Exhibit 99.2

Quarterly Commentary

Second Quarter 2018

April 1, 2018 - June 30, 2018

July 31, 2018

Second Quarter 2018 Performance Summary

In the second quarter of 2018 we advanced our operating priorities and completed capital markets transactions with significant benefits for our business. In the second quarter, we won a strategic contract for a custom payload on our Intelsat 39 satellite for services in Asia, sold new services and expanded our distribution network for our mobility services, entered into new and renewed contracts in our government business and welcomed new broadcasters to our media neighborhoods.

On January 1, 2018, we adopted the provisions of the Financial Accounting Standards Board Accounting Standards Codification Topic 606, Revenue from Contracts with Customers (“ASC 606”). The most significant adjustments to our reported results were related to contracts with a significant financing component, typically with respect to our long-term media and government contracts for which a prepayment was received, which resulted in an increase in revenue and an increase in interest expense, both of which arenon-cash. Only a small portion of our total contracts required accounting changes as a result of implementing ASC 606. This change further aligns Intelsat with international accounting practices consistent with our peer group.

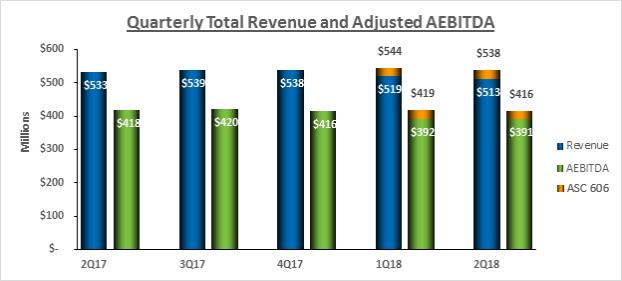

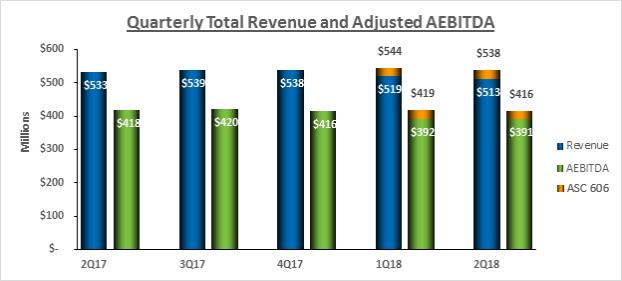

Total revenue was $538 million in the second quarter of 2018, an increase of $4 million, or 1 percent, as compared to the second quarter of 2017. Total revenue excluding the effects of ASC 606 was $513 million for the second quarter of 2018, a decline of $21 million, or 4 percent, as compared to the second quarter of 2017.

Net loss attributable to Intelsat S.A. was $47 million for the second quarter of 2018, as compared to net loss attributable to Intelsat S.A. of $24 million in the second quarter of 2017. Higher interest rate costs were the primary contributor to the greater loss.

Intelsat S.A.

Quarterly Commentary

2Q 2018

Adjusted EBITDA1, or earnings before interest, taxes, depreciation and amortization, of $416 million, or 77 percent of revenue, decreased from $418 million, or 78 percent of revenue, in the second quarter of 2017. Excluding the effects of ASC 606, Adjusted EBITDA was $391 million, or 76 percent of revenue, a decrease of $27.4 million, or 7 percent, as compared to the second quarter of 2017, primarily reflecting the overall lower revenue.

Factors reflected in the second quarter 2018 to second quarter 2017 comparison include: reduced volume fromnon-renewing data services, inclusive ofpoint-to-point telecommunications infrastructure services, replaced by higher volume, but lower priced services on high-throughput capacity in certain regions and applications andnon-renewals of certain media services. We continue to experience growth in revenue from commercial broadband mobility networks.

Contracted backlog at June 30, 2018 was $8.7 billion, inclusive of approximately $1.1 billion attributable to the effects of ASC 606. Excluding the effects of ASC 606, contracted backlog at June 30, 2018 was $7.5 billion, representing expected future revenue under existing contracts with customers, as compared to $7.6 billion at March 31, 2018. At approximately 3.5 times trailing 12 months revenue (from July 1, 2017 to June 30, 2018), our backlog remains sizable; we believe it provides a solid foundation for predictable cash flow and investment in our business. Nearlytwo-thirds of our backlog is related to our longer-term media contracts.

2018 Operational Priorities:Drive revenue stability and invest for growth, leveraging all assets and advancing our managed services and technology innovations to expand our market opportunities.

Our plan includes four operational priorities in 2018 which are designed to provide a stable foundation, developing new revenue sources that can provide growth in the near- tomid-term.

| | 1. | Leverage all assets within the Intelsat global network for maximum return. Further our momentum on our new assets and capturepre-launch commitments. Build on our market-leading neighborhoods, expansive ground network, growing managed services platform and strong commercial and government customer relationships to capture growth. Provide sector leadership by protecting and optimizing our spectrum rights. |

| | • | | The scale of our fleet and our global footprint positions Intelsat to serve the leading wireless, mobility and government users around the world. In the second quarter of 2018, Intelsat signed an agreement including a significant increase in volume from a previous commitment from the anchor customer on Intelsat 39, the Myanmar Ministry of Transportation and Communications (“MOTC”). The Intelsat 39 satellite is planned for launch in the second quarter of 2019, features a specially designed payload to provide 3G and 4G infrastructure for Myanmar, while also providing growth capacity at this orbital location for U.S. government applications. |

| | • | | Long-standing customer, TELE Greenland, extended its relationship with Intelsat well into the next decade, with services on our high-throughput satellite (“HTS”) Intelsat 35e. Satellite connectivity is an essential part of the TELE Greenland infrastructure. |

2

Intelsat S.A.

Quarterly Commentary

2Q 2018

| | • | | On July 12, 2018, European satellite operator, Eutelsat S.A., joined the Intelsat, Intel Corporation and SES S.A.C-band Joint Use Proposal presented to the United States Federal Communications Commission (“FCC”). Under the proposal, portions of theC-band spectrum in the3.7-4.2 GHz range currently assigned to fixed satellite services operators in the United States would be made available for joint use with the wireless sector through a market-based solution managed by a satellitesector-led consortium. |

A Notice of Proposed Rule Making (“NPRM”) was unanimously approved by the FCC in a July 12, 2018 Open Meeting. Once entered into the U.S. Federal Record, a60-day comment period will begin, to be followed by a30-day reply period.

Our joint proposal provides a breakthrough, market-based solution to protect the quality and reliability of the services we provide to users while accelerating access to spectrum for 5G deployments. We believe our proposal is well-positioned in the NPRM for the following reasons:

| | • | | Our proposal could be implemented quickly and efficiently, addressing the emphasis for speed to making spectrum available for 5G services presented in the NPRM and in the individual comments of the FCC Commissioners. |

| | • | | Our proposal is the only one to address a key goal presented in the NPRM, which is to protect the valuable incumbent services provided inC-band today. Our proposal provides the reliability and the certainty that we and our customers need in order to continue providing services in the band. |

We intend to continue to work constructively with the FCC, our customers and other stakeholders. The satellite operators will work to demonstrate our ability to efficiently implement our market-based proposal, protecting theC-band services environment from disruptive interference while clearing spectrum to accelerate the era of 5G in the U.S.

We believe that it is possible the FCC may issue its final Report and Order in early tomid-2019. However, we can provide no assurance as to the likelihood of the FCC’s acceptance of the various facets of our proposal, or the timing of a final ruling, all of which are in the control of the FCC.

| | 2. | Scale our IntelsatOne®Flex and other managed services across targeted commercial and government opportunities, including new services for growing applications and building strategic partnerships to amplify our marketing efforts. |

| | • | | Intelsat General announced a new managed service platform to supply aeronautical broadband solutions to the government sector. IntelsatOne FlexAir is a worldwidein-flight connectivity service designed for aircraft with high-performance requirements, such as manned and unmanned intelligence, surveillance and reconnaissance (“ISR”) aircraft. The globalKu-band platform is comprised of beams on our high-throughput Intelsat EpicNG satellites and our traditional wide-beam spacecraft. The service is compatible with multiple types of fuselage and tail-mounted antennas on both manned and unmanned aircraft. |

The service allows customers to use existingKu-band terminals on aircraft already in service just by adding a modem. This is far less expensive and time intensive than replacing a previously installed antenna. The managed service offers different subscription plans and committed information rates as high as 10 Mbps to the aircraft and 3 Mbps from the airframe, or even unlimited data allocations for use by heads of state and commanders.

3

Intelsat S.A.

Quarterly Commentary

2Q 2018

| | • | | In the second quarter, Intelsat added maritime technology leader, Navarino, as a distributor of IntelsatOne Flex services, building geographic and sector depth, especially with respect to the shipping industry. IntelsatOne Flex equips service providers with higher throughput and the ability to create customized services as compared to other mobility solutions. Building on the first quarter 2018 addition of KDDI Corporation, which provides important distribution capability in Asia, Navarino joins a growing list of IntelsatOne Flex distributors. |

| | 3. | Lead the industry in seamless implementation of satellite-based telecommunications solutions with the global telecommunications infrastructure. Invest in and develop innovative terminals and ground hardware, and participate in standards development, to realize Intelsat’s vision of simplified access and expanded use of satellite solutions. |

| | • | | Building upon Intelsat’s activity with the 3rd Generation Partnership Project (“3GPP”) through the Alliance for Telecommunications Industry Solutions (“ATIS”), Intelsat announced that it joined the Seamless Air Alliance, a consortium founded by Airbus, Airtel, Delta, OneWeb, and Sprint to usher in a new era ofin-flight connectivity. The Seamless Air Alliance aims to drive standards development that will enable open innovation inside the cabin and facilitate a better, more seamless, inflight connectivity experience for passengers. The ultimate goal of the alliance is to empower mobile operators to extend their services into airline cabins. With satellite serving as the primary means of connecting aircraft, Intelsat will contribute to the integration of geostationary andlow-Earth orbit satellite solutions into the hybrid network and help define standards, test equipment and develop service packages focused on the aeronautical sector. |

| | 4. | Pursue continued financial discipline to maximize flexibility during a period of continued business transition. |

| | • | | Intelsat completed important steps in its plan to achieve enhancements in its capital structure, including addressing near-term maturities and reducing cash interest costs. The total capital raise of approximately $633 million included an issuance of common equity of approximately $230 million and a convertible debt issuance of approximately $403 million aggregate principal amount by Intelsat S.A. |

| | • | | In concert with the transactions, Intelsat announced a change in its capital investment guidance and strategy, moving to a less capital intensive plan over the near- tomid-term (see2018 Outlook and Guidance, below). |

In themid-term, Intelsat is shifting to an emphasis on software-defined satellite designs. Software-defined satellites are expected to result in streamlined manufacturing, lowering costs, while using advanced software to define the satellite mission once in orbit. This next generation of technology is now advancing to include higher-throughput satellites that will be designed to provide maximum flexibility, increasing our ability to respond to new opportunities and shifts in the market. Given Intelsat’s industry leading collection of orbital rights, we believe we are well-positioned to maximize the strategic benefits of this emerging technology.

4

Intelsat S.A.

Quarterly Commentary

2Q 2018

2Q 2018 Business Highlights and Customer Set Performance

All 2018 comparisons are to 2017 unless noted otherwise

| | |

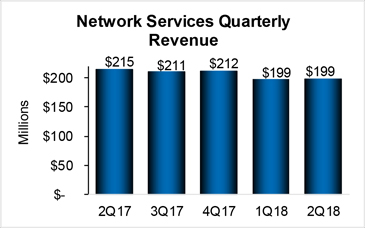

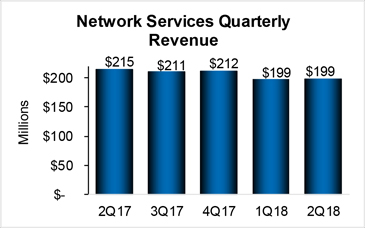

Network Services Network services revenue was $199 million in the second quarter of 2018, a $16 million, or 8 percent, decrease from the prior year quarter. There were no significant adjustments attributable to ASC 606. The largest factors contributing to the year-over-year decline werenon-renewals and contraction of services, the largest of which werepoint-to-point international trunking services and cellular backhaul services for customers in Latin America, as well as lower prices on renewing wide-beam business. In addition, $4 million of network services revenues were reclassified to our government customer set due to clarification ofend-use applications. These declines were partially offset by growth in revenue from broadband mobility services for the commercial maritime sector. | |  |

As compared to the first quarter of 2018, network services revenue was stable, with growth in mobility solutions leveraging the Intelsat EpicNG high-throughput network offsettingnon-renewals ofpoint-to-point and other services.

Second Quarter Network Services Highlights and Business Trends:

Intelsat continues to build backlog commitments for our next generation Intelsat EpicNG fleet and managed services platforms, while also booking new business and renewals on our traditional satellites. In the second quarter of 2018, we continued to advance our goal of supporting, and seamlessly integrating with, wireless network infrastructure. Contracts in the wireless sector included:

| | • | | The MOTC of Myanmar broadened its relationship with Intelsat, using our satellites to accelerate the deployment of the country’s 3G and 4G wireless communications infrastructure in Myanmar. The MOTC will utilize services on Intelsat 39, aKu-and-C-band satellite which is scheduled to replace Intelsat 902 at 62°E in 2019. Under the new long-term agreement, which significantly increases an earlier commitment in terms of volume and term, Intelsat 39 will host a customized payload which includesC- andKu-band satellite services optimized for the Myanmar requirement. The Government of Myanmar plans to use the connectivity to significantly enhance its existing infrastructure, as well as the networks of other mobile operators and media companies. |

| | • | | Vodacom International (“Vodacom”) renewed and expanded services supporting its African satellite wireless network. Under the multi-year commitment, Vodacom more than tripled its volume requirements, including the porting of services to Intelsat 37e. Vodacom is aggressively expanding its rural service territories to capture new growth and satisfy regulatory requirements. Intelsat provides Vodacom with a satellite-based solution that features higher-performance and use of solar power to achieve lower total cost of service economics in low population density regions. |

5

Intelsat S.A.

Quarterly Commentary

2Q 2018

| | • | | TELE Greenland renewed its commitment for services on Intelsat 35e, extending its commitment well into the next decade. The services are used by TELE Greenland for connectivity to remote corners of Greenland, supporting wireless and enterprise applications. |

Enterprise networks are large private data networks that use satellite solutions because of geographic reach, efficient broadcast transmissions and reliability. Enterprise contracts signed in the second quarter of 2018 include:

| | • | | A U.S.-based intergovernmental organization renewed a portfolio of services on five Intelsat satellites and added a multi-year commitment for new services on Intelsat 33e. The customer uses Intelsat services as part of a global network supporting security, logistics and administrative functions, as well as disaster recovery support. |

| | • | | Telespazio Brasil S.A. (“Telespazio”), a leading provider of satellite services in Brazil, signed a multi-transponder agreement for services on Intelsat 21. Telespazio will use the connectivity to sustain its enterprise and institutional data network business. |

| | • | | AT&T Corporation renewed a portfolio of services across the Intelsat North American fleet. Using services on four Intelsat satellites, the connectivity is used to support disaster recovery requirements, such as for private enterprise networks and U.S. government applications including the First Responder Network Authority (FirstNet) network. |

Mobility services, which provide broadband connectivity to planes and ocean vessels, are fast growing applications which use our wide-beam satellites, Intelsat EpicNG satellites, and IntelsatOne Flex managed services. Mobility contracts signed in the second quarter include:

| | • | | Gogo LLC,the global leader in providing broadband connectivity solutions and wireless entertainment to the aviation industry, signed a new agreement with Intelsat for services on the Intelsat 37e satellite. Gogo uses services on a number of Intelsat satellites, including five Intelsat EpicNG satellites, as part of its global passenger broadband aeronautical network. |

On a global basis, growth opportunities for our network services business include increased demand for aeronautical and maritime mobility applications, and high-throughput capacity for fixed and mobile broadband applications for telecommunications providers and enterprise networks. Longer term, Intelsat’s strategy includes building seamless solutions for the land mobile sector, including connected cars and other forms of land transport.

6

Intelsat S.A.

Quarterly Commentary

2Q 2018

| | |

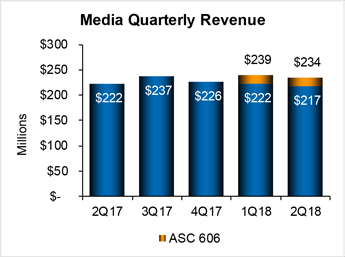

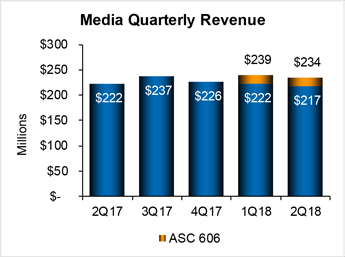

Media Media revenue was $234 million in the second quarter of 2018, a $12 million, or 5 percent increase, when compared to the prior year quarter. Excluding $17 million of revenue attributable to ASC 606, media revenue in the second quarter declined by $5 million, or 2 percent, to $217 million as compared to the second quarter of 2017. This decline reflects revenue from cash basis customers and termination fees in the second quarter of 2017 which did not occur in the current period, andnon-renewals in North America, Africa, the Middle East and Latin America, partially offset by new revenues recognized in the second quarter of 2018 from managed services and fees earned from third-party satellites. As compared to the first quarter of 2018, media revenues decreased by $5 million, or 2 percent. The decline was primarily due to lower revenues from transponder services in the Africa, Middle East and | |  |

| North America regions as a result ofnon-renewals, partially offset by net growth in managed video solutions. The impact of ASC 606 was constant between the first and second quarters of 2018 and thus is not a factor in the comparison of the two periods. |

Second Quarter Media Highlights and Business Trends:

Business activity was driven primarily by renewing contracts related to Intelsat’s media distribution neighborhoods in North America.

| | • | | C-SPAN, the Washington, D.C.-based public affairs network, signed a new long-term contract forC-band distribution, IntelsatOne transport and uplink services and associatedin-orbit protection services on Intelsat’s Galaxy 14 satellite, one of the premier video neighborhoods in North America, reaching more than 100 million households in the United States. Galaxy 14 is planned for replacement by Galaxy 30 in 2020. |

Our next media satellite will be Intelsat 38, which is primarily designed to replace capacity for an existing Intelsat satellite as well as provide growth capacity fordirect-to-home applications for Central and Eastern Europe and Asia. We are responding to the trends in our media business by emphasizing the introduction of new products beyond traditional broadcast services. We also aim to expand the types of services we provide to our media customers, particularly those who distribute content globally, where we can leverage our fleet and our IntelsatOne terrestrial network.

7

Intelsat S.A.

Quarterly Commentary

2Q 2018

| | |

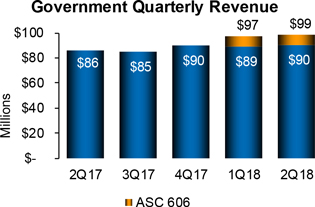

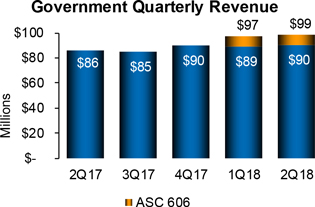

Government Sales to government customers generated revenue of $99 million in the second quarter of 2018, a $13 million, or 15 percent, increase as compared to the prior year quarter. Excluding $8 million of revenue attributable to ASC 606, government revenue in the second quarter increased by $4 million, or 5 percent, to $90 million as compared to the second quarter of 2017. The increase in the period primarily reflects the reclassification of $4 million in revenue from our network services business to government. As compared to the first quarter of 2018, revenue increased by $1 million, or 1 percent. The impact of | |  |

| ASC 606 was constant between the first and second quarters of 2018, and thus is not a factor in the comparison of the two periods. The slight increase reflects modest growth in revenue fromoff-network transponder services. |

On-Network revenue represented 62 percent of government services in the second quarter of 2018, as compared to 65 percent in the second quarter of 2017.

Second Quarter Government Highlights and Business Trends:

The pace of RFP issuances and subsequent awards for new programs remains modestly improved from 2017 levels. We note continued reliance on LPTA (lowest price, technically acceptable) as the predominant evaluation criteria for awards of new transponder services contracts.

| | • | | At the close of the second quarter, Intelsat General had successfully retired nearly all of its 2018 renewal risk, through awards of new contracts forre-competed business or extensions of current contracts for an additional period of one year. This reduces our exposure to pricing pressure that exists in the current environment, depending upon the solution required and region served, especially given the increasing reliance by the U.S. government on LPTA evaluation criteria. |

| | • | | Intelsat General’s track record of strong renewal win rates continued in the second quarter of 2018. Intelsat General renewed over 1,000 MHz of services, achieving a near perfect renewal rate, with a combination ofon- andoff-network services. |

| | • | | In April 2018, aLeidos-led team including Intelsat General was awarded a hosted payload program by the U.S. Federal Aviation Administration. As previously disclosed, the payload supports aircraft navigation, and is planned to be integrated on the Intelsat Galaxy 30 satellite which is currently under construction. |

Over themid-term, our strategy to grow our government business includes the introduction of several new services based upon our differentiated capacity, including Intelsat EpicNG high throughput capabilities, designed to address expected U.S. government demand for aeronautical and ground mobile applications This includes the recently announced IntelsatOne FlexAir managed service detailed above, which leverages the growth capacity provided by our next generation Intelsat EpicNG HTS services.

8

Intelsat S.A.

Quarterly Commentary

2Q 2018

Fleet and Operations Update

Intelsat’s average fill rate on our approximately 1,850 station-kept wide-beam transponders was 79 percent at June 30, 2018.

As of June 30, 2018, the HTS Intelsat EpicNG unit count was approximately 1,150 units in service, stable in comparison to the Intelsat EpicNG transponder count at March 31, 2018.

Our two launches for 2018, Intelsat 38 and Horizons 3e, are planned for launch on a single Arianespace rocket in September 2018.

Intelsat currently has seven satellites covered by our 2018 to 2020 capital expenditure plan, three of which are in the design and manufacturing phase or recently launched. The remaining four satellites are replacement satellites, for which manufacturing contracts have not yet been signed. In addition, we are working on one custom payload being built on a third-party satellite and a separate joint venture satellite which do not require capital expenditures, each noted below as a“Non-Capex Satellite.”

Our fleet plan includes the use of mission extension vehicles, or “MEVs,” to extend the operational life of two of our wide-beam satellites, which reduces overall capital expenditures in the near- tomid-term, but will increase operating expenses as each MEV enters service.

Our owned satellites, third-party payloads and a joint venture project currently in the design and manufacturing stages are noted below. Intelsat EpicNG-class satellites are noted with a small “e” following the satellite number.

| | | | | | | | | | | | |

Satellite | | Follows | | Orbital

Location | | Launch Provider | | Estimated

Launch

Date | | Estimated

In-Service

Date | | Application |

Intelsat 39 | | IS-902 | | 62°E | | Arianespace Ariane 5 | | 2Q 2019 | | 3Q 2019 | | Broadband Infrastructure |

Galaxy 30 | | G-14 | | 235°E | | Arianespace Ariane 5 | | 2020 | | 2020 | | Media, Broadband |

| | | | | | |

Non-Capex Satellite | | Follows | | Orbital

Location | | Launch Provider | | Estimated

Launch

Date | | Estimated

In-Service

Date | | Application |

Intelsat 38 | | IS-904, G-11 | | 45°E | | Arianespace Ariane 5 | | Sept 2018 | | 1Q 2019 | | Media, Broadband |

Horizons 3e | | IS-805 | | 169°E | | Arianespace Ariane 5 | | Sept 2018 | | 1Q 2019 | | Broadband Infrastructure |

9

Intelsat S.A.

Quarterly Commentary

2Q 2018

Cash Flows

During the second quarter of 2018, net cash provided by operating activities was $57 million. Cash paid for interest was $299 million, of which $7 million was capitalized. Under our existing debt agreements, Intelsat makes significantly greater interest payments in the second and fourth quarters as compared to the first and third quarters of the year.

Capital expenditures were $52 million, resulting in free cash flow from operations1 of $5 million for the second quarter of 2018.

Our ending cash balance at June 30, 2018 was $444 million.

Capital Markets and Debt Transactions

On May 2, 2018, pursuant to a previously issued notice of redemption, Intelsat (Luxembourg) S.A. (“Intelsat Luxembourg”) redeemed $46.0 million aggregate principal amount of its 6 3⁄4% Senior Notes due 2018 and in June 2018 repaid the remaining outstanding principal at maturity, retiring this issue in its entirety.

On June 14, 2018, Intelsat S.A. completed an offering of 15,498,652 common shares, nominal value $0.01 per share (the “Common Shares”), at a public offering price of $14.84 per common share, with total gross proceeds of approximately $230 million. In addition, on June 18, 2018, Intelsat S.A. completed an offering of approximately $403 million aggregate principal amount of its newly issued 4.5% Convertible Senior Notes due 2025 (the “2025 Convertible Notes”). These notes are guaranteed by a direct subsidiary of Intelsat Luxembourg, Intelsat Envision Holdings LLC (“Intelsat Envision”).

The net proceeds from the Common Shares offering and 2025 Convertible Notes offering were used to repurchase approximately $600 million principal amount of Intelsat Luxembourg’s 7.75% Senior Notes due 2021 in privately negotiated transactions with individual holders in June 2018. We intend to use any remaining proceeds for further debt repurchases and general corporate purposes.

The repurchased Intelsat Luxembourg 7.75% Senior Notes due 2021 remain outstanding and are currently held by Intelsat Envision. Intelsat Envision currently intends to use the interest received on these notes in part to fund the interest payments required under the Intelsat S.A. 2025 Convertible Notes, as well as to build cash to fund principal at maturity on the remaining outstanding Intelsat Luxembourg 7.75% Senior Notes due 2021. This transaction puts into place a structure similar to that implemented in early 2017 to address the repayment of Intelsat Luxembourg’s 6.75% Senior Notes due 2018 at maturity, discussed above.

Our successful June 2018 transactions provide a path to further enhance our capital structure through ongoing capital markets activities. We appreciate the continued support of the investment community as we further execute on this 2018 operating priority.

10

Intelsat S.A.

Quarterly Commentary

2Q 2018

2018 Outlook & Guidance

| | • | | Intelsat reaffirmed its 2018 revenue and Adjusted EBITDA guidance issued on February 26, 2018. |

| | • | | Intelsat reaffirmed the capital expenditure guidance updated on June 11, 2018. |

| | • | | Intelsat introduced cash tax guidance for 2018 and a modeling assumption range for future periods. |

We expect the following results,excluding the effects of ASC 606:

Revenue Guidance: We expect full-year 2018 revenue in a range of $2.060 billion to $2.110 billion.

Adjusted EBITDA Guidance: Intelsat forecasts Adjusted EBITDA performance for the full-year 2018 to be in a range of $1.560 billion to $1.605 billion.

Capital Expenditure Guidance:

Over the next three years we are in a cycle of lower required investment, due to timing of replacement satellites and smaller satellites being built. We are committed to our 2018 operating priority to incorporate new innovations into our fleet development program. The new initiatives are planned to allow us to achieve a lowercost-per-bit for our global fleet while also attaining lower overall capital intensity to support operations. Innovations will contribute to commercial flexibility and strong competitive positioning and include:

| | • | | driving development of commercially-scaled software-definable satellites; |

| | • | | leveraging new manufacturing practices; |

| | • | | use of mission extension vehicles; and |

| | • | | increased use of reusable rocket launchers. |

See “2018 Operational Priorities: Pursue continued financial discipline…” above.

We expect the following capital expenditure ranges:

| | • | | 2018: $300 million to $350 million; |

| | • | | 2019: $325 million to $400 million; and |

| | • | | 2020: $300 million to $400 million. |

Our capital expenditure guidance includes capitalized interest. Capitalized interest is expected to average approximately $40 million annually during the guidance period.

In adjusting our capital expenditure guidance downward on June 11, 2018, Intelsat incorporated two primary changes: the deferral of a new satellite order from 2018 to 2019, and a reduction in assumed launch costs related to operational and supply improvements in the launch sector.

By early 2019, we plan to have completed the investment program in the current series of Intelsat EpicNG HTS and payloads, thereby increasing our total transmission capacity. By the conclusion of the guidance period at the end of 2020, the net number of transponder equivalents is expected to increase by a compound annual growth rate (“CAGR”) of approximately 5 percent, reflecting the net activity of satellites entering and leaving service during the guidance period. Capital expenditure incurrence is subject to the timing of achievement of contract, satellite manufacturing, launch and other milestones.

11

Intelsat S.A.

Quarterly Commentary

2Q 2018

Cash Taxes: We expect cash taxes in 2018 to be approximately $55 million to $65 million. In future periods, we expect cash taxes to range from $30 million to $40 million annually.

Stephen Spengler, Chief Executive Officer, Intelsat S.A.

Jacques Kerrest, Executive Vice President and Chief Financial Officer, Intelsat S.A.

| 1 | In this quarterly commentary, financial measures are presented both in accordance with U.S. GAAP and also on anon-U.S. GAAP basis. EBITDA, Adjusted EBITDA (“AEBITDA”), free cash flow from (used in) operations and related margins included in this commentary arenon-U.S. GAAP financial measures. Please see the consolidated financial information found in our earnings release and available on our website for information reconcilingnon-U.S. GAAP financial measures to comparable U.S. GAAP financial measures. |

12

Intelsat S.A.

Quarterly Commentary

2Q 2018

Safe Harbor Statement

Some of the information and statements contained in this quarterly commentary and certain oral statements made from time to time by representatives of Intelsat constitute “forward-looking statements” that do not directly or exclusively relate to historical facts. When used in this earnings release, the words “may,” “will,” “might,” “should,” “expect,” “plan,” “anticipate,” “project,” “believe,” “estimate,” “predict,” “intend,” “potential,” “outlook,” and “continue,” and the negative of these terms, and other similar expressions are intended to identify forward-looking statements and information. Forward-looking statements include: statements regarding our guidance regarding our expectation that the launches of our satellites in the future will position us for growth; our plans for satellite launches in the near tomid-term; our intention to maximize the value of our spectrum rights, including the pursuit of partnerships to optimize new satellite business cases and the exploration of joint use of certain spectrum with the wireless sector in certain geographies; our expectations as to the potential timing of a final FCC ruling with respect to ourC-band Joint Use Proposal; guidance regarding our expectations for our revenue performance and Adjusted EBITDA performance; our capital expenditure guidance over the next several years; our belief that the scale of our fleet can reduce the financial impact of satellite or launch failures and protect against service interruptions; our belief that the diversity of our revenue and customer base allow us to recognize trends across regions and capture new growth opportunities; our expectation that developing differentiated services and investing in new technology will allow us to unlock essential opportunities; our expectations as to the increased number of transponder equivalents on our fleet over the next several years; and our expectations as to the level of our cash tax payments in the future.

The forward-looking statements reflect Intelsat’s intentions, plans, expectations, anticipations, projections, estimations, predictions, outlook, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors, many of which are outside of Intelsat’s control. Important factors that could cause actual results to differ materially from the expectations expressed or implied in the forward-looking statements include known and unknown risks. Some of the factors that could cause actual results to differ from historical results or those anticipated or predicted by these forward-looking statements include: risks associated with operating ourin-orbit satellites; satellite anomalies, launch failures, satellite launch and construction delays andin-orbit failures or reduced performance; potential changes in the number of companies offering commercial satellite launch services and the number of commercial satellite launch opportunities available in any given time period that could impact our ability to timely schedule future launches and the prices we pay for such launches; our ability to obtain new satellite insurance policies with financially viable insurance carriers on commercially reasonable terms or at all, as well as the ability of our insurance carriers to fulfill their obligations; possible future losses on satellites that are not adequately covered by insurance; U.S. and other government regulation; changes in our contracted backlog or expected contracted backlog for future services; pricing pressure and overcapacity in the markets in which we compete; our ability to access capital markets for debt or equity; the competitive environment in which we operate; customer defaults on their obligations to us; our international operations and other uncertainties associated with doing business internationally; and litigation. Known risks include, among others, the risks described in Intelsat’s Annual Report on Form20-F for the year ended December 31, 2017, and its other filings with the U.S. Securities and Exchange Commission, the political, economic and legal conditions in the markets we are targeting for communications services or in which we operate, and other risks and uncertainties inherent in the telecommunications business in general and the satellite communications business in particular. Because actual results could differ materially from Intelsat’s intentions, plans, expectations, anticipations, projections, estimations, predictions, outlook, assumptions and beliefs about the future, you are urged to view all forward-looking statements with caution. Intelsat does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact

Dianne VanBeber

Vice President, Investor Relations

dianne.vanbeber@intelsat.com

+1703-559-7406

13