Exhibit 10.29

Loan Agreement between

ARC RMNUSGER01 LLC

and

Deutsche Pfandbriefbank AG

Execution Copy

LOAN AGREEMENT

(- hereinafter referred to as theAgreement -)

between

ARC RMNUSGER01 LLC

c/o Corporation Service Company,

2711, Centerville Road, Suite 400,

Wilmington, New Castle County, Delaware 19808

USA

(- hereinafter referred to as theBorrower -)

and

DEUTSCHE PFANDBRIEFBANK AG

Local Court of Munich HRB 41054

Freisinger Straße 5

85716 Unterschleißheim

Germany

(- hereinafter referred to as theBank -)

Loan Agreement between

ARC RMNUSGER01 LLC

and

Deutsche Pfandbriefbank AG

Contents

| 1. | Preamble | 3 |

| 2. | Definitions | 5 |

| 3. | Facility | 7 |

| 4. | Purpose | 7 |

| 5. | Term | 7 |

| 6. | Availability | 7 |

| 7. | Equity Contribution | 7 |

| 8. | Utilization | 7 |

| 9. | Interest | 8 |

| 10. | Default Interest | 10 |

| 11. | Repayment / Prepayment | 10 |

| 12. | Fees and Costs | 12 |

| 13. | Tax Gross up and FATCA-Compliance | 13 |

| 14. | Collateral | 15 |

| 15. | Conditions Precedent | 15 |

| 16. | Representations | 16 |

| 17. | Information | 19 |

| 18. | Financial Covenants | 22 |

| 19. | Undertakings | 24 |

| 20. | Cash Trap / Cash Sweep | 29 |

| 21. | Termination | 29 |

| 22. | Indemnification, Prepayment Costs and Prepayment Fee | 31 |

| 23. | Payments | 32 |

| 24. | Assignments and Transfers by the Bank / Exemption from Banking Secrecy | 33 |

| 25. | Assignments and Transfers by the Borrower | 34 |

| 26. | Statute of Limitation | 35 |

| 27. | Place of Jurisdiction, Place of Performance, Applicable Law and Language of Contract | 35 |

| 28. | Written Form | 35 |

| 29. | Communication and Service of Process | 35 |

| 30. | Severability Clause | 36 |

| 31. | Value-Added Tax (VAT) | 36 |

| 32. | Information Required pursuant to Sect. 4 Money Laundering Act | 37 |

| 33. | Additional Conditions | 38 |

| 34. | Signatures | 39 |

| 35. | Annex 1 "Collateral Asset" | 40 |

| 36. | Annex 2 "Drawdown Request" | 41 |

| 37. | Annex 3 "Collateral" | 42 |

| 38. | Annex 4 "Conditions Precedent" | 45 |

| 39. | Annex 5 "Sources and Uses" | 48 |

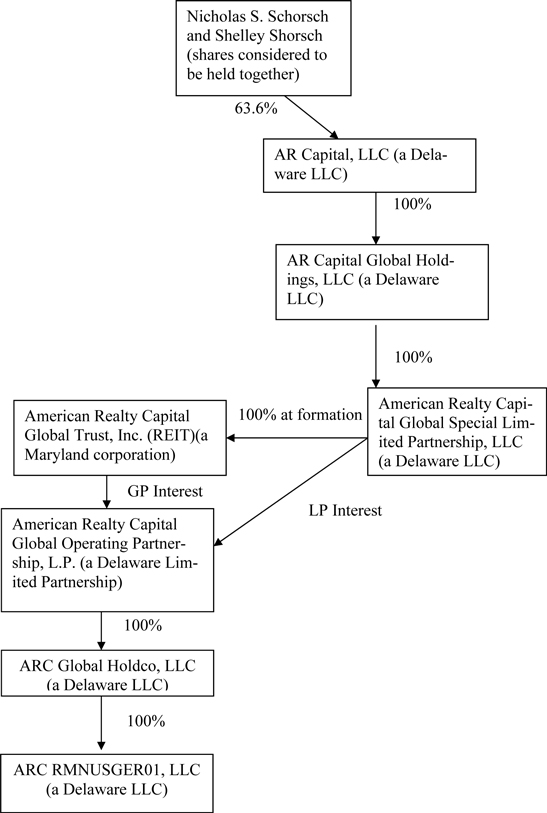

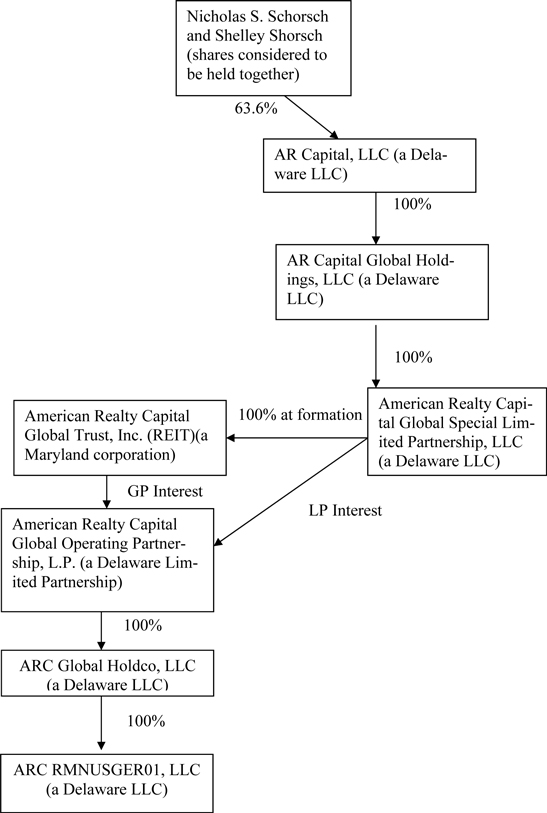

| 40. | Annex 6 "Structure Chart" | 49 |

| 41. | Annex 7 "General Terms and Conditions" | 50 |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 3 of 50 |

TheBorrower is a company in the legal form of a Limited Liability Company under Delaware law.

| (a) | TheCollateral Assetis an office and production asset located in Leuschstraße 1-4, 41460 Neuss. Itincludes all properties as defined inANNEX 1 "COLLATERAL ASSET". |

| (b) | TheBorrowerhas acquired theCollateral Asset by purchase agreement which was entered into before the notary public Dr. Alexander Gebele, Hamburg, on 19 November 2013 by notarial deed no. 1731/2013 AG, the Purchase Agreement. |

| (c) | Property Managerof theCollateral Asset isRheinmetall Immobilien GmbH, the tenant of the Collateral Asset, with the oversight of Moor Park Property Management GmbH. |

| (d) | Asset Manager will be Moor Park Capital Partners LLP. |

TheBorrower has calculated and theBank has approved a budget of approximately € 22,900,000 (twenty nine million Euros) for the acquisition of theCollateral Assetincluding related costs, fees and expenses (including transfer tax and registration duties), hereinafter referred to as theTotal Costs.

The financing structure is set out inANNEX 5 "SOURCES AND USES". A minimum amount of approximately € 12,300,000 (twelve million three hundred thousandEuros) will be financed by equity.Shareholder, intra-group or third party debt must be subordinated in accordance with thisAgreement to count towards this minimum amount.

The corporate structure of theBorrower is set out in the structure chart inANNEX 6 "STRUCTURE CHART".

ARC Global HoldCo LLC (Delaware) (theShareholder) holds 100 % of the shares in theBorrower.American Reality Capital Global Operating Partnership LP (Delaware holds 100 % of the shares in ARC Global HoldCo LLC. American Reality Capital Global Trust Inc (Maryland) (theREIT)holds 99.9 % of the shares in American Reality Capital Global Operating Partnership LP as a General Partner. The Special Limited Partner, American Reality Capital Global Special Limited Partnership LLC (Delaware) holds the remaining 0.1 % in American Reality Capital Global Operating Partnership LP.

A shareholder loan will be given by ARC Global HoldCo LLC to the Borrower

TheBorrower and theShareholderarehereinafter referred to asGroup Companies and, together with theBorrower, asGroup.

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 4 of 50 |

ThisAgreement, theSecurity Agreements and theHedging Agreement shall hereinafter be referred to as theFinance Documents.

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 5 of 50 |

In thisAgreementthe following terms are defined on the pages indicated:

| Advance | 7 |

| | |

| Agreement | 1 |

| | |

| Asset Manager | 3 |

| | |

| Availability Period | 7 |

| | |

| Bank | 1 |

| | |

| Borrower | 1 |

| | |

| Business Day | 8 |

| | |

| Business Plan | 45 |

| | |

| Calculation Date | 22 |

| | |

| Calculation Period | 22 |

| | |

| Cash Sweep | 29 |

| | |

| Collateral Assets | 3 |

| | |

| Compensation Amount | 11 |

| | |

| Conditions Precedent | 15 |

| | |

| Contributed Equity | 7 |

| | |

| Default Interest | 10 |

| | |

| Drawdown Date | 8 |

| | |

| Drawdown Request | 7 |

| | |

| Duty of Care Agreement | 44 |

| | |

| EONIA Rate | 32 |

| | |

| Escrow Account | 25 |

| | |

| Event of Default | 29 |

| | |

| Facility | 7 |

| | |

| Final Repayment Date | 7 |

| | |

| Finance Documents | 4 |

| | |

| Financial Covenants | 22 |

| | |

| General Account | 25 |

| | |

| Group | 3 |

| | |

| Group Companies | 3 |

| | |

| Hedging Agreement | 9 |

| | |

| Initial Valuation | 23 |

| | |

| Interest Basis | 8 |

| | |

| Interest Payment Date | 9 |

| | |

| Interest Period | 8 |

| | |

| Interest Rate | 8 |

| | |

| ISC Ratio | 22 |

| | |

| Land Charge | 42 |

| | |

| Letting Situation | 22 |

| | |

| LTV Ratio | 23 |

| | |

| Margin | 8 |

| | |

| Material Adverse Effect | 17 |

| | |

| Operating Expenses | 25 |

| | |

| Outstanding Amount | 8 |

| | |

| Payment Default | 10 |

| | |

| Potential Event of Default | 31 |

| | |

| Process Agent | 36 |

| | |

| Projected Interest Service | 23 |

| | |

| Projected Net Operating Income | 22 |

| | |

| Property Manager | 3 |

| | |

| Property Report | 20 |

| | |

| Purchase Agreement | 3 |

| | |

| REIT | 3 |

| | |

| Rental Account | 25 |

| | |

| Rental Income Waterfall | 25 |

| | |

| Reports | 11 |

| | |

| Representations | 16 |

| | |

| Security Agreements | 15 |

| | |

| Shareholder | 3 |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 6 of 50 |

| Third-Party Collateral Provider | 15 |

| | |

| Three Months EURIBOR | 8 |

| | |

| Total Costs | 3 |

| | |

| Total Net Rental Income | 22 |

| | |

| Undertakings | 24 |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 7 of 50 |

Subject to the terms and conditions of thisAgreement, theBank grants to theBorrowera loan facility in the total amount of the lower of

| (a) | € 10,600,000 (ten million sixhundred thousand Euros); |

| (b) | The amount which results in a LTV of maximum 50 % (fifty per cent) on the basis of theInitial Valuation |

(hereinafter referred to as theFacility).

| (a) | TheFacility is provided exclusively for theBorrower and for the sole purpose of of partially financing the acquisition of theCollateral Asset. |

| (b) | TheBorrower has to provide appropriate proof of its use of funds at any time when so requested by theBank without undue delay. TheBankis not obliged to monitor and verify the utilization of theFacility. |

The term of theFacility shall expire on the earlier of (i) 5 years after theDrawdown Date and (ii) 31 January 2019, on which date all amounts outstanding under theFacility have to be repaid. The date of expiry is referred to as theFinal Repayment Date.

| (a) | TheFacility may be drawn down until the date following two months after the signing of thisAgreement (theAvailability Period)provided that theConditions Precedent have been satisfied in full. |

| (b) | Any amounts not drawn by the end of theAvailability Period shall be automatically cancelled. |

Prior to the firstDrawdown Request theBorrower shall provide evidence to the satisfaction of theBank regarding the receipt of contributions in an amount equal to the difference between theTotal Costsand theFacility (theContributed Equity).At the discretion of theBorrower, these funds may take the form of cash equivalent contributions or subordinated shareholder or affiliate loans.

| (a) | Subject to the terms of thisAgreement and upon the prior satisfaction of theConditions Precedent set forth in ANNEX 5 "CONDITIONS PRECEDENT” theFacility may be drawn in oneAdvance. |

| (b) | TheAdvanceshall require an irrevocable drawdown request signed by theBorrower in accordance withANNEX 2 "DRAWDOWN REQUEST"(theDrawdown Request). |

| (c) | TheDrawdownRequest may only be delivered to theBank by theBorrower once theBank |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 8 of 50 |

has confirmed the satisfaction of theConditions Precedent.

| (d) | The disbursement will occur on the date specified by theBorrower in accordance with the limitations specified above (theDrawdown Date), provided that theDrawdownRequest has been received by theBank at the latest at 10:30 a.m. 3 (three)BusinessDaysprior to the requestedDrawdownDate and theDrawdown Date is aBusiness Day. ABusiness Day shall be regarded any day on which banks in Munich are open for ordinary business and payments denominated in Euros can be settled in TARGET2 ("Trans-European Automated Real-Time Gross Settlement Transfer 2"). |

| (e) | With prior written notice, theBank may set-off identified due claims against theBorrower's drawdown claims on theDrawdown Date. These due claims particularly include without limitation the Arrangement Fee according to Section 12.1 and other fees and costs payable by theBorrower. |

| (f) | The drawings made by theBorrowerunder theFacility and not yet repaid or prepaid shall be referred to as theOutstanding Amount. |

| (a) | The time period for which a fixed interest rate is agreed upon with regard to theFacilityis hereinafter referred to as anInterest Period. |

| (b) | The Interest Periods of theFacility(with the exception of the first and the lastInterest Period) shall be 3 (three) months. |

| (c) | The firstInterest Period shall begin on theDrawdown Date (inclusive) and shall end at the end of the day before the followingInterest Payment Date. If an amount is drawn by way of transfer to a third party (e.g. to a credit institution to be redeemed or to a notary), the respective amount shall be regarded to be drawn down as of the day the debit is booked. Each subsequentInterest Period shall begin on the followingInterest Payment Date (inclusive) and end on the next followingInterest Payment Date(exclusive), i.e. each subsequentInterest Period follows automatically the last expiredInterest Period. The lastInterest Periodshall end on theFinal Repayment Date(inclusive). |

| (a) | A fixed, nominal interest rate is hereby agreed upon for eachInterest Period. TheInterest Rate for eachInterest Periodis the sum of theThree Months Euribor for the applicable Interest Period (“Interest Basis”) and theMarginand is expressed as an annual interest rate. |

| (b) | Margin means 165 bps p.a. (one hundred sixty five basis points per annum). TheMargin includes all funding costs (other thanThree Months EURIBOR) of theBank. |

| (c) | Three Months EURIBOR means the EURIBOR percentage rate per annum, applicable for a 3 (three) months period as determined by the Banking Federation of the European Union which appears on Reuter’s page “EURIBOR 01” or if such page is replaced or service ceases to be available, such other page or service as may replace such page or which is agreed upon by theBankand theBorrower.If there is no publication, or an obviously deficient publication, in the REUTERS system, then theBank shall use another comparable source of information for calculating theInterest Rate(in particular the Bloomberg page |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 9 of 50 |

"GPGX 509 8 1 EBF"). If no such page or service is available, then theBank shall determine theInterest Rate according to Section 315 BGB ("BGB" means “Bürgerliches Gesetzbuch” - the German Civil Code), at its own equitable discretion, with corresponding application of the criteria established above.

| (d) | For the first and lastInterest Period theInterest Basis shall be - as the case may be -determined via interpolation. |

| (e) | In case of a deficient publication, theBank is entitled and/or obliged to make a subsequentInterest Rate-adjustment. |

| (f) | TheInterest Rate shall be determined as the relevant rate published on the relevant page or service on the second precedingBusiness Day before theDrawdown Date or before eachInterest Payment Datefor all followingInterest Periods. |

| (g) | TheBank shall inform theBorrower of theInterest Rate determined in this way via telefax or email. |

| 9.3. | Interest Payment Date |

| (a) | Interest shall be payable quarterly in arrears on 10 January, 10 April, 10 July and 10 October of each calendar year (each of such dates referred to as anInterest Payment Date) until and including theFinal Repayment Date. The first Interest Payment Date shall be 10 April 2014. |

| (b) | If anInterest Payment Date falls on a day which is not aBusiness Day, suchInterest Payment Datewill be on the next followingBusiness Dayin that calendar month (if there is one) or on the first precedingBusiness Day (if there is not) and any interest shall accrue and be payable up to that date. |

| 9.4. | Calculation of Interest |

| (a) | Interest shall accrue on theOutstandingAmountat theInterest Rate during eachInterest Period. |

| (b) | Interest shall be calculated according to the “EURIBOR 360 Method”, i.e. interest shall accrue on the basis of the actual number of days elapsed in anyInterest Period and on the basis of a 360- (three hundred and sixty) day year (actual/360). |

| 9.5. | Limitation of Interest Exposure |

| (a) | Prior to the firstDrawdown Date theBorrower is obliged to enter into aHedging Agreement for 100 % (onehundred percent) of theFacilitywhich limitsthe interest exposure (excluding theMargin) for theFacilityat or below 1.75 % p. a. (one point seventy five percent per annum) until theFinal Repayment Date(inclusive). |

| (b) | The following are to be considered as aHedging Agreement satisfactory to theBank: Hedging arrangements (such as interest rate swap or cap agreement or other financial derivatives or a combination thereof) on the basis of the ISDA ("International Swaps and Derivatives Association") master agreement or the German Framework Agreement (“Deutscher Rahmenvertrag – DRV”). |

| (c) | TheHedging Agreement to be stipulated shall be maintained until theFinal Repayment Date. |

| (d) | TheHedging Agreementshall be concluded between theBorrower and a third party hedging counterpart on an unsecured basis. The rating (short term/long term) of such hedging |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 10 of 50 |

counterpart needs to be (at least) the following: “F1/A” by Fitch, “P-1/A2” by Moody’s and/or “A-1/A” by Standard & Poor’s.

| (e) | All rights and claims under suchHedging Agreement have to be pledged to theBank. |

| 10.1. | Timeliness of Payments |

The day of receipt of the respective monies on the respective bank account (and not the day on which the payment is made or transferred) shall be decisive for punctual payment.

| 10.2. | Occurrence of Payment Default |

TheBorrower is inPayment Default, even without prior notice, if it fails to pay or makes incomplete payment of any amount payable by it under theFinance Documents on its due date.

| (a) | If theBorrower is inPayment Default, theBank may chargeDefault Interest on the overdue amount calculated on the legal interest rate on arrears, amounting to 5 (five) percentage points above the basis interest rate on an annual basis announced by Deutsche Bundesbank for the duration of the arrears. |

| (b) | If theBorrower completely or partially fails to pay theDefault Interest, theBankmay, after giving prior notice to theBorrower,charge furtherDefault Interest on the overdueDefault Interest, as further damage compensation, calculated on the legal interest rate on arrears (5 (five) percentage points above the base interest rate on an annual basis announced by Deutsche Bundesbank); further Default Interest on such overdueDefault Interestmay only be charged 3 (three) months after the last notice. |

| (c) | TheBank is entitled to claim indemnification caused by delay in an amount exceeding the legal interest rate on arrears. TheBorrower is entitled to prove lesser damage. |

| 11. | Repayment / Prepayment |

| (a) | During the term of theFacility no regular amortization is foreseen. |

| (b) | On theFinal Repayment Date theBorrower has to repay theOutstanding Amount together with all accrued and unpaid interest thereon and any other payments owed by theBorrower to theBank under or in connection with theFinance Documents to theBank. |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 11 of 50 |

| 11.2.1. | Voluntary Prepayments |

| (a) | TheBorroweris entitled to prepay voluntarily theFacility in whole or in part at anyInterest Payment Datesubject to Section 12.2 (“Prepayment Fee”). If theBorrower prepays theFacility in whole or in part on a different day than anInterest Payment Date, the prepayment is furthermore subject to the payment of prepayment costs according to Section 22.2 (“Prepayment Costs”). |

| (b) | In case of partial prepayment of theFacility, the prepaid amount shall be at least € 1,000,000 (one million Euros). |

| 11.2.2. | Partial Prepayments in Case of Disposal of the Collateral Asset and Warranty Claims |

TheBorrower is obliged to prepay the Facilityunder the following conditions, without a termination of theFacilitybeing necessary:

| (a) | Disposal of Collateral Asset |

| (i) | In case of the disposal (asset or share deal) of theCollateral Asset, theOutstanding Amount must be prepaid in one amount, subject to the payment of prepayment costs according to Section 22.2 (“Prepayment Costs”) and a prepayment fee according to Section 12.2 (“Prepayment Fee”). |

| (ii) | TheBorrower shall instruct the buyer of theCollateral Asset (or the shares in theBorrower) to effect payments of the purchase price for theCollateral Asset (or the shares in theBorrower) to theEscrow Account only. The surplus (if any) to the prepayment amount under (i) will be paid out to theBorroweron the nextInterest Payment Date which follows the disposal. |

| (b) | Asset related Warranty Claims and Damage Compensation |

| (i) | If theBorrower - in relation to theCollateral Asset-is entitled to warranty claims, damage compensation or other payment claims with respect to theCollateral Asset, and such claims exceed an amount of € 100,000 (one hundred thousand Euros) against a third party (such as the seller), theFacilityshall be repaid in the corresponding amount resulting from these claims at the firstInterest Payment Date after payment by the respective debtor, such an amount hereinafter being referred to asCompensation Amount. |

| (ii) | If theBorrower is entitled to any damage compensation or other payment claims under anyReports issued with respect to theCollateral Asset and such claims exceed an amount of € 100,000 (one hundred thousand Euros) against a third party, theFacility shall be prepaid in the corresponding amount resulting from these claims at the firstInterest Payment Date after payment by the respective debtor.Reports means all legal, tax, technical or valuation reports or papers which have been issued to theGroup. |

| (iii) | If any insurance amount is paid according to the insurance requirements for restoring the insuredCollateral Asset(nach den Versicherungsbestimmungen zur Wiederherstellung des versicherten Gegenstandes bezahlt), suchCompensation Amount shall repay theFacility at the firstInterest Payment Date after payment of such amount by the respective insurance company, unless (i) theBorrower demonstrates his binding decision to restore theCollateral Asset within a period of 3 (three) months after the occurrence of the respective damage event and (ii) the appropriate utilization of the insurance amount is evidenced without undue delay in the course of the restoring. The period of three months set out before may be extended by theBank upon application of theBorrower by another 3 (three) months if e.g. the technical nature of the building or the necessity for external involvement for the assessment of the situation requires |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 12 of 50 |

such extention.

| (iv) | TheBorrowershall inform theBank without undue delay as soon as theBorrowerbecomes aware of circumstances that could trigger a partial prepayment under this Section 11.2.2 (b) ("Asset related Warranty Claims and Damage Compensation"). All amounts payable to theBorrower under paragraphs (i) through (iii) shall be paid to theEscrow Account. |

| (v) | TheBorrowershall instruct the third party debtors that any amounts which have to be used for a partial prepayment under this Section 11.2.2 (b) ("Asset related Warranty Claims and Damage Compensation") have to be paid into theEscrow Account. TheBankis entitled to transfer such monies standing to the credit of theEscrow Accountinto the respective credit account on eachInterest Payment Date. |

| 11.2.3 | General Rules for Voluntary and Partial Prepayments |

| (a) | TheBorrowers must notify theBank of each prepayment pursuant to this Section 11.2 (“Prepayments”) in writing not less than 10 (ten)Business Days in advance and must include (i) any and all accrued and unpaid interest on the amounts repaid or prepaid, plus (ii) additional commissions, fees and expenses. TheBorrower is not entitled to reborrow all or part of theFacility which is prepaid. |

| (b) | Any legal right of theBorrower to a prepayment of theFacility according to Section 490 par. 2 BGB remains unaffected. |

| (c) | If, due to a repayment or prepayment, aFinancial Covenant and/or anUndertakingis not complied with, theBank may require additional prepaymentsnecessary to remedy the violation of theFinancial Covenantsor theUndertaking. |

For the arrangement and commitment of theFaciltiy theBorrower shall pay a flat up-front fee to theBank of € 79,500 (seventy nine thousand five hundred Euros). This fee is due and payable upon the date of thisAgreement and may be deducted from the firstAdvance.

| (a) | TheBorrowershall pay a prepayment fee in the amount as set out in the following table: |

| Period from Drawdown | | Prepayment Fee (expressed as a percentage of the amount

to be prepaid) | |

| Year 1 | | | 1.00 | % |

| Year 2 | | | 0.75 | % |

| Year 3 | | | 0.5 | % |

| Thereafter | | | 0.25 | % |

| (b) | The prepayment fee shall be due and payable together with the prepaid amount. |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 13 of 50 |

| (c) | The Prepayment Fee does not apply to prepayments in case of: |

| (i) | a prediscussed deleverage from the Ultimate Shareholder, by utilization of a corporate credit line, following thePlanned IPO, taking the LTV of the Facility to appr. 25 % LTV; |

| (ii) | prepayments pursuant to Section 11.2.2 (b); or |

| (iii) | the Borrower curing a breach of a Financial Covenant. |

TheBorrower shall pay to the Bank all reasonable external fees, costs and expenses (including without limitation legal fees and valuation costs), plus VAT if applicable, associated with the financing hereunder including - but not limited to - costs in connection with the enforcement or the preservation of any rights under the Finance Documents.

Prior to any professionals being instructed, estimates of fees/costs are to be obtained by theBank and to be advised by theBorrower and where possible, cap amounts are to be mutually agreed, unless (i) anl Event of Default has occurred and is continuing or (ii) such advice/mutual agreement is not economically reasonable (zumutbar) for theBank or (iii) the relevant document has been requested by theBorrower.

| 13. | Tax Gross up and FATCA-Compliance |

| 13.1. | Withholding Tax Deductions |

If theBorroweris obligated, with respect to amounts that are to be paid to theBank according to this loan agreement, to undertake a deduction or withholding of taxes, dues, official charges or similar burdens of any kind imposed by a governmental authority (collectively,Taxes), then theBorrowershall withhold or deduct suchTaxes to the extent required by applicable law. Except as provided below, theBorrowershall increase the amount to be paid to theBankin such a way, that theBank receives a net amount that corresponds to the amount that it would have received if such a deduction or withholding had not been required. Within 30 days of withholding or deducting from amounts paid to theBank (or paying such withheld or deducted amounts to the applicable tax authorities),theBorrower is obligated to present theBankwith verification of the completed payment of the withheld or deducted amounts. TheBorrower shall not be required to pay any additional amounts to thebank with respect to the deduction or withholding of the followingTaxes:

| (a) | Taxesthat are precipitated solely by organizational or company-law measures of theBank(e.g. relocation of business, change of legal form), which are implemented after the closing of this contract, |

| (b) | in the case of the advent of a new lender,Taxes for which theBorrowerhad not previously been obligated to pay an increased amount to theBankhereunder, unless the payment obligation results from a change of the authoritative tax laws or their interpretation by the financial administration and would have led also to a gross-up vis-à-vis the Bank, |

| (c) | suchTaxesthat could have been avoided had theBanktaken appropriate and reasonable measures requested by theBorrower, |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 14 of 50 |

| (d) | Taxesthat would not have been imposed had theBank complied with its obligations under clause 13.5, or |

| (e) | Taxesthat would not have been imposed had theBank complied with its obligations under clause 13.6. |

If theBankencounters a tax or payment obligation with regard to a payment it made to theBorroweror with regard to an incoming payment made by theBorrower (with the exception of

| (i) | Taxeson the proceeds or the income of theBank, |

| (ii) | Taxesfor which theBankaccording to clause 13.1 (Withholding Tax Deductions) has already received compensation, or |

| (iii) | Taxesfor which theBank would have been compensated under clause 13.1 but for an exception in clause 13.1(a) through 13.1(e),) |

theBorrowermust indemnify theBankfor suchTaxeswithin ten (10) business days after the time of theBank'srequest.

If theBanksubsequently receives a tax credit, tax refund, tax-offset, or a tax deduction that stems from a payment that was increased in accordance with this clause 13 (Tax Gross up an FATCA Compliance), it must pay to theBorrower(insofar as this is possible without prejudice to the payment received by it) the amount of this benefit within ten (10) business days after the receipt thereof to which theBorroweris entitled up to the amount of the tax effect on theBank. The entitlement is not to be interest-bearing. TheBorrower and theBank shall cooperate with one another in obtaining any tax benefit.

If theBank,pursuant to the abovementioned clause 13.3 (Tax Credit), provides a payment to theBorrowerand a governmental authority subsequently determines that the credit or benefit, to which the payment corresponded, (a) did not apply to theBank, or (b) was disallowed, or (c) could not be fully claimed by it, theBank shall provide theBorrower with evidence of such determination by such governmental authority. TheBorrowermust, upon receipt of such evidence, reimburse theBankfor the amount that is requiredfor theBankto be in the same position in which it would have been if theBankcould have claimed the full amount of the respective credit or benefit.

| 13.5. | Compliance with the intergovernmental agreement regarding FATCA |

TheBankintends to comply with its obligations under theintergovernmental agreementregarding FATCA. For the purposes of clause 13.5,the “intergovernmental agreement regarding FATCA” shall mean the agreement concluded on May 31, 2013 between the Federal Republic of Germany and the United States of America for the facilitation of tax compliance in international circumstances and with regard to the US-American information and registration requirements known as the Foreign Account Tax Compliance Act (or any amended or successor agreement), which the German Bundestag (Federal Parliament) approved on June 27, 2013 and the Bundesrat (Federal Council) on July 5, 2013 along with the approved law for the ratification of the agreement to implementFATCA in Germany, as amended from time to time. The term “FATCA” shall mean Chapter 4 (which currently includes Sections 1471 through 1474) of the U.S. Internal Revenue Code of 1986, as amended

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 15 of 50 |

(theCode), and any current or future regulation or official interpretation thereof.TheBankshall comply with all applicable requirements (including the obligation to notify the appropriate governmental authorities) that are necessary for theBankto fully comply with theintergovernmental agreement regarding FATCA. TheBorrower will provide theBank with all relevant and necessary information required for compliance with theintergovernmental agreement regarding FATCAand reasonably requested by theBank that results from the execution of this loan agreement.

| 13.6. | U.S. Tax Certification |

TheBank, on or prior to the date of its execution and delivery of this agreement (and any other lender, on or prior to the date on which such person becomes a lender under this agreement), and prior to any such form or certificate having expired, and promptly upon any such form or certificate having become inaccurate, and from time to time if requested in writing by theBorrower(but only so long as theBank or such other lender remains lawfully able to do so), shall provide theBorrower with a properly completed and executed Internal Revenue Service Form W-8BEN (or successor form) certifying that (i) theBank(or such other lender) is the beneficial owner of interest and other amounts received hereunder, and (ii) such interest and other amounts qualify for exemption from U.S. withholding tax pursuant to an income tax treaty to which the United States is a party.

| (a) | TheBorrowershall provide theBank with the collateral described inANNEX 3 "COLLATERAL"in separateSecurity Agreements in line with standardBank forms. |

| (b) | If the collateral is not provided by theBorrower, but by a third party – hereinafter referred to as theThird-Party Collateral Provider – theBorroweris obliged to ensure (i) that such collateral is without undue delay and effectively provided by suchThird-Party Collateral Provider;and that eachThird-Party Collateral Providernot being aGroup Company makes theRepresentationsaccording to Section 16 to theBank. |

| (c) | TheBorrowerand theBank shall conclude appropriate agreements on the intended purpose of the collateral for the collateral provided. If the collateral is provided by aThird-Party Collateral Provider, theBorrowershall ensure that such provider enters into an appropriate agreement with theBank on the intended purpose of the collateral.Unless otherwise agreed, the collateral provided serves to secure any of theBank’scurrent and future claims to which it is entitled arising out of or in connection with theFinance Documents, including but not limited to the repayment claims following a successful termination of thisAgreement or in case a contractual stipulation is void. |

| (d) | TheBorrowershall bear the costs and expenses for providing thecollateral. |

| (a) | The obligation of theBank to disburse theAdvance under theFacility is subject to the conditions precedent listed inANNEX 4 "CONDITIONS PRECEDENT" (the Conditions Precedent). |

| (b) | If reference is made to documents or evidence, such documents or evidence shall be presented to theBank satisfactory in both form and content. Unless agreed otherwise, the documents listed have to be presented to theBank as originals. |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 16 of 50 |

| (c) | The valid execution and existence (Wirksamkeit) of thisAgreement is not subject to (aufschiebend bedingt) the satisfaction of theConditions Precedent. |

TheBorrower and eachGroup Company makes the followingRepresentations as of the date of thisAgreement.

TheBorrower is a duly incorporated company and validly existing; the corporate structure is accurately described in the preamble of thisAgreement and inANNEX 6 "STRUCTURE CHART".

| 16.2. | Validity of Finance Documents |

| (a) | TheBorrowerhas the power and authority to enter into and perform the obligations under theFinance Documents and any other agreement related to this borrowing to which it is or will be a party and the transactions contemplated by theFinance Documents and such other agreements. |

| (b) | No limit on powers of theBorrower will be exceeded as a result of the borrowing, granting of security or giving of guarantees or indemnities contemplated by theFinance Documents. |

| (c) | TheBorrowerhas not granted or agreed to grant any collateral in favour of third parties, other than the collateral provided or to be provided by theBorrower for theBank,in accordance withANNEX 3 "COLLATERAL". |

| (d) | TheBorrowerrepresents that the collateral provided or to be provided in accordance withANNEX 3 "COLLATERAL" is or will be validly provided and retain their priority status with regard to all other collateral provided. |

The entry into theFinance Documents is in compliance with the certificate of formation and the LLC agreement of theBorrowerand theGroup Companies and such entry does not violate any legalor court-imposed prohibitions or restrictions. Upon conclusion of the aforementioned agreements, neither the Borrower nor theGroup Companieswill be in violation of any binding contracts with third parties, nor has theBorrower or theShareholder agreed to grant any other party a security interest in theCollateral Asset or the related shareholder loan.

There is noEvent of Default outstanding and no circumstances are present that may have aMaterial Adverse Effect.An effect shall be regarded to be materially adverse if:

| (i) | the ability of theBorrower to conduct its business as contemplated in thisAgreement and to comply with its material obligations under theFinance Documents;or |

| (ii) | the financial solvency of theBorrower; or |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 17 of 50 |

| (iii) | the validity or enforceability of anyFinance Document, |

will be materially adversely impaired (Material Adverse Effect).

No reasons for insolvency, incapacity to pay, threatened incapacity to pay or over-indebtedness are present either with theBorroweror aGroup Company, as per applicable insolvency laws.

All documents made available and information provided by theBorrower or aGroup Company(also within the course of a due diligence) are based on actual information carefully examined for its correctness and completeness. The documents handed over and information provided include all material information relevant to the credit decision. In particular, this applies to all documents with regard to the current tenant and lease agreements.

| 16.7. | Financial Statements |

The annual financial statements of theBorrower,theGroup Companies and theREIT,as well as the budget and theBusiness Plan have been prepared properly, carefully and correctly.

No claims or tax investigations by any tax or social security authority are being conducted against theBorrower, which are likely to have aMaterial Adverse Effect, or for which no adequate reserves have been allocated by theBorrower. TheBorrower has punctually submitted all tax and other relevant statements.

TheBorrower has not received any subsidies from any government, state or other public authority or agency in violation of national or European Union law.

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 18 of 50 |

| 16.10. | Arms-Length Principle |

The contractual and market relationships amongst theGroup are at arms-length and customary to the market.

No litigation, arbitration or administrative proceedings or investigations of, or before, any court, arbitral body or agency concerning an amount of more than € 100,000 (one hundred thousand Euros) that has not been notified to the Bank under 17.1(viii) are current, pending or threatened against theBorrower.

TheBorrowers’ payment obligations arising from theFinance Documentshave at least the same priority as the claims of all of its other unsecured and unsubordinate debt, with the exception of liabilities that have priority under mandatory law.

TheBorrowerhas complied with all material regulations and administrative acts in its control concerning environmental and health protection and workplace safety.

| 16.14. | Insurance Protection |

All operationally essential assets of theBorrower are insured against damage and loss to the degree necessary and customary to the market (as demanded in Section 19.1 (Insurance)). There is an appropriate insurance policy against operational business interruptions and third-party damages. The insurance contracts are in effect and to theBorrower’sbest knowledge no cancellation has been threatened. TheBank has to be provided with proof of insurance coverage upon written request.

| 16.15. | No Negative Development |

Since the date of the last annual financial statement of the Borrower no circumstances have arisen that may have aMaterial Adverse Effect.

| (a) | (i) TheBorroweris (i) either the registered owner of theCollateral Asset and his title is, except for already existing non value reducing encumbrances in section II and already existing land charges in section III of the land register (that have to be redeemed at the latest with the disbursement of theFacility and have to be deleted within 15 (fifteen) days in the respective land registers), in no way limited, and it is the sole legal and economic holder of all rights and claims arising out of or in connection with all lease agreements concluded with respect to theCollateral Asset, or(ii) there are effectively registered priority notices of conveyances in the respective land registers in favour of theBorrower and it will become the legal and economic proprietor of theCollateral Asset in consequence of the registration in the respective land registers and will also be the holder of all rights and claims arising out of |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 19 of 50 |

or in connection with all lease agreements concluded with respect to theCollateral Asset and its ownership of theCollateral Asset will not be limited in any way (except for the already existing non value reducing encumbrances in section II). All lease agreements concluded with respect to theCollateral Asset comply with the written form requirement (Schriftformerfordernis), are legal, valid and binding, and theBorrower fulfills all its obligations under or in connection with all lease agreements (apart from issues, which were explicitly disclosed in writing before the closing of thisAgreement by reference to this Section 16.16 (Collateral Asset) to theBank).

| (b) | There are no damages to theCollateral Asset which could have an impact on the use or on the value of theCollateral Asset. TheCollateral Assetis (i) in good condition (apart from issues explicitly disclosed in writing before the closing of thisAgreement by reference to this Section 16.16 (Collateral Asset) to theBank) and (ii) has no structural defects, flood or surface subsidence damages. |

| (a) | TheBorrower has no employees nor had any employees in the past. |

| (b) | TheBorrower is not a part of a tax group (Organschaft) in terms of the German Codes on Trade Income Tax (Gewerbesteuergesetz), Corporate Income Tax (Körperschaftssteuergesetz) or Value Added Tax (Umsatzsteuergesetz). |

| (c) | TheBorrower is not a party to a profit and loss agreement. |

| (d) | The Borrower does not have a permanent establishment in Germany. No material business decisions are taken in Germany. |

| (e) | TheBorrower is a special purpose vehicle with the sole purpose of holding title of theCollateral Asset. TheBorrowerhas not entered into any commitments or financial indebtedness and will not enter into any commitments or financial indebtedness other than (a) commitments which are (i) directly in connection with thisAgreement and with the correspondingSecurity Agreements and (ii) the property and the management of theCollateral Asset and, (b) which, if necessary, were explicitly disclosed in writing before the closing of thisAgreement by reference to this Section 16.17 (Borrowers). |

TheBorrower and eachGroup Company will repeat allRepresentationson theDrawdown Date, and eachInterest Payment Date.

| 17.1. | Disclosure of the Borrower’s Economic Situation |

According to German banking supervisory law theBank is obliged to monitor the current credit risk. Therefore, theBorrower shall provide all information necessary for assessing the economic circumstances of theBorrower and anyThird-Party Guarantorthat provides personal collateral (such as guarantees), as well as to all risk-relevant circumstances which relate to theCollateral Assets. TheBorrowershall also disclose all information of considerable significance to the assessment of the asset and debt structure, as well as to the assessment of the current and anticipated profitability and liquidity of theBorrower, and the profitability

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 20 of 50 |

and creditworthiness with regard to theCollateral Assets.

TheBorrower shall - without being requested - provide theBank with the following documents and information during the agreed time periods:

| (i) | (Property Report) AProperty Report regardingtheCollateralAssetshas to be submitted within 6 (six) weeks after the end of each calendar quarter. AProperty Report shall include information on (i) up-to-date tenancy schedules containing names of tenants, let area, rent/lease amounts and terms, (ii) the current development of the operating and administrative expenses; (iii) any outstanding rent/lease payments, including the reasons for any arrears in payment; (iv) claimed or announced set-off against rent/lease amounts and/or claimed or announced rent/lease reductions, including the reasons for the (announced) set-offs and/or rent/lease reduction; (v) unused and/or vacant spaces and rooms; (vi) repair or maintenance work to be performed, (vii) changes to theBusiness Plan and (vii) other events or circumstances with regard to theCollateral Assetsthat could considerably and detrimentally impact the value of theCollateral Assets. |

| (ii) | (Annual Financial Statements of the Tenant) As long as Rheinmetall AG is a publicly traded company, annual financial statements of Rheinmetall AGand any ad-hoc notices theBorrowerbecomes aware of; if Rheinmetall AGceases to be a publiclay traded company, such documents shall be provided on a best efforts basis. |

| (iii) | (Amendments to Rental, Insurance, Property or Asset Management Contracts) Without undue delay information on any intended amendment to or termination of rental, insurance, property management, or asset management (if any) contracts. |

| (iv) | (Disposal ofCollateral Asset) Without undue delay, information on any intended disposal of theCollateral Asset and delivery of copies of the relevant agreements. |

| (v) | (Annual and semi-annual Financial Statements) No later than 150 (one hundred and fifty) calendar days after the end of a financial year the (audited, if an audit opinion is legally required or is voluntarily prepared) annual financial statements of theBorrower,profit and loss statementand a cash flow statement of theBorrowerfor the financial year concerned and as soon as available, the semi-annualfinancial statements of theBorrower,profit and loss statementand a cash flow statement of theBorrowerfor the half financial year concerned. If so required and if the preparation of the audited annual financial statement is delayed, the documents have to be submitted preliminary in their temporary form. If the financial statements are unaudited they have to be signed by the Borrower. |

| (vi) | (Business Plan) No later than one quarter before the end of each financial year aBusiness Plan and cash flow statement for the following financial year and a report on the compliance with the Business Plan within 6 weeks after the end of the calendar year. |

| (vii) | (Amendments to the Constitutions / Articles of Association) Without undue delay, information on any intended material amendment to the by-laws or the articles of association of theBorrower or a change in the legal form of theBorrower. |

| (viii) | (Disputes) Without undue delay information on any disputes (e.g. any litigation, arbitration or administrative proceedings which are current, threatened or pending) concerning an amount of at least € 100,000 (one hundred thousand Euros). |

| (ix) | (Inspection of the Collateral Assets) TheBorrower shall allow any person which is authorized by theBankin writing, irrespectively of being aBankemployee, to inspect anyCollateral Asset during customary business hours, with reasonable prior notice. |

| (x) | (Other Specific Information) Upon request by theBank, specific information and documents on legal and actual circumstances with regard to theCollateral Assets, as well |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 21 of 50 |

as on the financial situation of theBorrowerand that of any tenants and lessees, if they are available and are reasonably needed by theBank,so as to be able to verify observance of the conditions of theFinance Documents and recognize future risks early. If such information and documents are not available immediately, theBorrowershall take reasonable measures to obtain them.

| (xi) | (Other Occurrences) Information on all other occurrences that may, in the reasonable assessment of theBorrower,be material to the risk assessment such as the expiration of insurance coverage. |

| 17.2. | Financial Information on the Group |

Until the complete repayment of theFacility,theBorrower shall inform theBankregularly on the development of the economic situation of theGroup and each individualGroup Company and, without being requested, provide theBankwith the following documents and information within the agreed time period:

| (i) | (Consolidated Financial Statement) Complete audited and unrestrictedly certified consolidated annual financial statement of American Realty Capital Global Trust, Inc. (REIT) |

| (ii) | (Individual Financial Statement) Individual annual financial statements of allGroup Companies, no later than 150 (one hundred and fifty) days after the end of each financial year. |

| (iii) | (Loan Termination by another Bank) Without undue delay information if another lender terminates (kündigt) a loan with aGroup Company which leads to a negative impact on the financial health of theBorrower. |

| (iv) | (Changes within the Group) Without undue delay information on all other occurrences and changes within theGroup which, in the reasonable assessment of theBorrower, could be of importance. If the information is not to be provided by theBorrower, but by aGroup Company instead, theBorrower must procure the delivery of that relevant information. |

| 17.3. | Change of Accounting Principles |

In case of any change of its financial year or its balancing approach and assessment method, including the exercise of the voting rights, which is reflected in its annual financial statement, theBorrower shall allow theBank to instruct an independent auditor to (i) prepare a conversion statement and (ii) explain to theBank the economic effects of the new methods.

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 22 of 50 |

TheBorrower has to comply with the followingFinancial Covenantsthroughout the term of theFacility:

| 18.1. | Interest Service Coverage (ISC) |

| (a) | TheBorrowerhas to maintain anISC Ratio of at least 200 % (two hundred percent) throughout the term of theFacility that is calculated by theBank as follows: |

TheISC Ratio shall be calculated as the ratio between

| (i) | theProjected Net Operating Income and |

| (ii) | theProjected Interest Service |

during the currentCalculation Period.

| (b) | TheBankwill calculate theISC Ratio for the first time before the first drawdown and then on a quarterly basis on the relevantInterest Payment Dates(these dates hereinafter referred to as aCalculation Date).Calculation Periodis the period of 12 (twelve) months after aCalculation Date. |

| (c) | TheProjected Net Operating Income shall be |

| (i) | theBorrower'stotal net rental income from theCollateral Assets(excluding tenants’ payments for operating expenses) resulting from the relevant tenants’ contractual payment obligations in theLetting Situation during the relevantCalculation Period, as determined in accordance with Sub-Paragraph (d) of this Section (Total Net Rental Income) |

less (-)

| (ii) | any non-recoverable operating expenses or other non-recoverable expenditures in respect of theCollateral Assets, as well as any other expenditures by theBorrowerwhich are not to be borne by the tenants (e.g. theBorrower'sgeneral taxes or other charges or withholdings of a similar nature), as determined in accordance with Sub-Paragraph (d) of this Section |

during theCalculation Periodconcerned.

| (d) | In particular, when calculating theProjected Net Operating Income, theLetting Situationduring the relevantCalculation Period shall be determined as follows: |

| (aa) | If any rental space in theCollateral Assets is not leased on the relevantCalculation Date and to the extent that there is no a lease agreement with rental payments starting within theCalculation Period, it is assumed that no rental payments are to be expected during theCalculation Period. |

| (bb) | If during theCalculation Period |

| (i) | a lease agreement expires or |

| (ii) | the termination of a lease agreement is legally possible |

and there is no subsequent lease agreement available, then it is assumed that there will be no rental payments from the expiry or termination date until the end of theCalculation Period.

| (cc) | The assumed receivables on the basis of a lease agreement include both the base rental |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 23 of 50 |

payments as well as, if applicable, any rental amount dependent on turnover. Any turnover-dependent rent to be paid during theCalculation Period is calculated on the assumption that the turnover for theCalculation Period will be equivalent to the turnover achieved during the 12-month period ending one month before the relevantCalculation Date. Payments received for the surrender or an agreement to terminate the lease agreement early are notProjected Net Operating Income.

| (dd) | The percentage of all rent shortfalls during theCalculation Periodis assumed to be equivalent to the percentage of all rent shortfalls on theCalculation Date, provided the reason for the shortfall continues to exist. |

| (ee) | For the calculation of the non-recoverable operating expenses, capital expenditures or any other expenditures not to be paid by the tenants for theCollateral Assetsand a minimum amount of asset management fees of 14 % (fourteen per cent) of theTotal Net Rental Income pursuant to section 18.1(c)(i) is assumed, such actual amounts shall be calculated on the basis of the expenses and expenditures actually paid within the previousCalculation Period. However if theBorrower provides satisfactory evidence to theBank, that any such fees are borne by theBorrower due to planned expeditures then such amounts can be deducted from theProjected Net Operating Income instead of using historic information. |

| (e) | TheProjected Interest Service shall be the aggregate of all interest payments falling due during theCalculation Period under theFacility, taking into account an existing limitation of the interest exposure as a result of a Hedging Agreement. |

| 18.2. | Loan to Value ("LTV") |

| (a) | TheBorrower has to maintain aLTV Ratio of not more than 62.5 % (sixty two comma five percent) throughout the term of theFacility, that is calculated by theBank as follows: |

| - | TheLTV Ratio is the ratio between (i) theOutstandingAmountand (ii) the most recent net market value of theCollateral Assetin aggregate as determined by an independent external appraiser appointed by theBank. Until and including the first anniversary of theDrawdown Date theLTV Ratio shall be calculated on the basis of theInitial Valuation. |

| (b) | The calculation of theLTV Ratio takes place on eachCalculation Date and then after any new determination of the market value of theCollateral Asset. |

| (c) | The market value of theCollateral Asset was first determined on 27 November 2013 by an external appraiser (Colliers) (“Initial Valuation”) and set at € 21,400,000 (twenty-one million four hundred thousand Euros). |

| (d) | TheBank may determine the market value of theCollateral Asset, |

| (i) | in intervals of 1 (one) year, |

| (ii) | at any time an event occurs that may, in the reasonable opinion of theBank, have a material effect on the value of theCollateral Asset;or |

| (iii) | at any time if theBank reasonably expects that the new valuation will show that a breach of theLTV Ratio has occured |

by an independent external appraiser chosen and mandated by theBank.The appraisal must be based on the definition of the market value according to Section 194 BauGB ("BauGB" means “Baugesetzbuch” - the German Building Law) andWertermittlungsverordnung and include the mortgage lending value (Beleihungswert).

| (e) | TheBankwill inform theBorrower about the result of each evaluation. This result will be |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 24 of 50 |

binding to the parties unless Section 319 Par. 1 BGB applies.

| (f) | The costs of all valuations shall be borne by theBorrowerin respect of para. (d)(i) above and in respect of para. d(ii) and d(iii) where such valuation proves anEvent of Defaulthas occurred, in all other circumstances theBank. |

If aFinancial Covenant is breached theBorrower may indicate by notifying theBank without undue delay that it intends to remedy the breach, in which case theBorrowermust within 20 (twenty)Business Days from the notification remedy the breach by depositing cash as additional security into theEscrow Account in an amount which, if applied towards prepayment of theFacility, would be sufficient to reduce theFacilitysuch that the relevantFinancial Covenantwould no longer be in breach; in each case using the proceeds of:

| a) | new loans by shareholders, affiliated companies or third parties subject to entering into a subordination agreement (Nachrangvereinbarung); and/or |

| b) | new equity in theBorrowerwhich does not get applied in prepayment of theFacility. |

Subject to Section 20(e), this cure right may not be exercised on more than two consecutive times and more than three times during the overall term of theFacility.

TheUndertakings contained in this Section 19 have to be fulfilled by theBorrower and remain in force and effect from the date of thisAgreementuntil the total discharge of all theBorrower's liabilities under theFinance Documents.

TheBorrower

| (i) | has to maintain the following insurance policy(ies) with (an) insurance company(ies) satisfactory to theBank: |

| - | “All-risk” insurance (covering, among others, fire, storm, or other natural disasters, terrorism and vandalism, in each case at a floating replacement value ("Gleitender Neuwert") for theCollateral Asset including the constructions and improvements thereon up to the replacement costs. Insurance for terrorism may be waived after consultation with theBank, if, due to the location and situation of theCollateral Asset, a terrorist attack seems unlikely and if such waiver has no negative implications in case of securitization or syndication. |

| - | Liability insurance in an appropriate amount for damages arising in connection with the ownership and operation of theCollateral Asset; |

| - | Business interruption insurance against loss of rental income for a period of at least 3 (three) years as a consequence of damages to theCollateral Asset; |

| (ii) | may not agree to a material change or amendment of the terms and conditions of any insurance agreement which could result in an increase of the premium or in a restriction of insurance coverage; |

| (iii) | has to duly pay or procure the payment of the insurance premiums; |

| (iv) | has to deliver to theBank copies of all insurance policies and agreements and any |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 25 of 50 |

replacementsthereof and all material correspondence with the insurance companies without undue delay (e.g. correspondence with respect to the occurrence of any event or circumstance that results in theBorrower having a right to make a claim exceeding € 50,000 (fifty thousand Euros) under any of the insurances).

| 19.2.1 | Permissible Accounts |

| (a) | TheBorrowermay and has to maintain exclusively the following accounts: |

| (iv) | aRental Account (i) for the collection of all rent and lease receivables from theCollateral Asset, including payments of ancillary costs from the tenants, as well as any other receivables and (ii) to settle all expenses and other payments in accordance with Section 0 (“19.2.2 Cash Flow Waterfall”). |

| (v) | anEscrow Account serving to establish a cash reserve and for the purposes agreed upon in thisAgreement, and |

| (vi) | aGeneral Account for the free disposal of theBorrower in accordance with the stipulations in thisAgreement. |

| (b) | TheRental Account and theEscrow Account have to be held with a German bank with a requisite short term rating of at least one of the following: “F1” by Fitch, “P-1” by Moody’s and/or “A-1+” by Standard & Poor’s, or another bank accepted by theBank. . TheRental Account and theEscrow Accounthave to be pledged to theBank creating a first-priority pledge. |

| (c) | TheBorrowerhas to submit a confirmation of the account holding bank to theBank,according to which this institution, with regard to the pledged account – for the duration of the pledge to theBank – (i) waives any set-off and retention rights ("Aufrechnungs- und Zurückbehaltungsrechte") and (ii) a right of lien (e.g. according to its general terms of business) of the account holding bank is excluded and/or subordinated to theBank’sright of lien. However, a right of lien of the account holding bank may remain in place to the extent it guarantees expenses and fees exclusively related to the account holding as well as amounts not finally credited to the account (e.g. return debit notes). |

| (d) | TheBorrowermay not have any accounts other than as set out in paragraph (a) above. |

| 19.2.2 | Cash Flow Waterfall |

| (a) | TheBorrower undertakes to ensure that all rental income from theCollateral Asset,including payments ofancillary costs from the tenants, as well as any other receivables by theBorrower are exclusively paid into theRental Account, unless agreed otherwise in thisAgreement. |

| (b) | TheBorrowermay disburse the credit balance in theRental Account, without affecting the Bank’s pledge, on eachInterest Payment Date in the following order (theRental Income Waterfall): |

| (i) | to settle (i) the expenses necessary for the operation and maintenance of theCollateral Assetexcluding any capital expenditures (Operating Expenses); and (ii)taxes due as well as any other public duties due; |

| (ii) | to theBank regarding any fees and remunerations due other than interest and principal, in as far as such amounts are not withheld from the drawdown amount; |

| (iii) | to theBank regarding interest accrued under theFacility; |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 26 of 50 |

| (iv) | to settle any amounts due under theHedging Agreement; |

| (v) | to settle capital expenditures due in accordance with theBusiness Plan (if any); |

| (vi) | to settle asset management fees up to an amount of 14 % of theProjected Net Operating Income; |

| (vii) | to theEscrow Account in case of aCash Trap orCash Sweep according to Section 20 (Cash Trap / Cash Sweep); |

| (viii) | for the free disposal of theBorrower(e.g. towards payment of asset management fees over and above fees paid in accordance with (vi)) as long as (i)noEvent of Default has occurred and is continuing and(ii) noCash Trap orCash Sweep has occurred and is continuing. |

| a) | Rental Account: TheBorrower may dispose of amounts standing to the credit of theRental Account without theBank’sconsent in accordance with theRental Income Waterfall set forth under Section 19.2.2 (Cash Flow Waterfall) until revocation of such authority by theBank. TheBankis entitled to revoke the authority of theBorrower upon the accurance of an Event of Default. |

| b) | Escrow Account: TheBorrower may dispose of the amounts standing to the credit of the Escrow Account only with theBank’sprior approval, unless the disbursement is used for payments under theFacility in accordance with theFinance Documents. |

| c) | General Account:TheBorrower may dispose of the amounts standing to the credit of theGeneral Account. |

| 19.2.4 | Online Access / Account Statements / Direct Debit Authorization |

| (a) | In case the accounts listed under Section 19.2.1 (Permissible Accounts) above are not held with theBank the Borrower shall obtain – if technically feasible – an online access to these respective accounts in favour of theBank. If this is technically not possible, theBorrowershall provide theBankwith monthly account statements regarding these accounts. |

| (b) | TheBankshall be authorized, without any further consent of, or notification to, theBorrower, to collect any payments due to be made by theBorrower under thisAgreementfrom theRental Accountand theEscrow Account. |

| 19.3. | Borrower’s Company Purpose |

TheBorrower shall be and has to remain a special purpose company with the sole purpose of holding, managing and operating theCollateral Asset.

| 19.4. | Borrower’s Administrative Seat |

The organization of theBorrower is structured so as to not create a permanent establishment in Germany. This means in particular that no material business decisions are taken in Germany.

| 19.5. | Measures Requiring Approval |

The economic reputation of theBorrowerand of the shareholders and theGroup as well as

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 27 of 50 |

the trust in the qualification of theBorrower’smanagement are significant factors for the positive risk assessment of the overall financing project and are thus a significant precondition for granting theFacility. Since a change in any of the aforementioned factors may result in a significant increase of the risk of theFacilityor may establish a (partial) risk of a shortfall under theFacility, the execution of the following measures requires theBank’sprior written consent:

| (i) | capital increases and decreases, as well as increases and decreases in reserves by theBorrower; |

| (ii) | change of control over theBorrower;Controlmeans that any individual or group of individualsActing together holds, directly or indirectly, more than 50 % (fifty percent) of the shares in theBorrower (excluding shares in the company that do not grant any right to a profit or capital distribution beyond a certain amount) and/or of the voting rights or has the possibility to appoint the majority of the members of the management, of the managing board or of the representatives of the shareholders in the supervisory board. Furthermore, a company shall be regarded as controlled directly or indirectly by an individual, if the company is considered in the consolidated annual accounts of that individual consistent with the generally accepted accounting principles of its country of establishment. |

Acting together means when individual persons or legal entities coordinate their conduct with regard to the exercise of control or the exercise of voting rights or in any other manner on the basis of an agreement or on any other basis.

TheBank’s consent is deemed to be given for the following measures:

| · | a merger of theREIT with another listed or unlisted REIT (either on the level of theREIT or theShareholder) whereby AR Capital LLC or other group company (group company for the purposes of this section shall be any of the companies mentioned in theStructure Chart) stays in control of theBorrower; or |

| · | Listing of the currently unlistedREIT on a stock exchange |

(thePlanned IPO), subject to the prior information of theBank about the implementation of thePlanned IPOand submission of all documents required for the Banks compliance with § 19 II KWG.

| (iii) | changes in the management of theBorrower; |

| (iv) | conversions, mergers, splits and changes in status of theBorrower; |

| (v) | acquisition of a participation in another company by theBorrower; |

| (vi) | assignment or sale of the entire or almost the entire business ofGroup Companies; |

| (vii) | any material change in theBusiness Plan, including capital expenditures and material construction works related to theCollateral Asset; |

| (viii) | any entering into / surrender of / assignment of / amendment to any lease agreement with respect to theCollateral Asset as well as any consent to sub-lease; |

| (ix) | contracts with officers and shareholders, conclusion, amendment or cancellation of contracts with executives, members of a supervisory board, work councils or shareholders of theBorrower, if the total value of such contracts exceeds € 100,000.00 (one hundred thousand Euros); |

| (x) | loans to officers, shareholders, executives, members of a supervisory board or work councils of theBorrower; |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 28 of 50 |

| (xi) | entering into financial obligations (including loan liabilities as well as the granting of warranties and guarantees) with third parties outside the normal course of business operations, whose total amount exceeds € 50,000 (fifty thousand Euros), provided the Borroweris not obliged to do so under applicable law or administrative or court orders. TheBorrowershall inform theBankwithout undue delay on any corresponding administrative / court order and take legal action at theBank’sreasonable request. All costs and expenses arising in the course of or in accordance with such legal actions shall be borne by theBorrower. |

Upon the written request by theBank, theBorrower shall provide detailed information on any of the aforementioned measures or shall procure that theBank is provided with such information.

TheBank shall grant its consent if no increase of the credit risk is to be expected as a result of the prescribed measures over the remaining term of theFacility and if no negative implications are to be expected in respect of a securitization, the securitizability or a syndication of the loan or any notes emitted in the course of a securitization (in particular regarding a downgrading).

| 19.6. | Management of the Collateral Asset |

| (a) | At all times, theBorrower shall maintain theCollateral Asset in good repair and condition and implement all reasonable measures required to preserve the value of theCollateral Asset. |

| (b) | At all times, theBorrower must to ensure that the services of theProperty Manager andAssetManageror a new property or asset manager are conducted properly at conditions customary to the market. |

| (c) | The Borrower has to ensure that thePropertyManagerandAssetManagerhave the necessary experience. TheBorrower has to ensure that theAssetManager submits a writtenDuty of Care Agreement to theBank. |

| (d) | TheBorrowerwill provide theBank without undue delay with an energy pass (Energieausweis) for theCollateral Asset, if and as soon as, during the term of theFacility, a legal obligation to issue such an energy pass is imposed. |

| (e) | Any conclusion, material amendment, termination or replacement of a property management agreement concluded with the Property Manager andAsset Manageror with a new property manager with regard to theCollateral Asset,as well as any change of use of theCollateral Assetrequire theBank’sprior consent, such consent not to be unreasonably withheld. |

Any facilities granted to theBorrower by third parties (this also includes direct and indirect shareholders of theBorrower) as well as comparable liabilities of theBorrowerand interest payments thereon, any dividend payments and distributions on equity shall be subordinated pursuant to a subordination agreement (Nachrangvereinbarung), rights for repayment assigned to the Bank upon the condition that anEvent of Default occurs, theBank intends to enforce its rights under the pledge of shares and declares an assignment of payment rights. The final maturity of such loans shall fall after theFinal Repayment Date. No security shall be granted for such facilities by theBorrower.

| 20. | Cash Trap / Cash Sweep |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 29 of 50 |

| (i) | theLTV Ratio exceeds 60 % (sixty per cent); |

| (ii) | anEvent of Default has occurred and is continuing |

(each aCash Trap Event),

all amounts standing to the credit of theRental Account – after deduction of any expenses and payment obligations in accordance with theRental Income Waterfall under No. (i) to No (v). - shall at eachInterest Payment Date be transferred from theRental Account to theEscrow Account (theCash Trap).

| (b) | TheCash Trap shall continue to operate until theBank confirms to theBorrowerthat theCash Trap Event has been remedied or waived by theBank. TheBorrower may cure theCash Trap Event in the same way as a breach ofFinancial Covenant. |

For clarification: No monies standing to the credit of theRental Account are subject to free disposal by theBorrower during aCash Trap;in particular, no distributions to theBorrower’sshareholders are permissible during aCash Trap.

| (c) | Any funds held in theEscrow Account due to aCash Trap will be released to theBorrowerif, for at least two completeInterest Periods, theLTV Ratio has remained below the level defined in paragraph (a)(i) and no Event of Default orPotential Event of Defaultis continuing. Any release will be limited to such an amount which will not result in a newCash Trap Event. |

| (d) | If aCash Trap Event has continued for at least two full interest periods, then theBankmay at anytime thereafter use any of the funds accumulated due to theCash Trapto prepay any outstanding amounts under the Facility (theCash Sweep). |

| (e) | Any funds standing on theEscrow Account due to aCash Trap will be taken into consideration for the calculation of theLTV Ratio but not for the calculation of theISC Ratio. |

| (f) | Section 21.2 remains unaffected. |

| 21.1. | Borrower’s Right of Termination |

Reference is made toSection 11.2.1. (Voluntary Prepayments). TheBorrower'slegal rights of termination remain unaffected.

| 21.2. | Bank’s Right of Termination |

Without prejudice to mandatory provisions of law, theBank has the right to terminate theFacility in whole or in part in case anEvent of Default occurs ("aus wichtigem Grund"), i.e. an important reason that makes the continuation of theFacility unacceptable to the Bank,taking theBorrower’sjustified interests into account. Particularly the following circumstances constitute anEvent of Default:

| (i) | (Payment Default) Any failure of theBorrower to make any payment due under thisAgreement, where such failure (i) exceeds more than a quarter of theBorrower’s payment obligations owed to the Bank in one year and (ii) continues at least 10 (ten)Business Days after the delivery of a written notice by theBank of the failure to make such payment and referencing to the right of termination. |

Loan Agreement between

ARC RMNUSGER01 LLC and Deutsche Pfandbriefbank AG | Page 30 of 50 |

| (ii) | (Breach of Financial Covenants) AFinancial Covenant is breached and not rectified within 20 (twenty)Business Days after the delivery of a written notice by theBank also referencing to the right of termination. |

| (iii) | (Impairment of Economic Circumstances) A material impairment occurs in theBorrower’seconomic circumstances or threatens to occur and thus the repayment of theFacilityor the satisfaction of any other liability towards theBankis jeopardized – even when applying any existing collateral. |

| (iv) | (Change of Control) Any change in theControl of the Borrower (or any part thereof) occurs without theBank’s prior consent, subject to the Planned IPO as agreed in section 19.5(ii). The parties hereby agree that the continued exercise ofControl over theBorrower for the term of theFacility is an inherent basis for theBank’sdecision and therefore, in case of a change inControl – without prior consent – the continuation of theFacilityis unacceptable to theBank, taking theBorrower’slegitimate interests into account. |

| (v) | (Insolvency) If theBorrower becomes insolvent, i.e. is unable to meet its payment obligations or is over-indebted, or if an application for insolvency proceedings over theBorroweris filed, provided such application is not revoked or refused within 20 (twenty)Business Days after its submission. |

| (vi) | (Enforcement Measures) The Borrowerbecomes subject to enforcement measures (“Zwangsvollstreckung”) exceeding an amount of EUR 50,000 (fifty thousand Euros). |

| (vii) | (Exposure of Collateral) Any collateral stipulated in thisAgreement and not waived by the Bank is not established or its validity is or becomes doubtful and such collateral has not been validly established within 20 (twenty)Business Days after the delivery of a written notice by theBank drawing attention to this fact, or the realisation of any collateral is hindered or jeopardized and at the time no replacement collateral of an equivalent value is provided within the aforementioned time period. |

| (viii) | (Impairment of Collateral) The value of any collateral granted to theBank decreases materially and such decrease jeopardizes the repayment of theFacility or the fulfilment of any other payment obligation vis-à-vis the Bank, without theBorrower having offered to theBank other adequate additional security within 20 (twenty)Business Days after the delivery of a written notice by theBank drawing attention to the right of termination. |

| (ix) | (Change of Business) TheBorrower extends its business operations contrary to thisAgreement (see Section 19.3 (Borrower’s Company Purpose)) beyond the ownership, development, refurbishment, management and operation of theCollateral Asset and activities ancillary thereto or terminates its business operations. |

| (x) | (Incorrect Information) Any of theRepresentations or any of the information pursuant to Section 17 (Information) or any other significant information that theBorroweror aGroup Company has provided in order to obtain theFacilityor to prove observance of its obligations arising from thisAgreement is proven to be incorrect or incomplete and therefore misleading. |