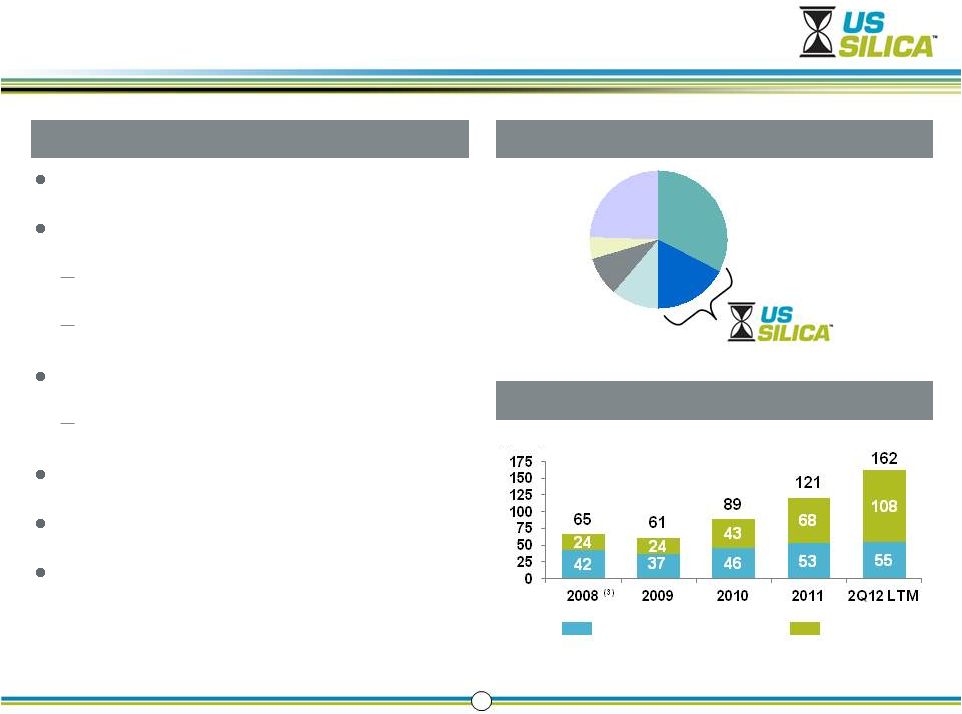

Non-GAAP Financial Performance Measures 20 Segment Contribution Margin The Company organizes its business into two reportable segments, Oil & Gas Proppants and Industrial & Specialty Products, based on end markets. The reportable segments are consistent with how management views the markets served by the Company and the financial information reviewed by the chief operating decision maker. The Company manages its Oil & Gas Proppants and Industrial & Specialty Products businesses as components of an enterprise for which separate information is available and is evaluated regularly by the chief operating decision maker in deciding how to allocate resources and assess performance. An operating segment’s performance is primarily evaluated based on segment contribution margin, which excludes certain corporate costs not associated with the operations of the segment. These corporate costs are separately stated and include costs that are related to functional areas such as operations management, corporate purchasing, accounting, treasury, information technology, legal and human resources. The Company believes that segment contribution margin, as defined above, is an appropriate measure for evaluating the operating performance of its segments. However, this measure should be considered in addition to, not a substitute for, or superior to, income from operations or other measures of financial performance prepared in accordance with generally accepted accounting principles. For a reconciliation of segment contribution margin to its most directly comparable GAAP financial measure, see Note T to our financial statements in our Quarterly Report a Form 10-Q for quarter ended June 30, 2012. Adjusted EBITDA Adjusted EBITDA is not a measure of our financial performance or liquidity under GAAP and should not be considered as an alternative to net income as a measure of operating performance, cash flows from operating activities as a measure of liquidity or any other performance measure derived in accordance with GAAP. Additionally, Adjusted EBITDA is not intended to be a measure of free cash flow for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. Adjusted EBITDA contains certain other limitations, including the failure to reflect our cash expenditures, cash requirements for working capital needs and cash costs to replace assets being depreciated and amortized, and excludes certain non-recurring charges that may recur in the future. Management compensates for these limitations by relying primarily on our GAAP results and by using Adjusted EBITDA only as a supplement. Our measure of Adjusted EBITDA is not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the methods of calculation. |