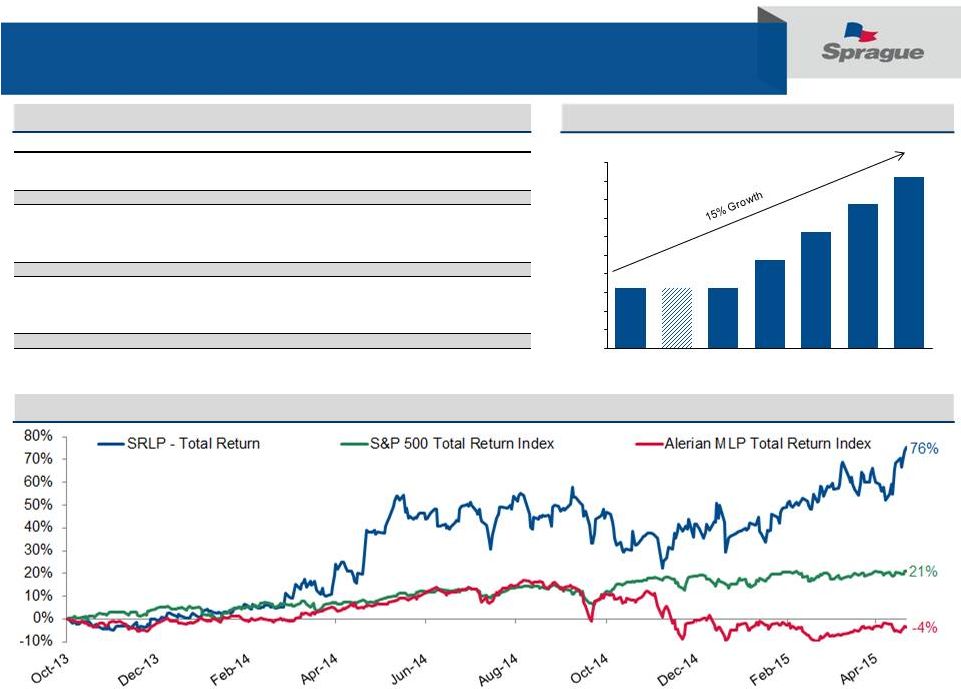

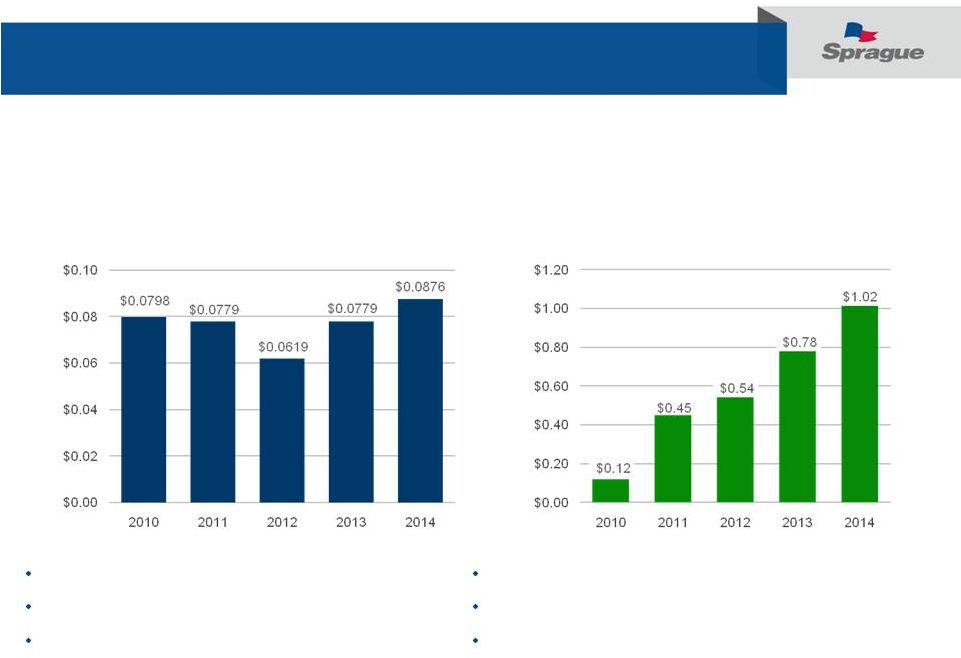

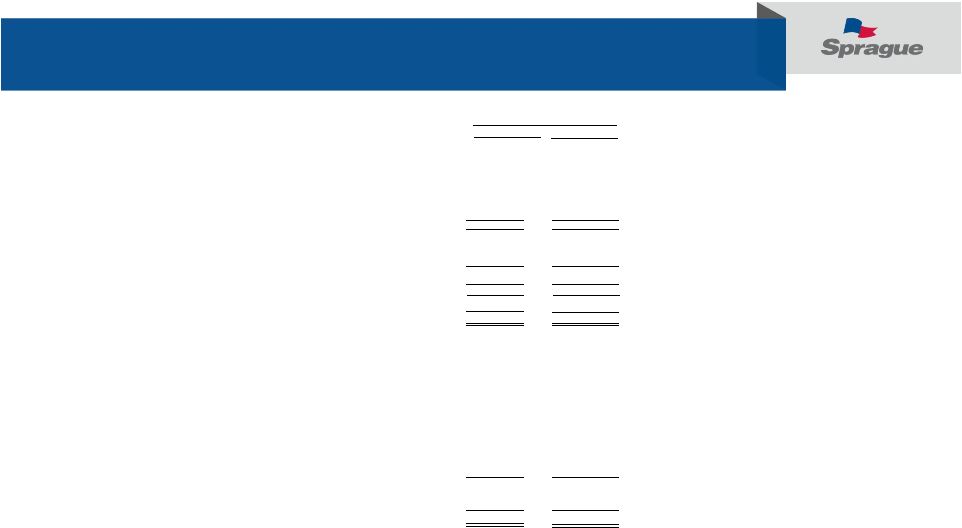

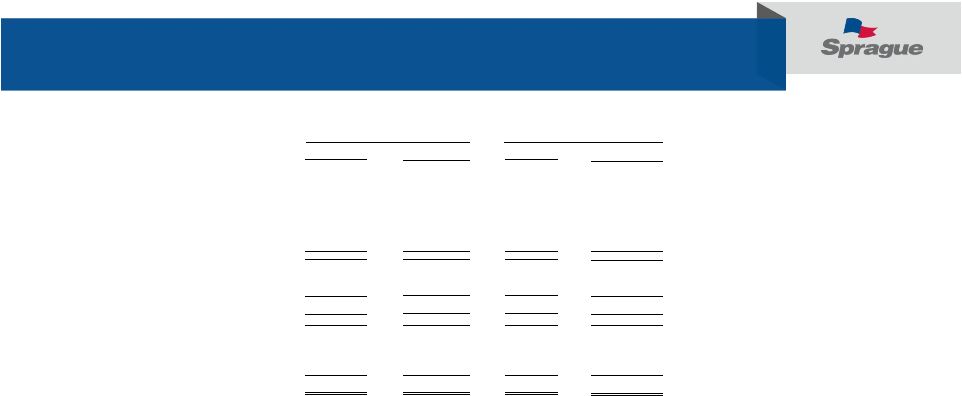

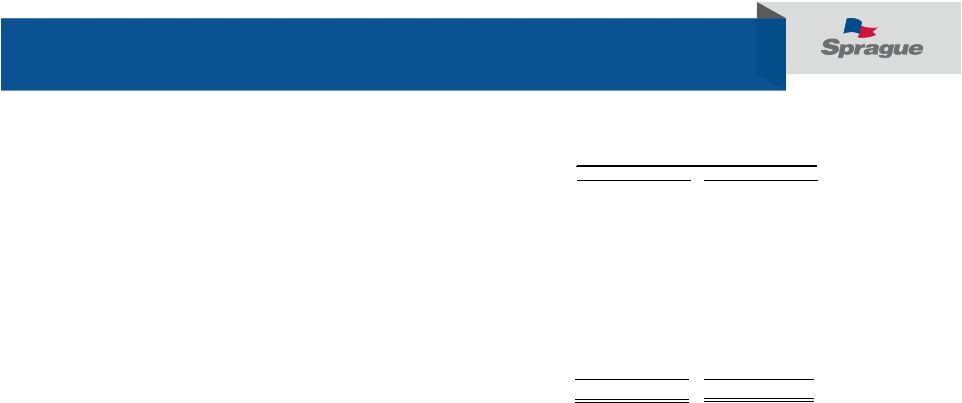

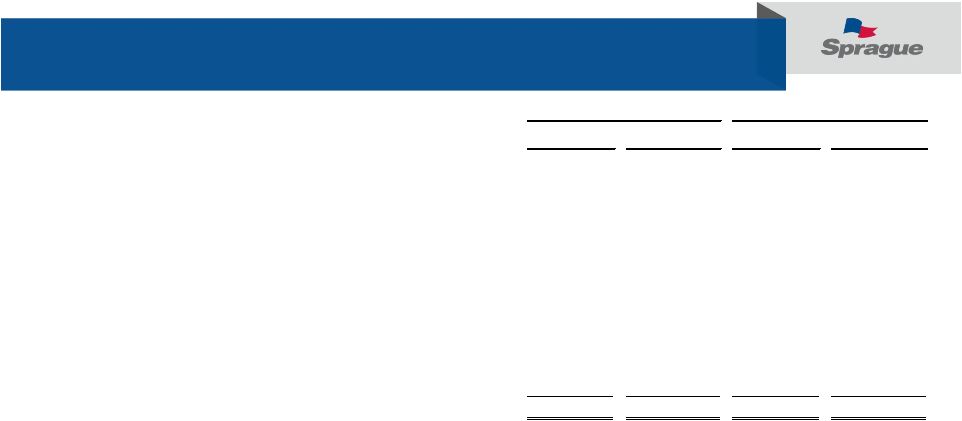

31 Summary Financial Data – YE 2014 (1) 1) On December 9, 2014, the Partnership acquired all of the equity interests in Kildair through the acquisition of the equity interests of Kildair’s parent Sprague Canadian Properties LLC. As the acquisition of Kildair by the Partnership represents a transfer of entities under common control, the Consolidated and Combined Financial Statements and related information presented herein have been recast by including the historical financial results of Kildair for all periods that were under common control. 2) Adjusted EBITDA respresents EBITDA increased by unrealized hedging losses and decreased by unrealized hedging gains, in each case with respect to refined products and natural gas inventory and natural gas transportation contracts, and adjusted for bio-fuel excise tax credits. 3) Net loss per unit for three months ended and year ended December 31, 2013, is only calculated for the Partnership after the IPO as no units were outstanding prior to October 30, 2013. (3) ………………………………………………………………….......... ………………………………………………… ………………………………………………………… ……………………………………………………… ……………………………………… ………………………………………. ……………………………… ………………………………………………………… ………………………………………………… ………………………………………………………… ………………………………………………………… ……………………………………………… ………………………………………… ………………………………………………………………. ………………… ………………………………………..………… ………………………..……… 10,271,010 10,453,910 10,071,970 10,071,970 10,071,970 10,071,970 4,554,188 51,979 (2) Three Months Ended Year Ended December 31, December 31, 2014 2013 Predecessor 2014 2013 Predecessor (unaudited) (unaudited) ($ in thousands) ($ in thousands) Statement of Operations Data: Net sales $ 1,197,994 $ 1,276,301 $ 5,069,762 $ 4,683,349 Operating costs and expenses: Cost of products sold (exclusive of depreciation and amortization) 1,076,155 1,271,750 4,755,031 Operating expenses 17,199 12,829 62,993 53,273 Selling, general and administrative 22,159 15,521 76,420 55,210 Depreciation and amortization 5,167 4,044 17,625 16,515 Total operating costs and expenses 1,120,680 1,304,144 4,912,069 4,679,186 Operating income (loss) 77,314 (27,843) 157,693 4,163 Other (expense) income (288) (33) (288) 568 Interest income 168 83 569 604 Interest expense (8,103) (9,068) (29,651) (30,914) Income (loss) before income taxes 69,091 (36,861) 128,323 (25,579) Income tax (provision) benefit (3,503) 1,819 (5,509) (4,259) Net income (loss) 65,588 (35,042) 122,814 (29,838) Adjust: Predecessor (loss) income through October 29, 2013 - (2,470) - 2,734 Adjust: Income (loss) attributable to Kildair from October 29, 2013 through December 8th, 2014 1,977 (2,338) 4,080 (2,338) Limited partners' interest in net income (loss) $ 63,611 $ (30,234) $ 118,734 $ (30,234) Net income (loss) per limited partner unit : Common - basic $ 3.13 $ (1.50) $ 5.88 $ (1.50) Common - diluted $ 3.07 $ (1.50) $ 5.84 $ (1.50) Subordinated - basic and diluted $ 3.13 $ (1.50) $ 5.88 $ (1.50) Units used to compute net income per limited partner unit - Common - basic 10,071,970 10,131,928 Common - diluted 10,071,970 10,195,566 Subordinated - basic and diluted 10,071,970 10,071,970 Adjusted EBITDA (unaudited) $ 30,014 $ 28,648 $ 105,266 $ 76,158 Other Financial and Operating Data (unaudited) Capital expenditures $ 5,266 $ 11,016 $ 18,580 $ 28,090 Total refined products volumes sold (gallons) 475,398 399,462 1,668,240 1,472,100 Total natural gas volumes sold (MMBtus) 16,166 13,667 54,430 |