Exhibit 99.2

Quarterly Commentary

Fourth Quarter and Full-Year Ended

December 31, 2017

February 26, 2018

Fourth Quarter and Full-Year 2017 Performance Summary

Our performance in the fourth quarter of 2017 was in line with our expectations. In the fourth quarter, we advanced our operating priorities, including the orbit-raising of our fifth next-generation Intelsat EpicNG satellite, Intelsat 37e, building significant new business on our Intelsat EpicNG fleet, activating our IntelsatOne®Flex managed services platform and optimizing use of our orbital rights. We completed the amendment and refinancing of the Secured Term Loan Facility of our subsidiary Intelsat Jackson Holdings S.A., with extended maturities through 2023 and 2024, strengthening our financial foundation.

Fourth quarter 2017 revenue was $538 million, a 2 percent decline as compared to revenue of $551 million in the fourth quarter of 2016. Fourth quarter revenue included approximately $10 million in project completions and other unusual business, including certain technical services and fees related to third-party satellites, a hardware sale to government customers and delayed mobility billings. Net loss attributable to Intelsat S.A. was $90.0 million for the fourth quarter of 2017, as compared to net income attributable to Intelsat S.A. of $663 million in the fourth quarter of 2016, which included a sizeable gain on the extinguishment of debt. Adjusted EBITDA1, or earnings before interest, taxes, depreciation and amortization, of $416 million, or 77 percent of revenue, was essentially unchanged from $417 million, or 76 percent of revenue, in the fourth quarter of 2016.

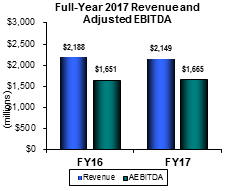

Full-year 2017 revenue was $2,149 million, a 2 percent decline as compared to revenue of $2,188 million in 2016. Net loss attributable to Intelsat S.A. was $178.7 million for the full-year of 2017, reflecting higher interest expense as compared to the prior year period. Adjusted EBITDA of $1,665 million, or 77 percent of revenue, increased by 2 percent from $1,651 million, or 75 percent of revenue, for the full-year of 2016. The favorable Adjusted EBITDA and Adjusted EBITDA margin reflect unusually low bad debt expense and disciplined expense control related to staffing and other operating expenses, somewhat offsetting the lower full-year revenue.

Intelsat S.A.

Quarterly Commentary, 4Q 2017

Factors reflected in the year-over-year results include: lower pricing associated with high volume commitments on high-throughput capacity in certain regions and applications; reduced volume fromnon-renewing data services, inclusive ofpoint-to-point telecommunications infrastructure services moving to fiber alternatives; and the previously reported end of a U.S. government contract. These trends were partially offset as new satellites entered service and we gained new business over the course of the year.

Contracted backlog at December 31, 2017 was $7.8 billion, representing expected future revenue under existing contracts with customers, as compared to $7.9 billion at September 30, 2017. At approximately 3.6 times trailing 12 months revenue (from January 1, 2017 to December 31, 2017), our backlog remains sizable; we believe it provides a solid foundation for predictable cash flow and investment in our business. Nearlytwo-thirds of our backlog is related to our longer term media contracts. Approximately $1.0 billion of our December 31, 2017 backlog is related to our contracts for our Intelsat EpicNG high-throughput fleet.

2018 Operational Priorities:Drive revenue stability and invest for growth, leveraging all assets and advancing our managed services and technology innovations to expand our market opportunities.

Our plan includes four operational priorities in 2018 which are designed to provide a stable foundation, developing new revenue sources that can provide growth in the near- tomid-term.

| | 1. | Leverage all assets within the Intelsat global network for maximum return. Further our momentum on our new assets and capturepre-launch commitments. Build on our market-leading neighborhoods, expansive ground network, growing managed services platform and strong commercial and government customer relationships to capture growth. Provide sector leadership by protecting and optimizing our spectrum rights, ensuring continued reliability of our services while securing appropriate compensation for joint use and opportunity loss. |

| | • | | Contract momentum on the Intelsat EpicNG high-throughput satellites (“HTS”) shifted to the Asia-Pacific region in advance of the anticipated launch of our joint venture satellite, Horizons 3e, in the fourth quarter of 2018. Intelsat signed a significant, long-term agreement with a leading Asian wireless operator for a fully-managed solution for use in expanding its wireless infrastructure and enhancing disaster recovery capabilities, as detailed further below, in4Q17 Business Highlights: Network Services. |

| | • | | In the fourth quarter of 2017, Intelsat signed approximately 25 additional Intelsat EpicNG agreements with commercial and government customers, spanning applications including mobility, enterprise and fixed and wireless infrastructure. Of the total megahertz contracted this quarter, the majority was incremental business, with the mobile network operator sector providing most growth. Contract terms on the entire Intelsat EpicNG fleet continue to be favorable, with the average contract length on growth services over 5 years, longer than that of the average fleet-wide network services contract. The Intelsat EpicNG backlog is comprised of approximately 190 customers atyear-end 2017, with approximately $1.25 billion in total contract value signedinception-to-year-end 2017. |

2

Intelsat S.A.

Quarterly Commentary, 4Q 2017

| | • | | Intelsat and Intel Corporation continue to progress theirC-band Joint Use Proposal presented to the United States Federal Communications Commission (“FCC”), including the announcement on February 9, 2018 that SES Global had joined the proposal. Under the proposal, portions of theC-band spectrum in the3.7-4.2 GHz range currently assigned to fixed satellite services operators in the United States would be made available for joint use with the wireless sector through a market-based solution managed by a satellitesector-led consortium. Intelsat continues to meet with relevant parties, including mobile operators and regulators, to advocate for our commercial framework that would result in an efficient and timely process should the FCC implement the proposal. |

| | 2. | Scale our IntelsatOne®Flex and other managed services across targeted commercial and government opportunities, including new services for growing applications and building strategic partnerships to amplify our marketing efforts. |

| | • | | Intelsat announced that maritime broadband services provider, KVH Industries, Inc. (“KVH”), tripled its commitment to the IntelsatOne®Flex platform. KVH’s mini-VSAT Broadband service is being marketed globally as a higher performance broadband maritime service for fleet services, supporting applications as diverse as voice and data, IP-MobileCast content delivery and video training. |

| | 3. | Lead the industry in seamless implementation of satellite-based telecommunications solutions with the global telecommunications infrastructure. Invest in and develop innovative terminals and ground hardware, and participate in standards development, to realize Intelsat’s vision of simplified access and expanded use of satellite solutions. |

| | • | | In November 2017, Dejero Labs, Inc. (“Dejero”) announced a minority equity investment from Intelsat S.A. Dejero’s technology blends satellite services with wireless and other transmission media for a seamless, robust infrastructure. In August 2017, Intelsat and Dejero introduced the CellSat service, a blended cellular andKu-band IP solution that provides newscasters the bandwidth to report live from virtually anywhere, regardless of ground network congestion. |

| | 4. | Pursue continued financial discipline to maximize flexibility during a period of continued business transition. |

| | • | | In early January 2018, Intelsat announced it had committed for a second mission extension vehicle (“MEV”) with Orbital ATK, for a mission expected to launch in 2019, extending satellite life and providing revenue continuity, resulting in deferred capital expenditures. |

3

Intelsat S.A.

Quarterly Commentary, 4Q 2017

4Q 2017 Business Highlights and Customer Set Performance

All 2017 comparisons are to 2016 unless noted otherwise

Network Services

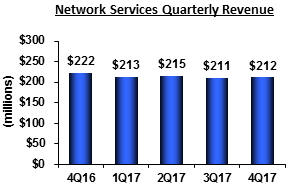

Network services revenue was $212 million in the fourth quarter of 2017, a $10 million, or 4 percent, decrease from the prior year quarter. The largest factors contributing to the year-over-year decline werenon-renewals and contraction of services by certain cellular backhaul customers on wide-band services primarily in the Latin America and Asia-Pacific regions,non-renewals ofpoint-to-point international trunking services, and pricing adjustments related to renewing wide-beam business. These declines were partially offset by growth in revenue from broadband services for the commercial aeronautical and maritime sectors.

As compared to the third quarter of 2017, network services revenue increased slightly, with growth in broadband mobility applications due to $3.1 million in delayed billings and other new business starts more than offsetting slight declines in international trunking services.

Fourth Quarter Network Services Highlights and Business Trends:

Intelsat continues to build backlog commitments for our next generation Intelsat EpicNG fleet, while also booking new business and renewals on our wide-beam assets. In the fourth quarter of 2017, we successfully expanded the Intelsat EpicNG position in wireless network infrastructure with important contracts for services in the Asia-Pacific region and Africa. Contracts in the wireless sector included:

| | • | | One of Asia’s leading mobile network operators signed a significant contract, with a term in excess of ten years for an Intelsat fully-managed solution to upgrade and expand infrastructure across the mobile operator’s service territory. The contract also features services leveraging satellite’s ability to provide near-instant infrastructure whenre-establishing connectivity following natural disasters. Services will initially be provided with a combination ofon-network andoff-network services, ultimately migrating to Horizons 3e, our joint venture project and sixth Intelsat EpicNG satellite, which is planned for launch in the fourth quarter of 2018. |

| | • | | Orange SA signed a new contract for services on four Intelsat satellites serving the Africa region, including Intelsat 33e, to reinforce and expand its 2G and 3G wireless infrastructure in the Democratic Republic of Congo, as well as to support enterprise and mobility applications. The high performance and greater efficiencies generated by the Intelsat EpicNG satellites will ensure high service availability and help accelerate Orange’s expansion of its network into the more remote regions of the country. |

| | • | | Gilat Satellite Networks, a worldwide leader in satellite networking technology, solutions and services, selected Intelsat to provide broadband infrastructure services for network solutions for premier U.S. mobile network operators. Gilat integrates Intelsat’sKu-band capacity into a solution supporting and accelerating the expansion of 4G networks into rural areas across North America. |

4

Intelsat S.A.

Quarterly Commentary, 4Q 2017

Enterprise networks—large private data networks that use satellite solutions because of geographic reach, efficient broadcast transmissions and reliability—represent one of the largest applications within our network services business. Enterprise contracts signed in the fourth quarter of 2017 include:

| | • | | Saudi Telecom, which signed a multi-year renewal of existing services as well as a multi-transponder commitment for incremental services on two Intelsat satellites. Saudi Telecom will use the services to provide enterprise network solutions and consumer broadband services. |

Mobility services, which provide broadband connectivity to planes and ocean vessels, are fast growing applications which use our wide-beam satellites, Intelsat EpicNG satellites, and our IntelsatOne® Flex managed services. Mobility contracts signed in the fourth quarter include:

| | • | | KVH signed a new, multi-year contract, more than tripling its original commitment to the IntelsatOne® Flex Maritime platform. KVH is utilizing IntelsatOne® Flex across all 14 geographic regions covered by the maritime platform, which leverages the global Intelsat EpicNG infrastructure. Intelsat is also providing services via its IntelsatOne® teleport and terrestrial network, which will allow KVH to customize the delivery of its service across regions and fleet types. |

| | • | | Intelsat signed a multi-year renewal for satellite services to support aeronautical broadband services over Africa. The global network infrastructure for this aeronautical services provider incorporates services from 21 Intelsat satellites as well as the IntelsatOne® terrestrial platform. |

On a global basis, growth opportunities for our network services business include increased demand for aeronautical and maritime mobility applications, and high-throughput capacity for fixed and mobile broadband applications for telecommunications providers and enterprise networks.

Although high-performance capacity, such as that provided by Intelsat EpicNG, is an important element of capturing this growth, our customers also need managed services, such as our IntelsatOne® Flex services, that simplify network buildouts in the HTS environment. Customers also seek smaller, more capable, site hardware that is easier to install and operate.

5

Intelsat S.A.

Quarterly Commentary, 4Q 2017

Media

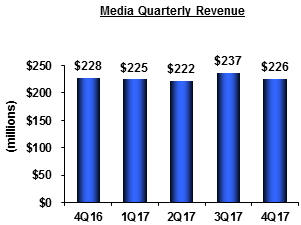

Media revenue was $226 million in the fourth quarter of 2017, a $2 million, or 1 percent decline, when compared to the prior year quarter. The essentially flat performance was related to service mix.

As compared to the third quarter of 2017, media revenues decreased by $10 million, or 4 percent, primarily due to approximately $13 million of revenue recognized in the third quarter of 2017 related to advance customer payments forfeited and fees paid following the partial termination of a project, as previously disclosed.

Fourth Quarter Media Highlights and Business Trends:

Business activity was driven primarily by renewing contracts related to Intelsat’s media distribution neighborhoods in North America and Eastern Europe.

| | • | | Romania Cable Systems and Romania Data Systems S.A. (“RCS & RDS”), a leadingdirect-to-home (“DTH”) video content provider in Eastern Europe, signed a multi-year, multi-transponder renewal with Intelsat for services at 1ºW. RCS & RDS originally launched its service at the 1ºW neighborhood in 2004. It subsequently expanded its lineup via services on Intelsat 1002 and the Thor 5 and Intelsat 1W satellites, which share the 1ºW orbital slot. This neighborhood serves approximately 18 million DTH and cable homes throughout Central and Eastern Europe and the Nordic Region. |

| | • | | North America’s A&E and Lifetime Networks renewed contracts on Intelsat’s Galaxy fleet for distribution services into the next decade. Using Intelsat’s leading North American Galaxy cable distribution neighborhood, the A&E and Lifetime Networks began distributing content in MPEG4 several years ago. |

Our next media satellite will be Intelsat 38, currently planned for launch in the second quarter of 2018, which is primarily designed to replace capacity for an existing Intelsat satellite as well as provide growth capacity for DTH applications operating at that orbital location. In 2018, our priorities for our media business include building growth on our new media neighborhood in Latin America on Intelsat 14 and broadening our partnership with Dejero beyond CellSat to other applications.

6

Intelsat S.A.

Quarterly Commentary, 4Q 2017

Government

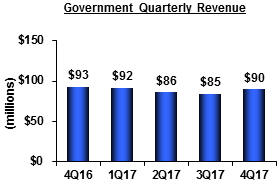

Sales to government customers generated revenue of $90 million in the fourth quarter of 2017, a $3 million, or 3 percent, decrease as compared to the prior year quarter. The majority of the decline in this period primarily reflects the previously announced end of the Commercial Broadband Satellite Program (“CBSP”) contract, terminated on March 31, 2017, offset somewhat by increases in other transponder services revenue and increased revenues from mobile satellite services.

As compared to the third quarter of 2017, revenue increased by $6 million, or 7 percent, primarily due to a $3 million customer premises equipment sale.

On-Network revenue represented 60 percent of government services in the fourth quarter of 2017, as compared to 61 percent in the fourth quarter of 2016.

Fourth Quarter Government Highlights and Business Trends:

Revenues from our government business in 2017 were relatively stable, excluding the effects of the contract termination discussed above. The pace of RFP issuances and subsequent awards for new programs remains slow although modestly improved from 2017 levels.

We note continued reliance on LPTA (lowest price, technically acceptable) as the predominant evaluation criteria for awards of new transponder services contracts.

| | • | | Fourth quarter 2017 activity included contract extensions and renewals comprised of approximately 40 services representing nearly 850 MHz ofon- andoff-network capacity. |

| | • | | In early 2018, we signed a five-year strategic agreement with a government contractor to provide all of its satellite requirements for major programs, bothon-network andoff-network. |

Approximately 15 percent of our 2017 annual revenues will be subject to renewal and replacement in 2018, which could result in pricing pressure depending upon the solution required and region served, especially given the increasing reliance by the U.S. government on LPTA. Over themid-term, our strategy to grow our government business includes providing mobility services to the U.S. government for aeronautical and ground mobile requirements, leveraging our next generation Intelsat EpicNG HTS services that are now activated in regions of interest to the U.S. government.

7

Intelsat S.A.

Quarterly Commentary, 4Q 2017

Fleet and Operations Update

Intelsat’s average fill rate on our approximately 1,950 station-kept wide-beam transponders was 79 percent at December 31, 2017, reflecting the classification of two satellites into inclined orbit operations.

As of December 31, 2017, the HTS Intelsat EpicNG unit count was approximately 825 units in service, with no new satellites entering service in the fourth quarter. Intelsat 37e is nearing the end of its drift andin-orbit testing, and is planned to enter service in the first quarter of 2018.

Intelsat currently has seven satellites covered by our 2018 to 2020 capital expenditure plan, three of which are in the design and manufacturing phase or recently launched. The remaining four satellites are replacement satellites, for which manufacturing contracts have not yet been signed. In addition, we are working on one custom payload being built on a third-party satellite and a separate joint venture satellite which do not require capital expenditures, each noted below as a “Non-Capex Satellite.”

Our fleet plan includes the use of MEVs to extend the operational life of two of our wide-beam satellites, which reduces overall capital expenditures in the near- tomid-term, but will increase operating expenses as each MEV enters service.

Our owned satellites, third-party payloads and a joint venture project currently in the design and manufacturing stages are noted below. Intelsat EpicNG-class satellites are noted with a small “e” following the satellite number.

| | | | | | | | | | | | |

| | | | | | | | | Estimated | | Estimated | | |

| | | | | Orbital | | | | Launch | | In-Service | | |

Satellite | | Follows | | Location | | Launch Provider | | Date | | Date | | Application |

Intelsat 37e | | IS-901 | | 342°E | | Arianespace Ariane 5 | | Launched

Sept. 29, 2017 | | March 2018 | | Broadband Infrastructure |

Intelsat 39 | | IS-902 | | 62°E | | Arianespace Ariane 5 | | 2019 | | 2019 | | Broadband Infrastructure |

Galaxy 30 | | G-14 | | 235°E | | Arianespace Ariane 5 | | 2020 | | 2020 | | Media, Broadband |

| | | | | | |

| | | | | | | | | Estimated | | Estimated | | |

| Non-Capex | | | | Orbital | | | | Launch | | In-Service | | |

Satellite | | Follows | | Location | | Launch Provider | | Date | | Date | | Application |

Intelsat 38 | | IS-904, G-11 | | 45°E | | Arianespace Ariane 5 | | 2Q18 | | 3Q18 | | Media, Broadband |

Horizons 3e | | IS-805 | | 169°E | | Arianespace Ariane 5 | | 4Q18 | | 1Q19 | | Broadband Infrastructure |

8

Intelsat S.A.

Quarterly Commentary, 4Q 2017

Cash Flows

During the fourth quarter of 2017, net cash provided by operating activities was $22 million. Cash paid for interest was $284 million. Under our existing debt agreements, Intelsat makes significantly greater interest payments in the second and fourth quarters as compared to the first and third quarters of the year.

Capital expenditures were $58 million, resulting in free cash flow used in operations1 of $35 million for the fourth quarter of 2017.

Our ending cash balance at December 31, 2017 was $525 million.

Capital Markets and Debt Transactions

In the fourth quarter, Intelsat conducted a number of capital markets transactions, with the objective of enhancing liquidity, addressing maturities and capturing value for our shareholders.

On November 27, 2017, our subsidiary, Intelsat Jackson Holdings S.A. (“Intelsat Jackson”), entered into an amendment and joinder agreement, which amended the Intelsat Jackson Secured Credit Agreement. The amendment extended the maturity date of $2.0 billion of the existing floating rateB-2 Tranche Term Loans (the“B-3 Tranche Term Loans”) to November 27, 2023.

On January 2, 2018, Intelsat Jackson entered into another amendment and joinder agreement, which further amended the Intelsat Jackson Secured Credit Agreement, refinancing the remaining $1.095 billionB-2 Tranche Term Loans, through the creation of (i) a new incremental floating rate tranche of term loans with a principal amount of $395.0 million (the“B-4 Tranche Term Loans”), and (ii) a new incremental fixed rate tranche of term loans with a principal amount of $700.0 million (the“B-5 Tranche Term Loans”). The maturity date of theB-4 Tranche Term Loans and theB-5 Tranche Term Loans is January 2, 2024.

TheB-3 Tranche Term Loans have an applicable interest rate margin of 3.75% for LIBOR loans and 2.75% for base rate loans, among other terms. TheB-4 Tranche Term Loans have an applicable interest rate margin of 4.50% per annum for LIBOR loans and 3.50% per annum for base rate loans, and theB-5 Tranche Term Loans have an interest rate of 6.625% per annum.

As of December 31, 2017, we held interest rate caps, effective in February 2018, with an aggregate notional value of $2.4 billion to mitigate the risk of interest rate expense increase on the floating-rate term loans under our Intelsat Jackson senior secured credit facilities.

We continue to look for opportunities to enhance our capital structure through ongoing liability management initiatives.

9

Intelsat S.A.

Quarterly Commentary, 4Q 2017

Proposed Implementation and Expected 2018 Impact of New Revenue Recognition Rules

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update (“ASU”)2014-09, Revenue from Contracts with Customers (Topic 606) (“ASC 606”), which will supersede the revenue recognition requirements in FASB ASC Topic 605 – Revenue Recognition.

We will adopt the new revenue standard effective January 1, 2018, using the modified retrospective transition method applied to contracts which were still in service at that date.

The most significant adjustments to our reported results will be related to contracts with a significant financing component, typically with respect to our long-term contracts for which apre-payment was received, which will result in an increase in revenue and an increase in interest expense, both of which arenon-cash. Only a small portion of our total contracts require accounting changes as a result of implementing ASC 606.

We expect the change in 2018 to be an increase of $100 million to $105 million in revenue and $110 million to $115 million in interest expense. Should there be amendments or terminations of the relevant underlying contracts, or should we enter into additional long-term agreements with significant prepayments, we will update this assessment.

Our opening balance sheet in 2018 is currently expected to reflect the following adjustments relating to ASC 606:

| | |

| Prepayment Contracts: | | a $345 million to $355 million increase in Accumulated Deficit |

| |

| Multiple element arrangements: | | a $5 million to $15 million decrease in Accumulated Deficit |

| |

| Contract acquisition costs: | | a $5 million to $10 million decrease in Accumulated Deficit |

We do not intend to restate historical results. Instead, we plan to facilitate same-basis comparisons by providing supplementary material in our future earnings releases, quarterly commentaries and quarterly reports on Form6-K.

A complete discussion of ASC 606, including adjustments related to other revenue categories and the balance sheet, is provided in our Annual Report on Form20-F for the year-ended December 31, 2017, expected to be filed on 26 February 2018.

Implications of U.S. Tax Code Changes

On December 22, 2017, the U.S. Tax Cuts and Jobs Act (the “Act”) was signed into law. The Act includes a number of provisions, including the lowering of the U.S. corporate tax rate from 35 percent to 21 percent, effective January 1, 2018.

We accounted for the tax effects of the Act in our 2017 financial statements byre-measuring the deferred taxes of our U.S. subsidiaries to reflect the lower tax rate. This resulted in a $28 millionnon-cash income tax benefit.

The Act introduced some additional changes to the U.S. tax rules which we are currently evaluating. As we are a Luxembourg-domiciled company, any impact of these new rules should be limited to our U.S. operations.

10

Intelsat S.A.

Quarterly Commentary, 4Q 2017

2018 Outlook & Guidance

Business Environment: Our backlog provides the foundation for our revenue assumptions. Total backlog at December 31, 2017 was $7.8 billion. Our beginning of year backlog for 2018 was $1.8 billion, a decline of approximately $50 million as compared to the beginning of year backlog for 2017.

Over the course of 2017 we had three new Intelsat EpicNG satellites enter service; another satellite is expected to enter service in the first quarter of 2018. These satellites, which are designed to support lower price points, provide valuable new inventory that supports our strategic goals. In the early months of service, revenue uptake on certain of these satellites has been slower than we originally anticipated. The new revenues from our Intelsat EpicNG fleet are moderated by pressures described below that remain in our traditional wide-beam business, although we expect these pressures to lessen gradually over time:

| | • | | Our analyses indicate that price conditions are generally stable, with modest pricing pressures in certain regions, particularly for network services applications. High volume mobility applications remain the most price sensitive, with price declines experienced in competition over the past year. |

| | • | | Certain of our network services business is contracted at lower prices when renewed. We have approximately $275 million of legacy network services backlog that was last contracted prior to January 2015. Our forecast assumes that our revenues will be reduced as we renew portions of this backlog at current market rates. We continue to experience some volume reductions in network services due to certain services reaching end of lifecycle, specificallypoint-to-point trunking services, which can now be more economically delivered by fiber. Approximately $55 million of international trunking services remained in our backlog at the beginning of 2018. |

| | • | | A modest portion of our government revenue stream is expected to be renewed over the course of 2018 and could encounter lower prices in certain circumstances given the U.S. government’s trend toward more use of lowest price, technically acceptable (LPTA) procurement practices, depending upon the region being served and technical requirements. |

| | • | | Continuinggeo-economic conditions, which require increased accruals for bad debt expense or result in portfolio renegotiations. |

| | • | | A small portion of our North American media contracts is expected to be renewed over the course of 2018 and 2019 with customers that are considering the use of MPEG4 compression technology. This could result in lower committed volumes of services in 2019 and beyond. In 2017, continental U.S. media distribution services represented 7 percent of total Company revenue. |

These trends should be partially offset by several factors that are expected to have a positive impact on our business in 2018:

| | • | | Contracted and new revenues which are expected to build over the course of 2018 related to our broadband, mobility and government businesses on our Intelsat EpicNG and other satellites. |

| | • | | Contracted and new revenues from our IntelsatOne® Flex data services, and managed media services. |

| | • | | Incremental revenue opportunities on our new media neighborhood in Latin America, Intelsat 14, and on the Intelsat 38 satellite, which is planned for launch in the second quarter of 2018 and which includes modest growth capacity. |

11

Intelsat S.A.

Quarterly Commentary, 4Q 2017

Revenue Guidance: We expect full-year 2018 revenue in a range of $2.060 billion to $2.110 billion. In addition, in 2018 we intend to reclassify $16 million in expected revenue from network services to our government customer set due to clarification ofend-use applications. This change is reflected in our full-year 2018 customer set revenue expectations, as follows:

| | • | | Stable to a decline of 3 percent in our media business; |

| | • | | A decline of 5 percent to 8 percent in our network services business; and |

| | • | | An increase of 2 percent to a decline of 1 percent in our government business. |

Adjusted EBITDA Guidance: Intelsat forecasts Adjusted EBITDA performance for the full-year 2018 to be in a range of $1.560 billion to $1.605 billion. This reflects normalized bad debt costs, as compared to a benefit provided by bad debt recovery in 2017, as well as slightly higher staff costs as compared to 2017. We remain disciplined with respect to operating expenses and the support of cash flow.

The above guidance excludes the expected impact of ASC 606, summarized above. As we implement ASC 606, we will provide supplementary disclosure on a quarterly basis to allow for same basis period-over-period comparisons.

Cash Taxes: We are currently evaluating the impact of the recently enacted U.S. tax reform. We expect to be able to provide cash tax guidance later this year. Please see the section above “Implications of U.S. Tax Code Changes.”

Capital Expenditure Guidance:

Over the next three years we are in a cycle of lower required investment, due to timing of replacement satellites and smaller satellites being built.

We expect the following capital expenditure ranges:

| | • | | 2018: $375 million to $425 million; |

| | • | | 2019: $425 million to $500 million; and |

| | • | | 2020: $375 million to $475 million. |

Capital expenditure guidance for 2018 through 2020 (the “Guidance Period”), assumes investment in seven satellites, including a satellite launched in 2017, during the Guidance Period. We plan to launch two satellites in 2018, both of which are partnership satellites and do not require capital expenditures. We plan to launch one fully-owned satellite in 2019, and will continue work on five remaining satellites, four of which are expected to launch during the Guidance Period.

By early 2019, we plan to have completed the investment program in the current series of Intelsat EpicNG HTS and payloads, thereby increasing our total transmission capacity. By the conclusion of the Guidance Period at the end of 2020, the net number of transponder equivalents is expected to increase by a compound annual growth rate (“CAGR”) of approximately 5 percent, reflecting the net activity of satellites entering and leaving service during the Guidance Period.

Our capital expenditure guidance includes capitalized interest. Capitalized interest is expected to average approximately $40 million annually during the Guidance Period.

Stephen Spengler, Chief Executive Officer, Intelsat S.A.

Jacques Kerrest, Executive Vice President and Chief Financial Officer, Intelsat S.A.

12

Intelsat S.A.

Quarterly Commentary, 4Q 2017

| 1 | In this quarterly commentary, financial measures are presented both in accordance with U.S. GAAP and also on anon-U.S. GAAP basis. EBITDA, Adjusted EBITDA (“AEBITDA”), free cash flow from (used in) operations and related margins included in this commentary arenon-U.S. GAAP financial measures. Please see the consolidated financial information found in our earnings release and available on our website for information reconcilingnon-U.S. GAAP financial measures to comparable U.S. GAAP financial measures. |

Safe Harbor Statement

Some of the information and statements contained in this quarterly commentary and certain oral statements made from time to time by representatives of Intelsat constitute “forward-looking statements” that do not directly or exclusively relate to historical facts. When used in this earnings release, the words “may,” “will,” “might,” “should,” “expect,” “plan,” “anticipate,” “project,” “believe,” “estimate,” “predict,” “intend,” “potential,” “outlook,” and “continue,” and the negative of these terms, and other similar expressions are intended to identify forward-looking statements and information. Examples of these forward-looking statements include, but are not limited to, statements regarding the following: our expectation that the launches of our satellites in the future will position us for growth; our plans for satellite launches in the near tomid-term; our intention to maximize the value of our spectrum rights, including the pursuit of partnerships to optimize new satellite business cases and the exploration ofjoint-use of certain spectrum with the wireless sector in certain geographies; our guidance regarding our expectations for our revenue performance and Adjusted EBITDA performance; our capital expenditure guidance over the next several years; our belief that the scale of our fleet can reduce the financial impact of satellite or launch failures and protect against service interruptions; our belief that the diversity of our revenue and customer base allow us to recognize trends across regions and capture new growth opportunities; our expectation that developing differentiated services and investing in new technology will allow us to unlock essential opportunities; our expectations as to the increased number of transponder equivalents on our fleet over the next several years; and our expectations as to the level of our cash tax payments in the future. The forward-looking statements reflect Intelsat’s intentions, plans, expectations, anticipations, projections, estimations, predictions, outlook, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors, many of which are outside of Intelsat’s control. Important factors that could cause actual results to differ materially from the expectations expressed or implied in the forward-looking statements include known and unknown risks. Some of the factors that could cause actual results to differ from historical results or those anticipated or predicted by these forward-looking statements include: risks associated with operating ourin-orbit satellites; satellite anomalies, launch failures, satellite launch and construction delays andin-orbit failures or reduced performance; potential changes in the number of companies offering commercial satellite launch services and the number of commercial satellite launch opportunities available in any given time period that could impact our ability to timely schedule future launches and the prices we pay for such launches; our ability to obtain new satellite insurance policies with financially viable insurance carriers on commercially reasonable terms or at all, as well as the ability of our insurance carriers to fulfill their obligations; possible future losses on satellites that are not adequately covered by insurance; U.S. and other government regulation; changes in our contracted backlog or expected contracted backlog for future services; pricing pressure and overcapacity in the markets in which we compete; our ability to access capital markets for debt or equity; the competitive environment in which we operate; customer defaults on their obligations to us; our international operations and other uncertainties associated with doing business internationally; and litigation. Known risks include, among others: the risks described in Intelsat’s Annual Report on Form20-F for the year ended December 31, 2017 and its other filings with the U.S. Securities and Exchange Commission; the political, economic and legal conditions in the markets we are targeting for communications services or in which we operate; and other risks and uncertainties inherent in the telecommunications business in general and the satellite communications business in particular. Because actual results could differ materially from Intelsat’s intentions, plans, expectations, anticipations, projections, estimations, predictions, outlook, assumptions and beliefs about the future, you are urged to view all forward-looking statements with caution. Intelsat does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact

Dianne VanBeber

Vice President, Investor Relations

dianne.vanbeber@intelsat.com

+1703-559-7406

13