UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-22578

Vericimetry Funds

(Exact name of registrant as specified in charter)

972 West Campus Lane

Goleta, CA 93117

(Address of principal executive offices) (Zip code)

Dr. Mendel Fygenson

Vericimetry Advisors LLC

972 West Campus Lane

Goleta, CA 93117

(Name and address of agent for service)

Registrant's telephone number, including area code: (805) 570-1086

Date of fiscal year end: September 30

Date of reporting period: September 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Vericimetry U.S. Small Cap Value Fund

VYSVX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the Vericimetry U.S. Small Cap Value Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund such as the prospectus, financial information, and fund holdings at https://www.vericimetry.com/vysvx/fund-information.php. You can also request this information by contacting us at 1-855-755-7550.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a

$10,000 investment |

| Vericimetry U.S. Small Cap Value Fund | $68 | 0.60% |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

In general, the Fund seeks to deliver the long side of the small-value risk premiums in U.S. securities through a well-diversified portfolio. The outcomes of this fiscal year demonstrate management’s commitment to the Fund’s mandated strategy and its stated investment philosophy. Please note that returns mentioned in the summary below, for both the Fund and for the indices, include both price appreciation/depreciation and reinvestment of dividends.

For the fiscal year ended on September 30, 2024, the Fund had positive returns, and it outperformed its benchmark – the Russell 2000® Value Index (the “Benchmark”). Overall, the Fund’s fiscal-year annualized return was a positive 26.35% versus the Benchmark’s positive return of 25.88%. For most of the year, the Fund was more than 95% fully invested and had a well- diversified portfolio, with at least 773 equity holdings.

As managers of a U.S. small cap value fund, we face the challenge of maintaining the Fund’s outperformance of its benchmark during periods of declining US 10-year Treasury yields. Given the Fund’s mandate, we cannot invest in interest rate-sensitive sectors like REITs. To address this challenge, we overweight sectors that tend to correlate with REITs’ performance, such as Homebuilding. This strategy helps offset the impact of our benchmark’s significant REIT allocation, which can be up to 13% of its weight.

The views in this letter were as of September 30, 2024, and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

| Vericimetry U.S. Small Cap Value Fund | 1 |

Fund Performance

The following graph and chart compare the initial and subsequent account values for the Fund. It assumes a $10,000 initial investment in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| Date | Vericimetry U.S. Small Value Fund $23,098 | Russell 2000 Value Index $22,042 |

| 2014-09-30 | $ 9,880 | $ 9,880 |

| 2015-09-30 | $ 9,880 | $ 9,880 |

| 2016-09-30 | $ 10,958 | $ 11,587 |

| 2017-09-30 | $ 13,204 | $ 14,012 |

| 2018-09-30 | $ 14,281 | $ 15,359 |

| 2019-09-30 | $ 12,485 | $ 13,922 |

| 2020-09-30 | $ 10,509 | $ 11,766 |

| 2021-09-30 | $ 17,874 | $ 19,671 |

| 2022-09-30 | $ 16,168 | $ 16,168 |

| 2023-09-30 | $ 18,323 | $ 17,246 |

| 2024-09-30 | $ 23,098 | $ 22,042 |

AVERAGE ANNUAL TOTAL RETURN

| | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

| Vericimetry U.S. Small Cap Value Fund | 26.35% | 8.53% | 13.05% | 8.73% |

| Russell 2000 Value Index | 25.88% | 3.77% | 9.29% | 8.22% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $179,952,623 |

| Total number of portfolio holdings | 840 |

| Total advisory fees paid (net) | $795,044 |

| Portfolio turnover rate as of the end of the reporting period | 23% |

| Vericimetry U.S. Small Cap Value Fund | 2 |

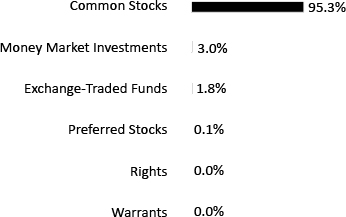

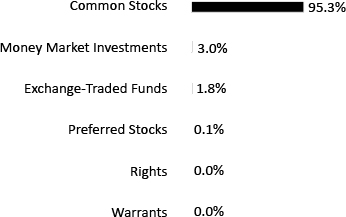

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Sector Allocation chart represents Common Stocks held by the Fund.

| TOP TEN HOLDINGS |

| | |

| Taylor Morrison Home Corp. | 1.00% |

| Carpenter Technology Corp. | 0.90% |

| SkyWest, Inc. | 0.83% |

| Meritage Homes Corp. | 0.82% |

| Tri Pointe Homes, Inc. | 0.76% |

| Commercial Metals Co. | 0.76% |

| Modine Manufacturing Co. | 0.74% |

| Amkor Technology, Inc. | 0.72% |

| Jackson Financial, Inc. - Class A | 0.71% |

| Mr Cooper Group, Inc. | 0.70% |

ASSET ALLOCATION

SECTOR ALLOCATION

| Common Stocks | 95.3% |

| Money Market Investments | 3.0% |

| Exchange-Traded Funds | 1.8% |

| Preferred Stocks | 0.1% |

| Rights | 0.0% |

| Warrants | 0.0% |

| Financial | 30.1% |

| Industrial | 17.6% |

| Consumer Cyclical | 16.9% |

| Consumer Non-Cyclical | 9.9% |

| Energy | 8.5% |

| Basic Materials | 6.1% |

| Technology | 3.7% |

| Communications | 1.8% |

| Utilities | 0.7% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, and fund holdings at https://www.vericimetry.com/vysvx/fund-information.php. You can also request this information by contacting us at 1-855-755-7550.

Principal Risks of Investing

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. Please read the prospectus carefully before investing.

| Vericimetry U.S. Small Cap Value Fund | 3 |

(b) Not applicable.

Item 2. Code of Ethics.

The Registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party. A copy of this code of ethics is attached hereto as an Exhibit.

There were no substantive amendments, during the period covered by this report, to a provision of the code of ethics that applies to the Registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party, and that relates to any element of the code of ethics description. The Registrant has not granted any waivers, including an implicit waiver, from a provision of the code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The Registrant’s board of trustees has determined that Mr. Brian Wing is an audit committee financial expert serving on its audit committee and that Mr. Wing is independent.

Item 4. Principal Accountant Fees and Services.

The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the Registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements are listed below:

| | | For the Year Ended September 30, 2024 | | | For the Year Ended September 30, 2023 | |

| Audit Fees | | $ | 12,000 | | | $ | 12,000 | |

| Audit-Related Fees | | $ | 0 | | | $ | 0 | |

| Tax Fees | | $ | 2,000 | | | $ | 2,000 | |

| All Other Fees | | $ | 0 | | | $ | 0 | |

The Registrant’s audit committee has adopted an Audit Committee Charter that requires that the Audit Committee review the scope and plan of the registered public accounting firm’s annual and interim examinations, approve the services to be performed for the Registrant by the independent public accountants and approve the fees and other compensation payable to the independent accountants. For the year ended September 30, 2024, all of the audit and non-audit services provided by the Registrant’s principal accountant were pre-approved by the audit committee.

(f) None.

(g) None.

(h) Not applicable.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Included as part of the report to shareholders filed under Item 7(a) of this Form N-CSR. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| (a) | Copy of the most recent financial statements. |

Vericimetry U.S. Small Cap Value Fund

Financial Statements and Other Information

(Form N-CSR Items 7-11)

September 30, 2024

Vericimetry Funds

TABLE OF CONTENTS

SEPTEMBER 30, 2024

Please note the Financial Statements and Other Information only contains Items 7-11 required on Form N-CSR. All other required items will be filed with the SEC.

| | Pages |

Item 7. | |

Schedule of Investments | 1 |

Statement of Assets and Liabilities | 11 |

Statement of Operations | 12 |

Statements of Changes in Net Assets | 13 |

Financial Highlights | 14 |

Notes to Financial Statements | 15 |

Report of Independent Registered Public Accounting Firm | 21 |

Item 8. | |

Changes in and Disagreements with Accountants for Open-End Management Investment Companies | 22 |

Item 9. | |

Proxy Disclosures for Open-End Management Investment Companies. | 22 |

Item 10. | |

Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies. | 22 |

Item 11. | |

Statement Regarding Basis for Approval of Investment Advisory Contract. | 22 |

Vericimetry U.S. Small Cap Value Fund

Schedule of Investments

AS OF SEPTEMBER 30, 2024

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| | | Number

of Shares | | | Value | |

COMMON STOCKS — 95.3% | | | | | | | | |

BASIC MATERIALS — 6.1% | | | | | | | | |

AdvanSix, Inc. | | | 4,652 | | | $ | 141,328 | |

Alcoa Corp. | | | 9,540 | | | | 368,053 | |

American Vanguard Corp. | | | 2,750 | | | | 14,575 | |

Ashland, Inc. | | | 1,203 | | | | 104,625 | |

ATI, Inc.* | | | 10,079 | | | | 674,386 | |

Avient Corp. | | | 3,830 | | | | 192,726 | |

Cabot Corp. | | | 2,208 | | | | 246,788 | |

Carpenter Technology Corp. | | | 10,207 | | | | 1,628,833 | |

Century Aluminum Co.* | | | 6,340 | | | | 102,898 | |

Coeur Mining, Inc.* | | | 16,440 | | | | 113,107 | |

Commercial Metals Co. | | | 24,920 | | | | 1,369,603 | |

Ecovyst, Inc.* | | | 7,110 | | | | 48,704 | |

Element Solutions, Inc. | | | 45,260 | | | | 1,229,262 | |

H.B. Fuller Co. | | | 2,372 | | | | 188,289 | |

Hawkins, Inc. | | | 1,810 | | | | 230,721 | |

Haynes International, Inc. | | | 2,510 | | | | 149,445 | |

Hecla Mining Co. | | | 94,158 | | | | 628,034 | |

Huntsman Corp. | | | 14,365 | | | | 347,633 | |

Innospec, Inc. | | | 340 | | | | 38,451 | |

Kaiser Aluminum Corp. | | | 643 | | | | 46,630 | |

Koppers Holdings, Inc. | | | 1,921 | | | | 70,174 | |

Kronos Worldwide, Inc. | | | 7,750 | | | | 96,487 | |

Mercer International, Inc. | | | 9,520 | | | | 64,450 | |

Minerals Technologies, Inc. | | | 6,040 | | | | 466,469 | |

NewMarket Corp. | | | 98 | | | | 54,085 | |

Oil-Dri Corp. of America | | | 430 | | | | 29,666 | |

Olin Corp. | | | 6,995 | | | | 335,620 | |

Orion S.A. | | | 2,480 | | | | 44,169 | |

Perimeter Solutions S.A.* | | | 5,980 | | | | 80,431 | |

Rayonier Advanced Materials, Inc.* | | | 32,505 | | | | 278,243 | |

Stepan Co. | | | 1,230 | | | | 95,017 | |

Sylvamo Corp. | | | 1,760 | | | | 151,096 | |

Tronox Holdings PLC | | | 26,655 | | | | 389,963 | |

United States Steel Corp. | | | 22,260 | | | | 786,446 | |

Universal Stainless & Alloy Products, Inc.* | | | 2,120 | | | | 81,896 | |

Valhi, Inc. | | | 1,300 | | | | 43,381 | |

| | | | | | | | 10,931,684 | |

COMMUNICATIONS — 1.8% | | | | | | | | |

Advantage Solutions, Inc.* | | | 9,710 | | | | 33,305 | |

ATN International, Inc. | | | 2,579 | | | | 83,405 | |

Cars.com, Inc.* | | | 1,045 | | | | 17,514 | |

CommScope Holding Co., Inc.* | | | 6,790 | | | | 41,487 | |

Consolidated Communications Holdings, Inc.* | | | 8,840 | | | | 41,018 | |

EchoStar Corp. - Class A* | | | 6,095 | | | | 151,278 | |

Entravision Communications Corp. - Class A | | | 17,020 | | | | 35,231 | |

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

COMMUNICATIONS (Continued) |

ePlus, Inc.* | | | 3,950 | | | $ | 388,443 | |

Frontier Communications Parent, Inc.* | | | 8,259 | | | | 293,442 | |

Gannett Co., Inc.* | | | 15,220 | | | | 85,536 | |

Gray Television, Inc. | | | 10,645 | | | | 57,057 | |

HealthStream, Inc. | | | 890 | | | | 25,668 | |

InterDigital, Inc. | | | 790 | | | | 111,888 | |

Iridium Communications, Inc. | | | 1,180 | | | | 35,931 | |

Lands’ End, Inc.* | | | 3,150 | | | | 54,400 | |

Liberty Latin America Ltd. - Class A* | | | 15,460 | | | | 148,107 | |

Lumen Technologies, Inc.* | | | 15,310 | | | | 108,701 | |

NETGEAR, Inc.* | | | 1,500 | | | | 30,090 | |

Nexstar Media Group, Inc. | | | 360 | | | | 59,526 | |

Opendoor Technologies, Inc.* | | | 12,790 | | | | 25,580 | |

Preformed Line Products Co. | | | 720 | | | | 92,218 | |

QuinStreet, Inc.* | | | 2,250 | | | | 43,043 | |

Ribbon Communications, Inc.* | | | 5,824 | | | | 18,928 | |

Scholastic Corp. | | | 8,473 | | | | 271,221 | |

Shenandoah Telecommunications Co. | | | 3,550 | | | | 50,090 | |

Sinclair, Inc. | | | 5,600 | | | | 85,680 | |

Sphere Entertainment Co.* | | | 2,850 | | | | 125,913 | |

TEGNA, Inc. | | | 13,920 | | | | 219,658 | |

Telephone and Data Systems, Inc. | | | 17,329 | | | | 402,899 | |

Thryv Holdings, Inc.* | | | 1,696 | | | | 29,222 | |

TripAdvisor, Inc.* | | | 1,850 | | | | 26,807 | |

Viasat, Inc.* | | | 1,347 | | | | 16,083 | |

| | | | | | | | 3,209,369 | |

CONSUMER, CYCLICAL — 16.9% | | | | | | | | |

Abercrombie & Fitch Co. - Class A* | | | 3,493 | | | | 488,671 | |

Academy Sports & Outdoors, Inc. | | | 3,983 | | | | 232,448 | |

Acushnet Holdings Corp. | | | 355 | | | | 22,631 | |

Adient PLC* | | | 7,251 | | | | 163,655 | |

Advance Auto Parts, Inc. | | | 380 | | | | 14,816 | |

Alaska Air Group, Inc.* | | | 3,630 | | | | 164,112 | |

Allegiant Travel Co. | | | 710 | | | | 39,093 | |

American Axle & Manufacturing | | | | | | | | |

Holdings, Inc.* | | | 18,305 | | | | 113,125 | |

American Eagle Outfitters, Inc. | | | 10,152 | | | | 227,303 | |

Asbury Automotive Group, Inc.* | | | 1,275 | | | | 304,202 | |

AutoNation, Inc.* | | | 1,807 | | | | 323,308 | |

Bassett Furniture Industries, Inc. | | | 1,330 | | | | 19,219 | |

Beacon Roofing Supply, Inc.* | | | 4,738 | | | | 409,505 | |

Beazer Homes USA, Inc.* | | | 1,990 | | | | 67,998 | |

Biglari Holdings, Inc. - Class B* | | | 50 | | | | 8,601 | |

BJ’s Restaurants, Inc.* | | | 810 | | | | 26,374 | |

BlueLinx Holdings, Inc.* | | | 1,490 | | | | 157,076 | |

Brinker International, Inc.* | | | 370 | | | | 28,316 | |

See accompanying Notes to Financial Statements.

1

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

AS OF SEPTEMBER 30, 2024

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

CONSUMER, CYCLICAL (Continued) |

Buckle, Inc. | | | 1,000 | | | $ | 43,970 | |

Build-A-Bear Workshop, Inc. | | | 2,380 | | | | 81,801 | |

Caleres, Inc. | | | 1,933 | | | | 63,886 | |

Carter’s, Inc. | | | 510 | | | | 33,140 | |

Century Communities, Inc. | | | 8,722 | | | | 898,192 | |

Citi Trends, Inc.* | | | 980 | | | | 18,003 | |

CompX International, Inc. | | | 100 | | | | 2,921 | |

Daktronics, Inc.* | | | 4,820 | | | | 62,226 | |

Dana, Inc. | | | 21,146 | | | | 223,302 | |

Designer Brands, Inc. - Class A | | | 3,500 | | | | 25,830 | |

Dick’s Sporting Goods, Inc. | | | 1,650 | | | | 344,355 | |

Dillard’s, Inc. - Class A | | | 1,391 | | | | 533,713 | |

Dorman Products, Inc.* | | | 630 | | | | 71,266 | |

El Pollo Loco Holdings, Inc.* | | | 5,670 | | | | 77,679 | |

Ethan Allen Interiors, Inc. | | | 6,952 | | | | 221,699 | |

Everi Holdings, Inc.* | | | 4,480 | | | | 58,867 | |

EVgo, Inc.* | | | 10,000 | | | | 41,400 | |

FirstCash Holdings, Inc. | | | 152 | | | | 17,450 | |

Flexsteel Industries, Inc. | | | 1,360 | | | | 60,234 | |

Foot Locker, Inc. | | | 4,433 | | | | 114,549 | |

Forestar Group, Inc.* | | | 7,592 | | | | 245,753 | |

Gap, Inc. | | | 14,502 | | | | 319,769 | |

Genesco, Inc.* | | | 1,260 | | | | 34,234 | |

G-III Apparel Group Ltd.* | | | 6,390 | | | | 195,023 | |

GMS, Inc.* | | | 7,440 | | | | 673,841 | |

Goodyear Tire & Rubber Co.* | | | 37,386 | | | | 330,866 | |

Green Brick Partners, Inc.* | | | 7,248 | | | | 605,353 | |

Group 1 Automotive, Inc. | | | 3,154 | | | | 1,208,108 | |

Guess?, Inc. | | | 2,430 | | | | 48,916 | |

H&E Equipment Services, Inc. | | | 515 | | | | 25,070 | |

Hamilton Beach Brands Holding Co. - Class A | | | 2,891 | | | | 87,973 | |

Haverty Furniture Cos., Inc. | | | 3,140 | | | | 86,256 | |

HNI Corp. | | | 3,380 | | | | 181,979 | |

Hooker Furnishings Corp. | | | 1,980 | | | | 35,798 | |

Hovnanian Enterprises, Inc. - Class A* | | | 150 | | | | 30,656 | |

Interface, Inc. | | | 6,110 | | | | 115,907 | |

JAKKS Pacific, Inc.* | | | 680 | | | | 17,354 | |

JetBlue Airways Corp.* | | | 30,874 | | | | 202,533 | |

Johnson Outdoors, Inc. - Class A | | | 720 | | | | 26,064 | |

KB Home | | | 5,280 | | | | 452,443 | |

Kohl’s Corp. | | | 9,910 | | | | 209,101 | |

Kontoor Brands, Inc. | | | 1,260 | | | | 103,043 | |

Landsea Homes Corp.* | | | 1,440 | | | | 17,784 | |

La-Z-Boy, Inc. | | | 8,190 | | | | 351,597 | |

LCI Industries | | | 1,647 | | | | 198,529 | |

Leggett & Platt, Inc. | | | 2,300 | | | | 31,326 | |

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

CONSUMER, CYCLICAL (Continued) |

LGI Homes, Inc.* | | | 1,661 | | | $ | 196,862 | |

Life Time Group Holdings, Inc.* | | | 12,550 | | | | 306,471 | |

Lifetime Brands, Inc. | | | 2,950 | | | | 19,293 | |

Light & Wonder, Inc.* | | | 2,092 | | | | 189,807 | |

M/I Homes, Inc.* | | | 5,925 | | | | 1,015,308 | |

Macy’s, Inc. | | | 26,044 | | | | 408,630 | |

Madison Square Garden Entertainment | | | | | | | | |

Corp.* | | | 1,950 | | | | 82,933 | |

Malibu Boats, Inc. - Class A* | | | 950 | | | | 36,870 | |

Marcus Corp. | | | 6,530 | | | | 98,407 | |

MarineMax, Inc.* | | | 3,970 | | | | 140,022 | |

Marriott Vacations Worldwide Corp. | | | 2,060 | | | | 151,369 | |

Meritage Homes Corp. | | | 7,176 | | | | 1,471,582 | |

Methode Electronics, Inc. | | | 3,160 | | | | 37,794 | |

Miller Industries, Inc. | | | 2,335 | | | | 142,435 | |

MillerKnoll, Inc. | | | 6,500 | | | | 160,940 | |

Movado Group, Inc. | | | 3,090 | | | | 57,474 | |

MRC Global, Inc.* | | | 1,420 | | | | 18,091 | |

Murphy USA, Inc. | | | 292 | | | | 143,918 | |

National Vision Holdings, Inc.* | | | 3,408 | | | | 37,181 | |

Norwegian Cruise Line Holdings Ltd.* | | | 2,450 | | | | 50,249 | |

ODP Corp.* | | | 8,700 | | | | 258,825 | |

OPENLANE, Inc.* | | | 14,244 | | | | 240,439 | |

Oxford Industries, Inc. | | | 1,050 | | | | 91,098 | |

Papa John’s International, Inc. | | | 730 | | | | 39,325 | |

Patrick Industries, Inc. | | | 2,950 | | | | 419,991 | |

PC Connection, Inc. | | | 4,362 | | | | 329,026 | |

Peloton Interactive, Inc. - Class A* | | | 5,760 | | | | 26,957 | |

Penske Automotive Group, Inc. | | | 2,110 | | | | 342,706 | |

Playa Hotels & Resorts N.V.* | | | 9,727 | | | | 75,384 | |

PriceSmart, Inc. | | | 970 | | | | 89,027 | |

PVH Corp. | | | 7,829 | | | | 789,398 | |

Red Rock Resorts, Inc. - Class A | | | 620 | | | | 33,753 | |

Reservoir Media, Inc.* | | | 1,980 | | | | 16,058 | |

Resideo Technologies, Inc.* | | | 18,290 | | | | 368,361 | |

REV Group, Inc. | | | 5,540 | | | | 155,452 | |

Rocky Brands, Inc. | | | 1,220 | | | | 38,869 | |

Rush Enterprises, Inc. - Class A | | | 14,422 | | | | 761,914 | |

Rush Enterprises, Inc. - Class B | | | 5,992 | | | | 287,316 | |

Sabre Corp.* | | | 9,620 | | | | 35,305 | |

Sally Beauty Holdings, Inc.* | | | 2,860 | | | | 38,810 | |

ScanSource, Inc.* | | | 4,700 | | | | 225,741 | |

Shoe Carnival, Inc. | | | 5,220 | | | | 228,897 | |

Signet Jewelers Ltd. | | | 2,410 | | | | 248,567 | |

Skechers USA, Inc. - Class A* | | | 1,230 | | | | 82,312 | |

SkyWest, Inc.* | | | 17,490 | | | | 1,487,000 | |

Sonic Automotive, Inc. - Class A | | | 4,157 | | | | 243,101 | |

See accompanying Notes to Financial Statements.

2

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

AS OF SEPTEMBER 30, 2024

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

CONSUMER, CYCLICAL (Continued) |

Sonos, Inc.* | | | 1,440 | | | $ | 17,698 | |

Standard Motor Products, Inc. | | | 1,390 | | | | 46,148 | |

Steelcase, Inc. - Class A | | | 10,665 | | | | 143,871 | |

Sun Country Airlines Holdings, Inc.* | | | 1,380 | | | | 15,470 | |

Sweetgreen, Inc.* | | | 1,860 | | | | 65,937 | |

Tapestry, Inc. | | | 1,310 | | | | 61,544 | |

Taylor Morrison Home Corp.* | | | 25,523 | | | | 1,793,246 | |

Texas Roadhouse, Inc. | | | 140 | | | | 24,724 | |

Thor Industries, Inc. | | | 6,348 | | | | 697,582 | |

Titan International, Inc.* | | | 3,340 | | | | 27,154 | |

Titan Machinery, Inc.* | | | 5,500 | | | | 76,615 | |

TKO Group Holdings, Inc.* | | | 300 | | | | 37,113 | |

Toll Brothers, Inc. | | | 3,140 | | | | 485,099 | |

Topgolf Callaway Brands Corp.* | | | 4,350 | | | | 47,763 | |

Tri Pointe Homes, Inc.* | | | 30,265 | | | | 1,371,307 | |

Under Armour, Inc. - Class A* | | | 10,172 | | | | 90,633 | |

UniFirst Corp. | | | 600 | | | | 119,190 | |

Urban Outfitters, Inc.* | | | 12,439 | | | | 476,538 | |

VF Corp. | | | 2,010 | | | | 40,099 | |

Vista Outdoor, Inc.* | | | 7,369 | | | | 288,717 | |

VSE Corp. | | | 1,600 | | | | 132,368 | |

Wabash National Corp. | | | 2,150 | | | | 41,258 | |

WESCO International, Inc. | | | 3,042 | | | | 510,995 | |

Winmark Corp. | | | 240 | | | | 91,903 | |

Winnebago Industries, Inc. | | | 6,395 | | | | 371,613 | |

Wolverine World Wide, Inc. | | | 1,310 | | | | 22,820 | |

Zumiez, Inc.* | | | 3,090 | | | | 65,817 | |

| | | | | | | | 30,522,702 | |

CONSUMER, NON-CYCLICAL — 9.9% | | | | | | | | |

ABM Industries, Inc. | | | 13,275 | | | | 700,389 | |

Acadia Healthcare Co., Inc.* | | | 6,554 | | | | 415,589 | |

ACCO Brands Corp. | | | 8,320 | | | | 45,510 | |

AdaptHealth Corp.* | | | 5,630 | | | | 63,225 | |

Adtalem Global Education, Inc.* | | | 10,390 | | | | 784,237 | |

Alight, Inc.* | | | 20,250 | | | | 149,850 | |

American Public Education, Inc.* | | | 6,910 | | | | 101,923 | |

Amneal Pharmaceuticals, Inc.* | | | 2,110 | | | | 17,555 | |

Andersons, Inc. | | | 8,610 | | | | 431,705 | |

AngioDynamics, Inc.* | | | 3,590 | | | | 27,930 | |

ANI Pharmaceuticals, Inc.* | | | 580 | | | | 34,603 | |

Artivion, Inc.* | | | 3,060 | | | | 81,457 | |

Assembly Biosciences, Inc.* | | | 1,070 | | | | 16,200 | |

Avanos Medical, Inc.* | | | 6,650 | | | | 159,799 | |

B&G Foods, Inc. | | | 1,990 | | | | 17,671 | |

Bioventus, Inc. - Class A* | | | 4,210 | | | | 50,310 | |

Bright Horizons Family Solutions, Inc.* | | | 180 | | | | 25,223 | |

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

CONSUMER, NON-CYCLICAL (Continued) |

BrightView Holdings, Inc.* | | | 6,980 | | | $ | 109,865 | |

Brookdale Senior Living, Inc.* | | | 8,815 | | | | 59,854 | |

Calavo Growers, Inc. | | | 1,120 | | | | 31,954 | |

Cal-Maine Foods, Inc. | | | 3,833 | | | | 286,862 | |

Caribou Biosciences, Inc.* | | | 12,920 | | | | 25,323 | |

CBIZ, Inc.* | | | 3,325 | | | | 223,739 | |

Central Garden & Pet Co. - Class A* | | | 9,187 | | | | 288,472 | |

Chefs’ Warehouse, Inc.* | | | 870 | | | | 36,549 | |

Coca-Cola Consolidated, Inc. | | | 310 | | | | 408,084 | |

Community Health Systems, Inc.* | | | 6,700 | | | | 40,669 | |

CRA International, Inc. | | | 1,070 | | | | 187,592 | |

Cross Country Healthcare, Inc.* | | | 1,430 | | | | 19,219 | |

Deluxe Corp. | | | 5,100 | | | | 99,399 | |

Dun & Bradstreet Holdings, Inc. | | | 12,440 | | | | 143,184 | |

Edgewell Personal Care Co. | | | 9,400 | | | | 341,596 | |

Emergent BioSolutions, Inc.* | | | 4,860 | | | | 40,581 | |

Ennis, Inc. | | | 5,900 | | | | 143,488 | |

Enovis Corp.* | | | 6,598 | | | | 284,044 | |

Envista Holdings Corp.* | | | 7,800 | | | | 154,128 | |

First Advantage Corp.* | | | 5,210 | | | | 103,419 | |

FONAR Corp.* | | | 1,270 | | | | 20,561 | |

Fresh Del Monte Produce, Inc. | | | 11,020 | | | | 325,531 | |

FTI Consulting, Inc.* | | | 210 | | | | 47,788 | |

Fulgent Genetics, Inc.* | | | 3,350 | | | | 72,796 | |

Graham Holdings Co. - Class B | | | 570 | | | | 468,380 | |

Grand Canyon Education, Inc.* | | | 120 | | | | 17,022 | |

Green Dot Corp. - Class A* | | | 4,510 | | | | 52,812 | |

Grocery Outlet Holding Corp.* | | | 2,070 | | | | 36,329 | |

GXO Logistics, Inc.* | | | 1,290 | | | | 67,170 | |

Hain Celestial Group, Inc.* | | | 4,290 | | | | 37,023 | |

Heidrick & Struggles International, Inc. | | | 2,765 | | | | 107,448 | |

Herc Holdings, Inc. | | | 153 | | | | 24,393 | |

Huron Consulting Group, Inc.* | | | 1,730 | | | | 188,051 | |

ICF International, Inc. | | | 2,973 | | | | 495,867 | |

ICU Medical, Inc.* | | | 500 | | | | 91,110 | |

Ingles Markets, Inc. - Class A | | | 4,487 | | | | 334,730 | |

Ingredion, Inc. | | | 1,988 | | | | 273,211 | |

Innoviva, Inc.* | | | 11,450 | | | | 221,099 | |

Integer Holdings Corp.* | | | 5,840 | | | | 759,200 | |

John B Sanfilippo & Son, Inc. | | | 230 | | | | 21,691 | |

Kelly Services, Inc. - Class A | | | 8,850 | | | | 189,478 | |

Korn Ferry | | | 8,965 | | | | 674,527 | |

Laureate Education, Inc. | | | 13,940 | | | | 231,543 | |

Ligand Pharmaceuticals, Inc.* | | | 1,005 | | | | 100,590 | |

LiveRamp Holdings, Inc.* | | | 3,239 | | | | 80,262 | |

ManpowerGroup, Inc. | | | 990 | | | | 72,785 | |

Matthews International Corp. - Class A | | | 2,790 | | | | 64,728 | |

See accompanying Notes to Financial Statements.

3

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

AS OF SEPTEMBER 30, 2024

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

CONSUMER, NON-CYCLICAL (Continued) |

National HealthCare Corp. | | | 1,820 | | | $ | 228,901 | |

National Research Corp. | | | 900 | | | | 20,574 | |

Natural Grocers by Vitamin Cottage, Inc. | | | 4,950 | | | | 146,965 | |

Omni AB, Inc. - Earnout Shares1 | | | 477 | | | | — | |

Omni AB, Inc. - Earnout Shares1 | | | 477 | | | | — | |

Omnicell, Inc.* | | | 1,710 | | | | 74,556 | |

OraSure Technologies, Inc.* | | | 5,810 | | | | 24,809 | |

Owens & Minor, Inc.* | | | 5,770 | | | | 90,531 | |

Paysafe Ltd.* | | | 770 | | | | 17,271 | |

Pediatrix Medical Group, Inc.* | | | 5,537 | | | | 64,174 | |

Perdoceo Education Corp. | | | 12,310 | | | | 273,774 | |

Perrigo Co. PLC | | | 1,150 | | | | 30,165 | |

Pilgrim’s Pride Corp.* | | | 5,613 | | | | 258,479 | |

Post Holdings, Inc.* | | | 3,720 | | | | 430,590 | |

Premier, Inc. - Class A | | | 1,320 | | | | 26,400 | |

Prestige Consumer Healthcare, Inc.* | | | 8,915 | | | | 642,771 | |

PROG Holdings, Inc. | | | 6,013 | | | | 291,570 | |

Quad/Graphics, Inc. | | | 4,040 | | | | 18,342 | |

Quanex Building Products Corp. | | | 7,465 | | | | 207,154 | |

QuidelOrtho Corp.* | | | 2,150 | | | | 98,040 | |

Repay Holdings Corp.* | | | 6,580 | | | | 53,693 | |

Select Medical Holdings Corp. | | | 3,224 | | | | 112,421 | |

Seneca Foods Corp. - Class A* | | | 1,430 | | | | 89,132 | |

SpartanNash Co. | | | 8,083 | | | | 181,140 | |

Sprouts Farmers Market, Inc.* | | | 2,718 | | | | 300,094 | |

StoneCo Ltd. - Class A* | | | 1,650 | | | | 18,579 | |

Strategic Education, Inc. | | | 3,300 | | | | 305,415 | |

Stride, Inc.* | | | 7,215 | | | | 615,512 | |

Supernus Pharmaceuticals, Inc.* | | | 1,542 | | | | 48,080 | |

Surgery Partners, Inc.* | | | 2,930 | | | | 94,463 | |

Tandem Diabetes Care, Inc.* | | | 2,550 | | | | 108,146 | |

Tenet Healthcare Corp.* | | | 580 | | | | 96,396 | |

TreeHouse Foods, Inc.* | | | 7,777 | | | | 326,478 | |

TrueBlue, Inc.* | | | 3,150 | | | | 24,854 | |

UFP Technologies, Inc.* | | | 130 | | | | 41,171 | |

United Natural Foods, Inc.* | | | 7,570 | | | | 127,327 | |

Universal Corp. | | | 400 | | | | 21,244 | |

Universal Technical Institute, Inc.* | | | 2,450 | | | | 39,837 | |

Upbound Group, Inc. | | | 4,820 | | | | 154,192 | |

Utz Brands, Inc. | | | 1,310 | | | | 23,187 | |

Varex Imaging Corp.* | | | 3,540 | | | | 42,197 | |

Veracyte, Inc.* | | | 2,973 | | | | 101,201 | |

Village Super Market, Inc. - Class A | | | 2,030 | | | | 64,534 | |

Weis Markets, Inc. | | | 7,729 | | | | 532,760 | |

Willdan Group, Inc.* | | | 630 | | | | 25,799 | |

Zimvie, Inc.* | | | 3,200 | | | | 50,784 | |

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

CONSUMER, NON-CYCLICAL (Continued) |

Zymeworks, Inc.* | | | 2,790 | | | $ | 35,015 | |

| | | | | | | | 17,806,039 | |

ENERGY — 8.5% | | | | | | | | |

Adams Resources & Energy, Inc. | | | 560 | | | | 15,120 | |

Alpha Metallurgical Resources, Inc. | | | 1,248 | | | | 294,753 | |

Amplify Energy Corp.* | | | 5,030 | | | | 32,846 | |

Antero Midstream Corp. | | | 14,680 | | | | 220,934 | |

Antero Resources Corp.* | | | 4,590 | | | | 131,503 | |

APA Corp. | | | 11,204 | | | | 274,050 | |

Arch Resources, Inc. | | | 1,510 | | | | 208,622 | |

Archrock, Inc. | | | 23,210 | | | | 469,770 | |

Baytex Energy Corp. | | | 0 | | | | 1 | |

Berry Corp. | | | 8,485 | | | | 43,613 | |

Bristow Group, Inc.* | | | 3,950 | | | | 137,025 | |

California Resources Corp. | | | 7,375 | | | | 386,966 | |

ChampionX Corp. | | | 2,110 | | | | 63,617 | |

Chord Energy Corp. | | | 4,381 | | | | 570,538 | |

Civeo Corp. | | | 2,250 | | | | 61,650 | |

Civitas Resources, Inc. | | | 7,051 | | | | 357,274 | |

CNX Resources Corp.* | | | 33,381 | | | | 1,087,219 | |

Comstock Resources, Inc. | | | 24,844 | | | | 276,514 | |

CONSOL Energy, Inc. | | | 6,521 | | | | 682,423 | |

Crescent Energy Co. - Class A | | | 9,703 | | | | 106,248 | |

Delek U.S. Holdings, Inc. | | | 5,708 | | | | 107,025 | |

Diamondback Energy, Inc. | | | 2,569 | | | | 442,896 | |

DMC Global, Inc.* | | | 1,240 | | | | 16,095 | |

DNOW, Inc.* | | | 10,475 | | | | 135,442 | |

EnLink Midstream LLC | | | 13,765 | | | | 199,730 | |

EQT Corp. | | | 5,307 | | | | 194,448 | |

Expro Group Holdings N.V.* | | | 1,115 | | | | 19,145 | |

FutureFuel Corp. | | | 6,560 | | | | 37,720 | |

Geospace Technologies Corp.* | | | 800 | | | | 8,272 | |

Golar LNG Ltd. | | | 1,985 | | | | 72,969 | |

Green Plains, Inc.* | | | 1,270 | | | | 17,196 | |

Gulfport Energy Corp.* | | | 1,420 | | | | 214,917 | |

Hallador Energy Co.* | | | 4,010 | | | | 37,814 | |

Helix Energy Solutions Group, Inc.* | | | 27,060 | | | | 300,366 | |

Helmerich & Payne, Inc. | | | 16,799 | | | | 511,026 | |

Innovex International, Inc.* | | | 5,840 | | | | 85,731 | |

Liberty Energy, Inc. | | | 12,069 | | | | 230,397 | |

Mammoth Energy Services, Inc.* | | | 10,483 | | | | 42,875 | |

Matador Resources Co. | | | 9,194 | | | | 454,367 | |

Murphy Oil Corp. | | | 28,371 | | | | 957,238 | |

NACCO Industries, Inc. - Class A | | | 1,750 | | | | 49,613 | |

Natural Gas Services Group, Inc.* | | | 2,280 | | | | 43,571 | |

Newpark Resources, Inc.* | | | 14,965 | | | | 103,707 | |

Noble Corp. PLC | | | 992 | | | | 35,851 | |

See accompanying Notes to Financial Statements.

4

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

AS OF SEPTEMBER 30, 2024

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

ENERGY (Continued) |

Northern Oil & Gas, Inc. | | | 2,010 | | | $ | 71,174 | |

NOV, Inc. | | | 5,925 | | | | 94,622 | |

Oceaneering International, Inc.* | | | 4,982 | | | | 123,902 | |

Oil States International, Inc.* | | | 10,265 | | | | 47,219 | |

Par Pacific Holdings, Inc.* | | | 1,299 | | | | 22,862 | |

Patterson-UTI Energy, Inc. | | | 22,443 | | | | 171,689 | |

PBF Energy, Inc. - Class A | | | 18,417 | | | | 570,006 | |

Peabody Energy Corp. | | | 21,613 | | | | 573,609 | |

Permian Resources Corp. | | | 27,724 | | | | 377,324 | |

ProPetro Holding Corp.* | | | 19,710 | | | | 150,979 | |

Ramaco Resources, Inc. - Class A | | | 1,900 | | | | 22,230 | |

Range Resources Corp. | | | 2,399 | | | | 73,793 | |

Ranger Energy Services, Inc. | | | 5,600 | | | | 66,696 | |

REX American Resources Corp.* | | | 3,450 | | | | 159,700 | |

RPC, Inc. | | | 3,960 | | | | 25,186 | |

SandRidge Energy, Inc. | | | 2,136 | | | | 26,123 | |

Seadrill Ltd.* | | | 2,200 | | | | 87,428 | |

SM Energy Co. | | | 10,764 | | | | 430,237 | |

Smart Sand, Inc.* | | | 12,337 | | | | 24,304 | |

SunCoke Energy, Inc. | | | 21,790 | | | | 189,137 | |

Sunnova Energy International, Inc.* | | | 5,670 | | | | 55,226 | |

Sunrun, Inc.* | | | 3,310 | | | | 59,779 | |

Talos Energy, Inc.* | | | 19,408 | | | | 200,873 | |

Targa Resources Corp. | | | 3,000 | | | | 444,030 | |

TechnipFMC PLC | | | 20,670 | | | | 542,174 | |

Tidewater, Inc.* | | | 960 | | | | 68,918 | |

Transocean Ltd.* | | | 53,643 | | | | 227,983 | |

VAALCO Energy, Inc. | | | 13,370 | | | | 76,744 | |

Vital Energy, Inc.* | | | 2,350 | | | | 63,215 | |

Warrior Met Coal, Inc. | | | 7,005 | | | | 447,619 | |

Weatherford International PLC | | | 660 | | | | 56,047 | |

| | | | | | | | 15,289,925 | |

FINANCIAL — 30.1% | | | | | | | | |

1st Source Corp. | | | 5,572 | | | | 333,651 | |

ACNB Corp. | | | 500 | | | | 21,835 | |

Air Lease Corp. | | | 19,804 | | | | 896,923 | |

Amalgamated Financial Corp. | | | 3,210 | | | | 100,698 | |

Ambac Financial Group, Inc.* | | | 4,800 | | | | 53,808 | |

Amerant Bancorp, Inc. | | | 840 | | | | 17,951 | |

Ameris Bancorp | | | 8,312 | | | | 518,586 | |

AMERISAFE, Inc. | | | 860 | | | | 41,564 | |

AMREP Corp.* | | | 650 | | | | 19,299 | |

Anywhere Real Estate, Inc.* | | | 19,790 | | | | 100,533 | |

Associated Banc-Corp | | | 30,670 | | | | 660,632 | |

Assured Guaranty Ltd. | | | 12,228 | | | | 972,371 | |

Atlantic Union Bankshares Corp. | | | 16,309 | | | | 614,360 | |

Axis Capital Holdings Ltd. | | | 9,025 | | | | 718,480 | |

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

FINANCIAL (Continued) |

Axos Financial, Inc.* | | | 4,575 | | | $ | 287,676 | |

Banc of California, Inc. | | | 9,080 | | | | 133,748 | |

BancFirst Corp. | | | 484 | | | | 50,941 | |

Bancorp, Inc.* | | | 4,527 | | | | 242,194 | |

Bank of Hawaii Corp. | | | 2,141 | | | | 134,391 | |

Bank of Marin Bancorp | | | 1,900 | | | | 38,171 | |

Bank of NT Butterfield & Son Ltd. | | | 1,180 | | | | 43,518 | |

Bank OZK | | | 17,199 | | | | 739,385 | |

Bank7 Corp. | | | 770 | | | | 28,852 | |

BankFinancial Corp. | | | 1,530 | | | | 18,635 | |

BankUnited, Inc. | | | 14,354 | | | | 523,060 | |

Banner Corp. | | | 6,730 | | | | 400,839 | |

Bar Harbor Bankshares | | | 1,790 | | | | 55,204 | |

BCB Bancorp, Inc. | | | 1,600 | | | | 19,744 | |

Berkshire Hills Bancorp, Inc. | | | 7,906 | | | | 212,909 | |

Bread Financial Holdings, Inc. | | | 7,800 | | | | 371,124 | |

Bridgewater Bancshares, Inc.* | | | 2,910 | | | | 41,235 | |

Brighthouse Financial, Inc.* | | | 8,212 | | | | 369,786 | |

Brookfield Asset Management Ltd. - Class A | | | 4,393 | | | | 207,745 | |

Brookfield Business Corp. - Class A | | | 1,130 | | | | 28,623 | |

Brookline Bancorp, Inc. | | | 13,105 | | | | 132,229 | |

Burke & Herbert Financial Services Corp. | | | 1,397 | | | | 85,203 | |

Business First Bancshares, Inc. | | | 3,150 | | | | 80,860 | |

Byline Bancorp, Inc. | | | 3,970 | | | | 106,277 | |

C&F Financial Corp. | | | 710 | | | | 41,429 | |

Cadence Bank | | | 16,541 | | | | 526,831 | |

Camden National Corp. | | | 2,431 | | | | 100,449 | |

Capital City Bank Group, Inc. | | | 1,190 | | | | 41,995 | |

Carter Bankshares, Inc.* | | | 3,660 | | | | 63,647 | |

Cathay General Bancorp | | | 10,950 | | | | 470,302 | |

Central Pacific Financial Corp. | | | 2,620 | | | | 77,316 | |

Chemung Financial Corp. | | | 680 | | | | 32,654 | |

ChoiceOne Financial Services, Inc. | | | 500 | | | | 15,455 | |

Citizens, Inc.*2 | | | 8,843 | | | | 32,012 | |

City Holding Co. | | | 2,059 | | | | 241,706 | |

Cleanspark, Inc.* | | | 11,070 | | | | 103,394 | |

CNB Financial Corp. | | | 2,560 | | | | 61,594 | |

CNO Financial Group, Inc. | | | 25,059 | | | | 879,571 | |

Coastal Financial Corp.* | | | 780 | | | | 42,112 | |

Columbia Banking System, Inc. | | | 11,191 | | | | 292,197 | |

Comerica, Inc. | | | 730 | | | | 43,734 | |

Community Financial System, Inc. | | | 2,612 | | | | 151,679 | |

Community Trust Bancorp, Inc. | | | 1,470 | | | | 73,000 | |

Community West Bancshares | | | 1,800 | | | | 34,668 | |

ConnectOne Bancorp, Inc. | | | 8,940 | | | | 223,947 | |

Consumer Portfolio Services, Inc.* | | | 3,597 | | | | 33,740 | |

CrossFirst Bankshares, Inc.* | | | 3,800 | | | | 63,422 | |

See accompanying Notes to Financial Statements.

5

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

AS OF SEPTEMBER 30, 2024

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

FINANCIAL (Continued) |

Cushman & Wakefield PLC* | | | 10,460 | | | $ | 142,570 | |

Customers Bancorp, Inc.* | | | 5,605 | | | | 260,352 | |

CVB Financial Corp. | | | 5,390 | | | | 96,050 | |

Dime Community Bancshares, Inc. | | | 6,639 | | | | 191,203 | |

Donegal Group, Inc. - Class A | | | 1,421 | | | | 20,946 | |

Eagle Bancorp, Inc. | | | 4,147 | | | | 93,639 | |

Employers Holdings, Inc. | | | 5,219 | | | | 250,355 | |

Enact Holdings, Inc. | | | 2,253 | | | | 81,851 | |

Encore Capital Group, Inc.* | | | 4,510 | | | | 213,188 | |

Enova International, Inc.* | | | 3,885 | | | | 325,524 | |

Enstar Group Ltd.* | | | 1,260 | | | | 405,203 | |

Enterprise Financial Services Corp. | | | 4,315 | | | | 221,187 | |

Esquire Financial Holdings, Inc. | | | 1,589 | | | | 103,619 | |

ESSA Bancorp, Inc. | | | 960 | | | | 18,451 | |

Essent Group Ltd. | | | 7,347 | | | | 472,339 | |

Evercore, Inc. - Class A | | | 640 | | | | 162,138 | |

EZCORP, Inc. - Class A* | | | 11,690 | | | | 131,045 | |

F&G Annuities & Life, Inc. | | | 1,740 | | | | 77,813 | |

FB Financial Corp. | | | 1,720 | | | | 80,720 | |

Federal Agricultural Mortgage Corp. - Class C | | | 1,228 | | | | 230,139 | |

Finance Of America Cos., Inc. - Class A* | | | 700 | | | | 8,099 | |

Financial Institutions, Inc. | | | 2,980 | | | | 75,901 | |

First BanCorp/Puerto Rico | | | 52,310 | | | | 1,107,403 | |

First Bancorp/Southern Pines NC | | | 2,038 | | | | 84,760 | |

First Bancshares, Inc. | | | 3,916 | | | | 125,821 | |

First Bank/Hamilton NJ | | | 1,170 | | | | 17,784 | |

First Busey Corp. | | | 6,979 | | | | 181,594 | |

First Business Financial Services, Inc. | | | 1,420 | | | | 64,738 | |

First Commonwealth Financial Corp. | | | 21,140 | | | | 362,551 | |

First Community Bankshares, Inc. | | | 1,750 | | | | 75,513 | |

First Financial Bancorp | | | 20,709 | | | | 522,488 | |

First Financial Corp. | | | 1,821 | | | | 79,851 | |

First Financial Northwest, Inc. | | | 1,360 | | | | 30,627 | |

First Foundation, Inc. | | | 6,160 | | | | 38,438 | |

First Hawaiian, Inc. | | | 1,640 | | | | 37,966 | |

First Horizon Corp. | | | 4,782 | | | | 74,264 | |

First Internet Bancorp | | | 2,760 | | | | 94,558 | |

First Interstate BancSystem, Inc. - Class A | | | 6,166 | | | | 189,173 | |

First Merchants Corp. | | | 6,962 | | | | 258,986 | |

First Mid Bancshares, Inc. | | | 2,812 | | | | 109,415 | |

Flushing Financial Corp. | | | 2,970 | | | | 43,303 | |

FNB Corp. | | | 38,057 | | | | 536,984 | |

FRP Holdings, Inc.* | | | 2,140 | | | | 63,900 | |

FS Bancorp, Inc. | | | 620 | | | | 27,584 | |

FTAI Aviation Ltd. | | | 960 | | | | 127,584 | |

FTAI Infrastructure, Inc. | | | 2,520 | | | | 23,587 | |

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

FINANCIAL (Continued) |

Fulton Financial Corp. | | | 40,311 | | | $ | 730,838 | |

Genworth Financial, Inc.* | | | 103,288 | | | | 707,523 | |

German American Bancorp, Inc. | | | 1,000 | | | | 38,750 | |

Glacier Bancorp, Inc. | | | 2,150 | | | | 98,255 | |

Great Southern Bancorp, Inc. | | | 1,845 | | | | 105,737 | |

Hancock Whitney Corp. | | | 17,453 | | | | 893,070 | |

Hanmi Financial Corp. | | | 9,080 | | | | 168,888 | |

Hanover Insurance Group, Inc. | | | 240 | | | | 35,546 | |

HarborOne Bancorp, Inc. | | | 3,260 | | | | 42,315 | |

Heartland Financial USA, Inc. | | | 5,040 | | | | 285,768 | |

Heritage Commerce Corp. | | | 6,040 | | | | 59,675 | |

Heritage Financial Corp. | | | 3,008 | | | | 65,484 | |

Heritage Insurance Holdings, Inc.* | | | 2,821 | | | | 34,529 | |

Hilltop Holdings, Inc. | | | 12,462 | | | | 400,778 | |

Home Bancorp, Inc. | | | 940 | | | | 41,905 | |

HomeStreet, Inc. | | | 2,050 | | | | 32,308 | |

Hope Bancorp, Inc. | | | 19,307 | | | | 242,496 | |

Horace Mann Educators Corp. | | | 5,961 | | | | 208,337 | |

Horizon Bancorp, Inc. | | | 3,741 | | | | 58,173 | |

Howard Hughes Holdings, Inc.* | | | 5,619 | | | | 435,079 | |

Independent Bank Corp. | | | 3,950 | | | | 131,732 | |

Independent Bank Corp. | | | 2,345 | | | | 138,660 | |

Independent Bank Group, Inc. | | | 5,175 | | | | 298,390 | |

International Bancshares Corp. | | | 12,765 | | | | 763,219 | |

Invesco Ltd. | | | 12,170 | | | | 213,705 | |

Investar Holding Corp. | | | 1,000 | | | | 19,400 | |

Jackson Financial, Inc. - Class A | | | 13,963 | | | | 1,273,844 | |

Janus Henderson Group PLC | | | 10,032 | | | | 381,918 | |

Kearny Financial Corp. | | | 7,382 | | | | 50,714 | |

Kemper Corp. | | | 2,100 | | | | 128,625 | |

Kennedy-Wilson Holdings, Inc. | | | 8,395 | | | | 92,765 | |

LendingClub Corp.* | | | 19,750 | | | | 225,742 | |

LendingTree, Inc.* | | | 450 | | | | 26,114 | |

Live Oak Bancshares, Inc. | | | 3,380 | | | | 160,111 | |

Marcus & Millichap, Inc. | | | 1,460 | | | | 57,860 | |

McGrath RentCorp | | | 1,675 | | | | 176,344 | |

Mercantile Bank Corp. | | | 3,170 | | | | 138,592 | |

Merchants Bancorp | | | 1,270 | | | | 57,099 | |

Mercury General Corp. | | | 2,892 | | | | 182,138 | |

Metrocity Bankshares, Inc. | | | 1,000 | | | | 30,620 | |

Metropolitan Bank Holding Corp.* | | | 560 | | | | 29,445 | |

MGIC Investment Corp. | | | 37,540 | | | | 961,024 | |

Midland States Bancorp, Inc. | | | 3,660 | | | | 81,911 | |

MidWestOne Financial Group, Inc. | | | 1,400 | | | | 39,942 | |

Mr Cooper Group, Inc.* | | | 13,692 | | | | 1,262,129 | |

Navient Corp. | | | 30,574 | | | | 476,649 | |

NBT Bancorp, Inc. | | | 3,290 | | | | 145,517 | |

See accompanying Notes to Financial Statements.

6

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

AS OF SEPTEMBER 30, 2024

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

FINANCIAL (Continued) |

Nelnet, Inc. - Class A | | | 5,820 | | | $ | 659,290 | |

Newmark Group, Inc. - Class A | | | 11,470 | | | | 178,129 | |

NMI Holdings, Inc.* | | | 15,117 | | | | 622,669 | |

Northeast Bank | | | 1,190 | | | | 91,785 | |

Northfield Bancorp, Inc. | | | 6,850 | | | | 79,460 | |

Northrim BanCorp, Inc. | | | 1,860 | | | | 132,469 | |

Northwest Bancshares, Inc. | | | 25,491 | | | | 341,070 | |

Oak Valley Bancorp | | | 1,610 | | | | 42,778 | |

OceanFirst Financial Corp. | | | 11,811 | | | | 219,566 | |

OFG Bancorp | | | 14,850 | | | | 667,062 | |

Old National Bancorp | | | 40,696 | | | | 759,387 | |

Old Second Bancorp, Inc. | | | 2,780 | | | | 43,340 | |

OneMain Holdings, Inc. | | | 1,790 | | | | 84,255 | |

Oppenheimer Holdings, Inc. - Class A | | | 2,470 | | | | 126,365 | |

Orrstown Financial Services, Inc. | | | 2,317 | | | | 83,319 | |

Pacific Premier Bancorp, Inc. | | | 18,260 | | | | 459,422 | |

Palomar Holdings, Inc.* | | | 440 | | | | 41,655 | |

Park National Corp. | | | 185 | | | | 31,076 | |

Pathward Financial, Inc. | | | 3,445 | | | | 227,404 | |

PCB Bancorp | | | 3,540 | | | | 66,517 | |

Peapack-Gladstone Financial Corp. | | | 3,435 | | | | 94,153 | |

PennyMac Financial Services, Inc. | | | 6,077 | | | | 692,596 | |

Peoples Bancorp, Inc. | | | 6,923 | | | | 208,313 | |

Peoples Financial Services Corp. | | | 1,290 | | | | 60,475 | |

Pinnacle Financial Partners, Inc. | | | 2,757 | | | | 270,103 | |

Piper Sandler Cos. | | | 2,073 | | | | 588,338 | |

PJT Partners, Inc. - Class A | | | 200 | | | | 26,668 | |

Popular, Inc. | | | 9,530 | | | | 955,573 | |

PRA Group, Inc.* | | | 1,650 | | | | 36,894 | |

Preferred Bank/Los Angeles CA | | | 3,270 | | | | 262,417 | |

Premier Financial Corp. | | | 6,454 | | | | 151,540 | |

Primerica, Inc. | | | 440 | | | | 116,666 | |

Primis Financial Corp. | | | 2,444 | | | | 29,768 | |

ProAssurance Corp.* | | | 5,465 | | | | 82,194 | |

Provident Financial Holdings, Inc. | | | 1,180 | | | | 16,933 | |

Provident Financial Services, Inc. | | | 31,378 | | | | 582,376 | |

QCR Holdings, Inc. | | | 1,667 | | | | 123,408 | |

Radian Group, Inc. | | | 17,552 | | | | 608,879 | |

RE/MAX Holdings, Inc. - Class A | | | 4,319 | | | | 53,772 | |

Regional Management Corp. | | | 2,250 | | | | 73,598 | |

Renasant Corp. | | | 10,463 | | | | 340,047 | |

Republic Bancorp, Inc. - Class A | | | 1,290 | | | | 84,237 | |

S&T Bancorp, Inc. | | | 4,703 | | | | 197,385 | |

Safety Insurance Group, Inc. | | | 1,430 | | | | 116,945 | |

Sandy Spring Bancorp, Inc. | | | 7,741 | | | | 242,835 | |

Seacoast Banking Corp. of Florida | | | 3,015 | | | | 80,350 | |

Seaport Entertainment Group, Inc.* | | | 569 | | | | 15,602 | |

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

FINANCIAL (Continued) |

Selective Insurance Group, Inc. | | | 1,551 | | | $ | 144,708 | |

ServisFirst Bancshares, Inc. | | | 790 | | | | 63,556 | |

Sierra Bancorp | | | 2,330 | | | | 67,290 | |

Simmons First National Corp. - Class A | | | 16,097 | | | | 346,729 | |

SiriusPoint Ltd.* | | | 17,140 | | | | 245,788 | |

Skyward Specialty Insurance Group, Inc.* | | | 700 | | | | 28,511 | |

SLM Corp. | | | 1,590 | | | | 36,363 | |

SmartFinancial, Inc. | | | 1,970 | | | | 57,406 | |

SoFi Technologies, Inc.* | | | 7,570 | | | | 59,500 | |

Southside Bancshares, Inc. | | | 1,366 | | | | 45,665 | |

SouthState Corp. | | | 4,843 | | | | 470,643 | |

Stellar Bancorp, Inc. | | | 2,529 | | | | 65,476 | |

Stewart Information Services Corp. | | | 2,660 | | | | 198,808 | |

Stifel Financial Corp. | | | 2,680 | | | | 251,652 | |

Stock Yards Bancorp, Inc. | | | 840 | | | | 52,072 | |

StoneX Group, Inc.* | | | 2,796 | | | | 228,936 | |

Texas Capital Bancshares, Inc.* | | | 9,492 | | | | 678,298 | |

Timberland Bancorp, Inc. | | | 1,578 | | | | 47,750 | |

Tiptree, Inc. | | | 9,480 | | | | 185,524 | |

Tompkins Financial Corp. | | | 899 | | | | 51,953 | |

Towne Bank/Portsmouth VA | | | 2,010 | | | | 66,451 | |

TriCo Bancshares | | | 3,083 | | | | 131,490 | |

TrustCo Bank Corp. NY | | | 3,330 | | | | 110,123 | |

Trustmark Corp. | | | 8,127 | | | | 258,601 | |

United Bankshares, Inc. | | | 11,352 | | | | 421,159 | |

United Community Banks, Inc. | | | 7,632 | | | | 221,939 | |

United Fire Group, Inc. | | | 2,240 | | | | 46,883 | |

Universal Insurance Holdings, Inc. | | | 5,090 | | | | 112,794 | |

Univest Financial Corp. | | | 5,460 | | | | 153,644 | |

Unum Group | | | 11,056 | | | | 657,169 | |

Valley National Bancorp | | | 50,383 | | | | 456,470 | |

Veritex Holdings, Inc. | | | 2,990 | | | | 78,697 | |

Virtu Financial, Inc. - Class A | | | 2,010 | | | | 61,225 | |

Virtus Investment Partners, Inc. | | | 428 | | | | 89,645 | |

WaFd, Inc. | | | 19,580 | | | | 682,363 | |

Walker & Dunlop, Inc. | | | 1,684 | | | | 191,286 | |

Washington Trust Bancorp, Inc. | | | 1,970 | | | | 63,454 | |

Waterstone Financial, Inc. | | | 4,134 | | | | 60,770 | |

Webster Financial Corp. | | | 7,689 | | | | 358,384 | |

WesBanco, Inc. | | | 10,891 | | | | 324,334 | |

Westamerica BanCorp | | | 1,630 | | | | 80,555 | |

Western Alliance Bancorp | | | 2,306 | | | | 199,446 | |

White Mountains Insurance Group Ltd. | | | 295 | | | | 500,379 | |

Wintrust Financial Corp. | | | 5,134 | | | | 557,193 | |

World Acceptance Corp.* | | | 540 | | | | 63,709 | |

WSFS Financial Corp. | | | 8,221 | | | | 419,189 | |

Zions Bancorp N.A. | | | 3,250 | | | | 153,465 | |

| | | | | | | 54,157,289 | |

See accompanying Notes to Financial Statements.

7

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

AS OF SEPTEMBER 30, 2024

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

INDUSTRIAL — 17.6% | | | | | | | | |

AAR Corp.* | | | 8,750 | | | $ | 571,900 | |

Acuity Brands, Inc. | | | 140 | | | | 38,555 | |

Air Transport Services Group, Inc.* | | | 8,750 | | | | 141,663 | |

American Woodmark Corp.* | | | 2,633 | | | | 246,054 | |

Apogee Enterprises, Inc. | | | 1,370 | | | | 95,921 | |

Applied Industrial Technologies, Inc. | | | 490 | | | | 109,334 | |

ArcBest Corp. | | | 4,220 | | | | 457,659 | |

Arcosa, Inc. | | | 5,709 | | | | 540,985 | |

Ardmore Shipping Corp. | | | 6,720 | | | | 121,632 | |

Argan, Inc. | | | 180 | | | | 18,257 | |

Astec Industries, Inc. | | | 3,117 | | | | 99,557 | |

Astronics Corp.* | | | 1,280 | | | | 24,934 | |

Avnet, Inc. | | | 13,386 | | | | 726,994 | |

AZEK Co., Inc.* | | | 2,210 | | | | 103,428 | |

AZZ, Inc. | | | 1,710 | | | | 141,263 | |

Barnes Group, Inc. | | | 8,307 | | | | 335,686 | |

Bel Fuse, Inc. - Class B | | | 2,320 | | | | 182,143 | |

Belden, Inc. | | | 890 | | | | 104,246 | |

Benchmark Electronics, Inc. | | | 9,620 | | | | 426,358 | |

Boise Cascade Co. | | | 7,384 | | | | 1,040,996 | |

Brady Corp. - Class A | | | 1,955 | | | | 149,812 | |

Clearwater Paper Corp.* | | | 2,595 | | | | 74,061 | |

Coherent Corp.* | | | 4,803 | | | | 427,035 | |

Columbus McKinnon Corp. | | | 4,100 | | | | 147,600 | |

Comfort Systems USA, Inc. | | | 259 | | | | 101,101 | |

Core Molding Technologies, Inc.* | | | 850 | | | | 14,629 | |

Costamare, Inc. | | | 23,217 | | | | 364,971 | |

Covenant Logistics Group, Inc. | | | 1,962 | | | | 103,672 | |

DHT Holdings, Inc. | | | 41,380 | | | | 456,421 | |

Dorian LPG Ltd. | | | 9,113 | | | | 313,669 | |

Ducommun, Inc.* | | | 2,697 | | | | 177,544 | |

DXP Enterprises, Inc.* | | | 1,480 | | | | 78,973 | |

Eagle Materials, Inc. | | | 200 | | | | 57,530 | |

EMCOR Group, Inc. | | | 678 | | | | 291,899 | |

Enerpac Tool Group Corp. | | | 920 | | | | 38,539 | |

EnerSys | | | 1,780 | | | | 181,649 | |

Enpro, Inc. | | | 3,555 | | | | 576,550 | |

Enviri Corp.* | | | 8,040 | | | | 83,134 | |

Esab Corp. | | | 4,603 | | | | 489,345 | |

ESCO Technologies, Inc. | | | 2,323 | | | | 299,621 | |

Federal Signal Corp. | | | 2,698 | | | | 252,155 | |

Flowserve Corp. | | | 1,710 | | | | 88,390 | |

Forward Air Corp. | | | 2,070 | | | | 73,278 | |

FreightCar America, Inc.* | | | 2,630 | | | | 28,378 | |

Frontdoor, Inc.* | | | 6,820 | | | | 327,292 | |

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

INDUSTRIAL (Continued) |

Frontline PLC | | | 16,624 | | | $ | 379,858 | |

GATX Corp. | | | 7,955 | | | | 1,053,640 | |

Genco Shipping & Trading Ltd. | | | 7,925 | | | | 154,537 | |

Gibraltar Industries, Inc.* | | | 819 | | | | 57,273 | |

Granite Construction, Inc. | | | 6,413 | | | | 508,423 | |

Great Lakes Dredge & Dock Corp.* | | | 7,720 | | | | 81,292 | |

Greenbrier Cos., Inc. | | | 7,215 | | | | 367,171 | |

Greif, Inc. - Class A | | | 5,540 | | | | 347,136 | |

Griffon Corp. | | | 4,110 | | | | 287,700 | |

Hayward Holdings, Inc.* | | | 2,676 | | | | 41,050 | |

Heartland Express, Inc. | | | 2,240 | | | | 27,507 | |

Hillenbrand, Inc. | | | 1,097 | | | | 30,497 | |

Hub Group, Inc. - Class A | | | 16,370 | | | | 744,016 | |

Hurco Cos., Inc. | | | 900 | | | | 18,963 | |

Ichor Holdings Ltd.* | | | 2,228 | | | | 70,873 | |

IES Holdings, Inc.* | | | 140 | | | | 27,947 | |

International Seaways, Inc. | | | 8,384 | | | | 432,279 | |

Itron, Inc.* | | | 830 | | | | 88,652 | |

JELD-WEN Holding, Inc.* | | | 5,330 | | | | 84,267 | |

Kennametal, Inc. | | | 7,425 | | | | 192,530 | |

Kimball Electronics, Inc.* | | | 6,580 | | | | 121,796 | |

Kirby Corp.* | | | 5,581 | | | | 683,282 | |

Knowles Corp.* | | | 15,245 | | | | 274,867 | |

Kratos Defense & Security Solutions, Inc.* | | | 3,012 | | | | 70,180 | |

L B Foster Co. - Class A* | | | 1,450 | | | | 29,624 | |

Latham Group, Inc.* | | | 4,240 | | | | 28,832 | |

Limbach Holdings, Inc.* | | | 1,060 | | | | 80,306 | |

Louisiana-Pacific Corp. | | | 990 | | | | 106,385 | |

LSI Industries, Inc. | | | 1,560 | | | | 25,194 | |

Manitowoc Co., Inc.* | | | 3,920 | | | | 37,710 | |

Marten Transport Ltd. | | | 17,425 | | | | 308,422 | |

Masterbrand, Inc.* | | | 1,990 | | | | 36,895 | |

Materion Corp. | | | 2,824 | | | | 315,893 | |

Matson, Inc. | | | 6,081 | | | | 867,272 | |

MDU Resources Group, Inc. | | | 2,030 | | | | 55,642 | |

Mesa Laboratories, Inc. | | | 200 | | | | 25,972 | |

Metallus, Inc.* | | | 8,632 | | | | 128,013 | |

Mistras Group, Inc.* | | | 4,020 | | | | 45,707 | |

Modine Manufacturing Co.* | | | 10,012 | | | | 1,329,493 | |

Mohawk Industries, Inc.* | | | 3,638 | | | | 584,554 | |

Moog, Inc. - Class A | | | 1,435 | | | | 289,899 | |

Mueller Industries, Inc. | | | 7,600 | | | | 563,160 | |

National Presto Industries, Inc. | | | 460 | | | | 34,564 | |

NL Industries, Inc. | | | 5,450 | | | | 40,494 | |

Nordic American Tankers Ltd. | | | 8,300 | | | | 30,461 | |

Northwest Pipe Co.* | | | 1,917 | | | | 86,514 | |

nVent Electric PLC | | | 3,475 | | | | 244,153 | |

See accompanying Notes to Financial Statements.

8

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

AS OF SEPTEMBER 30, 2024

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

INDUSTRIAL (Continued) |

O-I Glass, Inc.* | | | 11,355 | | | $ | 148,978 | |

Olympic Steel, Inc. | | | 2,199 | | | | 85,761 | |

Pactiv Evergreen, Inc. | | | 4,380 | | | | 50,414 | |

PAM Transportation Services, Inc.* | | | 2,254 | | | | 41,699 | |

Park-Ohio Holdings Corp. | | | 1,410 | | | | 43,287 | |

Plexus Corp.* | | | 3,350 | | | | 457,978 | |

Powell Industries, Inc. | | | 1,000 | | | | 221,990 | |

Primoris Services Corp. | | | 6,700 | | | | 389,136 | |

Proto Labs, Inc.* | | | 910 | | | | 26,727 | |

RXO, Inc.* | | | 910 | | | | 25,480 | |

Ryder System, Inc. | | | 2,573 | | | | 375,143 | |

Ryerson Holding Corp. | | | 4,449 | | | | 88,580 | |

Saia, Inc.* | | | 80 | | | | 34,981 | |

Sanmina Corp.* | | | 14,011 | | | | 959,053 | |

Schneider National, Inc. - Class B | | | 7,120 | | | | 203,205 | |

Scorpio Tankers, Inc. | | | 8,366 | | | | 596,496 | |

SFL Corp. Ltd. | | | 3,130 | | | | 36,214 | |

Smith & Wesson Brands, Inc. | | | 7,030 | | | | 91,249 | |

SPX Technologies, Inc.* | | | 2,665 | | | | 424,961 | |

Standex International Corp. | | | 400 | | | | 73,112 | |

Star Bulk Carriers Corp. | | | 6,000 | | | | 142,140 | |

Sterling Infrastructure, Inc.* | | | 1,530 | | | | 221,881 | |

Sturm Ruger & Co., Inc. | | | 359 | | | | 14,963 | |

Summit Materials, Inc. - Class A* | | | 11,328 | | | | 442,132 | |

TD SYNNEX Corp. | | | 1,180 | | | | 141,694 | |

Teekay Corp.* | | | 16,632 | | | | 153,014 | |

Teekay Tankers Ltd. - Class A | | | 5,263 | | | | 306,570 | |

Terex Corp. | | | 1,885 | | | | 99,735 | |

Thermon Group Holdings, Inc.* | | | 2,600 | | | | 77,584 | |

Timken Co. | | | 1,255 | | | | 105,784 | |

TriMas Corp. | | | 5,030 | | | | 128,416 | |

Trinity Industries, Inc. | | | 14,845 | | | | 517,200 | |

TTM Technologies, Inc.* | | | 30,394 | | | | 554,690 | |

Tutor Perini Corp.* | | | 2,840 | | | | 77,134 | |

UFP Industries, Inc. | | | 2,800 | | | | 367,388 | |

Vishay Intertechnology, Inc. | | | 26,509 | | | | 501,285 | |

Watts Water Technologies, Inc. - Class A | | | 260 | | | | 53,869 | |

Werner Enterprises, Inc. | | | 9,190 | | | | 354,642 | |

Willis Lease Finance Corp. | | | 1,840 | | | | 273,810 | |

World Kinect Corp. | | | 11,110 | | | | 343,410 | |

Worthington Enterprises, Inc. | | | 2,520 | | | | 104,454 | |

Worthington Steel, Inc. | | | 3,300 | | | | 112,233 | |

| | | | | | | 31,634,180 | |

TECHNOLOGY — 3.7% | | | | | | | | |

ACI Worldwide, Inc.* | | | 890 | | | | 45,301 | |

Adeia, Inc. | | | 18,127 | | | | 215,893 | |

Alpha & Omega Semiconductor Ltd.* | | | 7,115 | | | | 264,109 | |

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

TECHNOLOGY (Continued) |

Ambarella, Inc.* | | | 510 | | | $ | 28,767 | |

Amkor Technology, Inc. | | | 42,676 | | | | 1,305,886 | |

Amtech Systems, Inc.* | | | 2,100 | | | | 12,180 | |

ASGN, Inc.* | | | 960 | | | | 89,501 | |

AXT, Inc.* | | | 534 | | | | 1,292 | |

Box, Inc.* | | | 1,240 | | | | 40,585 | |

CACI International, Inc. - Class A* | | | 1,449 | | | | 731,107 | |

Cerence, Inc.* | | | 6,600 | | | | 20,790 | |

Climb Global Solutions, Inc. | | | 180 | | | | 17,917 | |

Cohu, Inc.* | | | 5,952 | | | | 152,966 | |

Conduent, Inc.* | | | 23,730 | | | | 95,632 | |

CoreCard Corp.* | | | 3,020 | | | | 43,850 | |

Corsair Gaming, Inc.* | | | 5,310 | | | | 36,958 | |

Diebold Nixdorf, Inc.* | | | 870 | | | | 38,854 | |

Digi International, Inc.* | | | 5,825 | | | | 160,362 | |

Diodes, Inc.* | | | 1,347 | | | | 86,329 | |

Donnelley Financial Solutions, Inc.* | | | 780 | | | | 51,347 | |

DXC Technology Co.* | | | 2,610 | | | | 54,158 | |

Immersion Corp. | | | 1,770 | | | | 15,788 | |

Insight Enterprises, Inc.* | | | 5,035 | | | | 1,084,489 | |

Integral Ad Science Holding Corp.* | | | 3,650 | | | | 39,457 | |

Kulicke & Soffa Industries, Inc. | | | 2,148 | | | | 96,939 | |

Kyndryl Holdings, Inc.* | | | 2,040 | | | | 46,879 | |

LivePerson, Inc.* | | | 14,750 | | | | 18,880 | |

Maximus, Inc. | | | 930 | | | | 86,639 | |

Navitas Semiconductor Corp.* | | | 7,250 | | | | 17,763 | |

NetScout Systems, Inc.* | | | 13,590 | | | | 295,583 | |

Onto Innovation, Inc.* | | | 1,084 | | | | 224,995 | |

Parsons Corp.* | | | 1,090 | | | | 113,011 | |

Photronics, Inc.* | | | 12,433 | | | | 307,841 | |

Rambus, Inc.* | | | 845 | | | | 35,676 | |

RingCentral, Inc. - Class A* | | | 1,080 | | | | 34,160 | |

Semtech Corp.* | | | 590 | | | | 26,939 | |

SolarWinds Corp. | | | 3,010 | | | | 39,281 | |

Super Micro Computer, Inc.* | | | 846 | | | | 352,274 | |

Ultra Clean Holdings, Inc.* | | | 1,570 | | | | 62,690 | |

Veradigm, Inc.* | | | 18,109 | | | | 175,657 | |

Vishay Precision Group, Inc.* | | | 2,480 | | | | 64,232 | |

| | | | | | | 6,632,957 | |

| | | | | | | | | |

UTILITIES — 0.7% | | | | | | | | |

American States Water Co. | | | 240 | | | | 19,990 | |

Black Hills Corp. | | | 640 | | | | 39,117 | |

Brookfield Infrastructure Corp. - Class A | | | 7,983 | | | | 346,702 | |

Clearway Energy, Inc. - Class C | | | 2,030 | | | | 62,280 | |

MGE Energy, Inc. | | | 834 | | | | 76,269 | |

New Jersey Resources Corp. | | | 3,426 | | | | 161,707 | |

See accompanying Notes to Financial Statements.

9

Vericimetry U.S. Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

AS OF SEPTEMBER 30, 2024

| | | Number

of Shares | | | Value | |

COMMON STOCKS (Continued) |

UTILITIES (Continued) |

NRG Energy, Inc. | | | 3,892 | | | $ | 354,561 | |

ONE Gas, Inc. | | | 840 | | | | 62,513 | |

Ormat Technologies, Inc. | | | 271 | | | | 20,851 | |

Otter Tail Corp. | | | 1,101 | | | | 86,054 | |

| | | | | | | 1,230,044 | |

TOTAL COMMON STOCKS (Cost $103,802,006) | | | | | | | 171,414,189 | |

| | | | | | | | |

EXCHANGE-TRADED FUNDS — 1.8% | | | | | | | | |

Direxion Daily 20 Year Plus Treasury Bull 3x Shares ETF | | | 1,660 | | | | 95,882 | |

Direxion Daily Small Cap Bull 3X Shares ETF | | | 16,554 | | | | 734,004 | |

iShares Russell 2000 Value ETF | | | 6,035 | | | | 1,006,759 | |

iShares S&P Small-Cap 600 Value ETF | | | 2,010 | | | | 216,396 | |

SPDR S&P Regional Banking ETF2 | | | 19,183 | | | | 1,085,758 | |

VanEck Oil Services ETF | | | 400 | | | | 113,484 | |

| | | | | | | | | |

TOTAL EXCHANGE-TRADED FUNDS (Cost $2,269,347) | | | 3,252,283 | |

| | | | | | | | | |

PREFERRED STOCKS — 0.1% | | | | | | | | |

CONSUMER, CYCLICAL — 0.1% | | | | | | | | |

Qurate Retail, Inc. 8.00%, 3/15/20313 | | | 274 | | | | 11,919 | |

WESCO International, Inc. 10.63%3,4,5 | | | 5,008 | | | | 129,457 | |

| | | | | | | | 141,376 | |

INDUSTRIAL — 0.0% | | | | | | | | |

Steel Partners Holdings LP 6.00%, 2/7/20263 | | | 1,855 | | | | 45,076 | |

| | | | | | | | | |

TOTAL PREFERRED STOCKS | | | | | | | | |

(Cost $188,490) | | | | | | | 186,452 | |

| | | | | | | | | |

RIGHTS — 0.0% | | | | | | | | |

FINANCIAL — 0.0% | | | | | | | | |

Seaport Entertainment Group, Inc.* | | | 569 | | | | 1,679 | |

| | | | | | | | | |

TOTAL RIGHTS | | | | | | | | |

(Cost $0) | | | | | | | 1,679 | |

| | | | | | | | | |

WARRANTS — 0.0% | | | | | | | | |

BASIC MATERIALS — 0.0% | | | | | | | | |

Resolute Forest Products, Inc., Expiration Date: December 31, 2025*1 | | | 12,820 | | | | — | |

| | | | | | | | | |

| | | Number

of Shares | | | Value | |

CONSUMER, NON-CYCLICAL — 0.0% | | | | | | | | |

Akouos, Inc., Expiration Date: December 5, 2024*1 | | | 5,159 | | | $ | — | |

Jounce Therapeutics, Expiration Date: December 31, 2025*1 | | | 18,810 | | | | — | |

| | | | | | | | — | |

TOTAL WARRANTS | | | | | | | | |

(Cost $0) | | | | | | | — | |

| | | | | | | | | |

MONEY MARKET INVESTMENTS — 3.0% | | | | |

Federated Treasury Obligations Fund - Class Institutional, 4.73%4,6 | | | 500,000 | | | | 500,000 | |

Fidelity Institutional Government Portfolio, 4.77%4 | | | 3,823,124 | | | | 3,823,124 | |

Invesco Government & Agency Portfolio, 4.84%4,7 | | | 1,343,275 | | | | 1,343,275 | |

| | | | | |

TOTAL MONEY MARKET INVESTMENTS | | | | |

(Cost $5,666,399) | | | | | | | 5,666,399 | |

| | | | | | | | | |

TOTAL INVESTMENTS — 100.2% | | | | | | | | |

(Cost $111,926,242) | | | | | | | 180,521,002 | |

| | | | | | | | | |

Liabilities less other assets — (0.2)% | | | | | | | (568,379 | ) |

| | | | | | | | | |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 179,952,623 | |

LLC – Limited Liability Company

LP – Limited Partnership

PLC – Public Limited Company

* | Non-income producing security. |

1 | Security valued at fair value as determined by the investment adviser under the supervision of the Board of Trustees. Value determined using significant unobservable inputs. See Note 2 in the Notes to |

2 | All or a portion of shares are on loan. Total loaned securities had a fair value of $1,328,236 at September 30, 2024. |

4 | Variable rate security; the rate shown represents the rate at September 30, 2024. |

5 | Perpetual security; maturity date is not applicable. |

6 | All or a portion of this security is segregated as collateral for options contracts. The total value of these securities is $500,000 at September 30, 2024. The Fund had option contracts transactions during the period ended September 30, 2024, however, due to the timing of these transactions, there were no open options contracts as of September 30, 2024. |

7 | Investments purchased with cash proceeds from securities lending. Total collateral had a fair value of $1,343,275 at September 30, 2024. |

See accompanying Notes to Financial Statements.

10

Vericimetry Funds

Vericimetry U.S. Small Cap Value Fund

Statement of Assets and Liabilities

AS OF SEPTEMBER 30, 2024

ASSETS: | | | | |

Investments in securities, at value (cost $111,926,242) | | $ | 180,521,002 | (1) |

Cash held at broker | | | 771,423 | |

Receivables: | | | | |

Dividends and interest | | | 121,185 | |

Securities lending income | | | 372 | |

Prepaid expenses and other assets | | | 11,616 | |

Total assets | | | 181,425,598 | |

| | | | | |

LIABILITIES: | | | | |

Collateral due to broker for securities loaned | | | 1,343,275 | |

Payables: | | | | |

Fund shares redeemed | | | 250 | |

Due to Trustees | | | 4,351 | |

Due to Adviser | | | 66,289 | |

Fund accounting and administration fees and expenses | | | 13,665 | |

Transfer agent fees | | | 10,586 | |

Custody fees | | | 7,026 | |

Accrued other expenses | | | 27,533 | |

Total liabilities | | | 1,472,975 | |

| | | | | |

Commitments and contingencies (Note 3) | | | | |

| | | | | |

NET ASSETS | | $ | 179,952,623 | |

| | | | | |

COMPONENTS OF NET ASSETS: | | | | |

Paid-in capital | | $ | 98,829,264 | |

Total distributable earnings | | | 81,123,359 | |

NET ASSETS | | $ | 179,952,623 | |

| | | | | |

Shares outstanding, no par value (unlimited shares authorized) | | | 8,096,834 | |

| | | | | |

Net asset value, offering and redemption price per share | | $ | 22.23 | |

(1) | Includes securities on loan of $1,328,236 (see Note 2). |

See accompanying Notes to Financial Statements.

11

Vericimetry Funds

Vericimetry U.S. Small Cap Value Fund

Statement of Operations

FOR THE YEAR ENDED SEPTEMBER 30, 2024

INVESTMENT INCOME | | | | |

Income | | | | |

Dividends (net of foreign withholding taxes of $2,315) | | $ | 3,083,679 | |

Securities lending income | | | 7,276 | |

Interest | | | 201,159 | |

Total investment Income | | | 3,292,114 | |

| | | | | |

Expenses | | | | |

Investment advisory fees | | | 876,974 | |

Fund accounting and administration fees and expenses | | | 81,469 | |

Registration fees | | | 41,726 | |

Professional fees | | | 39,000 | |

Transfer agent fees | | | 37,682 | |

Custody fees | | | 28,429 | |

Shareholder reporting fees | | | 13,750 | |

Trustees’ fees and expenses | | | 8,701 | |

Insurance fees | | | 6,568 | |

Total expenses | | | 1,134,299 | |

Fees waived by the Adviser | | | (81,930 | ) |

Net expenses | | | 1,052,369 | |

Net investment income | | | 2,239,745 | |

| | | | | |

Net Realized and Unrealized Gain on Investments and Options Contracts | | | | |

Net realized gain on: | | | | |

Investments | | | 14,023,044 | |

Purchased options contracts | | | 76,820 | |

Written options contracts | | | 16,487 | |

Net realized gain | | | 14,116,351 | |

Net change in unrealized appreciation/depreciation on investments | | | 24,489,734 | |

Net realized and unrealized gain on investments and options contracts | | | 38,606,085 | |

| | | | | |

Net Increase in Net Assets from Operations | | $ | 40,845,830 | |

See accompanying Notes to Financial Statements.

12

Vericimetry Funds

Vericimetry U.S. Small Cap Value Fund

Statements of Changes in Net Assets

| | | For the Year Ended

September 30, 2024 | | | For the Year Ended

September 30, 2023 | |

INCREASE (DECREASE) IN NET ASSETS FROM: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 2,239,745 | | | $ | 2,515,697 | |

Net realized gain on investments, purchased options contracts and written options contracts | | | 14,116,351 | | | | 2,515,630 | |

Net change in unrealized appreciation/depreciation on investments | | | 24,489,734 | | | | 14,957,988 | |

Net increase in net assets resulting from operations | | | 40,845,830 | | | | 19,989,315 | |

| | | | | | | | | |

Distributions to Shareholders | | $ | (5,030,033 | ) | | $ | (13,076,800 | ) |

| | | | | | | | | |

Capital Transactions | | | | | | | | |

Proceeds from shares issued | | | 425,921 | | | | 14,107,742 | |

Reinvestment of distributions | | | 5,024,733 | | | | 13,062,117 | |

Cost of shares redeemed | | | (25,608,658 | ) | | | (25,379,178 | ) |

Net increase (decrease) resulting from capital transactions | | | (20,158,004 | ) | | | 1,790,681 | |

| | | | | | | | | |

Total increase in net assets | | | 15,657,793 | | | | 8,703,196 | |

| | | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of year | | | 164,294,830 | | | | 155,591,634 | |

End of year | | $ | 179,952,623 | | | $ | 164,294,830 | |

| | | | | | | | | |

Capital Share Activity | | | | | | | | |

Shares issued | | | 23,329 | | | | 769,395 | |

Shares reinvested | | | 261,356 | | | | 689,602 | |

Shares redeemed | | | (1,257,116 | ) | | | (1,384,441 | ) |

Net increase (decrease) in capital shares | | | (972,431 | ) | | | 74,556 | |

See accompanying Notes to Financial Statements.

13

Vericimetry Funds

Vericimetry U.S. Small Cap Value Fund

Financial Highlights

For a capital share outstanding throughout each year |

| | | For the

Year Ended

September 30,

2024 | | | For the

Year Ended

September 30,

2023 | | | For the

Year Ended

September 30,

2022 | | | For the

Year Ended

September 30,

2021 | | | For the

Year Ended

September 30,

2020 | |

Net asset value, beginning of year | | $ | 18.12 | | | $ | 17.30 | | | $ | 23.11 | | | $ | 13.69 | | | $ | 16.56 | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.26 | | | | 0.27 | | | | 0.23 | | | | 0.18 | | | | 0.16 | |

Net realized and unrealized gain (loss) on investments | | | 4.42 | | | | 2.00 | | | | (2.14 | ) | | | 9.44 | | | | (2.61 | ) |

Total from investment operations | | | 4.68 | | | | 2.27 | | | | (1.91 | ) | | | 9.62 | | | | (2.45 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Less Distributions: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.26 | ) | | | (0.28 | ) | | | (0.20 | ) | | | (0.20 | ) | | | (0.19 | ) |

From net realized gain | | | (0.31 | ) | | | (1.17 | ) | | | (3.70 | ) | | | — | | | | (0.23 | ) |

Total distributions | | | (0.57 | ) | | | (1.45 | ) | | | (3.90 | ) | | | (0.20 | ) | | | (0.42 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 22.23 | | | $ | 18.12 | | | $ | 17.30 | | | $ | 23.11 | | | $ | 13.69 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return | | | 26.35 | % | | | 12.85 | % | | | (10.34 | )% | | | 70.44 | % | | | (15.24 | )% |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in thousands) | | $ | 179,953 | | | $ | 164,295 | | | $ | 155,592 | | | $ | 160,188 | | | $ | 110,095 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets (including interest expense) | | | | | | | | | | | | | | | | | | | | |

Before fees reimbursed by the Adviser | | | 0.65 | % | | | 0.66 | % | | | 0.66 | % | | | 0.67 | % | | | 0.76 | %1 |

After fees reimbursed by the Adviser | | | 0.60 | % | | | 0.60 | % | | | 0.60 | % | | | 0.60 | % | | | 0.63 | %1 |

Ratio of net investment income to average net assets (including interest expense) | | | | | | | | | | | | | | | | | | | | |

Before fees reimbursed by the Adviser | | | 1.23 | % | | | 1.42 | % | | | 1.07 | % | | | 0.77 | % | | | 0.93 | % |