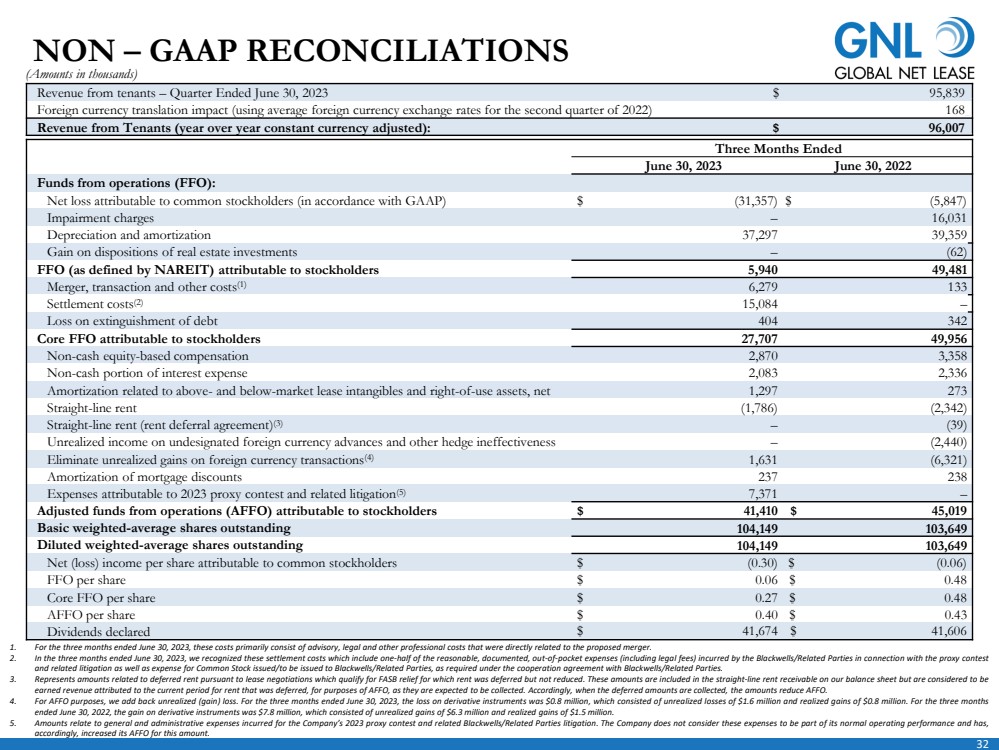

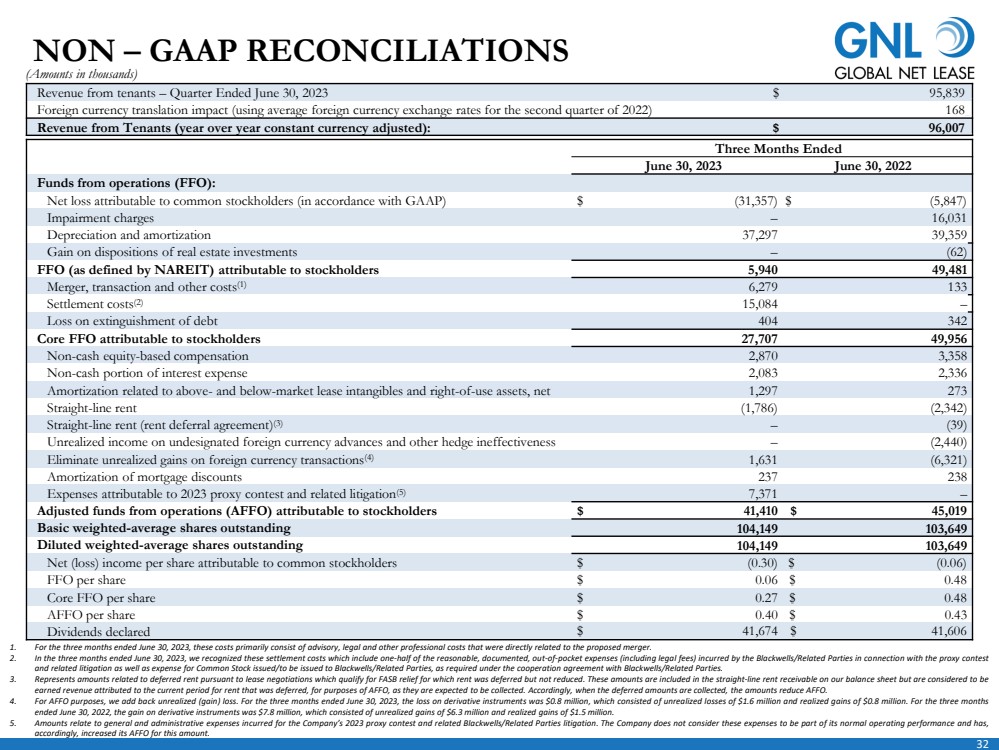

| 32 NON – GAAP RECONCILIATIONS Revenue from tenants – Quarter Ended June 30, 2023 $ 95,839_ Foreign currency translation impact (using average foreign currency exchange rates for the second quarter of 2022) 168_ Revenue from Tenants (year over year constant currency adjusted): $ 96,007_ (Amounts in thousands) Three Months Ended June 30, 2023 June 30, 2022 Funds from operations (FFO): Net loss attributable to common stockholders (in accordance with GAAP) $ (31,357) $ (5,847) Impairment charges – 16,031 Depreciation and amortization 37,297 39,359 Gain on dispositions of real estate investments – (62) FFO (as defined by NAREIT) attributable to stockholders 5,940 49,481 Merger, transaction and other costs(1) 6,279 133 Settlement costs(2) 15,084 – Loss on extinguishment of debt 404 342 Core FFO attributable to stockholders 27,707 49,956 Non-cash equity-based compensation 2,870 3,358 Non-cash portion of interest expense 2,083 2,336 Amortization related to above- and below-market lease intangibles and right-of-use assets, net 1,297 273 Straight-line rent (1,786) (2,342) Straight-line rent (rent deferral agreement)(3) – (39) Unrealized income on undesignated foreign currency advances and other hedge ineffectiveness – (2,440) Eliminate unrealized gains on foreign currency transactions(4) 1,631 (6,321) Amortization of mortgage discounts 237 238 Expenses attributable to 2023 proxy contest and related litigation(5) 7,371 – Adjusted funds from operations (AFFO) attributable to stockholders $ 41,410 $ 45,019 Basic weighted-average shares outstanding 104,149 103,649 Diluted weighted-average shares outstanding 104,149 103,649 Net (loss) income per share attributable to common stockholders $ (0.30) $ (0.06) FFO per share $ 0.06 $ 0.48 Core FFO per share $ 0.27 $ 0.48 AFFO per share $ 0.40 $ 0.43 Dividends declared $ 41,674 $ 41,606 1. For the three months ended June 30, 2023, these costs primarily consist of advisory, legal and other professional costs that were directly related to the proposed merger. 2. In the three months ended June 30, 2023, we recognized these settlement costs which include one-half of the reasonable, documented, out-of-pocket expenses (including legal fees) incurred by the Blackwells/Related Parties in connection with the proxy contest and related litigation as well as expense for Common Stock issued/to be issued to Blackwells/Related Parties, as required under the cooperation agreement with Blackwells/Related Parties. 3. Represents amounts related to deferred rent pursuant to lease negotiations which qualify for FASB relief for which rent was deferred but not reduced. These amounts are included in the straight-line rent receivable on our balance sheet but are considered to be earned revenue attributed to the current period for rent that was deferred, for purposes of AFFO, as they are expected to be collected. Accordingly, when the deferred amounts are collected, the amounts reduce AFFO. 4. For AFFO purposes, we add back unrealized (gain) loss. For the three months ended June 30, 2023, the loss on derivative instruments was $0.8 million, which consisted of unrealized losses of $1.6 million and realized gains of $0.8 million. For the three months ended June 30, 2022, the gain on derivative instruments was $7.8 million, which consisted of unrealized gains of $6.3 million and realized gains of $1.5 million. 5. Amounts relate to general and administrative expenses incurred for the Company’s 2023 proxy contest and related Blackwells/Related Parties litigation. The Company does not consider these expenses to be part of its normal operating performance and has, accordingly, increased its AFFO for this amount. |