UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22582

Western Asset Middle Market Income Fund Inc.

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 777-0102

Date of fiscal year end: April 30

Date of reporting period: October 31, 2017

ITEM 1. REPORT TO STOCKHOLDERS.

The Semi-Annual Report to Stockholders is filed herewith.

| | |

| Semi-Annual Report | | October 31, 2017 |

WESTERN ASSET

MIDDLE MARKET

INCOME FUND INC.

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objectives

The Fund’s primary investment objective is to provide high income. As a secondary investment objective, the Fund seeks capital appreciation.

The Fund seeks to achieve its investment objectives by investing, under normal market conditions, at least 80% of its managed assets (the net assets of the Fund plus the principal amount of any borrowings and any preferred stock that may be outstanding) in securities, including loans, issued by middle market companies. For investment purposes, “middle market” refers to companies with annual revenues of between $100 million and $1 billion at the time of investment by the Fund. Securities of middle market issuers are typically considered below investment grade (also commonly referred to as “junk bonds”).

Letter from the chairman

Dear Shareholder,

We are pleased to provide the semi-annual report of Western Asset Middle Market Income Fund Inc. for the six-month reporting period ended October 31, 2017. Please read on for Fund performance information and a detailed look at prevailing economic and market conditions during the Fund’s reporting period.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.lmcef.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund prices and performance, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

Chairman, President and Chief Executive Officer

November 30, 2017

| | |

| II | | Western Asset Middle Market Income Fund Inc. |

Investment commentary

Economic review

Economic activity in the U.S. improved during the six months ended October 31, 2017 (the “reporting period”). Looking back, the U.S. Department of Commerce reported that first quarter 2017 U.S. gross domestic product (“GDP”)i growth, as revised, was 1.2%. Second quarter 2017 GDP growth then accelerated to 3.1%. Finally, the U.S. Department of Commerce’s second estimate for third quarter 2017 GDP growth — released after the reporting period ended — was 3.3%. Stronger growth was attributed to a number of factors, including positive contributions from personal consumption expenditures, private inventory investment, nonresidential fixed investment and exports. These factors were partly offset by a decrease in imports.

Job growth in the U.S. was solid overall and a tailwind for the economy during the reporting period. When the reporting period ended on October 31, 2017, the unemployment rate was 4.1%, as reported by the U.S. Department of Labor. This represented the lowest unemployment rate since December 2000. The percentage of longer-term unemployed fluctuated during the reporting period. In October 2017, 24.8% of Americans looking for a job had been out of work for more than six months, versus 24.0% when the period began.

| | |

| Western Asset Middle Market Income Fund Inc. | | III |

Investment commentary (cont’d)

Market review

Q. How did the Federal Reserve Board (the “Fed”)ii respond to the economic environment?

A. Looking back, after an extended period of maintaining the federal funds rateiii at a historically low range between zero and 0.25%, the Fed increased the rate at its meeting on December 16, 2015. In particular, the U.S. central bank raised the federal funds rate to a range between 0.25% and 0.50%. The Fed then kept rates on hold at each meeting prior to its meeting on December 14, 2016, at which time, the Fed raised rates to a range between 0.50% and 0.75%.

After holding rates steady at its meeting that concluded on February 1, 2017, the Fed raised rates to a range between 0.75% and 1.00% at its meeting that ended on March 15, 2017. At its meeting that concluded on June 14, 2017, the Fed raised rates to a range between 1.00% and 1.25%. At its meeting that concluded on July 26, 2017, the Fed kept rates on hold, as expected. At its meeting that concluded on September 20, 2017, the Fed again kept rates on hold, but reiterated its intention to begin reducing its balance sheet, saying, “In October, the Committee will initiate the balance sheet normalization program….” Finally, at its meeting that ended on November 1, 2017, after the reporting period ended, the Fed maintained the federal funds rate in the target range of 1.00% to 1.25%, but left open the possibility of another rate hike in December 2017.

Q. Did Treasury yields trend higher or lower during the reporting period?

A. Both short-term and longer-term Treasury yields moved higher during the six-month reporting period ended October 31, 2017. The yield for the two-year Treasury note began the reporting period at 1.28% and ended the period at 1.60%. The low for the period of 1.26% occurred on May 17, 2017 and the peak of 1.63% took place on October 26, 2017. The yield for the ten-year Treasury began the reporting period at 2.29% and ended the period at 2.38%. The low for the period of 2.05% occurred on September 7, 2017, and the peak of 2.46% took place on October 26, 2017.

Q. What factors impacted the spread sectors (non-Treasuries) during the reporting period?

A. The spread sectors posted mixed results during the reporting period. Performance fluctuated given shifting expectations for global growth, questions regarding future central bank monetary policy and several geopolitical issues. The broad U.S. bond market, as measured by the Bloomberg Barclays U.S. Aggregate Indexiv, returned 1.58% during the six-month reporting period ended October 31, 2017.

Q. How did the high-yield bond market perform over the during the reporting period?

A. The U.S. high-yield bond market, as measured by the Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Indexv, gained 3.44% for the six months ended October 31, 2017. The high-yield market rallied from May through July 2017. This was driven by overall robust demand from investors looking to generate incremental yield in the low interest rate environment. The high yield market was then relatively flat in August 2017, and again moved higher in September and October 2017.

| | |

| IV | | Western Asset Middle Market Income Fund Inc. |

Q. How did the emerging markets debt asset class perform over the reporting period?

A. The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)vi returned 3.15% during the six months ended October 31, 2017. The asset class posted positive results during the first two months of the reporting period. This was triggered by overall strong investor demand, less concern over a significant shift in U.S. trade policy and a weakening U.S. dollar. The asset class then modestly declined in June 2017, but moved higher from July through October 2017.

Performance review

For the six months ended October 31, 2017, Western Asset Middle Market Income Fund Inc. returned 2.19% based on its net asset value (“NAV”)vii. The Fund’s unmanaged benchmark, the Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Caa Component Indexviii returned 4.08% for the same period. The Lipper High Yield (Leveraged) Closed-End Funds Category Average ix returned 3.67% over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV.

During the reporting period, the Fund made distributions to shareholders totaling $41.90 per share. As of October 31, 2017, the Fund estimates that 96.00% of the distributions were sourced from investment income and 4.00% constitutes a return of capital.* The performance table shows the Fund’s six-month total return based on its NAV as of October 31, 2017. Past performance is no guarantee of future results.

| | | | |

Performance Snapshot as of October 31, 2017

(unaudited) | |

| Price Per Share | | 6-Month Total Return** | |

| $774.71 (NAV) | | | 2.19 | %† |

All figures represent past performance and are not a guarantee of future results. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

** Total return is based on changes in NAV. Return reflects the deduction of all Fund expenses, including management fees, operating expenses, and other Fund expenses. Return does not reflect the deduction of brokerage commissions or taxes that investors pay on distributions or the disposition of shares.

† Total return assumes the reinvestment of all distributions, including returns of capital, if any, at NAV.

Looking for additional information?

The Fund’s daily NAV is available on-line under the symbol “XWMFX” on most financial websites. In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern Time, for the Fund’s current NAV and other information.

| * | These estimates are not for tax purposes. The Fund will issue a Form 1099 with final composition of the distributions for tax purposes after year-end. A return of capital is not taxable and results in a reduction in the tax basis of a shareholder’s investment. For more information about a distribution’s composition, please refer to the Fund’s distribution press release or, if applicable, the Section 19 notice located in the press release section our website, www.lmcef.com (click on the name of the Fund). |

| | |

| Western Asset Middle Market Income Fund Inc. | | V |

Investment commentary (cont’d)

Thank you for your investment in Western Asset Middle Market Income Fund Inc. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Jane Trust, CFA

Chairman, President and Chief Executive Officer

November 30, 2017

RISKS: The Fund is a non-diversified closed-end management investment company. An investment in the Fund involves a high degree of risk. The Fund should be considered an illiquid investment. This Fund is not publicly traded and is closed to new investors. The Fund does not intend to apply for an exchange listing, and it is highly unlikely that a secondary market will exist for the purchase and sale of the Fund’s shares. Investors could lose some or all of their investment. An investment in the Fund is not appropriate for all investors and is not intended to be a complete investment program. The Fund is designed as a long-term investment for investors who are prepared to hold the Fund’s Common Stock until the expiration of its term, and is not a trading vehicle. Because the Fund is non-diversified, it may be more susceptible to economic, political or regulatory events than a diversified fund. The Fund’s investments are subject to numerous risks, including but not limited to, credit, inflation, income, prepayment and interest rates risks. As interest rates rise, the value of fixed-income securities falls. Middle market companies have additional risks due to their limited operating histories, limited financial resources, less predictable operating results, narrower product lines and other factors. Securities of middle market issuers are typically considered high-yield. High-yield fixed income securities of below-investment-grade quality are regarded as having predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. High-yield bonds (“junk bonds”) are subject to higher credit risk and a greater risk of default. The Fund may invest all or a portion of its managed assets in illiquid securities. The Fund may make significant investments in securities for which there are no observable market prices; the prices must be estimated by Western Asset, the Fund’s subadviser, and approved by the Legg Mason North Atlantic Fund Valuation Committee. Investments in foreign securities involve risks, including the possibility of losses due to changes in currency exchange rates and negative developments in the political, economic or regulatory structure of specific countries or regions. These risks are greater in emerging markets. Leverage may result in greater volatility of the net asset value of common shares and increases a shareholder’s risk of loss. Derivative instruments can be illiquid, may disproportionately increase losses and have a potentially large impact on Fund performance. Distributions are not guaranteed and are subject to change.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| | |

| VI | | Western Asset Middle Market Income Fund Inc. |

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| iv | The Bloomberg Barclays U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| v | The Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Bloomberg Barclays U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. |

| vi | The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds and local market instruments. |

| vii | Net asset value (“NAV”) is calculated by subtracting total liabilities, including liabilities associated with financial leverage (if any), from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. |

| viii | The Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Caa Component is an index of the 2% Issuer Cap component of the Bloomberg Barclays U.S. Corporate High Yield Index and is comprised of the Caa-rated securities included in this Index. |

| ix | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended October 31, 2017, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 35 funds in the Fund’s Lipper category. |

| | |

| Western Asset Middle Market Income Fund Inc. | | VII |

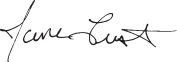

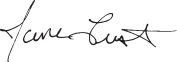

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of October 31, 2017 and April 30, 2017. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at anytime. |

| ‡ | Represents less than 0.1%. |

| | |

| Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report | | 1 |

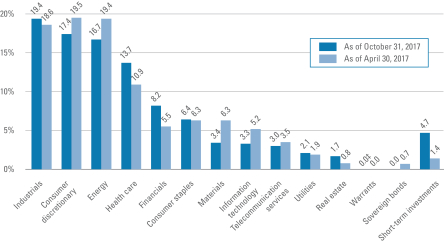

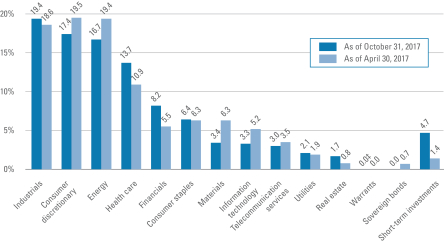

Spread duration (unaudited)

Economic exposure — October 31, 2017

| | |

| Total Spread Duration |

| XWMFX | | — 2.16 years |

| Benchmark | | — 2.96 years |

Spread duration measures the sensitivity to changes in spreads. The spread over Treasuries is the annual risk-premium demanded by investors to hold non-Treasury securities. Spread duration is quantified as the % change in price resulting from a 100 basis points change in spreads. For a security with positive spread duration, an increase in spreads would result in a price decline and a decline in spreads would result in a price increase. This chart highlights the market sector exposure of the Fund’s sectors relative to the selected benchmark sectors as of the end of the reporting period.

| | |

| Benchmark | | — Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Caa Component Index |

| EM | | — Emerging Markets |

| HY | | — High Yield |

| XWMFX | | — Western Asset Middle Market Income Fund Inc. |

| | |

| 2 | | Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report |

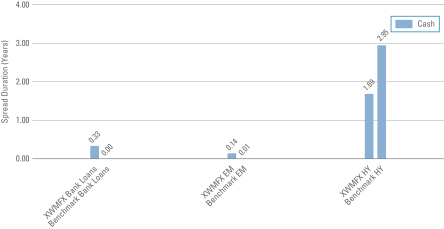

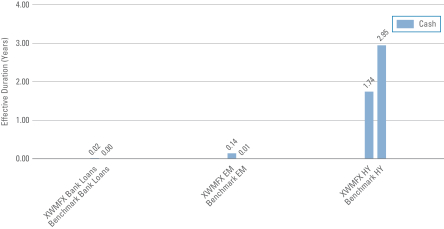

Effective duration (unaudited)

Interest rate exposure — October 31, 2017

| | |

| Total Effective Duration |

| XWMFX | | — 1.90 years |

| Benchmark | | — 2.96 years |

Effective duration measures the sensitivity to changes in relevant interest rates. Effective duration is quantified as the % change in price resulting from a 100 basis points change in interest rates. For a security with positive effective duration, an increase in interest rates would result in a price decline and a decline in interest rates would result in a price increase. This chart highlights the interest rate exposure of the Fund’s sectors relative to the selected benchmark sectors as of the end of the reporting period.

| | |

| Benchmark | | — Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Caa Component Index |

| EM | | — Emerging Markets |

| HY | | — High Yield |

| XWMFX | | — Western Asset Middle Market Income Fund Inc. |

| | |

| Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report | | 3 |

Schedule of investments (unaudited)

October 31, 2017

Western Asset Middle Market Income Fund Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Corporate Bonds & Notes — 94.6% | | | | | | | | | | | | | | | | |

| Consumer Discretionary — 18.1% | | | | | | | | | | | | | | | | |

Hotels, Restaurants & Leisure — 12.7% | | | | | | | | | | | | | | | | |

24 Hour Fitness Worldwide Inc., Senior Notes | | | 8.000 | % | | | 6/1/22 | | | $ | 2,500,000 | | | $ | 2,325,000 | (a)(b) |

CEC Entertainment Inc., Senior Notes | | | 8.000 | % | | | 2/15/22 | | | | 4,000,000 | | | | 4,155,000 | (b) |

Golden Nugget Inc., Senior Notes | | | 8.750 | % | | | 10/1/25 | | | | 1,910,000 | | | | 1,967,300 | (a) |

Inn of the Mountain Gods Resort & Casino, Senior Secured Notes | | | 9.250 | % | | | 11/30/20 | | | | 3,491,169 | | | | 3,176,964 | (a)(b) |

Jack Ohio Finance LLC/Jack Ohio Finance 1 Corp., Secured Notes | | | 10.250 | % | | | 11/15/22 | | | | 3,000,000 | | | | 3,307,500 | (a)(b) |

Jacobs Entertainment Inc., Secured Notes | | | 7.875 | % | | | 2/1/24 | | | | 2,990,000 | | | | 3,236,675 | (a)(b) |

Nathan’s Famous Inc., Senior Secured Notes | | | 10.000 | % | | | 3/15/20 | | | | 220,000 | | | | 232,463 | (a) |

Nathan’s Famous Inc., Senior Secured Notes | | | 6.625 | % | | | 11/1/25 | | | | 2,400,000 | | | | 2,460,000 | (a)(c) |

Silversea Cruise Finance Ltd., Senior Secured Notes | | | 7.250 | % | | | 2/1/25 | | | | 2,905,000 | | | | 3,130,137 | (a) |

Sugarhouse HSP Gaming Prop Mezz LP/Sugarhouse HSP Gaming Finance Corp., Senior Secured Notes | | | 5.875 | % | | | 5/15/25 | | | | 3,000,000 | | | | 2,932,500 | (a) |

Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 26,923,539 | |

Household Durables — 1.4% | | | | | | | | | | | | | | | | |

APX Group Inc., Senior Notes | | | 8.750 | % | | | 12/1/20 | | | | 3,000,000 | | | | 3,082,500 | (b) |

Leisure Products — 1.7% | | | | | | | | | | | | | | | | |

Gibson Brands Inc., Senior Secured Notes | | | 8.875 | % | | | 8/1/18 | | | | 4,266,000 | | | | 3,540,780 | (a)(b) |

Multiline Retail — 0.7% | | | | | | | | | | | | | | | | |

Neiman Marcus Group Ltd. LLC, Senior Notes (8.750% Cash or 9.500% PIK) | | | 8.750 | % | | | 10/15/21 | | | | 2,618,750 | | | | 1,414,125 | (a)(b)(d) |

Specialty Retail — 1.6% | | | | | | | | | | | | | | | | |

Guitar Center Inc., Senior Secured Bonds | | | 6.500 | % | | | 4/15/19 | | | | 2,500,000 | | | | 2,337,500 | (a)(b) |

Hot Topic Inc., Senior Secured Notes | | | 9.250 | % | | | 6/15/21 | | | | 1,200,000 | | | | 1,000,500 | (a)(b) |

Total Specialty Retail | | | | | | | | | | | | | | | 3,338,000 | |

Total Consumer Discretionary | | | | | | | | | | | | | | | 38,298,944 | |

| Consumer Staples — 4.0% | | | | | | | | | | | | | | | | |

Beverages — 0.6% | | | | | | | | | | | | | | | | |

Carolina Beverage Group LLC/Carolina Beverage Group Finance Inc., Secured Notes | | | 10.625 | % | | | 8/1/18 | | | | 1,300,000 | | | | 1,319,500 | (a)(b) |

Food & Staples Retailing — 1.3% | | | | | | | | | | | | | | | | |

Beverages & More Inc., Senior Secured Notes | | | 11.500 | % | | | 6/15/22 | | | | 3,000,000 | | | | 2,707,500 | (a) |

Tobacco — 2.1% | | | | | | | | | | | | | | | | |

Alliance One International Inc., Secured Notes | | | 9.875 | % | | | 7/15/21 | | | | 4,960,000 | | | | 4,389,600 | (b) |

Total Consumer Staples | | | | | | | | | | | | | | | 8,416,600 | |

See Notes to Financial Statements.

| | |

| 4 | | Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report |

Western Asset Middle Market Income Fund Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Energy — 13.6% | | | | | | | | | | | | | | | | |

Energy Equipment & Services — 1.1% | | | | | | | | | | | | | | | | |

Pride International Inc., Senior Notes | | | 7.875 | % | | | 8/15/40 | | | $ | 2,750,000 | | | $ | 2,310,000 | (b) |

Oil, Gas & Consumable Fuels — 12.5% | | | | | | | | | | | | | | | | |

Berry Petroleum Co. Escrow | | | — | | | | — | | | | 10,119,000 | | | | 0 | *(e)(f)(g) |

Blue Racer Midstream LLC/Blue Racer Finance Corp., Senior Notes | | | 6.125 | % | | | 11/15/22 | | | | 2,379,000 | | | | 2,492,003 | (a)(b) |

Comstock Resources Inc., Senior Secured Notes

(10.000% Cash or 12.500% PIK) | | | 10.000 | % | | | 3/15/20 | | | | 1,000,000 | | | | 1,040,000 | (d) |

Magnum Hunter Resources Corp. Escrow | | | — | | | | — | | | | 6,090,000 | | | | 0 | *(e)(f)(g) |

MEG Energy Corp., Senior Notes | | | 6.375 | % | | | 1/30/23 | | | | 1,500,000 | | | | 1,380,000 | (a)(b) |

Oasis Petroleum Inc., Senior Notes | | | 7.250 | % | | | 2/1/19 | | | | 1,000,000 | | | | 1,005,000 | (b) |

Oasis Petroleum Inc., Senior Notes | | | 6.500 | % | | | 11/1/21 | | | | 4,088,000 | | | | 4,179,980 | (b) |

Oasis Petroleum Inc., Senior Notes | | | 6.875 | % | | | 3/15/22 | | | | 210,000 | | | | 216,300 | |

Oasis Petroleum Inc., Senior Notes | | | 6.875 | % | | | 1/15/23 | | | | 2,607,000 | | | | 2,665,657 | (b) |

Petrobras Global Finance BV, Senior Notes | | | 6.750 | % | | | 1/27/41 | | | | 1,900,000 | | | | 1,919,000 | |

Rice Energy Inc., Senior Notes | | | 6.250 | % | | | 5/1/22 | | | | 500,000 | | | | 523,825 | (b) |

Rice Energy Inc., Senior Notes | | | 7.250 | % | | | 5/1/23 | | | | 1,490,000 | | | | 1,605,788 | (b) |

Sanchez Energy Corp., Senior Notes | | | 6.125 | % | | | 1/15/23 | | | | 5,060,000 | | | | 4,250,400 | (b) |

Shelf Drilling Holdings Ltd., Secured Notes | | | 9.500 | % | | | 11/2/20 | | | | 5,000,000 | | | | 5,100,000 | (a) |

Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 26,377,953 | |

Total Energy | | | | | | | | | | | | | | | 28,687,953 | |

| Financials — 10.0% | | | | | | | | | | | | | | | | |

Capital Markets — 1.7% | | | | | | | | | | | | | | | | |

Jefferies Finance LLC/JFIN Co.-Issuer Corp., Senior Notes | | | 7.375 | % | | | 4/1/20 | | | | 3,500,000 | | | | 3,626,875 | (a)(b) |

Consumer Finance — 4.3% | | | | | | | | | | | | | | | | |

Stearns Holdings Inc., Senior Secured Notes | | | 9.375 | % | | | 8/15/20 | | | | 4,695,000 | | | | 4,906,275 | (a)(b) |

TMX Finance LLC/TitleMax Finance Corp., Senior Secured Notes | | | 8.500 | % | | | 9/15/18 | | | | 4,500,000 | | | | 4,173,750 | (a)(b) |

Total Consumer Finance | | | | | | | | | | | | | | | 9,080,025 | |

Diversified Financial Services — 4.0% | | | | | | | | | | | | | | | | |

Interface Special Holdings Inc., Senior Notes

(19.000% PIK) | | | 19.000 | % | | | 11/1/23 | | | | 2,283,508 | | | | 2,294,926 | (a)(d) |

NewStar Financial Inc., Senior Notes | | | 7.250 | % | | | 5/1/20 | | | | 5,000,000 | | | | 5,212,500 | |

Werner FinCo LP/Werner FinCo Inc., Senior Notes | | | 8.750 | % | | | 7/15/25 | | | | 1,000,000 | | | | 1,035,000 | (a) |

Total Diversified Financial Services | | | | | | | | | | | | | | | 8,542,426 | |

Total Financials | | | | | | | | | | | | | | | 21,249,326 | |

| Health Care — 15.7% | | | | | | | | | | | | | | | | |

Biotechnology — 1.4% | | | | | | | | | | | | | | | | |

AMAG Pharmaceuticals Inc., Senior Notes | | | 7.875 | % | | | 9/1/23 | | | | 2,869,000 | | | | 2,933,553 | (a)(b) |

See Notes to Financial Statements.

| | |

| Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report | | 5 |

Schedule of investments (unaudited) (cont’d)

October 31, 2017

Western Asset Middle Market Income Fund Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Health Care Equipment & Supplies — 4.3% | | | | | | | | | | | | | | | | |

DJO Finance LLC/DJO Finance Corp., Secured Notes | | | 10.750 | % | | | 4/15/20 | | | $ | 3,500,000 | | | $ | 3,097,500 | (b) |

Immucor Inc., Senior Notes | | | 11.125 | % | | | 2/15/22 | | | | 5,700,000 | | | | 6,013,500 | (a) |

Total Health Care Equipment & Supplies | | | | | | | | | | | | | | | 9,111,000 | |

Health Care Providers & Services — 8.7% | | | | | | | | | | | | | | | | |

Air Medical Group Holdings Inc., Senior Notes | | | 6.375 | % | | | 5/15/23 | | | | 3,685,000 | | | | 3,574,450 | (a)(b) |

BioScrip Inc., Second Lien Delayed Draw Notes | | | 10.500 | % | | | 8/15/20 | | | | 318,182 | | | | 313,663 | (f)(g)(h) |

BioScrip Inc., Second Lien Notes | | | 10.500 | % | | | 6/30/22 | | | | 3,181,819 | | | | 3,136,637 | (f)(g)(h) |

BioScrip Inc., Senior Notes | | | 8.875 | % | | | 2/15/21 | | | | 6,000,000 | | | | 5,565,000 | (b) |

Tenet Healthcare Corp., Senior Notes | | | 8.125 | % | | | 4/1/22 | | | | 690,000 | | | | 696,038 | |

Universal Hospital Services Inc., Secured Notes | | | 7.625 | % | | | 8/15/20 | | | | 5,155,000 | | | | 5,245,212 | (b) |

Total Health Care Providers & Services | | | | | | | | | | | | | | | 18,531,000 | |

Pharmaceuticals — 1.3% | | | | | | | | | | | | | | | | |

Valeant Pharmaceuticals International Inc., Senior Notes | | | 7.000 | % | | | 10/1/20 | | | | 430,000 | | | | 435,375 | (a) |

Valeant Pharmaceuticals International Inc., Senior Notes | | | 7.250 | % | | | 7/15/22 | | | | 1,480,000 | | | | 1,422,650 | (a) |

Valeant Pharmaceuticals International Inc., Senior Notes | | | 5.875 | % | | | 5/15/23 | | | | 1,000,000 | | | | 847,500 | (a)(b) |

Total Pharmaceuticals | | | | | | | | | | | | | | | 2,705,525 | |

Total Health Care | | | | | | | | | | | | | | | 33,281,078 | |

| Industrials — 21.8% | | | | | | | | | | | | | | | | |

Aerospace & Defense — 2.2% | | | | | | | | | | | | | | | | |

CBC Ammo LLC/CBC FinCo Inc., Senior Notes | | | 7.250 | % | | | 11/15/21 | | | | 3,254,000 | | | | 3,310,945 | (a)(b) |

Heligear Acquisition Co., Senior Secured Bonds | | | 10.250 | % | | | 10/15/19 | | | | 1,241,000 | | | | 1,313,536 | (a)(b) |

Total Aerospace & Defense | | | | | | | | | | | | | | | 4,624,481 | |

Commercial Services & Supplies — 2.2% | | | | | | | | | | | | | | | | |

Garda World Security Corp., Senior Notes | | | 7.250 | % | | | 11/15/21 | | | | 2,610,000 | | | | 2,678,513 | (a)(b) |

Monitronics International Inc., Senior Notes | | | 9.125 | % | | | 4/1/20 | | | | 2,150,000 | | | | 1,875,875 | (b) |

Total Commercial Services & Supplies | | | | | | | | | | | | | | | 4,554,388 | |

Construction & Engineering — 9.5% | | | | | | | | | | | | | | | | |

Ausdrill Finance Pty Ltd., Senior Notes | | | 6.875 | % | | | 11/1/19 | | | | 5,000,000 | | | | 5,093,750 | (a)(b) |

Brundage-Bone Concrete Pumping Inc., Senior Secured Notes | | | 10.375 | % | | | 9/1/23 | | | | 5,000,000 | | | | 5,150,000 | (a) |

HC2 Holdings Inc., Senior Secured Notes | | | 11.000 | % | | | 12/1/19 | | | | 4,500,000 | | | | 4,680,000 | (a)(b) |

Michael Baker Holdings LLC/Michael Baker Finance Corp., Senior Notes (8.875% Cash or 9.625% PIK) | | | 8.875 | % | | | 4/15/19 | | | | 5,122,830 | | | | 5,148,444 | (a)(b)(d) |

Total Construction & Engineering | | | | | | | | | | | | | | | 20,072,194 | |

Machinery — 1.6% | | | | | | | | | | | | | | | | |

BlueLine Rental Finance Corp./BlueLine Rental LLC, Senior Secured Notes | | | 9.250 | % | | | 3/15/24 | | | | 3,070,000 | | | | 3,338,625 | (a) |

See Notes to Financial Statements.

| | |

| 6 | | Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report |

Western Asset Middle Market Income Fund Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Marine — 1.8% | | | | | | | | | | | | | | | | |

Navios Maritime Acquisition Corp./Navios Acquisition Finance U.S. Inc., Senior Secured Notes | | | 8.125 | % | | | 11/15/21 | | | $ | 4,260,000 | | | $ | 3,770,100 | (a)(b) |

Road & Rail — 1.0% | | | | | | | | | | | | | | | | |

Flexi-Van Leasing Inc., Senior Notes | | | 7.875 | % | | | 8/15/18 | | | | 2,210,000 | | | | 2,221,050 | (a)(b) |

Trading Companies & Distributors — 1.8% | | | | | | | | | | | | | | | | |

Ahern Rentals Inc., Secured Notes | | | 7.375 | % | | | 5/15/23 | | | | 1,970,000 | | | | 1,812,400 | (a)(b) |

Emeco Pty Ltd., Senior Secured Notes | | | 9.250 | % | | | 3/31/22 | | | | 1,978,824 | | | | 2,077,765 | |

Total Trading Companies & Distributors | | | | | | | | | | | | | | | 3,890,165 | |

Transportation — 1.7% | | | | | | | | | | | | | | | | |

Neovia Logistics Services LLC/SPL Logistics Finance Corp., Senior Secured Notes | | | 8.875 | % | | | 8/1/20 | | | | 4,330,000 | | | | 3,658,850 | (a)(b) |

Total Industrials | | | | | | | | | | | | | | | 46,129,853 | |

| Materials — 4.2% | | | | | | | | | | | | | | | | |

Chemicals — 1.6% | | | | | | | | | | | | | | | | |

Eco Services Operations LLC/Eco Finance Corp., Senior Notes | | | 8.500 | % | | | 11/1/22 | | | | 1,500,000 | | | | 1,560,937 | (a)(b) |

Techniplas LLC, Senior Secured Notes | | | 10.000 | % | | | 5/1/20 | | | | 2,400,000 | | | | 1,932,000 | (a)(b) |

Total Chemicals | | | | | | | | | | | | | | | 3,492,937 | |

Construction Materials — 1.3% | | | | | | | | | | | | | | | | |

Hardwoods Acquisition Inc., Senior Secured Notes | | | 7.500 | % | | | 8/1/21 | | | | 1,000,000 | | | | 938,750 | (a) |

NWH Escrow Corp., Senior Secured Notes | | | 7.500 | % | | | 8/1/21 | | | | 1,930,000 | | | | 1,778,013 | (a)(b) |

Total Construction Materials | | | | | | | | | | | | | | | 2,716,763 | |

Metals & Mining — 0.8% | | | | | | | | | | | | | | | | |

Murray Energy Corp., Senior Secured Notes | | | 11.250 | % | | | 4/15/21 | | | | 3,000,000 | | | | 1,665,000 | (a)(b) |

Paper & Forest Products — 0.5% | | | | | | | | | | | | | | | | |

Mercer International Inc., Senior Notes | | | 6.500 | % | | | 2/1/24 | | | | 1,000,000 | | | | 1,060,000 | |

Total Materials | | | | | | | | | | | | | | | 8,934,700 | |

| Real Estate — 2.1% | | | | | | | | | | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 1.1% | | | | | | | | | | | | | | | | |

Uniti Group Inc./CSL Capital LLC, Senior Notes | | | 8.250 | % | | | 10/15/23 | | | | 2,500,000 | | | | 2,418,750 | (b) |

Real Estate Management & Development — 1.0% | | | | | | | | | | | | | | | | |

Kennedy-Wilson Inc., Senior Notes | | | 5.875 | % | | | 4/1/24 | | | | 2,000,000 | | | | 2,077,500 | |

Total Real Estate | | | | | | | | | | | | | | | 4,496,250 | |

| Telecommunication Services — 3.7% | | | | | | | | | | | | | | | | |

Diversified Telecommunication Services — 1.1% | | | | | | | | | | | | | | | | |

Cogent Communications Group Inc., Senior Secured Notes | | | 5.375 | % | | | 3/1/22 | | | | 1,200,000 | | | | 1,273,500 | (a) |

Windstream Services LLC, Senior Notes | | | 7.500 | % | | | 6/1/22 | | | | 1,500,000 | | | | 1,125,000 | |

Total Diversified Telecommunication Services | | | | | | | | | | | | | | | 2,398,500 | |

See Notes to Financial Statements.

| | |

| Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report | | 7 |

Schedule of investments (unaudited) (cont’d)

October 31, 2017

Western Asset Middle Market Income Fund Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Wireless Telecommunication Services — 2.6% | | | | | | | | | | | | | | | | |

CSC Holdings LLC, Senior Notes | | | 10.125 | % | | | 1/15/23 | | | $ | 590,000 | | | $ | 677,025 | (a) |

CSC Holdings LLC, Senior Notes | | | 10.875 | % | | | 10/15/25 | | | | 747,000 | | | | 916,943 | (a)(b) |

Sprint Communications Inc., Senior Notes | | | 11.500 | % | | | 11/15/21 | | | | 815,000 | | | | 1,024,862 | |

Sprint Corp., Senior Notes | | | 7.875 | % | | | 9/15/23 | | | | 2,520,000 | | | | 2,822,400 | (b) |

Total Wireless Telecommunication Services | | | | | | | | | | | | | | | 5,441,230 | |

Total Telecommunication Services | | | | | | | | | | | | | | | 7,839,730 | |

| Utilities — 1.4% | | | | | | | | | | | | | | | | |

Independent Power and Renewable Electricity Producers — 1.4% | | | | | | | | | | | | | |

Mirant Mid Atlantic LLC, Pass-Through Certificates, Secured Bonds | | | 10.060 | % | | | 12/30/28 | | | | 2,922,883 | | | | 2,879,040 | (b) |

Total Corporate Bonds & Notes (Cost — $192,129,715) | | | | | | | | | | | | 200,213,474 | |

| Senior Loans — 16.6% | | | | | | | | | | | | | | | | |

| Consumer Discretionary — 3.2% | | | | | | | | | | | | | | | | |

Hotels, Restaurants & Leisure — 1.9% | | | | | | | | | | | | | | | | |

Affinity Gaming LLC, Second Lien Term Loan

(1 mo. LIBOR + 8.250%) | | | 9.492 | % | | | 9/14/24 | | | | 3,990,000 | | | | 4,046,526 | (i)(j)(k) |

Specialty Retail — 0.2% | | | | | | | | | | | | | | | | |

Spencer Gifts LLC, Second Lien Term Loan

(2 mo. LIBOR + 8.250%) | | | 9.530 | % | | | 6/29/22 | | | | 690,000 | | | | 379,500 | (g)(i)(j)(k) |

Textiles, Apparel & Luxury Goods — 1.1% | | | | | | | | | | | | | | | | |

TOMS Shoes LLC, Term Loan B

(3 mo. LIBOR + 5.500%) | | | 6.820 | % | | | 10/28/20 | | | | 4,436,447 | | | | 2,218,224 | (g)(i)(j)(k) |

Total Consumer Discretionary | | | | | | | | | | | | | | | 6,644,250 | |

| Consumer Staples — 3.8% | | | | | | | | | | | | | | | | |

Food Products — 3.8% | | | | | | | | | | | | | | | | |

CSM Bakery Solutions LLC, Second Lien Term Loan

(3 mo. LIBOR + 7.750%) | | | 9.080 | % | | | 7/3/21 | | | | 4,000,000 | | | | 3,775,000 | (i)(j)(k) |

Shearer’s Foods Inc., Second Lien Term Loan

(3 mo. LIBOR + 6.750%) | | | 8.083 | % | | | 6/30/22 | | | | 4,500,000 | | | | 4,286,250 | (g)(i)(j)(k) |

Total Consumer Staples | | | | | | | | | | | | | | | 8,061,250 | |

| Energy — 1.5% | | | | | | | | | | | | | | | | |

Oil, Gas & Consumable Fuels — 1.5% | | | | | | | | | | | | | | | | |

Westmoreland Coal Co., Term Loan B

(3 mo. LIBOR + 6.500%) | | | 7.833 | % | | | 12/16/20 | | | | 4,902,273 | | | | 3,097,188 | (i)(j)(k) |

| Health Care — 1.0% | | | | | | | | | | | | | | | | |

Health Care Equipment & Supplies — 1.0% | | | | | | | | | | | | | | | | |

Lantheus Medical Imaging Inc., 2017 Term Loan

(1 mo. LIBOR + 4.500%) | | | 5.742 | % | | | 6/30/22 | | | | 2,099,450 | | | | 2,114,541 | (i)(j)(k) |

See Notes to Financial Statements.

| | |

| 8 | | Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report |

Western Asset Middle Market Income Fund Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Industrials — 1.9% | | | | | | | | | | | | | | | | |

Aerospace & Defense — 0.2% | | | | | | | | | | | | | | | | |

WP CPP Holdings LLC, New Second Lien Term Loan

(3 mo. LIBOR + 7.750%) | | | 9.130 | % | | | 4/30/21 | | | $ | 492,500 | | | $ | 482,650 | (g)(i)(j)(k) |

Marine — 1.7% | | | | | | | | | | | | | | | | |

Commercial Barge Line Co., 2015 First Lien Term Loan

(1 mo. LIBOR + 8.750%) | | | 9.992 | % | | | 11/12/20 | | | | 4,636,709 | | | | 3,589,587 | (i)(j)(k) |

Total Industrials | | | | | | | | | | | | | | | 4,072,237 | |

| Information Technology — 4.0% | | | | | | | | | | | | | | | | |

Electronic Equipment, Instruments & Components — 1.9% | | | | | | | | | | | | | |

Allflex Holdings III Inc., New Second Lien Term Loan

(3 mo. LIBOR + 7.000%) | | | 8.363 | % | | | 7/19/21 | | | | 3,924,528 | | | | 3,949,056 | (i)(j)(k) |

Internet Software & Services — 2.1% | | | | | | | | | | | | | | | | |

Ancestry.com Operations Inc., Second Lien Term Loan

(1 mo. LIBOR + 8.250%) | | | 9.490 | % | | | 10/19/24 | | | | 4,446,000 | | | | 4,557,150 | (i)(j)(k) |

Total Information Technology | | | | | | | | | | | | | | | 8,506,206 | |

| Utilities — 1.2% | | | | | | | | | | | | | | | | |

Electric Utilities — 1.2% | | | | | | | | | | | | | | | | |

Panda Temple Power LLC, 2015 Term Loan B

(3 Month ICE LIBOR + 6.250% PIK) | | | 7.250 | % | | | 3/4/22 | | | | 3,681,526 | | | | 2,601,612 | *(d)(i)(j)(l) |

Total Senior Loans (Cost — $40,026,062) | | | | | | | | | | | | 35,097,284 | |

| | | | |

| | | | | | | | | Shares | | | | |

| Common Stocks — 2.9% | | | | | | | | | | | | | | | | |

| Energy — 2.9% | | | | | | | | | | | | | | | | |

Oil, Gas & Consumable Fuels — 2.9% | | | | | | | | | | | | | | | | |

Berry Petroleum Co. | | | | | | | | | | | 396,380 | | | | 2,873,755 | *(g) |

Blue Ridge Mountain Resources Inc. | | | | | | | | | | | 313,603 | | | | 3,136,030 | *(f) |

Total Common Stocks (Cost — $13,237,589) | | | | | | | | | | | | 6,009,785 | |

| Convertible Preferred Stocks — 2.5% | | | | | | | | | | | | | | | | |

| Energy — 2.5% | | | | | | | | | | | | | | | | |

Oil, Gas & Consumable Fuels — 2.5% | | | | | | | | | | | | | | | | |

Berry Petroleum Co., (6.000% Cash or 6.000% PIK) | | | 6.000 | % | | | | | | | 432,359 | | | | 5,026,173 | (d) |

Berry Petroleum Co., (6.000% Cash or 6.000% PIK) | | | 6.000 | % | | | | | | | 6,477 | | | | 75,295 | (d)(h) |

Sanchez Energy Corp. | | | 6.500 | % | | | | | | | 11,500 | | | | 211,945 | |

Total Convertible Preferred Stocks (Cost — $4,469,890) | | | | | | | | | | | | 5,313,413 | |

| | | | |

| | | | | | Expiration

Date | | | Warrants | | | | |

| Warrants — 0.0% | | | | | | | | | | | | | | | | |

BioScrip Inc. (Cost — $114,077) | | | | | | | 6/30/27 | | | | 1 | | | | 67,864 | *(f)(g)(h) |

Total Investments Before Short-Term Investments (Cost — $249,977,333) | | | | | | | | 246,701,820 | |

See Notes to Financial Statements.

| | |

| Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report | | 9 |

Schedule of investments (unaudited) (cont’d)

October 31, 2017

Western Asset Middle Market Income Fund Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | | | | Shares | | | Value | |

| Short-Term Investments — 5.7% | | | | | | | | | | | | | | | | |

State Street Institutional U.S. Government Money Market Fund, Premier Class (Cost — $12,099,184) | | | 0.961 | % | | | | | | | 12,099,184 | | | $ | 12,099,184 | |

Total Investments — 122.3% (Cost — $262,076,517) | | | | | | | | | | | | | | | 258,801,004 | |

Liabilities in Excess of Other Assets — (22.3)% | | | | | | | | | | | | | | | (47,117,414 | ) |

Total Net Assets — 100.0% | | | | | | | | | | | | | | $ | 211,683,590 | |

| * | Non-income producing security. |

| (a) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors. |

| (b) | All or a portion of this security is pledged as collateral pursuant to the loan agreement. |

| (c) | Securities traded on a when-issued or delayed delivery basis. |

| (d) | Payment-in-kind security for which the issuer has the option at each interest payment date of making interest payments in cash or additional debt securities. |

| (e) | Value is less than $1. |

| (f) | Security is valued in good faith in accordance with procedures approved by the Board of Directors (See Note 1). |

| (g) | Security is valued using significant unobservable inputs (See Note 1). |

| (h) | Restricted security (See Note 9). |

| (i) | Senior loans may be considered restricted in that the Fund ordinarily is contractually obligated to receive approval from the agent bank and/or borrower prior to the disposition of a senior loan. |

| (j) | Interest rates disclosed represent the effective rates on senior loans. Ranges in interest rates are attributable to multiple contracts under the same loan. |

| (k) | Variable rate security. Interest rate disclosed is as of the most recent information available. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| (l) | The coupon payment on these securities is currently in default as of October 31, 2017. |

See Notes to Financial Statements.

| | |

| 10 | | Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report |

Statement of assets and liabilities (unaudited)

October 31, 2017

| | | | |

| |

| Assets: | | | | |

Investments, at value (Cost — $262,076,517) | | $ | 258,801,004 | |

Cash | | | 75,103 | |

Interest receivable | | | 4,831,797 | |

Prepaid expenses | | | 1,533 | |

Total Assets | | | 263,709,437 | |

| |

| Liabilities: | | | | |

Loan payable (Note 6) | | | 48,900,000 | |

Payable for securities purchased | | | 2,718,182 | |

Investment management fee payable | | | 266,005 | |

Interest payable | | | 28,474 | |

Directors’ fees payable | | | 1,655 | |

Accrued expenses | | | 111,531 | |

Total Liabilities | | | 52,025,847 | |

| Total Net Assets | | $ | 211,683,590 | |

| |

| Net Assets: | | | | |

Par value ($0.001 par value; 273,242 shares issued and outstanding; 100,000,000 shares authorized) | | $ | 273 | |

Paid-in capital in excess of par value | | | 283,427,867 | |

Undistributed net investment income | | | 390,480 | |

Accumulated net realized loss on investments | | | (68,859,517) | |

Net unrealized depreciation on investments | | | (3,275,513) | |

| Total Net Assets | | $ | 211,683,590 | |

| |

| Shares Outstanding | | | 273,242 | |

| |

| Net Asset Value | | | $774.71 | |

See Notes to Financial Statements.

| | |

| Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report | | 11 |

Statement of operations (unaudited)

For the Six Months Ended October 31, 2017

| | | | |

| |

| Investment Income: | | | | |

Interest | | $ | 13,490,227 | |

Dividends | | | 53,063 | |

Total Investment Income | | | 13,543,290 | |

| |

| Expenses: | | | | |

Investment management fee (Note 2) | | | 1,823,923 | |

Interest expense (Note 6) | | | 651,984 | |

Transfer agent fees | | | 53,126 | |

Audit and tax fees | | | 40,160 | |

Directors’ fees | | | 33,989 | |

Shareholder reports | | | 30,112 | |

Legal fees | | | 22,470 | |

Fund accounting fees | | | 18,161 | |

Insurance | | | 2,107 | |

Custody fees | | | 1,169 | |

Miscellaneous expenses | | | 8,241 | |

Total Expenses | | | 2,685,442 | |

Less: Fee waivers and/or expense reimbursements (Note 2) | | | (145,675) | |

Net Expenses | | | 2,539,767 | |

| Net Investment Income | | | 11,003,523 | |

| |

| Realized and Unrealized Loss on Investments (Notes 1 and 3): | | | | |

Net Realized Loss From Investment Transactions | | | (4,583,442) | |

Change in Net Unrealized Appreciation (Depreciation) From Investments | | | (1,707,629) | |

| Net Loss on Investments | | | (6,291,071) | |

| Increase in Net Assets From Operations | | $ | 4,712,452 | |

See Notes to Financial Statements.

| | |

| 12 | | Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report |

Statements of changes in net assets

| | | | | | | | |

For the Six Months Ended October 31, 2017 (unaudited)

and the Year Ended April 30, 2017 | | 2017 | | | 2017 | |

| | |

| Operations: | | | | | | | | |

Net investment income | | $ | 11,003,523 | | | $ | 26,414,822 | |

Net realized loss | | | (4,583,442) | | | | (7,194,487) | |

Change in net unrealized appreciation (depreciation) | | | (1,707,629) | | | | 35,632,994 | |

Increase in Net Assets From Operations | | | 4,712,452 | | | | 54,853,329 | |

| | |

| Distributions to Shareholders From (Note 1): | | | | | | | | |

Net investment income | | | (11,852,342) | | | | (27,213,345) | |

Decrease in Net Assets From Distributions to Shareholders | | | (11,852,342) | | | | (27,213,345) | |

| | |

| Fund Share Transactions: | | | | | | | | |

Reinvestment of distributions (1,581 and 3,365 shares issued, respectively) | | | 1,224,350 | | | | 2,569,839 | |

Cost of shares repurchased through tender offer (14,129 and 30,233 shares repurchased, respectively) (Note 5) | | | (10,950,347) | | | | (23,255,589) | |

Decrease in Net Assets From Fund Share Transactions | | | (9,725,997) | | | | (20,685,750) | |

Increase (Decrease) in Net Assets | | | (16,865,887) | | | | 6,954,234 | |

| | |

| Net Assets: | | | | | | | | |

Beginning of period | | | 228,549,477 | | | | 221,595,243 | |

End of period* | | $ | 211,683,590 | | | $ | 228,549,477 | |

*Includes undistributed net investment income of: | | | $390,480 | | | | $1,239,299 | |

See Notes to Financial Statements.

| | |

| Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report | | 13 |

Statement of cash flows (unaudited)

For the Six Months Ended October 31, 2017

| | | | |

| |

| Increase (Decrease) in Cash: | | | | |

| Cash Provided (Used) by Operating Activities: | | | | |

Net increase in net assets resulting from operations | | $ | 4,712,452 | |

Adjustments to reconcile net increase in net assets resulting from operations

to net cash provided (used) by operating activities: | | | | |

Purchases of portfolio securities | | | (17,410,187) | |

Sales of portfolio securities | | | 88,053,789 | |

Net purchases, sales and maturities of short-term investments | | | (9,747,586) | |

Payment-in-kind | | | (341,384) | |

Net amortization of premium (accretion of discount) | | | (1,896,737) | |

Decrease in receivable for securities sold | | | 806,850 | |

Decrease in interest receivable | | | 1,753,980 | |

Increase in prepaid expenses | | | (114) | |

Decrease in payable for securities purchased | | | (5,377,346) | |

Decrease in investment management fee payable | | | (40,174) | |

Decrease in Directors’ fees payable | | | (2,486) | |

Decrease in interest payable | | | (15,515) | |

Decrease in accrued expenses | | | (40,263) | |

Net realized loss on investments | | | 4,583,442 | |

Change in net unrealized appreciation (depreciation) of investments | | | 1,707,629 | |

Net Cash Provided by Operating Activities | | | 66,746,350 | |

| |

| Cash Flows From Financing Activities:* | | | | |

Distributions paid on common stock | | | (10,627,992) | |

Proceeds from loan facility borrowings | | | 10,400,000 | |

Repayment of loan facility borrowings | | | (55,500,000) | |

Payment for shares repurchased through tender offers | | | (10,950,347) | |

Net Cash Used in Financing Activities | | | (66,678,339) | |

| Net Increase in Cash | | | 68,011 | |

Cash at Beginning of Period | | | 7,092 | |

Cash at End of Period | | $ | 75,103 | |

| |

| Non-Cash Financing Activities: | | | | |

Proceeds from reinvestment of distributions | | $ | 1,224,350 | |

| * | Included in operating expenses is cash of $667,499 paid for interest on borrowings. |

See Notes to Financial Statements.

| | |

| 14 | | Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report |

Financial highlights

| | | | | | | | | | | | | | | | |

| For a share of capital stock outstanding throughout each year ended April 30, unless otherwise noted: | |

| | | 20171,2 | | | 20171 | | | 20161 | | | 20151,3 | |

| | | | |

| Net asset value, beginning of period | | | $799.71 | | | | $708.75 | | | | $915.01 | | | | $998.00 | 4 |

| | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 39.17 | | | | 87.83 | | | | 86.64 | | | | 50.82 | |

Net realized and unrealized gain (loss) | | | (22.27) | | | | 93.13 | | | | (202.90) | | | | (92.81) | |

Total income (loss) from operations | | | 16.90 | | | | 180.96 | | | | (116.26) | | | | (41.99) | |

| | | | |

| Less distributions from: | | | | | | | | | | | | | | | | |

Net investment income | | | (41.90) | 5 | | | (90.00) | | | | (90.00) | | | | (41.00) | |

Total distributions | | | (41.90) | | | | (90.00) | | | | (90.00) | | | | (41.00) | |

| | | | |

| Net asset value, end of period | | | $774.71 | | | | $799.71 | | | | $708.75 | | | | $915.01 | |

Total return, based on NAV6 | | | 2.19 | % | | | 26.72 | % | | | (12.74) | % | | | (4.11) | % |

| | | | |

| Net assets, end of period (000s) | | | $211,684 | | | | $228,549 | | | | $221,595 | | | | $290,749 | |

| | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | |

Gross expenses | | | 2.40 | %7 | | | 2.45 | % | | | 1.83 | % | | | 1.55 | %7 |

Net expenses | | | 2.27 | 7,8 | | | 2.40 | 8 | | | 1.83 | | | | 1.55 | 7 |

Net investment income | | | 9.85 | 7 | | | 11.37 | | | | 11.20 | | | | 7.99 | 7 |

| | | | |

| Portfolio turnover rate | | | 6 | % | | | 51 | % | | | 39 | % | | | 29 | % |

| | | | |

| Supplemental data: | | | | | | | | | | | | | | | | |

Loan Outstanding, End of Period (000s) | | | $48,900 | | | | $94,000 | | | | $53,000 | | | | $53,000 | |

Asset Coverage Ratio for Loan Outstanding9 | | | 533 | % | | | 343 | % | | | 518 | % | | | 649 | % |

Asset Coverage, per $1,000 Principal Amount of Loan Outstanding9 | | | $5,329 | | | | $3,431 | | | | $5,181 | | | | $6,486 | |

Weighted Average Loan (000s) | | | $67,563 | | | | $88,175 | | | | $53,000 | | | | $40,118 | 10 |

Weighted Average Interest Rate on Loan | | | 1.90 | % | | | 1.37 | % | | | 1.00 | % | | | 0.89 | %10 |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the six months ended October 31, 2017 (unaudited). |

| 3 | For the period August 26, 2014 (commencement of operations) to April 30, 2015. |

| 4 | Initial public offering price of $1,000.00 per share, exclusive of sales load, less offering costs of $2.00 per share. |

| 5 | The actual source of the Fund’s current fiscal year distributions may be from net investment income, return of capital or a combination of both. Shareholders will be informed of the tax characteristics of the distributions after the close of the fiscal year. |

| 6 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 8 | Reflects fee waivers and/or expense reimbursements. |

| 9 | Represents value of net assets plus the loan outstanding at the end of the period divided by the loan outstanding at the end of the period. |

| 10 | Weighted average based on the number of days that the Fund had a loan outstanding. |

See Notes to Financial Statements.

| | |

| Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report | | 15 |

Notes to financial statements (unaudited)

1. Organization and significant accounting policies

Western Asset Middle Market Income Fund Inc. (the “Fund”) was incorporated in Maryland on June 29, 2011 and is registered as a non-diversified, limited-term, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund commenced operations on August 26, 2014. The Fund’s primary investment objective is to provide high income. As a secondary objective, the Fund seeks capital appreciation. The Fund seeks to achieve its investment objectives by investing, under normal market conditions, at least 80% of its managed assets (the net assets of the Fund plus the principal amount of any borrowings and any preferred stock that may be outstanding) in securities, including loans, issued by middle market companies. For investment purposes, “middle market” refers to companies with annual revenues of between $100 million and $1 billion at the time of investment by the Fund. Securities of middle market issuers are typically considered below investment grade (also commonly referred to as “junk bonds”). It is anticipated that the Fund will terminate on December 30, 2022. Upon its termination, it is anticipated that the Fund will have distributed substantially all of its net assets to stockholders, although securities for which no market exists or securities trading at depressed prices, if any, may be placed in a liquidating trust.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. The valuations for fixed income securities (which may include, but are not limited to, corporate, government, municipal, mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. Short-term fixed income securities that will mature in 60 days or less are valued at amortized cost, unless it is determined that using this method would not reflect an investment’s fair value. Investments in open-end funds are valued at the closing net asset value per share of each fund on the day of valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. When the Fund holds securities or other assets that are denominated in a foreign currency, the Fund will normally use the currency exchange rates as of 4:00 p.m. (Eastern Time). If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market

| | |

| 16 | | Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report |

price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Directors.

The Board of Directors is responsible for the valuation process and has delegated the supervision of the daily valuation process to the Legg Mason North Atlantic Fund Valuation Committee (the “Valuation Committee”). The Valuation Committee, pursuant to the policies adopted by the Board of Directors, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Board of Directors. When determining the reliability of third party pricing information for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making fair value determinations. Examples of possible methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or a multiple thereof; risk premium/yield analysis; yield to maturity; and/or fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of possible factors include, but are not limited to, the type of security; the issuer’s financial statements; the purchase price of the security; the discount from market value of unrestricted securities of the same class at the time of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender offers affecting the security; the price and extent of public trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board of Directors, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are reported to the Board of Directors quarterly.

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

| | |

| Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report | | 17 |

Notes to financial statements (unaudited) (cont’d)

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

| • | | Level 1 — quoted prices in active markets for identical investments |

| • | | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

| | | | | | | | | | | | | | | | |

| ASSETS | |

| Description | | Quoted Prices

(Level 1) | | | Other Significant

Observable Inputs

(Level 2) | | | Significant

Unobservable

Inputs

(Level 3) | | | Total | |

| Long-term investments†: | | | | | | | | | | | | | | | | |

Corporate bonds & notes: | | | | | | | | | | | | | | | | |

Energy | | | — | | | $ | 28,687,953 | | | $ | 0 | * | | $ | 28,687,953 | |

Health care | | | — | | | | 29,830,778 | | | | 3,450,300 | | | | 33,281,078 | |

Other corporate bonds & notes | | | — | | | | 138,244,443 | | | | — | | | | 138,244,443 | |

Senior loans: | | | | | | | | | | | | | | | | |

Consumer discretionary | | | — | | | | 4,046,526 | | | | 2,597,724 | | | | 6,644,250 | |

Consumer staples | | | — | | | | 3,775,000 | | | | 4,286,250 | | | | 8,061,250 | |

Industrials | | | — | | | | 3,589,587 | | | | 482,650 | | | | 4,072,237 | |

Other senior loans | | | — | | | | 16,319,547 | | | | — | | | | 16,319,547 | |

Common stocks: | | | | | | | | | | | | | | | | |

Energy | | | — | | | | 3,136,030 | | | | 2,873,755 | | | | 6,009,785 | |

Convertible preferred stocks | | | — | | | | 5,313,413 | | | | — | | | | 5,313,413 | |

Warrants | | | — | | | | — | | | | 67,864 | | | | 67,864 | |

| Total long-term investments | | | — | | | | 232,943,277 | | | | 13,758,543 | | | | 246,701,820 | |

| Short-term investments† | | $ | 12,099,184 | | | | — | | | | — | | | | 12,099,184 | |

| Total investments | | $ | 12,099,184 | | | $ | 232,943,277 | | | $ | 13,758,543 | | | $ | 258,801,004 | |

| † | See Schedule of Investments for additional detailed categorizations. |

| * | Amount represents less than $1. |

| | |

| 18 | | Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | | | | | | | | | | |

| | | Corporate Bonds & Notes | |

| Investments in Securities | | Energy | | | Health Care | | | Industrials | |

| Balance as of April 30, 2017 | | $ | 262,500 | | | | — | | | $ | 2,022,834 | |

| Accrued premiums/discounts | | | (5,487) | | | $ | 5,988 | | | | 6,805 | |

| Realized gain (loss)1 | | | (1,158,830) | | | | — | | | | — | |

| Change in unrealized appreciation (depreciation)2 | | | 1,252,442 | | | | 58,389 | | | | (2,838) | |

| Purchases | | | — | | | | 3,385,923 | | | | — | |

| Sales | | | (350,625) | | | | — | | | | (2,026,801) | |

| Transfers into Level 33 | | | — | | | | — | | | | — | |

| Transfers out of Level 3 | | | — | | | | — | | | | — | |

| Balance as of October 31, 2017 | | $ | 0 | | | $ | 3,450,300 | | | | — | |

| Net change in unrealized appreciation (depreciation) for investments in securities still held at October 31, 20172 | | | — | | | $ | 58,389 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Senior Loans | |

Investments in

Securities (cont’d) | | Consumer

Discretionary | | | Consumer

Staples | | | Energy | | | Health Care | | | Industrials | | | Utilities | |

| Balance as of April 30, 2017 | | $ | 6,995,400 | | | $ | 7,848,125 | | | $ | 5,140,792 | | | $ | 3,295,250 | | | $ | 4,793,523 | | | $ | 2,650,698 | |

| Accrued premiums/discounts | | | 5,449 | | | | 17,844 | | | | 75,054 | | | | 1,786 | | | | 21,777 | | | | 6,439 | |

| Realized gain (loss)1 | | | 13,354 | | | | — | | | | 10,806 | | | | 24,543 | | | | 4,442 | | | | — | |

| Change in unrealized appreciation (depreciation)2 | | | (188,176) | | | | 195,281 | | | | (1,509,076) | | | | (54,912) | | | | (622,189) | | | | (55,525) | |

| Purchases | | | — | | | | — | | | | 24,521 | | | | — | | | | — | | | | — | |

| Sales | | | (2,400,000) | | | | — | | | | (644,909) | | | | (3,266,667) | | | | (125,316) | | | | — | |

| Transfers into Level 33 | | | 2,218,223 | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Transfers out of Level 34 | | | (4,046,526) | | | | (3,775,000) | | | | (3,097,188) | | | | — | | | | (3,589,587) | | | | (2,601,612) | |

| Balance as of October 31, 2017 | | $ | 2,597,724 | | | $ | 4,286,250 | | | | — | | | | — | | | $ | 482,650 | | | | — | |

| Net change in unrealized appreciation (depreciation) for investments in securities still held at October 31, 20172 | | $ | (200,156) | | | $ | (156,342) | | | | — | | | | — | | | $ | 34,384 | | | | — | |

| | |

| Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report | | 19 |

Notes to financial statements (unaudited) (cont’d)

| | | | | | | | | | | | | | | | |

| | | Common

Stock | | | Convertible

Preferred

Stock | | | | | | | |

| Investments In Securities (cont’d) | | Energy | | | | Warrants | | | Total | |

| Balance as of April 30, 2017 | | $ | 7,657,388 | | | $ | 5,046,614 | | | | — | | | $ | 45,713,124 | |

| Accrued premiums/discounts | | | — | | | | — | | | | — | | | | 135,655 | |

| Realized gain (loss)1 | | | — | | | | — | | | | — | | | | (1,105,685) | |

| Change in unrealized appreciation (depreciation)2 | | | (1,647,603) | | | | 54,855 | | | $ | (46,213) | | | | (2,565,565) | |

| Purchases | | | — | | | | — | | | | 114,077 | | | | 3,524,521 | |

| Sales | | | — | | | | — | | | | — | | | | (8,814,318) | |

| Transfers into Level 33 | | | — | | | | — | | | | — | | | | 2,218,223 | |

| Transfers out of Level 34 | | | (3,136,030) | | | | (5,101,469) | | | | — | | | | (25,347,412) | |

| Balance as of October 31, 2017 | | $ | 2,873,755 | | | | — | | | $ | 67,864 | | | $ | 13,758,543 | |

| Net change in unrealized appreciation (depreciation) for investments in securities still held at October 31, 20172 | | $ | (1,882,805) | | | | — | | | $ | (46,213) | | | $ | (2,192,743) | |

The Fund’s policy is to recognize transfers between levels as of the end of the reporting period.

| * | Amount represents less than $1. |

| 1 | This amount is included in net realized gain (loss) from investment transactions in the accompanying Statement of Operations. |

| 2 | Change in unrealized appreciation (depreciation) includes net unrealized appreciation (depreciation) resulting from changes in investment values during the reporting period and the reversal of previously recorded unrealized appreciation (depreciation) when gains or losses are realized. |

| 3 | Transferred into Level 3 as a result of the unavailability of a quoted price in an active market for an identical investment or the unavailability of other significant observable inputs. |

| 4 | Transferred out of Level 3 as a result of the availability of a quoted price in an active market for an identical investment or the availability of other significant observable inputs. |

The following table summarizes the valuation techniques used and unobservable inputs approved by the Valuation Committee to determine the fair value of certain, material Level 3 investments. The table does not include Level 3 investments with values derived utilizing prices from prior transactions or third party pricing information without adjustment (e.g., broker quotes, pricing services, net asset values).

| | | | | | | | | | | | | | | | | | | | |

| | | Fair Value

at 10/31/17

(000’s) | | | Valuation

Technique(s) | | | Unobservable Input(s) | | | Range/Weighted

Average | | | Impact to Valuation

from an Increase in

Input* | |

| Corporate Bonds & Notes | | $ | 3,450 | | |

| Market

Approach |

| | | Yield to Maturity | | |

| 5.903%-

11.528% |

| | | Decrease | |

| | | | | | | | | | | | Transaction Spread | | | | 3.844% | | | | Decrease | |

| Warrants | | | 68 | | |

| Black-Scholes

Options Model |

| |

| Trading Restriction

Discount |

| | | 20% | | | | Decrease | |

| * | This column represents the directional change in the fair value of the Level 3 investments that would result in an increase from the corresponding unobservable input. A decrease to the unobservable input would have the opposite effect. Significant increases and decreases in these unobservable inputs in isolation could result in significantly higher or lower fair value measurements. |

(b) Foreign currency translation. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment secu-

| | |

| 20 | | Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report |

rities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of U.S. dollar denominated transactions as a result of, among other factors, the possibility of lower levels of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

(c) Loan participations. The Fund may invest in loans arranged through private negotiation between one or more financial institutions. The Fund’s investment in any such loan may be in the form of a participation in or an assignment of the loan. In connection with purchasing participations, the Fund generally will have no right to enforce compliance by the borrower with the terms of the loan agreement related to the loan, or any rights of off-set against the borrower and the Fund may not benefit directly from any collateral supporting the loan in which it has purchased the participation.

The Fund assumes the credit risk of the borrower, the lender that is selling the participation and any other persons interpositioned between the Fund and the borrower. In the event of the insolvency of the lender selling the participation, the Fund may be treated as a general creditor of the lender and may not benefit from any off-set between the lender and the borrower.

(d) Securities traded on a when-issued and delayed delivery basis. The Fund may trade securities on a when-issued or delayed delivery basis. In a when-issued and delayed delivery transaction, the securities are purchased or sold by the Fund with payment and delivery taking place in the future in order to secure what is considered to be an advantageous price and yield to the Fund at the time of entering into the transaction.

Purchasing such securities involves risk of loss if the value of the securities declines prior to settlement. These securities are subject to market fluctuations and their current value is determined in the same manner as for other securities.

| | |

| Western Asset Middle Market Income Fund Inc. 2017 Semi-Annual Report | | 21 |

Notes to financial statements (unaudited) (cont’d)

(e) Cash flow information. The Fund invests in securities and distributes dividends from net investment income and net realized gains, which are paid in cash and may be reinvested at the discretion of shareholders. These activities are reported in the Statement of Changes in Net Assets and additional information on cash receipts and cash payments are presented in the Statement of Cash Flows.

(f) Foreign investment risks. The Fund’s investments in foreign securities may involve risks not present in domestic investments. Since securities may be denominated in foreign currencies, may require settlement in foreign currencies or pay interest or dividends in foreign currencies, changes in the relationship of these foreign currencies to the U.S. dollar can significantly affect the value of the investments and earnings of the Fund. Foreign investments may also subject the Fund to foreign government exchange restrictions, expropriation, taxation or other political, social or economic developments, all of which affect the market and/or credit risk of the investments.

(g) Credit and market risk. The Fund invests in high-yield and emerging market instruments that are subject to certain credit and market risks. The yields of high-yield and emerging market debt obligations reflect, among other things, perceived credit and market risks. The Fund’s investments in securities rated below investment grade typically involve risks not associated with higher rated securities including, among others, greater risk related to timely and ultimate payment of interest and principal, greater market price volatility and less liquid secondary market trading. The consequences of political, social, economic or diplomatic changes may have disruptive effects on the market prices of investments held by the Fund. The Fund’s investments in non-U.S. dollar denominated securities may also result in foreign currency losses caused by devaluations and exchange rate fluctuations.

(h) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income (including interest income from payment-in-kind securities), adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. Foreign dividend income is recorded on the ex-dividend date or as soon as practicable after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.