Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Vericimetry U.S. Small Cap Value Fund

Annual Report

September 30, 2013

Vericimetry Funds

| Letter to Shareholders | 1 |

| Manager’s Discussion and Analysis | 2 |

| Performance Summary | 3 |

| Schedule of Investments | 4 |

| Financial Statements | 17 |

| Financial Highlights | 20 |

| Notes to Financial Statements | 21 |

| Report of Independent Registered Public Accounting Firm | 26 |

| Expense Example | 27 |

| Proxy Voting | 28 |

| Quarterly Holdings | 28 |

| Risk Disclosures | 28 |

| Trustees and Officers | 29 |

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by a current prospectus.

Except for historical information, the matters discussed in this report may constitute forward-looking statements. These include any predictions, assessments, analyses or outlooks for individual securities, industries, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for the Fund in the current prospectus, other factors bearing on these statements include the accuracy of the Adviser’s forecasts and predictions, and the appropriateness of the investment programs designed by the Adviser to implement its strategies efficiently and effectively. Any one or more of these factors, as well as other risks affecting the securities markets and investment instruments generally, could cause the actual results of the Fund to differ materially as compared to applicable benchmarks.

Vericimetry Funds

LETTER TO SHAREHOLDERS

September 30, 2013 (Unaudited)

Dear Shareholders,

We are pleased to present the enclosed annual report for the Vericimetry U.S. Small Cap Value Fund (the “Fund”) for the fiscal year ended September 30, 2013.

Vericimetry Advisors, LLC (the “Adviser”) is an academically based, quantitatively structured investment adviser providing capacity-constrained asset class strategies to an exclusive group of elite financial advisors.

The Fund invests in a wide and diverse universe of U.S. small cap value stocks using a structured quantitative investment approach based on a set of well defined, fundamental characteristics to identify value stocks. We identify value stocks by considering multiple factors such as book-to-market, price-to-earnings, price-to-sales or price-to-operating cash flow. (1)

The Fund is managed with the intent of maintaining a reasonably priced management fee and low transactions costs, expenses and turnover in an effort to enhance net returns to the investor. We are committed to limit the growth of its assets under management once optimal capacity for the Fund is achieved.

Our capacity planned approach, working with an exclusive set of financial advisors, seeks to provide exposure to the small and value equity risk premiums. The portfolio pursues a purer value by using a multifactor screening approach and focuses on a set of smaller capitalized stocks by its thoughtful academically based quantitatively structured methodology.

We thank you for your investment in the Vericimetry U.S. Small Cap Value Fund and the confidence and trust you place in Vericimetry.

Sincerely

Dr. Glenn S. Freed

Chief Executive Officer

Economic, political, and issuer specific events will cause the value of securities to rise or fall. Because the value of your investment in the Fund will fluctuate, there is the risk that you will lose money. Securities of small and microcap companies are often less liquid, more volatile and they may have more limited resources. Value stocks may perform differently from the market as a whole and may underperform equity funds that use other investment strategies. The investment strategies, practices and risk analysis used by the Adviser may not produce the desired results.

| (1) | Book-to-market is the value ratio of a company’s book value to its market value. Price-to-earnings, price-to-sales and price-to-operating cash flow ratios are the value of a company’s share price compared to its previous twelve months earnings per share, sales per share or operating cash flow per share, respectively. |

Vericimetry Funds

Manager’s Discussion and Analysis

September 30, 2013 (Unaudited)

The Fund started the fiscal year, on October 1, 2012, with $38.8 million in assets under management (“AUM”) and closed the fiscal year, on September 30, 2013, with $103.8 million in AUM – an increase of more than 160% in AUM.

The fiscal year under review provides an excellent business cycle in which to view the Fund’s investment style and purpose. The results of this fiscal year show that the Fund closely follows its stated investment style and purpose: to deliver size and value risk premiums using a wide and well-diversified portfolio of publically traded securities. The securities in the Fund’s portfolio are smaller in size and deeper in value than the securities in its benchmark – the Russell 2000 Value Index (the “Benchmark”). In the analysis that follows, returns quoted for both the Fund and the Benchmark include both price appreciation/depreciation and reinvestment of dividends.

The Fund had positive return performance for all four quarters of the fiscal year ending September 30, 2013. The Fund’s return outperformed the Benchmark for each quarterly fiscal period. For the fiscal year overall, the Fund’s annual return was strong on both an absolute and a relative basis, gaining 34.88% versus 27.04% for the Benchmark. The Fund was almost fully invested, well-diversified with over 1,000 holdings, and each of its equity positions was under 0.46% in portfolio weight at fiscal year-end.

Examining the returns of different segments of the U.S. equity markets over this fiscal year provides additional information (see below). The broad market had strong positive returns, as illustrated by the Russell 3000 Index. Large cap stocks, represented by the Russell 1000 Index, had substantially lower returns while small cap stocks, represented by the Russell 2000 Indices, were stronger. This positively impacted relative returns of the Fund, which had greater exposure to the small cap segment of the market. Furthermore, the smaller company investment design contributed to the Fund’s returns given that microcap stocks, as represented by the Russell Microcap Index, had the highest returns over this fiscal period.

Within the Russell small cap universe, value indices had lower returns than growth indices, but this only resulted in a modest drag on the Fund’s performance. Similarly, within the Russell microcap universe, value indices had lower returns than growth indices. However, the Fund’s deeper and purer multi-factor approach to value was rewarded during the fiscal period, counterbalancing growth indices’ returns.

Two other notable factors affecting the Fund’s performance were real estate investment trusts (“REITs”) and utility stocks. The Fund does not hold REITs by design, so investors can consider REITs as a separate asset class. The Fund also does not invest in utility stocks because the regulated nature of the industry diminishes the risk and return profile of utilities. By contrast, the Russell indices do hold REITs and utility stocks, with the Russell 2000 Value Index having a REIT weight above 10% and a Utility stock weight above 5%. Both REITs and utilities had weak returns this fiscal year, enhancing the Fund’s performance compared to the Benchmark.

Overall, the fiscal year was strong in terms of absolute and relative returns, while providing shareholders well-diversified exposure to the small size and value risk premiums.

Returns for the Fiscal Year Ended September 30, 2013

Russell 3000® Index (broad market) | 21.60% |

Russell 1000® Index (large cap) | 20.91% |

Russell 2000® Index (small cap) | 30.06% |

Russell Microcap® Index (microcap) | 32.12% |

Russell 2000® Value Index | 27.04% |

Russell 2000® Growth Index | 33.07% |

Russell Microcap® Value Index | 30.29% |

Russell Microcap® Growth Index | 34.99% |

Source: Russell Investment Group

Vericimetry Funds

PERFORMANCE SUMMARY (Unaudited)

For the Period from December 27, 2011** to September 30, 2013

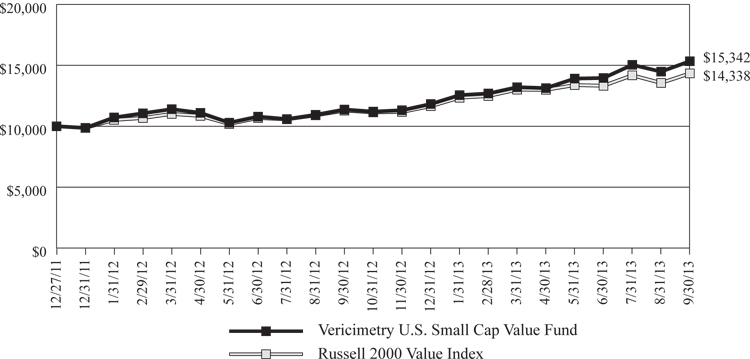

| Comparison of a Hypothetical $10,000 Investment |

| in the Vericimetry U.S. Small Cap Value Fund and the Russell 2000 Value Index* |

Total Returns For the periods ended September 30, 2013 |

| | | Average Annual Since Inception ** | |

| Vericimetry U.S. Small Cap Value Fund | 34.88% | 27.50% | |

| Russell 2000 Value Index | 27.04% | 22.70% | |

| | | | |

| * | The Russell 2000 Value Index measures the performance of small-cap value segment of the U.S. equity universe. It includes those Russell 2000 Index companies with lower price-to-book ratios and lower forecasted growth values. |

| ** | Commencement of operations for the Vericimetry U.S. Small Cap Value Fund was December 27, 2011. |

The Fund’s net expense ratio of 0.60% and gross expense ratio of 2.80% are reflective of the information disclosed in the Fund’s prospectus dated February 1, 2013 and may differ from the expense ratios disclosed in this report. The Adviser has contractually agreed to waive all or a portion of its management fees and/or reimburse expenses at least through January 31, 2015 in order to keep the Fund’s net annual operating expenses from exceeding 0.60% of its average daily net assets. Performance data quoted represents past performance which is not predictive of future performance. The investment return and principal value of Fund shares will fluctuate and when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To receive current performance to the most recent month end, please call 1-855-755-7550. Please read prospectus carefully before investing.

The line graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s results as shown are net of fees.

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS

As of September 30, 2013

| | | | | | | |

| COMMON STOCKS – 99.7% | | | | | | |

| BASIC MATERIALS – 5.2% | | | | | | |

| A Schulman, Inc. | | | 7,200 | | | $ | 212,112 | |

| Aceto Corp. | | | 4,065 | | | | 63,495 | |

| Allied Nevada Gold Corp.* | | | 29,000 | | | | 121,220 | |

| Boise, Inc. | | | 22,400 | | | | 282,240 | |

Century Aluminum Co.*, 1 | | | 18,866 | | | | 151,871 | |

| Charles & Colvard Ltd.* | | | 4,000 | | | | 28,040 | |

Codexis, Inc.*, 1 | | | 24,300 | | | | 42,768 | |

| Coeur Mining, Inc.* | | | 24,000 | | | | 289,200 | |

Commercial Metals Co.1 | | | 25,500 | | | | 432,225 | |

| Friedman Industries, Inc. | | | 3,500 | | | | 35,000 | |

Horsehead Holding Corp.*, 1 | | | 10,400 | | | | 129,584 | |

Intrepid Potash, Inc.1 | | | 8,400 | | | | 131,712 | |

Kaiser Aluminum Corp.1 | | | 4,400 | | | | 313,500 | |

| Kraton Performance Polymers, Inc.* | | | 8,400 | | | | 164,556 | |

Kronos Worldwide, Inc.1 | | | 21,500 | | | | 333,035 | |

| Landec Corp.* | | | 5,600 | | | | 68,320 | |

| Material Sciences Corp.* | | | 4,600 | | | | 43,148 | |

| Materion Corp. | | | 4,800 | | | | 153,888 | |

Minerals Technologies, Inc.1 | | | 4,000 | | | | 197,480 | |

Molycorp, Inc.*, 1 | | | 22,000 | | | | 144,320 | |

| Noranda Aluminum Holding Corp. | | | 20,710 | | | | 50,947 | |

Northern Technologies International Corp.*, 1 | | | 2,300 | | | | 38,686 | |

| Olin Corp. | | | 14,500 | | | | 334,515 | |

| OM Group, Inc.* | | | 7,100 | | | | 239,838 | |

| Penford Corp.* | | | 3,600 | | | | 51,552 | |

| PH Glatfelter Co. | | | 5,200 | | | | 140,764 | |

Schnitzer Steel Industries, Inc. - Class A1 | | | 5,900 | | | | 162,486 | |

| Sensient Technologies Corp. | | | 9,700 | | | | 464,533 | |

| Shiloh Industries, Inc. | | | 3,320 | | | | 43,492 | |

Stillwater Mining Co.*, 1 | | | 19,400 | | | | 213,594 | |

| Universal Stainless & Alloy Products, Inc.* | | | 2,600 | | | | 84,578 | |

| Zep, Inc. | | | 6,000 | | | | 97,560 | |

Zoltek Cos., Inc.*, 1 | | | 6,700 | | | | 111,823 | |

| | | | | | | | 5,372,082 | |

| COMMUNICATIONS – 6.6% | | | | | | | | |

| 1-800-Flowers.com, Inc. - Class A* | | | 2,570 | | | | 12,670 | |

| Active Network, Inc.* | | | 13,400 | | | | 191,754 | |

| AH Belo Corp. - Class A | | | 4,235 | | | | 33,245 | |

| Anaren, Inc.* | | | 2,762 | | | | 70,431 | |

| ARRIS Group, Inc.* | | | 26,800 | | | | 457,208 | |

Aviat Networks, Inc.*, 1 | | | 10,600 | | | | 27,348 | |

| Aware, Inc. | | | 6,300 | | | | 34,398 | |

| Beasley Broadcasting Group, Inc. - Class A | | | 2,900 | | | | 25,201 | |

| Black Box Corp. | | | 2,900 | | | | 88,856 | |

| Blucora, Inc.* | | | 5,700 | | | | 130,986 | |

CafePress, Inc.*, 1 | | | 4,100 | | | | 25,092 | |

| Calix, Inc.* | | | 5,600 | | | | 71,288 | |

| | | Number of Shares | | | Value | |

| COMMON STOCKS (Continued) | | | | | | |

| COMMUNICATIONS (Continued) | | | | | | |

| Cbeyond, Inc.* | | | 5,500 | | | $ | 35,255 | |

| Central European Media Enterprises Ltd. - Class A* | | | 8,400 | | | | 44,268 | |

ClearOne, Inc.*, 1 | | | 3,000 | | | | 24,330 | |

| Communications Systems, Inc. | | | 1,900 | | | | 21,489 | |

| Comtech Telecommunications Corp. | | | 3,826 | | | | 93,048 | |

Courier Corp.1 | | | 1,800 | | | | 28,476 | |

Demand Media, Inc.*, 1 | | | 22,150 | | | | 139,988 | |

Dex Media, Inc.*, 1 | | | 1,946 | | | | 15,819 | |

Digital Generation, Inc.*, 1 | | | 8,800 | | | | 113,784 | |

Dolan Co.*, 1 | | | 11,200 | | | | 25,312 | |

EarthLink, Inc.1 | | | 17,000 | | | | 84,150 | |

Entercom Communications Corp. - Class A*, 1 | | | 8,600 | | | | 75,508 | |

Envivio, Inc.*, 1 | | | 5,000 | | | | 15,700 | |

| ePlus, Inc. | | | 1,424 | | | | 73,592 | |

| EW Scripps Co. - Class A* | | | 11,300 | | | | 207,355 | |

| Extreme Networks, Inc.* | | | 10,000 | | | | 52,200 | |

FAB Universal Corp.*, 1 | | | 8,400 | | | | 61,908 | |

| Finisar Corp.* | | | 14,400 | | | | 325,872 | |

| Global Sources Ltd.* | | | 6,300 | | | | 46,746 | |

| Globecomm Systems, Inc.* | | | 3,400 | | | | 47,702 | |

| Gray Television, Inc. - Class A* | | | 4,881 | | | | 35,363 | |

| Harmonic, Inc.* | | | 18,200 | | | | 139,958 | |

| Harte-Hanks, Inc. | | | 12,968 | | | | 114,508 | |

Hawaiian Telcom Holdco, Inc.*, 1 | | | 2,300 | | | | 61,180 | |

ICG Group, Inc.*, 1 | | | 4,800 | | | | 68,112 | |

ID Systems, Inc.*, 1 | | | 1,600 | | | | 9,856 | |

| Inteliquent, Inc. | | | 5,000 | | | | 48,300 | |

| IntraLinks Holdings, Inc.* | | | 11,800 | | | | 103,840 | |

Iridium Communications, Inc.*, 1 | | | 18,000 | | | | 123,840 | |

| Journal Communications, Inc. - Class A* | | | 11,500 | | | | 98,325 | |

| KVH Industries, Inc.* | | | 2,600 | | | | 35,880 | |

| Leap Wireless International, Inc.* | | | 10,600 | | | | 167,374 | |

Limelight Networks, Inc.*, 1 | | | 26,200 | | | | 50,566 | |

Local Corp.*, 1 | | | 5,000 | | | | 9,700 | |

Marchex, Inc. - Class B1 | | | 4,800 | | | | 34,944 | |

| Martha Stewart Living Omnimedia, Inc. - Class A* | | | 10,000 | | | | 23,000 | |

MeetMe, Inc.*, 1 | | | 15,000 | | | | 27,150 | |

Meredith Corp.1 | | | 2,200 | | | | 104,764 | |

| ModusLink Global Solutions, Inc.* | | | 14,200 | | | | 38,908 | |

| NeoPhotonics Corp.* | | | 7,700 | | | | 56,903 | |

| NETGEAR, Inc.* | | | 8,900 | | | | 274,654 | |

NII Holdings, Inc.*, 1 | | | 35,400 | | | | 214,878 | |

| Novatel Wireless, Inc.* | | | 8,700 | | | | 22,707 | |

Oclaro, Inc.*, 1 | | | 36,950 | | | | 65,402 | |

See accompanying Notes to Financial Statements.

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2013

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| COMMUNICATIONS (Continued) | | | | | | |

| PC-Tel, Inc. | | | 3,100 | | | $ | 27,435 | |

| Perficient, Inc.* | | | 5,500 | | | | 100,980 | |

Polycom, Inc.*, 1 | | | 30,300 | | | | 330,876 | |

| Preformed Line Products Co. | | | 490 | | | | 35,246 | |

| Premiere Global Services, Inc.* | | | 12,811 | | | | 127,598 | |

| Primus Telecommunications Group, Inc. | | | 6,000 | | | | 20,340 | |

QuinStreet, Inc.*, 1 | | | 10,800 | | | | 102,060 | |

| Radio One, Inc. - Class A* | | | 5,841 | | | | 15,303 | |

Radio One, Inc. - Class D*, 1 | | | 12,878 | | | | 34,642 | |

| RealNetworks, Inc.* | | | 9,500 | | | | 81,320 | |

RLJ Entertainment, Inc.*, 1 | | | 6,000 | | | | 31,200 | |

| Salem Communications Corp. - Class A | | | 3,300 | | | | 27,324 | |

Scholastic Corp.1 | | | 5,900 | | | | 169,035 | |

| Shenandoah Telecommunications Co. | | | 3,700 | | | | 89,170 | |

| ShoreTel, Inc.* | | | 15,000 | | | | 90,600 | |

| Symmetricom, Inc.* | | | 11,800 | | | | 56,876 | |

Synacor, Inc.*, 1 | | | 10,000 | | | | 25,800 | |

TeleCommunication Systems, Inc. - Class A*, 1 | | | 22,103 | | | | 54,373 | |

| Telenav, Inc.* | | | 9,111 | | | | 53,208 | |

| Tellabs, Inc. | | | 66,300 | | | | 150,501 | |

Tessco Technologies, Inc.1 | | | 1,600 | | | | 53,920 | |

| TheStreet, Inc.* | | | 5,300 | | | | 11,077 | |

| U.S. Auto Parts Network, Inc.* | | | 7,400 | | | | 9,768 | |

| United Online, Inc. | | | 19,730 | | | | 157,445 | |

UniTek Global Services, Inc.*, 1 | | | 3,930 | | | | 4,677 | |

| USA Mobility, Inc. | | | 5,300 | | | | 75,048 | |

Voltari Corp.*, 1 | | | 668 | | | | 3,560 | |

Vonage Holdings Corp.*, 1 | | | 26,300 | | | | 82,582 | |

Zynga, Inc. - Class A*, 1 | | | 48,800 | | | | 179,584 | |

| | | | | | | | 6,832,639 | |

| CONSUMER, CYCLICAL – 14.0% | | | | | | | | |

| Ambassadors Group, Inc. | | | 3,400 | | | | 11,730 | |

| America's Car-Mart, Inc.* | | | 1,700 | | | | 76,687 | |

AMREP Corp.*, 1 | | | 2,595 | | | | 22,551 | |

| Ark Restaurants Corp. | | | 900 | | | | 19,278 | |

Barnes & Noble, Inc.*, 1 | | | 7,400 | | | | 95,756 | |

| Bassett Furniture Industries, Inc. | | | 2,850 | | | | 46,141 | |

Beazer Homes USA, Inc.*, 1 | | | 3,700 | | | | 66,600 | |

bebe stores, Inc.1 | | | 19,000 | | | | 115,710 | |

| Biglari Holdings, Inc.* | | | 159 | | | | 65,615 | |

Black Diamond, Inc.*, 1 | | | 8,600 | | | | 104,576 | |

| Bob Evans Farms, Inc. | | | 3,000 | | | | 171,810 | |

| Body Central Corp.* | | | 2,900 | | | | 17,690 | |

| Bravo Brio Restaurant Group, Inc.* | | | 500 | | | | 7,550 | |

Brown Shoe Co., Inc.1 | | | 6,700 | | | | 157,249 | |

| Build-A-Bear Workshop, Inc.* | | | 6,171 | | | | 43,074 | |

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| CONSUMER, CYCLICAL (Continued) | | | | | | |

Callaway Golf Co.1 | | | 17,000 | | | $ | 121,040 | |

| Carrols Restaurant Group, Inc.* | | | 8,276 | | | | 50,484 | |

Cash America International, Inc.1 | | | 5,600 | | | | 253,568 | |

Cato Corp. - Class A1 | | | 4,500 | | | | 125,910 | |

| Century Casinos, Inc.* | | | 11,000 | | | | 62,920 | |

| Children's Place Retail Stores, Inc.* | | | 400 | | | | 23,144 | |

| Churchill Downs, Inc. | | | 1,160 | | | | 100,363 | |

Citi Trends, Inc.*, 1 | | | 4,100 | | | | 71,668 | |

| Columbia Sportswear Co. | | | 6,300 | | | | 379,449 | |

| Compx International, Inc. | | | 1,794 | | | | 23,286 | |

| Core-Mark Holding Co., Inc. | | | 2,500 | | | | 166,100 | |

| Crocs, Inc.* | | | 16,500 | | | | 224,565 | |

| Crown Crafts, Inc. | | | 2,560 | | | | 18,432 | |

dELiA*s, Inc.*, 1 | | | 18,000 | | | | 21,780 | |

| Delta Apparel, Inc.* | | | 3,000 | | | | 49,680 | |

| Destination XL Group, Inc.* | | | 7,700 | | | | 49,819 | |

| Dixie Group, Inc.* | | | 2,751 | | | | 30,646 | |

| Dover Downs Gaming & Entertainment, Inc. | | | 5,900 | | | | 8,024 | |

Dover Motorsports, Inc.1 | | | 8,000 | | | | 19,280 | |

DreamWorks Animation SKG, Inc. - Class A*, 1 | | | 3,800 | | | | 108,148 | |

| Emerson Radio Corp.* | | | 19,000 | | | | 35,720 | |

| Escalade, Inc. | | | 4,700 | | | | 40,467 | |

| Ezcorp, Inc. - Class A* | | | 10,500 | | | | 177,240 | |

Federal-Mogul Corp.*, 1 | | | 16,686 | | | | 280,158 | |

Finish Line, Inc. - Class A1 | | | 8,000 | | | | 198,960 | |

| Flexsteel Industries, Inc. | | | 1,872 | | | | 46,744 | |

Fred's, Inc. - Class A1 | | | 5,700 | | | | 89,205 | |

| Frisch's Restaurants, Inc. | | | 1,600 | | | | 38,608 | |

| Fuel Systems Solutions, Inc.* | | | 5,400 | | | | 106,164 | |

Full House Resorts, Inc.*, 1 | | | 7,900 | | | | 21,962 | |

| G&K Services, Inc. - Class A | | | 1,700 | | | | 102,663 | |

| G-III Apparel Group Ltd.* | | | 2,400 | | | | 131,016 | |

| Gaiam, Inc. - Class A* | | | 4,600 | | | | 23,046 | |

| Gaming Partners International Corp. | | | 1,516 | | | | 12,295 | |

| Genesco, Inc.* | | | 2,800 | | | | 183,624 | |

| Group 1 Automotive, Inc. | | | 4,300 | | | | 334,024 | |

Haverty Furniture Cos., Inc.1 | | | 2,600 | | | | 63,778 | |

Hawaiian Holdings, Inc.*, 1 | | | 13,400 | | | | 99,696 | |

hhgregg, Inc.*, 1 | | | 7,500 | | | | 134,325 | |

| Hooker Furniture Corp. | | | 3,600 | | | | 53,820 | |

Iconix Brand Group, Inc.*, 1 | | | 9,000 | | | | 298,980 | |

| International Speedway Corp. - Class A | | | 2,600 | | | | 83,980 | |

| Isle of Capri Casinos, Inc.* | | | 4,570 | | | | 34,549 | |

JAKKS Pacific, Inc.1 | | | 7,500 | | | | 33,675 | |

JetBlue Airways Corp.*, 1 | | | 56,500 | | | | 376,290 | |

See accompanying Notes to Financial Statements.

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2013

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| CONSUMER, CYCLICAL (Continued) | | | | | | |

Joe's Jeans, Inc.*, 1 | | | 31,722 | | | $ | 33,943 | |

| Johnson Outdoors, Inc. - Class A* | | | 2,600 | | | | 69,732 | |

Jones Group, Inc.1 | | | 17,900 | | | | 268,679 | |

Jos A Bank Clothiers, Inc.*, 1 | | | 6,900 | | | | 303,324 | |

| Kimball International, Inc. - Class B | | | 7,000 | | | | 77,630 | |

| Kirkland's, Inc.* | | | 3,500 | | | | 64,540 | |

| La-Z-Boy, Inc. | | | 6,500 | | | | 147,615 | |

LeapFrog Enterprises, Inc.*, 1 | | | 10,100 | | | | 95,142 | |

Life Time Fitness, Inc.*, 1 | | | 5,900 | | | | 303,673 | |

| Lifetime Brands, Inc. | | | 3,700 | | | | 56,573 | |

| Luby's, Inc.* | | | 5,100 | | | | 36,618 | |

M/I Homes, Inc.*, 1 | | | 6,000 | | | | 123,720 | |

| Marcus Corp. | | | 3,500 | | | | 50,855 | |

| MarineMax, Inc.* | | | 7,500 | | | | 91,500 | |

| Marriott Vacations Worldwide Corp.* | | | 7,900 | | | | 347,600 | |

| MDC Holdings, Inc. | | | 9,000 | | | | 270,090 | |

| Men's Wearhouse, Inc. | | | 9,300 | | | | 316,665 | |

| Miller Industries, Inc. | | | 2,400 | | | | 40,752 | |

| Modine Manufacturing Co.* | | | 6,300 | | | | 92,169 | |

| Monarch Casino & Resort, Inc.* | | | 1,800 | | | | 34,164 | |

Office Depot, Inc.*, 1 | | | 33,300 | | | | 160,839 | |

OfficeMax, Inc.1 | | | 10,500 | | | | 134,295 | |

| Pantry, Inc.* | | | 7,801 | | | | 86,435 | |

PC Connection, Inc.1 | | | 6,600 | | | | 99,594 | |

| PCM, Inc.* | | | 3,600 | | | | 33,480 | |

Pep Boys-Manny Moe & Jack*, 1 | | | 9,800 | | | | 122,206 | |

Perfumania Holdings, Inc.*, 1 | | | 3,800 | | | | 18,316 | |

| Perry Ellis International, Inc. | | | 3,200 | | | | 60,288 | |

| Quiksilver, Inc.* | | | 29,800 | | | | 209,494 | |

RadioShack Corp.*, 1 | | | 20,000 | | | | 68,200 | |

| Reading International, Inc. - Class A* | | | 4,200 | | | | 27,594 | |

Red Lion Hotels Corp.*, 1 | | | 3,800 | | | | 20,026 | |

Regis Corp.1 | | | 8,860 | | | | 130,065 | |

Remy International, Inc.1 | | | 6,300 | | | | 127,512 | |

| Republic Airways Holdings, Inc.* | | | 11,900 | | | | 141,610 | |

| RG Barry Corp. | | | 3,000 | | | | 56,730 | |

| Rick's Cabaret International, Inc.* | | | 1,642 | | | | 19,359 | |

| Rocky Brands, Inc. | | | 2,800 | | | | 48,748 | |

| Roundy's, Inc. | | | 7,800 | | | | 67,080 | |

| Ruby Tuesday, Inc.* | | | 15,000 | | | | 112,500 | |

| Rush Enterprises, Inc. - Class A* | | | 5,395 | | | | 143,021 | |

Rush Enterprises, Inc. - Class B*, 1 | | | 2,580 | | | | 58,747 | |

Saks, Inc.*, 1 | | | 18,700 | | | | 298,078 | |

| ScanSource, Inc.* | | | 5,187 | | | | 179,470 | |

| Scientific Games Corp. - Class A* | | | 2,000 | | | | 32,340 | |

Sears Hometown and Outlet Stores, Inc.*, 1 | | | 4,600 | | | | 146,050 | |

| Shoe Carnival, Inc. | | | 3,400 | | | | 91,834 | |

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| CONSUMER, CYCLICAL (Continued) | | | | | | |

| Skechers U.S.A., Inc. - Class A* | | | 6,200 | | | $ | 192,882 | |

Skullcandy, Inc.*, 1 | | | 6,500 | | | | 40,170 | |

| Skyline Corp.* | | | 140 | | | | 696 | |

| SkyWest, Inc. | | | 13,000 | | | | 188,760 | |

Spartan Motors, Inc.1 | | | 6,600 | | | | 40,062 | |

| Speed Commerce, Inc.* | | | 7,800 | | | | 25,584 | |

| Speedway Motorsports, Inc. | | | 9,419 | | | | 168,600 | |

Stage Stores, Inc.1 | | | 7,500 | | | | 144,000 | |

Standard Motor Products, Inc.1 | | | 700 | | | | 22,512 | |

Stanley Furniture Co., Inc.*, 1 | | | 10,355 | | | | 38,417 | |

Stein Mart, Inc.1 | | | 5,900 | | | | 80,948 | |

| Strattec Security Corp. | | | 700 | | | | 26,845 | |

| Superior Industries International, Inc. | | | 5,300 | | | | 94,499 | |

| Superior Uniform Group, Inc. | | | 1,120 | | | | 14,022 | |

| Supreme Industries, Inc. - Class A* | | | 4,500 | | | | 28,710 | |

| Systemax, Inc. | | | 6,723 | | | | 62,322 | |

| Tandy Leather Factory, Inc.* | | | 2,176 | | | | 17,125 | |

| Tilly's, Inc.* | | | 1,697 | | | | 24,623 | |

Titan International, Inc.1 | | | 12,200 | | | | 178,608 | |

Titan Machinery, Inc.*, 1 | | | 4,900 | | | | 78,743 | |

| Trans World Entertainment Corp. | | | 9,000 | | | | 41,670 | |

Tuesday Morning Corp.*, 1 | | | 5,300 | | | | 80,931 | |

| Unifi, Inc.* | | | 3,600 | | | | 84,096 | |

| UniFirst Corp. | | | 2,300 | | | | 240,166 | |

| United Stationers, Inc. | | | 3,700 | | | | 160,950 | |

| Universal Electronics, Inc.* | | | 3,087 | | | | 111,225 | |

| VOXX International Corp.* | | | 4,500 | | | | 61,650 | |

Wendy's Co.1 | | | 37,900 | | | | 321,392 | |

| Wesco Aircraft Holdings, Inc.* | | | 11,800 | | | | 246,974 | |

| West Marine, Inc.* | | | 7,200 | | | | 87,840 | |

| Weyco Group, Inc. | | | 1,600 | | | | 45,312 | |

Zale Corp.*, 1 | | | 5,200 | | | | 79,040 | |

| | | | | | | | 14,479,581 | |

| CONSUMER, NON-CYCLICAL – 14.7% | | | | | | | | |

| Aaron's, Inc. | | | 13,260 | | | | 367,302 | |

| ABM Industries, Inc. | | | 9,600 | | | | 255,552 | |

| ACCO Brands Corp.* | | | 24,500 | | | | 162,680 | |

| Addus HomeCare Corp.* | | | 1,500 | | | | 43,455 | |

Affymetrix, Inc.*, 1 | | | 17,000 | | | | 105,400 | |

| Albany Molecular Research, Inc.* | | | 5,800 | | | | 74,762 | |

| Alere, Inc.* | | | 10,000 | | | | 305,700 | |

Alliance One International, Inc.*, 1 | | | 26,000 | | | | 75,660 | |

| Almost Family, Inc. | | | 3,200 | | | | 62,176 | |

| Alphatec Holdings, Inc.* | | | 22,900 | | | | 45,113 | |

Amedisys, Inc.*, 1 | | | 6,900 | | | | 118,818 | |

Amsurg Corp.*, 1 | | | 6,100 | | | | 242,170 | |

Andersons, Inc.1 | | | 3,200 | | | | 223,680 | |

See accompanying Notes to Financial Statements.

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2013

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| CONSUMER, NON-CYCLICAL (Continued) | | | | |

| AngioDynamics, Inc.* | | | 7,900 | | | $ | 104,280 | |

| Anika Therapeutics, Inc.* | | | 2,500 | | | | 59,900 | |

Apollo Group, Inc. - Class A*, 1 | | | 20,300 | | | | 422,443 | |

| ARC Document Solutions, Inc.* | | | 9,600 | | | | 44,064 | |

BioTelemetry, Inc.*, 1 | | | 6,700 | | | | 66,397 | |

Boulder Brands, Inc.*, 1 | | | 10,500 | | | | 168,420 | |

Bridgepoint Education, Inc.*, 1 | | | 12,800 | | | | 230,912 | |

| Career Education Corp.* | | | 17,000 | | | | 46,920 | |

CBIZ, Inc.*, 1 | | | 12,200 | | | | 90,768 | |

| CDI Corp. | | | 3,757 | | | | 57,520 | |

Central Garden and Pet Co.*, 1 | | | 6,162 | | | | 43,381 | |

| Central Garden and Pet Co. - Class A* | | | 11,800 | | | | 80,830 | |

| Chindex International, Inc.* | | | 1,280 | | | | 21,824 | |

| Chiquita Brands International, Inc.* | | | 11,200 | | | | 141,792 | |

| CONMED Corp. | | | 6,700 | | | | 227,733 | |

| Consolidated Graphics, Inc.* | | | 1,700 | | | | 95,302 | |

Convergys Corp.1 | | | 19,100 | | | | 358,125 | |

Corinthian Colleges, Inc.*, 1 | | | 18,900 | | | | 41,391 | |

| Costa, Inc.* | | | 1,500 | | | | 28,530 | |

| CRA International, Inc.* | | | 2,800 | | | | 52,136 | |

| Craft Brew Alliance, Inc.* | | | 3,400 | | | | 45,696 | |

| Cross Country Healthcare, Inc.* | | | 10,700 | | | | 64,842 | |

| CryoLife, Inc. | | | 8,000 | | | | 56,000 | |

| CSS Industries, Inc. | | | 2,300 | | | | 55,223 | |

| Cumberland Pharmaceuticals, Inc.* | | | 5,000 | | | | 22,650 | |

DeVry, Inc.1 | | | 11,700 | | | | 357,552 | |

Diamond Foods, Inc.*, 1 | | | 4,800 | | | | 113,184 | |

Digirad Corp.*, 1 | | | 10,000 | | | | 25,200 | |

Dole Food Co., Inc.*, 1 | | | 12,200 | | | | 166,164 | |

| Edgewater Technology, Inc.* | | | 5,000 | | | | 26,350 | |

| Electro Rent Corp. | | | 2,500 | | | | 45,350 | |

| Ennis, Inc. | | | 5,200 | | | | 93,808 | |

| Essex Rental Corp.* | | | 5,200 | | | | 17,888 | |

| Exactech, Inc.* | | | 3,100 | | | | 62,465 | |

| Five Star Quality Care, Inc.* | | | 15,200 | | | | 78,584 | |

| Fresh Del Monte Produce, Inc. | | | 12,000 | | | | 356,160 | |

FTI Consulting, Inc.*, 1 | | | 8,900 | | | | 336,420 | |

| Great Lakes Dredge & Dock Corp. | | | 11,400 | | | | 84,588 | |

| Greatbatch, Inc.* | | | 5,600 | | | | 190,568 | |

| Green Dot Corp. - Class A* | | | 5,400 | | | | 142,182 | |

| Hackett Group, Inc. | | | 5,000 | | | | 35,650 | |

| Harvard Bioscience, Inc.* | | | 5,400 | | | | 28,404 | |

| Health Net, Inc.* | | | 1,500 | | | | 47,550 | |

Healthways, Inc.*, 1 | | | 4,400 | | | | 81,444 | |

| Heidrick & Struggles International, Inc. | | | 4,000 | | | | 76,240 | |

| Helen of Troy Ltd.* | | | 6,400 | | | | 282,880 | |

| Heska Corp. | | | 600 | | | | 3,594 | |

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| CONSUMER, NON-CYCLICAL (Continued) | | | | |

| Hill International, Inc.* | | | 10,100 | | | $ | 33,330 | |

| Hudson Global, Inc.* | | | 10,964 | | | | 35,523 | |

| ICF International, Inc.* | | | 4,898 | | | | 173,438 | |

| Impax Laboratories, Inc.* | | | 13,800 | | | | 283,038 | |

| Information Services Group, Inc.* | | | 14,500 | | | | 60,030 | |

| Ingles Markets, Inc. - Class A | | | 4,000 | | | | 114,920 | |

| Intersections, Inc. | | | 5,490 | | | | 48,147 | |

| Invacare Corp. | | | 7,400 | | | | 127,798 | |

| John B Sanfilippo & Son, Inc. | | | 3,168 | | | | 73,466 | |

| Kelly Services, Inc. - Class A | | | 6,787 | | | | 132,143 | |

| Kindred Healthcare, Inc. | | | 11,800 | | | | 158,474 | |

| Korn/Ferry International* | | | 9,500 | | | | 203,300 | |

| LHC Group, Inc.* | | | 5,100 | | | | 119,646 | |

| LifePoint Hospitals, Inc.* | | | 8,700 | | | | 405,681 | |

| Lincoln Educational Services Corp. | | | 4,400 | | | | 20,284 | |

| Mac-Gray Corp. | | | 2,890 | | | | 42,078 | |

| Magellan Health Services, Inc.* | | | 5,893 | | | | 353,344 | |

Matthews International Corp. - Class A1 | | | 2,600 | | | | 99,008 | |

| Medical Action Industries, Inc.* | | | 8,900 | | | | 59,096 | |

| Merit Medical Systems, Inc.* | | | 11,500 | | | | 139,495 | |

| MGP Ingredients, Inc. | | | 5,046 | | | | 26,441 | |

| Molina Healthcare, Inc.* | | | 8,500 | | | | 302,600 | |

| Monster Worldwide, Inc.* | | | 24,900 | | | | 110,058 | |

Multi-Color Corp.1 | | | 2,000 | | | | 67,860 | |

| Nash Finch Co. | | | 1,900 | | | | 50,179 | |

| National American University Holdings, Inc. | | | 10,000 | | | | 34,300 | |

| National Healthcare Corp. | | | 2,806 | | | | 132,640 | |

| Natural Alternatives International, Inc.* | | | 389 | | | | 2,237 | |

| Natus Medical, Inc.* | | | 7,900 | | | | 112,022 | |

| Navigant Consulting, Inc.* | | | 12,700 | | | | 196,342 | |

| Newtek Business Services, Inc.* | | | 13,713 | | | | 40,591 | |

| Nutraceutical International Corp. | | | 2,410 | | | | 57,213 | |

| NuVasive, Inc.* | | | 5,500 | | | | 134,695 | |

| Omega Protein Corp.* | | | 5,500 | | | | 55,935 | |

| PDI, Inc.* | | | 1,264 | | | | 6,092 | |

Pendrell Corp.*, 1 | | | 28,700 | | | | 55,678 | |

| Perceptron, Inc. | | | 2,700 | | | | 28,836 | |

Pernix Therapeutics Holdings*, 1 | | | 7,617 | | | | 20,794 | |

| PharMerica Corp.* | | | 7,300 | | | | 96,871 | |

PHH Corp.*, 1 | | | 11,400 | | | | 270,636 | |

| PhotoMedex, Inc.* | | | 2,700 | | | | 42,930 | |

| Post Holdings, Inc.* | | | 7,200 | | | | 290,664 | |

Primo Water Corp.*, 1 | | | 5,421 | | | | 12,902 | |

QC Holdings, Inc.1 | | | 3,900 | | | | 9,204 | |

Quad/Graphics, Inc.1 | | | 4,900 | | | | 148,764 | |

| RCM Technologies, Inc. | | | 4,100 | | | | 24,723 | |

Rent-A-Center, Inc.1 | | | 10,700 | | | | 407,670 | |

See accompanying Notes to Financial Statements.

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2013

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| CONSUMER, NON-CYCLICAL (Continued) | | | | |

| Resources Connection, Inc. | | | 7,900 | | | $ | 107,203 | |

| RPX Corp.* | | | 6,000 | | | | 105,180 | |

| RTI Surgical, Inc.* | | | 13,300 | | | | 49,742 | |

| Select Medical Holdings Corp. | | | 31,749 | | | | 256,214 | |

Seneca Foods Corp. - Class A*, 1 | | | 3,400 | | | | 102,306 | |

Skilled Healthcare Group, Inc. - Class A*, 1 | | | 4,400 | | | | 19,184 | |

| Solta Medical, Inc.* | | | 22,700 | | | | 47,216 | |

| Spartan Stores, Inc. | | | 6,300 | | | | 138,978 | |

Spectrum Pharmaceuticals, Inc.1 | | | 8,000 | | | | 67,120 | |

StarTek, Inc.*, 1 | | | 5,710 | | | | 36,772 | |

| Stewart Enterprises, Inc. - Class A | | | 9,500 | | | | 124,830 | |

| Summer Infant, Inc.* | | | 8,726 | | | | 24,171 | |

Swisher Hygiene, Inc.*, 1 | | | 35,000 | | | | 21,228 | |

| Symmetry Medical, Inc.* | | | 8,800 | | | | 71,808 | |

| Synergetics USA, Inc.* | | | 6,691 | | | | 30,444 | |

| Theragenics Corp.* | | | 7,200 | | | | 15,696 | |

| TMS International Corp. - Class A | | | 2,800 | | | | 48,832 | |

| Triple-S Management Corp. - Class B* | | | 5,927 | | | | 108,998 | |

Universal American Corp.1 | | | 18,900 | | | | 144,018 | |

Universal Corp.1 | | | 4,400 | | | | 224,092 | |

| Universal Technical Institute, Inc. | | | 1,650 | | | | 20,015 | |

| VCA Antech, Inc.* | | | 8,556 | | | | 234,948 | |

| Viad Corp. | | | 3,500 | | | | 87,325 | |

| Village Super Market, Inc. - Class A | | | 1,800 | | | | 68,436 | |

| Weis Markets, Inc. | | | 5,993 | | | | 293,297 | |

| | | | | | | | 15,230,941 | |

| DIVERSIFIED – 0.4% | | | | | | | | |

| Harbinger Group, Inc.* | | | 32,600 | | | | 338,062 | |

| Resource America, Inc. - Class A | | | 3,400 | | | | 27,302 | |

| | | | | | | | 365,364 | |

| ENERGY – 6.8% | | | | | | | | |

| Adams Resources & Energy, Inc. | | | 1,000 | | | | 55,510 | |

Alon USA Energy, Inc.1 | | | 16,400 | | | | 167,444 | |

Alpha Natural Resources, Inc.*, 1 | | | 20,500 | | | | 122,180 | |

| Apco Oil and Gas International, Inc.* | | | 1,700 | | | | 24,242 | |

Arch Coal, Inc.1 | | | 24,600 | | | | 101,106 | |

| Basic Energy Services, Inc.* | | | 10,766 | | | | 136,082 | |

Bill Barrett Corp.*, 1 | | | 11,100 | | | | 278,721 | |

BioFuel Energy Corp.*, 1 | | | 1,000 | | | | 3,650 | |

C&J Energy Services, Inc.*, 1 | | | 12,600 | | | | 253,008 | |

Cal Dive International, Inc.*, 1 | | | 26,000 | | | | 53,300 | |

| Callon Petroleum Co.* | | | 13,500 | | | | 73,845 | |

Carrizo Oil & Gas, Inc.*, 1 | | | 6,000 | | | | 223,860 | |

Clayton Williams Energy, Inc.*, 1 | | | 2,700 | | | | 141,669 | |

| Cloud Peak Energy, Inc.* | | | 5,900 | | | | 86,553 | |

Comstock Resources, Inc.1 | | | 11,900 | | | | 189,329 | |

| Crimson Exploration, Inc.* | | | 7,400 | | | | 22,274 | |

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| ENERGY (Continued) | | | | | | |

| Dawson Geophysical Co.* | | | 1,800 | | | $ | 58,446 | |

| Delek U.S. Holdings, Inc. | | | 12,700 | | | | 267,843 | |

| Double Eagle Petroleum Co.* | | | 990 | | | | 2,970 | |

Endeavour International Corp.*, 1 | | | 15,000 | | | | 80,250 | |

| EPL Oil & Gas, Inc.* | | | 3,000 | | | | 111,330 | |

| Exterran Holdings, Inc.* | | | 13,400 | | | | 369,438 | |

| Forbes Energy Services Ltd.* | | | 6,808 | | | | 31,725 | |

| FutureFuel Corp. | | | 6,600 | | | | 118,536 | |

| Global Geophysical Services, Inc.* | | | 15,000 | | | | 40,650 | |

| Green Plains Renewable Energy, Inc. | | | 6,400 | | | | 102,720 | |

| Gulf Island Fabrication, Inc. | | | 3,600 | | | | 88,236 | |

| Hallador Energy Co. | | | 8,656 | | | | 63,189 | |

Harvest Natural Resources, Inc.*, 1 | | | 6,700 | | | | 35,845 | |

Hercules Offshore, Inc.*, 1 | | | 38,200 | | | | 281,534 | |

| ION Geophysical Corp.* | | | 38,000 | | | | 197,600 | |

James River Coal Co.*, 1 | | | 6,000 | | | | 11,880 | |

| Key Energy Services, Inc.* | | | 36,500 | | | | 266,085 | |

| Magellan Petroleum Corp.* | | | 15,000 | | | | 15,450 | |

| Matrix Service Co.* | | | 7,800 | | | | 153,036 | |

Midstates Petroleum Co., Inc.*, 1 | | | 17,300 | | | | 88,749 | |

| Mitcham Industries, Inc.* | | | 3,100 | | | | 47,399 | |

| Natural Gas Services Group, Inc.* | | | 3,441 | | | | 92,288 | |

Newpark Resources, Inc.*, 1 | | | 20,100 | | | | 254,466 | |

Northern Oil and Gas, Inc.*, 1 | | | 14,600 | | | | 210,678 | |

| Parker Drilling Co.* | | | 30,000 | | | | 171,000 | |

Penn Virginia Corp.*, 1 | | | 19,600 | | | | 130,340 | |

| Pioneer Energy Services Corp.* | | | 13,400 | | | | 100,634 | |

| Renewable Energy Group, Inc.* | | | 7,000 | | | | 106,050 | |

Resolute Energy Corp.*, 1 | | | 5,300 | | | | 44,308 | |

| REX American Resources Corp.* | | | 2,818 | | | | 86,625 | |

| Rex Energy Corp.* | | | 4,800 | | | | 107,040 | |

Saratoga Resources, Inc.*, 1 | | | 13,725 | | | | 32,666 | |

SEACOR Holdings, Inc.1 | | | 2,300 | | | | 208,012 | |

Stone Energy Corp.*, 1 | | | 11,600 | | | | 376,188 | |

Swift Energy Co.*, 1 | | | 10,400 | | | | 118,768 | |

| TETRA Technologies, Inc.* | | | 17,900 | | | | 224,287 | |

U.S. Energy Corp. Wyoming*, 1 | | | 7,000 | | | | 14,770 | |

Vantage Drilling Co.*, 1 | | | 60,760 | | | | 105,115 | |

W&T Offshore, Inc.1 | | | 3,300 | | | | 58,476 | |

Walter Energy, Inc.1 | | | 12,300 | | | | 172,569 | |

Warren Resources, Inc.*, 1 | | | 13,400 | | | | 39,262 | |

| Willbros Group, Inc.* | | | 8,500 | | | | 78,030 | |

| | | | | | | | 7,097,256 | |

| FINANCIAL – 28.2% | | | | | | | | |

1st Century Bancshares, Inc.*, 1 | | | 1,200 | | | | 9,252 | |

| 1st Constitution Bancorp* | | | 100 | | | | 1,049 | |

| 1st Source Corp. | | | 5,200 | | | | 139,984 | |

See accompanying Notes to Financial Statements.

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2013

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| FINANCIAL (Continued) | | | | | | |

| Access National Corp. | | | 771 | | | $ | 10,994 | |

ACNB Corp.1 | | | 1,200 | | | | 20,352 | |

American Equity Investment Life Holding Co.1 | | | 13,100 | | | | 277,982 | |

| American Independence Corp.* | | | 676 | | | | 6,726 | |

| American National Bankshares, Inc. | | | 980 | | | | 22,736 | |

| American National Insurance Co. | | | 3,100 | | | | 303,924 | |

| American Realty Investors, Inc.* | | | 5,028 | | | | 23,028 | |

| American River Bankshares* | | | 1,300 | | | | 11,245 | |

| Ameris Bancorp* | | | 2,000 | | | | 36,760 | |

| AMERISAFE, Inc. | | | 3,688 | | | | 130,961 | |

| AmeriServ Financial, Inc. | | | 6,200 | | | | 19,530 | |

Ames National Corp.1 | | | 500 | | | | 11,385 | |

Amtrust Financial Services, Inc.1 | | | 2,176 | | | | 84,995 | |

| Argo Group International Holdings Ltd. | | | 5,200 | | | | 222,976 | |

Arrow Financial Corp.1 | | | 1,428 | | | | 36,428 | |

| Asta Funding, Inc. | | | 5,000 | | | | 44,450 | |

Astoria Financial Corp.1 | | | 14,800 | | | | 184,112 | |

Atlantic American Corp.1 | | | 3,400 | | | | 13,702 | |

| AV Homes, Inc.* | | | 600 | | | | 10,476 | |

| Baldwin & Lyons, Inc. - Class B | | | 3,500 | | | | 85,330 | |

| Banc of California, Inc. | | | 2,602 | | | | 35,986 | |

| Bancfirst Corp. | | | 1,192 | | | | 64,451 | |

| Bancorp of New Jersey, Inc. | | | 1,100 | | | | 15,675 | |

| Bancorp, Inc.* | | | 6,500 | | | | 115,180 | |

| BancorpSouth, Inc. | | | 17,600 | | | | 350,944 | |

Bank of Commerce Holdings1 | | | 4,000 | | | | 22,960 | |

| Bank of Kentucky Financial Corp. | | | 380 | | | | 10,378 | |

| Bank of Marin Bancorp | | | 250 | | | | 10,388 | |

| Banner Corp. | | | 4,164 | | | | 158,898 | |

Bar Harbor Bankshares1 | | | 200 | | | | 7,358 | |

| BBCN Bancorp, Inc. | | | 16,900 | | | | 232,544 | |

| BCB Bancorp, Inc. | | | 1,100 | | | | 11,792 | |

| Berkshire Bancorp, Inc. | | | 1,100 | | | | 8,822 | |

Berkshire Hills Bancorp, Inc.1 | | | 5,216 | | | | 130,974 | |

| BGC Partners, Inc. - Class A | | | 15,400 | | | | 87,010 | |

BNC Bancorp1 | | | 2,700 | | | | 36,018 | |

Boston Private Financial Holdings, Inc.1 | | | 17,300 | | | | 192,030 | |

| Bridge Bancorp, Inc. | | | 1,000 | | | | 21,500 | |

| Bridge Capital Holdings* | | | 1,535 | | | | 26,064 | |

Brookline Bancorp, Inc.1 | | | 14,400 | | | | 135,504 | |

| Bryn Mawr Bank Corp. | | | 1,077 | | | | 29,047 | |

C&F Financial Corp.1 | | | 500 | | | | 24,200 | |

Calamos Asset Management, Inc. - Class A1 | | | 6,000 | | | | 59,940 | |

| California First National Bancorp | | | 1,600 | | | | 27,312 | |

| Camco Financial Corp.* | | | 2,900 | | | | 11,687 | |

| Camden National Corp. | | | 681 | | | | 27,853 | |

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| FINANCIAL (Continued) | | | | | | |

Cape Bancorp, Inc.1 | | | 2,500 | | | $ | 22,900 | |

| Capital Bank Financial Corp. - Class A* | | | 6,722 | | | | 147,548 | |

Capital City Bank Group, Inc.*, 1 | | | 2,900 | | | | 34,162 | |

| Cardinal Financial Corp. | | | 8,000 | | | | 132,240 | |

| Cascade Bancorp* | | | 100 | | | | 583 | |

Cathay General Bancorp1 | | | 14,300 | | | | 334,191 | |

| Center Bancorp, Inc. | | | 3,000 | | | | 42,720 | |

| Centerstate Banks, Inc. | | | 3,800 | | | | 36,784 | |

Central Pacific Financial Corp.1 | | | 10,400 | | | | 184,080 | |

| Central Valley Community Bancorp | | | 1,060 | | | | 10,759 | |

| Century Bancorp, Inc. - Class A | | | 415 | | | | 13,832 | |

CFS Bancorp, Inc.1 | | | 1,000 | | | | 11,080 | |

| Chemical Financial Corp. | | | 5,800 | | | | 161,936 | |

| Chemung Financial Corp. | | | 134 | | | | 4,640 | |

Cheviot Financial Corp.1 | | | 3,900 | | | | 42,393 | |

| Citizens & Northern Corp. | | | 1,200 | | | | 23,928 | |

Citizens, Inc.*, 1 | | | 11,870 | | | | 102,557 | |

| City Holding Co. | | | 1,300 | | | | 56,212 | |

| CNB Financial Corp. | | | 930 | | | | 15,856 | |

CoBiz Financial, Inc.1 | | | 12,000 | | | | 115,920 | |

| Codorus Valley Bancorp, Inc. | | | 510 | | | | 9,328 | |

| Colony Bankcorp, Inc.* | | | 1,500 | | | | 8,775 | |

| Columbia Banking System, Inc. | | | 6,569 | | | | 162,254 | |

| Commercial National Financial Corp. | | | 190 | | | | 4,009 | |

| Community Bank Shares of Indiana, Inc. | | | 571 | | | | 10,455 | |

Community Bank System, Inc.1 | | | 4,700 | | | | 160,364 | |

Community Bankers Trust Corp.*, 1 | | | 2,100 | | | | 7,728 | |

Community Trust Bancorp, Inc.1 | | | 1,800 | | | | 73,062 | |

Consumer Portfolio Services, Inc.*, 1 | | | 3,600 | | | | 21,348 | |

| Cowen Group, Inc. - Class A* | | | 33,000 | | | | 113,850 | |

Crawford & Co. - Class A1 | | | 2,800 | | | | 20,552 | |

Customers Bancorp, Inc.*, 1 | | | 4,400 | | | | 70,840 | |

| CVB Financial Corp. | | | 12,600 | | | | 170,352 | |

DFC Global Corp.*, 1 | | | 5,000 | | | | 54,950 | |

| Dime Community Bancshares, Inc. | | | 9,500 | | | | 158,175 | |

| Donegal Group, Inc. - Class A | | | 5,331 | | | | 74,581 | |

| Doral Financial Corp.* | | | 2,300 | | | | 43,884 | |

| Eagle Bancorp, Inc.* | | | 2,337 | | | | 66,114 | |

| Eastern Insurance Holdings, Inc. | | | 1,500 | | | | 36,615 | |

| Eastern Virginia Bankshares, Inc.* | | | 6,900 | | | | 42,090 | |

| EMC Insurance Group, Inc. | | | 2,716 | | | | 81,969 | |

| Employers Holdings, Inc. | | | 7,400 | | | | 220,076 | |

Encore Capital Group, Inc.*, 1 | | | 3,900 | | | | 178,854 | |

| Endurance Specialty Holdings Ltd. | | | 8,100 | | | | 435,132 | |

| Enstar Group Ltd.* | | | 1,600 | | | | 218,560 | |

| Enterprise Bancorp, Inc. | | | 1,000 | | | | 18,910 | |

| Enterprise Financial Services Corp. | | | 1,400 | | | | 23,492 | |

See accompanying Notes to Financial Statements.

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2013

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| FINANCIAL (Continued) | | | | | | |

| ESB Financial Corp. | | | 1,308 | | | $ | 16,677 | |

Evans Bancorp, Inc.1 | | | 200 | | | | 3,925 | |

| EverBank Financial Corp. | | | 21,480 | | | | 321,770 | |

| Farmers Capital Bank Corp.* | | | 1,800 | | | | 39,348 | |

Farmers National Banc Corp.1 | | | 3,500 | | | | 22,085 | |

| FBL Financial Group, Inc. - Class A | | | 4,534 | | | | 203,577 | |

| FBR & Co.* | | | 3,200 | | | | 85,792 | |

| Federal Agricultural Mortgage Corp. - Class C | | | 2,648 | | | | 88,390 | |

| Federated National Holding Co. | | | 2,050 | | | | 19,516 | |

Fidelity Southern Corp.1 | | | 1,811 | | | | 27,781 | |

| Financial Institutions, Inc. | | | 2,430 | | | | 49,718 | |

| First Acceptance Corp.* | | | 6,879 | | | | 12,038 | |

| First Bancorp, Inc. | | | 870 | | | | 14,599 | |

| First BanCorp/Puerto Rico* | | | 22,200 | | | | 126,096 | |

| First Bancorp/Troy NC | | | 2,400 | | | | 34,680 | |

| First Bancshares, Inc. | | | 236 | | | | 3,304 | |

| First Busey Corp. | | | 20,896 | | | | 108,868 | |

| First Business Financial Services, Inc. | | | 606 | | | | 19,780 | |

| First Citizens Banc Corp. | | | 2,340 | | | | 15,912 | |

| First Citizens BancShares, Inc. - Class A | | | 1,300 | | | | 267,280 | |

| First Clover Leaf Financial Corp. | | | 2,500 | | | | 21,575 | |

| First Commonwealth Financial Corp. | | | 18,320 | | | | 139,049 | |

| First Community Bancshares, Inc. | | | 5,202 | | | | 85,053 | |

| First Community Corp. | | | 400 | | | | 4,172 | |

| First Defiance Financial Corp. | | | 1,700 | | | | 39,763 | |

| First Financial Bancorp | | | 14,000 | | | | 212,380 | |

| First Financial Corp. | | | 1,100 | | | | 34,727 | |

First Financial Holdings, Inc.1 | | | 3,755 | | | | 207,126 | |

| First Financial Northwest, Inc. | | | 5,000 | | | | 52,150 | |

First Internet Bancorp1 | | | 1,478 | | | | 39,536 | |

| First Interstate Bancsystem, Inc. | | | 1,500 | | | | 36,225 | |

First Merchants Corp.1 | | | 3,699 | | | | 64,104 | |

First of Long Island Corp.1 | | | 900 | | | | 34,965 | |

First South Bancorp, Inc./Washington NC*, 1 | | | 500 | | | | 3,140 | |

| First United Corp.* | | | 2,495 | | | | 20,484 | |

| Firstbank Corp./Alma MI | | | 730 | | | | 14,213 | |

| Flagstar Bancorp, Inc.* | | | 11,700 | | | | 172,692 | |

Flushing Financial Corp.1 | | | 7,100 | | | | 130,995 | |

FNB Corp.1 | | | 26,800 | | | | 325,084 | |

| Fortegra Financial Corp.* | | | 1,969 | | | | 16,756 | |

| Franklin Financial Corp. | | | 600 | | | | 11,376 | |

| FS Bancorp, Inc. | | | 100 | | | | 1,700 | |

Gain Capital Holdings, Inc.1 | | | 10,000 | | | | 125,900 | |

| German American Bancorp, Inc. | | | 710 | | | | 17,906 | |

| GFI Group, Inc. | | | 21,100 | | | | 83,345 | |

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| FINANCIAL (Continued) | | | | | | |

| Gleacher & Co., Inc.* | | | 2,352 | | | $ | 32,340 | |

| Great Southern Bancorp, Inc. | | | 1,300 | | | | 36,699 | |

| Greenlight Capital Re Ltd. - Class A* | | | 6,700 | | | | 190,548 | |

Guaranty Bancorp1 | | | 3,000 | | | | 41,070 | |

| Hallmark Financial Services, Inc.* | | | 4,500 | | | | 39,915 | |

| Hanmi Financial Corp. | | | 7,400 | | | | 122,618 | |

| Hanover Insurance Group, Inc. | | | 7,000 | | | | 387,240 | |

Heartland Financial USA, Inc.1 | | | 1,700 | | | | 47,362 | |

| Heritage Commerce Corp. | | | 2,639 | | | | 20,188 | |

| Heritage Financial Corp. | | | 4,700 | | | | 72,944 | |

| Heritage Financial Group, Inc. | | | 1,700 | | | | 29,614 | |

| Heritage Oaks Bancorp* | | | 2,870 | | | | 18,368 | |

HF Financial Corp.1 | | | 650 | | | | 8,346 | |

| Hilltop Holdings, Inc.* | | | 14,600 | | | | 270,100 | |

Hingham Institution for Savings1 | | | 371 | | | | 25,937 | |

Home Bancorp, Inc.*, 1 | | | 1,220 | | | | 22,033 | |

| HomeStreet, Inc. | | | 4,300 | | | | 82,990 | |

| HopFed Bancorp, Inc. | | | 2,574 | | | | 28,803 | |

| Horace Mann Educators Corp. | | | 6,900 | | | | 195,822 | |

| Horizon Bancorp | | | 1,500 | | | | 35,025 | |

| Hudson Valley Holding Corp. | | | 1,288 | | | | 24,189 | |

| Iberiabank Corp. | | | 2,900 | | | | 150,423 | |

IF Bancorp, Inc.1 | | | 200 | | | | 3,220 | |

| Imperial Holdings, Inc.* | | | 1,322 | | | | 8,368 | |

Independence Holding Co.1 | | | 4,150 | | | | 59,262 | |

| Independent Bank Corp.* | | | 4,389 | | | | 43,890 | |

Independent Bank Corp./Rockland MA1 | | | 2,700 | | | | 96,390 | |

| Infinity Property & Casualty Corp. | | | 2,800 | | | | 180,880 | |

| Interactive Brokers Group, Inc. - Class A | | | 10,000 | | | | 187,700 | |

| International Bancshares Corp. | | | 13,500 | | | | 292,005 | |

Intervest Bancshares Corp.*, 1 | | | 7,000 | | | | 55,510 | |

| INTL. FCStone, Inc.* | | | 2,395 | | | | 48,978 | |

| Investment Technology Group, Inc.* | | | 5,057 | | | | 79,496 | |

Investors Bancorp, Inc.1 | | | 7,000 | | | | 153,160 | |

| Investors Title Co. | | | 200 | | | | 15,020 | |

Janus Capital Group, Inc.1 | | | 42,800 | | | | 364,228 | |

| JMP Group, Inc. | | | 2,700 | | | | 16,713 | |

| Kansas City Life Insurance Co. | | | 2,530 | | | | 111,877 | |

| Kemper Corp. | | | 10,300 | | | | 346,080 | |

Lakeland Bancorp, Inc.1 | | | 9,100 | | | | 102,375 | |

| Lakeland Financial Corp. | | | 1,400 | | | | 45,710 | |

| Laporte Bancorp, Inc. | | | 815 | | | | 8,525 | |

LCNB Corp.1 | | | 800 | | | | 15,672 | |

| LNB Bancorp, Inc. | | | 1,600 | | | | 14,960 | |

Macatawa Bank Corp.*, 1 | | | 4,200 | | | | 22,596 | |

| Maiden Holdings Ltd. | | | 12,300 | | | | 145,263 | |

| MainSource Financial Group, Inc. | | | 2,250 | | | | 34,177 | |

See accompanying Notes to Financial Statements.

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2013

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| FINANCIAL (Continued) | | | | | | |

| Manning & Napier, Inc. | | | 3,800 | | | $ | 63,384 | |

| Marlin Business Services Corp. | | | 3,500 | | | | 87,360 | |

| MB Financial, Inc. | | | 11,000 | | | | 310,640 | |

| MBIA, Inc.* | | | 30,400 | | | | 310,992 | |

| MBT Financial Corp.* | | | 7,000 | | | | 26,810 | |

Meadowbrook Insurance Group, Inc.1 | | | 15,300 | | | | 99,450 | |

Mercantile Bank Corp.1 | | | 900 | | | | 19,602 | |

| Merchants Bancshares, Inc. | | | 310 | | | | 8,975 | |

| Meta Financial Group, Inc. | | | 1,600 | | | | 60,800 | |

| Metro Bancorp, Inc.* | | | 1,460 | | | | 30,675 | |

| MetroCorp Bancshares, Inc. | | | 3,305 | | | | 45,477 | |

MGIC Investment Corp.*, 1 | | | 33,400 | | | | 243,152 | |

| MicroFinancial, Inc. | | | 2,411 | | | | 18,999 | |

| Middleburg Financial Corp. | | | 1,700 | | | | 32,776 | |

| MidSouth Bancorp, Inc. | | | 406 | | | | 6,293 | |

| MidWestOne Financial Group, Inc. | | | 1,000 | | | | 25,710 | |

Monarch Financial Holdings, Inc.1 | | | 1,800 | | | | 21,150 | |

Montpelier Re Holdings Ltd.1 | | | 9,409 | | | | 245,104 | |

| MutualFirst Financial, Inc. | | | 820 | | | | 12,579 | |

NASB Financial, Inc.*, 1 | | | 520 | | | | 14,264 | |

| National Bankshares, Inc. | | | 800 | | | | 28,712 | |

| National Interstate Corp. | | | 3,033 | | | | 84,348 | |

National Penn Bancshares, Inc.1 | | | 17,150 | | | | 172,357 | |

| National Western Life Insurance Co. - Class A | | | 500 | | | | 100,885 | |

| Naugatuck Valley Financial Corp. | | | 300 | | | | 2,259 | |

| Navigators Group, Inc.* | | | 3,000 | | | | 173,310 | |

| NBT Bancorp, Inc. | | | 10,600 | | | | 243,588 | |

| Nelnet, Inc. - Class A | | | 7,100 | | | | 272,995 | |

| New Hampshire Thrift Bancshares, Inc. | | | 1,286 | | | | 17,400 | |

| NewBridge Bancorp* | | | 2,100 | | | | 15,309 | |

| North Valley Bancorp* | | | 1,300 | | | | 24,570 | |

| Northeast Bancorp | | | 594 | | | | 5,993 | |

| Northrim BanCorp, Inc. | | | 800 | | | | 19,280 | |

| Northwest Bancshares, Inc. | | | 22,100 | | | | 292,162 | |

| Norwood Financial Corp. | | | 66 | | | | 1,914 | |

| Oak Valley Bancorp* | | | 400 | | | | 3,192 | |

Ocean Shore Holding Co.1 | | | 310 | | | | 4,538 | |

| OceanFirst Financial Corp. | | | 2,400 | | | | 40,584 | |

Old Line Bancshares, Inc.1 | | | 1,300 | | | | 17,316 | |

Old National Bancorp1 | | | 19,800 | | | | 281,160 | |

| Old Point Financial Corp. | | | 861 | | | | 11,107 | |

| OneBeacon Insurance Group Ltd. - Class A | | | 6,100 | | | | 90,036 | |

| Oneida Financial Corp. | | | 1,030 | | | | 13,647 | |

| Oppenheimer Holdings, Inc. - Class A | | | 3,623 | | | | 64,381 | |

| Oritani Financial Corp. | | | 4,400 | | | | 72,424 | |

Orrstown Financial Services, Inc.*, 1 | | | 533 | | | | 9,301 | |

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| FINANCIAL (Continued) | | | | | | |

| Pacific Continental Corp. | | | 2,900 | | | $ | 38,019 | |

| Pacific Mercantile Bancorp* | | | 1,800 | | | | 11,178 | |

Pacific Premier Bancorp, Inc.*, 1 | | | 1,930 | | | | 25,939 | |

PacWest Bancorp1 | | | 3,700 | | | | 127,132 | |

| Palmetto Bancshares, Inc.* | | | 400 | | | | 5,216 | |

Park National Corp.1 | | | 1,800 | | | | 142,344 | |

Parke Bancorp, Inc.*, 1 | | | 2,400 | | | | 21,216 | |

| Peapack Gladstone Financial Corp. | | | 540 | | | | 10,017 | |

| Penns Woods Bancorp, Inc. | | | 400 | | | | 19,928 | |

| Peoples Bancorp of North Carolina, Inc. | | | 300 | | | | 3,705 | |

| Peoples Bancorp, Inc. | | | 790 | | | | 16,495 | |

| Phoenix Cos., Inc.* | | | 900 | | | | 34,803 | |

| PICO Holdings, Inc.* | | | 4,000 | | | | 86,640 | |

| Pinnacle Financial Partners, Inc.* | | | 3,900 | | | | 116,259 | |

Piper Jaffray Cos.*, 1 | | | 3,800 | | | | 130,302 | |

| Platinum Underwriters Holdings Ltd. | | | 5,400 | | | | 322,542 | |

| Preferred Bank/Los Angeles CA* | | | 1,500 | | | | 26,685 | |

| Premier Financial Bancorp, Inc. | | | 2,300 | | | | 26,772 | |

| Primerica, Inc. | | | 10,200 | | | | 411,468 | |

| PrivateBancorp, Inc. | | | 15,547 | | | | 332,706 | |

Provident Financial Holdings, Inc.1 | | | 3,200 | | | | 53,152 | |

| Provident Financial Services, Inc. | | | 12,000 | | | | 194,520 | |

Provident New York Bancorp1 | | | 5,300 | | | | 57,717 | |

| Pulaski Financial Corp. | | | 1,490 | | | | 15,362 | |

PVF Capital Corp.*, 1 | | | 3,100 | | | | 12,772 | |

| QCR Holdings, Inc. | | | 500 | | | | 7,945 | |

Radian Group, Inc.1 | | | 6,000 | | | | 83,580 | |

| Regional Management Corp.* | | | 407 | | | | 12,943 | |

| Renasant Corp. | | | 4,299 | | | | 116,804 | |

| Republic Bancorp, Inc. - Class A | | | 2,400 | | | | 66,120 | |

Republic First Bancorp, Inc.*, 1 | | | 3,400 | | | | 10,846 | |

Riverview Bancorp, Inc.*, 1 | | | 3,648 | | | | 9,594 | |

RLI Corp.1 | | | 2,200 | | | | 192,324 | |

| Rockville Financial, Inc. | | | 5,000 | | | | 65,000 | |

| S&T Bancorp, Inc. | | | 3,800 | | | | 92,036 | |

| Safety Insurance Group, Inc. | | | 2,800 | | | | 148,316 | |

| Sandy Spring Bancorp, Inc. | | | 3,000 | | | | 69,780 | |

Security National Financial Corp. - Class A*, 1 | | | 5,300 | | | | 32,118 | |

| Selective Insurance Group, Inc. | | | 11,100 | | | | 271,950 | |

| Severn Bancorp, Inc.* | | | 4,200 | | | | 21,504 | |

| Shore Bancshares, Inc.* | | | 3,600 | | | | 31,680 | |

| Sierra Bancorp | | | 1,700 | | | | 26,741 | |

| Simmons First National Corp. - Class A | | | 2,002 | | | | 62,242 | |

| Simplicity Bancorp, Inc. | | | 1,400 | | | | 21,770 | |

| Southern First Bancshares, Inc.* | | | 2,000 | | | | 26,760 | |

Southern National Bancorp of Virginia, Inc.1 | | | 1,800 | | | | 17,262 | |

See accompanying Notes to Financial Statements.

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2013

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| FINANCIAL (Continued) | | | | | | |

Southside Bancshares, Inc.1 | | | 1,575 | | | $ | 42,241 | |

| Southwest Bancorp, Inc./Stillwater OK* | | | 5,000 | | | | 74,050 | |

StanCorp Financial Group, Inc.1 | | | 6,000 | | | | 330,120 | |

| State Auto Financial Corp. | | | 4,300 | | | | 90,042 | |

| State Bank Financial Corp. | | | 7,600 | | | | 120,612 | |

| StellarOne Corp. | | | 2,700 | | | | 60,750 | |

Sterling Bancorp1 | | | 2,900 | | | | 39,817 | |

| Sterling Financial Corp. | | | 12,600 | | | | 360,990 | |

| Stewart Information Services Corp. | | | 4,600 | | | | 147,154 | |

Stifel Financial Corp.*, 1 | | | 5,050 | | | | 208,161 | |

| Stratus Properties, Inc.* | | | 3,300 | | | | 43,923 | |

| Suffolk Bancorp* | | | 1,200 | | | | 21,264 | |

| Summit Financial Group, Inc.* | | | 1,501 | | | | 12,984 | |

| SWS Group, Inc.* | | | 9,200 | | | | 51,336 | |

| SY Bancorp, Inc. | | | 1,300 | | | | 36,829 | |

| Symetra Financial Corp. | | | 23,900 | | | | 425,898 | |

| Synovus Financial Corp. | | | 61,800 | | | | 203,940 | |

Taylor Capital Group, Inc.*, 1 | | | 2,400 | | | | 53,160 | |

| TCF Financial Corp. | | | 8,400 | | | | 119,952 | |

| Teche Holding Co. | | | 836 | | | | 38,188 | |

| Territorial Bancorp, Inc. | | | 1,100 | | | | 24,167 | |

| Timberland Bancorp, Inc. | | | 1,378 | | | | 12,402 | |

| Tompkins Financial Corp. | | | 3,029 | | | | 140,000 | |

| Tower Financial Corp. | | | 300 | | | | 6,969 | |

TowneBank/Portsmouth VA1 | | | 3,000 | | | | 43,260 | |

Transcontinental Realty Investors, Inc.*, 1 | | | 1,100 | | | | 9,823 | |

| Trico Bancshares | | | 1,900 | | | | 43,282 | |

TrustCo Bank Corp. NY1 | | | 12,000 | | | | 71,520 | |

Trustmark Corp.1 | | | 12,100 | | | | 309,760 | |

| Two River Bancorp | | | 1,700 | | | | 12,716 | |

Umpqua Holdings Corp.1 | | | 20,800 | | | | 337,376 | |

Union First Market Bankshares Corp.1 | | | 5,900 | | | | 137,883 | |

United Bankshares, Inc.1 | | | 5,000 | | | | 144,900 | |

United Community Banks, Inc.*, 1 | | | 5,600 | | | | 84,000 | |

| United Community Financial Corp.* | | | 5,417 | | | | 21,072 | |

| United Financial Bancorp, Inc. | | | 1,700 | | | | 27,489 | |

| United Fire Group, Inc. | | | 5,800 | | | | 176,726 | |

United Insurance Holdings Corp.1 | | | 4,506 | | | | 39,788 | |

| United Security Bancshares/Fresno CA* | | | 4,309 | | | | 18,183 | |

| United Security Bancshares/ Thomasville AL* | | | 500 | | | | 4,375 | |

| Unity Bancorp, Inc. | | | 650 | | | | 4,849 | |

| Universal Insurance Holdings, Inc. | | | 6,300 | | | | 44,415 | |

| Univest Corp. of Pennsylvania | | | 1,800 | | | | 33,930 | |

Valley National Bancorp1 | | | 36,000 | | | | 358,200 | |

ViewPoint Financial Group, Inc.1 | | | 4,700 | | | | 97,149 | |

| Virginia Commerce Bancorp, Inc.* | | | 2,500 | | | | 38,825 | |

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| FINANCIAL (Continued) | | | | | | |

| Walker & Dunlop, Inc.* | | | 4,900 | | | $ | 77,959 | |

| Walter Investment Management Corp.* | | | 6,800 | | | | 268,872 | |

| Washington Banking Co. | | | 3,000 | | | | 42,180 | |

| Washington Federal, Inc. | | | 12,500 | | | | 258,500 | |

| Washington Trust Bancorp, Inc. | | | 1,600 | | | | 50,288 | |

| WashingtonFirst Bankshare, Inc.* | | | 200 | | | | 2,600 | |

| Waterstone Financial, Inc.* | | | 2,930 | | | | 29,739 | |

| Webster Financial Corp. | | | 9,400 | | | | 239,982 | |

| WesBanco, Inc. | | | 5,900 | | | | 175,407 | |

| West Bancorporation, Inc. | | | 4,020 | | | | 55,476 | |

| Western Alliance Bancorp* | | | 9,000 | | | | 170,370 | |

| Westfield Financial, Inc. | | | 6,000 | | | | 42,360 | |

| Wilshire Bancorp, Inc. | | | 12,200 | | | | 99,796 | |

| Wintrust Financial Corp. | | | 7,500 | | | | 308,025 | |

| WSFS Financial Corp. | | | 800 | | | | 48,200 | |

| Xenith Bankshares, Inc.* | | | 5,700 | | | | 34,599 | |

| Yadkin Financial Corp.* | | | 2,445 | | | | 42,127 | |

| | | | | | | | 29,301,827 | |

| INDUSTRIAL – 17.0% | | | | | | | | |

AAR Corp.1 | | | 7,955 | | | | 217,410 | |

| Advanced Energy Industries, Inc.* | | | 3,600 | | | | 63,072 | |

Aegion Corp.*, 1 | | | 7,853 | | | | 186,352 | |

Air Transport Services Group, Inc.*, 1 | | | 12,200 | | | | 91,378 | |

Alamo Group, Inc.1 | | | 2,800 | | | | 136,948 | |

| Albany International Corp. - Class A | | | 2,500 | | | | 89,675 | |

Allied Motion Technologies, Inc.1 | | | 2,606 | | | | 21,083 | |

AM Castle & Co.*, 1 | | | 7,100 | | | | 114,310 | |

| Ameresco, Inc. - Class A* | | | 6,622 | | | | 66,352 | |

| Ampco-Pittsburgh Corp. | | | 3,700 | | | | 66,304 | |

API Technologies Corp.*, 1 | | | 7,502 | | | | 21,981 | |

Arkansas Best Corp.1 | | | 5,200 | | | | 133,484 | |

| Astec Industries, Inc. | | | 4,100 | | | | 147,436 | |

| Atlas Air Worldwide Holdings, Inc.* | | | 4,700 | | | | 216,717 | |

| AVX Corp. | | | 30,600 | | | | 401,778 | |

| Ballantyne Strong, Inc.* | | | 7,865 | | | | 33,505 | |

Barnes Group, Inc.1 | | | 9,900 | | | | 345,708 | |

| Bel Fuse, Inc. - Class B | | | 2,480 | | | | 43,251 | |

| Benchmark Electronics, Inc.* | | | 11,400 | | | | 260,946 | |

Brady Corp. - Class A1 | | | 8,900 | | | | 271,450 | |

Briggs & Stratton Corp.1 | | | 10,900 | | | | 219,308 | |

Bristow Group, Inc.1 | | | 2,700 | | | | 196,452 | |

| Broadwind Energy, Inc.* | | | 5,701 | | | | 44,639 | |

| CAI International, Inc.* | | | 5,500 | | | | 127,985 | |

| Celadon Group, Inc. | | | 3,900 | | | | 72,813 | |

| Chase Corp. | | | 2,351 | | | | 69,072 | |

| Checkpoint Systems, Inc.* | | | 6,000 | | | | 100,200 | |

| CIRCOR International, Inc. | | | 1,550 | | | | 96,379 | |

See accompanying Notes to Financial Statements.

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2013

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| INDUSTRIAL (Continued) | | | | | | |

| Coherent, Inc. | | | 2,000 | | | $ | 122,900 | |

| Columbus McKinnon Corp.* | | | 5,700 | | | | 136,971 | |

| Comfort Systems USA, Inc. | | | 3,500 | | | | 58,835 | |

| Core Molding Technologies, Inc.* | | | 3,500 | | | | 33,530 | |

| Covenant Transportation Group, Inc. - Class A* | | | 8,442 | | | | 53,522 | |

CPI Aerostructures, Inc.*, 1 | | | 2,200 | | | | 25,498 | |

| CTS Corp. | | | 5,600 | | | | 88,312 | |

Cubic Corp.1 | | | 6,100 | | | | 327,448 | |

| Curtiss-Wright Corp. | | | 8,200 | | | | 385,072 | |

| CyberOptics Corp.* | | | 2,022 | | | | 12,577 | |

| DHT Holdings, Inc. | | | 399 | | | | 1,744 | |

| Ducommun, Inc.* | | | 2,600 | | | | 74,568 | |

Dycom Industries, Inc.*, 1 | | | 5,600 | | | | 156,744 | |

| Dynamic Materials Corp. | | | 2,607 | | | | 60,430 | |

Eagle Bulk Shipping, Inc.*, 1 | | | 7,900 | | | | 56,722 | |

| Eastern Co. | | | 1,500 | | | | 24,255 | |

| Ecology and Environment, Inc. - Class A | | | 950 | | | | 11,068 | |

| Electro Scientific Industries, Inc. | | | 4,900 | | | | 57,379 | |

| EMCOR Group, Inc. | | | 2,800 | | | | 109,564 | |

Encore Wire Corp.1 | | | 4,500 | | | | 177,480 | |

| EnerNOC, Inc.* | | | 1,456 | | | | 21,825 | |

| EnerSys, Inc. | | | 4,000 | | | | 242,520 | |

| Engility Holdings, Inc.* | | | 4,806 | | | | 152,494 | |

EnPro Industries, Inc.*, 1 | | | 2,900 | | | | 174,609 | |

| Era Group, Inc.* | | | 2,300 | | | | 62,514 | |

Erickson Air-Crane, Inc.*, 1 | | | 3,465 | | | | 54,262 | |

ESCO Technologies, Inc.1 | | | 5,300 | | | | 176,119 | |

| Esterline Technologies Corp.* | | | 2,900 | | | | 231,681 | |

Fabrinet*, 1 | | | 7,600 | | | | 127,984 | |

| Flow International Corp.* | | | 12,595 | | | | 50,254 | |

FreightCar America, Inc.1 | | | 2,500 | | | | 51,700 | |

| Frequency Electronics, Inc. | | | 4,000 | | | | 46,720 | |

Frontline Ltd./Bermuda*, 1 | | | 20,900 | | | | 55,385 | |

| Fuel Tech, Inc.* | | | 3,100 | | | | 13,516 | |

| Furmanite Corp.* | | | 4,200 | | | | 41,580 | |

| GATX Corp. | | | 7,900 | | | | 375,408 | |

Genco Shipping & Trading Ltd.*, 1 | | | 6,500 | | | | 25,545 | |

| Gencor Industries, Inc.* | | | 4,000 | | | | 34,320 | |

| General Cable Corp. | | | 10,256 | | | | 325,628 | |

| General Finance Corp.* | | | 3,760 | | | | 20,154 | |

| Gibraltar Industries, Inc.* | | | 8,000 | | | | 114,080 | |

| Global Power Equipment Group, Inc. | | | 3,500 | | | | 70,385 | |

GrafTech International Ltd.*, 1 | | | 27,300 | | | | 230,685 | |

Granite Construction, Inc.1 | | | 7,200 | | | | 220,320 | |

| Greenbrier Cos., Inc.* | | | 6,500 | | | | 160,745 | |

| Griffon Corp. | | | 10,000 | | | | 125,400 | |

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| INDUSTRIAL (Continued) | | | | | | |

GSE Holding, Inc.*, 1 | | | 11,400 | | | $ | 23,712 | |

| Gulfmark Offshore, Inc. - Class A | | | 3,200 | | | | 162,848 | |

Hardinge, Inc.1 | | | 4,200 | | | | 64,890 | |

| Harsco Corp. | | | 4,150 | | | | 103,335 | |

| Haynes International, Inc. | | | 3,000 | | | | 135,990 | |

Heritage-Crystal Clean, Inc.*, 1 | | | 3,200 | | | | 57,664 | |

Hudson Technologies, Inc.*, 1 | | | 11,829 | | | | 24,013 | |

Hurco Cos., Inc.1 | | | 1,600 | | | | 41,376 | |

| Identive Group, Inc.* | | | 10,000 | | | | 7,000 | |

| IEC Electronics Corp.* | | | 1,180 | | | | 4,331 | |

| II-VI, Inc.* | | | 12,900 | | | | 242,778 | |

| Insteel Industries, Inc. | | | 3,200 | | | | 51,520 | |

| Integrated Electrical Services, Inc.* | | | 2,200 | | | | 8,932 | |

International Shipholding Corp.1 | | | 1,700 | | | | 46,648 | |

| Intevac, Inc.* | | | 4,500 | | | | 26,370 | |

Iteris, Inc.*, 1 | | | 10,667 | | | | 19,521 | |

| Itron, Inc.* | | | 8,700 | | | | 372,621 | |

| Kadant, Inc. | | | 3,200 | | | | 107,488 | |

Kemet Corp.*, 1 | | | 13,000 | | | | 54,340 | |

Key Technology, Inc.*, 1 | | | 2,200 | | | | 30,558 | |

Knightsbridge Tankers Ltd.1 | | | 2,300 | | | | 23,391 | |

| Kratos Defense & Security Solutions, Inc.* | | | 13,600 | | | | 112,608 | |

| Lawson Products, Inc.* | | | 3,546 | | | | 36,559 | |

| Layne Christensen Co.* | | | 3,900 | | | | 77,844 | |

| LB Foster Co. - Class A | | | 1,900 | | | | 86,906 | |

LMI Aerospace, Inc.*, 1 | | | 3,420 | | | | 45,691 | |

| LoJack Corp.* | | | 1,200 | | | | 3,840 | |

| LS Starrett Co. - Class A | | | 2,221 | | | | 24,431 | |

LSI Industries, Inc.1 | | | 5,900 | | | | 49,796 | |

| Lydall, Inc.* | | | 3,088 | | | | 53,021 | |

| Marten Transport Ltd. | | | 6,000 | | | | 102,900 | |

Metalico, Inc.*, 1 | | | 25,000 | | | | 35,000 | |

| Methode Electronics, Inc. | | | 5,500 | | | | 154,000 | |

| Mfri, Inc.* | | | 1,420 | | | | 16,216 | |

| Moog, Inc. - Class A* | | | 4,200 | | | | 246,414 | |

Multi-Fineline Electronix, Inc.*, 1 | | | 5,900 | | | | 95,698 | |

| MYR Group, Inc.* | | | 6,100 | | | | 148,230 | |

| NACCO Industries, Inc. - Class A | | | 900 | | | | 49,878 | |

| NAPCO Security Technologies, Inc.* | | | 2,700 | | | | 14,337 | |

National Presto Industries, Inc.1 | | | 600 | | | | 42,246 | |

| National Technical Systems, Inc.* | | | 800 | | | | 18,280 | |

| NN, Inc. | | | 4,000 | | | | 62,240 | |

| Northwest Pipe Co.* | | | 2,300 | | | | 75,624 | |

Nuverra Environmental Solutions, Inc.*, 1 | | | 65,000 | | | | 148,850 | |

Olympic Steel, Inc.1 | | | 3,400 | | | | 94,452 | |

| Orbital Sciences Corp.* | | | 11,800 | | | | 249,924 | |

| Orion Energy Systems, Inc.* | | | 4,504 | | | | 16,935 | |

See accompanying Notes to Financial Statements.

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2013

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| INDUSTRIAL (Continued) | | | | | | |

| Orion Marine Group, Inc.* | | | 8,000 | | | $ | 83,280 | |

| Pacer International, Inc.* | | | 6,020 | | | | 37,264 | |

PAM Transportation Services, Inc.1 | | | 2,839 | | | | 49,654 | |

| Perma-Fix Environmental Services* | | | 6,040 | | | | 4,349 | |

PHI, Inc. *, 2 | | | 3,000 | | | | 113,130 | |

| PHI, Inc.* | | | 100 | | | | 3,624 | |

| Pike Electric Corp. | | | 4,900 | | | | 55,468 | |

Plexus Corp.*, 1 | | | 5,800 | | | | 215,760 | |

PMFG, Inc.*, 1 | | | 6,500 | | | | 48,100 | |

| Providence and Worcester Railroad Co. | | | 100 | | | | 2,017 | |

Quanex Building Products Corp.1 | | | 7,200 | | | | 135,576 | |

Rand Logistics, Inc.*, 1 | | | 7,200 | | | | 35,136 | |

| Roadrunner Transportation Systems, Inc.* | | | 3,100 | | | | 87,544 | |

| Rofin-Sinar Technologies, Inc.* | | | 7,000 | | | | 169,470 | |

| Rogers Corp.* | | | 2,000 | | | | 118,960 | |

| RTI International Metals, Inc.* | | | 7,600 | | | | 243,504 | |

| Sanmina Corp.* | | | 17,000 | | | | 297,330 | |

Ship Finance International Ltd.1 | | | 8,800 | | | | 134,376 | |

SIFCO Industries, Inc.1 | | | 1,100 | | | | 20,240 | |

| SL Industries, Inc. | | | 1,700 | | | | 41,565 | |

| Sparton Corp.* | | | 2,600 | | | | 66,300 | |

| Sterling Construction Co., Inc.* | | | 5,200 | | | | 48,100 | |

| Stoneridge, Inc.* | | | 6,200 | | | | 67,022 | |

STR Holdings, Inc.*, 1 | | | 28,000 | | | | 62,440 | |

SunPower Corp.*, 1 | | | 6,000 | | | | 156,960 | |

| Synalloy Corp. | | | 2,103 | | | | 34,447 | |

| Sypris Solutions, Inc. | | | 7,285 | | | | 22,729 | |

| Tech Data Corp.* | | | 3,500 | | | | 174,685 | |

| Tecumseh Products Co. - Class A* | | | 5,200 | | | | 46,540 | |

| Tecumseh Products Co. - Class B* | | | 3,300 | | | | 28,677 | |

Teekay Tankers Ltd. - Class A1 | | | 19,900 | | | | 52,138 | |

| Tetra Tech, Inc.* | | | 13,900 | | | | 359,871 | |

| Transcat, Inc.* | | | 1,941 | | | | 15,217 | |

| TTM Technologies, Inc.* | | | 14,900 | | | | 145,275 | |

| Tutor Perini Corp.* | | | 11,400 | | | | 243,048 | |

| Twin Disc, Inc. | | | 1,900 | | | | 49,647 | |

| UFP Technologies, Inc.* | | | 2,600 | | | | 59,202 | |

| Ultralife Corp.* | | | 4,800 | | | | 19,200 | |

Universal Forest Products, Inc.1 | | | 4,000 | | | | 168,400 | |

| USA Truck, Inc.* | | | 5,361 | | | | 48,035 | |

UTi Worldwide, Inc.1 | | | 12,316 | | | | 186,095 | |

Viasystems Group, Inc.*, 1 | | | 3,854 | | | | 55,690 | |

Vicor Corp.*, 1 | | | 4,700 | | | | 38,446 | |

Vishay Intertechnology, Inc.*, 1 | | | 26,000 | | | | 335,140 | |

| Vishay Precision Group, Inc.* | | | 4,000 | | | | 58,200 | |

| VSE Corp. | | | 1,500 | | | | 70,425 | |

| Watts Water Technologies, Inc. - Class A | | | 3,800 | | | | 214,206 | |

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |

| INDUSTRIAL (Continued) | | | | | | |

| Willis Lease Finance Corp.* | | | 2,869 | | | $ | 45,129 | |

XPO Logistics, Inc.*, 1 | | | 3,200 | | | | 69,344 | |

Zagg, Inc.*, 1 | | | 5,800 | | | | 26,100 | |

Zygo Corp.*, 1 | | | 4,288 | | | | 68,522 | |

| | | | | | | | 17,639,263 | |

| TECHNOLOGY – 6.8% | | | | | | | | |

| Agilysys, Inc.* | | | 1,082 | | | | 12,897 | |

Alpha & Omega Semiconductor Ltd.*, 1 | | | 8,700 | | | | 73,167 | |

| Amkor Technology, Inc.* | | | 39,600 | | | | 169,884 | |

| Amtech Systems, Inc.* | | | 4,850 | | | | 35,405 | |

| ANADIGICS, Inc.* | | | 22,500 | | | | 44,325 | |

| Astro-Med, Inc. | | | 2,600 | | | | 28,496 | |

| ATMI, Inc.* | | | 5,200 | | | | 137,904 | |

Audience, Inc.*, 1 | | | 6,800 | | | | 76,432 | |

| Avid Technology, Inc.* | | | 5,150 | | | | 30,900 | |

| Axcelis Technologies, Inc.* | | | 19,300 | | | | 40,723 | |

AXT, Inc.*, 1 | | | 19,000 | | | | 44,460 | |

| Brooks Automation, Inc. | | | 12,500 | | | | 116,375 | |

CACI International, Inc. - Class A*, 1 | | | 4,700 | | | | 324,817 | |

| Cascade Microtech, Inc.* | | | 3,230 | | | | 28,973 | |

| CIBER, Inc.* | | | 14,300 | | | | 47,190 | |

| Cohu, Inc. | | | 5,144 | | | | 56,121 | |

| Digi International, Inc.* | | | 5,200 | | | | 52,052 | |

| Digital River, Inc.* | | | 4,400 | | | | 78,628 | |

| Diodes, Inc.* | | | 5,332 | | | | 130,634 | |

| DSP Group, Inc.* | | | 4,700 | | | | 33,135 | |

Dynamics Research Corp.*, 1 | | | 3,800 | | | | 28,880 | |

Echelon Corp.*, 1 | | | 8,500 | | | | 20,315 | |

| Electronics For Imaging, Inc.* | | | 7,100 | | | | 224,928 | |

Emcore Corp.*, 1 | | | 6,400 | | | | 28,736 | |

Emulex Corp.*, 1 | | | 16,200 | | | | 125,712 | |

| Entegris, Inc.* | | | 25,100 | | | | 254,765 | |

| Entropic Communications, Inc.* | | | 23,900 | | | | 104,682 | |

| Epiq Systems, Inc. | | | 6,600 | | | | 87,252 | |

Fairchild Semiconductor International, Inc.*, 1 | | | 24,806 | | | | 344,555 | |

| FormFactor, Inc.* | | | 8,000 | | | | 54,880 | |

| Geeknet, Inc.* | | | 1,500 | | | | 25,260 | |

GSI Technology, Inc.*, 1 | | | 2,790 | | | | 19,614 | |

GT Advanced Technologies, Inc.*, 1 | | | 14,100 | | | | 119,991 | |

| Hutchinson Technology, Inc.* | | | 7,000 | | | | 24,360 | |

| Imation Corp.* | | | 13,900 | | | | 56,990 | |

| Innodata, Inc.* | | | 6,900 | | | | 17,871 | |

| Insight Enterprises, Inc.* | | | 9,100 | | | | 172,172 | |

| Integrated Silicon Solution, Inc.* | | | 7,400 | | | | 80,586 | |

International Rectifier Corp.*, 1 | | | 9,900 | | | | 245,223 | |

| IXYS Corp. | | | 4,400 | | | | 42,460 | |

See accompanying Notes to Financial Statements.

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2013

| | | | | | | |

| COMMON STOCKS (Continued) | | | | | | |