- TRIP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

Tripadvisor (TRIP) DEFA14AAdditional proxy soliciting materials

Filed: 19 Dec 24, 7:32am

Exhibit 99.2

Tripadvisor and Liberty TripAdvisor Planned Merger December 19, 2024

Cautionary Note Regarding Forward Looking Statements 2 Tripadvisor This presentation, including slides contained herein, contain certain forward - looking statements within the meaning of Section 2 7A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including certain statements relating t o t he completion of the proposed transaction, the timing of the proposed transaction and other matters related to such proposed transaction. All stat eme nts other than statements of historical fact are “forward - looking statements” for purposes of federal and state securities laws. These forward - looking sta tements generally can be identified by phrases such as “possible,” “potential,” “intends” or “expects” or other words or phrases of similar import or fut ure or conditional verbs such as “will,” “may,” “might,” “should,” “would,” “could,” or similar variations. These forward - looking statements involve many risks a nd uncertainties that could cause actual results and the timing of events to differ materially from those expressed or implied by such statements, including, b ut not limited to: historical financial information may not be representative of future results; there may be significant transaction costs in connection w ith the proposed transaction (including significant tax liability); any effect of the announcement of the proposed transaction on the ability of Tripadvis or and Liberty TripAdvisor to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships; the p art ies may not realize the potential benefits of the proposed transaction in the near term or at all; the satisfaction of all conditions to the proposed tr ansaction (including stockholder approvals) may not be achieved; the proposed transaction may not be consummated; there may be liabilities that are not known, pr obable or estimable at this time; the proposed transaction may result in the diversion of management’s time and attention to issues relating to the pro posed transaction; unfavorable outcome of legal proceedings; risks related to disruption of management time from ongoing business operations due to the proposed transaction; risks related to Liberty TripAdvisor’s failure to repay the Parent Loan Facility when due; risks relating to Tri pad visor operating without a controlling stockholder after consummation of the proposed transaction; risks inherent to the business may result in additional strategic an d operational risks, which may impact Tripadvisor’s and/or Liberty TripAdvisor’s risk profiles, which each company may not be able to mitigate effective ly; and other risks and uncertainties detailed in periodic reports that Tripadvisor and Liberty TripAdvisor file with the SEC. These forward - looking sta tements speak only as of the date of this presentation, and Tripadvisor and Liberty TripAdvisor expressly disclaim any obligation or undertaking to dissem ina te any updates or revisions to any forward - looking statement contained herein to reflect any change in Tripadvisor’s or Liberty TripAdvisor’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly filed docume nts of Tripadvisor and Liberty TripAdvisor, including their most recent Forms 10 - K and 10 - Q, as such risk factors may be amended, supplemented or superseded fr om time to time by other reports Tripadvisor or Liberty TripAdvisor subsequently file with the SEC, for additional information about Tripadvisor and L ibe rty TripAdvisor and about the risks and uncertainties related to Tripadvisor’s and Liberty TripAdvisor’s businesses which may affect the statements made in th is presentation.

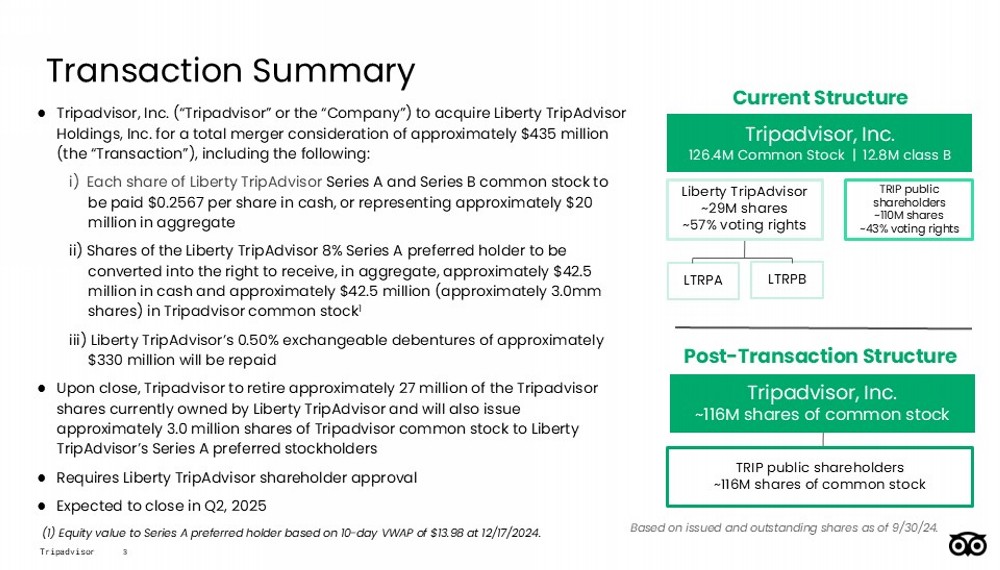

Transaction Summary ● Tripadvisor, Inc. (“Tripadvisor” or the “Company”) to acquire Liberty TripAdvisor Holdings, Inc. for a total merger consideration of approximately $435 million (the “Transaction”), including the following: i) Each share of Liberty TripAdvisor Series A and Series B common stock to be paid $0.2567 per share in cash, or representing approximately $20 million in aggregate ii) Shares of the Liberty TripAdvisor 8% Series A preferred holder to be converted into the right to receive, in aggregate, approximately $42.5 million in cash and approximately $42.5 million (approximately 3.0mm shares) in Tripadvisor common stock 1 iii) Liberty TripAdvisor’s 0.50% exchangeable debentures of approximately $330 million will be repaid ● Upon close, Tripadvisor to retire approximately 27 million of the Tripadvisor shares currently owned by Liberty TripAdvisor and will also issue approximately 3.0 million shares of Tripadvisor common stock to Liberty TripAdvisor’s Series A preferred stockholders ● Requires Liberty TripAdvisor shareholder approval ● Expected to close in Q2, 2025 3 Tripadvisor Tripadvisor, Inc. 126.4M Common Stock | 12.8M class B Liberty TripAdvisor ~29M shares ~57% voting rights TRIP public shareholders ~110M shares ~43% voting rights LTRPA LTRPB TRIP public shareholders ~116M shares of common stock Tripadvisor, Inc. ~116M shares of common stock Post - Transaction Structure Current Structure Based on issued and outstanding shares as of 9/30/24. (1) Equity value to Series A preferred holder based on 10 - day VWAP of $13.98 at 12/17/2024.

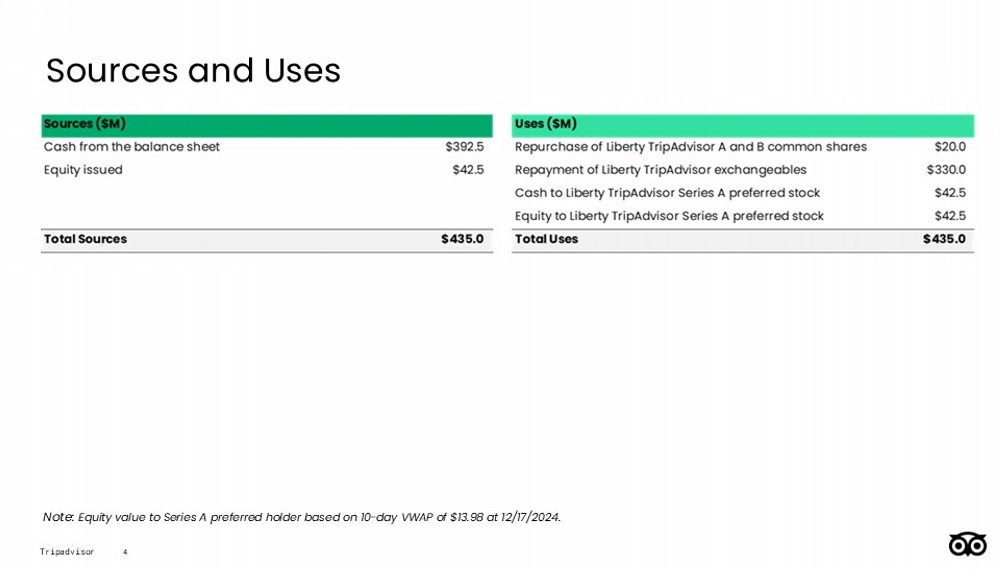

Sources and Uses 4 Tripadvisor Note: Equity value to Series A preferred holder based on 10 - day VWAP of $13.98 at 12/17/2024.

Retiring 19% of Share Capital at an Attractive Price 5 Tripadvisor Implied premium to 10 - day VWAP of 16% Notes: 19% of share capital based on ~139 million issued and outstanding shares as of 9/30/24. Equity value to Series A preferred holder based on 10 - day VWAP of $13.98 at 12/17/2024.

Transaction Benefits ● Results in a meaningful buyback of ~19% of shares of Tripadvisor’s common stock and Class B common stock at an attractive price ● Simplifies ownership structure with alignment of voting power and economic ownership for all Tripadvisor shareholders ● Provides more strategic flexibility as a non - controlled entity ● Enhances trading and liquidity with single class of shares ⎼ Potential to expand investor base ⎼ Potential for additional index inclusion ● Immediately cash flow accretive to remaining shareholders ● Tripadvisor expects to continue with strong liquidity post transaction 6 Tripadvisor

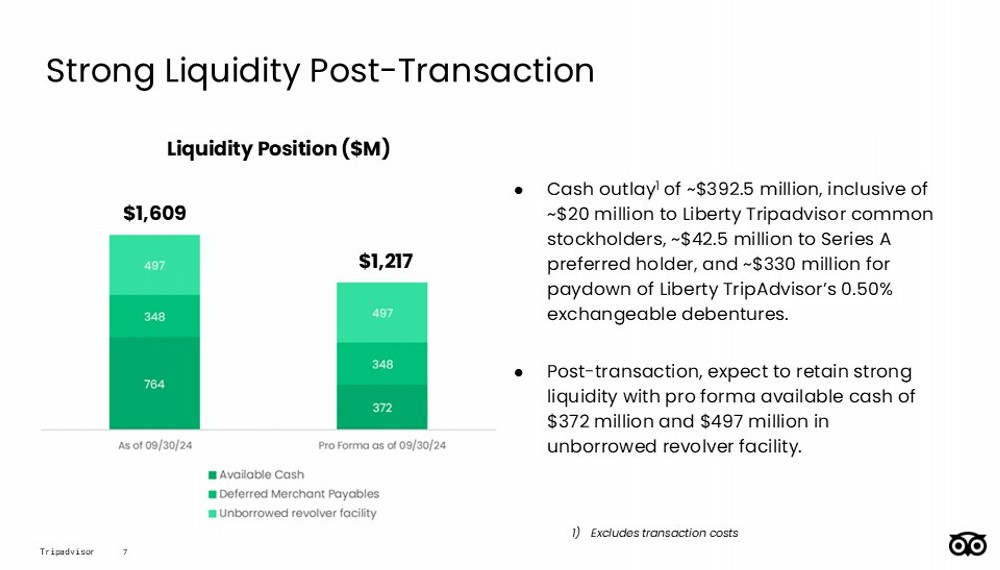

Strong Liquidity Post - Transaction 7 Tripadvisor ● Cash outlay 1 of ~$392.5 million, inclusive of ~$20 million to Liberty Tripadvisor common stockholders, ~$42.5 million to Series A preferred holder, and ~$330 million for paydown of Liberty TripAdvisor’s 0.50% exchangeable debentures. ● Post - transaction, expect to retain strong liquidity with pro forma available cash of $372 million and $497 million in unborrowed revolver facility. $1,609 Liquidity Position ($M) $1,217 1) Excludes transaction costs

End - to - end platform for planning, booking, and experiencing Continuing to Build Our Strategic Position as the Leading Platform across Travel, Experiences, and Dining World’s largest online travel guidance platform Leading European online restaurant discovery and booking platform Leading global online bookable experiences platform 8 Tripadvisor Strong Partner Relationships Unique, Community - Driven Content Trusted Brands Large Global Audience Data Technology World Class Talent BRAND

Appendix

Details on Liberty TripAdvisor Exchangeables and Loan Agreement 10 Tripadvisor ● Holders of the Liberty TripAdvisor 0.50% Exchangeable Debentures have put rights to LTRP on March 27, 2025 ● The Liberty TripAdvisor exchangeables will be repaid on or before closing ● Should the Transaction not close by March 27, 2025, Tripadvisor will provide a loan facility to Liberty TripAdvisor in the amount of up to $330 million to satisfy any potential put or exchanges from the debenture holders ● Interest will accrue in kind (in lieu of cash) on a quarterly basis ● The loan will be secured by all of Liberty TripAdvisor’s assets, which are almost exclusively the common stock and Class B shares of TRIP ● The loan will mature upon the earlier of transaction closing or termination Refer to Form 8 - K filed in conjunction with this transaction, including the loan agreement.

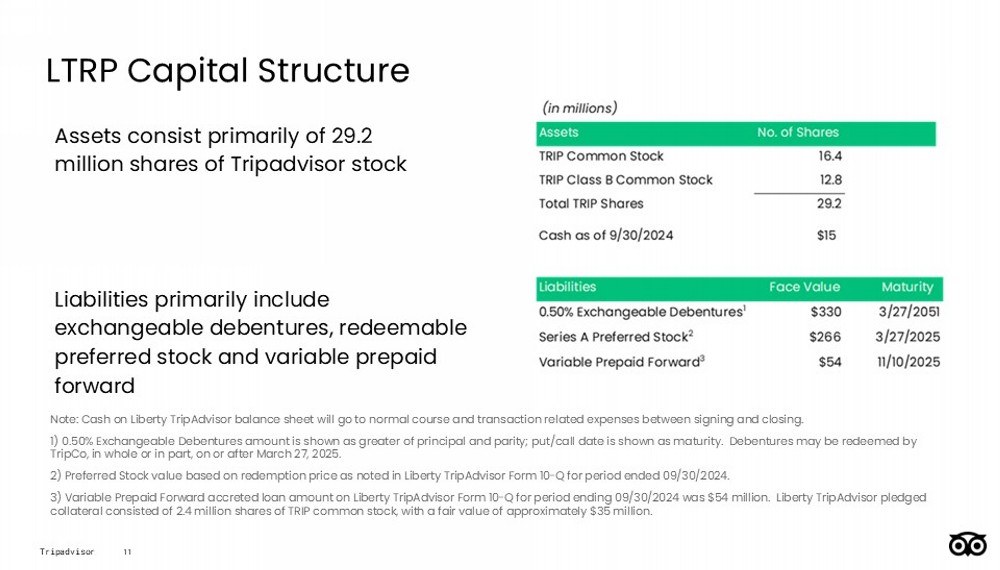

LTRP Capital Structure Assets consist primarily of 29.2 million shares of Tripadvisor stock 11 Tripadvisor Liabilities primarily include exchangeable debentures, redeemable preferred stock and variable prepaid forward Note: Cash on Liberty TripAdvisor balance sheet will go to normal course and transaction related expenses between signing and cl osing. 1) 0.50% Exchangeable Debentures amount is shown as greater of principal and parity; put/call date is shown as maturity. Deb ent ures may be redeemed by TripCo, in whole or in part, on or after March 27, 2025. 2) Preferred Stock value based on redemption price as noted in Liberty TripAdvisor Form 10 - Q for period ended 09/30/2024. 3) Variable Prepaid Forward accreted loan amount on Liberty TripAdvisor Form 10 - Q for period ending 09/30/2024 was $54 million. Liberty TripAdvisor pledged collateral consisted of 2.4 million shares of TRIP common stock, with a fair value of approximately $35 million.

Additional Information

No Offer or Solicitation 13 Tripadvisor This communication is not intended to, and does not, constitute a proxy statement or solicitation of a proxy, consent, vote o r a uthorization with respect to any securities or in respect of the Merger. This communication does not constitute an offer to sell or the solici tat ion of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in wh ich such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Additional Information In connection with the Merger, Liberty TripAdvisor intends to file with the SEC the relevant materials, including a proxy sta tem ent on Schedule 14A (the “Proxy Statement”) in preliminary and definitive form, the definitive version of which will be sent or provided to Liber ty TripAdvisor’s stockholders, and a Schedule 13E - 3 transaction statement. Tripadvisor or Liberty TripAdvisor may also file other documents with the SEC regarding the Merger. This document is not a substitute for the Proxy Statement, the Schedule 13E - 3 transaction statement or any other rel evant document which Liberty TripAdvisor may file with the SEC. Promptly after filing its definitive Proxy Statement with the SEC, Liberty T rip Advisor will mail or provide the definitive Proxy Statement and a proxy card to each stockholder of Liberty TripAdvisor entitled to vote at the me eti ng relating to the Merger. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND THE SCHEDULE 13E - 3 TRANSACTION STATEMENT WHEN THEY BECOME AVAILABLE, TOGETHER WITH ALL RELEVANT SEC FILINGS REGARDING THE PROPOSED TRANSACTION, AND ANY OTHER RELEVANT DOCU MEN TS THAT ARE FILED OR WILL BE FILED (INCLUDING AS EXHIBITS THEREWITH) WITH THE SEC (WHEN THEY ARE AVAILABLE), AS WELL AS ANY AMEN DME NTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE TRANSACTIONS BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER AND RELATED MATTERS. Investors and security holders may obtain free copies of the Proxy Statement, the Schedule 13E - 3 transaction statement and other documents tha t are filed or will be filed with the SEC by Liberty TripAdvisor or Tripadvisor (when they are available) through the website maintained by the SEC at www.sec.gov, Liberty TripAdvisor’s investor relations website at www.libertytripadvisorholdings.com/investors or Tripadvisor’ s i nvestor relations website at ir.tripadvisor.com.

Participants in a Solicitation 14 Tripadvisor Tripadvisor anticipates that the following individuals may be participants (the “Tripadvisor Participants”) in the solicitati on of proxies from holders of Liberty TripAdvisor Series A Common Stock and Series B Common Stock in connection with the proposed transaction: G reg ory B. Maffei, Chairman of the Tripadvisor Board, Matt Goldberg, President and Chief Executive Officer and Director, Trynka Shineman Bl ake, Betsy Morgan, Jay C. Hoag, Greg O’Hara, Jeremy Philips, Albert E. Rosenthaler, Jane Jie Sun and Robert S. Wiesenthal, all of whom a re members of the Tripadvisor Board, Mike Noonan, Chief Financial Officer, and Seth J. Kalvert, Chief Legal Officer and Secretary. Informa tio n about the Tripadvisor Participants, including a description of their direct or indirect interests, by security holdings or otherwise, a nd Tripadvisor’s transactions with related persons is set forth in the sections entitled “Proposal No. 1: Election of Directors”, “Proposal No . 3 : Advisory Vote on Compensation of Named Executive Officers”, “Proposal No. 4: Advisory Vote on the Frequency of Future Advisory Resolutions to App rove The Compensation Of Tripadvisor’s Named Executive Officers”, “Executive Officers”, “Compensation Discussion and Analysis”, “CEO P ay Ratio”, “Pay Versus Performance”, “Executive Compensation”, “Director Compensation”, “Security Ownership of Certain Beneficial Owners an d Management” and “Certain Relationships and Related Transactions” contained in Tripadvisor’s definitive proxy statement for it s 2 024 annual meeting of shareholders, which was filed with the SEC on April 29, 2024 (which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1526520/000095017024049349/trip - 20240426.htm) and other documents subsequently filed by Tripadvisor with the SEC. To the extent holdings of Tripadvisor capital stock by the directors and executive officer s o f Tripadvisor have changed from the amounts of Tripadvisor capital stock held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the Tripadvisor Pa rticipants in the proxy solicitation and a description of their interests will be contained in the proxy statement for Liberty TripAdvis or’ s special meeting of stockholders and other relevant materials to be filed with the SEC in respect of the contemplated transactions when they b eco me available. These documents can be obtained free of charge from the sources indicated above.

Participants in a Solicitation (cont.) 15 Tripadvisor Liberty TripAdvisor anticipates that the following individuals will be participants (the “Liberty TripAdvisor Participants”) in the solicitation of proxies from holders of Liberty TripAdvisor’s LTRPA and LTRPB common stock in connection with the proposed transaction: Grego ry B. Maffei, Chairman of the Liberty TripAdvisor Board and Liberty TripAdvisor’s President and Chief Executive Officer, Christy Haubegger, Mi chael J. Malone, Chris Mueller, Larry E. Romrell, Albert E. Rosenthaler and J. David Wargo, all of whom are members of the Liberty Tri pAd visor Board, Brian J. Wendling, Liberty TripAdvisor’s Senior Vice President and Chief Financial Officer, and Renee L. Wilm, Liberty TripAd vis or’s Chief Legal Officer and Chief Administrative Officer. Information regarding the Liberty TripAdvisor Participants, including a description of their direct or indirect interests, by security holdings or otherwise, and Liberty TripAdvisor’s transactions with related persons can be fou nd under the captions “Proposal 1 – The Election of Directors Proposal”, “Director Compensation”, “Proposal 3 – The Say - On - Pay Proposal”, “Executive Officers”, “Executive Compensation”, “Security Ownership of Certain Beneficial Owners and Management — Security Ownership of Management” and “Certain Relationships and Related Party Transactions” contained in Liberty TripAdvisor’s definitive proxy st ate ment for its 2024 annual meeting of stockholders (the “Liberty Proxy Statement”), which was filed with the SEC on April 24, 2024 and is av ail able at: https://www.sec.gov/ix?doc=/Archives/edgar/data/1606745/000110465924051281/tm242814d2_def14a.htm. To the extent that certain Lib erty TripAdvisor Participants or their affiliates have acquired or disposed of security holdings since the “as of” date disclosed in the Liberty Proxy Statement, such transactions have been or will be reflected on Statements of Change in Ownership on Form 4 or amendments to b ene ficial ownership reports on Schedules 13D filed with the SEC, which are available at: https://www.sec.gov/edgar/browse/?CIK=1606745&owner=exclude. Additional information regarding the Liberty TripAdvisor Partici pan ts in the proxy solicitation and a description of their interests will be contained in the proxy statement for Liberty TripAdvisor’ s s pecial meeting of stockholders and other relevant materials to be filed with the SEC in respect of the contemplated transactions when they beco me available. These documents can be obtained free of charge from the sources indicated above.

End