Washington, D.C. 20549

1968 N. Lake Avenue, #303

Dr. Mendel Fygenson

1968 N. Lake Avenue, #303

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Vericimetry U.S. Small Cap Value Fund

Annual Report

September 30, 2017

Vericimetry Funds

TABLE OF CONTENTS

September 30, 2017

| Letter to Shareholders | 1 |

| Manager’s Discussion and Analysis | 2 |

| Performance Summary | 3 |

| Schedule of Investments | 4 |

| Financial Statements | 18 |

| Financial Highlights | 21 |

| Notes to Financial Statements | 22 |

| Report of Independent Registered Public Accounting Firm | 27 |

| Expense Example | 28 |

| Other Information | 29 |

| Trustees and Officers | 30 |

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by a current prospectus.

Except for historical information, the matters discussed in this report may constitute forward-looking statements. These include any predictions, assessments, analyses or outlooks for individual securities, industries, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for the Fund in the current prospectus, other factors bearing on these statements include the accuracy of the Adviser’s forecasts and predictions, and the appropriateness of the investment programs designed by the Adviser to implement its strategies efficiently and effectively. Any one or more of these factors, as well as other risks affecting the securities markets and investment instruments generally, could cause the actual results of the Fund to differ materially as compared to applicable benchmarks.

Vericimetry Funds

LETTER TO SHAREHOLDERS

September 30, 2017 (Unaudited)

Dear Shareholders,

We are pleased to present the enclosed annual report for the Vericimetry U.S. Small Cap Value Fund (the “Fund”) for the year ended September 30, 2017.

Vericimetry Advisors, LLC (the “Adviser”) is an academically based, quantitatively structured investment adviser. We provide a selected group of elite financial advisors access to an enhanced index strategy for a well-defined asset class with a predetermined benchmark. The Fund’s objective is to achieve long-term capital appreciation through its principal investment strategy of investing in U.S. small capitalization and value securities.

The Fund invests in a wide and diverse universe of U.S. small capitalization value stocks using a structured quantitative investment approach based on a set of well-defined fundamental characteristics that historically has shown to deliver the risk-premiums in U.S. small and value equities. Given our capacity advantage, we employ a multi-factor approach to identify value securities. To this end, securities considered for the Fund must pass a “value screen” which combines factors such as book-to-market, price-to-earnings, price to-sales or price-to-operating cash flow.1

In an effort to enhance net returns to the investor, we implement disciplined and patient trading strategies. The Fund is managed with the intent of maintaining competitive management fees and low transaction costs, expenses and turnover in an effort to enhance net returns to the investor. We are committed to limiting the growth of the Fund’s assets under management once it reaches its optimal capacity.

We thank you for your investment in the Vericimetry U.S. Small Cap Value Fund and for the confidence and trust you place in the Adviser’s investment team.

Sincerely,

Dr. Mendel Fygenson

Chief Executive Officer

Economic, political, and issuer specific events may cause the value of securities to rise or fall. Because the value of your investment in the Fund will fluctuate, there is the risk that you will lose money. Securities of small and microcap companies are often less liquid, more volatile and they may have more limited resources. Value stocks may perform differently from the market as a whole and may underperform equity funds that use other investment strategies. The investment strategies, practices and risk analysis used by the Adviser may not produce the desired results.

1 | Book-to-market is the value ratio of a company’s book value to its market value. Price-to-earnings, price-to-sales and price-to-operating cash flow ratios are the value of a company’s share price compared to its previous twelve months earnings per share, sales per share or operating cash flow per share, respectively. |

1

Vericimetry Funds

MANAGER’S DISCUSSION AND ANALYSIS

September 30, 2017 (Unaudited)

The following overview summarizes the results of the Vericimetry U.S. Small Cap Value Fund for the fiscal year ended on September 30, 2017. In general, the Fund seeks to deliver the long side of the size-value risk premiums in U.S. securities through a well diversified portfolio. The outcomes of this fiscal year demonstrate management’s commitment to the Fund’s mandated strategy and its stated investment philosophy. Please note that returns mentioned in the summary below, for both the Fund and for the indices, are total returns.

For the fiscal year ended on September 30, 2017, the Fund had positive returns, but it underperformed its benchmark – the Russell 2000® Value Index (the “Benchmark”). Overall, the Fund’s fiscal-year annual return was a positive 19.06% versus the Benchmark’s positive return of 20.55%. For most of the year, the Fund was almost fully invested and had a well-diversified portfolio, with well over 1,000 equity holdings.

Examining the returns of different segments of the U.S. equity markets over this fiscal year provides additional information (shown below). The broad market had a large positive return, as illustrated by the Russell 3000® Index. Small cap stocks, represented by the Russell 2000® Indices, had higher returns than large cap stocks, represented by the Russell 1000® Indices. Given the Fund’s greater exposure to the smaller cap segment of the market, this size differential had a positive impact on the Fund’s returns. In general, Value stocks have underperformed Growth stocks within most of the sizes, as illustrated by the various Russell indices. Thus, the value differential, which the Fund seeks to deliver through a multifactor approach, had a small negative impact on the Fund’s returns.

For the entire fiscal year, the Fund underperformed the Benchmark by a total of 1.49%. This deficit can be entirely attributed to the performance differentials during the historic fourth quarter of 2016 (the “Quarter”). For that entire Quarter, the Fund’s return was a positive 12.49% versus the Benchmark’s positive return of 14.07%. The Benchmark’s return was greatly propelled by its large exposure to regional banks, which as a group rose more than 30% during the Quarter. As in all other quarters since the Fund’s inception, the Benchmark held, on average, 5% more weight in regional banks than the Fund, causing the Fund’s underperformance for the entire fiscal year.

Returns for the Fiscal Year Ended September 30, 2017

Russell Microcap® Value Index | 26.15% |

Russell Microcap® Index | 22.33% |

Russell 1000® Growth Index | 21.94% |

Russell 3000® Growth Index | 21.87% |

Russell 2000® Growth Index | 20.98% |

Russell 2000® Index | 20.74% |

Russell 2000® Value Index | 20.55% |

Russell 3000® Index | 18.71% |

Russell 1000® Index | 18.54% |

Russell Microcap® Growth Index | 17.27% |

Russell 3000® Value Index | 15.53% |

Russell 1000® Value Index | 15.12% |

Source: Russell Investment Group

2

Vericimetry Funds

PERFORMANCE SUMMARY (Unaudited)

September 30, 2017

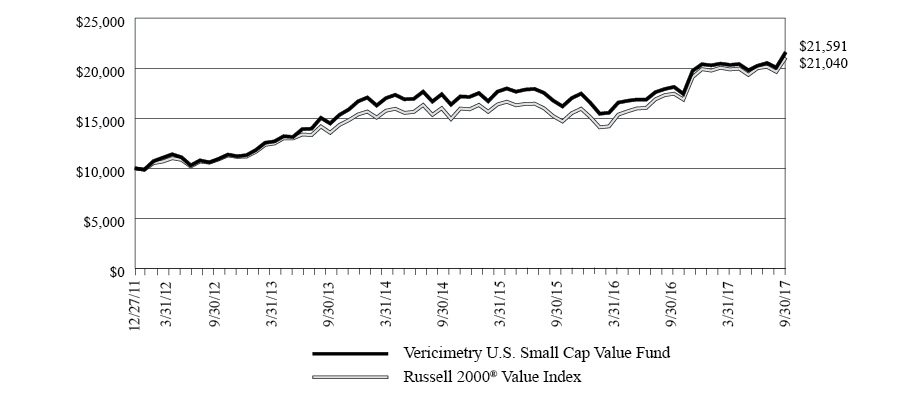

Comparison of a Hypothetical $10,000 Investment

in the Vericimetry U.S. Small Cap Value Fund and the Russell 2000® Value Index*

Total Returns

For the periods ended September 30, 2017 |

| | One Year | Five Year | Average Annual Since Inception ** | |

| Vericimetry U.S. Small Cap Value Fund | 19.06% | 13.68% | 14.29% | |

Russell 2000® Value Index* | 20.55% | 13.27% | 13.78% | |

| * | The Russell 2000® Value Index measures the performance of small-cap value segment of the U.S. equity universe. It includes those Russell 2000 Index companies with lower price-to-book ratios and lower forecasted growth values. |

| ** | Commencement of operations for the Vericimetry U.S. Small Cap Value Fund was December 27, 2011. |

The Fund's net expense ratio of 0.61% and gross expense ratio of 0.69% are reflective of the information disclosed in the Fund's prospectus dated January 27, 2017, and differ from the expense ratios disclosed in this report, which are 0.60% and 0.66% respectively. The Adviser has contractually agreed to waive all or a portion of its management fees and/or reimburse expenses at least through January 31, 2018 in order to keep the Fund’s net annual operating expenses (excluding certain non-operating expenses) from exceeding 0.60% of its average daily net assets. Performance data quoted represents past performance which is not predictive of future performance. The investment return and principal value of Fund shares will fluctuate and when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To receive current performance to the most recent month end, please call 1-855-755-7550. Please read prospectus carefully before investing.

The line graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s results as shown are net of fees.

3

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS

As of September 30, 2017

| | | Number

of Shares | | | Value | |

COMMON STOCKS – 96.2% | | | | | | |

BASIC MATERIALS – 4.9% | | | | | | |

| A Schulman, Inc. | | | 5,150 | | | $ | 175,873 | |

AgroFresh Solutions, Inc.*1 | | | 27,000 | | | | 189,810 | |

AK Steel Holding Corp.*1 | | | 36,500 | | | | 204,035 | |

Allegheny Technologies, Inc.*1 | | | 17,200 | | | | 411,080 | |

| American Vanguard Corp. | | | 11,500 | | | | 263,350 | |

| Calgon Carbon Corp. | | | 8,400 | | | | 179,760 | |

| Carpenter Technology Corp. | | | 15,700 | | | | 754,071 | |

| Century Aluminum Co.* | | | 42,700 | | | | 707,966 | |

| Chemours Co. | | | 22,400 | | | | 1,133,664 | |

| Clearwater Paper Corp.* | | | 2,000 | | | | 98,500 | |

| Cleveland-Cliffs, Inc.* | | | 40,200 | | | | 287,430 | |

| Commercial Metals Co. | | | 36,000 | | | | 685,080 | |

| CSW Industrials, Inc.* | | | 2,960 | | | | 131,276 | |

| Domtar Corp. | | | 1,500 | | | | 65,085 | |

Fairmount Santrol Holdings, Inc.*1 | | | 9,600 | | | | 45,888 | |

| Ferroglobe PLC | | | 17,500 | | | | 230,300 | |

| Hecla Mining Co. | | | 189,800 | | | | 952,796 | |

| Huntsman Corp. | | | 6,950 | | | | 190,569 | |

| Innophos Holdings, Inc. | | | 2,700 | | | | 132,813 | |

| Innospec, Inc. | | | 1,050 | | | | 64,733 | |

Intrepid Potash, Inc.*1 | | | 57,100 | | | | 248,956 | |

| Kaiser Aluminum Corp. | | | 5,513 | | | | 568,611 | |

| KMG Chemicals, Inc. | | | 5,031 | | | | 276,101 | |

| Koppers Holdings, Inc.* | | | 4,600 | | | | 212,290 | |

| Kraton Corp.* | | | 14,600 | | | | 590,424 | |

| Kronos Worldwide, Inc. | | | 33,700 | | | | 769,371 | |

| Landec Corp.* | | | 9,200 | | | | 119,140 | |

| Materion Corp. | | | 10,300 | | | | 444,445 | |

| Mercer International, Inc. | | | 21,200 | | | | 251,220 | |

| Minerals Technologies, Inc. | | | 2,500 | | | | 176,625 | |

| Oil-Dri Corp. of America | | | 1,400 | | | | 68,502 | |

| Olin Corp. | | | 24,770 | | | | 848,372 | |

| OMNOVA Solutions, Inc.* | | | 6,900 | | | | 75,555 | |

Orchids Paper Products Co.1 | | | 3,400 | | | | 47,872 | |

| PH Glatfelter Co. | | | 21,967 | | | | 427,258 | |

| Platform Specialty Products Corp.* | | | 7,200 | | | | 80,280 | |

| PolyOne Corp. | | | 4,700 | | | | 188,141 | |

Rayonier Advanced Materials, Inc.1 | | | 8,050 | | | | 110,285 | |

| Schnitzer Steel Industries, Inc. - Class A | | | 10,800 | | | | 304,020 | |

| Schweitzer-Mauduit International, Inc. | | | 3,300 | | | | 136,818 | |

| Stepan Co. | | | 8,850 | | | | 740,391 | |

| Tronox Ltd. - Class A | | | 33,300 | | | | 702,630 | |

| United States Lime & Minerals, Inc. | | | 500 | | | | 42,000 | |

United States Steel Corp.1 | | | 12,600 | | | | 323,316 | |

| Univar, Inc.* | | | 5,400 | | | | 156,222 | |

| Universal Stainless & Alloy Products, Inc.* | | | 4,600 | | | | 95,910 | |

| | | | | | | | 14,908,834 | |

COMMON STOCKS (Continued) | | | | | | | | |

COMMUNICATIONS – 3.3% | | | | | | | | |

| 1-800-Flowers.com, Inc. - Class A* | | | 3,813 | | | | 37,558 | |

| ADTRAN, Inc. | | | 3,200 | | | | 76,800 | |

| AH Belo Corp. - Class A | | | 9,635 | | | | 44,321 | |

| ATN International, Inc. | | | 2,529 | | | | 133,278 | |

| Aware, Inc.* | | | 3,673 | | | | 17,079 | |

| Bankrate, Inc.* | | | 23,100 | | | | 322,245 | |

| Blucora, Inc.* | | | 29,800 | | | | 753,940 | |

| Boingo Wireless, Inc.* | | | 4,200 | | | | 89,754 | |

Chegg, Inc.*1 | | | 11,000 | | | | 163,240 | |

| Comtech Telecommunications Corp. | | | 9,100 | | | | 186,823 | |

Consolidated Communications Holdings, Inc.1 | | | 3,942 | | | | 75,213 | |

Daily Journal Corp.*1 | | | 200 | | | | 43,722 | |

| EchoStar Corp. - Class A* | | | 4,800 | | | | 274,704 | |

Entercom Communications Corp. - Class A1 | | | 10,900 | | | | 124,805 | |

| ePlus, Inc.* | | | 9,280 | | | | 857,936 | |

| EW Scripps Co. - Class A* | | | 13,216 | | | | 252,558 | |

| Finisar Corp.* | | | 2,300 | | | | 50,991 | |

| Gannett Co., Inc. | | | 26,300 | | | | 236,700 | |

| Gigamon, Inc.* | | | 2,400 | | | | 101,160 | |

| Global Eagle Entertainment, Inc.* | | | 13,900 | | | | 47,538 | |

| Gray Television, Inc.* | | | 24,000 | | | | 376,800 | |

| Hawaiian Telcom Holdco, Inc.* | | | 1,100 | | | | 32,802 | |

| Houghton Mifflin Harcourt Co.* | | | 7,400 | | | | 89,170 | |

| Infinera Corp.* | | | 9,400 | | | | 83,378 | |

| InterDigital, Inc. | | | 700 | | | | 51,625 | |

Iridium Communications, Inc.*1 | | | 25,000 | | | | 257,500 | |

| Limelight Networks, Inc.* | | | 16,345 | | | | 64,890 | |

| Meet Group, Inc.* | | | 13,600 | | | | 49,504 | |

Meredith Corp.1 | | | 4,700 | | | | 260,850 | |

| NETGEAR, Inc.* | | | 9,400 | | | | 447,440 | |

| New Media Investment Group, Inc. | | | 8,400 | | | | 124,236 | |

New York Times Co. - Class A1 | | | 16,600 | | | | 325,360 | |

Oclaro, Inc.*1 | | | 34,750 | | | | 299,892 | |

| Overstock.com, Inc.* | | | 2,700 | | | | 80,190 | |

| PC-Tel, Inc. | | | 13,100 | | | | 82,530 | |

| Perficient, Inc.* | | | 2,900 | | | | 57,043 | |

| Preformed Line Products Co. | | | 1,100 | | | | 74,030 | |

Proofpoint, Inc.*1 | | | 2,800 | | | | 244,216 | |

| QuinStreet, Inc.* | | | 18,400 | | | | 135,240 | |

| Saga Communications, Inc. - Class A | | | 2,700 | | | | 123,120 | |

| Salem Media Group, Inc. | | | 5,121 | | | | 33,799 | |

| Scholastic Corp. | | | 14,430 | | | | 536,796 | |

| Sonus Networks, Inc.* | | | 8,700 | | | | 66,555 | |

| Spok Holdings, Inc. | | | 7,800 | | | | 119,730 | |

Stamps.com, Inc.*1 | | | 600 | | | | 121,590 | |

| TechTarget, Inc.* | | | 5,900 | | | | 70,446 | |

See accompanying Notes to Financial Statements.

4

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2017

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | |

COMMUNICATIONS (Continued) | | | | | | |

| Telephone & Data Systems, Inc. | | | 15,200 | | | $ | 423,928 | |

| Time, Inc. | | | 7,800 | | | | 105,300 | |

| TiVo Corp. | | | 21,760 | | | | 431,936 | |

| Tribune Media Co. - Class A | | | 3,900 | | | | 159,354 | |

| U.S. Auto Parts Network, Inc.* | | | 14,200 | | | | 41,038 | |

ViaSat, Inc.*1 | | | 1,600 | | | | 102,912 | |

| Viavi Solutions, Inc.* | | | 16,300 | | | | 154,198 | |

| Vonage Holdings Corp.* | | | 20,800 | | | | 169,312 | |

| Web.com Group, Inc.* | | | 4,200 | | | | 105,000 | |

| West Corp. | | | 8,450 | | | | 198,322 | |

| YuMe, Inc. | | | 16,539 | | | | 76,576 | |

| | | | | | | | 10,066,973 | |

CONSUMER, CYCLICAL – 14.3% | | | | | | | | |

Abercrombie & Fitch Co. - Class A1 | | | 40,000 | | | | 577,600 | |

AMC Entertainment Holdings, Inc. - Class A1 | | | 6,840 | | | | 100,548 | |

America's Car-Mart, Inc.*1 | | | 3,700 | | | | 152,163 | |

| American Axle & Manufacturing Holdings, Inc.* | | | 20,900 | | | | 367,422 | |

| American Eagle Outfitters, Inc. | | | 21,200 | | | | 303,160 | |

| American Woodmark Corp.* | | | 700 | | | | 67,375 | |

| Anixter International, Inc.* | | | 2,900 | | | | 246,500 | |

Ascena Retail Group, Inc.*1 | | | 32,700 | | | | 80,115 | |

AV Homes, Inc.*1 | | | 8,620 | | | | 147,833 | |

| Barnes & Noble Education, Inc.* | | | 13,400 | | | | 87,234 | |

| Barnes & Noble, Inc. | | | 29,100 | | | | 221,160 | |

| Bassett Furniture Industries, Inc. | | | 4,050 | | | | 152,685 | |

| Beacon Roofing Supply, Inc.* | | | 5,910 | | | | 302,888 | |

| Beazer Homes USA, Inc.* | | | 24,800 | | | | 464,752 | |

| Belmond Ltd. - Class A* | | | 24,550 | | | | 335,107 | |

Big 5 Sporting Goods Corp.1 | | | 7,600 | | | | 58,140 | |

Big Lots, Inc.1 | | | 5,600 | | | | 299,992 | |

| Biglari Holdings, Inc.* | | | 167 | | | | 55,659 | |

Blue Bird Corp.*1 | | | 2,000 | | | | 41,200 | |

| Boot Barn Holdings, Inc.* | | | 5,100 | | | | 45,390 | |

| Boyd Gaming Corp. | | | 13,300 | | | | 346,465 | |

Buckle, Inc.1 | | | 5,300 | | | | 89,305 | |

| Burlington Stores, Inc.* | | | 2,300 | | | | 219,558 | |

| Caesars Acquisition Co. - Class A* | | | 32,200 | | | | 690,690 | |

Caesars Entertainment Corp.*1 | | | 16,000 | | | | 213,600 | |

Caleres, Inc.1 | | | 13,100 | | | | 399,812 | |

| Callaway Golf Co. | | | 12,450 | | | | 179,654 | |

| Casey's General Stores, Inc. | | | 1,700 | | | | 186,065 | |

| Cato Corp. - Class A | | | 2,500 | | | | 33,075 | |

Cavco Industries, Inc.*1 | | | 600 | | | | 88,530 | |

| Century Casinos, Inc.* | | | 5,600 | | | | 45,976 | |

| Century Communities, Inc.* | | | 4,372 | | | | 107,988 | |

COMMON STOCKS (Continued) | | | | | | | | |

CONSUMER, CYCLICAL (Continued) | | | | | | | | |

Children's Place, Inc.1 | | | 4,840 | | | | 571,846 | |

| Choice Hotels International, Inc. | | | 4,000 | | | | 255,600 | |

| Churchill Downs, Inc. | | | 960 | | | | 197,952 | |

| Citi Trends, Inc. | | | 6,700 | | | | 133,129 | |

| Clarus Corp.* | | | 18,900 | | | | 141,750 | |

| Columbia Sportswear Co. | | | 10,816 | | | | 666,049 | |

| Commercial Vehicle Group, Inc.* | | | 8,600 | | | | 63,210 | |

Conn's, Inc.*1 | | | 5,300 | | | | 149,195 | |

Cooper Tire & Rubber Co.1 | | | 6,200 | | | | 231,880 | |

| Cooper-Standard Holdings, Inc.* | | | 5,150 | | | | 597,245 | |

| Copa Holdings S.A. - Class A | | | 2,200 | | | | 273,966 | |

Core-Mark Holding Co., Inc.1 | | | 1,976 | | | | 63,509 | |

| Crocs, Inc.* | | | 11,700 | | | | 113,490 | |

| Culp, Inc. | | | 2,150 | | | | 70,413 | |

| Daktronics, Inc. | | | 10,700 | | | | 113,099 | |

| Dana, Inc. | | | 18,800 | | | | 525,648 | |

| Deckers Outdoor Corp.* | | | 5,600 | | | | 383,096 | |

| Del Frisco's Restaurant Group, Inc.* | | | 4,600 | | | | 66,930 | |

| Del Taco Restaurants, Inc.* | | | 9,400 | | | | 144,196 | |

Delta Apparel, Inc.*1 | | | 6,000 | | | | 129,060 | |

| Denny's Corp.* | | | 5,700 | | | | 70,965 | |

Dillard's, Inc. - Class A1 | | | 2,500 | | | | 140,175 | |

| Dixie Group, Inc.* | | | 7,600 | | | | 30,400 | |

| Dorman Products, Inc.* | | | 1,300 | | | | 93,106 | |

| Douglas Dynamics, Inc. | | | 2,500 | | | | 98,500 | |

| DSW, Inc. - Class A | | | 24,400 | | | | 524,112 | |

Eldorado Resorts, Inc.*1 | | | 10,772 | | | | 276,302 | |

| Essendant, Inc. | | | 12,700 | | | | 167,259 | |

| Express, Inc.* | | | 12,900 | | | | 87,204 | |

| Extended Stay America, Inc. | | | 11,900 | | | | 238,000 | |

| EZCORP, Inc. - Class A* | | | 20,300 | | | | 192,850 | |

| Finish Line, Inc. - Class A | | | 7,100 | | | | 85,413 | |

| FirstCash, Inc. | | | 11,208 | | | | 707,785 | |

| Flexsteel Industries, Inc. | | | 3,072 | | | | 155,750 | |

Fossil Group, Inc.*1 | | | 11,400 | | | | 106,362 | |

| Fox Factory Holding Corp.* | | | 5,800 | | | | 249,980 | |

Fred's, Inc. - Class A1 | | | 18,500 | | | | 119,140 | |

| Full House Resorts, Inc.* | | | 1,105 | | | | 3,083 | |

| G-III Apparel Group Ltd.* | | | 5,700 | | | | 165,414 | |

| Gaia, Inc.* | | | 7,700 | | | | 92,400 | |

| GameStop Corp. - Class A | | | 7,200 | | | | 148,752 | |

| Genesco, Inc.* | | | 7,400 | | | | 196,840 | |

| Gentherm, Inc.* | | | 2,500 | | | | 92,875 | |

| Golden Entertainment, Inc.* | | | 9,000 | | | | 219,420 | |

| Green Brick Partners, Inc.* | | | 7,898 | | | | 78,190 | |

| Group 1 Automotive, Inc. | | | 11,000 | | | | 797,060 | |

| Guess?, Inc. | | | 41,150 | | | | 700,784 | |

See accompanying Notes to Financial Statements.

5

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2017

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | |

CONSUMER, CYCLICAL (Continued) | | | | | | |

| Haverty Furniture Cos., Inc. | | | 3,600 | | | $ | 94,140 | |

| Hawaiian Holdings, Inc.* | | | 6,712 | | | | 252,036 | |

| Hibbett Sports, Inc.* | | | 6,300 | | | | 89,775 | |

| HNI Corp. | | | 1,900 | | | | 78,793 | |

| Hooker Furniture Corp. | | | 5,260 | | | | 251,165 | |

| Iconix Brand Group, Inc.* | | | 15,800 | | | | 89,902 | |

| ILG, Inc. | | | 24,500 | | | | 654,885 | |

| Installed Building Products, Inc.* | | | 3,900 | | | | 252,720 | |

| International Speedway Corp. - Class A | | | 4,400 | | | | 158,400 | |

| Jack in the Box, Inc. | | | 1,670 | | | | 170,206 | |

| JetBlue Airways Corp.* | | | 10,370 | | | | 192,156 | |

| Johnson Outdoors, Inc. - Class A | | | 6,700 | | | | 490,976 | |

| KB Home | | | 29,500 | | | | 711,540 | |

| Kewaunee Scientific Corp. | | | 1,300 | | | | 38,350 | |

| Kimball International, Inc. - Class B | | | 9,000 | | | | 177,930 | |

| Kirkland's, Inc.* | | | 5,000 | | | | 57,150 | |

| La Quinta Holdings, Inc.* | | | 14,300 | | | | 250,250 | |

| La-Z-Boy, Inc. | | | 4,330 | | | | 116,477 | |

| Lakeland Industries, Inc.* | | | 5,200 | | | | 73,320 | |

| LCI Industries | | | 4,060 | | | | 470,351 | |

LGI Homes, Inc.*1 | | | 3,800 | | | | 184,566 | |

| Libbey, Inc. | | | 6,600 | | | | 61,116 | |

| Liberty TripAdvisor Holdings, Inc. - Class A* | | | 23,000 | | | | 284,050 | |

| Lifetime Brands, Inc. | | | 8,047 | | | | 147,260 | |

Lumber Liquidators Holdings, Inc.*1 | | | 10,000 | | | | 389,800 | |

| M/I Homes, Inc.* | | | 12,600 | | | | 336,798 | |

| Malibu Boats, Inc. - Class A* | | | 5,400 | | | | 170,856 | |

| Marcus Corp. | | | 9,780 | | | | 270,906 | |

| Marine Products Corp. | | | 18,901 | | | | 303,361 | |

| Marriott Vacations Worldwide Corp. | | | 7,000 | | | | 871,710 | |

| MDC Holdings, Inc. | | | 25,210 | | | | 837,224 | |

| Meritage Homes Corp.* | | | 11,800 | | | | 523,920 | |

| Meritor, Inc.* | | | 19,400 | | | | 504,594 | |

| Miller Industries, Inc. | | | 5,025 | | | | 140,449 | |

| Mobile Mini, Inc. | | | 7,700 | | | | 265,265 | |

| Modine Manufacturing Co.* | | | 25,504 | | | | 490,952 | |

| Monarch Casino & Resort, Inc.* | | | 8,300 | | | | 328,099 | |

| Movado Group, Inc. | | | 6,950 | | | | 194,600 | |

| NACCO Industries, Inc. - Class A | | | 2,891 | | | | 248,048 | |

| Nathan's Famous, Inc.* | | | 800 | | | | 59,160 | |

Navistar International Corp.*1 | | | 15,300 | | | | 674,271 | |

| Office Depot, Inc. | | | 56,600 | | | | 256,964 | |

Oxford Industries, Inc.1 | | | 2,300 | | | | 146,142 | |

| PC Connection, Inc. | | | 13,242 | | | | 373,292 | |

| Penn National Gaming, Inc.* | | | 3,787 | | | | 88,578 | |

| Perry Ellis International, Inc.* | | | 17,100 | | | | 404,586 | |

COMMON STOCKS (Continued) | | | | | | | | |

CONSUMER, CYCLICAL (Continued) | | | | | | | | |

| PICO Holdings, Inc.* | | | 3,200 | | | | 53,440 | |

| Pool Corp. | | | 1,100 | | | | 118,987 | |

| RCI Hospitality Holdings, Inc. | | | 6,300 | | | | 155,925 | |

| Reading International, Inc. - Class A* | | | 15,989 | | | | 251,347 | |

| Red Lion Hotels Corp.* | | | 12,700 | | | | 109,855 | |

| Regis Corp.* | | | 27,146 | | | | 387,373 | |

| Rush Enterprises, Inc. - Class A* | | | 17,337 | | | | 802,530 | |

| Rush Enterprises, Inc. - Class B* | | | 4,880 | | | | 212,866 | |

| ScanSource, Inc.* | | | 9,300 | | | | 405,945 | |

| Scientific Games Corp. - Class A* | | | 13,200 | | | | 605,220 | |

Shoe Carnival, Inc.1 | | | 9,200 | | | | 205,896 | |

| Skechers U.S.A., Inc. - Class A* | | | 3,910 | | | | 98,102 | |

| Skyline Corp.* | | | 3,400 | | | | 41,106 | |

| SkyWest, Inc. | | | 30,980 | | | | 1,360,022 | |

| Sonic Automotive, Inc. - Class A | | | 17,200 | | | | 350,880 | |

| Spartan Motors, Inc. | | | 14,327 | | | | 158,313 | |

| Speedway Motorsports, Inc. | | | 16,619 | | | | 353,985 | |

| Standard Motor Products, Inc. | | | 1,700 | | | | 82,025 | |

| Steelcase, Inc. - Class A | | | 4,280 | | | | 65,912 | |

| Steven Madden Ltd.* | | | 6,900 | | | | 298,770 | |

| Strattec Security Corp. | | | 3,792 | | | | 155,093 | |

| Superior Industries International, Inc. | | | 13,300 | | | | 221,445 | |

| Superior Uniform Group, Inc. | | | 3,554 | | | | 81,387 | |

| Systemax, Inc. | | | 2,300 | | | | 60,789 | |

| Tailored Brands, Inc. | | | 5,300 | | | | 76,532 | |

| Taylor Morrison Home Corp. - Class A* | | | 16,300 | | | | 359,415 | |

| Tilly's, Inc. - Class A | | | 14,990 | | | | 179,730 | |

Titan International, Inc.1 | | | 12,050 | | | | 122,308 | |

| Titan Machinery, Inc.* | | | 7,647 | | | | 118,758 | |

| Toro Co. | | | 3,600 | | | | 223,416 | |

| Tower International, Inc. | | | 6,700 | | | | 182,240 | |

| TravelCenters of America LLC* | | | 14,800 | | | | 62,900 | |

| TRI Pointe Group, Inc.* | | | 9,500 | | | | 131,195 | |

| Triton International Ltd./Bermuda | | | 10,400 | | | | 346,112 | |

Tuesday Morning Corp.*1 | | | 27,500 | | | | 88,000 | |

| Unifi, Inc.* | | | 5,497 | | | | 195,858 | |

| UniFirst Corp. | | | 3,900 | | | | 590,850 | |

| Universal Electronics, Inc.* | | | 1,200 | | | | 76,080 | |

| Urban Outfitters, Inc.* | | | 11,900 | | | | 284,410 | |

| Vail Resorts, Inc. | | | 900 | | | | 205,308 | |

| Vista Outdoor, Inc.* | | | 18,300 | | | | 419,802 | |

| Visteon Corp.* | | | 1,100 | | | | 136,147 | |

| VOXX International Corp.* | | | 6,900 | | | | 58,995 | |

Wabash National Corp.1 | | | 12,700 | | | | 289,814 | |

| Wendy's Co. | | | 34,100 | | | | 529,573 | |

| WESCO International, Inc.* | | | 5,650 | | | | 329,112 | |

William Lyon Homes - Class A*1 | | | 9,100 | | | | 209,209 | |

See accompanying Notes to Financial Statements.

6

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2017

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | |

CONSUMER, CYCLICAL (Continued) | | | | | | |

| Winnebago Industries, Inc. | | | 1,000 | | | $ | 44,750 | |

| Wolverine World Wide, Inc. | | | 12,200 | | | | 351,970 | |

| Zumiez, Inc.* | | | 9,300 | | | | 168,330 | |

| | | | | | | | 43,082,141 | |

CONSUMER, NON-CYCLICAL – 12.5% | | | | | | | | |

AAC Holdings, Inc.*1 | | | 4,324 | | | | 42,937 | |

| Aaron's, Inc. | | | 15,700 | | | | 684,991 | |

| ABM Industries, Inc. | | | 7,550 | | | | 314,910 | |

| ACCO Brands Corp.* | | | 54,600 | | | | 649,740 | |

| Acorda Therapeutics, Inc.* | | | 12,500 | | | | 295,625 | |

| Addus HomeCare Corp.* | | | 2,000 | | | | 70,600 | |

| Adtalem Global Education, Inc. | | | 14,100 | | | | 505,485 | |

Agenus, Inc.*1 | | | 14,200 | | | | 62,622 | |

| Alico, Inc. | | | 1,900 | | | | 64,885 | |

| Almost Family, Inc.* | | | 2,100 | | | | 112,770 | |

AMAG Pharmaceuticals, Inc.*1 | | | 10,700 | | | | 197,415 | |

| American Public Education, Inc.* | | | 4,600 | | | | 96,830 | |

| Analogic Corp. | | | 2,100 | | | | 175,875 | |

| Andersons, Inc. | | | 10,400 | | | | 356,200 | |

| AngioDynamics, Inc.* | | | 9,700 | | | | 165,773 | |

| Anika Therapeutics, Inc.* | | | 800 | | | | 46,400 | |

| Aralez Pharmaceuticals, Inc.* | | | 21,700 | | | | 49,693 | |

| ARC Document Solutions, Inc.* | | | 10,800 | | | | 44,172 | |

Array BioPharma, Inc.*1 | | | 6,800 | | | | 83,640 | |

Arrowhead Pharmaceuticals, Inc.*1 | | | 27,700 | | | | 119,941 | |

| Ascent Capital Group, Inc. - Class A* | | | 7,100 | | | | 92,584 | |

| Assembly Biosciences, Inc.* | | | 5,023 | | | | 175,403 | |

| Barrett Business Services, Inc. | | | 1,700 | | | | 96,101 | |

| Bovie Medical Corp.* | | | 14,700 | | | | 49,686 | |

| Brookdale Senior Living, Inc.* | | | 17,400 | | | | 184,440 | |

| CAI International, Inc.* | | | 13,500 | | | | 409,320 | |

| Cambium Learning Group, Inc.* | | | 7,000 | | | | 46,410 | |

| Career Education Corp.* | | | 15,506 | | | | 161,107 | |

| Carriage Services, Inc. | | | 4,900 | | | | 125,440 | |

| CBIZ, Inc.* | | | 14,300 | | | | 232,375 | |

| Celldex Therapeutics, Inc.* | | | 35,800 | | | | 102,388 | |

| Central Garden & Pet Co. - Class A* | | | 31,370 | | | | 1,166,650 | |

| Chemed Corp. | | | 1,000 | | | | 202,050 | |

| Chiasma, Inc.* | | | 18,400 | | | | 46,920 | |

| Chimerix, Inc.* | | | 10,500 | | | | 55,125 | |

| Civeo Corp.* | | | 58,400 | | | | 166,440 | |

Community Health Systems, Inc.*1 | | | 18,500 | | | | 142,080 | |

| CONMED Corp. | | | 10,700 | | | | 561,429 | |

| CorVel Corp.* | | | 3,300 | | | | 179,520 | |

| CRA International, Inc. | | | 5,800 | | | | 238,090 | |

| Cross Country Healthcare, Inc.* | | | 2,800 | | | | 39,844 | |

COMMON STOCKS (Continued) | | | | | | | | |

CONSUMER, NON-CYCLICAL (Continued) | | | | | |

| CSS Industries, Inc. | | | 7,200 | | | | 207,504 | |

| Cutera, Inc.* | | | 4,300 | | | | 177,805 | |

| Darling Ingredients, Inc.* | | | 53,300 | | | | 933,816 | |

| Dimension Therapeutics, Inc.* | | | 15,948 | | | | 95,688 | |

| Diplomat Pharmacy, Inc.* | | | 15,200 | | | | 314,792 | |

| Dynavax Technologies Corp.* | | | 15,300 | | | | 328,950 | |

| Enanta Pharmaceuticals, Inc.* | | | 4,400 | | | | 205,920 | |

| Endo International PLC* | | | 29,800 | | | | 255,237 | |

| Ennis, Inc. | | | 12,100 | | | | 237,765 | |

Ensign Group, Inc.1 | | | 5,340 | | | | 120,631 | |

Entellus Medical, Inc.*1 | | | 5,100 | | | | 94,146 | |

| Epizyme, Inc.* | | | 3,300 | | | | 62,865 | |

Esperion Therapeutics, Inc.*1 | | | 4,400 | | | | 220,528 | |

| Everi Holdings, Inc.* | | | 17,000 | | | | 129,030 | |

| Exactech, Inc.* | | | 4,900 | | | | 161,455 | |

| Exelixis, Inc.* | | | 12,350 | | | | 299,241 | |

| FONAR Corp.* | | | 1,900 | | | | 57,950 | |

| Franklin Covey Co.* | | | 3,700 | | | | 75,110 | |

| Fresh Del Monte Produce, Inc. | | | 25,000 | | | | 1,136,500 | |

| FTI Consulting, Inc.* | | | 12,200 | | | | 432,856 | |

| Grand Canyon Education, Inc.* | | | 2,700 | | | | 245,214 | |

| Great Lakes Dredge & Dock Corp.* | | | 43,100 | | | | 209,035 | |

| Green Dot Corp. - Class A* | | | 14,100 | | | | 699,078 | |

| Halyard Health, Inc.* | | | 1,900 | | | | 85,557 | |

| Harvard Bioscience, Inc.* | | | 13,900 | | | | 52,125 | |

| HealthEquity, Inc.* | | | 1,600 | | | | 80,928 | |

| Heidrick & Struggles International, Inc. | | | 6,600 | | | | 139,590 | |

Hertz Global Holdings, Inc.*1 | | | 34,900 | | | | 780,364 | |

| Huron Consulting Group, Inc.* | | | 1,800 | | | | 61,740 | |

| ICF International, Inc.* | | | 8,798 | | | | 474,652 | |

| ICU Medical, Inc.* | | | 1,600 | | | | 297,360 | |

| Ignyta, Inc.* | | | 9,400 | | | | 116,090 | |

| Immunomedics, Inc.* | | | 11,400 | | | | 159,372 | |

| Impax Laboratories, Inc.* | | | 21,200 | | | | 430,360 | |

| Ingles Markets, Inc. - Class A | | | 6,450 | | | | 165,765 | |

Innoviva, Inc.*1 | | | 12,300 | | | | 173,676 | |

| Inogen, Inc.* | | | 1,400 | | | | 133,140 | |

Inotek Pharmaceuticals Corp.*1 | | | 39,800 | | | | 70,844 | |

| Insmed, Inc.* | | | 1,900 | | | | 59,299 | |

| Insperity, Inc. | | | 2,950 | | | | 259,600 | |

| Integer Holdings Corp.* | | | 11,560 | | | | 591,294 | |

| Inter Parfums, Inc. | | | 2,800 | | | | 115,500 | |

Invacare Corp.1 | | | 11,200 | | | | 176,400 | |

| John B Sanfilippo & Son, Inc. | | | 3,168 | | | | 213,238 | |

| Juno Therapeutics, Inc.* | | | 4,200 | | | | 188,412 | |

| K12, Inc.* | | | 16,250 | | | | 289,900 | |

| Karyopharm Therapeutics, Inc.* | | | 5,300 | | | | 58,194 | |

See accompanying Notes to Financial Statements.

7

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2017

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | |

CONSUMER, NON-CYCLICAL (Continued) | | | | |

| Kelly Services, Inc. - Class A | | | 10,000 | | | $ | 250,900 | |

| Korn/Ferry International | | | 9,020 | | | | 355,659 | |

| Landauer, Inc. | | | 1,300 | | | | 87,490 | |

| Lantheus Holdings, Inc.* | | | 7,200 | | | | 128,160 | |

LendingTree, Inc.*1 | | | 1,900 | | | | 464,455 | |

| LHC Group, Inc.* | | | 6,600 | | | | 468,072 | |

| LifePoint Health, Inc.* | | | 9,400 | | | | 544,260 | |

| LSC Communications, Inc. | | | 1,637 | | | | 27,027 | |

| MacroGenics, Inc.* | | | 3,000 | | | | 55,440 | |

| Magellan Health, Inc.* | | | 10,100 | | | | 871,630 | |

| Matthews International Corp. - Class A | | | 2,130 | | | | 132,593 | |

| McGrath RentCorp | | | 8,035 | | | | 351,531 | |

| Merit Medical Systems, Inc.* | | | 11,500 | | | | 487,025 | |

Merrimack Pharmaceuticals, Inc.1 | | | 5,000 | | | | 72,700 | |

MGP Ingredients, Inc.1 | | | 3,446 | | | | 208,931 | |

| Molina Healthcare, Inc.* | | | 5,500 | | | | 378,180 | |

| Momenta Pharmaceuticals, Inc.* | | | 9,700 | | | | 179,450 | |

| MoneyGram International, Inc.* | | | 15,900 | | | | 256,149 | |

| Myriad Genetics, Inc.* | | | 25,400 | | | | 918,972 | |

| National HealthCare Corp. | | | 2,800 | | | | 175,196 | |

| Natural Alternatives International, Inc.* | | | 5,100 | | | | 54,315 | |

| Nature's Sunshine Products, Inc. | | | 4,800 | | | | 48,720 | |

| Navigant Consulting, Inc.* | | | 13,900 | | | | 235,188 | |

| Neff Corp. - Class A* | | | 5,300 | | | | 132,500 | |

Omega Protein Corp.1 | | | 12,317 | | | | 205,078 | |

| On Assignment, Inc.* | | | 1,000 | | | | 53,680 | |

| OraSure Technologies, Inc.* | | | 8,200 | | | | 184,500 | |

| Pacific Biosciences of California, Inc.* | | | 10,500 | | | | 55,125 | |

| PDL BioPharma, Inc.* | | | 72,300 | | | | 245,097 | |

| PharMerica Corp.* | | | 13,600 | | | | 398,480 | |

Post Holdings, Inc.*1 | | | 3,850 | | | | 339,839 | |

| Prestige Brands Holdings, Inc.* | | | 2,510 | | | | 125,726 | |

Prothena Corp. PLC*1 | | | 900 | | | | 58,293 | |

| PTC Therapeutics, Inc.* | | | 5,800 | | | | 116,058 | |

| Quad/Graphics, Inc. | | | 12,725 | | | | 287,712 | |

| Quorum Health Corp.* | | | 15,700 | | | | 81,326 | |

| RadNet, Inc.* | | | 22,069 | | | | 254,897 | |

| REGENXBIO, Inc.* | | | 3,200 | | | | 105,440 | |

| RPX Corp.* | | | 35,200 | | | | 467,456 | |

| RTI Surgical, Inc.* | | | 14,800 | | | | 67,340 | |

| Sanderson Farms, Inc. | | | 4,450 | | | | 718,764 | |

| SciClone Pharmaceuticals, Inc.* | | | 13,532 | | | | 151,558 | |

| Seaboard Corp. | | | 64 | | | | 288,320 | |

| SEACOR Marine Holdings, Inc.* | | | 10,912 | | | | 170,664 | |

| Select Medical Holdings Corp.* | | | 48,949 | | | | 939,821 | |

| Seneca Foods Corp. - Class A* | | | 3,700 | | | | 127,650 | |

| Smart & Final Stores, Inc.* | | | 6,400 | | | | 50,240 | |

COMMON STOCKS (Continued) | | | | | | | | |

CONSUMER, NON-CYCLICAL (Continued) | | | | | |

| Snyder's-Lance, Inc. | | | 7,700 | | | | 293,678 | |

| Sotheby's* | | | 3,300 | | | | 152,163 | |

| SP Plus Corp.* | | | 2,400 | | | | 94,800 | |

| SpartanNash Co. | | | 20,600 | | | | 543,222 | |

| Spectrum Pharmaceuticals, Inc.* | | | 24,500 | | | | 344,715 | |

| Strayer Education, Inc. | | | 850 | | | | 74,180 | |

T2 Biosystems, Inc.*1 | | | 13,800 | | | | 57,960 | |

Textainer Group Holdings Ltd.*1 | | | 11,600 | | | | 198,940 | |

Tivity Health, Inc.*1 | | | 10,000 | | | | 408,000 | |

| Trevena, Inc.* | | | 10,800 | | | | 27,540 | |

| TriNet Group, Inc.* | | | 8,000 | | | | 268,960 | |

| Triple-S Management Corp. - Class B* | | | 10,500 | | | | 248,640 | |

| United Natural Foods, Inc.* | | | 15,400 | | | | 640,486 | |

| Universal Corp. | | | 4,010 | | | | 229,773 | |

| Vectrus, Inc.* | | | 1,500 | | | | 46,260 | |

| Viad Corp. | | | 7,500 | | | | 456,750 | |

| Vital Therapies, Inc.* | | | 16,100 | | | | 81,305 | |

| Voyager Therapeutics, Inc.* | | | 6,800 | | | | 140,012 | |

Weight Watchers International, Inc.*1 | | | 5,200 | | | | 226,460 | |

| Weis Markets, Inc. | | | 4,652 | | | | 202,362 | |

| WellCare Health Plans, Inc.* | | | 600 | | | | 103,044 | |

| Willdan Group, Inc.* | | | 1,600 | | | | 51,936 | |

| | | | | | | | 37,757,215 | |

ENERGY – 6.7% | | | | | | | | |

| Adams Resources & Energy, Inc. | | | 2,975 | | | | 123,462 | |

| Andeavor | | | 4,002 | | | | 412,806 | |

| Archrock, Inc. | | | 48,500 | | | | 608,675 | |

Atwood Oceanics, Inc.*1 | | | 46,600 | | | | 437,574 | |

| Bill Barrett Corp.* | | | 47,900 | | | | 205,491 | |

Bristow Group, Inc.1 | | | 22,300 | | | | 208,505 | |

California Resources Corp.*1 | | | 14,200 | | | | 148,532 | |

| Callon Petroleum Co.* | | | 34,900 | | | | 392,276 | |

CARBO Ceramics, Inc.*1 | | | 7,400 | | | | 63,862 | |

| Clean Energy Fuels Corp.* | | | 26,500 | | | | 65,720 | |

| CONSOL Energy, Inc.* | | | 6,600 | | | | 111,804 | |

| Delek U.S. Holdings, Inc. | | | 44,838 | | | | 1,198,520 | |

| Denbury Resources, Inc.* | | | 75,200 | | | | 100,768 | |

Diamond Offshore Drilling, Inc.*1 | | | 18,500 | | | | 268,250 | |

| Dril-Quip, Inc.* | | | 2,100 | | | | 92,715 | |

| Eclipse Resources Corp.* | | | 17,100 | | | | 42,750 | |

Ensco PLC - Class A1 | | | 61,300 | | | | 365,961 | |

| Era Group, Inc.* | | | 12,100 | | | | 135,399 | |

| Exterran Corp.* | | | 8,900 | | | | 281,329 | |

| First Solar, Inc.* | | | 3,900 | | | | 178,932 | |

| Forum Energy Technologies, Inc.* | | | 18,507 | | | | 294,261 | |

FuelCell Energy, Inc.*1 | | | 21,200 | | | | 37,100 | |

| FutureFuel Corp. | | | 10,400 | | | | 163,696 | |

See accompanying Notes to Financial Statements.

8

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2017

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | |

ENERGY (Continued) | | | | | | |

| Geospace Technologies Corp.* | | | 4,300 | | | $ | 76,626 | |

| Green Plains, Inc. | | | 19,700 | | | | 396,955 | |

Gulf Island Fabrication, Inc.1 | | | 5,500 | | | | 69,850 | |

| Hallador Energy Co. | | | 5,300 | | | | 30,316 | |

| Helix Energy Solutions Group, Inc.* | | | 35,700 | | | | 263,823 | |

| Jones Energy, Inc. - Class A* | | | 23,700 | | | | 45,504 | |

Matador Resources Co.*1 | | | 15,900 | | | | 431,685 | |

| Matrix Service Co.* | | | 14,300 | | | | 217,360 | |

| McDermott International, Inc.* | | | 125,140 | | | | 909,768 | |

| MRC Global, Inc.* | | | 24,400 | | | | 426,756 | |

| Murphy USA, Inc.* | | | 2,300 | | | | 158,700 | |

| Nabors Industries Ltd. | | | 39,000 | | | | 314,730 | |

| Natural Gas Services Group, Inc.* | | | 10,341 | | | | 293,684 | |

| Newpark Resources, Inc.* | | | 32,400 | | | | 324,000 | |

Noble Corp. plc*1 | | | 73,400 | | | | 337,640 | |

| Noble Energy, Inc. | | | 9,210 | | | | 261,196 | |

| Oasis Petroleum, Inc.* | | | 73,100 | | | | 666,672 | |

| Oceaneering International, Inc. | | | 9,800 | | | | 257,446 | |

| Oil States International, Inc.* | | | 7,500 | | | | 190,125 | |

| Pacific Ethanol, Inc.* | | | 20,700 | | | | 114,885 | |

| Parsley Energy, Inc. - Class A* | | | 4,000 | | | | 105,360 | |

| Patterson-UTI Energy, Inc. | | | 35,500 | | | | 743,370 | |

PBF Energy, Inc. - Class A1 | | | 35,700 | | | | 985,677 | |

| PDC Energy, Inc.* | | | 15,900 | | | | 779,577 | |

| Pioneer Energy Services Corp.* | | | 45,800 | | | | 116,790 | |

Plug Power, Inc.*1 | | | 27,100 | | | | 70,731 | |

Renewable Energy Group, Inc.*1 | | | 18,400 | | | | 223,560 | |

REX American Resources Corp.*1 | | | 5,218 | | | | 489,605 | |

| Rice Energy, Inc.* | | | 5,000 | | | | 144,700 | |

| Ring Energy, Inc.* | | | 9,300 | | | | 134,757 | |

| Rowan Cos. Plc - Class A* | | | 42,800 | | | | 549,980 | |

RPC, Inc.1 | | | 20,900 | | | | 518,111 | |

| RSP Permian, Inc.* | | | 14,550 | | | | 503,284 | |

| SEACOR Holdings, Inc.* | | | 9,354 | | | | 431,313 | |

SemGroup Corp. - Class A1 | | | 12,800 | | | | 368,000 | |

Stone Energy Corp.*1 | | | 5,500 | | | | 159,830 | |

| SunCoke Energy, Inc.* | | | 34,600 | | | | 316,244 | |

| Superior Energy Services, Inc.* | | | 13,600 | | | | 145,248 | |

| TETRA Technologies, Inc.* | | | 44,800 | | | | 128,128 | |

| Transocean Ltd.* | | | 39,800 | | | | 428,248 | |

| Unit Corp.* | | | 23,000 | | | | 473,340 | |

| W&T Offshore, Inc.* | | | 19,900 | | | | 60,695 | |

| Willbros Group, Inc.* | | | 23,807 | | | | 76,659 | |

| WPX Energy, Inc.* | | | 38,050 | | | | 437,575 | |

| | | | | | | | 20,116,891 | |

COMMON STOCKS (Continued) | | | | | | | | |

FINANCIAL – 27.0% | | | | | | | | |

| 1st Source Corp. | | | 10,812 | | | | 549,250 | |

| Access National Corp. | | | 1,702 | | | | 48,779 | |

| ACNB Corp. | | | 2,100 | | | | 58,170 | |

| Air Lease Corp. | | | 12,700 | | | | 541,274 | |

| Aircastle Ltd. | | | 19,560 | | | | 435,992 | |

| Alexander & Baldwin, Inc. | | | 3,900 | | | | 180,687 | |

| Allegiance Bancshares, Inc.* | | | 800 | | | | 29,440 | |

| Ambac Financial Group, Inc.* | | | 11,800 | | | | 203,668 | |

| American Equity Investment Life Holding Co. | | | 44,890 | | | | 1,305,401 | |

| American National Bankshares, Inc. | | | 1,366 | | | | 56,279 | |

| American National Insurance Co. | | | 1,900 | | | | 224,352 | |

| American River Bankshares | | | 1,300 | | | | 18,239 | |

Ameris Bancorp1 | | | 6,300 | | | | 302,400 | |

| AMERISAFE, Inc. | | | 6,688 | | | | 389,242 | |

| AmeriServ Financial, Inc. | | | 6,700 | | | | 26,800 | |

| Ames National Corp. | | | 500 | | | | 14,925 | |

| Argo Group International Holdings Ltd. | | | 8,794 | | | | 540,831 | |

| Arrow Financial Corp. | | | 1,435 | | | | 49,292 | |

| Artisan Partners Asset Management, Inc. - Class A | | | 6,700 | | | | 218,420 | |

| Aspen Insurance Holdings Ltd. | | | 5,060 | | | | 204,424 | |

| Associated Banc-Corp | | | 9,400 | | | | 227,950 | |

| Astoria Financial Corp. | | | 37,700 | | | | 810,550 | |

| Atlantic Coast Financial Corp.* | | | 3,000 | | | | 26,430 | |

| Atlas Financial Holdings, Inc.* | | | 2,500 | | | | 47,250 | |

| Baldwin & Lyons, Inc. - Class B | | | 7,000 | | | | 157,850 | |

| BancFirst Corp. | | | 2,384 | | | | 135,292 | |

| Bancorp, Inc.* | | | 18,300 | | | | 151,341 | |

| BancorpSouth, Inc. | | | 14,500 | | | | 464,725 | |

| Bank Mutual Corp. | | | 11,501 | | | | 116,735 | |

| Bank of Commerce Holdings | | | 5,400 | | | | 62,100 | |

| Bank of Hawaii Corp. | | | 1,700 | | | | 141,712 | |

| Bank of Marin Bancorp | | | 1,055 | | | | 72,267 | |

| BankFinancial Corp. | | | 9,450 | | | | 150,160 | |

| Bankwell Financial Group, Inc. | | | 1,600 | | | | 59,104 | |

| Banner Corp. | | | 3,110 | | | | 190,581 | |

| Bar Harbor Bankshares | | | 5,854 | | | | 183,581 | |

Bear State Financial, Inc.1 | | | 4,900 | | | | 50,274 | |

| Beneficial Bancorp, Inc. | | | 8,600 | | | | 142,760 | |

| Berkshire Hills Bancorp, Inc. | | | 9,036 | | | | 350,145 | |

| BOK Financial Corp. | | | 4,200 | | | | 374,136 | |

| Boston Private Financial Holdings, Inc. | | | 11,900 | | | | 196,945 | |

| Bridge Bancorp, Inc. | | | 2,300 | | | | 78,085 | |

| Brookline Bancorp, Inc. | | | 25,600 | | | | 396,800 | |

| Bryn Mawr Bank Corp. | | | 477 | | | | 20,893 | |

| C&F Financial Corp. | | | 500 | | | | 27,500 | |

See accompanying Notes to Financial Statements.

9

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2017

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | |

FINANCIAL (Continued) | | | | | | |

| Camden National Corp. | | | 4,271 | | | $ | 186,386 | |

| Canadian Imperial Bank of Commerce | | | 6,492 | | | | 568,180 | |

| Capital Bank Financial Corp. - Class A | | | 6,722 | | | | 275,938 | |

| Capital City Bank Group, Inc. | | | 3,545 | | | | 85,115 | |

| Capitol Federal Financial, Inc. | | | 29,900 | | | | 439,530 | |

| Carolina Financial Corp. | | | 3,600 | | | | 129,168 | |

| Cass Information Systems, Inc. | | | 1,400 | | | | 88,816 | |

| Cathay General Bancorp | | | 18,000 | | | | 723,600 | |

| CenterState Bank Corp. | | | 8,200 | | | | 219,760 | |

| Central Pacific Financial Corp. | | | 3,000 | | | | 96,540 | |

| Central Valley Community Bancorp | | | 7,760 | | | | 173,048 | |

| Century Bancorp, Inc. - Class A | | | 815 | | | | 65,282 | |

| Charter Financial Corp. | | | 2,700 | | | | 50,031 | |

| Chemical Financial Corp. | | | 11,490 | | | | 600,467 | |

| Citizens & Northern Corp. | | | 700 | | | | 17,192 | |

City Holding Co.1 | | | 3,499 | | | | 251,613 | |

| Civista Bancshares, Inc. | | | 5,240 | | | | 117,062 | |

| Clifton Bancorp, Inc. | | | 6,400 | | | | 107,008 | |

| CNB Financial Corp. | | | 4,430 | | | | 121,028 | |

| CNO Financial Group, Inc. | | | 54,580 | | | | 1,273,897 | |

| CoBiz Financial, Inc. | | | 4,300 | | | | 84,452 | |

| Codorus Valley Bancorp, Inc. | | | 1,118 | | | | 34,334 | |

| Colony Bankcorp, Inc. | | | 3,800 | | | | 50,920 | |

| Columbia Banking System, Inc. | | | 13,600 | | | | 572,696 | |

| Community Bank System, Inc. | | | 4,872 | | | | 269,178 | |

Community Bankers Trust Corp.*1 | | | 3,286 | | | | 30,231 | |

Community Financial Corp.1 | | | 900 | | | | 31,833 | |

| Community Trust Bancorp, Inc. | | | 680 | | | | 31,620 | |

| ConnectOne Bancorp, Inc. | | | 3,800 | | | | 93,480 | |

| Consumer Portfolio Services, Inc.* | | | 14,700 | | | | 67,032 | |

| County Bancorp, Inc. | | | 1,800 | | | | 54,090 | |

| Cowen, Inc.* | | | 6,650 | | | | 118,370 | |

| Crawford & Co. - Class B | | | 8,300 | | | | 99,268 | |

| CU Bancorp* | | | 2,352 | | | | 91,199 | |

| Customers Bancorp, Inc.* | | | 6,050 | | | | 197,351 | |

| CVB Financial Corp. | | | 16,200 | | | | 391,554 | |

| Dime Community Bancshares, Inc. | | | 4,900 | | | | 105,350 | |

| Donegal Group, Inc. - Class A | | | 5,031 | | | | 81,150 | |

| Eagle Bancorp, Inc.* | | | 2,137 | | | | 143,286 | |

| eHealth, Inc.* | | | 4,650 | | | | 111,088 | |

| EMC Insurance Group, Inc. | | | 7,749 | | | | 218,134 | |

| Employers Holdings, Inc. | | | 18,200 | | | | 827,190 | |

Encore Capital Group, Inc.*1 | | | 6,800 | | | | 301,240 | |

| Enova International, Inc.* | | | 10,200 | | | | 137,190 | |

| Enstar Group Ltd.* | | | 2,500 | | | | 555,875 | |

| Enterprise Bancorp, Inc. | | | 4,500 | | | | 163,395 | |

| Enterprise Financial Services Corp. | | | 3,100 | | | | 131,285 | |

COMMON STOCKS (Continued) | | | | | | | | |

FINANCIAL (Continued) | | | | | | | | |

| ESSA Bancorp, Inc. | | | 11,128 | | | | 174,710 | |

| Evans Bancorp, Inc. | | | 2,900 | | | | 125,280 | |

| Farmers Capital Bank Corp. | | | 2,000 | | | | 84,100 | |

Farmers National Banc Corp.1 | | | 5,600 | | | | 84,280 | |

| FBL Financial Group, Inc. - Class A | | | 14,400 | | | | 1,072,800 | |

| Federal Agricultural Mortgage Corp. - Class C | | | 7,808 | | | | 567,954 | |

Fidelity & Guaranty Life1 | | | 3,310 | | | | 102,775 | |

| Fidelity Southern Corp. | | | 9,107 | | | | 215,289 | |

| Financial Institutions, Inc. | | | 3,930 | | | | 113,184 | |

| First American Financial Corp. | | | 7,460 | | | | 372,776 | |

| First Bancorp, Inc. | | | 3,070 | | | | 93,052 | |

| First BanCorp/Puerto Rico* | | | 48,800 | | | | 249,856 | |

| First Bancorp/Southern Pines NC | | | 5,900 | | | | 203,019 | |

First Bancshares, Inc.1 | | | 1,086 | | | | 32,743 | |

| First Bank/Hamilton NJ | | | 1,300 | | | | 17,290 | |

| First Busey Corp. | | | 14,229 | | | | 446,221 | |

| First Business Financial Services, Inc. | | | 1,212 | | | | 27,573 | |

| First Citizens BancShares, Inc. - Class A | | | 1,100 | | | | 411,279 | |

| First Commonwealth Financial Corp. | | | 33,960 | | | | 479,855 | |

| First Community Bancshares, Inc. | | | 3,700 | | | | 107,707 | |

| First Defiance Financial Corp. | | | 7,850 | | | | 412,046 | |

| First Financial Bancorp | | | 12,900 | | | | 337,335 | |

First Financial Bankshares, Inc.1 | | | 5,900 | | | | 266,680 | |

| First Financial Corp. | | | 3,081 | | | | 146,656 | |

| First Financial Northwest, Inc. | | | 5,400 | | | | 91,746 | |

| First Horizon National Corp. | | | 13,000 | | | | 248,950 | |

| First Internet Bancorp | | | 1,900 | | | | 61,370 | |

| First Interstate BancSystem, Inc. - Class A | | | 7,926 | | | | 303,169 | |

| First Merchants Corp. | | | 12,605 | | | | 541,133 | |

| First Mid-Illinois Bancshares, Inc. | | | 1,732 | | | | 66,509 | |

| First Midwest Bancorp, Inc. | | | 28,600 | | | | 669,812 | |

| First of Long Island Corp. | | | 5,025 | | | | 153,011 | |

| First United Corp.* | | | 6,300 | | | | 103,950 | |

| Flagstar Bancorp, Inc.* | | | 4,200 | | | | 149,016 | |

| Flushing Financial Corp. | | | 8,900 | | | | 264,508 | |

| FNB Corp. | | | 43,652 | | | | 612,438 | |

| FNFV Group* | | | 17,400 | | | | 298,410 | |

| Forestar Group, Inc.* | | | 8,300 | | | | 142,760 | |

| Franklin Financial Network, Inc.* | | | 2,100 | | | | 74,865 | |

| Fulton Financial Corp. | | | 56,400 | | | | 1,057,500 | |

| GAIN Capital Holdings, Inc. | | | 5,200 | | | | 33,228 | |

| Genworth Financial, Inc. - Class A* | | | 34,500 | | | | 132,825 | |

| German American Bancorp, Inc. | | | 6,387 | | | | 242,898 | |

Glacier Bancorp, Inc.1 | | | 13,400 | | | | 505,984 | |

| Global Indemnity Ltd.* | | | 2,000 | | | | 84,800 | |

| Great Southern Bancorp, Inc. | | | 2,415 | | | | 134,395 | |

See accompanying Notes to Financial Statements.

10

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2017

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | |

FINANCIAL (Continued) | | | | | | |

| Great Western Bancorp, Inc. | | | 4,960 | | | $ | 204,749 | |

| Green Bancorp, Inc.* | | | 12,500 | | | | 295,625 | |

| Greenlight Capital Re Ltd. - Class A* | | | 6,900 | | | | 149,385 | |

| Guaranty Bancorp | | | 3,000 | | | | 83,400 | |

| Guaranty Federal Bancshares, Inc. | | | 965 | | | | 20,661 | |

| Hallmark Financial Services, Inc.* | | | 12,699 | | | | 147,435 | |

| Hancock Holding Co. | | | 22,700 | | | | 1,099,815 | |

| Hanmi Financial Corp. | | | 6,200 | | | | 191,890 | |

| Hanover Insurance Group, Inc. | | | 6,900 | | | | 668,817 | |

HCI Group, Inc.1 | | | 4,200 | | | | 160,650 | |

| Heartland Financial USA, Inc. | | | 3,500 | | | | 172,900 | |

| Heritage Commerce Corp. | | | 7,540 | | | | 107,294 | |

| Heritage Financial Corp. | | | 7,070 | | | | 208,565 | |

Heritage Insurance Holdings, Inc.1 | | | 7,400 | | | | 97,754 | |

| HFF, Inc. - Class A | | | 7,200 | | | | 284,832 | |

| Hilltop Holdings, Inc. | | | 18,147 | | | | 471,822 | |

| HMN Financial, Inc.* | | | 1,020 | | | | 18,207 | |

| Home Bancorp, Inc. | | | 3,920 | | | | 163,934 | |

| HomeStreet, Inc.* | | | 4,200 | | | | 113,400 | |

| Hope Bancorp, Inc. | | | 12,217 | | | | 216,363 | |

| Horace Mann Educators Corp. | | | 15,900 | | | | 625,665 | |

| Horizon Bancorp | | | 4,561 | | | | 133,044 | |

| Huntington Bancshares, Inc. | | | 19,336 | | | | 269,931 | |

| IBERIABANK Corp. | | | 9,971 | | | | 819,118 | |

| Independence Holding Co. | | | 6,550 | | | | 165,387 | |

| Independent Bank Corp. | | | 4,889 | | | | 110,736 | |

| Independent Bank Corp./Rockland MA | | | 7,400 | | | | 552,410 | |

| Independent Bank Group, Inc. | | | 3,300 | | | | 198,990 | |

| Infinity Property & Casualty Corp. | | | 6,740 | | | | 634,908 | |

| International Bancshares Corp. | | | 17,700 | | | | 709,770 | |

| INTL. FCStone, Inc.* | | | 3,445 | | | | 132,012 | |

| Investment Technology Group, Inc. | | | 6,775 | | | | 149,998 | |

| Investors Title Co. | | | 1,000 | | | | 179,070 | |

| Janus Henderson Group PLC | | | 15,478 | | | | 539,254 | |

| Kearny Financial Corp. | | | 14,800 | | | | 227,180 | |

| Kemper Corp. | | | 22,330 | | | | 1,183,490 | |

| Lakeland Bancorp, Inc. | | | 13,435 | | | | 274,074 | |

| Lakeland Financial Corp. | | | 6,050 | | | | 294,756 | |

| Legg Mason, Inc. | | | 7,200 | | | | 283,032 | |

| LPL Financial Holdings, Inc. | | | 6,200 | | | | 319,734 | |

| Macatawa Bank Corp. | | | 4,200 | | | | 43,092 | |

| Maiden Holdings Ltd. | | | 37,040 | | | | 294,468 | |

| MainSource Financial Group, Inc. | | | 8,082 | | | | 289,821 | |

Malvern Bancorp, Inc.*1 | | | 2,546 | | | | 68,106 | |

| Marlin Business Services Corp. | | | 7,400 | | | | 212,750 | |

| MB Financial, Inc. | | | 12,543 | | | | 564,686 | |

| MBIA, Inc.* | | | 18,300 | | | | 159,210 | |

COMMON STOCKS (Continued) | | | | | | | | |

FINANCIAL (Continued) | | | | | | | | |

| MBT Financial Corp. | | | 7,000 | | | | 76,650 | |

| Mercantile Bank Corp. | | | 4,830 | | | | 168,567 | |

| Mercury General Corp. | | | 14,100 | | | | 799,329 | |

| Meridian Bancorp, Inc. | | | 6,700 | | | | 124,955 | |

| Meta Financial Group, Inc. | | | 2,600 | | | | 203,840 | |

| MGIC Investment Corp.* | | | 59,400 | | | | 744,282 | |

| MidWestOne Financial Group, Inc. | | | 2,100 | | | | 70,896 | |

| MutualFirst Financial, Inc. | | | 2,626 | | | | 100,970 | |

National Bankshares, Inc.1 | | | 1,700 | | | | 76,415 | |

| National Commerce Corp.* | | | 2,600 | | | | 111,280 | |

| National Western Life Group, Inc. - Class A | | | 1,900 | | | | 663,100 | |

| Nationstar Mortgage Holdings, Inc.* | | | 8,200 | | | | 152,274 | |

| Navigators Group, Inc. | | | 19,666 | | | | 1,147,511 | |

| NBT Bancorp, Inc. | | | 5,400 | | | | 198,288 | |

| Nelnet, Inc. - Class A | | | 6,700 | | | | 338,350 | |

| NewStar Financial, Inc. | | | 8,200 | | | | 96,268 | |

| Nicolet Bankshares, Inc.* | | | 2,265 | | | | 130,305 | |

| NMI Holdings, Inc. - Class A* | | | 29,500 | | | | 365,800 | |

| Northeast Bancorp | | | 2,410 | | | | 63,022 | |

| Northrim BanCorp, Inc. | | | 2,520 | | | | 88,074 | |

| Northwest Bancshares, Inc. | | | 20,108 | | | | 347,265 | |

| OceanFirst Financial Corp. | | | 14,809 | | | | 407,099 | |

OFG Bancorp1 | | | 17,700 | | | | 161,955 | |

| Old Line Bancshares, Inc. | | | 1,300 | | | | 36,400 | |

| Old National Bancorp | | | 33,566 | | | | 614,258 | |

Old Point Financial Corp.1 | | | 861 | | | | 27,896 | |

| Old Second Bancorp, Inc. | | | 14,600 | | | | 196,370 | |

| Opus Bank | | | 2,400 | | | | 57,600 | |

| Oritani Financial Corp. | | | 8,152 | | | | 136,954 | |

| Orrstown Financial Services, Inc. | | | 2,733 | | | | 68,052 | |

| Pacific Premier Bancorp, Inc.* | | | 5,778 | | | | 218,119 | |

| Park National Corp. | | | 2,100 | | | | 226,779 | |

| Park Sterling Corp. | | | 22,389 | | | | 278,071 | |

| Parke Bancorp, Inc. | | | 2,904 | | | | 64,469 | |

| Pathfinder Bancorp, Inc. | | | 1,600 | | | | 24,272 | |

| Peapack Gladstone Financial Corp. | | | 5,295 | | | | 178,653 | |

| Penns Woods Bancorp, Inc. | | | 1,000 | | | | 46,470 | |

| Peoples Bancorp, Inc. | | | 1,800 | | | | 60,462 | |

| PHH Corp.* | | | 10,300 | | | | 143,479 | |

| Pinnacle Financial Partners, Inc. | | | 13,823 | | | | 925,450 | |

| Piper Jaffray Cos. | | | 5,300 | | | | 314,555 | |

| Preferred Bank/Los Angeles CA | | | 7,100 | | | | 428,485 | |

| Premier Financial Bancorp, Inc. | | | 2,530 | | | | 55,129 | |

| Primerica, Inc. | | | 2,200 | | | | 179,410 | |

| ProAssurance Corp. | | | 5,500 | | | | 300,575 | |

| Provident Financial Holdings, Inc. | | | 4,300 | | | | 84,280 | |

| Provident Financial Services, Inc. | | | 14,800 | | | | 394,716 | |

See accompanying Notes to Financial Statements.

11

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2017

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | |

FINANCIAL (Continued) | | | | | | |

| QCR Holdings, Inc. | | | 2,640 | | | $ | 120,120 | |

| Radian Group, Inc. | | | 11,700 | | | | 218,673 | |

| RE/MAX Holdings, Inc. - Class A | | | 1,500 | | | | 95,325 | |

| Regional Management Corp.* | | | 7,900 | | | | 191,259 | |

| Renasant Corp. | | | 13,203 | | | | 566,409 | |

| Riverview Bancorp, Inc. | | | 12,348 | | | | 103,723 | |

| RLI Corp. | | | 4,200 | | | | 240,912 | |

| S&T Bancorp, Inc. | | | 10,016 | | | | 396,433 | |

| Safety Insurance Group, Inc. | | | 6,550 | | | | 499,765 | |

| Sandy Spring Bancorp, Inc. | | | 4,031 | | | | 167,045 | |

| Seacoast Banking Corp. of Florida* | | | 7,875 | | | | 188,134 | |

| Security National Financial Corp. - Class A* | | | 6,442 | | | | 32,854 | |

| Selective Insurance Group, Inc. | | | 33,593 | | | | 1,808,983 | |

ServisFirst Bancshares, Inc.1 | | | 4,000 | | | | 155,400 | |

| Shore Bancshares, Inc. | | | 3,600 | | | | 59,940 | |

| SI Financial Group, Inc. | | | 3,700 | | | | 55,315 | |

| Sierra Bancorp | | | 7,700 | | | | 209,055 | |

| Simmons First National Corp. - Class A | | | 4,052 | | | | 234,611 | |

| SLM Corp.* | | | 10,600 | | | | 121,582 | |

| South State Corp. | | | 2,755 | | | | 248,088 | |

| Southern First Bancshares, Inc.* | | | 2,000 | | | | 72,700 | |

Southern National Bancorp of Virginia, Inc.1 | | | 3,504 | | | | 59,533 | |

| Southside Bancshares, Inc. | | | 7,666 | | | | 278,736 | |

| Southwest Bancorp, Inc. | | | 6,100 | | | | 168,055 | |

| St. Joe Co.* | | | 6,200 | | | | 116,870 | |

| State Auto Financial Corp. | | | 15,545 | | | | 407,745 | |

| State Bank Financial Corp. | | | 9,400 | | | | 269,310 | |

| State National Cos., Inc. | | | 9,750 | | | | 204,652 | |

| Sterling Bancorp | | | 39,009 | | | | 961,572 | |

| Stewart Information Services Corp. | | | 7,280 | | | | 274,893 | |

| Stifel Financial Corp. | | | 9,300 | | | | 497,178 | |

| Stock Yards Bancorp, Inc. | | | 4,450 | | | | 169,100 | |

| Summit Financial Group, Inc. | | | 4,001 | | | | 102,666 | |

| Sutherland Asset Management Corp. | | | 5,600 | | | | 87,920 | |

| Synovus Financial Corp. | | | 8,828 | | | | 406,618 | |

| TCF Financial Corp. | | | 3,900 | | | | 66,456 | |

| Texas Capital Bancshares, Inc.* | | | 3,800 | | | | 326,040 | |

| Third Point Reinsurance Ltd.* | | | 18,000 | | | | 280,800 | |

| Timberland Bancorp, Inc. | | | 4,878 | | | | 152,877 | |

| Tiptree, Inc. | | | 8,100 | | | | 50,625 | |

| Tompkins Financial Corp. | | | 2,729 | | | | 235,076 | |

Towne Bank/Portsmouth VA1 | | | 7,392 | | | | 247,632 | |

| TriCo Bancshares | | | 4,525 | | | | 184,394 | |

| TriState Capital Holdings, Inc.* | | | 6,900 | | | | 158,010 | |

| Triumph Bancorp, Inc.* | | | 5,400 | | | | 174,150 | |

| TrustCo Bank Corp. NY | | | 19,200 | | | | 170,880 | |

| Trustmark Corp. | | | 20,750 | | | | 687,240 | |

COMMON STOCKS (Continued) | | | | | | | | |

FINANCIAL (Continued) | | | | | | | | |

Two River Bancorp1 | | | 1,890 | | | | 37,460 | |

| Umpqua Holdings Corp. | | | 50,724 | | | | 989,625 | |

| Union Bankshares Corp. | | | 11,809 | | | | 416,858 | |

United Bankshares, Inc.1 | | | 4,341 | | | | 161,268 | |

| United Community Bancorp | | | 995 | | | | 19,154 | |

| United Community Banks, Inc. | | | 16,200 | | | | 462,348 | |

| United Community Financial Corp. | | | 40,760 | | | | 391,296 | |

| United Financial Bancorp, Inc. | | | 7,289 | | | | 133,316 | |

| United Fire Group, Inc. | | | 17,370 | | | | 795,893 | |

| United Insurance Holdings Corp. | | | 3,006 | | | | 48,998 | |

| United Security Bancshares/Fresno CA | | | 8,200 | | | | 77,900 | |

| Unity Bancorp, Inc. | | | 3,303 | | | | 65,399 | |

Universal Insurance Holdings, Inc.1 | | | 13,760 | | | | 316,480 | |

| Univest Corp. of Pennsylvania | | | 13,530 | | | | 432,960 | |

| Validus Holdings Ltd. | | | 7,900 | | | | 388,759 | |

| Valley National Bancorp | | | 5,191 | | | | 62,552 | |

| Veritex Holdings, Inc.* | | | 8,900 | | | | 239,944 | |

| Virtus Investment Partners, Inc. | | | 1,100 | | | | 127,655 | |

Waddell & Reed Financial, Inc. - Class A1 | | | 14,400 | | | | 289,008 | |

| Walker & Dunlop, Inc.* | | | 9,600 | | | | 502,368 | |

| Washington Federal, Inc. | | | 28,200 | | | | 948,930 | |

| Washington Trust Bancorp, Inc. | | | 1,900 | | | | 108,775 | |

| Waterstone Financial, Inc. | | | 8,924 | | | | 174,018 | |

| Webster Financial Corp. | | | 10,840 | | | | 569,642 | |

| WesBanco, Inc. | | | 11,343 | | | | 465,290 | |

| West Bancorporation, Inc. | | | 2,220 | | | | 54,168 | |

| Westamerica Bancorporation1 | | | 4,300 | | | | 256,022 | |

| Western New England Bancorp, Inc. | | | 13,581 | | | | 148,033 | |

| Wintrust Financial Corp. | | | 12,300 | | | | 963,213 | |

World Acceptance Corp.*1 | | | 2,500 | | | | 207,225 | |

| WSFS Financial Corp. | | | 7,159 | | | | 349,001 | |

| Xenith Bankshares, Inc.* | | | 3,120 | | | | 101,400 | |

| | | | | | | | 81,573,121 | |

INDUSTRIAL – 20.0% | | | | | | | | |

| AAON, Inc. | | | 9,400 | | | | 324,065 | |

| AAR Corp. | | | 18,300 | | | | 691,374 | |

| Actuant Corp. - Class A | | | 4,900 | | | | 125,440 | |

Advanced Emissions Solutions, Inc.1 | | | 4,000 | | | | 43,880 | |

| Advanced Energy Industries, Inc.* | | | 4,100 | | | | 331,116 | |

| Aegion Corp.* | | | 7,989 | | | | 185,984 | |

| Aerovironment, Inc.* | | | 4,500 | | | | 243,540 | |

| Air Transport Services Group, Inc.* | | | 45,900 | | | | 1,117,206 | |

| Alamo Group, Inc. | | | 5,500 | | | | 590,535 | |

| Albany International Corp. - Class A | | | 3,600 | | | | 206,640 | |

| Allied Motion Technologies, Inc. | | | 4,006 | | | | 101,512 | |

American Railcar Industries, Inc.1 | | | 2,600 | | | | 100,360 | |

| Ampco-Pittsburgh Corp. | | | 2,800 | | | | 48,720 | |

See accompanying Notes to Financial Statements.

12

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2017

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | |

INDUSTRIAL (Continued) | | | | | | |

Applied Optoelectronics, Inc.*1 | | | 2,200 | | | $ | 142,274 | |

| ArcBest Corp. | | | 7,100 | | | | 237,495 | |

Ardmore Shipping Corp.*1 | | | 13,600 | | | | 112,200 | |

| Argan, Inc. | | | 3,600 | | | | 242,100 | |

| Arotech Corp.* | | | 10,300 | | | | 43,260 | |

| Astec Industries, Inc. | | | 4,397 | | | | 246,276 | |

| Atlas Air Worldwide Holdings, Inc.* | | | 17,050 | | | | 1,121,890 | |

| AVX Corp. | | | 10,700 | | | | 195,061 | |

| Ballantyne Strong, Inc.* | | | 3,565 | | | | 21,747 | |

| Barnes Group, Inc. | | | 13,600 | | | | 957,984 | |

| Bel Fuse, Inc. - Class B | | | 2,780 | | | | 86,736 | |

| Belden, Inc. | | | 2,700 | | | | 217,431 | |

| Benchmark Electronics, Inc.* | | | 23,800 | | | | 812,770 | |

| Berry Global Group, Inc.* | | | 2,920 | | | | 165,418 | |

| Brady Corp. - Class A | | | 5,300 | | | | 201,135 | |

| Briggs & Stratton Corp. | | | 20,700 | | | | 486,450 | |

| BWX Technologies, Inc. | | | 6,800 | | | | 380,936 | |

| Casella Waste Systems, Inc. - Class A* | | | 11,100 | | | | 208,680 | |

| CECO Environmental Corp. | | | 8,800 | | | | 74,448 | |

Celadon Group, Inc.1 | | | 19,700 | | | | 132,975 | |

| Chart Industries, Inc.* | | | 9,200 | | | | 360,916 | |

| Chase Corp. | | | 1,700 | | | | 189,380 | |

Chicago Bridge & Iron Co. N.V.1 | | | 11,100 | | | | 186,480 | |

| Coherent, Inc.* | | | 5,789 | | | | 1,361,399 | |

| Colfax Corp.* | | | 3,200 | | | | 133,248 | |

| Columbus McKinnon Corp. | | | 7,600 | | | | 287,812 | |

| Comfort Systems USA, Inc. | | | 3,000 | | | | 107,100 | |

| Control4 Corp.* | | | 7,700 | | | | 226,842 | |

| Core Molding Technologies, Inc. | | | 4,700 | | | | 103,118 | |

| Covenant Transportation Group, Inc. - Class A* | | | 6,542 | | | | 189,587 | |

| Cree, Inc.* | | | 3,800 | | | | 107,122 | |

| CTS Corp. | | | 5,600 | | | | 134,960 | |

| Cubic Corp. | | | 4,900 | | | | 249,900 | |

| Curtiss-Wright Corp. | | | 11,600 | | | | 1,212,664 | |

| DHT Holdings, Inc. | | | 28,600 | | | | 113,828 | |

| Dorian LPG Ltd.* | | | 7,000 | | | | 47,740 | |

| Ducommun, Inc.* | | | 8,022 | | | | 257,105 | |

| Dycom Industries, Inc.* | | | 1,100 | | | | 94,468 | |

| Eastern Co. | | | 2,500 | | | | 71,750 | |

| Echo Global Logistics, Inc.* | | | 8,400 | | | | 158,340 | |

| Electro Scientific Industries, Inc.* | | | 13,150 | | | | 183,048 | |

| EMCOR Group, Inc. | | | 6,700 | | | | 464,846 | |

| Encore Wire Corp. | | | 8,300 | | | | 371,633 | |

| EnPro Industries, Inc. | | | 1,700 | | | | 136,901 | |

| ESCO Technologies, Inc. | | | 2,900 | | | | 173,855 | |

| Esterline Technologies Corp.* | | | 10,540 | | | | 950,181 | |

COMMON STOCKS (Continued) | | | | | | | | |

INDUSTRIAL (Continued) | | | | | | | | |

| Fabrinet* | | | 4,300 | | | | 159,358 | |

| Federal Signal Corp. | | | 21,000 | | | | 446,880 | |

| Fluidigm Corp.* | | | 15,600 | | | | 78,624 | |

| FreightCar America, Inc. | | | 11,400 | | | | 222,984 | |

GasLog Ltd.1 | | | 13,700 | | | | 239,065 | |

GATX Corp.1 | | | 18,640 | | | | 1,147,478 | |

| Gencor Industries, Inc.* | | | 7,200 | | | | 127,080 | |

| Generac Holdings, Inc.* | | | 3,900 | | | | 179,127 | |

| General Cable Corp. | | | 21,600 | | | | 407,160 | |

| General Finance Corp.* | | | 10,700 | | | | 54,035 | |

| Gibraltar Industries, Inc.* | | | 16,950 | | | | 527,993 | |

| Global Brass & Copper Holdings, Inc. | | | 2,200 | | | | 74,360 | |

Golar LNG Ltd.1 | | | 12,500 | | | | 282,625 | |

| Goldfield Corp.* | | | 21,900 | | | | 137,970 | |

| Granite Construction, Inc. | | | 9,850 | | | | 570,808 | |

Greenbrier Cos., Inc.1 | | | 13,500 | | | | 650,025 | |

| Greif, Inc. - Class A | | | 8,900 | | | | 521,006 | |

| Griffon Corp. | | | 22,230 | | | | 493,506 | |

| Handy & Harman Ltd.* | | | 1,544 | | | | 50,257 | |

| Hardinge, Inc. | | | 9,900 | | | | 151,173 | |

| Harsco Corp.* | | | 24,300 | | | | 507,870 | |

| Heartland Express, Inc. | | | 10,200 | | | | 255,816 | |

| Heritage-Crystal Clean, Inc.* | | | 5,800 | | | | 126,150 | |

Hornbeck Offshore Services, Inc.*1 | | | 27,000 | | | | 109,080 | |

| Hub Group, Inc. - Class A* | | | 8,100 | | | | 347,895 | |

| Hurco Cos., Inc. | | | 4,902 | | | | 203,923 | |

| Hyster-Yale Materials Handling, Inc. | | | 4,080 | | | | 311,875 | |

| IES Holdings, Inc.* | | | 16,500 | | | | 285,450 | |

| II-VI, Inc.* | | | 18,870 | | | | 776,500 | |

| Itron, Inc.* | | | 5,900 | | | | 456,955 | |

| John Bean Technologies Corp. | | | 1,700 | | | | 171,870 | |

| Kadant, Inc. | | | 6,990 | | | | 688,864 | |

| Kaman Corp. | | | 2,000 | | | | 111,560 | |

KapStone Paper and Packaging Corp.1 | | | 11,100 | | | | 238,539 | |

| KBR, Inc. | | | 23,500 | | | | 420,180 | |

| KEMET Corp.* | | | 11,900 | | | | 251,447 | |

| Kennametal, Inc. | | | 18,000 | | | | 726,120 | |

| Kimball Electronics, Inc.* | | | 16,200 | | | | 350,730 | |

Kirby Corp.*1 | | | 1,600 | | | | 105,520 | |

| KLX, Inc.* | | | 9,200 | | | | 486,956 | |

| Knight-Swift Transportation Holdings, Inc.* | | | 8,400 | | | | 349,020 | |

| Kratos Defense & Security Solutions, Inc.* | | | 21,900 | | | | 286,452 | |

| Lawson Products, Inc.* | | | 1,646 | | | | 41,479 | |

| Layne Christensen Co.* | | | 6,500 | | | | 81,575 | |

| LB Foster Co. - Class A | | | 7,400 | | | | 168,350 | |

| Littelfuse, Inc. | | | 600 | | | | 117,528 | |

| Louisiana-Pacific Corp.* | | | 26,560 | | | | 719,245 | |

See accompanying Notes to Financial Statements.

13

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2017

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) | | | | | | |

INDUSTRIAL (Continued) | | | | | | |

LSB Industries, Inc.*1 | | | 7,700 | | | $ | 61,138 | |

| Lydall, Inc.* | | | 7,338 | | | | 420,467 | |

| Manitowoc Co., Inc.* | | | 22,800 | | | | 205,200 | |

| Marten Transport Ltd. | | | 27,000 | | | | 554,850 | |

| MasTec, Inc.* | | | 16,444 | | | | 763,002 | |

| Methode Electronics, Inc. | | | 2,730 | | | | 115,616 | |

| Milacron Holdings Corp.* | | | 1,900 | | | | 32,034 | |

| Moog, Inc. - Class A* | | | 5,600 | | | | 467,208 | |

| MSA Safety, Inc. | | | 2,400 | | | | 190,824 | |

| Mueller Industries, Inc. | | | 2,100 | | | | 73,395 | |

| Mueller Water Products, Inc. - Class A | | | 6,901 | | | | 88,333 | |

| Multi-Color Corp. | | | 5,238 | | | | 429,254 | |

| Myers Industries, Inc. | | | 4,500 | | | | 94,275 | |

| MYR Group, Inc.* | | | 5,100 | | | | 148,614 | |

| National Presto Industries, Inc. | | | 600 | | | | 63,870 | |

| NL Industries, Inc.* | | | 7,700 | | | | 70,455 | |

| NN, Inc. | | | 9,400 | | | | 272,600 | |

| Nordson Corp. | | | 1,700 | | | | 201,450 | |

| Northwest Pipe Co.* | | | 3,100 | | | | 58,962 | |

| Novanta, Inc.* | | | 5,350 | | | | 233,260 | |

| Olympic Steel, Inc. | | | 6,300 | | | | 138,600 | |

| Orion Group Holdings, Inc.* | | | 9,300 | | | | 61,008 | |

| Oshkosh Corp. | | | 1,900 | | | | 156,826 | |

| Owens-Illinois, Inc.* | | | 6,000 | | | | 150,960 | |

| PAM Transportation Services, Inc.* | | | 6,706 | | | | 160,475 | |

| Park Electrochemical Corp. | | | 4,700 | | | | 86,950 | |

| Park-Ohio Holdings Corp. | | | 4,700 | | | | 214,320 | |

| Patrick Industries, Inc.* | | | 1,460 | | | | 122,786 | |

| Plexus Corp.* | | | 5,800 | | | | 325,264 | |

| Powell Industries, Inc. | | | 2,600 | | | | 77,974 | |

| Primoris Services Corp. | | | 9,600 | | | | 282,432 | |

| Quanex Building Products Corp. | | | 9,000 | | | | 206,550 | |

| Radiant Logistics, Inc.* | | | 25,300 | | | | 134,343 | |

| Raven Industries, Inc. | | | 3,100 | | | | 100,440 | |

Regal Beloit Corp.1 | | | 5,900 | | | | 466,100 | |

| Rexnord Corp.* | | | 8,800 | | | | 223,608 | |

| Roadrunner Transportation Systems, Inc.* | | | 11,900 | | | | 113,407 | |

| Rogers Corp.* | | | 3,500 | | | | 466,480 | |

| Saia, Inc.* | | | 10,800 | | | | 676,620 | |

| Sanmina Corp.* | | | 44,190 | | | | 1,641,658 | |

| Scorpio Tankers, Inc. | | | 70,110 | | | | 240,477 | |

| Ship Finance International Ltd.1 | | | 15,765 | | | | 228,593 | |

| SigmaTron International, Inc.* | | | 3,300 | | | | 27,654 | |

| SPX Corp.* | | | 7,900 | | | | 231,786 | |

| Standex International Corp. | | | 500 | | | | 53,100 | |

| Sterling Construction Co., Inc.* | | | 5,600 | | | | 85,288 | |

| Stoneridge, Inc.* | | | 6,400 | | | | 126,784 | |

COMMON STOCKS (Continued) | | | | | | | | |

INDUSTRIAL (Continued) | | | | | | | | |

| Summit Materials, Inc. - Class A* | | | 15,013 | | | | 480,866 | |

| Synalloy Corp.* | | | 7,400 | | | | 92,500 | |

| SYNNEX Corp. | | | 15,200 | | | | 1,922,952 | |

| Tech Data Corp.* | | | 9,925 | | | | 881,836 | |

Teekay Corp.1 | | | 14,600 | | | | 130,378 | |

Teekay Tankers Ltd. - Class A1 | | | 39,000 | | | | 63,180 | |

| Teledyne Technologies, Inc.* | | | 5,000 | | | | 795,900 | |

| Terex Corp. | | | 25,100 | | | | 1,130,002 | |

| Tetra Tech, Inc. | | | 11,850 | | | | 551,618 | |

| TimkenSteel Corp.* | | | 19,000 | | | | 313,500 | |

| TopBuild Corp.* | | | 13,100 | | | | 853,727 | |

| Transcat, Inc.* | | | 5,141 | | | | 70,175 | |

| Tredegar Corp. | | | 10,592 | | | | 190,656 | |

| Trex Co., Inc.* | | | 6,000 | | | | 540,420 | |

| TriMas Corp.* | | | 8,300 | | | | 224,100 | |

| Trinseo S.A. | | | 9,600 | | | | 644,160 | |

| Triumph Group, Inc. | | | 6,100 | | | | 181,475 | |

| TTM Technologies, Inc.* | | | 52,444 | | | | 806,064 | |

| Tutor Perini Corp.* | | | 23,500 | | | | 667,400 | |

| U.S. Ecology, Inc. | | | 2,700 | | | | 145,260 | |

| Universal Forest Products, Inc. | | | 7,350 | | | | 721,476 | |

| USA Truck, Inc.* | | | 8,400 | | | | 118,020 | |

| Vishay Intertechnology, Inc. | | | 44,450 | | | | 835,660 | |

| Vishay Precision Group, Inc.* | | | 13,900 | | | | 339,160 | |

| VSE Corp. | | | 5,600 | | | | 318,416 | |

| Watts Water Technologies, Inc. - Class A | | | 3,400 | | | | 235,280 | |

| Werner Enterprises, Inc. | | | 12,400 | | | | 453,220 | |

| Willis Lease Finance Corp.* | | | 3,500 | | | | 86,065 | |

| Worthington Industries, Inc. | | | 1,400 | | | | 64,400 | |

| XPO Logistics, Inc.* | | | 17,612 | | | | 1,193,741 | |

YRC Worldwide, Inc.*1 | | | 4,700 | | | | 64,860 | |

| ZAGG, Inc.* | | | 26,260 | | | | 413,595 | |

| Zebra Technologies Corp. - Class A* | | | 1,800 | | | | 195,444 | |

| | | | | | | | 60,361,120 | |

TECHNOLOGY – 7.4% | | | | | | | | |

| Actua Corp.* | | | 11,600 | | | | 177,480 | |

| Acxiom Corp.* | | | 6,200 | | | | 152,768 | |

Advanced Micro Devices, Inc.*1 | | | 93,700 | | | | 1,194,675 | |

| Agilysys, Inc.* | | | 4,700 | | | | 56,165 | |

| Alpha & Omega Semiconductor Ltd.* | | | 20,050 | | | | 330,624 | |

| Amkor Technology, Inc.* | | | 58,300 | | | | 615,065 | |

| Amtech Systems, Inc.* | | | 6,900 | | | | 82,662 | |

| Axcelis Technologies, Inc.* | | | 4,525 | | | | 123,759 | |

| AXT, Inc.* | | | 14,450 | | | | 132,218 | |

| Brooks Automation, Inc. | | | 31,000 | | | | 941,160 | |

| Cabot Microelectronics Corp. | | | 4,900 | | | | 391,657 | |

| CACI International, Inc. - Class A* | | | 13,600 | | | | 1,895,160 | |

See accompanying Notes to Financial Statements.

14

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

As of September 30, 2017

| | | Number

of Shares | | | Value | |