MLP and Energy Infrastructure Conference Sprague Resources LP May 14, 2019

Forward Looking Statements and Non-GAAP Measures Forward-Looking Statements: Some of the statements in this presentation contain forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Statements concerning current estimates, expectations and projections about our future results, performance, prospects and opportunities and other statements, concerns, or matters that are not historical facts are "forward-looking statements," as that term is defined under United States securities laws. We believe these statements to be reasonable as of the date of this presentation only. Our actual future results and financial condition may differ materially because of risks and uncertainties that are difficult to predict. For a more detailed description of these and other risks and uncertainties, please see the “Risk Factors” section in our most recent Annual Report on Form 10-K, dated March 14, 2019, and our most recent Form10-Q, Form 8-K and other items filed with the U.S. Securities and Exchange Commission “SEC” and also available in the “Investor Relations” section of our website www.spragueenergy.com. Non-GAAP Measures: In this presentation, and in statements we make in connection with this presentation, we refer to certain historical and forward looking financial measures not prepared in accordance with U.S. generally accepted accounting principles, or GAAP. Non-GAAP measures include adjusted gross margin, adjusted gross unit margin, adjusted EBITDA, distributable cash flow (DCF), excess cash flow, liquidity and permanent leverage ratio. Please refer to the Appendix for a description of the non-GAAP measures used in this presentation, including reconciliations with comparable GAAP financial measures. Additional Information: This presentation contains unaudited quarterly results which should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year. Amounts shown as investments in acquisitions exclude consideration paid for working capital. Under the terms of a three-year earn-out agreement related to the Coen Energy acquisition, additional consideration of up to $12 million may be paid if certain performance targets are met.

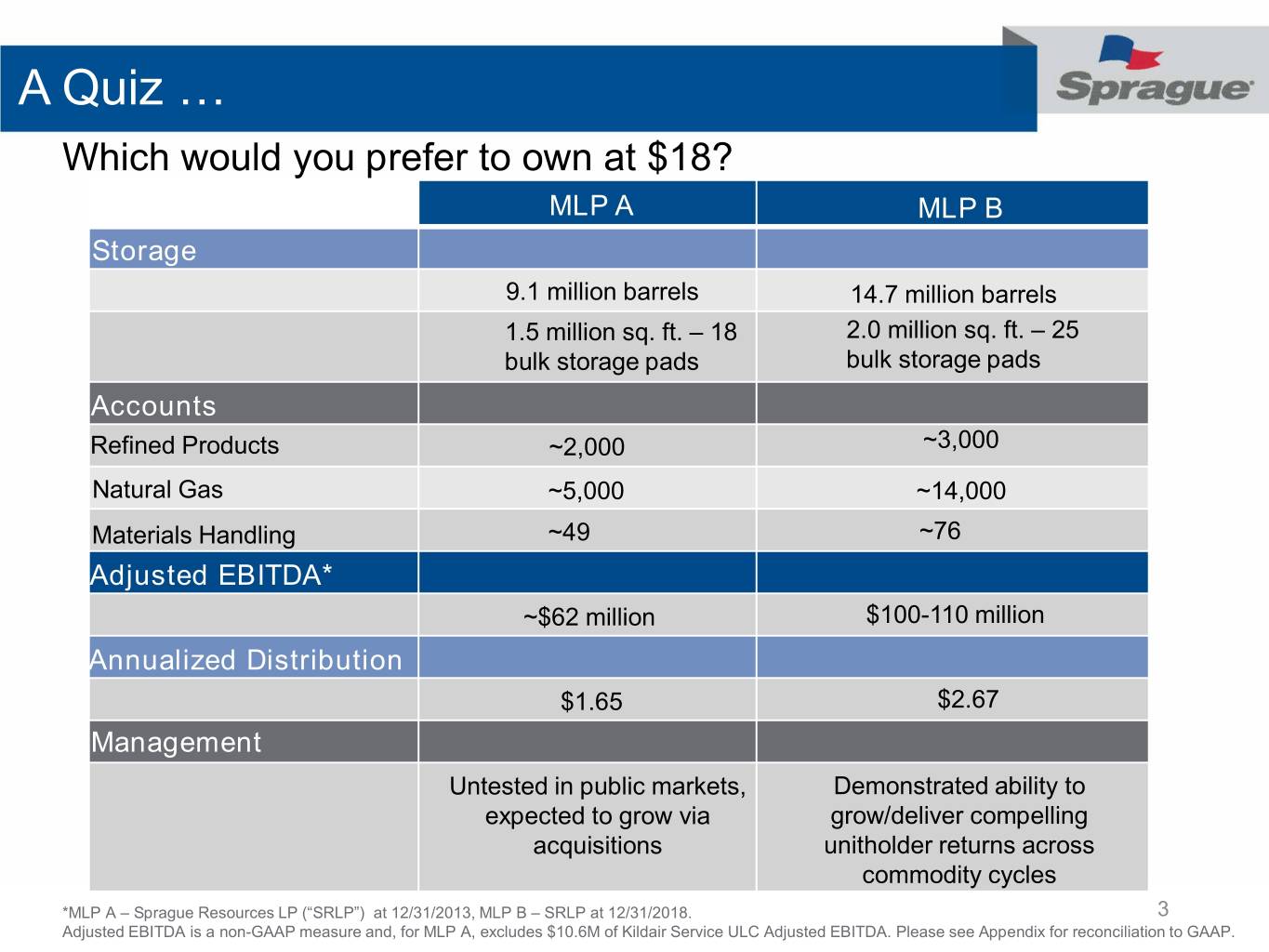

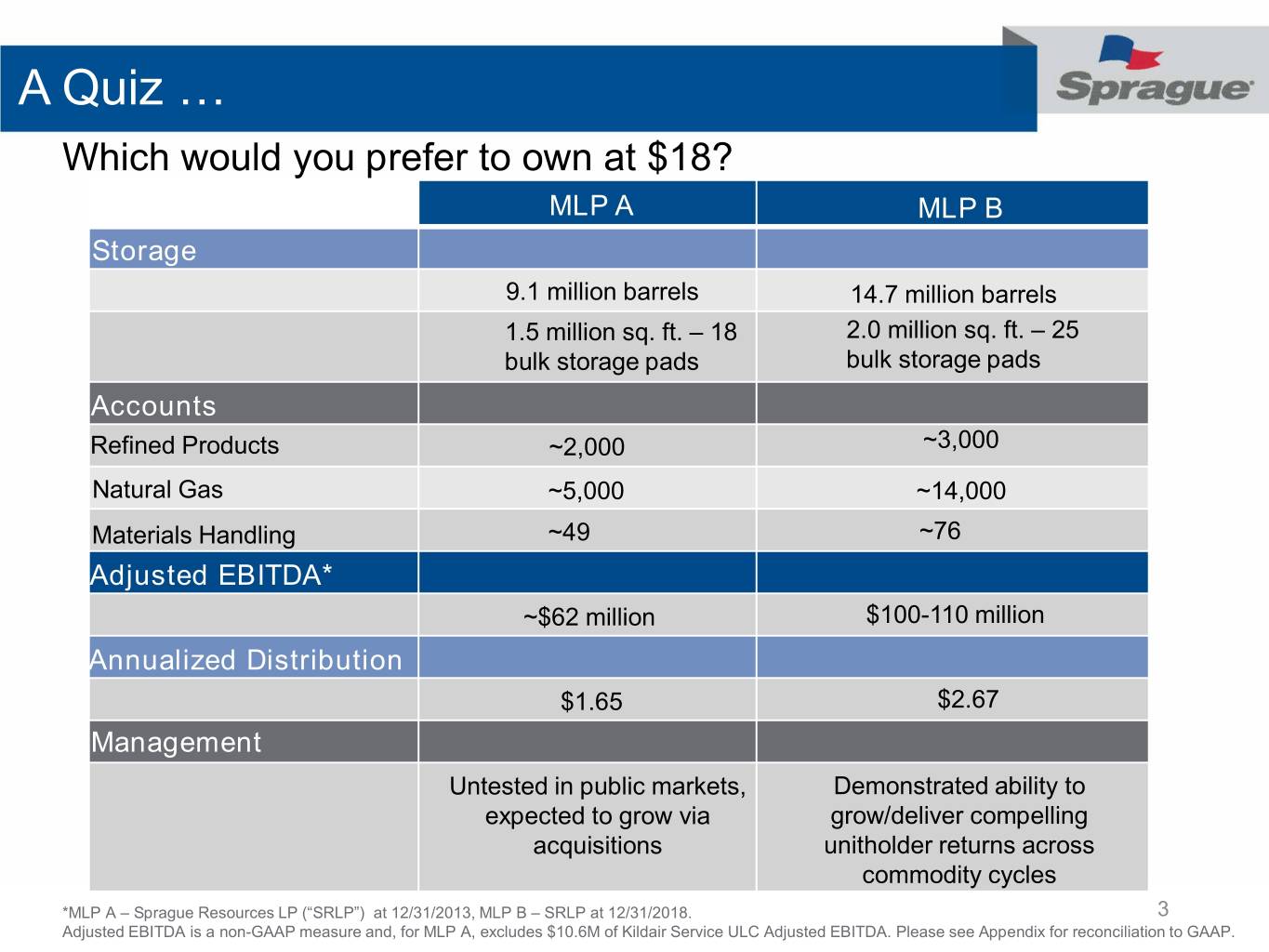

A Quiz … Which would you prefer to own at $18? MLP A MLP B Storage 9.1 million barrels 14.7 million barrels 1.5 million sq. ft. – 18 2.0 million sq. ft. – 25 bulk storage pads bulk storage pads Accounts Refined Products ~2,000 ~3,000 Natural Gas ~5,000 ~14,000 Materials Handling ~49 ~76 Adjusted EBITDA* ~$62 million $100-110 million Annualized Distribution $1.65 $2.67 Management Untested in public markets, Demonstrated ability to expected to grow via grow/deliver compelling acquisitions unitholder returns across commodity cycles *MLP A – Sprague Resources LP (“SRLP”) at 12/31/2013, MLP B – SRLP at 12/31/2018. 3 Adjusted EBITDA is a non-GAAP measure and, for MLP A, excludes $10.6M of Kildair Service ULC Adjusted EBITDA. Please see Appendix for reconciliation to GAAP.

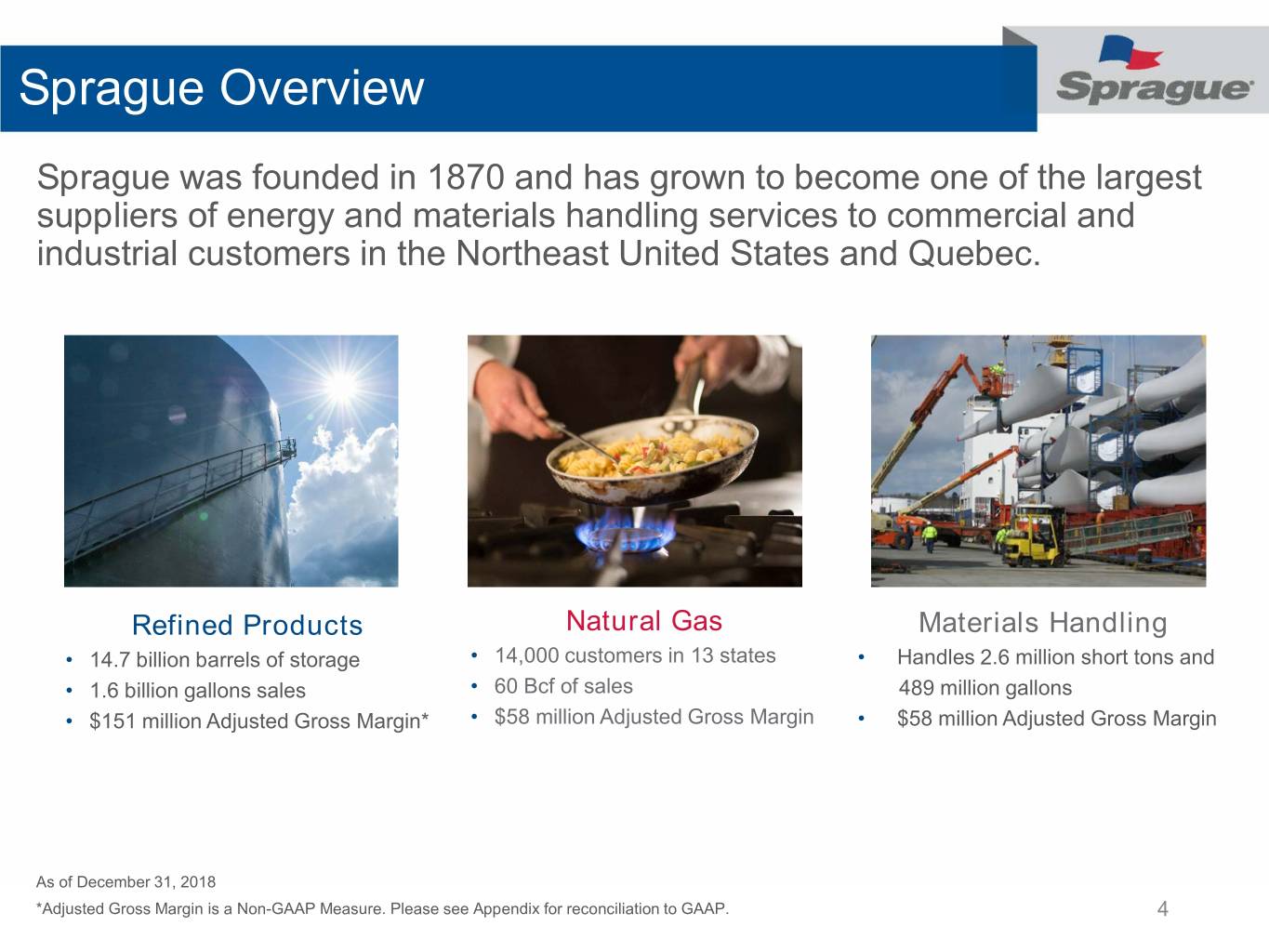

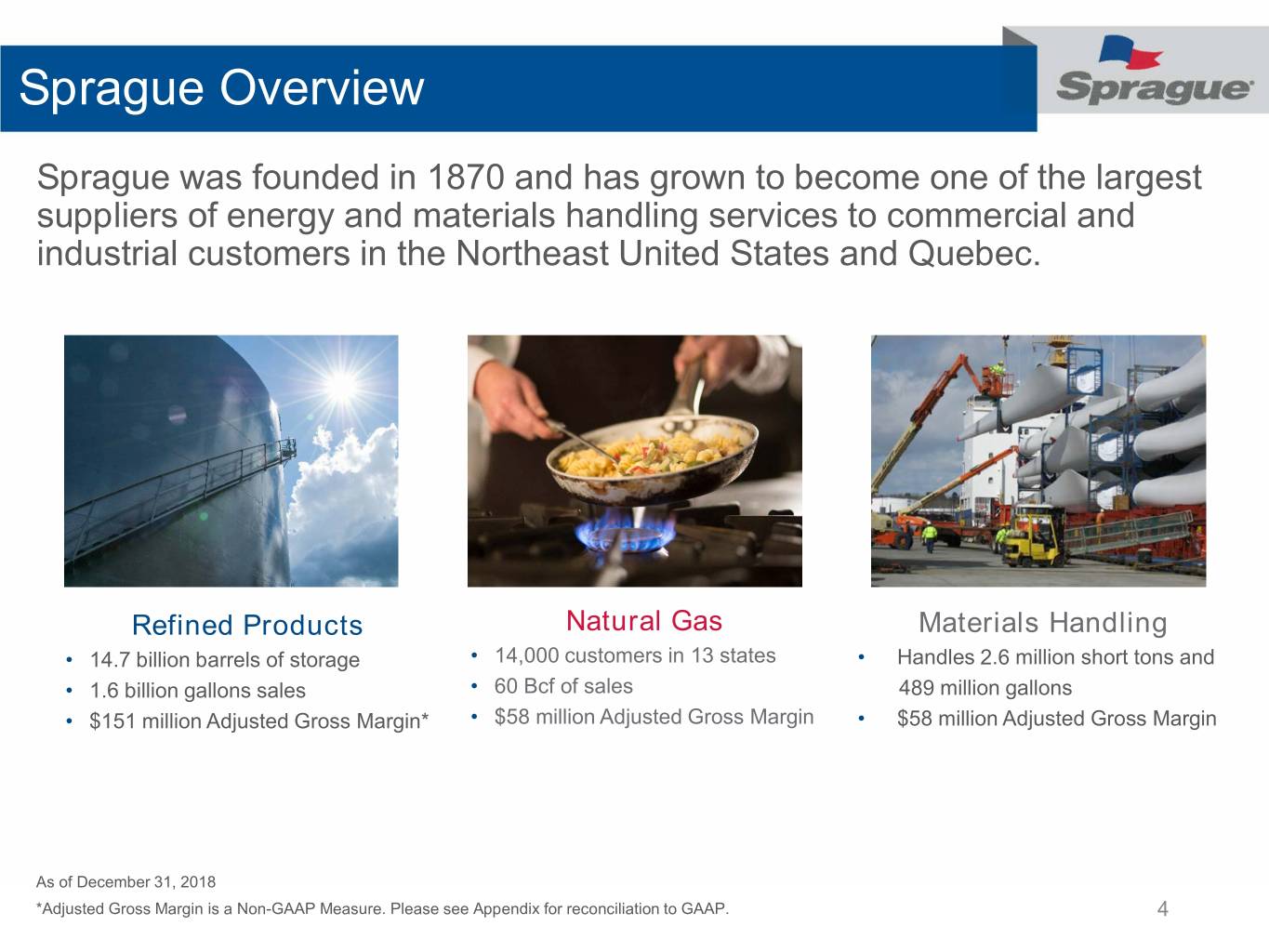

Sprague Overview Sprague was founded in 1870 and has grown to become one of the largest suppliers of energy and materials handling services to commercial and industrial customers in the Northeast United States and Quebec. Refined Products Natural Gas Materials Handling • 14.7 billion barrels of storage • 14,000 customers in 13 states • Handles 2.6 million short tons and • 1.6 billion gallons sales • 60 Bcf of sales 489 million gallons • $151 million Adjusted Gross Margin* • $58 million Adjusted Gross Margin • $58 million Adjusted Gross Margin As of December 31, 2018 *Adjusted Gross Margin is a Non-GAAP Measure. Please see Appendix for reconciliation to GAAP. 4

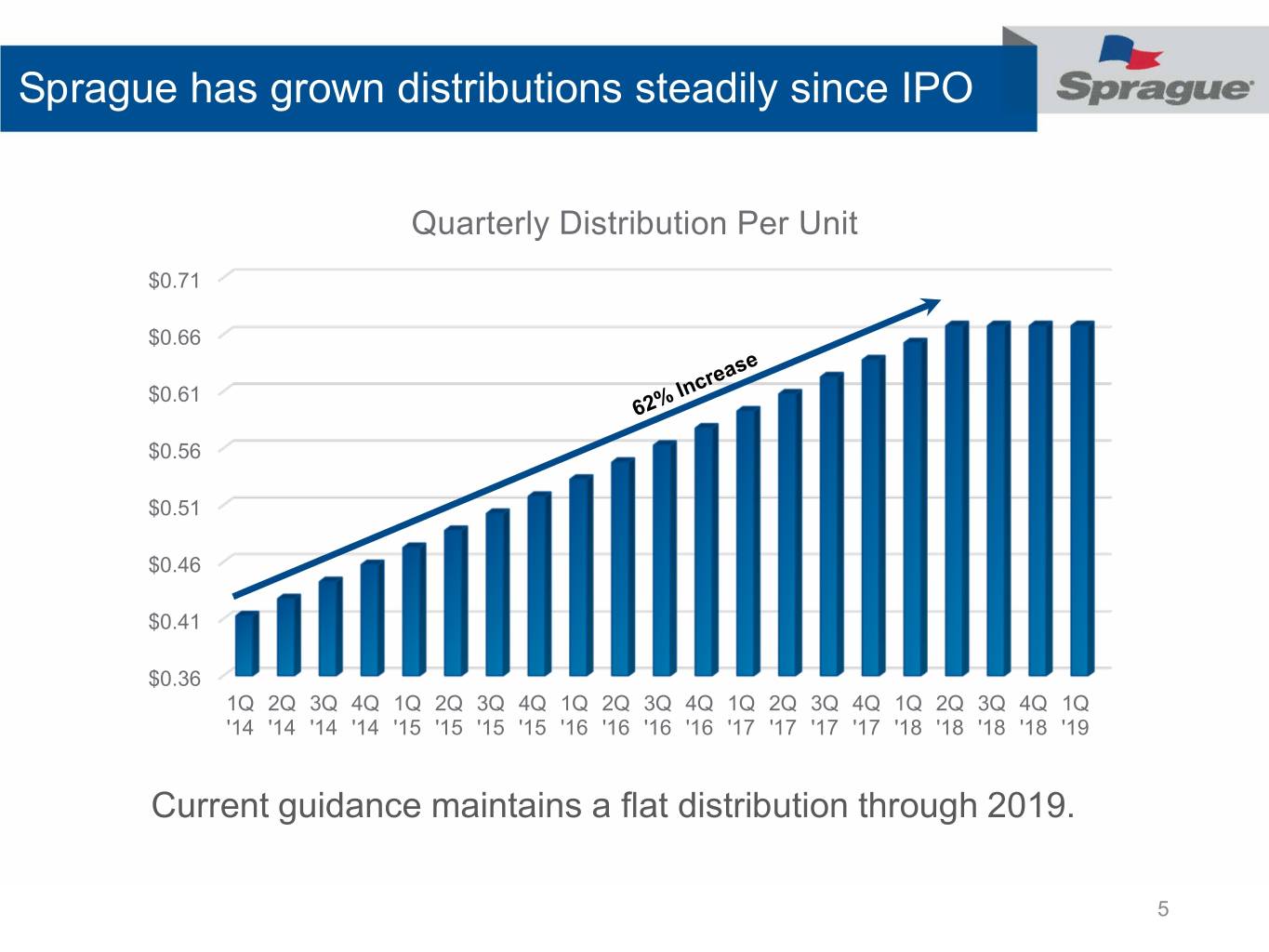

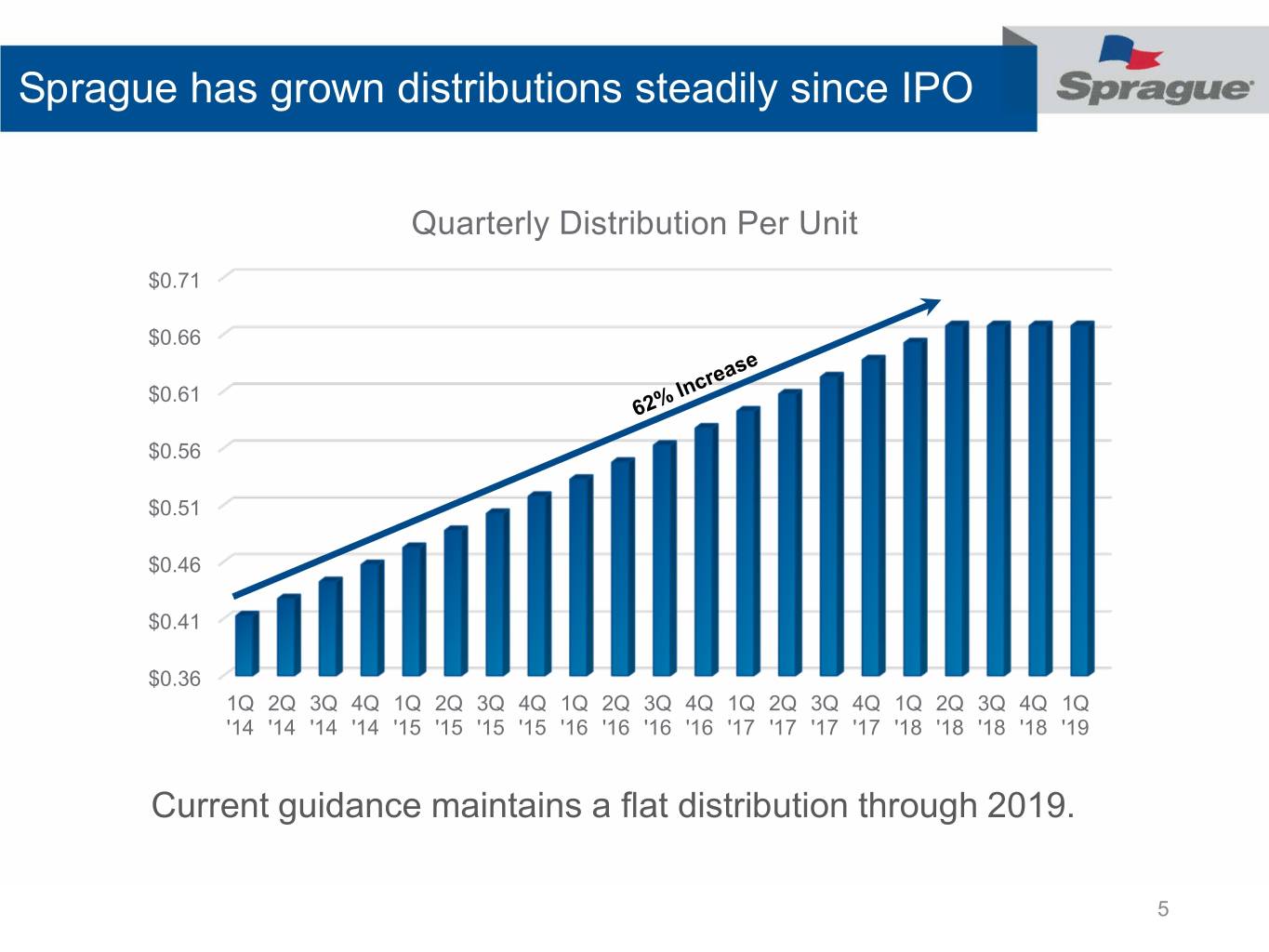

Sprague has grown distributions steadily since IPO Quarterly Distribution Per Unit $0.71 $0.66 $0.61 $0.56 $0.51 $0.46 $0.41 $0.36 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q '14 '14 '14 '14 '15 '15 '15 '15 '16 '16 '16 '16 '17 '17 '17 '17 '18 '18 '18 '18 '19 Current guidance maintains a flat distribution through 2019. 5

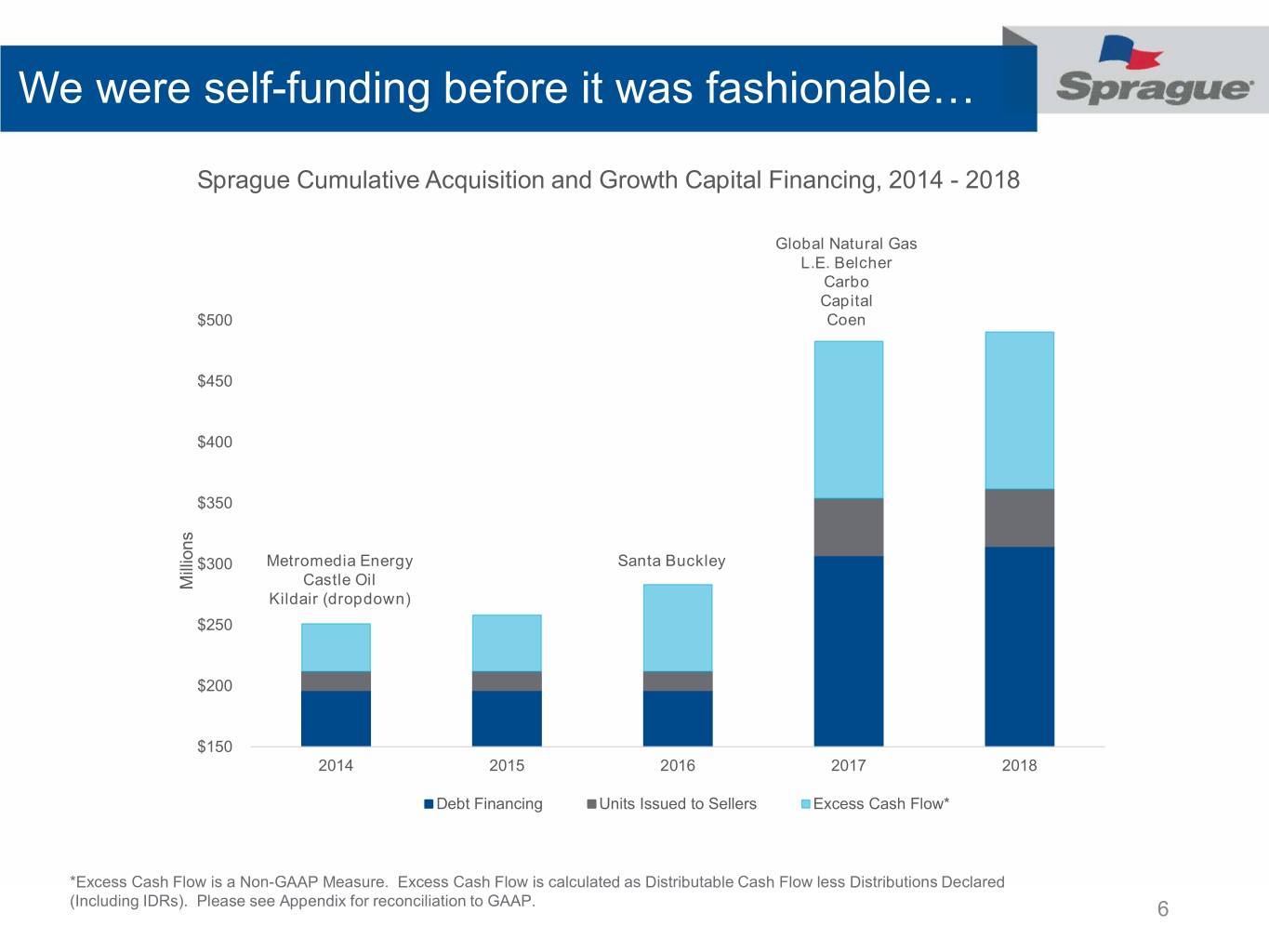

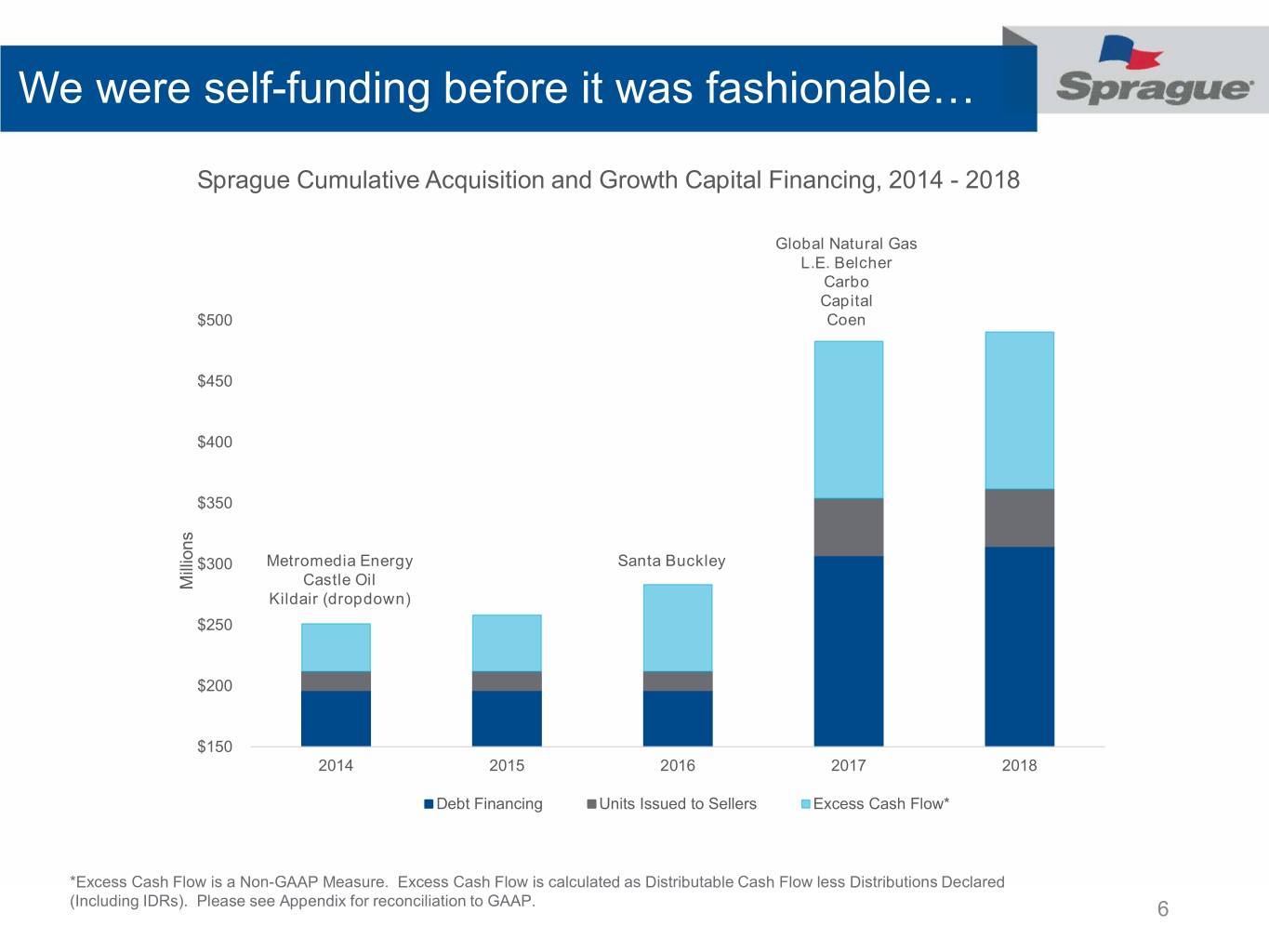

We were self-funding before it was fashionable… Sprague Cumulative Acquisition and Growth Capital Financing, 2014 - 2018 Global Natural Gas L.E. Belcher Carbo Capital $500 Coen $450 $400 $350 $300 Metromedia Energy Santa Buckley Millions Castle Oil Kildair (dropdown) $250 $200 $150 2014 2015 2016 2017 2018 Debt Financing Units Issued to Sellers Excess Cash Flow* *Excess Cash Flow is a Non-GAAP Measure. Excess Cash Flow is calculated as Distributable Cash Flow less Distributions Declared (Including IDRs). Please see Appendix for reconciliation to GAAP. 6

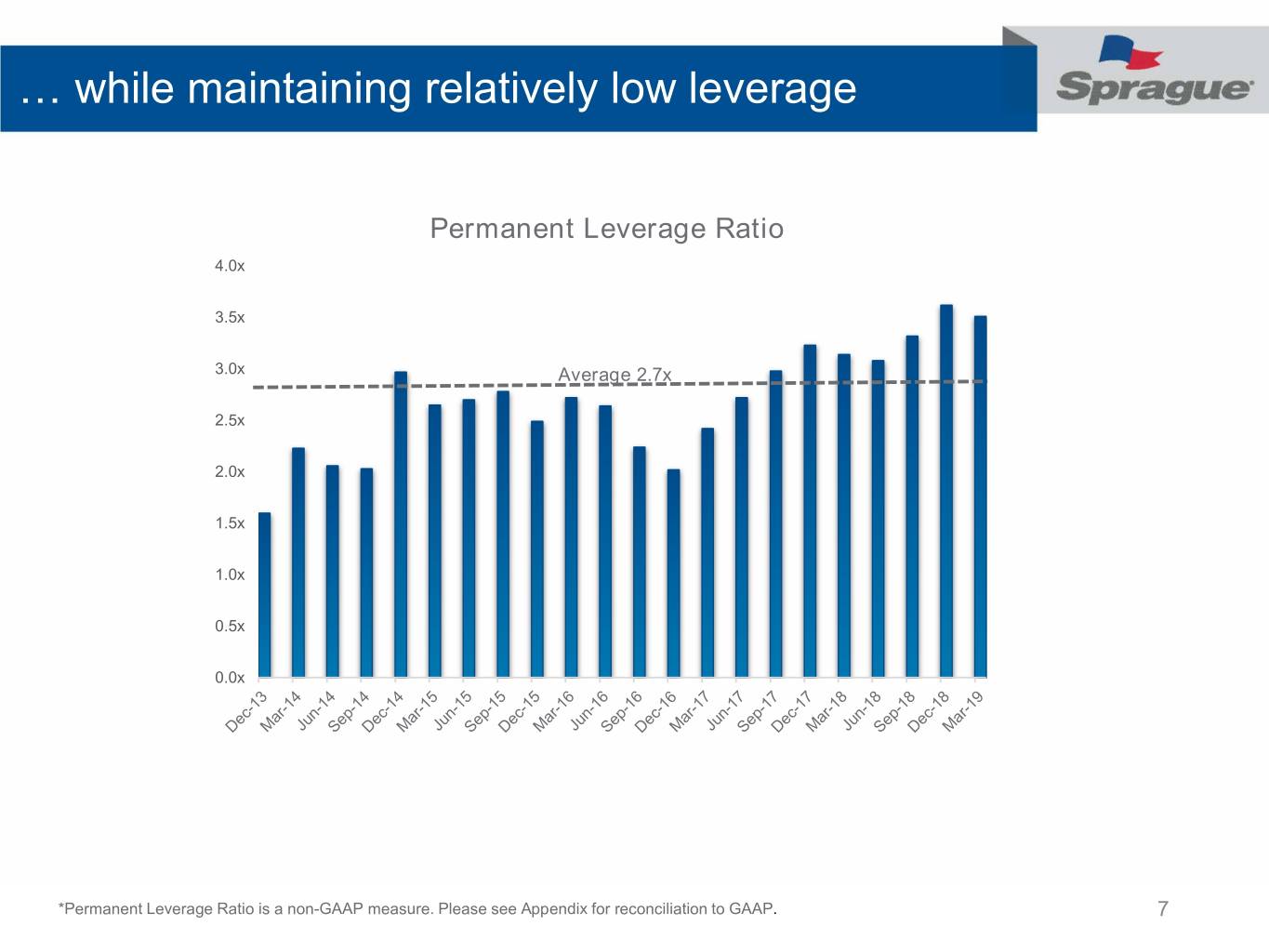

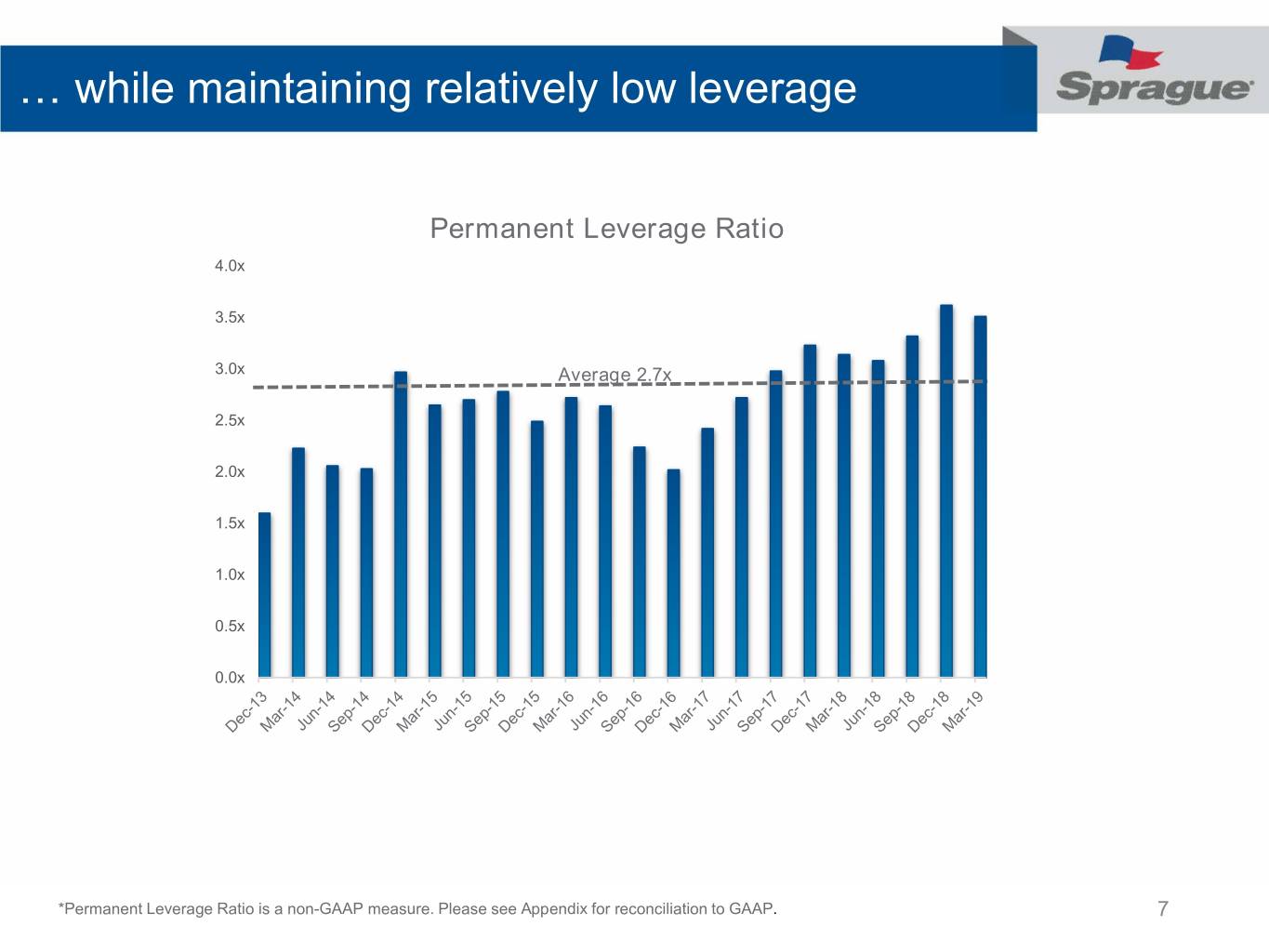

… while maintaining relatively low leverage Permanent Leverage Ratio 4.0x 3.5x 3.0x Average 2.7x 2.5x 2.0x 1.5x 1.0x 0.5x 0.0x *Permanent Leverage Ratio is a non-GAAP measure. Please see Appendix for reconciliation to GAAP. 7

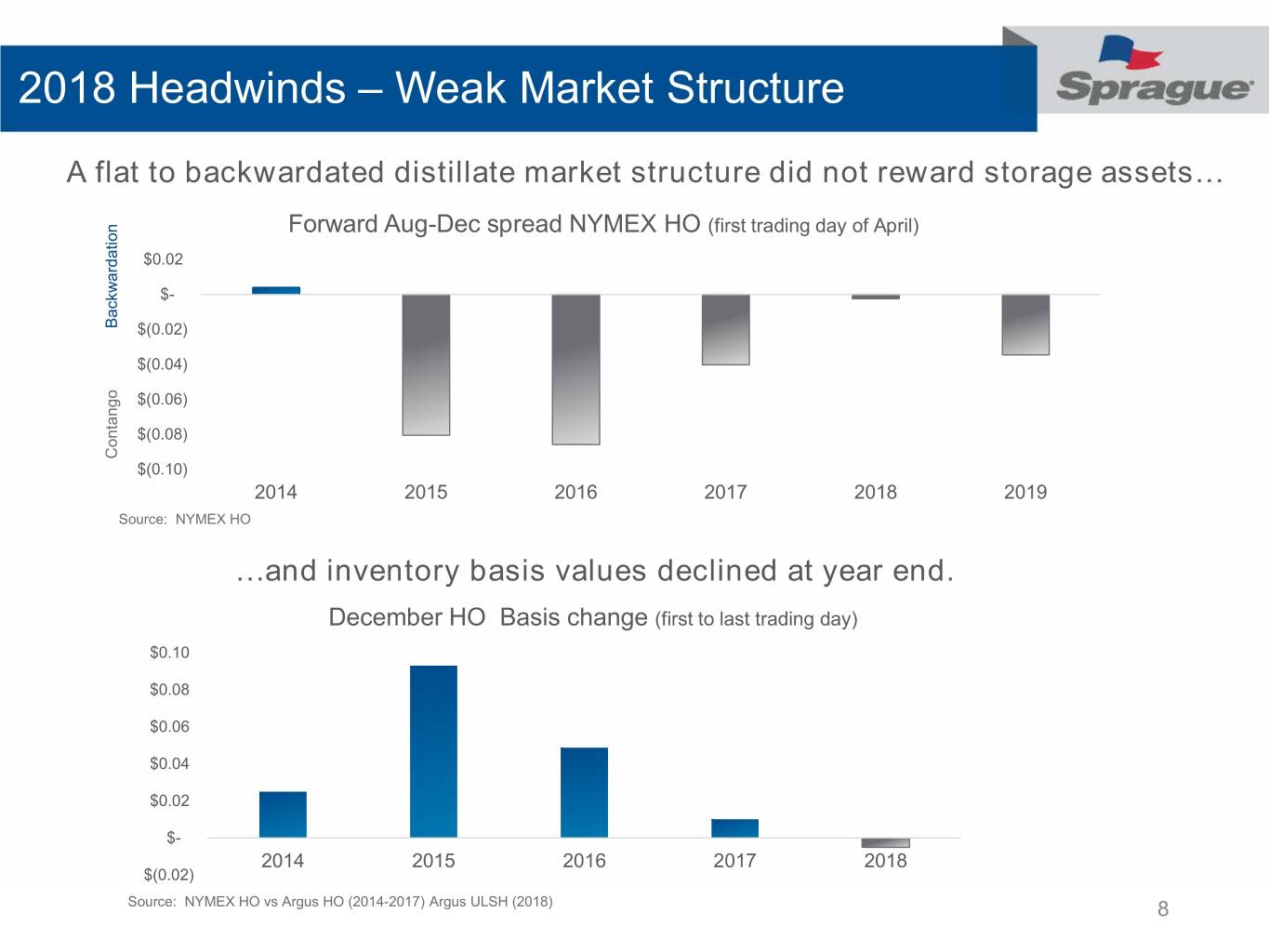

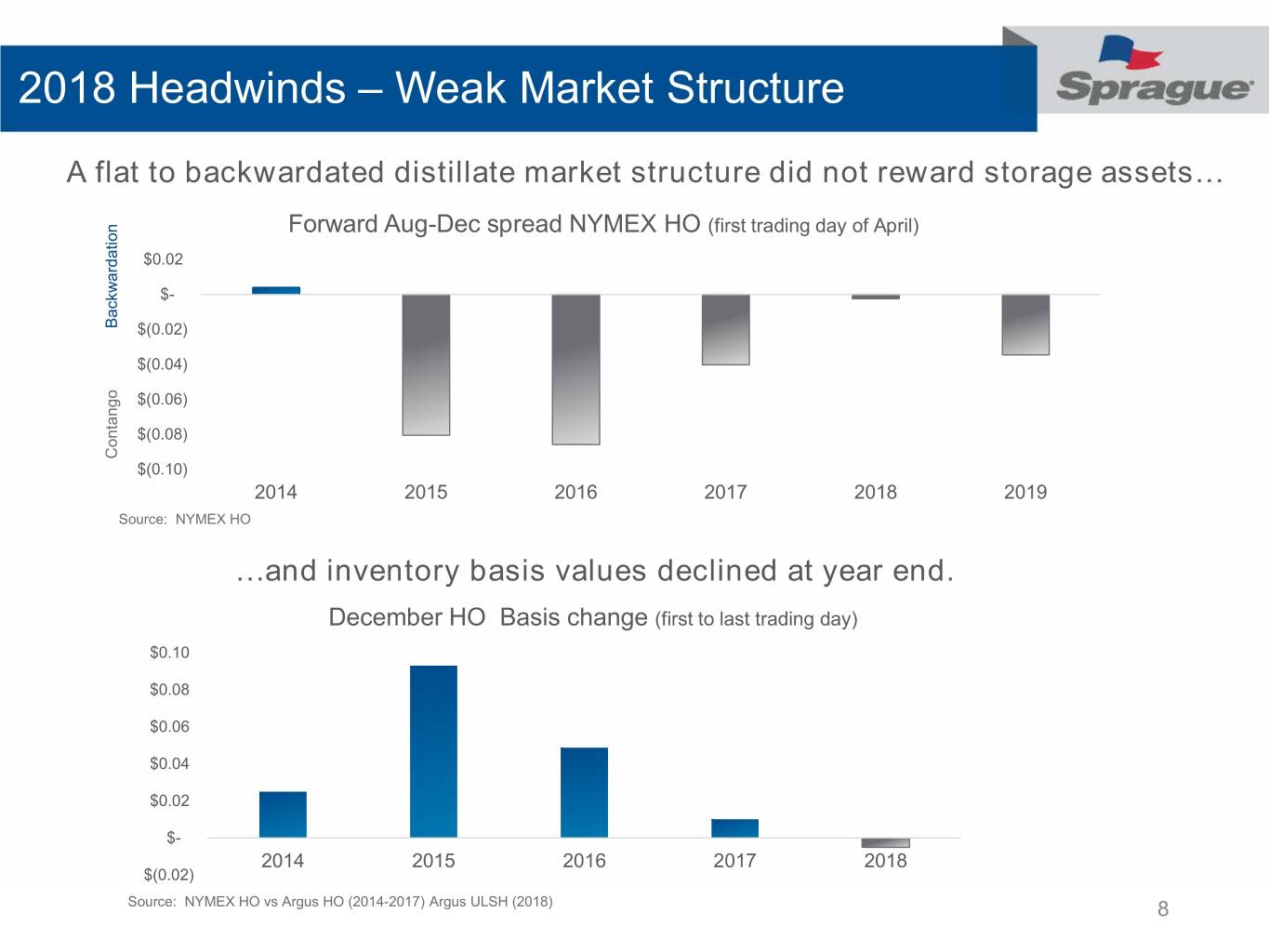

2018 Headwinds – Weak Market Structure A flat to backwardated distillate market structure did not reward storage assets… Forward Aug-Dec spread NYMEX HO (first trading day of April) $0.02 $- Backwardation $(0.02) $(0.04) $(0.06) $(0.08) Contango Contango $(0.10) 2014 2015 2016 2017 2018 2019 Source: NYMEX HO …and inventory basis values declined at year end. December HO Basis change (first to last trading day) $0.10 $0.08 $0.06 $0.04 $0.02 $- 2014 2015 2016 2017 2018 $(0.02) Source: NYMEX HO vs Argus HO (2014-2017) Argus ULSH (2018) 8

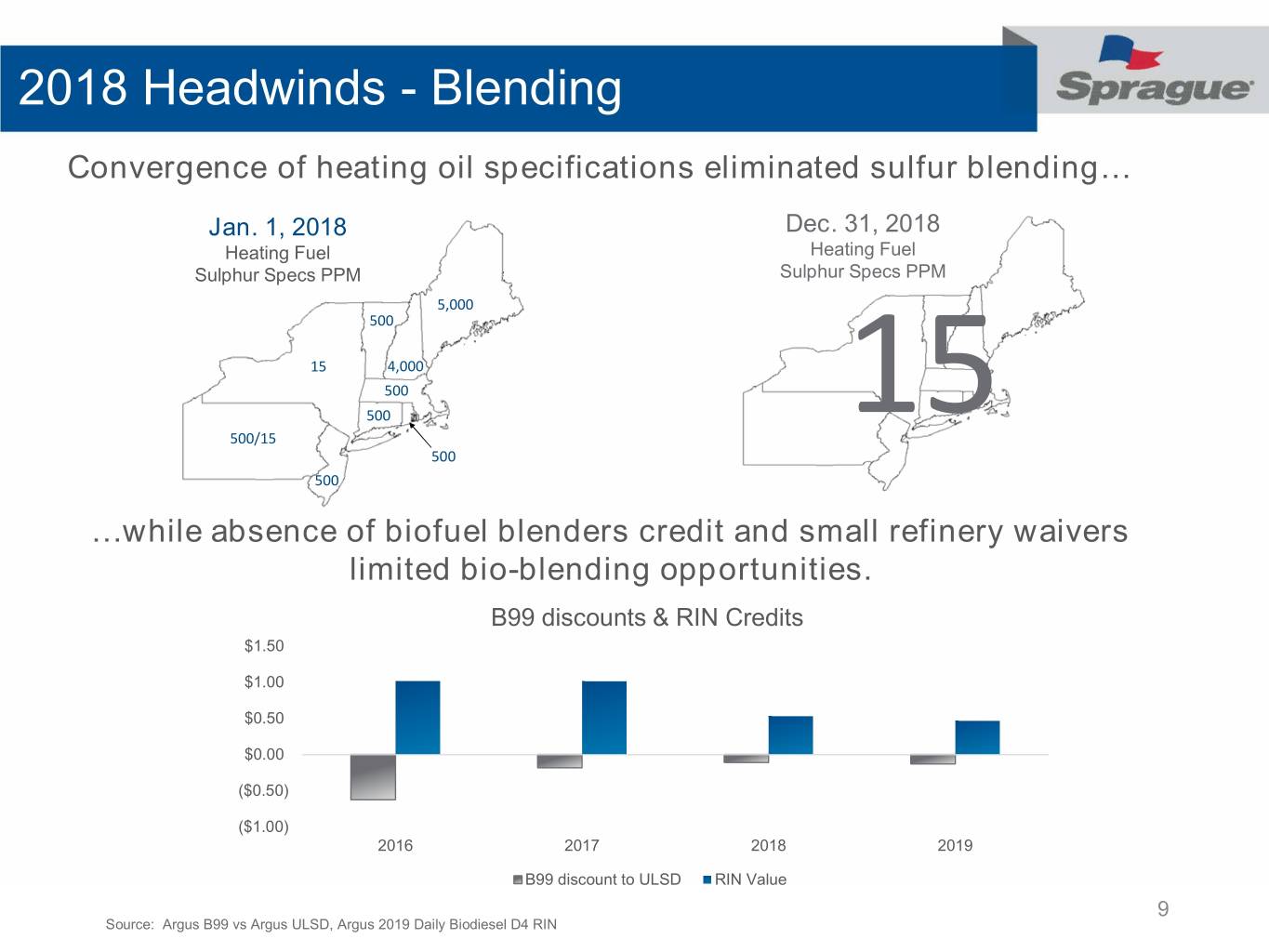

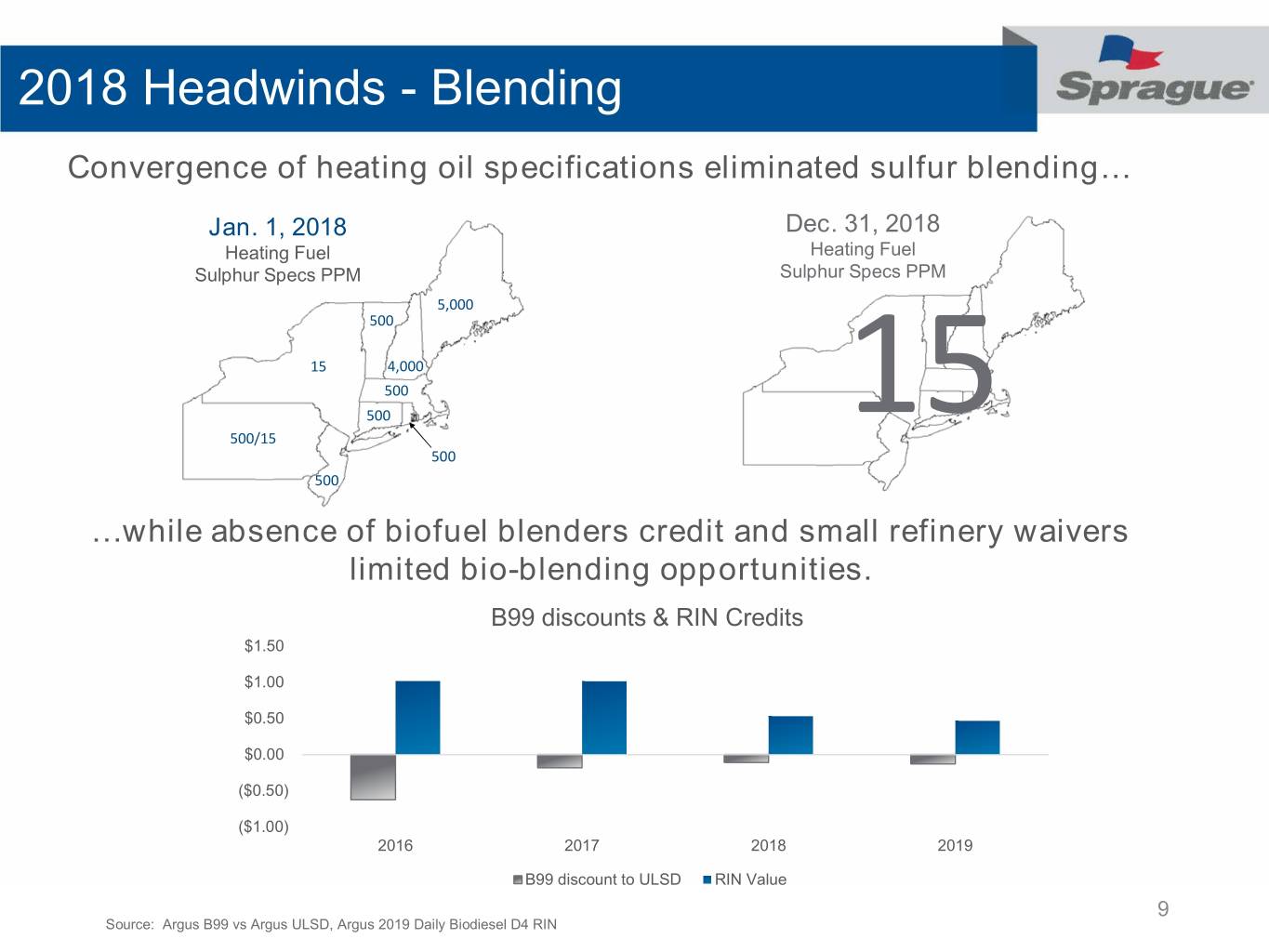

2018 Headwinds - Blending Convergence of heating oil specifications eliminated sulfur blending… Jan. 1, 2018 Dec. 31, 2018 Jan.Heating 1, Fuel 2018 Heating Fuel SulphurHeating Specs PPMFuel Sulphur Specs PPM Sulphur Specs PPM 5,000 500 15 4,000 500 500 500/15 15 500 500 …while absence of biofuel blenders credit and small refinery waivers limited bio-blending opportunities. B99 discounts & RIN Credits $1.50 $1.00 $0.50 $0.00 ($0.50) ($1.00) 2016 2017 2018 2019 B99 discount to ULSD RIN Value 9 Source: Argus B99 vs Argus ULSD, Argus 2019 Daily Biodiesel D4 RIN

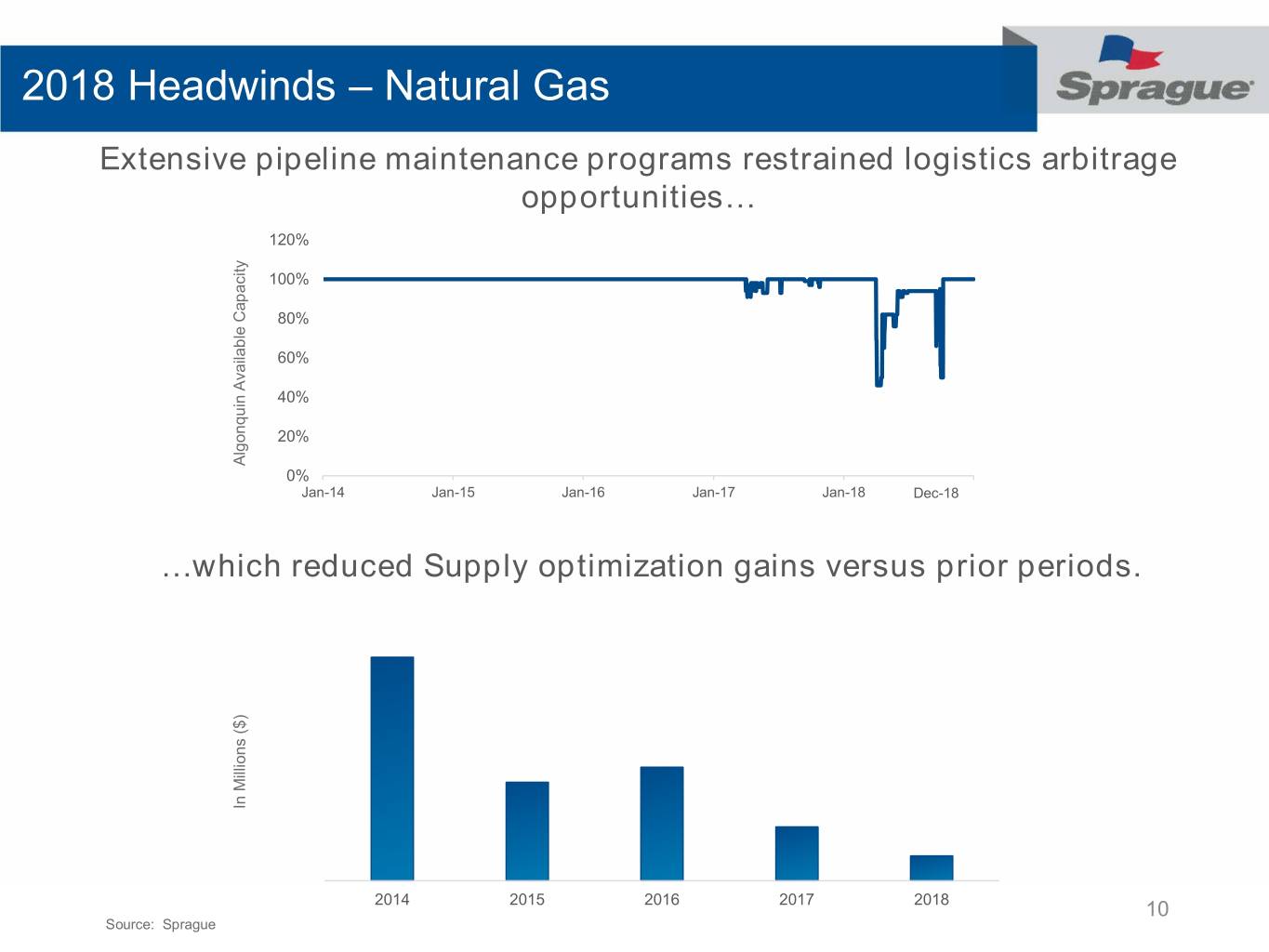

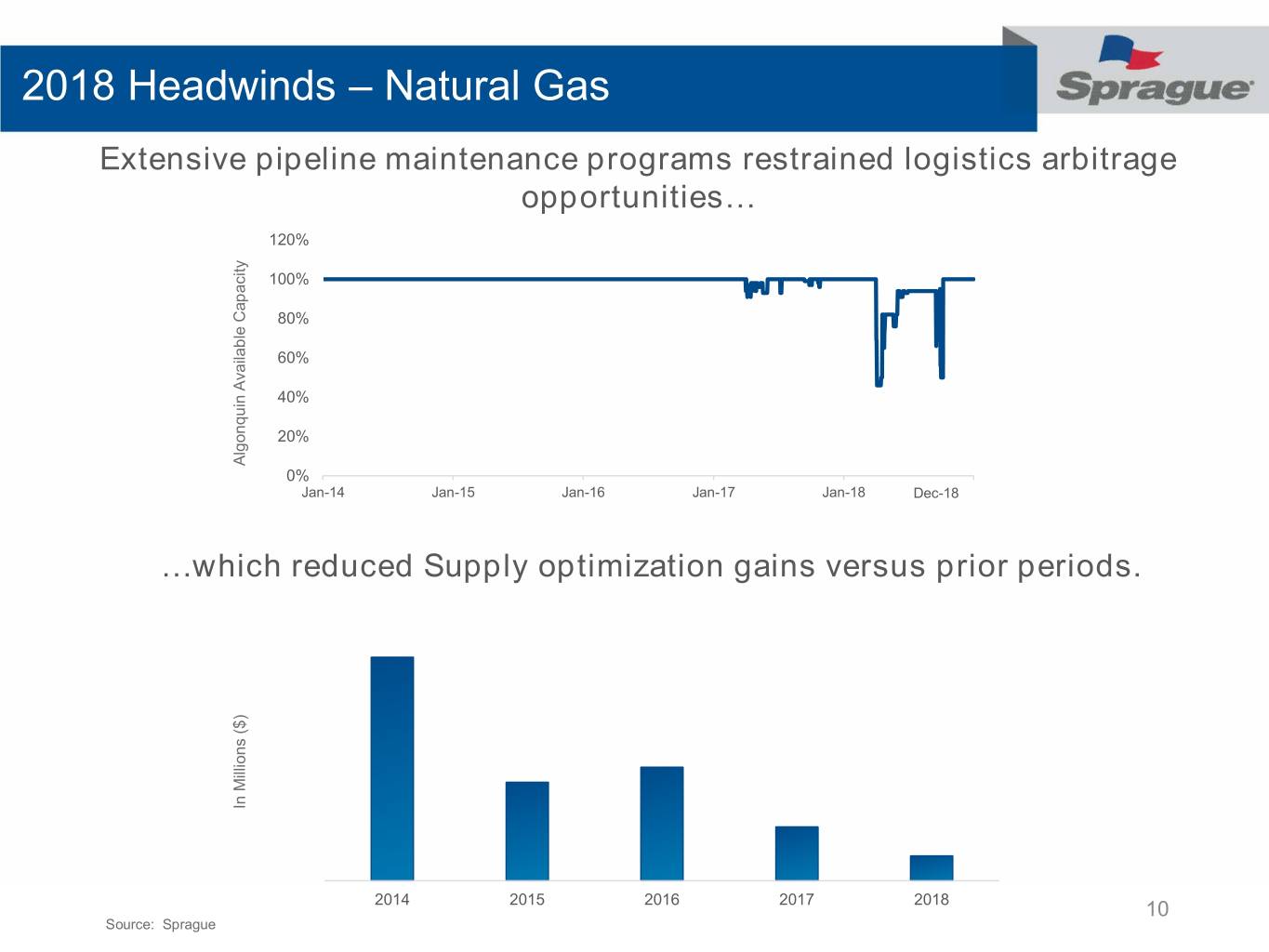

2018 Headwinds – Natural Gas Extensive pipeline maintenance programs restrained logistics arbitrage opportunities… 120% 100% 80% 60% 40% 20% Algonquin Available Available Capacity Algonquin 0% Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Dec-18 …which reduced Supply optimization gains versus prior periods. In Millions ($) Millions In 2014 2015 2016 2017 2018 10 Source: Sprague

Investment Thesis • Critical, irreplaceable infrastructure serving high demand markets • Demonstrated ability to adapt to changing market conditions • Experienced management and supportive ownership • Customer franchise • Healthy balance sheet • Evolution towards contracted business 11

Appendix

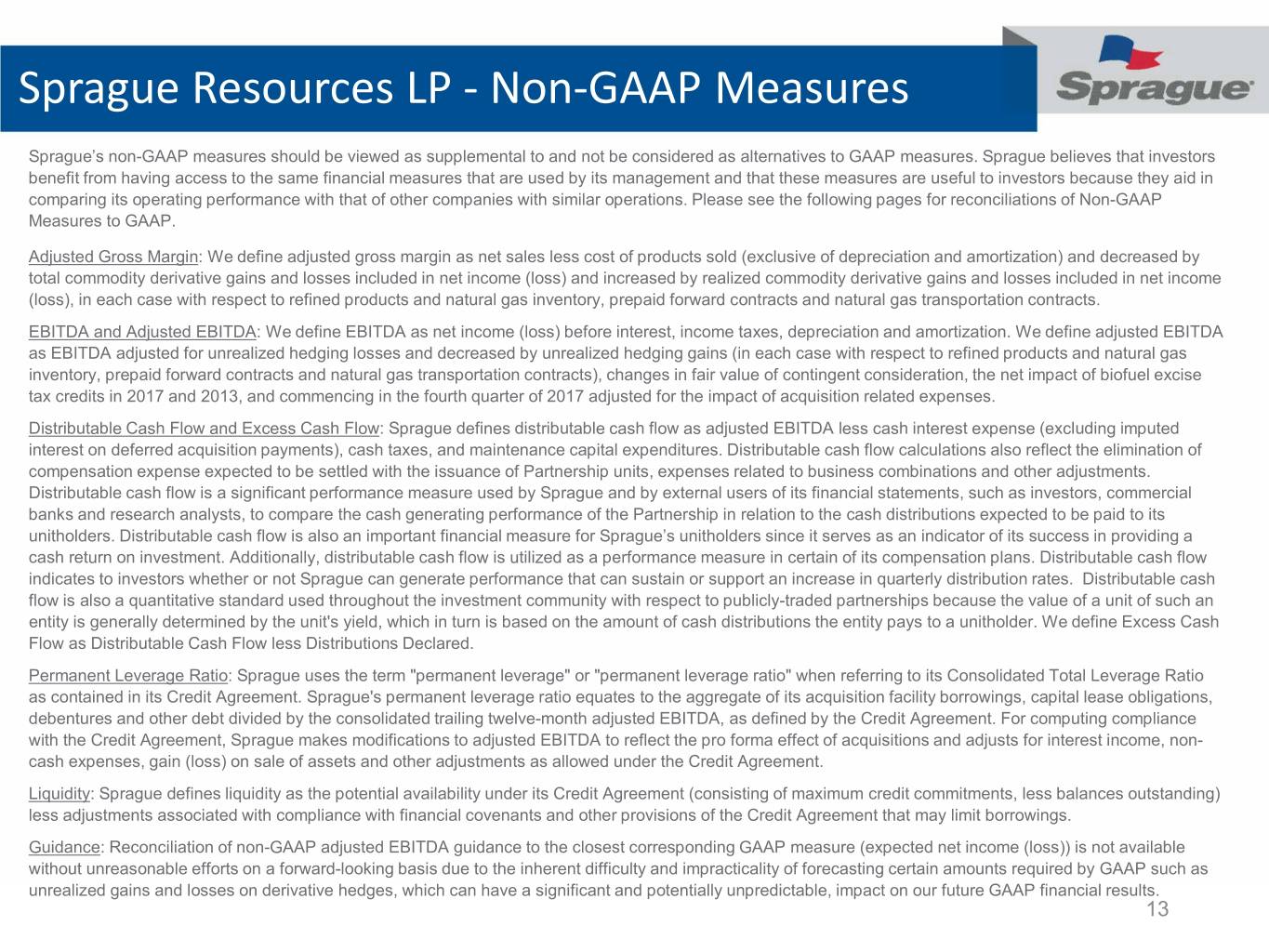

Sprague Resources LP - Non-GAAP Measures Sprague’s non-GAAP measures should be viewed as supplemental to and not be considered as alternatives to GAAP measures. Sprague believes that investors benefit from having access to the same financial measures that are used by its management and that these measures are useful to investors because they aid in comparing its operating performance with that of other companies with similar operations. Please see the following pages for reconciliations of Non-GAAP Measures to GAAP. Adjusted Gross Margin: We define adjusted gross margin as net sales less cost of products sold (exclusive of depreciation and amortization) and decreased by total commodity derivative gains and losses included in net income (loss) and increased by realized commodity derivative gains and losses included in net income (loss), in each case with respect to refined products and natural gas inventory, prepaid forward contracts and natural gas transportation contracts. EBITDA and Adjusted EBITDA: We define EBITDA as net income (loss) before interest, income taxes, depreciation and amortization. We define adjusted EBITDA as EBITDA adjusted for unrealized hedging losses and decreased by unrealized hedging gains (in each case with respect to refined products and natural gas inventory, prepaid forward contracts and natural gas transportation contracts), changes in fair value of contingent consideration, the net impact of biofuel excise tax credits in 2017 and 2013, and commencing in the fourth quarter of 2017 adjusted for the impact of acquisition related expenses. Distributable Cash Flow and Excess Cash Flow: Sprague defines distributable cash flow as adjusted EBITDA less cash interest expense (excluding imputed interest on deferred acquisition payments), cash taxes, and maintenance capital expenditures. Distributable cash flow calculations also reflect the elimination of compensation expense expected to be settled with the issuance of Partnership units, expenses related to business combinations and other adjustments. Distributable cash flow is a significant performance measure used by Sprague and by external users of its financial statements, such as investors, commercial banks and research analysts, to compare the cash generating performance of the Partnership in relation to the cash distributions expected to be paid to its unitholders. Distributable cash flow is also an important financial measure for Sprague’s unitholders since it serves as an indicator of its success in providing a cash return on investment. Additionally, distributable cash flow is utilized as a performance measure in certain of its compensation plans. Distributable cash flow indicates to investors whether or not Sprague can generate performance that can sustain or support an increase in quarterly distribution rates. Distributable cash flow is also a quantitative standard used throughout the investment community with respect to publicly-traded partnerships because the value of a unit of such an entity is generally determined by the unit's yield, which in turn is based on the amount of cash distributions the entity pays to a unitholder. We define Excess Cash Flow as Distributable Cash Flow less Distributions Declared. Permanent Leverage Ratio: Sprague uses the term "permanent leverage" or "permanent leverage ratio" when referring to its Consolidated Total Leverage Ratio as contained in its Credit Agreement. Sprague's permanent leverage ratio equates to the aggregate of its acquisition facility borrowings, capital lease obligations, debentures and other debt divided by the consolidated trailing twelve-month adjusted EBITDA, as defined by the Credit Agreement. For computing compliance with the Credit Agreement, Sprague makes modifications to adjusted EBITDA to reflect the pro forma effect of acquisitions and adjusts for interest income, non- cash expenses, gain (loss) on sale of assets and other adjustments as allowed under the Credit Agreement. Liquidity: Sprague defines liquidity as the potential availability under its Credit Agreement (consisting of maximum credit commitments, less balances outstanding) less adjustments associated with compliance with financial covenants and other provisions of the Credit Agreement that may limit borrowings. Guidance: Reconciliation of non-GAAP adjusted EBITDA guidance to the closest corresponding GAAP measure (expected net income (loss)) is not available without unreasonable efforts on a forward-looking basis due to the inherent difficulty and impracticality of forecasting certain amounts required by GAAP such as unrealized gains and losses on derivative hedges, which can have a significant and potentially unpredictable, impact on our future GAAP financial results. 13

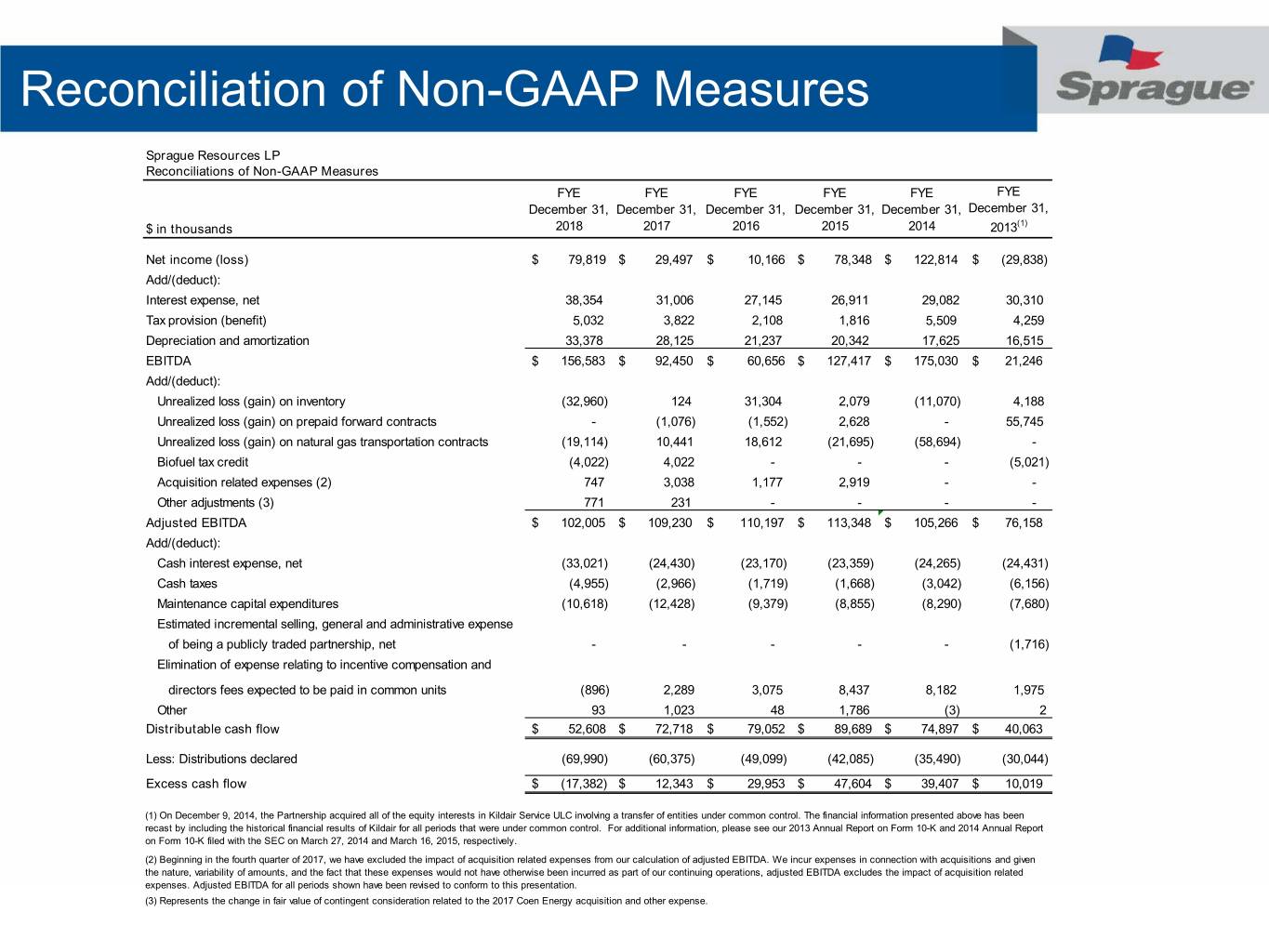

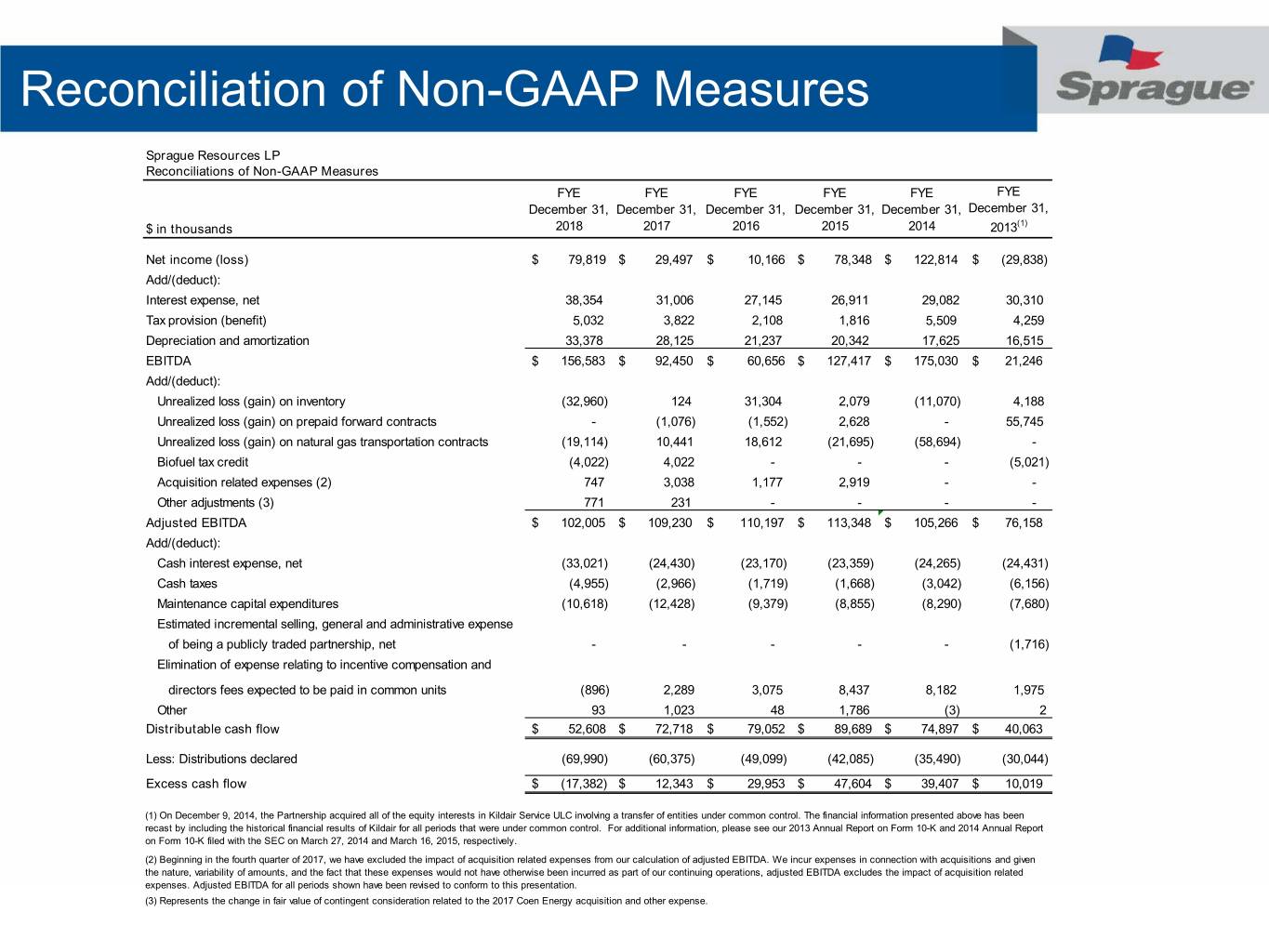

Reconciliation of Non-GAAP Measures Sprague Resources LP Reconciliations of Non-GAAP Measures FYE FYE FYE FYE FYE FYE December 31, December 31, December 31, December 31, December 31, December 31, (1) $ in thousands 2018 2017 2016 2015 2014 2013 Net income (loss) $ 79,819 $ 29,497 $ 10,166 $ 78,348 $ 122,814 $ (29,838) Add/(deduct): Interest expense, net 38,354 31,006 27,145 26,911 29,082 30,310 Tax provision (benefit) 5,032 3,822 2,108 1,816 5,509 4,259 Depreciation and amortization 33,378 28,125 21,237 20,342 17,625 16,515 EBITDA $ 156,583 $ 92,450 $ 60,656 $ 127,417 $ 175,030 $ 21,246 Add/(deduct): Unrealized loss (gain) on inventory (32,960) 124 31,304 2,079 (11,070) 4,188 Unrealized loss (gain) on prepaid forward contracts - (1,076) (1,552) 2,628 - 55,745 Unrealized loss (gain) on natural gas transportation contracts (19,114) 10,441 18,612 (21,695) (58,694) - Biofuel tax credit (4,022) 4,022 - - - (5,021) Acquisition related expenses (2) 747 3,038 1,177 2,919 - - Other adjustments (3) 771 231 - - - - Adjusted EBITDA $ 102,005 $ 109,230 $ 110,197 $ 113,348 $ 105,266 $ 76,158 Add/(deduct): Cash interest expense, net (33,021) (24,430) (23,170) (23,359) (24,265) (24,431) Cash taxes (4,955) (2,966) (1,719) (1,668) (3,042) (6,156) Maintenance capital expenditures (10,618) (12,428) (9,379) (8,855) (8,290) (7,680) Estimated incremental selling, general and administrative expense of being a publicly traded partnership, net - - - - - (1,716) Elimination of expense relating to incentive compensation and directors fees expected to be paid in common units (896) 2,289 3,075 8,437 8,182 1,975 Other 93 1,023 48 1,786 (3) 2 Distributable cash flow $ 52,608 $ 72,718 $ 79,052 $ 89,689 $ 74,897 $ 40,063 Less: Distributions declared (69,990) (60,375) (49,099) (42,085) (35,490) (30,044) Excess cash flow $ (17,382) $ 12,343 $ 29,953 $ 47,604 $ 39,407 $ 10,019 (1) On December 9, 2014, the Partnership acquired all of the equity interests in Kildair Service ULC involving a transfer of entities under common control. The financial information presented above has been recast by including the historical financial results of Kildair for all periods that were under common control. For additional information, please see our 2013 Annual Report on Form 10-K and 2014 Annual Report on Form 10-K filed with the SEC on March 27, 2014 and March 16, 2015, respectively. (2) Beginning in the fourth quarter of 2017, we have excluded the impact of acquisition related expenses from our calculation of adjusted EBITDA. We incur expenses in connection with acquisitions and given the nature, variability of amounts, and the fact that these expenses would not have otherwise been incurred as part of our continuing operations, adjusted EBITDA excludes the impact of acquisition related expenses. Adjusted EBITDA for all periods shown have been revised to conform to this presentation. (3) Represents the change in fair value of contingent consideration related to the 2017 Coen Energy acquisition and other expense.

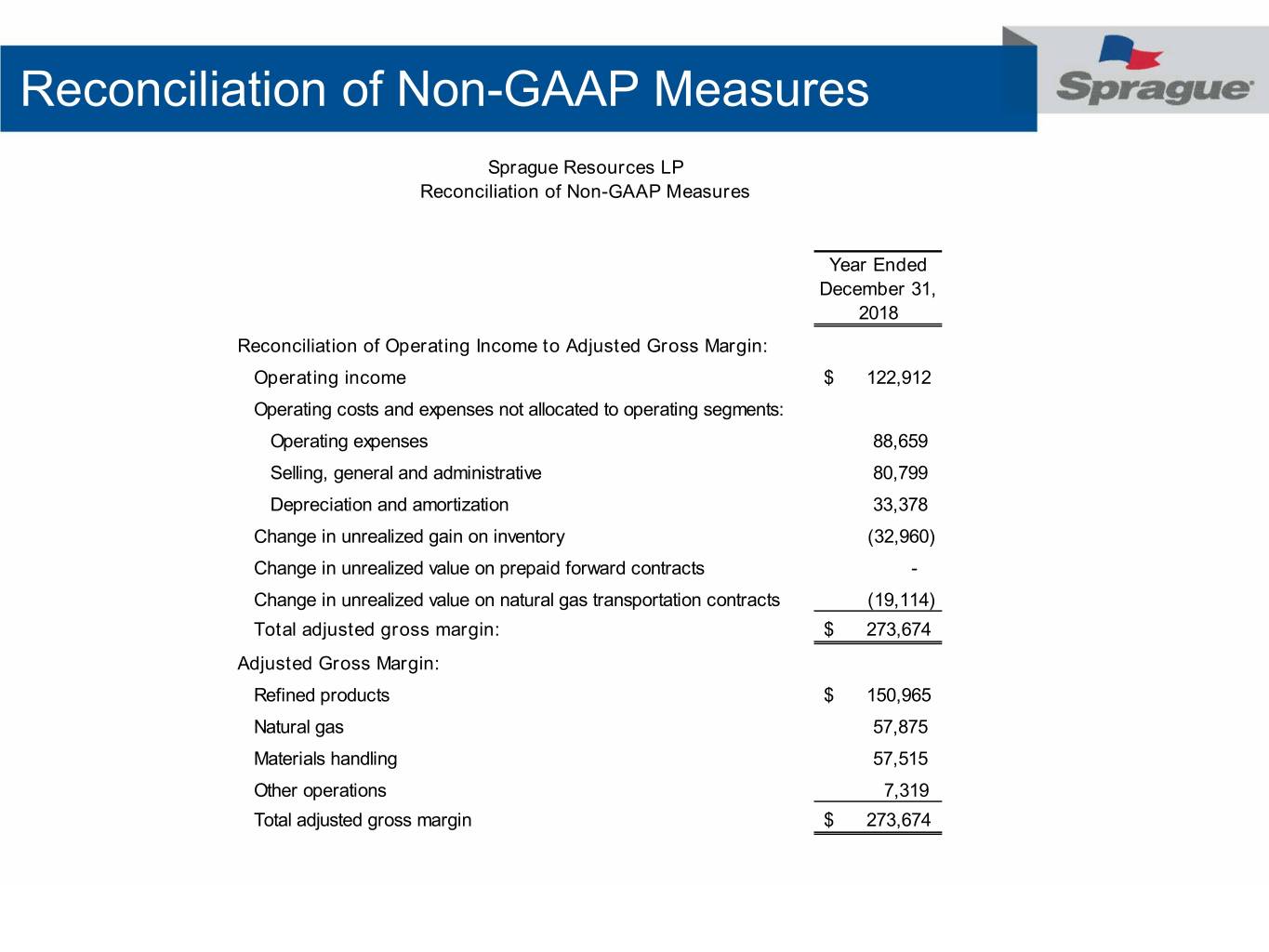

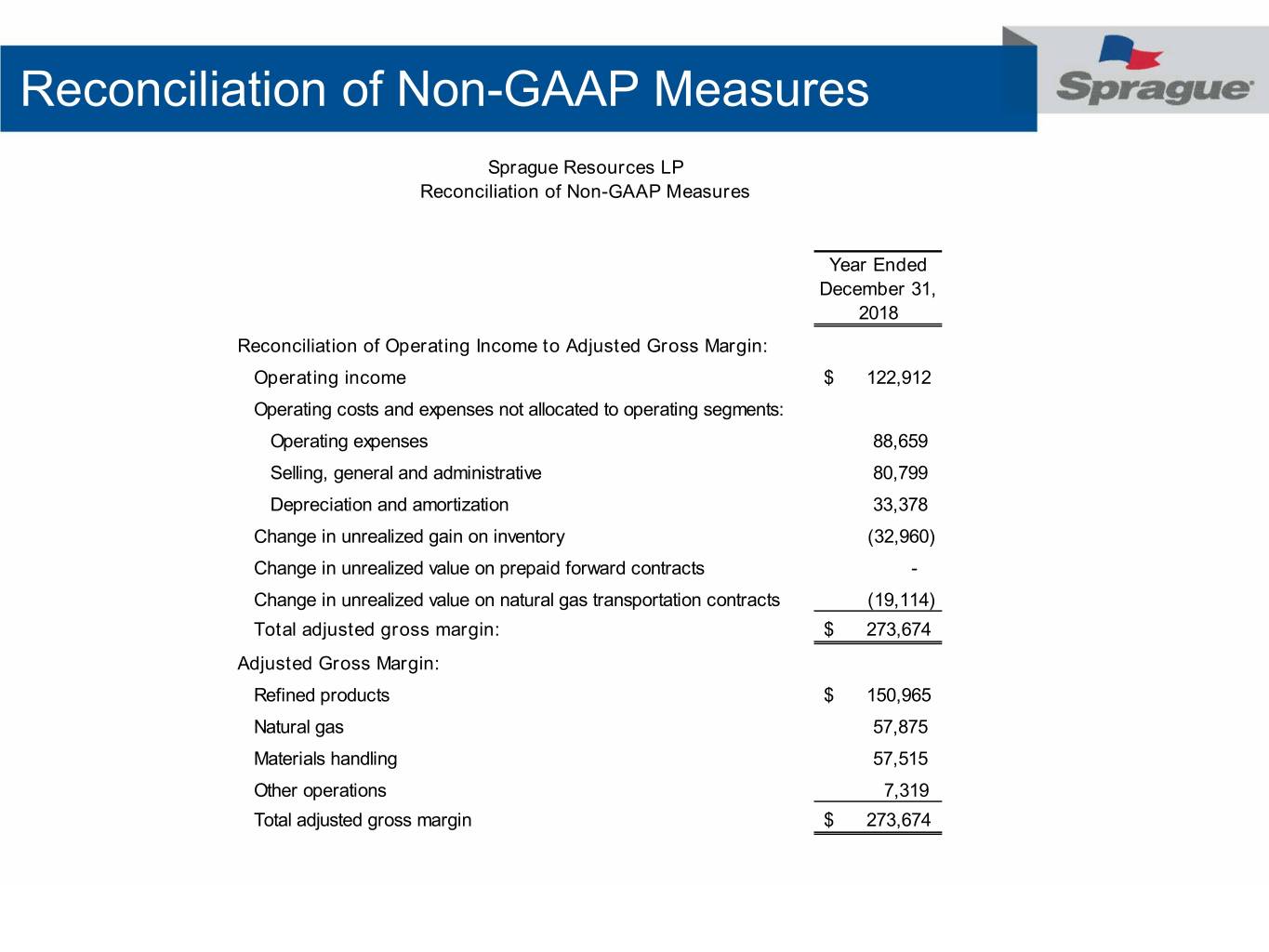

Reconciliation of Non-GAAP Measures Sprague Resources LP Reconciliation of Non-GAAP Measures Year Ended December 31, 2018 Reconciliation of Operating Income to Adjusted Gross Margin: Operating income $ 122,912 Operating costs and expenses not allocated to operating segments: Operating expenses 88,659 Selling, general and administrative 80,799 Depreciation and amortization 33,378 Change in unrealized gain on inventory (32,960) Change in unrealized value on prepaid forward contracts - Change in unrealized value on natural gas transportation contracts (19,114) Total adjusted gross margin: $ 273,674 Adjusted Gross Margin: Refined products $ 150,965 Natural gas 57,875 Materials handling 57,515 Other operations 7,319 Total adjusted gross margin $ 273,674

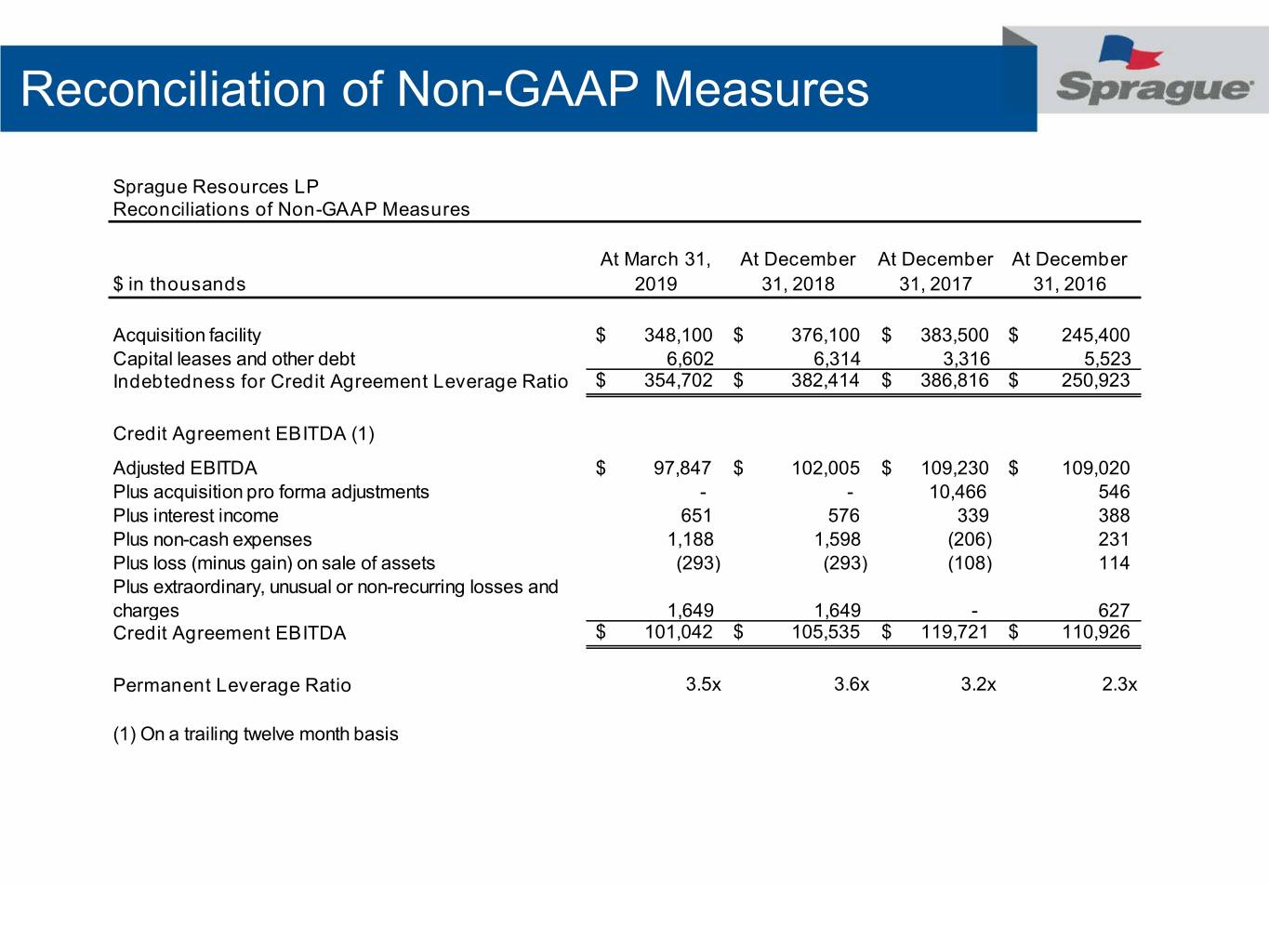

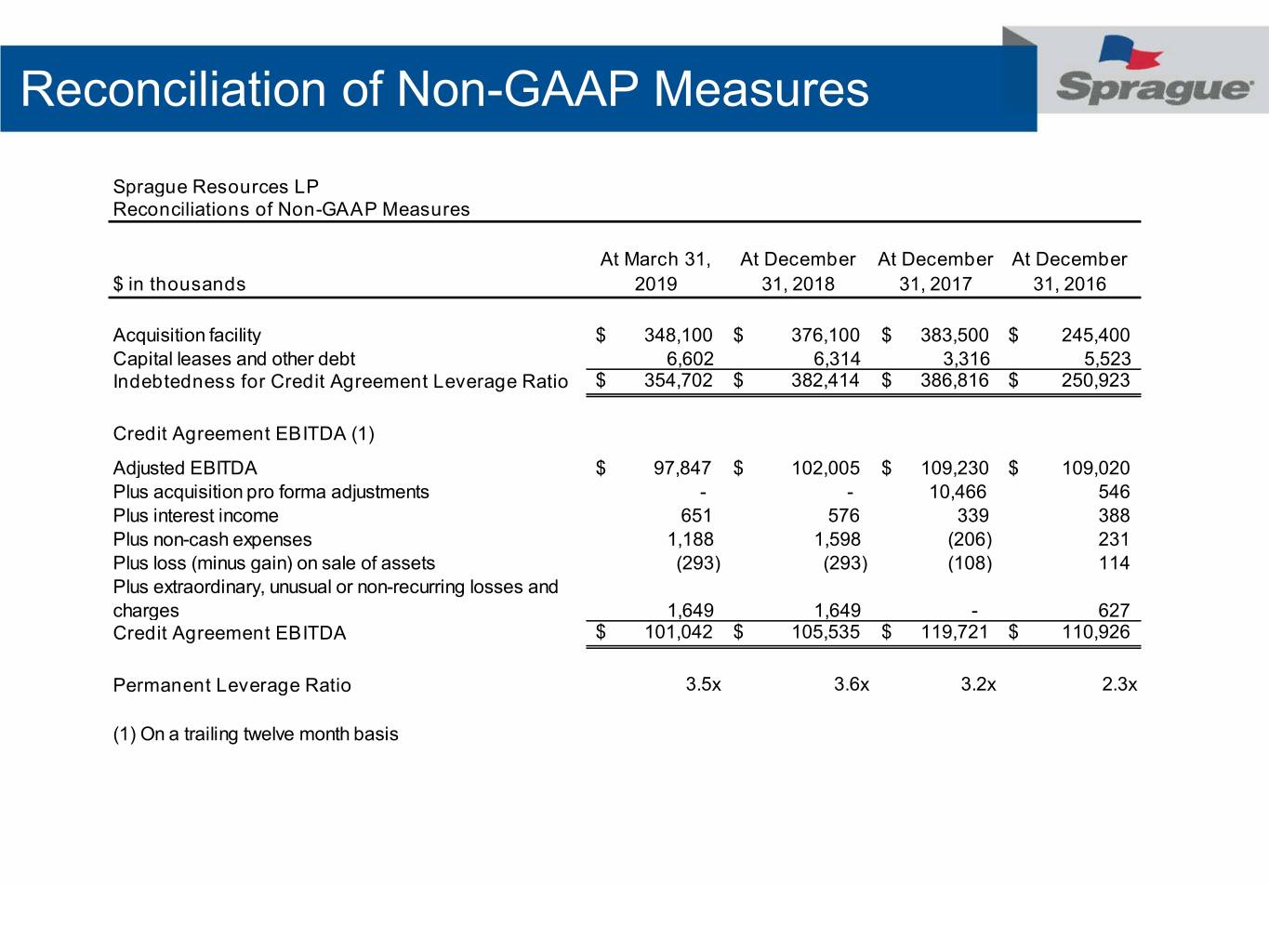

Reconciliation of Non-GAAP Measures Sprague Resources LP Reconciliations of Non-GAAP Measures At March 31, At December At December At December $ in thousands 2019 31, 2018 31, 2017 31, 2016 Acquisition facility $ 348,100 $ 376,100 $ 383,500 $ 245,400 Capital leases and other debt 6,602 6,314 3,316 5,523 Indebtedness for Credit Agreement Leverage Ratio $ 354,702 $ 382,414 $ 386,816 $ 250,923 Credit Agreement EBITDA (1) Adjusted EBITDA $ 97,847 $ 102,005 $ 109,230 $ 109,020 Plus acquisition pro forma adjustments - - 10,466 546 Plus interest income 651 576 339 388 Plus non-cash expenses 1,188 1,598 (206) 231 Plus loss (minus gain) on sale of assets (293) (293) (108) 114 Plus extraordinary, unusual or non-recurring losses and charges 1,649 1,649 - 627 Credit Agreement EBITDA $ 101,042 $ 105,535 $ 119,721 $ 110,926 Permanent Leverage Ratio 3.5x 3.6x 3.2x 2.3x (1) On a trailing twelve month basis