UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22585

Tortoise Pipeline & Energy Fund, Inc.

(Exact name of registrant as specified in charter)

11550 Ash Street, Suite 300, Leawood, KS 66211

(Address of principal executive offices) (Zip code)

David J. Schulte

11550 Ash Street, Suite 300, Leawood, KS 66211

(Name and address of agent for service)

913-981-1020

Registrant's telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: November 30, 2011

Item 1. Report to Stockholders.

Tortoise

Pipeline & Energy Fund, Inc. 2011 Annual Report

|

In today’s environment some investments

are more relevant than ever. |

Company at a glance

Tortoise believes Tortoise Pipeline & Energy Fund, Inc. (NYSE: TTP) is the first closed-end fund that focuses particularly on the broader $400 billion+ North American pipeline universe.

Investment strategy

TTP seeks to provide stockholders with a high level of total return, with an emphasis on current distributions. Our fund focuses particularly on North American pipeline companies that transport natural gas, natural gas liquids, crude oil and refined products, and to a lesser extent, on other energy infrastructure companies.

Because of our traditional tax flow-through nature as a regulated investment company (RIC), we have the differentiated ability and flexibility to efficiently target and access traditional pipeline corporations alongside master limited partnerships (MLPs). Over 75 percent of our portfolio will generally be in companies structured as corporations or limited liability companies domiciled in the United States, Canada or United Kingdom with the remaining up to 25 percent in MLPs. We believe the broader North American pipeline universe offers strong business fundamentals and expanded growth opportunities.

We also intend to write (sell) covered call options to seek to enhance long-term return potential across economic environments, increase current income and mitigate portfolio risk through option income. Our covered call strategy will focus on other energy infrastructure companies that we believe are integral links in the value chain for pipeline companies.

TTP seeks to provide:

Attractive total return potential with high current income in a defensive sector

Access to real, long-lived pipeline assets essential to the functioning of the US economy

Exposure to expanded energy infrastructure growth projects that connect new areas of supply with demand

Ability to efficiently invest across North American pipeline universe through traditional tax flow-through fund structure

Investor simplicity through one 1099, no K-1s, no unrelated business taxable income, IRA suitability

Expertise of Tortoise Capital Advisors, a leading and pioneering energy infrastructure investment firm

Fund information at Dec. 31, 2011 (unaudited)

| | Top 10 holdings | | | | | | |

| | | | | | | | Percent of | |

| | | | | Market value | | investment | |

| Name | | (in millions) | | securities | |

| 1. | | Williams Companies, Inc. | | $ | 30.7 | | 9.2% | |

| 2. | | Spectra Energy Corp. | | | 25.2 | | 7.5% | |

| 3. | | ONEOK, Inc. | | | 17.2 | | 5.1% | |

| 4. | | Kinder Morgan Mgmt, LLC | | | 17.1 | | 5.1% | |

| 5. | | NiSource, Inc. | | | 17.1 | | 5.1% | |

| | 6. | | TransCanada Corp. | | | 16.9 | | 5.0% | |

| | 7. | | CenterPoint Energy, Inc. | | | 14.6 | | 4.4% | |

| 8. | | Enbridge Energy Mgmt, LLC | | | 11.5 | | 3.4% | |

| 9. | | Enbridge, Inc. | | | 9.4 | | 2.8% | |

| 10. | | Energy Transfer Partners, L.P. | | 8.2 | | 2.5% | |

| | | Total | | $ | 167.9 | | 50.1% | |

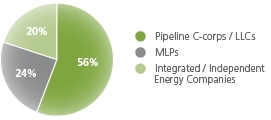

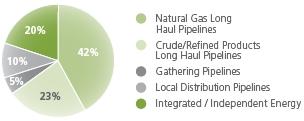

Portfolio statistics by ownership structure

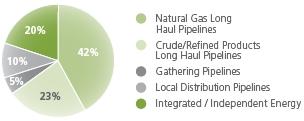

Portfolio statistics by asset type

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

January 12, 2012

Dear fellow shareholder,

We are pleased to introduce Tortoise Pipeline & Energy Fund (NYSE: TTP), which we believe to be the first closed-end fund that particularly focuses on the large and diverse $400 billion North American pipeline universe. As a flow-through regulated investment company, TTP has the differentiated ability and flexibility to efficiently access traditional pipeline corporations along with master limited partnerships.

The North American energy landscape is undergoing what we view to be a game-changing transformation, being validated by significant investments by some of the world’s largest energy companies. Technology improvements are driving this new chapter in our nation’s energy supply as abundant domestic oil and natural gas supply is now economically recoverable. Pipelines that connect new energy supply with growing demand are critical to this increased production. From 2011 – 2014 alone, we expect more than $65 billion will be invested in building out North American pipeline infrastructure. These are not “build it and they will come” type endeavors, but are generally identified and committed projects, with long-term contracts in place.

Fund highlights

We are pleased to report that we fully invested the capital received in our initial public offering in less than two months following the initial launch, meeting our target of investing 80 percent of the portfolio in North American pipeline companies that transport natural gas, natural gas liquids, crude oil and refined products, with the remainder in other energy infrastructure companies. We recently declared our first quarterly distribution of $0.40625 per share, to be paid on March 1, 2012 to stockholders of record on Feb. 22, 2012. This full run-rate distribution achieves the fund’s target of a 6.5 percent annualized yield on its $25 public offering price.

Following the 2011 fiscal year end, TTP finalized the funding of its leverage, which includes privately placed senior unsecured notes and mandatory redeemable preferred shares. Including its credit facility, TTP’s initial leverage is in line with its initial target of approximately 25 percent of total assets, with the majority at fixed rates. We continue to believe a primarily fixed-rate strategy with laddered maturities enhances the predictability and sustainability of our distributions across interest rate environments.

Additional information about our financial performance is available in the Management’s Discussion of this report.

Conclusion

TTP provides investors access to the sizeable pipeline network of one of the world’s largest consumers of energy, simplified tax reporting through a Form 1099 and no unrelated business taxable income, making it suitable for retirement and other tax-exempt accounts. You have many choices for your investments and we appreciate your confidence and trust.

Sincerely,

The Managing Directors

Tortoise Capital Advisors, L.L.C.

The adviser to Tortoise Pipeline & Energy Fund, Inc.

| | Table of contents | | |

| | | |

| Management’s Discussion | 5 | |

| | | |

| Financial Statements | 8 | |

| | | |

| | Notes to Financial Statements | 15 | |

| | | |

| Report of Independent Registered | | |

| Public Accounting Firm | 21 | |

| | | |

| Company Officers and Directors | 22 | |

| | | |

| Additional Information | 24 | |

| | | |

| Contacts | 26 | |

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Management’s Discussion (unaudited)

The information contained in this section should be read in conjunction with our Financial Statements and the Notes thereto. In addition, this report contains certain forward-looking statements. These statements include the plans and objectives of management for future operations and financial objectives and can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” or “continue” or the negative thereof or other variations thereon or comparable terminology. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors that could cause actual results and conditions to differ materially from those projected in these forward-looking statements are set forth in the “Risk Factors” section of our public filings with the SEC.

Introduction

We include the Management’s Discussion section in each quarterly report to provide you transparency and insight into the results of operations, including comparative information to prior periods and trends. Beginning in our report dated February 29, 2012, and quarterly thereafter, we will include a “Key Financial Data” page which provides quarterly and annual detail of our distributable cash flow (“DCF”) and other important metrics, including leverage and selected operating ratios. We hope that you find this discussion and financial data a useful supplement to the GAAP financial information included in this report. As this annual report is only for the initial stub period from the IPO through November 30, 2011, the financial results to discuss are limited. Our fiscal quarter report as of February 29, 2012, will include a complete discussion for the quarter ended February 29, 2012.

Overview

Tortoise Pipeline & Energy Fund, Inc. (“TTP”) completed its initial public offering and commenced operations on October 31, 2011. TTP issued 10,000,000 shares at $25.00 per share for net proceeds after issuance costs of approximately $238 million. TTP’s primary investment objective is to provide a high level of total return, with an emphasis on current distributions. We seek to provide stockholders an efficient vehicle to invest in a portfolio consisting primarily of equity securities of pipeline and other energy infrastructure companies. We intend to focus primarily on pipeline companies that engage in the business of transporting natural gas, natural gas liquids (“NGLs”), crude oil and refined petroleum products, and, to a lesser extent, on other energy infrastructure companies. Energy infrastructure companies own and operate a network of asset systems that transport, store, distribute, gather, process, explore, develop, manage or produce crude oil, refined petroleum products (including biodiesel and ethanol), natural gas or NGLs or that provide electrical power generation (including renewable energy), transmission and/or distribution. We also seek to provide current income from gains earned through an option strategy which consists of writing (selling) covered call options on selected equity securities in our portfolio.

TTP is a registered non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”), and expects to qualify as a regulated investment company (“RIC”) under the U.S. Internal Revenue Code of 1986, as amended (the “Code”). Tortoise Capital Advisors, L.L.C. (the “Adviser”) serves as investment adviser.

Company update

The initial IPO proceeds, and proceeds from leverage, were fully invested as of mid-December. The portfolio holdings and weightings are consistent with our target portfolio of at least 80 percent of our total assets invested in equity securities of pipelines and other energy infrastructure companies. Information on our $25 million credit facility and our senior notes and mandatorily redeemable preferred shares is included in the Liquidity and Capital Resources discussion below.

Critical accounting policies

The financial statements are based on the selection and application of critical accounting policies, which require management to make significant estimates and assumptions. Critical accounting policies are those that are both important to the presentation of our financial condition and results of operations and require management’s most difficult, complex, or subjective judgments. Our critical accounting policies are those applicable to the valuation of investments and certain revenue recognition matters as discussed in Note 2 in the Notes to Financial Statements.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Management’s Discussion (unaudited)

(continued)

Determining distributions to stockholders

Our portfolio generates cash flow from which we pay distributions to stockholders. Our Board of Directors considers our current and estimated future DCF in determining distributions to stockholders. Our Board of Directors reviews the distribution rate quarterly, and may adjust the quarterly distribution throughout the year. Our goal is to declare what we believe to be sustainable quarterly distributions with increases safely covered by earned DCF. In addition, on an annual basis, we may distribute additional capital gains if necessary to meet minimum distribution requirements and thus avoid being subject to excise taxes.

Determining DCF

DCF is simply income from investments less expenses. Income from investments includes the amount we receive as cash or paid-in-kind distributions from common stock, MLPs or affiliates of MLPs in which we invest and interest payments on short-term debt securities we own. Income also includes the net premium received from the sales of covered calls. The total expenses include current or anticipated operating expenses and leverage costs. In the future, each will be summarized for you in the Key Financial Data table and discussed in more detail below.

Income from investments

We seek to achieve our investment objectives by investing in a portfolio consisting primarily of equity securities of pipeline and other energy infrastructure companies. We evaluate each holding based upon its contribution to our investment income and its risk relative to other potential investments.

We focus primarily on pipeline companies that engage in the business of transporting natural gas, NGLs, crude oil and refined products through pipelines, and, to a lesser extent, on other energy infrastructure companies. These pipeline companies own and operate long haul, gathering and local gas distribution pipelines.

We also seek to provide current income from gains earned through an option strategy. We write (sell) covered call options on selected equity securities in our portfolio. We focus our covered call strategy on other energy infrastructure companies that we believe are integral links in the energy infrastructure value chain for pipeline companies.

In future reports, we will report on income from investments as a percent of average total assets for the quarter as compared to the prior quarter and the prior year.

Expenses

We incur two types of expenses: (1) operating expenses, consisting primarily of the advisory fee; and (2) leverage costs. In future reports, we will report on operating expenses and leverage costs for the quarter as compared to the prior quarter and the prior year.

While the contractual advisory fee is 1.10 percent of average monthly managed assets, the Adviser has agreed to waive an amount equal to 0.25 percent of average monthly managed assets for year 1, 0.20 percent of average monthly managed assets for year 2 and 0.15 percent of average monthly managed assets for year 3 following the closing of the initial public offering.

Distributable cash flow

As outlined above, DCF is simply income from investments less expenses. In future reports, this section will report our DCF for the quarter as compared to the prior quarter and the prior year.

On November 30, 2011, we declared a distribution of $0.40625 per share to be paid on March 1, 2012. This distribution achieves our target of a 6.5 percent annualized yield on the $25 public offering price.

Liquidity and capital resources

TTP had total assets of $309 million at year-end. Our total assets reflect the value of our investments, which are itemized in the Schedule of Investments. It also reflects cash, interest and receivables and any expenses that may have been prepaid. Subsequent to quarter-end, we completed the investment of our IPO proceeds and completed a private placement of our leverage.

On November 9, 2011, we entered into a $25 million, 364-day unsecured credit facility. Under the terms of the credit facility, The Bank of Nova Scotia serves as a lender and the lending syndicate agent on behalf of other lenders participating in the credit facility. The credit facility has a variable annual interest rate equal to the one-month LIBOR plus 1.25 percent and a non-use fee equal to an annual rate of 0.20 percent of the difference between the total credit facility commitment and the average outstanding balance at the end of each day.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Management’s Discussion (unaudited)

(continued)

On November 15, 2011, we received initial funding of $24.5 million of a $49 million private placement of notes and $8 million of a $16 million private placement of mandatorily redeemable preferred stock. The funding of the remaining $24.5 million of notes and $8 million of preferred stock occurred on December 8, 2011. Details of our notes and preferred stock are outlined in the tables below.

Senior Notes

| Series | | Amount | | Rate | | Due Date |

| Series A | | $ | 10,000,000 | | Floating rate | | December 15, 2016 |

| Series B | | | 17,000,000 | | 2.50% | | December 15, 2014 |

| Series C | | | 6,000,000 | | 3.49% | | December 15, 2018 |

| Series D | | | 16,000,000 | | 4.08% | | December 15, 2021 |

| | $ | 49,000,000 | | | | |

Mandatorily Redeemable Preferred Stock

| Series | | Amount | | Rate | | Due Date |

| Series A | | $ | 16,000,000 | | 4.29% | | December 15, 2018 |

The blended rate on the fixed rate portion of our notes and preferred stock is 3.59 percent with a weighted average maturity of 6.6 years. The current blended rate including our floating rate note and anticipated usage of our credit facility is 3.06 percent. We’ve fixed the rate on approximately 70 percent of our leverage, reducing our exposure to rising interest rates in the future.

We use leverage to acquire investments consistent with our investment philosophy. The terms of our leverage are governed by regulatory and contractual asset coverage requirements that arise from the use of leverage. Our coverage ratios are updated each week on our Web site at www.tortoiseadvisors.com.

Taxation of our distributions

We expect that distributions paid on common shares will generally consist of: (i) investment company taxable income which includes dividends (that under current law are eligible for a reduced tax rate, which we refer to as qualified dividend income), the excess of any short-term capital gains over net long-term capital losses and interest income; (ii) long-term capital gain (net gain from the sale of a capital asset held longer than 12 months over net short-term capital losses) and (iii) return of capital.

We may designate a portion of our quarterly distributions as capital gains and we may also distribute additional capital gains in the last fiscal quarter if necessary to meet minimum distribution requirements and to avoid being subject to excise taxes. If, however, we elect to retain any capital gains, we will be subject to U.S. capital gains taxes. The payment of those taxes will flow-through to stockholders as a tax credit to apply against their U.S. income tax payable on the deemed distribution of the retained capital gain.

Detailed individual tax information for each fiscal year will be reported to stockholders on Form 1099 after year-end.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Schedule of Investments

November 30, 2011

| Shares | | Fair Value |

| Common Stock — 69.2%(1) | | | | |

| |

| Crude/Refined Products Pipelines — 5.1%(1) | | | |

| Canada — 3.4%(1) | | | | |

| Enbridge Inc. | 151,450 | | $ | 5,341,641 |

| Pembina Pipeline Corporation | 103,700 | | | 3,024,732 |

| United States — 1.7%(1) | | | | |

| Kinder Morgan, Inc. | 141,050 | | | 4,160,975 |

| | | | 12,527,348 |

| Local Distribution Pipelines — 7.6%(1) | | | |

| United States — 7.6%(1) | | | | |

| CenterPoint Energy, Inc. | 443,000 | | | 8,815,700 |

| NiSource Inc. | 423,214 | | | 9,695,833 |

| | | | 18,511,533 |

| Marine Transportation — 2.4%(1) | | | | |

| Republic of the Marshall Islands — 2.4%(1) | | | |

| Teekay Offshore Partners L.P. | 68,100 | | | 1,899,309 |

| Teekay Offshore Partners L.P.(2) | 155,230 | | | 3,944,394 |

| | | | 5,843,703 |

| Natural Gas Gathering Pipelines — 1.6%(1) | | | |

| United States — 1.6%(1) | | | | |

| Targa Resources Corp. | 111,105 | | | 3,840,900 |

| |

| Natural Gas Pipelines — 25.9%(1) | | | | |

| Canada — 4.1%(1) | | | | |

| Keyera Corp. | 12,050 | | | 543,458 |

| TransCanada Corporation | 228,351 | | | 9,545,072 |

| United States — 21.8%(1) | | | | |

| EQT Corporation | 9,100 | | | 564,291 |

| National Fuel Gas Company | 9,600 | | | 556,320 |

| ONEOK, Inc. | 123,400 | | | 10,261,944 |

| Questar Corporation | 210,550 | | | 4,063,615 |

| Spectra Energy Corp. | 499,506 | | | 14,695,466 |

| Williams Companies, Inc. | 717,200 | | | 23,151,216 |

| | | | 63,381,382 |

| Oil and Gas Production — 26.6%(1)(3) | | | | |

| Canada — 3.1%(1) | | | | |

| Canadian Natural Resources Limited | 88,500 | | | 3,304,590 |

| Encana Corporation | 153,000 | | | 3,067,650 |

| Talisman Energy Inc. | 79,300 | | | 1,078,480 |

| United Kingdom — 1.3%(1) | | | | |

| BP PLC (ADR) | 73,200 | | | 3,187,860 |

| United States — 22.2%(1) | | | | |

| Anadarko Petroleum Corporation | 39,800 | | | 3,234,546 |

| Apache Corporation | 31,900 | | | 3,172,136 |

| Cabot Oil & Gas Corporation | 23,400 | | | 2,073,006 |

| Chesapeake Energy Corporation | 117,000 | | | 2,964,780 |

| Chevron Corporation | 30,200 | | | 3,105,164 |

| ConocoPhillips | 45,300 | | | 3,230,796 |

| Continental Resources, Inc.(4) | 50,300 | | | 3,550,677 |

| Devon Energy Corporation | 48,500 | | | 3,174,810 |

| EOG Resources, Inc. | 33,100 | | | 3,433,794 |

| Exxon Mobil Corporation | 40,700 | | | 3,273,908 |

| Hess Corporation | 51,300 | | | 3,089,286 |

| Newfield Exploration Company(4) | 77,300 | | | 3,540,340 |

| Noble Energy, Inc. | 35,500 | | | 3,492,845 |

| Occidental Petroleum Corporation | 33,400 | | | 3,303,260 |

| Pioneer Natural Resources Company | 36,000 | | | 3,403,440 |

| Range Resources Corporation | 45,500 | | | 3,262,805 |

| Southwestern Energy Company(4) | 76,500 | | | 2,910,825 |

| | | | 64,854,998 |

| Total Common Stock | | | | |

| (Cost $163,763,674) | | | | 168,959,864 |

| | | | | |

| Master Limited Partnerships and | | | | |

| Related Companies — 22.7%(1) | | | | |

| |

| Crude/Refined Products Pipelines — 11.3%(1) | | | |

| United States — 11.3%(1) | | | | |

| Buckeye Partners, L.P. | 50,300 | | | 3,209,140 |

| Enbridge Energy Management, L.L.C.(5) | 149,349 | | | 4,758,259 |

| Holly Energy Partners, L.P. | 29,258 | | | 1,630,256 |

| Kinder Morgan Management, LLC(5) | 125,933 | | | 8,912,278 |

| Magellan Midstream Partners, L.P. | 57,400 | | | 3,672,452 |

| Plains All American Pipeline, L.P. | 57,075 | | | 3,701,885 |

| Sunoco Logistics Partners L.P. | 18,230 | | | 1,882,430 |

| | | | 27,766,700 |

See accompanying Notes to Financial Statements.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Schedule of Investments (continued)

November 30, 2011

| Shares | | Fair Value |

| Natural Gas/Natural Gas Liquids Pipelines — 9.1%(1) | |

| United States — 9.1%(1) | | | | | |

| Energy Transfer Partners, L.P. | 107,050 | | $ | 4,684,508 | |

| Enterprise Products Partners L.P. | 98,893 | | | 4,498,643 | |

| ONEOK Partners, L.P. | 76,500 | | | 3,867,840 | |

| Regency Energy Partners LP | 155,749 | | | 3,583,784 | |

| TC PipeLines, LP | 37,600 | | | 1,789,008 | |

| Williams Partners L.P. | 65,810 | | | 3,820,929 | |

| | | | 22,244,712 | |

| Natural Gas Gathering/Processing — 2.3%(1) | | | | |

| United States — 2.3%(1) | | | | | |

| Chesapeake Midstream Partners, L.P. | 34,300 | | | 899,003 | |

| Copano Energy, L.L.C. | 28,015 | | | 927,297 | |

| DCP Midstream Partners, LP | 21,450 | | | 920,419 | |

| MarkWest Energy Partners, L.P. | 18,450 | | | 989,658 | |

| Targa Resources Partners LP | 24,950 | | | 936,373 | |

| Western Gas Partners LP | 24,500 | | | 923,160 | |

| | | | 5,595,910 | |

| Total Master Limited Partnerships | | | | | |

| and Related Companies (Cost $54,683,322) | | | 55,607,322 | |

| | | | | |

| Short-Term Investments — 34.3%(1) | | | | |

| | | | | |

| United States Investment Companies — 34.3%(1) | |

| Fidelity Institutional Money Market | | | | |

| Portfolio — Class I, 0.18%(6) | 41,442,619 | | | 41,442,619 | |

| Fidelity Institutional Prime Money | | | | |

| Market Portfolio — Class I, 0.12%(6) | 40,883 | | | 40,883 | |

| Invesco Liquid Assets | | | | | |

| Institutional Portfolio — | | | | | |

| Institutional Class, 0.16%(6) | 42,332,816 | | | 42,332,816 | |

| Total Short-Term Investments | | | | | |

| (Cost $83,816,318) | | | | 83,816,318 | |

| | | | | |

| Total Investments — 126.2%(1) | | | | |

| (Cost $302,263,314) | | | | 308,383,504 | |

| Long-Term Debt Obligations — (10.0%)(1) | | | (24,500,000 | ) |

| Mandatory Redeemable Preferred | | | | |

| Stock at Liquidation Value — (3.3%)(1) | | | (8,000,000 | ) |

| Total Value of Options Written | | | | |

| (Premiums received $741,641) — (0.3%)(1) | | | (830,786 | ) |

| Other Assets and Liabilities — (12.6%)(1) | | | (30,788,482 | ) |

| | | | | |

| Total Net Assets Applicable | | | | |

| to Common Stockholders — 100.0%(1) | | $ | 244,264,236 | |

| (1) | Calculated as a percentage of net assets applicable to common stockholders. |

| (2) | Restricted securities have been fair valued in accordance with procedures approved by the Board of Directors and have a total fair value of $3,944,394, which represents 1.6% of net assets. See Note 8 to the financial statements for further disclosure. |

| (3) | All or a portion of the security represents cover for outstanding call option contracts written. |

| (4) | Non-income producing security. |

| (5) | Security distributions are paid-in-kind. |

| (6) | Rate indicated is the current yield as of November 30, 2011. |

Key to Abbreviation

ADR = American Depository Receipts

See accompanying Notes to Financial Statements.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Schedule of Options Written

November 30, 2011

| | Expiration | | Expiration | | | | Fair |

| Call Options Written | | Date | | Price | | Contracts | | Value |

| Anadarko Petroleum | | | | | | | | | | |

| Corporation | | Dec-11 | | $ | 82.50 | | 74 | | $ | (16,280 | ) |

| Anadarko Petroleum | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 85.00 | | 73 | | | (8,395 | ) |

| Anadarko Petroleum | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 87.50 | | 62 | | | (3,100 | ) |

| Anadarko Petroleum | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 90.00 | | 133 | | | (3,591 | ) |

| Anadarko Petroleum | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 95.00 | | 56 | | | (280 | ) |

| Apache Corporation | | Dec-11 | | | 105.00 | | 319 | | | (39,875 | ) |

| BP PLC (ADR) | | Dec-11 | | | 47.00 | | 548 | | | (3,836 | ) |

| BP PLC (ADR) | | Dec-11 | | | 48.00 | | 184 | | | (552 | ) |

| Cabot Oil & Gas | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 87.50 | | 96 | | | (40,032 | ) |

| Cabot Oil & Gas | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 90.00 | | 96 | | | (28,800 | ) |

| Cabot Oil & Gas | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 92.50 | | 42 | | | (7,770 | ) |

| Canadian Natural | | | | | | | | | | | |

| Resources Limited | | Dec-11 | | | 38.00 | | 40 | | | (3,800 | ) |

| Canadian Natural | | | | | | | | | | | |

| Resources Limited | | Dec-11 | | | 39.00 | | 379 | | | (17,055 | ) |

| Canadian Natural | | | | | | | | | | | |

| Resources Limited | | Dec-11 | | | 41.00 | | 213 | | | (3,195 | ) |

| Canadian Natural | | | | | | | | | | | |

| Resources Limited | | Dec-11 | | | 42.00 | | 253 | | | (2,530 | ) |

| Chesapeake Energy | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 26.00 | | 385 | | | (26,565 | ) |

| Chesapeake Energy | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 27.00 | | 418 | | | (15,884 | ) |

| Chesapeake Energy | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 28.00 | | 31 | | | (620 | ) |

| Chesapeake Energy | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 29.00 | | 336 | | | (3,696 | ) |

| Chevron Corporation | | Dec-11 | | | 110.00 | | 52 | | | (1,352 | ) |

| Chevron Corporation | | Dec-11 | | | 115.00 | | 250 | | | (1,250 | ) |

| ConocoPhillips | | Dec-11 | | | 72.50 | | 243 | | | (23,814 | ) |

| ConocoPhillips | | Dec-11 | | | 75.00 | | 7 | | | (182 | ) |

| ConocoPhillips | | Dec-11 | | | 77.50 | | 203 | | | (203 | ) |

| Continental | | | | | | | | | | | |

| Resources, Inc. | | Dec-11 | | | 70.00 | | 141 | | | (40,185 | ) |

| Continental | | | | | | | | | | | |

| Resources, Inc. | | Dec-11 | | | 75.00 | | 362 | | | (32,580 | ) |

| Devon Energy | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 67.50 | | 89 | | | (9,968 | ) |

| Devon Energy | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 70.00 | | 89 | | | (3,649 | ) |

| Devon Energy | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 75.00 | | 98 | | | (784 | ) |

| Devon Energy | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 80.00 | | 209 | | | (209 | ) |

| Encana Corporation | | Dec-11 | | | 20.00 | | 674 | | | (43,810 | ) |

| Encana Corporation | | Dec-11 | | | 22.00 | | 236 | | | (2,360 | ) |

| Encana Corporation | | Dec-11 | | | 23.00 | | 256 | | | (1,280 | ) |

| Encana Corporation | | Dec-11 | | | 24.00 | | 364 | | | (3,640 | ) |

| EOG Resources, Inc. | | Dec-11 | | | 105.00 | | 158 | | | (54,194 | ) |

| EOG Resources, Inc. | | Dec-11 | | | 110.00 | | 5 | | | (700 | ) |

| EOG Resources, Inc. | | Dec-11 | | | 115.00 | | 168 | | | (8,400 | ) |

| Exxon Mobil | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 82.50 | | 109 | | | (6,540 | ) |

| Exxon Mobil | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 85.00 | | 298 | | | (4,470 | ) |

| Hess Corporation | | Dec-11 | | | 65.00 | | 132 | | | (7,128 | ) |

| Hess Corporation | | Dec-11 | | | 67.50 | | 4 | | | (96 | ) |

| Hess Corporation | | Dec-11 | | | 70.00 | | 367 | | | (3,670 | ) |

| Hess Corporation | | Dec-11 | | | 75.00 | | 10 | | | (50 | ) |

| Newfield Exploration | | | | | | | | | | | |

| Company | | Dec-11 | | | 45.00 | | 550 | | | (110,000 | ) |

| Newfield Exploration | | | | | | | | | | | |

| Company | | Dec-11 | | | 50.00 | | 223 | | | (11,150 | ) |

| Noble Energy, Inc. | | Dec-11 | | | 97.50 | | 98 | | | (34,300 | ) |

| Noble Energy, Inc. | | Dec-11 | | | 100.00 | | 170 | | | (36,550 | ) |

| Noble Energy, Inc. | | Dec-11 | | | 105.00 | | 87 | | | (6,960 | ) |

| Occidental Petroleum | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 100.00 | | 40 | | | (8,880 | ) |

| Occidental Petroleum | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 105.00 | | 132 | | | (8,976 | ) |

| Occidental Petroleum | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 110.00 | | 162 | | | (1,782 | ) |

| Pioneer Natural | | | | | | | | | | | |

| Resources Company | | Dec-11 | | | 95.00 | | 72 | | | (20,880 | ) |

| Pioneer Natural | | | | | | | | | | | |

| Resources Company | | Dec-11 | | | 100.00 | | 235 | | | (28,200 | ) |

| Pioneer Natural | | | | | | | | | | | |

| Resources Company | | Dec-11 | | | 105.00 | | 53 | | | (1,590 | ) |

| Range Resources | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 75.00 | | 249 | | | (46,065 | ) |

| Range Resources | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 77.50 | | 79 | | | (10,270 | ) |

| Range Resources | | | | | | | | | | | |

| Corporation | | Dec-11 | | | 80.00 | | 127 | | | (9,525 | ) |

| Southwestern Energy | | | | | | | | | | | |

| Company | | Dec-11 | | | 41.00 | | 206 | | | (7,828 | ) |

| Southwestern Energy | | | | | | | | | | | |

| Company | | Dec-11 | | | 42.00 | | 398 | | | (6,368 | ) |

| Southwestern Energy | | | | | | | | | | | |

| Company | | Dec-11 | | | 46.00 | | 161 | | | (1,127 | ) |

| Talisman Energy Inc. | | Dec-11 | | | 15.00 | | 250 | | | (1,250 | ) |

| Talisman Energy Inc. | | Dec-11 | | | 16.00 | | 543 | | | (2,715 | ) |

| Total Value of Call Options Written | | | | | | |

| (Premiums received $741,641) | | | | | | | $ | (830,786 | ) |

Key to Abbreviation

ADR = American Depository Receipts

See accompanying Notes to Financial Statements.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Statement of Assets & Liabilities

November 30, 2011

| Assets | | | | |

| Investments at fair value (cost $302,263,314) | | $ | 308,383,504 | |

| Receivable for Adviser expense reimbursement | | | 53,757 | |

| Interest and dividend receivable | | | 172,956 | |

| Receivable for call options written | | | 17,200 | |

| Prepaid expenses and other assets | | | 704,899 | |

| Total assets | | | 309,332,316 | |

| Liabilities | | | | |

| Options written, at fair value | | | | |

| (premiums received $741,641) | | | 830,786 | |

| Payable to Adviser | | | 236,532 | |

| Payable for investments purchased | | | 30,744,115 | |

| Accrued expenses and other liabilities | | | 756,647 | |

| Long-term debt obligations | | | 24,500,000 | |

| Mandatory redeemable preferred stock | | | | |

| ($25.00 liquidation value per share; | | | | |

| 320,000 shares outstanding) | | | 8,000,000 | |

| Total liabilities | | | 65,068,080 | |

| Net assets applicable to | | | | |

| common stockholders | | $ | 244,264,236 | |

| Net Assets Applicable to Common Stockholders | | |

| Consist of: | | | | |

| Capital stock, $0.001 par value; | | | | |

| 10,004,200 shares issued and outstanding | | | | |

| (100,000,000 shares authorized) | | $ | 10,004 | |

| Additional paid-in capital | | | 238,338,813 | |

| Accumulated net investment loss | | | (11,589 | ) |

| Accumulated net realized loss | | | (104,259 | ) |

| Net unrealized appreciation of investments | | | 6,031,267 | |

| Net assets applicable to | | | | |

| common stockholders | | $ | 244,264,236 | |

| Net Asset Value per common share outstanding | | | | |

| (net assets applicable to common stock, | | | | |

| divided by common shares outstanding) | | $ | 24.42 | |

Statement of Operations

Period from Oct. 31, 2011(1) through Nov. 30, 2011

| Investment Income | | | | |

| Distributions from master limited partnerships | | $ | 60,962 | |

| Less return of capital on distributions | | | (57,298 | ) |

| Net distributions from master | | | | |

| limited partnerships | | | 3,664 | |

| Dividends from common stock | | | | |

| (net of foreign taxes withheld of $3,535) | | | 164,630 | |

| Dividends from money market mutual funds | | | 17,148 | |

| Total Investment Income | | | 185,442 | |

| Operating Expenses | | | | |

| Advisory fees | | | 236,532 | |

| Professional fees | | | 49,500 | |

| Franchise fees | | | 20,000 | |

| Stockholder communication expenses | | | 19,399 | |

| Administrator fees | | | 8,601 | |

| Custodian fees and expenses | | | 4,860 | |

| Fund accounting fees | | | 4,028 | |

| Registration fees | | | 3,102 | |

| Stock transfer agent fees | | | 950 | |

| Other operating expenses | | | 2,571 | |

| Total Operating Expenses | | | 349,543 | |

| Leverage Expenses | | | | |

| Interest expense | | | 36,555 | |

| Distributions to mandatory redeemable | | | | |

| preferred stockholders | | | 15,253 | |

| Amortization of debt issuance costs | | | 4,818 | |

| Other leverage expenses | | | 5,072 | |

| Total Leverage Expenses | | | 61,698 | |

| Total Expenses | | | 411,241 | |

| Less expense reimbursement by Adviser | | | (53,757 | ) |

| Net Expenses | | | 357,484 | |

| Net Investment Loss | | | (172,042 | ) |

| Realized and Unrealized Gains | | | | |

| Net realized loss on investments | | | (188,877 | ) |

| Net realized gain on options | | | 243,613 | |

| Net realized gains | | | 54,736 | |

| Net unrealized appreciation of investments, | | | | |

| including foreign currency gain (loss) | | | 6,120,190 | |

| Net unrealized depreciation of options | | | (89,145 | ) |

| Net unrealized appreciation of other | | | | |

| assets and liabilities due to | | | | |

| foreign currency translation | | | 222 | |

| Net unrealized appreciation | | | 6,031,267 | |

| Net Realized and Unrealized Gains | | | 6,086,003 | |

| Net Increase in Net Assets Applicable | | | | |

| to Common Stockholders Resulting | | | | |

| from Operations | | $ | 5,913,961 | |

| (1) | Commencement of Operations. |

See accompanying Notes to Financial Statements.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Statement of Changes in Net Assets

Period from Oct. 31, 2011(1) through Nov. 30, 2011

| Operations | | | | |

| Net investment loss | | $ | (172,042 | ) |

| Net realized gains | | | 54,736 | |

| Net unrealized appreciation | | | 6,031,267 | |

| Net increase in net assets applicable to common stockholders resulting from operations | | | 5,913,961 | |

| Capital Stock Transactions | | | | |

| Proceeds from initial public offering of 10,000,000 common shares | | | 250,000,000 | |

| Underwriting discounts and offering expenses associated with the issuance of common stock | | | (11,750,000 | ) |

| Net increase in net assets applicable to common stockholders from capital stock transactions | | | 238,250,000 | |

| Total increase in net assets applicable to common stockholders | | | 244,163,961 | |

| Net Assets | | | | |

| Beginning of period | | | 100,275 | |

| End of period | | $ | 244,264,236 | |

| Accumulated net investment loss, end of period | | $ | (11,589 | ) |

| (1) | Commencement of Operations. |

See accompanying Notes to Financial Statements.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Statement of Cash Flows

Period from Oct. 31, 2011(1) through Nov. 30, 2011

| Cash Flows From Operating Activities | | | | |

| Distributions received from master limited partnerships | | $ | 60,962 | |

| Interest and dividend income received | | | 12,619 | |

| Purchases of long-term investments | | | (189,842,906 | ) |

| Proceeds from sales of long-term investments | | | 1,889,522 | |

| Purchases of short-term investments, net | | | (83,816,318 | ) |

| Proceeds received from call options written, net | | | 972,382 | |

| Other leverage expenses paid | | | (72,167 | ) |

| Operating expenses paid | | | (25,657 | ) |

| Net cash used in operating activities | | | (270,821,563 | ) |

|

| Cash Flows From Financing Activities | | | | |

| Issuance of common stock | | | 250,000,000 | |

| Common stock issuance costs | | | (11,251,760 | ) |

| Issuance of long-term debt obligations | | | 24,500,000 | |

| Issuance of mandatory redeemable preferred stock | | | 8,000,000 | |

| Debt issuance costs | | | (526,952 | ) |

| Net cash provided by financing activities | | | 270,721,288 | |

| Net change in cash | | | (100,275 | ) |

| Cash — beginning of period | | | 100,275 | |

| Cash — end of period | | $ | — | |

| |

| Reconciliation of net increase in net assets applicable to common stockholders | | | | |

| resulting from operations to net cash used in operating activities | | | | |

| Net increase in net assets applicable to common stockholders resulting from operations | | $ | 5,913,961 | |

| Adjustments to reconcile net increase in net assets applicable to common stockholders | | | | |

| resulting from operations to net cash used in operating activities: | | | | |

| Purchases of long-term investments | | | (220,587,021 | ) |

| Proceeds from sales of long-term investments | | | 1,889,522 | |

| Purchases of short-term investments, net | | | (83,816,318 | ) |

| Proceeds received from call options written, net | | | 989,582 | |

| Return of capital on distributions received | | | 57,298 | |

| Net unrealized appreciation | | | (6,031,267 | ) |

| Net realized gains | | | (54,736 | ) |

| Amortization of debt issuance costs | | | 4,818 | |

| Changes in operating assets and liabilities: | | | | |

| Increase in interest and dividend receivable | | | (172,734 | ) |

| Increase in prepaid expenses and other assets | | | (94,938 | ) |

| Increase in receivable for call options written | | | (17,200 | ) |

| Increase in payable for investments purchased | | | 30,744,115 | |

| Increase in payable to Adviser, net of expense reimbursement | | | 182,775 | |

| Increase in accrued expenses and other liabilities | | | 170,580 | |

| Total adjustments | | | (276,735,524 | ) |

| Net cash used in operating activities | | $ | (270,821,563 | ) |

| (1) | Commencement of Operations. |

See accompanying Notes to Financial Statements.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Financial Highlights

Period from Oct. 31, 2011(1) through Nov. 30, 2011

| Per Common Share Data(2) | | | | |

| Public offering price | | $ | 25.00 | |

| Income from Investment Operations | | | | |

| Net investment loss | | | (0.02 | ) |

| Net realized and unrealized gains | | | 0.61 | |

| Total income from investment operations | | | 0.59 | |

| Underwriting discounts and offering costs on issuance of common stock(3) | | | (1.17 | ) |

| Net Asset Value, end of period | | $ | 24.42 | |

| Per common share market value, end of period | | $ | 25.01 | |

| Total Investment Return Based on Market Value(4) | | | 0.04 | % |

| |

| Supplemental Data and Ratios | | | | |

| Net assets applicable to common stockholders, end of period (000’s) | | $ | 244,264 | |

| Average net assets (000’s) | | $ | 237,454 | |

| Ratio of Expenses to Average Net Assets(5) | | | | |

| Advisory fees | | | 1.17 | % |

| Other operating expenses | | | 0.56 | |

| Expense reimbursement | | | (0.27 | ) |

| Subtotal | | | 1.46 | |

| Leverage expenses | | | 0.31 | |

| Total expenses | | | 1.77 | % |

| |

| Ratio of net investment loss to average net assets before expense reimbursement(5) | | | (1.12 | )% |

| Ratio of net investment loss to average net assets after expense reimbursement(5) | | | (0.85 | )% |

| Portfolio turnover rate | | | 1.68 | % |

| Long-term debt obligations, end of period (000’s) | | $ | 24,500 | |

| Preferred stock, end of period (000’s) | | $ | 8,000 | |

| Per common share amount of long-term debt obligations outstanding, end of period | | $ | 2.45 | |

| Per common share amount of net assets, excluding long-term debt obligations, end of period | | $ | 26.87 | |

| Asset coverage, per $1,000 of principal amount of long-term debt obligations(6) | | $ | 11,296 | |

| Asset coverage ratio of long-term debt obligations(6) | | | 1,130 | % |

| Asset coverage, per $25 liquidation value per share of mandatory redeemable preferred stock(7) | | $ | 213 | |

| Asset coverage ratio of preferred stock(7) | | | 852 | % |

| (1) | Commencement of Operations. |

| (2) | Information presented relates to a share of common stock outstanding for the entire period. |

| (3) | Represents the dilution per common share from underwriting and other offering costs for the period from October 31, 2011 through November 30, 2011. |

| (4) | Not annualized. Total investment return is calculated assuming a purchase of common stock at the initial public offering price and a sale at the closing price on the last day of the period reported (excluding brokerage commissions). |

| (5) | Annualized for periods less than one full year. |

| (6) | Represents value of total assets less all liabilities and indebtedness not represented by long-term debt obligations and preferred stock at the end of the period divided by long-term debt obligations outstanding at the end of the period. |

| (7) | Represents value of total assets less all liabilities and indebtedness not represented by long-term debt obligations and preferred stock at the end of the period divided by long-term debt obligations and preferred stock outstanding at the end of the period. |

See accompanying Notes to Financial Statements.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Notes to Financial Statements

November 30, 2011

1. Organization

Tortoise Pipeline & Energy Fund, Inc. (the “Company”) was organized as a Maryland corporation on July 19, 2011, and is a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Company’s primary investment objective is to provide a high level of total return, with an emphasis on current distributions. The Company seeks to provide its stockholders an efficient vehicle to invest in a portfolio consisting primarily of equity securities of pipeline and other energy infrastructure companies. The Company commenced operations on October 31, 2011. The Company’s stock is listed on the New York Stock Exchange under the symbol “TTP.”

2. Significant accounting policies

A. Use of estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, recognition of distribution income and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

B. Investment valuation

The Company primarily owns securities that are listed on a securities exchange or over-the-counter market. The Company values those securities at their last sale price on that exchange or over-the-counter market on the valuation date. If the security is listed on more than one exchange, the Company uses the price from the exchange that it considers to be the principal exchange on which the security is traded. Securities listed on the NASDAQ will be valued at the NASDAQ Official Closing Price, which may not necessarily represent the last sale price. If there has been no sale on such exchange or over-the-counter market on such day, the security will be valued at the mean between the last bid price and last ask price on such day.

The Company may invest up to 30 percent of its total assets in unregistered or otherwise restricted securities. Restricted securities are subject to statutory or contractual restrictions on their public resale, which may make it more difficult to obtain a valuation and may limit the Company’s ability to dispose of them. Investments in restricted securities and other securities for which market quotations are not readily available will be valued in good faith by using fair value procedures approved by the Board of Directors. Such fair value procedures consider factors such as discounts to publicly traded issues, time until conversion date, securities with similar yields, quality, type of issue, coupon, duration and rating. If events occur that will affect the value of the Company’s portfolio securities before the net asset value has been calculated (a “significant event”), the portfolio securities so affected will generally be priced using fair value procedures.

An equity security of a publicly traded company acquired in a direct placement transaction may be subject to restrictions on resale that can affect the security’s liquidity and fair value. Such securities that are convertible or otherwise will become freely tradable will be valued based on the market value of the freely tradable security less an applicable discount. Generally, the discount will initially be equal to the discount at which the Company purchased the securities. To the extent that such securities are convertible or otherwise become freely tradable within a time frame that may be reasonably determined, an amortization schedule may be used to determine the discount.

Exchange-traded options are valued at the mean of the highest bid and lowest asked prices across all option exchanges.

The Company generally values debt securities at prices based on market quotations for such securities, except those securities purchased with 60 days or less to maturity are valued on the basis of amortized cost, which approximates market value.

C. Security transactions and investment income

Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on an identified cost basis. Interest income is recognized on the accrual basis, including amortization of premiums and accretion of discounts. Dividend and distribution income is recorded on the ex-dividend date. Distributions received from the Company’s investments in master limited partnerships (“MLPs”) generally are comprised of ordinary income, capital gains and return of capital from the MLPs. The Company allocates distributions between investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on information provided by each MLP and other industry sources. These estimates may subsequently be revised based on actual allocations received from MLPs after their tax reporting periods are concluded, as the actual character of these distributions is not known until after the fiscal year end of the Company.

In addition, the Company may be subject to withholding taxes on foreign-sourced income. The Company accrues such taxes when the related income is earned.

D. Foreign currency translation

For foreign currency, investments in foreign securities, and other assets and liabilities denominated in a foreign currency, the Company translates these amounts into U.S. dollars on the following basis: (i) market value of investment securities, assets and liabilities at the current rate of exchange on the valuation date, and (ii) purchases and sales of investment securities, income and expenses at the relevant rates of exchange on the respective dates of such transactions. The Company does not isolate that portion of gains and losses on investments that is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities.

E. Distributions to stockholders

Distributions to common stockholders will be recorded on the ex-dividend date. The Company intends to make quarterly cash distributions to its common stockholders. In addition, on an annual basis, the Company may distribute additional capital gains in the last fiscal quarter if necessary to meet minimum distribution requirements and thus avoid being subject to excise taxes. The amount of any distributions will be determined by the Board of Directors. The character of distributions to common stockholders

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Notes to Financial Statements (continued)

made during the year may differ from their ultimate characterization for federal income tax purposes. There were no distributions paid to common stockholders for the year ended November 30, 2011.

Distributions to mandatory redeemable preferred (“MRP”) stockholders are accrued daily and paid quarterly based on fixed annual rates. The Company may not declare or pay distributions to its preferred stockholders if it does not meet a 200 percent asset coverage ratio for its debt or the rating agency basic maintenance amount for the debt following such distribution. The character of distributions to stockholders made during the year may differ from their ultimate characterization for federal income tax purposes. There were no distributions paid to MRP stockholders for the year ended November 30, 2011.

F. Federal income taxation

The Company intends to elect to be treated and to qualify each year as a regulated investment company (“RIC”) under the U.S. Internal Revenue Code of 1986, as amended (the “Code”). As a result, the Company generally will not be subject to U.S. federal income tax on income and gains that it distributes each taxable year to stockholders if it meets certain minimum distribution requirements. The Company is required to distribute substantially all of its income, in addition to other asset diversification requirements. The Company is subject to a 4 percent non-deductible U.S. federal excise tax on certain undistributed income unless the Company makes sufficient distributions to satisfy the excise tax avoidance requirement. The Company invests in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Company reports its allocable share of the MLP’s taxable income in computing its own taxable income.

The Company has adopted financial reporting rules regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The Company has reviewed all open tax years and major jurisdictions and concluded that there is no impact on the Company’s net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on a tax return. All tax years since inception remain open to examination by federal and state tax authorities.

G. Offering and debt issuing costs

Offering costs related to the issuance of common stock are charged to additional paid-in capital when the stock is issued. Offering costs (excluding underwriter commissions) of $500,000 related to the issuance of common stock in the initial public offering were recorded to additional paid-in capital during the period ended November 30, 2011. Debt issuance costs related to long-term debt obligations and MRP Stock are capitalized and amortized over the period the debt and MRP Stock is outstanding. Capitalized costs (excluding underwriter commissions) were reflected for the Series A Notes ($22,351), Series B Notes ($37,996), Series C Notes ($13,410), Series D Notes ($35,761) and MRP Stock ($35,761) that were each issued in November 2011.

H. Derivative financial instruments

The Company seeks to provide current income from gains earned through an option strategy which will normally consist of writing (selling) call options on selected equity securities in the portfolio (“covered calls”). The premium received on a written call option will initially be recorded as a liability and subsequently adjusted to the then current fair value of the option written. Premiums received from writing call options that expire unexercised will be recorded as a realized gain on the expiration date. Premiums received from writing call options that are exercised will be added to the proceeds from the sale of the underlying security to calculate the realized gain (loss). If a written call option is repurchased prior to its exercise, the realized gain (loss) will be the difference between the premium received and the amount paid to repurchase the option.

I. Indemnifications

Under the Company’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Company. In addition, in the normal course of business, the Company may enter into contracts that provide general indemnification to other parties. The Company’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Company that have not yet occurred, and may not occur. However, the Company has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

J. Recent accounting pronouncement

In May 2011, the FASB issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements” in GAAP and the International Financial Reporting Standards (“IFRSs”). ASU No. 2011-04 amends FASB ASC Topic 820, Fair Value Measurements and Disclosures, to establish common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP and IFRSs. ASU No. 2011-04 is effective for fiscal years beginning after December 15, 2011 and for interim periods within those fiscal years. Management is currently evaluating the impact of these amendments and does not believe they will have a material impact on the Company’s financial statements.

3. Concentration of risk

Under normal circumstances, and once fully invested in accordance with its investment objective, the Company will have at least 80 percent of its total assets (including any assets obtained through leverage) in equity securities of pipeline and other energy infrastructure companies. Energy infrastructure companies own and operate a network of asset systems that transport, store, distribute, gather and/or process, explore, develop, manage or produce crude oil, refined petroleum products (including biodiesel and ethanol), natural gas or natural gas liquids (“NGLs”) or that provide electric power generation (including renewable energy), transmission and/or distribution. The Company may invest up to 30 percent of its total assets in restricted securities, primarily through direct investments in securities of listed companies. The Company may also invest up to 25 percent of its total assets in securities of MLPs. The Company will not invest in privately-held companies.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Notes to Financial Statements (continued)

4. Agreements

The Company entered into an Investment Advisory Agreement with the Adviser. Under the terms of the Agreement, the Company pays the Adviser a fee equal to an annual rate of 1.10 percent of the Company’s average monthly total assets (including any assets attributable to leverage) minus accrued liabilities (other than debt entered into for purposes of leverage and the aggregate liquidation preference of outstanding preferred stock, if any) (“Managed Assets”), in exchange for the investment advisory services provided. The Adviser has contractually agreed to waive fees in an amount equal to an annual rate of 0.25 percent of the Company’s average monthly Managed Assets for the first year following the commencement of operations, 0.20 percent of average monthly Managed Assets for the second year following the commencement of operations and 0.15 percent of average monthly Managed Assets for the third year following the commencement of operations.

U.S. Bancorp Fund Services, LLC serves as the Company’s administrator. The Company pays the administrator a monthly fee computed at an annual rate of 0.04 percent of the first $1,000,000,000 of the Company’s Managed Assets, 0.01 percent on the next $1,000,000,000 of Managed Assets and 0.005 percent on the balance of the Company’s Managed Assets.

Computershare Trust Company, N.A. serves as the Company’s transfer agent and registrar and Computershare Inc. serves as the Company’s dividend paying agent and agent for the automatic dividend reinvestment plan.

U.S. Bank, N.A. serves as the Company’s custodian. The Company pays the custodian a monthly fee computed at an annual rate of 0.004 percent of the average daily market value of the Company’s domestic assets and 0.015 percent of the average daily market value of the Company’s Canadian Dollar-denominated assets, plus portfolio transaction fees.

5. Income taxes

It is the Company’s intention to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in the financial statements.

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles. These differences are primarily due to differences in the timing of recognition of gains or losses on investments. Permanent book and tax basis differences resulted in the reclassifications of $160,453 to accumulated net investment loss, $(158,995) to accumulated net realized loss and $(1,458) to additional paid-in capital.

As of November 30, 2011, the components of accumulated earnings on a tax basis were as follows:

| Unrealized appreciation | | $ | 5,916,756 | |

| Undistributed ordinary income | | | 13,916 | |

| Other temporary differences | | | (15,253 | ) |

| Accumulated earnings | | $ | 5,915,419 | |

As of November 30, 2011, the aggregate cost of securities for federal income tax purposes was $302,377,825. The aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost was $7,072,902, the aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value was $1,067,223 and the net unrealized appreciation was $6,005,679.

6. Fair value of financial instruments

Various inputs are used in determining the value of the Company’s investments. These inputs are summarized in the three broad levels listed below:

| | Level 1 — | quoted prices in active markets for identical investments |

| | | |

| | Level 2 — | other significant observable inputs (including quoted prices for similar investments, market corroborated inputs, etc.) |

| | | |

| | Level 3 — | significant unobservable inputs (including the Company’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following table provides the fair value measurements of applicable Company assets and liabilities by level within the fair value hierarchy as of November 30, 2011. These assets and liabilities are measured on a recurring basis.

| | Fair Value | | | | | | | | | |

| Description | | at 11/30/11 | | Level 1 | | Level 2 | | Level 3 |

| Assets | | | | | | | | | | | | |

| Equity Securities: | | | | | | | | | | | | |

| Common Stock(a) | | $ | 168,959,864 | | $ | 165,015,470 | | $ | 3,944,394 | | $ | — |

| Master Limited Partnerships | | | | | | | | | | | | |

| and Related Companies(a) | | | 55,607,322 | | | 55,607,322 | | | — | | | — |

| Total Equity Securities | | | 224,567,186 | | | 220,622,792 | | | 3,944,394 | | | — |

| Other: | | | | | | | | | | | | |

| Short-term Investments(b) | | | 83,816,318 | | | 83,816,318 | | | — | | | — |

| Total Other | | | 83,816,318 | | | 83,816,318 | | | — | | | — |

| Total Assets | | $ | 308,383,504 | | $ | 304,439,110 | | $ | 3,944,394 | | $ | – |

| Liabilities | | | | | | | | | | | | |

| Written Call Options | | $ | 830,786 | | $ | 830,786 | | $ | — | | $ | — |

| (a) | All other industry classifications are identified in the Schedule of Investments. |

| (b) | Short-term investments are sweep investments for cash balances in the Company at November 30, 2011. |

The Company did not hold any Level 3 securities during the period ended November 30, 2011.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Notes to Financial Statements (continued)

Valuation techniques

In general, and where applicable, the Company uses readily available market quotations based upon the last updated sales price from the principal market to determine fair value. This pricing methodology applies to the Company’s Level 1 investments.

An equity security of a publicly traded company acquired in a private placement transaction without registration under the Securities Act of 1933, as amended (the “1933 Act”), is subject to restrictions on resale that can affect the security’s fair value. If such a security is convertible into publicly-traded common shares, the security generally will be valued at the common share market price adjusted by a percentage discount due to the restrictions and categorized as Level 2 in the fair value hierarchy. If the security has characteristics that are dissimilar to the class of security that trades on the open market, the security will generally be valued and categorized as Level 3 in the fair value hierarchy.

The Company utilizes the beginning of reporting period method for determining transfers between levels. There were no transfers between levels for the period ended November 30, 2011.

7. Derivative financial instruments

The Company has adopted the disclosure provisions of FASB Accounting Standard Codification 815, Derivatives and Hedging (“ASC 815”). ASC 815 requires enhanced disclosures about the Company’s use of and accounting for derivative instruments and the effect of derivative instruments on the Company’s results of operations and financial position. Tabular disclosure regarding derivative fair value and gain/loss by contract type (e.g., interest rate contracts, foreign exchange contracts, credit contracts, etc.) is required and derivatives accounted for as hedging instruments under ASC 815 must be disclosed separately from those that do not qualify for hedge accounting. Even though the Company may use derivatives in an attempt to achieve an economic hedge, the Company’s derivatives are not accounted for as hedging instruments under ASC 815 because investment companies account for their derivatives at fair value and record any changes in fair value in current period earnings.

Transactions in written option contracts for the period ended November 30, 2011, are as follows:

| | Number of | | | | |

| | Contracts | | Premium |

| Options outstanding at 10/31/11 | | | — | | | $ | — | |

| Options written | | | 19,501 | | | | 998,376 | |

| Options closed | | | (1,904 | ) | | | (8,794 | ) |

| Options expired | | | (5,500 | ) | | | (247,941 | ) |

| Options outstanding at 11/30/11 | | | 12,907 | | | $ | 741,641 | |

The following table presents the types and fair value of derivatives by location as presented on the Statement of Assets and Liabilities at November 30, 2011:

| | Assets | | Liabilities |

| Derivatives not | | | | | | | | | |

| accounted for as | | | | | | | | | |

| hedging instruments | | | | Fair | | | | Fair |

| under ASC 815 | | Location | | Value | | Location | | Value |

| Written equity | | N / A | | N / A | | Options written, | | $ | 830,786 |

| call options | | | | | | at fair value | | | |

The following table presents the effect of derivatives on the Statement of Operations for the period ended November 30, 2011:

| Derivatives not | | | | | | |

| Accounted for as | | Location of | | Net Realized | | Net Unrealized |

| Hedging instruments | | Gains (Losses) | | Gain on | | Depreciation |

| Under ASC 815 | | on Derivatives | | Derivatives | | of Derivatives |

| Written equity | | Options | | $243,613 | | $(89,145) |

| call options | | | | | | |

8. Restricted security

Certain of the Company’s investments are restricted and are valued as determined in accordance with procedures established by the Board of Directors, as more fully described in Note 2. The table below shows the shares, acquisition date, acquisition cost, fair value, fair value per share and percent of net assets which the security comprises at November 30, 2011.

| | | | | | | | | | Fair | | Fair Value |

| | | | | | | | | | Value | | as Percent |

| Investment | | Number | | Acquisition | | Acquisition | | | | Per | | of Total |

| Security | | of Shares | | Date | | Cost | | Fair Value | | Share | | Net Assets |

| Teekay Offshore | | 155,230 | | 11/25/11 | | $3,709,997 | | $3,944,394 | | $25.41 | | 1.6% |

| Partners L.P. | | | | | | | | | | | | |

| (Common Units) | | | | | | | | | | | | |

The carrying value per unit of unrestricted common units of Teekay Offshore Partners L.P. was $26.39 on November 9, 2011, the date of the purchase agreement and the date an enforceable right to acquire the restricted Teekay Offshore Partners L.P. units was obtained by the Company.

9. Investment transactions

For the period ended November 30, 2011, the Company purchased (at cost) and sold securities (proceeds received) in the amount of $220,587,021 and $1,889,522 (excluding short-term debt securities), respectively.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Notes to Financial Statements (continued)

10. Long-term debt obligations

The Company has $24,500,000 aggregate principal amount of private senior notes, Series A, Series B, Series C, and Series D (collectively, the “Notes”), outstanding. The Notes were issued on November 15, 2011. The Notes are unsecured obligations of the Company and, upon liquidation, dissolution or winding up of the Company, will rank: (1) senior to all of the Company’s outstanding preferred shares; (2) senior to all of the Company’s outstanding common shares; (3) on parity with any unsecured creditors of the Company and any unsecured senior securities representing indebtedness of the Company and (4) junior to any secured creditors of the Company. Holders of the Notes are entitled to receive cash interest payments each quarter until maturity. The Series B, Series C and Series D Notes accrue interest at fixed rates and the Series A Notes accrue interest at an annual rate that resets each quarter based on the 3-month LIBOR plus 1.75 percent. The Notes are not listed on any exchange or automated quotation system.

The Notes are redeemable in certain circumstances at the option of the Company. The Notes are also subject to a mandatory redemption if the Company fails to meet asset coverage ratios required under the 1940 Act or the rating agency guidelines if such failure is not waived or cured. At November 30, 2011, the Company was in compliance with asset coverage covenants and basic maintenance covenants for its senior notes.

The estimated fair value of each series of fixed-rate Notes was calculated, for disclosure purposes, by discounting future cash flows by a rate equal to the current U.S. Treasury rate with an equivalent maturity date, plus either 1) the spread between the interest rate on recently issued debt and the U.S. Treasury rate with a similar maturity date or 2) if there has not been a recent debt issuance, the spread between the AAA corporate finance debt rate and the U.S. Treasury rate with an equivalent maturity date plus the spread between the fixed rates of the Notes and the AAA corporate finance debt rate. The estimated fair value of the Series A Notes approximates the carrying amount because the interest rate fluctuates with changes in interest rates available in the current market. The following table shows the maturity date, interest rate, notional/carrying amount and estimated fair value for each series of Notes outstanding at November 30, 2011.

| | Maturity | | Interest | | Notional/Carrying | | Estimated |

| Series | | Date | | Rate | | Amount | | Fair Value |

| Series A | | 12/15/16 | | 2.20 | %(1) | | | $ | 5,000,000 | | | $ | 5,000,000 |

| Series B | | 12/15/14 | | 2.50 | % | | | | 8,500,000 | | | | 8,516,373 |

| Series C | | 12/15/18 | | 3.49 | % | | | | 3,000,000 | | | | 2,984,293 |

| Series D | | 12/15/21 | | 4.08 | % | | | | 8,000,000 | | | | 7,967,951 |

| | | | | | | | $ | 24,500,000 | | | $ | 24,468,617 |

| (1) | Floating rate; rate effective for period from November 15, 2011 (date of issuance) through March 15, 2012. |

11. Preferred stock

The Company has 10,000,000 shares of preferred stock authorized. Of that amount, the Company has 640,000 shares of Series A Mandatory Redeemable Preferred (“MRP”) Stock authorized and 320,000 shares are outstanding at November 30, 2011. The MRP Stock has a liquidation value of $25.00 per share plus any accumulated but unpaid distributions, whether or not declared. Holders of the MRP Stock are entitled to receive cash interest payments each quarter at a fixed rate until maturity. The MRP Stock is not listed on any exchange or automated quotation system.

The MRP Stock has rights determined by the Board of Directors. Except as otherwise indicated in the Company’s Charter or Bylaws, or as otherwise required by law, the holders of MRP Stock have voting rights equal to the holders of common stock (one vote per MRP share) and will vote together with the holders of shares of common stock as a single class except on matters affecting only the holders of preferred stock or the holders of common stock. The 1940 Act requires that the holders of any preferred stock (including MRP Stock), voting separately as a single class, have the right to elect at least two directors at all times.

The estimated fair value of MRP Stock was calculated, for disclosure purposes, by discounting future cash flows by a rate equal to the current U.S. Treasury rate with an equivalent maturity date, plus either 1) the spread between the interest rate on recently issued preferred stock and the U.S. Treasury rate with a similar maturity date or 2) if there has not been a recent preferred stock issuance, the spread between the AA corporate finance debt rate and the U.S. Treasury rate with an equivalent maturity date plus the spread between the fixed rates of the MRP Stock and the AA corporate finance debt rate. The following table shows the mandatory redemption date, fixed rate, number of shares outstanding, aggregate liquidation preference and estimated fair value as of November 30, 2011.

| | Mandatory | | | | | | Aggregate | | |

| | Redemption | | Fixed | | Shares | | Liquidation | | Estimated |

| Series | | Date | | Rate | | Outstanding | | Preference | | Fair Value |

| Series A | | 12/15/18 | | 4.29% | | 320,000 | | $8,000,000 | | $7,961,945 |

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Notes to Financial Statements (continued)

12. Credit facility

On November 9, 2011, the Company entered into a $25,000,000 committed credit facility maturing November 7, 2012. Under the terms of the credit facility, The Bank of Nova Scotia serves as a lender and the lending syndicate agent on behalf of other lenders participating in the facility. The credit facility has a variable annual interest rate equal to one-month LIBOR plus 1.25 percent and unused portions of the credit facility will accrue a non-usage fee equal to an annual rate of 0.20 percent. The Company did not utilize the credit facility during the period ended November 30, 2011.

Under the terms of the credit facility, the Company must maintain asset coverage required under the 1940 Act. If the Company fails to maintain the required coverage, it may be required to repay a portion of an outstanding balance until the coverage requirement has been met. At November 30, 2011, the Company was in compliance with the terms of the credit facility.

13. Common stock

The Company has 100,000,000 shares of capital stock authorized and 10,004,200 shares outstanding at November 30, 2011. Transactions in common stock for the period ended November 30, 2011, were as follows:

| Shares at October 31, 2011 | 4,200 |

| Shares sold through initial public offering | 10,000,000 |

| Shares at November 30, 2011 | 10,004,200 |

14. Subsequent events

On December 8, 2011, the Company issued additional amounts of its Series A Notes ($5,000,000), Series B Notes ($8,500,000), Series C Notes ($3,000,000), Series D Notes ($8,000,000) and Series A MRP Stock ($8,000,000).

The Company has performed an evaluation of subsequent events through the date the financial statements were issued and has determined that no additional items require recognition or disclosure.

| Tortoise Pipeline & Energy Fund, Inc. | www.tortoiseadvisors.com |

Report of Independent Registered Public Accounting Firm

The Board of Directors and Stockholders

Tortoise Pipeline & Energy Fund, Inc.

We have audited the accompanying statement of assets and liabilities of Tortoise Pipeline & Energy Fund, Inc. (the Company), including the schedule of investments, as of November 30, 2011, and the related statements of operations, cash flows, changes in net assets, and the financial highlights for the period from October 31, 2011 (commencement of operations) through November 30, 2011. These financial statements and financial highlights are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.