Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | |

| (Mark One) | | |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012 |

OR |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

|

Commission File Number 001-35549

IGNITE RESTAURANT GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | |

Delaware

(State or Other Jurisdiction of

Incorporation or Organization) | | 94-3421359

(I.R.S. Employer

Identification No.) |

9900 Westpark Drive, Suite 300, Houston, Texas

(Address of Principal Executive Offices) |

|

77063

(Zip Code) |

Telephone Number:(713) 366-7500

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of Each Class | | Name of Each Exchange on which Registered |

|---|

| Common Stock, $0.01 par value | | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý

(Do not check if a

smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý.

State the aggregate market value of the voting and non-voting common equity held by

non-affiliates of the registrant.

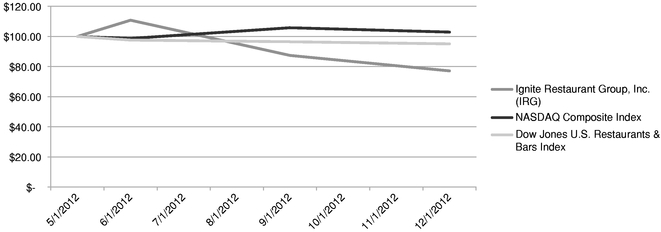

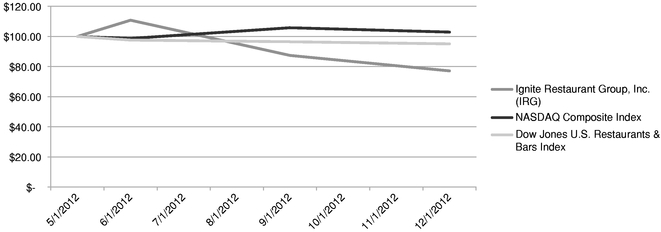

The aggregate market value of the common stock of the Registrant held by non-affiliates as of June 18, 2012 (the last business day of the most recently completed second quarter) was $126,550,861, calculated based on the closing price of our common stock as reported by the NASDAQ Global Select market on such date.

Indicate the number of shares outstanding of each of the registrant's classes of common stock,

as of the latest practicable date.

As of March 18, 2013, 25,636,602 shares of the Registrant's common stock were outstanding.

Documents Incorporated by Reference

Portions of the Registrant's Proxy Statement for its Annual Meeting of Shareholders on June 4, 2013, to be filed with the Securities and Exchange Commission no later than 120 days after December 31, 2012, are incorporated by reference into Part III of this Report.

Table of Contents

TABLE OF CONTENTS

| | | | | | |

| |

| | Page | |

|---|

PART I | |

Item 1. | | Business | | |

3 | |

Item 1A. | | Risk Factors | | | 16 | |

Item 1B. | | Unresolved Staff Comments | | | 35 | |

Item 2. | | Properties | | | 36 | |

Item 3. | | Legal Proceedings | | | 37 | |

Item 4. | | Mine Safety Disclosures | | | 38 | |

PART II | |

Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | |

38 | |

Item 6. | | Selected Financial Data | | | 39 | |

Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | | 41 | |

Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | | 62 | |

Item 8. | | Financial Statements and Supplementary Data | | | 63 | |

Item 9. | | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | | | 87 | |

Item 9A. | | Controls and Procedures | | | 87 | |

Item 9B. | | Other Information | | | 90 | |

PART III | |

Item 10. | | Directors, Executive Officers and Corporate Governance | | |

91 | |

Item 11. | | Executive Compensation | | | 91 | |

Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | | 91 | |

Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | | 91 | |

Item 14. | | Principal Accounting Fees and Services | | | 91 | |

PART IV | |

Item 15. | | Exhibits, Financial Statement Schedules | | |

92 | |

SIGNATURES

| | |

96 | |

2

Table of Contents

PART I

Item 1. BUSINESS.

Our Company

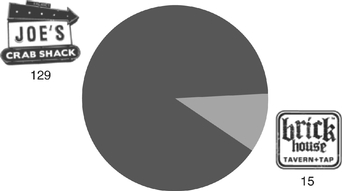

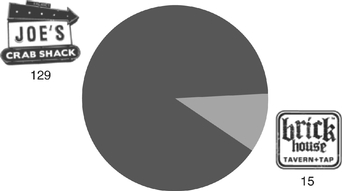

Ignite Restaurant Group, Inc., a Delaware corporation incorporated in 2002, operates two restaurant brands, Joe's Crab Shack ("Joe's") and Brick House Tavern + Tap ("Brick House"). Each of our restaurant brands offers a variety of high-quality food and beverages in a distinctive, casual, high-energy atmosphere. Joe's Crab Shack and Brick House Tavern + Tap operate in a diverse set of markets across the United States.

Joe's Crab Shack, founded in 1991, is an established, national chain of casual seafood restaurants serving a variety of high-quality seafood items, with an emphasis on crab. Joe's is a high-energy, family-friendly restaurant that encourages guests to "roll up your sleeves and crack into some crab."

Brick House Tavern + Tap, founded in 2008, is a casual restaurant brand that provides guests a differentiated "gastro pub" experience by offering a distinctive blend of menu items in a polished setting. As a next generation bar and grill, Brick House appeals to a broad audience by providing guests with an elevated experience. In 2011, Brick House was listed as the #1 "up and comer" full-service, varied-menu restaurant business by Technomic, a leading restaurant industry consulting and research firm, and recently was named by Nation's Restaurant News as one of the 50 Breakout Brands of 2013.

Our comparable restaurant sales have increased for 18 consecutive fiscal quarters and outperformed the KNAPP-TRACK™ report of casual dining restaurants, which is an average of approximately 50 casual dining restaurant brands, over the same period of time. We have grown our comparable restaurant sales by 15% on a cumulative basis over the last three years, which has outperformed the KNAPP-TRACK growth rate of 2% by more than 1,200 basis points on a cumulative basis over the same period of time. During fiscal year 2012, 2011 and 2010, our comparable restaurant sales increased by 2.2%, 6.9% and 4.9%, respectively, over the comparable period in our prior fiscal year.

The majority of our current management team was put in place in fiscal year 2007. This team developed and implemented many of the initiatives and strategies which serve as the foundation for what our company is today. The impact of these strategies began to take effect in fiscal year 2008. From the fiscal year ended January 3, 2011 through the fiscal year ended December 31, 2012, total revenues and Adjusted EBITDA (a non-GAAP financial measure) have improved at compounded annual growth rates of 15.1% and 14.9%, respectively. Over the same period, our total revenues increased from $351.3 million to $465.1 million and Adjusted EBITDA increased from $39.4 million to $52.0 million. We opened 32 new restaurants, including two conversions, and closed seven restaurants, including four conversions, which resulted in a net total of 25 new restaurants over the same period of time. For fiscal year 2012, we opened eleven new restaurants, including one conversion.

3

Table of Contents

As of December 31, 2012, we owned and operated 144 restaurants in 33 states.

On February 6, 2013, we entered into an agreement to acquire all of the issued and outstanding equity interest of Mac Parent LLC ("Mac Grill"), which, with its subsidiaries, operates and franchises the right to operate Romano's Macaroni Grill restaurants, for approximately $55.0 million in an all-cash transaction from private equity firm Golden Gate Capital, management and other investors. Mac Grill owns and operates 186 and franchises five Romano's Macaroni Grill units across 36 states, and franchises an additional 19 units in nine U.S. territories and foreign countries. The acquisition is expected to be completed in the second quarter of fiscal year 2013. To fund this acquisition, we received a commitment from our current lenders to upsize our new senior secured credit facility by adding a $50.0 million term loan facility.

Our Restaurants

Joe's Crab Shack

Joe's Crab Shack is a come-as-you-are, family restaurant that offers guests an environment that is laid-back, comfortable, fun, and energetic. Most locations offer an outdoor patio for guests to enjoy eating and drinking and a children's playground as part of the "I'm relaxed" restaurant experience. Joe's also has many locations that are located on waterfront property. Interior design elements include a nautical, vacation theme to invoke memories of beach vacations and a genuine crab shack experience. Table tops are decorated with art to prompt dinner conversation, while picnic tables across the patio and interior help guests feel the relaxed tropical vacation experience. Joe's Crab Shack restaurants are largely free-standing and average 8,000 square feet with over 200 seats. Most Joe's Crab Shack bars are separated from the dining area to provide for a distinct place to grab a drink while waiting for a table. Colorful party lights, a disco ball and bright paint colors enhance the dining experience. Many of our restaurants also include a small gift shop where guests can purchase souvenirs to commemorate their dining experience. Our new restaurant prototype, introduced in fiscal year 2010, contemporizes many of our key brand elements, while maintaining our authentic crab shack appeal.

Joe's Crab Shack restaurants perform well in targeted markets with high population density and a propensity for seafood as well as "destination" markets with national and regional tourist attractions, both of which are key characteristics of our new site selection strategy.

Brick House Tavern + Tap

Brick House is a trend-forward "gastro pub" set in an inviting, comfortable and modern venue that provides a distinctive guest experience. Brick House's interior décor includes custom lighting, dark mahogany woods, open sight lines, HD TVs, and an inviting fireplace. The interior design of Brick House Tavern + Tap consists of diverse seating and gathering areas where guests can pick multiple ways to enjoy their experience. In addition to a traditional dining room and bar area, Brick House also offers large communal tables and a section of leather recliners positioned in front of large HD TVs,

4

Table of Contents

where guests receive their own TV tray for dining. Each restaurant has a state-of-the-art entertainment package and provides guests with a clear line of sight to at least two HD TVs from every seat, making Brick House restaurants an ideal gathering place for sports enthusiasts. Outdoor seating is also available on the patio or around an open fire pit at nearly all locations. Both food and beverages are served by personable and engaging service staff. The typical Brick House restaurant is approximately 8,500 square feet and averages approximately 250 seats, which includes both traditional tables and unique seating options.

Our Business Strengths

We are focused on developing brands that have category leading and defendable positions within the casual dining segment. As a result, our core business strengths include the following:

Highly Differentiated Restaurant Brands. Our restaurants strive to provide a unique guest experience in a "come-as-you-are," upbeat and inviting restaurant environment. Both Joe's Crab Shack and Brick House Tavern + Tap are distinctively positioned restaurant brands, designed to have unique guest appeal. Joe's Crab Shack is a leading casual seafood brand that offers more than just a meal—a visit to Joe's is an event for the whole family. We provide a memorable, shareable "crab-cracking experience" where guests can roll up their sleeves and "break out of their shell" in a vacation-themed environment that offers an escape from the everyday. Brick House Tavern + Tap offers a comfortable, trend-forward yet timeless setting where guests can gather and share their passion for elevated, chef-inspired comfort food, while enjoying their favorite local, national or imported brand of beer and cheering for their favorite team. Each brand features food offerings and an atmosphere that attracts a diverse group of guests.

Authentic and Unique Menu Offerings. We offer high-quality, authentic seafood at Joe's Crab Shack and trend-forward, chef-inspired, contemporary tavern food at Brick House Tavern + Tap. Signature dishes at both brands feature craveable flavor profiles. Food menus are complemented by an assortment of beverages and distinctive cocktails, including Joe's Shark Bite and Brick House's tap-at-your-table Beer Bongs. Our culinary and beverage teams develop recipes and menu offerings for both Joe's and Brick House to ensure that all items feature distinctive twists on classic items, as well as items exclusive to each brand.

Memorable Guest Service. Our servers are friendly, attentive and responsive to the needs of our guests. In addition, our servers strive to provide guests an unforgettable dining experience. Joe's staff creates a fun-loving atmosphere through high-energy special occasion celebrations, while the staff at Brick House is focused on providing hospitable and personalized service to guests. We achieve this through experienced restaurant management teams that implement training programs specific to the menu and culture of each brand. We believe our distinctive guest service models provide an additional layer of brand differentiation.

Attractive Unit Economics. We have successfully increased our restaurant average unit volumes at a compounded annual growth rate of 4.2%, from $2.8 million in fiscal year 2010 to $3.1 million in fiscal year 2012. Over the same period of time, we have increased our restaurant-level profit margin (a non-GAAP financial measure) by 30 basis points from 16.6% to 16.9%.

Experienced Management Team. Our experienced team of industry veterans has an average of over 20 years of experience with restaurant companies such as T.G.I. Friday's, Darden, Applebee's, The Cheesecake Factory, Landry's and Sbarro. Our management team is led by Raymond A. Blanchette, III, our Chief Executive Officer, who joined us in 2007. Mr. Blanchette was a former President for Pick Up Stix and Executive Director of International Business at T.G.I. Friday's, both are brands operated by Carlson Restaurants Worldwide. Within twelve months of his arrival, Mr. Blanchette transformed our leadership team by recruiting several highly experienced restaurant

5

Table of Contents

executives. Despite a difficult economic environment, we have achieved 18 consecutive fiscal quarters of comparable restaurant sales growth, expanded our geographic footprint and improved our financial performance. From fiscal year 2010 to fiscal year 2012, we increased Adjusted EBITDA from $39.4 million to $52.0 million. The experience of our management team has allowed us to transform Joe's Crab Shack into a market leader while simultaneously developing and launching Brick House Tavern + Tap.

Our Strategy

Our strategies include the following:

Disciplined New Restaurant Growth. We believe there are meaningful opportunities to grow the number of restaurants of both Joe's Crab Shack and Brick House Tavern + Tap. We seek to maximize free cash flow for reinvestment into new restaurants at attractive returns. For both brands, we target new restaurant cash-on-cash returns, which we define as restaurant-level profit per store divided by total build-out cost (excluding capitalized interest) and cash pre-opening costs, to exceed 25%.

- •

- Joe's Crab Shack. We target steady state new restaurant average unit volumes of approximately $3.9 million for Joe's Crab Shack. Joe's has a narrowly defined new restaurant development strategy that predominantly targets (i) specific geographies with high population density and a propensity for seafood and (ii) locations in close proximity to regional and national tourist attractions. In fiscal year 2010, we developed a new restaurant prototype for Joe's Crab Shack, which has given Joe's a polished look and feel while maintaining the authentic crab shack ambiance. As of December 31, 2012, we have successfully opened 20 new restaurants using this new prototype and development strategy.

- •

- Brick House Tavern + Tap. We target steady state new restaurant average unit volumes of approximately $3.2 million for Brick House Tavern + Tap. We believe Brick House has significant growth potential and intend to focus future development in the top 50 designated market areas across the country. We initially opened a limited number of Brick House restaurants across a broad range of geographies with the intent of optimizing the brand prior to a continued build out.

For fiscal year 2013, we target opening as many as 14 new restaurants, the vast majority of which will be new Joe's Crab Shack restaurants, and converting as many as four existing restaurants to either a Joe's Crab Shack or a Brick House Tavern + Tap. Historically, our new restaurant growth had been substantially weighted towards new Joe's Crab Shack restaurants. However, with the impending acquisition of Mac Grill, we are evaluating our current restaurant development options.

Focus on Comparable Restaurant Sales Growth. We believe the following strategies have contributed to our successful growth and will allow us to generate comparable restaurant sales growth in the future:

- •

- Continuous Menu Innovation. We believe menu innovation is a critical factor in building guest loyalty and frequency. Both Joe's Crab Shack and Brick House Tavern + Tap have signature food and beverage offerings and a tradition of consistent menu innovation. New menu items are typically introduced at both brands twice a year and we test new menu items in restaurants across several diverse geographies before they are introduced into the broader base of restaurants. We have successfully introduced new and innovative items at both brands with such additions as Queen Crab, Skillet Paella and Mason Jars at Joe's Crab Shack and Brick Pizza, Meat and Cheese Board, Fried Stuffed Olives and Chicken & Waffles at Brick House Tavern + Tap. We plan to continue our tradition of menu innovation in the future.

- •

- Marketing our Restaurant Brands. We believe that our marketing strategies will continue to increase brand awareness while driving new guest trial and repeat guest visits. Our current

6

Table of Contents

marketing strategy for Joe's Crab Shack is supported by quantitative analysis that is designed to increase comparable restaurant sales and guest count, as well as build the brand for the future. We advertise using a national cable platform, which provides television advertising reach to the Joe's Crab Shack restaurants that are outside of the spot/local television markets and previews the Joe's Crab Shack brand in new development markets. These national marketing efforts are complemented by a combination of local marketing programs and social media. Brick House Tavern + Tap is primarily marketed through local marketing, digital media and social media outlets. We also promote both brands using other in-restaurant sales initiatives, which are typically focused on products and are not price point promotions.

- •

- Driving Guest Satisfaction. We believe our focus on menu innovation and guest service has contributed to Joe's Crab Shack's overall guest satisfaction. At Joe's Crab Shack, we use this third party research consisting of feedback from more than 40,000 guests, to develop operational initiatives, which we expect will continue to deliver high levels of guest satisfaction. We implemented a similar program at Brick House Tavern + Tap during the fourth quarter of fiscal year 2011. We believe improving guest satisfaction will continue to build loyalty and lead to increased sales from our guests.

Leverage our Scale to Enhance our Profitability. We believe we have a scalable infrastructure and can continue to expand our margins as we execute our strategy. While both brands have independent field operations, we use our shared services platform to handle many of the administrative functions for both brands. This leverageable structure should further our ability to enhance our profitability as we grow.

Menu and Menu Development

We are focused on continually elevating our unique and high-quality food and beverage offerings. Born out of consumer insights, our in-house Marketing department continually creates new chef-driven food and beverage products for both Joe's Crab Shack and Brick House Tavern + Tap, which are intended to exceed guest expectations. A variety of research tools are used to identify opportunities and evaluate current offerings, including a brand-tracker program, segmentation and core menu studies, brand screens, focus groups and in-restaurant surveys. We use a third party econometric consulting firm to provide statistical analysis around pricing, allowing us to make fact-based decisions on pricing and menu engineering.

Joe's Crab Shack

Joe's Crab Shack aims to offer signature, craveable items to its guests by continuously seeking to innovate our menu offerings. For example, we have dramatically shifted the menu mix at Joe's to focus on entrées featuring crab over the past three fiscal years. Crab is strategically positioned center stage in our menu through the Steampots and Crab in a Bucket categories, highlighting the importance of the menu item that defines Joe's Crab Shack. Joe's Steampot and Crab in a Bucket offerings allow guests to choose between four varieties of crabs (Queen, Snow, Dungeness and King) and whole lobster. Steampots, our bestselling item, are overflowing with generous portions of crab, other seafood, red potatoes, a fresh ear of corn and sausage seasoned to our guests' tastes. Our Crab in a Bucket entrées allow guests to pair their favorite crab selection with several distinctive preparations ranging from BBQ to Chesapeake Style or Garlic Herb. Joe's Crab Shack also leverages its crab-forward menu with other craveable crab items, including Made-From-Scratch Crab Cakes, Crab Nachos and Crazy-Good Crab Dip. As a result of this strategy, the percentage of entrées at Joe's featuring crab is currently over 50% of total food revenues. We believe this crab-focused menu mix has contributed to increases in guest satisfaction, comparable restaurant sales and gross profit dollars. In addition to our core crab-focused menu, Joe's also offers a broad range of entrées featuring a variety of seafood, including the Get Stuffed Snapper, Surf 'N Turf Burger and The Big Hook Up, as well as a wide range of traditional

7

Table of Contents

seafood entrées like the Fisherman's Platter. Joe's also offers several "out of water" options such as Pan Fried Cheesy Chicken and Whiskey Smoked Ribs. In addition, alcoholic beverages have significantly evolved to support the elevated food strategy, with vacation-style drinks, including the 'Shark Bite,' 'Category 5 Hurricane' and Mason Jar cocktails emerging as guests' top choices.

Joe's menu includes more than 29 items made with either Queen, Snow, Dungeness or King Crabs sourced from government regulated and sustainable fisheries. Our current menu offers 14 appetizers, including Made-From-Scratch Crab Cakes, Crab Nachos and Crazy-Good Crab Dip, and over 50 entrées, including Steampots, Crab in a Bucket, Skillet Paella, Stuffed Snapper and "out of water" options like Whiskey Smoked Ribs. For fiscal year 2012, Joe's average check was $23.80, lunch and dinner represented 27% and 73% of revenue, respectively, and revenue distribution was 86% food, 13% alcohol and 1% retail. Prices currently range from $6.79 to $46.99 for items on Joe's menu, including appetizers ordered as entrées and entrées that are frequently shared.

Menu implementation roll-outs occur in April/May and November. For all new menu roll-outs, new product launches are combined with a new menu design and updated pricing to reflect the current economic environment, as well as the current strategic marketing and creative plan. A menu change typically includes the introduction of four to seven new menu items while maintaining a balance of approximately 75 total menu items, including appetizers. Menu items are added or removed only after thorough testing and analysis, which includes guest satisfaction feedback.

Brick House Tavern + Tap

The Brick House Tavern + Tap food and beverage menu was created to make the brand feel aspirational while inherently approachable. We believe Brick House's elevated menu has changed the game for the bar and grill customer by offering an innovative premium food selection, along with approximately 80 varieties of beer.

Brick House offers its guests a broad selection of high-quality, chef-inspired, contemporary tavern food. Brick House's menu includes 17 appetizers and over 53 entrées. Unique handcrafted appetizers include Deviled Eggs, Meatloaf Sliders, Brick Pizza, Meat and Cheese Board and Fried Stuffed Olives. Brick House offers an array of burgers, including The Kobe, which is hand formed from high-quality American Wagyu beef. Guests can also choose from a broad selection of homemade entrées such as Drunken Chops, BBQ Baby Backs, Chicken & Waffles, and our Prime Rib Sandwich. A daily special menu encourages continued innovation with featured items like Prosciutto Wrapped Meatloaf and Shepherd's Pie. In addition, Brick House's Brick Burgers, including the Gun Show Burger and the Black & Bleu Burger, offer guests a distinct take on the traditional burger. Brick House's beverage selection includes imported and domestic beers along with hand-pulled cask beer. Beer is served in vessels unique to our industry such as 40s and Brick House's signature tap-at-your table beer bongs. All Brick House restaurants have a full bar that supports a variety of liquor drinks, wine and beer cocktails like the Shandy and Bee Sting as well as specialty cocktails like the Dark & Stormy, Moscow Mule and The Zombie. For fiscal year 2012, Brick House had four full day parts with lunch, afternoon, dinner and late night accounting for 19%, 25%, 39% and 17%, respectively, and Brick House's revenue distribution was approximately 54% food and 46% alcohol. Brick House's entrées range in price from $7.50 to $20.00, including appetizers ordered as entrées.

Continuous menu innovation is a key strategy for Brick House Tavern + Tap. We revise the Brick House Tavern + Tap menu twice a year with design, pricing and product offerings assessed before each menu implementation. New menu offerings are created to reinforce differentiation in our appetizers, entrées and beverage offerings as part of our effort to provide our guests with exceptional food. Testing of new menu items is executed in-restaurant before a new item is rolled out system-wide.

8

Table of Contents

Marketing

Over 80% of our marketing budget is invested in advertising through television (national cable, syndication and satellite), and digital advertising (including location-based media, on-demand media as well as in the social media such as Facebook and Twitter), with the balance of the budget being spent on marketing research, in-restaurant advertising, menus and production costs. Our marketing strategy is fact-based, using consumer insights to build brand affinity, and drive menu optimization. Our marketing expenditures were 4.4%, 4.4% and 4.9% of revenues for the fiscal years 2012, 2011 and 2010, respectively.

Joe's Crab Shack's advertising campaigns typically occur four times per year and are annual, seasonal and frequency-focused campaigns aimed at attracting guests and communicating new menu items through quality-focused messaging. We engage in a national cable advertising campaign for Joe's that currently consists of 24 weeks on air. We supplement Joe's national advertising with innovative media support, including digital advertising, social media outreach, location-based mobile media, weather-triggered advertising, and added-value media. The Joe's email club currently has approximately 450,000 members.

Brick House Tavern + Tap's marketing efforts are focused on menu innovation and local marketing initiatives. Local marketing includes events such as bike nights and pint nights. In April 2011, we added a Happy Hour program using local sports radio, in-house promotion through check attachments, posters and banners, and social media to support the rollout. The Brick House email club currently has approximately 60,000 members and has more than doubled since January 2011. Digital advertising and public relations have been used to support initiatives around March Madness, football season, menu launches, and live music series.

Guest Satisfaction

We use third party vendors to systematically gather, record and analyze key guest data for both of our brands. Our marketing research tools include:

- •

- AAU, or attitude, awareness and usage surveys;

- •

- third party guest satisfaction surveys;

- •

- annual core menu studies; and

- •

- TURF, or total unduplicated reach and frequency analysis.

We use the insights gathered from market research and data analytics to support strategic and tactical decisions. We embrace and rely on the use of market research as a tool to better understand our business and drive improved performance. These market research and data analytics provide us with critical guest feedback that guide us to change or refine individual menu items and implement operational initiatives to drive positive results on "Satisfaction," "Likely to Return" and "Likely to Recommend" metrics. Our AAU also guides us on changes to perception and awareness of the Joe's Crab Shack brand when considering shifts in our marketing and advertising strategies and tactics. We believe improved performance of our menu items, in our restaurants and in the effectiveness of our advertising is driven by understanding guest feedback and making changes accordingly.

In particular, we use a third party vendor to conduct detailed guest satisfaction surveys of our current guests and provide comparable industry satisfaction survey data for industry peers. Several surveys have been conducted since 2008 for Joe's Crab Shack and 11 other anonymous national and regional casual dining restaurant chains. While we are unable to confirm the extent to which the results of the surveys represents a comparison to our primary competitors, of the seven casual dining companies included in the population study using phone surveys, Joe's ranks second at 77% for overall satisfaction (top box only) versus the leading company at 80%.

9

Table of Contents

We have also initiated the same guest satisfaction survey for Brick House. Since its pilot testing starting December 2010, Brick House registered an 1,800 basis point improvement. Brick House is also currently undergoing a customer segmentation study.

Restaurant Operations and Shared Services

While both brands have independent field operations, we maintain a shared services platform, which handles many of the administrative functions for both brands. We believe this provides a scalable infrastructure, which will allow us to increase our profitability and continue to grow.

Joe's Crab Shack

Joe's Crab Shack operations are currently led by a brand president and three regional vice presidents. Each regional vice president oversees five to eight directors of operations, who typically manage seven to ten restaurants. Restaurant-level management at Joe's typically includes a general manager, an assistant general manager, a restaurant manager and flex managers, as required. The flex manager is an hourly employee that is trained during the off-season and may be called upon to perform a managerial role during the peak season. Each restaurant also has a brand ambassador that coordinates with members of the local community on behalf of Joe's for group sales and fundraisers. Our restaurant managers have bonus incentives that are based on sales and restaurant-level profits.

The Joe's Crab Shack training has three distinct levels. Our manager training is designed to fit all manager levels from the hourly flex manager to general manager. This comprehensive program is up to nine weeks in length, depending on the knowledge base and skill of the trainee and is both classroom and on-the-job based. Our certified trainer training is a special workshop designed to develop training specialists that reside in a restaurant or market that can oversee the training programs in that area. In order to be a certified trainer, candidates must be a fully validated hourly team member with recommendations from their general manager and director of operations. Hourly trainees are orientated by the general manager of their home restaurant with their program, schedule of activities and on-the-job training then set by the certified trainer. Through the training process, hourly trainees will attend classroom sessions, take examinations, watch videos and work alongside a certified trainer or a highly recommended individual that reports back to the certified trainer on performance and progress.

Brick House Tavern + Tap

The Brick House team is led by a brand president who oversees three directors of operations who, in turn, each manage five to seven restaurants. Typical restaurant management includes a general manager, service manager, back-of-the-house manager, whom we refer to as our "executive chef," and bar manager. Brick House Tavern + Tap restaurant managers have bonus incentives that are based on sales and restaurant-level profits.

Our training programs are seven weeks for all salaried managers and one to two weeks for all hourly positions. Our new hire training program is conducted by in-house trainers who have been certified by our restaurant lead trainer. At the end of training, there is a comprehensive written test and an on-the-job training review that must be completed before permission to work independently is granted.

Shared Services

Both Joe's Crab Shack and Brick House Tavern + Tap are supported by our Restaurant Support Center located in Houston, Texas. The Restaurant Support Center provides support services to both brands including marketing, menu development, accounting, real estate and development, human resources, legal, purchasing and information systems. We believe our Restaurant Support Center allows

10

Table of Contents

us to leverage our scale and share best practices across key functional areas that are common to both of our brands.

Site Selection

We focus our development strategy for Joe's Crab Shack on new locations in narrowly defined geographic regions with high population density and a propensity for seafood and in close proximity to regional and national tourist attractions. Our development strategy for Brick House Tavern + Tap is largely intended to focus on opening new locations in the top 50 designated market areas across the country.We have a dedicated development team that takes an analytical, data-driven approach to selecting new sites, which is largely based upon, but not limited to, the following criteria:

- •

- with respect to Joe's, attractiveness of locations from a regional/national and/or "destination market" perspective;

- •

- local market demographics and psychographic profiles;

- •

- characteristics similar to our most successful existing restaurants;

- •

- regional consumer trends and preferences;

- •

- local performance of nationally branded peers;

- •

- vehicle traffic patterns, visibility and access;

- •

- occupancy rates and other performance data from local hotels and other retail establishments, offices and other establishments that draw restaurant traffic;

- •

- available square footage, parking and lease economics;

- •

- local investment and operating costs; and

- •

- development and expansion constraints.

Restaurant Development and Economics

We have in-house real estate and development capabilities. During 2012, we opened 11 new restaurants (all Joe's), which included one conversion of an existing Brick House restaurant. Our capital investment, which includes build-out costs and cash pre-opening costs, amounted to $41.7 million for restaurants opened in 2012. Factors contributing to the fluctuation in capital investment include size of the property, geographical location, type of construction, cost of liquor and other licenses, and concessions received from landlords. A majority of the Joe's Crab Shack restaurants opened during 2012 were newly developed and built restaurants. Conversions of other existing restaurants to Joe's or Brick House typically require less capital investment than newly developed and built restaurants.

We target steady state new restaurant average unit volumes of approximately $3.9 million for Joe's Crab Shack and $3.2 million for Brick House, and cash-on-cash returns, which is defined as restaurant-level profit per store divided by total build-out costs and cash pre-opening costs, to exceed 25%. For fiscal year 2013, we target opening as many as 14 new restaurants, the vast majority of which will be new Joe's Crab Shack restaurants, and converting as many as four of our own restaurants. With the impending acquisition of Mac Grill, we are evaluating our current restaurant development options.

Purchasing and Distribution

Our dedicated purchasing team sources, negotiates and purchases all food supplies, operating supplies, and all restaurant equipment, furniture and fixtures. We have developed an extensive network of suppliers, with many relationships dating back over 20 years. We maintain relationships with many

11

Table of Contents

suppliers and have the ability to shift purchasing among suppliers, should more favorable terms become available in the market. In addition, we maintain multiple approved suppliers for all key components of our menu to mitigate risk and ensure supply. Suppliers are chosen based upon their ability to provide (i) a continuous supply of product that meets all safety and quality specifications, (ii) logistics expertise and freight management, (iii) product innovation, (iv) customer service, (v) transparency of business relationship and (vi) competitive pricing. Specified products are distributed to all restaurants through a national distribution company under a negotiated contract. This distributor delivers products directly to our restaurants either two or three times per week depending on restaurant requirements. Produce is purchased locally from an approved supplier network to maximize operating efficiencies and to ensure freshness and product quality.

Our top selling menu items are based on Queen Crab, Snow Crab, Dungeness Crab, King Crab, whole lobster and shrimp, which collectively accounted for approximately 49% of our total food purchases in fiscal year 2012. We have established long-term relationships with key seafood vendors and usually source product directly from producers to get advantageous product access at the most competitive prices. As market conditions warrant, we can use these relationships to lock in forward pricing for six to 18 months. Pricing agreements are entered into for a minimum volume of product and are structured around current and historical prices and the projected menu mix. We employ a team at the Restaurant Support Center that is solely responsible for actively managing these contracts, which typically roll on a continuous basis.

In addition to using fixed price contracts, our Joe's menu provides inherent flexibility to help manage food cost. Crab is deliberately placed center stage as a defining item to the Joe's experience. Joe's Steampot and Crab in a Bucket offerings allow guests to choose between four varieties of crabs (Queen, Snow, Dungeness and King) and lobster. Each of these species has multiple fisheries and seasons. In addition to the ability to direct guests to other crab varieties, Steampots, the top selling item on the menu, provide additional product flexibility. The Steampot is a variety of both shellfish and non-seafood items served together in a simmering pot that have individual ingredients that can be adjusted based on prevailing market prices and general input availability. We believe this strategy greatly reduces our reliance on individual inputs and is largely opaque to the guest. In addition, should input prices increase, we have the ability to adjust menu prices very quickly, even within a few days, if appropriate.

Crab is harvested during seasons and in accordance with regulations which are determined by various regulatory agencies. Crab is processed, frozen and shipped to either cold storage or to the master distributor. The master distributor fulfills restaurant orders by delivering frozen crab, which our restaurants store in a frozen state until preparation for service to the guest. We believe our strong supplier relationships, coupled with the inherent flexibility of our menu, minimizes our exposure to seafood supply chain shortages and market price increases. Cost of sales as a percentage of revenues for fiscal year 2012, 2011 and 2010 were 31.3%, 31.5%, and 29.6%, respectively. In fiscal year 2012, our largest supplier accounted for 20% of our total food purchases.

Food Safety

We have food safety and quality assurance programs which are designed to ensure that our restaurant team members and managers are trained in proper food handling techniques. Our restaurants operate in various municipalities, which require us to have systems in place to adhere to various locals standards. With the goal of achieving industry leadership in the area of restaurant food safety and sanitation, we have implemented a national operating standard, which includes comprehensive, unannounced inspections by a third party service provider. Restaurant managers receive feedback and coaching as an integral part of the semi-annual visits to each restaurant.

12

Table of Contents

Our operations, procurement and culinary teams work in close coordination to exceed industry standards. Our procurement team works to ensure that product fulfillment fits to the specifications set by our culinary experts. This process requires that our seafood products are caught, produced or processed in environments that meet and often exceed legal requirements. Our culinary team works to use products that are safe for processing and handling in our restaurants' environment. Our training team provides both proprietary and non-proprietary materials and programs to educate salaried and hourly team members, while our operations team implements programs and sets standards for measurement of performance to ensure consistent performance at our restaurants.

We require all of our suppliers to adhere to strict Hazard Analysis and Critical Control Points, or HACCP, quality control and environmental standards in the development, harvest, catch, and production of food products. We require chemical, physical and microbiological testing of seafood and other commodities for conformance to safety and quality requirements.

All potential suppliers are required to meet our specified minimum standards to achieve approved supplier status for the Ignite system.

Information Systems and Restaurant Reporting

All of our restaurants use computerized management information systems, which are designed to improve operating efficiencies, provide restaurant and Restaurant Support Center management with timely access to financial and operating data and reduce administrative time and expense. Our integrated management information systems platform is a combination of in-house and outsourced systems. The major management information systems are divided by function:

- •

- restaurant point-of-sale;

- •

- restaurant back-of-house;

- •

- financial;

- •

- payroll/human resources; and

- •

- internal operational reports.

All of our restaurants are equipped with computerized point-of-sale, or POS, and back-of-house systems. We use a third party vendor for our restaurant POS System. We have the ability to generate weekly and period-to-date operating results on a company-wide, brand-wide, regional and/or individual restaurant basis. Together, this allows us to closely monitor sales, food and beverage costs and labor and operating expenses at each of our restaurants. Our system was updated in 2010 and runs on non-proprietary hardware with open architecture, intuitive touch screen interface and integrated credit and gift card processing. Our back-of-house systems include a kitchen display system for many of our restaurants. These systems also run on non-proprietary hardware with open architecture.

We contract with a third party service provider for outsourced business process services that include accounts payable, general ledger and internal financial reporting. Our third party service solution provides a complete web-based reporting package allowing for detailed profit and loss visibility at the restaurant-level. Our accounting department prepares period and year-to-date profit and loss statements, which provide a detailed analysis of sales and costs, and which are compared to budgets and to prior periods. Additionally, we use outsourced payroll processing and human resources information systems. These outsourced systems support standard payroll functions as well as hiring, promotion, and benefits administration.

13

Table of Contents

Employees

As of December 31, 2012, we employed approximately 9,700 employees, of whom 130 were Restaurant Support Center, executive management and multi-unit restaurant management personnel, 461 were restaurant-level management personnel and the remainder were hourly restaurant personnel. During 2012, total employee counts ranged from 12,800 during peak summer season to 9,700 during the winter. None of our employees are covered by collective bargaining agreements, and we believe we have good relations with our employees.

Competition

The restaurant industry is fragmented and intensely competitive. We believe guests make their dining selection based on a variety of factors such as menu offering, taste, quality and price of food offered, perceived value, service, atmosphere, location and overall dining experience. Our competitive landscape includes nationally-branded restaurant chains as well as regional and local restaurant operators.

For Joe's Crab Shack, our primary competitors in the casual seafood segment include Red Lobster, Bonefish Grill, Landry's Seafood and Bubba Gump Shrimp Company. Joe's is America's only national crab house. Red Lobster is our only large-scale, nationally branded seafood competitor. Both brands also compete with a broader range of other casual dining restaurants including newer brands such as BJ's Restaurants, Yard House, Cheesecake Factory, Bravo Brio and Buffalo Wild Wings, as well as traditional brands such as Applebee's, Chili's, T.G.I. Friday's, Texas Roadhouse and Outback Steakhouse.

Seasonality

There is a seasonal component to Joe's Crab Shack's business which typically peaks in the summer months (June, July and August) and slows in the winter months (November, December, January). Because of the seasonality of our system-wide business, results for any fiscal quarter are not necessarily indicative of the results that may be achieved for future fiscal quarters or for the full fiscal year.

Trademarks and Service Marks

Our registered trademarks and service marks include Joe's Crab Shack® and logo design, and Brick House Tavern + Tap® and logo design. We have used or intend to use all the foregoing marks in connection with our restaurants. We believe that our trademarks and service marks have significant value and are important to our brand-building efforts and identity and the marketing of our restaurant brand.

Licensing Arrangements

In addition to our Joe's Crab Shack restaurant operations, we have a licensing agreement to provide branded seafood options under the Joe's Crab Shack brand at various retailers. We receive royalty revenues in connection with the license of the Joe's Crab Shack brand name based on a percentage of product sales, subject to a minimum royalty requirement. We believe that this initiative further enhances Joe's Crab Shack brand awareness to prospective guests of our Joe's Crab Shack restaurants.

We also receive royalty revenues from a license granted to Landry's in connection with two Joe's Crab Shack restaurants. The license allows Landry's to use certain of our intellectual property, including the Joe's Crab Shack name, to operate its two restaurants. Under the license, we receive royalty revenues based on a percentage of sales at such restaurants. We do not receive any revenues from the operation of the restaurants other than license royalty revenues, and such restaurants are

14

Table of Contents

operated by Landry's entirely independent from our Joe's Crab Shack restaurants. Although Landry's is required to adhere to certain minimum quality standards under the license, including with respect to menu, promotional materials and the specification and preparation of food and beverage items, we do not have operational control over such restaurants, and they may not be operated in a manner consistent with the standards we uphold at our restaurants. Landry's closed one of its Joe's Crab Shack restaurants in February 2013 and has notified us that they intend to close the second restaurant in April 2013.

Government Regulation

We are subject to a variety of federal, state and local laws. Each of our restaurants is subject to permits, licensing and regulation by a number of government authorities, relating to alcoholic beverage control, health, safety, sanitation, building and fire codes, including compliance with the applicable zoning, land use and environmental laws and regulations. Difficulties in obtaining or failure to obtain required licenses or approvals could delay or prevent the development of a new restaurant in a particular area.

Alcoholic beverage control regulations require each of our restaurants to apply to a state authority and, in certain locations, county or municipal authorities for a license that typically, must be renewed annually and may be revoked or suspended for cause at any time. Alcoholic beverage control regulations affect many aspects of restaurant operations, including minimum age of patrons and employees, hours of operation, advertising, trade practices, wholesale purchasing, inventory control and handling, storage and dispensing of alcoholic beverages.

We are subject in certain states to "dram shop" statutes, which generally provide a person injured by an intoxicated person the right to recover damages from an establishment that wrongfully served alcoholic beverages to the intoxicated person. We carry liquor liability coverage as part of our comprehensive general liability insurance policy.

Our restaurant operations are also subject to federal and state laws governing employment (including the Fair Labor Standards Act of 1938, the Immigration Reform and Control Act of 1986), regarding such matters as the minimum hourly wage, unemployment tax rates, sales tax and similar matters. Significant numbers of our service, food preparation and other personnel are paid at rates related to the federal minimum wage, which currently is $7.25 per hour. The tip credit allowance is the amount an employer is permitted to assume an employee receives in tips when the employer calculates the employee's hourly wage for minimum wage compliance purposes.

In addition, our restaurants must comply with the applicable requirements of the ADA and related state accessibility statutes. Under the ADA and related state laws, we must provide equivalent service to disabled persons and make reasonable accommodation for their employment, and when constructing or undertaking significant remodeling of our restaurants, we must make those facilities accessible.

We are also subject to laws and regulations relating to nutritional content, nutritional labeling, product safety, menu labeling and other regulations imposed by the FDA. Regulations relating to nutritional labeling may lead to increased operational complexity and expenses and may impact our sales.

Litigation

Occasionally, we are a defendant or otherwise involved in lawsuits arising in the ordinary course of our business including claims resulting from "slip and fall" accidents, "dram shop" claims, construction-related disputes, employment-related claims, and claims from guests or employees alleging illness, injury or other food quality, health or operational concerns. When the potential liability can be estimated and the loss is considered probable, we record the estimated loss. Due to uncertainties

15

Table of Contents

related to the resolution of lawsuits and claims, the ultimate outcome may differ from our estimates. As of the date of this report, we do not believe the potential exposure with respect to any of these pending lawsuits and claims will have a material adverse effect on our consolidated financial position, results of operations or cash flows.

Available Information

We maintain a website with the addresswww.igniterestaurants.com. On our website, we make available at no charge our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, all amendments to those reports, and our proxy statement, as soon as reasonable practicable after these materials are filed with or furnished to the SEC. Our filings are also available on the SEC's website atwww.sec.gov. The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may also obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The contents of our website are not incorporated by reference into this Form 10-K.

Item 1A. RISK FACTORS.

You should carefully consider the following factors, which could materially affect our business, financial condition or results of operations. You should read these Risk Factors in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 and our Consolidated Financial Statements and related notes in Item 8.

Risks Related to Our Business

You should not rely on past increases in our comparable restaurant sales or our average unit volumes as an indication of our future results of operations because they may fluctuate significantly.

A number of factors have historically affected, and will continue to affect, our comparable restaurant sales and average unit volumes, including, among other factors:

- •

- our ability to execute our business strategy effectively;

- •

- unusually strong initial sales performance by new restaurants;

- •

- competition;

- •

- consumer trends and confidence;

- •

- introduction of new menu items; and

- •

- regional and national macroeconomic conditions.

Our comparable restaurant sales and average unit volumes may not increase at rates achieved over the past several fiscal years. Changes in our comparable restaurant sales and average unit volumes could cause the price of our common stock to fluctuate substantially.

If we fail to execute our growth strategy, which largely depends on our ability to open new restaurants that are profitable, our business could suffer.

One of the key means of achieving our growth strategies will be through opening new restaurants and operating those restaurants on a profitable basis. We expect this to be the case for the foreseeable future. For fiscal year 2013, we target opening as many as 14 new Joe's Crab Shack and/or Brick House restaurants. Because of the economic downturn, there are fewer new developments, such as shopping centers, being constructed, which reduce the supply of new restaurant locations. As a result, competition for prime locations is intense and the prices commanded for such locations have remained high. There is no guarantee that a sufficient number of locations will be available in desirable areas or

16

Table of Contents

on terms that are acceptable to us in order to achieve our growth plan. Delays or failures in opening new restaurants, or achieving lower than expected sales in new restaurants, could materially adversely affect our growth strategy. Once we have identified suitable restaurant sites, our ability to open new restaurants successfully and on the development schedule we anticipate will also depend on numerous other factors, some of which are beyond our control, including, among other items, the following:

- •

- our ability to secure suitable new restaurant sites;

- •

- our ability to control construction and development costs of new restaurants;

- •

- our ability to negotiate suitable lease terms;

- •

- our ability to secure required governmental approvals and permits in a timely manner and any changes in local, state or federal laws and regulations that adversely affect our costs or ability to open new restaurants;

- •

- the cost and availability of capital to fund construction costs and pre-opening expenses;

- •

- consumer acceptance of our new restaurants; and

- •

- limitations under our current and future credit facilities.

Although we target specified new restaurant average unit volumes, cash on cash returns and capital investment for both Joe's and Brick House, new restaurants may not meet these targets. Any restaurant we open may not be profitable or achieve operating results similar to those of our existing restaurants. We may not be able to respond on a timely basis to all of the changing demands that our planned expansion will impose on management and on our existing infrastructure, or be able to hire or retain the necessary management and operating personnel. Our existing restaurant management systems, financial and management controls and information systems may not be adequate to support our planned expansion. Our ability to manage our growth effectively will require us to continue to enhance these systems, procedures and controls and to locate, hire, train and retain management and operating personnel.

There is also the potential that some of our new restaurants will be located near areas where we have existing restaurants, thereby reducing the revenues of such existing restaurants.

Macroeconomic conditions could adversely affect our ability to increase the sales and profits of existing restaurants or to open new restaurants.

Although the global economy showed signs of recovery in 2012, the United States may continue to suffer from depressed economic activity. Recessionary economic cycles, higher fuel and other energy costs, lower housing values, low consumer confidence, inflation, increases in commodity prices, higher interest rates, higher levels of unemployment, higher consumer debt levels, higher tax rates and other changes in tax laws or other economic factors that may affect discretionary consumer spending could adversely affect our revenues and profit margins and make opening new restaurants more difficult. Our guests may have lower disposable income and reduce the frequency with which they dine out. This could result in reduced guest traffic, reduced average checks or limitations on the prices we can charge for our menu items, any of which could reduce our sales and profit margins. In addition, many of our Joe's Crab Shack restaurants are located in areas that we consider tourist or vacation destinations. Therefore, in those locations, we depend in large part on vacation travelers to frequent our Joe's Crab Shack restaurants, and such destinations typically experience a reduction in visitors during economic downturns, thereby reducing the potential guests that could visit our restaurants. Also, businesses in the shopping vicinity in which some of our restaurants are located may experience difficulty as a result of macroeconomic trends or cease to operate, which could, in turn, further negatively affect guest traffic at our restaurants. All of these factors could have a material adverse impact on our results of operations and growth strategy.

17

Table of Contents

Our success depends on our ability to compete with many other restaurants.

The restaurant industry is intensely competitive, and we compete with many well-established restaurant companies on the basis of food taste, price of products offered, guest service, atmosphere, location and overall guest experience. Our competitors include restaurant chains and individual restaurants that range from independent local operators to well-capitalized national and regional restaurant companies. Our Joe's Crab Shack restaurants compete against other casual seafood restaurants, including national and regional chains and local seafood restaurants, as well as against casual dining restaurants that provide a different type of food. Our Brick House Tavern + Tap restaurants compete against casual restaurants in the bar and grill segment and restaurants in the casual dining segment.

Some of our competitors have substantially greater financial and other resources than we do, which may allow them to react to changes in the restaurant industry better than we can. Other competitors are local restaurants that in some cases have a loyal guest base and strong brand recognition within a particular market. As our competitors expand their operations or as new competitors enter the industry, we expect competition to intensify. Should our competitors increase their spending on advertising and promotions, we could experience a loss of guest traffic to our competitors. Also, if our advertising and promotions become less effective than those of our competitors, we could experience a material adverse effect on our results of operations. We also compete with other restaurant chains and other retail businesses for quality site locations, management and hourly employees.

Our failure to establish and maintain effective disclosure controls and procedures and internal controls over financial reporting contributed to the restatement of our previously issued financial statements. If we fail to remediate material weaknesses in our internal controls over financial reporting or otherwise establish and maintain effective internal controls over financial reporting and disclosure controls and procedures, we may have additional material misstatements in our financial statements and we may not be able to report our financial results in a timely manner.

Our CEO and CFO performed an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures and concluded that they were not effective as of December 31, 2012 as a result of the material weaknesses in our internal controls over financial reporting described below. A "material weakness" is a deficiency, or combination of deficiencies, in internal controls such that there is a reasonable possibility that a material misstatement of our financial statements will not be prevented or detected in a timely basis. The following material weaknesses were identified in connection with the restatement of our previously issued financial statements:

- •

- lack of sufficient qualified accounting and tax personnel;

- •

- lack of adequate supervision;

- •

- lack of effective controls over the accounting for leases; and

- •

- lack of effective controls over the existence, completeness and accuracy of fixed assets and related depreciation and amortization expense.

These material weaknesses in our internal controls over financial reporting contributed to the restatement of our previously issued financial statements. We are taking steps to remediate the identified material weaknesses and we will continue to review our internal controls over financial reporting in the areas identified above and other areas and update our accounting policies and procedures accordingly. However, there is no guarantee that additional material weaknesses will not be identified in the future or that any of these measures will ensure that we implement and maintain adequate controls over our financial processes and reporting in the future. Any failure to implement new or improved controls or difficulties encountered in their implementation could cause us to fail to meet our reporting obligations. In particular, if the material weaknesses described above are not

18

Table of Contents

remediated, they could result in a misstatement of our accounts and disclosures that could result in a material misstatement to our annual or interim consolidated financial statements in future periods that would not be prevented or detected. If our financial statements are not timely or accurate, then, in addition to the risks described above, investors may lose confidence in our reported information and our ability to prevent fraud, we could be delisted from NASDAQ and we could lose our ability to access capital markets. For further discussion of our disclosure controls and procedures and internal controls over financial reporting, see Item 9A of Part II, "Controls and Procedures."

We have not completed the formal evaluation of our internal controls over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 because we are not currently required to do so. Our first Section 404 report will be prepared in connection with our Annual Report on Form 10-K for the fiscal year ending December 30, 2013. We cannot assure you that we will not uncover additional material weaknesses as of December 30, 2013 following this review. Also, until fully remediated, the control deficiencies outlined above could result in a material misstatement to our future annual or interim financial statements that would not be prevented or detected. In addition, our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal controls over financial reporting pursuant to Section 404 until the later of the fiscal year ending December 30, 2013, or the date we are no longer an "emerging growth company" as defined in the JOBS Act, if we continue to take advantage of the exemptions contained in the JOBS Act. We expect that we will remain an "emerging growth company" until the earliest of (i) the last day of our fiscal year following the fifth anniversary of our initial public offering (IPO); (ii) the last day of our fiscal year in which we have annual gross revenue of $1.0 billion or more; (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; and (iv) the date on which we are deemed to be a "large accelerated filer," which will occur at such time as we have (1) an aggregate worldwide market value of common equity securities held by non-affiliates of $700 million or more as of the last business day of our most recently completed second fiscal quarter, (2) been required to file annual, quarterly and current reports under the Exchange Act of 1934, as amended, or the Exchange Act, for a period of at least 12 calendar months, and (3) filed at least one annual report pursuant to the Exchange Act. As a result, we may qualify as an "emerging growth company" until as late as May 10, 2017. At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our controls are documented, designed or operating.

Legal proceedings or regulatory actions commenced in connection with the restatement could require us to incur significant costs and have an adverse impact on our business, financial condition and results of operations.

As a result of the restatement of our previously issued financial statements, a putative class action complaint was filed in the U.S. District Court for the Southern District of Texas against us, certain of our current directors and officers and the underwriters in the IPO. The plaintiffs allege that all the defendants violated Section 11 of the Securities Act of 1933 (the "Securities Act"), the underwriters violated Section 12 of the Securities Act and certain of our directors and officers have control person liability under Section 15 of the Securities Act, based on allegations that in light of the July 18, 2012 restatement announcement, our IPO registration statement and prospectus contained untrue statements of material facts, omitted to state other facts necessary to make the statements made not misleading, and omitted to state material facts required to be stated therein. Plaintiffs seek unspecified compensatory damages and attorneys' fees and costs. In addition to the IPO litigation, we may become subject to additional scrutiny from, or formal investigations by, regulatory authorities such as the SEC or additional civil litigation, all of which could require us to incur significant legal expenses, pay fines or other penalties or damages and divert time, money and other valuable resources away from our operations and, thereby, harm our business.

19

Table of Contents

Changes in food and supply costs, including the cost of crab, could adversely affect our results of operations.

Our profitability depends in part on our ability to anticipate and react to changes in food and supply costs. Operating margins for our restaurants are subject to changes in the price and availability of food commodities, including crab, shrimp, lobster and other seafood. In fiscal year 2012, Queen Crab, Snow Crab, Dungeness Crab, King Crab, lobster and shrimp accounted for approximately 49% of our total food purchases. Any increase in food prices, particularly for these food items, could adversely affect our operating results. In addition, we are susceptible to increases in food costs as a result of factors beyond our control, such as weather conditions (including hurricanes), oil spills, fisherman strikes, food safety concerns, costs of distribution, product recalls and government regulations. Furthermore, the introduction of or changes to tariffs on seafood, such as imported crab and shrimp or other food products, could increase our costs and possibly impact the supply of those products. We cannot predict whether we will be able to anticipate and react to changing food costs by adjusting our purchasing practices and menu items and prices, and a failure to do so could adversely affect our operating results. In addition, because our menu items are moderately priced, we may not seek to or be able to pass along price increases to our guests. If we adjust pricing there is no assurance that we will realize the full benefit of any adjustment due to changes in our guests' menu item selections and guest traffic.

Brick House is a newer and still evolving brand and our plans to expand Brick House may not be successful.

While Joe's and Brick House are subject to the risks and uncertainties described herein, there is an enhanced level of risk and uncertainty related to the expansion of Brick House, our newer brand. While Brick House has grown to 15 locations since its founding in 2008, it is still evolving and has not yet proven its long-term growth potential.

Initially, we opened Brick House restaurants across a broad range of geographies with the intent of optimizing the brand prior to a continued build out. We continue to incorporate key insights into our new restaurant rollout plans. There can be no assurance that the enhancements we intend to implement as part of the brand optimization process will be successful or that additional new restaurant growth will occur. Brick House will be subject to the risks and uncertainties that accompany any emerging restaurant brand. If Brick House fails to expand and/or continue generating profits, our operating results could suffer.

Food safety and food-borne illness concerns may have an adverse effect on our business.

Food safety is a top priority, and we dedicate substantial resources to ensure that our guests enjoy safe, quality food products. However, food-borne illnesses, such as salmonella, E. coli, hepatitis A, trichinosis or "mad cow disease," and food safety issues have occurred in the food industry in the past, and could occur in the future. In addition, publicity regarding certain illnesses and contaminations related to seafood, including high levels of mercury or other carcinogens, oil contaminations, vibrio vulnificus and the Norwalk virus could affect consumer preferences and the consumption of seafood. Any report or publicity linking us to instances of food-borne illness or other food safety issues, including food tampering or contamination, could adversely affect our brands and reputation as well as our revenues and profits. Even instances of food-borne illness, food tampering or food contamination occurring solely at restaurants of our competitors could result in negative publicity about the food service industry or seafood restaurants generally and adversely impact our sales.

In addition, our reliance on third-party food suppliers and distributors increases the risk that food-borne illness incidents could be caused by factors outside of our control and that multiple locations would be affected rather than a single restaurant. Although we inspect food products when they are delivered to us, we cannot assure that all food items are properly maintained during transport throughout the supply chain and that our employees will identify all products that may be spoiled and

20

Table of Contents

should not be used in our restaurants. New illnesses resistant to any precautions may develop in the future, or diseases with long incubation periods could arise, such as "mad cow disease," which could give rise to claims or allegations on a retroactive basis. In addition, our industry has long been subject to the threat of food tampering by suppliers, employees or guests, such as the addition of foreign objects in the food that we sell. Reports, whether or not true, of injuries caused by food tampering have in the past severely injured the reputations and brands of restaurant chains in the quick service restaurant segment and could affect us in the future as well. If our guests become ill from food-borne illnesses, we could also be forced to temporarily close some restaurants. Furthermore, any instances of food contamination, whether or not at our restaurants, could subject us or our suppliers to a food recall pursuant to the Food and Drug Administration Food Safety Modernization Act.

Changes in consumer preferences could harm our performance.

Consumer preferences often change rapidly and without warning, moving from one trend to another among many product or retail concepts. We also depend on trends regarding away-from-home dining. Consumer preferences towards away-from-home dining or certain food products might shift as a result of, among other things, health concerns or dietary trends related to cholesterol, carbohydrate, fat and salt content of certain food items, including crab or other seafood items, in favor of foods that are perceived as more healthy. Our menu is currently comprised of crab and other menu items and a change in consumer preferences away from these offerings would have a material adverse effect on our business. Negative publicity over the health aspects of such food items may adversely affect demand for our menu items and could result in lower guest traffic, sales and results of operations.

If we fail to continue to develop and maintain our restaurant brands, our business could suffer.

We believe that maintaining and developing our restaurant brands are critical to our success and our growth strategy, and that the importance of brand recognition is significant as a result of competitors offering products similar to our products. We have made significant marketing expenditures to create and maintain brand loyalty as well as to increase awareness of our brands. If our brand-building strategy is unsuccessful, these expenses may never be recovered, and we may be unable to increase our future sales or implement our business strategy.

Any incident that erodes consumer affinity for our brands could significantly reduce their respective values and damage our business. If guests perceive or experience a reduction in food quality, service or ambiance, or in any way believe we failed to deliver a consistently positive experience, our brand value could suffer and our business may be adversely affected.