UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

(RULE 14a-101) |

|

INFORMATION REQUIRED IN PROXY STATEMENT |

SCHEDULE 14A INFORMATION |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 |

|

Filed by the Registrant x |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

x | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a-12 |

|

HATTERAS GPEP FUND II, LLC |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

December 18, 2013

Dear Hatteras GPEP Fund II Investor,

On October 1, 2013, we announced that RCS Capital Corporation (NYSE: RCAP) entered into an agreement to acquire the Hatteras Funds Group, a group of affiliated companies that manage and distribute the Hatteras Funds family. The acquisition is subject to multiple approvals, including shareholder approval that will take place over the next few months.

After ten years as an independently-owned, boutique alternative investments firm, why did we agree to partner with RCAP? With this transaction, the Hatteras Fund Group will be able to dedicate greater financial resources toward developing and launching new alternative investment solutions. We will also be able to invest in our team, enabling us to continue to offer best-in-class investment management and client service.

RCAP and its affiliates operate a broadly diversified financial services firm that has experienced tremendous success in bringing publically registered alternative investment vehicles, including real estate investment trusts, to the financial advisor community. With this acquisition, RCAP will further diversify its business while also committing to the significant future growth of alternative investments.

In our partnership with RCAP, we will continue to operate autonomously. There will be no changes to our investment approach or our investment team as a result of the acquisition. We will maintain our commitment to Financial Advisors and to the creation of products that are designed to solve the needs of our clients.

Attached to this communication, please find a proxy statement asking for your support of the acquisition. Please review the proxy statement as it contains important information. We would very much appreciate your time in completing the proxy, and would be happy to answer any questions or concerns you may have about your investments with us or the acquisition.

We are proud of the past 10 years and appreciate the confidence you have placed in us. With this next step, we are excited to offer you our commitment to providing best-in-class investment management and client service. Please feel free to call us with any questions. Thank you for your continued confidence; our commitment to you remains unwavering.

Best regards,

David B. Perkins

CEO, Hatteras Funds Group

ADDITIONAL INFORMATION

The Boards of Directors and Managers of each of the Hatteras Funds, as well as David Perkins, who is a member of each of the Funds’ Boards and the sellers’ representative in connection with the acquisition, may be deemed participants in the solicitation of proxies in connection with the special meeting to approve matters related to acquisition. The Hatteras Funds intend to file a proxy statement with the Securities and Exchange Commission (“SEC”) in connection with the solicitation of proxies for the special meeting. Information concerning persons who may be considered participants in the solicitation of proxies will be set forth in the proxy statement for the special meeting. The proxy statement will be available for free from the websites of the SEC (www.sec.gov) and the Hatteras Funds (hatterasfunds.com).

HATTERAS GPEP FUND II, LLC

December 18, 2013

Dear Member:

NOTICE IS HEREBY GIVEN that a SPECIAL MEETING OF MEMBERS (the “Special Meeting”) of the Hatteras GPEP Fund II, LLC (the “Fund”) will be held on January 21, 2014, at 11:30 a.m., Eastern Time, at 8540 Colonnade Center Drive, Suite 401, Raleigh, NC 27615 to consider and vote on the following proposals (the “Proposals”):

· Proposal 1: To elect eight nominees to the Board of Managers of the Fund;

· Proposal 2: To approve the investment advisory agreement attached hereto as Appendix A between Scotland Acquisition, LLC d/b/a Hatteras Funds, LLC and the Fund;

· Proposal 3: To approve the investment sub-advisory agreement attached hereto as Appendix B among Capvent US Advisors LLC, Scotland Acquisition, LLC d/b/a Hatteras Funds, LLC and the Fund; and

· Proposal 4: To approve the transfer of any amount payable to the Fund’s investment manager in the Fund’s carried interest account to Scotland Acquisition, LLC d/b/a Hatteras Funds, LLC.

Members of record of the Fund at the close of business on November 22, 2013 are entitled to notice of, and to vote on, the Proposals at the Special Meeting or any adjournment thereof.

The question and answer section that begins on the front cover of the enclosed Proxy Statement provides important information about the Proposals. The Proxy Statement itself provides greater detail about the Proposals and their effects on the Fund. The Fund’s Board of Managers recommends that you read the enclosed materials carefully and vote on each of the Proposals.

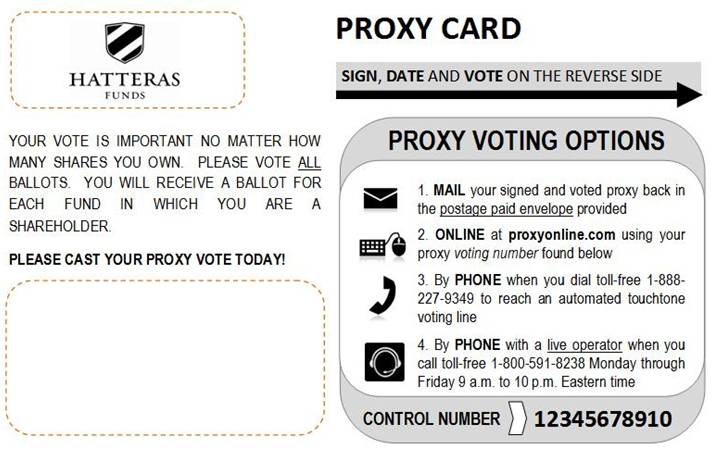

You may choose one of the following options to vote:

· Mail: Complete and return the enclosed proxy card.

· Internet: Access the website shown on your proxy card and follow the online instructions.

· Telephone (automated service): Call the toll-free number shown on your proxy card and follow the recorded instructions.

· In person: Attend the Special Meeting on January 21, 2014.

Your vote is very important to us. Whichever method you choose, please be sure to cast your vote on the Proposals as soon as possible. Even if you plan to attend the Special Meeting in person, you can vote in advance using one of the other methods.

If we do not hear from you in advance of the Special Meeting, we may contact you for your vote. Thank you for your response and for your continued investment with the Fund.

Respectfully,

David B. Perkins

Chief Executive Officer and Chairman of the Board of Managers

Hatteras GPEP Fund II, LLC

IMPORTANT INFORMATION

While we encourage you to read the full text of the enclosed Proxy Statement, for your convenience, we have provided a brief overview of the matters affecting the Hatteras GPEP Fund II, LLC (the “Fund”) that require a vote.

Questions & Answers

Q. Why am I receiving this Proxy Statement?

A. On October 1, 2013, RCS Capital Corporation (the “Company”), a publicly traded Delaware holding company formed to operate and grow businesses focused on the retail direct investment industry, and Scotland Acquisition, LLC d/b/a Hatteras Funds, LLC (the “Purchaser”), a newly formed wholly-owned subsidiary of RCS Advisory Services, LLC, which is an operating subsidiary of the Company, entered into an asset purchase agreement (the “Purchase Agreement”) with certain principals of the Hatteras Funds Group (defined below), Hatteras Investment Partners LLC, Hatteras Investment Management LLC, Hatteras Capital Investment Management, LLC (“HCIM”), Hatteras Alternative Mutual Funds LLC, and Hatteras Capital Investment Partners, LLC (each, a “Hatteras Seller,” and, collectively, the “Hatteras Sellers”), and David Perkins, as the sellers’ representative. Pursuant to the terms of the Purchase Agreement, Purchaser will purchase from the Hatteras Sellers and the Hatteras Sellers will sell to the Purchaser, substantially all the assets related to the business and operations of the Hatteras Sellers and their respective subsidiaries (collectively, the “Hatteras Funds Group”), the Purchaser will assume certain liabilities of such parties and the Company will guarantee certain obligations of the Purchaser (the “Purchase”).

When consummated, the Purchase will result in an “assignment” within the meaning of the Investment Company Act of 1940 (the “1940 Act”) of (i) the existing investment management agreement between HCIM and the Fund (the “HCIM Agreement”), and (ii) the existing investment sub-advisory agreement among HCIM, Capvent US Advisors LLC (“Capvent” or the “Sub-Adviser”) and the Fund (the “Capvent Agreement” and, together with the HCIM Agreement, the “Earlier Agreements”). An investment management agreement automatically terminates upon its assignment pursuant to certain provisions of the 1940 Act. Consequently, to facilitate management of the Fund’s assets, the Board of Managers of the Fund (the “Board”) seeks approval, as described in Proposal 2, necessary to set in place a new investment advisory agreement (the “Advisory Agreement”) for the Fund and approval, described in Proposal 3, necessary to set in place a new investment sub-advisory agreement for the Fund (the “Sub-Advisory Agreement” and, together with the Advisory Agreement, the “Agreements”), each effective as of the date of the Earlier Agreements’ termination.

The Purchase is expected to be consummated in the first quarter of 2014, but is subject to various conditions, including the approval of the Agreements. In connection with the Purchase, an individual recommended by the Purchaser is to be elected to the Board (the Purchaser recommends Peter M. Budko for such election), as described in Proposal 1, and as part of the Purchase, any amount payable to advisory entities in the Fund’s carried interest account is to be transferred to Scotland Acquisition, LLC d/b/a Hatteras Funds, LLC, as described in Proposal 4. Consequently, in addition to recommending approval of the Agreements, the Board, having found the Purchase to be in the best interests of the Fund, recommends approval of Proposal 1 and Proposal 4.

Q. What will happen if the Fund’s members do not approve the Proposals?

A. Effectiveness of each of the Proposals is conditioned on (i) the consummation of the Purchase and (ii) the approval by the Fund’s members of all of the Proposals. In other words, if one or more Proposals is approved by the Fund’s members and one or more Proposals is not, no Proposal shall become effective. If the Fund’s partners do not approve the Proposals at the Special Meeting, or at a postponement or adjournment thereof, the Purchase will not be consummated. If the Purchase is not consummated for any reason, no Proposal shall become effective. If the Proposals do not become effective, the Board may

consider the re-solicitation of proxies and may consider alternatives to the Proposals as it deems appropriate and in the best interests of the Fund.

Q. How will the Agreements affect the Fund?

A. The Fund and its investment objective and policies will not change as a result of the Agreements. The value of your investment will not change. The Advisory Agreement contains substantially similar terms and conditions as the HCIM Agreement and the Sub-Advisory Agreement contains substantially similar terms and conditions as the Capvent Agreement. The Agreements are discussed in more detail in the enclosed Proxy Statement.

Q. Will the investment management fee paid by the Fund be the same upon approval of the Agreements?

A. Yes. The investment management fee rate applicable to the Fund under the Advisory Agreements will be the same as the investment management fee rate applicable to the Fund under the Earlier Agreements.

Q. Who are the nominees for election as Managers?

A. Standing for election to the Board are seven current managers: David B. Perkins, H. Alexander Holmes, Steve E. Moss, Gregory S. Sellers, Daniel K. Wilson, Joseph Breslin and Thomas Mann. An additional nominee, Peter M. Budko, is also standing for election to the Board. Information about each of the nominees is set forth in the Proxy Statement.

Q. How many of the nominees will be Independent Managers if elected?

A. Six of the eight nominees will be Independent Managers (i.e., managers that are not “interested persons” of the Fund as that term is defined in the 1940 Act) if elected. Independent Managers have no affiliation with the Fund, apart from any personal investments they choose to make in the Fund as private individuals. Independent Managers play a critical role in overseeing Fund operations and representing the interests of partners.

Mr. Perkins and Mr. Budko would each be considered an “interested person” of the Fund, as that term is defined in the 1940 Act, and each is referred to as an “Interested Manager.” Each of Mr. Perkins and Mr. Budko would be an “Interested Manager” of the Fund by virtue of his position with the Purchaser.

Q. How long will each Manager serve?

A. Each incumbent Manager and, if elected, the additional nominee may serve on the Board for terms of indefinite duration. A Manager’s position in that capacity will terminate if the Manager is removed or resigns or, among other events, upon the Manager’s death, incapacity, retirement or bankruptcy. A Manager may resign upon written notice to the other Managers of the Fund, and may be removed either by (i) the vote of at least two-thirds of the Managers of the Fund not subject to the removal vote or (ii) the vote of Members of the Fund holding not less than two-thirds of the total number of votes eligible to be cast by all Members of the Fund. In the event of any vacancy in the position of a Manager, the remaining Managers may appoint an individual to serve as a Manager so long as immediately after the appointment at least two-thirds of the Managers then serving have been elected by Members. The Board may call a meeting of the Members to fill any vacancy in the position of a Manager, and must do so if the Managers who were elected by the Members of the Fund cease to constitute a majority of the Managers then serving on the Board.

Q. How will the transfer of the Fund’s carried interest account to the Purchaser affect the Fund?

A. The transfer of the Fund’s carried interest account to the Purchaser is not expected to impact the operations of the Fund and will not impact the value of your investment in the Fund.

Q. How does the Board recommend that I vote?

A. The Board, including all of the Independent Managers, recommends that the Fund’s members vote FOR each of Proposals 1, 2, 3 and 4. The reasons for the Board’s recommendations are discussed in more detail in the enclosed Proxy Statement.

Q. Will the Fund pay for the proxy solicitation and related legal costs?

A. The Fund will bear proxy solicitation and related costs, which are anticipated to be equal to approximately $[ ].

Q. When and where will the Special Meeting be held?

A. The Special Meeting will be held at 8540 Colonnade Center Drive, Suite 401, Raleigh, NC 27615 on January 21, 2014, at 11:30 a.m.

Q. Do I have to attend the Special Meeting in order to vote?

A. No. You may mail in the enclosed proxy card or use the telephone or internet procedures for voting, as set forth below.

Q. How can I vote?

A. You may choose from one of the following options, as described in more detail on the enclosed proxy card:

· Mail: Complete and return the enclosed proxy card.

· Internet: Access the website shown on your proxy card and follow the online instructions.

· Telephone (automated service): Call the toll-free number shown on your proxy card and follow the recorded instructions.

· In person: Attend the Special Meeting on January 21, 2014.

Q. Whom should I contact for additional information or if I have any questions about the enclosed Proxy Statement?

A. Please contact AST Fund Solutions, LLC at [ ].

HATTERAS GPEP FUND II, LLC

8540 COLONNADE CENTER DRIVE

RALEIGH, NORTH CAROLINA 27615

PROXY STATEMENT

Special meeting of members to be held on January 21, 2014

This Proxy Statement is solicited by the Board of Managers of the Hatteras GPEP Fund II, LLC (the “Board” of the “Fund”) for voting at a special meeting (the “Special Meeting” or the “Meeting”) of members of the Fund (“Members”) to be held on January 21, 2014 at 9:00 a.m., at 8540 Colonnade Center Drive, Suite 401, Raleigh, NC 27615. The Fund is limited liability company registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), as a non-diversified, closed-end management investment company. The Fund’s Members hold limited liability company interests (“Interests”) of the Fund.

This Proxy Statement and the enclosed proxy card are expected to be distributed to Partners on or about December 5, 2013. The solicitation of proxies will occur principally by mail, but proxies may also be solicited by telephone, facsimile, Internet or personal interview. A copy of the Proxy Statement is available on the website of the Fund’s current investment adviser, Hatteras Capital Investment Management, LLC (“HCIM”), at hatterasfunds.com/literature.

The cost of preparing, printing and mailing the enclosed proxy card and this Proxy Statement, and all other costs incurred in connection with the solicitation of proxies, including any additional solicitation made by letter, telephone, facsimile or telegraph, will be paid by the Fund. AST Fund Solutions, LLC has been retained to solicit proxies in connection with the Meeting for fees of approximately [ ]. In addition to the solicitation by mail, certain officers and representatives of the Fund, officers and employees of HCIM and certain financial services firms and their representatives, who will receive no extra compensation for their services, may solicit proxies by telephone, facsimile, letter or other electronic means.

The Meeting is being held to consider and vote on the following proposals (the “Proposals”):

· Proposal 1: To elect eight nominees to the Board of Managers of the Fund;

· Proposal 2: To approve the investment advisory agreement attached hereto as Appendix A between Scotland Acquisition, LLC d/b/a Hatteras Funds, LLC and the Fund;

· Proposal 3: To approve the investment sub-advisory agreement attached hereto as Appendix B among Capvent US Advisors LLC, Scotland Acquisition, LLC d/b/a Hatteras Funds, LLC and the Fund; and

· Proposal 4: To approve the transfer of any amount payable to the Fund’s investment manager in the Fund’s carried interest account to Scotland Acquisition, LLC d/b/a Hatteras Funds, LLC.

Transaction of such other business as may properly come before the Meeting and any postponements or adjournments thereof may also be considered.

A proxy card is enclosed with respect to the Interests you own in the Fund. If you return a properly executed proxy card, the investment represented by it will be voted at the Meeting in accordance with the included instructions.

Members are entitled to a number of votes equivalent to the Member’s “Investment Percentage” as of a record date, November 22, 2013 (the “Record Date”). “Investment Percentage” means the percentage of Interests owned by each Member of the total Units of the Fund. HCIM, the current investment adviser to

the Fund, will determine as of the Record Date the number of votes that each Member will be entitled to cast at the Meeting, or at any adjournment or postponement thereof, and will maintain a list setting out the name of each Member and the number of votes that each Member will be entitled to cast at the Meeting, or at any adjournment or postponement thereof. If you do not expect to be present at the Meeting and wish to vote, please complete the enclosed proxy card and mail it in the enclosed reply envelope, or vote by telephone or the Internet as described on the proxy card.

Any Member giving a proxy card may revoke it at any time before it is exercised by submitting to the Fund a written notice of revocation, by the execution of a later-dated proxy card, or by attending the Meeting and voting in person.

The presence in person or by proxy card of Members holding a majority of the total number of votes eligible to be cast by all Members as of the Record Date constitutes a quorum. Votes cast by proxy card or in person at the Special Meeting will be counted by persons appointed by the Fund as inspectors of election for the Special Meeting. The inspectors will count the total number of votes cast “FOR” approval of a Proposal for purposes of determining whether sufficient affirmative votes have been cast. Interests represented by proxy cards that reflect abstentions and “broker non-votes” (i.e., Interests held by brokers or nominees (i) as to which instructions have not been received from the beneficial owners or the persons entitled to vote and (ii) who do not have the discretionary voting power on a particular matter) will be counted as Interests that are present and entitled to vote on the matter for purposes of determining the presence of a quorum. With respect to the election of the Board, neither abstentions nor broker non-votes have an effect on the outcome of the Proposal relating thereto. With respect to any other Proposal, abstentions and broker non-votes have the effect of a negative vote.

If sufficient votes in favor of any of the Proposals set forth in this Proxy Statement are not received by the time scheduled for the Special Meeting, or if a quorum is not present or represented at the Special Meeting, the persons named as proxies may propose postponements or adjournments of the Special Meeting for a reasonable period or periods of time to permit further solicitation of proxy cards. In addition, the persons named as proxies may propose one or more postponements or adjournments if they determine such action to be advisable. Any adjournment will require the affirmative vote of a majority of the votes entitled to be cast on the question in person or by proxy card at the session of the Special Meeting to be adjourned. In the event of an adjournment, no additional notice is required. With respect to any Proposal, the persons named as proxies will vote in favor of adjournment those proxy cards at the Special Meeting that they are entitled to vote in favor of the Proposal and will vote against any such adjournment those proxy cards required to be voted against the Proposal. The Fund pays the costs of any additional solicitation and of any adjourned session. Any Proposals for which sufficient favorable votes have been received by the time of the Special Meeting may be acted upon and considered final regardless of whether the Special Meeting is adjourned with respect to any other Proposal.

The affirmative vote of a plurality of the votes cast is necessary to elect the Board. There is no cumulative voting in the election of Managers. For the purposes of the election of Managers, abstentions and broker non-votes will not be considered votes cast, and do not affect the plurality vote required. The approval of each of the Advisory Agreement and the Sub-Advisory Agreement requires the affirmative vote (measured by capital account balances) of “a majority of the outstanding voting securities” of the Fund, which is defined in the 1940 Act, to mean the vote (i) of 67 percent or more of the interests present at the Special Meeting, if the holders of more than 50 percent of the interests of the Fund outstanding as of the Record Date are present or represented by proxy card, or (ii) of more than 50 percent of the interests of the Fund outstanding as of the Record Date, whichever is less.

The cost of preparing, printing and mailing the enclosed proxy card and this Proxy Statement, and all other costs incurred in connection with the solicitation of proxies, including any additional solicitation made by letter, telephone, facsimile or telegraph, will be paid by the Fund. It is anticipated that the Fund will bear proxy solicitation and related costs equal to approximately $[ ].

For a free copy of the Fund’s annual report as of March 31, 2013 and for the period from June 1, 2012 (commencement of operations) to March 31, 2013, call 888.363.2324, visit hatterasfunds.com or write to the Fund, c/o UMB Fund Services, Inc., P.O. Box 2175, Milwaukee, Wisconsin 53201-2175.

Background regarding the Proposals

On October 1, 2013, RCS Capital Corporation (the “Company”), a publicly traded Delaware holding company formed to operate and grow businesses focused on the retail direct investment industry, and Scotland Acquisition, LLC d/b/a Hatteras Funds, LLC (the “Purchaser”), a newly formed wholly-owned subsidiary of RCS Advisory Services, LLC, which is an operating subsidiary of the Company, entered into an asset purchase agreement (the “Purchase Agreement”) with certain principals of the Hatteras Funds Group (defined below), Hatteras Investment Partners LLC, Hatteras Investment Management LLC, Hatteras Capital Investment Management, LLC (“HCIM”), Hatteras Alternative Mutual Funds LLC, and Hatteras Capital Investment Partners, LLC (each, a “Hatteras Seller,” and, collectively, the “Hatteras Sellers”), and David Perkins, as the sellers’ representative. Pursuant to the terms of the Purchase Agreement, Purchaser will purchase from the Hatteras Sellers and the Hatteras Sellers will sell to the Purchaser, substantially all the assets related to the business and operations of the Hatteras Sellers and their respective subsidiaries (collectively, the “Hatteras Funds Group”), the Purchaser will assume certain liabilities of such parties and the Company will guarantee certain obligations of the Purchaser (the “Purchase”).

When consummated, the Purchase will result in an “assignment” within the meaning of the Investment Company Act of 1940 (the “1940 Act”) of (i) the existing investment management agreement between HCIM and the Fund (the “HCIM Agreement”), and (ii) the existing investment sub-advisory agreement among HCIM, Capvent US Advisors LLC (“Capvent” or the “Sub-Adviser”) and the Fund (the “Capvent Agreement” and, together with the HCIM Agreement, the “Earlier Agreements”). An investment management agreement automatically terminates upon its assignment pursuant to certain provisions of the 1940 Act. Consequently, to facilitate management of the Fund’s assets, the Board of Managers of the Fund (the “Board”) seeks approval, as described in Proposal 2, necessary to set in place a new investment advisory agreement (the “Advisory Agreement”) for the Fund and approval, described in Proposal 3, necessary to set in place a new investment sub-advisory agreement for the Fund (the “Sub-Advisory Agreement” and, together with the Advisory Agreement, the “Agreements”), each effective as of the date of the Earlier Agreements’ termination.

The Purchase is expected to be consummated in the first quarter of 2014, but is subject to various conditions, including the approval of the Agreements. In connection with the Purchase, an individual recommended by the Purchaser is to be elected to the Board (the Purchaser recommends Peter M. Budko for such election), as described in Proposal 1 and as part of the Purchase, any amount payable to advisory entities in the Fund’s carried interest account is to be transferred to Scotland Acquisition, LLC d/b/a Hatteras Funds, LLC, as described in Proposal 4. Consequently, in addition to recommending approval of the Agreements, the Board, having found the Purchase to be in the best interests of the Fund, recommends approval of Proposal 1 and Proposal 4.

Each of these four Proposals is discussed in greater detail below.

PROPOSAL 1

ELECTION OF MANAGERS

The Fund’s Board recommends that Members vote FOR the approval of the election of eight nominees to the Board

At the Special Meeting, the Fund’s Members will be asked to approve the election of eight nominees to the Fund’s Board. In connection with the Purchase, an individual recommended by the Purchaser is to be elected to the Board. The Purchaser has recommended Peter M. Budko for such election. The other seven nominees are current members of the Board. Information regarding the background and expertise of each nominee is set forth below.

NOMINEE WHO IS A CURRENT INTERESTED MANAGER

NAME,

DATE OF

BIRTH | | POSITION(S)

HELD WITH

THE FUND | | LENGTH

OF

TIME

SERVED | | PRINCIPAL

OCCUPATION(S)

AND OTHER

DIRECTORSHIPS

DURING PAST 5 YEARS | | NUMBER OF

PORTFOLIOS IN

FUND COMPLEX

OVERSEEN BY

MANAGER** |

David B. Perkins*

July 18, 1962 | | President and Chairman of the Board of Managers | | Since Inception | | Mr. Perkins has been Chairman of the Board of Managers and President of the Fund since inception. Mr. Perkins is the Chief Executive Officer of Hatteras and its affiliated entities. He founded the firm in September 2003. Prior to that, he was the co-founder and Managing Partner of CapFinancial Partners, LLC. | | 18 |

* �� Mr. Perkins is deemed to be an “interested” Manager because of his affiliation with HCIM (and would continue to be deemed an “interested” Manager because of his affiliation with the Purchaser, should the Proposals be approved).

** The “Fund Complex” consists of the Fund, Hatteras Core Alternatives Fund, L.P., Hatteras Core Alternatives Institutional Fund, L.P., Hatteras Core Alternatives TEI Fund, L.P., Hatteras Core Alternatives TEI Institutional Fund, L.P., Hatteras Master Fund, L.P., Hatteras Global Private Equity Partners Institutional, LLC, Hatteras VC Co-Investment Fund II, LLC, Hatteras Alternative Mutual Funds Trust (consisting of five funds) and Underlying Funds Trust (consisting of five funds).

NOMINEES WHO ARE CURRENT INDEPENDENT MANAGERS

NAME, DATE

OF

BIRTH | | POSITION(S)

HELD WITH

THE FUND | | LENGTH

OF

TIME

SERVED | | PRINCIPAL OCCUPATION(S)

AND OTHER DIRECTORSHIPS

DURING PAST 5 YEARS | | NUMBER OF

PORTFOLIOS

IN FUND

COMPLEX

OVERSEEN

BY

MANAGER |

H. Alexander Holmes

May 4, 1942 | | Manager; Audit Committee Member | | Since Inception | | Mr. Holmes founded Holmes Advisory Services, LLC, a financial consultation firm, in 1993. | | 18 |

| | | | | | | | |

Steve E. Moss

February 18, 1953 | | Manager; Audit Committee Member | | Since Inception | | Mr. Moss is a principal of Holden, Moss, Knott, Clark & Copley, P.A. and has been a member manager of HMKCT Properties, LLC since January 1996. | | 18 |

| | | | | | | | |

Gregory S. Sellers

May 5, 1959 | | Manager; Audit Committee Member | | Since Inception | | Mr. Sellers has been the Chief Financial Officer of Imagemark Business Services, Inc., a strategic communications provider of marketing and print communications solutions, since June 2009. From 2003 to June 2009, Mr. Sellers was the Chief Financial Officer and a director of Kings Plush, Inc., a fabric manufacturer. | | 18 |

| | | | | | | | |

Daniel K. Wilson

June 22, 1948 | | Manager; Audit Committee Member of the Funds | | Since Inception | | Mr. Wilson was Executive Vice President and Chief Financial Officer of Parksdale Mills, Inc. from 2004 - 2008. Mr. Wilson currently is in private practice as a Certified Public Accountant. | | 18 |

| | | | | | | | |

Joseph E. Breslin

November 18, 1953 | | Manager | | Since Inception | | Mr. Breslin is currently a private investor. Mr. Breslin has been a Director of Kinetics Mutual Funds, Inc. (mutual fund) from 2000 to Present (8 portfolios); Trustee, Kinetics Portfolios Trust (mutual fund) from 2000 to Present (8 portfolios). From 2007 to 2009, Mr. Breslin was the Chief Operating Officer of Central Park Credit Holdings, Inc. and prior to that, was the Chief Operating Officer of Aladdin Capital Management LLC, beginning in 2005. | | 18 |

Thomas Mann

February 1, 1950 | | Manager | | Since Inception | | Mr. Mann is currently a private investor. From 2003 until 2012, Mr. Mann was the Managing Director and Group Head Financial Institutions Group, Société Générale, Sales of Capital Market Solutions and Products. Mr. Mann is also a Director of Virtus Global Multi-Sector Income Fund since 2011, Virtus Total Return Fund since 2012, and F-Squared Investments, Inc. since January 2012. | | 18 |

NOMINEE WHO IS NOT CURRENTLY A MANAGER

NAME,

DATE OF

BIRTH | | POSITION(S)

HELD WITH

THE FUND | | LENGTH

OF

TIME

SERVED | | PRINCIPAL

OCCUPATION(S)

AND OTHER

DIRECTORSHIPS

DURING PAST 5

YEARS | | NUMBER OF PORTFOLIOS

IN FUND COMPLEX

OVERSEEN BY NOMINEE |

Peter M. Budko*

[ ] | | Board Nominee | | N/A | | [ ] | | N/A |

* Mr. Budko would be deemed to be an “interested” Manager because of his affiliation with the Purchaser, should the Proposals be approved.

NOMINEE EXPERIENCE, QUALIFICATIONS, ATTRIBUTES AND/OR SKILLS AND THE BASIS ON WHICH NOMINEES ARE EVALUATED

The Board believes that the significance of each nominee’s experience, qualifications, attributes or skills is an individual matter (meaning that experience that is important for one Manager may not have the same value for another) and that these factors are best evaluated at the board level, with no single nominee/Manager, or particular factor, being controlling. The Board determined that each of the nominees is qualified to serve as a Manager of the Fund based on a review of the experience, qualifications, attributes and skills of each nominee. In reaching this determination, the Board has considered a variety of criteria, including, among other things: character and integrity; ability to review critically, evaluate, question and discuss information provided, to exercise effective business judgment in protecting member interests and to interact effectively with the other Managers, investment managers, other service providers, counsel and the independent registered accounting firm; and willingness and ability to commit the time necessary to perform the duties of a manager. In addition, the Board has taken into account the actual service and commitment of each incumbent Manager during his or her tenure (including the Manager’s commitment and participation in board and committee meetings, as well as his current and prior leadership of standing and ad hoc committees) in concluding that each should continue to serve. The Board generally believes that the Board benefits from diversity of background, experience and views among its members, and considers this as a factor in evaluating the composition of such board, but has not adopted any specific policy in this regard. Each nominee’s ability to perform his duties effectively is evidenced by his experience or achievements in the following areas: management or board experience in the investment management industry or companies in other fields; educational background and professional training; and experience as a Manager of the Fund or board member of other funds in the Fund Complex. Information as of March 31,

2013, indicating the specific experience, skills, attributes and qualifications of each nominee, which led to the Board’s determination that the nominee should serve in this capacity, is provided below.

David B. Perkins. Mr. Perkins has been a Manager since inception. He is founder, Chairman of the Board and President of the Fund and other funds in the Fund Complex. Mr. Perkins is also the Chief Executive Officer of the adviser entities in the Fund Complex (“Hatteras Funds”) and founded Hatteras Funds and affiliated entities in September 2003. Mr. Perkins has over 20 years of experience in investment management consulting and institutional and private client relations and offers proven experience building, operating and leading client-focused businesses.

Joseph E. Breslin. Mr. Breslin has been a Manager since inception. He has 25 years of investment management experience and has held positions as the chief operating officer of a financial services company and an investment management company. He currently serves as a director and trustee of other unrelated mutual funds and has held such positions since 2000.

H. Alexander Holmes. Mr. Holmes has been a Manager since inception. He has degrees in law and accounting and spent 25 years in the tax practice of a nationally recognized accounting firm and was a managing partner of one of its offices. He has over 40 years of experience as a tax professional and estate planning consultant and has served on the boards and audit committees of several public companies. He is a retired certified public accountant and the founder of a tax and financial consulting firm advising family businesses and high net worth individuals.

Thomas Mann. Mr. Mann has been a Manager since inception. He has 40 years of asset management and banking experience and is currently a private investor. He is a former managing director of an investment bank.

Steve E. Moss. Mr. Moss has been a Manager since inception. He has over 30 years of public accounting experience advising businesses and high net worth individuals. He is a certified public accountant and is currently a principal of an accounting firm and a manager of a real estate investment partnership.

Gregory S. Sellers. Mr. Sellers has been a Manager since inception. He has over 25 years of experience in finance, including public accounting, and has held positions in private companies as a chief financial officer and vice president of finance. He is currently the chief financial officer of a marketing and print communications solutions company.

Daniel K. Wilson. Mr. Wilson has been a Manager since inception. He has 30 years of finance and accounting experience, primarily as CFO of a large, privately held textile company. He is currently in private practice as a CPA.

[Info on Budko]

Based on all of the foregoing, the Board recommends that Members vote FOR Proposal 1.

PROPOSAL 2

TO APPROVE A NEW INVESTMENT ADVISORY AGREEMENT BETWEEN SCOTLAND ACQUISITION, LLC D/B/A HATTERAS FUNDS, LLC AND THE FUND

The Board recommends that Members vote FOR the Advisory Agreement between the Purchaser and the Fund

At the Special Meeting, Members will be asked to approve the Advisory Agreement between the Purchaser (the “Adviser”) and the Fund. The Advisory Agreement contains substantially similar terms and conditions as the existing HCIM Agreement between HCIM and the Fund. The form of the Advisory Agreement is attached hereto as Appendix A. The Board recommends approval of the Advisory Agreement to replace the HCIM Agreement, which, pursuant to the 1940 Act, will automatically terminate upon its assignment as part of the consummation of the Purchase.

If Members do not approve Proposal 2, the Purchase will not be consummated. The Board may re-solicit proxies, and may consider alternatives to the Purchase as it deems appropriate and in the best interests of the Fund, including the possible liquidation of the Fund.

HCIM and the HCIM Agreement

HCIM currently provides day-to-day investment management services to the Fund pursuant to the HCIM Agreement. HCIM is registered as an investment adviser with the U.S. Securities and Exchange Comission (the “SEC”) under the Investment Advisers Act of 1940 (the “Advisers Act”). As of March 31, 2013, approximately $[1.9 billion] of assets were under the management of HCIM and its affiliates. HCIM’s principal place of business is located at 8540 Colonnade Center Dr., Suite 401, Raleigh, NC 27615, Telephone (888) 363-2324, Facsimile (816) 860-3138.

For the services provided and the expenses assumed pursuant to the HCIM Agreement, the Fund pays HCIM compensation equal to 1.25% on an annualized basis of the net assets of the Fund. Such compensation is paid to HCIM at the end of each quarter. HCIM may, in its discretion and from time to time, waive all or a portion of its fee.

In accordance with the terms of the governing documents of the Fund, HCIM is also entitled to a carried interest once each Member has received a return of 125% of that Member’s capital contributions. After a Member has received distributions and/or repurchase proceeds equal to 125% of its capital contributions, the Fund makes distributions and repurchase proceeds on a 90%/ 5%/ 5% split among the Member, HCIM and Capvent, respectively.

After fee waivers and expense reimbursements, for the fiscal year ended March 31, 2013 HCIM received $[ ] pursuant to the HCIM Agreement.

The Adviser and the Advisory Agreement

If Proposal 2 is approved, the Adviser will assume HCIM’s role in providing day-to-day investment management services to the Fund. The Adviser is a newly-formed Delaware limited liability company.

The following table sets forth the name, position and principal occupation of each chief executive officer and each director of the Adviser as of the consummation of the Purchase. Each individual’s address will be 8540 Colonnade Center Drive, Suite 401, Raleigh, NC 27615.

Name | | Principal Occupation with Adviser |

David B. Perkins | | Chief Executive Officer |

Robert L. Worthington | | President |

J. Michael Fields | | Chief Operating Officer |

R. Lance Baker | | Chief Financial Officer |

Andrew P. Chica | | Chief Compliance Officer |

There were no brokerage commissions paid by the Fund to affiliated brokers of the Adviser for the fiscal year ended March 31, 2013.

A copy of the Advisory Agreement is attached hereto as Appendix A. The following description is only a summary. You should refer to Appendix A for the Advisory Agreement, and the description set forth in this Proxy Statement of the Advisory Agreement is qualified in its entirety by reference to Appendix A.

Advisory Services. Similar to HCIM’s services under the HCIM Agreement, under the Advisory Agreement, the Fund employs the Adviser to furnish and manage a continuous investment program for the Fund. The Adviser will continuously review, supervise and (where appropriate) administer the investment program of the Fund, to determine in its discretion (where appropriate) the securities to be purchased, held, sold or exchanged, to provide the Fund with records concerning the Adviser’s activities which the Fund is required to maintain and to render regular reports to the Fund’s officers and Managers concerning the Adviser’s discharge of the foregoing responsibilities. The Adviser may hire (subject to the approval of the Board and, except as otherwise permitted under the terms of any applicable exemptive relief obtained from the Securities and Exchange Commission, or by rule or regulation, a majority of the outstanding voting securities of the Fund) and thereafter supervise the investment activities of one or more sub-advisers deemed necessary to carry out the investment program of the Fund. The retention of a sub-adviser by the Adviser shall not relieve the Adviser of its responsibilities under the Advisory Agreement.

The Adviser shall discharge the foregoing responsibilities subject to the control of the Board and in compliance with such policies as the Board may from time to time establish, with the objectives, policies, and limitations for the Fund set forth in the Fund’s registration statement as amended from time to time, and with applicable laws and regulations.

Brokerage. Like the HCIM Agreement, the Advisory Agreement provides that the Adviser is authorized to select the brokers or dealers that will execute the purchases and sales of portfolio securities for the Fund and is directed to use its best efforts to obtain “best execution,” considering the Fund’s investment objectives, policies, and restrictions as stated in the Fund’s Private Placement Memorandum and Statement of Additional Information, as the same may be amended, supplemented or restated from time to time, and resolutions of the Fund’s Board. The Adviser will promptly communicate to the officers and the Board such information relating to portfolio transactions as they may reasonably request.

It is understood that the Adviser will not be deemed to have acted unlawfully, or to have breached a fiduciary duty to the Fund or be in breach of any obligation owing to the Fund under this Agreement, or otherwise, by reason of its having directed a securities transaction on behalf of the Fund to a broker-dealer in compliance with the provisions of Section 28(e) of the Securities Exchange Act of 1934 or as described from time to time by the Fund’s Private Placement Memorandum and Statement of Additional Information.

Advisory Fees. The Advisory Agreement contains a fee structure identical to that of the HCIM Agreement. For the services provided and the expenses assumed pursuant to the HCIM Agreement, the Fund pays HCIM compensation equal to 1.25% on an annualized basis of the net assets of the Fund. Such compensation is paid to HCIM at the end of each quarter. HCIM may, in its discretion and from time to time, waive all or a portion of its fee.

Like the HCIM Agreement, pursuant to the Advisory Agreement, and in accordance with the terms of the governing documents of the Fund, the Adviser is also entitled to a carried interest once each Member has received a return of 125% of that Member’s capital contributions. After a Member has received distributions and/or repurchase proceeds equal to 125% of its capital contributions, the Fund makes distributions and repurchase proceeds payments on a 90%/ 5%/ 5% split among the Member, the Adviser and Capvent, respectively.

Duration and Termination. Like the HCIM Agreement, the Advisory Agreement provides that, unless sooner terminated as provided therein, it shall remain in effect until two years from date of execution, and thereafter, for periods of one year so long as such continuance thereafter is specifically approved at least annually (a) by the vote of a majority of those Managers of the Board who are not parties to the Advisory Agreement or interested persons of any party to the Advisory Agreement, cast in person at a meeting called for the purpose of voting on such approval, and (b) by a vote of a majority of the Fund’s Board or by vote of a majority of the outstanding voting securities of the Fund; provided, however, that if the shareholders of the Fund fail to approve the Advisory Agreement as provided therein, the Adviser may continue to serve thereunder in the manner and to the extent permitted by the 1940 Act and rules and regulations thereunder. The foregoing requirement that continuance of the Advisory Agreement be “specifically approved at least annually” shall be construed in a manner consistent with the 1940 Act and the rules and regulations thereunder.

Notwithstanding the foregoing, the Advisory Agreement may be terminated as to the Fund at any time, without the payment of any penalty by vote of a majority of members of the Board or by vote of a majority of the outstanding voting securities of the Fund on 60 days’ written notice to the Adviser, or by the Adviser at any time without the payment of any penalty, on 60 days’ written notice to the Fund. The Advisory Agreement will automatically and immediately terminate in the event of its assignment.

Limitation on Liability and Indemnification. Like the HCIM Agreement, the Advisory Agreement provides that the Fund shall indemnify and hold harmless the Adviser, all affiliated persons thereof (within the meaning of Section 2(a)(3) of the 1940 Act) and all controlling persons (as described in Section 15 of the Securities Act of 1933, as amended (“1933 Act”)) (collectively, “Adviser Indemnitees”) against, any and all losses, claims, damages, liabilities or litigation (including reasonable legal and other expenses) to which any of the Adviser Indemnitees may become subject under the 1933 Act, the 1940 Act, the Advisers Act, or under any other statute, at common law or otherwise (“Losses”) except to the extent such Losses shall have been finally determined in a non-appealable decision on the merits in any such action, suit, investigation or other proceeding to have been incurred or suffered by such Adviser Indemnitee by reason of willful misfeasance, gross negligence, or reckless disregard of the duties involved in the conduct of such Adviser Indemnitee’s office.

Like the HCIM Agreement, the Advisory Agreement also provides that the Adviser shall indemnify and hold harmless the Fund, all affiliated persons thereof (within the meaning of Section 2(a)(3) of the 1940 Act) and all controlling persons (as described in Section 15 of the 1933 Act) (collectively, “Fund Indemnitees”) against, any and all losses, claims, damages, liabilities or litigation (including reasonable legal and other expenses) to which any of the Fund Indemnitees may become subject under the 1933 Act, the 1940 Act, the Advisers Act, or under any other statute, at common law or otherwise (“Fund Losses”) except to the extent such Fund Losses shall have been finally determined in a non-appealable decision on the merits in any such action, suit, investigation or other proceeding to have been incurred or suffered by such Fund Indemnitee by reason of willful misfeasance, gross negligence, or reckless disregard of the duties involved in the conduct of such Fund Indemnitee’s office.

BOARD APPROVAL AND RECOMMENDATION OF THE ADVISORY AGREEMENT

In reaching its decision to approve the Advisory Agreement, the members of the Fund Board (the “Managers”), including all of the “Independent Managers” (i.e., Managers that are not “interested persons” of the Fund as that term is defined in the 1940 Act), met in person at a meeting held on November 22, 2013 with senior executives of the Adviser. The Board reviewed information about the Purchase and its potential impact on the Fund, reviewed information about the Company, the Purchaser and their affiliates

and considered the terms of the Advisory Agreement. The Independent Managers also reviewed information concerning advisory and service fees to be paid to the Adviser by the Funds, certain service fees to be paid by the Adviser to a broker-dealer affiliate, as well as an expense sharing arrangement between RSC Capital Corporation and Hatteras Funds, LLC. The Board and legal counsel to the Independent Managers had an opportunity to review the information provided in advance of the meeting by the Adviser, including information pursuant to the requirements of Section 15(c) of the 1940 Act. This information also included materials requested by legal counsel to the Independent Managers that provided details concerning the terms of the Purchase and the financial stability of the Adviser.

The Independent Managers discussed the details of the Purchase with representatives of the Adviser and the Fund’s current investment adviser, HCIM. The Independent Managers noted that the Adviser will be a newly registered investment adviser. Following the Purchase, the Adviser will operate as an indirect subsidiary of RCS Capital Corporation. The sole owner of the Adviser will be RCS Advisory Services LLC, an operating subsidiary of RCS Capital Corporation. The Independent Managers discussed that there were no expected changes in the portfolio managers currently providing advisory services to the Fund as a result of the Purchase, and reviewed the background and experience of each of the portfolio managers. Further, the Independent Managers discussed with the Adviser whether the services to be provided to the Fund were expected to change as a result of the Purchase. The Adviser noted that the advisory services to be provided to the Fund are not expected to change, including the manner in which investment decisions are made and executed. The Board noted that the Fund’s investment objective and policies are not expected to change as a result of the Purchase.

The Independent Managers also considered that Realty Capital Securities, LLC, an affiliate of the Adviser, entered into an Acceptance, Waiver & Consent with FINRA and paid a nominal fine imposed by FINRA in connection with certain of its activities as a broker-dealer. Realty Capital Securities LLC is also named in an arbitration brought by another broker-dealer. The Adviser did not believe that these regulatory actions, fines or the arbitration would have a material impact on its management of the Fund.

In the course of their review, the Managers considered their legal responsibilities with regard to all factors deemed to be relevant to the Fund, including, but not limited to the following: (1) the quality of services to be provided to the Fund; (2) the performance of the Fund; (3) the Fund’s advisory fee and overall Fund expenses; (4) the fact that the Purchase is not expected to affect the manner in which the Fund is advised; (5) the fact that the current portfolio management team will continue to manage the Fund; (6) the fact that the fee structure under the Advisory Agreement would be identical to the fee structure under the HCIM Agreement; (7) payments by the Fund to the Adviser pursuant to a Servicing Agreement, (8) payments of service fees to an affiliated broker-dealer of the Adviser, (9) an expense sharing arrangement between the Adviser and its parent, RCS Capital Corporation, and (10) other factors deemed relevant by the Board, including the Adviser’s and Capvent’s investment process, and the particular services to be provided to the Fund by the Adviser and Capvent.

The Independent Managers reviewed, and discussed with the Adviser, comparative performance, advisory fee and overall Fund expense information for the Fund versus other similar closed-end hedge fund of funds. The Independent Managers noted that the Adviser stated that there were few truly comparative funds. The Adviser discussed with the Independent Managers the construction of the comparative fund group. The Independent Managers also discussed with the Adviser the underperformance of the Fund versus its comparative fund group. The Adviser also provided comparative performance information for the Fund versus two recognized private equity benchmarks, compiled by Prequin and Cambridge, which the Adviser believed to be more appropriate comparative performance benchmarks. Independent Manager’s counsel discussed with representatives of the Adviser the process used by the Adviser for determining appropriate comparative funds and indexes for the Fund.

The Managers evaluated the Advisory Agreement in light of information they had requested and received from the Adviser prior to the meeting. The Managers reviewed these materials with management of the Adviser, legal counsel to the Fund and the Adviser, and legal counsel to the Independent Managers. The Independent Managers also discussed the Advisory Agreement in an executive session, at which no representatives of the Adviser were present. The Managers considered whether the Advisory Agreement

would be in the best interests of the Fund and its Members and the overall fairness of the Advisory Agreement. Among other things, the Managers reviewed information concerning: (1) the nature, extent and quality of the services to be provided by the Adviser; (2) the Fund’s investment performance; (3) the cost of the services provided and the profits realized by the Adviser and its affiliates from their relationship with the Fund; (4) the extent to which economies of scale will be realized as the Fund grows and the extent to which fee levels reflect such economies of scale, if any, for the benefit of the Fund’s Members; and (5) ancillary benefits and other factors, including any fees to be paid to the Adviser pursuant to any other agreement. In their deliberations, the Managers did not rank the importance of any particular piece of information or factor considered, and it is presumed that each Manager attributed different weights to the various factors.

Nature, Extent and Quality of Services Provided to the Fund.

The Board considered information it believed necessary to assess the stability of the Adviser as a result of the Purchase and to assess the nature, extent and quality of services to be provided to the Fund by the Adviser following the closing of the Purchase. The Board members noted the Adviser will be a newly registered investment adviser, and that the Fund’s current portfolio managers will continue to provide services to the Fund following the Purchase. The Board members determined that the advisory services to be provided by the portfolio managers, after considering their background and experience, would continue to be a benefit to the Fund. The Board members considered that the advisory services to be provided to the Fund after the Purchase are not expected to change. Further, the Board members considered the advisory and other services to be provided by the Adviser, as well as the services to be provided by Capvent as sub-adviser. The Board members considered that the Fund’s investment objective and policies are not expected to change as a result of the Purchase.

Investment Performance of the Fund.

The Managers considered the investment experience of the Adviser, including the performance of the Fund. The Managers and their counsel asked several questions about the Fund’s relative underperformance against certain peer funds. The Board members noted that the Fund’s performance returns were lower than the performance of each unaffiliated fund in the comparative group of peer funds. The Managers also considered the Fund’s performance versus two benchmark indices identified by the Adviser, noting that the Fund’s performance compared more favorably versus these benchmarks.

Costs of Services Provided and Profits Realized by the Adviser

In connection with the Managers’ consideration of the level of the advisory fees, the Managers considered a number of factors. The Board members noted that the advisory fee rate to be paid to the Adviser under the Advisory Agreement is the same as the advisory fee rate paid by the Fund to HCIM under the HCIM Agreement. The Board members also considered that the Adviser may receive a distribution from the Fund, after shareholders have received distributions and/or repurchase proceeds equal to 125% of its capital contributions. This is same distribution rate provided for in the HCIM Agreement. Based on current Fund asset levels, management indicated that the Adviser earned a small profit margin providing services to the Fund. The Board members considered the relative profitability of the Adviser and Capvent with respect to the services they each provide to the Fund.

The Managers’ analysis of the Fund’s advisory fee and overall expenses included a discussion and review of data concerning the current fee and expense ratios of the Fund compared to a peer group. The Managers considered peer group rankings, noting that the Fund’s advisory fee and overall expense ratio was within the range of fees and expenses paid by funds in the peer group. The Board noted, however, that the Fund’s overall expenses were the highest among the funds in the comparative peer group.

Economies of Scale and Fee Levels Reflecting Those Economies.

The Managers considered the extent to which economies of scale were expected to be realized relative to fee levels, and whether the advisory fee levels reflect these economies of scale for the benefit of the Fund.

The Managers noted that the Fund is now closed to new investors, and did not consider the possibility of breakpoints in advisory fees for the Fund.

Other Benefits.

In addition to the above factors, the Managers also discussed other benefits received by the Adviser from its management of the Fund. The Board noted that the Adviser receives a Fund Servicing Fee for its services as Servicing Agent to the Fund under a fund servicing agreement. It was noted that the Adviser may waive (to all investors on a pro rata basis) or pay to third parties all or a portion of the Fund Servicing Fee in its sole discretion. The Board also noted that a broker-dealer affiliated with the Adviser, Hatteras Capital Distributors, LLC, receives service fees from the Adviser with respect to the Fund. The Managers considered that the Adviser and RCS Capital Corporation will enter into an expense sharing arrangement whereby a portion of Realty Capital Securities’ base distribution costs will be allocated to the Adviser based on the ratio of Fund sales to total firm security sales. Realty Capital Securities is RCS Capital Corporation’s affiliated broker-dealer.

Section 15(f) and Rule 15a-4 of the 1940 Act.

The Managers also considered whether the arrangement between the Adviser and the Fund complies with the conditions of Section 15(f) of the 1940 Act. Section 15(f) provides a non-exclusive safe harbor for an investment adviser to an investment company or any of its affiliated persons to receive any amount or benefit in connection with a change in control of the investment adviser so long as two conditions are met. First, for a period of three years after closing of the transaction, at least 75% of the board members of the Fund cannot be “interested persons” (as defined in the 1940 Act) of the investment adviser or predecessor adviser. Second, an “unfair burden” must not be imposed upon the Fund as a result of the transaction or any express or implied terms, conditions or understandings applicable thereto. The term “unfair burden” is defined in Section 15(f) to include any arrangement during the two-year period after the closing of the transaction whereby the investment adviser (or predecessor or successor adviser) or any interested person of any such investment adviser, receives or is entitled to receive any compensation, directly or indirectly, from the Fund or its partners (other than fees for bona fide investment advisory or other services) or from any person in connection with the purchase or sale of securities or other property to, from or on behalf of the Fund (other than bona fide ordinary compensation as principal underwriter for the Fund).

In connection with the first condition of Section 15(f), the Managers noted that at least 75% of the Fund’s Managers are currently not “interested persons” (as defined in the 1940 Act) of the Adviser in compliance with this provision of Section 15(f). With respect to the second condition of Section 15(f), the Adviser has represented that the Purchase will not have an economic impact on the Adviser’s ability to provide services to the Fund and no fee increases are contemplated and that, the Purchase will not result in an “unfair burden” (as defined in Section 15(f)) during the two-year period following the closing of the Purchase. The Adviser has represented that neither the Adviser nor any interested person of the Adviser will receive any compensation from the Master Fund or its partners, except as permitted pursuant to Section 15(f).

The Board also considered the requirements of Rule 15a-4, as described herein.

Based on all of the foregoing, the Board recommends that Members vote FOR Proposal 2 to approve the Advisory Agreement.

PROPOSAL 3

TO APPROVE A NEW INVESTMENT SUB-ADVISORY AGREEMENT AMONG CAPVENT US ADVISORS LLC, SCOTLAND ACQUISITION, LLC D/B/A HATTERAS FUNDS, LLC AND THE FUND

The Board recommends that Members vote FOR the Sub-Advisory Agreement among Capvent US Advisors LLC, the Purchaser and the Fund

At the Special Meeting, Members will be asked to approve the Sub-Advisory Agreement among Capvent US Advisors LLC (“Capvent” or the “Sub-Adviser”), the Purchaser and the Fund. The Sub-Advisory Agreement contains substantially similar terms and conditions as the existing Capvent Agreement among Capvent, HCIM and the Fund. The form of the Sub-Advisory Agreement is attached hereto as Appendix B. The Board recommends approval of the Sub-Advisory Agreement to replace the Capvent Agreement, which, pursuant to the 1940 Act, will automatically terminate upon its assignment as part of the consummation of the Purchase.

If Members do not approve Proposal 3, the Purchase will not be consummated. The Board may re-solicit proxies, and may consider alternatives to the Purchase as it deems appropriate and in the best interests of the Fund, including the possible liquidation of the Fund.

Capvent and the Capvent Agreement

Capvent currently provides day-to-day investment management services to the Fund pursuant to the Capvent Agreement. Capvent is registered as an investment adviser with the U.S. Securities and Exchange Comission (the “SEC”) under the Investment Advisers Act of 1940 (the “Advisers Act”). As of March 31, 2013, approximately $[ ] of assets were under the management of Capvent and its affiliates. Capvent’s principal place of business is located at [ ].

For the services provided and the expenses assumed pursuant to the Capvent Agreement, the Adviser will pay the Sub-Adviser a quarterly advisory fee with respect to the Fund equal to 0.625% on an annualized basis of the net asset value of the Fund. Except as may otherwise be prohibited by law or regulation (including, without limitation, any then current SEC staff interpretation), the Sub-Adviser may, in its discretion and from time to time, waive all or any portion of its advisory fee.

In accordance with the terms of the governing documents of the Fund, the Sub-Adviser is also entitled to a carried interest once each Member has received a return of 125% of that Member’s capital contributions. After a Member has received distributions and/or repurchase proceeds equal to 125% of its capital contributions, the Fund makes distributions and repurchase proceeds on a 90%/ 5%/ 5% split among the Member, HCIM and Capvent, respectively.

After fee waivers and expense reimbursements, for the fiscal year ended March 31, 2013 Capvent received $[ ] pursuant to the Capvent Agreement.

The Sub-Advisory Agreement

If Proposal 3 is approved, the Capvent, as Sub-Adviser, will continue in its role providing day-to-day investment management services to the Fund.

The following table sets forth the name, position and principal occupation of each chief executive officer and each director of the Sub-Adviser as of [ ]. Each individual’s address is [ ].

Name | | Principal Occupation with Adviser |

[ ] | | [ ] |

There were no brokerage commissions paid by the Fund to affiliated brokers of the Adviser for the fiscal year ended March 31, 2013.

A copy of the Sub-Advisory Agreement is attached hereto as Appendix B. The following description is only a summary. You should refer to Appendix B for the Sub-Advisory Agreement, and the description set forth in this Proxy Statement of the Sub-Advisory Agreement is qualified in its entirety by reference to Appendix B.

Advisory Services. Similar to Capvent’s services under the Capvent Agreement, under the Sub-Advisory Agreement, the Sub-Adviser will be involved with all aspects of the Fund’s investment program including, without limitation, asset allocation, portfolio construction, and manager search and selection. As part of the services it will provide hereunder, the Sub-Adviser will: (i) obtain and evaluate, to the extent deemed necessary and advisable by the Sub-Adviser in its discretion, pertinent economic, statistical, financial, and other information affecting the economy generally and individual underlying funds, companies or industries; (ii) formulate and implement a continuous investment program for the Fund as outlined in the Fund’s offering materials; (iii) take whatever steps are necessary to implement the investment program for the Fund including, without limitation, securing capacity with underlying funds; (iv) perform extensive preliminary due diligence on underlying funds and managers and provide formal written recommendations to the Adviser for each investment; (v) keep the Managers of the Fund and the Adviser fully informed in writing on an ongoing basis as agreed by the Adviser and the Sub-Adviser as to (1) all material facts concerning the investment and reinvestment of the assets in the Fund and (2) the Sub-Adviser and its key investment personnel and operations, make regular and periodic special written reports of such additional information concerning the same as may reasonably be requested from time to time by the Adviser or the Managers of the Fund; and attend meetings with the Adviser and/or the Managers, as reasonably requested, to discuss the foregoing; (vi) in accordance with procedures and methods established by the Managers of the Fund, which may be amended from time to time, provide assistance in determining the fair value of all securities and other investments/assets in the Fund; (vii) provide any and all material composite performance information, records and supporting documentation about accounts the Sub-Adviser manages, if appropriate, which are relevant to the Fund and that have investment objectives, policies, and strategies substantially similar to those employed by the Sub-Adviser in managing the Fund that may be reasonably necessary, under applicable laws, to allow the Fund or its agent to present information concerning the Sub-Adviser’s prior performance in any offering materials and any permissible reports and materials prepared by the Fund; and (viii) cooperate with and provide reasonable assistance to the Adviser, the Fund’s administrator, the Fund’s custodian and foreign custodians, the Fund’s transfer agent and pricing agents and all other agents and representatives of the Fund and the Adviser; keep all such persons fully informed as to such matters as they may reasonably deem necessary to the performance of their obligations to the Fund and the Adviser; provide prompt responses to reasonable requests made by such persons; and maintain any appropriate interfaces with each such person so as to promote the efficient exchange of information.

Advisory Fees. The Advisory Agreement contains a fee structure identical to that of the Capvent Agreement. For the services provided and the expenses assumed pursuant to the Capvent Agreement, the Adviser will pay the Sub-Adviser a quarterly advisory fee with respect to the Fund equal to 0.625% on an annualized basis of the net asset value of the Fund. Except as may otherwise be prohibited by law or regulation (including, without limitation, any then current SEC staff interpretation), the Sub-Adviser may, in its discretion and from time to time, waive all or any portion of its advisory fee.

In accordance with the terms of the governing documents of the Fund, the Sub-Adviser also will be entitled to a carried interest once each Member has received a return of 125% of that Member’s capital contributions. After a Member has received distributions and/or repurchase proceeds equal to 125% of its capital contributions, the Fund will make distributions and repurchase proceeds payments on a 90%/ 5%/ 5% split among the Member, Adviser and Sub-Adviser, respectively.

Duration and Termination. Like the Capvent Agreement, the Sub-Advisory Agreement provides that it shall not take effect unless it has first been approved: (i) by a vote of a majority of the Independent Managers, cast in person at a meeting called for the purpose of voting on such approval, and (ii) by vote of

a majority of the Fund’s outstanding voting securities. The Sub-Advisory Agreement shall continue in effect for a period of more than two years from the date of its execution only so long as such continuance is specifically approved at least annually by the Board of Managers provided that in such event such continuance shall also be approved by the vote of a majority of the Independent Managers cast in person at a meeting called for the purpose of voting on such approval. Like the Capvent Agreement, the Sub-Advisory Agreement may be terminated at any time, without the payment of any penalty, by the Board of Managers, including a majority of the Independent Managers, or by the vote of a majority of the outstanding voting securities of the Fund, on sixty (60) days’ written notice to the Adviser and the Sub-Adviser, or by the Adviser or Sub-Adviser on sixty (60) days’ written notice to the Fund and the other party. The Sub-Advisory Agreement will automatically terminate, without the payment of any penalty, (i) in the event of its assignment, or (ii) in the event the Advisory Agreement between the Adviser and the Fund is assigned or terminates for any other reason. The Sub-Advisory Agreement will also terminate upon written notice to the other party that the other party is in material breach of the Sub-Advisory Agreement, unless the party in material breach of this Agreement cures such breach to the reasonable satisfaction of the party alleging the breach within thirty (30) days after written notice.

Limitation on Liability and Indemnification. Like the Capvent Agreement, the Sub-Advisory Agreement provides that, except as may be provided by federal securities law, neither the Sub-Adviser nor any of its officers, directors, partners, members or employees (its “Affiliates”) shall be liable for any losses, claims, damages, liabilities or litigation (including legal and other expenses) incurred or suffered by the Adviser or the Fund as a result of any error of judgment or mistake of law by the Sub-Adviser or its Affiliates with respect to the Fund, except that nothing in this Agreement shall operate or purport to operate in any way to exculpate, waive or limit the liability of the Sub-Adviser or its Affiliates for, and the Sub-Adviser shall indemnify and hold harmless the Fund, the Adviser, all affiliated persons thereof (within the meaning of Section 2(a)(3) of the 1940 Act) and all controlling persons (as described in Section 15 of the 1933 Act) (collectively, “Adviser Indemnitees”) against, any and all losses, claims, damages, liabilities or litigation (including reasonable legal and other expenses) to which any of the Adviser Indemnitees may become subject under the 1933 Act, the 1940 Act, the Advisers Act, or under any other statute, at common law or otherwise arising out of or based on (i) any willful misconduct, bad faith, reckless disregard or gross negligence of the Sub-Adviser in the performance of any of its duties or obligations hereunder or (ii) any untrue statement of a material fact contained in any offering materials, proxy materials, reports, advertisements, sales literature, or other materials pertaining to the Fund or the omission to state therein a material fact known to the Sub-Adviser which was required to be stated therein or necessary to make the statements therein not misleading, if such statement or omission was made in reliance upon written information furnished to the Adviser or the Fund by the Sub-Adviser Indemnitees (as defined below) for use therein.

Like the Capvent Agreement, the Sub-Advisory Agreement also provides that the Fund and their respective Affiliates shall not be liable for any losses, claims, damages, liabilities or litigation (including legal and other expenses) incurred or suffered by the Sub-Adviser as a result of any error of judgment or mistake of law by the Adviser, the Fund and their respective Affiliates with respect to the Fund, except that nothing in this Agreement shall operate or purport to operate in any way to exculpate, waive or limit the liability of the Adviser for, and the Adviser shall indemnify and hold harmless the Sub-Adviser, all affiliated persons thereof (within the meaning of Section 2(a)(3) of the Investment Company Act) and all controlling persons (as described in Section 15 of the 1933 Act) (collectively, “Sub-Adviser Indemnitees”) against any and all losses, claims, damages, liabilities or litigation (including reasonable legal and other expenses) to which any of the Sub-Adviser Indemnitees may become subject under the 1933 Act, the 1940 Act, the Advisers Act, or under any other statute, at common law or otherwise arising out of or based on (i) any willful misconduct, bad faith, reckless disregard or gross negligence of the Adviser in the performance of any of its duties or obligations hereunder or (ii) any untrue statement of a material fact contained in any offering materials, proxy materials, reports, advertisements, sales literature, or other materials pertaining to the Fund or the omission to state therein a material fact known to the Adviser that was required to be stated therein or necessary to make the statements therein not misleading, unless such statement or omission was made in reliance upon information furnished to the Sub-Adviser or the Fund by the Adviser Indemnitees for use therein.

BOARD APPROVAL AND RECOMMENDATION OF THE SUB-ADVISORY AGREEMENT