business research organization. Mr. Tambakeras received a B.Sc. degree from the University of Witwatersrand, Johannesburg, South Africa and a master of business administration from Loyola Marymount University.

Mr. Tambakeras has strong strategic and global operational industrial experience, having worked in increasingly responsible positions for several technology and manufacturing companies, including leadership positions in South Africa and the Asia-Pacific area. In addition to his Board experience described above, Mr. Tambakeras has an extensive background in international operations, providing experience and skills relevant in leading our Board of Directors.

BOARD RECOMMENDATION: The Board of Directors recommends you vote FOR the election of each of the nominees listed above.

Continuing Members of the Board of Directors

Below are summaries of the background, business experience and a description of the principal occupation of each Director whose term continues beyond the 2015 Annual Meeting and who is not subject to election this year.

Class II — Directors Whose Term Expires in 2016

Curtis J. Crawford, Ph.D.

President and Chief Executive Officer, XCEO, Inc.

Curtis J. Crawford, 67, has served on our Board of Directors since October 31, 2011. Dr. Crawford has served as President and Chief Executive Officer of XCEO, Inc. since June 2003, which provides professional mentoring, personal leadership and governance programs. From April 1, 2002 to March 31, 2003, he served as President and Chief Executive Officer of Onix Microsystems, a private photonics technology company. He was Chairman of the Board of Directors of ON Semiconductor Corporation from September 1999 until April 1, 2002, where he is currently a director. Previously, he was President and Chief Executive Officer of ZiLOG, Inc. from

9

1998 to 2001 and its Chairman from 1999 to 2001. Dr. Crawford is currently acting as a consultant to The Chemours Company, a subsidiary of E.I. DuPoint, which is expected to be spun-off as an independent public company. Dr. Crawford served as a director of E.I. DuPont de Nemours and Company from 1998 until February 2015; served as a director of ITT Corporation from 1996 until 2011; and served as a director of Agilysys, Inc. from 2005 to 2008. Dr. Crawford also has extensive executive experience with AT&T Corporation and IBM Corporation. He holds a bachelor’s degree in business administration and computer science and a master’s degree from Governors State University, a master of business administration from DePaul University and a Ph.D. from Capella University. Governors State University awarded him an honorary doctorate in 1996 and he received an honorary doctorate degree from DePaul University in 1999.

Dr. Crawford is an expert on corporate governance and the author of three books on leadership and corporate governance and has significant experience leading high-technology companies. In 2011, Dr. Crawford was awarded the B. Kenneth West Lifetime Achievement Award from the National Association of Corporate Directors for his contribution to corporate governance and for having made a meaningful impact in the boardroom. Dr. Crawford’s experience as a director for other public companies provides additional relevant experience in serving on our Board of Directors.

Robert F. Friel

Chairman, President and Chief Executive Officer of PerkinElmer, Inc.

Robert F. Friel, 59, has served on our Board of Directors since December 2012. Mr. Friel has served as Chief Executive Officer of PerkinElmer, Inc., a multinational corporation focused on human and environmental health, since February 2008 and on its Board since 2006, serving as Vice Chairman until he was appointed Chairman in April 2009. Mr. Friel joined PerkinElmer in February 1999 as Senior Vice President and Chief Financial Officer. In 2004, he was named Executive Vice President and Chief Financial Officer with responsibility for business development and information technology, in addition to his oversight of the finance function. In January 2006, he was named President of Life and Analytical Sciences and in July 2007 he was named President and Chief Operating Officer until being named CEO. From 1980 to 1999, he held several senior management positions with AlliedSignal, Inc., now Honeywell International. He currently serves on the Board of Directors of CareFusion Corporation. Mr. Friel holds a bachelor of arts degree in economics from Lafayette College and a master of science degree in taxation from Fairleigh Dickinson University.

Mr. Friel has extensive experience in global industries as well as executive and financial leadership experience. He is a former member of the Board of Directors at Millennium Pharmaceuticals, Inc. and Fairchild Semiconductor, Inc., providing additional relevant experience in serving on our Board of Directors.

Surya N. Mohapatra, Ph.D.

Former Chairman, President, and Chief Executive Officer of Quest Diagnostics Incorporated

Surya N. Mohapatra, 65, has served on our Board of Directors since October 31, 2011. Dr. Mohapatra served as Chief Executive Officer of Quest Diagnostics Incorporated, a leading provider of diagnostic information services, from 2004 until 2012. Dr. Mohapatra joined Quest Diagnostics as Senior Vice President and Chief Operating Officer in 1999 and served as a director from 2002, and as Chairman of its Board from December 2004 to April 2012. Prior to joining Quest Diagnostics, Dr. Mohapatra was Senior Vice President and a member of the executive committee of Picker International, a worldwide leader in advanced medical imaging technologies, where he served in various executive positions during his 18-year tenure.

Dr. Mohapatra served as a director of ITT Corporation from 2008 to October 2011. Dr. Mohapatra is a Trustee of Rockefeller University and an Executive-in-Residence at Columbia Business School. Dr. Mohapatra holds a

10

bachelor’s degree in electrical engineering from Regional Engineering College (Rourkela)/Sambalpur University in India. Additionally, he holds a master’s degree in medical electronics from the University of Salford, England, as well as a doctorate in medical physics from the University of London and The Royal College of Surgeons of England.

Dr. Mohapatra has extensive international business experience with wide-ranging operational and strategic knowledge and has a strong technical background, with an emphasis on Six-Sigma quality and customer-focused business practices. Dr. Mohapatra has also served as a director for other public companies providing additional relevant experience in serving on our Board of Directors.

James P. Rogers

Former Chief Executive Officer and Chairman, Eastman Chemical Company

James P. Rogers, 63, has served on our Board of Directors since May 2013. Mr. Rogers served as Chief Executive Officer of Eastman Chemical Company, a global specialty chemical company, from May 2009 to December 2013 and Board Chairman from January 2011 until 2014. Mr. Rogers served previously as Executive Vice President and Chief Financial Officer of GAF Materials Corporation; Executive Vice President, Finance, of International Specialty Products, Inc.; Treasurer of Amphenol Corporation; a Vice President in the Corporate Finance group of Morgan Guaranty Trust; and a naval aviator in the United States Navy. Mr. Rogers serves on the Board of Directors of the Lord Corporation, a private technology company, and was formerly a member of the American Chemistry Council, the Business Roundtable, and the American Section of the Société de Chemie Industrielle. He graduated from the University of Virginia with a bachelor of arts degree in psychology and received an MBA from the Wharton School of the University of Pennsylvania.

Mr. Rogers is an experienced business leader, with multi-industry expertise in business operations and finance. Mr. Rogers has decided to resign from our Board effective May 12, 2015.

Class III — Directors Whose Term Expires in 2017

Sten E. Jakobsson

Former President and Chief Executive Officer, ABB AB

Sten E. Jakobsson, 66, has served on our Board of Directors since October 31, 2011. Mr. Jakobsson served in various positions with increasing responsibilities at ABB Ltd., a world leading company in power and industrial automation, for nearly 40 years until his retirement in 2011. Most recently in 2011, Mr. Jakobsson was CEO of ABB AB, the Swedish subsidiary of ABB Ltd., and from 2006 he also served as Head of North Europe Region, including UK, IRL, the Nordic countries, Russia and Central Asia and the Caucasus. From 1992 through 1996, Mr. Jakobsson was Global Business Area Manager for the global cable business in ABB and from 1996 EVP of ABB AB responsible for the Transmission and Distribution Segment.

Mr. Jakobsson has served on the Board of SAAB AB since 2008 and on the Board of FLSmidth&Co A/S since 2011. He also serves on the Board of several non-public companies: he has served on the Board of Stena Metall AB since 2005; he has been Chairman of the Board of Power Wind Partners AB since 2011; and has served on the Board of Luossavaara-Kiirunavaara AB since 2012, where he was appointed Chairman of the Board in 2014. Mr. Jakobsson has a master of science degree from The Royal Technical Institute of Stockholm.

Mr. Jakobsson has strong experience in managing international sales, complex project execution and manufacturing in a global company.

11

Steven R. Loranger

Former Chairman, President and Chief Executive Officer, ITT Corporation

Steven R. Loranger, 63, has served on our Board of Directors since October 31, 2011 and served as Chairman Emeritus of our Board until September 2013. Mr. Loranger served as interim Chief Executive Officer and President of Xylem Inc. from September 2013 until March 2014. Mr. Loranger served as Chairman, President and CEO of ITT Corporation, a global manufacturing company, from 2004 until October 2011 when Xylem was spun from ITT. Prior to joining ITT Corporation, Mr. Loranger served as Executive Vice President and Chief Operating Officer of Textron, Inc. from 2002 to 2004, overseeing Textron’s manufacturing businesses, including aircraft and defense, automotive, industrial products and components. From 1981 to 2002, Mr. Loranger held executive positions at Honeywell International Inc. and its predecessor company, AlliedSignal, Inc., including serving as President and Chief Executive Officer of its Engines, Systems and Services businesses.

Mr. Loranger is a Senior Advisor to the CEO of FlightSafety International and he serves on the Boards of the National Air and Space Museum, the Congressional Medal of Honor Foundation and the Wings Club. Mr. Loranger also served on the Board of Exelis Inc. from October 2011 until May 2013 and on the Board of FedEx Corporation from 2006 to 2014. Mr. Loranger was a member of the Business Roundtable and served on the Executive Committee of the Aerospace Industries Association Board of Governors until December 2011. Mr. Loranger holds a bachelor’s and master’s degree in science from the University of Colorado.

Mr. Loranger has extensive operational and manufacturing experience with industrial companies and has intimate knowledge of the Company’s business and operations.

Edward J. Ludwig

Former Chairman, President and Chief Executive Officer, Becton, Dickinson and Company

Edward J. Ludwig, 63, has served on our Board of Directors since October 31, 2011. Mr. Ludwig served as Chairman of the Board of Becton, Dickinson and Company (“BD”), a medical technology company, until July 2012. Since joining BD in 1979, Mr. Ludwig served as Chief Executive Officer from January 2000 through September 2011, and as President and Chief Financial Officer, among other positions. Before joining BD, he served as a Senior Auditor with Coopers and Lybrand (now PricewaterhouseCoopers), where he earned a CPA certificate, and as a Financial and Strategic Analyst at Kidde, Inc.

Mr. Ludwig serves as Lead Director of the Board of Directors of AETNA where he is also Chair of the Finance Committee. He also serves on the Board of Directors of Boston Scientific Corporation.

Mr. Ludwig is Vice Chairman of the Hackensack University Medical Center Network Board of Trustees, a member of the Strategic Advisory Committee of Capital Royalty and serves as a director of POCARED, Ltd., a private company. He is a Board Member of the Center for Higher Ambition Leadership and serves on the Columbia Business School Board of Overseers.

Mr. Ludwig served as Chairman of the Board of Directors of AdvaMed, the world’s largest medical technology association, and as a Chair of the Health Advisory Board for the Johns Hopkins Bloomberg School of Public Health. Mr. Ludwig holds a bachelor’s degree in economics and accounting from The College of the Holy Cross and a master of business administration with a concentration in finance from Columbia University.

Mr. Ludwig has extensive financial, management and manufacturing experience. His background as a director of various public and non-public companies provides additional relevant experience in serving on our Board of Directors.

12

Jerome A. Peribere

President and Chief Executive Officer of Sealed Air Corporation

Jerome A. Peribere, 60, has served on our Board of Directors since May 2013. He has served as President and Chief Executive Officer of Sealed Air Corporation, a global manufacturer of protective and specialty packaging for food and consumer goods, since March 1, 2013. He previously served as the President and Chief Operating Officer of Sealed Air and was elected to its Board in September 2012. Prior to joining Sealed Air, Mr. Peribere worked at The Dow Chemical Company (“Dow”) from 1977 through August 2012. Mr. Peribere served in multiple managerial roles with Dow, most recently as Executive Vice President of Dow and President and Chief Executive Officer, Dow Advanced Materials, a unit of Dow, from 2009 through August 2012. Mr. Peribere currently serves on the Board of the SEI Center for Advanced Studies in Management at the Wharton School of the University of Pennsylvania. Mr. Peribere graduated with a degree in business economics and finance from the Institut D’Etudes Politiques in Paris, France.

Mr. Peribere brings his extensive leadership, global operations, strategy and integration experience to the Board.

PROPOSAL 2 —Ratification of Appointment of the Independent Registered Public Accounting Firm

The Audit Committee has responsibility for the appointment of our independent registered public accounting firm. Our Audit Committee has appointed Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015.

The Audit Committee periodically considers the rotation of the Company’s independent registered public accounting firm. The Audit Committee believes that the continued retention of Deloitte as the Company’s independent registered public accounting firm for 2015 is in the best interests of the Company and its shareowners. In addition, in conjunction with the mandated rotation of the audit firm’s lead engagement partner, the Audit Committee was directly involved in the selection of the new lead engagement partner. Company policy provides that employees of Deloitte and related affiliates who are at the senior manager level or above, including lead or concurring partners, and who have been involved with the Company in the independent audit, shall not be employed by the Company in any capacity for a period of five years after the termination of their activities on the Company account.

The appointment of Deloitte for 2015 is being submitted for shareowner ratification with a view toward soliciting the opinion of shareowners, whose opinion will be taken into consideration in future deliberations. No determination has been made as to what action the Audit Committee would take if shareowners do not ratify the appointment.

Deloitte is a registered public accounting firm with the Public Company Accounting Oversight Board (“PCAOB”). The Audit Committee annually reviews and considers Deloitte’s performance of the Company’s audit. Performance factors reviewed include Deloitte’s:

• independence

• experience

• technical capabilities

• client service assessment

• responsiveness | • peer review program

• report on quality

• appropriateness of fees charged

• industry insight

• PCAOB inspection results |

The Audit Committee reviewed and discussed, with Deloitte and with management, the engagement letter between Deloitte and the Company, as well as Deloitte’s fees and services. The Audit Committee also determined that any non-audit services (services other than those described in the annual audit services

13

engagement letter) provided by Deloitte were permitted under the rules and regulations concerning auditor independence promulgated by the SEC and by the PCAOB in Rule 3526 and the Company’s applicable policies.

Representatives of Deloitte attended all regularly scheduled meetings of the Audit Committee during 2014. Representatives of Deloitte are expected to be present at the Annual Meeting, will have the opportunity to make a statement, if desired, and are expected to be available to respond to appropriate questions.

Independent Registered Public Accounting Firm Fees

Aggregate fees billed to Xylem for the years ended December 31, 2014 and 2013 represent fees and expenses billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (“Deloitte and related affiliates”).

| 2014 | 2013 | |||||||

| (In thousands) | ||||||||

Audit Fees(1) | $ | 7,966 | $ | 8,159 | ||||

Audit-Related Fees(2) | 250 | 372 | ||||||

Tax Compliance Services | 1,265 | 1,458 | ||||||

Tax Planning Services | 196 | 2,133 | ||||||

|

|

|

| |||||

Total Tax Services(3) | 1,461 | 3,591 | ||||||

All Other Fees(4) | 5 | 5 | ||||||

|

|

|

| |||||

Total | $ | 9,682 | $ | 12,127 | ||||

|

|

|

| |||||

| (1) | Fees for audit services billed consisted of: |

| • | Audit of the Company’s annual financial statements and internal controls over financial reporting; |

| • | Reviews of the Company’s quarterly financial statements; |

| • | Statutory and regulatory audits, consents and other services related to SEC matters; and |

| • | Financial accounting and reporting consultations. |

| (2) | Fees for audit-related services consisted of: |

| • | Audits and other attest work related to subsidiaries (other than statutory audits) and employee benefit plans; and |

| • | Other miscellaneous attest services. |

| (3) | Fees for tax services consisted of tax compliance and tax planning services: |

| • | Tax compliance services are services rendered, based upon facts already in existence or transactions that have already occurred, to document, compute, and obtain government approval for amounts to be included in tax filings consisting primarily of assistance with tax jurisdiction registrations; and |

| • | Tax planning services are services and advice rendered with respect to proposed transactions or services that alter the structure of a transaction to obtain an anticipated tax result. Such services consisted primarily of tax advice related to intra-group structuring. |

| (4) | Fees related to the Company’s subscription to a Deloitte research tool. |

Pre-Approval of Audit and Non-Audit Services

The Audit Committee has adopted a policy for the pre-approval of certain audit and non-audit services provided by the independent auditor. Specifically, the Audit Committee has approved specific categories of audit, audit-related and tax services incremental to the normal auditing function which the independent auditors may provide without further Audit Committee pre-approval. These categories include, among others, the following: employee benefit advisory services and employee benefit plan audits; acquisition and disposition services, including due diligence; audits of subsidiaries and other attest services unrelated to the consolidated integrated audit; tax compliance and certain tax planning advice work; accounting consultations and support related to generally accepted accounting principles in the United States; and reviews and consultations on internal control matters. The policy identifies thresholds for services, project amounts and circumstances where our independent auditors may perform permitted audit and non-audit services. A second level of review and approval by the Audit Committee is required when such permitted audit and non-audit services, project amounts, or circumstances exceed the specified amounts.

14

If fees for any pre-approved audit or non-audit services provided by any independent auditor exceed a pre-determined threshold during any calendar year, any additional proposed audit or non-audit services provided by that service provider must be submitted for second-level approval by the Audit Committee. Audit, audit-related and non-audit services which have not been pre-approved are subject to specific prior approval by the Audit Committee. The Audit Committee oversees the fees paid to the independent auditor for audit and non-audit services and receives periodic reports on the amount of fees paid. The Chair of the Audit Committee is authorized to pre-approve audit related or non-audit services up to an established threshold on behalf of the Audit Committee, provided such decisions are presented to the full Audit Committee at its next regularly scheduled meeting.

BOARD RECOMMENDATION: The Board of Directors recommends that you vote FOR the ratification of the appointment of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm.

PROPOSAL 3 —Advisory Vote to Approve Compensation of Named Executive Officers

Pursuant to Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the related rules of the SEC, our shareowners are being asked to vote, in an advisory manner, to approve the compensation of our NEOs as disclosed in “Executive Compensation — Compensation Discussion and Analysis” below.

This Proposal provides shareowners the opportunity to express their views on our 2014 executive compensation program and policies through the following resolution:

“RESOLVED, that the compensation paid to the Company’s NEOs as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables, and narrative discussion, is hereby approved.”

In considering their vote, shareowners may wish to review the information on the Company’s compensation policies and decisions regarding the NEOs presented in “Executive Compensation — Compensation Discussion and Analysis.”

At our 2014 Annual Meeting of Shareowners, our shareowners overwhelmingly approved our executive compensation policies, with approximately 98% of votes cast in favor of our proposal. We value this endorsement by our shareowners and believe that the outcome signals our shareowners’ support of our compensation program. As a result, we continued our general approach to compensation for fiscal year 2014.

Shareowners should note that the Company’s Leadership Development and Compensation Committee (the “LDCC”) bases its executive compensation decisions on the following:

| • | alignment of executive and shareowner interests by providing incentives linked to key financial performance metrics, which the LDCC believes will help drive long-term shareowner value; |

| • | the ability for executives to achieve long-term shareowner value creation without undue business risk; |

| • | the creation of a clear link between an executive’s compensation and his or her individual contribution and performance; |

| • | the extremely competitive nature of the industries in which we operate, and our need to attract and retain the most creative and talented industry leaders; and |

| • | comparability to the practices of peers in the industries in which we operate and other similar companies generally. |

While the results of the vote are advisory in nature, the Board and LDCC value feedback from shareowners and will carefully consider the outcome of the vote with their ongoing evaluation of the Company’s executive compensation principles and policies.

We currently intend to hold shareowner advisory votes on executive compensation on an annual basis. Accordingly, the next such shareowner advisory vote will occur at the 2016 annual meeting. In addition, the

15

required votes on the frequency of shareowner votes on executive compensation must be held at least once every six years. The next shareowner vote on frequency will occur at our 2018 annual meeting.

BOARD RECOMMENDATION: The Board of Directors recommends that you vote FOR the Advisory Vote to Approve Compensation of Named Executive Officers

In accordance with SEC rules, we have set forth below a shareowner proposal, along with the supporting statement of the shareowner proponent. Xylem is not responsible for any inaccuracies it may contain. The shareowner proposal is required to be voted on at our Annual Meeting only if properly presented.

John Chevedden, 2215 Nelson Avenue, No. 205, Redondo Beach, California 90278, beneficial owner of 100 shares of Xylem common stock, intends to present the following proposal and supporting statement at the Annual Meeting.

PROPOSAL 4 —Reincorporate in Delaware

RESOLVED, that shareholders urge the board of directors to take the necessary steps (excluding those that may be taken only by shareholders) to change our company’s jurisdiction of incorporation from Indiana to Delaware.

Our company is incorporated in Indiana. The Indiana Business Corporation Law is less shareholder-friendly than Delaware’s corporation code especially following the 2009 Indiana amendments. Delaware incorporation would benefit shareholders.

The 2009 Indiana amendments provided that a director will not be liable for any action or failure to act “regardless of the nature of the alleged breach of duty, including breaches of the duty of care, the duty of loyalty and the duty of good faith” unless the breach or failure constituted willful misconduct or recklessness. According to a June 9, 2009 client memo by Baker & Daniels, an Indianapolis law firm, this change effectively blocks fiduciary duty concepts from other jurisdictions, for example, Delaware’s duty of good faith, from circumventing the provisions that exculpate directors of Indiana corporations from liability.

Additionally, the default rule of Indiana law is that only the board, and not shareholders, may amend a company’s bylaws; shareholders can amend the bylaws only if the company’s charter specifically provides for that right. Section 109 of the Delaware General Corporation Law gives shareholders the right to amend the bylaws.

Indiana has more anti-takeover provisions than Delaware, including control share acquisition and poison pill endorsements. Control share acquisition provisions deny shares their voting rights when they contribute to an ownership level above a certain threshold. A poison pill endorsement prohibits shareholder ability to challenge the validity of an abusive management poison pill in court.

GMI Ratings, an independent investment research firm said Indiana unfortunately favors management rights and provides shareholders with a poor level of control. Indiana law contains multiple provisions which protect management from hostile takeovers, further diminishing shareholder interests. The Indiana Code effectively denies shareholders the right to act by written consent by requiring a whopping 100% approval of shareholders.

Indiana corporate law is moving in the wrong direction, toward greater director entrenchment and away from giving shareholders power over corporate ground rules. Please vote to protect shareholder value:Reincorporate in Delaware - Proposal 4

16

Board of Directors’ Statement of Opposition

BOARD RECOMMENDATION: The Board recommends a vote AGAINST the proposal to change the Company’s state of incorporation from Indiana to Delaware.

The Board believes that it is not in the best interests of the Company or our shareowners to change the Company’s jurisdiction of incorporation from Indiana to Delaware.

Our Board is committed to maintaining the highest standards of corporate governance, regardless of the Company’s state of incorporation and believes that despite its short history as an independent public company, it has demonstrated this commitment by making several corporate governance changes. In 2013, our Board supported a management proposal to declassify the Board and starting in 2016 all directors up for election will be elected for an annual term. In 2014, our Board proposed an amendment to the Company’s Articles of Incorporation to allow our shareowners to call special meetings and today, shareowners owning 25% or more of our shares can request that the Board call a special meeting. Additionally, the following reflect our on-going commitment to corporate governance.

| • | We opted out of provisions of Indiana law which would have allowed us to implement a mandatory classified board. |

| • | We elect our directors by majority voting in uncontested elections. |

| • | We do not have a “poison pill.” |

| • | Other than Mr. Decker, our President and CEO, all of our Directors are independent under the NYSE’s listing standards, including our Chairman. |

| • | We have a policy against hedging transactions by Company insiders, including Directors and officers, involving the Company’s common stock. |

| • | We have share ownership guidelines for all Directors and officers. |

| • | Our executive compensation structure has an emphasis on pay-for-performance. |

With respect to anti-takeover provisions, the proposal specifically addresses three corporate governance issues: anti-takeover provisions, director liability and shareowner amendment of by-laws. The proposal expresses concern with some Indiana statutory provisions, including the control share acquisition provisions. As of the date of the filing of this Proxy Statement, the control share acquisition provisions under the Indiana Business Corporation Law (the “IBCL”), and the anti-takeover protections offered by the control share acquisition provisions, do not apply to the acquisition of shares of our common stock, as Xylem does not have the requisite number of beneficial shareowners within the State of Indiana. In addition, while the IBCL expressly permits the issuance of rights and the adoption of poison pill plans, it does not insulate boards of directors from their fiduciary duty responsibilities in adopting such plans. Further, while the Delaware General Corporation Law does not have a similar provision expressly authorizing the issuance of rights and poison pill plans, Delaware courts have determined that Delaware corporations are permitted to adopt poison pill plans. As noted above, Xylem does not have a poison pill.

The proponent states that amendments to the IBCL provide that directors will not be liable “for any action or failure to act regardless of the nature of the alleged breach of duty, including breaches of the duty of care, the duty of loyalty and the duty of good faith unless the breach or failure constituted willful misconduct or recklessness,” and that fiduciary duty concepts from other jurisdictions are prevented from implementation in Indiana. The IBCL clearly dictates that a director has an affirmative duty to discharge his or her duties in good faith; with the care an ordinarily prudent person in a like position would exercise under similar circumstances; and in a manner the director reasonably believes to be in the best interests of the corporation. These same concepts are the basis of fiduciary duties addressed under Delaware law.

With respect to by-law amendments, the Board’s fiduciary duties require that it consider whether amendments are in the best interests of all shareowners. It is important to safeguard that no single interest group or

17

shareowner’s agenda are being advanced at the expense of other shareowners. Therefore, our Board believes that it is better positioned to consider the interests of all shareowners in determining what by-laws are appropriate for Xylem and its shareowners.

We have been an Indiana corporation since our formation. Reincorporating in Delaware, a state with which Xylem has no substantive historical or existing connection would be a costly process and would have other adverse consequences to us. Reincorporation may require us to obtain consents from, or provide notices to, third parties under certain of our agreements as well as obtain approvals and consents not only from shareowners but also from governmental and regulatory agencies and lenders. In addition, reincorporation to Delaware would subject us to an annual franchise tax under Delaware law; there is no such tax under Indiana law. It would also require us to incur substantial expense conducting a corporate review. Reincorporation would divert the time and attention of management from normal business operations without any commensurate benefit. The Board believes that management’s time and resources should remain focused on its efforts to continue to create value for all shareowners.

For the reasons cited above, we believe that there are significant advantages for us and our shareowners to remain incorporated in Indiana and that the advantages outweigh any perceived enhancement of shareowner rights that could result from reincorporation in Delaware.

Accordingly, the Board of Directors recommends that you voteAGAINST this proposal.

18

Corporate Governance Principles. The Board of Directors has adopted Corporate Governance Principles that provide the framework of governance for the Company and contain general principles regarding the functions and responsibilities of the Board and its committees. Pursuant to the Corporate Governance Principles, the Board sets policy for Xylem and advises and counsels the Chief Executive Officer (“CEO”) and other executive officers who manage Xylem’s business and affairs. The Corporate Governance Principles provide that Directors must be able to devote the requisite time for preparation and attendance at regularly scheduled Board and committee meetings, as well as be able to participate in other matters necessary for good corporate governance. To help assure that Directors are able to fulfill their commitments to the Company, the Corporate Governance Principles provide that Directors who are chief executive officers of publicly traded companies may not serve on more than two public company boards (including our Board) in addition to service on their own board. Directors, who are not chief executive officers of publicly traded companies, may not serve on more than four public company boards (including our Board). The Corporate Governance Principles are reviewed by the Board periodically. The Corporate Governance Principles are available on our website at www.xyleminc.com, by clicking on “Investors” and then “Corporate Governance.” A copy of the Corporate Governance Principles will be provided, free of charge, to any shareowner upon written request to our Corporate Secretary.

Board and Committee Roles in Risk Oversight. Our Board of Directors has primary responsibility for overall risk oversight, including the Company’s risk profile and management controls. The Board has delegated responsibility for the oversight of certain categories of risks to designated Board committees that report back to the full Board. The Audit Committee oversees and monitors the effectiveness of the Company’s overall risk assessment, risk management and mitigation processes. The Internal Auditor, who has responsibility for assessing, monitoring and auditing our global risk profile, reports directly to the Audit Committee and reports on a functional basis to our Chief Financial Officer (CFO). The Leadership Development and Compensation Committee reviews and assesses compensation program risks to ensure that our compensation programs balance appropriate business risk and rewards without encouraging unnecessary or excessive risk-taking behaviors. The Leadership Development and Compensation Committee also exercises oversight of risk relating to succession planning for executive officers, including the CEO. The Nominating and Governance Committee exercises oversight over our governance and compliance programs, including items such as anti-corruption and environmental, safety, health and security programs.

Leadership Structure. Our Board believes that the decision as to whether to combine or separate the CEO and Chairman of the Board of Directors positions will depend on the facts and circumstances facing the Company at a given time. In today’s challenging economic and regulatory environment, directors, more than ever, are required to spend a substantial amount of time and energy successfully navigating a wide variety of issues and guiding the policies and practices of the companies they oversee. To that end, we currently believe that having a separate Chairman, whose sole job is to lead the Board, allows our CEO to focus his time and energy on running the day-to-day operations of our Company. However, the Board will consider the continued appropriateness of this structure as necessary to meet the best interests of the Company. The Board believes that our current leadership structure does not affect the Board’s role in risk oversight of the Company.

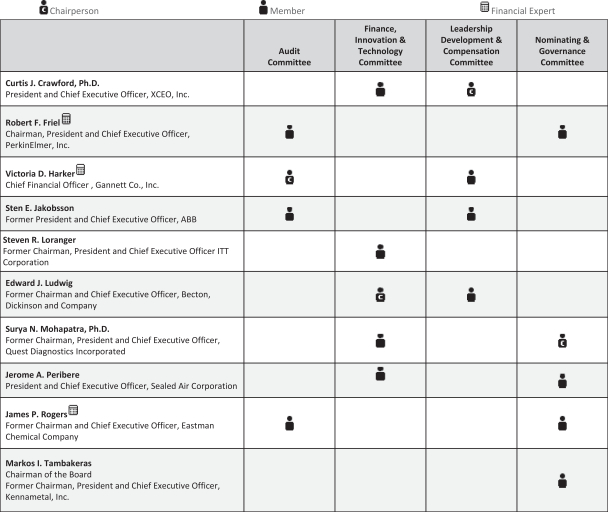

Director Independence. Our Corporate Governance Principles require a majority of our Board to be comprised of Directors who are independent in accordance with the NYSE’s listing standards. The Board conducted an annual review and affirmatively determined that ten of our eleven Directors (Curtis J. Crawford, Robert F. Friel, Victoria D. Harker, Sten E. Jakobsson, Steven R. Loranger, Edward J. Ludwig, Surya N. Mohapatra, Jerome A. Peribere, James P. Rogers and Markos I. Tambakeras) meet the independence requirements in the NYSE’s listing standards. Steven R. Loranger, who served as our Chief Executive Officer from September 2013 until March 2014, currently meets the independence requirements in the NYSE’s listing standards as his service as CEO was on an interim basis. Patrick K. Decker is not independent because he serves as President and CEO of Xylem.

19

Meetings of the Board and Committees. During 2014, there were seven Board meetings and 19 standing committee meetings. All Directors attended at least 75% of the aggregate of all meetings of the Board and standing committees on which they served. It is Company practice that all Directors attend our Annual Meeting of Shareowners. All of our Directors were present at the annual meeting held in 2014 and all of our Directors are expected to attend the Annual Meeting this year. Our non-management directors hold regular Board and committee executive sessions without management present, and our independent Directors met privately in 2014. Mr. Tambakeras, the Chairman of the Board, presides over independent sessions.

Identifying and Evaluating Director Nominees. Our Nominating and Governance Committee is responsible for identifying and recommending qualified director candidates to the Board of Directors. In fulfilling this responsibility, the Nominating and Governance Committee seeks to identify candidates who possess the attributes and experiences necessary to provide a broad range of personal characteristics to the Board, including diversity, management skills, and technological, business and international experience. The Board of Directors actively seeks to consider diverse candidates for membership on the Board, taking into account diversity in terms of viewpoints, professional experience, education and skills as well as race, gender and national origin.

On an annual basis, as part of its self-assessment, the Board of Directors will assess whether the mix of directors is appropriate given the Company’s needs. As part of its process in identifying new candidates to join the Board of Directors, the Nominating and Governance Committee considers whether and to what extent the candidate’s attributes and experiences will individually and collectively complement the existing Board, recognizing that Xylem’s businesses and operations are diverse and global in nature.

Prior to recommending nominees for election as directors, our Nominating and Governance Committee engages in a deliberative, evaluative process. Biographical information for each candidate is evaluated and candidates participate in interviews with existing Board members and management. Each candidate is subject to a thorough background check. Director nominees must be willing to commit the requisite time for preparation and attendance at regularly scheduled Board and committee meetings and participation in other matters necessary for good corporate governance.

The Nominating and Governance Committee identifies director candidates through a variety of sources including personal references and business contacts. The Nominating and Governance Committee may also use a search firm to identify and screen director candidates and pays a fee to that firm for each such candidate elected to the Board of Xylem. The Nominating and Governance Committee will consider director nominees recommended by shareowners who meet the qualification standards described above. Shareowners wishing to propose a candidate for consideration may do so by submitting the proposed candidate’s full name and address, resume and biographical information to the attention of our Corporate Secretary at Xylem Inc., 1 International Drive, Rye Brook, New York 10573. The Nominating and Governance Committee and Board use the same criteria for evaluating candidates regardless of the source of the referral.

Communication with the Board. Any matter intended for the Board, or for any individual member or members of the Board, should be directed to our Corporate Secretary at Xylem Inc., 1 International Drive, Rye Brook, New York 10573, with a request to forward the communication to the intended recipient or recipients. In general, any shareowner communication delivered to us for forwarding to the Board or specified Board members will be forwarded in accordance with the shareowner’s instructions. Junk mail, advertisements, resumes, spam and surveys will not be forwarded to the Board or Board Members. Abusive, threatening or otherwise inappropriate materials will also not be forwarded.

Code of Conduct. We have a Code of Conduct which applies to all of our Directors, officers and employees. The Code of Conduct is available on our website at www.xyleminc.com, by clicking “Investors” and then “Corporate Governance.” We will disclose within four business days any substantive changes in or waivers of the Code of Conduct granted to our CEO, CFO and Chief Accounting Officer, or persons performing similar functions, by posting such information on our website as set forth above rather than by filing a Form 8-K. A copy of the Code of Conduct will be provided, free of charge, to any shareowner upon request to our Corporate Secretary of Xylem.

20

Policies and Procedures for Related Person Transactions. We have a written policy for the review, approval or ratification of transactions with related persons. Pursuant to the policy, Directors and executive officers must promptly disclose any actual or potential related person transactions to the Chairman of the Nominating and Governance Committee and our Corporate Secretary for evaluation and appropriate resolution.

Our policy generally groups transactions with related persons into two categories: (1) transactions requiring the approval of the Nominating and Governance Committee and (2) transactions, including ordinary course transactions below established financial thresholds, that are deemed pre-approved by the Nominating and Governance Committee.

In reviewing related person transactions, the Nominating and Governance Committee will consider the relevant facts and circumstances, including:

| • | whether terms or conditions of the transaction are generally similar to those available to third parties; |

| • | the level of interest or benefit to the related person; |

| • | the availability of alternative suppliers or customers; and |

| • | the benefit to the Company. |

The Nominating and Governance Committee is deemed to have pre-approved certain transactions identified in Item 404(a) of Regulation S-K that are not required to be disclosed even if the amount involved exceeds $120,000. In addition, any transaction with another company at which a related person’s only relationship is as an employee (other than an executive officer), director and/or beneficial owner of less than 10% of that company’s shares is deemed pre-approved; provided, however, that with respect to Directors, if a Director is a current employee, or if an immediate family member of the Director is a current executive officer of a company that has made payments to, or received payments from, Xylem for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues, such transaction will not be considered appropriate for automatic pre-approval and shall be reviewed by the Nominating and Governance Committee.

There were no related person transactions in fiscal year 2014 that are required to be disclosed pursuant to Item 404(a) of Regulation S-K under the Exchange Act.

21

COMMITTEES OF THE BOARD OF DIRECTORS