| | |

Chesapeake Granite Wash Trust c/o The Bank of New York Mellon Trust Company, N.A 919 Congress Avenue, Suite 500 Austin, Texas 78701 | | Chesapeake Energy Corporation 6100 North Western Avenue Oklahoma City, Oklahoma 73118 |

October 18, 2011

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549-7010

Attention: Mr. H. Roger Schwall, Assistant Director

| | Re: | Chesapeake Granite Wash Trust |

Amendment No. 2 to Registration Statement on Form S-1

Filed September 19, 2011

File No. 333-175395

| | | Chesapeake Energy Corporation |

Amendment No. 2 to Registration Statement on Form S-3

Filed September 19, 2011

File No. 333-175395-01

Ladies and Gentlemen:

Set forth below are the responses of Chesapeake Granite Wash Trust, a Delaware statutory trust (the “Trust”), and Chesapeake Energy Corporation, an Oklahoma corporation (“Chesapeake” or the “Company,” and, together with the Trust, “we,” “us” or “our”), to comments received from the Staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) by letter dated September 30, 2011, with respect to Amendment No. 2 (“Amendment No. 2”) to the Registration Statement on Forms S-1 and S-3, respectively (File Nos. 333-175395 and 333-175395-01), filed with the Commission on September 19, 2011 (as amended, the “Registration Statement”).

Concurrently with the submission of this letter, we are filing through EDGAR Amendment No. 3 to the Registration Statement (“Amendment No. 3”). For your convenience, we will hand deliver to the members of the Staff listed in the letter from the Staff dated September 30, 2011, seven copies of Amendment No. 3 that are marked to show all changes made since the filing of Amendment No. 2.

For the Staff’s convenience, each response is prefaced by the exact text of the Staff’s corresponding comment in bold, italicized text. Unless otherwise specified, all references to

Securities and Exchange Commission

October 18, 2011

Page 2 of 15

page numbers and captions in our responses correspond to the prospectus included as part of Amendment No. 3.

General

| 1. | We remind you of prior comment four from our letter dated August 4, 2011. In that regard, please file all omitted exhibits. Also, please file the complete versions of your material agreements. For example, we note the missing schedules and exhibits in several of your filed agreements. |

Response: We acknowledge the Staff’s comment, and we have filed all remaining exhibits with Amendment No. 3, including the form of underwriting agreement (exhibit 1.1), the opinion and related consent of Richards, Layton & Finger, P.A. (exhibits 5.1 and 23.6), the opinions and related consent of Bracewell & Giuliani LLP (exhibits 5.2, 8.1 and 23.7) and the form of hedge contract (exhibit 10.8).

We advise the Staff that, with respect to exhibits filed in preliminary form, the missing information, including that to be contained in the missing schedules and exhibits, is information of the type contemplated by Instruction 1 to Item 601 of Regulation S-K in that such information is dependent upon the finalization and pricing of the offering and such information appears elsewhere in the Registration Statement or prospectus. Accordingly, we contemplate (i) relying upon such Instruction 1 in requesting the Staff to declare the Registration Statement effective and (ii) promptly, following the completion of the offering, filing complete copies of any such exhibits as exhibits to a Current Report on Form 8-K. We note that this appears to be the approach followed by the other recent royalty trust registrants of which we are aware.

| 2. | We note your response to comment three from our letter dated September 6, 2011, and your undertaking to provide the omitted information regarding the hedging arrangements in an amendment. Please ensure to provide adequate time for our review of such information. |

Response: We acknowledge the Staff’s comment and we have included the information regarding the hedging arrangements in Amendment No. 3.

Underlying Properties, page 4

| 3. | You state that the Colony Granite Wash is a relatively low risk, laterally extensive and hydrocarbon liquids-rich reservoir. Please expand your disclosure to also state that the Colony Granite Wash is primarily a natural gas reservoir. |

Securities and Exchange Commission

October 18, 2011

Page 3 of 15

Response: We acknowledge the Staff’s comment, and we have revised our disclosure to clarify that the Colony Granite Wash is primarily a natural gas and natural gas condensate reservoir based on reserve volumes. However, we also note that oil and natural gas liquids production generates more revenue than natural gas production in the Colony Granite Wash due to prices that have historically been, and currently are, significantly higher for oil and natural gas liquids than for natural gas. See pages 4 and 64.

| 4. | You state here and on page 63 that the development costs for the Granite Wash are approximately $15 per barrels of oil equivalent. However, the development costs for proved undeveloped reserves in the reserve report appear to be materially less than that. In addition, you state that the costs are similar to other unconventional developments in the Mid-Continent. However, the Granite Wash is not an unconventional reservoir and is significantly different than shale reservoirs. Please reconcile these issues. |

Response: We acknowledge the Staff’s comment. We have reviewed the information we considered in stating that development costs for horizontal wells drilled in the Colony Granite Wash average approximately $15.00 per barrel of oil equivalent (boe), and we have determined that such figure is not accurate with respect to the area of mutual interest of the Trust (the “AMI”); rather, these costs correspond to a larger area that we consider to be the greater Colony Granite Wash, of which the AMI is a subset. The actual average historic development costs for horizontal wells drilled by Chesapeake within the AMI is $8.31 per boe, and we have revised our disclosure in Amendment No. 3 accordingly. See pages 5 and 64.

The projected development costs for proved undeveloped (“PUD”) reserves used in the reserve report prepared by Ryder Scott Company, L.P. (“Ryder Scott”) relating to the underlying properties owned by Chesapeake is $9.18 per boe, which we believe reasonably estimates the future development costs for the PUD wells in which the Trust will receive a royalty interest and is also consistent with Chesapeake’s historical development costs in the AMI discussed above.

We advise the Staff that we consider the Colony Granite Wash to be an unconventional reservoir due to the required use therein of horizontal drilling and advanced completion techniques to enhance the economic producibility of the reservoir. However, we have reviewed our use of the term “unconventional reservoir” in connection with the Colony Granite Wash in the Registration Statement and we have modified our disclosure, as appropriate, to refer to “large-scale resource developments” in order to avoid any confusion with shale developments. See pages 5 and 64.

Securities and Exchange Commission

October 18, 2011

Page 4 of 15

Risk Factors, page 20

| 5. | We note the response by Chesapeake Energy Corporation to comment two in our letter dated August 2, 2011 as well as your risk factor discussions at pages 20 and 33-35. Specifically, we note that your risk factors do not disclose any specific risks associated with hydraulic fracturing, such as the underground migration and the surface spillage or mishandling of fracturing fluids, including chemical additives. In light of the information provided in response to comment two regarding Chesapeake’s procedures and historical experience with its hydraulic fracturing operations, please advise whether you believe your current risk factor disclosure addresses all your material risk or whether there are additional material operational and financial risks stemming from your business that require disclosure hereunder. |

Response: We acknowledge the Staff’s comment, and we have reviewed both Chesapeake’s response to comment two in the Staff’s letter dated August 2, 2011 and the risk factor disclosure in the Registration Statement relating to hydraulic fracturing and we believe that such disclosure addresses the material risks to which the Trust is subject.

With respect to risks associated with surface spillage or mishandling of fracturing fluids, including chemical additives, we believe our risk factor disclosure beginning on page 34 (see “Oil and gas drilling and producing operations can be hazardous and may expose Chesapeake to liabilities, including environmental liabilities.”) adequately addresses these risks, as follows:

| | • | | the first sentence of paragraph one of the referenced risk factor refers to the risks of “well blowouts. . . pipe failures. . . uncontrollable flows of natural gas, oil, brine or well fluids and other environmental hazards and risks;” |

| | • | | the second paragraph of the referenced risk factor refers to the losses that could occur as a result of these risks including injury or the loss of life, severe damages to or destruction of natural resources, pollution or other environmental damage, clean-up responsibilities, investigations and administrative, civil and criminal penalties and injunctions resulting in limitation or suspension of operations; and |

| | • | | the first sentence of paragraph three describes the “inherent risk of incurring significant environmental costs and liabilities. . . due to the generation, handling and disposal of materials, including wastes and petroleum hydrocarbons.” |

We have not specifically referred to hydraulic fracturing, or to the fluids or additives used in connection therewith, as hydraulic fracturing is only one part of one stage of designing, drilling, completing and equipping a well and making that well ready for production, most of which parts and stages are subject to the disclosed risks. Limiting our disclosure of the risks to hydraulic fracturing would

Securities and Exchange Commission

October 18, 2011

Page 5 of 15

be inaccurate, as these risks are similarly pronounced in other phases of the drilling and completion process; likewise, we believe that singling out the application of hydraulic fracturing treatments to a well would wrongly suggest that the other stages, such as drilling the well and other aspects of completing the well, are somehow less subject to environmental risks. Similarly, a number of substances, products and chemicals are present at every well site and are used in different stages of the drilling and completion process, and the release or spillage of, or improper human exposure to, any of such substances, products and chemicals would subject Chesapeake to the enumerated risks. Accordingly, we believe it would be inaccurate to limit our disclosure to fracturing fluids and chemicals and it would be misleading to specifically mention such fluids and chemicals to the exclusion of others.

With respect to the risk of underground migration of hydraulic fracturing fluids from the reservoir into freshwater aquifers, we have considered both the test for evaluating the materiality of events that are contingent or speculative in nature enumerated by the United States Supreme Court inBasic v. Levinson, 485 U.S. 224 (1988), and the relevant guidance issued by the Commission, and we have concluded that such migration is not reasonably likely to occur and accordingly does not create a material risk as to which disclosure is required.

The Supreme Court inBasic stated that materiality “with respect to contingent or speculative information or events. . . will depend at any given time upon a balancing of both the indicated probability that the event will occur and the anticipated magnitude of the event in light of the totality of the company activity” (internal quotations omitted), and we note that the Commission has adopted this “probability/magnitude” standard in subsequent interpretive releases as being applicable to the analysis of contingent or speculative events generally.1 The Commission has also repeatedly stated that, in the context of management’s discussion and analysis of financial condition and results of operations, management is not required to disclose a

| 1 | See Interpretive Release No. 33-9106, Commission Guidance Regarding Disclosure Related to Climate Change, effective February 8, 2010, at 17-18 (“In addition, the time horizon of a known trend, event or uncertainty may be relevant to a registrant’s assessment of the materiality of the matter and whether or not the impact is reasonably likely. As with respect to other subjects of disclosure, materiality ‘with respect to contingent or speculative information or event. . . will depend at any given time upon a balancing of both the indicated probability that the event will occur and the anticipated magnitude of the event in light of the totality of the company activity.’” [quotingBasic at 238]). |

Securities and Exchange Commission

October 18, 2011

Page 6 of 15

known trend, demand, commitment, event or uncertainty if it determines that such trend, demand, commitment, event or uncertainty is not reasonably likely to occur.2

We believe that, based on both the underlying geologic principles and Chesapeake’s (and the industry’s) extensive history of performing hydraulic fracturing treatments on wells, the possibility of underground migration of hydraulic fracturing fluids from the reservoir into freshwater aquifers is so remote that it does not present a material risk under either theBasic probability/ magnitude standard or the Commission’s reasonable likelihood standard. In particular, we note that nearly all water wells are drilled into freshwater aquifers that lie a few hundred feet below the surface. By contrast, the reservoirs into which Chesapeake injects hydraulic fracturing fluids lie several thousand feet below the surface (in the case of the Colony Granite Wash, between 11,500 and 13,000 feet below the surface) and are separated from freshwater aquifers by several thousand feet of impermeable rock formations, making it highly improbable (if not technically impossible) that hydraulic fracturing fluids could migrate several thousand feet upwards against great pressures and through multiple impermeable rock formations to negatively impact underground fresh water sources. Additionally, we note that Chesapeake has applied hydraulic fracturing treatments to approximately 15,000 wells since 1989, and the industry as a whole applies hydraulic fracturing treatments to approximately 95% of all wells drilled today. We have considered both Chesapeake’s and the industry’s extensive experience and we are not aware of any documented cases of hydraulic fracturing fluids migrating from the target reservoir into fresh water sources. Accordingly, we have concluded that, with respect to the risk of underground migration of hydraulic fracturing fluids, any such migration is not reasonably likely to occur and has a sufficiently low probability of actually occurring that we do not consider it a material risk.

Significant Assumptions Used to Calculate the Target Distributions, page 56

| 6. | It appears there have been material changes to the NYMEX futures prices for both oil and natural gas since August 5, 2011. Please revise your document to reflect up to date NYMEX prices for these commodities in your target distribution calculations. |

| 2 | Release No. 33-6835, Management’s Discussion and Analysis of Financial Condition and Results of Operations; Certain Investment Company Disclosures, (May 18, 1989): “Where a trend, demand, commitment, event or uncertainty is known, management must make two assessments: (1) Is the known trend, demand, commitment, event or uncertainty likely to come to fruition? If management determines that it is not reasonably likely to occur, no disclosure is required. (2) If management cannot make that determination, it must evaluate objectively the consequences of the known trend, demand, commitment, event or uncertainty, on the assumption that it will come to fruition. Disclosure is then required unless management determines that a material effect on the registrant's financial condition or results of operations is not reasonably likely to occur. Each final determination resulting from the assessments made by management must be objectively reasonable, viewed as of the time the determination is made.” |

Securities and Exchange Commission

October 18, 2011

Page 7 of 15

Response: We acknowledge the Staff’s comment, and we have included in Amendment No. 3 updated disclosure based on NYMEX futures prices for oil and natural gas as of October 10, 2011.

| 7. | In regards to your response to prior comment ten of our letter dated September 6, 2011, we do not agree with your response. Tell us whether you utilized the same price in calculating the reserves associated with the perpetual royalty interests as you did for those associated with the 20 year term. If so, tell us why you believe that this is appropriate given that you will not be producing those quantities but will instead be seeking to sell the perpetual royalty interest. |

Response: We acknowledge the Staff’s comment and, pursuant to our telephone conversation with the Staff on October 14, 2011, we have revised our disclosure to describe the process by which we have estimated the “tail” value of the Trust’s perpetual royalty interests to Trust unitholders and to disclose the estimated quantity and value of the reserves attributable to perpetual royalty interests on the termination date of the Trust included in the reserve report and pro forma financial information. See pages 14, 60, 69, F-21, F-22 and Annex B.

| 8. | Regarding your response to prior comment thirteen, we understand that the annual administrative expenses are treated as a reduction in the net proceeds available to the Trust as distributable income in the filing. However, these expenses were not included in the reserve evaluation preformed by Ryder Scott. Presumably the inclusion of these costs in the reserve evaluation could impact the proved reserve volumes, resulting in a further reduction in net proceeds that has not been accounted for in the filing as well as a reduction in the standardized measure. Please tell us how you plan to address this. |

Response: We acknowledge the Staff’s comment. We have reviewed the reserve report for the Trust’s royalty interests and we have discussed the Staff’s concerns with Ryder Scott. We believe that including the Trust’s administrative expenses in the reserves calculation would be inconsistent with the Commission’s rules and industry standards for determining the economic producibility of reserves because the Trust’s administrative expenses are akin to corporate-level general and administrative expenses, which are not typically included in assessing economic producibility of reserves. We also note that the other recent royalty trust registrants of which we are aware do not appear to have deducted the trust’s administrative expenses in calculating reserve volumes.

We have, however, considered whether the inclusion of the Trust’s administrative expenses would impact economic producibility of the reserves and have concluded that doing so would not. In light of this conclusion, we believe that including the Trust’s administrative expenses as a deduction from net proceeds available to the Trust in calculating the pro-forma financial information and in

Securities and Exchange Commission

October 18, 2011

Page 8 of 15

calculating the target cash distributions to Trust unitholders, each as set forth in the Registration Statement, is adequately informative to investors. See “Target Distributions and Subordination Thresholds—Significant Assumptions Used in Calculating Target Distributions—Administrative Expense” on page 59 and “Unaudited Pro Forma Statement of Distributable Income” on F-16.

| 9. | In regards to your response to prior comment fourteen, as we stated in that comment, all proved reserves must meet the standard of reasonable certainty. While a few thousands of vertical wells, a very small subset of the total wells that were drilled fifty or more years ago, have exhibited long lives, this would appear to support only the possibility that horizontal wells may exhibit lives of fifty to sixty five years. As a very small subset or possibility, it does not rise to the level of reasonable certainty that is required for proved reserves. Reasonable certainty means that it is much more likely than not that the estimated ultimate recovery will increase or remain the same then to decrease as more information is obtained. By assuming wells lives that only a small percentage of vertical wells have achieved, it does not appear that your reserve estimate is reasonably certain to occur. Therefore, please revise your filing to limit the reserves to well lives that are more reasonably certain to occur. Because these wells exhibit strong hyperbolic declines early in the production history, a shorter more reasonably certain well life will not necessarily reduce the reserves in the same proportion as the reduction in well life. Please revise your reserves and document accordingly. |

Response: We acknowledge the Staff’s comment, and we note our belief that the geology of the Colony Granite Wash is such that horizontal wells have a significant inherent advantage over vertical wells in terms of development efficiency and production results. The Colony Granite Wash is a low permeability (0.008 md) Des Moinesian aged series of deep water fans (turbidites), which are vertically stacked and laterally extensive. The low permeability and the nature of deposition have the combined result of making vertical well development inefficient in the Colony Granite Wash. In our experience, horizontal well development ties the vertically stacked pay zones together via fracture stimulations along the well bore. Additionally, horizontal wells improve production and development efficiency by dramatically increasing the stimulated area of the low permeability rock resulting in greater cross sectional exposure to the flow paths.

We have compared the rate-time decline curves of horizontal wells drilled by Chesapeake in the Colony Granite Wash to the rate-time decline curves of vertical wells in the Colony Granite Wash area, and such comparison shows a strong and

positive correlation in support of long well lives without sudden or abrupt changes in decline trends.

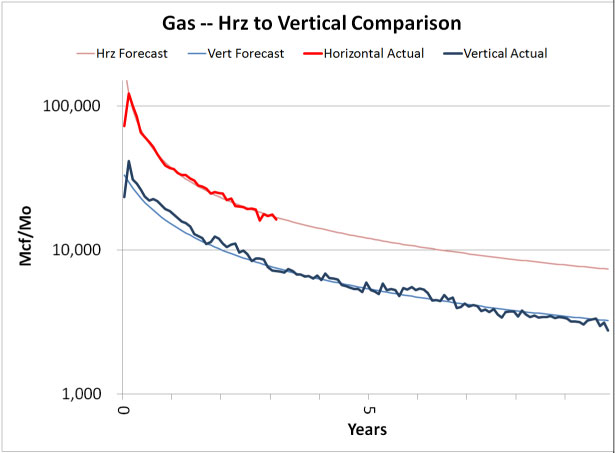

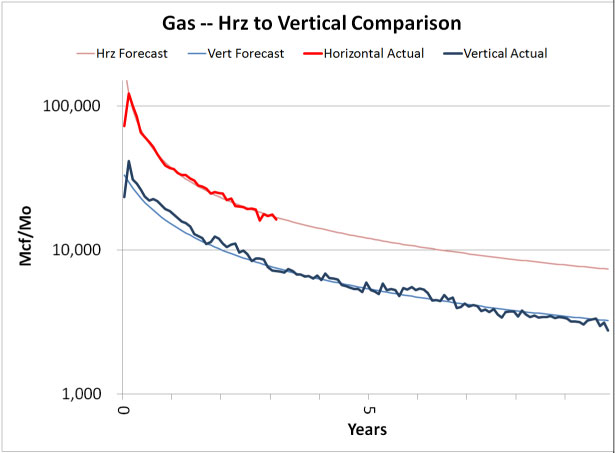

Figure 1 provides the comparison of the decline curve derived from 100 Colony Granite Wash vertical wells with more than 10 years of production history that are located in the AMI or within 4 miles thereof to the decline curve derived from all producing horizontal wells in the AMI for which we have sufficient production history for comparison purposes (which consists of 47 wells that commenced production prior to January 2009). Each data set was time normalized based on gas production. The vertical well set was rate-time forecasted based upon the observed trend with a 6% terminal decline rate imposed. The horizontal forecast is the normalized average of the forecasts from the Ryder Scott reserve report, which also incorporates a 6% terminal decline rate.

Securities and Exchange Commission

October 18, 2011

Page 9 of 15

Figure 1 confirms that horizontal wells demonstrate significantly better production than vertical wells in the Colony Granite Wash. We note that the average rate multiple from a vertical well to a horizontal well is 2.3x. We further note that the shapes of the actual production curves are very similar. The decline rates after six months of production for both vertical and horizontal wells are essentially the same.

Securities and Exchange Commission

October 18, 2011

Page 10 of 15

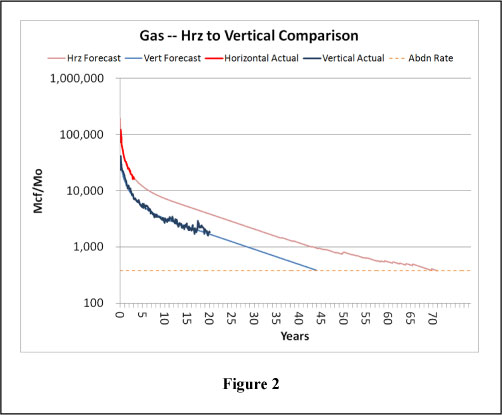

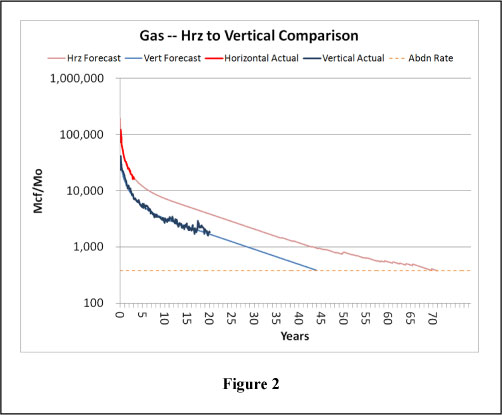

Figure 2 below provides an expanded view of the decline curve comparison in Figure 1. We believe that the established production trends of the decline curves in Figure 2 demonstrate that compared to vertical wells, horizontal wells in the Colony Granite Wash exhibit higher production rates, drain larger areas and produce for significantly longer periods before reaching an economic abandonment rate.

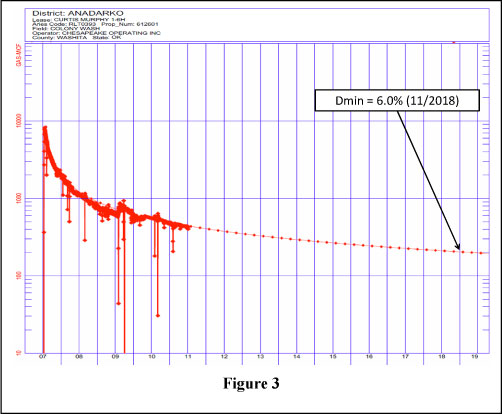

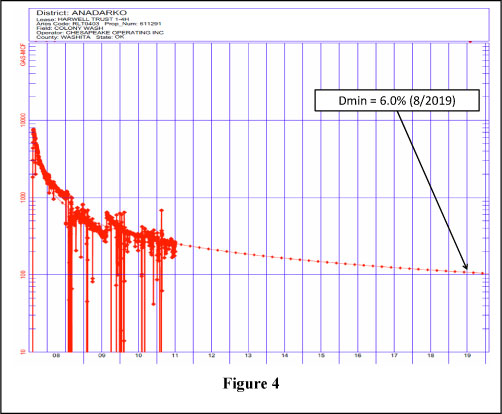

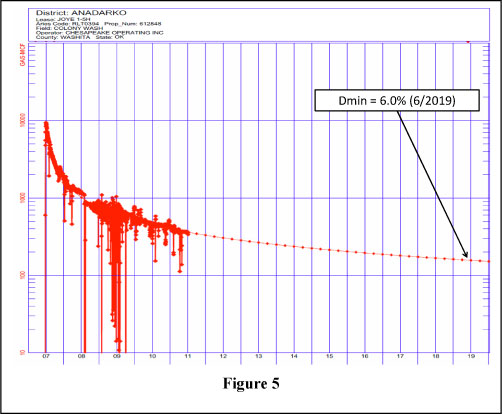

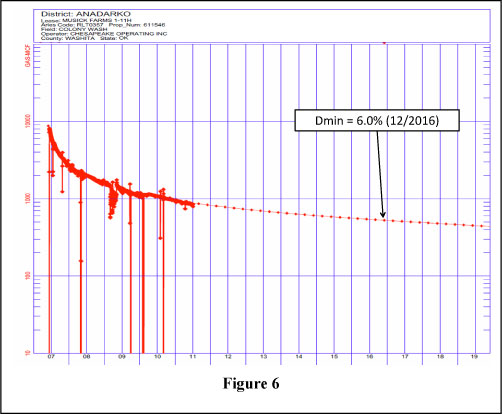

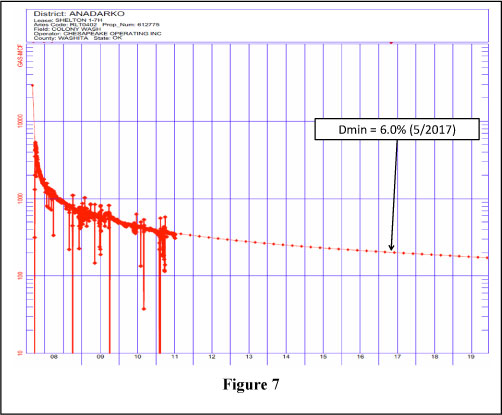

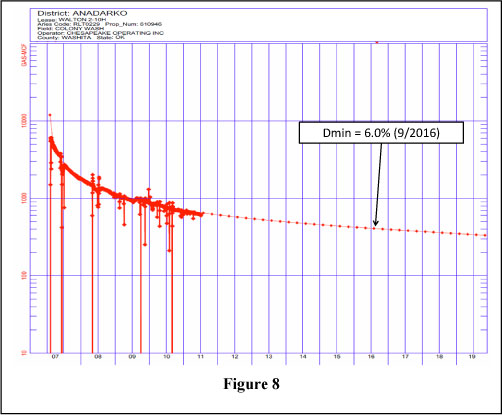

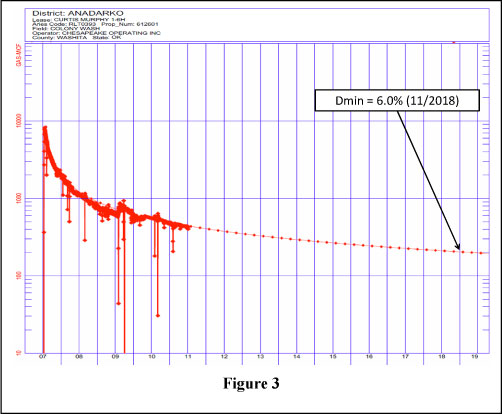

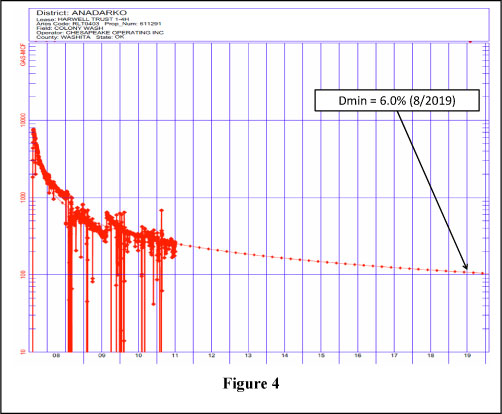

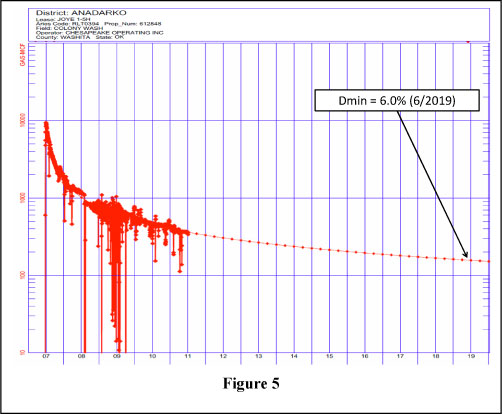

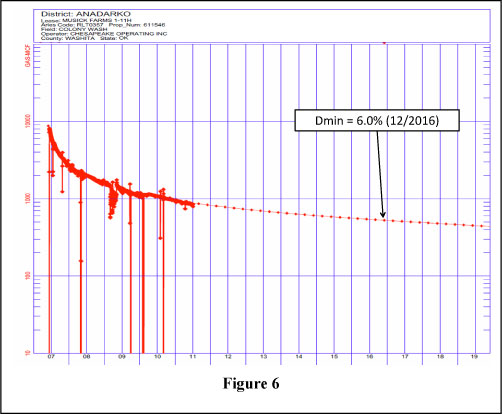

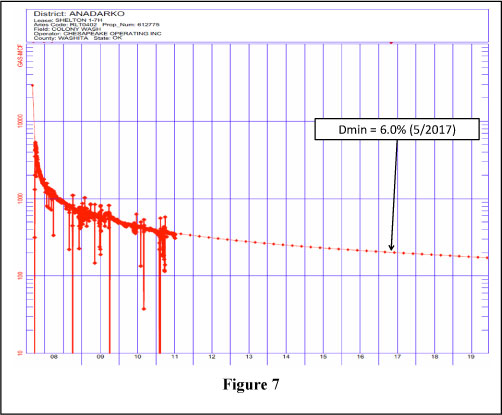

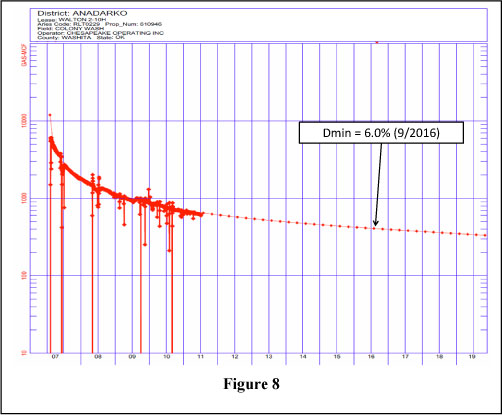

We now have four to five years of production data for the oldest horizontal wells drilled by Chesapeake in the Colony Granite Wash, and such wells exhibit stable production and decline curves that are reasonably certain. Figures 3 through 8 below show production data for the first six horizontal wells drilled by Chesapeake in the AMI, each of which commenced production in either 2007 or the first quarter of 2008.

Securities and Exchange Commission

October 18, 2011

Page 11 of 15

Securities and Exchange Commission

October 18, 2011

Page 12 of 15

Securities and Exchange Commission

October 18, 2011

Page 13 of 15

Securities and Exchange Commission

October 18, 2011

Page 14 of 15

With respect to the ultimate recoverability of reserves in horizontal wells in the AMI, we have determined that the ultimate cumulative natural gas production of proved reserves within the AMI represents 66% of the volumetric original-gas-in-place (OGIP). Additionally, we estimate that the ultimate cumulative natural gas recovery factor at 1,000 psi abandonment pressure would be 83%. The difference between these recovery factors represents 169 billion cubic feet of natural gas that is not included in the proved reserves.

In summary, based on the fundamental reservoir analysis we have described above, both we and Ryder Scott have concluded that the range of well lives projected in the reserve reports is reasonably certain and is likely conservative. This conclusion is supported by the following points:

| | • | | availability of production data for a significant number of older horizontal wells in the Colony Granite Wash provides reasonable certainty that our decline curve analysis is effective and accordingly supports our 65 year well life assumptions. In other words, our analysis does not rely on “early time” data points; |

Securities and Exchange Commission

October 18, 2011

Page 15 of 15

| | • | | normalized comparisons of horizontal wells and vertical wells producing from the Colony Granite Wash indicate similar rate time shapes and trends and also that horizontal wells in the Colony Granite Wash are significantly rate-advantaged compared to vertical wells, and are therefore likely to produce in economic quantities for significantly longer periods than vertical wells; |

| | • | | forecasted producing life for undeveloped reserves used by Ryder Scott in preparing the reserve reports range from 32 years to a maximum of 65 years; and |

| | • | | volumetric recovery represented by the cumulative natural gas production to date plus production of proved reserves is a conservative 66% of the OGIP for horizontal wells drilled in the AMI. |

Should any member of the Staff have a question regarding our responses to the comments set forth above, or need additional information, please do not hesitate to call Michael A. Johnson at (405) 935-9229, Michael J. Ulrich at (512) 236-6599, Jennifer M. Grigsby at (405) 835-9225 or our outside counsel Michael S. Telle at (713) 221-1327 at Bracewell & Giuliani LLP.

As you requested in the comment letter, we acknowledge that:

| | • | | we are responsible for the adequacy and accuracy of the disclosure in the filing; |

| | • | | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | | we may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Very truly yours,

| | |

Chesapeake Granite Wash Trust By: Chesapeake Energy Corporation |

| |

| By: | | /s/ Jennifer M. Grigsby |

| Name: | | Jennifer M. Grigsby |

| Title: | | Senior Vice President, Treasurer and Corporate Secretary |

|

| Chesapeake Energy Corporation |

| |

| By: | | /s/ Jennifer M. Grigsby |

| Name: | | Jennifer M. Grigsby |

| Title: | | Senior Vice President, Treasurer and Corporate Secretary |